The latest research report from business intelligence provider Visiongain offers a comprehensive analysis of the Top Gas Insulated Substation (GIS) Companies.

The Gas Insulated Substation (GIS) is a compact assembly consisting of multiple components enclosed in a metallic covering with compressed sulphur hexafluoride (SF6) gas as an insulating medium. The concept of the gas insulated substation was introduced in 1920 when oil was used as the insulating medium in the system.

A substation is considered as one of the vital elements of power system infrastructure. Presently there are two types of substations primarily being used: Air Insulated Substation (AIS) and Gas Insulated Substation (GIS).

In the past few years, the demand for gas insulated substations has gained wide momentum across several countries. It is mainly due to its compact design and high-reliability index as compared to its counterpart air insulated substation (AIS).

With increasing concerns over energy security and carbon emission issues, there has been a significant increase in the adoption of renewable and nuclear sources for power generation. Increasing energy demand in several developing countries is, therefore, augmenting the demand for gas insulated substations (GIS).

Owing to the advantages of minimal space requirement, protection against pollution and safety, economic mobility and easy installation and commissioning at low operating costs there has been an increased adoption of gas insulated substations among residential, commercial and utility applications. Most of the gas insulated substation companies are looking forward to expanding their business presence through strategic supply agreements and partnerships.

Visiongain’s Top 20 Gas Insulated Substation (GIS) Companies will keep you informed and up to date with the developments in the market.

With reference to this report, it details the key investment trends in the global market

Analysis Total Company Sales, the share of total company sales from the company division that includes Gas Insulated Substation and information on Gas Insulated Substation Contracts / Projects / Programmes.

The report will answer questions such as:

– How is the Gas Insulated Substation market evolving?

– What is driving and restraining the Gas Insulated Substation market dynamics?

– Who are the leading players and what are their prospects for the development of gas insulated substation projects?

– How will the sector evolve as alliances form during the period between 2019 and 2029?

Four Reasons Why You Must Order and Read This Report Today:

1) Financial structure of 20 Leading players in the Gas Insulated Substation (GIS) market

– Total Company Sales (US$m)

– Research and Development (US$m)

– Company Overview

– Total Company Revenue by Region

– Company Revenue by Segment (US$ Bn)

2) The report reveals extensive details and analysis of Gas Insulated Substation (GIS) contracts, projects and programmes:

– Date

– Country

– Subcontractor

– Value (US$m)

– Product

– Details

3) The report provides Drivers and Restraints affecting the Gas Insulated Substation (GIS) Market

4) The report provides market share and detailed profiles of the leading companies operating within the Gas Insulated Substation (GIS) market:

– Alstom

– Bharat Heavy Electricals Limited (BHEL)

– Hyundai Electric

– Elsewedy Electric Co

– Crompton Greaves Limited

– CHEM

– Meidensha Corporation

– Nissin Electric

– Hyosung

– Mistras Group

– Hitachi

– ABB

– General Electric

– Siemens

– Mitsubishi Electric

– Fuji Electric

– Toshiba Corporation

– Schneider Electric

– Larsen & Toubro

– Eaton Electric

This independent 127-page report guarantees you will remain better informed than your competitors. With 88 tables and figures examining the GIS market space, the report gives you profiles of leading companies operating within the Gas Insulated Substation (GIS) market with financial analysis as well as in-depth analysis of contracts, projects and programmes.

This report is essential reading for you or anyone in the Energy sector. Purchasing this report today will help you to recognise those important market opportunities and understand the possibilities there. I look forward to receiving your order.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1. Report Overview

1.1. Global Gas Insulated Substation Market Overview

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report Include:

1.5 Who is This Report For?

1.6 Methodology

1.6.1 Secondary Research

1.6.2 Market Evaluation & Forecasting Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to the Gas Insulated Substation Market 2019-2029

