Industries > Defence > Military Identification Friend or Foe Market Forecast 2019-2029

Military Identification Friend or Foe Market Forecast 2019-2029

Forecasts by Platform (Land – Ground-Based, Vehicle-Mounted / Airborne – Fixed-Wing, Rotary-Wing, UAV / Naval – Surface Vessels, Submarines), by System (IFF Interrogator, IFF Transponder, Combined Interrogator-Transponder, CNI, Crypto Computer & Other Components), by Region (North America, Europe, Asia-Pacific & Rest of World). Plus, Analysis of the Leading Countries & Players in the Market Space

What are the Prospects of the Military IFF Market?

Visiongain expects the Military IFF market to generate sales of USD 1.19 billion in 2019 and estimates that this figure will increase to USD 2.08 billion by 2029. The Compound Annual Growth Rate (CAGR) for the forecast period is 5.79 per cent.

This timely, 159-page study will enhance your strategic decision making, update you with crucial market developments and, ultimately, help to maximise your company’s profitability and potential.

Read on to discover even more ways of how this report can help to develop your business.

This Report Addresses the Pertinent Issues, Such As:

• How is the Military IFF market evolving?

• How will each Military IFF submarket segment grow over the forecast period, and how much sales revenue will these submarkets account for in 2029?

• What is driving and restraining the Military IFF market?

• How will shares of the regional markets change by 2029 and which nation will lead the market in the same year?

• Who are the leading players, and what agreements and contracts have they entered into?

Research & Analysis Highlights

• Independent, impartial and objective analysis of the Global Military IFF market from 2019 to 2029, including 250 tables and charts.

• Forecasts by system type, platform and geographic region, covering the period 2019-2029.

Military IFF Forecasts by Platform, 2019-2029

– Land-Based Submarket Forecast, 2019-2029

– Naval Submarket Forecast, 2019-2029

– Airborne Submarket Forecast, 2019-2029

Military IFF Forecasts by System, 2019-2029

– IFF Interrogator Submarket Forecast, 2019-2029

– IFF Transponder Submarket Forecast, 2019-2029

– Combined Interrogator-Transponder Submarket Forecast, 2019-2029

– CNI Submarket Forecast, 2019-2029

– Crypto Computer Submarket Forecast, 2019-2029

– ‘Other Components’ Submarket Forecast, 2019-2029

Military IFF Forecasts by Region, 2019-2029

– North America Submarket Forecast, 2019-2029

– Europe Submarket Forecast, 2019-2029

– Asia-Pacific Submarket Forecast, 2019-2029

– Rest of World Submarket Forecast, 2019-2029

• Details of the latest technological trends and how these will shape the industry.

• Profiles of the 10 leading companies involved in the development of IFF systems – including a brief overview of their manufacturing and financial operations and a table of their most recent agreed-upon contracts.

How This Report Will Benefit You

• You will most likely have a body of conflicting and unclear information, and so you require one, definitive report to base your business decisions upon. This visiongain study provides the clarity and expertise that you are after.

• Our insightful report speaks to your need for reliable market data, fair-minded analysis and definitive conclusions. This will help you to develop informed growth strategies.

• You need the information in an easily digestible form. This report excels at delivering just that.

• Our forecasts give you a crucial advantage by enhancing your strategic decision making.

• Knowledge is vital to you and your business, and you desire as much evidence as possible to inform crucial investment decisions. Let visiongain increase your industry knowledge, build your technical insight and strengthen your competitor analysis.

• In short, without this exhaustive visiongain report, you will fall into the same pitfalls as your competitors.

Who Should Read This Report?

• Senior Executives

• Business Development Managers

• Marketing Managers

• Consultants

• Chief Executive Officers

• Chief Information Officers

• Chief Operating Officers

Governments, agencies & organisations actively working or interested in the Military IFF industry will also find significant value in our research.

Don’t Miss Out on This Business Advantage

This information is not available anywhere else. With our report, you are less likely to fall behind your business competitors and miss any emerging market opportunities.

Discover how this study benefits your research and analysis and watch how you save time and receive recognition for commercial and technical insight.

Visiongain’s report is for anyone wanting to understand the Military IFF industry and its underlying dynamics better. It proves useful for businesses who wish to expand into different sectors or explore a new region for their existing operations.

Get our Military Identification Friend or Foe Market Forecast 2019-2029 today.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1.1 Global Military Identification Friend or Foe Market Introduction

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report Include:

