Industries > Aviation > Top 20 Companies Developing Commercial Electric Aircraft 2020

Top 20 Companies Developing Commercial Electric Aircraft 2020

Competitive Landscape Analysis by Major Developments and Research and Developments Spending in the Electric Aircraft and Electric Propulsion Technology

Commercial electric aircraft is an aircraft powered by electric motors. Electric power may be supplied by a variety of methods including batteries, ground power cables, solar cells, ultra capacitors, fuel cells and power beaming. Electrification of aircrafts not only offers the capability to reduce emissions, but could also unlock the potential for more energy-efficient aircrafts and brand new architectures and use cases. Electrification could also revolutionise the supply base in the aerospace industry, posing an existential threat to incumbent suppliers and facilitating access for new entrants. There are two concurrent technological trends in the electric aircraft developments, this includes More Electric Aircraft and Electrical Propulsion aircrafts. The More Electric Aircraft (MEA) is an evolutionary trend in which each successive generation of aircraft has typically employed more electrical equipment in place of systems that would previously have been mechanical, hydraulic or pneumatic, and Electrical Propulsion, a potentially revolutionary new approach which has gained much recent publicity, and which, if adopted widely, would transform large segments of the aerospace industry, affecting not only propulsion, but also aircraft systems, and leading to radically new aircraft architectures. Despite advances in the electrification, electrical systems deployed in the aircrafts do come with the drawbacks of requiring advances in power electronics to handle the ever-increasing loads, and the need to dissipate, or put to use, excess heat created by losses within the electrical power chain. However, as a result of the advantages of increasing electrification in terms of reduced weight, greater reliability, lower maintenance costs and increased efficiency, it is expected that a continuation or even acceleration of the MEA trend as long as the current higher costs of some electrical systems can be restrained. As safety in aviation is of paramount importance, evolutionary changes are expected, implemented through step-by-step adoption of electrically-powered equipment in additional aircraft systems.

The major 20 players identified in the value chain which are currently developing commercial electric aircrafts and their necessary components includes Boeing, Airbus S.A., Wright Electric, Israel Aerospace Industries, Bye Aerospace, Dufour Aerospace, Electric Aircraft Corporation, Eviation Alice, Faradair, Longanair Ltd., Ampaire, Zunum Aero, Joby Aviation, Embraer SA, Pipistrel, Siemens, Rolls Royce, Magnix, GE Aviation, and Dixion Motors Inc.

Leading 20 companies developing Commercial Electric Aircraft responds to your need for definitive market data.

Read on to discover how you can exploit the future business opportunities emerging in this sector. Visiongain’s new study tells you and tells you NOW.

The 113-page report provides clear, detailed insight into the global Commercial Electric Aircraft companies. Discover the key drivers and challenges affecting the market.

Also in this report are project tables covering over 200 leading current and future projects

By ordering and reading our brand-new report today, you stay better informed and ready to act.

Report Scope

The report delivers considerable added value by revealing:

• 249 tables, charts and graphs are analysing and revealing the growth prospects and outlook for the Commercial Electric Aircraft market.

• Leading 20 Companies developing commercial electric aircraft 2020

• Commercial Electric Aircraft market provides CAPEX and CAPACITY forecasts and analysis from 2020-2030 for three submarkets:

The report will answer questions such as:

• Who are the leading companies in the Commercial Electric Aircraft industry?

• What is their strategy?

• What is their existing processing capacity and where is it based?

• What are their core strengths and weaknesses?

• Do they have expansion plans, and if so where are they likely to go?

• What is driving and restraining the involvement of each leading company within the market?

• What is the total size of the Commercial Electric Aircraft market in 2015 and 2016? How much will it grow and why?

• What are the leading countries for the development of the Commercial Electric Aircraft market?

• Which individual technologies will prevail and how will these shifts be responded to?

• In what instances is Commercial Electric Aircraft a core part of a company strategy and, if so, why?

