Industries > Pharma > Pharmaceutical Contract Manufacturing Market 2019-2029

Pharmaceutical Contract Manufacturing Market 2019-2029

Active Ingredient (API) and Finished Dose Formulation (FDF), Generic APIs, HPAPIs, Solid Dosages, Injectable Dosages

The pharmaceutical contract manufacturing market is expected to grow at a CAGR of 5.7% in the first half of the forecast period. The API Manufacturing submarket held 67% of the market in 2018. Visiongain estimated that the pharmaceutical contract manufacturing market will reach $138bn in 2024.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand new 231-page report you will receive 73 tables and 55 figures– all unavailable elsewhere.

The 231-page report provides clear detailed insight into the pharmaceutical contract manufacturing market. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand-new report today you stay better informed and ready to act.

Report Scope

• Global Pharmaceutical Contract Manufacturing Market forecasts from 2019-2029

• Submarket forecasts at world level, from 2019-2029:

• Active pharmaceutical ingredients (APIs), with sub forecasts for generic APIs, high potency active pharma ingredients (HPAPIs) and other products

• Finished dosage formulations (FDFs), with sub forecasts for solid dose forms, injectable dosages and other dosage types

• Other applications of outsourced production – other related services

• Revenue forecasts from 2019-2029, for these regional and national markets:

• The US

• Canada

• Japan

• EU5: Germany, France, the UK, Italy and Spain

• BRIC: Brazil, Russia, India, China

• South Korea

• Turkey

• Mexico

• Others

• Assessment of selected leading companies that hold major market shares in the pharmaceutical contract manufacturing industry

• Qualitative Analysis from a CMO Perspective

• Qualitative Analysis from a Client Perspective

• Key questions answered by this report:

• What is the current size of the total global pharmaceutical contract manufacturing market?

• How much will this market be worth from 2018 to 2029?

• How is the pharmaceutical contract manufacturing market evolving?

• What is driving and restraining the pharmaceutical contract manufacturing market?

• What are the market shares of each segment of the overall pharmaceutical contract manufacturing market currently and how will these change to 2029?

• What are the main submarkets and how much revenue will each pharmaceutical contract manufacturing submarket account for over the next 10 years to 2029 and why?

• How will the market shares for each pharmaceutical contract manufacturing submarket develop from 2018 to 2029?

• Who are the leading players and what are their prospects over the forecast period?

• How will the industry evolve to 2029?

• What are the largest national markets for pharmaceutical contract manufacturing? What is the current status and how will it develop over the next ten years? What are their forecasts for 2019-2029?

• Who are the most prominent companies, and what are their activities and outlooks?

• What are the main trends that will affect the pharmaceutical contract manufacturing market between 2018 and 2029?

Visiongain’s study is intended for anyone requiring commercial analyses for the pharmaceutical contract manufacturing market. You find data, trends and predictions.

Buy our report today Pharmaceutical Contract Manufacturing Market 2019-2029: Active Ingredient (API) and Finished Dose Formulation (FDF), Generic APIs, HPAPIs, Solid Dosages, Injectable Dosages.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1.1 Global Pharmaceutical Contract Manufacturing Market Segmentation

1.2 Global Pharmaceutical Contract Manufacturing Market Overview

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report

1.6 Who is This Report For?

1.7 Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to Pharmaceutical Contract Manufacturing

