The Military Embedded Systems Market Report 2024-2034: This report will prove invaluable to leading firms striving for new revenue pockets if they wish to better understand the industry and its underlying dynamics. It will be useful for companies that would like to expand into different industries or to expand their existing operations in a new region.

Advancements in Defence Technologies

The continuous evolution of defence technologies acts as a cornerstone for the global military embedded systems market. Innovations like artificial intelligence, machine learning, and quantum computing are revolutionizing military operations. Artificial intelligence, for instance, enables embedded systems to analyse vast datasets in real-time. This analysis enhances threat detection, predictive maintenance, and decision-making processes. Machine learning algorithms embedded in military systems can adapt and learn from data, improving their performance over time. Quantum computing, with its immense processing power, offers the potential for solving complex military challenges, such as cryptography and logistics optimization. These advancements highlight the symbiotic relationship between cutting-edge technologies and military embedded systems, driving continuous market growth.

Critical Security Procedures in Embedded Devices

In an era of heightened cybersecurity threats, the stringent security requirements imposed on military embedded systems can act as a restraining factor for market growth. These systems must adhere to rigorous security standards to safeguard sensitive data, critical infrastructure, and national security. Implementing robust security measures, such as encryption, intrusion detection, and secure boot processes, adds complexity to the design and validation phases. Moreover, ensuring the integrity of the supply chain for embedded components becomes paramount. Verifying the authenticity and trustworthiness of hardware and software components is a critical security procedure but can also be time-consuming and costly. Any vulnerabilities or compromises in the supply chain can have severe consequences for the security and functionality of military embedded systems.

What Questions Should You Ask before Buying a Market Research Report?

• How is the military embedded systems market evolving?

• What is driving and restraining the military embedded systems market?

• How will each military embedded system submarket segment grow over the forecast period and how much revenue will these submarkets account for in 2034?

• How will the market shares for each military embedded systems submarket develop from 2024 to 2034?

• What will be the main driver for the overall market from 2024 to 2034?

• Will leading military embedded systems markets broadly follow the macroeconomic dynamics, or will individual national markets outperform others?

• How will the market shares of the national markets change by 2034 and which geographical region will lead the market in 2034?

• Who are the leading players and what are their prospects over the forecast period?

• What are the military embedded systems projects for these leading companies?

• How will the industry evolve during the period between 2024 and 2034? What are the implications of military embedded systems projects taking place now and over the next 10 years?

• Is there a greater need for product commercialisation to further scale the military embedded systems market?

• Where is the military embedded systems market heading and how can you ensure you are at the forefront of the market?

• What are the best investment options for new product and service lines?

• What are the key prospects for moving companies into a new growth path and C-suite?

You need to discover how this will impact the military embedded systems market today, and over the next 10 years:

• Our 437-page report provides 132 tables and 224 charts/graphs exclusively to you.

• The report highlights key lucrative areas in the industry so you can target them – NOW.

• It contains in-depth analysis of global, regional and national sales and growth.

• It highlights for you the key successful trends, changes and revenue projections made by your competitors.

This report tells you TODAY how the military embedded systems market will develop in the next 10 years, and in line with the variations in COVID-19 economic recession and bounce. This market is more critical now than at any point over the last 10 years.

Forecasts to 2034 and other analyses reveal commercial prospects

• In addition to revenue forecasting to 2034, our new study provides you with recent results, growth rates, and market shares.

• You will find original analyses, with business outlooks and developments.

• Discover qualitative analyses (including market dynamics, drivers, opportunities, restraints and challenges), cost structure, impact of rising military embedded systems prices and recent developments.

This report includes data analysis and invaluable insight into how COVID-19 will affect the industry and your company. Four COVID-19 recovery patterns and their impact, namely, “V”, “L”, “W” and “U” are discussed in this report.

