Industries > Energy > Grid-Scale Battery Storage Technologies Market Report 2018-2028

Grid-Scale Battery Storage Technologies Market Report 2018-2028

Capex Forecasts for Lithium-ion (Li-Poly, LFP, LTO), Flow (VRFB, Li-Air, Zn-Air, Zn-Br, PSB), Sodium-Based (Na-S, Na-NiCl), Advanced Lead Acid and Other Batteries (Li-Air, Mg-Ion, Ni-Zn, Ni-Fe, Ni-Cd), Energy Storage Technologies (EST) for Electricity Transmission & Distribution (T&D) Grids to Optimise Off-Grid Storage of Renewable Wind, Concentrated Solar Power (CSP) & Photo-Voltaic (PV) Energy

The latest research report from business intelligence provider Visiongain offers comprehensive analysis of the Grid Scale Battery Storage market. Visiongain assesses that this market will generate $1.99bn in 2018.

The Grid-Scale Battery Storage Technologies Market Report 2018-2028 responds to your need for definitive market data:

Read on to discover how you can exploit the future business opportunities emerging in this sector. Visiongain’s new study tells you and tells you NOW.

In this brand-new report, you find 159 in-Depth tables, charts and graphs all unavailable elsewhere.

The 209-page report provides clear detailed insight into the global Grid Scale Battery Storage Technologies market. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand-new report today you stay better informed and ready to act.

Report Scope

The report delivers considerable added value by revealing:

• 159 tables, charts and graphs analysing and revealing the growth prospects and outlook for the Grid Scale Battery Storage Technologies market.

• Grid Scale Battery Storage Technologies market forecasts and analysis from 2018-2028.

• Grid Scale Battery Storage Technologies submarket forecasts from 2018-2028

• Lithium-ion batteries submarket forecast 2018-2028

• Sodium-based batteries submarket forecast 2018-2028

• Flow batteries submarket forecast 2018-2028

• Advanced lead acid batteries submarket forecast 2018-2028

• Other batteries submarket forecast 2018-2028

• Regional Grid Scale Battery Storage Technologies market forecasts from 2018-2028 with drivers and restraints for the regions including;

• US

• Japan

• China

• Italy

• Germany

• South Korea

• UK

• Rest of the world

• Company profiles for the leading 13 Grid Scale Battery Storage Technologies companies

• NGK Insulators Ltd.

• BYD Co. Ltd.

• Sumitomo Electric Industries, Ltd.

• Samsung SDI Co. Ltd.

• General Electric

• Tesla

• GS Yuasa Corporation

• LG Chem Ltd.

• Mitsubishi Electric Corporation

• ABB Group

• Panasonic Corporation

• Electrovaya

• Hitachi Ltd

• Conclusions and recommendations which will aid decision-making

How will you benefit from this report?

• Keep your knowledge base up to speed. Don’t get left behind

• Reinforce your strategic decision-making with definitive and reliable market data

• Learn how to exploit new technological trends

• Realise your company’s full potential within the market

• Understand the competitive landscape and identify potential new business opportunities & partnerships

Who should read this report?

• Anyone with interest in the Grid Scale Battery Storage market

• Battery Manufacturers

• Utility Companies

• Commodity traders

• Investment managers

• Energy price reporting companies

• Energy company managers

• Energy consultants

• Heads of strategic development

• Business development managers

• Marketing managers

• Market analysts,

• Technologists

• Suppliers

• Investors

• Banks

• Government agencies

Visiongain’s study is intended for anyone requiring commercial analyses for the Grid Scale Battery Storage market and leading companies. You find data, trends and predictions.

Buy our report today the Grid-Scale Battery Storage Technologies Market Report 2018-2028: Capex Forecasts for Lithium-ion (Li-Poly, LFP, LTO), Flow (VRFB, Li-Air, Zn-Air, Zn-Br, PSB), Sodium-Based (Na-S, Na-NiCl), Advanced Lead Acid and Other Batteries (Li-Air, Mg-Ion, Ni-Zn, Ni-Fe, Ni-Cd), Energy Storage Technologies (EST) for Electricity Transmission & Distribution (T&D) Grids to Optimise Off-Grid Storage of Renewable Wind, Concentrated Solar Power (CSP) & Photo-Voltaic (PV) Energy. Avoid missing out by staying informed – get our report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Grid-Scale Battery Storage Technologies Market Overview

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report Include:

1.5 Who is This Report For?

1.6 Methodology

1.6.1 Primary Research

1.6.2 Secondary Research

1.6.3 Market Evaluation & Forecasting Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to Grid-Scale Battery Storage Technologies Market

