Industries > Electronics > Top 20 Lithium-Ion Battery Manufacturing Companies 2018

Top 20 Lithium-Ion Battery Manufacturing Companies 2018

Market Share Analysis of Leading Companies Including Financial Data & Analysis of Battery Production Facilities for Applications in Automotive Battery Electric Vehicles (BEV), Grid Energy Storage Technologies (EST), Renewable Energy, Industrial & Consumer Electronics

The development of the automotive battery market is important for the automotive sector as batteries serve different automotive applications in alternate and conventional products. Increasing adoption of electric vehicles with favourable government initiatives including subsidies and tax rebates will encourage demand for Lithium-Ion batteries. Hybrid and plug-in hybrid electric vehicles are key application areas.

Lithium-ion batteries use a cobalt-based cathode and a graphite-based anode owing to high energy density achieved by the combination. High energy density increases the power storage and can energise electronics and applications with high power requirements. Compared to other types of batteries, Lithium-Ion batteries can deliver upwards of 3.6 volts, which is three times higher.

With increasing concerns over energy security and carbon emission issues, there has been a significant increase in the adoption of renewable and nuclear sources for power generation. This leads to an increased focus on more efficient and reliable energy storage and therefore, augmenting the demand for lithium-ion batteries.

Visiongain’s Top 20 Lithium-Ion Battery Manufacturing Companies Report 2018 will keep you informed and up to date with the developments in the market.

With reference to this report, it details the key investment trends in the global market, Analysis on Total Company Sales and the share of total company sales from Lithium-Ion Batteries and information on Lithium-Ion Battery Manufacturing Company Contracts / Projects / Programmes.

The report will answer questions such as:

– How is the Lithium-Ion Battery Manufacturing market evolving?

– What is driving and restraining the Lithium-Ion Battery Manufacturing market dynamics?

– Who are the leading players and what are their prospects for the development of Lithium-Ion Battery Manufacturing projects?

Five Reasons Why You Must Order and Read This Report Today:

1) Financial structure of 20 Leading players in the Lithium-Ion Battery Manufacturing market

– Total Company Sales (US $m)

– Operating Profit/Loss (US $m)

– Share of Company Revenue from Li-ion Battery Business (%)

– Net Income/Loss (US $m)

– Sales from Li-Ion Battery Business (US $m)

– Total Company Sales by Region

– Revenue of Business Segment that includes Li-Ion Battery Business (US $m)

– Share in Li-Ion Battery Market (%)

2) The report reveals extensive details and analysis of 59 Lithium-Ion Battery Production Facilities:

– Country

– Location

– Plant Description

3) The report lists Competitor Positioning in the Global Lithium-Ion Battery Manufacturing Market

– Strategic Supply Agreements and Partnerships

4) The report provides Drivers and Restraints affecting the Lithium-Ion Battery Manufacturing Market

5) The report provides market share analysis by Revenue and detailed profiles of the leading companies operating within the Lithium-Ion Battery Manufacturing market:

– A123 Systems Inc.

– Automotive Energy Supply Corporation (AESC)

– Aviation Industry Corporation of China (AVIC)

– BYD Company Ltd.

– CBAK Energy Technology Inc.

– Comtemporary Amperex Technology Ltd (CATL)

– GS Yuasa Corporation

– Hefei Guoxuan High-tech Power Energy Co., Ltd

– Hitachi Chemical Co., Ltd.

– Johnson Controls International Plc.

– LG Chem

– Microvast Inc.

– Panasonic Corporation

– Saft Batteries

– Samsung SDI Co. Ltd.

– TDK Corporation/Amperes Technology Ltd (ATL)

– Tesla Inc.

– Tianjin Lishen Battery Joint-Stock Co., Ltd.

– Tianneng Power International Ltd

– Toshiba Corporation

This independent 160-page report guarantees you will remain better informed than your competitors. With 160 tables and figures examining the Lithium-Ion Battery Manufacturing market space, the report gives you profiles of the leading companies operating within the Lithium-Ion Battery Manufacturing market with financial analysis as well as in-depth analysis of contracts, projects and programmes.

This report is essential reading for you or anyone in the Energy sector. Purchasing this report today will help you to recognise those important market opportunities and understand the possibilities there. I look forward to receiving your order.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1.1 Global Lithium-Ion Battery Market Overview

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report Include:

1.5 Who is this Report for?

1.6 Methodology

1.6.1 Primary Research

1.6.2 Secondary Research

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to the Lithium-Ion Battery Market