Segments Covered in the Report

Market Segment by Component

• Hardware

• Software

Market Segment by End-User

• Army

• Navy

• Air Force

Market Segment by System

• Avionics Systems

• Land-Based Systems

• Naval Systems

• Space-Based Systems

Market Segment by Processor

• Single Board Computers (SBC)

• Microcontrollers (MCU)

• Digital Signal Processors (DSP)

• Field-Programmable Gate Arrays (FPGA)

• Other Processor Type

Market Segment by Application

• Communication and Navigation Systems

• Command and Control Systems

• Surveillance and Reconnaissance Systems

• Weapon Systems

• Electronic Warfare and Countermeasures

• Other Applications

In addition to the revenue predictions for the overall world market and segments, you will also find revenue forecasts for four regional and 20 leading national markets:

North America

• U.S.

• Canada

Europe

• Germany

• Russia

• United Kingdom

• France

• Italy

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Australia

• South Korea

• Rest of Asia Pacific

Latin America

• Brazil

• Mexico

• Rest of Latin America

Middle East & Africa

• GCC

• South Africa

• Rest of Middle East & Africa

Need industry data? Please contact us today.

The report also includes profiles and for some of the leading companies in the Military Embedded Systems Market, 2024 to 2034, with a focus on this segment of these companies’ operations.

Leading companies profiled in the report

• BAE Systems PLC

• Curtiss-Wright Corporation

• Elbit Systems Ltd.

• GE Aerospace

• General Dynamics Corporation

• Honeywell International Inc.

• L3Harris Technologies, Inc.

• Leonardo S.p.A.

• Lockheed Martin Corporation

• Northrop Grumman Corporation

• Raytheon Technologies Corporation

• Saab AB

• TE Connectivity Ltd.

• Thales Group

• Viasat

Overall world revenue for military embedded systems market, 2024 to 2034 in terms of value the market will surpass US$2,116.8 million in 2024, our work calculates. We predict strong revenue growth through to 2034. Our work identifies which organizations hold the greatest potential. Discover their capabilities, progress, and commercial prospects, helping you stay ahead.

How will the Military Embedded Systems Market, 2024 to 2034 report help you?

In summary, our 430+ page report provides you with the following knowledge:

• Revenue forecasts to 2034 for Military Embedded Systems Market, 2024 to 2034 Market, with forecasts for component, end-user, system, processor, and application, each forecast at a global and regional level – discover the industry’s prospects, finding the most lucrative places for investments and revenues.

• Revenue forecasts to 2034 for four regional and 20 key national markets – See forecasts for the Military Embedded Systems Market, 2024 to 2034 market in North America, Europe, Asia-Pacific, Latin America and Middle East & Africa. Also forecasted is the market in the US, Canada, Brazil, Germany, France, UK, Russia, China, India, Japan, and Australia among other prominent economies.

• Prospects for established firms and those seeking to enter the market – including company profiles for 15 of the major companies involved in the military embedded systems market, 2024 to 2034.

Find quantitative and qualitative analyses with independent predictions. Receive information that only our report contains, staying informed with invaluable business intelligence.

Information found nowhere else

With our new report, you are less likely to fall behind in knowledge or miss out on opportunities. See how our work could benefit your research, analyses, and decisions. Visiongain’s study is for everybody needing commercial analyses for the Military Embedded Systems

To access the data contained in this document please email contactus@visiongain.com

Buy our report today Military Embedded Systems Market Report 2024-2034: Forecasts by Component (Hardware, Software), by End user (Army, Navy, Air Force), by System (Avionics Systems, Land-Based Systems, Naval Systems, Space-Based Systems), by Processor (Single Board Computers (SBC), Microcontrollers (MCU), Digital Signal Processors (DSP), Field-Programmable Gate Arrays (FPGA), Other), by Application (Communication and Navigation Systems, Command and Control Systems, Surveillance and Reconnaissance Systems, Weapon Systems, Electronic Warfare and Countermeasures, Other) AND Regional and Leading National Market Analysis PLUS Analysis of Leading Companies AND COVID-19 Impact and Recovery Pattern Analysis. Avoid missing out by staying informed – order our report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for a specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: contactus@visiongain.com