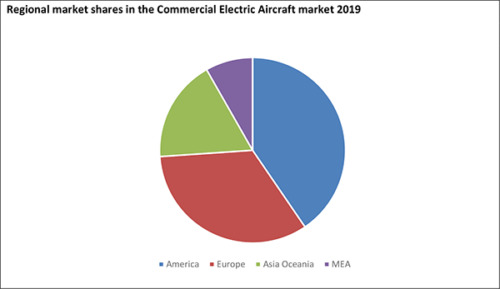

Regional Commercial Electric Aircraft market forecasts from 2020-2030 with drivers and restraints for the countries including:

• Canada

• U.S.

• Brazil

• U.K.

• Norway

• Germany

• France

• Mexico

• Italy

• South Africa

• Egypt

• China

• Japan

• Malaysia

• Indonesia

• India

• Saudi Arabia

• Kuwait

• Company profiles for the leading Commercial Electric Aircraft companies

• Boeing

• Airbus

• Dufour Aerospace

• Eviation Alice

• Israel Aerospace Industries

• Faradair

• Roll-Royce Holdings Plc

• Wright Electric

• Zunum Aero Inc.

• GE Aviation

• Longanair Ltd.

• Bye Aerospace

• Siemens

• Pipistrel USA

• Ampaire

• Joby Aviation

• Electric Aircraft Corporation

• Magnix

• Embraer

• Duxon Motors

Conclusions and recommendations which will aid decision-making

How will you benefit from this report?

• Keep your knowledge base up to speed. Don’t get left behind

• Reinforce your strategic decision-making with definitive and reliable market data

• Learn how to exploit new technological trends

• Realise your company’s full potential within the market

• Understand the competitive landscape and identify potential new business opportunities & partnerships

Who should read this report?

• Anyone with involvement in the Commercial Electric Aircraft products

• Commercial Electric Aircraft market analysts

• Commercial Electric Aircraft investors

• Business, marketing

• Competitive intelligence manager

• Director

• Strategic marketing

• Business intelligence

• Competitive intelligence analyst

• Consultant

• Marketing manager

• Marketing executive

• Marketing consultant

• Business development manager

• Strategy director

• Strategic affairs

• Strategic development

• Business Seat Types manager

Buy our report today Top 20 Commercial Electric Aircraft Companies : Competitive Landscape Analysis by Major Developments and Research and Developments Spending in the Electric Aircraft and Electric Propulsion Technology. Avoid missing out by staying informed – order our report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1. Report Overview

1.1 Report Benefits & Highlights

1.2 Why You Should Read This Report

1.3 Report Structure

1.4 How This Report Delivers

1.5 Who is This Report for?

1.6 Methodology

1.6.1 Primary Research

1.6.2 Secondary Research

1.6.3 Market Evaluation & Forecasting Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to the Commercial Electric Aircraft Market

2.1 Commercial Electric Aircraft Market Definition & Overview

2.2 Global Commercial Electric Aircraft Market Dynamics 2020

2.2.1 Factors Driving the growth of the Market

2.2.1.2 Rising focus of airline companies towards reducing CO2 will primarily drive the global Commercial Electric Aircraft Market

2.2.1.3 Partnership with the regulators and companies operating in the value could significantly driver the growth of the market in near future

2.2.1.4 Evolution of Aerospace engineering courses in Universities integrated with electrical engineering will drive the growth of the market

2.2.2 Factors Restraining the growth of the Market

2.2.2.1 Financial hurdles for startups companies aiming towards the development of electric aircraft may restrain the growth of the market

2.2.2.2 Current battery offerings are identified as one of the major hurdles towards the development of commercial electric aircraft

2.2.3 Major Trends in the Global Commercial Electric Aircraft Market 2020 – 2030

Technological Development

2.2.3.1 China is expected to become one of the major development centers of commercial electric aircraft in the future

3. Commercial Electric Aircraft Market Projects and Developments Analysis

3.1 Development Analysis by Aircraft Manufacturer Type

3.2 Development Analysis by Location of Aircraft Manufacturer

3.3 Development Cost Analysis of a Commercial Electric Hybrid Aircraft

3.4 Why Electric / Battery Option is more efficient than other conventional sources of energy to power aircraft?

3.4.1 Developments in battery performance is one of the major factor behind development of 3.4.2 commercial electric aircraft

