Industries > Pharma > Global Medical Device Contract Manufacturing Market Forecast 2019-2029

Global Medical Device Contract Manufacturing Market Forecast 2019-2029

Electronic Manufacturing Services-Medical Diagnostic Devices, Monitoring & Surgical Equipment, and Therapeutic Devices; Materials Processing; and Finished Products

The global medical device contract manufacturing market was valued at $75.84bn in 2018. Visiongain forecasts this market to increase to $130bn in 2024. The market will grow at a CAGR of 10.2% throughout the forecast period.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand-new report, you find 260-page report you will receive 94 tables and 95 figures – all unavailable elsewhere.

The 260-page report provides clear detailed insight into the global medical device contract manufacturing market. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand new report today you stay better informed and ready to act.

Report Scope

• Global Medical Device Market forecasts from 2019-2029

• Global Medical Device Contract Manufacturing Market forecasts from 2019-2029

• Medical Device Contract Manufacturing national market forecasts from 2019-2029, covering:

• United States

• Japan

• Germany

• France

• United Kingdom

• Italy

• Spain

• China

• Central America & South America

• India

• Rest of the World

• Medical Device Contract Manufacturing submarket forecasts from 2019-2029 covering:

• Electronic Manufacturing Services (EMS) – further segmented into Medical Diagnostic Devices, Monitoring & Surgical Equipments and Therapeutic Devices

• Materials Processing

• Finished Products

• Assessment of the leading companies in the medical device contract manufacturing market:

• Benchmark Electronics, Inc.

• Celestica, Inc.

• Flextronics International Ltd.

• Forefront Medical Technology

• Greatbatch, Inc.

• Jabil Circuit, Inc.

• Nortech Systems

• Plexus Corp.

• Sanmina Corporation

• TE Connectivity (Cregenna Medical)

• Vention Medical

• West Pharmaceutical Services, Inc

• SWOT and Porter’s Five Forces Analysis of the medical device contract manufacturing market

• Key questions answered by this report:

• How is the market for medical device contract manufacturing evolving?

• What is driving and restraining the medical device contract manufacturing market dynamics?

• What were the market shares of the submarkets for electronics, materials processing and finished products from the overall medical device contract manufacturing market in 2018?

• How will each of the submarket segments within the medical device contract manufacturing market grow over the forecast period and how much revenue will these submarkets account for by 2029?

• How will the market shares for each of the submarkets within the medical device contract manufacturing market develop from 2019 to 2029?

• Which submarkets will be the main driver of growth in the overall market from 2019 to 2029?

• How will the regional market shares in medical device contract manufacturing change by 2029 and which geographical region will lead the market by 2029?

Visiongain’s study is intended for anyone requiring commercial analyses for the global medical device contract manufacturing market and leading companies. You find data, trends and predictions.

Buy our report today Global Medical Device Contract Manufacturing Market Forecast 2019-2029: Electronic Manufacturing Services-Medical Diagnostic Devices, Monitoring & Surgical Equipment, and Therapeutic Devices; Materials Processing; and Finished Products.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1.1 Global Medical Device Contract Manufacturing Market Overview

