The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global Rigid Plastic Packaging market. Visiongain assesses that this market will generate revenues of $208.50 Bn in 2018.

Now: “EU sets 2030 targets for recyclable packaging“ This is an example of the business-critical headline that you need to know about – and more importantly, you need to read Visiongain’s objective analysis of how this will impact your company and the industry more broadly. How are you and your company reacting to this news? Are you sufficiently informed?

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in the rigid plastic packaging sector. Visiongain’s new study tells you and tells you NOW.

In this brand-new report, you find 165 in-Depth tables, charts and graphs exclusive interviews – all unavailable elsewhere.

The 197-page report provides clear detailed insight into the global rigid plastic packaging market. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand-new report today you stay better informed and ready to act.

Report Scope

• Global Rigid Plastic Packaging Market Report Market Forecasts From 2018-2028

• Rigid Plastic Packaging Submarket Forecasts By Resin Type From 2018-2028

• PE Plastic Packaging Forecast 2018-2028

• PET Plastic Packaging Forecast 2018-2028

• PP Plastic Packaging Forecast 2018-2028

• PS Plastic Packaging Forecast 2018-2028

• PV Plastic Packaging Forecast 2018-2028

• EPS Plastic Packaging Forecast 2018-2028

• Others Plastic Packaging Forecast 2018-2028

• Rigid Plastic Packaging Submarket Forecasts By Packaging Type From 2018-2028

• Bottles & Jars Plastic Packaging Forecast 2018-2028

• Trays,Tubs Plastic Packaging Forecast 2018-2028

• Cups & Pots Plastic Packaging Forecast 2018-2028

• Rigid Bulk Products Plastic Packaging Forecast 2018-2028

• Others Plastic Packaging Forecast 2018-2028

• Rigid Plastic Packaging Submarket Forecasts By End Use From 2018-2028 Covering

• Beverage Plastic Packaging Forecast 2018-2028

• Food Plastic Packaging Forecast 2018-2028

• Health Care Plastic Packaging Forecast 2018-2028

• Personal Care Plastic Packaging Forecast 2018-2028

• Industrial Plastic Packaging Forecast 2018-2028

• Others Plastic Packaging Forecast 2018-2028

• Regional Rigid Plastic Packaging Market Forecasts From 2018-2028 Covering

• North America Rigid Plastic Packaging Market 2018-2028

• U.S. Rigid Plastic Packaging Market 2018-2028

• Canada Rigid Plastic Packaging Market 2018-2028

• Mexico Rigid Plastic Packaging Market 2018-2028

• Asia-Pacific Rigid Plastic Packaging Market 2018-2028

• China Rigid Plastic Packaging Market 2018-2028

• Japan Rigid Plastic Packaging Market 2018-2028

• India Rigid Plastic Packaging Market 2018-2028

• Australia Rigid Plastic Packaging Market 2018-2028

• Other APAC Rigid Plastic Packaging Market 2018-2028

• Europe Rigid Plastic Packaging Market 2018-2028

• U.K. Rigid Plastic Packaging Market 2018-2028

• Germany Rigid Plastic Packaging Market 2018-2028

• France Rigid Plastic Packaging Market 2018-2028

• Italy Rigid Plastic Packaging Market 2018-2028

• Spain Rigid Plastic Packaging Market 2018-2028

• Other European Rigid Plastic Packaging Market 2018-2028

• Rest Of The World Rigid Plastic Packaging Market 2018-2028

• Brazil Rigid Plastic Packaging Market 2018-2028

• Argentina Rigid Plastic Packaging Market 2018-2028

• South Africa Rigid Plastic Packaging Market 2018-2028

• Remaining Countries Rigid Plastic Packaging Market 2018-2028

• Analysis Of The Key Factors Driving Growth In The Global, Regional And Country Level Rigid Plastic Packaging Markets From 2018-2028

• Profiles Of The Leading Rigid Plastic Packaging Companies

• Amcor

• ALPLA

• Anchor Packaging

• Bemis

• Berry Plastics

• Greif

• Reynolds Group Holdings

• Sealed Air

• Silgan Holdings

Who should read this report?

