Industries > Energy > Small Scale Liquefied Natural Gas (LNG) Market Forecast 2019-2029

Small Scale Liquefied Natural Gas (LNG) Market Forecast 2019-2029

Forecast by Capex ($mn) and Capacity (MTPA), by Type (Liquefaction, Regasification, Satellite Station, Bunkering Facilities for Vessels & Fueling), by Geography, Plus Profiles of Leading Companies Small Scale Liquefied Natural Gas (LNG) Market

Visiongain has calculated that the global Small Scale Liquefied Natural Gas (LNG) Market will see a capital expenditure (CAPEX) of $5,539mn in 2019. Read on to discover the potential business opportunities available.

Small Scale LNG is used to supply small or isolated demand centers not connected to pipeline infrastructure, small scale LNG infrastructure is now increasingly deployed to cater to the growing demand for LNG as a transport fuel.

Natural gas can be transported from gas production centers to consumption centers in the form of liquefied natural gas (LNG) through ships and pipelines. Natural gas can be transported in ships and trucks to locations that are not connected to pipelines. Transportation of LNG takes place between exporting terminal (liquefaction plant) to importing terminal (regasification plant).

Small scale liquefaction and regasification infrastructure are ideally placed to assist with the development of stranded assets, the supply of remote residential and commercial demand centers but also the provision of LNG as a fuel.

LNG adoption is rapidly increasing due to the fact that natural gas is a competitive and environment-friendly option when compared to other fossil fuel sources. Small-scale LNG import terminals are primarily designed to serve the fuel requirements of a particular industry such as power generation and/or functions as a hub for ship and truck fueling. The risks associated with the development of large LNG facilities are significantly high when compared to small-scale terminals.

Small-scale LNG import terminals are the most economical option for such nations which have just started adopting LNG as a fuel in their respective industries. Several small nations are importing or planning to import LNG in small quantities specifically to cater to the feeling requirements of the power generation industry.

Several nations such as the Dominican Republic have just started importing LNG in small quantities to fulfil some of their industrial requirements. Such countries do not prefer importing large shipments of LNG as the demand for natural gas is still in the nascent stages in these nations.

The global market for small scale LNG is driven by high levels of spending in established and emerging markets. An important share of future capital expenditure will be driven by the greater deployment of LNG as a fuel, and growing investment in small scale LNG carriers.

Visiongain’s global Small Scale Liquefied Natural Gas (LNG)) Market report can keep you informed and up to date with the developments in the market, across six different nations: China, Indonesia, Japan, U.S, Europe and Rest of the World

With reference to this report, it details the key investments trend in the global market, subdivided by regions, capital expenditure and equipment. Through extensive secondary research and interviews with industry experts, visiongain has identified a series of market trends that will impact the Small Scale Liquefied Natural Gas (LNG) Market over the forecast timeframe.

The report will answer questions such as:

• How is the Small Scale Liquefied Natural Gas (LNG) market evolving?

• What is driving and restraining the Small Scale Liquefied Natural Gas (LNG) market dynamics?

• How will each technology in Small Scale Liquefied Natural Gas (LNG segment grow over the forecast period and how much sales will these submarkets account for in 2029?

• How will market shares of each the Small Scale Liquefied Natural Gas (LNG) submarket develop from 2019-2029?

• Which individual technologies will prevail and how will these shifts be responded to?

• Which Small Scale Liquefied Natural Gas (LNG) submarket will be the main driver of the overall market from 2019-2029?

• How will political and regulatory factors influence regional the Small Scale Liquefied Natural Gas (LNG) market and submarkets?

• Will leading national the Small Scale Liquefied Natural Gas (LNG) market broadly follow macroeconomic dynamics, or will individual country sectors outperform the rest of the economy?

• How will market shares of the national markets change by 2029 and which nation will lead the market in 2029?

• Who are the leading players and what are their prospects over the forecast period?

• How will the sector evolve as alliances form during the period between 2019 and 2029?