2.1. Gas Insulated Substation Market Structure

2.2 Gas Insulated Substation Market Definition

2.3 Brief History of Gas Insulated Substation

2.4 Gas Insulated Substation Submarkets Definition

2.4.1 Gas Insulated Substation – Medium Voltage ( 72.5 kV) Submarket Definition

3. Global Gas Insulated Substation Market 2019-2029

3.1 Gas Insulated Substation Market Forecast 2019-2029

3.2 Gas Insulated Substation Market Drivers & Restraints

3.2.1 Drivers in the Gas Insulated Substation Market

3.2.1.1 Minimal Space Requirement

3.2.1.2 Protection Against Pollution and Safety Under Faulty Conditions

3.2.1.3 Economical Mobility of the Substation

3.2.1.4 Easy Installation and Commissioning and Low Operating Costs

3.2.1.5 Dielectric Strength of SF6

3.2.2 Restraints in the Gas Insulated Substation Market

3.2.2.1 High Initial Investment

3.2.2.2 Procurement and Supply of SF6 is Difficult

3.2.2.3 Regular Cleanliness to Avoid the System Breakdown

3.2.2.4 High Level Monitoring as Gas Leakage can be Harmful and Hazardous to Health

4. Top 20 Gas Insulated Substation Companies 2018

4.1 Leading 20 Companies in the Gas Insulated Substation Market

5. Company Profile

5.1 ABB

5.1.1 ABB Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

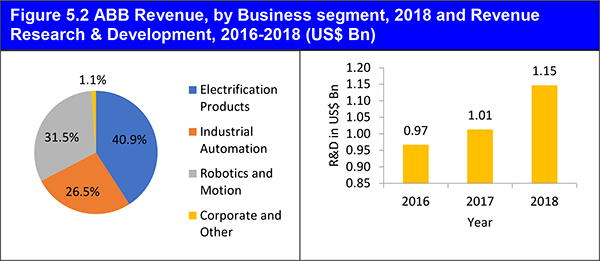

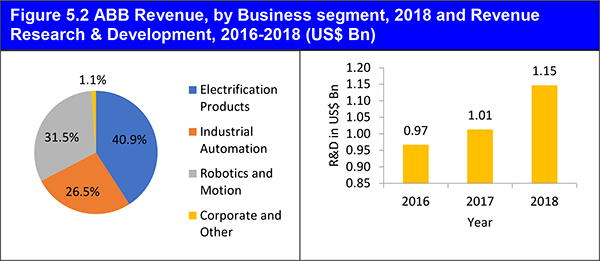

5.1.2 ABB Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018

5.1.3 ABB Group Substation Products

5.1.4 ABB Developments

5.1.5 ABB Analysis

5.2 Toshiba Corporation

5.2.1 Toshiba Corporation Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

5.2.2 Toshiba Corporation Revenue, by Business Segment, 2018 and Research & Development, 2016-2018

5.2.3 Toshiba Corporation GIS Products / Services

5.2.4 Toshiba Corporation Developments

5.2.5 Toshiba Corporation Analysis

5.3 Siemens AG Company

5.3.1 Siemens AG Company Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

5.3.2 Siemens AG Company Revenue, by Business Segment, 2018 and Research & Development, 2016-2018

5.3.3 Siemens AG GIS Products / Services

5.3.4 Siemens AG Recent Developments

5.3.5 Siemens AG Company Analysis

5.4 General Electric Company

5.4.1 General Electric Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

5.4.2 General Electric Revenue, by Business Segment, 2018 and Research & Development, 2016-2018

5.4.3 General Electric GIS Products / Services

5.4.4 General Electric Developments

5.4.5 General Electric Analysis

5.5 Eaton Corporation PLC

5.5.1 Eaton Corporation Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

5.5.2 Eaton Corporation Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018

5.5.3 Eaton Corporation GIS Products / Services

5.5.4 Eaton Corporation Recent Developments

5.5.5 Eaton Corporation Analysis

5.6 Schneider Electric

5.6.1 Schneider Electric Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

5.6.2 Schneider Electric Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018

5.6.3 Schneider Electric GIS Products / Services

5.6.4 Schneider Electric Developments

5.6.5 Schneider Electric Analysis

5.7 Fuji Electric Co. Ltd

5.7.1 Fuji Electric Co. Ltd Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

5.7.2 Fuji Electric Co. Ltd Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

5.7.3 Fuji Electric Co. Ltd GIS Products / Services

5.7.4 Fuji Electric Co. Ltd. Developments

5.7.5 Fuji Electric Co. Ltd Analysis

5.8 Hitachi

5.8.1 Hitachi Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

5.8.2 Hitachi Revenue, by Business segment, 2017 and Revenue Research & Development, 2015-2017

5.8.3 Hitachi GIS Products / Services

5.8.4 Hitachi Developments

5.8.5 Hitachi Analysis

5.9 Crompton Greaves Limited.

5.9.1 Crompton Greaves Limited, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

5.9.2 Crompton Greaves Limited Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018

5.9.3 Crompton Greaves Limited GIS Products / Services

