The Liquefied Natural Gas (LNG) Infrastructure Market Report 2023-2033: This report will prove invaluable to leading firms striving for new revenue pockets if they wish to better understand the industry and its underlying dynamics. It will be useful for companies that would like to expand into different industries or to expand their existing operations in a new region.

Growing Global LNG Trade: Expanding the LNG Footprint

The growth of global LNG trade is a pivotal driver for the LNG infrastructure market. LNG, as a versatile and cleaner energy source, is experiencing increasing demand worldwide. This demand is driven by the desire to reduce greenhouse gas emissions and diversify energy sources. As more countries recognize the environmental benefits and energy security advantages of LNG, they are investing in the necessary infrastructure to facilitate LNG import and export. For LNG to be efficiently transported and utilized, a well-developed infrastructure network is essential. This includes LNG liquefaction plants, export terminals, LNG carriers, regasification facilities, and associated pipelines. The expanding footprint of LNG infrastructure is enabling countries to access LNG from various suppliers and regions, ensuring a stable and diverse energy supply.

Environmental Concerns: Transition to Cleaner Energy

Environmental concerns are a prominent driver of LNG infrastructure development. As countries and industries aim to reduce their carbon footprint and air pollution, they are increasingly turning to cleaner energy sources like LNG. LNG combustion produces lower carbon emissions, sulphur dioxide, and particulate matter compared to traditional fossil fuels. Therefore, it is seen as a crucial step toward meeting emission reduction targets and addressing climate change.

The adoption of LNG for power generation, transportation, and industrial processes aligns with global efforts to transition away from coal and oil. The construction of LNG infrastructure, including liquefaction and regasification facilities, is a strategic response to these environmental imperatives, facilitating the availability and utilization of cleaner energy options.

What Questions Should You Ask before Buying a Market Research Report?

• How is the liquefied natural gas (LNG) infrastructure market evolving?

• What is driving and restraining the liquefied natural gas (LNG) infrastructure market?

• How will each liquefied natural gas (LNG) infrastructure submarket segment grow over the forecast period and how much revenue will these submarkets account for in 2033?

• How will the market shares for each liquefied natural gas (LNG) infrastructure submarket develop from 2023 to 2033?

• What will be the main driver for the overall market from 2023 to 2033?

• Will leading liquefied natural gas (LNG) infrastructure markets broadly follow the macroeconomic dynamics, or will individual national markets outperform others?

• How will the market shares of the national markets change by 2033 and which geographical region will lead the market in 2033?

• Who are the leading players and what are their prospects over the forecast period?

• What are the liquefied natural gas (LNG) infrastructure projects for these leading companies?

• How will the industry evolve during the period between 2023 and 2033? What are the implications of liquefied natural gas (LNG) infrastructure projects taking place now and over the next 10 years?

• Is there a greater need for product commercialisation to further scale the liquefied natural gas (LNG) infrastructure market?

• Where is the liquefied natural gas (LNG) infrastructure market heading and how can you ensure you are at the forefront of the market?

• What are the best investment options for new product and service lines?

• What are the key prospects for moving companies into a new growth path and C-suite?

You need to discover how this will impact the liquefied natural gas (LNG) infrastructure market today, and over the next 10 years:

• Our 437-page report provides 131 tables and 216 charts/graphs exclusively to you.

• The report highlights key lucrative areas in the industry so you can target them – NOW.

• It contains in-depth analysis of global, regional and national sales and growth.

• It highlights for you the key successful trends, changes and revenue projections made by your competitors.

This report tells you TODAY how the liquefied natural gas (LNG) infrastructure market will develop in the next 10 years, and in line with the variations in COVID-19 economic recession and bounce. This market is more critical now than at any point over the last 10 years.

Forecasts to 2033 and other analyses reveal commercial prospects

• In addition to revenue forecasting to 2033, our new study provides you with recent results, growth rates, and market shares.

• You will find original analyses, with business outlooks and developments.

• Discover qualitative analyses (including market dynamics, drivers, opportunities, restraints and challenges), cost structure, impact of rising liquefied natural gas (LNG) infrastructure prices and recent developments.

This report includes data analysis and invaluable insight into how COVID-19 will affect the industry and your company. Four COVID-19 recovery patterns and their impact, namely, “V”, “L”, “W” and “U” are discussed in this report.

Segments Covered in the Report

Market Segment by Distribution

• Pipeline Networks

• Virtual Pipeline Solutions

Market Segment by Regasification

• LNG Import Terminals

• Floating Storage and Regasification Units (FSRUs)

• Onshore Regasification Facilities

Market Segment by Production

• Liquefaction Plants

• Natural Gas Processing Facilities

• LNG Storage Tanks

• Other Production Infrastructure

Market Segment by Transportation

• Large-Scale LNG Carriers

• Floating LNG Ships

• Small-Scale LNG Carriers

• LNG Bunkering Vessels

• LNG Trucking and ISO Containers

Market Segment by Type

• Production Infrastructure

• Transportation Infrastructure

• Regasification Infrastructure

• Distribution Infrastructure

• Storage Facilities

• Other Infrastructure Types

In addition to the revenue predictions for the overall world market and segments, you will also find revenue forecasts for four regional and 20 leading national markets:

North America

• U.S.

• Canada

Europe

• Germany

• Russia

• United Kingdom

• France

• Italy

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Thailand

• South Korea

• Rest of Asia Pacific

Latin America

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa

• GCC

• South Africa

• Rest of Middle East & Africa

Need industry data? Please contact us today.

The report also includes profiles and for some of the leading companies in the Liquefied Natural Gas (LNG) Infrastructure Market, 2023 to 2033, with a focus on this segment of these companies’ operations.

Leading companies and the potential for market growth

• BP PLC

• Cheniere Energy

• Chevron Corporation

• ConocoPhillips

• Eni S.p.A.

• Equinor ASA

• Exxon Mobil Corporation

• TotalEnergies SE

• Mitsubishi Corporation

• Petroleo Brasileiro S.A.

• Qatar Petroleum

• Royal Dutch Shell

• Santos Ltd.

• Sempra Energy

• Tellurian Inc.

Overall world revenue for Liquefied Natural Gas (LNG) Infrastructure Market, 2023 to 2033 in terms of value the market will surpass US$193.7 billion in 2023, our work calculates. We predict strong revenue growth through to 2033. Our work identifies which organizations hold the greatest potential. Discover their capabilities, progress, and commercial prospects, helping you stay ahead.

How will the Liquefied Natural Gas (LNG) Infrastructure Market, 2023 to 2033 report help you?

In summary, our 430+ page report provides you with the following knowledge:

• Revenue forecasts to 2033 for Liquefied Natural Gas (LNG) Infrastructure Market, 2023 to 2033 Market, with forecasts for distribution, regasification, production, transportation, type, each forecast at a global and regional level – discover the industry’s prospects, finding the most lucrative places for investments and revenues.

• Revenue forecasts to 2033 for four regional and 20 key national markets – See forecasts for the Liquefied Natural Gas (LNG) Infrastructure Market, 2023 to 2033 market in North America, Europe, Asia-Pacific, Latin America and Middle East & Africa. Also forecasted is the market in the US, Canada, Germany, France, UK, Italy, China, India, Japan, and Russia among other prominent economies.