• Packaging companies

• Plastic suppliers

• Chemical companies

• Wholesalers

• Retailers

• NPD specialists

• Packaging & product designers,

• Food companies

• Beverage companies

• Pharmaceutical companies

• Healthcare companies,

• Personal care companies

• Technology providers

• Anti-counterfeiting companies

• Senior executives

• Head of product development

• Marketing staff

• Market analysts

• Procurement staff

• Industry associations

• Consultants

• Managers

• Business development managers

• Investors

• Government departments & agencies

Visiongain’s study is intended for anyone requiring commercial analyses for the rigid plastic packaging market and leading companies. You find data, trends and predictions.

Buy our report today Rigid Plastic Packaging Market Report 2018-2028: Forecasts by Resin Type (PE, PET, PP, PS, PV, EPS, Others), by Packaging Type (Bottles & Jars, Trays, Tubs, Cups & Pots, Rigid Bulk Products, Others), by End User (Beverage, Food, Health Care, Personal Care, Industrial, Others). Avoid missing out by staying informed – get our report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Rigid Plastic Packaging Overview

1.2 Global Rigid Plastic Packaging Market Segmentation

1.3 Global Rigid Plastic Packaging Market by Resin Type

1.4 Global Rigid Plastic Packaging Market by Resin Type

1.5 How this Report Delivers

1.6 Key Questions Answered by This Analytical Report Include:

1.7 Who is this report for?

1.8 Methodology

1.9 Frequently Asked Questions (FAQ)

1.10 Associated Visiongain Reports

1.11 About Visiongain

2. Executive Summary

2.1 What is Rigid Plastic?

2.2 Rigid Plastic Packaging, By Production process

2.2.1 Extrusion

2.2.2 Injection Molding

2.2.3 Blow Molding

2.2.4 Thermoforming

2.2.5 Others

2.3 Market Insights

3. Market Overview

3.1 Introduction

3.2 History of Packaging

3.3 Advantages of Rigid Plastic Packaging

3.4 Rigid Plastic Packaging Alternative

3.4.1 Metal Packaging

3.4.2 Glass Packaging

3.4.3 Mixed Materials Packaging

3.5 Market Segmentation

3.6 Global Rigid Plastic Packaging Market Forecast 2018-2028

3.6.1 Production Analysis

3.6.2 Demand Analysis

3.6.3 Rigid Plastic Packaging Market Key Trends

3.7 Rigid Plastic Packaging Market Dynamics

3.7.1 Drivers

3.7.1.1 Rising Demand From Emerging Economy From Asia-Pacific Region

3.7.1.2. Strong Demand From The Food And Beverages Industry

3.7.1.3 Rapidly Growing Healthcare Packaging Sector

3.7.2 Restraints

3.7.2.1 Volatility In Raw Material Prices

3.7.2.2 Fierce Competition From Flexible Plastic Packaging

3.7.2.3 Stringent Regulations in Rigid Plastic Regulations

3.7.3 Opportunities

3.7.3.1 Change In Demographic Trends

3.7.3.2 Change in lifestyle pattern

3.8 Industry Outlook

3.8.1 Value Chain Analysis

3.8.2 Industry Analysis

4. Rigid Plastic Packaging Market by End-Use Sectors 2018-2028

4.1 Introduction

4.2 Rigid Packaging End-Use Industry Summary

4.3 Beverages Rigid Plastic Packaging Forecast & Analysis 2018-2028

4.4 Food Industry Rigid Plastic Packaging Forecast & Analysis 2018-2028