5.9.4 Crompton Greaves Limited Analysis

5.10 Mitsubishi Electric

5.10.1 Mitsubishi Electric Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

5.10.2 Mitsubishi Electric Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018

5.10.3 Mitsubishi Electric GIS Products / Services

5.10.4 Mitsubishi Electric Developments

5.10.5 Mitsubishi Electric Analysis

5.11 Alstom Grid

5.11.1 Alstom Grid Revenue, by Geographic Region, 2019 and Revenue & Y-o-Y Growth, 2017-2019

5.11.2 Alstom Grid Revenue, by Business segment, 2019 and Revenue Research & Development, 2017-2019

5.11.3 Alstom Grid Substation Products

5.11.4 Alstom Grid Developments

5.11.5 Alstom Grid Analysis

5.12 Nissin Electric Co., Ltd.

5.12.1 Nissin Electric Co., Ltd. Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

5.12.2 Nissin Electric Co., Ltd. Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018

5.12.3 Nissin Electric Co., Ltd. Substation Products

5.12.4 Nissin Electric Co., Ltd. Developments

5.12.5 Nissin Electric Co., Ltd. Analysis

5.13 Hyosung Corporation

5.13.1 Hyosung Corporation Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

5.13.2 Hyosung Corporation Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018

5.13.3 Hyosung Corporation Substation Products

5.13.4 Hyosung Corporation Developments

5.13.5 Hyosung Corporation Analysis

5.14 Larsen & Toubro Ltd.

5.14.1 Larsen & Toubro Ltd. Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

5.14.2 Larsen & Toubro Ltd. Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018

5.14.3 Larsen & Toubro Ltd. Substation Products

5.14.4 Larsen & Toubro Ltd. Developments

5.14.5 Larsen & Toubro Ltd. Analysis

5.15 Chung-Hsin Electric and Machinery Manufacturing Corp. (CHEM)

5.15.1 CHEM Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

5.15.2 CHEM Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018

5.15.3 CHEM Substation Products

5.15.4 CHEM Developments

5.15.5 CHEM Analysis

5.16 Elsewedy Electric

5.16.1 Elsewedy Electric Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

5.16.2 Elsewedy Electric Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018

5.16.3 Elsewedy Electric Substation Products

5.16.4 Elsewedy Electric Developments

5.16.5 Elsewedy Electric Analysis

5.17 Mistras Group

5.17.1 Mistras Group Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

5.17.2 Mistras Group Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018

5.17.3 Mistras Group Substation Products

5.17.4 Mistras Group Developments

5.17.5 Mistras Group Analysis

5.18 Bharat Heavy Electricals Limited (BHEL)

5.18.1 Bharat Heavy Electricals Limited (BHEL)Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

5.18.2 Bharat Heavy Electricals Limited (BHEL)Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018

5.18.3 Bharat Heavy Electricals Limited (BHEL)Substation Products

5.18.4 Bharat Heavy Electricals Limited (BHEL) Developments

5.18.5 Bharat Heavy Electricals Limited (BHEL) Analysis

5.19 Hyundai Heavy Industries

5.19.1 Hyundai Heavy Industries Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

5.19.2 Hyundai Heavy Industries Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018

5.19.3 Hyundai Heavy Industries Substation Products

5.19.4 Hyundai Heavy Industries Developments

5.19.5 Hyundai Heavy Industries Analysis

5.20 Meidensha Corp.

5.20.1 Meidensha Corp. Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

5.20.2 Meidensha Corp. Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018

5.20.3 Meidensha Corp. Substation Products

5.20.4 Meidensha Corp. Developments

5.20.5 Meidensha Corp. Analysis

6. SWOT Analysis of the Gas Insulated Substation Market 2019-2029

7. Conclusions & Recommendations

8. Glossary

List of Tables

Table 2.1 Gas Insulated Substation Market Drivers & Restraints

Table 3.1 Global Gas Insulated Substation Market Forecast 2019-2029 (US$bn, AGR %, CAGR %, Cumulative)