2.1 Grid-Scale Battery Storage Technologies Market Definition

2.2 Grid-Scale Battery Storage Technologies Market Structure

2.3 Applications for Grid-Scale Battery Storage

2.3.1 Power Generation Support – Load Levelling and Peaking

2.3.2 Power Generation Support – Grid Support Services

2.3.3 Renewable Energy Integration

2.3.4 Transmission & Distribution Support

2.3.5 Distributed Power Generation and End-User Support

2.4 A Brief Aside on Batteries

2.5 Overview of the Leading Grid-Scale Battery Technologies

2.5.1 Lithium-Ion Batteries

2.5.2 Sodium-Based Batteries

2.5.3 Flow Batteries

2.5.4 Advanced Lead Acid Batteries

2.5.5 Other Battery Designs

3. Global Grid-Scale Battery Storage Technologies Market 2018-2028

3.1 Global Grid-Scale Battery Storage Technologies Market Forecast 2018-2028

3.2 Grid-Scale Battery Storage Technologies Market Drivers & Restraints 2018

3.2.1 Drivers in Grid-Scale Battery Storage Technologies Market

3.2.1.1 How Rising Energy Prices Indirectly Incentivise Grid-Scale Battery Storage

3.2.1.2 Investments in Research, Development and Demonstration Projects

3.2.1.3 The Importance of Renewable Energy Integration

3.2.1.4 Smart Grids and Distributed Power Generation Systems

3.2.1.5 How Expanding Electricity Demand Can Drive Demand for Grid-Scale Battery Storage

3.2.1.6 The Developing Electric Vehicle Market as a Growth Factor

3.2.1.7 The Role of Changing National Policies towards Energy Storage

3.2.1.8 The Potential of Deregulating the Electric Utility Markets

3.2.1.9 Growing Experience Monetising Storage

3.2.1.10 Ancillary Services Issues

3.2.2 Restraints in Grid-Scale Battery Storage Technologies Market

3.2.2.1 Long-Standing High Upfront Capital Costs

3.2.2.2 How Conservatism in the Utility Industry May Hinder Growth

3.2.2.3 The Policy and Regulatory Challenges Ahead

3.2.2.4 The Impact of Weak Market Demand for Grid-Scale Battery Storage

3.2.2.5 Competition from Other Energy Storage Technologies

3.2.2.6 Limited Cost Recovery Opportunities

4. Global Grid-Scale Battery Storage Technologies Market By Type Forecast 2018-2028

4.1 Lithium-Ion Battery Storage Market Forecast 2018-2028

4.1.1 Impact of Electric Vehicle Development on Li-Ion Batteries

4.1.2 Lithium-Ion Battery Storage Market Drivers and Restraints

4.2 Sodium-Based Battery Storage Market Forecast 2018-2028

4.2.1 Sodium-Based Battery Storage Market Drivers and Restraints

4.3 Flow Battery Storage Market Forecast 2018-2028

4.3.1 Flow Battery Storage Market Drivers and Restraints

4.4 Advanced Lead Acid Battery Storage Market Forecast 2018-2028

4.4.1 Advanced Lead Acid Battery Storage Market Drivers and Restraints

4.5 Other Battery Storage Market Forecast 2018-2028

4.5.1 Other Battery Storage Market Drivers and Restraints

5. Leading National Grid-Scale Battery Storage Technologies Market Forecast 2018-2028

5.1 Barriers to Entry Analysis

5.2 The US Grid-Scale Battery Storage Technologies Market Forecast 2018-2028

5.2.1 Why the US is the World’s Largest Grid-Scale Battery Market

5.2.2 California: The Impact of the 1.3 GW Mandate

5.2.3 New York

5.2.4 Texas (ERCOT)

5.2.5 Hawaii

5.2.6 PJM

5.2.7 Other Grids

5.2.8 US Grid-Scale Battery Storage Technologies Market Drivers & Restraints

5.3 Japan Grid-Scale Battery Storage Technologies Market Forecast 2018-2028

5.3.1 The State of Affairs in the Early Adopter Japan

5.3.2 Japan Grid-Scale Battery Market Drivers & Restraints

5.4 China Grid-Scale Battery Storage Technologies Market Forecast 2018-2028

5.4.1 The Outlook for a Promising Grid-Scale Battery Market

5.4.2 China Grid-Scale Battery Market Drivers & Restraints

5.5 Italy Grid-Scale Battery Storage Technologies Market Forecast 2018-2028

5.5.1 Future Developments in the Italian Grid-Scale Battery Storage Market

5.5.2 Italy Grid-Scale Battery Market Drivers & Restraints

5.6 Germany Grid-Scale Battery Storage Technologies Market Forecast 2018-2028

5.6.1 Grid-Scale Battery Storage Market Opportunities in Germany

5.6.2 Germany Grid-Scale Battery Market Drivers & Restraints

5.7 South Korea Grid-Scale Battery Storage Technologies Market Forecast 2018-2028

5.7.1 Developments in the South Korean Grid-Scale Battery Storage Market

5.7.2 South Korea Grid-Scale Battery Market Drivers & Restraints

5.8 The UK Grid-Scale Battery Storage Technologies Market Forecast 2018-2028

5.8.1 Strengths and Weaknesses of the UK Grid-Scale Battery Storage Market

5.8.2 UK Grid-Scale Battery Market Drivers & Restraints

5.9 Rest of the World Grid-Scale Battery Storage Technologies Market Forecast 2018-2028

5.9.1 The Outlook for the Australian Grid-Scale Battery Storage Market

5.9.2 The Outlook for the Canadian Grid-Scale Battery Storage Market

5.9.3 The Outlook for the French Grid-Scale Battery Storage Market

5.9.4 The Outlook for the Spanish Grid-Scale Battery Storage Market

5.9.5 The Outlook for the Middle East and African Grid-Scale Battery Storage Market

6. PEST Analysis of Grid-Scale Battery Storage Technologies Market 2018-2028

6.1 Political

6.2 Economic

6.3 Social

6.4 Technological

7. The Leading Companies in Grid-Scale Battery Storage Technologies Market

7.1 Panasonic Corporation

