Industries > Pharma > Medical Device Leader Series: Top Pre-Filled Injection Device Manufacturers 2019-2029

Medical Device Leader Series: Top Pre-Filled Injection Device Manufacturers 2019-2029

Profiles, R&D and Revenue Forecasting for Leading Syringe, Injector and Component Producers and Contract Filling Services

The Pre-Filled Device Manufacturing market is estimated to reach $8.3bn in 2024, growing at a CAGR of 9.5% throughout the forecast period.

The majority of revenues for pre-filled syringe manufacturers, including component manufacturers and pen injector/autoinjector manufacturers, came from developed markets.

How this 224-page report delivers:

• Provides an overview and revenue forecasts of the global pre-filled injectable devices market from 2019 to 2029

• Profiles of selected leading companies in the pre-filled injection device manufacturing:

• Leading pre-filled syringe manufacturers

• Leading pre-filled injectable component manufacturers

• Leading pen injector and autoinjector manufacturers

• Leading pre-filled injectable devices contract manufacturers

• Companies profiled in this report:

• Aptar Stelmi

• Becton, Dickinson, & Co (BD)

• Bespak Injectables

• Boehringer Ingelheim

• Catalent

• Dätwyler Holding

• Gerresheimer

• Haselmeier

• Laboratorios Farmacéuticos ROVI

• Nemera.

• Nipro

• Ompi

• Owen Mumford

• Roselabs Group.

• Schott

• SHL Group

• Tip-top

• Vetter Pharma

• Weigao Group Pharmaceutical Packaging Products Company

• West Pharmaceutical Services.

• Ypsomed

• Information provided for the selected leading companies, when available:

• Overview of the company

• Historical Revenues

• Revenue forecasts from 2019-2029

• A SWOT analysis

• A competitive analysis

• Products & Services

• Business Developments: Expansion, new products, mergers, acquisitions, collaborations.

• This report also discusses the key trends in the pre-filled injection device manufacturing market.

• 109 charts unavailable elsewhere

Visiongain’s study is intended for anyone requiring commercial analyses for the pre-filled injection device manufacturing market. You find data, trends and predictions.

Buy our report today Top Pre-Filled Injection Device Manufacturers 2019-2029: Profiles, R&D and Revenue Forecasting for Leading Syringe, Injector and Component Producers and Contract Filling Services.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1.1 Global Pre-Filled Injection Devices Market Overview

1.2 Pre-Filled Injectable Devices Market Segmentation

1.3 Top Pre-Filled Injectable Devices Market: An Overview

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report

1.6 Who is This Report For?

1.7 Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to Pre-Filled Injectable Devices