1 Report Overview

1.1 Objectives of the Study

1.2 Introduction to Military Embedded Systems Market

1.3 What This Report Delivers

1.4 Why You Should Read This Report

1.5 Key Questions Answered by This Analytical Report

1.6 Who Is This Report for?

1.7 Methodology

1.7.1 Market Definitions

1.7.2 Market Evaluation & Forecasting Methodology

1.7.3 Data Validation

1.7.3.1 Primary Research

1.7.3.2 Secondary Research

1.8 Frequently Asked Questions (FAQs)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2 Executive Summary

3 Market Overview

3.1 Key Findings

3.2 Market Dynamics

3.2.1 Market Driving Factors

3.2.1.1 Technological Advancement in Network Convergence Driving the Market Growth

3.2.1.2 Increase Focus on Cloud Computing and Wireless Technologies Driving the Market Growth

3.2.1.3 Rising Demand for New and Advanced Electric Combat Systems Driving the Market Growth

3.2.2 Market Restraining Factors

3.2.2.1 Increased Barriers in Designing Military Embedded Systems

3.2.2.2 Critical Security Procedures in Embedded Devices

3.2.2.3 Budget Constraints are a Significant Factor that can Impact the Military Embedded Systems Market

3.2.3 Market Opportunities

3.2.3.1 Development of EW Systems with Enhanced Capabilities

3.2.3.2 Artificial intelligence (AI) and Machine Learning are being Integrated into Military Embedded Systems to Improve Decision-Making, Autonomous Operations, and Threat Detection

3.2.3.3 The Militarization of Space is a Growing Trend, Leading to Opportunities for Embedded Systems Designed for Satellite Communication, Navigation, and Surveillance Applications

3.3 Porter’s Five Forces Analysis

3.3.1 Bargaining Power of Suppliers (Medium)

3.3.2 Bargaining Power of Buyers (High)

3.3.3 Competitive Rivalry (High)

3.3.4 Threat from Substitutes (Low)

3.3.5 Threat of New Entrants (Low)

3.4 COVID-19 Impact Analysis

3.4.1 “V-Shaped Recovery”

3.4.2 “U-Shaped Recovery”

3.4.3 “W-Shaped Recovery”

3.4.4 “L-Shaped Recovery”

