Industries > Defence > Military Satellites Market Report 2018-2028

Military Satellites Market Report 2018-2028

Militarisation of Space for Defence, Security & Information: Forecasts for Military Satellite Buses (Standard, Micro and Nano), Payloads & Communication Terminals (Transponders, SATCOM, C4 Management & Networking Systems, Intelligence, Surveillance, Reconnaissance, Missile Early-Warning, Electro Optical Infrared Sensors), Launch Services (Launch Vehicles, Modules, Fuel, Ground-control, Infrastructure), Anti-Satellite Weapon Systems (ASAT)

• Do you need definitive military satellite market data?

• Succinct military satellite market analysis?

• Technological insight?

• Clear competitor analysis?

• Actionable business recommendations?

Read on to discover how this definitive 307 page defence report can transform your own research and save you time.

The $14.63bn Military Satellite market is expected to flourish in the next few years because of increased demand for satellite intelligence in South East.

Report highlights

151 tables and 156 figures

Major Military Satellite contracts and programmes

• Detailed tables of significant Military Satellite contracts, projects & programmes categorized by leading country and each leading company.

Analysis of key players in Military Satellite technologies

• The Boeing Company

• Israel Aerospace Industries

• Lockheed-Martin

• Mitsubishi Electric Corporation

• Raytheon Company

• Inmarsat

• ISS Reshetnev

• Orbital ATK Inc.

• SES S.A.

• Space Exploration Technologies Corporation

• ViaSat Inc

• Thales Alenia Space

Military Satellite Market outlook and analysis from 2018-2028

Military Satellite type forecasts and analysis from 2018-2028

• Satellite Buses Forecast 2018-2028

• Payloads & Communications Terminals Forecast 2018-2028

• Launch Services Forecast 2018-2028

• Anti-Satellite Weapons (ASATs) Forecast 2018-2028

Regional Military Satellite market forecasts from 2018-2028

• Australia Military Satellite Forecast 2018-2028

• China Military Satellite Forecast 2018-2028

• France Military Satellite Forecast 2018-2028

• Germany Military Satellite Forecast 2018-2028

• India Military Satellite Forecast 2018-2028

• Israel Military Satellite Forecast 2018-2028

• Italy Military Satellite Forecast 2018-2028

• France Military Satellite Forecast 2018-2028

• Italy Military Satellite Forecast 2018-2028

• Russia Military Satellite Forecast 2018-2028

• Spain Military Satellite Forecast 2018-2028

• United Kingdom Military Satellite Forecast 2018-2028

• United States Military Satellite Forecast 2018-2028

• Rest of the World Military Satellite Forecast 2018-2028

Key questions answered

• What does the future hold for the military satellite industry?

• Where should you target your business strategy?

• Which applications should you focus upon?

• Which disruptive technologies should you invest in?

• Which companies could you form strategic alliances with?

• Which company is likely to success and why?

• What business models should you adopt?

• What industry trends should you be aware of?

Target audience

• Military Satellite companies

• Defence contractors

• System integrators

• Avionics manufacturers

• Defence software providers

• Sub-component manufacturers

• Electronics companies

• R&D staff

• Consultants

• Analysts

• CEO’s

• CIO’s

• COO’s

• Business development managers

• Investors

• Governments

• Agencies

• Industry organisations

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1.1 Military Satellites Market Overview

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report Include:

1.5 Who is This Report For?

1.6 Methodology

1.6.1 Primary Research

1.6.2 Secondary Research

1.6.3 Market Evaluation & Forecasting Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to the Military Satellites Market

2.1 Military Satellites Market Structure

2.2 Military Satellites Market Definition

2.2.1 Military Satellites Satellite Buses Submarket Definition

2.2.2 Military Satellites Payloads and Communications Terminals Submarket Definition

2.2.3 Military Satellites Launch Services Submarket Definition

2.2.4 Military Satellites Anti-Satellite Weapons (ASATs) Submarket Definition

2.3 Significant Current and Future Developments in Military Satellite Technology

2.3.1 Electro-Optical Imaging Technology

2.3.2 Small, Micro and Nanosatellites

2.3.3 Electric Propulsion Systems

2.3.4 Satellite-launching Technology

3. Global Military Satellites Market 2018-2028

3.1 Global Military Satellites Market Forecast 2018-2028

3.2 Global Military Satellites Market Drivers & Restraints 2018

3.2.1 Sources of Growth & Contraction in the Global Military Satellites Market

4. Global Military Satellites Submarket Forecast 2018-2028

4.1 Global Military Satellites Satellite Buses Submarket Forecast 2018-2028

4.1.1 Satellite Buses: Large Multi-Tasking Military Satellite Buses at Risk from Disaggregation and Commercial Platforms

4.2 Global Military Satellites Payloads & Communications Terminals Submarket Forecast 2018-2028

4.2.1 Payloads & Communications Terminals: Ever-Growing Bandwidth Demands Will Make Submarket Largest Within Military Satellites Market

4.3 Global Military Satellites Launch Services Submarket Forecast 2018-2028

4.3.1 Launch Services: Submarket to Slow in Growth Rates as Costs of Launches Decrease

4.4 Global Military Satellites Anti-Satellite Weapons (ASATs) Submarket Forecast 2018-2028

4.4.1 Anti-Satellite Weapons (ASATs)

5. Leading National Military Satellites Market Forecast 2018-2028

5.1 Global Military Satellites Market by National Market Share Forecast 2018-2028

5.2 Australian Military Satellites Market Forecast 2018-2028

5.2.1 Australian Military Satellites Market Contracts & Programmes

5.2.2 Australia Likely To Launch its Own Military Satellite Constellation in Next Twenty Years to Maintain Information Superiority in Asia-Pacific Region

5.2.3 Australian Military Satellites Market Drivers & Restraints

5.3 Chinese Military Satellites Market Forecast 2018-2028

5.3.1 Chinese Military Satellites Market Contracts & Programmes

5.3.2 China Looks to Build Second Largest Global Military Satellite Fleet Over the Next Decade

5.3.3 China is a Competitive Player in the Anti-Satellite Weapons (ASATs) Submarket

5.3.4 Chinese Military Satellites Market Drivers & Restraints

5.4 French Military Satellites Market Forecast 2018-2028

5.4.1 French Military Satellites Market Contracts & Programmes

5.4.2 French Military Satellite Market Growth Driven by High Levels of European Cooperation and Comprehensive Replacement of Military Satellite Fleet

5.4.3 French Military Satellites Market Drivers & Restraints

5.5 German Military Satellites Market Forecast 2018-2028

5.5.1 German Military Satellites Market Contracts & Programmes

5.5.2 Steady German military satellite market growth forecast as country seeks to expand independent military satellite capability

5.5.3 German Military Satellites Market Drivers & Restraints

5.6 Indian Military Satellites Market Forecast 2018-2028

5.6.1 Indian Military Satellites Market Contracts & Programmes

5.6.2 India Set to be Second-Fastest Growing Military Satellite Market Over the Next Decade as Military Seeks Network-Centric Capabilit8

5.6.3 Indian Military Satellites Market Drivers & Restraints

5.7 Israeli Military Satellites Market Forecast 2018-2028

5.7.1 Israeli Military Satellites Market Contracts & Programmes

5.7.2 Short Operational Service of Israeli Military Satellites Will Drive Continuous Market Growth

5.7.3 Israeli Military Satellites Market Drivers & Restraints

5.8 Italian Military Satellites Market Forecast 2018-2028

5.8.1 Italian Military Satellites Market Contracts & Programmes

5.8.2 Italian Military Satellite Market Set to Continue Revolving Around Dual-Use Military-Civilian Satellites and Cooperation with European Allies

5.8.3 Italian Military Satellites Market Drivers & Restraints

5.9 Russian Military Satellites Market Forecast 2018-2028

5.9.1 Russian Military Satellites Market Contracts & Programmes

5.9.2 Large-Scale Military Satellite Fleet Modernisation Between 2005 and 2015 Alongside Economic Problems Will Restrain Military Satellite Spending Until 2019