2.1 What are Pre-Filled Injectable Devices?

2.2 Classification of Companies in the Pre-Filled Injectable Devices Market

2.2.1 Pen Injectors and Autoinjectors

2.2.2 Benefits and Weaknesses of Pre-Filled Injectors

2.3 The Pre-Filled Injection Devices Market 2018-2029

2.4 Contract Manufacturing as a Sector of the Pre-Filled Injectable Devices Market

2.5 Demand on the Western Market is the Highest

2.6 Key Trends in the Pre-Filled Injection Device Market 2018-2029

2.6.1 Increased Market Consolidation

2.6.2 Increased Development of Biologics and Biosimilars

2.6.3 Rise in At Home Care

2.6.4 Greater Demands for Safety Leading Innovation

2.6.5 Threat from Other Drug Delivery Technologies

3. Leading Companies in the Pre-Filled Syringes Manufacturing Market 2019-2029

3.1 Becton, Dickinson, & Co (BD)

3.1.1 BD: Broad Portfolio of Syringe Products

3.1.1.1 BD Hypak: The First Glass Pre-Filled Syringe Worldwide

3.1.1.2 BD Sterifill

3.1.1.3 BD Neopak

3.1.1.4 BD Hylok for Viscous and Intravenous Drugs

3.1.1.5 BD Uniject on the Emerging Market

3.1.1.6 BD Physioject Autoinjector

3.1.1.7 BD Nano 4mm Pen Needles

3.1.1.8 BD Pen Injectors: BD Liquid Dry Injector and BD Reusable Pen

3.1.1.9 BD Vystra Disposable Pen

3.1.1.10 BD Proprietary Syringe Safety Systems

3.1.2 R&D - New Product Launches Planned

3.1.3 BD Acquires C.R. Bard

3.1.4 BD’s Pre-Filled Injection Historical Revenue 2017-2018

3.1.5 Major Acquisitions and Focus on Core Competencies

3.1.6 BD’s Main Strategic Goals

3.1.7 BD: Trend for Strategic Partnering

3.1.8 BD SWOT Analysis, 2019-2029

3.1.8.1 Collaboration and Expansion: Strategies for Growth and Rebranding

3.1.8.2 BD Medical Revenue Forecast 2018-2029

3.2 Gerresheimer AG

3.2.1 Pre-Filled Syringe Manufacture at Gerresheimer

3.2.1.1 RTF (Ready-To-Fill) Glass Syringes at Gerresheimer

3.2.1.2 ClearJect RTF Plastic Syringes at Gerresheimer

3.2.1.3 New German-made RTF ClearJect Syringe Combines the RTF Concept with Plastic

3.2.2 Pen Injector Manufacture at Gerresheimer

3.2.3 Gerresheimer Historical Revenue 2017-2018

3.2.4 Strategic Acquisitions and Collaborations– Sensile Medical and West Pharmaceuticals

3.2.5 Strategic Sale of Glass Tubing Business: Company Focus on Medical Devices and Primary Packaging

3.2.6 Strong Growth in the Plastics and Devices Division with a Focus on Modernisation

3.2.7 Standardisation as a Strategy

3.2.8 Gerresheimer SWOT Analysis, 2019-2029

3.2.8.1 Rapid Growth Planned for Emerging Markets

3.2.8.2 Gerresheimer is Well-Placed for Biologics Growth and More Stringent Regulatory Changes

3.2.8.3 Gerresheimer Plastics & Devices Market Revenue Forecast 2018 to 2029

3.3 SCHOTT AG

3.3.1 Schott Markets Glass and Plastic Pre-Filled Syringes

3.3.1.1 SyriQ BioPure Launch for Sensitive Drugs

3.3.1.2 Glass Syringes at Schott: Forma 3s and syriQ

3.3.1.3 TopPac Polymer Syringes

3.3.1.4 InJentle Syringes for Sensitive Drug Products

3.3.1.5 Other New Innovations at Schott

3.3.2 Schott Historical Revenue

3.3.3 Expansion in Developed and Emerging Markets

3.3.3.1 Growth in the Emerging Market

3.3.4 Schott SWOT Analysis, 2019-2029

3.3.4.1 Schott’s Emerging Market Strategy

3.4 Nipro Medical Corporation

3.4.1 Overview of Nipro’s Pre-Filled Syringe Portfolio

3.4.2 New Products at Nipro

3.4.3 Nipro is Expanding Globally

3.4.4 Nipro SWOT Analysis, 2019-2029

3.4.4.1 Responding to Rising Diabetes Incidence

3.5 Stevanato Group/Ompi

3.5.1 Ompi Markets Glass Pre-Filled Syringes and Cartridges

3.5.1.1 EZ-Fill Syringe

3.5.1.2 Extra High Quality (XQ) Syringes

3.5.1.3 Acquisitions Collaborations and Innovations at Ompi

3.5.2 Focused on Growth for Cartridges and Vials Manufacturing Especially in Emerging Markets

3.5.3 Ompi SWOT Analysis, 2019-2029

