Industries > Automotive > Automotive Cyber Security Market Report 2018-2028

Automotive Cyber Security Market Report 2018-2028

Forecasts by (Hardware, Software, Network, Cloud) Plus Analysis of Prospects for Connected Car & Vehicle-to-Everything (V2X, V2V, V2I, V2G, V2H, V2P, IN-V) Communication Safety & Security Within The Internet of Things (IoT) Ecosystem

The Automotive Cyber Security Market Analysis: evaluates the market drivers and technological solutions essential to the protection of the connected car infrastructure and assesses how the market will develop in the future.

Today connected cars are rapidly becoming a reality. Connected cars act as a connectivity device on wheels offering comfort, convenience, performance, safety and security combined with powerful network technology. This will keep the drivers and passengers connected to the outer world and offer them the comfort of an office and home experience even when they are travelling. The automotive industry is going through a phase of digital revolution. In the next, few years, automobiles will transform into communication devices. New hi-tech devices, smart phones and high-speed internet have transformed the concept of connected vehicles.

However, the advanced connectivity solutions provided in a vehicle can also reveal certain vulnerabilities and lead to certain fraudulent activities and thus demands effective cyber security solutions. Some of the major factors driving the cyber security market in the automotive industry are safety and security concerns.

Visiongain’s report on automotive cyber security provides a detailed overview of the market, creating an accurate picture that will offer clarity to anyone involved in the market. Importantly, the report also delivers a forecast of the market, giving you an insight into the future business opportunities that exist in the automotive cyber security market.

Visiongain assesses that the global automotive cyber security market will reach $298.3m in 2018.

The Report Reveals A Global Automotive Cyber Security Forecast From 2018-2028

This Report Also Offers Regional Automotive Cyber Security Market Forecasts From 2018-2028

• China Automotive Cyber Security Market 2018-2028

• France Automotive Cyber Security Market 2018-2028

• Israel Automotive Cyber Security Market 2018-2028

• Japan Automotive Cyber Security Market Forecast 2018-2028

• Russia Automotive Cyber Security Market 2018-2028

• Germany Cyber Security Market 2018-20

• South Korea Automotive Cyber Security Market 2018-2028

• US Automotive Cyber Security Market 2018-2028

• UK Automotive Cyber Security Market 2018-2028

• RoW Automotive Cyber Security Market 2018-2028

And The Following Automotive Cyber Security Forecast Subsegments Are Forecast From 2018-2028

• Hardware Cyber Security Submarket Forecast 2018-2028

• Software Cyber Security Submarket Forecast 2018-2028

• Network Cyber Security Submarket Forecast 2018-2028

• Cloud Cyber Security Submarket Forecast 2018-2028

In Order To Offer An Accurate Snapshot Of The Current Market, Visiongain Also Profiles The Following Leading Automotive Cyber Security Companies:

• Cisco Systems

• Intel Corporation

• Symantec Corporation

• International Business Machines (IBM)

• Harman International

• NXP Semiconductors

• Infineon Technologies AG

• Argus Cyber Security

• Trillium Inc.

• Karamba Security

Who Should Read This Report?

• Cyber security companies

• Automotive OEM;s

• Software developers

• Connected car specialists

• Telematics providers

• Electronics companies

• Telecoms vendors

• R&D staff

• Cyber security start-ups

• CEOs

• Asset managers

• Heads of strategic development

• Business development managers

• Marketing staff

• Market analysts

• Company managers

• Industry administrators

• Industry associations

• Consultants

• Banks

• Investors

• Regulators

• Governmental departments & agencies

The Automotive Cyber Security Forecast Market Report 2018-2028 is a fantastic opportunity to increase your knowledge of this sector. SWOT analysis as well as analysis of the drivers and restraints for the overall market concisely informs you of the major factors affecting the automotive cyber security market, whilst Visiongain’s data-rich approach provides greater insight into the business opportunities.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1. Global Automotive Cyber Security Market Overview

1.2. Global Automotive Cyber Security Market Segmentation

1.3. Why You Should Read This Report

1.4. How This Report Delivers

1.5. Key Questions Answered by This Analytical Report Include:

1.6. Who is This Report For?

1.7. Methodology

1.7.1. Primary Research

1.7.2. Secondary Research

1.7.3. Market Evaluation & Forecasting Methodology

1.8. Frequently Asked Questions (FAQ)

1.9. Associated Visiongain Reports

1.10. About Visiongain

2. Introduction to Automotive Cyber Security Market

2.1. Understanding the Vehicle-based Cyber Attack

2.1.1. Types of Vehicle Connectivity

2.1.1.1. Vehicle-to-Vehicle Communication (V2V)

2.1.1.2. Vehicle-to-Infrastructure Communication (V2I)

2.1.1.3. Vehicle-to-Pedestrian Communication (V2P)

2.1.1.4. Vehicle-to-Home Communication (V2H)

2.1.1.5. In-Vehicle Communication (IN-V)

2.1.2. Attack Surface

2.1.2.1. On-Board Diagnostics II (OBD-II)

2.1.2.2. CDs, USBs and Portable Devices

2.1.2.3. Bluetooth

2.1.2.4. Remote Keyless Entry (RKE)

2.1.2.5. Immobilizer

2.1.2.6. Tyre Pressure Monitoring System (TPMS)

2.1.2.7. Dedicated Short-Ranged Communication (DSRC)

2.1.2.8. GPS, Radio Data System (RDS) and Traffic Message Channel (TMC)

2.1.2.9. Remote Telematics Systems

2.1.3. Who and Why Hacks Cars?

2.1.3.1. White Hat Hackers and Researchers

2.1.3.2. Black Hat Hackers and Activists

2.1.3.3. Grey Hat Hackers and Drivers

2.1.3.4. Vehicle Theft

2.1.3.5. Personal Data Theft

2.1.4. Most Important Mechanisms of Car Cyber Attacks

2.1.5. Stage of Cyber Attacks

2.2. List of Cars with Vulnerabilities

2.3. Media Coverage of Car Hacking

2.4. Key Findings

2.4.1. Top Factors Impacting Automotive Cyber Security Market

2.5. Porter’s Five Force Analysis

2.5.1. Large Number Of Suppliers Present In Market, Low Switching Cost Involved, Threat Of Backward Integration Of Buyer And Undifferentiated Product Reduce The Bargaining Power Of Supplier