1.2 Global Medical Device Contract Manufacturing: Market Segmentation

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report

1.6 Who Is This Report For?

1.7 Methodology

1.8 Frequently Asked Questions (FAQs)

1.9 Associated Reports

1.10 About Visiongain

2. Medical Device Contract Manufacturing: An Introduction

2.1 What Are Medical Devices?

2.2 The Medical Device Industry: An Overview

2.3 An Introduction to Medical Device Outsourcing

2.4 Advantage of Outsourcing Medical Device Manufacturing

2.4.1 The Reasons behind Strategic Outsourcing of Medical Device Manufacturing

2.4.1.1 Outsourcing: Focusing on Core Competencies

2.4.1.2 Reducing Time-to-Market for Medical Devices

2.4.1.3 Outsourcing: A Tactical and Strategic Tool

2.4.1.4 Outsourcing: Lowering Fixed Operating Costs

2.5 Identifying Compatible CMOs

2.5.1 Building Contractual Agreements

2.5.2 Reviewing the Quality Manual: CMO-OEM Relationships

2.5.3 Audit and Site Visits

2.6 Medical Devices Classification Systems

2.6.1 The US Medical Devices Classification System

2.6.2 The EU Medical Devices Classification System

2.7 Regulation of Medical Devices

2.7.1 Regulation in the US

2.7.1.1 An Introduction to Regulatory Developments in the US

2.7.1.2 The US Approval and Regulation System

2.7.1.3 Medical Device Bans

2.7.2 The EU Approval and Regulation System

2.7.2.1 Post-Marketing Surveillance in the EU

2.7.3 Regulation in Japan

2.7.4 Regulation in China

2.7.5 Regulation in Central and South America

2.7.5.1 Regulation in Brazil

2.7.5.2 Regulation in Mexico

2.7.6 Regulation in India

2.8 Final Discussions

2.8.1 Product Requirement Specifications

2.8.2 Term Sheets and Supply Agreements

2.8.3 Project Management

2.9 Medical Device Quality Management Systems

2.10 Medical Device Outsourcing Segments

2.10.1 Design Engineering

2.10.2 Device (Contract) Manufacturing

2.10.2.1 Electronic Manufacturing Services

2.10.2.2 Material Processing

2.10.2.3 Finished Products

2.10.3 Final Goods Assembly

3. The Medical Device Market, 2019-2029

3.1 The Global Medical Device Market: Market Overview

3.2 The Growing Global Ageing Population

3.3 The Global Medical Device Market: Market Forecast, 2019-2029

3.4 The Global Medical Device Market: Drivers and Restraints

3.5 The Medical Device Outsourcing Market: Market Overview

3.5.1 Medical Device Outsourcing: Market Segmentation

3.5.2 Blusterous Future Growth for Design Engineering

3.5.3 Relatively High Costs of Goods Sold (COGS) for Medical Devices

3.6 Recent Trends in Medical Device Outsourcing

3.7 Estimating the Size of Outsourced Medical Device Manufacturing

4. The Medical Device Contract Manufacturing Market: Submarket Analysis and Forecast 2019-2029

4.1 Medical Device Contract Manufacturing Market: Overview of Market Segments, 2018

4.2 Medical Device Contract Manufacturing: Market Forecast 2019-2029

4.2.1 Market Sectors That Will Drive Growth in Medical Device Contract Manufacturing

4.2.2 Global Medical Device Contract Manufacturing Market - Changing Market Shares by Sector 2019-2029

4.3 Electronic Manufacturing Services (EMS): Market Overview

4.3.1 Electronic Manufacturing Services (EMS) For Medical Devices: Market Overview, 2018

4.3.2 Leading Companies in Electronic Manufacturing Services (EMS), 2018

4.3.3 Outsourced Electronics Manufacturing: Market Forecast, 2019-2029

4.4 Materials Processing: Market Overview, 2018

4.4.1 The Materials Processing Market: Market Forecast 2019-2029

4.4.2 Medical Moulding

4.4.3 Medical Extrusion

4.5 Finished Products: Market Overview

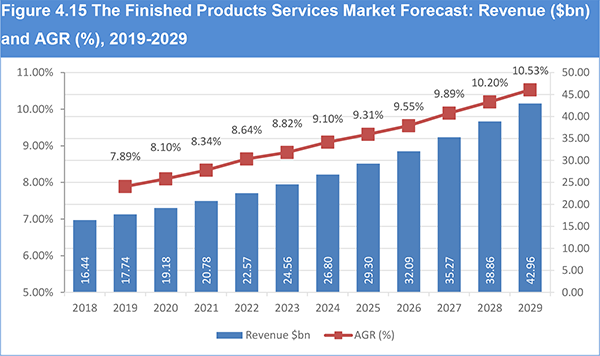

4.5.1 Outsourced Finished Products Market Forecast 2019-2029

5. Leading Regional Markets for Medical Device Contract Manufacturing, 2019-2029

5.1 The Medical Device Contract Manufacturing Market by Region

5.1.1 The Global Distribution of Medical Device Contract Manufacturing in 2018

5.2 Leading National Markets: Market Forecast 2019-2029

5.2.1 Changing Market Shares by Region

5.3 Regional Medical Device Contract Manufacturing Markets: Analysis and Forecasts, 2019-2029

5.3.1 United States: The Largest Medical Device Contract Manufacturing Market

5.3.1.1 US Medical Device Contract Manufacturing Market: Market Forecast 2019-2029

5.3.2 The EU5 Markets: Growth Expected In Each Country

5.3.2.1 EU5 Medical Device Contract Manufacturing Market: Market Forecast 2019-2029

5.3.2.2 EU5 Markets: Changing Market Shares by Country, 2019-2029

5.3.3 Germany

5.3.3.1 German Medical Device Contract Manufacturing Market: Market Forecast 2019-2029

5.3.4 UK

5.3.4.1 UK Medical Device Contract Manufacturing Market: Market Forecast 2019-2029

5.3.5 Spain

5.3.5.1 Spanish Medical Device Contract Manufacturing Market: Market Forecast 2019-2029

5.3.6 France

5.3.6.1 French Medical Device Contract Manufacturing Market: Market Forecast 2019-2029

5.3.7 Italy

5.3.7.1 Italian Medical Device Contract Manufacturing Market: Market Forecast 2019-2029

5.3.8 Japan

5.3.8.1 Japanese Medical Device Contract Manufacturing Market: Market Forecast 2019-2029

5.3.9 China

5.3.9.1 Chinese Medical Device Contract Manufacturing Market: Market Forecast 2019-2029

5.3.10 Central America & South America

5.3.10.1 Major National Markets in the Region

5.3.10.1.1 Brazil

5.3.10.1.2 Mexico

5.3.10.2 Central America & South America Medical Device Contract Manufacturing Market: Market Forecast 2019-2029

5.3.11 India

5.3.11.1 Indian Medical Device Contract Manufacturing Market: Market Forecast 2019-2029

5.3.12 Rest of the World

5.3.12.1 Rest of the World Medical Device Contract Manufacturing Market: Market Forecast 2019-2029

6. Leading Companies in Medical Device Contract Manufacturing, 2019-2029

6.1 Medical Device Contract Manufacturing: A Rapidly Consolidating Market

6.2 Flextronics International, Ltd.

6.2.1 Flextronics: Historical Financial and Performance Analysis, 2011-2018

6.2.2 Flextronics: Business Segment Revenue Analysis, 2019

6.2.3 Flextronics: Geographic Analysis, 2019

6.2.4 Flextronics: Business Capabilities

6.2.5 Flextronics: Recent Developments

6.2.5.1 Partnership with MAS Holdings to Drive Innovation in Wearable Technology for Clothing

6.2.5.2 Partnership with Enable Injections for Production of Wearable High-Volume Injectors

6.2.5.3 Business Restructuring

6.2.5.4 Flextronics’ Acquisition of RIWISA AG

6.2.5.5 Spin-Off of Supply Chain Software

6.2.5.6 Global Strategic Alliance and Partnerships

6.2.5.7 Acquisition of Farm Design

6.2.5.8 Partnership with Enable Injections

6.3 Jabil Circuit Inc.

6.3.1 Jabil Circuit: Historical Financial and Performance Analysis 2011-2018

6.3.2 Jabil Circuit: Business Segment Performance Analysis, 2018

6.3.3 Jabil Circuit National Market Segmentation by Geography, 2016-2018

6.3.4 Jabil Circuit: Recent Developments

6.3.4.1 New Product Launch

6.3.4.2 Nypro Expands Manufacturing Facility in Tiszaújváros

6.3.4.3 Jabil Increases 3D Printing Leadership & Manufacturing Agility with Global Services Expansion into Six Countries and Strategic Partnership with HP