3.5.3.1 Ompi’s Products for the Biologics Market

3.5.3.2 Investing to Expand Capacity and Deal with Increasing Demand

3.6 Vista Dental Products

3.6.1 Vistra Markets Dental Pre-Filled Syringes

3.6.2 Some of the company’s products

3.6.2.1 Best-Etch

3.6.2.2 Porcelain Etch

3.6.2.3 CHX-Plus

3.6.2.4 Quick-Stat FREE

3.6.3 Vista SWOT Analysis, 2019-2029

3.7 Pre-Filled Syringe Manufacturers: Competitor Analysis 2019 to 2029

3.7.1 The Need for Advanced Safety Systems

3.7.2 Meeting the Demands of Biologics and Biosimilar Developers

3.7.3 Product Portfolio Diversity

3.7.4 What Demand is there in Emerging Markets?

3.8 High Barriers to Market Entry Will Limit Competition to 2029

3.9 Other Manufacturers of Interest in this Market

3.9.1 Weigao Group Pharmaceutical Packaging Products Company

3.9.1.1 Weigao’s Historical Revenue 2016-2018

3.9.1.2 Weigao Pre-Filled Syringes Revenue Forecast 2018-2029

3.9.2 Roselabs Group

4. Leading Companies in the Pre-Filled Injectable Components Manufacturing Market

4.1 Aptar Stelmi is a Pharma Packaging Specialist

4.1.1 Aptar Stelmi’s Pre-Fillwed Syringe Components

4.1.1.1 Aptar Stelmi’s Rigid Needle Shields

4.1.2 Aptar: Strategically Increasing Market Access to the Autoinjector Market

4.1.3 Aptar Stelmi’s Expansion and Innovations

4.1.4 Aptar Stelmi’s Historical Revenue 2016-2018

4.1.5 Aptar Stelmi SWOT Analysis, 2019-2029

4.1.5.1 Regional Expansion is Important for Continued Growth

4.1.6 Aptar Stelmi Revenue Forecast 2018-2029

4.2 Dätwyler Holding AG

4.2.1 Dätwyler’s Pre-Filled Syringe Components

4.2.1.1 Omniflex Coating: An Alternative to Silicone Oil

4.2.2 Demand from Insulin Manufacturers Drives Revenue Growth 2016-2018

4.2.3 Dätwyler is Focused on Strategic Acquisition and Expansion

4.2.4 Growth in Emerging Markets

4.2.5 Dätwyler SWOT Analysis, 2019-2029

4.2.6 Dätwyler Healthcare Revenue Forecast 2018-2029

4.3 West Pharmaceutical Services, Inc.

4.3.1 West Manufactures Syringes and Syringe Components

4.3.1.1 Daikyo Crystal Zenith: Licensed from Daikyo Seiko

4.3.1.2 MixJect for Lyophilised Drugs

4.3.1.3 West’s Self-Injection Systems

4.3.1.4 West Markets Three Safety Systems

4.3.1.5 Innovation and Investment at West

4.3.2 Recent Financial Performance

4.3.3 Collaborations with Big Pharma for Product Development

4.3.4 Expansion at West

4.3.5 West SWOT Analysis, 2019-2029

4.3.6 West Pharmaceutical Revenue Forecast 2018-2029

4.4 AbbVie Contract Manufacturing, a division of AbbVie Inc.

4.4.1 AbbVie’ Contract Manufacturing Pre-Filled Syringes

4.4.1.1 AbbVie’ Contract Manufacturing Pre-Filled Syringes Capabilities

4.4.2 AbbVie, Inc. Historical Revenue Growth 2016-2018

4.4.3 AbbVie SWOT Analysis, 2019-2029

4.4.4 AbbVie Revenue Forecast 2018-2029

4.5 Pre-Filled Syringe Component Manufacturers: Competitor Analysis 2019-2029

4.5.1 How Can Component Manufacturers React to Increased Safety Demands?

4.5.2 Other Manufacturers of Interest in this Market

4.5.2.1 tip-top.com Ltd.: Three Safety Products for Pre-Filled Syringes

4.5.2.2 Nemera: Formed from Rexam’s Sale of Healthcare Division

4.5.3 Entering the Autoinjector Market

4.5.4 Component Manufacturers Following Pre-Filled Syringe Manufacturers to Emerging Markets

5. Leading Companies in the Pen Injector and Autoinjector Manufacturing Market 2019-2029

5.1 Wilhelm Haselmeier GmbH & Co. KG

5.1.1 Haselmeier Markets Six Injection Systems

5.1.1.1 Axis Pen Systems

5.1.1.2 i-Pen: Haselmeier’s Insulin Pen Injector

5.1.2 Company Growth in Germany and India

5.1.3 Haselmeier SWOT Analysis, 2019-2029

5.2 Owen Mumford Ltd

5.2.1 Autoinjector and Pen Injector Overview

5.2.1.1 Autoject

5.2.1.2 Autopen

5.2.1.3 SimpleJect: Designed for RA Patients