Five Reasons Why You Must Order and Read This Report Today:

1) The study analyses the Small Scale Liquefied Natural Gas (LNG) 2019-2029 Market in terms of:

– CAPEX ($ mn)

– Capacity MTPA)

2) The report provides Forecasts for the Small Scale Liquefied Natural Gas (LNG) Market by Type, for the period 2019-2029

– Small Scale Regasification Forecast 2019-2029

– Small Scale Liquefaction Forecast 2019-2029

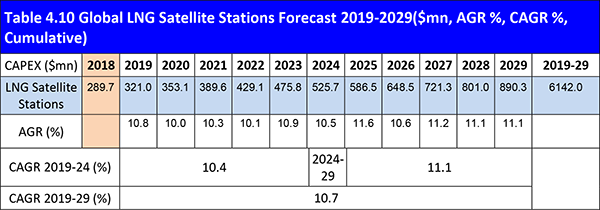

– LNG Satellite Stations Forecast 2019-2029

– LNG Bunkering Facilities for Vessels Forecast 2019-2029

– Fueling Forecast 2019-2029

3) The report also Forecasts and Analyses the Small Scale Liquefied Natural Gas (LNG) Market by Geography from 2019-2029

China Small Scale LNG Market Forecast 2019-2029

– Small Scale Regasification Forecast 2019-2029

– Small Scale Liquefaction Forecast 2019-2029

– LNG Satellite Stations Forecast 2019-2029

– LNG Bunkering Facilities for Vessels Forecast 2019-2029

– Fueling Forecast 2019-2029

U.S Small Scale LNG Market Forecast 2019-2029

– Small Scale Regasification Forecast 2019-2029

– Small Scale Liquefaction Forecast 2019-2029

– LNG Satellite Stations Forecast 2019-2029

– LNG Bunkering Facilities for Vessels Forecast 2019-2029

– Fueling Forecast 2019-2029

Europe Small Scale LNG Market Forecast 2019-2029

– Small Scale Regasification Forecast 2019-2029

– Small Scale Liquefaction Forecast 2019-2029

– LNG Satellite Stations Forecast 2019-2029

– LNG Bunkering Facilities for Vessels Forecast 2019-2029

– Fueling Forecast 2019-2029

Indonesia Small Scale LNG Market Forecast 2019-2029

– Small Scale Regasification Forecast 2019-2029

– Small Scale Liquefaction Forecast 2019-2029

– LNG Satellite Stations Forecast 2019-2029

– LNG Bunkering Facilities for Vessels Forecast 2019-2029

– Fueling Forecast 2019-2029

Japan Small Scale LNG Market Forecast 2019-2029

– Small Scale Regasification Forecast 2019-2029

– Small Scale Liquefaction Forecast 2019-2029

– LNG Satellite Stations Forecast 2019-2029

– LNG Bunkering Facilities for Vessels Forecast 2019-2029

– Fueling Forecast 2019-2029

Rest of the World Small Scale LNG Market Forecast 2019-2029

– Small Scale Regasification Forecast 2019-2029

– Small Scale Liquefaction Forecast 2019-2029

– LNG Satellite Stations Forecast 2019-2029

– LNG Bunkering Facilities for Vessels Forecast 2019-2029

– Fueling Forecast 2019-2029

4) The report lists Extensive Details and Analysis of Global Projects in the Small Scale Liquefied Natural Gas (LNG) Market including:

– Region

– Country

– Project Name

– Terminal Type

– Type

– Terminal Operator

– Project Throughput (Tons/Annum)

– Current Status

– Commissioning Date

5) The report provides Detailed Profiles of The Leading Companies Operating within the Small Scale Liquefied Natural Gas (LNG) Market:

– Gasnor Shell

– Gasum

– Gazprom

– Wartsila

– Prometheus Energy Company

– Petronas

– EcoElectrica Inc.

– Air Products and Chemicals, Inc.

– ENN Energy Holdings Limited

– Sinopec

This independent 170-page report guarantees you will remain better informed than your competitors. With 105 tables and figures examining the Small Scale Liquefied Natural Gas (LNG) market space, the report gives you a direct, detailed breakdown of the market. PLUS, Capital expenditure and Capacity by type and geography, as well as in-depth analysis of leading companies in the Small Scale Liquefied Natural Gas (LNG) market from 2019-2029 that will keep your knowledge that one step ahead of your rivals.