7.1.1 Panasonic Corporation Total Company Sales 2011-2016

7.1.2 Panasonic Corporation Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2013-2016

7.2 Samsung SDI Co. Ltd.

7.2.1 Samsung SDI Co. Ltd. Total Company Sales 2011-2016

7.2.2 Samsung SDI Co. Ltd. Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2011-2016

7.3 LG Chem Ltd.

7.3.1 LG Chem Ltd. Total Company Sales 2011-2016

7.3.2 LG Chem Ltd. Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2012-2016

7.4 BYD Co. Ltd.

7.4.1 BYD Co. Ltd. Total Company Sales 2011-2016

7.4.2 BYD Co. Ltd. Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2011-2016

7.5 GS Yuasa Corporation

7.5.1 GS Yuasa Corporation Total Company Sales 2011-2016

7.5.2 GS Yuasa Corporation Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2011-2016

7.6 Hitachi Ltd.

7.6.1 Hitachi Ltd. Total Company Sales 2011-2016

7.6.2 Hitachi Ltd. Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2011-2016

7.7 Electrovaya Inc.

7.7.1 Electrovaya Inc. Total Company Sales 2011-2017

7.8 ABB Ltd.

7.8.1 ABB Ltd. Total Company Sales 2011-2017

7.8.2 ABB Ltd. Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2015-2017

7.9 Tesla

7.9.1 Tesla Total Company Sales 2011-2016

7.9.2 Tesla Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2015-2016

7.10 General Electric Company

7.10.1 General Electric Company Total Company Sales 2012-2016

7.10.2 General Electric Company Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2012-2016

7.11 Mitsubishi Electric Corporation

7.11.1 Mitsubishi Electric Corporation Total Company Sales 2011-2016

7.11.2 Mitsubishi Electric Corporation Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2011-2016

7.12 NGK Insulators Ltd.

7.12.1 NGK Insulators Ltd. Total Company Sales 2011-2016

7.12.2 NGK Insulators Ltd. Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2011-2016

7.13 Sumitomo Electric Industries, Ltd.

7.13.1 Sumitomo Electric Industries, Ltd. Total Company Sales 2011-2016

7.13.2 Sumitomo Electric Industries, Ltd. Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2013-2016

7.14 Other Companies Involved in the Grid-Scale Battery Storage Technologies Market 2018

8. Conclusions and Recommendations

8.1 Key Findings

8.2 Recommendations

9. Glossary

Associated visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 1.1 Leading National Grid-Scale Battery Storage Technologies Market Forecast 2018-2028 (US$mn, Global AGR %, Cumulative)

Table 1.2 Global Grid-Scale Battery Storage Technologies Market By Type Forecast 2018-2028 (US$mn, AGR %, CAGR %, Cumulative)

Table 2.1 Comparison of Grid-Scale Battery Storage Technologies (Maturity, Capacity MW, Output MWh, Discharge Duration, Efficiency %, Number of Cycles)

Table 3.1 Global Grid-Scale Battery Storage Technologies Market Forecast 2018-2028 (US$mn, AGR %, CAGR %, Cumulative)

Table 3.2 Grid-Scale Battery Storage Technologies Market Drivers & Restraints

Table 3.3 Recent Demonstration Projects Funded by ARRA (Name, EST, MW Size, $m Cost, Application)

Table 4.1 Global Grid-Scale Battery Storage Technologies Market By Type Forecast 2018-2028 (US$mn, AGR %, Cumulative)

Table 4.2 Global Grid-Scale Battery Storage Technologies Market By Type CAGR Forecast 2018-2023, 2023-2028, 2018-2028 (CAGR %)

Table 4.3 Lithium-Ion Battery Storage Market Forecast 2018-2028 (US$mn, AGR %, CAGR %, Cumulative)

Table 4.4 Grid-Scale Lithium-Ion Battery Storage Submarket Drivers & Restraints

Table 4.5 Sodium-Based Battery Storage Market Forecast 2018-2028 (US$mn, AGR %, CAGR %, Cumulative)

Table 4.6 Grid Scale Sodium-Based Battery Storage Submarket Drivers & Restraints

Table 4.7 Flow Battery Storage Market Forecast 2018-2028 (US$mn, AGR %, CAGR %, Cumulative)

Table 4.8 Grid Scale Flow Battery Storage Submarket Drivers & Restraints

Table 4.9 Advanced Lead Acid Battery Storage Market Forecast 2018-2028 (US$mn, AGR %, CAGR %, Cumulative)

Table 4.10 Grid Scale Advanced Lead Acid Battery Storage Submarket Drivers & Restraints

Table 4.11 Other Battery Storage Market Forecast 2018-2028 (US$mn, AGR %, CAGR %, Cumulative)

Table 4.12 Other Grid Scale Battery Storage Submarket Drivers & Restraints

Table 5.1 Leading National Grid-Scale Battery Storage Technologies Market Forecast 2018-2028 (US$mn, Global AGR %, Cumulative)

Table 5.2 Leading National Grid-Scale Battery Storage Technologies Market Percentage Change in Market Share 2018-2023, 2023-2028, 2018-2028 (% Change)

Table 5.3 US Grid-Scale Battery Storage Technologies Market Forecast 2018-2028 (US$mn, AGR %, CAGR %, Cumulative)

Table 5.4 US Grid-Scale Battery Storage Market Forecast By Application 2018-2028 ($m, AGR %, CAGR %, Cumulative)

Table 5.5 US Grid-Scale Battery Storage Technologies Market Drivers & Restraints

Table 5.6 Japan Grid-Scale Battery Storage Technologies Market Forecast 2018-2028 (US$mn, AGR %, CAGR %, Cumulative)

Table 5.7 Japan Grid-Scale Battery Market Drivers & Restraints

Table 5.8 China Grid-Scale Battery Storage Technologies Market Forecast 2018-2028 (US$mn, AGR %, CAGR %, Cumulative)

Table 5.9 China Grid-Scale Battery Storage Market Forecast By Application 2018-2028 ($m, AGR %, CAGR %, Cumulative)

