Industries > Pharma > Global Stem Cell Technologies and Applications Market 2019-2029

Global Stem Cell Technologies and Applications Market 2019-2029

Cancer, Cardiovascular, CNS, Other Disease Areas and Non-Therapeutic Applications

The global stem cell technologies and applications market is estimated to have reached $14bn in 2018 and is expected to grow at a CAGR of 12.3% in the first half of the forecast period.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand new 292-page report you will receive 110 charts– all unavailable elsewhere.

The 292-page report provides clear detailed insight into the global stem cell technologies and applications market. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand-new report today you stay better informed and ready to act.

Report Scope

• Global Stem Cell Technologies and Applications Market forecasts from 2019-2029

• Global Stem Cell Technologies and Applications submarket forecasts from 2019-2029:

• Cancer treatment

• Cardiovascular therapy

• CNS

• Other therapies

• Non-therapeutic applications

• Individual revenue forecast to 2029 for selected top products:

• MSC-100-IV (Mesoblast)

• Hearticellgram-AMI (Pharmicell)

• CardioRel (Reliance Life Sciences)

• Osteocel Plus (NuVasive)

• Trinity Evolution and Elite (Orthofix)

• CARTISTEM (MEDIPOST)

• Analysis of the most promising pipeline therapies in each therapeutic segment

• Discussion on regulatory environments and developments in the US, Japan, Europe and other leading countries

• Analysis of what drives and restrains the market

• This study also discusses other influences on that field, including these:

• Haematopoietic stem cell transplantation (HSCT)

• Embryonic stem cells (ESCs), induced pluripotent adult (IPSCs) and parthenogenetic cells

• Uses for umbilical cord blood and related technologies, including cellular and blood banking

• Agents for osteogenesis and treating autoimmune conditions

• Applications in cell-based assays, diagnostics and drug development.

• Key questions answered by this report:

• What is the size of the total stem cells market, and how will the market evolve between 2019 and 2029

• How will the main segments within the overall stem cells market develop between 2019-2029

• What are the main drivers and restraints that will shape the overall stem cells market, and its individual segments over the next ten years?

• What is the state of stem cell research in the different therapeutic segments?

• What are some of the most prominent companies within this space, and what are their latest developments?

• What are the most promising pipeline therapies in each therapeutic segment?

• What are the revenue prospects for some of the stem cell therapies which have already been approved?

• What are the main strengths, weaknesses, opportunities and threats for the stem cell market?

• What are the main social, technological, economic and political factors that influence this market?

Visiongain’s study is intended for anyone requiring commercial analyses for the Global Stem Cell Technologies and Applications Market. You find data, trends and predictions.

Buy our report today Global Stem Cell Technologies and Applications Market Analysis : Cancer, Cardiovascular, CNS, Other Disease Areas and Non-Therapeutic Applications.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help sara.peerun@visiongain.com

1. Report Overview

1.1 Global Stem Cell Technologies and Applications Market Overview

1.2 Why you should Read This Report

1.3 How this Report Delivers

1.4 Key Questions Answered by This Report

1.5 Who is this Report for?

1.6 Research and Analysis Methods

1.7 Frequently Asked Questions (FAQ)

1.8 Some Associated Reports

1.9 About Visiongain

2. Introduction to Stem Cell Technologies and Applications

2.1 What are Stem Cells? Defining Characteristics

2.2 Timeline of Stem Cell Research

2.3 Embryonic Stem Cells (ESCs) Enter the Picture

2.4 Classifying Stem Cells by Potency

2.4.1 Post Fertilisation and Germ Layers

2.5 The Main Types of Stem Cells and Their Properties

2.6 iPSCs: The Benefits of ESCs, but Without the Downsides?

