Industries > Pharma > The Companion Diagnostics (CDx) Market Forecast 2018-2028

The Companion Diagnostics (CDx) Market Forecast 2018-2028

Leading Companies, Trends and Developments in the Growing Theranostics Market

What can be expected from the Companion Diagnostics market? Which areas are going to grow at the fastest rates? This visiongain report shows you potential revenues to 2028, assessing data, trends, opportunities and prospects there.

Our 183-page report provides 127 tables, charts, and graphs. Discover the most lucrative areas in the industry and the future market prospects. Our new study lets you assess forecasted sales across the whole companion diagnostics market. You will see financial results, trends, opportunities, and revenue predictions. There is much opportunity in this fast moving market.

Forecasts from 2018-2028 and other analyses show you commercial prospects

Besides revenue forecasting to 2028, our new study provides you with recent results, growth rates, and market shares. Discover qualitative analyses (including SWOT and Porter’s Five Forces analysis) and commercial developments.

The report also includes will find revenue forecasts to 2028 for the following submarkets in the companion diagnostics market:

• Theranostics

• Other Companion Diagnostics

Additionally, this report includes a forecast to 2026 for the global in vitro diagnostics market.

The report also includes will find revenue forecasts to 2028 for the following national and regional markets for companion diagnostics:

• US

• Germany

• France

• Italy

• Spain

• UK

• Japan

• China

• India

• Russia

• Brazil

• South Korea

The report provides detailed profiles of key companies operating within the companion diagnostics market:

• F. Hoffmann-La Roche Ltd

• Qiagen N.V.

• Abbott Laboratories

• Agilent Technologies

• Myriad Genetics

• bioMerieux

• Thermo Fisher Scientific

Leading companies and potential for market growth

Overall revenue for the Companion Diagnostics market will reach $14.60n in 2023, our work forecasts. We predict strong revenue growth through to 2028. Advances in cellular and tissue research, an improving regulatory landscape, strong support from governments in multiple regions and the launch of several new therapies in areas of unmet clinical need will drive sales to 2028.

Our work analyses the key companies in the market. See visiongain’s analysis of 7 leading companies, including these:

• F. Hoffmann-La Roche Ltd

• Qiagen N.V.

• Abbott Laboratories

• Agilent Technologies

• Myriad Genetics

• bioMerieux

• Thermo Fisher Scientific

A company profile gives you the following information where available:

• Discussion of a company’s activities and outlook

• Historic revenue, analysis and discussion of company performance over the past 5 years

• Analysis of major products currently on the market

• Acquisitions and strategic partnerships

Discover capabilities, progress, and commercial prospects, helping you stay ahead.

What issues will affect the companion diagnostics industry?

Our new report discusses issues and events affecting the companion diagnostics market. You will find discussions, including qualitative analyses:

• Highly diverse market needing strong knowledge of key therapeutic indications

• Changing regulatory landscape challenging new entrants and major market players alike

• Emerging therapies with the potential to reshape the market

You will see discussions of technological, commercial, and economic matters, with emphasis on the competitive landscape and business outlooks.

How the Companion Diagnostics: Market Forecast 2018-2028 report helps you

In summary, our 183-page report gives you the following knowledge:

• Revenue forecasts to 2028 for the Companion Diagnostics market – discover the industry’s prospects, finding promising places for investments and revenues

• Revenue forecasts to 2028 for each major submarket – discover prospects for leading companion diagnostics products in the following areas: theranostics and other companion diagnostics.

• Revenue forecasts to 2028 for twelve leading national markets – US, Germany, France, Italy, Spain, UK, Japan, China, India, Russia, Brazil and South Korea

• Assessment of 7 leading companies – analysis of products, revenue, mergers & acquisitions, sales by region and products

• Discussion of what stimulates and restrains companies and the market

• Prospects for established firms and those seeking to enter the market

You will find quantitative and qualitative analyses with independent predictions. You will receive information that only our report contains, staying informed with this invaluable business intelligence.

Information found nowhere else

With our survey you are less likely to fall behind in knowledge or miss opportunities. See how you could benefit your research, analyses, and decisions. Also see how you can save time and receive recognition for commercial insight.