2.1. Lithium-Ion Battery Market Structure

2.2. Lithium-Ion Battery Market Definition

2.3. Brief History of Lithium-Ion Battery

2.4. Lithium-Ion Battery Market Drivers & Restrains

2.4.1. Drivers in the Lithium-Ion Battery Market

2.4.1.1. Increasing Usage of Lithium-Ion Batteries in Industrial Applications

2.4.1.2. Automotive and Energy Sector Continues to Enhance Growth Prospects for Lithium-Ion Batteries

2.4.1.3. Growth in Mobile and Computing Technologies to Boost Lithium-Ion Battery Usage in Consumer Electronics

2.4.2. Restraints in the Lithium-Ion Battery Market

2.4.2.1. Safety Concerns

2.4.2.2. Grapheme Battery as an Alternative to Lithium-Ion Battery

2.4.2.3. High Cost of Lithium-Ion Battery

3. Competitor Positioning in the Global Lithium-Ion Battery Market

3.1. Securing Supply & Product Development Contracts

3.2. Growing Development of Electric/Hybrid Power Vehicle

3.3. Lowering the Prices of Batteries

3.4. Securing Raw Material Sources

3.5. Product Portfolio of Major Lithium-Ion Battery Suppliers

3.6. The Leading Twenty Companies’ Market Share in the Global Lithium-Ion Battery Market 2017

4. The Leading Twenty Companies in the Global Lithium Ion (Li-Ion) Battery Market

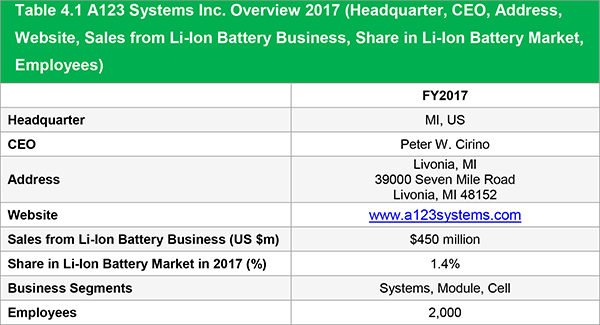

4.1. A123 Systems Inc.

4.1.1. A123 Systems Inc. Lithium-Ion Production Facilities

4.1.2. Innovations at A123 Systems

4.1.3. A123 Systems Inc. SWOT Analysis

4.2. Automotive Energy Supply Corporation (AESC)

4.2.1. Automotive Energy Supply Corporation (AESC) Total Company Sales 2015-2017

4.2.2. Automotive Energy Supply Corporation (AESC) Lithium-Ion Production Facilities

4.2.3. Automotive Energy Supply Corporation (AESC) Sales from Lithium-Ion Battery

4.2.4. Automotive Energy Supply Corporation (AESC) SWOT Analysis

4.3. BYD Company Ltd.

4.3.1. BYD Total Company Sales 2012-2017

4.3.2. BYD Lithium-Ion Production Facilities

4.3.3. Innovations at BYD:

4.3.4. BYD Sales in the Business Segment that includes Lithium-Ion Battery 2012-2017

4.3.5. BYD SWOT Analysis

4.4. CBAK Energy Technology Inc.

4.4.1. CBAK Total Company Sales 2014-2017

4.4.2. CBAK Lithium-Ion Production Facilities

4.4.3. CBAK SWOT Analysis

4.5. China Aviation Lithium Battery Co., Ltd. (CALB)

4.5.1. China Aviation Lithium Battery Co., Ltd. (CALB) Total Company Sales 2015-2017

4.5.2. China Aviation Lithium Battery Co., Ltd. (CALB) Lithium-Ion Production Facilities

4.5.3. China Aviation Lithium Battery Co., Ltd. (CALB) Sales From Lithium-Ion Battery

4.5.4. China Aviation Lithium Battery Co., Ltd. (CALB) SWOT Analysis

4.6. Contemporary Amperex Technology Ltd (CATL)

4.6.1. CATL Total Company Sales 2015-2017

4.6.2. CATL Lithium-Ion Production Facilities

4.6.3. CATL Sales form Lithium-Ion Battery

4.6.4. CATL SWOT Analysis

4.7. GS Yuasa Corporation

4.7.1. GS Yuasa Corporation Total Company Sales 2012-2017

4.7.2. GS Yuasa Corporation Lithium-Ion Production Facilities

4.7.3. Innovations at GS Yuasa Corporation

4.7.4. GS Yuasa Corporation Sales in the Business Segment that includes Lithium-Ion Battery 2012-2017

4.7.5. GS Yuasa Corporation SWOT Analysis

4.8. Hefei Guoxuan High-Tech Power Energy Co. Ltd.

4.8.1. Hefei Guoxuan High-Tech Power Energy Co. Ltd. Total Company Sales 2012-2017

4.8.2. Hefei Guoxuan High-Tech Power Energy Co. Ltd. Lithium-Ion Production Facilities

4.8.3. Hefei Guoxuan High-Tech Power Energy Co. Ltd. Sales form Lithium-Ion Battery

4.8.4. Hefei Guoxuan High-Tech Power Energy Co. Ltd. SWOT Analysis

4.9. Hitachi Chemical Co. Ltd.

4.9.1. Hitachi Chemical Total Company Sales 2012-2017

4.9.2. Hitachi Chemical Lithium-Ion Production Facilities

4.9.3. Innovations at Hitachi Chemical

4.9.4. Hitachi Chemical Sales in the Business Segment that includes Lithium-Ion Battery 2012-2017

4.9.5. Hitachi Chemical SWOT Analysis

4.10. Johnson Controls International Plc.

4.10.1. Johnson Controls Total Company Sales 2012-2017

4.10.2. Johnson Controls Lithium-Ion Production Facilities

4.10.3. Innovations at Johnson Controls

4.10.4. Johnson Controls Sales in the Business Segment that includes Lithium-Ion Battery 2012-2017

4.10.5. Johnson Controls SWOT Analysis

4.11. LG Chem

4.11.1. LG Chem Total Company Sales 2012-2017

4.11.2. LG Chem Lithium-Ion Production Facilities