2.6.1 CIRM hPSC Repository Launches 300 iPSC Lines

2.7 Parthenogenetic Stem Cells: Scientific Background

2.7.1 Are they Ethical Alternatives to ESCs? What are the Commercial Applications?

2.8 Autologous Versus Allogeneic Stem Cells

2.8.1 Are Universal Stem Cell Products Possible?

2.9 Phases of Clinical Trials

2.10 Scope of this Report

3. International Developments and Stem Cell Regulatory Environments

3.1 Regulatory Environment in the US

3.1.1 Dynamic Biotechnology Sector and Liberal Stance on Patents

3.1.2 Understanding ‘Homologous’ Use

3.1.3 Controversy Surrounding ESC Research

3.1.4 NIH ESC Stem Cell Registry: Has Made Good Progress, but not enough for its Critics

3.1.5 CIRM and NIH Stem Cell Funding into Various Channels

3.1.6 FDA vs Regenerative Sciences

3.1.7 Are Stem Cells Clinics the ‘Wild West’ of Medicine?

3.1.8 Stem Cell Clinics Using Loopholes to Avoid Oversight?

3.1.9 FDA Releases Three New Draft Guidances, but is it Doing Enough?

3.2 Regulatory Environment in Europe

3.2.1 Unified Overarching System of Regulation Across EU

3.2.2 Difference between EU Member States Regarding hESC Research

3.2.3 European Court of Justice Performs a U-Turn and Clears Path towards Stem Cell Patents

3.2.4 The UK: A Leader in European Stem Cell Research

3.3 Regulatory Environment in Japan

3.3.1 Liberal Stance on hESC but with Excessive Bureaucracy?

3.3.2 Japan: A Pioneer in iPSC Research, Although First In-Human Trial has been suspended

3.3.3 The STAP Cell Events: Excitement Dashed

3.3.3.1 Riken Concludes Investigation

3.3.4 Government Committed to Regenerative Medicines and iPSC Research

3.3.5 Japan Becomes Very Attractive Market for Stem Cell Companies due to Favourable Regulatory Changes

3.4 Regulatory Environment in South Korea

3.4.1 Highs and Lows with Regard to hESC Research

3.4.2 Regulators are Quick to Approve Therapies, although this has Drawn Criticism

3.4.3 Tracheal Transplant Patient Dies

3.4.4 New changes a requirement for the current research and development in HESC

3.5 Chinese Regulatory Environment

3.5.1 Liberal Regulation on Stem Cells and Very High Number of Stem Cell Clinical Trials Taking Place in the Country

3.5.2 Stem Cell Medical Tourism Very Popular

3.5.3 CFDA Releases New Stem Cell Draft Guidance

3.6 Israel Regulatory Environment: A Strong Presence in Stem Cell Research

3.7 Indian Regulatory Environment: Emerging Stem Cell Industry – in Need of more Regulation?

4. Stem Cell Technologies and Applications: World Market 2019-2029

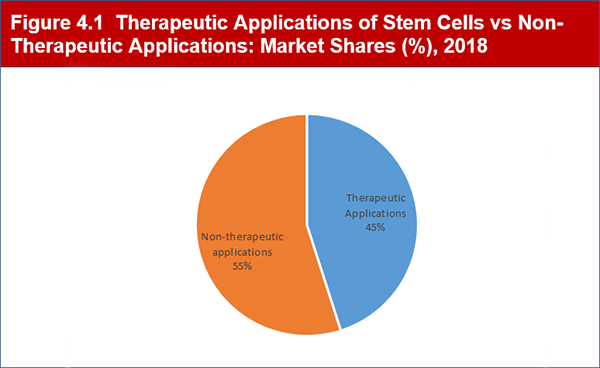

4.1 Therapeutic Applications versus Non-Therapeutic Applications of Stem Cells

4.2 Regional Breakdown of the World Market

4.3 Market Segmentation

4.4 Stem Cell Technologies and Applications Market: Forecast 2019-2029

4.5 Stem Cell Technologies and Applications Market: Forecast by Segment 2019-2029

4.6 How Will Segmental Market Shares Change to 2029?

4.7 Stem Cell Technologies and Applications Market: Drivers and Restraints

5. Stem Cell Cancer Therapeutics Segment 2019-2029

5.1 Stem Cell Cancer Therapeutics: Overview and Current Status

5.2 Stem Cell Cancer Therapeutics: Market Forecast 2019-2029

5.3 Haematopoietic Stem Cell Transplantation (HCST)

5.3.1 An Established Treatment for Haematological Cancers

5.3.2 Autologous HSCT: Dominant Form of HSCT

5.3.3 Autologous Versus Allogeneic HSCT: Advantages and Disadvantages

5.3.4 GvHD: The Major Issue for HSCT

5.3.5 Strengths and Weaknesses of the Three Major Sources of HSCs

5.3.6 What is Cord Blood?

5.3.6.1 Cord Blood Use is Rising in HSCT

5.3.7 Number of HSCT Operations Performed Worldwide, Split by Autologous Versus Allogeneic HSCT, 2015-2017

5.3.7.1 Numbers of HSCT Operations Performed in Europe, Split by Donor Type, 2011-2017

5.3.8 HSCT Costs and Medicare Coverage

5.3.9 The Indications which can be treated with HSCT: Haematological Malignancies are the Major Indications

5.3.10 HSCT has the Potential to Address Multiple Cancers, which represent a $20bn+ Market

5.4 From Procedures to Products: Cord Blood Stem Cell Approvals

5.4.1 Hemacord (New York Blood Center): The First FDA-Approved Cord Blood Product

5.4.1.1 Hemacord Awarded Prix Galien ‘Best Biotechnology Product’ Award

5.4.2 HPC, Cord Blood (ClinImmune Labs / University of Colorado Blood Bank)

5.4.3 Ducord (Duke University School of Medicine)

5.4.4 Allocord (SSM Cardinal Glennon Children’s Medical Center)

5.4.5 HPC, Cord Blood BLA 125432 (LifeSouth Community Blood Centers)

5.4.6 CLEVECORD

5.4.7 HPC, Cord Blood (BLA 125585)

5.5 Stem Cell Cancer Therapeutics Pipeline

5.5.1 Agenmestencel-T (Apceth)

5.5.2 CLT-008 and CLT-009 (Cellerant Therapeutics): Company Receives $47.5m Grant from US Government

5.5.3 ProHema (Fate Therapeutics)

5.5.3.1 ProTmune

5.5.4 StemEx and NiCord (Gamida Cell)

5.5.4.1 StemEx Shows Improved Survival at 100 Days – but FDA Wants Another Clinical Trial

5.5.4.2 Copper Chelator Based Technology

5.5.4.3 NiCord

5.5.4.4 NiCord: The Company Aiming for a “Paradigm Shift” in Treatment Practice, Receives Orphan Drug Designation

5.5.4.5 NiCord: Gamida Cell Reaches Agreement on Phase 3 Design Outline with the FDA and EMA

5.5.4.6 NAM Technology Platform

5.5.4.7 Novartis Chooses not to buy Gamida Cell

5.5.5 MSC-100-IV (Previously Known as Prochymal) and Unnamed MPC-Expanded Cord Blood Product (Mesoblast)

5.5.5.1 MSC-100-IV: World’s First Approved Stem Cell Drug Outside of South Korea

5.5.5.2 MSC-100-IV: Culture Expanded and Able to Treat GvHD

5.5.5.3 An Important Role to Play in the Future of HSCT

5.5.5.4 Wins Approval in Japan, through Partner JCR Pharmaceuticals, and Phase 3 Trial will Support US BLA

5.5.5.5 MSC-100-IV / Temcell HS Injection Revenue Forecast 2019-2029

5.5.5.6 MPC-Expanded Cord Blood Product in a Phase 3 Trial for Haematological Malignancies

5.5.6 HSC835 (Novartis)

5.5.6.1 Novartis Enters Partnership Agreement with Regenerex to Develop Novel Cell-Based Therapies

5.5.6.2 Collaborations with Intellia Therapeutics and Caribou for CRISPR and HSCs

5.5.6.3 Collaborations with Gamida Cell, Israel

5.5.7 Ancillary Products for the HSCT Setting

5.5.8 Targeting of Cancer Stem Cells (CSCs)

5.6 Stem Cell Cancer Therapeutics: Drivers and Restraints 2019-2029

6. Stem Cell Cardiovascular Therapeutics Segment 2019-2029

6.1 Stem Cell Cardiovascular Therapeutics: Overview and Current Status

6.2 Stem Cell Cardiovascular Therapeutics: Market Forecast 2019-2029

6.3 Cardiovascular Diseases Make up a Large part of the Global Pharmaceutical Market

6.3.1 Stem Cell Treatments for Stroke: Touched Upon in This Chapter but mainly Covered under Central Nervous System Therapeutics

6.4 Stem Cell Cardiovascular Therapeutics on the Market

6.4.1 Hearticellgram-AMI (Pharmicell)

6.4.1.1 One of the First Approved Cardiovascular Stem Cell Treatments in the World

6.4.1.2 Hearticellgram-AMI Sales Estimates 2014-2017

6.4.1.3 Will Have Difficulty Getting Approved in Markets Outside of South Korea

6.4.1.4 Hearticellgram-AMI Revenue Forecast 2019-2029

6.4.2 CardioRel (Reliance Life Sciences)

6.4.2.1 Available on the Indian Market, but Does Data Back it up?

6.4.2.2 CardioRel Revenue Forecast 2019-2029

6.4.3 Cardiovascular and Cerebrovascular Conditions are the World’s Most Fatal Diseases

6.4.4 AMI, CLI and Stroke: Major Ischemic Disease Targets

6.5 The State of Stem Cell Research for Cardiovascular Diseases

6.5.1 Practical Advantages to Choosing the Heart as a Target for Stem Cell R&D

6.5.2 Defining Cardiovascular Stem Cells: Scientific Context

6.6 The Mysterious Effects of Stem Cells in the Heart

6.6.1 MSCs in the Heart: Evidence to Support their Use, as well as Doubts over their Efficacy

6.6.2 Cardiosphere-Derived Cells, hESC-Derived Cardiomyocytes and C-kit Cells

6.7 Stem Cell Cardiovascular Therapeutics Pipeline

6.7.1 Ixmyelocel-T (Vericel Corporation)

6.7.1.1 Vericel Shifts Focus Away from CLI and Towards DCM

6.7.1.2 Currently it has obtained RMAT designation

6.7.2 Alecmestencel-T (Apceth)

6.7.3 Arteriocyte: Using its ‘Magellan System’ to Treat CLI

6.7.4 MultiStem (Athersys) for Myocardial Infarction and Stroke

6.7.4.1 Updates from Athersys Regarding Trial Status: Did MultiStem Fail in Stroke, or was it just Being Assessed in the Wrong Treatment Window?