Visiongain’s study is for everybody needing commercial analyses for the companion diagnostics market and leading companies. You will find data, trends and predictions. Please order our report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 The Companion Diagnostics Market Overview

1.2 Companion Diagnostics Market Segmentation

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report

1.6 Who is This Report For?

1.7 Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Reports

1.10 About Visiongain

2. Introduction to Companion Diagnostics

2.1 The Foundation of Personalised Medicine

2.2 Personalised Medicine: Changing the Patient Treatment Paradigm

2.3 In Vitro Diagnostic (IVD) Tests

2.3.1 Companion Diagnostics: A Type of IVD

2.3.2 Differences between Companion Diagnostics and Theranostics

2.3.3 Biomarkers to Companion Diagnostics

2.3.4 Genomic Biomarkers

2.3.5 Genomic Oncology Biomarkers

2.4 Regulations in the Companion Diagnostics Market

2.4.1 FDA's Final Guidance on Companion Diagnostics

2.4.2 LDTs: A Changing Landscape

2.5 Encouraging the Contemporaneous Development of Companion Diagnostics

3. The World Companion Diagnostics Market, 2017-2028

3.1 Scope and Limitations

3.2 The Global Companion Diagnostics Market, 2016 and 2017

3.3 The Global Companion Diagnostics Market Sales Forecast, 2017-2028

3.4 Companion Diagnostics: Growth Outpacing the Rest of the IVD Market

3.5 Companion Diagnostics: Increasing Market Share of the IVD Market

3.6 The Companion Diagnostics Market by Submarket, 2017

3.7 Theranostics: Fastest Growing Segment of the CDx Market

3.8 Changing Market Shares of the Leading Companion Diagnostics Submarkets, 2017-2028

4. Leading National Markets for Companion Diagnostics, 2017-2028

4.1 The Leading National Markets for Companion Diagnostics: Led by 3 Dominant Markets in 2017

4.2 The Leading National Markets for Companion Diagnostics Sales Forecast, 2017-2028

4.2.1 Changing Market Shares of Leading National Markets, 2017-2028

4.3 The US Companion Diagnostics Market Sales Forecast, 2017-2028

4.3.1 The US Will Continue to Dominate the Market

4.4 The EU5 Companion Diagnostics Sales Market, 2017

4.4.1 The EU5 Companion Diagnostics Market Sales Forecast, 2017-2028

4.4.2 Changing Market Shares of the EU5 Companion Diagnostics Market

4.4.3 The German Companion Diagnostics Market Sales Forecast 2017-2028

4.4.4 The French Companion Diagnostics Market Sales Forecast, 2017-2028

4.4.5 The Italian Companion Diagnostics Market Sales Forecast, 2017 2028

4.4.6 The Spanish Companion Diagnostics Market Sales Forecast, 2017-2028

4.4.7 The UK Companion Diagnostics Market Sales Forecast, 2017-2028

4.5 The Japanese Companion Diagnostics Market Sales Forecast, 2017-2028

4.5.1 Japan’s Medical Technology Regulatory Process Reducing Time to Market

4.6 The Chinese Companion Diagnostics Market Sales Forecast, 2017-2028

4.6.1 Cancer Rates will Drive Adoption of Companion Diagnostic Tests

4.7 The Indian Companion Diagnostics Market Sales Forecast, 2017-2028

4.8 The Brazilian Companion Diagnostics Market Sales Forecast, 2017-2028

4.9 The Russian Companion Diagnostics Market Sales Forecast, 2017-2028

4.10 The South Korean Companion Diagnostics Market Sales Forecast, 2017-2028

4.11 The Rest of the World Companion Diagnostics Market Sales Forecast, 2017-2028

5. The Companion Diagnostics Market: Marketed Products and Pipeline Partnerships