6.3.4.4 Jabil to Build New Headquarters in St. Petersburg, Florida

6.3.4.5 Jabil and Baicells Sign Manufacturing Agreement for Mini-Cell Base Stations

6.3.4.6 Jabil Opens Newest Innovation Center in Marcianise, Italy

6.3.4.7 Acquisition of Nypro

6.3.4.8 Divestment of Jabil’s Aftermarket Services Business

6.3.4.9 Acquisition of Plasticos

6.3.4.10 Acquisition of Clothing+

6.3.4.11 Partnership with DayaMed

6.4 Celestica Inc.

6.4.1 Celestica Inc.: Historical Financial and Performance Analysis 2011-2018

6.4.2 Celestica Inc.: Business Segment Performance Analysis, 2018

6.4.3 Celestica Inc.: National Market Segmentation by Geography, 2017

6.4.4 Celestica Inc.: Recent Developments

6.4.4.1 Acquisition of Atrenne Integrated Solutions

6.4.4.2 Expands Operation in Oradea, Romania

6.4.4.3 Asset Acquisition from Karel Manufacturing

6.4.5 Benchmark Electronics, Inc.

6.4.5.1 Benchmark Electronics, Inc.: Historical Financial and Performance Analysis, 2011-2018

6.4.5.2 Benchmark Electronics: Business Segment Performance Analysis

6.4.5.3 Benchmark Electronics Inc. Regional Market Segmentation, 2017-2018

6.4.5.4 Benchmark Electronics Inc.: Recent Developments

6.4.5.4.1 Expansion of Precision Technologies Group in Malaysia

6.4.5.4.2 Collaboration with Qualcomm

6.4.5.4.3 Acquisition of the EMS Sector of CTS Corporation

6.4.5.4.4 Acquisition of Secure Technology

6.5 Sanmina Corporation

6.5.1 Sanmina Corporation Historical Financial and Performance Analysis, 2012-2018

6.5.2 Sanmina Corporation: Business Segment Performance Analysis

6.5.3 Sanmina Corporation: Regional Market Segmentation, 2016-2018

6.5.4 Sanmina Corporation: Recent Developments

6.5.4.1 Partnership with Tyndall

6.5.4.2 Launch of Rapid IIoT Cloud Solution for Manufacturers

6.5.4.3 Launch of Rapid eDHR Cloud Solution for Medical Device Manufacturers

6.5.4.4 Partnership with Brighter to Manufacturer Actiste

6.5.4.5 Agreement with Ouraring to Manufacture Smart Wearable Device

6.6 Greatbatch, Inc.

6.6.1 Greatbatch Inc.: Historical Financial and Performance Analysis 2010-2015

6.6.2 Greatbatch Inc.: Recent Acquisition Activities

6.6.2.1 Acquisition of Centro de Construccion de Cardioestimuladores del Uraguay (CCC)

6.6.2.2 Acquisition of NeuroNexus

6.6.2.3 Acquisition of Micro Power Electronics

6.6.2.4 Acquisition of Lake Region Medical

6.6.3 Organisational Restructuring and Investments

6.7 Plexus Corp

6.7.1 Plexus Corp: Historical Financial and Performance Analysis, 2011-2018

6.7.2 Plexus Corporation: Business Segment Performance Analysis

6.7.3 Plexus Corp: Regional Market Segmentation, 2016-2018

6.7.4 Plexus Corp.: Recent Expansion Activities

6.7.4.1 Expansion in Malaysia

6.7.4.2 New Manufacturing Facility in Mexico

6.7.4.3 Investment in New Surface Mount Technology Line for Electronics Manufacturing

6.8 West Pharmaceutical Services, Inc.

6.8.1 West Pharmaceutical Services, Inc.: Historical Financial and Performance Analysis 2016-2018

6.8.2 West Pharmaceutical Services, Inc.: Recent Developments

6.8.2.1 New Product Launces

6.8.2.2 Investment to Expand Kinston, North Carolina, Production Center

6.8.2.3 Contract Manufacturing Capacity Expansion

6.8.2.4 Collaboration with HealthPrize Technologies

6.9 Tecomet Inc (Symmetry Medical)

6.9.1 Symmetry Medical: Historical Financial and Performance Analysis 2009-2013

6.9.2 Symmetry Medical: Business Segment Analysis, 2013 and 2014

6.9.3 Total Solutions Approach

6.9.4 Symmetry Medical Regional Market Segmentation, 2012

6.9.5 Tecomet (Symmetry Medical): Recent Acquisition Activities

6.9.5.1 Acquisition of Mountainside Medical

6.9.5.2 Acquisition of 3D Medical Manufacturing, Inc.

6.9.5.3 Tecomet’s Acquisition of Symmetry Medical

6.10 Nortech Systems Incorporated

6.10.1 Nortech Systems: Historical Financial and Performance Analysis 2010-2018

6.10.2 Nortech Systems: Business Segment Performance Analysis, 2016-2018

6.10.3 Nortech Systems: Recent Acquisition Activities

6.10.3.1 Expansion of Mexico Operations

6.10.3.2 Collaboration with Panasonic to Expand Manufacturing Capabilities

6.10.3.4 Launch of PCBA Operations in Mexico

6.10.3.5 Acquisition of Devicix

6.11 TE Connectivity (Creganna Medical)

6.11.1 Acquisition of Precision Wire Components LLC

6.11.2 Creganna Medical’s Product and Services Portfolio

6.11.3 Pilot Manufacturing

6.11.4 Volume Manufacturing

6.11.5 Creganna Medical: Merger and Acquisition Activities Prior to Acquisition by TE Connectivity

6.11.5.1 Partnership with BBA

6.11.5.2 Acquisitions of ABT Medical

6.11.5.3 Creganna Medical’s Developments in Asia

6.12 Forefront Medical Technology

6.12.1 Forefront Medical Service Offerings

6.13 Vention Medical

6.13.1 Vention Medical: Recent Developments

6.13.1.1 Nordson Corporation acquired Vention Medical’s Advanced Medical Technologies Business

6.13.1.2 Acquisition of Lithotech Medical

6.13.1.3 Expansion in Ireland

6.13.1.4 Partnership with DSM

6.13.1.5 Expansion in Costa Rica

6.13.1.6 Acquisition of RiverTech Medical

6.13.1.7 Acquisition of Fast Forward Medical

6.14 Integer Holdings Corporation

6.14.1 nteger Holdings Corporation: Medical Business Segments

6.14.2 Integer Holdings Corporation: Financial Performance 2016-2018

6.14.3 Integer Holdings Corporation: Recent Developments

