Industries > Energy > Top 20 Gas Insulated Substation (GIS) Companies Report 2018

Top 20 Gas Insulated Substation (GIS) Companies Report 2018

Profiles of Leading Companies Operating Within the Gas Insulated Substation Market Including Financial Analysis and Market Share plus In-Depth Analysis of Major Projects in Various Regions

The latest research report from business intelligence provider Visiongain offers a comprehensive analysis of the Top Gas Insulated Substation (GIS) Companies.

The Gas Insulated Substation (GIS) is a compact assembly consisting of multiple components enclosed in a metallic covering with compressed sulphur hexafluoride (SF6) gas as an insulating medium. The concept of the gas insulated substation was introduced in 1920 when oil was used as the insulating medium in the system.

A substation is considered as one of the vital elements of power system infrastructure. Presently there are two types of substations primarily being used: Air Insulated Substation (AIS) and Gas Insulated Substation (GIS).

In the past few years, the demand for gas insulated substations has gained wide momentum across several countries. It is mainly due to its compact design and high-reliability index as compared to its counterpart air insulated substation (AIS).

With increasing concerns over energy security and carbon emission issues, there has been a significant increase in the adoption of renewable and nuclear sources for power generation. Increasing energy demand in several developing countries is, therefore, augmenting the demand for gas insulated substations (GIS).

Owing to the advantages of minimal space requirement, protection against pollution and safety, economic mobility and easy installation and commissioning at low operating costs there has been an increased adoption of gas insulated substations among residential, commercial and utility applications. Most of the gas insulated substation companies are looking forward to expanding their business presence through strategic supply agreements and partnerships.

Visiongain’s Top 20 Gas Insulated Substation (GIS) Companies Report 2018 will keep you informed and up to date with the developments in the market.

With reference to this report, it details the key investment trends in the global market,

Analysis Total Company Sales, the share of total company sales from the company division that includes Gas Insulated Substation and information on Gas Insulated Substation Contracts / Projects / Programmes.

The report will answer questions such as:

– How is the Gas Insulated Substation market evolving?

– What is driving and restraining the Gas Insulated Substation market dynamics?

– Who are the leading players and what are their prospects for the development of gas insulated substation projects?

– How will the sector evolve as alliances form during the period between 2018 and 2028?

Five Reasons Why You Must Order and Read This Report Today:

1) Financial structure of 20 Leading players in the Gas Insulated Substation (GIS) market

– Total Company Sales (US$m)

– Sales from company division that includes GIS (US$m)

– Share of total company sales from company division that includes Gas Insulated Substation (%)

– Net Income / Loss (US$m)

– Net Capital Expenditure (US$m)

– Total Company Sales by Region

2) The report reveals extensive details and analysis of Gas Insulated Substation (GIS) contracts, projects and programmes:

– Date

– Country

– Subcontractor

– Value (US$m)

– Product

– Details

3) The report lists Competitor Positioning in the Global Gas Insulated Substation (GIS) Market

– Strategic Supply Agreements and Partnerships

4) The report provides Drivers and Restraints affecting the Gas Insulated Substation (GIS) Market

5) The report provides market share and detailed profiles of the leading companies operating within the Gas Insulated Substation (GIS) market:

– ABB Ltd.

– BGR Energy Systems Limited

– Bharat Heavy Electricals Limited

– Chem Group

– Crompton Greaves Limited

– Eaton Corporation Plc

– Elsewedy Electric

– Fuji Electric Co. Ltd.

– General Electric Company

– Hitachi Ltd.

– Hyundai Heavy Industries

– Larsen & Toubro Limited

– Meidensha Corporation

– Mistras Group

– Mitsubishi Electric Corporation

– Nissin Electric Co., Ltd.

– Schneider Electric SE

– Siemens AG

– Toshiba Corporation

– UGL Pty Limited

This independent 150-page report guarantees you will remain better informed than your competitors. With 155 tables and figures examining the GIS market space, the report gives you profiles of leading companies operating within the Gas Insulated Substation (GIS) market with financial analysis as well as in-Depth analysis of contracts, projects and programmes.

This report is essential reading for you or anyone in the Energy sector. Purchasing this report today will help you to recognise those important market opportunities and understand the possibilities there. I look forward to receiving your order.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Gas Insulated Substation Market Overview

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report Include:

1.5 Who is This Report For?

1.6 Methodology

1.6.1 Primary Research

1.6.2 Secondary Research

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to the Gas Insulated Substation Market

