Industries > Aviation > Top 15 Small Satellite Companies 2019

Top 15 Small Satellite Companies 2019

Competitive Landscape Analysis of Leading Suppliers of Nanosatellite, Minisatellite, Femtosatellite, Microsatellite, Picosatellite for Application Including Meteorology, Earthquake/Seismic Monitoring, Security/Surveillance, and Scientific Research

• Do you need Top 15 Small Satellite Companies market data?

• Succinct Top 15 Small Satellite Companies market analysis?

• Technological insight?

• Clear competitor analysis?

• Actionable business recommendations?

Read on to discover how this definitive report can transform your own research and save you time.

The global Top 15 Small Satellite Companies 2019 provides the reader with a thorough overview of the competitive landscape in the Small Satellite market and to identify key growth areas and business opportunities. The report is valuable for anyone who wants to understand the dynamics of Small Satellite industry and the implementation and adoption of Small Satellite services. It will be useful for existing players, new entrants and businesses who wish to expand into this sector or explore a new geographical region for market development.

Report highlights

• 200 quantitative tables, charts, and graphs

• Analysis of key players in Small Satellite Companies System

• Space Systems Loral

• Airbus Defense and Space and SST Ltd.

• Lockheed Martin Corporation

• (Northrop Grumman) Orbital ATK

• Boeing

• (Thales Group) Thales Alenia Space

• Mitsubishi Electric.

• Harris Corporation

• Spire Global Inc.

• Planet Labs Inc.

• Sierra Nevada Corporation

• China Aerospace Science and Technology Corporation

• Dauria Aerospace Ltd.

• ISS Reshetnevn

• Global Top 15 Small Satellite Companies 2019

• Top 15 Leading companies in the Small Satellite Companies Market 2019

• Leading Companies in the Small Satellite Companies Market Financial Analysis

• Leading Companies in the Small Satellite Companies Market Share Analysis

• Leading Companies in the Small Satellite Companies Product Portfolio Analysis

• Recent Developments in the Small Satellite Market

• Key questions answered

• What does the future hold for the companies in the global Small Satellite Companies Market?

• Where should you target your business strategy?

• Which applications should you focus upon?

• Which disruptive technologies should you invest in?

• Which companies should you form strategic alliances with?

• Which company is likely to success and why?

• What business models should you adopt?

• What industry trends should you be aware of?

• Target audience

• Small Satellite Solution providers

• Suppliers

• Contractors

• Technologists

• R&D staff

• Consultants

• Analysts

• CEO’s

• CIO’s

• COO’s

• Business development managers

• Investors

• Governments

• Agencies

• Aerospace & Defense Industry organizations

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1.1 Report Benefits & Highlights