2.5.2. Low Switching Cost, Capability To Perform Backward Integration, Price Sensitive Consumer, Well-Educated Buyer And Undifferentiated Products Increase The Bargaining Power Of Buyer

2.5.3. Unavailability Of Substitute Lowers The Threat Of Substitution

2.5.4. Undifferentiated Product, Low Switching Cost Easy Access To Distribution Channel Increases The Threat Of New Entrant

2.5.5. Numerous Competitors, Undifferentiated Products And Low Switching Cost Increase The Rivalry Within The Industry

2.6. Value Chain Analysis

2.6.1. OEM & Utility Manufacturers

2.6.2. Vehicle Manufacturers & Dealers/Distributors

2.6.3. Network, connectivity device and application providers

2.7. Case studies

2.8. Market Dynamics

2.8.1. Drivers

2.8.2. Restraints

2.8.3. Opportunities

2.9. Government Regulations in Automotive Cyber Security by Region

2.9.1. US Regulations Overview

2.9.1.1. US SPY Car Act

2.9.1.2. Information Sharing and Analysis Centre for Cyber Security

2.9.2. European Regulations Overview

2.9.2.1. European Parliament to Abolish Roaming Charges

2.9.2.2. Sweden Declined DAB

2.9.2.3. eCall Mandate

2.9.3. Chinese Regulations Overview

2.9.3.1. Counter-terrorism Law

2.9.4. Russian Regulations Overview

2.9.4.1. ERA-GLONASS

2.9.5. Brazil Regulations Overview

2.9.5.1. SINRAV 245 and SINIAV

2.10. Automotive Cyber Security Submarkets Definition

2.10.1. Hardware Security

2.10.1.1. Sensors

2.10.1.2. Processors

2.10.2. Software Security

2.10.3. Network Security

2.10.4. Cloud Security

3. Global Automotive Cyber Security Market 2018-2028

3.1. Global Automotive Cyber Security Market Forecast 2018-2028

3.2. Regional Automotive Cyber Security Market Forecast 2018-2028

3.3. Regional Automotive Cyber Security Market Share Breakdowns 2018-2028

3.4. Global Automotive Cyber Security Drivers & Restraints 2018

4. Global Automotive Cyber Security Submarket Forecast 2018-2028

4.1. Global Hardware Cyber Security Submarket Forecast 2018-2028

4.2. Global Software Cyber Security Submarket Forecast 2018-2028

4.3. Global Network Cyber Security Submarket Forecast 2018-2028

4.4. Global Cloud Cyber Security Submarket Forecast 2018-2028

5. Leading 9 National Automotive Cyber Security Markets Forecast 2018-2028

5.1. Leading 9 National Automotive Cyber Security Markets Share Forecast 2018-2028

5.2. China Automotive Cyber Security Market 2018-2028

5.2.1 China Country Profile

5.2.2. China Automotive Cyber Security Market Forecast 2018-2028

5.2.3. Cyber Security in China

5.2.4.Automotive Cyber Security in China

5.2.5 China Automotive Cyber Security Market Drivers & Restraints

5.3. France Automotive Cyber Security Market 2018-2028

5.3.1. France Country Profile

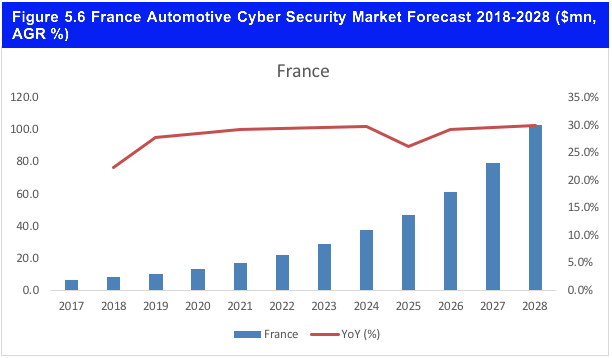

5.3.2. France Automotive Cyber Security Market Forecast 2018-2028

5.3.3. Cyber Security in France

5.3.4. French Views on Automotive Cyber Security

5.3.5. France Automotive Cyber Security Market Drivers and Restraints

5.4. Israel Automotive Cyber Security Market 2018-2028

5.4.1. Israel Country Profile

5.4.2. Israel Automotive Cyber Security Market Forecast 2018-2028

5.4.3. Israel’s Cyber Security

5.4.4. Automotive Cyber Security in Israel

5.4.5. Israel Automotive Cyber Security Market Drivers and Restrains

5.5. Japan Automotive Cyber Security Market 2018-2028

5.5.1.Japan Country Profile

5.5.2. Japan Automotive Cyber Security Market Forecast 2018-2028

5.5.3. Cyber Security in Japan

5.5.4. Automotive Cyber Security in Japan

5.5.4.1. Information Security for Networked Vehicles in Japan

5.5.5. Japan Automotive Cyber Security Market Drivers and Restraints

5.6. Russia Automotive Cyber Security Market 2018-2028

5.6.1. Russia Country Profile

5.6.2. Russia Automotive Cyber Security Market Forecast 2018-2028

5.6.3. Cyber Security in Russia

5.6.4. Automotive Cyber Security in Russia

5.6.5. Russia Automotive Cyber Security Market Drivers and Restraints

5.7. Germany Cyber Security Market 2018-2028

5.7.1. Germany Country Profile

5.7.2. Germany Automotive Cyber Security Market Forecast 2018-2028

5.7.3. Cyber Security in Germany

5.7.4. Automotive Cyber Security in Germany

5.7.5. Germany Automotive Cyber Security Market Drivers and Restraints

5.8. South Korea Automotive Cyber Security Market 2018-2028

5.8.1. South Korea Country Profile

5.8.2. S. Korea Automotive Cyber Security Market Forecast 2018-2028