6.7.5 Baxter: Phase 3 CD34+ Stem Cell Therapy for Refractory Angina

6.7.6 CardiAMP (BioCardia) for Heart Failure: Scheduled to Finally Begin Phase 3 in January 2017

6.7.7 MyoCell (U.S. Stem Cell, Inc. – Formerly Bioheart): Autologous ‘Muscle Stem Cell’ Therapy

6.7.7.1 MyoCell: Is the Company Still Trying to Secure Funds to Restart the Phase 2/3 MARVEL Trial?

6.7.7.2 MyoCell: MIRROR Trial on Hold

6.7.7.3 MyoCell SDF-1: Improved Version of MyoCell

6.7.7.4 MyoCell SDF-1 Phase 1 Trial (Regen): Another Trial Put on Hold

6.7.8 CAP-1001 and CAP-1002 (Carpricor): Cardiospehere-Derived Cells for Heart Repair

6.7.9 Ceylad (Formerly Cardio3): Proprietary Cardiopoiesis Technology Platform - Can be Applied to Various Stem Cell Sources

6.7.9.1 C-Cure: Stem Cell Therapy for the Treatment of Heart Failure

6.7.9.2 C-Cure: Two Phase 3 Trials Under Way

6.7.10 Mesoblast: Mesenchymal Precursor Cells for Heart Failure and Myocardial Infarction

6.7.10.1 Rexlemestrocel-L for Congestive Heart Failure (CHF), Chief Executive Provides Update

6.7.10.2 CEP-41750: Promising Phase 2 Results, More Effective in a Particular Subset of Heart Failure Patients?

6.7.10.3 Phase 2 Trial of MPCs in Acute Myocardial Infarction

6.7.11 Caladrius Biosciences: Will not Continue Development of CLBS10, the Company’s Former Lead Candidate

6.7.11.1 CLBS12 for CLI: Due to Start Phase 2 in Japan in January 2016

6.7.12 Stemedica Cell Technologies: ‘Ischaemic-Tolerant’ Stem Cell Platform

6.7.12.1 Trials in Myocardial Infarction and Stroke

6.7.13 Gemacell and Cryocell (Human Stem Cells Institute): Awaiting Important Russian Legislation to be Passed before Development Can Continue

6.8 Stem Cell Cardiovascular Therapeutics: Drivers and Restraints 2019-2029

7. Stem Cell Central Nervous System Therapeutics Segment 2019-2029

7.1 Stem Cell Central Nervous System Therapeutics: Overview and Current Status

7.2 Stem Cell Central Nervous System Therapeutics: Market Forecast 2019-2029

7.3 The State of Stem Cell Research in CNS Diseases

7.3.1 Stem Cells are the Best Hope for Many Serious CNS Conditions

7.3.2 Awaiting a First Breakthrough Approval

7.3.3 Human Neural Stem Cells (NSCs) Successfully Isolated

7.3.4 NSCs Reach the Clinic without Serious Controversy

7.3.5 CNS Disorders are a Major Focus for ESC Research

7.3.6 MSCs: Can Glial Cell and Astrocyte Formation Help Neurological Conditions?

7.4 Progress in Specific CNS Conditions

7.4.1 HSCT in MS: Could ‘Resetting’ the Immune System Treat MS?

7.4.1.1 Clinical Trials Involving HSCT in MS

7.4.1.2 Barriers to Overcome Before HSCT Could Become an Established Therapy for MS

7.4.2 ALS: Could this Rare Disease be the First Neurodegenerative Condition for Stem Cell Treatment?

7.4.3 Parkinson’s Disease: Field Recovering after Voluntary Moratorium on Stem Cell Research by Many Western Nations Ends

7.4.4 Dry Age-Related Macular Degeneration: A Major Unmet Need

7.5 Several Multi-Billion Dollar Markets are Open to Stem Cell Developers if they can Translate the Potential of Stem Cells into Therapies

7.6 Stem Cell Central Nervous System Therapeutics Pipeline

7.6.1 MA09-hRPE (Ocata Therapeutics): Stem Cells for Eye Diseases

7.6.1.1 Orphan Drug Status in both the US and EU

7.6.1.2 Current Clinical Trials in SMD

7.6.1.3 Early Signs of Efficacy

7.6.1.4 Has Moved into Phase 2 in AMD

7.6.2 NurOwn (BrainStorm Cell Therapeutics): Neurotrophic Factor -Releasing Stem Cells for ALS

7.6.2.1 Phase 2 Trial in 48 ALS Patients Underway

7.6.2.2 Phase 2a Results Demonstrate “Statistically Significant Effect”

7.6.3 International Stem Cell Corporation: Company Signals Intent to Start Phase 1/2a Study in PD Soon

7.6.4 Neuralstem: Allogeneic NSCs for Synaptic Repair and Neuroprotection

7.6.4.1 NSI-566 in ALS

7.6.4.2 NSI-566 in ALS: Encouraging Data from Completed Phase 2 Trial

7.6.4.3 NSI-566 for Chronic Spinal Cord Injury: Phase 1 Top-Line Data Expected Q4 2015

7.6.4.4 NSI-566 for Ischaemic Stroke: Phase 1/2 Trials Underway in China

7.6.4.5 Preclinical Investigation in 11 Other Indications

7.6.5 PF-05206388 (Pfizer and the London Project to Cure Blindness): Finally Begins Phase 1Trial, with first Successful Surgery