1.2 Small Satellite Market Segmentation

1.3 Why You Should Read This Report

1.4 Report Structure

1.5 How This Report Delivers

1.6 Who is This Report for?

1.7 Methodology

1.7.1 Primary Research

1.7.2 Secondary Research

1.7.3 Market Evaluation & Forecasting Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to the Small Satellite Market

2.1 Small Satellite Market Structure

2.2 Small Satellite Market Definition & Overview

2.3 Significant Current and Future Developments in Small Satellite Technology

2.3.1 Development of Dedicated Launch Vehicles for Small Satellites

2.3.2 Use of 3D Printing Technology to Develop Small Satellites

2.4 Global Small Satellite Market Drivers & Restraints 2019

2.4.1 Sources of Growth & Contraction in the Global Small Satellite Market

3. Competitor Positioning in the Small Satellite Market 2019

3.1 15 leading Established Companies in the Small Satellite Market 2019

3.2 Assessing the Small Satellite Market Landscape in 2019

4. Leading 15 Established Small Satellite Companies

4.1 ISS Reshetnev

4.1.1 ISS Reshetnev Small Satellite Selected Recent Contracts & Programmes 2014-2018

4.1.2 ISS Reshetnev Primary Market Competitors 2019

4.1.3 ISS Reshetnev Small Satellite Products / Services

4.1.4 ISS Reshetnev Analysis

4.2 Dauria Aerospace Ltd.

4.2.1 Dauria Aerospace Ltd. Small Satellite Selected Recent Contracts & Programmes 2014-2018

4.2.2 Dauria Aerospace Ltd. Primary Market Competitors 2019

4.2.3 Dauria Aerospace Ltd. Small Satellite Products / Services

4.2.4 Dauria Aerospace Ltd. Analysis

4.3 China Aerospace Science and Tecnology Corporation

4.3.1 China Aerospace Science and Tecnology Corporation Small Satellite Selected Recent Contracts & Programmes 2014-2018

4.3.2 China Aerospace Science and Tecnology Corporation Small Satellite Products / Services

4.3.3 China Aerospace Science and Tecnology Corporation Analysis

4.4 Sierra Nevada Corporation

4.4.1 Sierra Nevada Corporation Small Satellite Selected Recent Contracts & Programmes 2014-2018

4.4.2 Sierra Nevada Corporation Primary Market Competitors 2019

4.4.3 Sierra Nevada Corporation Small Satellite Products / Services

4.4.4 Sierra Nevada Corporation Analysis

4.5 Planet Labs Inc.

4.5.1 Planet Labs Inc. Small Satellite Selected Recent Contracts & Programmes 2013-2018

4.5.2 Planet Labs Inc. Primary Market Competitors 2019

4.5.3 Planet Labs Inc. Small Satellite Products / Services

4.5.4 Planet Labs Inc. Analysis

4.6 Spire Global Inc.

4.6.1 Spire Global Inc. Small Satellite Selected Recent Contracts & Programmes 2016-2018

4.6.2 Spire Global Inc. Primary Market Competitors 2019

4.6.3 Spire Global Inc. Analysis

4.7 Harris Corporation

4.7.1 Harris Corporation Small Satellite Selected Recent Contracts & Programmes 2015-2018

4.7.2 Harris Corporation Total Company Sales 2015-2018

4.7.3 Harris Corporation Sales by Segment of Business 2017-20178

4.7.4 Harris Corporation Net Income 2015-2018

4.7.5 Harris Corporation Regional Emphasis

4.7.6 Harris Corporation Organisational Structure / Notable Subsidiaries

4.7.7 Harris Corporation Small Satellite Products / Services

4.7.8 Harris Corporation Primary Market Competitors 2018

4.7.9 Harris Corporation Mergers & Acquisitions (M&A) Activity

4.7.10 Harris Corporation Analysis

4.8 Mitsubishi Electric Corporation

4.8.1 Mitsubishi Electric Corporation Small Satellite Selected Recent Contracts & Programmes 2014-2018

4.8.2 Mitsubishi Electric Corporation Total Company Sales 2015-2018

4.8.3 Mitsubishi Electric Corporation Sales Share (%) by Segment of Business 2018

4.8.4 Mitsubishi Electric Corporation Sales Share (%) by Region 2018

4.8.5 Mitsubishi Electric Corporation Net Income 2015-2018

4.8.6 Mitsubishi Electric Corporation Primary Market Competitors 2019

4.8.7 Mitsubishi Electric Corporation Analysis

4.9 Thales Group (Operates in the Small Satellite Market through Thales Alenia Space)

4.9.1 Thales Group Small Satellite Selected Recent Contracts & Programmes 2014-2018

4.9.2 Thales Group Total Company Sales 2013-2017

4.9.3 Thales Group Sales by Segment of Business 2013-2017

4.9.4 Thales Group Net Income / Loss 2013-2017

4.9.5 Thales Group Regional Emphasis

4.9.6 Thales Group Organisational Structure / Notable Subsidiaries

4.9.7 Thales Group Primary Market Competitors 2019