5.8.3. Cyber Security in South Korea

5.8.4. South Korean Automotive Cyber Security

5.8.5. South Korea Automotive Cyber Security Market Drivers and Restraints

5.9. US Automotive Cyber Security Market 2018-2028

5.9.1. US Country Profile

5.9.2. US Automotive Cyber Security Market Forecast 2018-2028

5.9.3. Cyber Security in the US

5.9.4. US Automotive Cyber Security

5.9.4.1. National Highway Traffic Safety Administration (NHTSA)

5.9.4.2. US Department of Transportation (USDOT)

5.9.4.3. US Senate

5.9.5. US Automotive Cyber Security Market Drivers and Restraints

5.10. UK Automotive Cyber Security Market 2018-2028

5.10.1. UK Country Profile

5.10.2. UK Automotive Cyber Security Market Forecast 2018-2028

5.10.3. Cyber Security in the UK

5.10.4. UK’s Automotive Cyber Security

5.10.5. UK Automotive Cyber Security Market Drivers and Restraints

6. Global Automotive Cyber Security Market SWOT Analysis

7. Leading Automotive Cyber Security Companies

7.1. Cisco Systems

7.1.1. Cisco’s Role in Cyber Security

7.1.2. Cisco Total Company Sales 2008-2017

7.1.3. Cisco Net Profit 2010-2017

7.1.4. Cisco Cost of Research & Development 2010-2017

7.1.5. Cisco Sales by Segment of Business 2017

7.1.6. Cisco Sales by Region 2010-2017

7.1.7. Cisco Organisational Structure and Number of Employees

7.1.8. Cisco M&As 2013-2018

7.1.9. Cisco’s Role in Automotive Cyber Security

7.2. Intel Corporation

7.2.1. Intel Corporation’s Role in the Cyber Security Market

7.2.2 .Intel Corporation Sales 2008-2016

7.2.3. Intel Corporation Net Profit 2010-2016

7.2.4. Intel Corporation Cost of Research & Development 2010-2015

7.2.5. Intel Corporation Sales by Segment of Business, 2016

7.2.6. Intel Corporation Sales by Geographical Location

7.2.7. Intel Corporation No. of Employees 2010-2016

7.2.8. Intel Corporation Acquisitions Activity

7.2.9. Intel Corporation’s Role in the Automotive Cyber Security Market

7.3. Symantec Corporation

7.3.1. Symantec’s Role in Cyber Security

7.3.2. Symantec Total Company Sales 2015-2017

7.3.3. Symantec Sales by Region 2017

7.3.4. Symantec Organisational Structure and Number of Employees

7.3.5. Symantec Mergers & Acquisitions Activity

7.3.6. Symantec’s Role in the Automotive Cyber Security Market

7.3.6.1. In-Vehicle Security

7.3.6.2. End-to-End Protection

7.3.7. Full List of Symantec Security Products for the Connected Car Market

7.4. International Business Machines (IBM)

7.4.1. IBM’s Role in Cyber Security

7.4.2. IBM Total Company Sales 2008-2017

7.4.3. IBM Net Profit 2010-2017

7.4.4. IBM Cost of R&D 2010-2015

7.4.5. IBM Sales by Segment of Business 2010-2017

7.4.6. IBM Sales by Geographic Location 2010-2017

7.4.7. IBM Organisational Structure and Number of Employees 2010-2017

7.4.8. IBM Acquisitions Activity

7.4.9. IBM’s Role in Automotive Cyber Security

7.5. Harman International

7.5.1. Harman’s Role in the Automotive Industry

7.5.2. Harman Total Company Sales 2011-2016

7.5.3. Harman Net Income 2011-2016

7.5.4. Harman Organisational Structure and Number of Employees

7.5.5. Harman Acquisitions Activity

7.5.6. Strategic Moves and Developments

7.5.7. Harman’s Role in Automotive Cyber Security

7.5.7.1. Harman Redbend’s Automotive Security Solution

7.5.7.2. Harman’s TowerSec Automotive Security Solutions

7.6. NXP Semiconductors

7.6.1. NXP’s Role in the Automotive Industry

7.6.2. NXP Total Company Sales 2010-2016

7.6.3. NXP Cost of R&D 2010-2016

7.6.4. NXP Sales by Business Segment

7.6.5. NXP Sales by Geographic Location 2010-2016

7.6.6. NXP Number of Employees 2010-2016

7.6.7. NXP Acquisitions Activity

7.6.8. NXP’s Role in Automotive Cyber Security

7.7. Infineon Technologies AG

7.7.1. Infineon’s Role in the Automotive Industry

7.7.2. Infineon Total Company Sales 2011-2017

7.7.3. Infineon Net Income 2011-2017

7.7.4. Infineon Cost of R&D 2011-2017

7.7.5. Infineon Acquisitions Activity

7.7.6. Infineon’s Role in Automotive Cyber Security

7.7.6.1. Infineon’s Trusted Platform Module

7.7.6.2. Infineon’s Aurix Security Solutions

7.7.6.3. Security Controllers for Automotive Communications

7.8. Argus Cyber Security

7.8.1. Argus Cyber Security’s Role in Automotive Cyber Security

7.8.1.1. Argus Connectivity Solutions

7.8.1.2. Argus In-Vehicle Network Protection

7.8.1.3. Argus ECU Protection

7.8.1.4. Argus Lifespan Protection

7.8.1.5. Argus Aftermarket Protection

7.8.1.6. Argus Business Strategies