4.5 Health Care Rigid Plastic Packaging Forecast & Analysis 2018-2028

4.6 Personal Care Rigid Plastic Packaging Forecast & Analysis 2018-2028

4.7 Industrial Rigid Plastic Packaging Forecast & Analysis 2018-2028

4.8 Other Industries Rigid Plastic Packaging Forecast & Analysis 2018-2028

5. Rigid Plastic Packaging Market by Resin Type 2018-2028

5.1 Introduction

5.2 Rigid Plastic Packaging By Resin Type Summary

5.3 Polyethylene (PE) Rigid Plastic Packaging Forecast & Analysis 2018-2028

5.4 Polyethylene Terephthalate (PET) Rigid Plastic Packaging Forecast & Analysis 2018-2028

5.5 Polypropylene (PP) Rigid Plastic Packaging Forecast & Analysis 2018-2028

5.6 Polystyrene (PS) Rigid Plastic Packaging Forecast & Analysis 2018-2028

5.7 Polyvinyl Chloride (PVC) Rigid Plastic Packaging Forecast & Analysis 2018-2028

5.8 Expanded Polystyrene (EPS) Rigid Plastic Packaging Forecast & Analysis 2018-2028

5.9 Others (PC, PLA, Polyamide) Rigid Plastic Packaging Forecast & Analysis 2018-2028

6. Rigid Plastic Packaging Market by Type 2018-2028

6.1 Introduction

6.2 Rigid Plastic Packaging By Type Summary 2018-2028

6.3 Bottles & Jars Rigid Plastic Packaging Forecast & Analysis 2018-2028

6.4 Trays Rigid Plastic Packaging Forecast & Analysis 2018-2028

6.5 Tubs Cups & Pots Rigid Plastic Packaging Forecast & Analysis 2018-2028

6.6 Rigid Bulk Products Packaging Forecast & Analysis 2018-2028

6.7 Other Types Rigid Plastic Packaging Forecast & Analysis 2018-2028

7. Rigid Plastic Packaging Markets, By Geography 2018-2028

7.1 Introduction

7.2 Rigid Plastic Packaging By Region Summary

7.3 North America Rigid Plastic Packaging Forecast & Analysis 2018-2028

7.3.1 U.S. Rigid Plastic Packaging Forecast & Analysis 2018-2028

7.3.2 Canada Rigid Plastic Packaging Forecast & Analysis 2018-2028

7.3.3 Mexico Rigid Plastic Packaging Forecast & Analysis 2018-2028

7.4 Europe Rigid Plastic Packaging Forecast & Analysis 2018-2028

7.4.1 Germany Rigid Plastic Packaging Forecast & Analysis 2018-2028

7.4.2 France Rigid Plastic Packaging Forecast & Analysis 2018-2028

7.4.3 U.K. Rigid Plastic Packaging Forecast & Analysis 2018-2028

7.4.4 Italy Rigid Plastic Packaging Forecast & Analysis 2018-2028

7.4.5 Spain Rigid Plastic Packaging Forecast & Analysis 2018-2028

7.4.6 Other European Countries Rigid Plastic Packaging Forecast & Analysis 2018-2028

7.5 Asia Pacific Rigid Plastic Packaging Forecast & Analysis 2018-2028

7.5.1 China Rigid Plastic Packaging Forecast & Analysis 2018-2028

7.5.2 India Rigid Plastic Packaging Forecast & Analysis 2018-2028

7.5.3 Japan Rigid Plastic Packaging Forecast & Analysis 2018-2028

7.5.4 Australia Rigid Plastic Packaging Forecast & Analysis 2018-2028

7.5.5 Rest of Asia Pacific Countries Rigid Plastic Packaging Forecast & Analysis 2018-2028

7.6 Rest of the World Rigid Plastic Packaging Forecast & Analysis 2018-2028

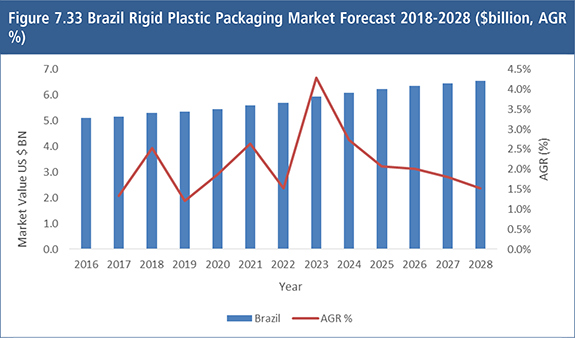

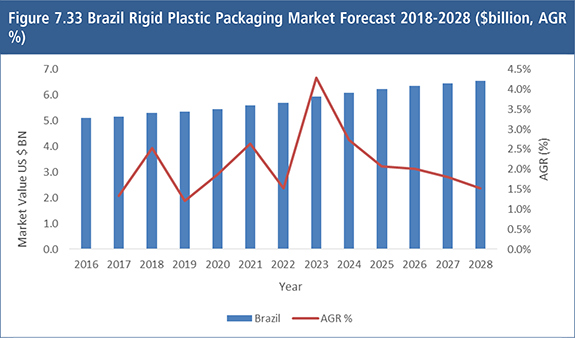

7.6.1 Brazil Rigid Plastic Packaging Forecast & Analysis 2018-2028

7.6.2 Argentina Rigid Plastic Packaging Forecast & Analysis 2018-2028