2.1 What is Pharmaceutical Contract Manufacturing?

2.2 The Benefits of Outsourcing in the Pharmaceutical Market

2.3 Pharmaceutical Contract Manufacturing Services

2.4 Strategy and Tactics: The Importance of Outsourcing Wisely

2.5 Trends in Contract Manufacturing, 2018-2029

2.6 Pharmaceutical Contract Manufacturing: Market Segmentation

3. Pharmaceutical Contract Manufacturing: World Market 2019-2029

3.1 Pharmaceutical Contract Manufacturing Market:

3.1.1 Contract Manufacturing is the Most Mature Pharma Outsourcing Sector

3.1.2 The Pharma Contract Manufacturing Market by Sector 2018

3.2 Pharma Contract Manufacturing: Overall Market Forecast 2019-2029

3.2.1 Changing Market Shares by Segment 2018-2029

3.2.2 Drivers for Growth in the Contract Manufacturing Market to 2029

3.2.3 Generics: A Driver or Restraint?

3.2.4 Other Contract Manufacturing Services Market: Outlook and Forecast, 2019-2029

3.2.4.1 Increasing Demand for Formulation Development Services

4. The Contract API Manufacturing Services Submarket 2019-2029

4.1 The Contract API Manufacturing Submarket

4.1.1 Chemical APIs Will Experience Resurgence after the Shift of Focus to Biological APIs

4.1.2 The API Manufacturing Submarket by Sector, 2018

4.2 The Contract API Manufacturing Submarket: Outlook and Forecast 2019-2029

4.2.1 Drivers for Growth in the API Submarket to 2029

4.2.2 The Potential for Microreactors in Commercial Manufacturing to 2029

4.2.3 How Will New EU Regulations Impact the API Manufacturing Submarket?

4.2.4 Contract API Manufacturing Submarket Restraint 2019-2029

4.2.4.1 Backwards Integration for Generics Manufacturers

4.3 The Contract Generic API Manufacturing Submarket 2019-2029

4.3.1 The Contract Generic API Manufacturing Submarket Forecast 2019-2029

4.3.2 The Contract Generic API Manufacturing Submarket Drivers and Restraints to 2029

4.3.2.1 The US Generic Drug User Fee Act and API Manufacturing

4.4 The Contract HPAPI Manufacturing Submarket 2015-2028

4.4.1 Challenges and Opportunities in High Containment Manufacturing

4.4.2 Company Investment into HPAPI Manufacturing Facilities: Growth Increases in the HPAPI Manufacturing Sector

4.4.3 The Contract HPAPI Manufacturing Submarket Forecast 2018-2029

4.4.4 The Contract HPAPI Manufacturing Submarket Drivers and Restraints to 2029

5. The Contract FDF Manufacturing Services Submarket 2019-2029

5.1 The Contract FDF Manufacturing Submarket, 2018

5.1.1 Solid Dosage Manufacturing Leads the Market

5.1.2 CMOs Report High Demand for Softgel Formulations

5.2 The Contract FDF Manufacturing Submarket Forecast 2019-2029

5.2.1 Complex Molecule Manufacturing Will Drive Growth to 2029

5.2.2 What Will Restrain Growth in FDF Outsourcing?

5.3 The Contract Solid Dosage Manufacturing Submarket 2019-2029

5.3.1 How Will Revenue for Solid Dosage Manufacturing Grow to 2029?

5.3.2 The Solid Dosage Manufacturing Submarket Drivers and Restraints 2019-2029

5.3.2.1 Will Product Reformulation Drive Growth to 2029?

5.4 The Contract Injectable Dosage Manufacturing Submarket 2019-2029

5.4.1 The Contract Injectable Dosage Manufacturing Submarket Forecast 2019-2029

5.4.1.1 Drug Shortages Offer Opportunity to CMOs in the Short-Term

5.4.2 Demand for Biopharma Manufacturing Will Drive Growth 2019-2029

5.4.2.1 Interest in Antibody-Drug Conjugate Development Is Growing

5.4.2.3 Challenges in Manufacturing Antibody-Drug Conjugates

5.4.3 Lyophilisation and Aseptic Filling Demand Will Rise

5.4.3.1 Will Spray Drying Replace Lyophilisation in FDF Manufacturing?

6. Leading National Markets for Pharmaceutical Contract Manufacturing 2019-2029

6.1 Leading National Markets for Pharmaceutical Contract Manufacturing, 2018

6.1.1 Challenges in Assessing the Market: Supply versus Demand

6.1.2 Leading National Pharmaceutical Contract Manufacturing Markets: Revenue Forecasts 2019-2029

6.1.3 Pharmaceutical Manufacturing in the US: Regulatory Oversight, 2018

6.1.4 Controlling Foreign Manufacturing Sites

6.1.5 What Impact Will the GDUFA 2012 Have on Foreign Manufacturing?

6.1.6 Outsourcing and US Manufacturing Regulations

6.1.7 Increased Demand for Domestic API Manufacturing?

6.2 The US Contract Manufacturing Market Forecast 2019-2029

6.3 Canada Contract Manufacturing Market Forecast 2019-2029

6.4 Outlook for Pharmaceutical Contract Manufacturing in the EU

6.4.1 The EU is the Leading Destination for Pharmaceutical Contract Manufacturing

6.4.2 Regulatory Aspects of Pharma Manufacturing in the EU

6.4.2.1 The European Commission Amends Annex 16

6.4.2.2 The Falsified Medicine Directive: Controlling API Imports

6.4.3 Biopharma Manufacturing Demand Will Rise

6.4.4 The EU Contract Manufacturing Market Forecast 2019-2029

6.4.5 Germany: The Leading EU Destination for API and FDF Manufacturing

6.4.5.1 Demand for Contract Manufacturing in Germany: Revenue Forecast 2019-2029

6.4.6 CMOs Account for a Third of Manufacturing Sites in France

6.4.6.1 French Pharma Contract Manufacturing Market Forecast 2019-2029

6.4.7 Italy: Strong API Manufacturing Traditions

6.4.7.1 Revenue Forecast for the Italian Pharma Contract Manufacturing Market 2019-2029

6.4.8 Spain: How Will Demand for Manufacturing Services Grow?

6.4.9 UK: Pharmaceutical Contract Manufacturing Market Forecast 2019-2029

6.5 Pharma Contract Manufacturing in Japan to 2029

6.5.1 Pharmaceutical Manufacturing Regulations in Japan

6.5.1.1 The Pharmaceutical Affairs Law

6.5.2 Greater API Outsourcing to Drive Japanese Market Growth to 2028 In Spite of Currency Devaluation Weakening the Economy