This report is essential reading for you or anyone in the Energy sector. Purchasing this report today will help you to recognise those important market opportunities and understand the possibilities there. I look forward to receiving your order.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1. Report Overview

1.1 Small Scale Liquefied Natural Gas (LNG) Market Overview

1.2 Market Structure Overview and Market Definition

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report Include

1.6 Who is This Report For?

1.7 Methodology

1.7.1 Primary Research

1.7.2 Secondary Research

1.7.3 Market Evaluation & Forecasting Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to the Small Scale Liquefied Natural Gas (LNG) Market

2.1 Global Small-Scale LNG Market Structure

2.2 Market Definition

2.3 Small Scale LNG Industry Outlook

2.4 Small Scale LNG- Value Chain Analysis

3. Global Overview of Small Scale Liquefied Natural Gas (LNG) Market 2019-2029

3.1 Global Small Scale Liquefied Natural Gas (LNG), Market Attractiveness Analysis

3.2 Global Small Scale Liquefied Natural Gas (LNG) Market Drivers and Restraints

4. Small Scale Liquefied Natural Gas (LNG) Submarkets Forecasts 2019-2029

4.1 Global Small Scale Liquefied Natural Gas (LNG) Submarkets Forecast, by Type 2019-2029

4.1.1 Global Small Scale Regasification Forecast 2019-2029

4.1.1.1 Global Small Scale Regasification Drivers and Restraints

4.1.2 Global Small Scale Liquefaction Forecast 2019-2029

4.1.2.1 Global Small Scale Liquefaction Drivers and Restraints

4.1.3 Global LNG Satellite Stations Forecast 2019-2029

4.1.3.1 Global LNG Satellite Stations Drivers and Restraints

4.1.4 Global LNG Bunkering Facilities for Vessels Forecast 2019-2029

4.1.4.1 Global LNG Bunkering Facilities for Vessels Drivers and Restraints

4.1.5 Global Fueling Forecast 2019-2029

4.1.5.1 Global Fueling Drivers and Restraints

5. Leading National Small Scale Liquefied Natural Gas (LNG) Market Forecast 2019-2029

5.1 China Small Scale Liquefied Natural Gas (LNG) Market 2019-2029

5.1.1 China Small Scale Liquefied Natural Gas (LNG) Submarket Forecast 2019-2029

5.1.2 China Small Scale Liquefied Natural Gas (LNG) Market Analysis

5.2 Indonesia Small Scale Liquefied Natural Gas (LNG) Market 2019-2029

5.2.1 Indonesia Small Scale Liquefied Natural Gas (LNG) Submarket Forecast 2019-2029

5.2.2 Indonesia Small Scale Liquefied Natural Gas (LNG) Market Analysis

5.3 Japan Small Scale Liquefied Natural Gas (LNG) Market 2019-2029

5.3.1 Japan Small Scale Liquefied Natural Gas (LNG) Submarket Forecast 2019-2029

5.3.2 Japan Small Scale Liquefied Natural Gas (LNG) Market Analysis

5.4 U.S. Small Scale Liquefied Natural Gas (LNG) Market 2019-2029

5.4.1 U.S. Small Scale Liquefied Natural Gas (LNG) Submarket Forecast 2019-2029

5.4.2 U.S. Small Scale Liquefied Natural Gas (LNG) Market Analysis

5.5 Europe Small Scale Liquefied Natural Gas (LNG) Market 2019-2029

5.5.1 Europe Small Scale Liquefied Natural Gas (LNG) Submarket Forecast 2019-2029

5.5.2 Europe Small Scale Liquefied Natural Gas (LNG) Market Analysis

5.6 Rest of the World Small Scale Liquefied Natural Gas (LNG) Market 2019-2029

5.6.1 Rest of the World Small Scale Liquefied Natural Gas (LNG) Submarket Forecast 2019-2029

5.6.2 Rest of the World Small Scale Liquefied Natural Gas (LNG) Market Analysis

6. PEST Analysis of the Small Scale Liquefied Natural Gas (LNG) 2019-2029

7. Expert Opinion

7.1 Primary Correspondents

7.2 Small Scale LNG Market Outlook

7.3 Drivers & Restraints

7.4 Dominant Region in the Small Scale LNG Market

7.5 By Type Market Scenario

7.6 Overall Growth Rate