Table 5.10 China Grid-Scale Battery Market Drivers & Restraints

Table 5.11 Italy Grid-Scale Battery Storage Technologies Market Forecast 2018-2028 (US$mn, AGR %, CAGR %, Cumulative)

Table 5.12 Italy Grid-Scale Battery Market Drivers & Restraints

Table 5.13 Germany Grid-Scale Battery Storage Technologies Market Forecast 2018-2028 (US$mn, AGR %, CAGR %, Cumulative)

Table 5.14 Germany Grid-Scale Battery Market Drivers & Restraints

Table 5.15 South Korea Grid-Scale Battery Storage Technologies Market Forecast 2018-2028 (US$mn, AGR %, CAGR %, Cumulative)

Table 5.16 South Korea Grid-Scale Battery Market Drivers & Restraints

Table 5.17 The UK Grid-Scale Battery Storage Technologies Market Forecast 2018-2028 (US$mn, AGR %, CAGR %, Cumulative)

Table 5.18 UK Grid-Scale Battery Market Drivers & Restraints

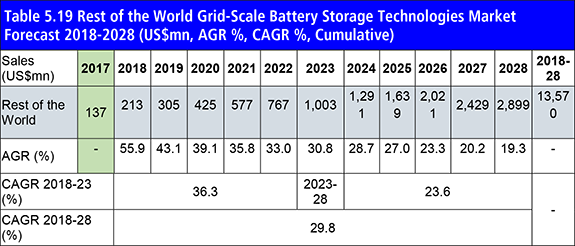

Table 5.19 Rest of the World Grid-Scale Battery Storage Technologies Market Forecast 2018-2028 (US$mn, AGR %, CAGR %, Cumulative)

Table 6.1 Global Grid-Scale Battery Storage Technologies Market PEST Analysis 2018-2028

Table 7.1 Panasonic Corporation 2017 (CEO, Total Company Sales US$m, Sales of business segment which includes Grid-Scale Battery Storage Technologies in the Market US$m, Share of Company Sales of division which includes Grid-Scale Battery Storage Technologies Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.2 Panasonic Corporation Total Company Sales 2010-2016 (US$m, AGR %)

Table 7.3 Panasonic Corporation Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2012-2016 (US$m, AGR %)

Table 7.4 Samsung SDI Co. Ltd. 2017 (CEO, Total Company Sales US$m, Sales of business segment which includes Grid-Scale Battery Storage Technologies in the Market US$m, Share of Company Sales of division which includes Grid-Scale Battery Storage Technologies Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.5 Samsung SDI Co. Ltd. Total Company Sales 2010-2016 (US$m, AGR %)

Table 7.6 Samsung SDI Co. Ltd. Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2010-2016 (US$m, AGR %)

Table 7.7 LG Chem Ltd. Profile 2017 (CEO, Total Company Sales US$m, Sales of business segment which includes Grid-Scale Battery Storage Technologies in the Market US$m, Share of Company Sales of division which includes Grid-Scale Battery Storage Technologies Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.8 LG Chem Ltd. Total Company Sales 2010-2016 (US$m, AGR %)

Table 7.9 LG Chem Ltd. Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2011-2016 (US$m, AGR %)

Table 7.10 BYD Co. Ltd. 2017 (CEO, Total Company Sales US$m, Sales of business segment which includes Grid-Scale Battery Storage Technologies in the Market US$m, Share of Company Sales of division which includes Grid-Scale Battery Storage Technologies Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.11 BYD Co. Ltd. Total Company Sales 2010-2016 (US$m, AGR %)

Table 7.12 BYD Co. Ltd. Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2010-2016 (US$m, AGR %)

Table 7.13 GS Yuasa Corporation 2017 (CEO, Total Company Sales US$m, Sales of business segment which includes Grid-Scale Battery Storage Technologies in the Market US$m, Share of Company Sales of division which includes Grid-Scale Battery Storage Technologies Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.14 GS Yuasa Corporation Total Company Sales 2010-2016 (US$m, AGR %)

Table 7.15 GS Yuasa Corporation Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2010-2016 (US$m, AGR %)

Table 7.16 Hitachi Ltd. 2017 (CEO, Total Company Sales US$m, Sales of business segment which includes Grid-Scale Battery Storage Technologies in the Market US$m, Share of Company Sales of division which includes Grid-Scale Battery Storage Technologies Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.17 Hitachi Ltd. Total Company Sales 2010-2016 (US$m, AGR %)

Table 7.18 Hitachi Ltd. Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2010-2016 (US$m, AGR %)

Table 7.19 Electrovaya Inc. Profile 2017 (CEO, Total Company Sales US$m, Sales of business segment which includes Grid-Scale Battery Storage Technologies in the Market US$m, Share of Company Sales of division which includes Grid-Scale Battery Storage Technologies Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.20 Electrovaya Inc. Total Company Sales 2010-2017 (US$m, AGR %)

Table 7.21 ABB Ltd. 2017 (CEO, Total Company Sales US$m, Sales of business segment which includes Grid-Scale Battery Storage Technologies in the Market US$m, Share of Company Sales of division which includes Grid-Scale Battery Storage Technologies Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.22 ABB Ltd. Total Company Sales 2010-2017 (US$m, AGR %)

Table 7.23 ABB Ltd. Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2014-2017 (US$m, AGR %)

Table 7.24 Tesla Profile 2017 (CEO, Total Company Sales US$m, Sales of business segment which includes Grid-Scale Battery Storage Technologies in the Market US$m, Share of Company Sales of division which includes Grid-Scale Battery Storage Technologies Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.25 Tesla Total Company Sales 2010-2016 (US$m, AGR %)

Table 7.26 Tesla Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2014-2016 (US$m, AGR %)