5.1 Biomarkers: At the Forefront of Companion Diagnostics Development

5.2 US FDA Approved Companion Diagnostic Tests, 2016

5.3 Oncology Continues to Dominate the R&D Pipeline of Companion Diagnostics

5.4 Expensive Cancer Therapies Encourages the Development of CDx

5.5 Companion Diagnostic/Pharma Partnerships, 2013-2014

6. Business Models and Stakeholders in the Companion Diagnostics Market

6.1 Business Models for the Development of Companion Diagnostics

6.1.1 The Partnership Model is the Most Practiced Method

6.1.2 The Stand-Alone Model: Licensing an IP

6.1.3 The One Stop Shop Model: An Approach by Big Pharma

6.1.4 Using Contract Diagnostics Organisations (CDO): An Emerging Trend

6.2 Factors Driving Companies to Enter the Companion Diagnostics Market

6.3 Stakeholders Influencing the Companion Diagnostics Market

6.3.1 Pharmaceutical Companies and Diagnostic Manufacturers

6.3.2 Regulatory Authorities

6.3.3 Testing Laboratories

6.3.4 Physicians and Patients

6.3.5 Payers

6.4 Companion Diagnostics Competitive Landscape, 2017

7. Leading Companies in the Companion Diagnostics Market 2017

7.1 Roche: Global Diagnostics Leader

7.1.1 Ventana Medical Systems (Roche)

7.1.2 Sales and Recent Performance Analysis, 2016

7.1.3 Roche Diagnostics by Region, 2016

7.1.4 Roche: Growing Diagnostic Portfolio

7.1.5 Approval of Ventana and Cobas EGFR Mutation Test V2

7.1.6 Roche’s Portfolio of Companion Diagnostic Project Pipeline and Marketed Companion Diagnostics, 2017

7.1.7 Ventana Companion Diagnostics: Robust New Prototype Assays

7.1.8 Recent Companion Diagnostic External Collaborations, 2014-2017

7.1.8.1 Roche/Ariosa Diagnostics and Signature Diagnostics

7.1.8.2 Loxo Oncology/ Roche: Larotrectinib Pan-TRK IHC Companion Diagnostic

7.1.8.3 CAPP Medical/ Roche: Development for Diagnostic Operating Segment

7.1.8.4 GENEWEAVE and Kapa Acquisitions Help Cement Roche’s Position as the Market Leader

7.1.8.5 Foundation Medicine/Roche

7.1.8.6 MedImmune (AstraZeneca)/Ventana: Assay for NSCLC Targeted Clinical Trials

7.1.8.7 Merck/Ventana: CDx for an Undisclosed Target

7.1.8.8 AstraZeneca/Roche: CDx to Support Target Drug AZD9291

7.1.8.9 Boehringer Ingelheim/Roche

7.1.8.10 ImmunoGen/ Ventana

7.2 Qiagen N.V.: Leading CDx Collaborator with Pharmaceutical Companies

7.2.1 Sales and Recent Performance Analysis, 2012-2016

7.2.2 Qiagen Sales by Region

7.2.3 Qiagen’s Portfolio of Marketed Companion Diagnostics, 2016

7.2.4 Companion Diagnostics Collaboration Agreements with Pharma, 2016

7.2.4.1 Collaboration with Therawis Diagnostics

7.2.4.2 Collaboration with HTG Molecular Diagnostics

7.2.4.3 Collaboration with Array BioPharma

7.2.4.4 Collaboration with Singulex

7.2.4.5 Strategic Acquisitions

7.3 Abbott Molecular: An Established Competitor

7.3.1 Sales and Recent Performance Analysis, 2014-2016

7.3.2 Abbott Molecular: Expansive Oncology Biomarker Pipeline

7.3.3 Recent Collaborations

7.3.3.1 Collaboration with Celgene and Agios

7.3.3.2 Collaboration with AstraZeneca

7.3.3.3 Collaborative Efforts with Idera

7.4 Agilent Technologies (Dako)

7.4.1 Life Sciences and Diagnostics Business

7.4.2 Agilent Life Sciences and Diagnostics, Sales and Recent Performance Analysis, 2016

7.4.3 Agilent: Next Generation Sequencing Platforms

7.4.4 Recent Companion Diagnostic Approvals

7.4.4.1 Expanded FDA Approval for the Use of Dako PD-L1 IHC 22C3 pharmDx Companion Diagnostic in Gastric or Gastroesophageal Junction (GEJ) Cancer