4.9.8 Thales Group Mergers & Acquisitions (M&A) Activity

4.9.9 Thales Group Analysis

4.10 The Boeing Company

4.10.1 The Boeing Company Small Satellite Selected Recent Contracts / Projects / Programmes2015-2018

4.10.2 The Boeing Company Total Company Sales 2013-2017

4.10.3 The Boeing Company Sales Share by Segment of Business 2017

4.10.4 The Boeing Company Net Income 2013-2017

4.10.5 The Boeing Company Regional Emphasis / Focus

4.10.6 The Boeing Company Organisational Structure / Subsidiaries

4.10.7 The Boeing Company Small Satellite Products / Services

4.10.8 The Boeing Company Primary Market Competitors 2019

4.10.9 The Boeing Company Mergers & Acquisitions (M&A) Activity

4.10.10 The Boeing Company Analysis

4.11 Northrop Grumman Corporation

4.11.1 Northrop Grumman Corporation Small Satellite Selected Recent Contracts & Programmes 2015-2018

4.11.2 Northrop Grumman Corporation Total Company Sales 2013-2017

4.11.3 Northrop Grumman Corporation Sales by Segment of Business 2013-2018

4.11.4 Northrop Grumman Corporation Net Income 2013-2018

4.11.5 Northrop Grumman Corporation Regional Emphasis

4.11.6 Northrop Grumman Corporation Organisational Structure / Notable Subsidiaries

4.11.7 Northrop Grumman Corporation Small Satellite Products / Services

4.11.8 Northrop Grumman Corporation Primary Market Competitors 2019

4.11.9 Northrop Grumman Corporation Mergers & Acquisitions (M&A) Activity

4.11.10 Northrop Grumman Corporation Analysis

4.12 Airbus Group SE (Operates in the Market through Airbus Defence and Space)

4.12.1 Airbus Group SE Small Satellite Selected Recent Contracts & Programmes 2017-2018

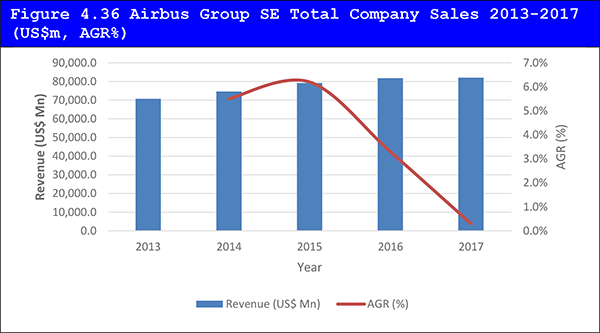

4.12.2 Airbus Group SE Total Company Sales 2013-2017

4.12.3 Airbus Group SE Sales by Segment of Business 2013-2017

4.12.4 Airbus Group SE Net Income 2013-2017

4.12.5 Airbus Group SE Regional Emphasis

4.12.6 Airbus Group SE Organisational Structure / Notable Subsidiaries

4.12.7 Airbus Group SE Small Satellite Products / Services

4.12.8 Airbus Group SE Primary Market Competitors 2019

4.12.9 Airbus Group SE Mergers & Acquisitions (M&A) Activity

4.12.10 Airbus Group Analysis

4.13 Surrey Satellite Technology Ltd (SSTL)

4.13.1 Surrey Satellite Technology Ltd Small Satellite Selected Recent Contracts & Programmes 2017-2018

4.13.2 Surrey Satellite Technology Ltd Primary Market Competitors 2019

4.13.3 Surrey Satellite Technology Ltd Small Satellite Products / Services

4.13.4 Surrey Satellite Technology Ltd Analysis

4.14 Lockheed Martin Corporation

4.14.1 Lockheed Martin Corporation Small Satellite Selected Recent Contracts & Programmes 2016-2018

4.14.2 Lockheed Martin Corporation Total Company Sales 2013-2017

4.14.3 Lockheed Martin Corporation Sales by Segment of Business 2013-2017

4.14.4 Lockheed Martin Corporation Net Income 2013-2017

4.14.5 Lockheed Martin Corporation Regional Emphasis

4.14.6 Lockheed Martin Corporation Organisational Structure / Notable Subsidiaries

4.14.7 Lockheed Martin Corporation Small Satellite Products / Services

4.14.8 Lockheed Martin Corporation Primary Market Competitors 2019

4.14.9 Lockheed Martin Corporation Mergers & Acquisitions (M&A) Activity

4.14.10 Lockheed Martin Corporation Analysis

4.15 Space Systems Loral

4.15.1 Space Systems Loral Small Satellite Selected Recent Contracts & Programmes 2017-2018

4.15.2 Space Systems Loral Primary Market Competitors 2019

4.15.3 Space Systems Loral Small Satellite Products / Services

4.15.4 Space Systems Loral Analysis

4.16 Other Notable Companies Involved in the Small Satellite Market 2019

5. PEST Analysis of the Small Satellite Market 2019

6. Conclusions and Recommendations

6.1 Dedicated Launch for Small Satellites

6.2 3D Printing in Manufacturing Satellite Parts

6.3 Major shift in the demand for the satellite for survelliance and communication applications

6.4 New demand for small spacecraft launches represent significant opportunity for small satellite manufacturers

6.5 Shifiting trend towards Earth Observation from communication, technology and scientific applications

7. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Figures

Figure 1.1 Small Satellite Market Segmentation Overview

Figure 1.2 Sample Map of Company Regional Focus 2019

Figure 1.3 Sample Company Sales by Segment of Business 2014-2018 (US$m, AGR%)

