Industries > Pharma > Top 25 Anaesthesia Drugs Manufacturers 2020

Top 25 Anaesthesia Drugs Manufacturers 2020

Novartis, Mylan, Teva, Merck and Other Companies

The global anaesthesia drugs market is expected to reach $11.8bn in 2024 and is estimated to grow at a CAGR of 3.9% from 2019-2024. The local anaesthesia segment accounted for the largest share in the anaesthesia drugs market in 2018.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand new 155-page report you will receive 67 tables and 83 figures– all unavailable elsewhere.

The 155-page report provides clear detailed insight into the top 25 anaesthesia drugs manufacturers. Discover the key drivers and challenges affecting the market.

Report Scope

• Profiles of leading anaesthesia drugs manufacturers:

• Abbott Laboratories

• AbbVie

• Aspen Pharmacare

• AstraZeneca

• B. Braun Melsungen AG

• Baxter International

• Boehringer Ingelheim

• Eisai

• Endo International

• Fresenius Kabi AG

• GlaxoSmithKline

• Hikma Pharmaceuticals

• Jiangsu Hengrui Pharmaceutical Co., Ltd.

• Johnson & Johnson

• Lannett

• Merck

• Other companies

• The report provides information and discussion on:

• Company overview & analysis

• Product offerings

• Financial information

• Strategic developments

• This report discusses factors that drive and challenge the anaesthesia drugs market. Moreover, this report discusses the trends in anaesthesia drugs market.

• This report discusses the leading drugs and potential molecules in the pipeline.

• Key questions answered by this report:

• What are the drivers and restraints of the anaesthesia drugs market?

• Who are the leading anaesthesia drugs manufacturers?

• What are their products, developmental candidates and therapeutic applications?

• What is the status of the clinical trials they are undergoing?

• What are the latest news and developments from those companies?

Visiongain’s study is intended for anyone requiring commercial analyses for the Top 25 Anaesthesia Drugs Manufacturers 2020. You find data, trends and predictions.

Buy our report today Top 25 Anaesthesia Drugs Manufacturers 2020: Novartis, Mylan, Teva, Merck and Other Companies.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1. Report Overview