6.14.3.1 Launch of RadialSeal

6.14.3.2 Agreement with Mainstay Medical Limited

6.15 Gerresheimer

6.15.1 Gerresheimer: Medical Device Segment

6.15.2 Gerresheimer: Financial Performance Analysis 2018

6.15.3 Gerresheimer: Recent Developments

6.15.3.1 Acquisition of Sensile Medical AG

6.16 Consort Medical PLC

6.16.1 Consort Medical PLC: Product/Service

6.16.2 Consort Medical PLC: Financial Analysis, 2015-2018

6.16.3 Consort Medical PLC: Recent Developments

6.16.3.1 Consort Medical Completes Syrina Auto-Injector Master Development Agreement

6.16.3.2 Launch of Syrina AR 2.25 auto-injector

6.17 Nipro Corporation

6.17.1 Nipro Corporation: Financial Performance Analysis 2015-2018

6.17.2 Nipro Corporation: Recent Developments

6.17.2.1 Expands Operation in Developing Countries

6.18 Teleflex Inc.

6.18.1 Teleflex Inc.: Business Overview

6.19 Other Companies Operating within the Medical Device Contract Manufacturing

7. Medical Contract Manufacturing Market Share, 2018

7.1 Flextronics International Ltd.

7.2 Jabil Circuit Inc.

7.3 Celestics Inc.

8. Qualitative Analysis of the Medical Device Contract Manufacturing Market, 2019-2029

8.1 Market Factors Influencing Medical Device Contract Manufacturing

8.2 SWOT Analysis of the Global Medical Device Contract Manufacturing Market, 2019-2029

8.2.1 Strengths

8.2.1.1 The Cost-Advantages of Outsourced Manufacturing

8.2.1.2 Outsourcing as a Strategy to Meet Short-term Goals

8.2.1.3 Rapidly Contracting Development Cycle and Market Entry

8.2.1.4 Increasing Focus of Medical Device Companies on Core Competencies

8.2.2 Weaknesses

8.2.2.1 Strong Dependence on the Continued Success of OEMs

8.2.2.2. The Impact of Reimbursements and Payment Approvals on Contract Manufacturing

8.2.2.3 Small Pool of Customers Accounting for a Large Proportion of CMOs’ Income

8.2.2.4 The Perception of Risk Associated with Intellectual Property Protection

8.2.2.5 Medical Device Counterfeiting – A Restraint to Growth in Emerging Markets

8.2.3 Opportunities

8.2.3.1 Intensifying Price Pressures on Medical Device Companies

8.2.3.2 Globalisation as a Potential Driver of Growth

8.2.3.3 Changes to Taxation Systems May Impact upon Contract Manufacturing

8.2.3.4 Rapid Expansion in Emerging Markets

8.2.3.5 Asian Regions Offer Attractive Manufacturing Locations

8.2.4 Threats

8.2.4.1 Slower Growth Expected for Medical Devices

8.2.4.2 Changes to Reimbursement in Various Markets Globally

8.2.4.3 Manufacturing Costs on the Rise in Traditionally Low-Cost Regions

8.3 Porter’s Five Force Analysis of the Global Medical Device Contract Manufacturing Market

8.3.1 Rivalry Among Competitors: High

8.3.2 Threat of New Entrants: Medium

8.3.3 Power of Buyers: High

8.3.4 Power of Suppliers: Medium

8.3.5 Threat of Substitutes: High

9. Conclusions

9.1 Overview of Current Market Conditions and Market Forecast, 2019-2029

9.2 Leading Sectors in Medical Device Contract Manufacturing in 2018

9.3 Leading Regions in the Medical Device Contract Manufacturing Market in 2018

9.4 Future Outlook for the Various Sectors within Medical Device Contract Manufacturing, 2019-2029

9.5 Electronic Manufacturing Services Provides the Glimpse of Future Growth

9.6 Consolidation in the Contract Manufacturing Market

9.7 Concluding Remarks

Appendices

Associated Reports

Visiongain Report Sales Order Form

About Visiongain

Visiongain Report Evaluation Form

List of Tables

Table 2.1 Reasons for Outsourcing Medical Device Manufacturing, 2018

Table 2.2 The US: Classification of Medical Devices

Table 2.3 The US: Time, Cost, and Complexity of Registration Process

Table 2.4 The European Commission Classification of Medical Devices

Table 2.5 Medical Devices and Durations of use

Table 2.6 Classification System for Medical Devices in Japan

Table 2.7 Japan: Time, Cost & Complexity of Registration Process of Medical Devices

Table 2.8 China: Time, Cost & Complexity of Registration Process of Medical Devices

Table 2.9 Brazil: Time, Cost & Complexity of Registration Process of Medical Devices

Table 2.10 Mexico: Time, Cost & Complexity of Registration Process of Medical Devices

Table 2.11 Regulated Medical Devices in India, 2018

Table 2.12 India: Time, Cost & Complexity of Registration Process of Medical Devices

Table 3.1 World 65+ Population Forecast: Size (m), AGR (%) and CAGR (%), 2019-2029

Table 3.2 The Global Medical Device Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 3.3 Global Market for Outsourced Medical Devices: Market Size ($bn) and Market Share (%) by Sector, 2018

Table 3.4 Medical Device Market: Market Size ($bn), Cost of Goods Sold (COGS) ($bn) and Market Share (%), 2018

Table 3.5 Spending on In-house and Outsourced Device Manufacturing ($bn) and Share (%) of COGS, 2018

Table 4.1 Medical Device Contract Manufacturing Market: Market Size ($bn) and Market Shares (%) by Sector, 2018

Table 4.2 The Global Medical Device Contract Manufacturing Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 4.3 The Global Medical Device Contract Manufacturing Market Forecast: CAGR (%) by Sector, 2019-2024, 2024-2029 and 2019-2029

Table 4.4 The Global Medical Device Contract Manufacturing Market: Revenue ($bn) by Sector, 2019, 2024, and 2029