5.2.2 Innovative Products to Drive Growth

5.2.3 Expanding in Established and New Markets

5.2.4 Owen Mumford SWOT Analysis 2019-2029

5.3 SHL Group

5.3.1 SHL Manufactures a Broad Range of Injection Devices

5.3.1.1 DAI Autoinjectors

5.3.2 SHL Group Continues to Grow in Taiwan

5.3.3 SHL Group SWOT Analysis, 2019-2029

5.4 Ypsomed Holding AG

5.4.1 Product Portfolio

5.4.1.1 YpsoPen

5.4.1.2 ServoPen

5.4.1.3 UnoPen

5.4.1.4 LyoTwist Injectors for Lyophilised Drugs

5.4.1.5 Ypsomed Markets Two Autoinjectors

5.4.1.6 Expansion at Ypsomed: Current and Future Plans

5.4.2 Ypsomed: Financial Performance 2016-2018

5.4.3 A Focus on Diabetes

5.4.4 Ypsomed SWOT Analysis, 2019-2029

5.4.5 Ypsomed Revenue Forecast 2019-2029

5.5 Pen Injector and Autoinjector Manufacturers: Competitor Analysis 2018-2029

5.5.1 A Competitive Market 2019-2029

5.5.2 Other Manufacturers of Interest in this Market

5.5.2.1 Bespak Injectables

5.5.3 How Are Companies Differentiating Their Autoinjectors?

5.5.4 Rising Demand in At-Home Care

5.5.4.1 Specific Demands in RA and MS

5.5.5 Contract Manufacturing for Autoinjectors

6. Leading Companies in the Contract Pre-Filled Injectable Devices Manufacturing Market 2018-2029

6.1 Catalent

6.1.1 Pre-Filled Syringe Contract Manufacturing Capabilities

6.1.2 Catalent Offers an Autoinjector

6.1.3 Innovations at Catalent

6.1.4 Catalent Pharma Solutions: Financial Performance 2016-2018

6.1.5 Expanding Filling Capacity for Clinical Trial Materials

6.1.6 Acquisitions and Collaborations

6.1.7 Catalent SWOT Analysis 2019-2029

6.1.8 Catalent Biologics and Speciality Drug Delivery Revenue Forecast 2018-2029

6.2 Vetter Pharmaceutical

6.2.1 Vetter is an Injectable Manufacturing Specialist

6.2.2 Vetter’s Ten-Year Expansion Plan

6.2.3 New Services and Collaborations

6.3 The Competitive Outlook for Leading CMOs in the Market 2019-2029

6.3.1 Biologics, Lyophilisation, and Dual-Chamber Syringes

6.3.2 An Increasingly Competitive Market

6.3.3 Important of Keeping Up with Regulations

6.4 Other Pre-Filled Syringe Contract Manufacturers 2018

6.4.1 Laboratorios Farmacéuticos ROVI

6.4.1.1 ROVI CM’s Pre-Filled Syringe Capabilities

6.4.2 Boehringer Ingelheim

7. Conclusions

7.1 Outlook for the Pre-Filled Injection System Market 2018-2029

7.2 Outlook for Leading Pre-Filled Injection System Manufacturers 2019-2029

7.2.1 How Will Leading Companies’ Revenues Grow to 2029?

7.3 The Future of the Pre-Filled Medical Devices Market

Appendices

Associated Visiongain Reports

Visiongain Report Sales Order Form

About Visiongain

Visiongain report evaluation form

List of Tables

Table 2.1 Total Pre-Filled Device Manufacturing Market Forecast: Revenues ($m), AGR (%) and CAGR (%), 2018-2029

Table 2.2 Pre-Filled Injection Device Market by Region, 2018

Table 2.3 Pre-Filled Injection Device Market: STEP Analysis, 2018-2029

Table 2.4 Selected Recent Acquisitions in the Pre-Filled Injection Devices Industry, 2014-2019

Table 3.1 BD Overview, 2019

Table 3.2 BD Revenue by Division ($m), 2018

Table 3.3 BD Historical Revenue by Division ($m), AGR (%), 2017-2018

Table 3.4 Medical Division Revenue ($m), 2017-2018

Table 3.5 BD: Pharmaceutical Systems Revenue ($m), AGR (%), CAGR (%), 2016-2018

Table 3.6 BD Pre-Filled Injection Devices: SWOT Analysis, 2019-2029

Table 3.7 BD Pharmaceutical Systems Revenue Forecast ($m), AGR (%), CAGR (%), 2018-2029

Table 3.8 Gerresheimer: Employees by Region, 2018

Table 3.9 Gerresheimer Overview, 2019

Table 3.10 Gerresheimer: Revenue by Division ($m), AGR (%), 2017-2018

Table 3.11 Gerresheimer Pre-Filled Injection Devices: SWOT Analysis, 2019-2029

Table 3.12 Gerresheimer Plastics and Devices: Revenue Forecast ($m), AGR (%), CAGR (%), 2018-2029