7.6.6 Q-Cells (Q Therapeutics): Phase 1/2 Trial Begins

7.6.7 ReNeuron: CTX Neural Cell Line and its Advantages

7.6.7.1 CTX for Stroke

7.6.7.2 CTX for Stroke: Long-Term PISCES Study Shows Promising Results

7.6.7.3 CTX for Stroke: Undergoing Phase 2, Using Highest Cell Dose from PISCES Study

7.6.8 SB623 (SanBio): Enters Phase 2 for Stroke, as well as for Traumatic Brain Injury

7.6.9 StemCells, Inc: A Leader in Neural Stem Cells

7.6.9.1 HuCNS-SC for Pelizaeus-Merzbacher Disease: Undergoing Second Phase 1 Trial

7.6.9.2 HuCNS-SC for NCL: Second Phase 1 Trial Withdrawn

7.6.9.3 HuCNS-SC for Spinal Cord Injury: Phase 2

7.6.9.4 HuCNS-SC for AMD: Top-Line Phase 1/2 Results Released

7.7 Stem Cell Central Nervous System Therapeutics: Drivers and Restraints 2019-2029

8. Stem Cell Therapeutics in Other Disease Areas 2019-2029

8.1 Stem Cell Therapeutics in Other Disease Areas: Overview and Current Status

8.2 Stem Cell Therapeutics in Other Disease Areas: Market Forecast 2019-2029

8.3 Stem Cell Therapeutics in Other Disease Areas: Therapies on the Market

8.3.1 Osteocel Plus (NuVasive)

8.3.1.1 Osteocel to Osteocel Plus: Passing Through Different Companies and Patent Disputes

8.3.1.2 The Leading Stem Cell Orthobiologic

8.3.1.3 Is it Better than Autograft?

8.3.1.4 Osteocel Plus Revenue Forecast 2019-2029

8.3.2 Trinity Evolution and Trinity Elite (Orthofix): Stem Cell Orthobiologics

8.3.2.1 Positive Results from New Trial in Foot and Ankle Procedures

8.3.2.2 Trinity Evolution and Elite Revenue 2010-2014

8.3.2.3 Trinity Evolution and Elite Revenue Forecast 2019-2029

8.3.3 CARTISTEM (MEDIPOST)

8.3.3.1 CARTISTEM: The World’s First Allogeneic Stem Cell Drug

8.3.3.2 CARTISTEM: Latest Updates Includes Results from Phase 3 Trial, Initiation of Phase 1/2 Trial in the US

8.3.3.3 CARTISTEM: Revenues 2014 –2016

8.3.3.4 CARTISTEM Revenue Forecast 2019-2029

8.3.4 Allostem (Allosource)

8.3.5 Map3 (RTI Surgical)

8.3.6 ReliNethra for Ocular Surface Damage (Reliance Life Sciences)

8.3.7 Cupistem (Anterogen)

8.4 Stem Cell Therapeutics for Other Diseases: Research Areas

8.4.1 HSCT for Orphan Diseases

8.4.2 Potential for Genetically Modified Stem Cells for HIV and Other Diseases?

8.4.3 Stem Cells Contribute to the Osteogenesis Process in Bone Repair

8.4.4 Stem Cells Gaining Increasing Importance in Bone Graft Market, but whether these are True ‘Stem Cell Products’ is Debatable

8.4.5 Stem Cells also have Potential in Autoimmune Disorders

8.4.6 Potential Cure for Diabetes?

8.4.6.1 Clinical Stage Programmes in Diabetes

8.4.7 Stem Cells in Active Liver Repair

8.4.8 Long-Term Possibilities

8.5 Stem Cell Therapeutics in Other Disease Areas: Pipeline

8.5.1 ALLO-ASC and ALLO-ASC-DFU (Anterogen)

8.5.2 MultiStem (Athersys): Fails Phase 2 Ulcerative Colitis, Still Undergoing Phase 1 as Immunomodulation Therapy after Liver Transplantation

8.5.3 BioTime: Multiple Subsidiaries Focused on Regenerative Medicine

8.5.3.1 AST-OPC1 and AST-VAC2 (Asterias Biotherapeutics)

8.5.3.2 OpRegen (Cell Cure Neurosciences)

8.5.3.3 Other BioTime Subsidiaries Related to Stem Cells: OncoCyte, ReCyte, ESI Bio, LifeMap Sciences Etc.

8.5.4 Calimmune: Dual Anti-HIV Gene Therapy via Stem Cells

8.5.5 (PDA-001 and PDA-002) Celgene Corporation

8.5.6 ReJoin (Cellular Biomedicine Group): Interim Results from the MSCs for Knee Osteoarthritis

8.5.7 PNEUMOSTEM (MEDIPOST)

8.5.7.1 NEUROSTEM (MEDIPOST): Undergoing Phase 1/2 Trial and Obtains Patents Around the Globe

8.5.8 Translational Biosciences: Set Up for the Sole Purpose of Conduction Stem Cell Clinical Trials, Five Phase 1/2 Trials Ongoing