Table 7.27 General Electric Company 2017 (CEO, Total Company Sales US$m, Sales of business segment which includes Grid-Scale Battery Storage Technologies in the Market US$m, Share of Company Sales of division which includes Grid-Scale Battery Storage Technologies Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.28 General Electric Company Total Company Sales 2011-2016 (US$m, AGR %)

Table 7.29 General Electric Company Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2011-2016 (US$m, AGR %)

Table 7.30 Mitsubishi Electric Corporation 2017 (CEO, Total Company Sales US$m, Sales of business segment which includes Grid-Scale Battery Storage Technologies in the Market US$m, Share of Company Sales of division which includes Grid-Scale Battery Storage Technologies Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.31 Mitsubishi Electric Corporation Total Company Sales 2010-2016 (US$m, AGR %)

Table 7.32 Mitsubishi Electric Corporation Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2010-2016 (US$m, AGR %)

Table 7.33 NGK Insulators Ltd. Profile 2017 (CEO, Total Company Sales US$m, Sales of business segment which includes Grid-Scale Battery Storage Technologies in the Market US$m, Share of Company Sales of division which includes Grid-Scale Battery Storage Technologies Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.34 NGK Insulators Ltd. Total Company Sales 2010-2016 (US$m, AGR %)

Table 7.35 NGK Insulators Ltd. Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2011-2016 (US$m, AGR %)

Table 7.36 Sumitomo Electric Industries, Ltd. Profile 2017 (CEO, Total Company Sales US$m, Sales of business segment which includes Grid-Scale Battery Storage Technologies in the Market US$m, Share of Company Sales of division which includes Grid-Scale Battery Storage Technologies Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.37 Sumitomo Electric Industries, Ltd. Total Company Sales 2010-2016 (US$m, AGR %)

Table 7.38 Sumitomo Electric Industries, Ltd. Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2012-2016 (US$m, AGR %)

Table 7.39 Other Companies Involved in the Grid-Scale Battery Storage Technologies Market 2017 (Company, Location)

Table 8.1 Global Grid-Scale Battery Storage Technologies Market By Type Forecast 2018-2028 (US$mn, AGR %, Cumulative)

Table 8.2 Leading National Grid-Scale Battery Storage Technologies Market Forecast 2018-2028 (US$mn, Global AGR %, Cumulative)

List of Figures

Figure 2.1 Global Grid-Scale Battery Storage Technologies Market Segmentation Overview

Figure 2.2 Global Cumulative Installed Wind Capacity, 2001-2017 (MW)

Figure 2.3 Global Cumulative Installed Solar PV and CSP Capacity, 2001-2016 (MW)

Figure 2.4 Grid-Scale Battery Storage Positioning in the Power Supply Chain

Figure 3.1 Global Grid-Scale Battery Storage Technologies Market Forecast 2018-2028 (US$mn, AGR %)

Figure 3.2 Share of Total Public Energy RD&D spending of IEA members 1974-2016 (Energy Efficiency, Fossil Fuels, Renewables, Hydrogen and Fuel Cells, Other Power and Storage, Cross-Cutting, Nuclear)

Figure 3.3 Evolution of Total Public Energy RD&D Spending by Selected IEA members ($m)

Figure 3.4 Global Electricity Production by Source, 1971-2015 (TWh)

Figure 3.5 Renewable Power Capacities in the World, BRICS, EU-28 and Top 6 Countries, 2016

Figure 3.6 OECD and Non-OECD GDP Expressed in Purchasing Power Parity, 2012-2040 (Trillion kWh)

Figure 3.7 OECD and Non-OECD Net Electricity Generation, 1990-2040 (Trillion kWh)

Figure 3.8 Global Electric Car Stock, By Country, 2005-2016 (thousands)

Figure 3.9 Electricity Storage Matrix: EST Characteristics and Requirements of Key Applications

Figure 4.1 Global Grid-Scale Battery Storage Technologies Market By Type AGR Forecast 2018-2028 (AGR %)

Figure 4.2 Global Grid-Scale Battery Storage Technologies Market By Type Forecast 2018-2028 (US$mn, Global AGR %)

Figure 4.3 Global Grid-Scale Battery Storage Technologies Market By Type, Cumulative Sales 2018-2028 ($m)

Figure 4.4 Global Grid-Scale Battery Storage Technologies Market By Type Share Forecast 2018 (% Share)

Figure 4.5 Global Grid-Scale Battery Storage Technologies Market By Type Share Forecast 2023 (% Share)

Figure 4.6 Global Grid-Scale Battery Storage Technologies Market By Type Share Forecast 2028 (% Share)

Figure 4.7 Lithium-Ion Battery Storage Market Forecast 2018-2028 (US$mn, Global AGR %)

Figure 4.8 Share of Lithium-Ion Battery Storage Market 2018-2028 (%)

Figure 4.9 Sodium-Based Battery Storage Market Forecast 2018-2028 (US$mn, Global AGR %)

Figure 4.10 Share of Sodium-Based Battery Storage Market 2018-2028 (%)

Figure 4.11 Flow Battery Storage Market Forecast 2018-2028 (US$mn, Global AGR %)

Figure 4.12 Share of Flow Battery Storage Market 2018-2028 (%)

Figure 4.13 Advanced Lead Acid Battery Storage Market Forecast 2018-2028 (US$mn, Global AGR %)

Figure 4.14 Share of Advanced Lead Acid Battery Storage Market 2018-2028 (%)

Figure 4.15 Other Battery Storage Market Forecast 2018-2028 (US$mn, Global AGR %)

Figure 4.16 Share of Other Battery Storage Market 2018-2028 (%)