Table 3.13 Schott Overview, 2019

Table 3.14 Schott Revenue ($m), AGR (%), CAGR (%), 2016-2018

Table 3.15 Schott Pre-Filled Injection Devices: SWOT Analysis, 2019-2029

Table 3.16 Nipro Overview, 2019

Table 3.17 Nipro Revenue ($m), AGR (%), CAGR (%), 2016-2018

Table 3.18 Nipro Pre-Filled Injection Devices: SWOT Analysis, 2019-2029

Table 3.19 Stevanato Group/Ompi Overview, 2019

Table 3.20 Ompi Pre-Filled Injection Devices: SWOT Analysis, 2019-2029

Table 3.21 Vista Dental Product: Overview, 2019

Table 3.22 Vista Pre-Filled Injection Devices: SWOT Analysis, 2019-2029

Table 3.23 Pre-Filled Syringes: Leading Product Comparisons, 2019

Table 3.24 Leading Pre-Filled Syringe Manufacturers: Comparative Product Ranges, 2019

Table 3.25 Weigao Group Pharmaceutical Packaging Products Company Overview, 2019

Table 3.26 Weigao: Pre-Filled Syringes Revenue ($m), AGR (%), CAGR (%), 2016-2018

Table 3.27 Weigao: Revenue Forecast ($m), AGR (%), CAGR (%), 2018-2029

Table 3.28 Roselabs Group Overview, 2019

Table 4.1 Aptar Stelmi Overview, 2019

Table 4.2 Aptar Stelmi – Pharma Injectables: Revenue ($m), AGR (%), CAGR (%), 2016-2018

Table 4.3 Aptar Stelmi Pre-Filled Injection Devices: SWOT Analysis, 2019-2029

Table 4.4 Aptar Stelmi: Revenue Forecast ($m), AGR (%), CAGR (%), 2018-2029

Table 4.5 Dätwyler Overview, 2018

Table 4.6 Dätwyler: Sealing Solutions Revenue ($m), AGR (%), CAGR (%), 2016-2018

Table 4.7 Dätwyler Pre-Filled Injection Devices: SWOT Analysis, 2019-2029

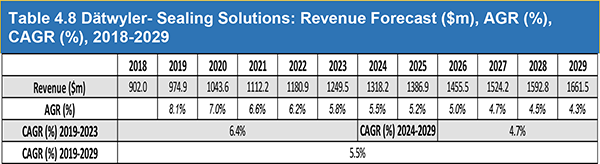

Table 4.8 Dätwyler- Sealing Solutions: Revenue Forecast ($m), AGR (%), CAGR (%), 2018-2029

Table 4.9 West Pharmaceutical Services Overview, 2019

Table 4.10 West: Selected Pharmaceutical Industry Partners, 2019

Table 4.11 West: Revenue by Division ($m), 2016-2018

Table 4.12 West Pre-Filled Injection Devices: SWOT Analysis, 2019-2029

Table 4.13 West Pharmaceuticals: Revenue Forecast ($m), AGR (%), CAGR (%), 2018-2029

Table 4.14 AbbVie Overview, 2019

Table 4.15 AbbVie: Revenue ($m), AGR (%), CAGR (%), 2016-2018

Table 4.16 AbbVie: Region Revenue ($m), 2016-2018

Table 4.17 AbbVie Pre-Filled Injection Devices: SWOT Analysis, 2019-2029

Table 4.18 AbbVie: Revenue Forecast ($m), AGR (%), CAGR (%), 2018-2029

Table 4.19 Tip-top Overview, 2019

Table 4.20 Nemera Overview, 2019

Table 5.1 Haselmeier Overview, 2019

Table 5.2 Selected Partners for the i-Pen, 2019

Table 5.3 Haselmeier Pre-Filled Injection Devices: SWOT Analysis, 2019-2029

Table 5.4 Owen Mumford Overview, 2019

Table 5.5 Selected Autoject Range Products, 2019

Table 5.6 Owen Mumford Pre-Filled Injection Devices: SWOT Analysis, 2019 to 2029

Table 5.7 SHL Group Overview, 2019

Table 5.8 SHL Group: Pen Injectors and Autoinjectors, 2019

Table 5.9 SHL Group Pre-Filled Injection Devices: SWOT Analysis, 2019-2029

Table 5.10 Ypsomed Overview, 2019

Table 5.11 Ypsomed: Pen Injectors and Autoinjectors, 2019

Table 5.12 Selected Pharmaceutical Partners for Ypsomed’s Pen Injectors, 2019

Table 5.13 LyoTwist Injectors Available, 2019

Table 5.14 Ypsomed: Revenue by Division ($m), CAGR (%), 2016-2018

Table 5.15 Ypsomed Pre-Filled Injection Devices: SWOT Analysis, 2019-2029

Table 5.16 Ypsomed Delivery Devices: Revenue Forecast ($m), AGR (%), CAGR (%), 2018-2029