2.1 Gas Insulated Substation Market Structure

2.2 Gas Insulated Substation Market Definition

2.3 Brief History of Gas Insulated Substation

2.4 Gas Insulated Substation Submarkets Definition

2.4.1 Gas Insulated Substation – Medium Voltage (<72.5 kV) Submarket Definition

2.4.2 Gas Insulated Substation – High Voltage (> 72.5 kV) Submarket Definition

2.5 Gas Insulated Substation Market Drivers & Restraints 2018

2.5.1 Drivers in Gas Insulated Substation Market

2.5.1.1 Minimal Space Requirement

2.5.1.2 Protection Against Pollution And Safety Under Faulty Conditions

2.5.1.3 Economical Mobility of the Substation

2.5.1.4 Easy Installation and Commissioning and Low Operating Costs

2.5.1.5 Dielectric Strength of SF6

2.5.2 Restraints in the Gas Insulated Substation Market

2.5.2.1 High Initial Investment

2.5.2.2 Procurement and Supply of SF6 is Difficult

2.5.2.3 Regular Cleanliness to Avoid the System Breakdown

2.5.2.4 High Level Monitoring as Gas Leakage can be Harmful and Hazardous to Health

3. Competitor Positioning in the Global Gas Insulated Substation Market

3.1 Increasing Supply Agreements

3.2 Increasing Demand for Electricity

3.3 Cost Competitiveness and Economy of Scale

3.4 The Leading Twenty Companies’ Market Share in the Global Gas Insulated Substation Market 2018

3.5 Regional Gas Insulated Substation Investment Emphasis

4. The Leading Twenty Companies in the Gas Insulated Substation Market 2018

4.1 Toshiba Corporation

4.1.1 Toshiba Corporation Gas Insulated Substation Selected Recent Contracts / Projects / Programmes 2016-2017

4.1.2 Toshiba Corporation Total Company Regional Sales 2016

4.1.3 Toshiba Corporation Total Company Sales 2013-2016

4.1.4 Toshiba Corporation Sales in the Business Segment that includes Gas Insulated Substation Market 2015-2016

4.1.5 Toshiba Corporation SWOT Analysis

4.2 Siemens AG

4.2.1 Siemens AG Gas Insulated Substation Selected Recent Contracts / Projects / Programmes 2015-2017

4.2.2 Siemens AG Total Company Regional Sales 2017

4.2.3 Siemens AG Total Company Sales 2011-2017

4.2.4 Siemens AG Sales in the Business Segment that includes Gas Insulated Substation Market 2014-2017

4.2.5 Siemens AG SWOT Analysis

4.3 Mitsubishi Electric Corporation

4.3.1 Mitsubishi Electric Corporation Gas Insulated Substation Selected Recent Contracts / Projects / Programmes 2015

4.3.2 Mitsubishi Electric Corporation Total Company Regional Sales 2016

4.3.3 Mitsubishi Electric Corporation Total Company Sales 2011-2016

4.3.4 Mitsubishi Electric Corporation Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2016

4.3.5 Mitsubishi Electric Corporation SWOT Analysis

4.4 General Electric Company

4.4.1 General Electric Company Gas Insulated Substation Selected Recent Contracts / Projects / Programmes 2016-2017

4.4.2 General Electric Total Company Regional Sales 2017

4.4.3 General Electric Company Total Company Sales 2012-2017

4.4.4 General Electric Company Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2016

4.4.5 General Electric Company SWOT Analysis

4.5 Eaton Corporation Plc

4.5.1 Eaton Corporation Plc Gas Insulated Substation Selected Recent Contracts / Projects / Programmes 2016

4.5.2 Eaton Corporation Plc Total Company Regional Sales 2017

4.5.3 Eaton Corporation Plc Total Company Sales 2011-2017

4.5.4 Eaton Corporation Plc Sales in the Business Segment that includes Gas Insulated Substation Market 2012-2017

4.5.5 Eaton Corporation Plc SWOT Analysis

4.6 ABB Ltd.

4.6.1 ABB Ltd. Gas Insulated Substation Selected Recent Contracts / Projects / Programmes 2015-2018

4.6.2 ABB Ltd Total Company Regional Sales 2017

4.6.3 ABB Ltd Total Company Sales 2011-2017

4.6.4 ABB Ltd Sales in the Business Segment that includes Gas Insulated Substation Market 2015-2017

4.6.5 ABB Ltd. SWOT Analysis

4.7 Schneider Electric SE

4.7.1 Schneider Electric SE Total Company Regional Sales 2017

4.7.2 Schneider Electric SE Total Company Sales 2011-2017

4.7.3 Schneider Electric SE Sales in the Business Segment that includes Gas Insulated Substation Market 2012-2017

4.7.4 Schneider Electric SE SWOT Analysis

4.8 Fuji Electric Co. Ltd

4.8.1 Fuji Electric Co. Ltd Total Company Regional Sales 2016

4.8.2 Fuji Electric Co. Ltd Total Company Sales 2011-2016

4.8.3 Fuji Electric Co. Ltd Sales in the Business Segment that includes Gas Insulated Substation Market 2012-2016

4.8.4 Fuji Electric Co. Ltd. SWOT Analysis

4.9 Hitachi Ltd.