Table 3.2 Gas Insulated Substation Market Drivers & Restraints

Table 4.1 Leading 20 Companies in the Gas Insulated Substation 2018 (Market Ranking, Total Revenue $Bn, Revenue in Gas Insulated Substation $Bn, Market Share %)

Table 5.1 ABB Overview

Table 5.2 ABB Group Substation Products

Table 5.3 Toshiba Corporation Overview

Table 5.4 BAE Systems Air & Defense Missile Systems Products / Services

Table 5.5 Siemens AG Company overview

Table 5.6 Siemens AG Company GIS Products / Services

Table 5.7 General Electric Company Overview

Table 5.8 General Electric GIS Products / Services

Table 5.9 Eaton Corporation Overview

Table 5.10 Eaton Corporation GIS Products / Services

Table 5.11 Schneider Electric Overview

Table 5.12 Schneider Electric GIS Products / Services

Table 5.13 Fuji Electric Co.Ltd Overview

Table 5.14 Fuji Electric Co.Ltd GIS Products / Services

Table 5.15 Safran Group Overview

Table 5.16 Hitachi GIS Products / Services

Table 5.17 Crompton Greaves Limited Overview

Table 5.18 Crompton Greaves Limited GIS Products / Services

Table 5.19 Mitsubishi Electric Overview

Table 5.20 Mitsubishi Electric GIS Products / Services

Table 5.21 Alstom Grid Overview

Table 5.22 Alstom Grid Substation Products

Table 5.23 Nissin Electric Co., Ltd. Overview

Table 5.24 Nissin Electric Co., Ltd. Substation Products

Table 5.25 Hyosung Corporation Overview

Table 5.26 Hyosung Corporation Group Substation Products

Table 5.27 Larsen & Toubro Ltd. Overview

Table 5.28 Larsen & Toubro Ltd. Substation Products

Table 5.29 CHEM Overview

Table 5.30 CHEM Substation Products

Table 5.31 Elsewedy Electric Overview

Table 5.32 Elsewedy Electric Substation Products

Table 5.33 Mistras Group Overview

Table 5.34 Mistras Group Substation Products

Table 5.35 Bharat Heavy Electricals Limited (BHEL) Overview

Table 5.36 Bharat Heavy Electricals Limited (BHEL)Group Substation Products

Table 5.37 Hyundai Heavy Industries Overview

Table 5.38 Hyundai Heavy Industries Substation Products

Table 5.39 Meidensha Corp. Overview

Table 5.40 ABB Group Substation Products

Table 6.1 Global Gas Insulated Substation Market SWOT Analysis 2019-2029

List of Figures

Figure 2.1 Global Gas Insulated Substation Market Segmentation Overview

Figure 3.1 Global Gas Insulated Substation Market Forecast 2019-2029 (US$bn, AGR %)

Figure 4.1 Leading 20 Companies in the GIS Market 2018 (% share)

Figure 5.1 ABB Revenue, by Geographic Region, 2018 (% Share) and Revenue & Y-o-Y Growth, 2016-2018 (US$ Bn, Y-o-Y %)

Figure 5.2 ABB Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018 (US$ Bn)

Figure 5.3 Toshiba Corporation Revenue, by Geographic Region, 2018 (% Share) and Revenue & Y-o-Y Growth, 2016-2018 (US$ Bn, Y-o-Y %)

Figure 5.4 Toshiba Corporation Revenue, by Business Segment, 2017 (% Share) and Research & Development, 2015-2017 (US$ Bn), 2016-2018

Figure 5.5 Siemens AG Company Revenue, by Geographic Region, 2017 (% Share) and Revenue & Y-o-Y Growth, 2015-2017 (US$ Bn, Y-o-Y %)

Figure 5.6 Siemens AG Company Revenue, by Business Segment, 2018 and Research & Development, 2016-2018

Figure 5.7 General Electric Revenue, by Geographic Region, 2018 (% Share) and Revenue & Y-o-Y Growth, 2016-2018 (US$ Bn, Y-o-Y %)

Figure 5.8 General Electric Revenue, by Business Segment, 2018 (% Share) and Research & Development, 2016-2018 (US$ Bn)

Figure 5.9 Eaton Corporation Revenue, by Geographic Region, 2018 (% Share) and Revenue & Y-o-Y Growth, 2016-2018 (US$ Bn, Y-o-Y %)