7.6.3 South Africa Rigid Plastic Packaging Forecast & Analysis 2018-2028

7.6.4 Remaining Countries Rigid Plastic Packaging Forecast & Analysis 2018-2028

8. SWOT Analysis of the Rigid Plastic Packaging Market 2018-2028

8.1 The Strengths of the Rigid Plastic Packaging Market

8.1.1 Rigid Plastic Has Many Positive Properties Over Rival Materials For Packaging Applications

8.1.2 Flexibility and Adaptability

8.2 The Weaknesses of the Rigid Plastic Packaging Market

8.2.1 Plastic Packaging Degrades in Quality as it is Recycled

8.2.2 Rigid Plastic Packaging is Heavily Dependent on Oil and Natural Gas

8.3 The Opportunities Facing the Rigid Plastic Packaging Market

8.3.1 Ageing Population

8.3.2 Fast Growth in Emerging Economies

8.3.3 Rigid Plastic Packaging can erode the ‘Green’ Credentials of Glass Packaging

8.4 The Threats to the Rigid Plastic Packaging Market

8.4.1 Mounting Public Opinion against Bisphenol A

8.4.2 Competition from Flexible Plastic Packaging

9. Leading Companies in the Rigid Plastic Packaging Market

9.1 Amcor

9.1.1 Amcor Overview

9.1.2 Amcor Analysis

9.1.4 Amcor Analyst View

9.2 ALPLA

9.2.1 ALPLA Overview

9.2.2 ALPLA Analyst View

9.3 Anchor Packaging Company

9.4 Bemis

9.4.1 Bemis Overview

9.4.2 Bemis Analysis

9.4.3 Bemis Financial Snapshot

9.4.4 Bemis Analyst View

9.5 Berry Plastics

9.5.1 Berry Plastic Overview

9.5.2 Berry Plastics Analysis: Rigid Plastic Packaging

9.5.3 Berry Plastics Financial Snapshot

9.5.4 Berry Plastics Analyst View

9.6 Greif

9.6.1 Greif Overview

9.6.2 Greif Analysis

9.6.3 Greif Financial Snapshot

9.6.4 Greif Analyst View

9.7 Reynolds Group Holdings

9.7.1 Reynolds Group Holdings Overview

9.7.2 Reynolds Group Holdings Closures Analysis and Competitors

9.7.3 Pactiv Foodservice Analysis and Competitors

9.7.4 Graham Packaging Analysis and Competitors

9.7.5 Reynolds Group Holdings Financial Snapshot

9.7.6 Reynolds Group Holdings Analyst View

9.8 Sealed Air

9.8.1 Sealed Air Overview

9.8.2 Sealed Air Analysis: Packaging Segments

9.8.3 Sealed Air Financial Snapshot

9.8.4 Sealed Air Analyst View

9.9 Silgan Holdings

9.9.1 Silgan Holdings Overview

9.9.2 Silgan Holdings Analysis

9.9.3 Silgan Holdings Financial Snapshot

9.9.4 Silgan Holdings Analyst View

9.10 Other Leading Companies in the Rigid Plastic Packaging Market

10. Conclusions

10.1 Rigid Plastic Packaging Market Study Conclusion

10.2 Drivers & Restraints in the Global Rigid Plastic Packaging Market 2018-2028

10.3 Rigid Plastic Packaging Market Prospects-By Resin Type 2018-2028

10.4 Rigid Plastic Coating Market Prospects-By Type 2018-2028

10.5 Rigid Plastic Coating Market Prospects-By End-Use Industry 2018-2028

10.6 Leading National Rigid Plastic Packaging Markets Forecast Summary 2018-2028

11. Glossary

List of Tables

Table 3.1 Global Rigid Plastic Packaging Market Forecast 2016-2028 ($bn, CAGR %, CAGR %)

Table 3.2 Key Trends of the Global Rigid Plastic Packaging Market 2018

Table 4.1 Rigid Plastic Packaging Market by End-Use Industry Forecast 2018-2028 ($bn, AGR %, CAGR %)