5.9.3 Russian Military Satellites Market Drivers & Restraints

5.10 Spanish Military Satellites Market Forecast 2018-2028

5.10.1 Spanish Military Satellites Market Contracts & Programmes

5.10.2 Replacement to Spanish Military Satellite SpainSat will drive military satellite market growth from 2019

5.10.3 Spanish Military Satellites Market Drivers & Restraints

5.11 UK Military Satellites Market Forecast 2018-2028

5.11.1 UK Military Satellites Market Contracts & Programmes

5.11.2 Skynet 5 Military Satellite Constellation Replacement Future Beyond Line of Sight Programme to Drive UK Spending Throughout Next Decade

5.11.3 UK Military Satellites Market Drivers & Restraints

5.12 USA Military Satellites Market Forecast 2018-2028

5.12.1 USA Military Satellites Market Selected Contracts & Programmes 2014-2018

5.12.2 Analysis of US Military Satellite Market Forecast

5.12.3 US Air Force Will Not Accept the Status Quo in Procuring Further US Military Satellites: Disaggregation and Standardisation of Launch Payloads Amongst the Solutions

5.12.4 Significant US Future Vetronics Spending Programmes

5.12.4.1 Advanced Extremely High Frequency (AEHF): Next stage C4ISR bandwidth

5.12.4.2 Wideband Global SATCOM

5.12.4.3 Space-Based Infra-Red System (SBIRS)

5.12.4.4 Defense Meteorological Satellite Program (DMSP) to Weather-System Follow-On (WSF)

5.12.4.5 Evolved Expendable Launch Vehicle (EELV) No Longer the Pentagon’s Go-To Launch Vehicle

5.12.4.6 Satellite Defence Systems

5.12.5 USA Military Satellites Market Drivers & Restraints

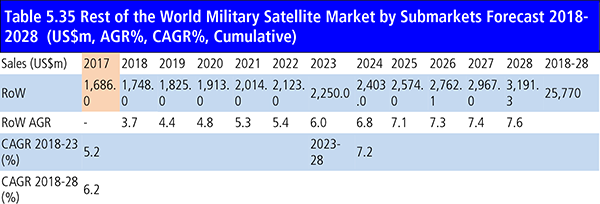

5.13 Rest of the World Military Satellites Market Forecast 2018-2028

5.13.1 Rest of the World Military Satellites Market Contracts & Programmes

5.13.2 Innovation in Civilian Space Sector Will Begin to Drive Down Costs in the Military Satellite Market Decreasing the Barriers to Entry Across the Rest of the World

5.13.3 NATO Nations See the Cost-Benefits of WGS Shareholding Over Leasing of Military Payloads on Commercial Platforms

5.13.4 Rest of the World Military Satellites Market Drivers & Restraints

6. SWOT Analysis of the Military Satellites Market 2018-2028

6.1 Strengths

6.1.1 Near-Exponential Increase in Bandwidth Demand

6.1.2 Civilian Space Sector Boom

6.1.3 Major Military Satellite Programmes to Launch Across the Decade

6.2 Weaknesses

6.2.1 High costs of military satellite market entry

6.2.2 Reliance of NATO and European States on US and French Military Satellite capability

6.2.3 Civilian Space Sector boom limited outside the US

6.2.4 Low Profit Margin and risk associated with some Military Satellite systems

6.3 Opportunities

6.3.1 Reduced Launch Costs

6.3.2 Introduction of More COTS Systems

6.3.3 New Markets in the Rest of the World

6.4 Threats

6.4.1 Increasing Complexity and Cost of Military Satellite Communication Payloads

6.4.2 Falling Defence Budgets

6.4.3 Slowing Economic Growth in Emerging Markets

6.4.4 Continued Restrictions in Emerging Markets

7. PEST Analysis of the Military Satellites Market 2018-2028

8. Leading 13 Military Satellites Companies

8.1 Leading 13 Military Satellites Companies FY2017

8.2 Airbus Group SE

8.2.1 Airbus Group SE Military Satellites Selected Recent Contracts 2003-2016

8.2.2 Airbus Group SE Total Company Sales 2012-2017

8.2.3 Airbus Group SE Sales by Segment of Business 2012-2017

8.2.4 Airbus Group SE Net Income 2012-2017

8.2.5 Airbus Group SE Cost of Research & Development 2012-2017

8.2.6 Airbus Group SE Regional Emphasis / Focus

8.2.7 Airbus Group SE Organisational Structure / Subsidiaries

8.2.8 Airbus Group SE Mergers & Acquisitions (M&A) and Divestiture Activity

8.2.9 Airbus Group SE Analysis: Airbus Will Remain Market Leader in Europe With Large Current and Future Contracts But Must be Cognizant of Commercial Rivals

8.3 The Boeing Company

8.3.1 The Boeing Company Military Satellites Selected Recent Contracts 2014-2017

8.3.2 The Boeing Company Total Company Sales 2012-2017

8.3.3 The Boeing Company Sales by Segment of Business 2012-2017

8.3.4The Boeing Company Net Income / Loss 2012-2017

8.3.5 The Boeing Company Cost of Research & Development 2012-2017

8.3.6 The Boeing Company Regional Emphasis / Focus

8.3.7 The Boeing Company Organisational Structure / Subsidiaries

8.3.8 The Boeing Company Mergers& Acquisitions (M&A) Activity

8.3.9 The Boeing Company Analysis: Boeing Seeks to Maintain Position as Second Largest Military Satellite Producer in the World by Exploiting Commercial Constellation Expertise

8.3.10 The Boeing Company Joint-Venture United Launch Alliance (ULA) Under Threat from SpaceX as Launch Service Provider

8.4 Inmarsat

8.4.1 Inmarsat Military Satellites Selected Recent Contracts 2014

8.4.2 Inmarsat Total Company Sales 2012-2017

8.4.3 Inmarsat Sales by Segment of Business 2012-2017

8.4.4 Inmarsat Net Income 2012-2017

8.4.5 Inmarsat Cost of Research & Development 2012-2017

8.4.6 Inmarsat Regional Emphasis / Focus

8.4.7 Inmarsat Organisational Structure

8.4.8 Inmarsat Analysis: Company Hopes Global Xpress Satellite System Will Help Recover Ground Lost in Military Satellite Market

8.5 Israel Aerospace Industries

8.5.1 Israel Aerospace Industries Military Satellites -Selected Recent Contracts 2012-2017

8.5.2 Israel Aerospace Industries Total Company Sales 2012-2017

8.5.3 Israel Aerospace Industries Sales by Segment of Business 2012-2017

8.5.4 Israel Aerospace Industries Net Income 2012-2015

8.5.5 Israel Aerospace Industries Cost of Research & Development 2010-2015

8.5.6 Israeli Aerospace Industries Regional Emphasis / Focus

8.5.7 Israel Aerospace Industries Organisational Structure

8.5.8 IAI Mergers& Acquisitions (M&A) Activity

8.5.9 Israel Aerospace Industries Analysis: IAI’s Development of Military Satellite Ofeq 11 Offers Significant Chance for Company to Become Indian Contractor of Choice

8.6 ISS Reshetnev

8.6.1 ISS Reshetnev Military Satellites Selected Recent Contracts & Programmes 2005-2020

8.6.2 ISS Reshetnev Regional Emphasis / Focus

8.6.3 ISS Reshetnev Analysis: Singapore Airshow Presence Indicates Willingness to Expand Beyond Domestic Military Satellite Market

