Industries > Defence > Military Aviation Sensors & Switches Market Report 2019-2029

Military Aviation Sensors & Switches Market Report 2019-2029

Forecasts Within Aircraft Connectivity by Sensor Type (Proximity Sensors, Position Sensors, Speed Sensors, Temperature Sensors, Pressure Sensors, Angle of Attack Sensors, Field Switches), by Application (Fighter Aircraft, Transport Aircraft, Training Aircraft, Helicopter, UAV, Space), by End Uses (Engine, Cabin/Avionics, Health Monitoring System (HMS), Other) & by Region Plus Analysis of Leading Companies

• Do you need definitive Military Aviation Sensors & Switches market data?

• Succinct Military Aviation Sensors & Switches analysis?

• Sectoral insights?

• Clear competitor analysis?

• Actionable business recommendations?

Read on to discover how this definitive report can transform your own research and save you time.

Military aviation sensors and switches are devices that collect data from various sections of an aircraft like engine, landing gear, wings, cabin, cockpit, and aerostructures and transmit that data to computers or avionics which uses that information to ensure safe and efficient performance of the aircraft.

This latest in-depth report on the global military aviation sensor and switches market describes trends in the market both quantitatively and qualitatively. In recent years, the global military aviation sensor and switches market has recorded consistent strong growth owing to the increasing demand for military aircraft from developed and developing economies and increasing demand for sensors in the growing Unmanned Aerial Vehicles (UAVs) applications.

Visiongain assesses the military aviation sensor and switches market to be valued at $179.5m in 2019.

Report highlights

• 241 tables, charts, and graphs

• Analysis of Key Players in Military Aviation Sensors and Switches Market

• Honeywell International Inc

• Thales SA

• Raytheon Company

• GE Aviation

• United Technologies Corporation

• TE Connectivity Ltd.

• Ametek Inc.

• Meggitt PLC

• Safran Electronics & Defence

• Curtiss Wright Corporation

• Esterline Technologies Corporation

• Global Military Aviation Sensors and Switches Market Outlook and Analysis from 2019-2029

• Global Military Aviation Sensors and Switches Market by Type projections analysis and potential from 2019-2029

• Proximity Sensors Forecast 2019-2029

• Position Sensors Forecast 2019-2029

• Speed Sensors Forecast 2019-2029

• Thermal Sensors Forecast 2019-2029

• Pressure Sensors Forecast 2019-2029

• Angle-of-Attack Sensors Forecast 2019-2029

• Field Switches Forecast 2019-2029

• Global Military Aviation Sensors and Switches Market by Application projections analysis and potential from 2019-2029

• Fighter Aircraft Sensors and Switches Forecast 2019-2029

• Transport Aircraft Sensors and Switches Forecast 2019-2029

• Training Aircraft Sensors and Switches Forecast 2019-2029

• Helicopter Sensors and Switches Forecast 2019-2029

• UAV Sensors and Switches Forecast 2019-2029

• Space Sensors and Switches Forecast 2019-2029

• Global Military Aviation Sensors and Switches Market by End Use projections analysis and potential from 2019-2029

• Engine Sensors and Switches Forecast 2019-2029

• Cabin / Avionics Sensors and Switches Forecast 2019-2029

• Health Monitoring System (HMS) Sensors and Switches Forecast 2019-2029

• Other Sensors and Switches Forecast 2019-2029

• Regional Military Aviation Sensors and Switches Market Forecast from 2019-2029

• North America Military Aviation Sensors and Switches Forecast 2019-2029

– U.S. Military Aviation Sensors and Switches Forecast 2019-2029

– Canada Military Aviation Sensors and Switches Forecast 2019-2029

– Mexico Military Aviation Sensors and Switches Forecast 2019-2029

• Europe Military Aviation Sensors and Switches Forecast 2019-2029

– U.K. Military Aviation Sensors and Switches Forecast 2019-2029

– Germany Military Aviation Sensors and Switches Forecast 2019-2029

– France Military Aviation Sensors and Switches Forecast 2019-2029

– Rest of Europe Military Aviation Sensors and Switches Forecast 2019-2029

• Asia-Pacific Military Aviation Sensors and Switches Forecast 2019-2029

– China Military Aviation Sensors and Switches Forecast 2019-2029

– Japan Military Aviation Sensors and Switches Forecast 2019-2029

– India Military Aviation Sensors and Switches Forecast 2019-2029

– Rest of Asia-Pacific Military Aviation Sensors and Switches Forecast 2019-2029

• ROW Military Aviation Sensors and Switches Forecast 2019-2029

– Latin America Military Aviation Sensors and Switches Forecast 2019-2029

– Middle East Military Aviation Sensors and Switches Forecast 2019-2029

– Africa Military Aviation Sensors and Switches Forecast 2019-2029

• Key questions answered

• How is the military aviation sensors & switches market evolving?

• What is driving and restraining military aviation sensors & switches market dynamics?

• How will each military aviation sensors & switches submarket segment grow over the forecast period and how much sales will these submarkets account for in 2029?

• Which individual technologies will prevail and how will these shifts be responded to?

• How will political and regulatory factors influence regional military aviation sensors & switches markets and submarkets?

• Will leading national military aviation sensors & switches markets broadly follow macroeconomic dynamics, or will individual country sectors outperform the rest of the economy?

• Who are the leading players and what are their prospects over the forecast period?

• How will the sector evolve as alliances form during the period between 2019 and 2029?

Who should read this report?

• Military aircraft manufacturers

• Aircraft component manufacturers

• Sensor manufacturers

• System integrators

• Electronics companies

• Connected aircraft companies

• Suppliers

• Defence contractors

• Technologists

• R&D staff

• Consultants

• Market analysts

• Senior executives

• Business development managers

• Investors

• Governments

• Departments of defence

• Agencies

• Industry organisations

• Banks

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1.1. Global Military Aviation Sensors and Switches Market Overview