3.4.2 Environmental concerns supporting transition to electrically powered automotive vehicles presents favourable opportunities for the development of battery powered electric aircraft

3.4.3 Enhanced Efficiency combined with reduced emission standards unlocks potential for more energy efficient aircrafts

3.4.5 Storage density concerns may inhibit growth but developments in new material technology will provide increase in the number of applications for batteries in the large aerial application

3.5 Economics of developing and using electric aircraft over fuel based aircrafts (savings/revenue/maintenance cost)

4. Competitor Positioning in the Commercial Electric Aircraft Market 2020

4.1 20 leading Established Companies in the Commercial Electric Aircraft Market 2019

4.2 Assessing the Commercial Electric Aircraft Market Landscape in 2020

4.3 Most Recent Developments / Programmes in the Commercial Electric Aircraft Market 2020 By Year (2018-2020), By Company

4.4 Top 20 companies, comparing total investment/ current status/ performance/ expected launch/ technology used to build the aircraft

5. Leading 20 Established Commercial Electric Aircraft Companies

5.1 The Boeing Company

5.1.1 The Boeing Company Commercial Electric Aircraft Selected Developments

5.1.2 The Boeing Company Total Company Sales 2014-2018

5.1.3 The Boeing Company Sales Share by Segment of Business 2018

5.1.4 The Boeing Company Net Income 2014-2018

5.1.5 The Boeing Company Regional Emphasis / Focus

5.1.6 The Boeing Company Organisational Structure / Subsidiaries

5.1.7 The Boeing Company Analysis

5.2 Airbus Group SE

5.2.1 Airbus Group SE Commercial Electric Aircraft Selected Developments

5.2.2 Airbus Group SE Total Company Sales 2014-2018

5.2.3 Airbus Group SE Sales by Segment of Business, 2018

5.2.4 Airbus Group SE Regional Emphasis

5.2.5 Airbus Group SE Organisational Structure / Notable Subsidiaries

5.2.6 Airbus Group Analysis

5.3 Wright Electric Inc.

5.3.1 Wright Electric Inc. Commercial Electric Aircraft Selected Developments

5.3.2 Wright Electric Inc. Aircraft Performance Analysis

5.3.3 Wright Electric Inc. Analysis

5.4 Israel Aerospace Industries (IAI)

5.4.1 Israel Aerospace Industries (IAI) Commercial Electric Aircraft 2013-2018

5.4.2 Israel Aerospace Industries (IAI) Total Company Sales 2013-2017

5.4.3 Israel Arropase Industries (IAI) Regional Emphasis

5.4.4 Israel Aerospace Industries (IAI) Organisational Structure / Notable Subsidiaries

5.4.5 Israel Aerospace Industries (IAI) Analysis

5.5 Bye Aerospace

5.5.1 Bye Aerospace Commercial Electric Aircraft Selected Developments

5.5.2 Bye Aerospace Aircraft Performance Analysis

5.5.3 Bye Aerospace Analysis

5.6 Dufour Aerospace

5.6.1 Dufour Aerospace Commercial Electric Aircraft Selected Developments

5.6.2 Dufour Aerospace Aircraft Performance Analysis

5.6.3 Dufour Aerospace Analysis

5.7 Eviation Alice

5.7.1 Eviation Alice Commercial Electric Aircraft Selected Developments

5.7.2 Eviation Alice Aircraft Performance Analysis

5.7.3 Eviation Alice Analysis

5.8 Faradair

5.8.1 Faradair Commercial Electric Aircraft Selected Developments

5.8.2 Faradair Aircraft Component Performance Analysis

5.8.3 Faradair Analysis

5.9 Longnair Limited

5.9.1 Loganair Limited Commercial Electric Aircraft Selected Developments