3.5 PEST Analysis

4 Military Embedded Systems Market Analysis by Component

4.1 Key Findings

4.2 Component Segment: Market Attractiveness Index

4.3 Military Embedded Systems Market Size Estimation and Forecast by Component

4.4 Hardware

4.4.1 Market Size by Region, 2024-2034 (US$ Million)

4.4.2 Market Share by Region, 2024 & 2034 (%)

4.5 Software

4.5.1 Market Size by Region, 2024-2034 (US$ Million)

4.5.2 Market Share by Region, 2024 & 2034 (%)

5 Military Embedded Systems Market Analysis by End-User

5.1 Key Findings

5.2 End-User Segment: Market Attractiveness Index

5.3 Military Embedded Systems Market Size Estimation and Forecast by End-User

5.4 Army

5.4.1 Market Size by Region, 2024-2034 (US$ Million)

5.4.2 Market Share by Region, 2024 & 2034 (%)

5.5 Navy

5.5.1 Market Size by Region, 2024-2034 (US$ Million)

5.5.2 Market Share by Region, 2024 & 2034 (%)

5.6 Air Force

5.6.1 Market Size by Region, 2024-2034 (US$ Million)

5.6.2 Market Share by Region, 2024 & 2034 (%)

6 Military Embedded Systems Market Analysis by System

6.1 Key Findings

6.2 System Segment: Market Attractiveness Index

6.3 Military Embedded Systems Market Size Estimation and Forecast by System

6.4 Avionics Systems

6.4.1 Market Size by Region, 2024-2034 (US$ Million)

6.4.2 Market Share by Region, 2024 & 2034 (%)

6.5 Land-Based Systems

6.5.1 Market Size by Region, 2024-2034 (US$ Million)

6.5.2 Market Share by Region, 2024 & 2034 (%)

6.6 Naval Systems

6.6.1 Market Size by Region, 2024-2034 (US$ Million)

6.6.2 Market Share by Region, 2024 & 2034 (%)

6.7 Space-Based Systems

6.7.1 Market Size by Region, 2024-2034 (US$ Million)

6.7.2 Market Share by Region, 2024 & 2034 (%)

7 Military Embedded Systems Market Analysis by Processor

7.1 Key Findings

7.2 Processor Segment: Market Attractiveness Index

7.3 Military Embedded Systems Market Size Estimation and Forecast by Processor

7.4 Single Board Computers (SBC)

7.4.1 Market Size by Region, 2024-2034 (US$ Million)

7.4.2 Market Share by Region, 2024 & 2034 (%)

7.5 Microcontrollers (MCU)

7.5.1 Market Size by Region, 2024-2034 (US$ Million)

7.5.2 Market Share by Region, 2024 & 2034 (%)

7.6 Digital Signal Processors (DSP)

7.6.1 Market Size by Region, 2024-2034 (US$ Million)

7.6.2 Market Share by Region, 2024 & 2034 (%)

7.7 Field-Programmable Gate Arrays (FPGA)

7.7.1 Market Size by Region, 2024-2034 (US$ Million)

7.7.2 Market Share by Region, 2024 & 2034 (%)

7.8 Other Processor Type

7.8.1 Market Size by Region, 2024-2034 (US$ Million)

7.8.2 Market Share by Region, 2024 & 2034 (%)

8 Military Embedded Systems Market Analysis by Application

8.1 Key Findings

8.2 Application Segment: Market Attractiveness Index

8.3 Military Embedded Systems Market Size Estimation and Forecast by Application

8.4 Communication and Navigation Systems

8.4.1 Market Size by Region, 2024-2034 (US$ Million)

8.4.2 Market Share by Region, 2024 & 2034 (%)

8.5 Command and Control Systems

8.5.1 Market Size by Region, 2024-2034 (US$ Million)

8.5.2 Market Share by Region, 2024 & 2034 (%)

8.6 Surveillance and Reconnaissance Systems

8.6.1 Market Size by Region, 2024-2034 (US$ Million)

8.6.2 Market Share by Region, 2024 & 2034 (%)

8.7 Weapon Systems

8.7.1 Market Size by Region, 2024-2034 (US$ Million)

8.7.2 Market Share by Region, 2024 & 2034 (%)

8.8 Electronic Warfare and Countermeasures

8.8.1 Market Size by Region, 2024-2034 (US$ Million)

8.8.2 Market Share by Region, 2024 & 2034 (%)

8.9 Other Applications

8.9.1 Market Size by Region, 2024-2034 (US$ Million)

8.9.2 Market Share by Region, 2024 & 2034 (%)

9 Military Embedded Systems Market Analysis by Region

9.1 Key Findings

9.2 Regional Market Size Estimation and Forecast

10 North America Military Embedded Systems Market Analysis

10.1 Key Findings

10.2 North America Military Embedded Systems Market Attractiveness Index

10.3 North America Military Embedded Systems Market by Country, 2024, 2029 & 2034 (US$ Million)

10.4 North America Military Embedded Systems Market Size Estimation and Forecast