1.2. Global Military Aviation Sensors and Switches Market Segmentation

1.3. Why You Should Read This Report

1.4. How This Report Delivers

1.5. Key Questions Answered by This Analytical Report Include

1.6. Who is This Report For

1.7. Methodology

1.8. Frequently Asked Questions (FAQ)

1.9. Associated Visiongain Reports

1.10. About Visiongain

2. Introduction to the Military Aviation Sensors and Switches Market

2.1. Global Military Aviation Sensors and Switches Market Structure

2.2. Military Aviation Sensors and Switches Market Definition

2.3. Military Aviation Sensors and Switches Types Definition

2.3.1. Proximity Sensors Submarket Definition

2.3.2. Position Sensors Submarket Definition

2.3.3. Speed Sensors Submarket Definition

2.3.4. Thermal Sensors Submarket Definition

2.3.5. Pressure Sensors Submarket Definition

2.3.6. Angle-of-Attack Sensors Submarket Definition

2.3.7. Field Switches Submarket Definition

2.4. Military Aviation Sensors & Switches Applications Definition

2.4.1. Fighter Aircraft

2.4.2. Transport Aircraft

2.4.3. Training Aircraft

2.4.4. Helicopter

2.4.5. UAV

2.4.6. Space

2.5. Military Aviation Sensors & Switches End Uses Definition

2.5.1. Engine

2.5.2. Cabin / Avionics

2.5.3. Health Monitoring System (HMS)

2.5.4. Other

3. Global Military Aviation Sensors & Switches Market 2019-2029

3.1. Global Military Aviation Sensors & Switches Market Forecast 2019-2029

3.2. Global Military Aviation Sensors & Switches Market Volume Forecast 2019-2029

3.3. Global Military Aviation Sensors & Switches Drivers & Restraints

3.3.1. Global Military Aviation Sensors & Switches Drivers

3.3.2. Global Military Aviation Sensors & Switches Restraints

4. Global Military Aviation Sensors & Switches Applications Forecast 2019-2029

4.1. Global Military Aviation Sensors & Switches Market by Applications: Overview

4.1.1. Military Fighter Aircraft Sensors & Switches Forecast by Regional Market 2019-2029

4.1.2. Military Transport Aircraft Sensors & Switches Forecast by Regional Market 2019-2029

4.1.3. Military Training Aircraft Sensors & Switches Forecast by Regional Market 2019-2029

4.1.4. Military UAV Aircraft Sensors & Switches Forecast by Regional Market 2019-2029

4.1.5. Military Space Aircraft Sensors & Switches Forecast by Regional Market 2019-2029

4.1.6. Military Helicopter Aircraft Sensors & Switches Forecast by Regional Market 2019-2029

5. Global Military Aviation Aircraft Sensors & Switches Type Forecast 2019-2029

5.1. Global Military Aviation Sensors & Switches Marketby Type: Overview

5.1.1. Military Aviation Proximity Sensors Forecast 2019-2029

5.1.2. Military Aviation Position Sensors Forecast 2019-2029

5.1.3. Military Aviation Speed Sensors Forecast 2019-2029

5.1.4. Military Aviation Temperature Sensors Forecast 2019-2029

5.1.5. Military Aviation Pressure Sensors Forecast 2019-2029

5.1.6. Military Aviation Angle-of-Attack Sensors Forecast 2019-2029

5.1.7. Military Aviation Field Switches Forecast 2019-2029

6. Global Military Aviation Aircraft Sensors & Switches End Use Forecast 2019-2029

6.1. Global Military Aviation Sensors & Switches Market by End Use: Overview

6.1.1. Military Aviation Engine Sensors Forecast 2019-2029

6.1.2. Military Aviation Cabin / Avionics Sensors Forecast 2019-2029

6.1.3. Military Aviation Health Monitoring System (HMS) Sensors Forecast 2019-2029

6.1.4. Military Aviation Others Sensors Forecast 2019-2029

7. Regional Military Aviation Aircraft Sensors & Switches Market Forecast 2019-2029

7.1. North America Military Aviation Aircraft Sensors & Switches Market Forecast 2019-2029

7.1.1. North America Military Aviation Aircraft Sensors & Switches Application Market Forecast 2019-2029

7.1.2. North America Military Aviation Aircraft Sensors & Switches Market Forecast by Country 2019-2029

7.1.3. North America Military Aviation Sensors and Switches Market Analysis

7.1.4. North America Military Aviation Sensors and Switches Market Major Contracts

7.2. Europe Military Aviation Aircraft Sensors & Switches Market Forecast 2019-2029

7.2.1. Europe Military Aviation Aircraft Sensors & Switches Application Market Forecast 2019-2029

7.2.2. Europe Military Aviation Aircraft Sensors & Switches Market Forecast by Country 2019-2029

7.2.3. Europe Military Aviation Sensors and Switches Market Analysis

7.2.4. Europe Military Aviation Sensors and Switches Market Major Contracts

7.3. Asia Pacific Military Aviation Aircraft Sensors & Switches Market Forecast 2019-2029

7.3.1. Asia Pacific Military Aviation Aircraft Sensors & Switches Application Market Forecast 2019-2029

7.3.2. Asia Pacific Military Aviation Aircraft Sensors & Switches Market Forecast by Country 2019-2029

7.3.3. Asia Pacific Military Aviation Sensors and Switches Market Analysis

7.3.4. Asia Pacific Military Aviation Sensors and Switches Market Major Contracts

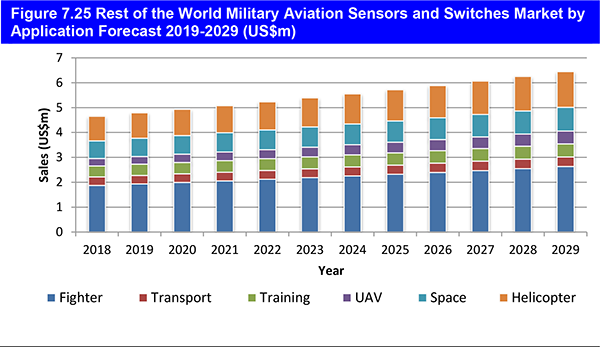

7.4. Rest of the World Military Aviation Aircraft Sensors & Switches Market Forecast 2019-2029

7.4.1. Rest of the World Military Aviation Aircraft Sensors & Switches Application Market Forecast 2019-2029

7.4.2. Rest of the World Military Aviation Aircraft Sensors & Switches Market Forecast by Country 2019-2029

7.4.3. Rest of the World Military Aviation Sensors and Switches Market Analysis

7.4.4. Rest of the World Military Aviation Sensors and Switches Market Major Contracts

8. Leading Companies in Military Aviation Sensors and Switches Market

8.1. Honeywell International Inc

8.1.1 Honeywell International Inc. Introduction

8.1.2 Honeywell International Inc. Aviation Sensors and Switches Market Selected Recent Contracts / Projects / Programmes 2015-2018

8.1.3 Honeywell International Inc. Total Company Sales 2013-2017

8.1.4 Honeywell International Inc. Net Income 2013-2017

8.1.5 Honeywell International Inc Net Capital Expenditure 2013-2017

8.1.6 Honeywell International Inc. Sales by Segment of Business 2013-2017

8.1.7 Honeywell International Inc. Number of Employees 2013-2017

8.1.8 Honeywell International Inc. Future Outlook

8.1.9 Honeywell International Inc SWOT Analysis

8.2. Thales SA

8.2.1 Thales SA Overview

8.2.2 Thales SA Military Aviation Sensors and Switches Market Selected Recent Contracts / Projects / Programmes 2015-2019