8.5.9 Mesoblast: MPCs for Various Indications

8.5.9.1 MPC-300-IV in Diabetes

8.5.9.2 MPC-300-IV in Rheumatoid Arthritis

8.5.9.3 MPC-06-ID in Chronic Back Pain, Enters Phase 3

8.5.10 Pluristem Therapeutics: Uses PLX Cells to Secrete Therapeutic Proteins in Damaged Tissues

8.5.10.1 PLX-PAD: Phase 2 for Intermittent Claudication

8.5.10.2 PLX-PAD: Completes Phase 1/2 for Injured Gluteal Muscle

8.5.10.3 PLX-R18: In Preclinical Development for ARS

8.5.11 Regeneus: Adipose Derived MSC Therapies

8.5.11.1 Progenza Undergoing Phase 1 Trial

8.5.12 S-Evans Biosciences: Menstrual Stem Cells

8.5.13 TiGenix: Expanded Adipose-Derived Stem Cell Therapies

8.5.13.1 EASC Technology Platform

8.5.13.2 Cx601: Meets Primary Endpoint in Phase 3 Trial

8.5.13.4 Cx611 for Rheumatoid Arthritis and also Severe Sepsis

8.5.13.5 Cx621 – Positive Results from Phase 1 Trial, but Development on Hold

8.5.13.6 ChondroCelect Already on the Market – Although is More of a Cell Therapy Rather than a Stem Cell Therapy

8.5.14 VC-01 (ViaCyte)

8.6 Genetically Modified Stem Cell Therapies

8.6.1 BluebirdBio: Gene-Modified HSCs for Orphan Diseases

8.6.2 GSK: Stem Cell Gene Therapies for Rare Diseases, Including one which has been Submitted for Approval in Europe

9. Stem Cell Non-Therapeutic Applications 2019-2029

9.1 Stem Cell Non-Therapeutic Applications: Overview and Current Status

9.2 Stem Cell Non-Therapeutic Applications: Market Forecast 2019-2029

9.3 Stem Cell Banking: Growing Demand Worldwide

9.3.1 Impact of the current epidemic of Zika Virus and HIV in cord cell banking

9.3.2 Is there a Need for Stem Cell Banking as a Form of ‘Health Insurance’?

9.3.3 Stem Cell Banking Companies in the US and Around the World

9.3.4 Dental Stem Cell Banking: An Alternative to Cord Blood Banks?

9.4 Stem Cell Supply and Processing: iPSCs are the New Driver

9.4.1 Stem Cell Supply and Processing Companies

9.5 Stem Cell-Based Assays: Major Potential for Preclinical Screens

9.5.1 Advantages of Stem Cell-Based Assays

9.5.2 Stem Cell-Based Assay Companies

9.6 Research, Reagents, and Other Non-Therapeutic Stem Cell Activities

9.7 Drivers and Restraints

10. Qualitative Analysis of the Stem Cell Technologies and Applications Market 2019-2029

10.1 SWOT Analysis of the Stem Cell Technologies and Applications Market

10.2 Strengths

10.2.1 HSCT is already an Established Procedure

10.2.2 Approvals for Stem Cell Therapies

10.2.3 Relaxation of Regulatory Barriers

10.3 Weaknesses

10.3.1 Phase 3 Trials only make up a Small Fraction of the Currently Ongoing Clinical Trials

10.3.2 Uncertain Mechanisms of Action in Stem Cell Therapies

10.3.3 Regulatory and Reimbursement Concerns

10.3.4 The scare of a possible immune rejection after a stem cell transplant

10.4 Opportunities

10.4.1 Huge Potential in Unmet Clinical Needs

10.4.2 Opportunities in the Non-Therapeutic Uses of Stem Cells, including Cord Blood Banking and Cell-Based Assays

10.4.3 Interactions with Related Technologies will Offer new Opportunities

10.4.4 Genetic Modification of Stem Cells

10.5 Threats

10.5.1 Financial Risks and Under-Capitalisation of the Stem Cells Sector

10.5.2 Threat of Pipeline Failures

10.5.3 Long-Term Safety Concerns

10.6 STEP Analysis of the Stem Cell Technologies and Applications Market

10.7 Social Factors

10.7.1 Increasing Burden of Disease as World Population Ages

10.7.2 Biological Insurance through Stem Cell Banking

10.7.3 Stem Cell Tourism: Both an Opportunity and Threat to the Market

10.8 Technological Factors

10.8.1 Increasing Research Output

10.8.2 IPSC Advances

10.8.3 Greater Understanding of Stem Cell Differentiation

10.8.4 Interactions with Other Technologies

10.8.5 CRISPR: A Breakthrough in Genome Editing

10.9 Economic Factors

10.9.1 Grey Market for Stem Cell Therapies

10.9.2 Broad Changes in Pharma / Healthcare Markets

10.9.3 New Business Models are required due to the Unique Challenges Posed by these Non-Traditional Therapies

10.10 Political Factors

10.10.1 Controversies over Embryonic Stem Cell Research

10.10.2 Support from National Governments

10.10.3 Patient Pressure to Deregulate the Stem Cell Therapies Market

11. Conclusions

11.1 Stem Cell Technologies and Applications: An Emerging Market

11.2 Current Leading Segments and Regional Markets

11.3 World Stem cell Technologies and Applications Market Forecast 2019-2029

11.4 The Future of the Stem Cell Market

11.5 Concluding Remarks

Appendices

Glossary

Associated Reports

Visiongain Report Sales Order Form

About Visiongain

Visiongain report evaluation form

List of Tables

Table 2.1 Classifying Stem Cells by Potency

Table 2.2 The Different Germ Layers and Their Associated Types of Cells and Organs

Table 2.3 Main Types of Stem Cells and Their Properties

Table 2.4 Stem Cell Donor Terminology

Table 2.5 The Different Phases of Clinical Trials

Table 3.1 NIH Embryonic Stem Cell Registry: Stem Cell Lines by Status, 2016 and 2017

Table 3.2 Estimated and expected NIH spending in Stem cell research from 2015-2020 (expected) (in million USD)

Table 3.3 New FDA Draft Guidance’s

Table 3.4 StemGen’s Classifications of European Nations by Level of Permissiveness towards hESC research

Table 4.1 Stem Cell Technologies and Applications Market by Region: Revenues ($m), Market Shares (%), 2018

Table 4.2 Stem Cell Technologies and Applications Market by Segment: Revenues ($m), Market Shares (%), 2018

Table 4.3 Stem Cell Technologies and Applications Market Forecast: Revenues ($m), AGR (%), CAGR (%), 2018-2023

Table 4.4 Stem Cell Technologies and Applications Market Forecast: Revenues ($m), AGR (%), CAGR (%), 2024-2029

Table 5.1 Stem Cell Cancer Therapeutics Market Forecast: Revenues ($m), AGR (%), CAGR (%), 2018-2023

Table 5.2 Stem Cell Cancer Therapeutics Market Forecast: Revenues ($m), AGR (%), CAGR (%), 2024-2029

Table 5.3 Comparison of Bone Marrow, Peripheral Blood and Cord Blood for HSCT

Table 5.4 Estimated Number of HSCT Operations Performed Globally, by Donor Type: AGR (%), CAGR (%), 2015-2017

Table 5.5 European HSCT Operations: Number of Operations by Donor Type, 2011-2017

Table 5.6 Indications with Medicare Coverage for HSCT (both Autologous and Allogeneic)

Table 5.7 Malignancies and Other Haematological Diseases which may be Treated with HSCT

Table 5.8 HSCT-Addressable Cancers: Estimated Combined Incidence in the US, Japan and Western Europe (Number of Cases), CAGR (%), 2012-2024

Table 5.9 FDA-Approved Cord Blood-Derived Stem Cell Products for HSCT, 2018

Table 5.10 Past and Present ProHema (Fate Therapeutics) Clinical Trials

Table 5.11 MSC-100-IV / Temcell HS Forecast (Mesoblast / JCR Pharmaceuticals): Revenues ($m), AGR (%), CAGR (%), 2018-2023

Table 5.12 MSC-100-IV / Temcell HS Forecast (Mesoblast / JCR Pharmaceuticals): Revenues ($m), AGR (%), CAGR (%), 2024-2029

Table 5.13 HSC835 (Novartis) Ongoing Clinical Trials, 2017

Table 6.1 Stem Cell Cardiovascular Therapeutics Market Forecast: Revenues ($m), AGR (%), CAGR (%), 2018-2023

Table 6.2 Stem Cell Cardiovascular Therapeutics Market Forecast: Revenues ($m), AGR (%), CAGR (%), 2024-2029

Table 6.3 Global Cardiovascular Disease Market by Drug Class: Revenue($bn), 2018

Table 6.4 Hearticellgram-AMI (Pharmicell) Sales Estimates: Revenue ($m), AGR (%), 2014-2017

Table 6.5 Hearticellgram-AMI Forecast (Pharmicell): Revenues ($m), AGR (%), CAGR (%), 2018-2023