• Prospects for established firms and those seeking to enter the market – including company profiles for 15 of the major companies involved in the Liquefied Natural Gas (LNG) Infrastructure Market, 2023 to 2033.

Find quantitative and qualitative analyses with independent predictions. Receive information that only our report contains, staying informed with invaluable business intelligence.

Information found nowhere else

With our new report, you are less likely to fall behind in knowledge or miss out on opportunities. See how our work could benefit your research, analyses, and decisions. Visiongain’s study is for everybody needing commercial analyses for the Liquefied Natural Gas (LNG) Infrastructure Market, 2023 to 2033, market-leading companies. You will find data, trends and predictions.

To access the data contained in this document please email contactus@visiongain.com

Buy our report today Liquefied Natural Gas (LNG) Infrastructure Market Report 2023-2033: Forecasts by Distribution (Pipeline Networks, Virtual Pipeline Solutions), by Regasification (LNG Import Terminals, Floating Storage and Regasification Units (FSRUs), Onshore Regasification Facilities), by Production (Liquefaction Plants, Natural Gas Processing Facilities, LNG Storage Tanks, Other), by Transportation (Large-Scale LNG Carriers, Floating LNG Ships, Small-Scale LNG Carriers, LNG Bunkering Vessels, LNG Trucking and ISO Containers), by Type (Production Infrastructure, Transportation Infrastructure, Regasification Infrastructure, Distribution Infrastructure, Storage Facilities, Other) AND Regional and Leading National Market Analysis PLUS Analysis of Leading Companies AND COVID-19 Impact and Recovery Pattern Analysis. Avoid missing out by staying informed – order our report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for a specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: contactus@visiongain.com

1 Report Overview

1.1 Objectives of the Study

1.2 Introduction to Liquefied Natural Gas (LNG) Infrastructure Market

1.3 What This Report Delivers

1.4 Why You Should Read This Report

1.5 Key Questions Answered by This Analytical Report

1.6 Who Is This Report for?

1.7 Methodology

1.8 Market Definitions

1.8.1 Market Evaluation & Forecasting Methodology

1.8.2 Data Validation

1.8.2.1 Primary Research

1.8.2.2 Secondary Research

1.9 Frequently Asked Questions (FAQs)

1.10 Associated Visiongain Reports

1.11 About Visiongain

2 Executive Summary

3 Market Overview

3.1 Key Findings

3.2 Market Dynamics

3.2.1 Market Driving Factors

3.2.1.1 Reduction in the Prices of Natural Gas Driving the Market Growth

3.2.1.2 Governments in Many Countries are Providing Regulatory Support for the Development of LNG Infrastructure

3.2.1.3 Increasing Demand for Power Generation Driving the Market Growth

3.2.2 Market Restraining Factors

3.2.2.1 Cancellation of LNG Shipments can Hinder the Market Growth

3.2.2.2 Changing Role of Gas in Developed Economies Hinder the Market Growth

3.2.2.3 Competition from Other Energy Sources Hinder the LNG Market Growth

3.2.3 Market Opportunities

3.2.3.1 Construction of new LNG Terminals to Meet the Growing Demand for LNG

3.2.3.2 Development of Small-Scale LNG Infrastructure More Accessible

3.2.3.3 Improved Storage Technologies Opportunities for the LNG Infrastructure Market

3.3 Porter’s Five Forces Analysis

3.3.1 Bargaining Power of Suppliers (Medium to High)

3.3.2 Bargaining Power of Buyers (Medium to High)

3.3.3 Competitive Rivalry (High)

3.3.4 Threat from Substitutes (Medium)

3.3.5 Threat of New Entrants (Low to Medium)

3.4 COVID-19 Impact Analysis

3.4.1 “V-Shaped Recovery”

3.4.2 “W-Shaped Recovery”

3.4.3 “U-Shaped Recovery”

3.4.4 “L-Shaped Recovery”