1.5 Who is This Report For?

1.6 Methodology at a Glance

1.6.1 Secondary Research

1.6.2 Market Evaluation & Forecasting Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to the Military IFF Market

2.1 Military IFF Market Structure

2.2 Military IFF Market Definition

2.3 Military IFF Submarket Definitions

2.3.1 IFF Interrogator

2.3.2 IFF Transponder

2.3.3 Combined Interrogator and Transponder

2.3.4 CNI

2.3.5 Crypto Computer

2.3.6 Other Components

3. Military IFF Market

3.1 Military IFF Market Forecast 2019-2029

3.2 Military IFF Drivers & Restraints

4. Military IFF Submarket Forecasts 2019-2029

4.1 Military IFF System Forecast 2019-2029

4.1.1 IFF Interrogator by Region 2019-2029

4.1.2 IFF Interrogator by Type 2019-2029

4.1.2.1 Short Range IFF Interrogators

4.1.2.2 Long Range IFF Interrogators

4.1.3 IFF Transponder Forecast by Region 2019-2029

4.1.4 Combined Interrogator and Transponder Forecast by Region 2019-2029

4.1.5 Communication, Navigation & Identification (CNI) Forecast by Region 2019-2029

4.1.6 Crypto Computer Forecast by Region 2019-2029

4.1.7 Other Components Forecast by Region 2019-2029

4.2 Military IFF Platform Submarket Forecast 2019-2029

4.2.1 Land Based Forecast by Region 2019-2029

4.2.2 Land Based Forecast by Type 2019-2029

4.2.3 Naval Forecast by Region 2019-2029

4.2.4 Naval Forecast by Type 2019-2029

4.2.4.2 Surface Vessels Submarket

4.2.4.2 Submarines Submarket

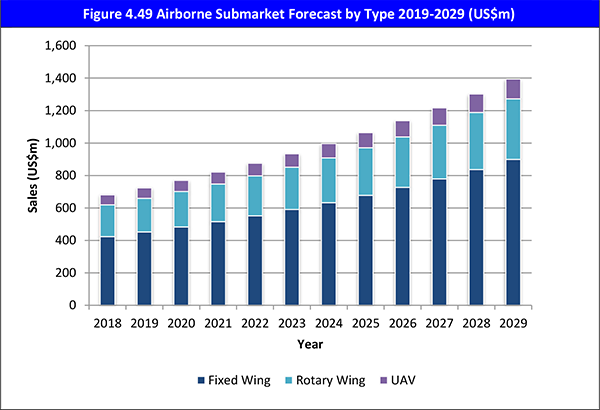

4.2.5 Airborne Forecast by Region 2019-2029

4.2.6 Airborne Forecast by Type 2019-2029

4.2.6.1 Fixed Wing Aircraft Submarket

4.2.6.2 Rotary Wing Submarket

4.2.6.3 UAV Submarket

5 Leading Regional and National Military IFF Market Forecasts 2019-2029

5.1 Overview of Regional Military IFF Market Forecast 2019-2029

5.2 North America Military IFF Market Market Forecast 2019-2029

5.2.1 North America Military IFF System Market Forecast 2019-2029

5.2.2 North America Military IFF Platform Market Forecast 2019-2029

5.2.3 North America Military IFF Country Market Forecast 2019-2029

5.2.3.1 US Military IFF Market Forecast

5.2.3.2 US Military IFF Platform Market Forecast 2019-2029

5.2.3.3 Canada Military IFF Market Forecast

5.2.3.4 Canada Military IFF Platform Market Forecast 2019-2029

5.3 Europe Military IFF Market Market Forecast 2019-2029

5.3.1 Europe Military IFF System Market Forecast 2019-2029

5.3.2 Europe Military IFF Platform Market Forecast 2019-2029

5.3.3 Europe Military IFF Country Market Forecast 2019-2029

5.3.3.1 UK Military IFF Market Forecast

5.3.3.2 UK Military IFF Platform Market Forecast 2019-2029

5.3.3.3 Germany Military IFF Market Forecast

5.3.3.4 Germany Military IFF Platform Market Forecast 2019-2029

5.3.3.5 France Military IFF Market Forecast

5.3.3.4 France Military IFF Platform Market Forecast 2019-2029

5.3.3.7 Italy Military IFF Market Forecast

5.3.3.8 Italy Military IFF Platform Market Forecast 2019-2029

5.3.3.9 Rest of Europe Military IFF Market Forecast

5.3.3.10 Rest of Europe Military IFF Platform Market Forecast 2019-2029

5.4 Asia-Pacific Military IFF Market Market Forecast 2019-2029

5.4.1 Asia-Pacific Military IFF System Market Forecast 2019-2029

5.4.2 Asia-Pacific Military IFF Platform Market Forecast 2019-2029

5.4.3 Asia-Pacific Military IFF Country Market Forecast 2019-2029

5.4.3.1 Japan Military IFF Market Forecast

5.4.3.2 Japan Military IFF Platform Market Forecast 2019-2029

5.4.3.3 India Military IFF Market Forecast

5.4.3.4 India Military IFF Platform Market Forecast 2019-2029

5.4.3.5 South Korea Military IFF Market Forecast

5.4.3.4 South Korea Military IFF Platform Market Forecast 2019-2029

5.4.3.7 Rest of Asia-Pacific Military IFF Market Forecast

5.4.3.8 Rest of Asia-Pacific Military IFF Platform Market Forecast 2019-2029

5.5 Rest of World Military IFF Market Forecast 2019-2029

5.5.1 Rest of World Military IFF System Market Forecast 2019-2029

5.5.2 Rest of World Military IFF Platform Market Forecast 2019-2029

6. Industry Trends – Analysis of the Military IFF Market 2019-2029

6.1 F-35 IFF System

6.2 NATO Mode 5

7. Leading 10 Military IFF Companies

7.1 Leading Military IFF Companies 2019

7.2 BAE Systems PLC

7.2.1 Introduction

7.2.2 BAE Systems PLC Military IFF Recent Contracts

7.2.3 BAE Systems PLC Total Company Sales 2014-2018

7.2.4 BAE Systems PLC Sales by Segment of Business 2013-2017

7.2.5 BAE Systems PLC Net Income 2014-2018

7.2.6 BAE Systems PLC Sales by Regional Segment of Business 2014-2018

7.2.7 BAE Systems PLC Analysis

7.2.7.1 BAE Systems PLC SWOT Analysis

7.3 General Dynamics Corporation

7.3.1 Introduction

7.3.2 General Dynamics Corporation Military IFF Recent Contracts

7.3.3 General Dynamics Corporation Total Company Sales 2014-2018