8. Leading Companies in Small Scale Liquefied Natural Gas (LNG) Market

8.1 Gasnor Shell

8.1.1 Gasnor Shell Company Analysis

8.1.2 Gasnor Shell Company Outlook

8.2 Gasum

8.2.1 Gasum Company Analysis

8.2.2 Gasum Company Outlook

8.3 Gazprom

8.3.1 Gazprom Company Analysis

8.3.2 Gazprom Company Outlook

8.4 Wartsila

8.4.1 Wartsila Company Analysis

8.4.2 Wartsila Company Outlook

8.5 Prometheus Energy Company

8.5.1 Prometheus Energy Company Analysis

8.5.2 Prometheus Energy Company Outlook

8.6 PETRONAS

8.6.1 PETRONAS Company Analysis

8.6.2 PETRONAS Company Outlook

8.7 EcoElectrica Inc.

8.7.1 EcoElectrica Inc. Company Analysis

8.7.2 EcoElectrica Inc. Company Outlook

8.8 Air Products and Chemicals, Inc.

8.8.1 Air Products and Chemicals, Inc. Company Analysis

8.9 ENN Energy Holdings Limited

8.9.1 ENN Energy Holdings Limited Company Analysis

8.9.2 ENN Energy Holdings Limited Company Outlook

8.10 Sinopec Corp.

8.10.1 Sinopec Corp. Company Analysis

9. Conclusion & Recommendations

10. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

table 1.1 The Small Scale LNG market by regional market forecast 2019-2029 ($ mn, mtpa, AGR %, CAGR)

table 3.1 Global Small Scale liquefied natural gas (LNG) market, by region forecast 2019-2029 ($mn, AGR %, CAGR %, cumulative)

table 3.2 Global Small Scale liquefied natural gas (LNG) capacity, by region forecast 2019-2029 (mtpa, AGR %, CAGR %, cumulative)

table 3.3 Global Small Scale liquefied natural gas (LNG) market drivers and restraints

table 4.1 Global Small Scale liquefied natural gas (LNG) market forecast 2019-2029($mn, AGR %, cumulative)

table 4.2 Global Small Scale regasification forecast 2019-2029 ($mn, AGR %, CAGR %, cumulative)

table 4.3 Small Scale regasification operational projects examples (plant name, country, start date, company, status)

table 4.4 Small Scale regasification projects examples (plant name, location, country, receiving capacity, start date, company, status)

table 4.5 Global Small Scale regasification drivers and restraints

table 4.6 Global Small Scale liquefaction forecast 2019-2029($mn, AGR %, CAGR %, cumulative)

table 4.7Small Scale liquefaction projects examples (name, country, start date, company, status)

table 4.8 Small Scale liquefaction projects examples (name, country, liquefaction capacity, start date, company, status)

table 4.9 Global Small Scale liquefaction drivers and restraints

table 4.10 Global LNG satellite stations forecast 2019-2029($mn, AGR %, CAGR %, cumulative)

table 4.11 Global LNG satellite stations drivers and restraints

table 4.12 Global LNG bunkering facilities for vessels forecast 2019-2029($mn, AGR %, CAGR %, cumulative)

table 4.13operational LNG bunkering facilities for vessels (name, location, country, company, date, notes)

table 4.14operational LNG bunkering facilities for vessels (name, location, country, company, date, notes)

table 4.15 Global LNG bunkering facilities for vessels drivers and restraints

table 4.16 Global fueling forecast 2019-2029($mn, AGR %, CAGR %, cumulative)

table 4.17 LNG refueling stations (station name, year built, country, location, operator)

table 4.18 Global fueling drivers and restraints

table 5.1 Leading national Small Scale liquefied natural gas (LNG) market forecast 2019-2029($mn, AGR)

table 5.2 Leading national Small Scale liquefied natural gas (LNG) market capacity forecast 2019-2029 (mtpa, AGR %)

table 5.3 China Small Scale liquefied natural gas (LNG) market& capacity forecast 2019-2029($mn, mtpa, AGR %, CAGR %, cumulative)

table 5.4 China Small Scale liquefied natural gas (LNG) market, by type forecast 2019-2029($mn, AGR %, CAGR %, cumulative)