4.11.3. Innovations at LG Chem

4.11.4. LG Chem Sales in the Business Segment that includes Lithium-Ion Battery 2012-2017

4.11.5. LG Chem SWOT Analysis

4.12. Microvast Inc.

4.12.1. Microvast Inc. Total Company Sales 2015-2017

4.12.2. Microvast Lithium-Ion Production Facilities

4.12.3. Innovations at Microvast

4.12.4. Microvast SWOT Analysis

4.13. Panasonic Corporation

4.13.1. Panasonic Corporation Total Company Sales 2012-2017

4.13.2. Panasonic Corporation Lithium-Ion Production Facilities

4.13.3. Innovations at Panasonic

4.13.4. Panasonic Corporation Sales in the Business Segment that includes Lithium-Ion Battery 2012-2017

4.13.5. Panasonic Corporation SWOT Analysis

4.14. Saft Batteries

4.14.1. Saft Batteries Total Company Sales 2012-2017

4.14.2. Saft Batteries Lithium-Ion Production Facilities

4.14.3. Innovations at Saft Batteries

4.14.4. Saft Batteries Sales from Lithium-Ion Battery

4.14.5. Saft Batteries SWOT Analysis

4.15. Samsung SDI Co. Ltd.

4.15.1. Samsung SDI Total Company Sales 2012-2017

4.15.2. Samsung SDI Lithium-Ion Production Facilities

4.15.3. Innovations at Samsung SDI

4.15.4. Samsung SDI Sales in the Business Segment that includes Lithium-Ion Battery 2012-2017

4.15.5. Samsung SDI SWOT Analysis

4.16. TDK Corporation/Amperex Technology Ltd (ATL)

4.16.1. TDK Total Company Sales 2012-2017

4.16.2. TDK Lithium-Ion Production Facilities

4.16.3. TDK Sales in the Business Segment that includes Lithium-Ion Battery 2012-2017

4.16.4. TDK/Amperex Technology Ltd (ATL) SWOT Analysis

4.17. Tesla Inc.

4.17.1. Tesla Total Company Sales 2013-2017

4.17.2. Tesla Lithium-Ion Production Facilities

4.17.3. Tesla Sales in the Business Segment that includes Lithium-Ion Battery 2015-2017

4.17.4. Tesla SWOT Analysis

4.18. Tianjin Lishen Battery Joint-Stock Co. Ltd.

4.18.1. Tianjin Lishen Battery Lithium-Ion Production Facilities

4.18.2. Innovations at Tianjin Lishen Battery

4.18.3. Tianjin Lishen Battery SWOT Analysis

4.19. Tianneng Power International Ltd.

4.19.1. Tianneng Power International Ltd Total Company Sales 2013-2017

4.19.2. Tianneng Power International Ltd Lithium-Ion Production Facilities

4.19.3. Tianneng Power International Ltd Sales in the Business Segment that includes Lithium-Ion Battery 2013-2017

4.19.4. Tianneng Power International Ltd SWOT Analysis

4.20. Toshiba Corporation

4.20.1. Toshiba Corporation Total Company Sales 2012-2017

4.20.2. Toshiba Corporation Lithium-Ion Production Facilities

4.20.3. Innovations at Toshiba

4.20.4. Toshiba Corporation Sales in the Business Segment that includes Lithium-Ion Battery 2014-2017

4.20.5. Toshiba Corporation SWOT Analysis

5. PEST Analysis of the Lithium-Ion Battery Market

6. Conclusion & Recommendation

7. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Figures

Figure 2.1 Global Lithium-Ion Battery Market Segmentation Overview

Figure 3.1 The Leading Twenty Companies in the Lithium-Ion Battery Market 2017 (Market Share %)

Figure 4.1 Automotive Energy Supply Corporation (AESC) Company Sales 2015-2017 (US $m, AGR %)

Figure 4.2 Automotive Energy Supply Corporation (AESC) Lithium-Ion Battery Segment Sales in Total Company Revenue 2017 (%)

Figure 4.3 BYD Company Sales 2012-2017 (US $m, AGR %)

Figure 4.4 BYD Sales by Business Segment 2017 (%)

Figure 4.5 BYD Sales by Region 2017 (%)

Figure 4.6 BYD Sales in the Business Segment that includes Lithium-Ion 2012-2017 (US$m, AGR %)

Figure 4.7 BYD Lithium-Ion Battery Segment Sales in Total Company Revenue 2017 (%)

Figure 4.8 CBAK Company Sales 2014-2017 (US $m, AGR %)

Figure 4.9 China Aviation Lithium Battery Co., Ltd. (CALB) Company Sales 2015-2017 (US $m, AGR %)

Figure 4.10 China Aviation Lithium Battery Co., Ltd. (CALB) Lithium-Ion Battery Segment Sales in Total Company Revenue 2017 (%)

Figure 4.11 CATL Company Sales 2015-2017 (US $m, AGR %)

Figure 4.12 CATL Lithium-Ion Battery Segment Sales in Total Company Revenue 2017 (%)

Figure 4.13 GS Yuasa Corporation Company Sales 2012-2017 (US $m, AGR %)

Figure 4.14 GS Yuasa Corporation Sales by Business Segment 2017 (%)

Figure 4.15 GS Yuasa Corporation Sales by Region 2017 (%)

Figure 4.16 GS Yuasa Corporation Sales in the Business Segment that includes Lithium-Ion 2012-2017 (US$m, AGR %)