1.1 Why You Should Read This Report

1.2 How This Report Delivers

1.3 Key Questions Answered by This Analytical Report Include:

1.4 Who is This Report For?

1.5 Methodology

1.5.1 Primary Research

1.5.2 Secondary Research

1.5.3 Market Evaluation & Forecasting Methodology

1.6 Frequently Asked Questions (FAQ)

1.7 Associated Visiongain Reports

1.8 About Visiongain

2. Introduction to Anaesthetic Drugs

2.1 What is an Anaesthesia?

2.1.1 Types of Anaesthetics

2.1.1.1 General Anaesthetics

2.1.1.2 Local Anaesthetics

2.1.1.3 Sedation

2.2 What are the Risk and Side Effects of Anaesthesia Drugs?

2.2.1 Localized side effects

2.2.2 General side effects

2.3 Epidemiology of Anaesthetic Drugs

2.4 Humanistic and Economic Burden

2.4.1 Mortality

2.4.2 Morbidity

2.4.3 Economic Impact

3. Introduction to the Global Anaesthesia Drugs Market

4. Leading Drugs in the Global Anaesthesia Drugs Market

4.1 Propofol (Diprivan)

4.2 Sevoflurane (Sojourn, Ultane)

4.3 Remifentanil

4.4 Midazolam

4.5 Lidocaine

4.6 Ropivacaine

5. Market Growth Drivers

5.1 Increasing incidence of surgeries

5.2 Increasing cosmetic surgeries

5.3 Designated ICD-10 Code

5.4 Demand for general anaesthesia drugs

5.5 Increased investment in R&D

5.6 Advancements in medical power supply products

5.7 Rise in Geriatric population

6. Market Challenges

6.1 Healthcare consolidation

6.2 Stringent Regulatory Guidelines

6.3 Paucity of large, prospective and collaborative outcome studies

7. Market Trends

7.1 Advances in modern technologies

7.2 Strategic alliances among key players in the market

7.3 Expansion of healthcare sector in developing countries due to growing investments by major players

7.4 Advancements in drug delivery methods

7.5 Paucity of new drugs to change the practice of operating room Anaesthesia

7.6 Expect improved safety statistics regarding anaesthesia mortality and morbidity

7.7 Rising trend of home healthcare

8. Pipeline Molecules

8.1 Promising Potential Pipeline Molecules

8.1.1 Phase IV Molecules

8.1.1.1 Exparel (Bupivacaine Liposome)

8.1.2 Phase III Molecules

8.1.2.1 Remimazolam (CNS 7056)

8.1.3 Phase I Molecules

8.1.3.1 Cyclopropyl-methoxycarbonyl metomidate (ABP-700)

8.1.3.2 Carboetomidate

8.1.3.3 JM-1232 (-) (MR04A3)

8.1.3.4 Propofol

8.1.3.5 PF0713

8.1.3.6 Fospropofol

8.1.3.7 AZD-3043 (TD4756)

9. Leading Companies in Global Anaesthetic Drugs Market, 2018

9.1. Novartis AG

9.1.1. Company overview

9.1.2. Company snapshot

9.1.3. Operating business segments

9.1.4. Product portfolio

9.1.5. Business performance

9.2. Mylan N.V.

9.2.1. Company overview

9.2.2. Company snapshot

9.2.3. Operating business segments

9.2.4. Product portfolio

9.2.5. Business performance

9.3. Teva Pharmaceuticals Industries Limited AG

9.3.1. Company overview

9.3.2. Company snapshot

9.3.3. Operating business segments

9.3.4. Product portfolio

9.3.5. Business performance

9.4. Merck & Co., Inc.

9.4.1. Company overview

9.4.2. Company snapshot

9.4.3. Operating business segments

9.4.4. Product portfolio

9.4.5. Business performance

9.5. Pacira Pharmaceuticals, Inc.,

9.5.1. Company overview

9.5.2. Company snapshot

9.5.3. Product portfolio

9.5.4. Business performance

9.6. Hikma Pharmaceuticals. plc

9.6.1. Company overview

9.6.2. Company snapshot

9.6.3. Operating business segments

9.6.4. Product portfolio

9.6.5. Business performance

9.7. Glaxosmithkine plc

9.7.1. Company overview

9.7.2. Company snapshot

9.7.3. Operating business segments

9.7.4. Product portfolio