table 5.5 Indonesia Small Scale liquefied natural gas (LNG) market& capacity forecast 2019-2029($mn, mtpa, AGR %, CAGR %, cumulative)

table 5.6 Indonesia Small Scale liquefied natural gas (LNG) market, by type forecast 2019-2029($mn, AGR %, CAGR %, cumulative)

table 5.7 Japan Small Scale liquefied natural gas (LNG) market& capacity forecast 2019-2029($mn, mtpa, AGR %, CAGR %, cumulative)

table 5.8 Japan Small Scale liquefied natural gas (LNG) market, by type forecast 2019-2029($mn, AGR %, CAGR %, cumulative)

table 5.9 U.S. Small Scale liquefied natural gas (LNG) market& capacity forecast 2019-2029($mn, mtpa, AGR %, CAGR %, cumulative)

table 5.10 U.S. Small Scale liquefied natural gas (LNG) market, by type forecast 2019-2029($mn, AGR %, CAGR %, cumulative)

table 5.11 Europe Small Scale liquefied natural gas (LNG) market& capacity forecast 2019-2029($mn, mtpa, AGR %, CAGR %, cumulative)

table 5.12 Europe Small Scale liquefied natural gas (LNG) market, by type forecast 2019-2029($mn, AGR %, CAGR %, cumulative)

table 5.13 rest of the world Small Scale liquefied natural gas (LNG) market& capacity forecast 2019-2029($mn, mtpa, AGR %, CAGR %, cumulative)

table 5.14 rest of the world Small Scale liquefied natural gas (LNG) market, by type forecast 2019-2029($mn, AGR %, CAGR %, cumulative)

table 5.15 Global projects scenario (region, country, project name, terminal type, type, terminal operator, project throughput (tons/annum), storage capacity (cubic meter), current status, commissioning date)

table 6.1 PEST analysis, Small Scale LNG market

table 8.1 Gasnor shell profile 2018 (market entry, public/private, headquarters, geography, key market, products/services)

table 8.2 Gasum 2017 (market entry, public/private, headquarters, no. of employees, revenue in $mn, geography, key market, products/services)

table 8.3 Gasum AS LNG operations

table 8.4 Gazprom 2018 (market entry, public/private, headquarters, no. of employees, revenue 2018 ($bn), change in revenue, geography, key market, listed on, products/services)

table 8.5 Gazprom, total company sales 2013-2018 ($bn, AGR %)

table 8.7 Wartsila profile 2018 (market entry, public/private, headquarters, no. of employees, revenue 2018 ($bn), change in revenue, geography, key market, listed on, products/services)

table 8.8 Wartsila total company sales 2014-2018 ($bn, AGR %)

table 8.9 Prometheus energy company profile 2018 (market entry, public/private, headquarters, geography, key market, products/services)

table 8.10 Petronas profile 2018 (market entry, public/private, headquarters, no. of employees, revenue 2017 ($bn), change in revenue, geography, key market, listed on, products/services)

table 8.11 Petronas total company revenue 2013-2017 ($bn, AGR %)

table 8.12 Ecoelectrica inc. 2018 (market entry, public/private, headquarters, geography, key market, products/services)

table 8.13 Air Products and chemicals, inc. profile 2018 (market entry, public/private, headquarters, no. of employees, revenue 2018 ($bn), change in revenue, geography, key market, listed on, products/services)

table 8.14 Air Products and chemicals, inc total company revenue 2014-2018 ($bn, AGR %)

table 8.15 ENN energy holdings limited profile 2018 (market entry, public/private, headquarters, no. of employees, revenue 20178 ($bn), change in revenue, geography, key market, listed on, products/services)

table 8.16 ENN energy holdings limited total company revenue 2014-2018 ($bn, AGR %)

table 8.17 Sinopec corp. profile (market entry, public/private, headquarter, no. of employees, revenue in $mn, 2017, change in revenue from 2016, geography, key markets, listed on, products/services)

table 8.18 Sinopec corp. total company sales 2013-2017 ($bn, AGR %)

table 9.1 Global Small Scale liquefied natural gas (LNG) market, by region forecast 2019-2029 ($mn, AGR %, CAGR %, cumulative)

table 9.2 Global Small Scale liquefied natural gas (LNG) capacity, by region forecast 2019-2029 (mtpa, AGR %, CAGR %, cumulative)