Table 4.2 Rigid Plastic Packaging Market by End-Use Industry Forecast CAGR (%) 2018-2028, 2018-2023, and 2023-2028

Table 4.3 Rigid Plastic Packaging Market for Beverage Forecast 2018-2028($bn, AGR %, CAGR %)

Table 4.4 Rigid Plastic Packaging Market for Food Industry Forecast 2018-2028 ($bn, AGR %, CAGR %)

Table 4.5 Rigid Plastic Packaging Market for Health Care Forecast 2018-2028 ($bn, AGR %, CAGR %)

Table 4.6 Rigid Plastic Packaging Market for Personal Care Forecast 2018-2028 ($bn, AGR %, CAGR %)

Table 4.7 Rigid Plastic Packaging Market for Industrial Forecast 2018-2028 ($bn, AGR %, CAGR %)

Table 4.8 Rigid Plastic Packaging Market for Other Industries Forecast 2018-2028 ($bn, AGR %, CAGR %)

Table 5.1 The Major Plastic Resins Used in Rigid Plastic Packaging (Resin Codes, Name, Acronym, Common Applications)

Table 5.2 Rigid Plastic Packaging Market by Resin Type Forecast 2018-2028 ($bn, CAGR %, CAGR %)

Table 5.3 Rigid Plastic Packaging Market by Resin Type Forecast CAGR (%) 2018-2028, 2018-2023, and 2022-2027

Table 5.4 PE Rigid Plastic Packaging Market Forecast 2018-2028 ($bn, AGR %, CAGR %)

Table 5.5 PET Rigid Plastic Packaging Market Forecast 2018-2028 ($bn, AGR %, CAGR %)

Table 5.6 PP Plastic Packaging Market Forecast 2018-2028 ($bn, AGR %, CAGR %)

Table 5.7 PS Rigid Plastic Packaging Market Forecast 2086-2028 ($bn, AGR %, CAGR %)

Table 5.8 PVC Rigid Plastic Packaging Market Forecast 2018-2028 ($bn, AGR %, CAGR %)

Table 5.9 EPS Rigid Plastic Packaging Market Forecast 2018-2028 ($bn, AGR %, CAGR %)

Table 5.10 Other Rigid Plastic Packaging Market Forecast 2018-2028 ($bn, AGR %, CAGR %)

Table 6.1 Rigid Plastic Packaging Market by Type Forecast 2018-2028 ($bn, AGR %, CAGR %)

Table 6.2 Rigid Plastic Packaging Market by Type Industry Forecast CAGR (%) 2018-2028, 2017-2023, and 2023-2028

Table 6.3 Rigid Plastic Packaging Market for Bottles & Jars Forecast 2018-2028 ($bn, AGR %, CAGR %)

Table 6.4 Rigid Plastic Packaging Market for Trays Forecast 2018-2028 ($bn, AGR %, CAGR %)

Table 6.5 Rigid Plastic Packaging Market for Tubs Cups & Pots Forecast 2018-2028 ($bn, AGR %, CAGR %)

Table 6.6 Rigid Plastic Packaging Market for Rigid Bulk Products Forecast 2018-2028 ($bn, AGR %, CAGR %)

Table 6.7 Rigid Plastic Packaging Market for Other Types Forecast 2018-2028 ($bn, AGR %, CAGR %)

Table 7.1 Rigid Plastic Packaging Market by Region Forecast 2018-2028 ($bn, AGR %)

Table 7.2 Leading National Rigid Plastic Packaging Markets Forecast 2018-2028 ($billion, AGR %, CAGR%)

Table 7.3 North America Rigid Plastic Packaging Market Forecast By Country 2018-2028 ($billion, CAGR %)

Table 7.4 U.S. Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %, CAGR %)

Table 7.5 Canada Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %, CAGR %)

Table 7.6 Mexico Rigid Plastic Packaging Market Forecast 2018-2028($billion, AGR %, CAGR %)

Table 7.7 Europe Rigid Plastic Packaging Market Forecast By Country 2018-2028 ($billion, CAGR %)

Table 7.8 Germany Rigid Plastic Packaging Market Forecast 2018-2028($billion, AGR %, CAGR %)

Table 7.9 France Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %, CAGR %)

Table 7.10 The U.K. Rigid Plastic Packaging Market Forecast 2018-2028($billion, AGR %, CAGR %)