Table 5.17 Pen Injectors: Selected Product Comparisons, 2019

Table 5.18 Autoinjectors: Selected Product Comparisons, 2019

Table 5.19 Selected Other Pen Injector and Autoinjector Manufacturers, 2017

Table 5.20 Bespak Injectables Overview, 2019

Table 6.1 Catalent Overview, 2019

Table 6.2 Catalent: Revenue by Division ($m), CAGR (%), 2016-2018

Table 6.3 Catalent Pre-Filled Injection Devices: SWOT Analysis, 2019-2029

Table 6.4 Catalent Biologics and Speciality Drug Delivery Division: Revenue Forecast ($m), AGR (%), CAGR (%), 2018-2029

Table 6.5 Vetter Pharma Overview, 2019

Table 6.6 Leading Pre-Filled Syringe CMOs: Company Comparison, 2019

Table 6.7 Laboratorios Farmacéuticos ROVI Overview, 2019

Table 6.8 Laboratorios Farmacéuticos ROVI: Revenue ($m), AGR (%), CAGR (%), 2016-2018

Table 6.9 Boehringer Ingelheim Overview, 2019

List of Figures

Figure 1.1 Global Pre-Filled Injectable Devices Market Segmentation Overview, 2019

Figure 2.1 Total Pre-Filled Device Manufacturing Market Forecast: Revenues ($m), 2018-2029

Figure 2.2 Pre-Filled Injection Device Market by Region, 2018

Figure 3.1 BD Revenue by Division ($m), 2018

Figure 3.2 BD Historical Revenue by Division ($m), 2017-2018

Figure 3.3 BD: Pharmaceutical Systems Revenue ($m), 2016-2018

Figure 3.4 BD Pharmaceutical Systems Revenue Forecast ($m), 2018-2029

Figure 3.5 Gerresheimer: Employees by Region, 2018

Figure 3.6 Gerresheimer: Revenue by Division ($m), 2017-2018

Figure 3.7 Gerresheimer Plastics and Devices: Revenue Forecast ($m), 2018-2029

Figure 3.8 Schott Revenue ($m), 2016-2018

Figure 3.9 Nipro Revenue ($m), 2016-2018

Figure 3.10 Weigao: Pre-Filled Syringes Revenue ($m), 2016-2018

Figure 3.11 Weigao: Revenue Forecast ($m), 2018-2029

Figure 4.1 Aptar Stelmi – Pharma Injectables: Revenue ($m), 2016-2018

Figure 4.2 Aptar Stelmi: Revenue Forecast ($m), 2018-2029

Figure 4.3 Dätwyler: Sealing Solutions Revenue ($m), 2016-2018

Figure 4.4 Dätwyler Healthcare: Revenue Forecast ($m), 2018-2029

Figure 4.5 West: Revenue by Division ($m), 2016-2018

Figure 4.6 West Pharmaceuticals: Revenue Forecast ($m), 2018-2029

Figure 4.7 Abbvie: Revenue ($m), 2016-2018

Figure 4.8 AbbVie: Revenue Forecast ($m), 2018-2029

Figure 5.1 Ypsomed: Revenue by Division ($m), 2016-2018

Figure 5.2 Ypsomed Delivery Devices: Revenue Forecast ($m), 2018-2029

Figure 6.1 Catalent: Employees by Region, 2018

Figure 6.2 Catalent: Revenue by Division ($m), 2016-2018

Figure 6.3 Catalent Biologics and Speciality Drug Delivery Division: Revenue Forecast ($m), 2018-2029

Figure 6.4 Laboratorios Farmacéuticos ROVI: Revenue ($m), 2016-2018

Actavis

AdvalTech

Aesica

Agência Nacional de Vigilância Sanitária (ANVISA) [Brazil]

Albany Molecular Research (AMRI)

AluPlast

Amcor Glass Tubing (part of Nipro)

American Stelmi (part of Aptar Stelmi)

Amgen

Amylin Pharmaceuticals

Antares Pharma

ANVISA

Apax Partners

Aptar Stelmi

AptarGroup

Aptuit

AstraZeneca

Aucta Pharmaceuticals

B. Braun Medical

Balda Group

Baxter

Baxter BioPharma Solutions (part of Baxter)