List of Figures

figure 1.1 the Small Scale LNG market by country/region market share forecast 2019, 2024, 2029 (% share)

figure 2.1 Global Small Scale LNG market segmentation overview

figure 2.2 Small Scale LNG, value chain analysis

figure 3.1 Global Small Scale liquefied natural gas (LNG) forecast 2019-2029 ($mn, AGR %)

figure 3.2 Small Scale liquefied natural gas (LNG) market by regional market share forecast 2019, 2024, 2029 (% share)

figure 3.3 Global Small Scale liquefied natural gas (LNG) market, market attractiveness, by region

figure 4.1 Global Small Scale liquefied natural gas (LNG) submarket forecast 2019-2029 ($mn, AGR%)

figure 4.2 Global Small Scale liquefied natural gas (LNG) market by type share forecast 2019, 2024, 2029 (% share)

figure 4.3 Small Scale liquefied natural gas (LNG) market, by Small Scale regasification forecast 2019-2029 ($mn, AGR%)

figure 4.4 Small Scale liquefied natural gas (LNG) market, by Small Scale liquefaction forecast 2019-2029 ($mn, AGR%)

figure 4.5 Small Scale liquefied natural gas (LNG) market, by LNG satellite stations, forecast 2019-2029 ($mn, AGR%)

figure 4.6 Small Scale liquefied natural gas (LNG) market, by LNG bunkering facilities for vessels forecast 2019-2029 ($mn, AGR%)

figure 4.7 Small Scale liquefied natural gas (LNG) market, by fueling forecast 2019-2029 ($mn, AGR%)

figure 5.1 Large Scale vs Small Scale LNG, Global LNG trade share % 2016

figure 5.2 Leading national Small Scale liquefied natural gas (LNG) capacity forecast 2019-2029 (mtpa)

figure 5.3 Leading regional players in Small Scale liquefied natural gas (LNG) market, % share, 2019

figure 5.4 Leading regional players in Small Scale liquefied natural gas (LNG) market, % share, 2024

figure 5.5 Leading regional players in Small Scale liquefied natural gas (LNG) market, share, 2029

figure 5.6 China Small Scale liquefied natural gas (LNG) market forecast 2019-2029 ($mn, AGR %)

figure 5.7 China Small Scale liquefied natural gas (LNG) market capacity forecast 2019-2029 (mtpa, AGR %)

figure 5.8 Indonesia Small Scale liquefied natural gas (LNG) market forecast 2019-2029 ($mn, AGR %)

figure 5.9 Indonesia Small Scale liquefied natural gas (LNG) capacity forecast 2019-2029 (mtpa, AGR %)

figure 5.10 Japan Small Scale liquefied natural gas (LNG) market forecast 2019-2029 ($mn, AGR %)

figure 5.11 Japan Small Scale liquefied natural gas (LNG) capacity forecast 2019-2029 (mtpa, AGR %)

figure 5.12 U.S. Small Scale liquefied natural gas (LNG) market forecast 2019-2029 ($mn, AGR %)

figure 5.13 U.S. Small Scale liquefied natural gas (LNG) market capacity forecast 2019-2029 (mtpa, AGR %)

figure 5.14 Europe Small Scale liquefied natural gas (LNG) market forecast 2019-2029 ($mn, AGR %)

figure 5.15 Europe Small Scale liquefied natural gas (LNG) capacity forecast 2019-2029 (mtpa, AGR %)

figure 5.16 rest of the world Small Scale liquefied natural gas (LNG) market forecast 2019-2029 ($mn, AGR %)

figure 5.17 rest of the world Small Scale liquefied natural gas (LNG) capacity forecast 2019-2029 (mtpa, AGR %)

figure 8.2 Wartsila, revenue($bn& AGR %), 2014-2018

figure 8.3 Wartsila revenue %share, by business segment, 2018

figure 8.4 Wartsila revenue %share, by regional segment, 2018

figure 8.5 Petronas total company revenue($bn & AGR %), 2013-2017

figure 8.6 Petronas revenue % share, by product segment, 2017

figure 8.7 Petronas revenue % share, by geographical trade, 2017

figure 8.8 Petronas revenue % share, by business segment, 2017

figure 8.9 Petronas revenue % share, by geographic segment, 2017

figure 8.10 Air Products and chemicals, inc total company revenue($bn, AGR %), 2014-2018