Figure 4.17 GS Yuasa Corporation Lithium-Ion Battery Segment Sales in Total Company Revenue 2017 (%)

Figure 4.18 Hefei Guoxuan High-Tech Power Energy Co. Ltd. Company Sales 2012-2017 (US $m, AGR %)

Figure 4.19 Hefei Guoxuan High-Tech Power Energy Co. Ltd. Lithium-Ion Battery Segment Sales in Total Company Revenue 2017 (%)

Figure 4.20 Hitachi Chemical Company Sales 2012-2017 (US $m, AGR %)

Figure 4.21 Hitachi Chemical Company Sales by Business Segment 2017 (%)

Figure 4.22 Hitachi Chemical Company Sales by Region 2017 (%)

Figure 4.23 Hitachi Chemical Sales in the Business Segment that includes Lithium-Ion 2012-2017 (US$m, AGR %)

Figure 4.24 Hitachi Chemical Lithium-Ion Battery Segment Sales in Total Company Revenue 2017 (%)

Figure 4.25 Johnson Controls Company Sales 2012-2017 (US $m, AGR %)

Figure 4.26 Johnson Controls Sales by Business Segment 2017 (%)

Figure 4.27 Johnson Controls Sales by Region 2017 (%)

Figure 4.28 Johnson Controls Sales in the Business Segment that includes Lithium-Ion 2012-2017 (US$m, AGR %)

Figure 4.29 Johnson Controls Lithium-Ion Battery Segment Sales in Total Company Revenue 2017 (%)

Figure 4.30 LG Chem Company Sales 2012-2017 (US $m, AGR %)

Figure 4.31 LG Chem Sales by Business Segment 2017 (%)

Figure 4.32 LG Chem Sales by Region 2017 (%)

Figure 4.33 LG Chem Sales in the Business Segment that includes Lithium-Ion 2012-2017 (US$m, AGR %)

Figure 4.34 LG Chem Lithium-Ion Battery Segment Sales in Total Company Revenue 2017 (%)

Figure 4.35 Microvast Inc. Company Sales 2015-2017 (US $m, AGR %)

Figure 4.36 Panasonic Corporation Company Sales 2012-2017 (US $m, AGR %)

Figure 4.37 Panasonic Corporation Sales by Business Segment 2017 (%)

Figure 4.38 Panasonic Corporation Sales by Region 2017 (%)

Figure 4.39 Panasonic Corporation Sales in the Business Segment that includes Lithium-Ion 2012-2017 (US$m, AGR %)

Figure 4.40 Panasonic Corporation Lithium-Ion Battery Segment Sales in Total Company Revenue 2017 (%)

Figure 4.41 Saft Batteries Company Sales 2012-2017 (US $m, AGR %)

Figure 4.42 Saft Batteries Company Sales by Business Segment 2016 (%)

Figure 4.43 Saft Batteries Company Sales by Region 2016 (%)

Figure 4.44 Saft Batteries Lithium-Ion Battery Segment Sales in Total Company Revenue 2017 (%)

Figure 4.45 Samsung SDI Company Sales 2012-2017 (US $m, AGR %)

Figure 4.46 Samsung SDI Sales by Business Segment 2017 (%)

Figure 4.47 Samsung SDI Sales by Region 2017 (%)

Figure 4.48 Samsung SDI Sales in the Business Segment that includes Lithium-Ion 2012-2017 (US$m, AGR %)

Figure 4.49 Samsung SDI Lithium-Ion Battery Segment Sales in Total Company Revenue 2017 (%)

Figure 4.50 TDK Company Sales 2012-2017 (US $m, AGR %)

Figure 4.51 TDK Corporation Sales by Business Segment 2017 (%)

Figure 4.52 TDK Corporation Sales by Region 2017 (%)

Figure 4.53 TDK Sales in the Business Segment that includes Lithium-Ion 2012-2017 (US$m, AGR %)

Figure 4.54 TDK Lithium-Ion Battery Segment Sales in Total Company Revenue 2017 (%)

Figure 4.55 Tesla Company Sales 2013-2017 (US $m, AGR %)

Figure 4.56 Tesla Company Sales by Business Segment 2017 (%)

Figure 4.57 Tesla Company Sales by Region 2017 (%)

Figure 4.58 Tesla Sales in the Business Segment that includes Lithium-Ion 2015-2017 (US$m, AGR %)

Figure 4.59 Tesla Lithium-Ion Battery Segment Sales in Total Company Revenue 2017 (%)

Figure 4.60 Tianneng Power International Ltd Company Sales 2013-2017 (US $m, AGR %)

Figure 4.61 Tianneng Power International Ltd Company Sales by Business Segment 2017 (%)

Figure 4.62 Tianneng Power International Ltd Sales in the Business Segment that includes Lithium-Ion 2013-2017 (US$m, AGR %)

Figure 4.63 Tianneng Power International Ltd Lithium-Ion Battery Segment Sales in Total Company Revenue 2017 (%)

Figure 4.64 Toshiba Corporation Company Sales 2012-2017 (US $m, AGR %)

Figure 4.65 Toshiba Corporation Sales by Business Segment 2017 (%)

Figure 4.66 Toshiba Corporation Sales by Region 2017 (%)