3.5 PEST Analysis

4 Liquefied Natural Gas (LNG) Infrastructure Market Analysis by Distribution

4.1 Key Findings

4.2 Distribution Segment: Market Attractiveness Index

4.3 Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Distribution

4.4 Pipeline Networks

4.4.1 Market Size by Region, 2023-2033 (US$ Billion)

4.4.2 Market Share by Region, 2023 & 2033 (%)

4.5 Virtual Pipeline Solutions

4.5.1 Market Size by Region, 2023-2033 (US$ Billion)

4.5.2 Market Share by Region, 2023 & 2033 (%)

5 Liquefied Natural Gas (LNG) Infrastructure Market Analysis by Regasification

5.1 Key Findings

5.2 Regasification Segment: Market Attractiveness Index

5.3 Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Regasification

5.4 LNG Import Terminals

5.4.1 Market Size by Region, 2023-2033 (US$ Billion)

5.4.2 Market Share by Region, 2023 & 2033 (%)

5.5 Floating Storage and Regasification Units (FSRUs)

5.5.1 Market Size by Region, 2023-2033 (US$ Billion)

5.5.2 Market Share by Region, 2023 & 2033 (%)

5.6 Onshore Regasification Facilities

5.6.1 Market Size by Region, 2023-2033 (US$ Billion)

5.6.2 Market Share by Region, 2023 & 2033 (%)

6 Liquefied Natural Gas (LNG) Infrastructure Market Analysis by Production

6.1 Key Findings

6.2 Production Segment: Market Attractiveness Index

6.3 Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Production

6.4 Liquefaction Plants

6.4.1 Market Size by Region, 2023-2033 (US$ Billion)

6.4.2 Market Share by Region, 2023 & 2033 (%)

6.5 Natural Gas Processing Facilities

6.5.1 Market Size by Region, 2023-2033 (US$ Billion)

6.5.2 Market Share by Region, 2023 & 2033 (%)

6.6 LNG Storage Tanks

6.6.1 Market Size by Region, 2023-2033 (US$ Billion)

6.6.2 Market Share by Region, 2023 & 2033 (%)

6.7 Other Production Infrastructure

6.7.1 Market Size by Region, 2023-2033 (US$ Billion)

6.7.2 Market Share by Region, 2023 & 2033 (%)

7 Liquefied Natural Gas (LNG) Infrastructure Market Analysis by Transportation

7.1 Key Findings

7.2 Transportation Segment: Market Attractiveness Index

7.3 Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Transportation

7.4 Large-Scale LNG Carriers

7.4.1 Market Size by Region, 2023-2033 (US$ Billion)

7.4.2 Market Share by Region, 2023 & 2033 (%)

7.5 Floating LNG Ships

7.5.1 Market Size by Region, 2023-2033 (US$ Billion)

7.5.2 Market Share by Region, 2023 & 2033 (%)

7.6 Small-Scale LNG Carriers

7.6.1 Market Size by Region, 2023-2033 (US$ Billion)

7.6.2 Market Share by Region, 2023 & 2033 (%)

7.7 LNG Bunkering Vessels

7.7.1 Market Size by Region, 2023-2033 (US$ Billion)

7.7.2 Market Share by Region, 2023 & 2033 (%)

7.8 LNG Trucking and ISO Containers

7.8.1 Market Size by Region, 2023-2033 (US$ Billion)

7.8.2 Market Share by Region, 2023 & 2033 (%)

8 Liquefied Natural Gas (LNG) Infrastructure Market Analysis by Type

8.1 Key Findings

8.2 Type Segment: Market Attractiveness Index

8.3 Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Transportation

8.4 Production Infrastructure

8.4.1 Market Size by Region, 2023-2033 (US$ Billion)

8.4.2 Market Share by Region, 2023 & 2033 (%)

8.5 Transportation Infrastructure

8.5.1 Market Size by Region, 2023-2033 (US$ Billion)

8.5.2 Market Share by Region, 2023 & 2033 (%)

8.6 Regasification Infrastructure

8.6.1 Market Size by Region, 2023-2033 (US$ Billion)

8.6.2 Market Share by Region, 2023 & 2033 (%)

8.7 Distribution Infrastructure

8.7.1 Market Size by Region, 2023-2033 (US$ Billion)

8.7.2 Market Share by Region, 2023 & 2033 (%)

8.8 Storage Facilities

8.8.1 Market Size by Region, 2023-2033 (US$ Billion)

8.8.2 Market Share by Region, 2023 & 2033 (%)

8.9 Other Infrastructure

8.9.1 Market Size by Region, 2023-2033 (US$ Billion)

8.9.2 Market Share by Region, 2023 & 2033 (%)

9 Liquefied Natural Gas (LNG) Infrastructure Market Analysis by Region

9.1 Key Findings

9.2 Regional Market Size Estimation and Forecast

10 North America Liquefied Natural Gas (LNG) Infrastructure Market Analysis

10.1 Key Findings

10.2 North America Liquefied Natural Gas (LNG) Infrastructure Market Attractiveness Index

10.3 North America Liquefied Natural Gas (LNG) Infrastructure Market by Country, 2023, 2028 & 2033 (US$ Billion)

10.4 North America Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast

10.5 North America Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Country

10.6 North America Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Distribution

10.7 North America Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Regasification

10.8 North America Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Production

10.9 North America Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Transportation

10.10 North America Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Type

10.11 U.S. Liquefied Natural Gas (LNG) Infrastructure Market Analysis

10.12 Canada Liquefied Natural Gas (LNG) Infrastructure Market Analysis

11 Europe Liquefied Natural Gas (LNG) Infrastructure Market Analysis

11.1 Key Findings

11.2 Europe Liquefied Natural Gas (LNG) Infrastructure Market Attractiveness Index

11.3 Europe Liquefied Natural Gas (LNG) Infrastructure Market by Country, 2023, 2028 & 2033 (US$ Billion)

11.4 Europe Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast

11.5 Europe Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Country

11.6 Europe Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Distribution

11.7 Europe Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Regasification

11.8 Europe Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Production

11.9 Europe Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Transportation

11.10 Europe Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Type

11.11 Germany Liquefied Natural Gas (LNG) Infrastructure Market Analysis

11.12 UK Liquefied Natural Gas (LNG) Infrastructure Market Analysis

11.13 France Liquefied Natural Gas (LNG) Infrastructure Market Analysis

11.14 Italy Liquefied Natural Gas (LNG) Infrastructure Market Analysis

11.15 Russia Liquefied Natural Gas (LNG) Infrastructure Market Analysis

11.16 Rest of Europe Liquefied Natural Gas (LNG) Infrastructure Market Analysis

12 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market Analysis

12.1 Key Findings

12.2 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market Attractiveness Index

12.3 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market by Country, 2023, 2028 & 2033 (US$ Billion)

12.4 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast

12.5 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Country

12.6 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Distribution

12.7 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Regasification

12.8 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Production

12.9 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Transportation

12.10 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Type

12.11 China Liquefied Natural Gas (LNG) Infrastructure Market Analysis

12.12 India Liquefied Natural Gas (LNG) Infrastructure Market Analysis

12.13 Japan Liquefied Natural Gas (LNG) Infrastructure Market Analysis

12.14 South Korea Liquefied Natural Gas (LNG) Infrastructure Market Analysis

12.15 Thailand Liquefied Natural Gas (LNG) Infrastructure Market Analysis

12.16 Rest of Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market Analysis

13 Middle East and Africa Liquefied Natural Gas (LNG) Infrastructure Market Analysis

13.1 Key Findings

13.2 Middle East and Africa Liquefied Natural Gas (LNG) Infrastructure Market Attractiveness Index

13.3 Middle East and Africa Liquefied Natural Gas (LNG) Infrastructure Market by Country, 2023, 2028 & 2033 (US$ Billion)

