We reveal the competitive positioning for the top 20 companies in the overall composites market- and also the leading companies by composites type for carbon fibre, glass fibre and aramid fibre.

Developments in composites have had a significant impact on various industry verticals from automotive, to energy and construction. Visiongain’s report provides a detailed overview of the market, creating an accurate picture that will offer clarity to anyone involved in the composites market.

Importantly, the report also reveals company market share by composite type, giving you an insight into the future opportunities that exist in the Carbon Fibre Reinforced Plastic (CFRP), Glass Fibre Reinforced Plastic (GFRP) & Aramid Fibre Reinforced Plastic (AFRP) market

Key features

69 tables & charts

Market share analysis, revenues and competitive positioning of the top 20 composites companies

• Asahi Fibreglass Company

• Guardian Fibre Glass

• Owens Corning

• Hexcel Corporation

• China Fibreglass Company

• Mitsubishi Chemical Corporation

• Teijin

• Johns Manville

• SGL Group

• Taishan Fibreglass SA

• Kurarey

• Formosa Plastic

• Toray

• DuPont

• Nippon Sheet Glass Co. Ltd.

• Kolon Industries

• KCC Corporation

• Saertex Glass

• PPG Industries

• Taiwan Glass Industry Corporation

In addition the report also provides market share analysis for the 3 main composite types.

• Glass Fibre Reinforced Plastic (GFRP) Market Share For The Top 20 Companies

• Carbon Fibre Reinforced Plastic (CFRP) Market Share For The Top 17 Companies,

• Aramid Fibre Reinforced Plastic (AFRP) Market Share For The Top 8 Companies,

Plus A SWOT Analysis For The Composites Market

This report is a fantastic opportunity to increase your knowledge of the composites sector. Market share analysis tables, as well as analysis of the key players for the overall composites market and by composite type concisely informs you of the major factors affecting this market, whilst Visiongain’s data-rich approach provides greater insight into this market.

Who should read this report?

• Composites companies

• Petrochemical companies

• Construction companies

• Energy companies

• Utility companies

• Automotive companies

• Aerospace companies

• Defence companies

• Wind power companies

• Sporting goods companies

• Transport companies

• Engineers

• R&D staff

• Scientists

• CEOs

• Procurement staff

• Marketing staff

• Market analysts

• Business Development Managers

• Consultants

• Governmental agencies

• Industry associations

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Leading Composites Companies Overview

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report Includes:

1.5 Who is This Report For?

1.6 Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to the Composites Market