4.9.1 Hitachi Ltd Total Company Regional Sales 2016

4.9.2 Hitachi Ltd. Total Company Sales 2012-2016

4.9.3 Hitachi Ltd. Sales in the Business Segment that includes Gas Insulated Substation Market 2014-2016

4.9.4 Hitachi Ltd. SWOT Analysis

4.10 Crompton Greaves Limited

4.10.1 Crompton Greaves Limited Gas Insulated Substation Selected Recent Contracts / Projects / Programmes 2016

4.10.2 Crompton Greaves Limited Total Company Regional Sales 2016

4.10.3 Crompton Greaves Limited Total Company Sales 2011-2016

4.10.4 Crompton Greaves Limited Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2016

4.10.5 Crompton Greaves Limited SWOT Analysis

4.11 Mistras Group

4.11.1 Mistras Group Total Company Regional Sales 2017

4.11.2 Mistras Group Total Company Sales 2011-2017

4.11.3 Mistras Group Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2017

4.11.4 Mistras Group SWOT Analysis

4.12 UGL Pty Limited

4.12.1 UGL Pty Limited Gas Insulated Substation Selected Recent Contracts / Projects / Programmes 2014

4.12.2 UGL Pty Limited Total Company Sales 2011-2016

4.12.3 UGL Pty Limited Sales in the Business Segment that includes Gas Insulated Substation Market 2015-2016

4.12.4 UGL Pty Limited SWOT Analysis

4.13 Hyundai Heavy Industries

4.13.1 Hyundai Heavy Industries Gas Insulated Substation Selected Recent Contracts / Projects / Programmes 2012-2014

4.13.2 Hyundai Heavy Industries Total Company Sales 2011-2016

4.13.3 Hyundai Heavy Industries Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2016

4.13.4 Hyundai Heavy Industries SWOT Analysis

4.14 Nissin Electric Co., Ltd.

4.14.1 Nissin Electric Co. Ltd Total Company Regional Sales 2017

4.14.2 Nissin Electric Co., Ltd. Total Company Sales 2011-2017

4.14.3 Nissin Electric Co., Ltd. Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2017

4.14.4 Nissin Electric Co., Ltd. SWOT Analysis

4.15 Meidensha Group

4.15.1 Meidensha Group Gas Insulated Substation Selected Recent Contracts / Projects / Programmes 2016-2017

4.15.2 Meidensha Group Total Company Regional Sales 2016

4.15.3 Meidensha Group Total Company Sales 2011-2016

4.15.4 Meidensha Group Sales in the Business Segment that includes Gas Insulated Substation Market 2012-2016

4.15.5 Meidensha Group SWOT Analysis

4.16 Bharat Heavy Electricals Limited

4.16.1 Bharat Heavy Electricals Limited Total Company Regional Sales 2016

4.16.2 Bharat Heavy Electricals Limited Total Company Sales 2011-2016

4.16.3 Bharat Heavy Electricals Limited Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2016

4.16.4 Bharat Heavy Electricals Limited SWOT Analysis

4.17 Elsewedy Electric

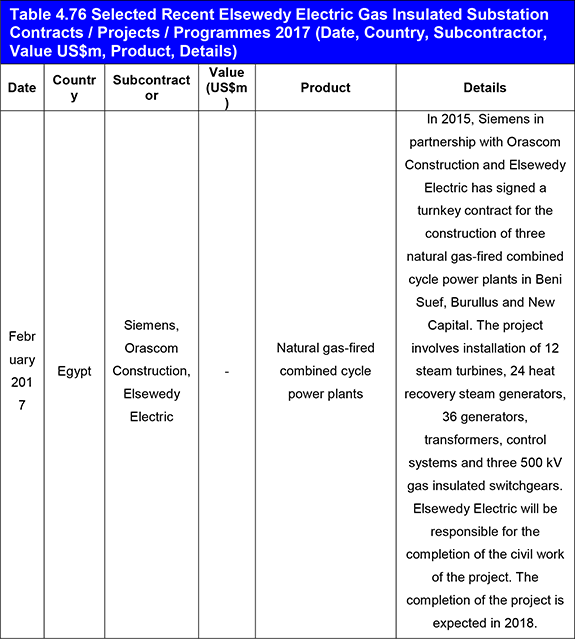

4.17.1 Elsewdy Electric Gas Insulated Substation Selected Recent Contracts / Projects / Programmes 2017

4.17.2 Elsewedy Electric Total Company Sales 2011-2016

4.17.3 Elsewedy Electric Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2016

4.17.4 Elsewedy Electric SWOT Analysis

4.18 Chem Group

4.18.1 Chem Group Total Company Sales 2011-2016

4.18.2 Chem Group Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2016

4.18.3 Chem Group SWOT Analysis

4.19 Larsen & Toubro Limited

4.19.1 Larsen & Toubro Limited Gas Insulated Substation Selected Recent Contracts / Projects / Programmes 2011-2018

4.19.2 Larsen & Toubro Limited Total Company Regional Sales 2016

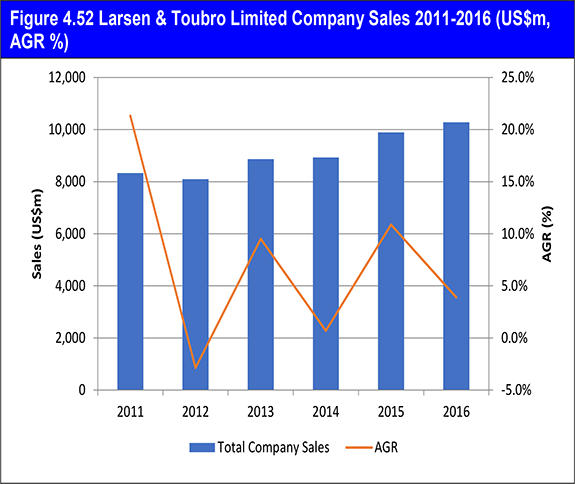

4.19.3 Larsen & Toubro Limited Total Company Sales 2011-2016

4.19.4 Larsen & Toubro Limited Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2016

4.19.5 Larsen & Toubro Limited SWOT Analysis

4.20 BGR Energy Systems Limited

4.20.1 BGR Energy Systems Limited Total Company Sales 2011-2016

4.20.2 BGR Energy Systems Limited Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2016

4.20.3 BGR Energy Systems Limited SWOT Analysis

5. SWOT Analysis of the Gas Insulated Substation Market 2018-2028

5.1 Strengths

5.2 Weaknesses

5.3 Opportunities

5.4 Threats

6. PEST Analysis of the Gas Insulated Substation Market 2018-2028

7. Conclusion & Recommendations

8. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 2.1 Gas Insulated Substation Market Drivers & Restraints

Table 3.1 Leading Gas Insulated Substation Companies - Strategic Supply Agreements and Partnership

Table 3.2 The Leading Twenty Companies in the Gas Insulated Substation Market 2018 (Rank, Company, Market Share %, CAPEX $m)