figure 8.11 Air Products and chemicals, inc revenue % share, by regional segment, 2018

figure 8.12 Air Products and chemicals, inc revenue % share, by business segment, 2018

figure 8.13 ENN energy holdings limited total company revenue($bn& AGR %), 2014-2018

figure 8.14 Sinopec corp., revenue, ($bn& AGR %), 2013-2017

figure 8.15 Sinopec corp., revenue %share, by regional segment, 2017

figure 8.16 Sinopec corp., sale of chemical products, by product, 2017 (thousand tonnes)

figure 9.1 Global Small Scale LNG market forecast 2019-2029 ($ mn)

AGA AB

Air Products and Chemicals, Inc.

APNG

Barents

Buffalo Marine Service

Buquebus

CCB

Clean Energy

Clean Marine Energy

Colony Energy Partners

Conferenza GNL LNG Europe

EcoElectrica Inc.

EnBW Kraftwerke Stutgart

Encana

ENN Energy Holdings Limited

ENOS LNG

Equinor

Fairbanks Natural Gas

Ferus

Flint Hills Resources

Gasnor

Gasnor Shell

Gasum

Gasunie

Gazprom

GDF Suez

Harvey Gulf

Hiroshima LNG

Hokkaido Gas

InterStream Barging

Jahre Marine

Japex

Kogas

Liquiline

LNG Gorskaya

LNG Silesia

Manga LNG

Naturgass More

Nihon Gas

Noble Energy

Northeast Midstream

Okayama Gas

Okinawa EP

Oy AGA Ab

Petronas

PGNiG

Prometheus Energy

Prometheus Energy Company

Puget Sound Energy

Repsol

RWE

Saga Fjordbase

Saibu Gas

Shell

Shin-Mintao Works

Sinopec

Spectrum

Spectrum LNG

Stabilis Energy

Stabilis Energy

Stolt LNGaz

Swedegas, Vopak

Takamatsu/ Shikoku Gas

Tenaska NG Fuels

TLF

Toho Gas

Wartsila

WesPac Midstream

Xilan Natural Gas Group

Organisations Mentioned

Association of Port and Harbours

International Maritime Organization

New York City Department of Transportation

Sendai Municipal Gas

South Korean Ministry of Trade

Download sample pages

Complete the form below to download your free sample pages for Small Scale Liquefied Natural Gas (LNG) Market Forecast 2019-2029

Related reports

-

LPG Vaporizer Market Report 2019-2029

Visiongain has calculated that the LPG Vaporizing market will see a capital expenditure (CAPEX) of $1.9 bn in 2019. Read...

Full DetailsPublished: 09 May 2019 -

Oil & Gas Subsea Umbilicals, Risers & Flowlines (SURF) Market Report 2019-2029

Visiongain has calculated that the global subsea umbilicals, risers and flowlines (SURF) market will see a capital expenditure (CAPEX) of...

Full DetailsPublished: 02 November 2018 -

Geothermal Power Market Forecast 2019-2029

Visiongain has calculated that the global Geothermal Power Market will see a capital expenditure (CAPEX) of $7,256mn in 2019. Read...

Full DetailsPublished: 23 May 2019 -

Liquefied Natural Gas (LNG) Bunkering Market 2019-2029

Visiongain has calculated that the LNG Bunkering market will see a capital expenditure (CAPEX) of $843mn in 2019. Read on...

Full DetailsPublished: 30 April 2019 -

Carbon Dioxide (CO2) Enhanced Oil Recovery (EOR) Market 2019-2029

The latest report from business intelligence provider visiongain offers in depth analysis of the global carbon dioxide (CO2) enhanced oil...Full DetailsPublished: 13 December 2018 -

Small & Mid-Scaled LNGC & LNGBV Market Report 2019-2029

Visiongain’s forecasts indicate that the global the Small-Scale LNG Carrier, Medium-Scale Carrier and LNG Bunkering Vessels see capital expenditures (CAPEX)...