7. Leading Emerging Markets for Pharmaceutical Contract Manufacturing Market 2019-2029

7.1 Pharmaceutical Contract Manufacturing in Developing Countries

7.1.1 Outsourcing to Emerging National Markets from Developed Markets

7.1.1.1 Demand Will Increase for Services in India and China

7.1.2 Domestic Demand for Pharmaceutical Contract Manufacturing Services

7.1.3 Pharmaceutical Contract Manufacturing: Leading Emerging National Market Forecasts 2019-2029

7.2 Chinese Demand for Pharma Contract Manufacturing Services 2019-2029

7.2.1 Improved Manufacturing Regulations in China

7.2.1.1 Regulations for Excipients and Guidance for API Manufacturing

7.2.1.2 What Are the Consequences to Stricter Manufacturing Regulations in China?

7.2.2 Chinese CMOs Are Investing in Biopharma Manufacturing

7.2.3 China Pharma Contract Manufacturing Market Forecast 2019-2029

7.3 India: CMOs with Strong Infrastructure and Growing Expertise

7.3.1 Regulatory Outlook for Indian Pharma Manufacturing

7.3.1.1 Stricter Quality Standards to Ensure Compliance with EU Rules

7.3.2 Domestic Manufacturing Dominates the Indian Pharma Market

7.3.3 Demand for Contract Manufacturing in India: Market Forecast 2019-2029

7.4 Brazil: Contract Manufacturing Outlook 2019-2029

7.4.1 Pharmaceutical Manufacturing Regulations in Brazil

7.4.1.1 Guidelines and Regulations Proposed

7.4.2 Brazil Imports Most of its APIs

7.4.3 Brazil: Pharma Contract Manufacturing Market Forecast 2019-2029

7.5 The Russian Pharma Contract Manufacturing Market 2019-2029

7.5.1 Pharma Manufacturing Regulations in Russia

7.5.1.1 Compliance with GMP in Russia

7.5.2 How Will Demand for Contract Manufacturing Grow in Russia to 2029?

7.6 South Korea: Government Supported Growth

7.6.1 South Korea: Strict GMP Regulations

7.6.2 South Korea: Pharma Contract Manufacturing Market Forecast 2019-2029

7.7 Turkey: Domestic Market to offer Huge Growth Opportunities

7.7.1 Turkey: An Important Hub for Global Pharma Companies

7.7.2 Drug Approvals Delaying Growth of the Turkey Pharma Market

7.7.3 Turkey: Pharma Contract Manufacturing Market Forecast 2019-2029

7.8 Mexico: Emerging Market Power

7.8.1 Healthcare – A Top Priority in Mexico

7.8.2 Strategic Management of High Expectations

7.8.3 Mexico: Pharma Contract Manufacturing Market Forecast 2019-2029

8. Leading Companies in the Pharmaceutical Contract Manufacturing Market

8.1 Leading CMOs in the Pharmaceutical Contract Manufacturing Market

8.2 Catalent: Leading CMO

8.2.1 Multiple Expansions and Increased Focus on Biologic Manufacturing

8.2.2 Recent Developments

8.3 Lonza: Potential to Lead in ADC Manufacturing

8.3.1 Lonza: Expanding its Capacities to Meet Customer Demand for Biologic Manufacturing

8.3.2 Recent Developments

8.4 Evonik Degussa: Specialising in Small Molecules

8.4.1 Recent Developments

8.5 DPx Holdings - DSM and Patheon: Recent Merger Has Strengthened Their Position

8.5.1 Increasing Capacity Tactically and Expanding Worldwide

8.6 Teva: The World’s Largest API Manufacturer

8.6.1 Will Teva Expand into Emerging Markets?

8.6.2 Recent Developments

8.7 Boehringer Ingelheim BioXcellence: Boehringer’s Biopharma Manufacturing Division

8.7.1 Recent Developments

8.7.2 Adding New Services for Growth

8.8 Famar: A Possible Candidate for Acquisition

8.8.1 Recent Developments

8.9 Fareva: A Strategic Shift from Acquisition to Increase in Capacity

8.10 Vetter Pharma: Specialists in Aseptic Filling, Lyophilisation and Siliconisation

8.10.1 Vetter’s Growth: Increasing in Capacity and Market Expansion

8.11 Mylan: A World Leader in Generics Manufacturing

8.11.1 Recent Developments

9. Pharmaceutical Contract Manufacturing Industry Trends: Qualitative Analysis from a CMO Perspective 2019-2029