Table 4.1 Toshiba Corporation Profile 2017 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Business Segment that includes Gas Insulated Substation Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.2 Selected Recent Toshiba Corporation Gas Insulated Substation Contracts / Projects / Programmes 2016-2017 (Date, Country, Subcontractor, Value US$m, Product, Details)

Table 4.3 Toshiba Corporation Total Company Sales 2012-2016 (US$m, AGR %)

Table 4.4 Toshiba Corporation Sales in the Business Segment that includes Gas Insulated Substation Market 2014-2016 (US$m, AGR %)

Table 4.5 SWOT Analysis of Toshiba Corporation

Table 4.6 Siemens AG Profile 2017 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Business Segment that includes Gas Insulated Substation Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.7 Selected Recent Siemens AG Gas Insulated Substation Contracts / Projects / Programmes 2015-2017 (Date, Country, Subcontractor, Value US$m, Product, Details)

Table 4.8 Siemens AG Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.9 Siemens AG Sales in the Business Segment that includes Gas Insulated Substation Market 2013-2017 (US$m, AGR %)

Table 4.10 SWOT Analysis of Siemens AG

Table 4.11 Mitsubishi Electric Corporation 2017 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Business Segment that includes Gas Insulated Substation Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.12 Selected Recent Mitsubishi Electric Corporation Gas Insulated Substation Contracts / Projects / Programmes 2015 (Date, Country, Subcontractor, Value US$m, Product, Details)

Table 4.13 Mitsubishi Electric Corporation Total Company Sales 2010-2016 (US$m, AGR %)

Table 4.14 Mitsubishi Electric Corporation Sales in the Business Segment that includes Gas Insulated Substation Market 2010-2016 (US$m, AGR %)

Table 4.15 SWOT Analysis of Mitsubishi Electric Corporation

Table 4.16 General Electric Company 2017 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Business Segment that includes Gas Insulated Substation Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.17 Selected Recent General Electric Company Gas Insulated Substation Contracts / Projects / Programmes 2016-2017 (Date, Country, Subcontractor, Value US$m, Product, Details)

Table 4.18 General Electric Company Total Company Sales 2011-2017 (US$m, AGR %)

Table 4.19 General Electric Company Sales in the Business Segment that includes Gas Insulated Substation Market 2010-2016 (US$m, AGR %)

Table 4.20 SWOT Analysis of General Electric Company

Table 4.21 Eaton Corporation Plc 2017 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Business Segment that includes Gas Insulated Substation Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.22 Selected Recent Eaton Corporation Plc Gas Insulated Substation Contracts / Projects / Programmes 2016 (Date, Country, Subcontractor, Value US$m, Product, Details)

Table 4.23 Eaton Corporation Plc Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.24 Eaton Corporation Plc Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2017 (US$m, AGR %)

Table 4.25 SWOT Analysis of Eaton Corporation Plc

Table 4.26 ABB Ltd 2017 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Business Segment that includes Gas Insulated Substation Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.27 Selected Recent ABB Ltd. Gas Insulated Substation Contracts / Projects / Programmes 2015-2018 (Date, Country, Subcontractor, Value US$m, Product, Details)

Table 4.28 ABB Ltd Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.29 ABB Ltd Sales in the Business Segment that includes Gas Insulated Substation Market 2014-2017 (US$m, AGR %)

Table 4.30 SWOT Analysis of ABB Ltd.

Table 4.31 Schneider Electric SE 2017 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Business Segment that includes Gas Insulated Substation Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.32 Schneider Electric SE Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.33 Schneider Electric SE Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2017 (US$m, AGR %)

Table 4.34 SWOT Analysis of Schneider Electric SE

Table 4.35 Fuji Electric Co. Ltd 2017 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Business Segment that includes Gas Insulated Substation Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.36 Fuji Electric Co. Ltd Total Company Sales 2010-2016 (US$m, AGR %)

Table 4.37 Fuji Electric Co.Ltd Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2016 (US$m, AGR %)

Table 4.38 SWOT Analysis of Fuji Electric Co. Ltd.