8.2.3 Thales SA Total Company Sales 2013-2017

8.2.4 Thales SA Net Income / Loss 2013-2017

8.2.5 Thales SA Net Capital Expenditure 2013-2017

8.2.6 Thales SA Sales by Segment of Business 2013-2017

8.2.7 Thales SA Number of Employees 2013-2017

8.2.8 Thales SA Future Outlook

8.2.9 Thales SA SWOT Analysis

8.3. Raytheon Company

8.3.1 Introduction

8.3.2 Raytheon Company Sensors and Switches Market Selected Recent Contracts /Projects / Programmes 2017-2019

8.3.3 The Raytheon Company Total Company Sales 2013-2017

8.3.4 The Raytheon Company Net Income / Loss 2013-2017

8.3.5 The Raytheon Company Sales by Segment of Business 2013-2017

8.3.6 The Raytheon Company Sales by Regional Segment of Business 2013-2017

8.3.7 Raytheon Company Number of Employees

8.3.8 Raytheon Company Future Outlook

8.3.9 Raytheon Company SWOT Analysis

8.4. GE Aviation

8.4.1 GE Aviation Overview

8.4.2 GE Aviation Parent Company Sales 2013-2017

8.4.3 GE Aviation Parent Company Net Income 2013-2017

8.4.4 GE Aviation Parent Company Sales by Segment of Business 2013-2017

8.4.5 GE Aviation Parent Company Sales by Regional Segment of Business 2013-2017

8.4.6 GE Aviation Parent Company Number of Employees

8.4.7 GE Aviation Future Outlook

8.4.8 GE Aviation SWOT Analysis

8.5. United Technologies Corporation

8.5.1 United Technologies Corporation Overview

8.5.2 United Technologies Corporation Aviation Sensors and Switches Market Recent Contracts / Projects / Programmes 2014-2019

8.5.3 United Technologies Corporation Total Company Sales 2013-2017

8.5.4 United Technologies Corporation Sales in Aerospace 2013-2017

8.5.5 United Technologies Corporation Net Income 2013-2017

8.5.6 United Technologies Corporation Future Outlook

8.5.7 United Technologies Corporation SWOT Analysis

8.6. TE Connectivity Ltd.

8.6.1 TE Connectivity Ltd. Introduction

8.6.2 TE Connectivity Ltd. Aviation Sensors and Switches Market Selected Recent Contracts / Projects / Programmes 2015-2018

8.6.3 TE Connectivity Ltd. Total Company Sales 2014-2018

8.6.4 TE Connectivity Ltd. Net Income 2014-2018

8.6.5 TE Connectivity Ltd. Net Capital Expenditure 2014-2018

8.6.6 TE Connectivity Ltd. Sales by Region 2014-2018

8.6.7 TE Connectivity Ltd. Number of Employees

8.6.8 TE Connectivity Ltd. Future Outlook

8.6.9 TE Connectivity Ltd. SWOT Analysis

8.7. Ametek Inc.

8.7.1 Ametek Inc. Overview

8.7.2 Ametek Inc. Aviation Sensors and Switches Market Selected Recent Contracts /Projects / Programmes 2015-2018

8.7.3 Ametek Inc. Total Company Sales 2013-2017

8.7.4 Ametek Inc. Net Income / Loss 2013-2017

8.7.5 Ametek Inc. Net Capital Expenditure 2013-2017

8.7.6 Ametek Inc. Sales by Segment of Business 2013-2017

8.7.7 Ametek Inc. Number of Employees 2013-2017

8.7.8 Ametek Inc. Future Outlook

8.7.9 Ametek Inc. SWOT Analysis

8.8. Meggitt PLC

8.8.1 Meggitt Plc Overview

8.8.2 Meggitt PLC Aviation Sensors and Switches Market Selected Recent Contracts / Projects / Programmes 2015-2019

8.8.3 Meggitt Plc Total Company Sales 2012-2016

8.8.4 Meggitt Plc Net Income 2013-2017

8.8.5 Meggitt Plc Net Capital Expenditure 2013-2017

8.8.6 Meggitt Plc Sales by Segment of Business 2013-2017

8.8.7 Meggitt Plc / Number of Employees

8.8.8 Meggitt Plc Sales by Geographical Location 2013-2016

8.8.9 Meggitt Plc Future Outlook

8.8.10 Meggitt Plc SWOT Analysis

8.9. Safran Electronics & Defence

8.9.1 Introduction

8.9.2 Safran Electronics & Defence Sensors and Switches Market Selected Recent Contracts /Projects / Programmes 2015-2018

8.9.3 Safran Group Total Company Sales 2013-2017

8.9.4 Safran Group Net Income / Loss 2013-2017

8.9.5 Safran Group Sales by Segment of Business 2013-2017

8.9.6 Safran Group Sales by Regional Segment of Business 2015-2017

8.9.7 Safran Group Number of Employees

8.9.8 Safran Group Future Outlook

8.9.9 Safran Electronics & Defence SWOT Analysis

8.10. Curtiss Wright Corporation

8.10.1 Curtiss-Wright Corporation Overview

8.10.2 Curtiss-Wright Corporation Recent Contracts / Projects / Programmes 2015-2018

8.10.3 Curtiss-Wright Corporation Total Sales 2013-2017

8.10.4 Curtiss-Wright Corporation Net Income 2013-2017

8.10.5 Curtiss-Wright Corporation Net Capital Expenditure 2013-2017

8.10.6 Curtiss-Wright Corporation Sales by Segment of Business 2013-2017

8.10.7 Curtiss-Wright Corporation Net Income/Loss 2013-2017

8.10.8 Curtiss-Wright Corporation Future Outlook

8.10.9 Curtiss-Wright Corporation SWOT Analysis

8.11. Esterline Technologies Corporation

8.11.1 Esterline Technologies Corporation Introduction

8.11.2 Esterline Technologies Corporation Aviation Sensors and Switches Market Selected Recent Contracts / Projects / Programmes 2014-2018

8.11.3 Esterline Technologies Corporation Total Company Sales 2014-2018

8.11.4 Esterline Technologies Corporation Net Income 2014-2018

8.11.5 Esterline Technologies Corporation Sales by Segment of Business 2014-2018

8.11.6 Esterline Technologies Corporation Sales by Segment of Geography 2014-2018

8.11.7 Esterline Technologies Corporation Future Outlook

8.11.8 Esterline Technologies Corporation SWOT Analysis

9. Analysis of Military Aviation Sensors & Switches Key Findings

9.1 What Are The Military Looking For Within Aircraft Connectivity?

9.2 How Is Big Data Being Used Within Aircraft Connectivity?

9.3 What Are The Important Technologies To Consider Within Military Aviation Sensors &Switches Within Aircraft Connectivity?