9.7.5. Business performance

9.8. Aspen Pharmacare Holdings Limited

9.8.1. Company overview

9.8.2. Company snapshot

9.8.3. Operating business segments

9.8.4. Product portfolio

9.8.5. Business performance

9.8.6. Key strategic moves and development

9.9. Endo International plc (Endo International)

9.9.1. Company overview

9.9.2. Company snapshot

9.9.3. Operating business segments

9.9.4. Product portfolio

9.9.5. Business performance

9.10. Nuvo Pharmaceuticals

9.10.1. Company overview

9.10.2. Company snapshot

9.10.3. Product portfolio

9.10.4. Business performance

9.11. Lannett

9.11.1. Company overview

9.11.2. Company snapshot

9.11.3. Operating business segment

9.11.4. Product portfolio

9.11.5. Business performance

9.12. Nichi-Iko Pharmaceutical Co., Ltd (Sagent Pharmaceuticals)

9.12.1. Company overview

9.12.2. Company snapshot

9.12.3. Operating business segment

9.12.4. Product portfolio

9.12.5. Business performance

9.13. Jiangsu Hengrui Medicine

9.13.1. Company overview

9.13.2. Company snapshot

9.13.3. Operating business segment

9.13.4. Product portfolio

9.13.5. Business performance

9.14. Mydent International

9.14.1. Company overview

9.14.2. Company snapshot

9.14.3. Operating business segment

9.14.4. Product portfolio

9.14.5. Business performance

9.15. Primex Pharmaceuticals AG

9.15.1. Company overview

9.15.2. Company snapshot

9.15.3. Product portfolio

9.15.4. Business performance

9.16. Fresenius Kabi AG

9.16.1. Company overview

9.16.2. Company snapshot

9.16.3. Operating business segments

9.16.4. Product portfolio

9.16.5. Business performance

9.17. Johnson and Johnson

9.17.1. Company overview

9.17.2. Company snapshot

9.17.3. Operating business segments

9.17.4. Product portfolio

9.17.5. Business performance

9.17.6. Key strategic move and development

9.18. Baxter International Inc.

9.18.1. Company overview

9.18.2. Company snapshot

9.18.3. Operating business segments

9.18.4. Product portfolio

9.18.5. Business performance

9.19. Abbott Laboratories

9.19.1. Company overview

9.19.2. Company snapshot

9.19.3. Operating business segments

9.19.4. Product portfolio

9.19.5. Business performance

9.20. AstraZeneca plc

9.20.1. Company overview

9.20.2. Company snapshot

9.20.3. Operating business segments

9.20.4. Product portfolio

9.20.5. Business performance

9.20.6. Key strategic move and development

9.21. F. Hoffman-La Roche AG

9.21.1. Company overview

9.21.2. Company snapshot

9.21.3. Operating business segments

9.21.4. Product portfolio

9.21.5. Business performance

9.22. AbbVie Inc.

9.22.1. Company overview

9.22.2. Company snapshot

9.22.3. Operating business segments

9.22.4. Product portfolio

9.22.5. Business performance

9.23. B. Braun Melsungen AG

9.23.1. Company overview

9.23.2. Company snapshot

9.23.3. Operating business segments

9.23.4. Product portfolio

9.23.5. Business performance

9.23.6. Key stratregic move and development

9.24. Eisai Co., Ltd.

9.24.1. Company overview

9.24.2. Company snapshot

9.24.3. Operating business segments

9.24.4. Product portfolio

9.24.5. Business performance

9.25. Boehringer Ingelheim GmbH

9.25.1. Company overview

9.25.2. Company snapshot

9.25.3. Operating business segments

9.25.4. Product portfolio

9.25.5. Business performance

10. Conclusions

Visiongain Report Sales Order Form

Associated Visiongain Reports

About Visiongain

Visiongain report evaluation form

List of Tables

Table 2.1 Type of Surgeries performed in 2010 and 2020 (%)