Figure 4.67 Toshiba Corporation Sales in the Business Segment that includes Lithium-Ion 2014-2017 (US$m, AGR %)

Figure 4.68 Toshiba Corporation Lithium-Ion Battery Segment Sales in Total Company Revenue 2017 (%)

List of Tables

Table 2.1 Lithium-Ion Battery Market Drivers & Restraints

Table 3.1 Leading Lithium-Ion Battery Companies - Supply & Product Development Agreements and Partnership (Battery Manufacturer, Client Name, Details)

Table 3.2 Presence of Leading Lithium-Ion Battery Manufacturer in Different Markets

Table 3.3 Presence of Leading Lithium-Ion Battery Manufacturer in Different Battery Technologies

Table 3.4 The Leading Twenty Companies in the Lithium-Ion Battery Market 2017 (Lithium-Ion Battery Revenue, Market Share %)

Table 4.1 A123 Systems Inc. Overview 2017 (Headquarter, CEO, Address, Website, Sales from Li-Ion Battery Business, Share in Li-Ion Battery Market, Employees)

Table 4.2 A123 Systems Inc. Lithium-Ion Battery Plant Location, Country, and Details

Table 4.3 SWOT Analysis of A123 Systems Inc.

Table 4.4 Automotive Energy Supply Corporation (AESC) Overview 2017 (Headquarter, CEO, Address, Website, Company Sales, Operating Profit, Sales from Li-Ion Battery Business, Net Profit, Employees, Business Segments, Share in Li-Ion Battery Market, Share of Company Revenue from Li-ion Battery Business)

Table 4.5 Automotive Energy Supply Corporation (AESC) Company Sales 2015-2017 (US $m, AGR %)

Table 4.6 Automotive Energy Supply Corporation (AESC) Lithium-Ion Battery Plant Location, Country, and Details

Table 4.7 SWOT Analysis of Automotive Energy Supply Corporation (AESC)

Table 4.8 BYD Overview 2017 (Headquarter, CEO, Address, Website, Company Sales, Operating Profit, Sales from Li-Ion Battery Business, Net Profit, Employees, Business Segments, Share in Li-Ion Battery Market, Share of Company Revenue from Li-ion Battery Business, Revenue of Business Segment that includes Li-Ion Battery Business, IR Contact, Ticker Symbol)

Table 4.9 BYD Company Sales 2012-2017 (US $m, AGR %)

Table 4.10 BYD Lithium-Ion Battery Plant Location, Country, and Details

Table 4.11 BYD Sales in the Business Segment that includes Lithium-Ion 2012-2017 (US$m, AGR %)

Table 4.12 SWOT Analysis of BYD

Table 4.13 CBAK Overview 2017 (Headquarter, CEO, Address, Website, Company Sales, Operating Profit, Sales from Li-Ion Battery Business, Net Profit, Employees, Business Segments, Share in Li-Ion Battery Market, Share of Company Revenue from Li-ion Battery Business, IR Contact, Ticker Symbol)

Table 4.14 CBAK Lithium-Ion Battery Plant Location, Country, and Details

Table 4.15 SWOT Analysis of CBAK

Table 4.16 China Aviation Lithium Battery Co., Ltd. (CALB) Overview 2017 (Headquarter, CEO, Address, Website, Company Sales, Sales from Li-Ion Battery Business, Share in Li-Ion Battery Market, Share of Company Revenue from Li-Ion Battery Business, Employees)

Table 4.17 China Aviation Lithium Battery Co., Ltd. (CALB) Company Sales 2015-2017 (US $m, AGR %)

Table 4.18 China Aviation Lithium Battery Co., Ltd. (CALB) Lithium-Ion Battery Plant Location, Country, and Details

Table 4.19 SWOT Analysis of China Aviation Lithium Battery Co., Ltd. (CALB)

Table 4.20 CATL Overview 2017 (Headquarter, CEO, Address, Website, Company Sales, Sales from Li-Ion Battery Business, Business Segments, Share in Li-Ion Battery Market, Share of Company Revenue from Li-Ion Battery Business, Employees)

Table 4.21 CATL Company Sales 2015-2017 (US $m, AGR %)

Table 4.22 CATL Lithium-Ion Battery Plant Location, Country, and Details

Table 4.23 SWOT Analysis of CATL

Table 4.24 GS Yuasa Corporation Overview 2017 (Headquarter, CEO, Address, Website, Company Sales, Operating Profit, Sales from Li-Ion Battery Business, Net Profit, Employees, Business Segments, Share in Li-Ion Battery Market, Share of Company Revenue from Li-ion Battery Business, Revenue of Business Segment that includes Li-Ion Battery Business, IR Contact, Ticker Symbol)

Table 4.25 GS Yuasa Corporation Company Sales 2012-2017 (US $m, AGR %)

Table 4.26 GS Yuasa Corporation Lithium-Ion Battery Plant Location, Country, and Details

Table 4.27 GS Yuasa Corporation Sales in the Business Segment that includes Lithium-Ion 2012-2017 (US$m, AGR %)

Table 4.28 SWOT Analysis of GS Yuasa Corporation

Table 4.29 Hefei Guoxuan High-Tech Power Energy Co. Ltd. Overview 2017 (Headquarter, CEO, Address, Website, Company Sales, Operating Profit, Sales from Li-Ion Battery Business, Net Profit, Employees, Business Segments, Share in Li-Ion Battery Market, Share of Company Revenue from Li-ion Battery Business, IR Contact, Ticker Symbol)

Table 4.30 Hefei Guoxuan High-Tech Power Energy Co. Ltd. Company Sales 2012-2017 (US $m, AGR %)

Table 4.31 Hefei Guoxuan High-Tech Power Energy Co. Ltd. Lithium-Ion Battery Plant Location, Country, and Details

Table 4.32 SWOT Analysis of Hefei Guoxuan High-Tech Power Energy Co. Ltd.