9.4 Insight To Next Generation Initiatives And Platforms For Military Aviation Sensors &Switches Within Aircraft Connectivity

9.5 How Are Military Aviation Sensors &Switches Being Driven By Predictive Maintenance (MRO)?

10. Conclusions and Recommendations

11. Glossary

List of Tables

Table 3.1 Global Military Aviation Sensors & Switches Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 3.2 Global Military Aviation Sensors & Switches Volume Forecast 2019-2029 (thousand units, AGR %, CAGR %, Cumulative)

Table 3.3 Global Military Aviation Sensors & Switches Market Drivers & Restraints 2019

Table 4.1 Global Military Aviation Sensors & Switches Applications Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 4.2 Military Fighter Aircraft Sensors and Switches Submarket by Regional Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 4.3 Global Military Transport Aircraft Sensors and Switches Submarket by Regional Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 4.4 Global Military Training Aircraft Sensors and Switches Submarket by Regional Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 4.5 Global Military UAV Sensors and Switches Submarket by Regional Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 4.6 Global Military Space Sensors and Switches Submarket by Regional Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 4.7 Global Military Helicopter Sensors and Switches Submarket by Regional Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.1 Global Military Aviation Sensors & Switches Type Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 5.2 Global Military Aviation Proximity Sensors Submarket Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.3 Global Military Aviation Position Sensors Submarket Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.4 Global Military Aviation Speed Sensors Submarket Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.5 Global Military Aviation Temperature Sensors Submarket Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.6 Global Military Aviation Pressure Sensors Submarket Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.7 Global Military Aviation Angle-of-Attack Sensors Submarket Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.8 Global Military Aviation Field Switches Submarket Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 6.1 Global Military Aviation Sensors & Switches End Use Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 6.2 Global Military Aviation Engine Sensors Submarket Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 6.3 Global Military Aviation Cabin/Avionics Sensors Submarket Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 6.4 Global Military Aviation HMS Sensors Submarket Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 6.5 Global Military Aviation Others Sensors Submarket Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 7.1 Regional Military Aviation Sensors and Switches Market Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 7.2 North America Military Aviation Sensors and Switches Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 7.3 North America Military Aviation Sensors and Switches Market by Application Forecast 2019-2029 (US$m and CAGR %)

Table 7.4 North America Military Aviation Sensors and Switches Market by Country Forecast 2019-2029 (US$m and CAGR %)

Table 7.5 North America Military Aviation Sensors and Switches Market Major Contracts &Programmes 2014-2018 (Date, Company, Value US$m, Details)

Table 7.6 Europe Military Aviation Sensors and Switches Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 7.7 Europe Military Aviation Sensors and Switches Market by Application Forecast 2019-2029 (US$m and CAGR %)

Table 7.8 Europe Military Aviation Sensors and Switches Market by Country Forecast 2019-2029 (US$m and CAGR %)

Table 7.9 Europe Military Aviation Sensors and Switches Market Major Contracts &Programmes 2012- 2018 (Date, Company, Details)

Table 7.10 Asia Pacific Military Aviation Sensors and Switches Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 7.11 Asia Pacific Military Aviation Sensors and Switches Market by Application Forecast 2019-2029 (US$m and CAGR %)

Table 7.12 Asia Pacific Military Aviation Sensors and Switches Market by Country Forecast 2019-2029 (US$m and CAGR %)

Table 7.13 Asia Pacific Military Aviation Sensors And Switches Market Major Contracts &Programmes 2015-2018 (Date, Company, Value US$m, Details)

Table 7.14 Rest of the World Military Aviation Sensors and Switches Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 7.15 Rest of the World Military Aviation Sensors and Switches Market by Application Forecast 2019-2029 (US$m and CAGR %)

Table 7.16 Rest of the World Military Aviation Sensors and Switches Market by Region Forecast 2019-2029 (US$m and CAGR %)

Table 7.17 Rest of the World Military Aviation Sensors & Switches Market Major Contracts &Programmes 2015-2018 (Date, Company, Value US$m, Details)

Table 8.1 Honeywell International Inc. Profile 2017 (CEO, Total Company Sales US $m, Net Income US$m, Net Capital Expenditure US $m, HQ, Founded, No. of Employees, Ticker, Website)

Table 8.2 Honeywell International Inc Aviation Sensors and Switches Market Contracts / Projects / Programmes 2017-2019 (Date, Country / Region, Subcontractor, Value US$m, Product, Details)

Table 8.3 Honeywell International Inc. Total Company Sales 2013-2017 (US $m, AGR %)

Table 8.4 Honeywell International Inc. Net Income 2013-2017 (US $m, AGR %)

Table 8.5 Honeywell International Inc. Net Capital Expenditure 2013-2017 (US$m, AGR %)

Table 8.6 Honeywell International Inc. Sales by Segment of Business 2013-2017 (US $m, AGR %)

Table 8.7 Honeywell International Inc Number of Employees 2013-2017 (No. of Employees, AGR %)

Table 8.8 Honeywell International Inc. SWOT Analysis 2019

Table 8.9 Thales SA Profile 2017 (Aviation Sensors and Switches Market CEO, Total Company Sales US $m, Net Income US $m, Net Capital Expenditure US $m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.10 Thales SA Military Aviation Sensors and Switches Market Contracts / Projects / Programmes 2015-2019 (Date, Country / Region, Subcontractor, Value US$m, Product, Details)

Table 8.11 Thales SA Total Company Sales 2013-2017 (US$m, AGR %)

Table 8.12 Thales SA Net Income / Loss 2013-2017 (US$m, AGR %)

Table 8.13 Thales SA Net Capital Expenditure 2013-2017 (US$m, AGR %)

Table 8.14 Thales SA Number of Employees 2013-2017 (No. of Employees, AGR %)

Table 8.15 Thales SA SWOT Analysis 2019

Table 8.16 Raytheon Company Profile 2017 (CEO, Total Company Sales US$m, Net Income US$m, HQ, Founded, No. of Employees, Ticker, Website)

Table 8.17 Raytheon Military Aviation Sensors and Switches Market Contracts / Projects / Programmes 2017-2019 (Date, Country / Region, Subcontractor, Value US$m, Product, Details)

Table 8.18 The Raytheon Total Company Sales 2013-2017 (US$m, AGR %)

Table 8.19 The Raytheon Net Income / Loss 2013-2017 (US$m, AGR %)

Table 8.20 The Raytheon Company Sales by Segment of Business 2013-2017 (US$m, AGR %)

Table 8.21 The Raytheon Company Sales by Regional Segment of Business 2013-2017 (US$m, AGR %)

Table 8.22 Raytheon Company Number of Employees 2013-2017 (No. of Employees, AGR %)

Table 8.23 Raytheon Company SWOT Analysis 2019

Table 8.24 GE Aviation Parent Company Profile 2019 (CEO, Parent Company Sales US$m, Parent Company Net Income US$m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.25 GE Aviation Total Company Sales 2013-2017 (US$m, AGR %)

Table 8.26 GE Aviation Parent Company Net Income 2013-2017 (US$m, AGR %)

Table 8.27 GE Aviation Parent Company Sales by Segment of Business 2013-2017 (US$m, AGR %)

Table 8.28 GE Aviation Parent Company Sales by Regional Segment of Business 2013-2017 (US$m, AGR %)

Table 8.29 GE Aviation Parent Company Number of Employees 2013-2017 (No. of Employees, AGR %)

Table 8.30 GE Aviation SWOT Analysis 2019

Table 8.31 United Technologies Corporation Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.32 Selected Recent United Technologies Corporation Aviation Sensors And Switches Contracts / Projects / Programmes 2014-2019 (Date, Country / Region, Value US$m, Product, Details)