7.3.4 General Dynamics Corporation Sales by Segment of Business 2014-2018

7.3.5 General Dynamics Corporation Net Income 2014-2018

7.3.6 General Dynamics Corporation Sales by Regional Segment of Business 2014-2018

7.3.7 General Dynamics Corporation Analysis

7.3.7.1 General Dynamics Corporation SWOT Analysis

7.4 Hensoldt

7.4.1 Introduction

7.4.2 Hensoldt Military IFF Recent Contracts

7.4.3 Hensoldt Mode 5 Compliance

7.5 Indra

7.5.1 Introduction

7.5.2 Indra Company Military IFF Recent Contracts

7.5.3 Indra Company Total Company Sales 2014-2018

7.5.4 Indra Company Net Income 2014-2018

7.5.5 Indra Company Sales by Segment of Business 2014-2018

7.5.6 Indra Company Sales by Regional Segment of Business 2014-2018

7.5.7 Indra Company Analysis

7.5.7.1 Indra Company SWOT Analysis

7.6 Leonardo S.p.A.

7.6.1 Introduction

7.6.2 Leonardo S.p.A. Military IFF Recent Contracts

7.6.3 Leonardo S.p.A. Total Company Sales 2014-2018

7.6.4 Leonardo S.p.A. Net Income 2014-2018

7.6.5 Leonardo S.p.A. Sales by Segment of Business 2014-2018

7.6.6 Leonardo S.p.A. Sales by Regional Segment of Business 2014-2018

7.6.7 Leonardo S.p.A. Analysis

7.6.7.1 Leonardo S.p.A. SWOT Analysis

7.6.7.2 Leonardo S.p.A. Mode 5 Compliance

7.7 Northrop Grumman

7.7.1 Introduction

7.7.2 Northrop Grumman Military IFF Recent Contracts

7.7.3 Northrop Grumman Total Company Sales 2014-2018

7.7.4 Northrop Grumman Net Income 2014-2018

7.7.5 Northrop Grumman Sales by Segment of Business 2014-2018

7.7.6 Northrop Grumman Sales by Regional Segment of Business 2014-2018

7.7.7 Northrop Grumman Analysis

7.7.7.1 Northrop Grumman SWOT Analysis

7.8 Raytheon Company

7.8.1 Introduction

7.8.2 Raytheon Company Military IFF Recent Contracts

7.8.3 Raytheon Company Total Company Sales 2014-2018

7.8.4 Raytheon Company Sales by Segment of Business 2014-2018

7.8.5 Raytheon Company Net Income 2014-2018

7.8.6 Raytheon Company Sales by Regional Segment of Business 2014-2018

7.8.7 Raytheon Company Analysis

7.8.7.1 Raytheon Company SWOT Analysis

7.9 Saab Group

7.9.1 Introduction

7.9.2 Saab Group Military IFF Recent Contracts

7.9.3 Saab Group Total Company Sales 2014-2018

7.9.4 Saab Group Net Income 2014-2018

7.9.5 Saab Group Sales by Segment of Business 2014-2018

7.9.6 Saab Group Sales by Regional Segment of Business 2014-2018

7.9.7 Saab Group Analysis

7.9.7.1 SAAB Group SWOT Analysis

7.10 Tellumat

7.10.1 Introduction

7.10.2 Tellumat Military IFF Recent Contracts

7.11 Thales Group

7.11.1 Introduction

7.11.2 Thales Group Military IFF Recent Contracts

7.11.3 Thales Group Total Company Sales 2014-2018

7.11.4 Thales Group Sales by Segment of Business 2014-2018

7.11.5 Thales Group Net Income 2014-2018

7.11.6 Thales Group Sales by Regional Segment of Business 2014-2018

7.11.7 Thales Group Analysis

7.11.7.1 Thales Group SWOT Analysis

7.12 Other Notable Companies in the Military IFF Market

8. Conclusions

8.1 Military IFF Market Key Drivers & Restraints

8.2 Military IFF Market 2019-2029

9. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain Report Evaluation Form

List of Figures

Figure 2.01 Global Military IFF Market Segmentation Overview

Figure 3.01 Military IFF Market Forecast 2019-2029 (US$m, AGR %)

Figure 4.01 Military IFF System Submarket AGR Forecast 2019-2029 (AGR %)

Figure 4.02 Military IFF System Submarket Forecast 2019-2029 (US$m, Global AGR %)

Figure 4.03 Military IFF System Submarket Shares Forecast 2019 (% Share)

Figure 4.04 Military IFF System Submarket Shares Forecast 2024 (% Share)

Figure 4.05 Military IFF System Submarket Shares Forecast 2029 (% Share)

Figure 4.06 IFF Interrogator Submarket Forecast by Regional Market 2019-2029 (US$m)

Figure 4.07 IFF Interrogator Submarket Share by Region 2019 (% Share)

Figure 4.08 IFF Interrogator Submarket Share by Region 2024 (% Share)

Figure 4.09 IFF Interrogator Submarket Share by Region 2029 (% Share)

Figure 4.10 IFF Interrogator Submarket Forecast by Type 2019-2029 (US$m)

Figure 4.11 IFF Transponder Submarket Forecast by Regional Market 2019-2029 (US$m)

Figure 4.12 IFF Transponder Submarket Share by Region 2019 (% Share)

Figure 4.13 IFF Transponder Submarket share by Region 2024 (% Share)

Figure 4.14 IFF Transponder Submarket Share by Region 2029 (% Share)

Figure 4.15 Combined Interrogator and Transponder Submarket Forecast by Regional Market 2019-2029 (US$m)

Figure 4.16 Combined Interrogator and Transponder Submarket Share by Region 2019 (% Share)

Figure 4.17 Combined Interrogator and Transponder Submarket Share by Region 2024 (% Share)

Figure 4.18 Combined Interrogator and Transponder Submarket Share by Region 2029 (% Share)

Figure 4.19 CNI Submarket Forecast by RegionalMarket 2019-2029 (US$m)

