The applications of composites within the automotive sector began in motorsport and premium segments primarily for performance objectives. However governmental regulations to meet emissions and fuel efficiency targets are now forcing automotive OEMs to increasingly look at ways to reduce vehicle weight to help reach these tightening emissions regulations.

However, composites are slow to manufacture and much more expensive than traditional steel or aluminium parts to mass produce. Consequently considerable R&D has been invested into developing production techniques to bring down the relatively high cost and slow speed of traditional composites production. As such composites components are now increasingly commonplace on car manufacturer’s vehicles and are inevitably trickling down their vehicle range from premium to medium and even budget segments.

Visiongain quantifies the automotive composites market as worth $14.34bn in 2018.

This report evaluates and quantifies who the leading 20 companies are in automotive composites by rank and market share %, including both automotive OEMs and composite specialists.

Report highlights:

Company profiles reveal the following information

• Automotive composites market share %

• Automotive composites ranking amongst the top 20 companies

• Company overview

• Key financials

• Analysis of recent automotive composites developments

• SWOT analysis

• Analysis of strategy

The leading 20 companies profiled in the study include a mixture of automotive OEMs and composites specialists

Automotive OEMs

• Daimler AG

• Fiat Chrysler

• PSA Peugeot-Citroen

• BMW AG

• General Motors (GM)

• Ford Motor Company

• Hyundai-Kia

• Toyota Motor Corporation

• Volkswagen AG

• Renault S.A.

Composites Specialists

• Cytec Industries Inc

• Gurit Holding AG

• Dow Automotive Systems

• SGL Group Systems

• DuPont

• Johnson Controls

• AGY

• Toray Industries

• TenCate

• Teijin (Toho Tenax)

Global market size for the automotive composites market

An analysis of the automotive composites market by type, and by component

There is also an evaluation of the future opportunities that exists in the automotive composites market.

Key questions answered

• What does the future hold for the automotive composites industry?

• Where should you target your business strategy?

• Which applications should you focus upon?

• Which disruptive technologies should you invest in?

• Which companies should you form strategic alliances with?

• Which company is likely to success and why?

• What business models should you adopt?

• What industry trends should you be aware of?

Target audience

• Leading composites companies

• Automotive OEMs

• Component suppliers

• Technologists

• R&D staff

• Consultants

• Market analysts

• CEO’s

• CIO’s

• COO’s

• Business development managers

• Investors

• Governments

• Agencies

• Industry organisations

• Banks

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Global Automotive Composites Market 2018 Overview