Table 6.6 Hearticellgram-AMI Forecast (Pharmicell): Revenues ($m), AGR (%), CAGR (%), 2024-2029

Table 6.7 CardioRel (Reliance Life Sciences) Forecast: Revenues ($m), AGR (%), CAGR (%), 2018-2023

Table 6.8 CardioRel (Reliance Life Sciences) Forecast: Revenues ($m), AGR (%), CAGR (%), 2024-2029

Table 6.9 Projected Global Deaths from Ischaemic Heart Disease and Stroke (millions), % of Total Deaths, Deaths Per 100,000 Population, 2015 and 2030

Table 6.10 Advantages, disadvantages and different clinical trials that are ongoing

Table 6.11 Past and Present MultiStem (Athersys) Clinical Trials, 2018

Table 6.12 Ongoing Stemedica Cell Technologies Clinical Trials in Cardiovascular Indications, 2018

Table 7.1 Stem Cell CNS Therapeutics Market Forecast: Revenues ($m), AGR (%), CAGR (%), 2018-2023

Table 7.2 Stem Cell CNS Therapeutics Market Forecast: Revenues ($m), AGR (%), CAGR (%), 2024-2029

Table 7.3 Ongoing MA09-hRPE (Ocata Therapeutics) Clinical Trials in SMD, 2018

Table 7.4 Ongoing MA09-hRPE (Ocata Therapeutics) Clinical Trials in AMD

Table 8.1 Stem Cell Therapeutics in Other Disease Areas Market Forecast: Revenues ($m), AGR (%), CAGR (%), 2018-2023

Table 8.2 Stem Cell Therapeutics in Other Disease Areas Market Forecast: Revenues ($m), AGR (%), CAGR (%), 2024-2029

Table 8.3 Osteocel Plus Forecast (NuVasive): Revenues ($m), AGR (%), CAGR (%), 2018-2023

Table 8.4 Osteocel Plus Forecast (NuVasive): Revenues ($m), AGR (%), CAGR (%), 2024-2029

Table 8.5 Trinity Evolution and Elite (Orthofix): Revenues ($m), AGR (%), CAGR (%), 2010-2014

Table 8.6 Trinity Evolution and Elite (Orthofix) Forecast: Revenues ($m), AGR (%), CAGR (%), 2018-2023

Table 8.7 Trinity Evolution and Elite (Orthofix) Forecast: Revenues ($m), AGR (%), CAGR (%), 2024-2029

Table 8.8 CARTISTEM Revenues: Revenue ($m), AGR (%), 2014-2016

Table 8.9 CARTISTEM (MEDIPOST) Forecast: Revenues ($m), AGR (%), CAGR (%), 2018-2023

Table 8.10 CARTISTEM (MEDIPOST) Forecast: Revenues ($m), AGR (%), CAGR (%), 2024-2029

Table 8.11 Non-Oncologic Diseases which can be Treated with HSCT

Table 8.12 Processes and Mechanisms of Bone Repair

Table 8.13 Anterogen Clinical Trials, 2018

Table 8.14 PDA-002 (Celgene Corporation) Current Clinical Trials

Table 8.15 PNEUMOSTEM (MEDIPOST) Past and Present Clinical Trials

Table 8.16 Translational Biosciences Currently Open Clinical Trials, 2015

Table 8.17 S-Evans Biosciences Clinical Trials, 2015

Table 9.1 Stem Cell Non-Therapeutic Applications Market Forecast: Revenues ($m), AGR (%), CAGR (%), 2018-2023

Table 9.2 Stem Cell Non-Therapeutic Applications Market Forecast: Revenues ($m), AGR (%), CAGR (%), 2024-2029

Table 9.3 Selected US Stem Cell Banks, 2018

Table 9.4 Selected Non-US Stem Cell Banks, 2017

Table 9.5. Prominent Dental Stem cell banks globally

Table 9.6 Selected Stem Cell Supply and Processing Companies

Table 9.7 Selected Companies with Involvement in Stem Cell-Based Assays, 2017

Table 10.1 World 65+ Population Forecast: Population (m), 2015-2050

Table 10.2 World 65+ Population Forecast: Population (m), CAGR (%), 2015-2050

List of Figures

Figure 1.1 Global Stem Cell Technologies and Applications Market Segmentation Overview, 2018

Figure 2.1 Timeline of Stem Cell Research

Figure 3.1 NIH Embryonic Stem Cell Registry: Stem Cell Lines by Status, 2017

Figure 3.2 NIH Spending for stem cell research by year (in USD billions)

Figure 3.3 CIRM Funding by Disease Area, Percentage (%), 2017

Figure 4.1 Therapeutic Applications of Stem Cells vs Non-Therapeutic Applications: Market Shares (%), 2018

Figure 4.2 Therapeutic Applications of Stem Cells vs Non-Therapeutic Applications: Market Shares (%), 2029

Figure 4.3 Stem Cell Technologies and Applications Market by Region: Market Shares (%), 2018

Figure 4.4 Stem Cell Technologies and Applications Market by Segment: Market Shares (%), 2018

Figure 4.5 Stem Cell Technologies and Applications Market Forecast: Revenues ($m), 2019-2029

Figure 4.6 Stem Cell Technologies and Applications Market Forecast by Segment: Revenue ($m), 2019-2029

Figure 4.7 Stem Cell Technologies and Applications Market: Market Shares (%) by Segment, 2023

Figure 4.8 Stem Cell Technologies and Applications Market: Market Shares (%) by Segment, 2029

Figure 4.9 Stem Cell Technologies and Applications Market: Drivers and Restraints

Figure 5.1 Estimated Proportions of Global HSCT Operations by Donor Type, 2017

Figure 5.2 European HSCT Operations by Donor Type, 2011-2017

Figure 5.3 Estimated New Cases of Leukemia, Lymphoma and Myeloma in 2017

Figure 5.4 Estimated new cases of leukemia diagnosed in 2017

Figure 5.5 HSCT-Addressable Cancers: Estimated Combined Incidence in the US, Japan and Western Europe (Number of Cases), 2012-2024

Figure 5.6 Most Common Diseases Treated by Cord Blood from LifeCord: Percentage (%) 2017

Figure 5.7 MSC-100-IV / Temcell HS Forecast (Mesoblast / JCR Pharmaceuticals): Revenue ($m), 2019-2029

Figure 5.8 Stem Cell Cancer Therapeutics Market: Drivers and Restraints

Figure 6.1 Stem Cell Cardiovascular Therapeutics Market Forecast: Revenue ($m), 2019-2029

Figure 6.2 Global Cardiovascular Disease Market by Drug Class: Market Shares (%), 2018

Figure 6.3 Hearticellgram-AMI (Pharmicell) Sales Estimates: Revenue ($m), 2014-2017