Figure 5.1 Leading National Grid-Scale Battery Storage Technologies Market Forecast 2018-2028 (US$mn, Global AGR %)

Figure 5.2 Leading National Grid-Scale Battery Storage Technologies Market AGR Forecast 2018-2028 (AGR %)

Figure 5.3 Leading National Grid-Scale Battery Storage Technologies Market Cumulative Sales 2018-2028 ($m)

Figure 5.4 Leading National Grid-Scale Battery Storage Technologies Market Share Forecast 2018 (% Share)

Figure 5.5 Leading National Grid-Scale Battery Storage Technologies Market Share Forecast 2023 (% Share)

Figure 5.6 Leading National Grid-Scale Battery Storage Technologies Market Share Forecast 2028 (% Share)

Figure 5.7 US Grid-Scale Battery Storage Technologies Market Forecast 2018-2028 (US$mn, Global AGR %)

Figure 5.8 Share of US Grid-Scale Battery Storage Technologies Market 2018-2028 (%)

Figure 5.9 Proposed Energy Storage Procurement Targets in Major Californian Utilities 2014, 2016, 2018, 2020 (MW)

Figure 5.10 Japan Grid-Scale Battery Storage Technologies Market Forecast 2018-2028 (US$mn, Global AGR %)

Figure 5.11 Share of Japan Grid-Scale Battery Storage Technologies Market 2018-2028 (%)

Figure 5.12 China Grid-Scale Battery Storage Technologies Market Forecast 2018-2028 (US$mn, Global AGR %)

Figure 5.13 Share of China Grid-Scale Battery Storage Technologies Market 2018-2028 (%)

Figure 5.14 New Wind Power Capacity Additions by Country, 2017 (%)

Figure 5.15 Italy Grid-Scale Battery Storage Technologies Market Forecast 2018-2028 (US$mn, Global AGR %)

Figure 5.16 Share of Italy Grid-Scale Battery Storage Technologies Market 2018-2028 (%)

Figure 5.17 Italian Installed Hydropower, Wind, Solar, Geothermal and Biofuels Capacity, 2010-2015 (MW)

Figure 5.18 Germany Grid-Scale Battery Storage Technologies Market Forecast 2018-2028 (US$mn, Global AGR %)

Figure 5.19 Share of Germany Grid-Scale Battery Storage Technologies Market 2018-2028 (%)

Figure 5.20 Renewable Capacity in Germany, 2010-2016 (MW)

Figure 5.21 South Korea Grid-Scale Battery Storage Technologies Market Forecast 2018-2028 (US$mn, Global AGR %)

Figure 5.22 Share of South Korea Grid-Scale Battery Storage Technologies Market 2018-2028 (%)

Figure 5.23 The UK Grid-Scale Battery Storage Technologies Market Forecast 2018-2028 (US$mn, Global AGR %)

Figure 5.24 Share of The UK Grid-Scale Battery Storage Technologies Market 2018-2028 (%)

Figure 5.25 Rest of the World Grid-Scale Battery Storage Technologies Market Forecast 2018-2028 (US$mn, Global AGR %)

Figure 5.26 Share of Rest of the World Grid-Scale Battery Storage Technologies Market 2018-2028 (%)

Figure 7.1 Panasonic Corporation Total Company Sales 2011-2016 (US$m, AGR %)

Figure 7.2 Panasonic Corporation Sales of Business Segemnt which includes Grid-Scale Battery Storage Technologies Market 2013-2016 (US$m, AGR %)

Figure 7.3 Samsung SDI Co. Ltd. Total Company Sales 2011-2016 (US$m, AGR %)

Figure 7.4 Samsung SDI Co. Ltd. Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2011-2016 (US$m, AGR %)

Figure 7.5 LG Chem Ltd. Total Company Sales 2011-2016 (US$m, AGR %)

Figure 7.6 LG Chem Ltd. Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2012-2016 (US$m, AGR %)

Figure 7.7 BYD Co. Ltd. Company Sales 2011-2016 (US$m, AGR %)

Figure 7.8 BYD Co. Ltd. Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2011-2016 (US$m, AGR %)

Figure 7.9 GS Yuasa Corporation Total Company Sales 2011-2016 (US$m, AGR %)

Figure 7.10 GS Yuasa Corporation Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2011-2016 (US$m, AGR %)

Figure 7.11 Hitachi Ltd. Company Sales 2011-2016 (US$m, AGR %)

Figure 7.12 Hitachi Ltd. Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2011-2016 (US$m, AGR %)

Figure 7.13 Electrovaya Inc. Total Company Sales 2011-2017 (US$m, AGR %)

Figure 7.14 ABB Ltd. Total Company Sales 2011-2017 (US$m, AGR %)

Figure 7.15 ABB Ltd. Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2015-2017 (US$m, AGR %)

Figure 7.16 Tesla Total Company Sales 2011-2016 (US$m, AGR %)

Figure 7.17 Tesla Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2015-2016 (US$m, AGR %)

Figure 7.18 General Electric Company Total Company Sales 2012-2016 (US$m, AGR %)

Figure 7.19 General Electric Company Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2012-2016 (US$m, AGR %)

Figure 7.20 Mitsubishi Electric Corporation Company Sales 2011-2016 (US$m, AGR %)

Figure 7.21 Mitsubishi Electric Corporation Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2011-2016 (US$m, AGR %)

Figure 7.22 NGK Insulators Ltd. Total Company Sales 2011-2016 (US$m, AGR %)

Figure 7.23 NGK Insulators Ltd. Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2011-2016 (US$m, AGR %)

Figure 7.24 Sumitomo Electric Industries, Ltd. Total Company Sales 2011-2016 (US$m, AGR %)

Figure 7.25 Sumitomo Electric Industries, Ltd.Sales of Business Segment which includes Grid-Scale Battery Storage Technologies Market 2013-2016 (US$m, AGR %)

A123 Energy Solutions

A123 Systems

ABB Ltd.