Table 8.33 United Technologies Corporation Total Company Sales 2013-2017 (US$m, AGR %)

Table 8.34 United Technologies Corporation Sales in Aerospace 2013-2017 (US$m, AGR %)

Table 8.35 United Technologies Corporation Net Income 2013-2017 (US$m, AGR %)

Table 8.36 United Technologies Corporation SWOT Analysis 2019

Table 8.37 TE Connectivity Ltd. Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Strongest Business Region, HQ, Founded, No. of Employees, Ticker, Website)

Table 8.38 TE Connectivity Ltd. Aviation Sensors and Switches Market Contracts / Projects / Programmes 2015-2018 (Date, Country / Region, Subcontractor, Value US$m, Product, Details)

Table 8.39 TE Connectivity Ltd. Total Company Sales 2014-2018 (US$m, AGR %)

Table 8.40 TE Connectivity Ltd. Net Income 2014-2018 (US$m, AGR %)

Table 8.41 TE Connectivity Ltd. Net Capital Expenditure 2014-2018 (US$m, AGR %)

Table 8.42 TE Connectivity Ltd. Number of Employees 2014-2018 (No. of Employees, AGR %)

Table 8.43 TE Connectivity Ltd. SWOT Analysis 2019

Table 8.44 Ametek Inc. Profile 2019 (Aviation Sensors and Switches Market CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.45 Ametek Inc. Aviation Sensors and Switches Market Contracts / Projects / Programmes 2015-2018 (Date, Country / Region, Subcontractor, Value US$m, Product, Details)

Table 8.46 Ametek Inc. SA Total Company Sales 2013-2017 (US$m, AGR %)

Table 8.47 Ametek Inc. Net Income / Loss 2013-2017 (US$m, AGR %)

Table 8.48 Ametek Inc. Net Capital Expenditure 2013-2017 (US$m, AGR %)

Table 8.49 Ametek Inc. Sales by Segment of Business 2013-2017 (US$m, AGR %)

Table 8.50 Ametek Inc. Number of Employees 2013-2017 (No. of Employees, AGR %)

Table 8.51 Ametek Inc. SWOT Analysis 2019

Table 8.52 Meggitt PLC Profile 2019 (CEO, Total Company Sales US$m, Net Income US $m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.53 Selected Recent Meggitt PLC Aviation Sensors and Switches Market Contracts / Projects / Programmes 2015-2019 (Date, Country / Region, Product, Details)

Table 8.54 Meggitt Plc Total Company Sales 2013-2017 (US$m, AGR %)

Table 8.55 Meggitt Plc Net Income 2013-2017 (US$m, AGR %)

Table 8.56 Meggitt Plc Net Capital Expenditure 2013-2017 (US$m, AGR %)

Table 8.57 Meggitt Plc Sales by Segment of Business 2013-2017 (US$m, AGR %)

Table 8.58 Meggitt Plc Number of Employees 2013-2017 (No. of Employees, AGR %)

Table 8.59 Meggitt Plc Sales by Geographical Location 2013-2017 (US$m, AGR %)

Table 8.60 Meggitt Plc Aerospace SA SWOT Analysis 2019

Table 8.61 Safran Electronics & Defence Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, HQ, Founded, No. of Employees, Ticker, Website)

Table 8.62 Safran Electronics & Defence Sensors and Switches Market Contracts / Projects / Programmes 2015-2018 (Date, Country / Region, Subcontractor, Value US$m, Product, Details)

Table 8.63 Safran Group Total Company Sales 2013-2017 (US$m, AGR %)

Table 8.64 Safran Group Net Income / Loss 2013-2017 (US$m)

Table 8.65 Safran Group Sales by Segment of Business 2013-2017 (US$m, AGR %)

Table 8.66 Safran Group Sales by Regional Segment of Business 2015-2017 (US$m, AGR %)

Table 8.67 Safran Group Number of Employees 2013-2017 (No. of Employees, AGR %)

Table 8.68 Safran Electronics & Defence SWOT Analysis 2019

Table 8.69 Curtiss Wright Corporation Profile 2019 (CEO, Total Company Sales US$m, Company Net Income US$m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.70 Selected Recent Curtiss-Wright Corporation Aviation Sensors and Switches Market Contracts / Projects / Programmes 2015-2018 (Date, Country / Region, Value US$m, Product, Details)

Table 8.71 Curtiss-Wright Corporation Sales 2013-2017 (US$m, AGR %)

Table 8.72 Curtiss-Wright Corporation Net Income 2013-2017 (US$m, AGR %)

Table 8.73 Curtiss-Wright Corporation Net Capital Expenditure 2013-2017 (US$m, AGR %)

Table 8.74 Curtiss-Wright Corporation Sales by Segment of Business 2013-2017 (US$m, AGR %)

Table 8.75 Curtiss-Wright Corporation Net Income / Loss 2013-2017 (US$m)

Table 8.76 Curtiss-Wright Corporation SWOT Analysis 2019

Table 8.77 Esterline Technologies Corporation Profile 2018(CEO, Total Company Sales US $m, Net Income US$m, Net Capital Expenditure US $m, HQ, Founded, No. of Employees, Ticker, Website)

Table 8.78 Esterline Technologies Corporation Aviation Sensors and Switches Market Contracts / Projects / Programmes 2014-2018 (Date, Country / Region, Subcontractor, Value US$m, Product, Details)

Table 8.79 Esterline Technologies Corporation Total Company Sales 2014-2018 (US $m, AGR %)

Table 8.80 Esterline Technologies Corporation Net Income 2014-2018 (US $m, AGR %)

Table 8.81 Esterline Technologies Corporation Sales by Segment of Business 2014-2018 (US $m, AGR %)

Table 8.82 Esterline Technologies Corporation Sales by Regional Segment of Business 2014-2018(US $m, AGR %)

Table 8.83 Esterline Technologies Corporation SWOT Analysis 2018

List of Figures

Figure 1.1 Global Military Aviation Sensors & Switches Market Segmentation Overview

Figure 2.1 Global Military Aviation Sensors & Switches Market Segmentation Overview

Figure 3.1 Global Military Aviation Sensors & Switches Market Forecast 2019-2029 (US$m, AGR %)

Figure 3.2 Global Military Aviation Sensors & Switches Volume Forecast 2019-2029 (Thousand Units, AGR %)

Figure 4.1 Global Military Aviation Sensors & Switches Applications AGR Forecast 2019-2029 (AGR %)

Figure 4.2 Global Military Aviation Sensors & Switches Applications Forecast 2019-2029 (US$m, Global AGR %)

Figure 4.3 Military Fighter Aircraft Sensors and Switches Submarket by Regional Market Forecast 2019-2029 (US$m)

Figure 4.4 Military Fighter Aircraft Sensors and Switches Submarket by Regional Market Forecast 2019 (% Share)

Figure 4.5 Military Fighter Aircraft Sensors and Switches Submarket by Regional Market Forecast2024(% Share)