7.9. Trillium Inc.

7.9.1.Trillium’s Role in Automotive Cyber Security

7.9.1.1. Trillium’s Secure Car

7.9.2. Trilliums’ Expansion Plans

7.10. Karamba Security

7.10.1. Karamba’s Role in the Automotive Cyber Security Market

7.10.1.1. Karamba’s Carwall

7.10.1.2. Strategies Adopted by Karamba Security

7.11.Other Leading Companies in the Automotive Cyber Security Market

8. Conclusions and Predictions

9. Glossary

List of Tables

Table 2.1 Mechanisms of Car Cyber Attacks (Type, Description)

Table 2.2 List of Hackable Cars (Manufacturer, Model, Year Make)

Table 2.3 Media Coverage of Car Hacking (Source, Title)

Table 2.4 Summary of the SPY Car Act (Cyber Security Standards, Privacy Standards)

Table 3.1 Global Automotive Cyber Security Market Forecast 2018-2028 ($ Million, AGR %, CAGR%)

Table 3.2 Regional Automotive Cyber Security Market Forecast 2018-2028 ($mn, AGR %, CAGR%)

Table 3.3 Regional Automotive Cyber Security Market Percentage Change in Market Share 2018-2028 (PP Change)

Table 3.4 Global Automotive Cyber Security Market Drivers & Restraints 2018

Table 4.1 Global Automotive Cyber Security Submarket Forecast 2018-2028 ($ million, AGR%)

Table 4.2 Automotive Cyber Security Submarket Percentage Change in Market Share 2018-2028 (PP Change)

Table 4.3 Hardware Cyber Security Submarket Forecast 2018-2028 ($mn, AGR %, CAGR %)

Table 4.4 Software Cyber Security Submarket Forecast 2018-2028 (US$, AGR %, CAGR %)

Table 4.5 Network Cyber Security Submarket Forecast 2018-2028 ($mn, AGR %, CAGR %)

Table 4.6 Cloud Cyber Security Submarket Forecast 2018-2028 ($mn, AGR %, CAGR %)

Table 5.1 Leading 9 National Automotive Cyber Security Markets Forecast 2018-2028 ($ Mn, AGR%)

Table 5.2 Leading 9 National Automotive Cyber Security Markets CAGR Forecast 2018-2028 (CAGR %)

Table 5.3 China Country Profile 2016 (GDP $bn, GDP per Capita, Population mn, Internet users %, Car Sales or Registrations mn, Terrorism Index /10, Cyberwellness Index)

Table 5.4 China Automotive Cyber Security Market Forecast 2018-2028 ($mn, AGR %, CAGR%)

Table 5.5 China Automotive Cyber Security Market Drivers & Restraints 2018

Table 5.6 France Country Profile 2016 (GDP $bn, GDP per Capita $, Population mn, Internet users %, Annual online transactions $bn, Car Sales or Registrations mn, Terrorism Index /10, Cyberwellness Index)

Table 5.7 France Automotive Cyber Security Market Forecast 2018-2028 ($mn, AGR %, CAGR%)

Table 5.8 France Automotive Cyber Security Market Drivers & Restraints 2018

Table 5.9 Israel Country Profile 2016 (GDP $bn, GDP per Capita $, Population mn, Internet users %, Car Sales or Registrations mn, Terrorism Index /10, Cyberwellness Index)

Table 5.10 Israel Automotive Cyber Security Market Forecast 2018-2028 ($mn, AGR %, CAGR%)

Table 5.11 Israel Automotive Cyber Security Market Drivers & Restraints 2018

Table 5.12 Japan Country Profile 2016 (GDP $tn, GDP per Capita $, Population mn, Internet users %, Car Sales or Registrations mn, Terrorism Index /10, Cyberwellness Index)

Table 5.13 Japan Automotive Cyber Security Market Forecast 2018-2028 (US$, AGR %, CAGR%)

Table 5.14 Japan’s Proposed Cyber Security and Data Protection Requirements

Table 5.15 Functions, Threats and Countermeasure Techniques for in-Vehicle Systems

Table 5.16 Japan Automotive Cyber Security Market Drivers & Restraints 2018

Table 5.17 Russia Country Profile 2017 (GDP $tn, GDP per Capita $, Population mn, Internet users %, Car Sales or Registrations mn, Terrorism Index /10, Cyberwellness Index)

Table 5.18 Russia Automotive Cyber Security Market Forecast 2018-2028 ($mn, AGR %, CAGR%)

Table 5.19 Russia Automotive Cyber Security Market Drivers & Restraints 2018

Table 5.20 Germany Country Profile 2017 (GDP $tn, GDP per Capita $, Population mn, Internet users %, Car Sales or Registrations mn, Terrorism Index /10, Cyberwellness Index)

Table 5.21 Germany Automotive Cyber Security Market Forecast 2018-2028 ($mn, AGR %, CAGR%)

Table 5.22 Germany Proposed Requirements for Cyber and Information Security

Table 5.23 Germany Automotive Cyber Security Market Drivers & Restraints 2018

Table 5.24 S. Korea Country Profile 2017 (GDP $tn, GDP per Capita $, Population mn, Internet users %, Car Sales or Registrations mn, Terrorism Index /10, Cyberwellness Index)

Table 5.25 S. Korea Automotive Cyber Security Market Forecast 2018-2028 ($mn, AGR %, CAGR%)