Figure 2.1 Small Satellite Market Segmentation Overview

Figure 2.2 15 leading Established Small Satellite Companies 2019

Figure 4.1 Leading Small Satellite Companies Market Share 2019 (%)

Figure 4.1 ISS Reshetnev Primary Market Competitors 2019

Figure 4.2 Dauria Aerospace Ltd. Primary Market Competitors 2019

Figure 4.3 Sierra Nevada Corporation Primary Market Competitors 2019

Figure 4.4 Planet Labs Inc. Primary Market Competitors 2019

Figure 4.5 Spire Global Inc. Primary Market Competitors 2019

Figure 4.6 Harris Corporation Total Company Sales 2015-2018 (US$m, AGR%)

Figure 4.7 Harris Corporation Sales by Segment of Business 2016-2017 (US$m)

Figure 4.8 Harris Corporation Net Income 2013-2017 (US$m, AGR%)

Figure 4.9 Harris Corporation Primary International Operations 2018

Figure 4.10 Harris Corporation Sales by Geographical Location 2013-2017 (US$m)

Figure 4.11 Harris Corporation Organisational Structure 2018

Figure 4.12 Harris Corporation Primary Market Competitors 2019

Figure 4.13 Mitsubishi Electric Corporation Total Company Sales 2015-2018 (US$Bn, AGR%)

Figure 4.14 Mitsubishi Electric Corporation Sales Share (%) by Segment of Business 2018

Figure 4.15 Mitsubishi Electric Corporation Sales Share by Region (%) 2018

Figure 4.16 Mitsubishi Electric Corporation Net Income 2015-2018 (US$Bn, AGR%)

Figure 4.17 Mitsubishi Electric Corporation Primary Market Competitors 2019

Figure 4.18 Thales Group Total Company Sales 2013-2017 (US$m, AGR%)

Figure 4.19 Thales Group Sales by Segment of Business 2013-2017 (US$m)

Figure 4.20 Thales Group Net Income / Loss 2013-2017 (US$m, AGR%)

Figure 4.21 Thales Group Primary International Operations 2019

Figure 4.22 Thales Group Sales by Geographical Location 2013-2017 (US$m)

Figure 4.23 Thales Group Organisational Structure 2019

Figure 4.24 Thales Group Primary Market Competitors 2019

Figure 4.25 The Boeing Company Sales Share by Business Segment 2017

Figure 4.26 The Boeing Company Sales Share by Geographical Location 2017 (% share)

Figure 4.27 The Boeing Company Organisational Structure 2019

Figure 4.28 The Boeing Company Primary Market Competitors 2019

Figure 4.29 Northrop Grumman Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Figure 4.30 Northrop Grumman Corporation Sales by Segment of Business 2013-2017 (US$m)

Figure 4.31 Northrop Grumman Corporation Net Income 2013-2017 (US$m, AGR%)

Figure 4.32 Northrop Grumman Corporation Primary International Operations 2019

Figure 4.33 Northrop Grumman Corporation Sales by Geographical Location 2013-2018 (US$m)

Figure 4.34 Northrop Grumman Corporation Organisational Structure 2019

Figure 4.35 Northrop Grumman Corporation Primary Market Competitors 2019

Figure 4.36 Airbus Group SE Total Company Sales 2013-2017 (US$m, AGR%)

Figure 4.37 Airbus Group SE Sales by Segment of Business 2013-2017 (US$m)

Figure 4.38 Airbus Group SE Net Income 2013-2017 (US$m, AGR%)

Figure 4.39 Airbus Group SE Primary International Operations 2019

Figure 4.40 Airbus Group SE Sales by Geographical Location 2013-2017 (US$m)

Figure 4.41 Airbus Group SE Organisational Structure 2019

Figure 4.42 Airbus Group SE Primary Market Competitors 2019

Figure 4.43 Surrey Satellite Technology Ltd Primary Market Competitors 2019

Figure 4.44 Lockheed Martin Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Figure 4.45 Lockheed Martin Corporation Sales by Segment of Business 2013-2017 (US$m)