Figure 4.6 Military Fighter Aircraft Sensors and Switches Submarket by Regional Market Forecast 2029 (% Share)

Figure 4.7 Global Military Transport Aircraft Sensors and Switches by Regional Market Forecast 2019-2029 (US$m)

Figure 4.8 Global Military Transport Aircraft Sensors and Switches by Regional Market Forecast 2019 (% Share)

Figure 4.9 Global Military Transport Aircraft Sensors and Switches Submarket by Regional Market Forecast 2024(% Share)

Figure 4.10 Global Military Transport Aircraft Sensors and Switches Submarket by Regional Market Forecast 2029 (% Share)

Figure 4.11 Global Military Training Aircraft Sensors and Switches by Regional Market Forecast 2019-2029 (US$m)

Figure 4.12 Global Military Training Aircraft Sensors and Switches Submarket by Regional Market Forecast 2019 (% Share)

Figure 4.13 Global Training Aircraft Sensors and Switches Submarket by Regional Market Forecast 2024 (% Share)

Figure 4.14 Global Training Aircraft Sensors and Switches Submarket by Regional Market Forecast 2029 (% Share)

Figure 4.15 Global Military UAV Sensors and Switches Submarket by Regional Market Forecast 2019-2029 (US$m)

Figure 4.16 Global Military UAV Sensors and Switches Submarket by Regional Market Forecast 2019 (% Share)

Figure 4.17 Global Military UAV Sensors and Switches Submarket by Regional Market Forecast 2024 (% Share)

Figure 4.18 Global Military UAV Sensors and Switches Submarket by Regional Market Forecast 2029(% Share)

Figure 4.19Global Military Space Sensors and Switches Submarket by Regional Market Forecast 2019-2029 (US$m)

Figure 4.20 Global Military Space Sensors and Switches Submarket by Regional Market Forecast 2019 (% Share)

Figure 4.21 Global Military Space Sensors and Switches Submarket by Regional Market Forecast 2024(% Share)

Figure 4.22 Global Military Space Sensors and Switches Submarket by Regional Market Forecast 2029 (% Share)

Figure 4.23 Global Military Helicopter Sensors and Switches Submarket by Regional Market Forecast 2019-2029 (US$m)

Figure 4.24 Global Military Helicopter Sensors and Switches Submarket by Regional Market Forecast 2019 (% Share)

Figure 4.25 Global Military Helicopter Sensors and Switches Submarket by Regional Market Forecast 2024 (% Share)

Figure 4.26 Global Military Helicopter Sensors and Switches Submarket by Regional Market Forecast 2029 (% Share)

Figure 5.1 Global Military Aviation Sensors & Switches Type AGR Forecast 2019-2029 (AGR %)

Figure 5.2 Global Military Aviation Sensors & Switches Type Forecast 2019-2029 (US$m, Global AGR %)

Figure 5.3 Global Military Aviation Sensors & Switches Type Share Forecast 2019 (% Share)

Figure 5.4 Global Military Aviation Sensors & Switches Type Share Forecast 2024 (% Share)

Figure 5.5 Global Military Aviation Sensors & Switches Type Share Forecast 2029 (% Share)

Figure 5.6 Global Military Aviation Proximity Sensors Submarket Forecast 2019-2029 (US$m, Global AGR %)

Figure 5.7 Global Military Aviation Position Sensors Submarket AGR Forecast 2019-2029 (AGR %)

Figure 5.8 Global Military Aviation Speed Sensors Submarket Forecast 2019-2029 (US$m, Global AGR %)

Figure 5.9 Global Military Aviation Temperature Sensors Submarket AGR Forecast 2019-2029 (US$m, Global AGR %)

Figure 5.10 Global Military Aviation Pressure Sensors Submarket Forecast 2019-2029 (US$m, Global AGR %)

Figure 5.11 Global Military Aviation Angle-of-Attack Sensors Submarket Forecast 2019-2029 (US$m, Global AGR %)

Figure 5.12 Global Military Aviation Field Switches Submarket Forecast 2019-2029 (US$m, Global AGR %)

Figure 6.1 Global Military Aviation Sensors & Switches End Use AGR Forecast 2019-2029 (AGR %)

Figure 6.2 Global Military Aviation Sensors & Switches End Use Forecast 2019-2029 (US$m, Global AGR %)

Figure 6.3 Global Military Aviation Sensors & Switches End Use Share Forecast 2019 (% Share)

Figure 6.4 Global Military Aviation Sensors & Switches End Use Share Forecast 2024 (% Share)

Figure 6.5 Global Military Aviation Sensors & Switches End Use Share Forecast 2029 (% Share)

Figure 6.6 Global Military Aviation Engine Sensors Submarket Forecast 2019-2029 (US$m, Global AGR %)

Figure 6.7 Global Military Aviation Cabin/Avionics Sensors Submarket Forecast 2019-2029 (US$m, Global AGR %)

Figure 6.8 Global Military Aviation HMS Sensors Submarket Forecast 2019-2029 (US$m, Global AGR %)

Figure 6.9 Global Military Aviation Others Sensors Submarket Forecast 2019-2029 (US$m, Global AGR %)

Figure 7.1 Regional Military Aviation Sensors and Switches Market Forecast 2019-2029 (US$m, Global AGR %)

Figure 7.2 Regional Military Aviation Sensors and Switches Market AGR Forecast 2019-2029 (US$m and AGR %)

Figure 7.3 Regional Military Aviation Sensors and Switches Market Share Forecast 2019 (% Share)

Figure 7.4 Regional Military Aviation Sensors and Switches Market Share Forecast 2024 (% Share)

Figure 7.5 Regional Military Aviation Sensors and Switches Market Share Forecast 2029 (% Share)

Figure 7.6 North America Military Aviation Sensors and Switches Market Forecast 2019-2029 (US$m, AGR %)

Figure 7.7 North America Military Aviation Sensors and Switches Market by Application Forecast 2019-2029 (US$m)

Figure 7.8 North America Military Aviation Sensors and Switches Market Share Forecast 2019 (% Share)

Figure 7.9 North America Military Aviation Sensors and Switches Market Share Forecast 2024 (% Share)

Figure 7.10 North America Military Aviation Sensors and Switches Market Share Forecast 2029 (% Share)

Figure 7.11 North America Military Aviation Sensors and Switches Market by Country Forecast 2019-2029 (US$m)

Figure 7.12 Europe Military Aviation Sensors and Switches Market Forecast 2019-2029 (US$m, AGR %)

Figure 7.13 Europe Military Aviation Sensors and Switches Market by Application Forecast 2019-2029 (US$m)

Figure 7.14 Europe Military Aviation Sensors and Switches Market Share Forecast 2019 (% Share)

Figure 7.15 Europe Military Aviation Sensors and Switches Market Share Forecast 2024 (% Share)

Figure 7.16 Europe Military Aviation Sensors and Switches Market Share Forecast 2029 (% Share)

Figure 7.17 Europe Military Aviation Sensors and Switches Market by Country Forecast 2019-2029 (US$m)