2.1 What are Composites?

2.2 Uses of Composites

2.2.1 The Use of Fibres within Composites

2.3 Glass Fibre Reinforced Polymers (GFRP)

2.4 Carbon Fibre Reinforced Polymers (GFRP)

2.5 Aramid Fibre Reinforced Polymers (GFRP)

2.6 Market Structure of the Composites Market

2.6.1 Transportation

2.6.2 Aviation

2.6.3 Energy

2.6.4 Sporting Goods

2.6.52 Consumer Goods

2.7 The Composites Industry

3. The Leading Composites Companies 2018

3.1 The Global Top 20 Composites Companies 2018

3.2 The Glass Fibre Market

3.2.1 The Global Top Glass Fibre Companies

3.3 The Carbon Fibre Market

3.3.1 The Global Top Carbon Fibre Companies

3.4 The Aramid Fibre Market

3.4.1 The Global Top Aramid Fibre Companies

4. The Leading Carbon, Glass & Aramid Fibre Companies 2018

4.1 Asahi Fibreglass Company

4.1.1 Asahi Fibreglass Overview and Operations & Locations

4.1.2 Asahi Fibreglass Outlook

4.1.3 Asahi Fibreglass Mergers, Acquisitions & News

4.2 Braj Binani Group

4.2.2 Braj Binani Group Outlook & News

4.3 China Fibreglass Company

4.3.1 China Fibreglass Company Overview and Operations & Locations

4.3.2 China Fibreglass Company Outlook & News

4.4 DuPont

4.4.1 DuPont Overview and Operations & Locations

4.4.2 DuPont Outlook & News

4.5 GKN

4.6.1 GKN Overview and Operations & Locations

4.6.2 GKN Outlook & News

4.6 Guardian Fibre Glass

4.6.1 Guardian Fibreglass Overview and Operations & Locations

4.7 Gurit

4.7.1 Gurit Overview and Operations & Locations

4.7.2 Gurit Outlook & News

4.8.1 Hexcel Overview and Operations & Locations

4.8.2 Hexcel Outlook & News

4.9 Johns Manville

4.9.1 Johns Manville Overview and Operations & Locations

4.10 Mitsubishi Chemical Corporation

4.10.1 Mitsubishi Chemical Corporation Overview and Operations & Locations

4.10.2 Mitsubishi Chemical Corporation Outlook & News

4.11 Nippon Sheet Glass Co. Ltd.

4.11.1 Nippon Sheet Glass Co. Ltd. Overview and Operations & Locations

4.11.2 Nippon Sheet Glass Co. Ltd. Corporation Outlook & News

4.12 Owens Corning

4.12.1 Owens Corning Overview and Operations & Locations

4.12.2 Owens Corning Outlook & News

4.12 PPG Industries

4.13.1 PPG Overview and Operations & Locations

4.13.2 PPG Outlook & News

4.14 Saint Gobain Vetrotex

4.14.1 Saint-Gobain Vetrotex Overview and Operations & Locations

4.14.2 Saint-Gobain Vetrotex Outlook & News

4.15 SGL Group

4.15.1 SGL Group Overview and Operations & Locations

4.15.2 SGL Group Outlook & News

4.16 Taishan Fibreglass SA

4.16.1 Taishan Fibreglass Overview and Operations & Locations

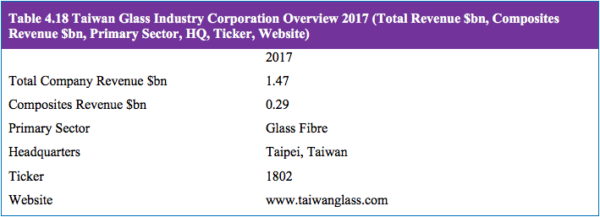

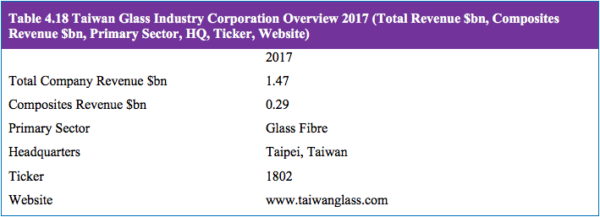

4.17 Taiwan Glass Industry Corporation

4.17.1 Taiwan Glass Industry Corporation Overview and Operations & Locations

4.17.2 Taiwan Glass Industry Corporation Outlook & News

4.18 Teijin

4.18.1 Teijin Overview and Operations & Locations

4.19 TenCate N.V.

4.19.1 TenCate Overview and Operations & Locations

4.19.2 TenCate Outlook & News

4.20 Toray

4.20.1 Toray Overview and Operations & Locations

4.20.2 Toray Outlook & News

4.21 Zoltek

4.21.1 Zoltek Overview and Operations & Locations

4.21.2 Zoltek Outlook & News

4.22 Other Leading Composite Companies

4.22.1 BGF

4.22.2 Advanced Glassfibre Yarns

4.22.3 Chomarat Group

4.22.4 KCC Corporation

4.22.5 Nitto Boseki

4.22.6 Plasan Carbon Composites

4.22.7 Crosby Composites

4.22.8 AKSA

4.22.9 Formosa Plastics Corporation

4.22.10 Fiberex Glass Corporation

4.22.11 Saertex Group

4.22.12 Innegra Technologies

4.22.13 Kuraray

4.22.14 Kolon Industries, Inc.

4.23 Other Leading Composites Companies

5. SWOT Analysis of The Composites Market

6. Conclusion

6.1 The Leading Companies in the Composites Market

7. Glossary

List of Tables

Table 3.1 The Global Top 20 Composite Companies 2018 (Total Revenue $bn, Sector Revenue $m, Total Composite Market Share (%)

Table 3.2 The Global Top Glass Fibre Composite Companies 2018 (Total Revenue $bn, Glass Fibre Composite Market Share (%)

Table 3.3 The Global Top Carbon Fibre Composite Companies 2018 (Total Revenue $bn, Carbon Fibre Composite Market Share (%)

Table 3.4 The Global Top Aramid Fibre Composite Companies 2018 (Total Revenue $bn, Sector Revenue $m, Aramid Fibre Composite Market Share (%)