Full DetailsPublished: 13 May 2019 -

Carbon Capture, Transportation & Storage Market Report 2021-2031

Government funding initiatives are crucial to ensure that government GHG emissions reduction targets are translated into tangible CCS projects. Visiongain...Full DetailsPublished: 29 September 2020 -

Grid-Scale Battery Storage Technologies Market Forecast 2019-2029

The latest research report from business intelligence provider Visiongain offers comprehensive analysis of the Grid Scale Battery Storage market. Visiongain...

Full DetailsPublished: 06 June 2019 -

Lithium-Ion Battery Market Report 2020-2030

Visiongain values the lithium-ion battery market at $43.8bn in 2019.

...Full DetailsPublished: 30 March 2020 -

Electric Power Transmission & Distribution (T&D) Infrastructure Market 2020-2030

The latest research report from business intelligence provider Visiongain offers comprehensive analysis of the Electric Power Transmission & Distribution (T&D)...

Full DetailsPublished: 06 May 2020

Download sample pages

Complete the form below to download your free sample pages for Small Scale Liquefied Natural Gas (LNG) Market Forecast 2019-2029

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain energy reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and industry experts where possible but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain energy reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

“The Visiongain report was extremely insightful and helped us construct our basic go-to market strategy for our solution.”

H.

“F.B has used Visiongain to prepare two separate market studies on the ceramic proppants market over the last 12 months. These reports have been professionally researched and written and have assisted FBX greatly in developing its business strategy and investment plans.”

F.B

“We just received your very interesting report on the Energy Storage Technologies (EST) Market and this is a very impressive and useful document on that subject.”

I.E.N

“Visiongain does an outstanding job on putting the reports together and provides valuable insight at the right informative level for our needs. The EOR Visiongain report provided confirmation and market outlook data for EOR in MENA with the leading countries being Oman, Kuwait and eventually Saudi Arabia.”

E.S

“Visiongain produced a comprehensive, well-structured GTL Market report striking a good balance between scope and detail, global and local perspective, large and small industry segments. It is an informative forecast, useful for practitioners as a trusted and upto-date reference.”

Y.N Ltd

Association of Dutch Suppliers in the Oil & Gas Industry

Society of Naval Architects & Marine Engineers

Association of Diving Contractors

Association of Diving Contractors International

Associazione Imprese Subacquee Italiane

Australian Petroleum Production & Exploration Association

Brazilian Association of Offshore Support Companies

Brazilian Petroleum Institute

Canadian Energy Pipeline

Diving Medical Advisory Committee

European Diving Technology Committee

French Oil and Gas Industry Council

IMarEST – Institute of Marine Engineering, Science & Technology

International Association of Drilling Contractors

International Association of Geophysical Contractors

International Association of Oil & Gas Producers

International Chamber of Shipping

International Shipping Federation

International Marine Contractors Association

International Tanker Owners Pollution Federation

Leading Oil & Gas Industry Competitiveness

Maritime Energy Association

National Ocean Industries Association

Netherlands Oil and Gas Exploration and Production Association

NOF Energy

Norsk olje og gass Norwegian Oil and Gas Association

Offshore Contractors’ Association

Offshore Mechanical Handling Equipment Committee

Oil & Gas UK

Oil Companies International Marine Forum

Ontario Petroleum Institute

Organisation of the Petroleum Exporting Countries

Regional Association of Oil and Natural Gas Companies in Latin America and the Caribbean

Society for Underwater Technology

Society of Maritime Industries

Society of Petroleum Engineers

Society of Petroleum Enginners – Calgary

Step Change in Safety

Subsea UK

The East of England Energy Group

UK Petroleum Industry Association

All the events postponed due to COVID-19.

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Energy news

Energy as a Service (EaaS) Market

The global Energy as a Service (EaaS) market is projected to grow at a CAGR of 12.6% by 2034

25 July 2024

Synthetic Fuels Market

The global Synthetic Fuels market is projected to grow at a CAGR of 23% by 2034

18 July 2024

Power-to-X (P2X) Market

The global Power-to-X (P2X) market is projected to grow at a CAGR of 10.6% by 2034

09 July 2024

Airborne Wind Energy Market

The global Airborne Wind Energy market is projected to grow at a CAGR of 9.7% by 2034

05 June 2024