Table 4.33 Hitachi Chemical Overview 2017 (Headquarter, CEO, Address, Website, Company Sales, Operating Profit, Sales from Li-Ion Battery Business, Net Profit, Employees, Business Segments, Share in Li-Ion Battery Market, Share of Company Revenue from Li-ion Battery Business, IR Contact, Ticker Symbol)

Table 4.34 Hitachi Chemical Company Sales 2012-2017 (US $m, AGR %)

Table 4.35 Hitachi Chemical Lithium-Ion Battery Plant Location, Country, and Details

Table 4.36 Hitachi Chemical Sales in the Business Segment that includes Lithium-Ion 2012-2017 (US$m, AGR %)

Table 4.37 SWOT Analysis of Hitachi Chemical

Table 4.38 Johnson Controls Overview 2017 (Headquarter, CEO, Address, Website, Company Sales, Operating Profit, Sales from Li-Ion Battery Business, Net Profit, Employees, Business Segments, Share in Li-Ion Battery Market, Share of Company Revenue from Li-ion Battery Business, Revenue of Business Segment that includes Li-Ion Battery Business, IR Contact, Ticker Symbol)

Table 4.39 Johnson Controls Company Sales 2012-2017 (US $m, AGR %)

Table 4.40 Johnson Controls Lithium-Ion Battery Plant Location, Country, and Details

Table 4.41 Johnson Controls Sales in the Business Segment that includes Lithium-Ion 2014-2017 (US$m, AGR %)

Table 4.42 SWOT Analysis of Johnson Controls

Table 4.43 LG Chem Overview 2017 (Headquarter, CEO, Address, Website, Company Sales, Operating Profit, Sales from Li-Ion Battery Business, Net Profit, Employees, Business Segments, Share in Li-Ion Battery Market, Share of Company Revenue from Li-ion Battery Business, Revenue of Business Segment that includes Li-Ion Battery Business, IR Contact, Ticker Symbol)

Table 4.44 LG Chem Company Sales 2012-2017 (US $m, AGR %)

Table 4.45 LG Chem Lithium-Ion Battery Plant Location, Country, and Details

Table 4.46 LG Chem Sales in the Business Segment that includes Lithium-Ion 2012-2017 (US$m, AGR %)

Table 4.47 SWOT Analysis of LG Chem

Table 4.48 Microvast Inc. Overview 2017 (Headquarter, CEO, Address, Website, Company Sales, Sales from Li-Ion Battery Business, Employees, Business Segments, Share in Li-Ion Battery Market, Share of Company Revenue from Li-ion Battery Business)

Table 4.49 Microvast Inc. Company Sales 2015-2017 (US $m, AGR %)

Table 4.50 Microvast Lithium-Ion Battery Plant Location, Country, and Details

Table 4.51 SWOT Analysis of Microvast

Table 4.52 Panasonic Corporation Overview 2017 (Headquarter, CEO, Address, Website, Company Sales, Operating Profit, Sales from Li-Ion Battery Business, Net Profit, Employees, Business Segments, Share in Li-Ion Battery Market, Share of Company Revenue from Li-ion Battery Business, Revenue of Business Segment that includes Li-Ion Battery Business, IR Contact, Ticker Symbol)

Table 4.53 Panasonic Corporation Company Sales 2012-2017 (US $m, AGR %)

Table 4.54 Panasonic Corporation Lithium-Ion Battery Plant Location, Country, and Details

Table 4.55 Panasonic Corporation Sales in the Business Segment that includes Lithium-Ion 2012-2017 (US$m, AGR %)

Table 4.56 SWOT Analysis of Panasonic Corporation

Table 4.57 Saft Batteries Overview 2017 (Headquarter, CEO, Address, Website, Company Sales, Sales from Li-Ion Battery Business, Employees, Business Segments, Share in Li-Ion Battery Market, Share of Company Revenue from Li-ion Battery Business)

Table 4.58 Saft Batteries Company Sales 2012-2017 (US $m, AGR %)

Table 4.59 Saft Batteries Lithium-Ion Battery Plant Location, Country, and Details

Table 4.60 SWOT Analysis of Saft Batteries

Table 4.61 Samsung SDI Co. Ltd Overview 2017 (Headquarter, CEO, Address, Website, Company Sales, Operating Profit, Sales from Li-Ion Battery Business, Net Profit, Employees, Business Segments, Share in Li-Ion Battery Market, Share of Company Revenue from Li-ion Battery Business, Revenue of Business Segment that includes Li-Ion Battery Business, IR Contact, Ticker Symbol)

Table 4.62 Samsung SDI Company Sales 2012-2017 (US $m, AGR %)

Table 4.63 Johnson Controls Lithium-Ion Battery Plant Location, Country, and Details