Table 4.39 Hitachi Ltd. 2017 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Business Segment that includes Gas Insulated Substation Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.40 Hitachi Ltd. Total Company Sales 2011-2016 (US$m, AGR %)

Table 4.41 Hitachi Ltd. Sales in the Business Segment that includes Gas Insulated Substation Market 2013-2016 (US$m, AGR %)

Table 4.42 SWOT Analysis of Hitachi Ltd.

Table 4.43 Crompton Greaves Limited 2017 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Business Segment that includes Gas Insulated Substation Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.44 Selected Recent Crompton Greaves Limited Gas Insulated Substation Contracts / Projects / Programmes 2016 (Date, Country, Subcontractor, Value US$m, Product, Details)

Table 4.45 Crompton Greaves Limited Total Company Sales 2010-2016 (US$m, AGR %)

Table 4.46 Crompton Greaves Limited Sales in the Business Segment that includes Gas Insulated Substation Market 2010-2016 (US$m, AGR %)

Table 4.47 SWOT Analysis of Crompton Greaves Limited

Table 4.48 Mistras Group 2017 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Business Segment that includes Gas Insulated Substation Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.49 Mistras Group Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.50 Mistras Group Sales in the Business Segment that includes Gas Insulated Substation Market 2010-2017 (US$m, AGR %)

Table 4.51 SWOT Analysis of Mistras Group

Table 4.52 UGL Pty Limited 2016 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Business Segment that includes Gas Insulated Substation Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.53 Selected Recent UGL Pty Limited Gas Insulated Substation Contracts / Projects / Programmes 2014 (Date, Country, Subcontractor, Value US$m, Product, Details)

Table 4.54 UGL Pty Limited Total Company Sales 2010-2016 (US$m, AGR %)

Table 4.55 UGL Pty Limited Sales in the Business Segment that includes Gas Insulated Substation Market 2014-2016 (US$m, AGR %)

Table 4.56 SWOT Analysis of UGL Pty Limited

Table 4.57 Hyundai Heavy Industries 2017 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Business Segment that includes Gas Insulated Substation Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.58 Selected Recent Hyundai Heavy Industries Gas Insulated Substation Contracts / Projects / Programmes 2012-2014 (Date, Country, Subcontractor, Value US$m, Product, Details)

Table 4.59 Hyundai Heavy Industries Total Company Sales 2010-2016 (US$m, AGR %)

Table 4.60 Hyundai Heavy Industries Sales in the Business Segment that includes Gas Insulated Substation Market 2010-2016 (US$m, AGR %)

Table 4.61 SWOT Analysis of Hyundai Heavy Industries

Table 4.62 Nissin Electric Co., Ltd. 2017 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Business Segment that includes Gas Insulated Substation Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.63 Nissin Electric Co., Ltd. Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.64 Nissin Electric Co., Ltd. Sales in the Business Segment that includes Gas Insulated Substation Market 2010-2017 (US$m, AGR %)

Table 4.65 SWOT Analysis of Nissin Electric Co., Ltd.

Table 4.66 Meidensha Group 2017 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Business Segment that includes Gas Insulated Substation Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.67 Selected Recent Meidensha Group Gas Insulated Substation Contracts / Projects / Programmes 2016-2017 (Date, Country, Subcontractor, Value US$m, Product, Details)

Figure 4.42 Meidensha Group Company Sales 2011-2016 (US$m, AGR %)

Table 4.68 Meidensha Group Total Company Sales 2010-2016 (US$m, AGR %)

Figure 4.43 Meidensha Group Sales in the Business Segment that includes Gas Insulated Substation Market 2012-2016 (US$m, AGR %)

Table 4.69 Meidensha Group Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2016 (US$m, AGR %)

Table 4.70 SWOT Analysis of Meidensha Group

Table 4.71 Bharat Heavy Electricals Limited 2016 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Business Segment that includes Gas Insulated Substation Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.72 Bharat Heavy Electricals Limited Total Company Sales 2010-2016 (US$m, AGR %)

Table 4.73 Bharat Heavy Electricals Limited Sales in the Business Segment that includes Gas Insulated Substation Market 2010-2016 (US$m, AGR %)

Table 4.74 SWOT Analysis of Bharat Heavy Electricals Limited

Table 4.75 Elsewedy Electric 2016 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Business Segment that includes Gas Insulated Substation Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.76 Selected Recent Elsewedy Electric Gas Insulated Substation Contracts / Projects / Programmes 2017 (Date, Country, Subcontractor, Value US$m, Product, Details)

Table 4.77 Elsewedy Electric Total Company Sales 2010-2016 (US$m, AGR %)

Table 4.78 Elsewedy Electric Sales in the Business Segment that includes Gas Insulated Substation Market 2010-2016 (US$m, AGR %)

Table 4.79 SWOT Analysis of Elsewedy Electric

Table 4.80 Chem Group 2016 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Business Segment that includes Gas Insulated Substation Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.81 Chem Group Total Company Sales 2010-2016 (US$m, AGR %)