5.9.2 Loganair Limited Analysis

5.10 Ampaire Inc.

5.10.1 Ampaire Inc. Commercial Electric Aircraft Selected Developments

5.10.2 Ampaire Inc. Aircraft Performance Analysis

5.10.3 Ampaire Inc. Analysis

5.11 Zunum Aero Inc.

5.11.1 Zunum Aero Inc. Commercial Electric Aircraft Selected Developments

5.11.2 Zunum Aero Inc. Aircraft Performance Analysis

5.11.3 Zunum Aero Inc. Analysis

5.12 Electric Aircraft Corporation

5.12.1 Electric Aircraft Corporation Aircraft Performance Analysis

5.12.2 Electric Aircraft Corporation Analysis

5.13 Pipistrel USA

5.13.1 Pipistrel USA Commercial Electric Aircraft Selected Developments

5.13.2 Pipistrel USA Aircraft Performance Analysis

5.13.3 Pipistrel USA Analysis

5.14 Joby Aviation

5.14.1 Joby Aviation Commercial Electric Aircraft Selected Developments

5.14.2 Joby Aviation Aircraft Performance Analysis

5.14.3 Joby Aviation Analysis

5.15 Rolls-Royce Holdings Plc

5.15.1 Rolls-Royce Holdings Plc Commercial Electric Aircraft Selected Developments

5.15.2 Rolls-Royce Holdings Plc Total Company Sales 2014-2018

5.15.3 Rolls-Royce Holdings Plc Sales by Segment of Business, 2018

5.15.4 Rolls-Royce Holdings Plc Regional Emphasis

5.15.5 Rolls-Royce Holdings Plc Analysis

5.16 Siemens

5.16.1 Siemens Commercial Electric Aircraft Selected Developments

5.16.2 Siemens Total Company Sales 2014-2018

5.16.3 Siemens Sales by Segment of Business, 2018

5.16.4 Siemens Regional Emphasis

5.16.5 Siemens Analysis

5.17 Magnix

5.17.1 Magnix Commercial Electric Aircraft Selected Developments

5.17.2 Magnix Aircraft Component Performance Analysis

5.17.3 Magnix Analysis

5.18 Embraer S.A.

5.18.1 Embraer S.A. Commercial Electric Aircraft Selected Developments

5.18.2 Embraer S.A. Total Company Sales 2014-2018

5.18.3 Embraer S.A. Sales Share by Segment of Business 2018

5.18.4 Embraer S.A. Net Income 2014-2018

5.18.5 Embraer S.A. Regional Emphasis / Focus

5.18.6 Embraer S.A. Analysis

5.19 GE Aviation

5.19.1 GE Aviation Commercial Electric Aircraft Selected Developments

5.19.2 Ge Aviation Analysis

5.20 Duxion Motors Inc.

5.20.1 Duxion Motors Inc. Commercial Electric Aircraft Selected Developments

5.20.2 Duxion Motors Inc. Aircraft Propulsion Systems Technologies

5.20.3 Duxion Motors Inc. Analysis

5.21 Other Notable Companies Involved in the Commercial Electric Aircraft Market 2019

6. Conclusions and Recommendations

7. Strategic Overview of the companies operating in the development of the Commercial Electric

7.1 Aircraft 2020

7.2 Strategic partnership among eco-system players to enhance product development in the market space

7.3 Establish companies acquiring and investing in technology savvy start-ups to enhance the development of commercial electric aircraft

7.4 Collaborative working among companies to establish industrial base for component manufacturing will bolster the developments in the commercial electric aircraft

8. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 1.1 Sample Company Sales by Geographical Area 2015-2019 (US$m, AGR%)

Table 3.1 Hybrid Electric Aircraft Cost Analysis

Table 3.2 Future Chemical Battery Energy Systems

Table 3.3: Cost per available seat mile (CASM) of the two common regional jets Embraer 145 (50 seater), 190 (100 seater), and a hypothetical hybrid version of the EMB 145. Units are US cent