13.4 Middle East and Africa Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast

13.5 Middle East and Africa Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Country

13.6 Middle East and Africa Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Distribution

13.7 Middle East and Africa Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Regasification

13.8 Middle East and Africa Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Production

13.9 Middle East and Africa Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Transportation

13.10 Middle East and Africa Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Type

13.11 GCC Liquefied Natural Gas (LNG) Infrastructure Market Analysis

13.12 South Africa Liquefied Natural Gas (LNG) Infrastructure Market Analysis

13.13 Rest of Middle East & Africa Liquefied Natural Gas (LNG) Infrastructure Market Analysis

14 Latin America Liquefied Natural Gas (LNG) Infrastructure Market Analysis

14.1 Key Findings

14.2 Latin America Liquefied Natural Gas (LNG) Infrastructure Market Attractiveness Index

14.3 Latin America Liquefied Natural Gas (LNG) Infrastructure Market by Country, 2023, 2028 & 2033 (US$ Billion)

14.4 Latin America Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast

14.5 Latin America Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Country

14.6 Latin America Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Distribution

14.7 Latin America Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Regasification

14.8 Latin America Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Production

14.9 Latin America Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Transportation

14.10 Latin America Liquefied Natural Gas (LNG) Infrastructure Market Size Estimation and Forecast by Type

14.11 Argentina Liquefied Natural Gas (LNG) Infrastructure Market Analysis

14.12 Mexico Liquefied Natural Gas (LNG) Infrastructure Market Analysis

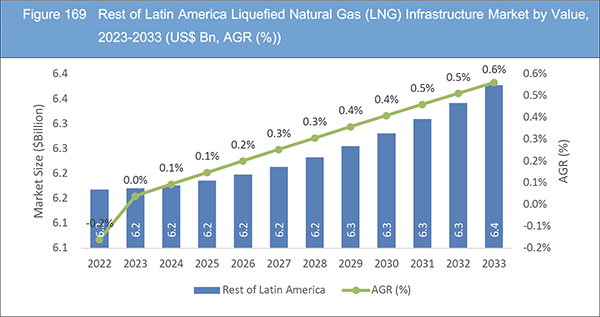

14.13 Rest of Latin America Liquefied Natural Gas (LNG) Infrastructure Market Analysis

15 Company Profiles

15.1 Competitive Landscape, 2022

15.2 Strategic Outlook

16 Company Profiles

16.1 BP PLC

16.1.1 Company Snapshot

16.1.2 Company Overview

16.1.3 Financial Analysis

16.1.3.1 Net Revenue, 2018-2022

16.1.3.2 Regional Market Shares, 2022

16.1.3.3 Segment Market Shares, 2022

16.1.4 Product Benchmarking

16.1.5 Strategic Outlook

16.2 Cheniere Energy

16.2.1 Company Snapshot

16.2.2 Company Overview

16.2.3 Financial Analysis

16.2.3.1 Net Revenue, 2018-2022

16.2.3.2 Segment Market Shares, 2022

16.2.4 Product Benchmarking

16.2.5 Strategic Outlook

16.3 Chevron Corporation

16.3.1 Company Snapshot

16.3.2 Company Overview

16.3.3 Financial Analysis

16.3.3.1 Net Revenue, 2018-2022

16.3.3.2 R&D, 2018-2022

16.3.3.3 Regional Market Shares, 2022

16.3.3.4 Segment Market Shares, 2022

16.3.4 Product Benchmarking

16.3.5 Strategic Outlook

16.4 ConocoPhillips

16.4.1 Company Snapshot

16.4.2 Company Overview

16.4.3 Financial Analysis

16.4.3.1 Net Revenue, 2018-2022

16.4.3.2 Regional Market Shares, 2022

16.4.3.3 Segment Market Shares, 2022

16.4.4 Product Benchmarking

16.4.5 Strategic Outlook

16.5 Eni S.p.A.

16.5.1 Company Snapshot

16.5.2 Company Overview

16.5.3 Financial Analysis

16.5.3.1 Net Revenue, 2018-2022

16.5.3.2 Regional Market Shares, 2022

16.5.3.3 Segment Market Shares, 2022

16.5.4 Product Benchmarking

16.5.5 Strategic Outlook

16.6 Equinor

16.6.1 Company Snapshot

16.6.2 Company Overview

16.6.3 Financial Analysis

16.6.3.1 Net Revenue, 2018-2022

16.6.3.2 Regional Market Shares, 2022

16.6.3.3 Segment Market Shares, 2022

16.6.4 Product Benchmarking

16.6.5 Strategic Outlook

16.7 ExxonMobil

16.7.1 Company Snapshot

16.7.2 Company Overview

16.7.3 Financial Analysis

16.7.3.1 Net Revenue, 2018-2022

16.7.3.2 R&D, 2018-2022

16.7.3.3 Regional Market Shares, 2022

16.7.3.4 Segment Market Shares, 2022

16.7.4 Product Benchmarking

16.7.5 Strategic Outlook

16.8 TotalEnergies

16.8.1 Company Snapshot

16.8.2 Company Overview

16.8.3 Financial Analysis

16.8.3.1 Net Revenue, 2018-2022

16.8.3.2 R&D, 2018-2022

16.8.3.3 Segment Market Shares, 2022

16.8.4 Product Benchmarking

16.8.5 Strategic Outlook

16.9 Mitsubishi Corporation

16.9.1 Company Snapshot

16.9.2 Company Overview

16.9.3 Financial Analysis

16.9.3.1 Net Revenue, 2018-2022

16.9.3.2 R&D, 2018-2022

16.9.3.3 Regional Market Shares, 2022

16.9.3.4 Segment Market Shares, 2022

16.9.4 Product Benchmarking

16.9.5 Strategic Outlook

16.10 Petronas

16.10.1 Company Snapshot

16.10.2 Company Overview

16.10.3 Financial Analysis

16.10.3.1 Net Revenue, 2018-2022

16.10.3.2 R&D, 2018-2022

16.10.3.3 Regional Market Shares, 2022

16.10.3.4 Segment Market Shares, 2022

16.10.4 Product Benchmarking

16.10.5 Strategic Outlook

16.11 Qatar Petroleum

16.11.1 Company Snapshot

16.11.2 Company Overview

16.11.3 Product Benchmarking

16.12 Royal Dutch Shell

16.12.1 Company Snapshot

16.12.2 Company Overview

16.12.3 Financial Analysis

16.12.3.1 Net Revenue, 2018-2022

16.12.3.2 R&D, 2018-2022

16.12.3.3 Regional Market Shares, 2022

16.12.3.4 Segment Market Shares, 2022

16.12.4 Product Benchmarking

16.12.5 Strategic Outlook

16.13 Santos Ltd.

16.13.1 Company Snapshot

16.13.2 Company Overview

16.13.3 Financial Analysis

16.13.3.1 Net Revenue, 2018-2022

16.13.3.2 Regional Market Shares, 2022

16.13.3.3 Segment Market Shares, 2022

16.13.4 Product Benchmarking

16.13.5 Strategic Outlook

16.14 Sempra Energy

16.14.1 Company Snapshot

16.14.2 Company Overview

16.14.3 Financial Analysis

16.14.3.1 Net Revenue, 2018-2022

16.14.3.2 Regional Market Shares, 2022

16.14.3.3 Segment Market Shares, 2022

16.14.4 Product Benchmarking

16.14.5 Strategic Outlook

16.15 Tellurian Inc.

16.15.1 Company Snapshot

16.15.2 Company Overview

16.15.3 Financial Analysis

16.15.3.1 Net Revenue, 2018-2022

16.15.3.2 R&D, 2018-2022

16.15.3.3 Segment Market Shares, 2022

16.15.4 Product Benchmarking

16.15.5 Strategic Outlook

17 Conclusion and Recommendations

17.1 Concluding Remarks from Visiongain

17.2 Recommendations for Market Players

List of Tables

Table 1 Liquefied Natural Gas (LNG) Infrastructure Market Snapshot, 2023 & 2033 (US$ Billion, CAGR %)

Table 2 Global Liquefied Natural Gas (LNG) Infrastructure Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%)) (V-Shaped Recovery Scenario)

Table 3 Global Liquefied Natural Gas (LNG) Infrastructure Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%)) (W-Shaped Recovery Scenario)

Table 4 Global Liquefied Natural Gas (LNG) Infrastructure Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%)) (U-Shaped Recovery Scenario)

Table 5 Global Liquefied Natural Gas (LNG) Infrastructure Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%)) (L-Shaped Recovery Scenario)

Table 6 Global Liquefied Natural Gas (LNG) Infrastructure Market by Distribution, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 7 Pipeline Networks Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 8 Virtual Pipeline Solutions Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 9 Global Liquefied Natural Gas (LNG) Infrastructure Market by Regasification, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 10 LNG Import Terminals Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 11 Floating Storage and Regasification Units (FSRUs) Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 12 Onshore Regasification Facilities Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 13 Global Liquefied Natural Gas (LNG) Infrastructure Market by Production, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 14 Liquefaction Plants Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 15 Natural Gas Processing Facilities Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 16 LNG Storage Tanks Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 17 Other Production Infrastructure Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 18 Global Liquefied Natural Gas (LNG) Infrastructure Market by Transportation, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 19 Large-Scale LNG Carriers Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 20 Floating LNG Ships Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 21 Small-Scale LNG Carriers Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 22 LNG Bunkering Vessels Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 23 LNG Trucking and ISO Containers Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 24 Global Liquefied Natural Gas (LNG) Infrastructure Market by Type, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 25 Production Infrastructure Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 26 Transportation Infrastructure Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 27 Regasification Infrastructure Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 28 Distribution Infrastructure Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 29 Storage Facilities Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 30 Other Infrastructure Market by Region, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 31 Liquefied Natural Gas (LNG) Infrastructure Market Forecast by Region, 2023-2033 (US$ Billion, AGR%, CAGR%)