Table 4.64 Samsung SDI Sales in the Business Segment that includes Lithium-Ion 2012-2017 (US$m, AGR %)

Table 4.65 SWOT Analysis of Samsung SDI

Table 4.66 TDK Corporation Overview 2017 (Headquarter, CEO, Address, Website, Company Sales, Operating Profit, Sales from Li-Ion Battery Business, Net Profit, Capital Expenditure, Employees, Business Segments, Share in Li-Ion Battery Market, Share of Company Revenue from Li-ion Battery Business, Revenue of Business Segment that includes Li-Ion Battery Business, IR Contact, Ticker Symbol)

Table 4.67 TDK Company Sales 2012-2017 (US $m, AGR %)

Table 4.68 Ampere Technology Ltd Lithium-Ion Battery Plant Location, Country, and Details

Table 4.69 TDK Sales in the Business Segment that includes Lithium-Ion 2012-2017 (US$m, AGR %)

Table 4.70 SWOT Analysis of TDK

Table 4.71 Tesla Overview 2017 (Headquarter, CEO, Address, Website, Company Sales, Operating Profit, Sales from Li-Ion Battery Business, Net Profit, Employees, Business Segments, Share in Li-Ion Battery Market, Share of Company Revenue from Li-ion Battery Business, Revenue of Business Segment that includes Li-Ion Battery Business, IR Contact, Ticker Symbol)

Table 4.72 Tesla Company Sales 2013-2017 (US $m, AGR %)

Table 4.73 Tesla Lithium-Ion Battery Plant Location, Country, and Details

Table 4.74 Tesla Sales in the Business Segment that includes Lithium-Ion 2015-2017 (US$m, AGR %)

Table 4.75 SWOT Analysis of Tesla

Table 4.76 Tianjin Lishen Battery Overview 2017 (Headquarter, CEO, Address, Website, Company Sales, Sales from Li-Ion Battery Business, Employees, Business Segments, Share in Li-Ion Battery Market, Share of Company Revenue from Li-ion Battery Business)

Table 4.77 Tianjin Lishen Battery Lithium-Ion Battery Plant Location, Country, and Details

Table 4.78 SWOT Analysis of Tianjin Lishen Battery

Table 4.79 Tianneng Power International Ltd Overview 2017 (Headquarter, CEO, Address, Website, Company Sales, Operating Profit, Sales from Li-Ion Battery Business, Net Profit, Employees, Business Segments, Share in Li-Ion Battery Market, Share of Company Revenue from Li-ion Battery Business, Revenue of Business Segment that includes Li-Ion Battery Business, IR Contact, Ticker Symbol)

Table 4.80 Tianneng Power International Ltd Company Sales 2013-2017 (US $m, AGR %)

Table 4.81 Tianneng Power International Ltd Lithium-Ion Battery Plant Location, Country, and Details

Table 4.82 Tianneng Power International Ltd Sales in the Business Segment that includes Lithium-Ion 2013-2017 (US$m, AGR %)

Table 4.83 SWOT Analysis of Tianneng Power International Ltd

Table 4.84 Toshiba Corporation Overview 2017 (Headquarter, CEO, Address, Website, Company Sales, Operating Profit, Sales from Li-Ion Battery Business, Net Profit, Employees, Business Segments, Share in Li-Ion Battery Market, Share of Company Revenue from Li-ion Battery Business, Revenue of Business Segment that includes Li-Ion Battery Business, IR Contact, Ticker Symbol)

Table 4.85 Toshiba Corporation Company Sales 2012-2017 (US $m, AGR %)

Table 4.86 Panasonic Corporation Lithium-Ion Battery Plant Location, Country, and Details

Table 4.87 Toshiba Corporation Sales in the Business Segment that includes Lithium-Ion 2014-2017 (US$m, AGR %)

Table 4.88 SWOT Analysis of Toshiba Corporation

Table 5.1 PEST Analysis of the Lithium-Ion Battery Market

A123 Systems Inc.

ABB

AES Distributed Energy

Amazon

Amperex Technology Ltd (ATL)

Anhui Zotye Automobile Co.

Apple

Aston Martin

Audi

Automotive Energy Supply Corporation (AESC)

Aviation Industry Corporation of China (AVIC)

BAIC Motor Corporation

Berkshire Hathaway Energy

BMW

Bren-Tronics Inc.

BYD Co. Ltd.

CBAK Energy Technology Inc.

Cheil Industries Inc.

Chengfei Integration Technology Co., Ltd. (CITC)

China Aviation Lithium Battery Co., Ltd. (CALB)

China Metallurgical Group

China Mobile

China Unicom

Chint Group

Contemporary Amperex Technology Ltd (CATL)

Coolpad

Daimler

Dayun Automobile Co., Ltd

Denso

DMA

Dongfeng Motor Corporation

EFA-S

Exxon

FCA (Fiat Chrysler Automobiles)

Ford

General Motors

Graphenano

Green Charge Networks

GS Yuasa Corporation

GSR Capital

GWL Power

Hefei Guoxuan High-tech Power Energy Co., Ltd

Higer

Hitachi Chemical Co., Ltd.

Hitachi Ltd.

Holyoke Gas & Electric

Honda

HTC

Huawei

Hyundai

JAC Motors

Jaguar, Land Rover

Japan Airlines

Japan Storage Battery Co., Ltd

Johnson Controls

Kia Motors

Kopin Corporation

Lenovo

LG Chem Ltd.