8.7 Lockheed Martin Corporation

8.7.1 Lockheed Martin Corporation Military SatellitesSelected Recent Contracts 2014-2017

8.7.2 Lockheed Martin Corporation Total Company Sales 2012-2017

8.7.3 Lockheed Martin Corporation Sales by Segment of Business 2012-2017

8.7.4 Lockheed Martin Corporation Net Income2012-2017

8.7.5 Lockheed Martin Corporation Cost of Research & Development 2012-2017

8.7.6 Lockheed Martin Corporation Regional Emphasis / Focus

8.7.7 Lockheed Martin Corporation Organisational Structure / Subsidiaries

8.7.8 Lockheed Martin CorporationMilitary SatellitesProducts / Services

8.7.9 Lockheed Martin Corporation Mergers & Acquisitions (M&A) and Divestiture Activity

8.7.10 Lockheed Martin Corporation Analysis: Lockheed Martin to Remain Largest Military Satellite Producer in the World

8.7.11 Lockheed Martin Joint-Venture United Launch Alliance (ULA) under threat from SpaceX as Launch Service Provider

8.8 Mitsubishi Electric Corporation

8.8.1 Mitsubishi Electric Corporation Selected Recent Military Satellites Contracts 2014-17

8.8.2 Mitsubishi Electric Corporation Total Company Sales 2013-2017

8.8.3 Mitsubishi Electric Corporation Sales by Segment of Business 2013-2017

8.8.4 Mitsubishi Electric Corporation Net Income 2013-2017

8.8.5 Mitsubishi Electric Corporation Cost of Research & Development 2013-2017

8.8.6 Mitsubishi Electric Corporation Regional Emphasis / Focus

8.8.7 Mitsubishi Electric Corporation Organisational Structure

8.8.8 Mitsubishi Electric Corporation Analysis: Mitsubishi Electric to Remain Largely Focussed on Commercial Satellite Market Outside Japanese Military Satellite Market Where Regional Security Concerns Will Drive Growth

8.9 Orbital ATK Inc.

8.9.1 Orbital ATK Inc. Selected Recent Military Satellites Contracts / Programmes 2015-2017

8.9.2 Orbital ATK Inc. Total Company Sales 2012-2017

8.9.3 Orbital ATK Inc. Sales by Segment of Business 2013-2017

8.9.4 Orbital ATK Inc. Sales AGR by Segment of Business 2014-2017

8.9.5 Orbital ATK Inc. Net Income 2012-2017

8.9.6 Orbital ATK Inc. Cost of Research & Development 2012-2017

8.9.7 Orbital ATK Inc. Regional Emphasis / Focus

8.9.8 Orbital ATK Inc. Sales AGR by Geographical Location 2014-2017

8.9.9 Orbital ATK Inc. Organisational Structure / Subsidiaries

8.9.10 Orbital ATK Inc.Mergers & Acquisitions (M&A) and Divestiture Activity

8.9.11 Orbital ATK Inc. Analysis: Orbital ATK Hopes Mission Extension Vehicle Commercial Success Will Revolutionise Satellite Logistics in Military Sector

8.10 Raytheon Company

8.10.1 Raytheon Company Selected Recent Military Satellites Contracts / Programmes 2014-2017

8.10.2 Raytheon Company Total Company Sales 2012-2017

8.10.3 Raytheon Company Sales by Segment of Business 2012-2017

8.10.4 Raytheon Company Net Income 2012-2017

8.10.5 Raytheon Company Cost of Research & Development 2012-2017

8.10.6 Raytheon Company Regional Emphasis / Focus

8.10.7 Raytheon Company Organisational Structure

8.10.8 Raytheon Company Mergers & Acquisitions (M&A) Activity

8.10.9 Raytheon Company Analysis: Raytheon Company Well Positioned to Remain Clear Market Leader in Payloads & Communications Terminals Submarket Going Forward

8.11 SES S.A.

8.11.1 SES S.A. Military Satellites Selected Recent Contracts 2015-16

8.11.2 SES S.A. Total Company Sales 2012-2017

8.10.3 SES S.A. Sales AGR by Segment of Business 2015-2016

8.11.4 SES S.A. Net Income 2012-2017

8.11.5 SES S.A. Regional Emphasis / Focus

8.11.6 SES S.A. Sales AGR by Geographical Location 2013-2017

8.11.7 SES S.A. Organisational Structure / Subsidiaries

8.11.8 Orbital ATK Inc. Mergers & Acquisitions and Divestitures 2016

8.11.9 SES S.A. Analysis: 2015 Contract with Luxembourg and NATO together with Acquisition of O3b Networks in 2016 Points Way Forward for SES’ Further Engagement in Military Satellite Market

8.12 Space Exploration Technologies Corporation

8.12.1 Space Exploration Technologies Corporation Military Satellites Selected Recent Contracts 2016-17

8.12.2 Space Exploration Technologies Corporation Analysis: April 2016 contract sees SpaceX take strides into Launch Service Submarket

8.12.3 With history of technological innovation SpaceX is well placed to make significant gains in Military Satellite Market

8.13 Thales Group

8.13.1 Thales Group Military Satellites Selected Recent Contracts 2013-2017

8.13.2 Thales Group Total Company Sales 2012-2017

8.13.3 Thales Group Sales by Segment of Business 2012-2017

8.13.4 Thales Group Net Income / Loss 2012-2017

8.13.5 Thales Group Cost of Research & Development 2012-2017

8.13.6 Thales Group Regional Emphasis / Focus

8.13.7 Thales Group Organisational Structure

8.13.8 Thales Group Mergers & Acquisitions (M&A) and Divestiture Activity

8.13.9 Thales Group Analysis: Thales Alenia Space at the heart of Franco-Italian Cooperation through the Sicral and Athena Fidus constellations

8.14 ViaSat Inc

8.14.1 ViaSat Inc Military Satellites Selected Recent Contracts 2014-2018

8.14.2 ViaSat Inc Total Company Sales 2013-2017

8.14.3 ViaSat Inc Sales by Segment of Business 2013-2017

8.14.4 ViaSat Inc Net Income / Loss 2013-2017

8.14.5 ViaSat Inc Regional Emphasis / Focus

8.14.6 ViaSat Inc Corporation Organisational Structure

8.14.7 ViaSat Inc. Mergers & Acquisitions (M&A) and Divestiture Activity

8.14.8 ViaSat Inc Analysis: ViaSat’s Cutting-Edge Commercial Technology Offers Potential High-Capacity Satellite Solutions to Military Satellite Market

8.15 Other Companies Involved in the Military Satellites Market 2017

8.15.1 DataPath Inc.

8.15.2Honeywell International Inc.

8.15.3LinQuest Corporation

8.15.5Pacific Defence Solutions LLC

8.15.6SpaceQuest Ltd

8.15.7SSL (formerly Space Systems/Loral LLC)

9. Conclusions and Recommendations

10. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 3.1 Global Military Satellites Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 3.2 Global Military Satellites Market Drivers & Restraints 2018

Table 4.1 Global Military Satellites Submarket Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 4.2 Global Military Satellites Submarket CAGR Forecast 2018-2023, 2023-2028, 2018-2028 (CAGR %)

Table 4.3 Global Military Satellites Submarket Percentage Change in Market Share 2018-2023, 2023-2028, 2018-2028 (% Change)

Table 4.4 Global Military Satellites Satellite Buses Submarket Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 4.5 Global Military Satellites Payloads & Communications Terminals Submarket Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 4.6 Global Military Satellites Launch Services Submarket Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 4.7 Global Military Satellites Anti-Satellite Weapons (ASATs) Submarket Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 5.1 Leading National Military Satellites Market Forecast 2018-2028 (US$m, Global AGR %, Cumulative)

Table 5.2 Global Military Satellites Submarket by National Market CAGR Forecast 2018-2023, 2023-2028, 2018-2028 (CAGR %)

Table 5.3 National Military Satellites Market Percentage Change in Market Share 2018-2023, 2023-2028, 2018-2028 (% Change)

Table 5.4 Australian Military Satellites Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 5.5 Australian Military Satellites Market Major Contracts & Launches 2007-2017 (Date, Company, Value US$m, Details)

Table 5.6 Australian Military Satellites Market Drivers & Restraints 2018

Table 5.7 Chinese Military Satellites Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 5.8 Chinese Military Satellites Market Major Contracts & Launches 2009-2018 (Company, Platform Designation, Launch dates, Description)

Table 5.9 Chinese Military Satellites Market Drivers & Restraints 2018

Table 5.10 French Military Satellites Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 5.11 French Military Satellites Market Major Contracts & Launches 2010-2016 (Date, Company, Value US$m, Details)

Table 5.12 French Military Satellites Market Drivers & Restraints 2018

Table 5.13 German Military Satellites Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 5.14 German Military Satellites Market Major Contracts & Launches 2013-2017 (Date, Company, Value US$m, Details)

Table 5.15 German Military Satellites Market Drivers & Restraints 2018

Table 5.16 Indian Military Satellites Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 5.17 Indian Military Satellites Market Major Contracts & Launches 2009-2017 (Agency/Company, Platform Designation, Launch Dates, Description)