Table 8.1 Active Pipeline Molecules under Development for Anaesthesia Drugs

Table 9.1. Novartis: Company Snapshot

Table 9.2. Novartis: Operating Segments

Table 9.3. Novartis: Product Portfolio

Table 9.4. Mylan N.V.: Company Snapshot

Table 9.5. Mylan N.V.: Operating Segments

Table 9.6. Mylan N.V.: Product Portfolio

Table 9.7. Teva Pharmaceuticals Industries Limited: Company Snapshot

Table 9.8. Teva Pharmaceuticals Industries Limited: Operating Segments

Table 9.9. Teva Pharmaceuticals Industries Limited: Product Portfolio

Table 9.10. Merck: Company Snapshot

Table 9.11. Merck: Operating Segments

Table 9.12. Merck: Product Portfolio

Table 9.13. Pacira: Company Snapshot

Table 9.14. Pacira: Product Portfolio

Table 9.15. Hikma: Company Snapshot

Table 9.16. Hikma: Operating Segments

Table 9.17. Hikma: Product Portfolio

Table 9.18. GSK: Company Snapshot

Table 9.19. GSK: Operating Segments

Table 9.20. GSK: Product Portfolio

Table 9.21. Aspen: Company Snapshot

Table 9.22. Aspen: Main Operating Segments

Table 9.23. Aspen: Product Portfolio

Table 9.24. Endo International: Company Snapshot

Table 9.25. Endo International: Operating Segments

Table 9.26. Endo International: Product Portfolio

Table 9.27. Nuvo: Company Snapshot

Table 9.28. Nuvo: Product Portfolio

Table 9.29. Lannett: Company Snapshot

Table 9.30. Lannett: Product Portfolio

Table 9.31. Nichi: Company Snapshot

Table 9.32. Nichi: Product Portfolio

Table 9.33. Jiangsu: Company Snapshot

Table 9.34. Jiangsu: Product Portfolio

Table 9.35. Mydent: Company Snapshot

Table 9.36. Mydent: Product Portfolio

Table 9.37. Primex: Company Snapshot

Table 9.38. Primex: Product Portfolio

Table 9.39. Fresenius: Company Snapshot

Table 9.40. Fresenius: Operating Segments

Table 9.41. Fresenius: Product Portfolio

Table 9.42. Johnson and Johnson: Company Snapshot

Table 9.43. Johnson and Johnson: Operating Segments

Table 9.44. Johnson and Johnson: Product Portfolio

Table 9.45. Baxter: Company Snapshot

Table 9.46. Baxter: Operating Segments

Table 9.47. Baxter: Product Portfolio

Table 9.48. Abbott: Company Snapshot

Table 9.49. Abbott: Operating Segments

Table 9.50. Abbott: Product Portfolio

Table 9.51. AstraZeneca: Company Snapshot

Table 9.52. AstraZeneca: Product Portfolio

Table 9.53. Roche: Company Snapshot

Table 9.54. Roche: Operating Segments

Table 9.55. Roche: Product Portfolio

Table 9.56. AbbVie: Company Snapshot

Table 9.57. AbbVie: Product Portfolio

Table 9.58. B. Braun: Company Snapshot

Table 9.59. B. Braun: Operating Segments

Table 9.60. B. Braun: Product Portfolio

Table 9.61. Eisai: Company Snapshot

Table 9.62. Eisai: Product Portfolio

Table 9.63. Boehringer: Company Snapshot

Table 9.64. Boehringer: Operating Segments

Table 9.65. Boehringer: Product Portfolio

List of Figures

Figure 9.1. Novartis: Net Sales, 2016–2018 ($Million)

Figure 9.2. Novartis: Revenue Share by Segment, 2018 (%)

Figure 9.3. Novartis: Revenue Share by Geography, 2018 (%)

Figure 9.4. Novartis: SWOT Analysis

Figure 9.5. Mylan N.V.: Net Sales, 2015–2017 ($Million)

Figure 9.6. Mylan N.V.: Revenue Share by Geography, 2017 (%)

Figure 9.7. Mylan N.V.: SWOT Analysis

Figure 9.8. Teva Pharmaceuticals Industries Limited: Net Sales, 2015–2017 ($Million)

Figure 9.9. Teva Pharmaceuticals Industries Limited: Revenue Share by Segment, 2017 (%)

Figure 9.10. Teva Pharmaceuticals Industries Limited: Revenue Share by Geography, 2017 (%)

Figure 9.11. Teva Pharmaceuticals Industries Limited: SWOT Analysis

Figure 9.12. Merck: Net Sales, 2015–2017 ($Million)

Figure 9.13. Merck: Revenue Share by Segment, 2017 (%)

Figure 9.14. Merck: Revenue Share by Geography, 2017 (%)

Figure 9.15. Merck: SWOT Analysis

Figure 9.16. Pacira: Net Sales, 2015–2017 ($Million)

Figure 9.17. Pacira: Revenue Share by Geography, 2017 (%)

Figure 9.18. Pacira: SWOT Analysis

Figure 9.19. Hikma: Net Sales, 2015–2017 ($Million)

Figure 9.20. Hikma: Revenue Share by Geography, 2017 (%)

Figure 9.21. Hikma: SWOT Analysis

Figure 9.22. GSK: Net Sales, 2015–2017 ($Million)

Figure 9.23. GSK: Revenue Share by Segment, 2017 (%)

Figure 9.24. GSK: Revenue Share by Geography, 2017 (%)

Figure 9.25. GSK: SWOT Analysis

Figure 9.26. Aspen: Net Sales, 2017–2018 ($Million)

Figure 9.27. Aspen: Revenue Share by Segment, 2018 (%)