Table 4.5 The Global Medical Device Contract Manufacturing Market Forecast: Market Share (%) by Sector, 2019, 2024, and 2029

Table 4.6 Medical EMS Market: Market Size ($bn) and Market Share (%) by Segment, 2018

Table 4.7 Leading Organisations Offering Moulding Services to Medical Device OEMs, 2018

Table 4.8 Global Electronic Manufacturing Services Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 4.9 The Materials Processing Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 4.10 Leading Organisations Offering Moulding Services to Medical Device OEMs, 2018

Table 4.11 The Finished Products Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.1 The Global Medical Device Contract Manufacturing Market: Market Size ($bn) and Market Share (%) by Region, 2018

Table 5.2 Global Medical Device Contract Manufacturing Market Forecast by National Market: Revenue ($bn), AGR (%) and CAGR (%) by Region, 2019-2029

Table 5.3 The Global Medical Device Contract Manufacturing Market Forecast by Region: CAGR (%), 2019-2024, 2024-2029, and 2019-2029

Table 5.4 The Global Medical Device Contract Manufacturing Market Forecast: Market Share (%) by Region, 2019, 2024, and 2029

Table 5.5 US Medical Device Contract Manufacturing Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.6 US Medical Device Contract Manufacturing Market Forecast by Subsegment: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.7 US Electronic Manufacturing Services (EMS) Market Forecast by Type: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.8 The EU5 Medical Device Contract Manufacturing Market: Market Size ($bn) and Market Share (%) by Country, 2018

Table 5.9 EU5 Medical Device Contract Manufacturing Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.10 EU5 Medical Device Contract Manufacturing Market Forecast by Region: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.11 EU5 Medical Device Contract Manufacturing Market Forecast by Subsegment: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.12 EU5 Electronic Manufacturing Services (EMS) Market Forecast by Type: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.13 The EU5 Medical Device Contract Manufacturing Market: EU5 Share (%) by Country, 2018, 2024, 2029

Table 5.14 Germany Medical Device Contract Manufacturing Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.15 UK Medical Device Contract Manufacturing Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.16 Spain Medical Device Contract Manufacturing Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.17 The French Medical Device Contract Manufacturing Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.18 The Italian Medical Device Contract Manufacturing Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.19 Japan Medical Device Contract Manufacturing Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.20 Japan Medical Device Contract Manufacturing Market Forecast by Subsegment: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.21 Japan Electronic Manufacturing Services (EMS) Market Forecast by Type: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.22 China Medical Device Contract Manufacturing Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.23 China Medical Device Contract Manufacturing Market Forecast by Subsegment: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.24 China Electronic Manufacturing Services (EMS) Market Forecast by Type: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.25 Central America & South America Medical Device Contract Manufacturing Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.26 Central America & South America Medical Device Contract Manufacturing Market Forecast by Subsegment: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.27 Central America & South America Electronic Manufacturing Services (EMS) Market Forecast by Type: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.28 India Medical Device Contract Manufacturing Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.29 India Medical Device Contract Manufacturing Market Forecast by Subsegment: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.30 India Electronic Manufacturing Services (EMS) Market Forecast by Type: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.31 RoW Medical Device Contract Manufacturing Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.32 RoW Medical Device Contract Manufacturing Market Forecast by Subsegment: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 5.33 RoW Electronic Manufacturing Services (EMS) Market Forecast by Type: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 6.1 Medical Device Contract Manufacturing Companies

Table 6.2 Flextronics: Historical Revenue ($m) 2011-2019

Table 6.3 Flextronics: Sales ($m) and Revenue Shares (%) by Business Segment, 2019

Table 6.4 Flextronics: Sales ($m) and Revenue Shares (%) by Geographic Segment, 2019

Table 6.5 Jabil Circuit: Historical Revenue ($m), AGR (%) and CAGR (%) 2011-2018

Table 6.6 Jabil Circuit: Revenue ($m) and Revenue Share (%) by Business Segment, 2016 – 2018

Table 6.7 Jabil Circuit Business Segment by National Market: Revenue ($m), Revenue Share (%), 2016-2018

Table 6.8 Celestica Inc.: Historical Revenue ($m), AGR (%) and CAGR (%) 2011-2018

Table 6.9 Celestica Inc.: Revenue ($m), Revenue Share (%) by Business Segment, 2016 - 2018

Table 6.10 Celestica Inc. Business Segment by National Market: Revenue ($m), Revenue Share (%), 2017

Table 6.11 Benchmark Electronics: Historical Revenue ($m), AGR (%) and CAGR (%) 2011-2018

Table 6.12 Benchmark Electronics: Revenue ($m) and Revenue Share (%) by Business Segment, 2016 & 2018

Table 6.13 Benchmark Electronics National Market Segmentation: Revenue ($m), Revenue Share (%), 2017 and 2018

Table 6.14 Sanmina Corporation: Historical Revenue ($m), AGR (%) and CAGR (%) 2012-2018

Table 6.15 Sanmina Corporation: Revenue ($m) and Revenue Share (%) by Business Segment, 2016, 2017 & 2018

Table 6.16 Sanmina Corporation National Market Segmentation: Revenue ($m), Revenue Share (%), 2016-2018

Table 6.17 Greatbatch Inc.: Historical Revenue ($m), AGR (%), and CAGR (%) 2010-2015

Table 6.18 Plexus Corp: Historical Revenue ($m), AGR (%) and CAGR (%) 2011-2018

Table 6.19 Plexus Corp: Revenue ($m) and Revenue Share (%) by Business Segment, 2016, 2017 & 2018

Table 6.20 Plexus Corp. National Market Segmentation: Revenue ($m), Revenue Share (%), 2016 - 2018

Table 6.21 West Pharmaceutical Services, Inc.: Business Segments Revenue ($m) and Market Share (%), 2016-2018

Table 6.22 Symmetry Medical: Historical Revenue ($m) and AGR (%), 2009-2013

Table 6.23 Symmetry Medical: Revenue ($bn) and Revenue Share (%) by Business Segment, 2013 and 2014