7.4.4.2 Agilent/ Bristol- Myers Squibb’s: Companion Diagnostic Approvals

7.4.4.3 Agilent/Pfizer/Merck: An Ongoing Collaboration

7.4.5 Strategic Acquisitions

7.4.5.1 Acquisition of i-Lab Solutions

7.4.5.2 Acquisition of Multiplicom

7.5 Myriad Genetics

7.5.1 Acquisition of Myriad RBM: Increases the Company’s Market Share of Companion Diagnostics

7.5.2 Companion Diagnostic Service Offerings

7.5.3 Sales and Recent Performance Analysis, 2016

7.5.3.1 myRisk: Next Generation Hereditary Cancer Testing

7.5.4 Myriad Genetics Recent Collaborations

7.5.4.1 Myriad/BeiGene: Collaboration Agreement

7.5.4.2 Myriad/AstraZeneca: Complementary Diagnostic FDA Approvals

7.5.4.3 Acquisition of /Sividone Diagnostics

7.5.4.4 Acquisition of Assurex Health

7.5.4.5 Collaboration with AbbVie

7.6 BioMérieux

7.6.1 Sales and Recent Performance Analysis, 2016

7.6.2 Sales by Region, 2016

7.6.3 Sales by Technology, 2016

7.6.4 Companion Diagnostics: Recent M&A Activity & Collaboration

7.6.4.1 Strategic Acquisitions

7.6.4.2 Collaboration with Banyan Biomarkers

7.6.4.3 Agreement with Astute Medical to Distribute Nephrocheck

7.6.4.4 Mergers, Acquisitions and Collaborations

7.6.5 bioTheranostics: Subsidiary for Oncology Diagnostics

7.7 Thermo Fisher Scientific

7.7.1 Sales and Recent Performance Analysis, 2014-2016

7.7.1.1 Thermo Fisher Scientific Sales by Region, 2016

7.7.2 Recent Collaborations and Acquisitions

7.7.2.1 Thermo Fisher Scientific/Seegene-FDA Clearances

7.7.2.2 Thermo Fisher Scientific/University Hospital Basel

7.7.2.3 Acquisition of Alfa Aesar

7.7.2.4 Affymetrix: Thermo Fisher’s Next Target

7.7.2.5 Thermo Fisher Scientific Collaboration with Pfizer and Novartis to Offer NGS-Based Companion Test for NSCLC

8. Qualitative Analysis of the Companion Diagnostics Market, 2017-2028

8.1 SWOT Analysis of the Companion Diagnostics Market

8.2 Strengths

8.2.1 A CDx Strategy Decreases the Length of Approval Process

8.2.2 Premium Prices for Companion Diagnostics

8.2.3 A CDx Development Strategy Can Generate More Effective Drugs

8.2.4 Therapeutics Tied with CDx can have Safer Profiles

8.2.5 Reducing the Cost of Healthcare

8.2.6 Increased Regulatory Scrutiny on Marketed Drugs

8.2.7 Targeted Therapies Will Drive the CDx Market

8.3 Weaknesses

8.3.1 Reimbursement Challenges

8.3.2 Lack of Clear Regulatory Guidelines

8.3.3 Capital Intensity is High

8.4 Opportunities

8.4.1 Fast-growing Emerging Markets

8.4.2 Next Generation Sequencing

8.4.3 Many New CDx/ Pharma Company Partnerships

8.5 Threats

8.5.1 Complex Business Models and Business Partnerships

8.5.2 Medical Device Excise Tax

8.6 Porter’s Five Forces Analysis of the Companion Diagnostics Market

8.6.1 Rivalry Among Competitors [High]

8.6.2 Power of Suppliers [High]

8.6.3 Power of Buyers [Medium]

8.6.4 Threat of New Entrants [Medium]

8.6.5 Threat of Substitutes [High]

9. Conclusions

9.1 Overview

9.2 Theranostics: A Fast Growing Market

9.3 Leading Companion Diagnostic Companies

9.4 Pharmaceutical/Diagnostic Partnership Model

9.5 Oncology is the Leading Therapy Area Driving Companion Diagnostics

9.6 Commercial Drivers of the Companion Diagnostics Market

9.7 Commercial Restraints of the Companion Diagnostics Market

9.8 Concluding Remarks

10. Glossary

Associated Reports

Visiongion Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain Report Evaluation Form

Table of Tables

Table 1.1 The CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%) 2017-2023

Table 1.2 The CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%) 2023-2028

Table 2.1 Examples of Clinically Relevant Cancer Biomarkers, 2016

Table 3.1 The World IVD Market: Revenue ($bn) and Market Share (%) by Segment, 2017

Table 3.2 The World CDx Market: Revenue ($bn), AGR (%) and CAGR (%), 2017-2023

Table 3.3 The World CDx Market: Revenue ($bn), AGR (%) and CAGR (%), 2023-2028

Table 3.4 The World IVD and CDx Market: Revenue ($bn), AGR (%) and CAGR (%), 2017-2023

Table 3.5 The World IVD and CDx Market: Revenue ($bn), AGR (%) and CAGR (%), 2023-2028

Table 3.6 CDx Market Share (%) in the IVD Market, 2017, 2023, 2028

Table 3.7 The World Companion Diagnostics Market: Revenue ($bn) and Market Share (%) by Submarket, 2017

Table 3.8 The World Companion Diagnostics Market by Submarket: Revenue ($bn), AGR (%) and CAGR (%), by Submarket, 2017-2023

Table 3.9 The World Companion Diagnostics Market by Submarket: Revenue ($bn), AGR (%) and CAGR (%), by Submarket, 2023-2028