Table 4.1 Leading 20 Commercial Electric Aircraft Companies 2019 (Market Ranking, Commercial Electric Aircraft Research and Development Spending, Market Share %)

Table 4.2 Most Recent Developments / Programmes in the Commercial Electric Aircraft By Year (2018-2020), By Company

Table 4.3 Top 20 companies, comparing total investment/ current status/ performance/ expected launch/ technology used to build the aircraft

Table 1.1 Sample Company Sales by Geographical Area 2015-2019 (US$m, AGR%)

Table 3.1 Hybrid Electric Aircraft Cost Analysis

Table 3.2 Future Chemical Battery Energy Systems

Table 4.1 Leading 20 Commercial Electric Aircraft Companies 2019 (Market Ranking, Commercial Electric Aircraft Research and Development Spending, Market Share %)

Table 4.2 Most Recent Developments / Programmes in the Commercial Electric Aircraft By Year (2018-2020), By Company

Table 4.3 Top 20 companies, comparing total investment/ current status/ performance/ expected launch/ technology used to build the aircraft

Table 5.1 The Boeing Company Overview 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.2 Selected Recent The Boeing Commercial Electric Aircraft Selected Developments (Date, Country, Value US$m, Product, Details)

Table 5.3 The Boeing Company Total Company Sales 2014-2018 (US$m, AGR %)

Table 5.4 The Boeing Company Net Income 2014-2018 (US$m, AGR %)

Table 5.5 The Boeing Company Subsidiaries (Subsidiary, Location)

Table 5.6 Airbus Group SE Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.7 Selected Recent Airbus Group SE Commercial Electric Aircraft Developments (Date, Product & Details)

Table 5.8 Airbus Group SE Total Company Sales 2014-2018 (US$m, AGR%)

Table 5.9 Airbus Group SE Notable Subsidiaries 2019 (Subsidiary, Location)

Table 5.10 Wright Electric Inc. Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.11 Selected Recent Wright Electric Inc. Commercial Electric Aircraft Developments (Date, Product & Details)

Table 5.12 Israel Aerospace Industries (IAI) Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.13 Selected Recent Israel Aerospace Industries (IAI) Border Security Contracts & Programmes 2013-2018 (Date, Country, Value US$m, Product & Details)

Table 5.14 Israel Aerospace Industries (IAI) Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.15 Israel Aerospace Industries (IAI) Notable Subsidiaries 2018 (Subsidiary, Location)

Table 5.16 Bye Aerospace Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.17 Selected Recent Bye Aerospace Commercial Electric Aircraft Developments (Date, Product & Details)

Table 5.18 Dufour Aerospace Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.19 Selected Recent Dufour Aerospace Commercial Electric Aircraft Developments (Date, Product & Details)

Table 5.20 Eviation Alice Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.21 Selected Recent Eviation Alice Commercial Electric Aircraft Developments (Date, Product & Details)

Table 5.22 Faradair Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, Website)

Table 5.23 Selected Recent Faradair Commercial Electric Aircraft Developments (Date, Product & Details)

Table 5.24 Loganair Limited Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.25 Selected Recent Loganair Limited Commercial Electric Aircraft Developments (Date, Product & Details)

Table 5.26 Ampaire Inc. Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.27 Selected Recent AMPAIRE INC. Commercial Electric Aircraft Developments (Date, Product & Details)

Table 5.28 Zunum Aero Inc. Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.29 Selected Recent Zunum Aero Inc. Commercial Electric Aircraft Developments (Date, Product & Details)

Table 5.30 Electric Aircraft Corporation Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.31 Pipistrel Usa Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.32 Selected Recent Pipistrel USA Commercial Electric Aircraft Developments (Date, Product & Details)

Table 5.33 Joby Aviation Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.34 Selected Recent Joby Aviation Commercial Electric Aircraft Developments (Date, Product & Details)

Table 5.35 Rolls-Royce Holdings Plc Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, Website)