Table 4.82 Chem Group Sales in the Business Segment that includes Gas Insulated Substation Market 2010-2016 (US$m, AGR %)

Table 4.83 SWOT Analysis of Chem Group

Table 4.84 Larsen & Toubro Limited 2017 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Business Segment that includes Gas Insulated Substation Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.85 Selected Recent Larsen & Toubro limited Gas Insulated Substation Contracts / Projects / Programmes 2011-2018 (Date, Country, Subcontractor, Value US$m, Product, Details)

Table 4.86 Larsen & Toubro Limited Total Company Sales 2010-2016 (US$m, AGR %)

Table 4.87 Larsen & Toubro Limited Sales in the Business Segment that includes Gas Insulated Substation Market 2010-2016 (US$m, AGR %)

Table 4.88 SWOT Analysis of Larsen & Toubro Limited

Table 4.89 BGR Energy Systems Limited 2017 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Business Segment that includes Gas Insulated Substation Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.90 BGR Energy Systems Limited Total Company Sales 2010-2016 (US$m, AGR %)

Table 4.91 BGR Energy Systems Limited Sales in the Business Segment that includes Gas Insulated Substation Market 2010-2016 (US$m, AGR %)

Table 4.92 SWOT Analysis of BGR Energy Systems Limited

Table 5.1 Global Gas Insulated Substation Market SWOT Analysis 2018-2028

Table 6.1 PEST Analysis of the Gas Insulated Substation Market 2018 – 2028

List of Figures

Figure 2.1 Global Gas Insulated Substation Market Segmentation Overview

Figure 3.1 The Leading Twenty Companies in the Gas Insulated Substation Market 2018 (Market Share %)

Figure 3.2 Leading National Gas Insulated Substation Markets Share Forecast 2018 (%)

Figure 4.1 Toshiba Corporation Total Company Regional Sales 2016 (%)

Figure 4.2 Toshiba Corporation Total Company Sales 2013-2016 (US$m, AGR %)

Figure 4.3 Toshiba Corporation Sales in the Business Segment that includes Gas Insulated Substation Market 2015-2016 (US$m, AGR %)

Figure 4.4 Siemens AG Total Company Regional Sales 2017 (%)

Figure 4.5 Siemens AG Total Company Sales 2011-2017 (US$m, AGR %)

Figure 4.6 Siemens AG Sales in the Business Segment that includes Gas Insulated Substation Market 2014-2017 (US$m, AGR %)

Figure 4.7 Mitsubishi Electric Corporation Total Company Regional Sales 2016 (%)

Figure 4.8 Mitsubishi Electric Corporation Total Company Sales 2011-2016 (US$m, AGR %)

Figure 4.9 Mitsubishi Electric Corporation Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2016 (US$m, AGR %)

Figure 4.10 General Electric Total Company Regional Sales 2017 (%)

Figure 4.11 General Electric Company Total Company Sales 2012-2017 (US$m, AGR %)

Figure 4.12 General Electric Company Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2016 (US$m, AGR %)

Figure 4.13 Eaton Corporation Plc Total Company Regional Sales 2017 (%)

Figure 4.14 Eaton Corporation Plc Total Company Sales 2011-2017 (US$m, AGR %)

Figure 4.15 Eaton Corporation Plc Sales in the Business Segment that includes Gas Insulated Substation Market 2012-2017 (US$m, AGR %)

Figure 4.16 ABB Ltd Total Company Regional Sales 2017 (%)

Figure 4.17 ABB Ltd Total Company Sales 2011-2017 (US$m, AGR %)

Figure 4.18 ABB Ltd Sales in the Business Segment that includes Gas Insulated Substation Market 2015-2017 (US$m, AGR %)

Figure 4.19 Schneider Electric SE Total Company Regional Sales 2017 (%)

Figure 4.20 Schneider Electric SE Total Company Sales 2011-2017 (US$m, AGR %)

Figure 4.21 Schneider Electric SE Sales in the Business Segment that includes Gas Insulated Substation Market 2012-2017 (US$m, AGR %)

Figure 4.22 Fuji Electric Co. Ltd Total Company Regional Sales 2016 (%)

Figure 4.23 Fuji Electric Co. Ltd Total Company Sales 2011-2016 (US$m, AGR %)

Figure 4.24 Fuji Electric Co. Ltd Sales in the Business Segment that includes Gas Insulated Substation Market 2012-2016 (US$m, AGR %)

Figure 4.25 Hitachi Ltd Total Company Regional Sales 2016 (%)

Figure 4.26 Hitachi Ltd. Total Company Sales 2012-2016 (US$m, AGR %)

Figure 4.27 Hitachi Ltd. Sales in the Business Segment that includes Gas Insulated Substation Market 2014-2016 (US$m, AGR %)

Figure 4.28 Crompton Greaves Limited Total Company Regional Sales 2016 (%)

Figure 4.29 Crompton Greaves Limited Company Sales 2011-2016 (US$m, AGR %)

Figure 4.30 Crompton Greaves Limited Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2016 (US$m, AGR %)