Table 3.10 Revenue ($bn) and Market Share (%) of Submarkets in the CDx Market, 2017, 2023, 2028

Table 4.1 The Leading National Markets for CDx: Sales ($m), Market Share (%), 2017

Table 4.2 The Leading National Companion Diagnostics Market Forecast: Revenues ($m), AGR (%) and CAGR (%), 2017-2023

Table 4.3 The Leading National Companion Diagnostics Market Forecast: Revenues ($m), AGR (%) and CAGR (%), 2023-2028

Table 4.4 Revenue ($bn) and Market Share (%) of the National Markets in the CDx Market, 2017, 2023, 2027

Table 4.5 The US CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%) 2017-2023

Table 4.6 The US CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%) 2023-2028

Table 4.7 The EU5 CDx Market Forecast: Revenue ($bn) and Market Share (%), 2017

Table 4.8 The EU5 Companion Diagnostic National Market Forecasts: Revenue ($bn), AGR (%) and CAGR (%), 2017-2023

Table 4.9 The EU5 Companion Diagnostic National Market Forecasts: Revenues ($bn), AGR (%) and CAGR (%), 2023-2028

Table 4.10 Market Share (%) of Each EU5 Region in the CDx Market, 2017, 2023, 2027

Table 4.11 The German CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2017-2028

Table 4.12 The German CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2017-2028

Table 4.13 The French CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2017-2023

Table 4.14 The French CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2023-2028

Table 4.15 The Italian CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2017-2023

Table 4.16 The Italian CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2023-2028

Table 4.17 The Spanish CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2017-2023

Table 4.18 The Spanish CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2023-2028

Table 4.19 The UK CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2017-2023

Table 4.20 The UK CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2023-2028

Table 4.21 The Japanese CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%) 2017-2023

Table 4.22 The Japanese CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%) 2023-2028

Table 4.23 The Chinese CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2017-2023

Table 4.24 The Chinese CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2023-2028

Table 4.25 The Indian CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2017-2023

Table 4.26 The Indian CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2023-2028

Table 4.27 The Brazilian CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2017-2023

Table 4.28 The Brazilian CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2027-2028

Table 4.29 The Russian CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2017-2023

Table 4.30 The Russian CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2023-2028

Table 4.31 The South Korean CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2017-2023

Table 4.32 The South Korean CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2023-2028

Table 4.33 The Rest of the World CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2017-2023

Table 4.34 The Rest of the World CDx Market Forecast: Revenue ($bn), AGR (%) and CAGR (%), 2023-2028

Table 5.1 List of FDA-Approved Drugs with Pharmacogenomic Biomarker Information in Their Labelling, 2018

Table 5.2 (Cont’d) List of FDA-Approved Drugs with Pharmacogenomic Biomarker Information in Their Labelling, 2018

Table 5.3 (Cont’d) List of FDA-Approved Drugs with Pharmacogenomic Biomarker Information in Their Labelling, 2018

Table 5.4 (Cont’d) List of FDA-Approved Drugs with Pharmacogenomic Biomarker Information in Their Labelling, 2018

Table 5.5 (Cont’d) List of FDA-Approved Drugs with Pharmacogenomic Biomarker Information in Their Labelling, 2018

Table 5.6 List of Cleared or Approved Companion Diagnostic Devices and Their Complementary Therapeutic Drug, 2015-2017

Table 5.7 List of CDx Diagnostic/Pharma Partnerships, 2015-2017

Table 6.1 List of Companies in the Companion Diagnostics Market, 2017

Table 6.2 (Cont’d) List of Companies in the Companion Diagnostics Market, 2017

Table 7.1 Roche Diagnostics: Revenue ($bn) and Revenue Share (%) by Business Area, 2016

Table 7.2 Roche Diagnostics: Revenue ($bn), Revenue Shares (%) by Region, 2016

Table 7.3 Roche: Instruments/devices planned for 2017

Table 7.4 Roche: Tests/Assays planned for 2017

Table 7.5 Roche Diagnostics: List of Marketed Companion Diagnostics, 2017

Table 7.6 Qiagen: Revenue ($bn), Net Income ($bn) and Profit Margin, 2012-2016

Table 7.7 Qiagen: Revenue ($m), Revenue Share (%) by Geography, 2014-2016

Table 7.8 Qiagen: Marketed Molecular Diagnostic Products, 2016

Table 7.9 Qiagen’s Molecular Diagnostics by Therapeutic Area, 2016

Table 7.10 Abbott: Revenue ($bn) by Segment, 2014-2016

Table 7.11 Abbott Molecular: Biomarker Pipeline, 2017

Table 7.12 Agilent Technologies: Revenue ($bn) by Business Segment 2014-2016

Table 7.13 Myriad Genetics: Biomarker Product Portfolio, 2016

Table 7.14 Myriad Genetics: Revenue ($bn) by Segment, FY ended June 2015- FY ended June 2017