10.5 North America Military Embedded Systems Market Size Estimation and Forecast by Country

10.6 North America Military Embedded Systems Market Size Estimation and Forecast by Component

10.7 North America Military Embedded Systems Market Size Estimation and Forecast by End-User

10.8 North America Military Embedded Systems Market Size Estimation and Forecast by System

10.9 North America Military Embedded Systems Market Size Estimation and Forecast by Processor

10.10 North America Military Embedded Systems Market Size Estimation and Forecast by Application

10.11 U.S. Military Embedded Systems Market Analysis

10.12 Canada Military Embedded Systems Market Analysis

11 Europe Military Embedded Systems Market Analysis

11.1 Key Findings

11.2 Europe Military Embedded Systems Market Attractiveness Index

11.3 Europe Military Embedded Systems Market by Country, 2024, 2029 & 2034 (US$ Million)

11.4 Europe Military Embedded Systems Market Size Estimation and Forecast

11.5 Europe Military Embedded Systems Market Size Estimation and Forecast by Country

11.6 Europe Military Embedded Systems Market Size Estimation and Forecast by Component

11.7 Europe Military Embedded Systems Market Size Estimation and Forecast by End-User

11.8 Europe Military Embedded Systems Market Size Estimation and Forecast by System

11.9 Europe Military Embedded Systems Market Size Estimation and Forecast by Processor

11.10 Europe Military Embedded Systems Market Size Estimation and Forecast by Application

11.11 Germany Military Embedded Systems Market Analysis

11.12 UK Military Embedded Systems Market Analysis

11.13 France Military Embedded Systems Market Analysis

11.14 Italy Military Embedded Systems Market Analysis

11.15 Russia Military Embedded Systems Market Analysis

11.16 Rest of Europe Military Embedded Systems Market Analysis

12 Asia-Pacific Military Embedded Systems Market Analysis

12.1 Key Findings

12.2 Asia-Pacific Military Embedded Systems Market Attractiveness Index

12.3 Asia-Pacific Military Embedded Systems Market by Country, 2024, 2029 & 2034 (US$ Million)

12.4 Asia-Pacific Military Embedded Systems Market Size Estimation and Forecast

12.5 Asia-Pacific Military Embedded Systems Market Size Estimation and Forecast by Country

12.6 Asia-Pacific Military Embedded Systems Market Size Estimation and Forecast by Component

12.7 Asia-Pacific Military Embedded Systems Market Size Estimation and Forecast by End-User

12.8 Asia-Pacific Military Embedded Systems Market Size Estimation and Forecast by System

12.9 Asia-Pacific Military Embedded Systems Market Size Estimation and Forecast by Processor

12.10 Asia-Pacific Military Embedded Systems Market Size Estimation and Forecast by Application

12.11 China Military Embedded Systems Market Analysis

12.12 India Military Embedded Systems Market Analysis

12.13 Japan Military Embedded Systems Market Analysis

12.14 South Korea Military Embedded Systems Market Analysis

12.15 Australia Military Embedded Systems Market Analysis

12.16 Rest of Asia-Pacific Military Embedded Systems Market Analysis

13 Middle East and Africa Military Embedded Systems Market Analysis

13.1 Key Findings

13.2 Middle East and Africa Military Embedded Systems Market Attractiveness Index

13.3 Middle East and Africa Military Embedded Systems Market by Country, 2024, 2029 & 2034 (US$ Million)

13.4 Middle East and Africa Military Embedded Systems Market Size Estimation and Forecast

13.5 Middle East and Africa Military Embedded Systems Market Size Estimation and Forecast by Country

13.6 Middle East and Africa Military Embedded Systems Market Size Estimation and Forecast by Component

13.7 Middle East and Africa Military Embedded Systems Market Size Estimation and Forecast by End-User

13.8 Middle East and Africa Military Embedded Systems Market Size Estimation and Forecast by System

13.9 Middle East and Africa Military Embedded Systems Market Size Estimation and Forecast by Processor

13.10 Middle East and Africa Military Embedded Systems Market Size Estimation and Forecast by Application

13.11 GCC Military Embedded Systems Market Analysis