Table 5.26 S. Korea Automotive Cyber Security Market Drivers & Restraints 2018

Table 5.27 US Country Profile 2017 (GDP $tn, GDP per Capita $, Population mn, Internet users %, Car Sales or Registrations mn, Terrorism Index /10, Cyberwellness Index)

Table 5.28 US Automotive Cyber Security Market Forecast 2018-2028 (US$, AGR %, CAGR%)

Table 5.29 NHTSA Reports to Support Automotive Cyber Security (Title, Description)

Table 5.30 US Automotive Cyber Security Market Drivers & Restraints 2018

Table 5.31 UK Country Profile 2017 (GDP $bn, GDP per Capita $, Population mn, Internet users %, Car Sales or Registrations mn, Terrorism Index /10, Cyberwellness Index)

Table 5.32 UK Automotive Cyber Security Market Forecast 2018-2028 ($mn, AGR %, CAGR%)

Table 5.33 UK Automotive Cyber Security Market Drivers & Restraints 2018

Table 6.1 Global Automotive Cyber Security Market SWOT Analysis 2018-2028

Table 7.1 Cisco Systems Profile 2017 (CEO, Total Company Sales US$m, Net Profit US$m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.2 Cisco Total Company Sales 2008-2015 (US$m, AGR %)

Table 7.3 Cisco Net Profit 2010-2017 (US$m, AGR %)

Table 7.4 Cisco Cost of Research & Development 2010-2017 ($m, AGR %)

Table 7.5 Cisco Sales by Region 2010-2017 ($m, AGR %)

Table 7.6 Cisco Number of Employees 2012-2017 (No. of Employees, AGR %)

Table 7.7 Cisco Acquisitions (Date, Company Involved, Value US$m, Details)

Table 7.8 Intel Corporation Profile 2016 (CEO, Total Company Sales US$m, Net Profit US$m, HQ, Founded, No. of Employees, Ticker, Website)

Table 7.9 Intel Corporation Total Company Sales 2008-2016 ($m, AGR %)

Table 7.10 Intel Corporation Net Profit 2010-2016 (US$m, AGR %)

Table 7.11 Intel Corporation Cost of Research & Development 2010-2016 (US$m, AGR %)

Table 7.12 Intel Corporation Sales by Segment of Business,2016 ( %)

Table 7.13 Intel Corporation Number of Employees 2010-2016 (No. of Employees, AGR %)

Table 7.14 Intel Corporation Acquisitions 2007-2017 (Date, Company Involved, Value US$m, Details)

Table 7.15 Symantec Corporation Profile 2017 (CEO, Total Company Sales US$m, Net Profit US$m, Net Capital Expenditure US$m, HQ, Founded, IR Contact, No. of Employees, Ticker, Website)

Table 7.16 Symantec Total Company Sales 2015-2017 (US$m, AGR %)

Table 7.17 Symantec Number of Employees 2010-2017 (No. of Employees, AGR %)

Table 7.18 Symantec Acquisitions 2005-2017 (Date, Company Involved, Value US$m, Details)

Table 7.19 Key Features of Symantec Embedded Security: Critical System Protection

Table 7.20 Symantec Device Certificate Service (Features, Benefits)

Table 7.21 Features of Symantec Anomaly Detection

Table 7.22 Symantec Secure Application Service (Features, Benefits)

Table 7.23 Full List of Symantec Security Products for Connected Car Market

Table 7.24 IBM Profile 2017 (CEO, Total Company Sales US$m, Net Profit US$m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.25 IBM Total Company Sales 2008-2017 (US$m, AGR %)

Table 7.26 IBM Net Profit 2010-2017 ($m, AGR %)

Table 7.27 IBM Cost of Research & Development 2010-2017 (US$m, AGR %)

Table 7.28 IBM Sales by Geographical Location 2010-2017 (US$m, AGR %)

Table 7.29 IBM Number of Employees 2010-2017 (No. of Employees, AGR %)

Table 7.30 IBM Acquisitions (Date, Company Involved, Value US$m, Details)

Table 7.31 Features of the Secure Gateway ECU

Table 7.32 IBM and G&D End-to-End Solutions Platform for Connected Cars (Component, Description)

Table 7.33 Harman International Profile 2016 (CEO, Total Company Sales US$m, Net Profit US$m, HQ, Founded, No. of Employees, Ticker, Website)

Table 7.34 Harman Total Company Sales 2011-2016 (US$m, AGR %)

Table 7.35 Harman Net Income 2011-2016 (US$m, AGR %)

Table 7.36 Harman Number of Employees 2012-2016 (No. of Employees, AGR %)

Table 7.37 Harman Acquisitions Activity 2011-2016 (Date, Company, Value US$m, Details)

Table 7.38 Harman 5+1 Automotive Security Framework (Layer, Description)

Table 7.39 Harman Redbend’s Automotive Security Solution (Security type, Description

Table 7.40 TowerSec’s ECUSHIELD Properties (Features, Highlights, Description)

Table 7.41 TowerSec’s TCUSHIELD Properties (Features, Highlights, Description)

Table 7.42 NXP Semiconductors Profile 2016 (CEO, Total Company Sales US$m, Net Profit US$m, HQ, Founded,

Table 7.43 NXP Total Company Sales 2010-2016 (US$m, AGR %)

Table 7.44 NXP Cost of R&D 2010-2016 (US$m, AGR %)

Table 7.45 NXP Sales by Business Segment 2010-2016 (US$m, AGR %)

Table 7.46 NXP Sales by Geographic Location 2010-2016 (US$m, AGR %)

Table 7.47 NXP Number of Employees 2010-2016 (US$m, AGR %)

Table 7.48 NXP Acquisitions Activity 2010-2017 (Date, Company, Value US$m, Details)