Table 5.18 Indian Military Satellites Market Drivers & Restraints 2018

Table 5.19 Israeli Military Satellites Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 5.20 Israeli Military Satellites Market Major Contracts & Launches 2008-2014 (Company, Platform Designation, Launch Dates, Description)

Table 5.21 Israeli Military Satellites Market Drivers & Restraints 2018

Table 5.22 Italian Military Satellites Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 5.23 Italian Military Satellites Market Major Contracts & Launches 2010-2017 (Date, Company, Value US$m, Details)

Table 5.24 Italian Military Satellites Market Drivers & Restraints 2018

Table 5.25 Russian Military Satellites Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 5.26 Russian Military Satellites Market Major Contracts & Launches 2005-2020 (Company, Platform Designation, Launch dates, Description)

Table 5.27 Russian Military Satellites Market Drivers & Restraints 2018

Table 5.28 Spanish Military Satellites Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 5.29 Spanish Military Satellites Market Major Contracts & Launches 2005-2018 (Launch Date, Company, Value US$m, Details)

Table 5.30 Spanish Military Satellites Market Drivers & Restraints 2018

Table 5.31 UK Military Satellites Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 5.32 UK Military Satellites Market Major Contracts & Launches 2003-2017 (Date, Company, Value US$m, Details)

Table 5.33 UK Military Satellites Market Drivers & Restraints 2018

Table 5.34 USA Military Satellites Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 5.35 USA Military Satellites Market Major Contracts & Launches 2014-2018 (Date, Company, Value US$m, Details)

Table 5.36 USA Military Satellites Market Drivers & Restraints 2018

Table 5.37 Rest of the World Military Satellites Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 5.38 Rest of the World Military Satellites Market Major Contracts & Launches 2012-2018 (Date, Country, Value US$m, Details)

Table 5.39 Rest of the World Military Satellites Market Drivers & Restraints 2018

Table 6.1 Global Military Satellites Market SWOT Analysis 2018-2028

Table 7.1 Global Military Satellites Market PEST Analysis 2018-2028

Table 8.1 Leading 13 Military Satellites Companies Listed Alphabetically (Company, FY2017 Total Company Sales (US$m), HQ)

Table 8.2 Airbus Group SE Profile 2017 (CEO, Total Company Sales US$m, Sales in the Defence and Space Market US$m, Share of Total Company Sales from Defence and SpaceSegment %, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, IR Contact, Ticker, Website)

Table 8.3 Selected Recent Airbus Group SE Military Satellites Contracts 2003-2016 (Date, Country, Subcontractor, Value US$m, Details)

Table 8.4 Airbus Group SE Total Company Sales 2012-2017 (US$m, AGR %)

Table 8.5 Airbus Group SE Sales by Segment of Business 2012-2017 (US$m, AGR %)

Table 8.6 Airbus Group SE Net Income 2012-2017 (US$m, AGR %)

Table 8.7 Airbus Group SE Cost of Research & Development 2012-2017 (US$m, AGR %)

Table 8.8 Airbus Group SE Sales by Geographical Location 2012-2017 (US$m, AGR %)

Table 8.9 Airbus Group SE Subsidiaries 2017 (Subsidiary, Location)

Table 8.10 Thales Group Mergers &Acquisitions and Divestitures2010-2017 (Type of action, Date, Details)

Table 8.11 The Boeing Company Profile 2017 (CEO, Total Company Sales US$m, Sales in the Market US$m,Net Income US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, IR Contact, Ticker, Website)

Table 8.12 Selected Recent The Boeing Company Military Satellites Contracts 2014-2017 (Date, Country, Value US$m, Details)

Table 8.13The Boeing Company Total Company Sales 2012-2017 (US$m, AGR %)

Table 8.14 The Boeing Company Sales by Segment of Business 2012-2017 (US$m, AGR %)

Table 8.15 The Boeing Company Net Income 2010-2015 (US$m, AGR %)

Table 8.16 The Boeing Company Cost of Research & Development 2012-2017 (US$m, AGR %)

Table 8.17 The Boeing Company Sales by Geographical Location 2012-2017 (US$m, AGR %)

Table 8.18 The Boeing Company Subsidiaries 2017 (Subsidiary, Location)

Table 8.19 The Boeing Company Mergers and Acquisitions 2008-2017 (Type of Activity, Date, Company Involved, Value US$m, Details)

Table 8.20 Inmarsat Profile 2017 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Company Sales from Government SystemsSegment %, Net Income / Loss US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, IR Contact, Ticker, Website)

Table 8.21 Selected Recent The Boeing Company Military Satellites Contracts 2014 (Date, Country, Value US$m, Details)

Table 8.22 Inmarsat Total Company Sales 2012-2017 (US$m, AGR %)

Table 8.23 Inmarsat Sales by Segment of Business 2012-2014 (US$m, AGR %)

Table 8.24 Inmarsat Net Income 2012-2017 (US$m, AGR %)

Table 8.25 Inmarsat Cost of Research & Development 2012-2017 (US$m, AGR %)

Table 8.26 Inmarsat Sales by Geographical Location 2012-2017 (US$m, AGR %)

Table 8.27 Inmarsat Subsidiaries 2017 (Subsidiary, Location)

Table 8.28 Israel Aerospace Industries Profile 2017 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, Ticker, Website)

Table 8.29 Selected Recent Israel Aerospace Industries Military Satellites Contracts 2012-2017 (Date, Country, Value US$m, Details)

Table 8.30 Israel Aerospace Industries Total Company Sales 2012-2017 (US$m, AGR %)

Table 8.31 Israel Aerospace Industries Sales by Segment of Business 2012-2017 (US$m, AGR %)

Table 8.32 Israel Aerospace Industries Net Income 2012-2017 (US$m, AGR %)

Table 8.33 Israel Aerospace Industries Cost of Research & Development 2012-2017 (US$m, AGR %)

Table 8.34 IAI Mergers and Acquisitions 2014-2017 (Type of Activity, Date, Company Involved, Value US$m, Details)

Table 8.35 ISS Reshetnev Profile 2017 (Director General, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Military Satellites Market %, Strongest Business Region, Submarket Involvement, HQ, Founded, Website)

Table 8.36 Selected Recent ISS Reshetnev Military Satellites Contracts / Programmes 2005-2020 (Launch Date, Country, Satellite Platform, Details)

Table 8.37 Lockheed Martin Corporation Profile 2017 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, IR Contact, Ticker, Website)

Table 8.38 Selected Recent Lockheed Martin Corporation Military SatellitesContracts 2014-2017 (Date, Country, Value US$m, Details)

Table 8.39 Lockheed Martin Corporation Total Company Sales 2012-2017 (US$m, AGR %)

Table 8.40 Lockheed Martin Corporation Sales by Segment of Business 2012-2017 (US$m, AGR %)

Table 8.41 Lockheed Martin Corporation Net Income2012-2017 (US$m, AGR %)

Table 8.42 Lockheed Martin Corporation Cost of Research & Development 2012-2017 (US$m, AGR %)

Table 8.43 Lockheed Martin Corporation Sales by Geographical Location 2012-2017 (US$m, AGR %)

Table 8.44 Lockheed Martin Corporation Subsidiaries 2017 (Subsidiary, Location)

Table 8.45 Lockheed Martin CorporationMilitary SatellitesProducts / Services (Segment of Business, Product, Specification / Features)

Table 8.46 Lockheed Martin Corporation Mergers & Acquisitions and Divestitures 2008-2015 (Type of activity, Date, Details)

Table 8.47 Mitsubishi Electric Corporation Profile 2017 (CEO, Total Company Sales US$m, Sales in the Information and Communication Systems Segment US$m, Share of Company Sales from Information and Communication Systems Segment%, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, IR Contact, Ticker, Website)

Table 8.48 Selected Recent Mitsubishi Electric Corporation Military Satellites Contracts / Programmes 2014-2017 (Launch Date, Country, Satellite Platform, Details)

Table 8.49 Mitsubishi Electric Corporation Total Company Sales 2013-2017 (US$m, AGR %)

Table 8.50 Mitsubishi Electric Corporation Sales by Segment of Business 2013-2017 (US$m, AGR %)