Figure 4.20 CNI Submarket Share by Region 2019 (% Share)

Figure 4.21 CNI Submarket Share by Region 2024 (% Share)

Figure 4.22 CNI Submarket Share by Region 2029 (% Share)

Figure 4.23 Crypto Computer Submarket Forecast by Regional Market 2019-2029 (US$m)

Figure 4.24 Crypto Computer Submarket Share by Region 2019 (% Share)

Figure 4.25 Crypto Computer Submarket Share by Region 2024 (% Share)

Figure 4.26 Crypto Computer Submarket Market Share by Region 2029 (% Share)

Figure 4.27 Other Components Submarket Forecast by Regional Market 2019-2029 (US$m)

Figure 4.28 Other Components Submarket Share by Region 2019 (% Share)

Figure 4.29 Other Components Submarket Share by Region 2024 (% Share)

Figure 4.30 Other Components Submarket Share by Region 2029 (% Share)

Figure 4.31 Military IFF Platform Submarket AGR Forecast 2019-2029 (AGR %)

Figure 4.32 Military IFF Platform Market Forecast 2019-2029 (US$m, Global AGR %)

Figure 4.33 Military IFF Platform Submarket Shares 2019 (% Share)

Figure 4.34 Military IFF Platform Submarket Shares 2024 (% Share)

Figure 4.35 Military IFF Platform Submarket Shares 2029 (% Share)

Figure 4.36 Land Based Submarket Forecast by Regional Market 2019-2029 (US$m)

Figure 4.37 Land Based Submarket Share by Region 2019 (% Share)

Figure 4.38 Land Based Submarket Share by Region 2024 (% Share)

Figure 4.39 Land Based Submarket Share by Region 2029 (% Share)

Figure 4.40 Land Based Submarket Forecast by Type 2019-2029 (US$m)

Figure 4.41 Naval Submarket Forecast by Regional Market 2019-2029 (US$m)

Figure 4.42 Naval Submarket Share by Region 2019 (% Share)

Figure 4.43 Naval Submarket share by Region 2024 (% Share)

Figure 4.44 Naval Submarket Share by Region 2029 (% Share)

Figure 4.45 Naval Submarket Forecast by Type 2019-2029 (US$m)

Figure 4.45 Airborne Submarket Forecast by Regional Market 2019-2029 (US$m)

Figure 4.46 Airborne Submarket Share by Region 2019 (% Share)

Figure 4.47 Airborne Submarket Share by Region 2024 (% Share)

Figure 4.48 Airborne Submarket Share by Region 2029 (% Share)

Figure 4.49 Airborne Submarket Forecast by Type 2019-2029 (US$m)

Figure 5.01 Leading Regional Military IFF Markets AGR Forecast 2019-2029 (AGR %)

Figure 5.02 Leading Regional Military IFF Markets Forecast 2019-2029 (Sales US$m, Global AGR %)

Figure 5.03 Leading Regional Military IFF Market Share by Region 2019 (% Share)

Figure 5.04 Leading Regional Military IFF Market Share by Region 2024 (% Share)

Figure 5.05 Leading Regional Military IFF Market Share by Region 2029 (% Share)

Figure 5.06 North America Military IFF Market Forecast by System 2019-2029 (US$m)

Figure 5.07 North America Military IFF Market Forecast by Platform 2019-2029 (US$m)

Figure 5.08 North America Military IFF Market Forecast by Country 2019-2029 (US$m, Regional AGR %)

Figure 5.09 North America Military IFF Market Forecast Market Share by Country 2019 (% Share)

Figure 5.10 North America Military IFF Market Forecast MarketShare by Country 2024 (% Share)

Figure 5.11 North America Military IFF Market Forecast MarketShare by Country 2029 (% Share)

Figure 5.12 US Military IFF Market Forecast 2019-2029 (US$m, AGR %)

Figure 5.16 US Military IFF Application Market Forecast by Platform 2019-2029 (US$m)

Figure 5.17 Canada Military IFF Market Forecast 2019-2029 (US$m, AGR %)

Figure 5.21 Canada Military IFF Application Market Forecast by Platform 2019-2029 (US$m)

Figure 5.22 Europe Military IFF Market Forecast by System 2019-2029 (US$m)

Figure 5.23 Europe Military IFF Market Forecast by Platform 2019-2029 (US$m)

Figure 5.24 Europe Military IFF Market Forecast by Country 2019-2029 (US$m, Regional AGR %)

Figure 5.25 Europe Military IFF Market Forecast Market Share by Country 2019 (% Share)

Figure 5.26 Europe Military IFF Market Forecast Market Share by Country 2024 (% Share)

Figure 5.27 Europe Military IFF Market Forecast Market Share by Country 2029 (% Share)

Figure 5.28 UK Military IFF Market Forecast 2019-2029 (US$m, AGR %)

Figure 5.32 UK Military IFF Application Market Forecast by Platform 2019-2029 (US$m)

Figure 5.33 Germany Military IFF Market Forecast 2019-2029 (US$m, AGR %)

Figure 5.37 Germany Military IFF Platform Market Forecast by Platform 2019-2029 (US$m)

Figure 5.38 France Military IFF Market Forecast 2019-2029 (US$m, AGR %)

Figure 5.42 France Military IFF Application Market Forecast by Platform 2019-2029 (US$m)

Figure 5.43 Italy Military IFF Market Forecast 2019-2029 (US$m, AGR %)

Figure 5.47 Italy Military IFF Application Market Forecast by Platform 2019-2029 (US$m)

Figure 5.48 RoE Military IFF Market Forecast 2019-2029 (US$m, AGR %)

Figure 5.52 RoE Military IFF Application Market Forecast by Platform 2019-2029 (US$m)