Table 32 North America Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 33 North America Liquefied Natural Gas (LNG) Infrastructure Market by Country, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 34 North America Liquefied Natural Gas (LNG) Infrastructure Market by Distribution, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 35 North America Liquefied Natural Gas (LNG) Infrastructure Market by Regasification, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 36 North America Liquefied Natural Gas (LNG) Infrastructure Market by Production, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 37 North America Liquefied Natural Gas (LNG) Infrastructure Market by Transportation, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 38 North America Liquefied Natural Gas (LNG) Infrastructure Market by Type, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 39 US Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 40 Canada Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 41 Europe Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 42 Europe Liquefied Natural Gas (LNG) Infrastructure Market by Country, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 43 Europe Liquefied Natural Gas (LNG) Infrastructure Market by Distribution, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 44 Europe Liquefied Natural Gas (LNG) Infrastructure Market by Regasification, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 45 Europe Liquefied Natural Gas (LNG) Infrastructure Market by Production, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 46 Europe Liquefied Natural Gas (LNG) Infrastructure Market by Transportation, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 47 Europe Liquefied Natural Gas (LNG) Infrastructure Market by Type, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 48 Germany Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 49 UK Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 50 France Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 51 Italy Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 52 Russia Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 53 Rest of Europe Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 54 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 55 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market by Country, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 56 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market by Distribution, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 57 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market by Regasification, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 58 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market by Production, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 59 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market by Transportation, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 60 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market by Type, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 61 China Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 62 India Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 63 Japan Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 64 South Korea Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 65 Thailand Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 66 Rest of Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 67 Middle East & Africa Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 68 Middle East & Africa Liquefied Natural Gas (LNG) Infrastructure Market by Country, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 69 Middle East & Africa Liquefied Natural Gas (LNG) Infrastructure Market by Distribution, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 70 Middle East & Africa Liquefied Natural Gas (LNG) Infrastructure Market by Regasification, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 71 Middle East & Africa Liquefied Natural Gas (LNG) Infrastructure Market by Production, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 72 Middle East & Africa Liquefied Natural Gas (LNG) Infrastructure Market by Transportation, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 73 Middle East & Africa Liquefied Natural Gas (LNG) Infrastructure Market by Type, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 74 GCC Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 75 South Africa Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 76 Rest of Middle East & Africa Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 77 Latin America Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 78 Latin America Liquefied Natural Gas (LNG) Infrastructure Market by Country, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 79 Latin America Liquefied Natural Gas (LNG) Infrastructure Market by Distribution, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 80 Latin America Liquefied Natural Gas (LNG) Infrastructure Market by Regasification, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 81 Latin America Liquefied Natural Gas (LNG) Infrastructure Market by Production, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 82 Latin America Liquefied Natural Gas (LNG) Infrastructure Market by Transportation, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 83 Latin America Liquefied Natural Gas (LNG) Infrastructure Market by Type, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 84 Argentina Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 85 Mexico Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 86 Rest of Latin America Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%), CAGR (%))

Table 87 Strategic Outlook - Contract

Table 88 BP Plc: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 89 BP Plc: Product Benchmarking

Table 90 BP- Strategic Outlook

Table 91 Cheniere Energy, Inc: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 92 Cheniere Energy, Inc: Product Benchmarking

Table 93 Cheniere Energy, Inc Strategic Outlook

Table 94 Chevron: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 95 Chevron: Product Benchmarking

Table 96 Chevron Strategic Outlook

Table 97 ConocoPhillips: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 98 ConocoPhillips: Product Benchmarking

Table 99 ConocoPhillips - Strategic Outlook

Table 100 Eni S.p.A: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 101 Eni S.p.A: Product Benchmarking

Table 102 Eni S.p.A Strategic Outlook

Table 103 Equinor ASA: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 104 Equinor ASA: Product Benchmarking

Table 105 Equinor ASA Strategic Outlook

Table 106 Exxon Mobil Corporation: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 107 Exxon Mobil Corporation: Product Benchmarking

Table 108 Exxon Mobil Corporation Strategic Outlook

Table 109 TotalEnergies SE: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 110 Total Energies SE: Product Benchmarking

Table 111 Total Energies SE Strategic Outlook

Table 112 Mitsubishi Corp: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 113 Mitsubishi Corp: Product Benchmarking

Table 114 Mitsubishi Corp Strategic Outlook

Table 115 Petroleo Brasileiro S.A.-: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 116 Petroleo Brasileiro S.A.-: Product Benchmarking

Table 117 Petroleo Brasileiro S.A.-Strategic Outlook

Table 118 Qatar Fuel-Woqod QSC: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 119 Qatar Fuel-Woqod QSC: Product Benchmarking

Table 120 Royal Dutch Shell: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 121 Royal Dutch Shell: Product Benchmarking

Table 122 Royal Dutch Shell Strategic Outlook

Table 123 Santos Limited: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 124 Santos Limited: Product Benchmarking

Table 125 Santos Limited Strategic Outlook

Table 126 Sempra's LNG: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 127 Sempra's LNG: Product Benchmarking

Table 128 Sempra's LNG Strategic Outlook

Table 129 Tellurian Inc: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 130 Tellurian Inc: Product Benchmarking

Table 131 Tellurian Inc Strategic Outlook

List of Figures

Figure 1 Liquefied Natural Gas (LNG) Infrastructure Market Segmentation

Figure 2 Liquefied Natural Gas (LNG) Infrastructure Market by Distribution: Market Attractiveness Index

Figure 3 Liquefied Natural Gas (LNG) Infrastructure Market by Regasification: Market Attractiveness Index

Figure 4 Liquefied Natural Gas (LNG) Infrastructure Market by Production: Market Attractiveness Index

Figure 5 Liquefied Natural Gas (LNG) Infrastructure Market by Transportation: Market Attractiveness Index

Figure 6 Liquefied Natural Gas (LNG) Infrastructure Market by Type: Market Attractiveness Index

Figure 7 Liquefied Natural Gas (LNG) Infrastructure Market Attractiveness Index by Region

Figure 8 Liquefied Natural Gas (LNG) Infrastructure Market: Market Dynamics

Figure 9 IEA total oil stocks, end-May 2023

Figure 10 Liquefied Natural Gas (LNG) Infrastructure Market: Porter’s Five Forces Analysis

Figure 11 Global Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by COVID, 2023-2033 (%)

Figure 12 Global Liquefied Natural Gas (LNG) Infrastructure Market by Region, 2023-2033 (US$ Bn, AGR (%)) (V-Shaped Recovery Scenario)

Figure 13 Global Liquefied Natural Gas (LNG) Infrastructure Market by Region, 2023-2033 (US$ Bn, AGR (%)) (W-Shaped Recovery Scenario)

Figure 14 Global Liquefied Natural Gas (LNG) Infrastructure Market by Region, 2023-2033 (US$ Bn, AGR (%)) (U-Shaped Recovery Scenario)

Figure 15 Global Liquefied Natural Gas (LNG) Infrastructure Market by Region, 2023-2033 (US$ Bn, AGR (%)) (L-Shaped Recovery Scenario)