1.1 Why You Should Read This Report

1.2 How This Report Delivers

1.3 Key Questions Answered By This Analytical Report Include:

1.4 Who is This Report For?

1.5 Methodology

1.6 Frequently Asked Questions (FAQs)

1.7 Associated Visiongain Reports

1.8 About Visiongain

2. Introduction to the Automotive Composites Market

3. Opportunities for the Automotive Composites Market: Light-weighting, Fuel Efficiency, Durability & Emission Reduction

3.1 CO2 Emission Regulations in the EU and the US

3.2 Automotive Composites-Applications in High End Vehicles

4. Automotive Composites Market Definition

4.1 Composite Materials Definition

4.2 Global Automotive Composites Market Definition

4.3 Automotive Composites Market Segmentation

4.3.1 By Type of Composite Materials

4.3.1.4 Polymer Matrix Composites

4.3.1.5 Carbon Fibre Reinforced Polymer(CFRP)

4.3.1.6 Metal Matrix Composites

4.3.1.7 Ceramic Matrix Composites

4.3.2 Automotive Composites Market Segmentation-By Type of Composite Components

4.3.2.4 Interior Components Submarket

4.3.2.5 Body Components Submarket

4.3.2.6 Engine & Drivetrain Components Submarket

4.3.2.7 Other Components Submarket

4.4 Learn What Drives the Growth of the Automotive Composites Market 2017

4.5 Why the Automotive Composites Market will Grow Faster than the Global Car Market

4.6 What is Restraining the Global Automotive Composites Market

4.7 Discover the Drivers & Restraints of the Global Automotive Composites Market

4.8 The Challenges that the Global Automotive Composites Market Will Face

4.9 Market Share of top companies in the Automotive Composites Market, 2017

4.10 Ranking of top 20 companies based on their revenues, 2017

5. The Leading Twenty Companies in the Automotive Composites Market 2018

5.1 Daimler AG

5.1.1 Daimler AG Overview

5.1.2 Daimler AG Recent Automotive Composites Developments

5.1.3 Daimler AG SWOT Analysis

5.1.4 Daimler AG Strategy

5.2 Fiat Chrysler

5.2.1 Fiat Chrysler Overview

5.2.2 Fiat Chrysler Recent Automotive Composites Developments

5.2.3 Fiat Chrysler SWOT Analysis

5.2.3.4 Fiat Chrysler Strategy

5.3 PSA Peugeot-Citroen

5.3.1 PSA Peugeot-Citroen Overview

5.3.2 PSA Peugeot Recent Automotive Composites Developments

5.3.3 PSA Peugeot SWOT Analysis

5.3.4 PSA Peugeot Strategy

5.4 Cytec Industries Inc.-Citroen

5.4.1 Cytec Industries Inc. Overview

5.4.2 Cytec Industries Inc. SWOT Analysis

5.4.3 Cytec Industries Inc. Strategy

5.5 Gurit Holding AG

5.5.1 Gurit Holding AG Overview

5.5.2 Gurit Holding AG Recent Automotive Composites Developments

5.5.36 Gurit Holding AG Strategy

5.6 Dow Automotive Systems

5.6.1 Dow Automotive Systems Overview

5.6.2 Dow Automotive Systems Recent Composites Developments

5.6.3 Dow Automotive Systems SWOT Analysis

5.6.4 Dow Automotive Systems Strategy

5.7 SGL Group Systems

5.7.1 SGL Group Overview

5.7.2 SGL Group Recent Automotive Composites Developments

5.7.3 SGL Group SWOT Analysis

5.7.4 SGL Group Strategy

5.8 DuPont

5.8.1 DuPont Overview

5.8.2 DuPont Recent Automotive Composites Developments

5.8.3 DuPont SWOT Analysis

5.8.4 DuPont Strategy

5.9 Johnson Controls Company

5.9.1 Johnson Controls Company Overview

5.9.2 Johnson Controls Company SWOT Analysis

5.9.3 Johnson Controls Company Strategy

5.10 BMW AG

5.10.1 BMW AG Overview

5.10.2 BMW AG Recent Automotive Composites Developments

5.10.3 BMW AG SWOT Analysis

5.10.4 BMW AG Strategy

5.11 General Motors (GM)

5.11.1 General Motors (GM) Overview

5.11.2 General Motors (GM) Recent Automotive Composites Developments

5.11.3 General Motors (GM) SWOT Analysis

5.11.4 General Motors (GM) Strategy

5.12 Ford Motor Company

5.12.1 Ford Motor Company Overview

5.12.2 Ford Motor Company Recent Automotive Composites Developments

5.12.3 Ford Motor Company SWOT Analysis

5.12.4 Ford Motor Company Strategy

5.13 AGY Company

5.13.1 AGY Company Overview

5.13.2 AGY Recent Automotive Composites Developments

5.13.3 AGY SWOT Analysis

5.13.4 AGY Strategy

5.14 Hyundai-Kia Company

5.14.1 Hyundai-Kia Company Overview

5.14.2 Hyundai-Kia Recent Automotive Composites Developments

5.14.3 Hyundai-Kia SWOT Analysis

5.14.4 Hyundai-Kia Strategy

5.15 Toyota Motor Corporation

5.15.1 Toyota Motor Corporation Overview