Table 7.11 Italy Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %, CAGR %)

Table 7.12 Spain Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %, CAGR %)

Table 7.13 Other European Countries Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %, CAGR %, Cumulative)

Table 7.14 Asia Pacific Rigid Plastic Packaging Market Forecast By Country 2018-2028 ($billion, CAGR %)

Table 7.15 China Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %, CAGR %)

Table 7.16 India Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %, CAGR %)

Table 7.17 Japan Rigid Plastic Packaging Market Forecast 2018-2028($billion, AGR %, CAGR %)

Table 7.18 Australia Rigid Plastic Packaging Market Forecast 2018-2028($billion, AGR %, CAGR %)

Table 7.19 Rest of Asia Pacific Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %, CAGR %)

Table 7.20 Rest of the World Rigid Plastic Packaging Market Forecast By Country 2018-2028 ($billion, CAGR %)

Table 7.21 Brazil Rigid Plastic Packaging Market Forecast 2018-2028($billion, AGR %, CAGR %)

Table 7.22 Argentina Rigid Plastic Packaging Market Forecast 2018-2028($billion, AGR %, CAGR %)

Table 7.23 South Africa Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %, CAGR %)

Table 7.24 Rest of World Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %, CAGR %)

Table 8.1 SWOT Analysis of the Rigid Plastic Packaging Market 2018-2028

Table 8.2 Packaging To Contents Weight Analysis (Packaging Material, Grams of Packaging Required per 100 Grams of Contents)

Table 8.3 Ageing Population in Major Rigid Plastic Packaging Markets 2015 (Market Share (%), Population over 65 (%), Population between 55-64 (%))

Table 9.1 Amcor Overview 2016 (Total Revenue $bn, Rigid Plastic Packaging Revenues, CEO, HQ, Number of Employees, Ticker, Contact, Website)

Table 9.2 Amcor Rigid Plastic Packaging Products/Services 2015 (Products & Specification)

Table 9.3 Amcor Acquisitions 2010-2015 (Company, Business Group, Completion Date, Currency, Acquisition Price (million))

Table 9.4 ALPLA Overview 2016 (Total Revenue $bn, HQ, Number of Employees, Ticker, Contact, Website)

Table 9.5 Bemis Overview 2016 (Total Revenue $bn, CEO, HQ, Number of Employees, Ticker, Contact, Website)

Table 9.6 Berry Plastics Overview 2016 (Total Revenue $bn,CEO, HQ, Number of Employees, Ticker, Contact, Website)

Table 9.7 Greif Overview 2016 (Total Revenue $bn, CEO, HQ, Number of Employees, Ticker, Contact, Website)

Table 9.8 Greif Rigid Plastic Packaging Products/ Services 2016 (Division, Product, Markets Served)

Table 9.9 Reynolds Group Holdings Overview 2016(Total Revenue $bn, CEO, HQ, Ticker, Website)

Table 9.10 Reynolds Group Holdings Rigid Plastic Packaging Products/ Services 2015 (Division, Product, Specification)

Table 9.11 Sealed Air Overview 2016 (Total Revenue $bn, Packaging Revenue $bn, CEO, HQ, Number of Employees, Ticker, Contact, Website)

Table 9.12 Sealed Air Packaging Products/ Services 2015 (Division, Product, Specification)

Table 9.13 Silgan Holdings Overview 2016 (Total Revenue $bn, Packaging Revenue $bn, CEO, HQ, Number of Employees, Ticker, Contact, Website)

Table 9.14 Other Leading Companies in the Rigid Plastic Packaging Market 2018

Table 10.1 Global Rigid Plastic Packaging Market Summary 2018 to 2028 (Market Value,CAGR%)

Table 10.2.Global Rigid Plastic Packaging Submarket Resin Type Forecast Summary 2018, 2023, 2028 (US$bn, CAGR%)

Table 10.3 Global Rigid Plastic Packaging Submarket Technology Forecast Summary 2018 to 2028 (US$bn, CAGR%)

Table 10.4 Global Rigid Plastic Packaging Submarket End-Use Industry Forecast Summary 2018, 2023, 2023 (US$ bn, CAGR%)

Table 10.5 Leading National Rigid Plastic Packaging Market Forecast Summary 2018-2028 ($bn, CAGR %)