Figure 4.46 Lockheed Martin Corporation Net Income 2013-2017 (US$m, AGR%)

Figure 4.47 Lockheed Martin Corporation Primary International Operations 2019

Figure 4.48 Lockheed Martin Corporation Sales by Geographical Location 2013-2017 (US$m)

Figure 4.49 Lockheed Martin Corporation Organisational Structure 2019

Figure 4.50 Lockheed Martin Corporation Primary Market Competitors 2019

Figure 4.51 Space Systems Loral Primary Market Competitors 2019

Figure 5.1: PEST Analysis of the Small Satellite Market 2019

List of Tables

Table 1.1 Sample Company Sales by Geographical Area 2014-2018 (US$m, AGR%)

Table 2.1 Global Small Satellite Market Drivers & Restraints 2018

Table 3.1 Leading 15 Small Satellite Companies 2017 (Market Ranking, Total Revenue, Small Satellite Revenue, Market Share %)

Table 4.1 ISS Reshetnev Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees)

Table 4.2 Selected Recent ISS Reshetnev Small Satellite Contracts & Programmes 2014-2018 (Date, Product & Details)

Table 4.3 ISS Reshetnevn Small Satellite Products / Services (Product, Specification / Features)

Table 4.4 Dauria Aerospace Ltd. Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, No. of Employees)

Table 4.5 Selected Recent Dauria Aerospace Ltd. Small Satellite Contracts & Programmes 2014-2018 (Date, Product & Details)

Table 4.6 Dauria Aerospace Ltd. Small Satellite Products / Services (Product, Specification / Features)

Table 4.7 China Aerospace Science and Tecnology Corporation Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees)

Table 4.8 Selected Recent China Aerospace Science and Tecnology Corporation Small Satellite Contracts & Programmes 2014-2018 (Date, Product & Details)

Table 4.9 Sierra Nevada Corporation Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees)

Table 4.10 Selected Recent Sierra Nevada Corporation Small Satellite Contracts & Programmes 2014-2018 (Date, Product & Details)

Table 4.11 Sierra Nevada Corporation Small Satellite Products / Services (Product, Specification / Features)

Table 4.12 Planet Labs Inc. Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees)

Table 4.13 Selected Recent Planet Labs Inc. Small Satellite Contracts & Programmes 2013-2018 (Date, Product & Details)

Table 4.14 Planet Labs Inc. Small Satellite Products / Services (Product, Specification / Features)

Table 4.15 Spire Global Inc. Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees)

Table 4.16 Selected Recent Spire Global Inc. Small Satellite Contracts & Programmes 2016-2018 (Date, Product & Details)

Table 4.17 Harris Corporation Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.18 Selected Recent Harris Corporation Small Satellite Contracts & Programmes 2015-2018 (Date, Product & Details)

Table 4.19 Harris Corporation Total Company Sales 2015-2018 (US$m, AGR%)

Table 4.20 Harris Corporation Sales by Segment of Business 2016-2017 (US$m)

Table 4.21 Harris Corporation Net Income 2013-2017 (US$m, AGR%)

Table 4.22 Harris Corporation Sales by Geographical Location 2015-2018 (US$m, AGR%)

Table 4.23 Harris Corporation Notable Subsidiaries 2018(Subsidiary, Location)

Table 4.24 Harris Corporation Small Satellite Products / Services (Segment of Business, Product, Specification / Features)

Table 4.25 Harris Corporation Mergers and Acquisitions 2013-2017 (Date, Company Involved, Value US$m, Details)

Table 4.26 Harris Corporation Divestitures 2013-2016(Date, Company Involved, Details)

Table 4.27 Mitsubishi Electric Corporation Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees)

Table 4.28 Selected Recent Mitsubishi Electric Corporation Small Satellite Contracts & Programmes 2014-2018 (Date, Product & Details)

Table 4.29 Mitsubishi Electric Corporation Total Company Sales 2013-2017 (US$Bn, AGR%)

Table 4.30 Mitsubishi Electric Corporation Net Income 2015-2018 (US$Bn, AGR%)

Table 4.31 Thales Group Profile 2018 (CEO, Total Company Sales US$m, Net Income / Loss US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Book US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.32 Selected Recent Thales Group Small Satellite Contracts & Programmes 2014-2018 (Date, Product & Details)