Table 7.15 bioMérieux : Revenue (€bn), ($bn) and AGR (%), 2012-2016

Table 7.16 bioMérieux: Revenue Share (%) by Technology, 2016

Table 7.17 Thermo Fisher Scientific: Revenue ($bn) and Market Share (%)

Table 7.18 Thermo Fisher Scientific: Revenue ($bn), Revenue Share (%) by Geography, 2016

Table 8.1 SWOT Analysis of the Companion Diagnostics Market, 2017-2028

Table 9.1 Theranostics and Other In Vitro Diagnostics: Global Sales Forecast ($bn), 2017, 2023 and 2028

Table of Figures

Figure 1.1 Companion Diagnostics: Overview of Submarkets

Figure 2.1 Development of Biomarkers into Companion Diagnostics, 2018

Figure 3.1 The World IVD Market: Market Share (%) in the IVD Market, 2017

Figure 3.2 The World CDx Market: Revenue ($bn), AGR (%) and CAGR (%), 2017-2028

Figure 3.3 The World IVD and CDx Market: Revenue ($bn), AGR (%) and CAGR (%), 2017-2028

Figure 3.4 The World CDx Market Share (%) in the IVD Market, 2023

Figure 3.5 The World CDx Market Share (%) in the IVD Market, 2028

Figure 3.6 The World Companion Diagnostics Market: Market Share (%) by Submarket, 2017

Figure 3.7 The World CDx Market by Submarket: Revenue ($bn) and AGR (%) 2017-2028

Figure 3.8 The World CDx Market Share (%) in the IVD Market, 2023

Figure 3.9 The World CDx Market Share (%) in the IVD Market, 2028

Figure 4.1 The Leading National Markets for CDx by Sales ($bn), 2017

Figure 4.2 The Leading National Markets for CDx by Market Share (%), 2017

Figure 4.3 The Leading National Markets for CDx by Market Share (%), 2023

Figure 4.4 The Leading National Markets for CDx by Market Share (%), 2027

Figure 4.5 The US CDx Market Forecast: Revenue ($bn) and AGR (%), 2017-2028

Figure 4.6 The EU5 Leading National Markets for CDx by Revenue ($bn), 2017

Figure 4.7 The EU5 Leading National Markets for CDx by Market Share (%), 2017

Figure 4.8 The EU5 National Markets for CDx by Market Share (%), 2023

Figure 4.9 The EU5 National Markets for CDx by Market Share (%), 2028

Figure 4.10 The German CDx Market Forecast: Revenue ($bn) and AGR (%) 2017-2028

Figure 4.11 The French CDx Market Forecast: Revenue ($bn) and AGR (%) 2017-2028

Figure 4.12 The Italian CDx Market Forecast: Revenue ($bn) and AGR (%) 2017-2028

Figure 4.13 The Spanish CDx Market Forecast: Revenue ($bn) and AGR (%) 2017-2028

Figure 4.14 The UK CDx Market Forecast: Revenue ($bn) and AGR (%) 2017-2028

Figure 4.15 The Japanese CDx Market Forecast: Revenue ($bn) and AGR (%), 2017-2028

Figure 4.16 The Chinese CDx Market Forecast: Revenue ($bn) and AGR (%) 2017-2028

Figure 4.17 The Indian CDx Market Forecast: Revenue ($bn) and AGR (%) 2017-2028

Figure 4.18 The Brazilian CDx Market Forecast: Revenue ($bn) and AGR (%) 2017-2028

Figure 4.19 The Russian CDx Market Forecast: Revenue ($bn) and AGR (%) 2017-2028

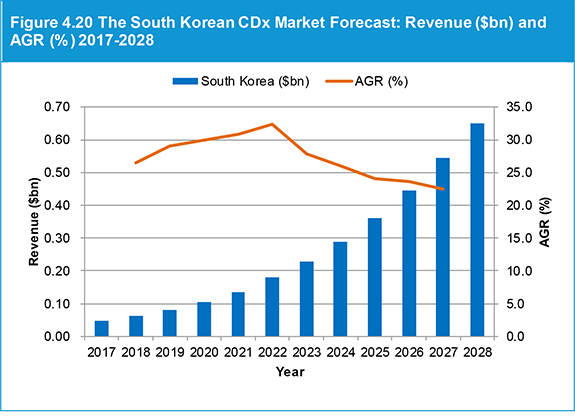

Figure 4.20 The South Korean CDx Market Forecast: Revenue ($bn) and AGR (%) 2017-2028