Figure 16 Liquefied Natural Gas (LNG) Infrastructure Market: PEST Analysis

Figure 17 Liquefied Natural Gas (LNG) Infrastructure Market by Distribution: Market Attractiveness Index

Figure 18 Global Liquefied Natural Gas (LNG) Infrastructure Market by Distribution, 2023-2033 (US$ Bn, AGR (%))

Figure 19 Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Distribution, 2023, 2028, 2033 (%)

Figure 20 Pipeline Networks Market by Region, 2023-2033 (US$ Bn, AGR (%))

Figure 21 Pipeline Networks Market Share Forecast by Region, 2023 & 2033 (%)

Figure 22 Virtual Pipeline Solutions Market by Region, 2023-2033 (US$ Bn, AGR (%))

Figure 23 Virtual Pipeline Solutions Market Share Forecast by Region, 2023 & 2033 (%)

Figure 24 Liquefied Natural Gas (LNG) Infrastructure Market by Regasification: Market Attractiveness Index

Figure 25 Global Liquefied Natural Gas (LNG) Infrastructure Market by Regasification, 2023-2033 (US$ Bn, AGR (%))

Figure 26 Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Regasification, 2023, 2028, 2033 (%)

Figure 27 LNG Import Terminals Market by Region, 2023-2033 (US$ Bn, AGR (%))

Figure 28 LNG Import Terminals Market Share Forecast by Region, 2023 & 2033 (%)

Figure 29 Floating Storage and Regasification Units (FSRUs) Market by Region, 2023-2033 (US$ Bn, AGR (%))

Figure 30 Floating Storage and Regasification Units (FSRUs) Market Share Forecast by Region, 2023 & 2033 (%)

Figure 31 Onshore Regasification Facilities Market by Region, 2023-2033 (US$ Bn, AGR (%))

Figure 32 Onshore Regasification Facilities Market Share Forecast by Region, 2023 & 2033 (%)

Figure 33 Liquefied Natural Gas (LNG) Infrastructure Market by Production: Market Attractiveness Index

Figure 34 Global Liquefied Natural Gas (LNG) Infrastructure Market by Production, 2023-2033 (US$ Bn, AGR (%))

Figure 35 Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Production, 2023, 2028, 2033 (%)

Figure 36 Liquefaction Plants Market by Region, 2023-2033 (US$ Bn, AGR (%))

Figure 37 Liquefaction Plants Market Share Forecast by Region, 2023 & 2033 (%)

Figure 38 Natural Gas Processing Facilities Market by Region, 2023-2033 (US$ Bn, AGR (%))

Figure 39 Natural Gas Processing Facilities Market Share Forecast by Region, 2023 & 2033 (%)

Figure 40 LNG Storage Tanks Market by Region, 2023-2033 (US$ Bn, AGR (%))

Figure 41 LNG Storage Tanks Market Share Forecast by Region, 2023 & 2033 (%)

Figure 42 Other Production Infrastructure Market by Region, 2023-2033 (US$ Bn, AGR (%))

Figure 43 Other Production Infrastructure Market Share Forecast by Region, 2023 & 2033 (%)

Figure 44 Liquefied Natural Gas (LNG) Infrastructure Market by Transportation: Market Attractiveness Index

Figure 45 Global Liquefied Natural Gas (LNG) Infrastructure Market by Transportation, 2023-2033 (US$ Bn, AGR (%))

Figure 46 Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Transportation, 2023, 2028, 2033 (%)

Figure 47 Large-Scale LNG Carriers Market by Region, 2023-2033 (US$ Bn, AGR (%))

Figure 48 Large-Scale LNG Carriers Market Share Forecast by Region, 2023 & 2033 (%)

Figure 49 Floating LNG Ships Market by Region, 2023-2033 (US$ Bn, AGR (%))

Figure 50 Floating LNG Ships Market Share Forecast by Region, 2023 & 2033 (%)

Figure 51 Small-Scale LNG Carriers Market by Region, 2023-2033 (US$ Bn, AGR (%))

Figure 52 Small-Scale LNG Carriers Market Share Forecast by Region, 2023 & 2033 (%)

Figure 53 LNG Bunkering Vessels Market by Region, 2023-2033 (US$ Bn, AGR (%))

Figure 54 LNG Bunkering Vessels Market Share Forecast by Region, 2023 & 2033 (%)

Figure 55 LNG Trucking and ISO Containers Market by Region, 2023-2033 (US$ Bn, AGR (%))

Figure 56 LNG Trucking and ISO Containers Market Share Forecast by Region, 2023 & 2033 (%)

Figure 57 Liquefied Natural Gas (LNG) Infrastructure Market by Type: Market Attractiveness Index

Figure 58 Global Liquefied Natural Gas (LNG) Infrastructure Market by Type, 2023-2033 (US$ Bn, AGR (%))

Figure 59 Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Type, 2023, 2028, 2033 (%)

Figure 60 Production Infrastructure Market by Region, 2023-2033 (US$ Bn, AGR (%))

Figure 61 Production Infrastructure Market Share Forecast by Region, 2023 & 2033 (%)

Figure 62 Transportation Infrastructure Market by Region, 2023-2033 (US$ Bn, AGR (%))

Figure 63 Transportation Infrastructure Market Share Forecast by Region, 2023 & 2033 (%)

Figure 64 Regasification Infrastructure Market by Region, 2023-2033 (US$ Bn, AGR (%))

Figure 65 Regasification Infrastructure Market Share Forecast by Region, 2023 & 2033 (%)

Figure 66 Distribution Infrastructure Market by Region, 2023-2033 (US$ Bn, AGR (%))

Figure 67 Distribution Infrastructure Market Share Forecast by Region, 2023 & 2033 (%)

Figure 68 Storage Facilities Market by Region, 2023-2033 (US$ Bn, AGR (%))

Figure 69 Storage Facilities Market Share Forecast by Region, 2023 & 2033 (%)

Figure 70 Other Infrastructure Market by Region, 2023-2033 (US$ Bn, AGR (%))

Figure 71 Other Infrastructure Market Share Forecast by Region, 2023 & 2033 (%)

Figure 72 Liquefied Natural Gas (LNG) Infrastructure Market Forecast by Region 2023 and 2033 (Revenue, CAGR%)

Figure 73 Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Region 2023, 2028, 2033 (%)

Figure 74 Liquefied Natural Gas (LNG) Infrastructure Market by Region, 2023-2033 (US$ Billion, AGR %)

Figure 75 North America Liquefied Natural Gas (LNG) Infrastructure Market Attractiveness Index

Figure 76 North America Liquefied Natural Gas (LNG) Infrastructure Market by Region, 2023, 2028 & 2033 (US$ Billion)

Figure 77 North America Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 78 North America Liquefied Natural Gas (LNG) Infrastructure Market by Country, 2023-2033 (US$ Bn, AGR (%))

Figure 79 North America Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Country, 2023 & 2033 (%)

Figure 80 North America Liquefied Natural Gas (LNG) Infrastructure Market by Distribution, 2023-2033 (US$ Bn, AGR (%))

Figure 81 North America Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast Distribution, 2023 & 2033 (%)