Table 4.33 Thales Group Total Company Sales 2013-2017 (US$m, AGR%)

Table 4.34 Thales Group Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 4.35 Thales Group Net Income / Loss 2013-2017 (US$m, AGR%)

Table 4.36 Thales Group Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 4.37 Thales Group Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.38 Thales Group Mergers and Acquisitions 2012-2014(Date, Company Involved, Value US$m, Details)

Table 4.39 The Boeing Company Overview 2017 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.40 Selected Recent The Boeing Company Small Satellite Contracts / Projects / Programmes 2015-2018 (Date, Product, Details)

Table 4.41 The Boeing Company Total Company Sales 2013-2017 (US$m, AGR %)

Table 4.42 The Boeing Company Net Income 2013-2017 (US$m, AGR %)

Table 4.43 The Boeing Company Subsidiaries (Subsidiary, Location)

Table 4.44 The Boeing Comapany Small Satellite Products / Services (Product, Specification / Features)

Table 4.45 The Boeing Company Mergers and Acquisitions 2008-2018 (Date, Company Involved, Value US$m, Details)

Table 4.46 The Boeing Company Divestiture 2015 (Date, Company Involved, Details)

Table 4.47 Northrop Grumman Corporation Profile 2017 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.48 Selected Recent Northrop Grumman Corporation Small Satellite Contracts & Programmes 2015-2018 (Date, Product & Details)

Table 4.49 Northrop Grumman Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Table 4.50 Northrop Grumman Corporation Sales by Segment of Business 2013-2018 (US$m, AGR%)

Table 4.51 Northrop Grumman Corporation Net Income 2013-2018 (US$m, AGR%)

Table 4.52 Northrop Grumman Corporation Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 4.53 Northrop Grumman Corporation Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.54 Northrop Grumman Corporation Small Satellite Products / Services (Product, Specification / Features)

Table 4.55 Northrop Grumman Corporation Mergers and Acquisitions 2013-2018 (Date, Company Involved, Value US$m, Details)

Table 4.56 Airbus Group SE Profile 2017 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.57 Selected Recent Airbus Group SE Small Satellite Contracts & Programmes 2017-2018 (Date, Product & Details)

Table 4.58 Airbus Group SE Total Company Sales 2013-2017 (US$m, AGR%)

Table 4.59 Airbus Group SE Net Income 2013-2017 (US$m, AGR%)

Table 4.60 Airbus Group SE Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 4.61 Airbus Group SE Notable Subsidiaries 2019 (Subsidiary, Location)

Table 4.62 Airbus Group SE Small Satellite Products / Services (Segment of Business, Product, Specification / Features)

Table 4.63 Airbus Group SE Mergers and Acquisitions 2012-2018 (Date, Company Involved, Details)

Table 4.64 Airbus Group Notable Divestitures 2014-2016 (Date, Company Involved, Value US$m, Details)

Table 4.65 Surrey Satellite Technology Ltd Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees)

Table 4.66 Selected Recent Surrey Satellite Technology Ltd Small Satellite Contracts & Programmes 2017-2018 (Date, Product & Details)

Table 4.67 Surrey Satellite Technology Ltd Small Satellite Products / Services (Product, Specification / Features)

Table 4.68 Lockheed Martin Corporation Profile 2017 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.69 Selected Recent Lockheed Martin Corporation Small Satellite Contracts & Programmes 2016-2018 (Date, Product & Details)

Table 4.70 Lockheed Martin Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Table 4.71 Lockheed Martin Corporation Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 4.72 Lockheed Martin Corporation Net Income 2010-2017 (US$m, AGR%)

Table 4.73 Lockheed Martin Corporation Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 4.74 Lockheed Martin Corporation Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.75 Lockheed Martin Corporation Small Satellite Products / Services (Segment of Business, Product, Specification / Features)

Table 4.76 Lockheed Martin Corporation Mergers and Acquisitions 2012-2015 (Date, Company Involved, Details)

Table 4.77 Lockheed Martin Corporation Divestitures 2010-2011 (Date, Company Involved, Details)

Table 4.78 Space Systems Loral Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees)

Table 4.79 Selected Recent Space Systems Loral Small Satellite Contracts & Programmes 2017-2018 (Date, Product & Details)

Table 4.80 Space Systems Loral Small Satellite Products / Services (Product, Specification / Features)

Table 4.81 Other Notable Companies Involved in the Small Satellite Market 2019

ABLE Engineering Inc

Adcole Maryland Aerospace

Adcole Maryland Aerospace, LLC

Aeroflex

Aerojet

Aerospace Corporation

Airbus Defense and Space

Aitech

Alenia Spazio

Amptek

Anaren

Angels Technologies Corporation

Antrix

APCO Technologies

APT Satellite

Arde

ATK

Austrian Aerospace

Ball Aerospace & Technologies Corp

Berlin Space Technologies Inc.