Figure 4.21 The Rest of the World CDx Market Forecast: Revenue ($bn) and AGR (%) 2017-2028

Figure 6.1 Current Business Models for the Development of Companion Diagnostics, 2017

Figure 6.2 Stakeholders in the Companion Diagnostics Market, 2017

Figure 7.1 Roche Diagnostics: Revenues ($bn) by Business Area, 2016

Figure 7.2 Roche Diagnostics: Revenue Share (%) by Business Area, 2016

Figure 7.3 Roche Diagnostics: Revenue Share (%) by Geography, 2016

Figure 7.4 Qiagen: Revenue ($bn) and Net Income ($bn), 2012-2016

Figure 7.5 Qiagen: Revenue Share (%) by Geography, 2016

Figure 7.6 Abbott Laboratories: Historical Revenue ($bn), 2013-2016

Figure 7.7 Abbott Laboratories: Revenue Share (%) by Business Sector, 2016

Figure 7.8 Agilent Technologies: Revenue ($bn) by Business Segment 2014-2016

Figure 7.9 Myriad Genetics: Segment Share (%), 2016

Figure 7.10 bioMérieux: Revenue ($bn) and AGR (%), 2012-2016

Figure 7.11 bioMérieux: Revenue by Region (%), 2016

Figure 7.12 bioMérieux: Revenue Share (%) by Technology, 2015

Figure 7.13 Thermo Fisher Scientific: Revenue Sales (%) by Business Sector, 2016

Figure 7.14 Thermo Fisher Scientific: Revenue Share (%) by Geography, 2016

Figure 8.1 Drivers and Restraints in the Companion Diagnostics Market, 2017-2028

Figure 8.2 Porter’s Five Analysis of the Companion Diagnostics Market, 2017-2028

Figure 9.1 Theranostics and Other In Vitro Diagnostics: World Sales Forecast ($bn), 2017, 2023 and 2028

20/20 Gene Systems

Abbott Diagnostics

Abbott Molecular

Affymetrix

Agilent (Dako)

Almac

Ambry Genetics

Amgen

Arca bipharma

Arno

Astellas Pharma

AstraZeneca

Asuragen

Bayer

Biogenex Laboratories, Inc.

bioMérieux

Biomonitor

Boehringer Ingelheim

Brain Resource Company

Bristol-Myers Squibb

Cancer Research UK

CancerGuide Diagnostics

Caprion Proteomics

Caris Life Sciences

Celera (acquired by Quest Diagnostics)

Celgene

Cepheid

ChemGenex Pharmaceuticals

Clarient

Clinical Reference Laboratory

Clovis

College of American Pathology (CAP)

CompanDx

Crescendo Bioscience

Curidium Medica

Dako (Agilent)

Deloitte

DiagnoCure

Dx assays

DxS

Eli Lilly

Endocyte

European Medicines Agency (EMA)

Exosome Diagnostics

Ferring

Flagship Biosciences

FlowMetric Diagnostics

Foundation Medical

Foundation Medicine

Genentech

Genfit

Genia Technologies

Genmab

GenMark Diagnostics

Gilead Sciences

GlaxoSmithKline

GSK

Hexie Health

HistologiX

Idera

Illumina

ImmunoGen

Incyte

InDex Pharmaceuticals

IntegraGen

Inverness Medical Innovations (now known as Alere)

Invivoscribe Technologies

Ipsen

Ipsogen

IQuum

Janssen Pharmaceutical

Kimball Genetics (a division of LabCorp)

Kunlun Health Insurance

Lab Corp

Lab21

Laboratory for Personalized Molecular Medicine

Leica

Leica Biosystems

Leica Micosystems

Life Technologies

Medical Research Council

Medicare

MedImmune (AstraZeneca)

Merck

Merck Serono

MolecularMD

Monogram Biosciences

Myriad Genetics

Myriad RBM

Nanosphere

Nanostring

NanoString Technologies

National Health Insurance (NHI) (South Korea)

NIH

Northern Institute for Cancer Research

Novartis

Oxford BioTherapeutics (earlier Oxford Genome Sciences)

Pacific Diagnostics Clinical Laboratory (ResearchDx)