Table 7.49 NXP’s 4+1 Layer Security Framework (Layer, Description)

Table 7.50 Infineon Technologies AG Profile 2017 (CEO, Total Company Sales US$m, Net Profit US$m, HQ, Founded, No. of Employees, Ticker, Website)

Table 7.51 Infineon Net Income 2011-2017 (US$m, AGR %)

Table 7.52 Infineon Cost of R&D 2011-2017 (US$m, AGR %)

Table 7.53 Infineon Acquisitions Activity 2004-2016 (US$m, AGR %)

Table 7.54 Argus In-Vehicle Network Protection Products (In-Vehicle Network Protection Product Name, Description, Features)

Table 7.55 Argus ECU Protection Products (ECU Protection Product Name, Description, Features)

Table 7.56 Argus Lifespan Protection Products (Lifespan Protection Product Name, Description, Features)

Table 7.57 Argus Aftermarket Protection Products (Aftermarket Protection Product Name, Description, Features)

Table 7.58 Karamba’s Carwall Solution (Layer, Description)

Table 7.59 Other Leading Companies in the Automotive Cyber Security Market (Company Name, Headquarter

List of Figures

Figure 1.1 Global Automotive Cyber Security Market Segmentation Overview

Figure 2.1 Common Stages of Cyber Attacks

Figure 2.2 Top Impacting Factors

Figure 2.3 Porters Five Forces Analysis

Figure 2.4 Value Chain Analysis

Figure 3.1 Global Automotive Cyber Security Market Forecast 2018-2028 ($mn, AGR %)

Figure 3.2 Automotive Cyber Security Regional Coverage (Region)

Figure 3.3 Regional Automotive Cyber Security Market Forecast 2018-2028 (US$mn)

Figure 3.4 Regional Automotive Cyber Security Market AGR Forecast 2018-2028 (AGR%)

Figure 3.5 Regional Automotive Cyber Security Market Percentage Change in Market Share 2018-2028 (% Change)

Figure 3.6 Regional Automotive Cyber Security Market Share Forecast 2018 (%)

Figure 3.7 Regional Automotive Cyber Security Market Share Forecast 2023 (%)

Figure 3.8 Regional Automotive Cyber Security Market Share Forecast 2028 (%)

Figure 4.1 Global Automotive Cyber Security Submarket Share Forecast 2018 (% Share)

Figure 4.2 Global Automotive Cyber Security Submarket Share Forecast 2028 (% Share)

Figure 4.3 Automotive Cyber Security Submarket Percentage Change in Market Share 2018-2028 (% Change)

Figure 4.4 Hardware Cyber Security Submarket Forecast 2018-2028 ($mn, AGR %)

Figure 4.5 Software Cyber Security Submarket Forecast 2018-2028 ($Mn, AGR %)

Figure 4.6 Network Cyber Security Submarket Forecast 2018-2028 ($mn, AGR %)

Figure 4.7 Cloud Cyber Security Submarket Forecast 2018-2028 (US$mn, AGR %)

Figure 5.1 Leading 9 National Automotive Cyber Security Markets CAGR Forecast 2018-2028 (CAGR %)

Figure 5.2 Leading 9 National Automotive Cyber Security Markets Share Forecast 2017 (% Share)

Figure 5.3 Leading 9 National Automotive Cyber Security Markets Share Forecast 2023 (% Share)

Figure 5.4 Leading 9 National Automotive Cyber Security Markets Share Forecast 2028 (% Share)

Figure 5.5 China Automotive Cyber Security Market Forecast 2018-2028 ($mn, AGR %)

Figure 5.6 France Automotive Cyber Security Market Forecast 2018-2028 ($mn, AGR %)

Figure 5.7 Israel Automotive Cyber Security Market Forecast 2018-2028 (US$mn, AGR %)

Figure 5.8 Japan Automotive Cyber Security Market Forecast 2018-2028 (US$mn, AGR %)

Figure 5.9 Trojan Attacks Comparison 2016 vs 2015 (%)

Figure 5.10 Russia Automotive Cyber Security Market Forecast 2018-2028 (US$mn, AGR %)

Figure 5.11 Germany Automotive Cyber Security Market Forecast 2018-2028 ($mn, AGR %)

Figure 5.12 S. Korea Automotive Cyber Security Market Forecast 2018-2028 (US$mn, AGR %)

Figure 5.13 US Automotive Cyber Security Market Forecast 2018-2028 ($mn, AGR %)

Figure 5.14 UK Automotive Cyber Security Market Forecast 2018-2028 ($mn, AGR %)

Figure 5.15 Vehicle Internet Connectivity

Figure 7.1 Cisco Total Company Sales 2008-2017 ($m, AGR %)

Figure 7.2 Cisco Sales by Segment of Business, 2017 (% Share)

Figure 7.3 Cisco Sales by Region, 2017 (%)

Figure 7.4 Cisco Organisational Structure 2018

Figure 7.5 Intel Corporation Total Company Sales 2008-2016 ($m, AGR %)

Figure 7.6 Intel Corporation Sales by Segment of Business,2016 ( %)

Figure 7.7 Intel Corporation Sales by Country,2016 (%)

Figure 7.8 Symantec Total Company Sales 2015-2017($m, AGR %)

Figure 7.9 Symantec Sales by Region 2017 (%)

Figure 7.10 Symantec Organisational Structure

Figure 7.11 IBM Total Company Sales 2008-2017 ($m, AGR %)

Figure 7.12 IBM Sales by Segment of Business, 2017 (%)

Figure 7.13 IBM Sales by Geographical Location, 2017 (%)

Figure 7.14 IBM Organisational Structure

Figure 7.15 Harman Total Company Sales 2011-2016 (US$m, AGR %)

Figure 7.16 Harman Organisational Structure

Figure 7.17 NXP Total Company Sales 2010-2016 (US$m, AGR %)

Figure 7.18 NXP Sales by Business Segment, 2016 (%)

Figure 7.19 NXP Sales by Geographic Location 2010-2016 (US$m, AGR %)

Figure 7.20 Infineon Total Company Sales 2011-2017 (US$m, AGR %)

1 Mainstream Inc

4FrontSecurity

Acano Limited

ADMtek

Agile 3 Solutions

Airbus

Alchemy API

Alienvault

Allianz

Allianz Ventures

Altera

Altiris

AMX LCC

AppStream

Argus Cyber Security Ltd

Arilou

Aspera inc.