Baxter International

Bayer

BD Medico

Becton, Dickinson & Co. (BD)

Berlin-Chemie

Berry Plastics Group

Bespak

Biocon

Biogen Idec

Bionime

Blackstone Group

Boehringer Ingelheim

Boehringer Ingelheim BioXcellence

Bristol-Myers Squibb

C.R. Bard

Cambridge Consultants

CAPS (Central Admixture Pharmacy Services)

Cardinal Health

Cardium Therapeutics

CareFusion

Carl Zeiss Foundation

Carmel Pharma

Catalent

CeifiT

Cellular Research

Centers for Disease Control and Prevention (CDC)

Centor

Clere (part of Ompi)

Columbia Engineered Rubber

ConnectMeSmart GmbH

Consort Medica

Corning

Crucell Spain

Daikyo Seiko

Dätwyler

Dätwyler Holding

Debiopharm Group

Diagenode

Disetronic Group

Disetronic Group (part of Roche)

Dong-A Pharmaceutical

Dr. Reddy’s Laboratories

DS WorldMed

Duoject

DuPont

Elcam Medical

Eli Lilly

EMA (European Medicines Agency)

European Commission

European Medicines Agency (EMA)

Euticals

EVER Nuro Pharma

Federal Commission for Protection against Health Risks

Ferring Pharmaceuticals

Food and Drug Administration (FDA) [US]

Fresenius

Future Injection Technologies

Gadea Pharmaceutical Group

GenCell Biosystems

Genentech

Genovi Pharmaceuticals Limited

GeroPharm

Gerresheimer

GSK

Hankook Sealtech

Hanmi Pharmaceutical Co

Haselmeier

HealthPrize

HEKUMA

Helvoet Pharma

Hospira

Hospira One2One (part of Hospira)

Hyaluron Contract Manufacturing (HCM, part of AMRI)

Incepta Pharmaceuticals

Injectronics

Insulet

J&J

Jabil Circuit

Janssen Biotech

Japanese MHLW (Ministry for Health, Labour, and Welfare)

Johnson & Johnson

Juniper Pharmaceuticals

Korea Food and Drug Administration (KFDA)

Laboratorios Farmacéuticos ROVI

LifeScan

Lupin

McKesson

Medicines and Healthcare Products Regulatory Agency (MHRA) [UK]

MedImmune (part of AstraZeneca)

Medimop Medical Projects (part of West Pharmaceutical Services)

Medtronic

Menarini Group

Merck & Co.

Merck KGaA

MG Sterile Products (part of Nipro)

MGlas

Ministry of Health, Labor and Welfare (MHLW) [Japan]

MJ Biopharm

Montagu

Montagu Private Equity

NanoPass Technologies

Nemera

Neutral Glass and Allied Industries

Nipro

Nipro Europe (part of Nipro)

Nipro Glass (part of Nipro)

Nipro Medical (part of Nipro)

Nipro North America

Novartis

Novo Nordisk

Nuova Ompi (Formerly Ompi, Italian part of Stevanato Group)

Nycomed

Nycomed (part of Takeda)

Nypro

Occupational Safety and Health Administration (OSHA) [US]

Ompi

Opiant Pharmaceuticals

Optrel (part of Stevanato Group)

Origom

Osu Biopharmaceutical Manufacturing

Oval Medical

Owen Mumford

PA Consulting Group

Palatin Technologies

Parker Institute

PATH

Pema Holding

Pfizer

Pharma-Pen (part of West Pharmaceutical Services)

PharmaTap

Pharmstandard

Phillips Medisize

Plastef Investissements

Polfa Tarchomin

Primequal

Primoceler Oy

QuiO

Revolutions Medical

Rexam

Roche

Roselabs Bioscience (part of Roselabs Group)

Roselabs Group

Roselabs Polymers (part of Roselabs Group)

ROVI CM (part of Laboratorios Farmacéuticos ROVI)

Rumpler Technologies

Safety Syringes (part of BD)

Sandoz (part of Novartis)

Sanex Packaging Connections

Sanofi

Sanofi Pasteur

Savient Pharmaceuticals

Scandinavian Health Ltd (SHL Group)

Schering-Plough (part of Merck & Co.)