9.1 Pharma Contract Manufacturing Market: Strengths and Weaknesses from a CMO Perspective 2019-2029

9.2 Pharma Contract Manufacturing Market: Opportunities and Threats from a CMO Perspective 2019-2029

9.3 Pharma Contract Manufacturing Market: STEP Analysis 2019-2029

9.3.1 Social Factors

9.3.2 New Technologies Will Drive Market Growth to 2029

9.3.2.1 Advantages of Single-Use Technologies in Biopharma Manufacturing

9.3.2.2 Green Technology in Contract Manufacturing

9.3.2.3 Drug Delivery Trends and CMOs

9.3.2.4 Biologics Are Causing Increased Demand for Lyophilisation

9.3.2.5 Improving Solubility and Stability for Small Molecules

9.3.2.6 Spray Drying as an Advantageous Alternative to Lyophilisation

9.3.2.7 Hot-Melt Extrusion: A Niche Opportunity

9.3.3 Economic Pressures

9.3.3.1 Developed-Market CMOs Facing Competition from Emerging Markets

9.3.4 Political Issues

9.3.4.1 How Will Regulatory Developments Affect CMOs?

9.4 Trends in Drug Development Affecting CMOs to 2028

9.4.1 Orphan Drug Development: Smaller Manufacturing Capacities

9.4.2 Complex Biologics: Interest in ADCs is increasing

9.4.3 How Will Biosimilar Market Growth Affect CMOs?

9.4.4 The Future of Small Molecule Outsourcing

9.5 How Will CMOs Expand in the Coming 10 Years?

9.5.1 CMO Consolidation Will Increase

9.5.2 There Will Be More Manufacturing Facilities Available for Acquisition

9.6 Developments in the Manufacturing Process

9.6.1 Rising Interest from Companies in Quality by Design (QbD)

9.6.2 A Move Towards Continuous Manufacturing

10. Pharmaceutical Contract Manufacturing Trends: Qualitative Analysis of the Pharmaceutical Contract Manufacturing Market from a Client Perspective 2019-2029

10.1 Pharma Contract Manufacturing Market: Strengths and Weaknesses from a Client Perspective 2019-2029

10.2 Pharma Contract Manufacturing Market: Opportunities and Threats from a Client Perspective 2019-2029

10.3 Important Aspects of the Outsourcing Decision

10.3.1 What Factors Will Influence CMO Selection?

10.3.2 CMO - Pharma Partnering Models

10.3.3 Strategic Partnering

10.3.4 Selecting a Local CMO vs. Offshoring

10.3.5 CMOs in Emerging Markets

10.3.6 Good Communication is Vital for Success

10.3.7 Ensuring Protection in Intellectual Property and Tech Transfer

10.3.8 Regulatory Compliance is a Key Deciding Factor for Pharma Clients

10.3.8.1 Regulatory Bodies and Outsourcing

10.3.8.2 Quality Agreement

10.3.8.3 Global Harmonisation Will Improve Compliance

10.4 Trends in Outsourcing Partnerships 2019-2029

10.4.1 Big Pharma and Outsourced Manufacturing

10.4.2 Small and Virtual Pharma Companies

10.4.3 How Will Biotech Funding Impact the Pharma Contract Manufacturing Industry to 2029?

11. Conclusions

11.1 The World Pharmaceutical Contract Manufacturing Market

11.2 Outlook for the Market to 2029

11.2.1 Rising Demand for High Value Services 2018-2029

11.2.2 Demand Will Be Highest Among Developed-Market Clients

11.3 Which New Technologies Will Stimulate Demand to 2029?

Appendices

Associated Visiongain Reports

Visiongain Report Sales Order Form

About Visiongain

Visiongain report evaluation form

List of Tables

Table 3.1 Pharma Contract Manufacturing Market: Revenue ($bn) and Market Share (%) by Sector, 2018

Table 3.2 Pharmaceutical Contract Manufacturing Market: Overall Market Forecasts by Sector, Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 3.3 Pharma Contract Manufacturing Market: Market Shares (%), 2018-2023

Table 3.4 Pharma Contract Manufacturing Market: Market Shares (%), 2024-2029

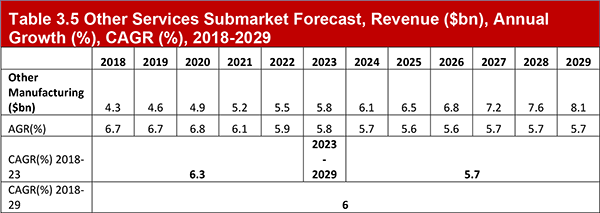

Table 3.5 Other Services Submarket Forecast, Revenue ($bn), Annual Growth (%), CAGR (%), 2018-2029