Assemblage

AT&T

Audi

Baidu

Bang & Olufsen

Bindview Development Corporation

Blackfin Security

Blue Box Group Inc.

Blue Coat

BMW

BT Assure Threat Defence

BT Group

BT Security

Bull

Cadillac

Catena

Chrysler

Cisco Systems Inc.

Citroen

ClearLeap

Clearwell Systems

Cleversafe

Cloudant

Cloudigo

Code Red Technologies

Cognitive Security

Collaborate.com

Comneon

Company-I

Composite Software

CrossIdeas

CSL International

Daeja Image Systems Ltd

Daimler AG

Delphi

Denso

Dodge

Elektrobit Automotive GmbH

Embrane

Escrypt

Explorys

Eyal Gura

Fiat Chrysler Automobiles

Fiberlink Communications

Ford

Freescale Semiconductors (FSL)

Gemalto

General Motors (GM)

Gideon Technologies

Giesecke & Devrient (G&D)

Google Inc.

Gravitant

Harman international

Havok

Healthcare Incorporated

Honda

Honeywell

Hyundai Motor Co

IAB

IBM

Imlogic Inc

Infineon Technologies

Infinity

Insieme Networks

Intel

Intel Security Group

International Business Machines (IBM) Corporation

International Rectifier

Intucell

Jeep

Jennic

JouleX

Karamba Security

Kaspersky Lab

Kia

KT

Lancope, Inc

Lear Corp

Lenovo

Lexus

LifeLock

Lighthouse Security Group, LLC

LiveOffice

Lockheed Martin

Logic

Lotus Engineering

Magma Venture Partners

Magna International

Mahindra

MaintenanceNet

Marvell

Mazda

McAfee

Memoir Systems

Mercedes-Benz

MessageLabs

Metacloud

Meteorix LLC

Mi5 Networks

Microsoft

Mitsubishi

Mobileye

Motus Ventures

MWM Acoustics

NCC Group

Neophis

Nissan

NitroDesk

NitroSecurity

Nokia Growth Partners (NGP)

Northrop Grumman

Now Factory

nSuite

Nukona

nVidia

NXP Semiconductors

Observable Network

Opel

OpenDNS

Oracle

Orange

OurCrowd

ParStream

PasswordBank

Pawaa

PC

Penta Security

PGP Corporation

Phytel

PistonCloud Computing

Porsche

Portcullis Computer

PSA Peugeot Citroën

Qualcomm Technologies Inc.,

RAD Group

Range Rover

Raytheon

Recon Instruments

Redbend

Relicore Inc.

Renault

Renesas Electronics Corporation

Safran

Sahil International

Samsung Electronics Co.

SBD & NCC

SBI Holdings

Secunet AG

Secure Computing

Security Group

Security InMotion

Security Innovation

Sentrigo

Silveerpop

Simics

Skoda

Skyport Systems, Inc.

SoftLayer

SoftScan

SolveDirect

Sony Pictures

Sophos

SourceFire Inc

Ssangyong

Star Analytics Inc

STMicroelectronics (STM)

StrongLoop

Subaru

Suzuki

SwapDrive

Sygate Technology

Sygic

Symantec Corporation

Symphony Teleca

Tail-f Systems

TalkTalk

Tata

TCS tata consultancy services

Telefonica

Telenor

Tesla

Thales

The Weather Company

ThreatGrid

TomTom

Tools

Toshiba

TowerSec

Toyota

Transparent

Trend Micro

Trillium Inc.

Tropo

Trusteer

Ubiquisys

UrbanCode Inc.

Utimaco

Vedecom Tech

VeriSign

Veritas

Verizon

Vertex Ventures

Virtutech

Visteon

Vivant

Volkswagen Group

Vontu

VW Data:Lab

WHIPTAIL

WholeSecurity

Wind River Systems

Wolfspeed

Xtify Inc

XtreamLok

ZiiLabs

Zohar ZIsapel

Organisations mentioned

5th Dimension Cyber Army

Agence National de la Security des Systemes d’Information (ANSSI)

Alliance for Cyber-Security

Alliance of Automobile Manufacturers

ASRB’s Technical Steering Committee (TSC)

Association of Global Automakers

Auto-ISAC Association

Automotive Cyber Security Committee (China)

Automotive Security Review Board (ASRB)

Bank of England

Beer Sheva’s Ben-Gurion University

CanBusHack, Inc.

CEN

Central Committee and General Office of the State Council

CERT-BUND

Chinese CERT

Cyber Command

Cyber War Centre

Cyberspace Administration of China (CAC)

ETSI

European Commission

European Parliament

Federal Bureau of Investigation (FBI)

Federal Office for Information Security (BSI)

Federal Trade Commission (FTC)

GCHQ

General Office of the Communist Party of China (CPC)

German Federal Motor Authority

GSMA

Inchon Airport

Information Sharing and Analysis Centre (ISAC)

Israel Defence Forces (IDF) cyber force

Israel National Cyber Bureau

ITS Connect Promotion Consortium

ITU

Korea Communications Commission (KCC)

Michigan Research Institute

Ministry of Industry and Information Technology (China)

Moscow Engineering Physics Institute

National Centre of Incident Readiness and Strategy for Cyber Security (NISC)

National Cyber Bureau

National Cyber investigative Joint Task Force (NCIJTF)

National Cyber Response Centre

National Cyber Security Authority

National Highway Traffic Safety Administration (NHTSA)

National Highway Traffic Safety Administration (NHTSA)

National Institute of Information and Communications Technology (NICT)

National Institute of Standards and Technology (NIST)

National Intelligence Service.