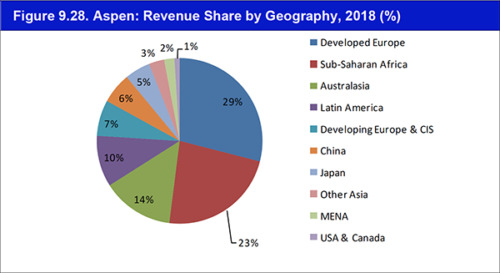

Figure 9.28. Aspen: Revenue Share by Geography, 2018 (%)

Figure 9.29. Aspen: SWOT Analysis

Figure 9.30. Endo International: Net Sales, 2016–2018 ($Million)

Figure 9.31. Endo International: Revenue Share by Segment, 2018 (%)

Figure 9.32. Endo International: SWOT Analysis

Figure 9.33. Nuvo: Net Sales, 2016–2017 ($Million)

Figure 9.34. Nuvo: Revenue Share by Geography, 2017 (%)

Figure 9.35. Nuvo: SWOT Analysis

Figure 9.36. Lannett: Net Sales, 2016–2018 ($Million)

Figure 9.37. Lannett: SWOT Analysis

Figure 9.38. Nichi: Net Sales, 2017–2018 ($Million)

Figure 9.39. Nichi: SWOT Analysis

Figure 9.40. Jiangsu: SWOT Analysis

Figure 9.41. Mydent: SWOT Analysis

Figure 9.42. Primex: SWOT Analysis

Figure 9.43. Fresenius: Net Sales, 2015–2017 ($Million)

Figure 9.44. Fresenius: Revenue Share by Segment, 2017 (%)

Figure 9.45. Fresenius: Revenue Share by Geography, 2017 (%)

Figure 9.46. Fresenius: SWOT Analysis

Figure 9.47. Johnson and Johnson: Net Sales, 2016–2018 ($Million)

Figure 9.48. Johnson and Johnson: Revenue Share by Segment, 2018 (%)

Figure 9.49. Johnson and Johnson: Revenue Share by Geography, 2018 (%)

Figure 9.50. Johnson and Johnson: SWOT Analysis

Figure 9.51. Baxter: Net Sales, 2016–2018 ($Million)

Figure 9.52. Baxter: Revenue Share by Segment, 2018 (%)

Figure 9.53. Baxter: Revenue Share by Geography, 2018 (%)

Figure 9.54. Baxter: SWOT Analysis

Figure 9.55. Abbott: Net Sales, 2016–2018 ($Million)

Figure 9.56. Abbott: Revenue Share by Segment, 2018 (%)

Figure 9.57. Abbott: Revenue Share by Geography, 2018 (%)

Figure 9.58. Abbott: SWOT Analysis

Figure 9.59. AstraZeneca: Net Sales, 2016–2018 ($Million)

Figure 9.60. AstraZeneca: Revenue Share by Segment, 2018 (%)

Figure 9.61. AstraZeneca: Revenue Share by Geography, 2018 (%)

Figure 9.62. AstraZeneca: SWOT Analysis

Figure 9.63. Roche: Net Sales, 2016–2018 ($Million)

Figure 9.64. Roche: Revenue Share by Segment, 2018 (%)

Figure 9.65. Roche: Revenue Share by Geography, 2018 (%)

Figure 9.66. Roche: SWOT Analysis

Figure 9.67. AbbVie: Net Sales, 2016–2018 ($Million)

Figure 9.68. AbbVie: Revenue Share by Segment, 2018 (%)

Figure 9.69. AbbVie: Revenue Share by Geography, 2018 (%)

Figure 9.70. Abbvie: SWOT Analysis

Figure 9.71. B. Braun: Net Sales, 2015–2017 ($Million)

Figure 9.72. B. Braun: Revenue Share by Segment, 2017 (%)

Figure 9.73. B. Braun: Revenue Share by Geography, 2017 (%)

Figure 9.74. B. Braun: SWOT Analysis

Figure 9.75. Eisai: Net Sales, 2016–2018 ($Million)

Figure 9.76. Eisai: Revenue Share by Geography, 2017 (%)