Table 6.24 Symmetry Medical Regional Market Segmentation: Revenue ($m) and Revenue Share (%), 2012

Table 6.25 Nortech Systems: Historical Revenue ($m), AGR (%) and CAGR (%) 2010-2018

Table 6.26 Nortech Systems: Revenue ($m) and Revenue Share (%) by Business Segment, 2016-2018

Table 6.27 Other Companies in Medical Device Contract Manufacturing, 2018

Table 6.28 Other Companies in Medical Device Contract Manufacturing, 2018 (continued)

Table 8.1 SWOT Analysis of the Global Medical Device Contract Manufacturing Market

Table 9.1 The Global Medical Device Contract Manufacturing Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2019-2029

Table 9.2 The Global Medical Device Contract Manufacturing Market: Market Size ($bn) and Market Shares (%) by Sector, 2018

Table 9.3 The Global Medical Device Contract Manufacturing Market: Market Size ($bn) by Region, 2019, 2024, and 2029

Table 9.4 Global Medical Device Contract Manufacturing: Market Forecast ($bn) by Sector, 2019, 2024, and 2029

List of Figures

Figure 1.1 Global Medical Device Contract Manufacturing Market: Market Sectors, 2018

Figure 2.1 Services Ofered by Medical Device Outsourcing Companies, 2018

Figure 2.2 US: Regulatory Process for Medical Devices

Figure 2.3 Europe: Regulatory Process for Medical Devices

Figure 2.4 Japan: Regulatory Process for Medical Devices

Figure 2.5 Brazil: Regulatory Process for Medical Devices

Figure 2.5 Mexico: Regulatory Process for Medical Devices

Figure 2.6 India: Regulatory Process for Medical Devices

Figure 2.7 Global Medical Device Outsourcing: Market Segmentation, 2018

Figure 3.1 World 65+ Population Forecast: Size (m) and AGR (%), 2019-2029

Figure 3.2 The Global Medical Device Market Forecast: Revenue ($bn) and AGR (%), 2019-2029

Figure 3.3 The Global Medical Device Market: Drivers and Restraints

Figure 3.4 Global Medical Device Outsourcing: Market Segmentation, 2018

Figure 3.5 Global Market for Outsourced Medical Devices: Market Share (%) by Sector, 2018

Figure 3.6 Spending on In-house and Outsourced Device Manufacturing (%), 2018

Figure 4.1 Medical Device Contract Manufacturing Market: Market Size ($bn) by Sector, 2018

Figure 4.2 Medical Device Contract Manufacturing Market: Market Shares (%) by Sector, 2018

Figure 4.3 The Global Medical Device Contract Manufacturing Market Forecast: Revenue ($bn) and AGR (%), 2019-2029

Figure 4.4 The Global Medical Device Contract Manufacturing Market Forecast: CAGR (%) by Sector, 2019-2024

Figure 4.5 The Global Medical Device Contract Manufacturing Market Forecast: CAGR (%) by Sector, 2024-2029

Figure 4.6 The Global Medical Device Contract Manufacturing Market Forecast: CAGR (%) by Sector, 2019-2029

Figure 4.7 The Global Medical Device Contract Manufacturing Market: Revenue ($bn) by Sector, 2019, 2024, and 2029

Figure 4.8 The Global Medical Device Contract Manufacturing Market Forecast: Market Share (%) by Sector, 2019

Figure 4.9 The Global Medical Device Contract Manufacturing Market Forecast: Market Share (%) by Sector, 2024

Figure 4.10 The Global Medical Device Contract Manufacturing Market Forecast: Market Share (%) by Sector, 2029

Figure 4.11 Medical EMS Market: Market Size ($bn) by Segment, 2018

Figure 4.12 Medical EMS Market: Market Share (%) by Segment, 2018

Figure 4.13 The Electronic Manufacturing Services Market Forecast: Revenue ($bn) and AGR (%), 2019-2029

Figure 4.14 The Materials Processing Market Forecast: Revenue ($bn) and AGR (%), 2019-2029

Figure 4.15 The Finished Products Services Market Forecast: Revenue ($bn) and AGR (%), 2019-2029

Figure 5.1 The Global Medical Device Contract Manufacturing Market: Market Size ($bn) by Country/Region, 2019-2029

Figure 5.2 Global Medical Device Contract Manufacturing Market Forecast by National Market: Revenue Share (%), 2019-2029

Figure 5.3 The Global Medical Device Contract Manufacturing Market Forecast: CAGR (%) by Region, 2019-2024

Figure 5.4 The Global Medical Device Contract Manufacturing Market Forecast: CAGR (%) by Region, 2024-2029

Figure 5.5 The Global Medical Device Contract Manufacturing Market Forecast: CAGR (%) by Region, 2019-2029

Figure 5.6 The Global Medical Device Contract Manufacturing Market Forecast: Market Share (%) by Region, 2019

Figure 5.7 The Global Medical Device Contract Manufacturing Market Forecast: Market Share (%) by Region, 2024

Figure 5.8 The Global Medical Device Contract Manufacturing Market Forecast: Market Share (%) by Region, 2029

Figure 5.9 The EU5 Medical Device Contract Manufacturing Market: EU5 Share (%) by Country, 2018

Figure 5.10 The EU5 Medical Device Contract Manufacturing Market: EU5 Share (%) by Country, 2024

Figure 5.11 The EU5 Medical Device Contract Manufacturing Market: EU5 Share (%) by Country, 2029

Figure 5.12 The German Medical Device Contract Manufacturing Market Forecast: Revenue ($bn) and AGR (%), 2019-2029

Figure 5.13 The UK Medical Device Contract Manufacturing Market Forecast: Revenue ($bn) and AGR (%), 2019-2029

Figure 5.14 The Spanish Medical Device Contract Manufacturing Market Forecast: Revenue ($bn) and AGR (%), 2019-2029

Figure 5.15 The French Medical Device Contract Manufacturing Market Forecast: Revenue ($bn) and AGR (%), 2019-2029

Figure 5.16 The Italian Medical Device Contract Manufacturing Market Forecast: Revenue ($bn) and AGR (%), 2019-2029