Blink Astro LLC

Blue Canyon Technologies

Boeing

Bradford Engineering

CGWIC

China Aerospace Science and Technology Corporation

ChinaSatcom

Clyde Space

Clyde Space Ltd

CMC Electronics

COM DEV

Compagnia Generale per lo Spazio

Credowan

CRISA

Dauria Aerospace Ltd.

EaglePicher

EMS Technologies

Endurosat

Eutelsat

Galileo Industries

GAUSS Srl

General Dynamics

GomSpace

Harris Corporation

Honeywell

Indian Space Research Organization

Inmarsat

Intersil

ISIS (Innovative Solutions In Space)

ISS Reshetnevn

ITT Industries

Lockheed Martin Corporation

Magellan Aerospace

Millennium Space Systems

Mitsubishi Electric.

NanoAvionics

Nanoracks

NearSpace Launch

NEXEYA

OHB-System

Orbital ATK (Northrop Grumman)

OSC

Planet Labs Inc.

Pumpkin Space Systems

Raytheon Company

RKK Energia

RSCC

Satellogic

Shin Satellite Plc.

Sierra Nevada Corporation

Space Inventor

Space Systems Loral

Spacecom Ltd.

Spaceflight Industries

SpaceQuest Ltd

Spire Global Inc.

SST Ltd.

Taqnia Space

Terran Orbital

Thales Alenia Space (Thales Group)

Tyvak

United Launch Alliance

UTIAS Space Flight Laboratory

Vector Space Systems

Download sample pages

Complete the form below to download your free sample pages for Top 15 Small Satellite Companies 2019

Related reports

-

Military Satellites Market Report 2018-2028

The $14.63bn Military Satellite market is expected to flourish in the next few years because of increased demand for satellite...Full DetailsPublished: 24 September 2018 -

Governmental Geospatial Intelligence (GEOINT) Solutions Market Report 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global Governmental Geospatial Intelligence (GEOINT) Solutions market....

Full DetailsPublished: 31 July 2018 -

Critical Infrastructure Protection (CIP) Market Report 2018-2028

Our 304 page report provides 198 tables, charts, and graphs. Read on to discover the most lucrative areas in the...

Full DetailsPublished: 28 June 2018 -

Small Satellite Market Report 2019-2029

The miniaturization of electronics in the commercial sector has encouraged the development of smaller satellites, thereby enabling them to emerge...

Full DetailsPublished: 30 April 2019 -

US Border Security Market Report 2019-2029

This report is essential reading for you or anyone in the aerospace and defence sector with an interest in Border...

Full DetailsPublished: 29 November 2018

Download sample pages

Complete the form below to download your free sample pages for Top 15 Small Satellite Companies 2019

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Visiongain aviation reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and automotive industry experts but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology please email jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Would you like to get the latest Visiongain aviation reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

Airline Passenger Experience Association (APEX)

Airlines for America

Airport Consultants Council (ACC)

Airports Council International (ACI)

Airports Council International-North America

American Association of Airport Executives

Arab Air Carriers Organization (AACO)

European Aerospace Cluster Partnership

Global Business Travel Association (GBTA)

International Air Transport Association (IATA)

Security Industry Association (SIA)

Security Manufacturers Coalition

Women in Aviation

World Aviation Services

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Aviation news

Aircraft Computers Market

The global Aircraft Computers market is projected to grow at a CAGR of 5.7% by 2034

24 June 2024

Space Mining Market

The global Space Mining market is projected to grow at a CAGR of 20.7% by 2034

07 June 2024

Connected Aircraft Market

The global Connected Aircraft market is projected to grow at a CAGR of 17.2% by 2034

05 June 2024

Satellite Ground Station Market

The global Satellite Ground Station market was valued at US$65.69 billion in 2023 and is projected to grow at a CAGR of 13.3% during the forecast period 2024-2034.

21 May 2024