Figure 4.31 Mistras Group Total Company Regional Sales 2017 (%)

Figure 4.32 Mistras Group Company Sales 2011-2017 (US$m, AGR %)

Figure 4.33 Mistras Group Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2017 (US$m, AGR %)

Figure 4.34 UGL Pty Limited Company Sales 2011-2016 (US$m, AGR %)

Figure 4.35 UGL Pty Limited Sales in the Business Segment that includes Gas Insulated Substation Market 2015-2016 (US$m, AGR %)

Figure 4.36 Hyundai Heavy Industries Company Sales 2011-2016 (US$m, AGR %)

Figure 4.37 Hyundai Heavy Industries Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2016 (US$m, AGR %)

Figure 4.38 Nissin Electric Co. Ltd Total Company Regional Sales 2017 (%)

Figure 4.39 Nissin Electric Co., Ltd. Company Sales 2011-2017 (US$m, AGR %)

Figure 4.40 Nissin Electric Co., Ltd. Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2017 (US$m, AGR %)

Figure 4.41 Meidensha Group Total Company Regional Sales 2016 (%)

Figure 4.44 Bharat Heavy Electricals Limited Total Company Regional Sales 2016 (%)

Figure 4.45 Bharat Heavy Electricals Limited Company Sales 2011-2016 (US$m, AGR %)

Figure 4.46 Bharat Heavy Electricals Limited Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2016 (US$m, AGR %)

Figure 4.47 Elsewedy Electric Company Sales 2011-2016 (US$m, AGR %)

Figure 4.48 Elsewedy Electric Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2016 (US$m, AGR %)

Figure 4.49 Chem Group Company Sales 2011-2016 (US$m, AGR %)

Figure 4.50 Chem Group Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2016 (US$m, AGR %)

Figure 4.51 Larsen & Toubro Limited Total Company Regional Sales 2016 (%)

Figure 4.52 Larsen & Toubro Limited Company Sales 2011-2016 (US$m, AGR %)

Figure 4.53 Larsen & Toubro Limited Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2016 (US$m, AGR %)

Figure 4.54 BGR Energy Systems Limited Company Sales 2011-2016 (US$m, AGR %)

Figure4.55 BGR Energy Systems Limited Sales in the Business Segment that includes Gas Insulated Substation Market 2011-2016 (US$m, AGR %)

3M

ABB Ltd.

Alinta Energy

Alstom

American Electric Power (AEP)

Asia General Electric Co. Ltd (AGE)

Asia General Transformer Co. Ltd (AGT)

BGR Energy Systems Limited

Bharat Heavy Electricals Limited

Chung-Hsin Electric and Machinery Manufacturing Corp. (CHEM)

Crompton Greaves Limited

Eaton Corporation Plc

Egyptian Electricity Transmission Company (EETC)

Energinet.dk

Elsewedy Electric

Fuji Electric Co. Ltd

GEA Energietechnik GmbH

General Electric Company

GE Power Statnett

Himachal Pradesh Power Transmission Corporation Limited

Nissin Electric Co., Ltd

Hitachi Ltd

HP Power Transmission Corporation Limited (HPPTCL)

Hyosung Corporation

Hyundai Heavy Industries

Iljin Electric

Kenya Power (KPLC)

L&T Construction

Larsen & Toubro Limited

Meidensha Corporation

Mistras Group

Mitsubishi Electric Corporation

Odisha Power Transmission Corporation Ltd

Orascom Construction

Pepco

Power Grid Company of Bangladesh

Power Grid Corporation India Ltd

Precise Electric MFG Co., Ltd

PT Twink Indonesia

Qatar General Water & Electricity Corporation

Red Electrica de Espana (REE)

Saudi Electric Company

Siemens AG

Schneider Electric SE

SP Energy Networks

The Power Grid Corporation India Ltd

Toshiba Transmission & Distribution Systems India Private Limited

Toyota Tsusho Corporation

Transmisora Electrica del Norte

UGL Pty Limited

West Bengal State Electricity Transmission Company Limited (WBSETCL)

Other Organisations Mentioned in this Report

Dubai Electricity & Water Authority (DEWA)

Egyptian Ministry of Electricity

National Grid Corporation of the Philippines

Public Service Electric & Gas (PSEG)

Qatar General Electricity & Water Corporation (KAHRAMAA)

Tamil Nadu Transmission Corporation

The Electricity Generating Authority of Thailand (EGAT)

US Energy Information Administration

Download sample pages

Complete the form below to download your free sample pages for Top 20 Gas Insulated Substation (GIS) Companies Report 2018

Related reports

-

The Gas Insulated Substation (GIS) Market Forecast 2018-2028

Visiongain has calculated that the global Gas Insulated Substation (GIS) Market will see a capital expenditure (CAPEX) of $26,069 mn...

Full DetailsPublished: 01 February 2018 -

The Electric Power Transmission & Distribution (T&D) Infrastructure Market Forecast 2018-2028

The latest research report from business intelligence provider Visiongain offers comprehensive analysis of the Electric Power Transmission & Distribution (T&D)...