ADS-TEC

AES Energy Storage

ALACAES

Alstom Asahi Kasei

Altair Nanotechnologies (Altairnano)

American Electric Power (AEP)

American Vanadium

Aquion Energy

Arenko Group

Asahi Kasei

Axion Power International

Beacon Power

Bloomberg New Energy Finance (BNEF)

Brattle group

BrightSource Energy

BYD Co. Ltd.

Con Edison

China Southern Power Grid (CSG)

Daewoo

Daimler AG

Deeya Energy

Demand Energy

Duke Energy

E.ON Climate and Renewables

East Penn Manufacturing

Ecoult

EDF Energy

Electrovaya Inc.

Emerson Network Power Australia

Endesa

EnerVault

Enel

Eos Energy Storage

EWE Gasspeicher

FIAMM

First Wind

Flextronics

Furukawa Battery

GE Energy Storage

GE Power

Gildemeister Energy Solutions

Global OEM

Google

Green Investment Bank

Greensmith Energy

Grid Battery Storage Limited (GBSL)

GS Yuasa Corporation

Hawaii Electric Company (HECO)

Hitachi Ltd

Hokkaido Electric

Hudson Clean Energy Partners

Imergy

Kokam

Korea Electric Power Corporation (KEPCO)

Korea South-East Power Co.

KT

LG Chem

Litarion GmbH

Mitsubishi Electric Corporation

Mitsubishi Materials

Mitsui & Co. Ltd.

National Grid

Neoen

NGK Insulators

Nichicon

Nissan

NRG Energy

Oncor

Panasonic Corporation

Power Grid Corporation of India

Primus Power

Prudent Energy Technology

Ray Power

Raytheon

RedFlow

Regenesys

RES America

Rockland Capital

Saft

Saint-Gobain

Samsung Corporation

Samsung SDI

Sanyo Electric

SB Energy

Schneider Electric

Shanghai Zhenhua Heavy Industries Company Limited

Siemens

SK Telecom

SoftBank

SolarCity

Sony

South Plains Electric Cooperative (SPEC)

Southern California Edison

Stem Inc.

Sumitomo Electric Industries

Sun Edison

Sunverge Energy

SustainX

Terna

Terna Plus

Telsa Energy

Tesla Motors

The Tokyo Electric Power Company Inc. (TEPCO)

Tohoku Electric

Toshiba

Toyota

ViZn Energy

Wanxiang Group

Wemag

Xcel Energy

Xtreme Power

Yokohama Dockyard & Machinery Works

Younicos

ZBB Energy

Other Organisations

Advanced Lead Acid Battery Consortium (ALABC)

Advanced Research Projects Agency-Energy (ARPA-E)

Australian Labor Party

Australian Renewable Energy Agency (ARENA)

California Energy Commission

California Public Utilities Commission (CPUC)

Centre for Renewable Energy Development (CRED)

Centre for the Commercialisc of Electric Technologies (CCET)

China Electrical Power Research Institute (CEPRI)

China Southern Power Grid

Commonwealth Scientific and Industrial Research Organisation (CSIRO)

Electric Vehicles Initiative (EVI)

Electric Reliability Council of Texas (ERCOT)

European Commission

European Commission Joint Research Centre

European Union

Federal Association of Energy Storage (BVES)

Fraunhofer Society Research Organisation

Fraunhofer Society

German Federal Association of Energy and Water Industries (BDEW)

Global Wind Energy Council (GWEC)

Harvard Business School

International Energy Agency (IEA)

Italian Ministry of Economy and Finances

Japan Aerospace Exploration Agency (JAXA)

Los Angeles Department of Water and Power (LADWP)

New York Battery and Energy Storage Technology Consortium (NY-BEST)

New York State Energy Research and Development Authority (NYSERDA)

Organisation for Economic Co-operation and Development (OECD)

Public Utilities Commission of Ohio (PUCO)

Renewable Energy Policy Network for the 21st Century (REN21)

Rutgers, The State University of New Jersey

Sandia National Laboratories

Seattle University

South Korean Ministry of Knowledge Economy

State Grid Corporation of China (SGCC)

Texas Public Utilities Commission

The California Public Utilities Commission (CPUC)

The China Electrical Power Research Institute (CEPRI)

The Federal Energy Regulatory Commission (FERC) (US)

The Korea Institute of Energy Research (KIER)

The Ministry of Economy and Finances (Japan)

The Ministry of Economy, Trade and Industry (METI)

The Ministry of Energy of Ontario

The New York State Energy Research and Development Authority (NYSERDA)

The Office of Gas and Electricity Markets (Ofgem)

The UK Department of Energy and Climate Change (DECC)

The US Department of Energy (DOE)

The US Energy Information Administration (EIA)

United Nations Framework Convention on Climate Change (UNFCCC)

UK Technology Strategy Board (TSB)

US Federal Energy Regulatory Commission (FERC)

US Republican Party

World Economic Forum

Download sample pages

Complete the form below to download your free sample pages for Grid-Scale Battery Storage Technologies Market Report 2018-2028

Related reports

-

Global Transformer Core Market 2017-2027

Visiongain has calculated that the Transformer Core market will see a capital expenditure (CAPEX) of $7,853 mn in 2017.Read on...