Figure 7.18 Asia Pacific Military Aviation Sensors and Switches Market Forecast 2019-2029 (US$m, AGR %)

Figure 7.19 Asia Pacific Military Aviation Sensors and Switches Market by Application Forecast 2019-2029 (US$m)

Figure 7.20 Asia Pacific Military Aviation Sensors and Switches Market Share Forecast 2019 (% Share)

Figure 7.21 Asia Pacific Military Aviation Sensors and Switches Market Share Forecast 2024 (% Share)

Figure 7.22 Asia Pacific Military Aviation Sensors and Switches Market Share Forecast 2029 (% Share)

Figure 7.23 Asia Pacific Military Aviation Sensors and Switches Market by Country Forecast 2019-2029 (US$m)

Figure 7.24 Rest of the World Military Aviation Sensors and Switches Market Forecast 2019-2029 (US$m, AGR %)

Figure 7.25 Rest of the World Military Aviation Sensors and Switches Market by Application Forecast 2019-2029 (US$m)

Figure 7.26 Rest of the World Military Aviation Sensors and Switches Market Share Forecast 2019 (% Share)

Figure 7.27 Rest of the World Military Aviation Sensors and Switches Market Share Forecast 2024 (% Share)

Figure 7.28 Rest of the World Military Aviation Sensors and Switches Market Share Forecast 2029 (% Share)

Figure 7.29 Rest of the World Military Aviation Sensors and Switches Market by Region Forecast 2019-2029 (US$m)

Figure 8.1 Honeywell International Inc. Total Company Sales 2013-2017 (US $m, AGR %)

Figure 8.2 Honeywell International Inc. Net Income 2013-2017 (US$m, AGR %)

Figure 8.3 Honeywell International Inc Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.4 Thales SA Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.5 Thales SA Net Income / Loss 2013-2017 (US$m)

Figure 8.6 Thales SA Net Capital Expenditure 2013-2017 (US$m, AGR %)

Figure 8.7 Thales SA Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.8 The Raytheon Company Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.9 The Raytheon Company Net Income / Loss 2013-2017 (US$m)

Figure 8.10 The Raytheon Company Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.11 The Raytheon Company Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.12 GE Aviation Parent Company Sales 2013-2017 (US$m, AGR %)

Figure 8.13 GE Aviation Parent Company Net Income 2013-2017 (US$m, AGR %)

Figure 8.14 GE Aviation Parent Company Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.15 GE Aviation Parent Company Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.16 United Technologies Corporation Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.17 United Technologies Corporation Net Income 2013-2017 (US$m, AGR %)

Figure 8.18 TE Connectivity Ltd. Total Company Sales 2014-2018 (US$m, AGR %)

Figure 8.19 TE Connectivity Ltd. Net Income 2014-2018 (US$m, AGR %)

Figure 8.20 TE Connectivity Ltd. Sales by Region of Business 2014-2018 (US$m, Total Company Sales AGR %)

Figure 8.21 Ametek Inc. Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.22 Ametek Inc. Net Income / Loss 2013-2017 (US$m)

Figure 8.23 Ametek Inc. Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.24 Meggitt Plc Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.25 Meggitt Plc Net Income 2013-2017 (US$m, AGR %)

Figure 8.26 Meggitt Plc Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.27 Meggitt Plc Sales by Geographical Location 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.28 Safran Group Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.29 Safran Group Net Income / Loss 2013-2017 (US$m)

Figure 8.30 Safran Group Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.31 Safran Group Sales by Regional Segment of Business 2015-2017 (US$m, Total Company Sales AGR %)

Figure 8.32 Curtiss-Wright Corporation Total Sales 2013-2017 (US$m, AGR %)

Figure 8.33 Curtiss-Wright Corporation Net Income 2013-2017 (US$m, AGR %)

Figure 8.34 Curtiss-Wright Corporation Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.35 Esterline Technologies Corporation Total Company Sales 2012-2016 (US$m, AGR %)

Figure 8.36 Esterline Technologies Corporation Net Income 2014-2018 (US$m, AGR %)

Figure 8.37 Esterline Technologies Corporation Sales by Segment of business 2014-2018 (US$m, Total Company Sales AGR %)

Figure 8.38 Esterline Technologies Corporation Sales by Geography Segment of 2014-2018 (US$m, Total Company Sales AGR %)

Advanced Electronics Systems International

AgustaWestland

AHS

Airbus

Airbus Defence and Space

Airbus Group SE

American Sensor Technologies, Inc. (AST)

Ametek Inc.

Amphenol

Aselsan AS

BAE Systems PLC

BAE Systems Spectral Solutions LLC

Bell

Boeing Company

Bombardier

CFM International

Cobham plc

COMAC

Crane Aerospace and Electronics

Curtiss-Wright Corporation

Dassault Aviation

Delphi

Delta Airlines

DRS Technologies

Eaton

Elbit Systems

Elbit Systems of America LLC

Elta Systems Ltd

Embraer

Eurocopter

Eurofighter GMBH

EuroSat

Exelis

Exelis Information Systems

Finmeccanica SpA

FLIR Systems

GE Aviation

General Atomics Aeronautical Systems Inc (GA-ASI)

General Electric (GE)

Gentex Corporation

Gulfstream

Hensoldt

Hindustan Aeronautics Ltd.

Honeywell International Inc.

Hydra Electric

inmarsat

Intelsat General

Intevac

Irkut

Israel Aerospace Industries (IAI) Ltd.

Japanese Aero Engines Corporation

Joint Armament Corporation

Kavlic-

Kawasaki Heavy Industries

Kellstrom Aerospace

Korea Aerospace Industries (KAI)

L-3 Wescam

Leonardo SpA

Lockheed Martin Corporation

Lufthansa

Mantech International

Measurement Specialties Inc.

Meggitt Plc

Meggitt Sensing Systems

Microsemi Corporation

Molex

MTS Systems Corp.

MTU Aero Engines

Newport News Shipbuilding

Northrop Grumman Corporation

Ophir Corporation

Otis

Piezotech LLC

Pratt & Whitney

Rafael Advanced Systems

Raytheon Applied Signal Technology Inc.

Raytheon Company

Raytheon Vision

Safran Electronics & Defence

Safran Group

Selex ES

Sensata Technologies

Sherborne Sensors

Siemens

Sumitomo

Tata Advanced Systems Ltd (TASL)

TE Connectivity Ltd

Teledyne

Textron

Thales Alenia Space

Thales Group

Thales Research & Technology (TRT

Thales SA

Turkish Aerospace Industries (TAI)

Ultra Electronics

United Aircraft Corporation

United Electric Controls Company

United Technologies Corporation (UTC)

UTC Aerospace Systems

UTC Building and Industrial Systems

UTC Climate, Control & Security

Vestek Savunma

ViaSat

Yazaki

Organisations mentioned

Air National Guard’s 153rd Airlift Wing

Army Aviation and Missile Research, Development and Engineering Center (AMRDEC)

Association of the United States Army (AUSA)

Defence Advanced Research Projects Agency (DARPA)

Defence Logistics Agency (DLA)

Defense Security Cooperation Agency

Denmark’s Defence Acquisition and Logistics Organization (DALO)

DGA

EASA

FAA

Federal Office of Bundeswehr Equipment, Information Technology and In-Service Support (BAAINBw)

German Army

German Army Joint Fire Support Teams (JFST)

Indian Army

Indian Navy

Israeli Air Force

Israeli Defence Ministry

Italian Air Force

Japan Ministry of Defence

Ministry of Defence of the Russian Federation

Moscow Institute of Electromechanics and Automatics

NATO

Royal Australian Air Force (RAAF)

Royal Danish Air Force (RDAF)

Royal Navy

Royal Netherlands Air Force

Royal Saudi Air Force

Royal Saudi Land Forces Aviation Command (RSLFAC).