Figure 5.53 Asia-Pacific Military IFF Market Forecast by System 2019-2029 (US$m)

Figure 5.54 Asia-Pacific Military IFF Market Forecast by Platform 2019-2029 (US$m)

Figure 5.55 Asia-Pacific Military IFF Market Forecast by Country 2019-2029 (US$m, Regional AGR %)

Figure 5.56 Asia-Pacific Military IFF Market Forecast Market Share by Country 2019 (% Share)

Figure 5.57 Asia-Pacific Military IFF Market Forecast Market Share by Country 2024 (% Share)

Figure 5.58 Asia-Pacific Military IFF Market Forecast Market Share by Country 2029 (% Share)

Figure 5.59 Japan Military IFF Market Forecast 2019-2029 (US$m, AGR %)

Figure 5.63 Japan Military IFF Application Market Forecast by Platform 2019-2029 (US$m)

Figure 5.64 India Military IFF Market Forecast 2019-2029 (US$m, AGR %)

Figure 5.68 India Military IFF Application Market Forecast by Platform 2019-2029 (US$m)

Figure 5.69 South Korea Military IFF Market Forecast 2019-2029 (US$m, AGR %)

Figure 5.73 South Korea Military IFF Application Market Forecast by Platform 2019-2029 (US$m)

Figure 5.74 RoAPAC Military IFF Market Forecast 2019-2029 (US$m, AGR %)

Figure 5.78 RoAPAC Military IFF Application Market Forecast by Platform 2019-2029 (US$m)

Figure 5.79 RoW Military IFF Market Forecast 2019-2029 (US$m, AGR %)

Figure 5.83 RoW Military IFF Market Forecast by System 2019-2029 (US$m)

Figure 5.84 RoW Military IFF Application Market Forecast by Platform 2019-2029 (US$m)

Figure 6.01 F-35 Aircraft Production Volume (2013-2018)

Figure 6.02 F-35 Active Fleet by Country (Share)

Figure 7.01 BAE Systems plc Total Company Sales 2014-2018 (US$m, AGR %)

Figure 7.02 BAE Systems plc Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR%)

Figure 7.03 BAE Systems plc Net Income 2014-2018 (US$m, AGR%)

Figure 7.04 General Dynamics Corporation Total Company Sales 2014-2018 (US$m, AGR %)

Figure 7.05 General Dynamics Corporation Sales by Segment of Business 2014-2018 (US$m, Total Company Sales AGR %)

Figure 7.06 General Dynamics Corporation Net Income / Loss 2014-2018 (US$m)

Figure 7.07 Indra Company Total Company Sales 2014-2018

Figure 7.08 Indra Company Net Income 2014-2018

Figure 7.09 Indra Company Sales by Segment of Business 2014-2018

Figure 7.10 Indra Company Sales by Region 2014-2018

Figure 7.11 Leonardo SpA Total Company Sales 2014-2018

Figure 7.12 Leonardo SpA Net Income 2014-2018

Figure 7.13 Leonardo SpA Sales by Segment of Business 2014-2018

Figure 7.14 Leonardo SpA Sales by Region 2014-2018

Figure 7.15 Northrop Grumman Total Company Sales 2014-2018 (US$m, AGR%)

Figure 7.16 Northrop Grumman Net Income 2014-2018 (US$m, AGR%)

Figure 7.17 Northrop Grumman Sales by Segment of Business 2014-2018 (US$m, Total Company Sales AGR%)

Figure 7.18 Northrop Grumman Sales by Geographical Location 2014-2018 (US$m, Total Company Sales AGR %)

Figure 7.19 Raytheon Company Total Company Sales 2014-2018 (US$m, AGR %)

Figure 7.20 Sales by Segment of Business 2014-2018 (US$m, Total Company Sales AGR %)

Figure 7.21 Raytheon Company Net Income 2014-2018 (US$m, AGR %)

Figure 7.22 Raytheon Company Sales by Geographical Location 2014-2018 (US$m, Total Company Sales AGR %)

Figure 7.23 Saab Group Total Company Sales 2014-2018 (US$m, AGR %)

Figure 7.24 Saab Group Net Income / Loss 2014-2018 (US$m)

Figure 7.25 Saab Group Sales by Segment of Business 2014-2018 (US$m)

Figure 7.26 Saab Group Sales by Region Segment 2014-2018 (US$m)

Figure 7.27 Thales Group Total Company Sales 2014-2018 (US$m, AGR %)

Figure 7.28 Thales Group Sales by Segment of Business 2014-2018 (US$m)

Figure 7.29 Thales Group.Net Income / Loss 2014-2018 (US$m)

Figure 7.30 Thales Group Sales by Geographical Regional 2014-2018(US$m)

List of Tables

Table 3.01 Military IFF Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 3.02 Military IFF Market Drivers & Restraints 2019

Table 4.01 Military IFF System Submarket Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 4.02 IFF Interrogator Submarket by Regional Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 4.03 IFF Interrogator Submarket by Type Forecast 2019-2029 (US$m, CAGR %)

Table 4.04 IFF Transponder by Regional Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 4.05 Combined Interrogator and Transponder Submarket by Regional Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 4.06 CNI Submarket by Regional Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 4.07 Crypto Computer Submarket by Regional Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 4.08 Other Components Submarket by Regional Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 4.09 Military IFF Platform Submarket Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 4.10 Land Based Submarket by Regional Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 4.11 Land Based Submarket by Type Forecast 2019-2029 (US$m, CAGR %)

Table 4.12 Naval by Regional Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 4.13 Naval Submarket by Type Forecast 2019-2029 (US$m, CAGR %)