Figure 6.1 Flextronics: Revenue Shares (%) by Business Segment, 2019

Figure 6.2 Flextronics: Revenue Shares (%) by Geography Segment, 2019

Figure 6.3 Jabil Circuit: Market Share (%) by Business Segment, 2018

Figure 6.4 Jabil Circuit: Market Share (%) by Business Segment, 2017

Figure 6.5 Jabil Circuit National Market Segmentation: Revenue Share (%), 2018

Figure 6.6 Jabil Circuit National Market Segmentation: Revenue Share (%), 2017

Figure 6.7 Celestica Inc.: Market Share (%) by Business Segment, 2018

Figure 6.8 Celestica Inc.: Market Share (%) by Business Segment, 2017

Figure 6.9 Celestica Inc. National Market Segmentation: Revenue Share (%), 2017

Figure 6.10 Benchmark Electronics: Revenue Share (%) by Business Segment, 2018

Figure 6.11 Benchmark Electronics: Revenue Share (%) by Business Segment, 2017

Figure 6.12 Benchmark Electronics National Market Segmentation: Revenue Share (%), 2018

Figure 6.13 Benchmark Electronics National Market Segmentation: Revenue Share (%), 2017

Figure 6.14 Sanmina Corporation: Revenue Share (%) by Business Segment, 2018

Figure 6.15 Sanmina Corporation: Revenue Share (%) by Business Segment, 2017

Figure 6.16 Sanmina Corporation National Market Segmentation: Revenue Share (%), 2018

Figure 6.17 Sanmina Corporation National Market Segmentation: Revenue Share (%), 2017

Figure 6.18 Greatbatch Inc.: Historical Revenue ($m) and AGR (%), 2010-2015

Figure 6.19 Plexus Corp.: Revenue Share (%) by Business Segment, 2018

Figure 6.20 Plexus Corp.: Revenue Share (%) by Business Segment, 2017

Figure 6.21 Plexus Corp. National Market Segmentation: Revenue Share (%), 2018

Figure 6.22 Plexus Corp. National Market Segmentation: Revenue Share (%), 2017

Figure 6.23 West Pharmaceutical Services, Inc. Business Segment: Market Share (%), 2018

Figure 6.24 West Pharmaceutical Services, Inc. by Business Segment: Market share (%), 2017

Figure 6.25 Symmetry Medical: Historical Revenue ($m), AGR (%), 2009-2013

Figure 6.26 Symmetry Medical OEM Solutions: Revenue Shares (%) by Product Line, 2013

Figure 6.27 Symmetry Medical OEM Solutions: Revenue Shares (%) by Product Line, 2014 (January — September)

Figure 6.28 Symmetry Medical Regional Market Segmentation: Revenue Share (%), 2012

Figure 6.29 Nortech Systems: Revenue Share (%) by Business Segment, 2018

Figure 6.30 Nortech Systems: Revenue Share (%) by Business Segment, 2017

Figure 6.31 Integer Holdings Corporation: Segment Revenue ($mn) 2016-2018

Figure 6.32 Integer Holdings Corporation: Historical Revenue ($mn) 2016-2018

Figure 6.33 Integer Holdings Corporation: Revenue Share (%) by Region, 2018

Figure 6.34 Gerresheimer: Financial Performance by Product Segment 2018

Figure 6.35 Gerresheimer: Financial Performance by Regional Segment 2018

Figure 6.36 Consort Medical PLC: Revenue ($mn) 2015 – 2018

Figure 6.37 Consort Medical PLC: Market Share (%) by Business Segment, 2018

Figure 6.38 Consort Medical PLC: Market Share (%) by Region, 2018

Figure 6.39 Nipro Corporation: Financial Performance ($m) 2015-2018

Figure 6.40 Teleflex Inc.: Financial Performance Revenue ($m) 2015-2018

Figure 6.41 Teleflex Inc.: Business Segment Revenue ($m), 2017 - 2018

Figure 6.42 Teleflex Inc.: Market Share (%) by Business Segment, 2018

Figure 6.43 Teleflex Inc.: Market Share (%) by Region, 2018

Figure 7.1 Medical Contract Manufacturing Market Share: Electronic manufacturing Services (EMS) by Key Players, 2018

Figure 8.1 Porter’s Five Force Analysis of the Medical Device Contract Manufacturing Market

Figure 9.1 Global Medical Device Contract Manufacturing Market Forecast: Revenue ($bn), 2019, 2024, and 2029

Figure 9.2 The Global Medical Device Contract Manufacturing Market: Market Size ($bn) by Sector, 2018

Figure 9.3 The Global Medical Device Contract Manufacturing Market Forecast: Market Size ($bn) by Region, 2019, 2024, and 2029

Figure 9.4 Global Medical Device Contract Manufacturing: Market Forecast (%) by Sector, 2019-2029

AccuPlace

Advanced Moulding Technologies

Advanced Scientifics (Thermo Fisher Scientific)

Advanced Semiconductors

AdvantaPure

Alcatel-Lucent

Ansamed

Applied Materials

Asteel Flash

ATEK Medical Group

Atrenne Integrated Solutions, Inc.

Avalon Medical Services Pte Ltd

B Braun

Bain Capital LLC

Benchmark Electronics

Beyonics Technology

Blackberry Limited

Boston Biomedical Associates (BBA)

Boston Scientific

C&J Industries

Celestica

Centro de Construccion de Cardioestimuladores del Uraguay (CCC)

CIRTEC Medical Systems

Cisco Systems

Codman surgical instruments

Cogmedix

Consort Medical PLC

Covidien

Creganna Medical

CTS Corporation

Da/Pro Rubber

Daiichi Jitsugyo Co., Ltd.

Dell

Drager Medica

DTR Medical

DTS Mechelec

Dynacast

Ekso Bionics

Electrochem Medical

Elementum

Ericsson

Europlaz

Fast Forward Medical

Filtertek Inc.

Flextronics

Forefront Medical Technology

Foxconn (Hon Hai Precision Industries)

Fresenius

Gerresheimer

Greatbatch Medical

GW Plastics Inc.