Table 8.51 Mitsubishi Electric Corporation Net Income 2013-2017 (US$m, AGR %)

Table 8.52 Mitsubishi Electric Corporation Cost of Research & Development 2013-2017 (US$m, AGR %)

Table 8.53 Mitsubishi Electric Corporation Sales by Geographical Location 2013-2017 (US$m, AGR %)

Table 8.54 Orbital ATK Inc. Profile 2017 (CEO, Total Company Sales US$m, Sales in the Space Systems Group US$m, Share of Total Company Sales from Space Systems Market %, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, IR Contact, Ticker, Website)

Table 8.55 Selected Recent Orbital ATK Inc. Military Satellites Contracts / Programmes 2015-2017 (Launch Date, Country, Satellite Platform, Details)

Table 8.56 Orbital ATK Inc. Total Company Sales 2012-2017 (US$m, AGR %)

Table 8.57 Orbital ATK Inc. Sales by Segment of Business 2013-2017 (US$m, AGR %)

Table 8.58 Orbital ATK Inc. Net Income 2012-2017 (US$m, AGR %)

Table 8.59 Orbital ATK Inc. Cost of Research & Development 2012-2017 (US$m, AGR %)

Table 8.60 Orbital ATK Inc. Sales by Geographical Location 2013-2017 (US$m, AGR %)

Table 8.61 Orbital ATK Inc. Subsidiaries 2017 (Subsidiary, Location)

Table 8.58Orbital ATK Inc. Mergers & Acquisitions and Divestitures 2013-2017 (Type of activity, Date, Details)

Table 8.62 Raytheon Company Profile 2017 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, IR Contact, Ticker, Website)

Table 8.63 Selected Recent Orbital ATK Inc. Military Satellites Contracts / Programmes 2014-2017 (Launch Date, Country, Satellite Platform, Details)

Table 8.64 Raytheon Company Total Company Sales 2012-2017 (US$m, AGR %)

Table 8.65 Raytheon Company Sales by Segment of Business 2012-2017 (US$m, AGR %)

Table 8.66 Raytheon Company Net Income 2012-2017 (US$m, AGR %)

Table 8.67 Raytheon Company Cost of Research & Development 2012-2017 (US$m, AGR %)

Table 8.68 Raytheon Company Sales by Geographical Location 2012-2017 (US$m, AGR %)

Table 8.69 Raytheon Company Mergers & Acquisitions 2001-2014 (Date, Details)

Table 8.70 SES S.A. Profile 2017 (CEO, Total Company Sales US$m, Sales in the Government Segment US$m, Share of Company Sales from Government Market %, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, IR Contact, Ticker, Website)

Table 8.71 Selected Recent SES S.A. Military Satellites Contracts / Projects / Programmes 2015-2016 (Date, Country, Value US$m, Details)

Table 8.72 SES S.A. Total Company Sales 2012-2017 (US$m, AGR %)

Table 8.73 SES S.A. Sales by Segment of Business 2014-2016 (US$m, AGR %)

Table 8.74 SES S.A. Net Income 2012-2017 (US$m, AGR %)

Table 8.75 SES S.A. Sales by Geographical Location 2012-2017 (US$m, AGR %)

Table 8.76 Orbital ATK Inc. Mergers & Acquisitions and Divestitures 2016 (Type of activity, Date, Details)

Table 8.77 Space Exploration Technologies Corporation Profile 2017 (CEO, Strongest Business Region, Submarket Involvement, HQ, Founded, Website)

Table 8.78 Selected Space Exploration Technologies Corporation Military Satellites Contracts 2017 (Date, Value US$m, Details)

Table 8.79 Thales Group Profile 2017 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, IR Contact, Ticker, Website)

Table 8.80 Selected Recent Thales Group Military Satellites Contracts 2013-2017 (Date, Contractor, Value US$m, Country, Details)

Table 8.81 Thales Group Total Company Sales 2012-2017 (US$m, AGR %)

Table 8.82 Thales Group Sales by Segment of Business 2012-2017 (US$m, AGR %)

Table 8.83 Thales Group Net Income / Loss 2012-2017 (US$m, AGR %)

Table 8.84 Thales Group Cost of Research & Development 2012-2017 (US$m, AGR %)

Table 8.85 Thales Group Sales by Geographical Location 2012-2017 (US$m, AGR %)

Table 8.86 Thales Group Mergers &Acquisitions and Divestitures2012-2016 (Activity, Date, Details)

Table 8.87 ViaSat Inc Profile 2017 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, IR Contact, Ticker, Website)

Table 8.88 Selected Recent ViaSat Inc Military Satellites Contracts 2014-2018 (Date, Country, Value US$m, Details)

Table 8.89 ViaSat Inc Total Company Sales 2013-2017 (US$m, AGR %)

Table 8.90 ViaSat Inc Sales by Segment of Business 2013-2017 (US$m, AGR %)

Table 8.91 ViaSat Inc Net Income / Loss 2013-2017 (US$m)

Table 8.92 ViaSat Inc Sales by Geographical Location 2013-2017 (US$m, AGR %)

Figure 8.96 ViaSat Inc Corporation Organisational Structure 2017

Table 8.93 ViaSat Inc. Mergers &Acquisitions and Divestitures2014 (Activity, Date, Details)

Table 8.94 Other Companies Involved in the Military Satellites Market 2017 (Company, Revenue US$m, Location)

Table 8.95 DataPath Inc. Overview 2017 (Total Company Revenue US$m, Activity in the Military Satellites Market, HQ, Ticker, IR Contact, Website)

Table 8.96 Honeywell International Inc. Overview 2017 (Total Company Revenue US$m, Activity in the Military Satellites Market, HQ, Ticker, IR Contact, Website)

Table 8.97 LinQuest Corporation Overview 2017 (Total Company Revenue US$m, Activity in the Military Satellites Market, HQ, IR Contact, Website)

Table 8.98 Northrop GrummanCorporation Overview 2015 (Total Company Revenue US$m, Activity in the Military Satellites Market, HQ, Ticker, IR Contact, Website)

Table 8.99 Pacific Defence Solutions LLC Overview 2017 (Total Company Revenue US$m, Activity in the Military Satellites Market, HQ, IR Contact)

Table 8.100 SpaceQuest Ltd Overview 2017 (Total Company Revenue US$m, Activity in the Military Satellites Market, HQ, IR Contact, Website)

Table 8.101 SSL Overview 2015 (Total Company Revenue US$m, Activity in the Military Satellites Market, HQ, Ticker, IR Contact, Website)

List of Figures

Figure 2.1 Global Military Satellites Market Segmentation Overview

Figure 3.1 Global Military Satellites Market Forecast 2018-2028 (US$m, AGR %)

Figure 4.1 Global Military Satellites Submarket AGR Forecast 2018-2028 (AGR %)

Figure 4.2 Global Military Satellites Submarket Forecast 2018-2028 (US$m, Global AGR %)

Figure 4.3 Global Military Satellites Market by Submarket Share Forecast 2018 (% Share)

Figure 4.4 Global Military Satellites Market by Submarket Share Forecast 2023 (% Share)

Figure 4.5 Global Military Satellites Market by Submarket Share Forecast 2028 (% Share)

Figure 4.6 Global Military Satellites Submarket CAGR Forecast 2018-2023 (CAGR %)

Figure 4.7 Global Military Satellites Submarket CAGR Forecast 2023-2028 (CAGR %)

Figure 4.8 Global Military Satellites Submarket CAGR Forecast 2018-2028 (CAGR %)

Figure 4.9 Global Military Satellites Submarket Percentage Change in Market Share 2018-2023 (% Change)

Figure 4.10 Global Military Satellites Submarket Percentage Change in Market Share 2023-2028 (% Change)

Figure 4.11 Global Military Satellites Submarket Percentage Change in Market Share 2018-2028 (% Change)

4.1 Global Military Satellites Satellite Buses Submarket Forecast 2018-2028

Figure 4.12 Global Military Satellites Satellite Buses Submarket Market Forecast 2018-2028 (US$m, AGR %)

Figure 4.13 Global Military Satellites Satellite Buses Market Share Market Forecast 2018 (% Share)