Table 4.1 Asahi Fibreglass Overview 2017 (Total Revenue $bn, Composites Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.2 Braj Binani Group Overview 2017 (Total Revenue $bn, Primary Sector, HQ, Ticker, Website)

Table 4.3 China Fibreglass Company Overview 2017 (Total Revenue $m, Composites Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.4 DuPont Overview 2017 (Total Revenue $bn, Composites Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.5 GKN Overview 2017 (Total Revenue $bn, Composites Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.6 Guardian Fibre Glass Overview 2017 (Total Revenue $bn ,Composites Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.7 Gurit Overview 2017 (Total Revenue $bn, Composites Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.8 Hexcel Overview 2017 (Total Revenue $bn, Composites Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.9 Hexcel Detailed Description of Composite Materials and Product End Uses

Table 4.10 Johns Manville Overview 2017 (Total Revenue $bn, Composite Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.11 Mitsubishi Chemical Corporation Overview 2017 (Total Revenue $m, Composites Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.12 Nippon Sheet Glass Co. Ltd. Overview 2017 (Total Revenue $bn, Composites Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.13 Owens Corning Overview 2017 (Total Revenue $bn, Composites Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.14 PPG Overview 2017 (Total Revenue $bn, Composites Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.15 Saint Gobain Vetrotex Overview 2017 (Total Revenue $bn, Composites Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.16 SGL Group Overview 2017 (Total Revenue $bn, Composites Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.17 Taishan Fibreglass Overview 2017 (Total Revenue $bn, Composites Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.18 Taiwan Glass Industry Corporation Overview 2017 (Total Revenue $bn, Composites Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.19 Teijin Overview 2017 (Total Revenue $bn, Composites Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.20 TenCate Overview 2017 (Total Revenue $bn, Composites Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.21 Toray Overview 2017 (Total Revenue $bn, Composites Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.22 Zoltek Overview 2017 (Total Revenue $bn, Composites Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.23 BGF Overview 2017 (Total Revenue $bn, Composites Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.24 Advanced Glassfibre Yarns Overview 2017 (Total Revenue $m, Sector Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.25 Chomarat Group Overview 2017 (Total Revenue $bn, Composites Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.26 KCC Corporation Overview 2017 (Total Revenue $bn, Sector Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.27 Nitto Boseki Overview 2017 (Total Revenue $bn, Sector Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.28 Plasan Carbon Composites Overview 2017 (Total Revenue $bn, Sector Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.29 Crosby Composites Overview 2017 (Total Revenue $bn, Composites Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.30 AKSA Overview 2017 (Total Revenue $bn, Sector Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.31 Formosa Plastics Corporation Overview 2017 (Total Revenue $bn, Sector Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.32 Fiberex Glass Corporation Overview 2017 (Total Revenue $bn, Sector Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.33 Saertex Group Overview 2017 (Total Revenue $bn, Sector Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.34 Innegra Technologies Overview 2017 (Total Revenue $bn, Composites Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.35 Kuraray Overview 2017 (Total Revenue $bn, Sector Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 4.36 Kolon Industries Overview 2017 (Total Revenue $bn, Sector Revenue $m, Primary Sector, HQ, Ticker, Website)

Table 5.1 SWOT Analysis of the Composites Market

List of Figures

Figure 2.1 Global Composite Overview by Composite Type

Figure 2.2 Global Composite Overview by End Use

Figure 3.1 The Global Top 20 Composite Companies 2018 (Market Share %)

Figure 3.2 The Global Top Glass Fibre Composite Companies 2018 (Market Share (%)

Figure 3.3 The Global Top Carbon Fibre Composite Companies 2018 (Market Share (%)

Figure 3.4 The Global Top Aramid Fibre Composite Companies 2018 (Market Share (%)

Figure 4.1 Asahi Fibreglass Net Sales by Material Segment 2017 (%)

Figure 4.2 Asahi Fibreglass Net Sales by Geographical Location 2017 (%)

Figure 4.3 China Fibreglass Company Revenue From International & Domestic Sales 2018 (%)

Figure 4.4 DuPont Net Sales by Business Segment 2017 (%)

Figure 4.5 GKN Net Sales Breakdown by Business Division 2017 (%)

Figure 4.6 GKN Net Sales Breakdown by Geographical Region 2017 (%)

Figure 4.7 GKN’s Top 10 Global Customers by Net Sales 2017 (%)