Table 4.1 Contract API Manufacturing Submarket: Revenue ($bn) and Submarket Share (%) by Sector, 2018

Table 4.2 Contract API Manufacturing Submarket: Overall Submarket Forecasts by Sector, Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 4.3 Contract API Manufacturing Submarket Shares (%), 2018-2023

Table 4.4 Contract API Manufacturing Submarket Shares (%), 2023-2029

Table 4.5 Contract API Manufacturing Submarket: Drivers and Restraints, 2018-2029

Table 4.6 Contract Generic API Manufacturing Submarket Forecast, Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 4.7 Contract Generic API Manufacturing Submarket: Drivers and Restraints, 2019-2029

Table 4.8 Contract HPAPI Manufacturing Submarket Forecast, Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 4.9 Contract HPAPI Manufacturing Submarket: Drivers and Restraints, 2019-2029

Table 5.1 Contract FDF Manufacturing Submarket: Revenue ($bn) and Submarket Share (%) by Sector, 2018

Table 5.2 Contract FDF Manufacturing Submarket: Overall Submarket Forecasts by Sector, Revenue ($bn), Annual Growth (%), CAGR (%), 2018-2029

Table 5.3 Contract FDF Manufacturing Submarket: Segment Shares (%), 2018-2023

Table 5.4 Contract FDF Manufacturing Submarket: Segment Shares (%), 2023-2029

Table 5.5 Contract FDF Manufacturing Submarket: Drivers and Restraints, 2019-2029

Table 5.6 Contract Solid Dosage Manufacturing Submarket Forecast, Revenue ($bn), Annual Growth (%), CAGR (%) 2019-2029

Table 5.7 Contract Solid Dosage Manufacturing Submarket: Drivers and Restraints, 2018-2029

Table 5.8 Contract Injectable Dosage Manufacturing Submarket Forecast, Revenue ($bn), Annual Growth (%), CAGR (%) 2019-2029

Table 5.9 Contract Injectable Dosage Manufacturing Submarket: Drivers and Restraints, 2019-2029

Table 5.10 Selected ADCs in Development, 2018

Table 5.11 Selected CMOs Investing in ADC Manufacturing Capacity, 2018

Table 6.1 Pharma Contract Manufacturing Market: Revenues ($bn) and Market Shares (%) by Region, 2018

Table 6.2 Pharma Contract Manufacturing Market: Regional Forecasts, Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 6.3 Pharmaceutical Contract Manufacturing Market: Submarket Shares (%), 2018-2023

Table 6.4 Pharmaceutical Contract Manufacturing Market: Submarket Shares (%), 2023-2029

Table 6.5 GDUFA: Annual Fees for Domestic and Foreign Manufacturing Sites, 2015-2016

Table 6.6 US Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), Annual Growth (%), CAGR (%), 2018-2029

Table 6.7 Canada Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), Annual Growth (%), CAGR (%), 2018-2029

Table 6.8 EU Pharma Contract Manufacturing Market: Revenue ($bn) and Market Share (%) by Leading Country, 2018

Table 6.9 EU Pharma Contract Manufacturing Market: Revenue ($bn) and Market Share (%) by Leading Country, 2023

Table 6.10 EU Pharma Contract Manufacturing Market: Revenue ($bn) and Market Share (%) by Leading Country, 2029

Table 6.11 EU5 Pharma Contract Manufacturing Market: National Market Forecasts, Revenue ($bn), Annual Growth (%), CAGR (%), 2018-2029

Table 6.12 German Pharma Contract Manufacturing: Forecast, Revenue ($bn), Annual Growth (%), CAGR (%), 2018-2029

Table 6.13 Selected French Manufacturing Site Acquisitions, 2009-2013

Table 6.14 French Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 6.15 Italian Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 6.16 Spanish Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 6.17 UK Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 6.18 Japanese Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 7.1 Pharma Contract Manufacturing Market: Emerging Market Revenue ($bn) and Market Share (%) by Top Country, 2018

Table 7.2 Pharma Contract Manufacturing Market: Leading Emerging Market Forecasts ($bn), Annual Growth (%), CAGR (%), 2018-2029

Table 7.3 Pharma Contract Manufacturing Market: Emerging Market Shares (%), 2018-2023

Table 7.4 Pharma Contract Manufacturing Market: Emerging Market Shares (%), 2023-2029

Table 7.5 Chinese Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 7.6 Indian Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 7.7 Brazilian Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 7.8 Russian Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 7.9 South Korean Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 7.10 Turkey Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 7.11 Mexico Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 8.1 Catalent: Revenue ($bn), Annual Growth, CAGR, 2013-2018

Table 8.2 Lonza: Revenue (CHF bn), Annual Growth (%), CAGR (%), 2013-2018

Table 8.3 Teva: Revenue ($bn), Annual Growth (%), CAGR (%), 2012-2017

Table 8.4 Boehringer Ingelheim BioXcellence: Revenue (CHF bn), Annual Growth (%), CAGR (%), 2012-2017