Table 5.36 Selected Recent Rolls-Royce Holdings Plc Commercial Electric Aircraft Developments (Date, Product & Details)

Table 5.37 Rolls-Royce Holdings Plc Total Company Sales 2014-2018 (US$m, AGR%)

Table 5.38 Siemens Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, Website)

Table 5.39 Selected Recent Siemens Commercial Electric Aircraft Developments (Date, Product & Details)

Table 5.40 Siemens Total Company Sales 2014-2018 (US$m, AGR%)

Table 5.41 Magnix Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.42 Selected Recent Magnix Commercial Electric Aircraft Developments (Date, Product & Details)

Table 5.43 Embraer S.A Overview 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, No. of Employees, Website)

Table 5.44 Selected Recent Embraer S.A. Commercial Electric Aircraft Selected Developments (Date, Country, Value US$m, Product, Details)

Table 5.45 Embraer S.A. Total Company Sales 2014-2018 (US$m, AGR %)

Table 5.46 Embraer S.A. Net Income 2014-2018 (US$m, AGR %)

Table 5.47 GE Aviation Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.48 Selected Recent Ge Aviation Commercial Electric Aircraft Developments (Date, Product & Details)

Table 5.49 Duxion Motors Inc. Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.50 Selected Recent Duxion Motors Inc. Commercial Electric Aircraft Developments (Date, Product & Details)

Table 5.51 Other Notable Companies Involved in the Commercial Electric Aircraft Market 2019

List of Figures

Figure 1.1 Sample Map of Company Regional Focus 2019

Figure 1.2 Sample Company Sales by Segment of Business 2015-2019 (US$m, AGR%)

Figure 3.1 Commercial Electric Aircraft Market Projects and Developments by Aircraft Manufacturer Type 2019 (%)

Figure 3.2 Commercial Electric Aircraft Market Projects and Developments by Aircraft Manufacturer Location 2019 (%)

Figure 5.1 Leading Commercial Electric Aircraft Companies R & D Spending Share 2019 (%)

Figure 5.2 The Boeing Company Sales Share by Business Segment 2018

Figure 5.3 The Boeing Company Sales Share by Geographical Location 2018 (% share)

Figure 5.4 The Boeing Company Organisational Structure 2020

Figure 5.5 Airbus Group SE Total Company Sales 2013-2017 (US$m, AGR%)

Figure 5.6 Airbus Group SE Sales by Segment of Business, 2018(%)

Figure 5.7 Airbus Group SE Primary International Operations 2019

Figure 5.8 Airbus Group SE Sales by Geographical Location, 2018

Figure 5.9 Airbus Group SE Organisational Structure 2019

Figure 5.10 Israel Aerospace Industries (IAI) Total Company Sales 2013-2017 (US$m, AGR%)

Figure 5.11 Israel Aerospace Industries (IAI) Primary International Operations 2018

Figure 5.12 Israel Aerospace Industries (IAI) Organisational Structure 2018

Figure 5.13 Rolls-Royce Holdings Plc Total Company Sales 2014-2018 (US$m, AGR%)

Figure 5.14 Rolls-Royce Holdings Plc Sales by Segment of Business, 2018(%)

Figur 5.15 Rolls-Royce Holdings Plc Sales by Geographical Location, 2018

Figure 5.16 Siemens Total Company Sales 2014-2018 (US$m, AGR%)

Figure 5.17 Siemens Sales by Segment of Business, 2018(%)

Figure 5.18 Siemens Sales by Geographical Location, 2018

Figure 5.19 Embraer S.A. Sales Share by Business Segment 2018

Figure 5.20 Embraer S.A. Sales Share by Geographical Location 2018 (% share)

AAR

Aer Lingus Group Plc

Aero Asahi Corporation

AeroAsia

AeroCentury Corp

Aerolineas Argentinas

Aeroman

Aeromexico

Air Astana

Air Berlin Plc

Air Canada

Air China

Air Dolomiti SpA

Air France

Air India Ltd

Air Lease Corp.