Table 4.14 Airborne Submarket by Regional Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 4.15 Airborne Submarket by Type Forecast 2019-2029 (US$m, CAGR %)

Table 5.01 Leading Regional Military IFF Markets by Submarket Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.02 North America Military IFF Market Forecast by System 2019-2029 (US$m, CAGR %)

Table 5.03 North America Military IFF Market Forecast by Platform 2019-2029 (US$m, CAGR %)

Table 5.04 North America Military IFF Market Forecast by Country 2019-2029 (US$m, AGR %, Cumulative)

Table 5.05 US Military IFF Market Forecast2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.06 US Military IFF Application Market Forecast by Platform 2019-2029 (US$m, CAGR %)

Table 5.07 Canada Military IFF Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.08 Canada Military IFF Application Market Forecast by Platform 2019-2029 (US$m, CAGR %)

Table 5.09 Europe Military IFF Market Forecast by System 2019-2029 (US$m, CAGR %)

Table 5.10 Europe Military IFF Market Forecast by Platform 2019-2029 (US$m, CAGR %)

Table 5.11 Europe Military IFF Market Forecast by Country 2019-2029 (US$m, AGR %, Cumulative)

Table 5.12 UK Military IFF Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.13 UK Military IFF Platform Market Forecast by Platform 2019-2029 (US$m, CAGR %)

Table 5.14 Germany Military IFF Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.15 Germany Military IFF Platform Market Forecast by Platform 2019-2029 (US$m, CAGR %)

Table 5.16 France Military IFF Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.17 France Military IFF Application Market Forecast by Platform 2019-2029 (US$m, CAGR %)

Table 5.18 Italy Military IFF Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.19 Italy Military IFF Application Market Forecast by Platform 2019-2029 (US$m, CAGR %)

Table 5.20 RoE Military IFF Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.21 RoE Military IFF Application Market Forecast by Platform 2019-2029 (US$m, CAGR %)

Table 5.22 Asia-Pacific Military IFF Market Forecast by System 2019-2029 (US$m, CAGR %)

Table 5.23 Asia-Pacific Military IFF Market Forecast Platform 2019-2029 (US$m, CAGR %)

Table 5.24 Asia-Pacific Military IFF Market Forecast by Country 2019-2029 (US$m, AGR %, Cumulative)

Table 5.25 Japan Military IFF Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.26 Japan Military IFF Application Market Forecast by Platform 2019-2029 (US$m, CAGR %)

Table 5.27 China Military IFF Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.28 India Military IFF Application Market Forecast by Platform 2019-2029 (US$m, CAGR %)

Table 5.29 South Korea Military IFF Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.30 South Korea Military IFF Application Market Forecast by Platform 2019-2029 (US$m, CAGR %)

Table 5.31 RoAPAC Military IFF Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.32 RoAPAC Military IFF Application Market Forecast by Platform 2019-2029 (US$m, CAGR %)

Table 5.33 RoW Military IFF Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.34 RoW Military IFF Market Forecast by System 2019-2029 (US$m, CAGR %)

Table 5.35 RoW Military IFF Platform Market Forecast by Platform 2019-2029 (US$m, CAGR %)

Table 7.01 Leading 10 Military IFF Companies Listed Alphabetically (Company Names, Revenue, HQ)

Table 7.02 BAE Systems plc Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, HQ, Founded, No. of Employees, Ticker, Website)

Table 7.03 BAE Systems plc Military IFF Selected Recent Contracts 2013-2019 (Date, Programme Type, Details)

Table 7.04 BAE Systems plc Total Company Sales 2014-2018 (US$m, AGR%)

Table 7.05 BAE Systems plc Sales by Segment of Business 2013-2017 (US$m, AGR %)

Table 7.06 BAE Systems plc Ltd Net Income / Loss 2014-2018 (US$m)

Table 7.07 BAE Systems plc Sales by Regional Segment of Business 2014-2018 (US$m, AGR %)

Table 7.08 BAE Systems plc SWOT Analysis 2018

Table 7.09 General Dynamics Corporation Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, HQ, Founded, No. of Employees, Ticker, Website)

Table 7.10 General Dynamics Corporation Selected Recent Military IFF Contracts, Partnership, and New Product Launches 2009-2019 (Date, Programme Type, Details)

Table 7.11 General Dynamics Corporation, Total Company Sales 2014-2018 (US$m, AGR %)

Table 7.12 General Dynamics Corporation Sales by Segment of Business 2014-2018 (US$m, AGR %)

Table 7.13 General Dynamics Corporation Net Income / Loss 2014-2018 (US$m)

Table 7.14 General Dynamics Corporation Sales by Regional Segment of Business 2014-2018 (US$m, AGR %)

Table 7.15 General Dynamics Corporation SWOT Analysis

Table 7.16 Hensoldt Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, HQ, Founded, No. of Employees, Ticker, Website)

Table 7.17 Hensoldt Military IFF Selected Recent Contracts/ Partnership/Mergers and Acquisitions/ New Product launch 2017-2019 (Date, Programme Type, Details)

Table 7.18 Indra Company Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, HQ, Founded, No. of Employees, Ticker, Website)

Table 7.19 Indra Company Selected Military IFF Contracts / Projects / Programmes 2008-2018 (Date, Country, Contractor, Value US$m, Product, Details)

Table 7.20 Indra Company Total Company Sales 2014-2018 (US$m, AGR %)

Table 7.21 Indra Company Net Income / Loss 2014-2018 (US$m)

Table 7.22 Indra Company Sales Segment of Business 2014-2018 (US$m, AGR %)

Table 7.23 Indra Company Sales by Region 2014-2018 (US$m, AGR %)

Table 7.24 Indra Group SWOT Analysis

Table 7.25 Leonardo S.p.A. Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, HQ, Founded, No. of Employees, Ticker, Website)