Saudi Arabia National Guard

South Korea’s Agency for Defence Development (ADD)

U.K. MOD

U.K. Royal Air Force

U.S. Air Force

U.S. Army

U.S. Army Night Vision and Electronic Sensors Directorate

U.S. Department of Defense

U.S. Government

U.S. Navy

U.S. State Department

Download sample pages

Complete the form below to download your free sample pages for Military Aviation Sensors & Switches Market Report 2019-2029

Related reports

-

Directed Energy Weapons (DEW) Market Report 2019-2029

Directed Energy Weapons (DEW) market worth $5.8 billion in 2019.

...Full DetailsPublished: 28 January 2019 -

Autonomous Weapons Market Report 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global Autonomous Weapons market. Visiongain assesses that...Full DetailsPublished: 21 August 2018 -

Military Embedded Systems Market Forecast 2019-2029

The $89.6 billion military embedded systems market is expected to flourish in the next few years because increasing investment towards...

Full DetailsPublished: 30 April 2019 -

Nano-UAV Market Report 2019-2029

The latest demand in Nano-UAV has led Visiongain to publish this unique report, which is crucial to your companies improved...

Full DetailsPublished: 16 May 2019 -

Military Aircraft Avionics Market Report 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global military aircraft avionics market. Visiongaain assesses...Full DetailsPublished: 31 July 2018 -

Air and Missile Defence System Market Forecast 2019-2029

Are you looking for a definitive report on the $14.1bn AMDS Market? You will receive a highly granular market analysis...

Full DetailsPublished: 31 January 2019 -

Military Augmented Reality (MAR) Technologies Market Report 2018-2028

The spate of investments in augmented reality technology has led Visiongain to publish this timely report.

...Full DetailsPublished: 05 October 2018 -

Wearable Technology Market 2018-2028

Our 172-page report provides 134 tables, charts, and graphs. Read on to discover the most lucrative areas in the industry...

Full DetailsPublished: 16 January 2018 -

Electronic Warfare (EW) Market Report 2019-2029

The recent developments in electronic warfare systems in defence platforms and systems, has led Visiongain to publish this timey report....

Full DetailsPublished: 26 March 2019 -

Military Aircraft Avionics Market Report 2019-2029

The $ 24 billion military avionics is expected to flourish in the next few years because of ongoing investment on...Full DetailsPublished: 26 February 2019

Download sample pages

Complete the form below to download your free sample pages for Military Aviation Sensors & Switches Market Report 2019-2029

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain defence reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible, Visiongain analysts reach out to market-leading vendors and industry experts and review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain defence reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

ADS Group

Aerial Refueling Systems Advisory Group

Aerospace and Defence Industries Association of Nova Scotia

Aerospace Industries Association

Aerospace Industries Association of Canada

AHS International – The Vertical Flight Technical Society

Air Force Association

Aircraft Electronics Association

Airlift/Tanker Association

American Astronautical Society

American Gear Manufacturers Association

American Institute of Aeronautics and Astronautics

American Logistics Association

American Society of Naval Engineers

AMSUS – The Society of the Federal Health Agencies

Armed Forces Communications and Electronics Association

Armed Forces Communications and Electronics Association

Army Aviation Association of America

ASD – Aerospace & Defence Association of Europe

Association for Unmanned Vehicle Systems International

Association of Aviation Manufacturers of the Czech Republic

Association of Naval Aviation

Association of Old Crows

Association of Polish Aviation Industry

Association of the Defense Industry of the Czech Republic

Association of the United States Army

Association of the United States Navy

Australia Defence Association

Australian Industry & Defence Network

Australian Industry Group Defence Council

Austrian Aeronautics Industries Group

Aviation Distributors and Manufacturers Association

Aviation Suppliers Association

Belgian Security and Defence Industry

Bulgarian Defence Industry Association

Business Executives for National Security

Canadian Association of Defence and Security Industries

Conference of Defense Associations

Council of Defense and Space Industry Associations

Danish Defence & Security Industries Association

Defence Industry Manufacturers Association

Defense Industry Initiative on Business Ethics and Conduct

Defense Industry Offset Association

Defense Orientation Conference Association

Deutsche Gesellschaft fur Wehrtechnik

Federal Association of the German Security and Defence Industry

Federation of Aerospace Enterprises in Ireland

French Aerospace Industries Association

French Land Defence Manufacturers Association (GICAT)

German Aerospace Industries Association

Helicopter Association International

Hellenic Aerospace & Defense Industries Group

Homeland Security & Defense Business Council

International Stability Operations Association

Japan Association of Defense Industry

Korea Defense Industry Association

Marine Corps Association & Foundation

National Aeronautic Association

National Association of Ordnance and Explosive Waste Contractors

National Defense Industrial Association

National Defense Transportation Association

National Guard Association of the U.S.

Navy League of the United States

Netherlands Aerospace Group

New Zealand Defence Industry Association

Portuguese Association of Defense Related Industries & New Technologies Companies

Québec Ground Transportation Cluster

Satellite Industry Association

Society of American Military Engineers

South African Aerospace Maritime and Defence Industries Association

Spanish Aerospace and Defence Association Industries

Submarine Industrial Base Council

Swedish Aerospace Industries

Swedish Security and Defence Industry Association

Swiss Aeronautical Industries Group

The Association of Finnish Defence and Aerospace Industries

The Italian Industries Association for Aerospace Systems and Defence

The Netherlands Defence Manufacturers Association

The Society of Japanese Aerospace Companies

UK AeroSpace, Defence & Security Industries

United Kingdom National Defence Association

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Defence news

Robotic Warfare Market

The global Robotic Warfare market is projected to grow at a CAGR of 6.7% by 2034

19 July 2024

Cyber Warfare Market

The global Cyber Warfare market is projected to grow at a CAGR of 17.7% by 2034

16 July 2024

Counter-UAV (C-UAV) Market

The global Counter-UAV (C-UAV) market is projected to grow at a CAGR of 29.6% by 2034

08 July 2024

Special Mission Aircraft Market

The global Special Mission Aircraft market is projected to grow at a CAGR of 4.6% by 2034

27 June 2024