Figure 82 North America Liquefied Natural Gas (LNG) Infrastructure Market by Regasification, 2023-2033 (US$ Bn, AGR (%))

Figure 83 North America Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Regasification, 2023 & 2033 (%)

Figure 84 North America Liquefied Natural Gas (LNG) Infrastructure Market by Production, 2023-2033 (US$ Bn, AGR (%))

Figure 85 North America Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Production, 2023 & 2033 (%)

Figure 86 North America Liquefied Natural Gas (LNG) Infrastructure Market by Transportation, 2023-2033 (US$ Bn, AGR (%))

Figure 87 North America Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Transportation, 2023 & 2033 (%)

Figure 88 North America Liquefied Natural Gas (LNG) Infrastructure Market by Type, 2023-2033 (US$ Bn, AGR (%))

Figure 89 North America Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Type, 2023 & 2033 (%)

Figure 90 US Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 91 Canada Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 92 Europe Liquefied Natural Gas (LNG) Infrastructure Market Attractiveness Index

Figure 93 Europe Liquefied Natural Gas (LNG) Infrastructure Market by Region, 2023, 2028 & 2033 (US$ Billion)

Figure 94 Europe Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 95 Europe Liquefied Natural Gas (LNG) Infrastructure Market by Country, 2023-2033 (US$ Bn, AGR (%))

Figure 96 Europe Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Country, 2023 & 2033 (%)

Figure 97 Europe Liquefied Natural Gas (LNG) Infrastructure Market by Distribution, 2023-2033 (US$ Bn, AGR (%))

Figure 98 Europe Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast Distribution, 2023 & 2033 (%)

Figure 99 Europe Liquefied Natural Gas (LNG) Infrastructure Market by Regasification, 2023-2033 (US$ Bn, AGR (%))

Figure 100 Europe Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Regasification, 2023 & 2033 (%)

Figure 101 Europe Liquefied Natural Gas (LNG) Infrastructure Market by Production, 2023-2033 (US$ Bn, AGR (%))

Figure 102 Europe Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Production, 2023 & 2033 (%)

Figure 103 Europe Liquefied Natural Gas (LNG) Infrastructure Market by Transportation, 2023-2033 (US$ Bn, AGR (%))

Figure 104 Europe Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Transportation, 2023 & 2033 (%)

Figure 105 Europe Liquefied Natural Gas (LNG) Infrastructure Market by Type, 2023-2033 (US$ Bn, AGR (%))

Figure 106 Europe Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Type, 2023 & 2033 (%)

Figure 107 Germany Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 108 UK Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 109 France Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 110 Italy Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 111 Russia Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 112 Rest of Europe Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 113 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market Attractiveness Index

Figure 114 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market by Region, 2023, 2028 & 2033 (US$ Billion)

Figure 115 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 116 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market by Country, 2023-2033 (US$ Bn, AGR (%))

Figure 117 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Country, 2023 & 2033 (%)

Figure 118 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market by Distribution, 2023-2033 (US$ Bn, AGR (%))

Figure 119 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast Distribution, 2023 & 2033 (%)

Figure 120 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market by Regasification, 2023-2033 (US$ Bn, AGR (%))

Figure 121 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Regasification, 2023 & 2033 (%)

Figure 122 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market by Production, 2023-2033 (US$ Bn, AGR (%))

Figure 123 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Production, 2023 & 2033 (%)

Figure 124 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market by Transportation, 2023-2033 (US$ Bn, AGR (%))

Figure 125 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Transportation, 2023 & 2033 (%)

Figure 126 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market by Type, 2023-2033 (US$ Bn, AGR (%))

Figure 127 Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Type, 2023 & 2033 (%)

Figure 128 China Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 129 India Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 130 Japan Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 131 South Korea Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 132 Thailand Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 133 Rest of Asia-Pacific Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 134 Middle East and Africa Liquefied Natural Gas (LNG) Infrastructure Market Attractiveness Index

Figure 135 Middle East and Africa Liquefied Natural Gas (LNG) Infrastructure Market by Region, 2023, 2028 & 2033 (US$ Billion)

Figure 136 Middle East & Africa Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 137 Middle East & Africa Liquefied Natural Gas (LNG) Infrastructure Market by Country, 2023-2033 (US$ Bn, AGR (%))

Figure 138 Middle East and Africa Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Country, 2023 & 2033 (%)

Figure 139 Middle East & Africa Liquefied Natural Gas (LNG) Infrastructure Market by Distribution, 2023-2033 (US$ Bn, AGR (%))

Figure 140 Middle East and Africa Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast Distribution, 2023 & 2033 (%)

Figure 141 Middle East & Africa Liquefied Natural Gas (LNG) Infrastructure Market by Regasification, 2023-2033 (US$ Bn, AGR (%))

Figure 142 Middle East and Africa Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Regasification, 2023 & 2033 (%)

Figure 143 Middle East & Africa Liquefied Natural Gas (LNG) Infrastructure Market by Production, 2023-2033 (US$ Bn, AGR (%))

Figure 144 Middle East and Africa Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Production, 2023 & 2033 (%)

Figure 145 Middle East & Africa Liquefied Natural Gas (LNG) Infrastructure Market by Transportation, 2023-2033 (US$ Bn, AGR (%))

Figure 146 Middle East and Africa Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Transportation, 2023 & 2033 (%)

Figure 147 Middle East & Africa Liquefied Natural Gas (LNG) Infrastructure Market by Type, 2023-2033 (US$ Bn, AGR (%))

Figure 148 Middle East and Africa Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Type, 2023 & 2033 (%)

Figure 149 GCC Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 150 South Africa Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 151 Rest of Middle East & Africa Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 152 Latin America Liquefied Natural Gas (LNG) Infrastructure Market Attractiveness Index

Figure 153 Latin America Liquefied Natural Gas (LNG) Infrastructure Market by Region, 2023, 2028 & 2033 (US$ Billion)

Figure 154 Latin America Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 155 Latin America Liquefied Natural Gas (LNG) Infrastructure Market by Country, 2023-2033 (US$ Bn, AGR (%))

Figure 156 Latin America Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Country, 2023 & 2033 (%)

Figure 157 Latin America Liquefied Natural Gas (LNG) Infrastructure Market by Distribution, 2023-2033 (US$ Bn, AGR (%))

Figure 158 Latin America Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast Distribution, 2023 & 2033 (%)

Figure 159 Latin America Liquefied Natural Gas (LNG) Infrastructure Market by Regasification, 2023-2033 (US$ Bn, AGR (%))

Figure 160 Latin America Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Regasification, 2023 & 2033 (%)

Figure 161 Latin America Liquefied Natural Gas (LNG) Infrastructure Market by Production, 2023-2033 (US$ Bn, AGR (%))

Figure 162 Latin America Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Production, 2023 & 2033 (%)

Figure 163 Latin America Liquefied Natural Gas (LNG) Infrastructure Market by Transportation, 2023-2033 (US$ Bn, AGR (%))

Figure 164 Latin America Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Transportation, 2023 & 2033 (%)

Figure 165 Latin America Liquefied Natural Gas (LNG) Infrastructure Market by Type, 2023-2033 (US$ Bn, AGR (%))

Figure 166 Latin America Liquefied Natural Gas (LNG) Infrastructure Market Share Forecast by Type, 2023 & 2033 (%)