Figure 4.8 Gurit Net Sales Breakdown by End Market 2017 (%)

Figure 4.9 Gurit Net Sales Breakdown by Geographic Region 2017 (%)

Figure 4.10 Hexcel Net Sales Breakdown by Business Segment 2017 (%)

Figure 4.11 Hexcel Net Sales Breakdown by Geography 2017 (%)

Figure 4.12 Owens Corning Net Sales Breakdown by Business Segment 2017 (%)

Figure 4.13 Owens Corning Net Sales Breakdown by Geographical Location and North American Business Segments 2017 (%)

Figure 4.14 PPG Net Sales Breakdown by Business Segment 2017 (%)

Figure 4.15 PPG Net Sales Breakdown by Geographic Segment 2017 (%)

Figure 4.16 Saint-Gobain Net Sales Breakdown by Business Segment 2017 (%)

Figure 4.17 Saint-Gobain Net Sales Breakdown by Geographical Location 2017 (%)

Figure 4.18 Taiwan Glass Industry Corporation Sales Revenue by Business Segment (%) 2017

Figure 4.19 Teijin Net Sales Breakdown by Business Segment 2017 (%)

Figure 4.20 TenCate Net Sales Breakdown by Business Segment 2017 (%)

Figure 4.21 Toray Net Sales Breakdown by Business Segment 2017 (%)

Figure 4.22 Zoltek Net Sales Breakdown by Geographical Location (%) 2017

AAT Composites (Pty) Ltd.

Accudyne Systems Inc

Advanced Glassfibre Yarns

Aernnova

AGC AeroComposites Yeovil

Airbus

Aircelle

AKSA

Amber Composites (UK)

Arabian Fibreglass Insulation Company Ltd.

Asahi Fibreglass Company

BAE Systems

Baycomp

BGF Industries Inc

Binani 3B

BMW

Boeing

Braj Binani Group

Brookhouse

BT Composites Limited

China Fibreglass Company

China National Building Material Company

China National Materials Company (Sinoma)

Chinamex

Chinese Ministry of Science & Technology

Chomarat Group

Chongquing Polycomp International Company

Composites Horizons LLC

Continental Structural Plastics Inc.

CPI Binani Inc

Cray Valley

Creative Composites Ltd.

Crosby composites

DAHER

Danisco

DowAksa

Dowty Propellers

Dr. Schnabel GmbH & Co.KG

DuPont

EADS

epo GmbH

Eurocopter

Fiberex Corporation

Fiberex Glass Corporation

Fiberteq LLC

FibreTEK Insulation West

Fisipe Fibras Sintéticas de Portugal S.A

Formaplex

Formax.

Formosa Plastic

GE

GKN

GMS Composites

Goa Glass Fibre Limited

Guardian Fibre Glass

Gurit

Hanwha Azdel

Hexcel Corporation

Honeywell

Icon Polymer Group Ltd

IDI Composite International

Innegra Technologies

Innovalight

Johns Manville

KAGY Holding Company

KCC Corporation

Kolon Corporation

Kolon Industries

Koninklijke Ten Cate B.V.

Kurarey

Lockheed Martin

Magna International Inc.

Mahindra Cie Automotive Ltd.

Mitsubishi Chemical Corporation (MCC)

Mubea Carbo Tech GmbH

National Intelligence & Technology Centre of China

Neptco LLC,

Nippon Sheet Glass Co. Ltd.

Nitto Boseki

Northrop Grumman

NP Aerospace

Owens Corning

Plasan Carbon Composites

Porcher Textile Group

PPG Industries

Pratt & Whitney

PT. ABC Plastindo,

Quantum Composites

Quickstep Holdings Ltd

Quinpario Partners

Reinforced Plastic Industries

RIBA Composites Srl

SABIC (Saudi Arabia Basic Industries Corporation)

Saertex Glass

Saertex Group

Saint-Gobain Vetrotex

Scott Bader

SGL Group

Siemens Wind Power

Sigmatex

Sikorsky

Solvay S.A.

Spraylat Corporation

Strata Manufacturing PJSC

Taishan Fibreglass SA

Taiwan Glass Industry Corporation

Teijin Group

Tencate

The Dow Chemical Company

The Gill Corporation

Toho Tenax

Toray

TPI Composites

Triumph Group Inc

UFP Technologies, Inc.

Welset Plast Extrusions Private Limited

Zoltek