Figure 6.4 Hearticellgram-AMI (Pharmicell) Forecast: Revenue ($m), 2019-2029

Figure 6.5 CardioRel (Reliance Life Sciences) Forecast: Revenue ($m), 2019-2029

Figure 6.6 Projected Global Deaths from Ischaemic Heart Disease and Stroke (millions ), 2015 and 2030

Figure 6.7 Stem Cell Cardiovascular Therapeutics Market: Drivers and Restraints, 2019-2029

Figure 7.1 Stem Cell CNS Therapeutics Market Forecast: Revenue ($m), 2019-2029

Figure 7.2 Stem Cell CNS Therapeutics Market: Drivers and Restraints

Figure 8.1 Stem Cell Therapeutics in Other Disease Areas Market Forecast: Revenues ($m) 2019-2029

Figure 8.2 Osteocel Plus (NuVasive) Forecast: Revenue ($m), 2019-2029

Figure 8.3 Trinity Evolution and Elite (Orthofix): Revenue ($m), 2010-2014

Figure 8.4 Trinity Evolution and Elite (Orthofix): Revenue ($m), 2019-2029

Figure 8.5 CARTISTEM (MEDIPOST) Forecast: Revenues ($m) 2019-2029

Figure 9.1 Stem Cell Non-Therapeutic Applications Market Forecast: Revenue ($m), 2019-2029

Figure 9.2 Stem Cell Non-Therapeutic Applications Market: Drivers and Restraints

Figure 10.1 SWOT Analysis of the Stem Cell Technologies and Applications Market

Figure 10.2 STEP Analysis of the Stem Cell Technologies and Applications Market

Figure 10.3 World 65+ Population Forecast: Population (m), 2015-2050

Figure 12.1 Stem Cell Technologies and Applications Market Forecast, split by Therapeutic vs Non-Therapeutic Applications: Revenue ($m), 2019-2029

Aastrom Biosciences

Advanced Cell Technology

Alder Biopharmaceuticals

Alkem

AllCells

Allergan

AlloSource

Americord

Americord

Amgen

Amgen

Angiocrine Bioscience

Angiocrine Bioscience

Anterogen

Anterogen

Apceth

Arteriocyte

Arteriocyte

Associated Press

Astellas Pharma

Asterias Biotherapeutics

Asterias Biotherapeutics

Athersys

Athersys

Auriga Ventures

Axiogenesis

Axiogenesis

Bank a Tooth

Baxter

Baxter Healthcare

BaYi Brain Hospital

BioCardia

BioCardia

BioE

BioE

BioEden

BioEden

Biogenea-Cellgenea

Bioheart, Inc.

Biologic Therapies

BioMet Orthopedics

Biosciences

BioTechnology

BioTime

BioTime Asia

Blackstone

Blackstone Medical

Bloodworks

Bluebird Bio

Brain Somatic Mosaicism

BrainStorm Cell Therapeutics

Caladrius Biosciences

California Institute for Regenerative Medicine (CIRM)

Calimmune

Capricor

Cardio3

Caribou

Carolinas Cord Blood Bank (CCBB)

Casey Eye Institute

Cedars-Sinai Heart Institute

Celgene

Cell Cure Neurosciences

Cell Research Groups

Cell Therapy Catapult

Cellartis

CellCentric

Cellectis

Cellerant Therapeutics

Cellerix

CELLTREE

Cellular Biomedicine Group (CBMG)

Cellular Dynamics International

Center for International Blood and Marrow Transplant Research (CIBMTR)

Centers for Medicare & Medicaid Services

Cephalon

Cesca Therapeutics

Ceylad

China Cord Blood Corporation

China Cord Blood Corporation

China Regenerative Medicine International Limited (CRMI)

Chugai Pharmaceutical Co. Ltd.

CJ CheilJedang

Clal Biotechnologies Industries

Cleveland Biolabs

Cleveland Cord Blood Center

ClinImmune Labs

Cochrane

Cognate BioServices

Cook General BioTechnology

Cord Blood America

Cordlife Group

CordVida

CRISPR Therapeutics

Cryo-Cell International

CryoCord

CryoHaldco

Cryonix CJSC

Cryo-Save

CryoViva

CXR Biosciences

Cytori Therapeutics

Denali Ventures

Dendreon

Dong-A Pharmaceuticals Co.

Dynamics

Elbit Imaging

Elbit Medical Technologies

Eli Lilly

EpiStem

ESI BIO

EuroStemCell

Fate Therapeutics

FDS Pharma

Fondazione Centro San Raffaele

Fondazione Telethon

Forbion Capital Partners

Forticell Bioscience

Future Health Biobank

Gamida Cell

Gemabank

Gene Cell International

Genetico

Genetrix Group

Geron Corporation

Gilead

GlobalStem

Globocan

GSK

Howard Hughes Medical Institute

Human Stem Cells Institute

ImmunoCellular Therapeutics

Immunovative Therapies

Indian Department of Biotechnology

Insception Biosciences

Intellia Therapeutics

IntelliCell Biosciences

IPS Academia Japan

Isar Medical Centre

Israel Healthcare Venture

Japan Institute of Biomedical Research.

JCR Pharmaceuticals

JingYuan Bio.

Johnson & Johnson

Kirby Institute

Lifebank Cryogenics

LifebankUSA

LifeCord

LifeMap Sciences

LifeMap Solutions

LifeSouth Community Blood Centers Inc

Lonza

Maxcyte

Mayo Clinic

MedCell Bioscience

MEDIPOST

Medistem Panama

Medistem Panama Inc.

Medtronic

Mesoblast

Miltenyi Biotec

National Dental Pulp laboratory

NeoStem

Neuralstem

New England Cord Blood Bank

New York Blood Center

Novartis

NovoCell

NurOwn

Nuvasive

Ocata Therapeutics

OncoCyte

Opexa Therapeutics

OrLife Bio

Orthofix

Osiris Therapeutics

Pahrump Valley Times

Pfizer

Pharmicell

Pharmsynthez

Plasticell

Pluristem Therapeutics

Polyphor

Precious Cell Group

Prix Galien

PsychENCODE

Pulp Laboratory

Q Therapeutics

Quest Biomedical

ReCyte Therapeutics

Ree Labs

Regenerative Sciences

Regenerex

Regeneron

Regeneus

Reliance Group

Reliance Life Sciences

ReNeuron

RepliCel Life Sciences

Reprobank

ReproCELL

RIKEN Center for Developmental Biology

Roche

Roslin Cellab

RTI Biologics

RTI Surgical

RUSNANO Corporation

RVC OJSC

SanBio

Sangamo BioSciences

Sanofi

S-Evans Biosciences

Spinesmith Partners

SSM Cardinal Glennon

SSM Cardinal Glennon Children's Medical Center

Stem Cell Bank

Stemade

Stemcell Technologies

StemCore

StemCyte

Stemedica Cell Technologies

StemGen

StemImmune Inc

Stemina Biomarker Discovery

StemSave

Store-a-tooth

SynBio

Systems

Takara Bio

Takeda

TAP Biosystems

Teva

The Zon Laboratory

TiGenix

Tong Yuan Stem Cell

Tooth Bank

TrakCel

Transcell Biologics Pvt Ltd.