Table 7.26 Leonardo S.p.A. Selected Military IFF Contracts / Projects / Programmes 2010-2019 (Date, Country, Contractor, Value US$m, Product, Details)

Table 7.27 Leonardo SpA Total Company Sales 2014-2018 (US$m, AGR %)

Table 7.28 Leonardo SpA Net Income / Loss 2014-2018 (US$m)

Table 7.29 Leonardo SpA Sales Segment of Business 2013-2017 (US$m, AGR %)

Table 7.30 Leonardo SpA Sales by Region 2014-2018 (US$m, AGR %)

Table 7.31 Leonardo SpA SWOT Analysis 2018

Table 7.32 Northrop Grumman Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, HQ, Founded, IR Contact, Ticker, Website)

Table 7.33 Northrop Grumman Selected Recent Military IFF Contracts, Collaboration, Contracts, Partnerships, and New Product Launches 2019-2019(Date, Programme Type, Details)

Table 7.34 Northrop Grumman Total Company Sales 2014-2018 (US$m, AGR%)

Table 7.35 Northrop Grumman Net Earnings 2014-2018 (US$m, AGR%)

Table 7.36 Northrop Grumman Sales by Segment of Business 2014-2018 (US$m, AGR%)

Table 7.37 Raytheon Company Sales by Geographical Location 2014-2018 (US$m, AGR %)

Table 7.38 Northrop Grumman SWOT Analysis

Table 7.39 Raytheon Company Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, HQ, Founded, No. of Employees FY2018, Ticker, Website)

Table 7.40 Raytheon CompanySelected Recent Military IFF Contracts, Partnerships, Collaboration and Programme 2014-2019 (Date, Programme Type, Details)

Table 7.41 Raytheon Company Total Company Sales 2014-2018 (US$m, AGR %)

Table 7.42 Raytheon Company Sales by Segment of Business 2014-2018 (US$m, AGR %)

Table 7.43 Raytheon Company Net Income 2014-2018 (US$m, AGR %)

Table 7.44 Raytheon Company Sales by Geographical Location 2014-2018 (US$m, AGR %)

Table 7.45 Raytheon Company SWOT Analysis

Table 7.46 Saab Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, HQ, Founded, No. of Employees, Ticker, Website)

Table 7.47 Saab Group Selected Recent Military IFF Contracts 2015-2019 (Date, Programme Type, Details)

Table 7.48 Saab Group Total Company Sales 2014-2018 (US$m, AGR %)

Table 7.49 Saab Group Net Income / Loss 2014-2018 (US$m)

Table 7.50 Saab Group Sales by Segment of Business 2014-2018 (US$m)

Table 7.51 Saab Group Sales by Regional Segment 2014-2018 (US$m)

Table 7.52 SAAB Group SWOT Analysis

Table 7.53 Tellumat Profile 2018 (CEO, HQ, Founded, No. of Employees, Ticker, Website)

Table 7.54 Tellumat Military IFF Contracts / Projects / Programmes 2010-2019 (Date, Country, Contractor, Value US$m, Product, Details)

Table 7.55 Thales SA. Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, HQ, Founded, No. of Employees, Ticker, Website)

Table 7.56 Thales Group Military IFF Selected Recent Contracts/ Partnership/Mergers and Acquisitions/ New Product launch 2010-2018 (Date, Programme Type, Details)

Table 7.57 Thales Group Total Company Sales 2014-2018 (US$m, AGR %)

Table 7.58 Thales Group Sales by Segment of Business 2014-2018 (US$m, AGR %)

Table 7.59 Thales Group Net Income / Loss 2014-2018 (US$m)

Table 7.60 Thales Group Sales by Geographical Regional 2014-2018 (US$m, AGR %)

Table 7.61 Thales Group SWOT Analysis

Table 7.62 Other Companies in the Market (Company Name)

Airports Authority of India

Andersdx

API Technologies Corp

Aselsan

Austal

Australian Army

Australian Defence Force

Avnet Inc.

BAE Systems

Bharat Electronics Ltd

Boeing

British Ministry of Defence

Bumar Elektronika

Dawn VME Products

Dutch Defence Material Organisation

Elma Electronic Inc

Esterel Technologies Sa

Eurocopter

Extreme Engineering Solutions Inc (X-ES)

French armed forces

French Army

French Ministry

General Dynamics

German Armed Forces

German Navy

Hensoldt

Hindustan Aeronautics Limited

Hitachi Kokusai

IAI

Indonesian Navy

Indra Company

Innovative Integration

Intersil Corp

Italian Ministry of Defence

Japan Ground Self Defence Force

Korea Aerospace Industries Ltd

Korean Air Lines

Leonardo

LIG Nex1

Lockheed Martin

Lockheed Martin Canada

Multitouch Ltd

NATO

NATO

Northrop Grumman

Planar Systems, Inc.

Raytheon

Republic of Korea Army

Royal Canadian Navy

Royal Saudi Air Force

Royal Thai Air Force

Russian Aircraft Corporation MiG

Saab Brazil

Saab Grintek Technologies Ltd.

Saab Group

Sagetech

South Korean military

Spanish Army

Swedish Defence Material Administration

Telephonics

Tellumat

Thales

UK MoD

US Air Force

US Army

US Marine Corps

US Navy

Winchester Systems Inc

Download sample pages

Complete the form below to download your free sample pages for Military Identification Friend or Foe Market Forecast 2019-2029

Related reports

-

Military Airborne Intelligence, Surveillance & Reconnaissance (ISR) Technologies Market 2019-2029

Visiongain expects the Airborne ISR market to generate sales of USD 30.6 billion in 2019 and estimates that this figure...Full DetailsPublished: 30 September 2019 -

Electronic Warfare (EW) Market Report 2020-2030

The realm of electronic warfare has conventionally been stayed in the confidential domain, even among the security community. It had...Full DetailsPublished: 29 July 2020 -

Electronic Warfare (EW) Market Report 2019-2029

The recent developments in electronic warfare systems in defence platforms and systems, has led Visiongain to publish this timey report....