Figure 4.14 Global Military Satellites Satellite Buses Market Share Market Forecast 2023 (% Share)

Figure 4.15 Global Military Satellites Satellite Buses Market Share Market Forecast 2028 (% Share)

Figure 4.16 Global Military Satellites Payloads & Communications Terminals Submarket Market Forecast 2018-2028 (US$m, AGR %)

Figure 4.17 Global Military Satellites Payloads & Communications Terminals Market Share Market Forecast 2018 (% Share)

Figure 4.18 Global Military Satellites Payloads & Communications Terminals Market Share Market Forecast 2023 (% Share)

Figure 4.19 Global Military Satellites Payloads & Communications Terminals Market Share Market Forecast 2026 (% Share)

Figure 4.20 Global Military Satellites Launch Services Submarket Market Forecast 2018-2028 (US$m, AGR %)

Figure 4.21 Global Military Satellites Launch Services Market Share Market Forecast 2018 (% Share)

Figure 4.22 Global Military Satellites Launch Services Market Share Market Forecast 2023 (% Share)

Figure 4.23 Global Military Satellites Launch Services Market Share Market Forecast 2028 (% Share)

Figure 4.24 Global Military Satellites Anti-Satellite Weapons (ASATs) Submarket Market Forecast 2018-2028 (US$m, AGR %)

Figure 4.25 Global Military Satellites Anti-Satellite Weapons (ASATs) Market Share Market Forecast 2018 (% Share)

Figure 4.26 Global Military Satellites Anti-Satellite Weapons (ASATs) Market Share Market Forecast 2023 (% Share)

Figure 4.27 Global Military Satellites Anti-Satellite Weapons (ASATs) Market Share Market Forecast 2028 (% Share)

Figure 5.1 Global Military Satellites Market by National Market Forecast 2018-2028 (US$m, Global AGR %)

Figure 5.2 Global Military Satellites Market by National Market AGR Forecast 2018-2028 (AGR %)

Figure 5.3 Leading National Military Satellites Market CAGR Forecast 2018-2023 (CAGR %)

Figure 5.4 Leading National Military Satellites Market CAGR Forecast 2023-2028 (CAGR %)

Figure 5.5 Leading National Military Satellites Market CAGR Forecast 2018-2028 (CAGR %)

5.1 Global Military Satellites Market by National Market Share Forecast 2018-2028

Figure 5.6 Global Military Satellites Market by National Market Share Forecast 2018 (% Share)

Figure 5.7 Global Military Satellites Market by National Market Share Forecast 2023 (% Share)

Figure 5.8 Global Military Satellites Market by National Market Share Forecast 2028 (% Share)

Figure 5.9 Australian Military Satellites Market Forecast 2018-2028 (AGR %)

Figure 5.10 Australian Military Satellites Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.11 Chinese Military Satellites Market Forecast 2018-2028 (AGR %)

Figure 5.12 Chinese Military Satellites Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.13 French Military Satellites Market Forecast 2018-2028 (AGR %)

Figure 5.14 French Military Satellites Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.15 German Military Satellites Market Forecast 2018-2028 (AGR %)

Figure 5.16 German Military Satellites Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.17 Indian Military Satellites Market Forecast 2018-2028 (AGR %)

Figure 5.18 Indian Military Satellites Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.19 Israeli Military Satellites Market Forecast 2018-2028 (AGR %)

Figure 5.20 Israeli Military Satellites Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.21 Italian Military Satellites Market Forecast 2018-2028 (AGR %)

Figure 5.22 Italian Military Satellites Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.23 Russian Military Satellites Market Forecast 2018-2028 (AGR %)

Figure 5.24 Russian Military Satellite Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.25 Spanish Military Satellites Market Forecast 2018-2028 (AGR %)

Figure 5.26 Spanish Military Satellites Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.27 UK Military Satellites Market Forecast 2018-2028 (AGR %)

Figure 5.28 UK Military Satellites Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.29 USA Military Satellites Market Forecast 2018-2028 (AGR %)

Figure 5.30 USA Military Satellites Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.31 Rest of the World Military Satellites Market Forecast 2018-2028 (AGR %)

Figure 5.32 Rest of the World Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 8.1 Airbus Group SE Total Company Sales 2012-2017

(US$m, AGR %)

Figure 8.2 Airbus Group SE Sales by Segment of Business 2012-2017 (US$m, Total Company Sales AGR %)

Figure 8.3 Airbus Group SE Sales AGR by Segment of Business 2013-2017 (Sales AGR %)

8.2.4 Airbus Group SE Net Income 2012-2017

Figure 8.4 Airbus Group SE Net Income 2012-2017 (US$m, AGR %)

8.2.5 Airbus Group SE Cost of Research & Development 2012-2017

Figure 8.5 Airbus Group SE Cost of Research & Development 2012-2017 (US$m, AGR %)

8.2.6 Airbus Group SE Regional Emphasis / Focus

Figure 8.6 Airbus Group SE Primary International Operations 2017

Figure 8.7 Airbus Group SE Sales AGR by Geographical Location 2013-2017 (AGR %)

Figure 8.8 Airbus Group SE Sales by Geographical Location 2012-2017 (US$m, Total Company Sales AGR %)

Figure 8.9 Airbus Group SE Organisational Structure 2017

Figure 8.10 The Boeing Company Total Company Sales 2012-2017 (US$m, AGR %)

Figure 8.11 The Boeing Company Sales by Segment of Business 2012-2017 (US$m, Total Company Sales AGR %)

Figure 8.12 The Boeing Company Sales AGR by Segment of Business 2013-2016 (AGR %)

8.3.4The Boeing Company Net Income / Loss 2012-2017

Figure 8.13 The Boeing Company Net Income 2012-2017 (US$m, AGR %)

8.3.5 The Boeing Company Cost of Research & Development 2012-2017

Figure 8.14 The Boeing Company Cost of Research & Development 2012-2017 (US$m, AGR %)

8.3.6 The Boeing Company Regional Emphasis / Focus

Figure 8.15 The Boeing Company Primary International Operations 2017

Figure 8.16 The Boeing Company Sales AGR by Geographical Location 2012-2017 (AGR %)

Figure 8.17 The Boeing Company Sales by Geographical Location 2012-2017 (US$m, Total Company Sales AGR %)

Figure 8.18 The Boeing Company Organisational Structure 2017

Figure 8.19 Inmarsat Total Company Sales 2012-2017 (US$m, AGR %)

Figure 8.20 Inmarsat Sales by Segment of Business 2012-2017 (US$m, Total Company Sales AGR %)

Figure 8.21 Inmarsat Sales AGR by Segment of Business 2013-2016 (Sales AGR %)

Figure 8.22 Inmarsat Net Income 2012-2017 (US$m, AGR %)

Figure 8.23 Inmarsat Cost of Research & Development 2012-2017 (US$m, AGR %)

Figure 8.24 Inmarsat Primary International Operations 2017

Figure 8.25 Inmarsat Sales AGR by Geographical Location 2013-2016 (AGR %)

Figure 8.26 Inmarsat Sales by Geographical Location 2012-2017 (US$m, Total Company Sales AGR %)

Figure 8.27 Inmarsat Organisational Structure 2017

Figure 8.28 Israel Aerospace Industries Total Company Sales 2012-2017 (US$m, AGR %)

Figure 8.29 Israel Aerospace Industries Sales by Segment of Business 2012-2017 (US$m, Total Company Sales AGR %)

Figure 8.30 Israel Aerospace Industries Sales AGR by Segment of Business 2013-2017 (AGR %)

Figure 8.31 Israel Aerospace Industries Net Income 2012-2015 (US$m, AGR %)

Figure 8.32 Israel Aerospace Industries Cost of Research & Development 2010-2015 (US$m, AGR %)

Figure 8.33 Israeli Aerospace Industries Primary International Operations 2017

Figure 8.34 Israel Aerospace Industries Organisational Structure 2017

Figure 8.35 ISS Reshetnev Primary International Operations 2017

Figure 8.36 Lockheed Martin Corporation Total Company Sales 2012-2017 (US$m, AGR %)

Figure 8.37 Lockheed Martin Corporation Sales by Segment of Business 2012-2017 (US$m, Total Company Sales AGR %)