5.15.2 Toyota Motor Corporation Recent Automotive Composites Developments

5.15.3 Toyota Motor Corporation SWOT Analysis

5.15.4 Toyota Motor Corporation Strategy

5.16 Volkswagen AG

5.16.1 Volkswagen AG Overview

5.16.2 Volkswagen AG Recent Automotive Composites Developments

5.16.3 Volkswagen AG SWOT Analysis

5.16.4 Volkswagen AG Strategy

5.17 Renault S.A.

5.17.1 Renault S.A. Overview

5.17.2 Renault S.A. Recent Automotive Composites Developments

5.17.3 Renault S.A. SWOT Analysis

5.17.4 Renault S.A. Strategy

5.18 Toray Industries

5.18.1 Toray Industries Overview

5.18.2 Toray Industries Recent Automotive Composites Developments

5.18.3 Toray Industries SWOT Analysis

5.18.4 Toray Industries Strategy

5.19 TenCate

5.19.1 TenCate Overview

5.19.2 TenCate Recent Automotive Composites Developments

5.19.3 TenCate Strategy

5.20 Teijin (Toho Tenax)

5.20.1 Teijin (Toho Tenax) Overview

5.20.2 Teijin (Toho Tenax) Recent Automotive Composites Developments

5.20.3 Teijin (Toho Tenax) Strategy

6. Other Players in the Automotive Composites Market

List of Tables

Table 3.1 Automotive Composites Applications-Carbon Fibre in Modern Cars

Table 4.1 Drivers & Restraints Of The Global Automotive Composites Market

Table 4.2 Challenges Of The Global Automotive Composites Market

Table 4.3 Rank of Top 20 Automotive Composites Companies 2017 (Company, Market Share %,)

Table 5.1 Daimler AG Overview 2017 (Founded, Website, CEO, Automotive Composites Market Share %, Total Company Sales 2017 $Bn, Income/Loss $Bn, Number Of Employees, Headquarters)

Table 5.2 Daimler AG Recent Developments

Table 5.3 SWOT Analysis of Daimler AG

Table 5.4 Fiat Chrysler Overview 2017 (Founded, CEO, Automotive Composites Market Share %, Total Company Sales 2017 $Bn, Income/Loss $Bn, Number Of Employees, Headquarters)

Table 5.5 Fiat Chrysler Recent Developments

Table 5.6 SWOT Analysis of Fiat Chrysler

Table 5.7 PSA Peugeot-Citroen Overview 2017 (Founded, Website, CEO, Automotive Composites Market Share %,, Total Company Sales 2016 $Bn, Income/Loss $Bn, Number Of Employees, Headquarters)

Table 5.8 PSA Peugeot Recent Developments

Table 5.9 SWOT Analysis of PSA Peugeot

Table 5.10 Cytec Industries Inc. Overview 2017 (Founded, Website, CEO, Automotive Composites Market Share %,, Total Company Sales 2017 $Bn, Income/Loss $Bn, Number Of Employees, Headquarters)

Table 5.11 SWOT Analysis of Cytec Industries Inc.

Table 5.12 Gurit Holding AG Overview 2017 (Founded, CEO, Automotive Composites Market Share %, Total Company Sales 2017 $Bn, Income/Loss $Bn, Number Of Employees, Headquarters)

Table 5.13 Gurit Holding AG Recent Developments

Table 5.14 Dow Automotive Systems Overview 2017 (Founded, Website, CEO, Automotive Composites Market Share %, Total Company Sales 2017 $Bn, Income/Loss $Bn, Number Of Employees, Headquarters)

Table 5.15 Dow Automotive Systems Recent Developments

Table 5.16 SWOT Analysis of Dow Automotive Systems

Table 5.17 SGL Group Overview 2017 (Founded, Website, CEO, Composites Market Share %, Total Company Sales 2017 $Bn, Income/Loss $Bn, Number Of Employees, Headquarters)

Table 5.18 SGL Group Recent Developments

Table. 5.19 SWOT Analysis of SGL Group

Table. 5.20 DuPont Overview 2017 (Founded, Website, CEO, Automotive Composites Market Share %, Total Company Sales 2017 $Bn, Income/Loss $Bn, Number Of Employees, Headquarters)

Table 5.21 DuPont Recent Developments

Table 5.22 SWOT Analysis of DuPont

Table 5.23 Johnson Controls Company Overview 2017 (Founded, Website, CEO, Automotive Composites Market Share %, Total Company Sales 2017 $Bn, Income/Loss $Bn, Number Of Employees, Headquarters)

Table 5.24 SWOT Analysis of Johnson Controls Company

Table 5.25 BMW AG Overview 2016 (Founded, Website, CEO, Automotive Composites Market Share %, Total Company Sales 2016 $Bn, Income/Loss $m, Capital Expenditure $Bn, Number Of Employees, Headquarters)

Table 5.26 BMW AG Recent Developments

Table 5.27 SWOT Analysis of BMW AG

Table 5.28 General Motors (GM) Overview 2016 (Founded, Website, CEO, Automotive Composites Market Share %, Total Company Sales 2017 $Bn, Income/Loss $Bn, Number Of Employees, Headquarters)

Table 5.29 General Motors (GM) Recent Developments

Table 5.30 SWOT Analysis of General Motors (GM)