Figure 9.77. Eisai: SWOT Analysis

Figure 9.78. Boehringer: Net Sales, 2016–2017 ($Million)

Figure 9.79. Boehringer: Revenue Share by Segment, 2017 (%)

Figure 9.80. Boehringer: Revenue Share by Geography, 2017 (%)

Figure 9.81. Boehringer: SWOT Analysis

Figure 10.1 Anaesthesia market, by type (% share 2016 & 2028)

Figure 10.2 Anaesthesia market by route of administration (% share 2016 & 2028)

Abbott Laboratories

AbbVie

Aspen Pharmacare Holdings Limited (Aspen)

AstraZeneca

B. Braun Melsungen AG

Baxter International Inc.

Boehringer Ingelheim GmbH

DePuy Synthes

Eisai Co., Ltd.

Endo International plc

Fresenius Kabi AG

GlaxoSmithKline plc (GSK)

Hikma Pharmaceuticals PLC

International Society of Aesthetic Plastic Surgery (ISAPS)

Janssen Pharmaceuticals

Jiangsu Hengrui Pharmaceutical Co., Ltd.

Johnson & Johnson

Lannett

Merck & Co., Inc.

Mydent International, Inc.

Mylan

National Institute of Health (NIH)

Nichi-Iko Pharmaceutical Co., Ltd.

Novartis

Nuvo Pharmaceuticals Inc.

Nuvo Research Inc.

Pacira Pharmaceuticals

Primex Pharmaceuticals AG

Roche

Siamab Therapeutics, Inc.

Teva Pharmaceuticals

Thermo Fisher Scientific

World Health Organization

Download sample pages

Complete the form below to download your free sample pages for Top 25 Anaesthesia Drugs Manufacturers 2020

Related reports

-

Medical Device Leader Series: Top Pre-Filled Injection Device Manufacturers 2019-2029

The Pre-Filled Device Manufacturing market is estimated to reach $8.3bn in 2024, growing at a CAGR of 9.5% throughout the...Full DetailsPublished: 30 August 2019 -

Global Pre-Filled Syringes Market Forecast 2019-2029

The global pre-filled syringes market was valued at $9.8bn in 2018. This market is estimated to grow at a CAGR...

Full DetailsPublished: 31 January 2019 -

Top 25 Biosimilar Drug Manufacturers 2019

Visiongain forecasts that the biosimilar drugs market will grow with a CAGR of 40% from 2018 to 2028.

...Full DetailsPublished: 17 April 2019 -

Global Biosimilars and Follow-On Biologics Market 2019-2029

The global biosimilars and follow-on biologics market is estimated to have reached $10.7bn in 2018 and expected to grow at...

Full DetailsPublished: 21 March 2019 -

Global Surgical Sutures Market 2020-2030

The global surgical sutures market is expected to reach $6.4bn in 2024 and is estimated to grow at a CAGR...

Full DetailsPublished: 08 October 2019

Download sample pages

Complete the form below to download your free sample pages for Top 25 Anaesthesia Drugs Manufacturers 2020

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Latest Pharma news

Visiongain Publishes Drug Delivery Technologies Market Report 2024-2034

The global Drug Delivery Technologies market is estimated at US$1,729.6 billion in 2024 and is projected to grow at a CAGR of 5.5% during the forecast period 2024-2034.

23 April 2024

Visiongain Publishes Cell Therapy Technologies Market Report 2024-2034

The cell therapy technologies market is estimated at US$7,041.3 million in 2024 and is projected to grow at a CAGR of 10.7% during the forecast period 2024-2034.

18 April 2024

Visiongain Publishes Automation in Biopharma Industry Market Report 2024-2034

The global Automation in Biopharma Industry market is estimated at US$1,954.3 million in 2024 and is projected to grow at a CAGR of 7% during the forecast period 2024-2034.

17 April 2024

Visiongain Publishes Anti-obesity Drugs Market Report 2024-2034

The global Anti-obesity Drugs market is estimated at US$11,540.2 million in 2024 and is expected to register a CAGR of 21.2% from 2024 to 2034.

12 April 2024