Figure 5.10 Eaton Corporation Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018 (US$ Mn)

Figure 5.11 Schneider Electric Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2016-2018

Figure 5.12 Schneider Electric Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018

Figure 5.13 Fuji Electric Co. Ltd Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

Figure 5.14 Fuji Electric Co. Ltd Research & Development, 2015-2017

Figure 5.15 Hitachi, by Geographic Region, 2017 (% Share) and Revenue & Y-o-Y Growth, 2015-2017 (US$ Bn, Y-o-Y %)

Figure 5.16 Hitachi Revenue, by Business segment, 2017 and Revenue Research & Development, 2015-2017 (US$ Bn)

Figure 5.17 Aerojet Rocketdyne Revenue, by Region, 2018, by Revenue & Y-o-Y Growth, 2016-2018 (US$ Bn, Y-o-Y %)

Figure 5.18 Crompton Greaves Limited Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018 (US$ Mn)

Figure 5.19 Mitsubishi Electric Revenue, by Geographic Region, 2017 (% Share) and Revenue & Y-o-Y Growth, 2015-2017 (US$ Bn, Y-o-Y %)

Figure 5.20 Mitsubishi Electric Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018 (US$ Mn)

Figure 5.21 Alstom Grid Revenue, by Geographic Region, 2019 (% Share) and Revenue & Y-o-Y Growth, 2017-2019 (US$ Bn, Y-o-Y %)

Figure 5.22 Alstom Grid Revenue, by Business segment, 2019 and Revenue Research & Development, 2017-2019 (US$ Mn)

Figure 5.23 Nissin Electric Co., Ltd. Revenue, by Geographic Region, 2018 (% Share) and Revenue & Y-o-Y Growth, 2016-2018 (US$ Mn, Y-o-Y %)

Figure 5.24 Nissin Electric Co., Ltd. Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018 (US$ Mn)

Figure 5.25 Hyosung Corporation Revenue, by Geographic Region, 2018 (% Share) and Revenue & Y-o-Y Growth, 2016-2018 (US$ Bn, Y-o-Y %)

Figure 5.26 Hyosung Corporation Research & Development, 2016-2018 (US$ Mn)

Figure 5.27 Larsen & Toubro Ltd. Revenue, by Geographic Region, 2018 (% Share) and Revenue & Y-o-Y Growth, 2016-2018 (US$ Bn, Y-o-Y %)

Figure 5.28 Larsen & Toubro Ltd. Revenue, by Business segment, 2018

Figure 5.29 CHEM Revenue, by Geographic Region, 2018 (% Share) and Revenue & Y-o-Y Growth, 2016-2018 (US$ Mn, Y-o-Y %)

Figure 5.30 CHEM Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018 (US$ Mn)

Figure 5.31 Elsewedy Electric Revenue, by Geographic Region, 2018 (% Share) and Revenue & Y-o-Y Growth, 2016-2018 (US$ Bn, Y-o-Y %)

Figure 5.32 Elsewedy Electric Revenue, by Business segment, 2018

Figure 5.33 Mistras Group Revenue, by Geographic Region, 2018 (% Share) and Revenue & Y-o-Y Growth, 2016-2018 (US$ Bn, Y-o-Y %)

Figure 5.34 Mistras Group Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018 (US$ Bn)

Figure 5.35 Bharat Heavy Electricals Limited (BHEL)Revenue, by Geographic Region, 2018 (% Share) and Revenue & Y-o-Y Growth, 2016-2018 (US$ Bn, Y-o-Y %)

Figure 5.36 Bharat Heavy Electricals Limited (BHEL)Revenue, by Business segment, 2018 and Revenue Research & Development, 2017-2018 (US$ Mn)

Figure 5.37 Hyundai Heavy Industries Revenue, by Geographic Region, 2018 (% Share) and Revenue & Y-o-Y Growth, 2016-2018 (US$ Bn, Y-o-Y %)

Figure 5.38 Hyundai Heavy Industries Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018 (US$ Mn)

Figure 5.39 Meidensha Corp. Revenue, by Geographic Region, 2018 (% Share) and Revenue & Y-o-Y Growth, 2016-2018 (US$ Bn, Y-o-Y %)

Figure 5.40 Meidensha Corp. Revenue, by Business segment, 2018 and Revenue Research & Development, 2016-2018 (US$ Bn)