Translational Biosciences

U.S. Stem Cell, Inc

UCL Business PLC

UCL Institute of Ophthalmology

UCLA

uniQure

US Stem Cell, Inc.

Valeant

VAULT Sc Inc.

Vericel Corporation

Vericel Corporation

Vesta Therapeutics

ViaCord

ViaCyte

ViroMed

Vita34

Vitro Biopharma

WA Optimum Health Care

WHO

List of Organisations Mentioned in the Report

American Academy of Neurology

American Academy of Pediatrics (AAP)

American Neurological Associates Annual Meeting

American Society of Blood and Marrow Transplantation.

Americas Committee for Treatment and Research in Multiple Sclerosis

Boston Children’s Hospital

Cha General Hospital

China Food and Drug Administration (CFDA)

Chinese Academy of Sciences

Chinese Ministry of Health

Chinese Ministry of Science and Technology

Committee for Medicinal Products for Human Use (CHMP)

Consortium of Multiple Sclerosis Centers

Cord Blood Registry

Duke University School of Medicine

EMA

European Court of Human Rights

European Court of Justice

European Group for Blood and Marrow Transplantation (EBMT)

European Haematology Association

Federal D.C. Court of Appeals

Harvard Business School

Harvard Stem Cell Institute

Harvard University

Human Fertilisation and Embryology Authority (HFEA)

Human Tissue Authority

International Society for Stem Cell Research (ISSCR)

International Stem Cell Corporation (ISCO)

International Stemcell Services

Israel Stem Cell Society

Japan’s Ministry of Economy, Trade and Industry (METI)

Japanese Health Ministry

Japanese Ministry of Labour and Welfare (MHLW)

Japanese Pharmaceuticals and Medical Devices Agency

Karolinska Institute

Korean Food and Drug Administration

Korean MFDS (Ministry of Food and Drug Safety)

Massachusetts General Hospital

McMaster University

Musculoskeletal Transplant Foundation (MTF)

New York Heart Association

NHS Blood and Transplant Authority

Northwestern University

Novartis Research Foundation

Oregon Health and Science University

Psychiatric Gene Networks

Queen Mary University of London

Tel Aviv University

The European Commission

The Marcus Foundation

UK Care Quality Commission

UK Department of Health

UK Department of Health and the Medical Research Council

UK Home Office

UK Medicines and Healthcare Products Regulatory Agency (MHRA)

UK National Institute for Health Research

UK Regenerative Medicine Platform

United Nation’s Department of Economic and Social Affairs

University of California

University of Colorado Anschutz Medical Campus (AMC)

University of Colorado Cord Blood Bank

University of Kyoto

University of Massachusetts

University of Washington

University of Western Ontario

University of Wisconsin Alumni Research Foundation

US Congress

US District Court for the District of Columbia

US FDA

US National Cord Blood Program

US National Institute of Allergy and Infectious Diseases (NIAID)

US National Institute of Health (NIH)

US Patent and Trademark Office

US Supreme Court

Yale University

Download sample pages

Complete the form below to download your free sample pages for Global Stem Cell Technologies and Applications Market 2019-2029

Related reports

-

3D Printing for Healthcare Market Report 2019-2029

The latest report from business intelligence provider Visiongain offers a comprehensive analysis of the global 3D printing for the Healthcare...

Full DetailsPublished: 02 August 2019 -

Global Vaccines Sales Market Forecast 2019-2029

The global vaccines market is estimated at $41bn in 2018 and is expected to grow at a CAGR of 10.9%...

Full DetailsPublished: 25 June 2019 -

Global Biosimilars and Follow-On Biologics Market 2019-2029

The global biosimilars and follow-on biologics market is estimated to have reached $10.7bn in 2018 and expected to grow at...

Full DetailsPublished: 21 March 2019 -

Collagen Market Report 2019-2029

The collagen market is estimated to have reached $3.8bn in 2018 and expected to grow at a CAGR of 8.10%...Full DetailsPublished: 08 April 2019 -

Pharmaceutical Contract Manufacturing Market 2019-2029

The pharmaceutical contract manufacturing market is expected to grow at a CAGR of 5.7% in the first half of the...Full DetailsPublished: 19 August 2019 -

Global Graft versus Host Disease (GVHD) Market 2019-2029

The global graft versus host disease market is expected to grow at a CAGR of 7% from 2016-2021 and CAGR...

Full DetailsPublished: 01 January 1970 -

Biologics Market Trends and Forecasts 2019-2029

The global biologics market is estimated to reach $266bn in 2024. The market is expected to grow at a CAGR...

Full DetailsPublished: 28 August 2019 -

Advanced Wound Care Market Forecast 2019-2029

The global advanced wound care market was valued at $9.2bn in 2018. The largest segment of the advanced wound care...

Full DetailsPublished: 30 August 2019 -

Biological Drug API Manufacturing Services World Industry and Market Forecast to 2029

The biological drug API manufacturing market is estimated to grow at a CAGR of 9.5% in the first half of...Full DetailsPublished: 07 November 2019 -

Global Drug Discovery Outsourcing Market Forecast to 2028

The global drug discovery outsourcing market is estimated to have reach $22.69bn in 2018, dominated by the chemistry services segment....

Full DetailsPublished: 16 April 2019

Download sample pages

Complete the form below to download your free sample pages for Global Stem Cell Technologies and Applications Market 2019-2029

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Latest Pharma news

Visiongain Publishes Cell Therapy Technologies Market Report 2024-2034

The cell therapy technologies market is estimated at US$7,041.3 million in 2024 and is projected to grow at a CAGR of 10.7% during the forecast period 2024-2034.

18 April 2024

Visiongain Publishes Automation in Biopharma Industry Market Report 2024-2034

The global Automation in Biopharma Industry market is estimated at US$1,954.3 million in 2024 and is projected to grow at a CAGR of 7% during the forecast period 2024-2034.

17 April 2024

Visiongain Publishes Anti-obesity Drugs Market Report 2024-2034

The global Anti-obesity Drugs market is estimated at US$11,540.2 million in 2024 and is expected to register a CAGR of 21.2% from 2024 to 2034.

12 April 2024

Visiongain Publishes Inflammatory Bowel Diseases (IBD) Drugs Market Report 2024-2034

The global Inflammatory Bowel Diseases (IBD) Drugs market was valued at US$27.53 billion in 2023 and is projected to grow at a CAGR of 6.2% during the forecast period 2024-2034.

11 April 2024