Table 5.31 Ford Motor Company Overview 2017 (Founded, Website, CEO, Automotive Composites Market Share %, Total Company Sales 2017 $Bn, Income/Loss $Bn, Number Of Employees, Headquarters)

Table 5.32 Ford Motor Company Recent Developments

Table 5.33 SWOT Analysis of Ford Motor Company

Table 5.34 AGY Overview 2017 (Founded, Website, CEO, Automotive Composites Market Share %, Total Company Sales 2017 $Bn, Income/Loss $Bn, Number Of Employees, Headquarters)

Table 5.35 AGY Recent Developments

Table 5.36 SWOT Analysis of AGY

Table 5.37 Hyundai-Kia Overview 2017 (Founded, Website, CEO, Automotive Composites Market Share %, Total Company Sales 2015 $Bn, Total Company Sales 2016 $Bn, Income/Loss $Bn, Number Of Employees, Headquarters)

Table 5.38 Hyundai-Kia Recent Developments

Table 5.39 SWOT Analysis of Hyundai-Kia

Table 5.40 Toyota Motor Corporation Overview 2017 (Founded, CEO, Automotive Composites Market Share %, Total Company Sales 2017 $Bn, Income/Loss $Bn, Number Of Employees, Headquarters)

Table 5.41.Toyota Motor Corporation Recent Developments

Table 5.42 SWOT Analysis of Toyota Motor Corporation

Table 5.43 Volkswagen AG Overview 2017 (Founded, CEO, Automotive Composites Market Share %, Total Company Sales 2017 $Bn, Income/Loss $Bn, Number Of Employees, Headquarters)

Table 5.44 Volkswagen AG Recent Developments

Table 5.45 SWOT Analysis of Volkswagen AG

Table 5.46 Renault S.A. Overview 2017 (Founded, Website, CEO, Automotive Composites Market Share %, Total Company Sales 2017 $Bn, Income/Loss $Bn, Number Of Employees, Headquarters)

Table 5.47 Renault S.A. Recent Developments

Table 5.48 SWOT Analysis of Renault S.A.

Table 5.49 Toray Industries Overview 2016 (Founded, Website, CEO, Automotive Composites Market Share %, Total Company Sales 2015 $Bn, Total Company Sales 2016 $Bn, Income/Loss $Bn, Number Of Employees, Headquarters)

Table 5.50 Toray Industries Recent Developments

Table 5.51 SWOT Analysis of Toray Industries

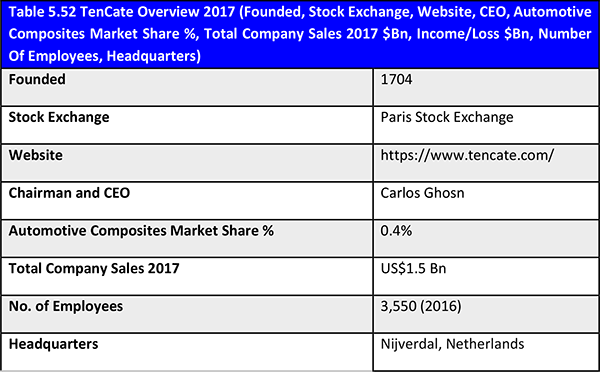

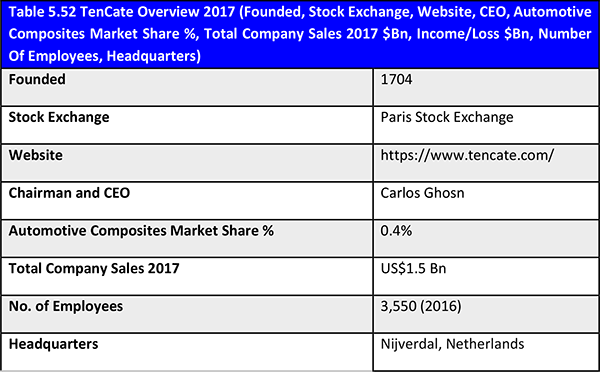

Table. 5.52 TenCate Overview 2017 (Founded , Website, CEO, Automotive Composites Market Share %, Total Company Sales 2017 $Bn, Number Of Employees, Headquarters)