List of Figures

Figure 1.1 World Age Pyramid 2017

Figure 1.2 Global Rigid Plastic Packaging Market Segmentation by End-Use Sector

Figure 1.3 Global Rigid Plastic Packaging Market Segmentation by Resin Type

Figure 2.1 Rigid Plastic Packaging Submarket Snapshot 2018 Vs 2028 (% Share)

Figure 2.2 PE Resin Is Expected To Dominate The Rigid Plastic Packaging Market till 2028

Figure 2.3 Emerging Economies Accelerating The Growth Of Global Rigid Plastic Market 2018 vs.2028

Figure 3.1 Evolution of Rigid Plastic Packaging

Figure 3.2 Alternative To Rigid Plastic Packaging, By Type Market Share 2017 (%)

Figure 3.3 Global Rigid Plastic Packaging Market Segmentation

Figure 3.4 Rigid Plastic Packaging Value Chain Analysis

Figure 3.5 Rigid Plastic Packaging Market, Porter’s Five Force Model

Figure 4.1 Rigid Plastic Packaging Market by End-Use Industry Forecast 2018-2028 ($bn)

Figure 4.2 Rigid Plastic Packaging End-Use Market Share Forecast 2018, 2023, 2028 (%)

Figure 4.3 Rigid Plastic Packaging Market by End-Use Industry Forecast 2018-2028 CAGR (%)

Figure 4.4 Rigid Plastic Packaging Market for Beverage Forecast 2017-2028 ($bn, AGR %)

Figure 4.5 Rigid Plastic Packaging Market for Food Industry Forecast 2018-2028 ($bn, AGR %)

Figure 4.6 Rigid Plastic Packaging Market for Health Care Industry Forecast 2018-2028 ($bn, AGR %)

Figure 4.7 Rigid Plastic Packaging Market for Personal Care Industry Forecast 2018-2028 ($bn, AGR %)

Figure 4.8 Rigid Plastic Packaging Market for Industrial Application Forecast 2018-2028 ($bn, AGR %)

Figure 4.9 Rigid Plastic Packaging Market for Other Industries Application Forecast 2018-2028 ($bn, AGR %)

Figure 5.1 Rigid Plastic Packaging Market by Resin Type Forecast 2018-2028 ($bn)

Figure 5.2 Rigid Plastic Packaging Resin Type Market Share Forecast 2018, 2023, 2028 (%)

Figure 5.3 Rigid Plastic Packaging Market by Resin Type Forecast 2018-2028 AGR (%)

Figure 5.4 PE Rigid Plastic Packaging Market Forecast 2018-2028 ($bn, AGR %)

Figure 5.5 PET Rigid Plastic Packaging Market Forecast 2018-2028 ($bn, AGR %)

Figure 5.6 PP Rigid Plastic Packaging Market Forecast 2018-2028 ($bn, AGR %)

Figure 5.7 PS Rigid Plastic Packaging Market Forecast 2018-2028 ($bn, AGR %)

Figure 5.8 PVC Rigid Plastic Packaging Market Forecast 2018-2028 ($bn, AGR %)

Figure 5.9 EPS Rigid Plastic Packaging Market Forecast 2018-2028 ($bn, AGR %)

Figure 5.10 Other Rigid Plastic Packaging Market Forecast 2018-2028 ($bn, AGR %)

Figure 6.1 Rigid Plastic Packaging Market by Type Forecast 2018-2028 ($bn)

Figure 6.2 Rigid Plastic Packaging Type Market Share Forecast 2018, 2023, 2028 (%)

Figure 6.3 Rigid Plastic Packaging Market by Type Industry Forecast 2018-2028 AGR (%)

Figure 6.4 Rigid Plastic Packaging Market for Bottles & Jars Forecast 2018-2028 ($bn, AGR %)

Figure 6.5 Rigid Plastic Packaging Market for Trays Forecast 2018-2028 ($bn, AGR %)

Figure 6.6 Rigid Plastic Packaging Market for Tubs Cups & Pots Forecast 2018-2028 ($bn, AGR %)

Figure 6.7 Rigid Plastic Packaging Market for Rigid Bulk Products Forecast 2018-2028 ($bn, AGR %)

Figure 6.8 Rigid Plastic Packaging Market for Other Types Forecast 2018-2028 ($bn, AGR %)