Lithium Energy and Power GmbH & Company KG

Lithium Energy Japan (LEJ)

LLC

Lucind Motor

Magna Steyr Battery Systems

Mahindra & Mahindra

Mahindra Electric Mobility Ltd.

Matthews Associates Inc.

Mercedes-Benz

Microvast Inc.

Mitsubishi Motors Corporation

NEC Corporation

NEC Tokin Corporation

Nissan Motor Company

Panasonic Corporation

Perbix

Porsche

POSCO

Potevio.

PowerGenix

Proterra Inc.

Renault

Robert Bosch Ltd.

Saft Batteries

Samsung SDI Co. Ltd.

SANYO

SB LiMotive

Scania

Shin-Kobe Electric Machinery

SQM

SsangYong

State Grid

Suzuki Motor Corporation

Tangshan Caofeidian Development Investment Group

Terra Motors

Tesla Inc.

Textron Specialized Vehicles Inc. (TSV)

Tianjin Lishen Battery Joint-Stock Co

Tianneng Power International Ltd

Tianqi Lithium Corporation

TOBU Railway Co. Ltd.

Tokyo Metro Co. Ltd.

Toshiba Corporation

Total

Toyota

Valmet Automotive

Van Hool

Volkswagen

Volvo Car Group

Wanxiang

Webasto

YUASA Battery

Zhabuye Lithium

Zhengzhou Yutong Group

List of Other Organisations Mentioned in this Report

Massachusetts Institute of Technology (MIT)

Nanyang Technological University, Singapore (NTU Singapore)

Oxford University

Shanghai Electric Group

The Binghamton University

The Chilean government

The Tokyo Institute of Technology

The UK government

Tohoku University

Download sample pages

Complete the form below to download your free sample pages for Top 20 Lithium-Ion Battery Manufacturing Companies 2018

Related reports

-

Lithium-Ion Battery Market Report 2019-2029

Visiongain values the lithium-ion battery market at $42.3bn in 2019.

...Full DetailsPublished: 16 May 2019 -

Global Autonomous Aircraft Market Report 2019-2029

Evolution of smart drones and reduced emissions has increased the autonomous aircraft market size.

...Full DetailsPublished: 01 January 1970 -

Battery Electric Vehicle (BEV) Market Report 2019-2029

The increasing need to reduce vehicular emissions, decreasing battery prices, and the introduction of stringent regulations by government bodies, has...Full DetailsPublished: 20 November 2018 -

Military Unmanned Aerial Vehicle (UAV) Market Report 2018-2028

The global Military Unmanned Aerial Vehicle (UAV) market consists of worldwide government spending on the procurement and development of Military...

Full DetailsPublished: 31 August 2018 -

Geotextiles Market Report 2018-2028

Geotextiles are part of the geosynthetic group of materials which include geogrids, geomembranes, geopipes, geocomposites, geosynthetic clay liners, and geonets....

Full DetailsPublished: 24 October 2018 -

Power Bank Market Report 2017-2027

Visiongain’s comprehensive new 138 page report reveals that power bank technologies will achieve revenues of $15.1bn in 2017.

...Full DetailsPublished: 07 February 2017 -

Battery Electric Vehicle (BEV) Market Report 2017-2027

Visiongain calculates the global battery electric vehicle market as worth $35.2bn in 201 with huge growth potential. If you want...

Full DetailsPublished: 03 November 2017 -

The Lithium-Ion Battery Market Report 2018-2028

Visiongain has calculated that the global Lithium-Ion Battery Market will see a capital expenditure (CAPEX) of $34,292 mn in 2018....

Full DetailsPublished: 30 January 2018 -

Global Wearable Medical Devices Market Forecast 2017-2027

The global wearable medical devices market is expected to grow at a CAGR of 4.6% in the first half of...

Full DetailsPublished: 17 November 2017 -

Manned Electric Aircraft Market Report 2019-2029

The latest demand in manned electric aircraft has led Visiongain to publish this unique report, which is crucial to your...Full DetailsPublished: 29 March 2019

Download sample pages

Complete the form below to download your free sample pages for Top 20 Lithium-Ion Battery Manufacturing Companies 2018

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain electronics related reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, Visiongain analysts reach out to market-leading vendors and industry experts but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain electronics reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

Latest Electronics news

Visiongain Publishes Printed Electronics Market Report 2023-2033

The global Printed Electronics market was valued at US$9.94 million in 2022 and is projected to grow at a CAGR of 15.5% during the forecast period 2023-2033.

27 March 2023

Visiongain Publishes Smart TV Market Report 2023-2033

The global Smart TV market was valued at US$224 billion in 2022 and is projected to grow at a CAGR of 10.9% during the forecast period 2023-2033. And in terms of volume the market is projected to reach 320.4 million units by 2033.

08 March 2023

Visiongain Publishes Smart Manufacturing Market Report 2023-2033

The global Smart Manufacturing market was valued at US$97.81 billion in 2022 and is projected to grow at a CAGR of 14.7% during the forecast period 2023-2033.

24 January 2023

Visiongain Publishes Smart Sensors Market Report 2023-2033

The global Smart Sensors market was valued at US$57.77 billion in 2022 and is projected to grow at a CAGR of 20.5% during the forecast period 2023-2033.

23 December 2022