Table 9.1 Pharma Contract Manufacturing Market Strengths and Weaknesses: CMO Perspective, 2019-2029

Table 9.2 Pharma Contract Manufacturing Market Opportunities and Threats: CMO Perspective, 2019-2029

Table 9.3 Pharma Contract Manufacturing Market: STEP Analysis, 2019-2029

Table 9.4 Selected Lyophilisation Service Providers

Table 9.5 Lyophilisation vs. Spray Drying: A Comparison

Table 9.6 Selected Biological Manufacturing Expansion, 2013-2018

Table 9.7 Selected EU-Approved Biosimilars: Manufacturers and Companies, 2018

Table 9.8 Selected CMOs Growing Faster than the Market, 2007-2012

Table 9.9 Regional Market Expansion, 2010-2017

Table 10.1 Pharma Contract Manufacturing Market Strengths and Weaknesses: Client Perspective, 2019-2029

Table 10.2 Pharma Contract Manufacturing Market Opportunities and Threats: Client Perspective, 2019-2029

Table 10.3 Benefits and Risks to Outsourcing Pharma Manufacturing

Table 10.4 ICH Guidelines: Key Facts and Adoption, 2000-2014

Table 12.1 Pharma Contract Manufacturing Market: Revenue ($bn), CAGR (%), and Market Share (%) by Sector, 2018, 2023 and 2029

Table 12.2 Pharma Contract Manufacturing Market: Revenue ($bn), CAGR (%), and Market Share (%) by Region, 2018, 2023 and 2029

List of Figures

Figure 1.1 Global Pharmaceutical Contract Manufacturing Market Segmentation Overview, 2019

Figure 2.1 Selected Services Offered by CMOs

Figure 2.2 Major Trends Affecting Pharma Contract Manufacturing Revenue Growth, 2018-2029

Figure 3.1 Pharma Contract Manufacturing: Market Share (%) by Sector, 2018

Figure 3.2 Pharmaceutical Contract Manufacturing Market: Overall Market Forecast, Revenue ($bn), 2018-2029

Figure 3.3 Pharma Contract Manufacturing Market: Shares (%), 2024

Figure 3.4 Pharma Contract Manufacturing Market: Shares (%), 2029

Figure 3.5 Pharma Contract Manufacturing Market: Drivers, 2018-2029

Figure 3.6 Pharma Contract Manufacturing Market: Restraints, 2018-2029

Figure 3.7 Other Services Submarket Forecast, Revenue ($bn), 2018-2029

Figure 4.1 Contract API Manufacturing Submarket: Segment Shares (%) by Sector, 2018

Figure 4.2 Contract API Manufacturing Submarket Forecast, Revenue ($bn), 2019-2029

Figure 4.3 Contract API Manufacturing Submarket: Segment Shares (%), 2023

Figure 4.4 Contract API Manufacturing Submarket: Segment Shares (%), 2029

Figure 4.5 Contract Generic API Manufacturing Submarket Forecast, Revenue ($bn), 2019-2029

Figure 4.6 Contract HPAPI Manufacturing Submarket Forecast, Revenue ($bn), 2018-2029

Figure 5.1 Contract FDF Manufacturing Submarket: Segment Shares (%) by Sector, 2018

Figure 5.2 Contract FDF Manufacturing Submarket Forecast, Revenue ($bn), 2019-2029

Figure 5.3 Contract FDF Manufacturing Submarket: Segment Shares (%), 2023

Figure 5.4 Contract FDF Manufacturing Submarket: Segment Shares (%), 2029

Figure 5.5 Contract Solid Dosage Manufacturing Submarket Forecast ($bn), 2019-2029

Figure 5.6 Contract Injectable Dosage Manufacturing Submarket Forecast, Revenue ($bn), 2019-2029

Figure 6.1 Pharma Contract Manufacturing Market: Share (%) by Region, 2018

Figure 6.2 Pharmaceutical Contract Manufacturing Market: Share (%) by Region, 2023

Figure 6.3 Pharmaceutical Contract Manufacturing Market: Share (%) by Region, 2029

Figure 6.4 US Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), 2018-2029

Figure 6.5 Canada Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), 2018-2029

Figure 6.6 EU5 Pharma Contract Manufacturing Market: Share (%) by Country, 2018

Figure 6.7 EU5 Pharma Contract Manufacturing Market: Share (%) by Country, 2023

Figure 6.8 EU5 Pharma Contract Manufacturing Market: Share (%) by Country, 2029

Figure 6.9 EU5 Pharma Contract Manufacturing Market, Revenue ($bn), 2018-2029

Figure 6.10 German Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), 2018-2029