Figure 8.38 Lockheed Martin Corporation Sales AGR by Segment of Business 2013-2016 (AGR %)

Figure 8.39 Lockheed Martin Corporation Net Income2012-2017 (US$m, AGR %)

Figure 8.40 Lockheed Martin Corporation Cost of Research & Development 2012-2017 (US$m, AGR %)

Figure 8.41 Lockheed Martin Corporation Primary International Operations 2017

Figure 8.42 Lockheed Martin Corporation Sales AGR by Geographical Location 2013-2017 (AGR %)

Figure 8.43 Lockheed Martin Corporation Sales by Geographical Location 2012-2017 (US$m, Total Company Sales AGR %)

Figure 8.44 Lockheed Martin Corporation Organisational Structure 2017

Figure 8.45 Mitsubishi Electric Corporation Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.46 Mitsubishi Electric Corporation Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.47 Mitsubishi Electric Corporation Sales AGR by Segment of Business 2014-2017 (AGR %)

Figure 8.48 Mitsubishi Electric Corporation Net Income2013-2017 (US$m, AGR %)

Figure 8.49 Mitsubishi Electric Corporation Cost of Research & Development 2013-2017 (US$m, AGR %)

Figure 8.50 Mitsubishi Electric Corporation Primary International Operations 2017

Figure 8.51 Mitsubishi Electric Corporation Sales AGR by Geographical Location 2014-2017 (AGR %)

Figure 8.52 Mitsubishi Electric Corporation Sales by Geographical Location 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.53 Mitsubishi Electric Corporation Organisational Structure 2017

Figure 8.54 Orbital ATK Inc. Total Company Sales 2012-2017 (US$m, AGR %)

Figure 8.55 Orbital ATK Inc. Sales by Segment of Business 2013-2016 (US$m)

Figure 8.56 Orbital ATK Inc. Sales AGR by Segment of Business 2014-2017 (US$m)

Figure 8.57 Orbital ATK Inc. Net Income 2012-2017 (US$m, AGR %)

Figure 8.58 Orbital ATK Inc. Cost of Research & Development 2012-2017 (US$m, AGR %)

Figure 8.59 Orbital ATK Inc. Primary International Operations 2017

Figure 8.60 Orbital ATK Inc. Sales by Geographical Location 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.61 Orbital ATK Inc. Sales AGR by Geographical Location 2014-2017 (AGR %)

Figure 8.62 Orbital ATK Inc. Organisational Structure 2017

Figure 8.63 Raytheon Company Total Company Sales 2012-2017 (US$m, AGR %)

Figure 8.64 Sales by Segment of Business 2012-2017 (US$m, Total Company Sales AGR %)

Figure 8.65 Raytheon Company Sales AGR by Segment of Business 2013-2017 (AGR %)

Figure 8.66 Raytheon Company Net Income 2012-2017 (US$m, AGR %)

Figure 8.67 Raytheon Company Cost of Research & Development 2012-2017 (US$m, AGR %)

Figure 8.68 Raytheon Company Primary International Operations 2017

Figure 8.69 Raytheon Company Sales AGR by Geographical Location 2013-2017 (AGR %)

Figure 8.70 Raytheon Company Sales by Geographical Location 2012-2017 (US$m, Total Company Sales AGR %)

Figure 8.71 Raytheon Company Organisational Structure 2017

Figure 8.72 SES S.A. Total Company Sales 2012-2017 (US$m, AGR %)

Figure 8.73 SES S.A. Sales AGR by Segment of Business 2015-2017 (Sales AGR %)

Figure 8.74 SES S.A. Sales by Segment of Business 2014-2017 (US$m)

Figure 8.75 SES S.A. Net Income 2012-2017 (US$m, AGR %)

Figure 8.76 SES S.A. Primary International Operations 2017

Figure 8.77 SES S.A. Sales AGR by Segment of Business 2013-2017 (Sales AGR %)

Figure 8.78 SES S.A. Sales by Geographical Location 2012-2017 (US$m, Total Company Sales AGR %)

Figure 8.79 SES S.A. Organisational Structure 2017

Figure 8.80 Thales Group Total Company Sales 2012-2017 (US$m, AGR %)

Figure 8.81 Thales Group Sales by Segment of Business 2012-2017 (US$m, Total Company Sales AGR %)

Figure 8.82 Thales Group Sales AGR by Segment of Business 2012-2017 (Sales AGR %)

Figure 8.83 Thales Group Net Income / Loss 2012-2017 (US$m, AGR %)

Figure 8.84 Thales Group Cost of Research & Development 2012-2017 (US$m, AGR %)

Figure 8.85 Thales Group Primary International Operations 2017

Figure 8.86 Thales Group Sales by Geographical Location 2012-2017 (US$m, Total Company Sales AGR %)

Figure 8.87 Thales Group Sales AGR by Geographical Location 2012-2017 (Sales AGR %)

Figure 8.88 Thales Group Organisational Structure 2017

Figure 8.89 ViaSat Inc Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.90 ViaSat Inc Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.91 ViaSat Inc Sales AGR by Segment of Business 2014-2017 (AGR %)

Figure 8.92 ViaSat Inc Net Income / Loss 2013-2017 (US$m)

Figure 8.93 ViaSat Inc Primary International Operations 2017

Figure 8.94 ViaSat Inc Sales AGR by Geographical Location 2014-2017 (AGR %)

Figure 8.95 ViaSat Inc Sales by Geographical Location 2013-2017 (US$m, Total Company Sales AGR %)

Amor Group

Applied Signal Technology, Inc

Areva SA

Arkoon Network Security

Asia Broadcast Satellite

Asia Public Co.,

Astrium Services GmbH, Ottobrunn

Astrotech

Aurora Flight Sciences

Aveos Fleet Performance

Ball Aerospace

Bharat Electronics Limited (BEL)

Blackbird Technologies, Incorporated

Boeing

BRAZILIAN SPACE AGENCY

C4 Advanced Solutions

Carl Zeiss Optronics GmbH

Cassidian

CDL Systems Ltd

Centre for Strategic and Budgetary Assessments

Chandler/May Inc

Chinese Aerospace Science and Technology Corporation

Cloudwatt

Danish armed forces

DARPA

Dassault Aviation

Data Path Inc

Dauria Aerospace

DCNS

Deposition Sciences Inc

Diehl Air Cabin GmbH

DLR,

DSN Corp

Dynamatic Technologies Ltd

Elancourt

Elbe Flugzeugwerke, Dresden

ELTA Systems Ltd.

Eurocopter

EutelSat

FIMI

Finmeccanica (now Leonardo)

French Defence Department

Générale de l’Armement (DGA) , France

Georgia Tech Research Institute

Getafe

GovSat

Harris Information Technology Services Inc.

Henggeler Computer Consultants Inc

Hensoldt

Herndon

Honeywell International Inc.

Hughes Network Systems

Immenstaad

Indian Space Research Organisation

Industrial Defender

Information Satellite Systems

Inmarsat

Intelsat

Iridium Communications Inc

Israel Aerospace Industries

ISS Reshetnev

Italian Defense Ministry

Japan Aerospace Exploration Agency

JenaOptronik GmbH

Kosmotras launch Agency and King Abdulaziz City for Science and Technology (KACST)

L&T Technology Services

L-3 Communications

L-3 Technologies

La Caisse des Dépôts

LaSalle Capital

Lindsay Goldberg LLC.

LinQuest Corporation

LiveTV

Lockheed Martin

LOMO

Loral

Maryland Aerospace Inc., Spaceflight Industries

Mitsubishi Electric Corporation

Nantero Inc’s

Narus

NASA

NATO

ND Satcom GmbH

Netasq

NetNearU Corp.

Northrop Grumman Corporation

Oberkochen

OHB Systems GmbH

OpenHydro

Orange Participations

Orbital ATK

Pacific Defence Solutions LLC

Parter Capital Group AG

Poseidon Scientific Instruments Pty Ltd

Procerus Technologies, L.C.