Full DetailsPublished: 20 October 2017 -

Battery Electric Vehicle (BEV) Market Report 2017-2027

Visiongain calculates the global battery electric vehicle market as worth $35.2bn in 201 with huge growth potential. If you want...

Full DetailsPublished: 03 November 2017 -

The Power Transformers Market Forecast 2018-2028

The increased focus on a more efficient energy grid infrastructure has led Visiongain to publish this timely report. The market...Full DetailsPublished: 27 July 2018 -

Wearable Technology Market 2018-2028

Our 172-page report provides 134 tables, charts, and graphs. Read on to discover the most lucrative areas in the industry...

Full DetailsPublished: 16 January 2018 -

Top 20 Lithium-Ion Battery Manufacturing Companies 2018

The development of the automotive battery market is important for the automotive sector as batteries serve different automotive applications in...Full DetailsPublished: 09 August 2018 -

Next Generation Energy Storage Technologies (EST) Market Forecast 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global next-generation energy storage technologies market. Visiongain...

Full DetailsPublished: 16 April 2018 -

Microgrid Monitoring Systems Market Report 2019-2029

The $411 million microgrid monitoring systems sector is expected to flourish in the next few years because of the declining...Full DetailsPublished: 10 December 2018 -

The Concentrating Solar Power (CSP) Market Forecast 2018-2028

Visiongain has calculated that the global Concentrated Solar Power (CSP) Market will see a capital expenditure (CAPEX) of $12,568 mn...

Full DetailsPublished: 15 February 2018 -

Offshore Wind Power Market Report 2018-2028

Visiongain has calculated that the global offshore wind market will see capital expenditure (CAPEX) of $24,448m in 2018, including spending...Full DetailsPublished: 14 September 2018 -

Gas Insulated Transformer Market Forecast 2019-2029

The increased focus on a more efficient energy grid infrastructure has led Visiongain to publish this timely report. ...Full DetailsPublished: 06 November 2018

Download sample pages

Complete the form below to download your free sample pages for Grid-Scale Battery Storage Technologies Market Report 2018-2028

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain energy reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and industry experts where possible but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain energy reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

“The Visiongain report was extremely insightful and helped us construct our basic go-to market strategy for our solution.”

H.

“F.B has used Visiongain to prepare two separate market studies on the ceramic proppants market over the last 12 months. These reports have been professionally researched and written and have assisted FBX greatly in developing its business strategy and investment plans.”

F.B

“We just received your very interesting report on the Energy Storage Technologies (EST) Market and this is a very impressive and useful document on that subject.”

I.E.N

“Visiongain does an outstanding job on putting the reports together and provides valuable insight at the right informative level for our needs. The EOR Visiongain report provided confirmation and market outlook data for EOR in MENA with the leading countries being Oman, Kuwait and eventually Saudi Arabia.”

E.S

“Visiongain produced a comprehensive, well-structured GTL Market report striking a good balance between scope and detail, global and local perspective, large and small industry segments. It is an informative forecast, useful for practitioners as a trusted and upto-date reference.”

Y.N Ltd

Association of Dutch Suppliers in the Oil & Gas Industry

Society of Naval Architects & Marine Engineers

Association of Diving Contractors

Association of Diving Contractors International

Associazione Imprese Subacquee Italiane

Australian Petroleum Production & Exploration Association

Brazilian Association of Offshore Support Companies

Brazilian Petroleum Institute

Canadian Energy Pipeline

Diving Medical Advisory Committee

European Diving Technology Committee

French Oil and Gas Industry Council

IMarEST – Institute of Marine Engineering, Science & Technology

International Association of Drilling Contractors

International Association of Geophysical Contractors

International Association of Oil & Gas Producers

International Chamber of Shipping

International Shipping Federation

International Marine Contractors Association

International Tanker Owners Pollution Federation

Leading Oil & Gas Industry Competitiveness

Maritime Energy Association

National Ocean Industries Association

Netherlands Oil and Gas Exploration and Production Association

NOF Energy

Norsk olje og gass Norwegian Oil and Gas Association

Offshore Contractors’ Association

Offshore Mechanical Handling Equipment Committee

Oil & Gas UK

Oil Companies International Marine Forum

Ontario Petroleum Institute

Organisation of the Petroleum Exporting Countries

Regional Association of Oil and Natural Gas Companies in Latin America and the Caribbean

Society for Underwater Technology

Society of Maritime Industries

Society of Petroleum Engineers

Society of Petroleum Enginners – Calgary

Step Change in Safety

Subsea UK

The East of England Energy Group

UK Petroleum Industry Association

All the events postponed due to COVID-19.

Latest Energy news

Visiongain Publishes Carbon Capture Utilisation and Storage (CCUS) Market Report 2024-2034

The global carbon capture utilisation and storage (CCUS) market was valued at US$3.75 billion in 2023 and is projected to grow at a CAGR of 20.6% during the forecast period 2024-2034.

19 April 2024

Visiongain Publishes Liquid Biofuels Market Report 2024-2034

The global Liquid Biofuels market was valued at US$90.7 billion in 2023 and is projected to grow at a CAGR of 6.7% during the forecast period 2024-2034.

03 April 2024

Visiongain Publishes Hydrogen Generation Market Report 2024-2034

The global Hydrogen Generation market was valued at US$162.3 billion in 2023 and is projected to grow at a CAGR of 3.7% during the forecast period 2024-2034.

28 March 2024

Visiongain Publishes Biofuel Industry Market Report 2024-2034

The global Biofuel Industry market was valued at US$123.2 billion in 2023 and is projected to grow at a CAGR of 7.6% during the forecast period 2024-2034.

27 March 2024