Figure 6.11 French Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), 2019-2029

Figure 6.12 Italian Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), 2018-2029

Figure 6.13 Spanish Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), 2019-2029

Figure 6.14 UK Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), 2019-2029

Figure 6.15 Japanese Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), 2019-2029

Figure 7.1 Pharma Contract Manufacturing Market: Emerging Market Share (%) by Top Country, 2018

Figure 7.2 Pharma Contract Manufacturing Market: Emerging Market Share (%) by Top Country, 2023

Figure 7.3 Pharma Contract Manufacturing Market: Emerging Market Share (%) by Top Country, 2029

Figure 7.4 Pharma Contract Manufacturing Market: Emerging Market Share (%) by Top Country, 2018, 2023 and 2029

Figure 7.5 Chinese Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), 2019-2029

Figure 7.6 Indian Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), 2019-2029

Figure 7.7 Brazilian Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), 2019-2029

Figure 7.8 Russian Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), 2019-2029

Figure 7.9 South Korean Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), 2019-2029

Figure 7.10 Turkey Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), 2019-2029

Figure 7.11 Mexico Pharma Contract Manufacturing: Market Forecast, Revenue ($bn), 2019-2029

Figure 8.1 Catalent: Revenue ($bn), 2012-2017

Figure 8.2 Lonza: Revenue (CHF bn), 2013-2018

Figure 8.3 Teva: Revenue ($bn), 2013-2018

Figure 8.4 Boehringer Ingelheim BioXcellence: Revenue ($bn), 2012-2017

Figure 10.1 Overview of Approved ICH Manufacturing Guidelines

Figure 12.1 Pharma Contract Manufacturing Market: Revenue ($bn) by Sector, 2018, 2023 and 2029

Figure 12.2 Pharma Contract Manufacturing Market: Revenue ($bn) by Region, 2018, 2023 and 2029

Actavis

ADC Biotechnology

Aegerion Pharmaceuticals

Aenova Group

Aesica Pharma

Agensys

Agila Specialties

Ajinomoto Althea Inc

Alexion Pharmaceuticals

Almac Group

Althea Technologies

AMRI (Albany Molecular Research Inc)

API Corporation (APIC)

Aspen Pharmacare

Astellas

AstraZeneca

Banner Life Sciences

Banner Pharmacaps

Baring Private Equity Asia

Bausch & Lomb

Bayer Healthcare

Ben Venue Laboratories

Bend Research

Biogen Idec

BioIndustry Association (BIA)

Biotest

Blackstone Group

Boehringer Ingelheim

Boehringer Ingelheim BioXcellence

Bristol-Myers Squibb Company

Bushu Pharmaceuticals

Cambrex

Cambridge Major Laboratories

Catalent Pharma Solutions

Cedarburg Hauser

Cell Therapy Catapult

Celldex Therapeutics

Celltrion

Cenexi

Chemisch-Pharmazeutisches Laboratorium Ravensburg

Chemtrix

China FDA (CFDA)

Cipla

Cook Pharmica

CordenPharma

CTC Bio

Daito Pharmaceutical

Delpharm

Dishman Pharmaceuticals

DPx Fine Chemicals

DPx Holdings B.V.

Dr. Reddy’s Laboratories

DSP (DSM Sinochem Pharmaceuticals)

Eisai

Eli Lilly

Esteve Quimica

Euticals

Evonik Degussa

Famar

Fareva

FUJIFILM Diosynth Biotechnologies,

Gallus Biopharmaceutical, LLC.

G-CON

GEA Pharma-Systems

Genentech

GlaxoSmithKline (GSK)

Granules India

Haupt Pharma

Hexal

Hospira

Hospira One2One

ImmunoGen

Immunomedics

Indian Pharmaceutical Alliance

Innovent Biologics

IRIX Pharmaceuticals

Janssen

JK Pharmaceutical

Johnson & Johnson

Knowledge Transfer Network (KTN)

Lonza

Lupin

Marinopoulos Group

Matrix Laboratories

Medice

Medichem

Merck & Co.

Micron Technologies

Millennium

Mitsui & Co

Momenta Pharmaceuticals

Mylan

Neuland Laboratories

NICE Insight

NPS Pharmaceuticals

Nycomed

Orchid Chemicals & Pharmaceuticals

Oxford Biomedica

Patheon

Patheon Biologics

Pfizer

Pharmapak Technologies

Piramal Pharma Solutions

Progenics

Quintiles

Recepta Biopharma

Recipharm

Redwood Bioscience

Rentschler Biotechnologie

Roche

Royal DSM

SAFC

SafeBridge

Samsung Bioepis

Samsung BioLogics

Sandoz

Sanofi

Seattle Genetics

Shandong Xinhua

ShangPharma

Shire

Siegfried AG

Sigmar Italia

SMS Pharmaceuticals

Solvias AG

Speedel

Stada

Stem CentRx

Stevenage Bioscience Catalyst

Takeda

Temmler Group

Teva API

Thermo Fisher Scientific

UMN Pharma

UNIGEN

Valeant Pharmaceuticals

Valerion Therapeutics, LLC.