Schott

Schott Kaisha

Sealing Technologies

Sensile Medical

Sentry BioPharma Services

Shandong Weigao Group Medical Polymer Company

Shanghai Fosun Pharmaceutical

Shire

SHL Group

Smiths Group

Spami (part of Stevanato Group)

Square Pharmaceuticals

Stallergenes

Stelmi Asia (part of Aptar Stelmi)

Stevanato Group

Sungwon Medical

Swedish Orphan Biovitrum (Sobi)

Taisei Kako

Teva

Teva Pharmaceutical Industries

The Medical House

The Parker Institute (part of The Parker Foundation)

The Tech Group (part of West Pharmaceutical Services)

ThinFilm

Tip-Top

Tissue Repair Company (part of Cardium Therapeutics)

Tolmar

Tonghua Dongbao

Triveni Polymers

UCB

UK Medicines and Healthcare Products Regulatory Agency (MHRA)

Unilife

US Agency for International Development

Valerius Biopharma

Vetter Pharma

Watson Pharmaceutical

Weigao Group Pharmaceutical Packaging Products Company

West Company Mexico

West Pharmaceutical India Packaging Private (part of West Pharmaceutical Services)

West Pharmaceutical Services

Wockhardt

World Health Organization (WHO)

WW Medical and Healthcare Company Limited

Ypsomed

Zeon Corporation

Zhongding Sealtech

Download sample pages

Complete the form below to download your free sample pages for Medical Device Leader Series: Top Pre-Filled Injection Device Manufacturers 2019-2029

Related reports

-

The Global ENT (Ear, Nose and Throat) Devices Market Forecast 2019-2029

Our 145-page report provides 129 tables, charts, and graphs. Read on to discover the most lucrative areas in the industry...

Full DetailsPublished: 01 January 1970 -

Top 50 Gastrointestinal Therapeutic Companies 2020

The gastrointestinal (GI) therapeutics industry is on the rise; growing to reach $68,237.0m by 2028.

...Full DetailsPublished: 04 October 2019 -

Pharma Wholesale and Distribution Market Forecasts 2020-2030

The pharma wholesale and distribution market is estimated to grow at a CAGR of 5% in the first half of...Full DetailsPublished: 30 September 2019 -

Global Pre-Filled Syringes Market Forecast 2019-2029

The global pre-filled syringes market was valued at $9.8bn in 2018. This market is estimated to grow at a CAGR...

Full DetailsPublished: 31 January 2019 -

Drug Delivery Technologies Market Forecast 2019-2029

The Drug Delivery Technologies market is estimated to grow at a CAGR of 8.3% in the first half of the...

Full DetailsPublished: 27 February 2019 -

Global Medical Device Contract Manufacturing Market Forecast 2019-2029

The global medical device contract manufacturing market was valued at $75.84bn in 2018. Visiongain forecasts this market to increase to...Full DetailsPublished: 06 August 2019 -

Global OTC Pharmaceutical Market Forecast 2019-2029

The global OTC Pharmaceuticals market is estimated to be $162.64bn in 2018 and is expected to grow at a CAGR...

Full DetailsPublished: 31 July 2019 -

mRNA Vaccines and Therapeutics Market Forecast 2019-2029

The mRNA Vaccines and Therapeutics Market is estimated at $3.43 billion in 2018. The Standardized Therapeutic Cancer mRNA Vaccines segment...

Full DetailsPublished: 07 May 2019 -

Top 20 Global Respiratory Inhalers Manufacturers 2019

The global respiratory inhalers market is estimated to reach $38bn in 2023. In the respiratory Inhalers market the top three...

Full DetailsPublished: 09 April 2019 -

Global Wearable Medical Devices Market Forecast 2019-2029

The global wearable medical devices market is expected to reach $23bn in 2024. In 2018, the therapeutic wearable medical devices...

Full DetailsPublished: 19 September 2019

Download sample pages

Complete the form below to download your free sample pages for Medical Device Leader Series: Top Pre-Filled Injection Device Manufacturers 2019-2029

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Pharma news

Retinal Gene Therapy Market

The global Retinal Gene Therapy market is projected to grow at a CAGR of 9.6% by 2034

26 July 2024

HIV Drugs and Injectables Market

The global HIV Drugs & Injectables market is projected to grow at a CAGR of 4.6 % by 2034

24 July 2024

Digital Twin Technology in Pharmaceutical Manufacturing Market

The global Digital Twin Technology in Pharmaceutical Manufacturing market is projected to grow at a CAGR of 31.3% by 2034

23 July 2024

Specialty Pharma Market

The global Specialty Pharma market is projected to grow at a CAGR of 7.5% by 2034

22 July 2024