Pfizer

PICC Health Insurance

Ping An Insurance Group

Prionics

Progenika Biopharma

Prometheus

Protagen

Protagen Diagnostics

Qiagen

Quintiles

Quintiles Transnational Corporation

Randox Pharma Services

ResearchDx

Resonance Health

Resonance Health Analysis Services

RiboMed Biotechnologies

Roche

Rule-Based Medicine

Saladax Biomedical

ServizioSanitarioNazionale (SSN)

Siemens

Siemens Healthcare

Signal Genetics

Sirius Genomics

Sistema Único de Saúde (SUS)

Skyline Diagnostics

Solvay Innogenetics

Sysmex Inostics

Takeda’s Millennium unit

Target Discovery

TcLand Expression

TESARO

The Association of British Pharmaceutical Industries

The Food and Drug Administration (FDA)

The Haute Autorité de santé (HAS)

The National Institute for Health and Care Excellence (NICE)

Theranostics (NZ)

Theranostics Health

Thermo Fisher

Thermo Fisher Scientific

Third Wave Technologies (Hologic)

TIB MolBiol

Tocagen

Tragara Pharmaceuticals

Transgenomic

TRICARE

TrimGen Corporation

Tufts Center for the Study of Drug Development

Unilabs

University of Newcastle

Ventana Medical Systems (a subsidiary of Roche)

ViiV Healthcare

Weisenthal Cancer Group

Download sample pages

Complete the form below to download your free sample pages for The Companion Diagnostics (CDx) Market Forecast 2018-2028

Related reports

-

Global Blood Cancer Market Forecast to 2028

The global blood cancer market reached $24bn in 2018 and is estimated to grow at a CAGR of 6.4% in...Full DetailsPublished: 11 April 2019 -

Global Ophthalmic Devices Market 2018-2028

The global ophthalmic devices market is expected to grow at a CAGR of 5.5% in the first half of the...

Full DetailsPublished: 25 June 2018 -

Brain Monitoring Devices Market Forecast 2017-2027

Our 155-page report provides 119 tables, charts, and graphs. Read on to discover the most lucrative areas in the industry...Full DetailsPublished: 02 February 2017 -

Gene Therapy R&D and Revenue Forecasts 2018-2028

The gene therapy market is projected to grow at a CAGR of 41.1% in the first half of the forecast...

Full DetailsPublished: 31 May 2018 -

The Ophthalmic Equipment Market Forecast 2019-2029

Ophthalmology is a branch of medical sciences that deals with the anatomical and physiological study of eyes such as function,...Full DetailsPublished: 31 May 2019 -

Global Respiratory Diagnostics Market Report 2017-2027

The global respiratory diagnostics market is expected to grow at a CAGR of 7.1% in the first half of the...Full DetailsPublished: 08 June 2017 -

Pharma Leader Series: Top 25 Ophthalmic Drug Manufacturers 2018-2028

The global ophthalmic drugs market was valued at $23bn in 2017. The market was dominated by the Retinal Disorder drug...

Full DetailsPublished: 19 July 2018 -

Global Alzheimer’s Disease Therapeutics and Diagnostics Market 2018-2028

The Alzheimer’s Disease Therapeutics and Diagnostics Market will reach $7.93bn in 2018. The Alzheimer’s Disease Therapeutics and Diagnostics Market is...

Full DetailsPublished: 18 June 2018 -

Global Ophthalmic Drugs Market Forecast 2018-2028

The global ophthalmic drugs market is expected to grow at a CAGR of 4.4% in the first half of the...

Full DetailsPublished: 26 June 2018 -

Global Precision Medicine Market Forecast 2018-2028

The global precision medicine market is expected to grow at an estimated CAGR of 12.08% from 2018 to 2028. The...

Full DetailsPublished: 26 March 2018

Download sample pages

Complete the form below to download your free sample pages for The Companion Diagnostics (CDx) Market Forecast 2018-2028

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Pharma news

Retinal Gene Therapy Market

The global Retinal Gene Therapy market is projected to grow at a CAGR of 9.6% by 2034

26 July 2024

HIV Drugs and Injectables Market

The global HIV Drugs & Injectables market is projected to grow at a CAGR of 4.6 % by 2034

24 July 2024

Digital Twin Technology in Pharmaceutical Manufacturing Market

The global Digital Twin Technology in Pharmaceutical Manufacturing market is projected to grow at a CAGR of 31.3% by 2034

23 July 2024

Specialty Pharma Market

The global Specialty Pharma market is projected to grow at a CAGR of 7.5% by 2034

22 July 2024