Full DetailsPublished: 06 March 2018 -

Gas Insulated Transformer Market Forecast 2019-2029

The increased focus on a more efficient energy grid infrastructure has led Visiongain to publish this timely report. ...Full DetailsPublished: 06 November 2018 -

The Power Transformers Market Forecast 2018-2028

The increased focus on a more efficient energy grid infrastructure has led Visiongain to publish this timely report. The market...Full DetailsPublished: 27 July 2018 -

Grid-Scale Battery Storage Technologies Market Report 2018-2028

The latest research report from business intelligence provider Visiongain offers comprehensive analysis of the Grid Scale Battery Storage market. Visiongain...

Full DetailsPublished: 12 April 2018 -

The Concentrating Solar Power (CSP) Market Forecast 2018-2028

Visiongain has calculated that the global Concentrated Solar Power (CSP) Market will see a capital expenditure (CAPEX) of $12,568 mn...

Full DetailsPublished: 15 February 2018 -

Gas Turbine Upgrades Market Report 2018-2028

The gas turbine upgrades market is valued at $14.9bn and is expected to flourish in the next few years because...Full DetailsPublished: 26 September 2018 -

The Electric Power Substation Automation Market Forecast 2018-2028

Visiongain has calculated that the global Electric Power Substation Automation market will see a capital expenditure (CAPEX) of $38,881mn in...Full DetailsPublished: 20 December 2017

Download sample pages

Complete the form below to download your free sample pages for Top 20 Gas Insulated Substation (GIS) Companies Report 2018

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain energy reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and industry experts where possible but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain energy reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

“The Visiongain report was extremely insightful and helped us construct our basic go-to market strategy for our solution.”

H.

“F.B has used Visiongain to prepare two separate market studies on the ceramic proppants market over the last 12 months. These reports have been professionally researched and written and have assisted FBX greatly in developing its business strategy and investment plans.”

F.B

“We just received your very interesting report on the Energy Storage Technologies (EST) Market and this is a very impressive and useful document on that subject.”

I.E.N

“Visiongain does an outstanding job on putting the reports together and provides valuable insight at the right informative level for our needs. The EOR Visiongain report provided confirmation and market outlook data for EOR in MENA with the leading countries being Oman, Kuwait and eventually Saudi Arabia.”

E.S

“Visiongain produced a comprehensive, well-structured GTL Market report striking a good balance between scope and detail, global and local perspective, large and small industry segments. It is an informative forecast, useful for practitioners as a trusted and upto-date reference.”

Y.N Ltd

Association of Dutch Suppliers in the Oil & Gas Industry

Society of Naval Architects & Marine Engineers

Association of Diving Contractors

Association of Diving Contractors International

Associazione Imprese Subacquee Italiane

Australian Petroleum Production & Exploration Association

Brazilian Association of Offshore Support Companies

Brazilian Petroleum Institute

Canadian Energy Pipeline

Diving Medical Advisory Committee

European Diving Technology Committee

French Oil and Gas Industry Council

IMarEST – Institute of Marine Engineering, Science & Technology

International Association of Drilling Contractors

International Association of Geophysical Contractors

International Association of Oil & Gas Producers

International Chamber of Shipping

International Shipping Federation

International Marine Contractors Association

International Tanker Owners Pollution Federation

Leading Oil & Gas Industry Competitiveness

Maritime Energy Association

National Ocean Industries Association

Netherlands Oil and Gas Exploration and Production Association

NOF Energy

Norsk olje og gass Norwegian Oil and Gas Association

Offshore Contractors’ Association

Offshore Mechanical Handling Equipment Committee

Oil & Gas UK

Oil Companies International Marine Forum

Ontario Petroleum Institute

Organisation of the Petroleum Exporting Countries

Regional Association of Oil and Natural Gas Companies in Latin America and the Caribbean

Society for Underwater Technology

Society of Maritime Industries

Society of Petroleum Engineers

Society of Petroleum Enginners – Calgary

Step Change in Safety

Subsea UK

The East of England Energy Group

UK Petroleum Industry Association

All the events postponed due to COVID-19.

Latest Energy news

Visiongain Publishes Carbon Capture Utilisation and Storage (CCUS) Market Report 2024-2034

The global carbon capture utilisation and storage (CCUS) market was valued at US$3.75 billion in 2023 and is projected to grow at a CAGR of 20.6% during the forecast period 2024-2034.

19 April 2024

Visiongain Publishes Liquid Biofuels Market Report 2024-2034

The global Liquid Biofuels market was valued at US$90.7 billion in 2023 and is projected to grow at a CAGR of 6.7% during the forecast period 2024-2034.

03 April 2024

Visiongain Publishes Hydrogen Generation Market Report 2024-2034

The global Hydrogen Generation market was valued at US$162.3 billion in 2023 and is projected to grow at a CAGR of 3.7% during the forecast period 2024-2034.

28 March 2024

Visiongain Publishes Biofuel Industry Market Report 2024-2034

The global Biofuel Industry market was valued at US$123.2 billion in 2023 and is projected to grow at a CAGR of 7.6% during the forecast period 2024-2034.

27 March 2024