Hamilton Group

Helix Medical

Heraeus Medical

Hewlett-Packard

Honeywell

Infinity Molding & Assembly, Inc.

Integer Holdings Corporation

Jabil

Johnson & Johnson

J-Pac Medical

Karel Manufacturing

Kimball Electronics Group

Kitron

Kohlberg Kravis Roberts & Co

Lake Region Medical (Accellent)

Lenovo

Lithotech Medical

Lorenz, Inc.

Medefab

Medtronic

MeKo

Micro Power Electronics

Microsoft

Moog

Motorola Mobility LLC

NeuroNexus Technologies Inc

Nipro Corporation

Nortech Systems

Nypro Inc

Olsen Medical

PCI Limited

Phillips-Medisize

Plasticos Castella

Plexus Corporation

Precision Wire Components LLC

Research in Motion

RiverTech Medical

RIWISA AG

Sanmina

Saturn Electronics and Engineering Inc

Sauflon

Secant Medical

Secure Technology

Siemens Medical

SIIX Corporation

Smith & Nephew

SMS Technologies

Sparqtron Corporation

St. Jude Medical

Stryker

Suntek Manufacturing Technologies, SA de CV

Symmetry Medical (Tecomet)

Syrma Technology

TE Connectivity

Tecomet, Inc.

Teleflex, Inc.

The Electrolizing Corporation

The Tech Group (West Pharmaceutical Services)

Tricor Systems

Vention Medical

Venture

Viasys Healthcare

VicPlas International Ltd

Vincent Medical

Wesley-Coe

West Pharmaceutical Services. Inc.

Winland Electronics

Wytech

Xerox

List of Organisations Mentioned in the Report

Agência Nacional de Vigilância Sanitária or National Health Surveillance Agency (ANVISA)

Central Drug Standards Control Organisation (CDSCO)

Centre for Devices and Radiological Health (CDRH)

China Food and Drug Administration (CFDA)

European Commission

European Databank on Medical Devices (EUDAMED)

The Federal Commission for the Protection against Sanitary Risk (COFEPRIS)

Food and Drugs Administration (FDA)

The Ministry of Health, Labour and Welfare (MHLW)

National Health and Planning Commission (NHPC)

Servizio Sanitario Nazionale (SSN) [Italy]

State Food and Drug Administration (SFDA)

World Health Organization (WHO)

World Trade Organization (WTO)

Download sample pages

Complete the form below to download your free sample pages for Global Medical Device Contract Manufacturing Market Forecast 2019-2029

Related reports

-

Global Immunochemistry Reagents, Analyzers and Test Kits Market 2019-2029

The global immunochemistry reagents, analyzers and test kits market is estimated to have reached $23bn in 2018 and is expected...

Full DetailsPublished: 30 September 2019 -

Checkpoint Inhibitors for Anti-Cancer Treatment Market 2019-2029

The global checkpoint inhibitors for anti-cancer treatment market is estimated to have reached $11.43 bn in 2018 and is expected...

Full DetailsPublished: 28 May 2019 -

mRNA Vaccines and Therapeutics Market Forecast 2019-2029

The mRNA Vaccines and Therapeutics Market is estimated at $3.43 billion in 2018. The Standardized Therapeutic Cancer mRNA Vaccines segment...

Full DetailsPublished: 07 May 2019 -

Global Protein Expression Market Forecast to 2029

The global protein expression market is estimated at $1.8bn in 2018. Visiongain estimated that the prokaryotic expression system accounted for...

Full DetailsPublished: 24 October 2019 -

Indian Pharmaceutical Market Forecast 2019-2029

The Indian pharmaceuticals market is estimated to have reach $28.8bn in 2018 and is expected to grow at a CAGR...

Full DetailsPublished: 09 May 2019 -

Global Influenza Vaccines Market Outlook 2019-2029

The latest report from business intelligence provider visiongain offers comprehensive analysis of the global influenza vaccines market. Visiongain assesses that...

Full DetailsPublished: 05 July 2019 -

Asia Vaccines Market Forecast to 2029

Asia vaccines market is estimated at $7bn in 2018 and is expected to grow at a CAGR of 8.8% during...

Full DetailsPublished: 28 October 2019 -

Global Pulmonary/Respiratory Drug Delivery Market Forecast 2019-2029

The global pulmonary/respiratory drug delivery market reached $40.67 bn in 2018 and is expected to grow at a CAGR of...

Full DetailsPublished: 29 May 2019 -

Top 20 Urology Devices Manufacturers 2020

In 2018, the urology devices market is estimated at $6.9bn and is expected to grow at a CAGR of 6.1%...

Full DetailsPublished: 19 December 2019 -

Global Ablation Technologies Market Forecast 2019-2029

The global ablation technologies market is expected to grow at a CAGR of 9.4% from 2017-2022 and CAGR of 9.7%...

Full DetailsPublished: 01 January 1970

Download sample pages

Complete the form below to download your free sample pages for Global Medical Device Contract Manufacturing Market Forecast 2019-2029

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Latest Pharma news

Visiongain Publishes Automation in Biopharma Industry Market Report 2024-2034

The global Automation in Biopharma Industry market is estimated at US$1,954.3 million in 2024 and is projected to grow at a CAGR of 7% during the forecast period 2024-2034.

17 April 2024

Visiongain Publishes Anti-obesity Drugs Market Report 2024-2034

The global Anti-obesity Drugs market is estimated at US$11,540.2 million in 2024 and is expected to register a CAGR of 21.2% from 2024 to 2034.

12 April 2024

Visiongain Publishes Inflammatory Bowel Diseases (IBD) Drugs Market Report 2024-2034

The global Inflammatory Bowel Diseases (IBD) Drugs market was valued at US$27.53 billion in 2023 and is projected to grow at a CAGR of 6.2% during the forecast period 2024-2034.

11 April 2024

Visiongain Publishes Female Health Tech Market Report 2024-2034

The global Female Health Tech market was estimated to be valued at US$ 140.9 billion in 2034 and is expected to register a CAGR of 9.6% from 2024 to 2034.

05 April 2024