Full DetailsPublished: 26 March 2019 -

MRO Software in Aviation Market Forecast Report 2019-2029

Airlines are increasingly connecting to artificial intelligence to their MRO strategies....Full DetailsPublished: 14 November 2019 -

Counter-UAV (C-UAV) Market Report 2019-2029

The recent developments in counter UAV systems by type, platform and technology has led Visiongain to publish this timely report....

Full DetailsPublished: 04 June 2019 -

Global Ground Surveillance Radar Market Report 2019-2029

The Global Ground Surveillance Radar market is expected to reach US$ 7.61bn in 2019, up from 7.34 bn in 2018...Full DetailsPublished: 30 November 2018 -

Military Radar System Market Report 2019-2029

The Global Military Radar System Market is expected to reach US$ 12.23bn in 2019, up 2.09% from 2018. ...Full DetailsPublished: 25 February 2019 -

Unmanned Surface Vehicle (USV) Market Report 2020-2030

Unmanned Surface Vehicle market to total USD 2 billion in 2030 post COVID-19.

...Full DetailsPublished: 01 May 2020 -

Airport Security Market Report 2019-2029

The US$8.83bn airport security market is expected to flourish in the next few years. If you want to be part...

Full DetailsPublished: 18 June 2019 -

Commercial Counter-UAV (C-UAV) Market Report 2019-2029

Visiongain expects the Commercial Counter-UAV market to generate sales of USD 282.5 million in 2019 and estimates that this figure...

Full DetailsPublished: 23 August 2019

Download sample pages

Complete the form below to download your free sample pages for Military Identification Friend or Foe Market Forecast 2019-2029

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain defence reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible, Visiongain analysts reach out to market-leading vendors and industry experts and review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain defence reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

ADS Group

Aerial Refueling Systems Advisory Group

Aerospace and Defence Industries Association of Nova Scotia

Aerospace Industries Association

Aerospace Industries Association of Canada

AHS International – The Vertical Flight Technical Society

Air Force Association

Aircraft Electronics Association

Airlift/Tanker Association

American Astronautical Society

American Gear Manufacturers Association

American Institute of Aeronautics and Astronautics

American Logistics Association

American Society of Naval Engineers

AMSUS – The Society of the Federal Health Agencies

Armed Forces Communications and Electronics Association

Armed Forces Communications and Electronics Association

Army Aviation Association of America

ASD – Aerospace & Defence Association of Europe

Association for Unmanned Vehicle Systems International

Association of Aviation Manufacturers of the Czech Republic

Association of Naval Aviation

Association of Old Crows

Association of Polish Aviation Industry

Association of the Defense Industry of the Czech Republic

Association of the United States Army

Association of the United States Navy

Australia Defence Association

Australian Industry & Defence Network

Australian Industry Group Defence Council

Austrian Aeronautics Industries Group

Aviation Distributors and Manufacturers Association

Aviation Suppliers Association

Belgian Security and Defence Industry

Bulgarian Defence Industry Association

Business Executives for National Security

Canadian Association of Defence and Security Industries

Conference of Defense Associations

Council of Defense and Space Industry Associations

Danish Defence & Security Industries Association

Defence Industry Manufacturers Association

Defense Industry Initiative on Business Ethics and Conduct

Defense Industry Offset Association

Defense Orientation Conference Association

Deutsche Gesellschaft fur Wehrtechnik

Federal Association of the German Security and Defence Industry

Federation of Aerospace Enterprises in Ireland

French Aerospace Industries Association

French Land Defence Manufacturers Association (GICAT)

German Aerospace Industries Association

Helicopter Association International

Hellenic Aerospace & Defense Industries Group

Homeland Security & Defense Business Council

International Stability Operations Association

Japan Association of Defense Industry

Korea Defense Industry Association

Marine Corps Association & Foundation

National Aeronautic Association

National Association of Ordnance and Explosive Waste Contractors

National Defense Industrial Association

National Defense Transportation Association

National Guard Association of the U.S.

Navy League of the United States

Netherlands Aerospace Group

New Zealand Defence Industry Association

Portuguese Association of Defense Related Industries & New Technologies Companies

Québec Ground Transportation Cluster

Satellite Industry Association

Society of American Military Engineers

South African Aerospace Maritime and Defence Industries Association

Spanish Aerospace and Defence Association Industries

Submarine Industrial Base Council

Swedish Aerospace Industries

Swedish Security and Defence Industry Association

Swiss Aeronautical Industries Group

The Association of Finnish Defence and Aerospace Industries

The Italian Industries Association for Aerospace Systems and Defence

The Netherlands Defence Manufacturers Association

The Society of Japanese Aerospace Companies

UK AeroSpace, Defence & Security Industries

United Kingdom National Defence Association

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Defence news

Robotic Warfare Market

The global Robotic Warfare market is projected to grow at a CAGR of 6.7% by 2034

19 July 2024

Cyber Warfare Market

The global Cyber Warfare market is projected to grow at a CAGR of 17.7% by 2034

16 July 2024

Counter-UAV (C-UAV) Market

The global Counter-UAV (C-UAV) market is projected to grow at a CAGR of 29.6% by 2034

08 July 2024

Special Mission Aircraft Market

The global Special Mission Aircraft market is projected to grow at a CAGR of 4.6% by 2034

27 June 2024