Figure 167 Argentina Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 168 Mexico Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

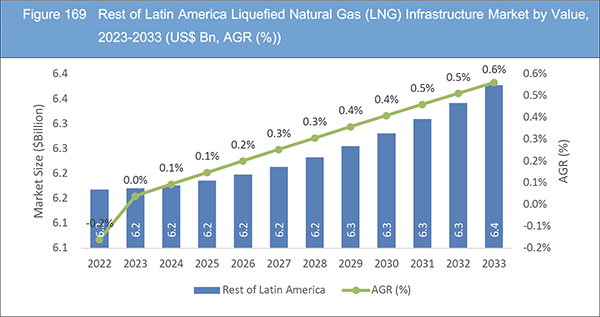

Figure 169 Rest of Latin America Liquefied Natural Gas (LNG) Infrastructure Market by Value, 2023-2033 (US$ Bn, AGR (%))

Figure 170 Liquefied Natural Gas (LNG) Infrastructure Market: Company Share, 2022

Figure 171 BP Plc: Net Revenue, 2018-2022 (US$Million, AGR%)

Figure 172 BP Plc: Regional Market Shares, 2022

Figure 173 BP Plc: Business Segment Market Shares, 2022

Figure 174 Cheniere Energy, Inc: Net Revenue, 2018-2022 (US$Million, AGR%)

Figure 175 Cheniere Energy, Inc: Business Segment Market Shares, 2022

Figure 176 Chevron: Net Revenue, 2018-2022 (US$Million, AGR%)

Figure 177 Chevron: R&D, 2018-2022 (US$Million, AGR%)

Figure 178 Chevron: Regional Market Shares, 2022

Figure 179 Chevron: Business Segment Market Shares, 2022

Figure 180 ConocoPhillips: Net Revenue, 2018-2022 (US$Million, AGR%)

Figure 181 ConocoPhillips: Regional Market Shares, 2022

Figure 182 ConocoPhillips: Business Segment Market Shares, 2022

Figure 183 Eni S.p.A: Net Revenue, 2018-2022 (US$Million, AGR%)

Figure 184 Eni S.p.A: Regional Market Shares, 2022

Figure 185 Eni S.p.A: Business Segment Market Shares, 2022

Figure 186 Equinor ASA: Net Revenue, 2018-2022 (US$Million, AGR%)

Figure 187 Equinor ASA: Regional Market Shares, 2022

Figure 188 Equinor ASA: Business Segment Market Shares, 2022

Figure 189 Exxon Mobil Corporation: Net Revenue, 2018-2022 (US$Million, AGR%)

Figure 190 Exxon Mobil Corporation: R&D, 2018-2022 (US$Million, AGR%)

Figure 191 Exxon Mobil Corporation: Regional Market Shares, 2022

Figure 192 Exxon Mobil Corporation: Business Segment Market Shares, 2022

Figure 193 Total Energies SE: Net Revenue, 2018-2022 (US$Million, AGR%)

Figure 194 Total Energies SE: R&D, 2018-2022 (US$Million, AGR%)

Figure 195 Total Energies SE: Business Segment Market Shares, 2022

Figure 196 Mitsubishi Corp: Net Revenue, 2018-2022 (US$Million, AGR%)

Figure 197 Mitsubishi Corp: R&D, 2018-2022 (US$Million, AGR%)

Figure 198 Mitsubishi Corp: Regional Market Shares, 2022

Figure 199 Mitsubishi Corp: Business Segment Market Shares, 2022

Figure 200 Petroleo Brasileiro S.A.-: Net Revenue, 2018-2022 (US$Million, AGR%)

Figure 201 Petroleo Brasileiro S.A.-: R&D, 2018-2022 (US$Million, AGR%)

Figure 202 Petroleo Brasileiro S.A.-: Regional Market Shares, 2022

Figure 203 Petroleo Brasileiro S.A.-: Business Segment Market Shares, 2022

Figure 204 Royal Dutch Shell: Net Revenue, 2018-2022 (US$Million, AGR%)

Figure 205 Royal Dutch Shell: R&D, 2018-2022 (US$Million, AGR%)

Figure 206 Royal Dutch Shell: Regional Market Shares, 2022

Figure 207 Royal Dutch Shell: Business Segment Market Shares, 2022

Figure 208 Santos Limited: Net Revenue, 2018-2022 (US$Million, AGR%)

Figure 209 Santos Limited: Regional Market Shares, 2022

Figure 210 Santos Limited: Business Segment Market Shares, 2022

Figure 211 Sempra's LNG: Net Revenue, 2018-2022 (US$Million, AGR%)

Figure 212 Sempra's LNG: Regional Market Shares, 2022

Figure 213 Sempra's LNG: Business Segment Market Shares, 2022

Figure 214 Tellurian Inc: Net Revenue, 2018-2022 (US$Million, AGR%)

Figure 215 Tellurian Inc: R&D, 2018-2022 (US$Million, AGR%)

Figure 216 Tellurian Inc: Business Segment Market Shares, 2022

List of Companies Profiled in the report

BP PLC

Cheniere Energy

Chevron Corporation

ConocoPhillips

Eni S.p.A.

Equinor ASA

Exxon Mobil Corporation

TotalEnergies SE

Mitsubishi Corporation

Petroleo Brasileiro S.A.

Qatar Petroleum

Royal Dutch Shell

Santos Ltd.

Sempra Energy

Tellurian Inc.

List of Other Companies Mentioned in the report

Adani Group

Bechtel Energy

BP (British Petroleum)

Cameron LNG

Cheniere Energy

Chevron

CNOOC (China National Offshore Oil Corporation)

Dominion Energy

Eni

Equinor

ExxonMobil

Freeport LNG

GAIL (India) Limited

Gazprom

German Chancellor Olaf Scholz

INEOS Energy Trading

JERA Co.

Justin Bird

Kinder Morgan

Mozambique LNG

Novatek

Pertamina

Petrobras

PetroChina

PETRONAS

Qatar Petroleum

QatarGas

Royal Dutch Shell

Santos Ltd.

Sempra Energy

Sempra Infrastructure

Tellurian Inc.

TotalEnergies

Venture Global LNG

Woodside Petroleum

List of Associations Mentioned in the Report

American Gas Association (AGA)

American Petroleum Institute (API)

Asia Pacific Economic Cooperation (APEC)

Canadian Gas Association (CGA)

Energy Charter Secretariat

European Association of LNG Terminals (EUROGATE)

European Network of Transmission System Operators for Gas (ENTSOG)

Gas Infrastructure Europe (GIE)

Institute of Gas Engineers and Managers (IGEM)

International Bunker Industry Association (IBIA)

International Gas Union (IGU)

International Group of Liquefied Natural Gas Importers (GIIGNL)

International Group of Liquefied Natural Gas Importers (IGLNGI)

International LNG Buyers Association (ILBA)

International Maritime Organization (IMO)

Japan Gas Association (JGA)

LNG Allies

National Association of Regulatory Utility Commissioners (NARUC)

Natural Gas Supply Association (NGSA)

Society of International Gas Tanker and Terminal Operators (SIGTTO)