Vetter Pharma-Fertigung GmbH

Vivante GMP Solutions

West Pharmaceutical Services

WuXi PharmaTech

Zhangjiang Biotech & Pharmaceutical Base Company

Zhejiang Jiang Yuan Tang Biotechnology

List or Organizations Mentioned in the Report

Agência Nacional de Vigilância Sanitária (ANVISA)

Asociación Española de Fabricantes de Productos de Química Fina (AFAQUIM)

Associação Brasileira da Indústria Farmoquímica e de Insumos Farmacêuticos (ABIQUIFI)

Association of British Pharmaceutical Industry (ABPI)

Central Drugs Standard Control Organization (CDSCO)

Department of Health and Family Welfare

Development and Reform Commission (NDRC)

European Commission

European Medicines Agency (EMA)

Food and Drug Administration (US FDA)

Indian Drug Manufacturer’s Association (IDMA)

International Society of Pharmaceutical Engineering (IPSE)

Korea Food and Drug Administration (KFDA)

Korea Pharmaceutical Manufacturer’s Association (KPMA)

Medicines and Healthcare Products Regulatory Agency (MHRA)

Medicines Manufacturing Industry Partnership (MMIP)

Ministry of Health (MOH)

Ministry of Health, Labor and Welfare (MHLW)

Ministry of Industry and Information Technology (MIIT)

Pharmaceutical and Medical Devices Agency (PMDA)

World Health Organization (WHO)

Download sample pages

Complete the form below to download your free sample pages for Pharmaceutical Contract Manufacturing Market 2019-2029

Related reports

-

Global Medical Device Contract Manufacturing Market Forecast 2019-2029

The global medical device contract manufacturing market was valued at $75.84bn in 2018. Visiongain forecasts this market to increase to...Full DetailsPublished: 06 August 2019 -

Generic Drugs Market Forecast 2019-2029

The generic drugs market is estimated to have reached $257.3bn in 2018 and is expected to grow at a CAGR...

Full DetailsPublished: 14 June 2019 -

3D Printing for Healthcare Market Report 2019-2029

The latest report from business intelligence provider Visiongain offers a comprehensive analysis of the global 3D printing for the Healthcare...

Full DetailsPublished: 02 August 2019 -

Global Protein Expression Market Forecast to 2029

The global protein expression market is estimated at $1.8bn in 2018. Visiongain estimated that the prokaryotic expression system accounted for...

Full DetailsPublished: 24 October 2019 -

Top 30 Oncology Drugs Manufacturers 2019

Cancer treating drugs market forms the most lucrative sector in pharmaceuticals. As the ageing population continues to rise across the...Full DetailsPublished: 03 May 2019 -

Nasal Drug Delivery Technology Market Forecast 2020-2030

The Global Nasal Drug Delivery Technology Market is estimated at $44,385 m in 2019 and is expected to grow at...

Full DetailsPublished: 30 March 2020 -

Biologics Market Trends and Forecasts 2019-2029

The global biologics market is estimated to reach $266bn in 2024. The market is expected to grow at a CAGR...

Full DetailsPublished: 28 August 2019 -

Global Stem Cell Technologies and Applications Market 2019-2029

The global stem cell technologies and applications market is estimated to have reached $14bn in 2018 and is expected to...

Full DetailsPublished: 31 July 2019 -

Global Wearable Medical Devices Market Forecast 2019-2029

The global wearable medical devices market is expected to reach $23bn in 2024. In 2018, the therapeutic wearable medical devices...

Full DetailsPublished: 19 September 2019 -

Top 20 Urology Devices Manufacturers 2020

In 2018, the urology devices market is estimated at $6.9bn and is expected to grow at a CAGR of 6.1%...

Full DetailsPublished: 19 December 2019

Download sample pages

Complete the form below to download your free sample pages for Pharmaceutical Contract Manufacturing Market 2019-2029

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Pharma news

Retinal Gene Therapy Market

The global Retinal Gene Therapy market is projected to grow at a CAGR of 9.6% by 2034

26 July 2024

HIV Drugs and Injectables Market

The global HIV Drugs & Injectables market is projected to grow at a CAGR of 4.6 % by 2034

24 July 2024

Digital Twin Technology in Pharmaceutical Manufacturing Market

The global Digital Twin Technology in Pharmaceutical Manufacturing market is projected to grow at a CAGR of 31.3% by 2034

23 July 2024

Specialty Pharma Market

The global Specialty Pharma market is projected to grow at a CAGR of 7.5% by 2034

22 July 2024