Table 5.53 TenCate Recent Developments

Table 5.54 Teijin (Toho Tenax) Overview 2017 (Founded, Website, CEO, Automotive Composites Revenues $bn, Automotive Composites Market Share %, Total Company Sales 2017 $Bn, Income/Loss $Bn, Number Of Employees, Headquarters)

Table 5.55 Teijin (Toho Tenax) Recent Developments

List of Figures

Figure 4.1 Global Automotive Composites Market Structure Overview

Figure 4.2 Global Automotive Composites Market Value Breakdown: Composite Raw Materials and Value Added Processes 2017, 2022, 2027 (%)

Figure 4.3 Global Automotive Composites Market by Type of Composite Materials

Figure 4.4 Picture Of A Honeycomb Structure Made Of Carbon-Fibre-Reinforced Polymer On A BMW i3

Figure 4.5 Picture of AMG Carbon Ceramic Brake Disc

Figure 4.6 Global Automotive Composites Market by Type of Composite Components

Figure 4.7 CFRP and Aramid Fibre interior on Jaguar XJR-15

Figure 4.8 Cut-out of BMW Turbo-Charged Engine

Figure 4.9 Global Passenger Car Sales 2005-16 (mn Units, AGR%)

Figure 4.10 Market Share Of Top Companies in the Automotive Composites Market 2017 (%)

3B Fiberglass Company

AAT Composites (Pty) Ltd.

Adler Group

AGY Asia.

AGY US

Airborne

Alcoa

Alfa Romeo

AMG

Audi

Autonomic

Axon Automotive

Barracuda Advanced Composites

BASF

Benteler Automobiltechnik GmbH

Benteler-SGL

BMW AG

BMW Group

Changan

Comau

Composite Castings, LLC

Continental Structural Plastics (CSP) inc.

Creative Composites Ltd.

Cytec Industries Inc.

Daewoo

Daimler

Dow Automotive Systems

DowAksa

DowDuPont

Dralon GmbH

DuPont

Elbe Flugzeugwerke

FastRTM

FCA US LLC

Fiat Chrysler Automobiles (FCA)

Ford Motor Company

Formaplex

General Motors

GMS Composites

Gurit

Gurit Holding AG

Hanwha Azdel

Hexcel Corporation

Hyosung Corporation

Hyundai Kia Automotive Group

Hyundai Motor Company

IDI Composite International

JaguarLandRover

Johnson Controls

Koninklijke Ten Cate B.V. (KTC)

Kuempers

Lotte Chemical

Magna International Inc.

Magneti Marelli

Mahindra and Mahindra Limited

Mahindra Cie Automotive Ltd.

MAI Carbon

Main Union Industrial Ltd.

McLaren

Mercedes

Mercedes-Benz Vans

MicroBiopharm Japan

Mitsubishi

Mitsubishi Chemical Corporation

Mitsubishi Rayon

Mitsui & Co. Ltd.

Mubea Carbo Tech GmbH

Nippon Sheet Glass Co. Ltd.

Nissan

Novelis

Owens Corning

Plasan Carbon Composites

PricewaterhouseCoopers (PwC)

PSA Peugeot Citroen

Quantum Composites

RCI Banque

Renault SA

SABIC (Saudi Arabia Basic Industries Corporation)

Safran

SGL Automotive Carbon Fibers

SGL Carbon SE

SGL Group

SGL Kuempers

SHAPE Machining Ltd

SK Global Chemical Co., LTD.

Smart

SOFICAR

Solvay Cytec group

Solvay S.A.

Suzuki Motor Corporation

Teijin Limited (Toho Tenax)

TenCate Advanced Composites Holding B.V. (TCAC)

Toho Tenax Co. Ltd.

Toho Tenax Europe GmbH (TTE)

Toray Carbon Fibers Europe S.A.

Toray Industries, Inc.

Toyota Motor Corporation

TPI Composites

UFP Technologies, Inc.

Volkswagen

Volvo

West Essex Graphics (WEG)

Organisations Mentioned

BMBF

Center of Automotive Management in Bergisch Gladbach

European Commission

European Environment Agency (EEA)

Federal Ministry of Education and Research

General Motors Advanced Powertrain Research Laboratory in the C.S. Mott Science and Engineering Building

Houston Methodist Research Institute

Japan Automobile Manufacturers Association (JAMA)

Kettering University's General Motors Mobility Research Center

U.S. Department of Energy (DoE)

UAW

University of Augsburg

University of Delaware’s Centre for Composite Materials

VEBA