QTC Holdings Inc

Quantum Industries S.à.r.l.,

Raytheon Company

RUAG

SafeNet Inc’s

Salzburg München Bank AG

Satrec Initiative

SES

Sikorsky Aircraft

Solutions made Simple Inc

Space and Naval Warfare Systems Command (SPAWAR)

Space Engineering SpA, Rome

Space Exploration Technologies Corporation

SpaceQuest Ltd

Speedcast

Sputnix

SSL (formerly Space Systems/Loral, LLC)

Sysgo AG

Systems Engineering & Assessment Limited

Tampa Microwave

Telespazio

Teligy Inc,

Thales

Thales Alenia Space

Thales-Raytheon Systems Co. Ltd

The Aerospace Corp.

the United Arab Emirates Air Force (UAEAF)

Trusted Computer Solutions Inc

TsSKB-Progress

U.S. Air Force

U.S. Army

U.S. Army Intelligence and Security Command (INSCOM)

U.S. Army's Space and Missile Defense Command/Army Forces Strategic Command (USASMDC/ARSTRAT)

U.S. Navy

United Launch Services, LLC

United Technologies Corporation

University of New South Wales (UNSW)

US Department of Defense (DoD)

Vector Aerospace Corporation

Veritas Capital

ViaSat

Visiona

Visionix

Visual Analytics Inc

Vought Aircraft Industries

Zeta

Organisations Mentioned

Association of the United States Army (AUSA)

Australian Defence Force

British Army

Chinese Aerospace Science and Technology Corporation

French Armed Forces

French Ministry of Defence

Georgia Tech Research Institute

German Bundeswehr

Indian Air Force

Indian Armed Forces

Indian Space Research Organisation

International Security Assistance Force (ISAF)

Israel Space Agency

Italian Navy

North Atlantic Treaty Organisation (NATO)

People’s Liberation Army (PLA)

Philippine Army

The Tank Automotive Research, Development and Engineering Center (TARDEC)

UK Ministry of Defence (MoD)

US Air Force (USAF)

US Army

US Department of Defense

US Joint Improvised Explosive Device Defeat Organisation (JIEDDO)

US Marine Corps (USMC)

US National Guard

US Navy

Download sample pages

Complete the form below to download your free sample pages for Military Satellites Market Report 2018-2028

Related reports

-

Military Hyperspectral Imaging Market Forecast 2019-2029

The $3075.3mn (2019) Hyperspectral Imaging market is expected to flourish in the next few years because of rising adoption of...Full DetailsPublished: 19 December 2018 -

Supersonic and Hypersonic Missiles Market Report 2019-2029

The increase in spending in supersonic and hypersonic missile systems by defence departments has led Visiongain to publish this timey...

Full DetailsPublished: 28 February 2019 -

Next Generation Information Technology in Aerospace and Defence Market Report 2018-2028

Read on to discover how this definitive report can transform your own research and save you time.

...Full DetailsPublished: 29 June 2018 -

Critical Infrastructure Protection (CIP) Market Report 2018-2028

Our 304 page report provides 198 tables, charts, and graphs. Read on to discover the most lucrative areas in the...

Full DetailsPublished: 28 June 2018 -

Military Radar System Market Report 2019-2029

The Global Military Radar System Market is expected to reach US$ 12.23bn in 2019, up 2.09% from 2018. ...Full DetailsPublished: 25 February 2019 -

Top 20 Companies Developing Commercial Electric Aircraft 2020

Commercial Electric Aircraft spending to grow at a double digit rate over the forecast period.

...Full DetailsPublished: 23 January 2020 -

Military Sensor Fusion Market Forecast 2019-2029

The $ 204 million military sensor fusion market is expected to flourish in the next few years because of rising...Full DetailsPublished: 26 November 2018 -

Australian Defence Market Report 2019-2029

Where is the Australian Defence market heading? If you are involved in this sector you must read this brand new...Full DetailsPublished: 16 May 2019 -

US Border Security Market Report 2019-2029

This report is essential reading for you or anyone in the aerospace and defence sector with an interest in Border...

Full DetailsPublished: 29 November 2018 -

Top 15 Small Satellite Companies 2019

The global Top 15 Small Satellite Companies 2019 provides the reader with a thorough overview of the competitive landscape in...Full DetailsPublished: 23 January 2019

Download sample pages

Complete the form below to download your free sample pages for Military Satellites Market Report 2018-2028

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain defence reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible, Visiongain analysts reach out to market-leading vendors and industry experts and review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain defence reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

ADS Group

Aerial Refueling Systems Advisory Group

Aerospace and Defence Industries Association of Nova Scotia

Aerospace Industries Association

Aerospace Industries Association of Canada

AHS International – The Vertical Flight Technical Society

Air Force Association

Aircraft Electronics Association

Airlift/Tanker Association

American Astronautical Society

American Gear Manufacturers Association

American Institute of Aeronautics and Astronautics

American Logistics Association

American Society of Naval Engineers

AMSUS – The Society of the Federal Health Agencies

Armed Forces Communications and Electronics Association

Armed Forces Communications and Electronics Association

Army Aviation Association of America

ASD – Aerospace & Defence Association of Europe

Association for Unmanned Vehicle Systems International

Association of Aviation Manufacturers of the Czech Republic

Association of Naval Aviation

Association of Old Crows

Association of Polish Aviation Industry

Association of the Defense Industry of the Czech Republic

Association of the United States Army

Association of the United States Navy

Australia Defence Association

Australian Industry & Defence Network

Australian Industry Group Defence Council

Austrian Aeronautics Industries Group

Aviation Distributors and Manufacturers Association

Aviation Suppliers Association

Belgian Security and Defence Industry

Bulgarian Defence Industry Association

Business Executives for National Security

Canadian Association of Defence and Security Industries

Conference of Defense Associations

Council of Defense and Space Industry Associations

Danish Defence & Security Industries Association

Defence Industry Manufacturers Association

Defense Industry Initiative on Business Ethics and Conduct

Defense Industry Offset Association

Defense Orientation Conference Association

Deutsche Gesellschaft fur Wehrtechnik

Federal Association of the German Security and Defence Industry

Federation of Aerospace Enterprises in Ireland

French Aerospace Industries Association

French Land Defence Manufacturers Association (GICAT)

German Aerospace Industries Association

Helicopter Association International

Hellenic Aerospace & Defense Industries Group

Homeland Security & Defense Business Council

International Stability Operations Association

Japan Association of Defense Industry

Korea Defense Industry Association

Marine Corps Association & Foundation

National Aeronautic Association

National Association of Ordnance and Explosive Waste Contractors

National Defense Industrial Association

National Defense Transportation Association

National Guard Association of the U.S.

Navy League of the United States

Netherlands Aerospace Group

New Zealand Defence Industry Association

Portuguese Association of Defense Related Industries & New Technologies Companies

Québec Ground Transportation Cluster

Satellite Industry Association

Society of American Military Engineers

South African Aerospace Maritime and Defence Industries Association

Spanish Aerospace and Defence Association Industries

Submarine Industrial Base Council

Swedish Aerospace Industries

Swedish Security and Defence Industry Association

Swiss Aeronautical Industries Group

The Association of Finnish Defence and Aerospace Industries

The Italian Industries Association for Aerospace Systems and Defence

The Netherlands Defence Manufacturers Association

The Society of Japanese Aerospace Companies

UK AeroSpace, Defence & Security Industries

United Kingdom National Defence Association

Latest Defence news

Visiongain Publishes Directed Energy Weapons (DEW) Market Report 2024-2034

The global Directed Energy Weapons (DEW) market was valued at US$6.4 billion in 2023 and is projected to grow at a CAGR of 19.6% during the forecast period 2024-2034.

26 February 2024

Visiongain Publishes Military Embedded Satellite Systems Market Report 2024-2034

The global Military Embedded Satellite Systems market is projected to grow at a CAGR of 8.7% by 2034

21 February 2024

Visiongain Publishes Military Simulation, Modelling and Virtual Training Market Report 2024-2034

The global military simulation, modelling and virtual training market was valued at US$13.2 billion in 2023 and is projected to grow at a CAGR of 8.3% during the forecast period 2024-2034.

15 February 2024

Visiongain Publishes Military Armoured Vehicle Market Report 2024-2034

The global Military Armoured Vehicle market was valued at US$36,123.6 million in 2023 and is projected to grow at a CAGR of 3.6% during the forecast period 2024-2034.

07 February 2024