National Protection and Programs Directorate (NPPD)

National Security Council (NSC)

NCSC

Nonghyup Cooperative

OECD

OFCOM Telecom Regulation and the Information Commissioner

Office of Cyber and infrastructure Analysis (OCIA)

Russian Ministry of Defence

Society of Automotive Engineers of China

South Korean National Assembly’s Public Administration & Security Committee

The Control Systems Security Centre (CSSC)

The Information Technology Promotion Agency (IPA)

The Ministry of Defence (MoD) i

The Ministry of Economy, Trade and Industry (METI)

The Ministry of internal Affairs and Communications (MIC)

The National Police Agency

The Office of Cybersecurity and Communications (CS&C)

Unit 8200

United Nations

United Nations Economic Commission for Europe

UP KRITIS

US Alliance of Automobile Manufacturers

US Defense Information Systems Agency (DISA)

US Department of Defense (DoD)

US Department of Homeland Security (DHS)

US Department of Justice

US Department of Transportation (DoT)

US National Security Agency (NSA)

World Economic Forum

Download sample pages

Complete the form below to download your free sample pages for Automotive Cyber Security Market Report 2018-2028

Related reports

-

Automotive Advanced Driver Assistance Systems (ADAS) Market Report 2018-2028

The world market for Automotive Advanced Driver Assistance Systems (ADAS) will record revenues of $38.4bn in 2018.

...Full DetailsPublished: 06 July 2018 -

Industrial Internet of Things (IIoT) Market Report 2018-2028

Visiongain has produced an in-Depth market research report studying the Industrial Internet of Things, analysing the rapid growth of this...

Full DetailsPublished: 01 May 2018 -

Cyber Insurance Market Report 2017-2027

Our 164-page report provides 113 tables, charts, and graphs. Read on to discover the most lucrative areas in the industry...

Full DetailsPublished: 30 October 2017 -

Cyber Security Market Report 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global Cyber Security market. Visiongain assesses that...

Full DetailsPublished: 13 July 2018 -

Oil & Gas Cyber Security Market 2017-2027

This latest report by business intelligence provider Visiongain assesses that oil & gas cyber security spending will reach $31.45bn in...

Full DetailsPublished: 17 March 2017 -

Biometric Vehicle Access Technologies Market Report 2019-2029

The $574.3m Biometric Vehicle Access Technologies market is expected to flourish in the next few years because of growing security...

Full DetailsPublished: 19 February 2019 -

Automotive Over the Air (OTA) Updates Market Report 2020-2030

As part of the broader $1,823.4 automotive over the air (OTA) updates market space, there are massive revenue streams within...

Full DetailsPublished: 23 March 2020 -

Automotive Vehicle to Everything (V2X) Communications Market 2018-2028

You will receive a highly granular market analysis segmented by region, by subsector and by end use, providing you with...Full DetailsPublished: 02 February 2018 -

Aviation Cyber Security Market Forecast 2017-2027

Developments in aviation cyber security have had a significant impact on the wider aviation and cyber security markets. Visiongain’s report...

Full DetailsPublished: 31 July 2017 -

Automotive Over the Air (OTA) Updates Market Report 2019-2029

Automotive OTA Updates market set to reach $1.71bn in 2019.

...Full DetailsPublished: 04 February 2019

Download sample pages

Complete the form below to download your free sample pages for Automotive Cyber Security Market Report 2018-2028

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain automotive reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and automotive industry experts but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain automotive reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

Alliance of Automobile Manufacturers (USA)

Association of Russian Automakers

Audio Video Bridging (AVB)

China Association Of Automoblie Manufacturers

European Association of Automotive Suppliers

European Automobile Manufacturers’ Association

European Council for Automotive Research and Development

Former Society of Automotive Engineers

German Association of the Automotive Industry

International Organization of Motor Vehicle Manufacturers

In-Vehicle Infotainment (IVI)

Italian Association of the Automotive Industry

Japan Automobile Manufacturers Association

One-Pair Ether-Net

Society of Indian Automobile Manufacturers (SIAM)

Society of Motor Manufacturers and Traders

The International Council For Clean Transport

US National Highway Traffic Safety Administration

Latest Automotive news

Visiongain Publishes Connected Vehicle Market Report 2024-2034

The global Connected Vehicle market was valued at US$82.67 billion in 2023 and is projected to grow at a CAGR of 14.7% during the forecast period 2024-2034.

24 April 2024

Visiongain Publishes Automotive Electronics Market Report 2024-2034

The global Automotive Electronics market was valued at US$270.7 million in 2023 and is projected to grow at a CAGR of 8.7% during the forecast period 2024-2034.

15 April 2024

Visiongain Publishes Automobile AI and Generative Design Market Report 2024-2034

The global Automobile AI and Generative Design market was valued at US$630.7 million in 2023 and is projected to grow at a CAGR of 19% during the forecast period 2024-2034.

02 April 2024

Visiongain Publishes Vehicle to Grid (V2G) Market Report 2024-2034

The global Vehicle to Grid (V2G) market was valued at US$3,391 million in 2023 and is projected to grow at a CAGR of 27.6% during the forecast period 2024-2034.

08 March 2024