Figure 7.1 Global Rigid Plastic Packaging Market, By Region Market Value Forecast 2018-2028

Figure 7.2 Global Rigid Plastic Packaging Market, By Region Market Value AGR Forecast 2018-2028 (AGR %)

Figure 7.3 North America Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %)

Figure 7.4 United States of America Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %)

Figure 7.5 United States of America Rigid Plastic Packaging Market: Drivers and Restraints, 2018-2028

Figure 7.6 Canada Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %)

Figure 7.7 Canadian Rigid Plastic Packaging Market: Drivers and Restraints, 2018-2028

Figure 7.8 Mexico Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %)

Figure 7.9 Mexico Rigid Plastic Packaging Market: Drivers and Restraints, 2018-2028

Figure 7.10 Europe Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %)

Figure 7.11 Germany Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %)

Figure 7.12 German Rigid Plastic Packaging Market: Drivers and Restraints, 2018-2028

Figure 7.13 France Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %)

Figure 7.14 French Rigid Plastic Packaging Market: Drivers and Restraints, 2018-2028

Figure 7.15 The U.K. Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %)

Figure 7.16 United Kingdom Rigid Plastic Packaging Market: Drivers and Restraints, 2018-2028

Figure 7.17 Italy Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %)

Figure 7.18 Italian Rigid Plastic Packaging Market: Drivers and Restraints, 2018-2028

Figure 7.19 Spain America Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %)

Figure 7.20 Spanish Rigid Plastic Packaging Market: Drivers and Restraints, 2018-2028

Figure 7.21 Other European Countries Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %)

Figure 7.22 Asia Pacific Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %)

Figure 7.23 China Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %)

Figure 7.24 Chinese Rigid Plastic Packaging Market: Drivers and Restraints, 2018-2028

Figure 7.25 India Rigid Plastic Packaging Market Forecast 2018-2028($billion, AGR %)

Figure 7.26 Indian Rigid Plastic Packaging Market: Drivers and Restraints, 2018-2028

Figure 7.27 Japan Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %)

Figure 7.28 Japanese Rigid Plastic Packaging Market: Drivers and Restraints, 2018-2028

Figure 7.29 Australia Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %)

Figure 7.30 Australian Rigid Plastic Packaging Market: Drivers and Restraints, 2018-2028

Figure 7.31 Rest of Asia Pacific d States of America Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %)

Figure 7.32 Rest of the World Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %)

Figure 7.33 Brazil Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %)

Figure 7.34 Argentina Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %)

Figure 7.35 South Africa Rigid Plastic Packaging Market Forecast 2018-2028($billion, AGR %)

Figure 7.36 Rest of World Rigid Plastic Packaging Market Forecast 2018-2028 ($billion, AGR %)

Figure 8.1 World Age Pyramid 2015

Figure 9.1 Amcor Business Division 2017

Figure 9.2 Amcor Revenue by Division 2016 (% Total Revenue)

Figure 9.3 Amcor Revenue by End Market 2016 (% Total Revenue)

Figure 9.4 Amcor Revenue by Region 2016 (% Total Revenue)

Figure 9.6 ALPLA Company Structure 2017

Figure 9.7 Bemis Historical Revenue 2013-2016, Regional Revenue Share and Business Segment Share 2016

Figure 9.8 Berry Plastics Historical Revenue 2013-2016, Regional Revenue Share and Business Segment Share 2016

Figure 9.9 Greif Company Structure 2017

Figure 9.10 Greif Historical Revenue 2012-2016, Regional Revenue Share and Business Segment Share 2015

Figure 9.11 Reynolds Group Holdings Company Structure 2017

Figure 9.12 Reynolds Group Holdings Revenue by Division 2016 (% Total Revenue)

Figure 9.13 Reynolds Group Holdings Historical Revenue 2013-2016, Regional Revenue Share and Business Segment Share 2016

Figure 9.14 Sealed Air Company Structure 2017

Figure 9.15 Sealed Air Packaging Historical Revenue 2013-2016, Regional Revenue Share and Business Segment Share 2016

Figure 9.16 Silgan Holdings Historical Revenue 2013-2016, Regional Revenue Share and Business Segment Share 2016

Figure 10.1 Rigid Plastic Packaging Market: Drivers and Restraints, 2018-2028