Air New Zealand

Air Transport Services Group (ATSG)

Airbus

Airbus Asia

Alaska Airlines Inc

Delta TechOps

Doric Nimrod Air Two Ltd.

Dubai Aviation Corporation

EASA

easyJet Plc

Egypt Air Holding Company

Elite Aerospace Inc

Embraer

Emirates Airline

Emirates Engineering

Epi Europrop International Gmbh

Era Helicopters LLC

ERJ aircraft

Esterline Technologies Corp.

Ethiopian Airlines Enterprise

Etihad Engineering

EVA Airways

FAA

Garuda Indonesia

GE Aviation

GE Celma

Download sample pages

Complete the form below to download your free sample pages for Top 20 Companies Developing Commercial Electric Aircraft 2020

Related reports

-

Aviation Blockchain Market Report 2020-2030

The recent developments in Aviation Blockchain technologies, has led Visiongain to publish this timely report. The $ 503.8 million Aviation...

Full DetailsPublished: 09 March 2020 -

Critical Infrastructure Protection (CIP) Market Report 2020-2030

In today's business environment, there is increase in the usage of digital solutions, connected devices, and IT systems due to...Full DetailsPublished: 20 November 2019 -

Commercial Aircraft NextGen Avionics Market Report 2020-2030

Commercial Aircraft NextGen Avionics market is projected to reach US$6 billion in 2020.

...Full DetailsPublished: 18 March 2020 -

Fiber Optic Networking in Aerospace and Defence Market Report 2020-2030

The recent developments in fiber optic networking in aerospace and defence technologies has led Visiongain to publish this timely report....

Full DetailsPublished: 20 August 2020 -

Governmental Geospatial Intelligence (GEOINT) Solutions Market Report 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global Governmental Geospatial Intelligence (GEOINT) Solutions market....

Full DetailsPublished: 31 July 2018 -

Military Satellites Market Report 2018-2028

The $14.63bn Military Satellite market is expected to flourish in the next few years because of increased demand for satellite...Full DetailsPublished: 24 September 2018 -

US Border Security Market Report 2019-2029

This report is essential reading for you or anyone in the aerospace and defence sector with an interest in Border...

Full DetailsPublished: 29 November 2018 -

Commercial Satellite Imaging (CSI) Market Report 2020-2030

Commercial Satellite Imagery market to total USD 7.98 billion in 2030.

...Full DetailsPublished: 18 March 2020 -

Border Security Market Report 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global border security market. Visiongain assesses that...

Full DetailsPublished: 29 May 2018 -

Aviation Cyber Security Market Report 2020-2030

Aviation Cyber Security market to total USD 5.87 billion in 2030.

...Full DetailsPublished: 24 January 2020

Download sample pages

Complete the form below to download your free sample pages for Top 20 Companies Developing Commercial Electric Aircraft 2020

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Visiongain aviation reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and automotive industry experts but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology please email jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Would you like to get the latest Visiongain aviation reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

Airline Passenger Experience Association (APEX)

Airlines for America

Airport Consultants Council (ACC)

Airports Council International (ACI)

Airports Council International-North America

American Association of Airport Executives

Arab Air Carriers Organization (AACO)

European Aerospace Cluster Partnership

Global Business Travel Association (GBTA)

International Air Transport Association (IATA)

Security Industry Association (SIA)

Security Manufacturers Coalition

Women in Aviation

World Aviation Services

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Aviation news

Aircraft Computers Market

The global Aircraft Computers market is projected to grow at a CAGR of 5.7% by 2034

24 June 2024

Space Mining Market

The global Space Mining market is projected to grow at a CAGR of 20.7% by 2034

07 June 2024

Connected Aircraft Market

The global Connected Aircraft market is projected to grow at a CAGR of 17.2% by 2034

05 June 2024

Satellite Ground Station Market

The global Satellite Ground Station market was valued at US$65.69 billion in 2023 and is projected to grow at a CAGR of 13.3% during the forecast period 2024-2034.

21 May 2024