13.12 South Africa Military Embedded Systems Market Analysis

13.13 Rest of Middle East & Africa Military Embedded Systems Market Analysis

14 Latin America Military Embedded Systems Market Analysis

14.1 Key Findings

14.2 Latin America Military Embedded Systems Market Attractiveness Index

14.3 Latin America Military Embedded Systems Market by Country, 2024, 2029 & 2034 (US$ Million)

14.4 Latin America Military Embedded Systems Market Size Estimation and Forecast

14.5 Latin America Military Embedded Systems Market Size Estimation and Forecast by Country

14.6 Latin America Military Embedded Systems Market Size Estimation and Forecast by Component

14.7 Latin America Military Embedded Systems Market Size Estimation and Forecast by End-User

14.8 Latin America Military Embedded Systems Market Size Estimation and Forecast by System

14.9 Latin America Military Embedded Systems Market Size Estimation and Forecast by Processor

14.10 Latin America Military Embedded Systems Market Size Estimation and Forecast by Application

14.11 Brazil Military Embedded Systems Market Analysis

14.12 Mexico Military Embedded Systems Market Analysis

14.13 Rest of Latin America Military Embedded Systems Market Analysis

15 Company Profiles

15.1 Competitive Landscape, 2022

15.2 Strategic Outlook

15.3 BAE Systems PLC

15.3.1 Company Snapshot

15.3.2 Company Overview

15.3.3 Financial Analysis

15.3.3.1 Net Revenue, 2018-2022

15.3.3.2 R&D, 2018-2022

15.3.3.3 Regional Revenue Share, 2022 (%)

15.3.3.4 Business Segment Revenue Share, 2022 (%)

15.3.4 Product Benchmarking

15.3.5 Strategic Outlook

15.4 Lockheed Martin Corporation

15.4.1 Company Snapshot

15.4.2 Company Overview

15.4.3 Financial Analysis

15.4.3.1 Net Revenue, 2018-2022

15.4.3.2 R&D, 2018-2022

15.4.3.3 Regional Revenue Share, 2022 (%)

15.4.3.4 Business Segment Revenue Share, 2022 (%)

15.4.4 Product Benchmarking

15.4.5 Strategic Outlook

15.5 Northrop Grumman Corporation

15.5.1 Company Snapshot

15.5.2 Company Overview

15.5.3 Financial Analysis

15.5.3.1 Net Revenue, 2018-2022

15.5.3.2 R&D, 2018-2022

15.5.3.3 Regional Revenue Share, 2022 (%)

15.5.3.4 Business Segment Revenue Share, 2022 (%)

15.5.4 Product Benchmarking

15.5.5 Strategic Outlook

15.6 Raytheon Technologies Corporation

15.6.1 Company Snapshot

15.6.2 Company Overview

15.6.3 Financial Analysis

15.6.3.1 Net Revenue, 2018-2022

15.6.3.2 R&D, 2018-2022

15.6.3.3 Regional Revenue Share, 2022 (%)

15.6.3.4 Business Segment Revenue Share, 2022 (%)

15.6.4 Product Benchmarking

15.6.5 Strategic Outlook

15.7 Honeywell International Inc.

15.7.1 Company Snapshot

15.7.2 Company Overview

15.7.3 Financial Analysis

15.7.3.1 Net Revenue, 2018-2022

15.7.3.2 R&D, 2018-2022

15.7.3.3 Regional Revenue Share, 2022 (%)

15.7.3.4 Business Segment Revenue Share, 2022 (%)

15.7.4 Product Benchmarking

15.7.5 Strategic Outlook

15.8 L3Harris Technologies, Inc.

15.8.1 Company Snapshot

15.8.2 Company Overview

15.8.3 Financial Analysis

15.8.3.1 Net Revenue, 2018-2022

15.8.3.2 R&D, 2018-2022

15.8.3.3 Regional Revenue Share, 2022 (%)

15.8.3.4 Business Segment Revenue Share, 2022 (%)

15.8.4 Product Benchmarking

15.8.5 Strategic Outlook

15.9 Thales Group

15.9.1 Company Snapshot

15.9.2 Company Overview

15.9.3 Financial Analysis

15.9.3.1 Net Revenue, 2018-2022

15.9.4 Product Benchmarking

15.9.5 Strategic Outlook

15.10 Curtiss-Wright Corporation

15.10.1 Company Snapshot

15.10.2 Company Overview

15.10.3 Financial Analysis

15.10.3.1 Net Revenue, 2018-2022

15.10.3.2 R&D, 2018-2022

15.10.4 Product Benchmarking

15.10.5 Strategic Outlook

15.11 Leonardo S.p.A.

15.11.1 Company Snapshot

15.11.2 Company Overview

15.11.3 Financial Analysis

15.11.3.1 Net Revenue, 2018-2022

15.11.3.2 R&D, 2018-2022

15.11.3.3 Regional Revenue Share, 2022 (%)

15.11.3.4 Business Segment Revenue Share, 2022 (%)

15.11.4 Product Benchmarking

15.11.5 Strategic Outlook

15.12 Elbit Systems Ltd.

15.12.1 Company Snapshot

15.12.2 Company Overview

15.12.3 Financial Analysis

15.12.3.1 Net Revenue, 2018-2022

15.12.3.2 R&D, 2018-2022

15.12.3.3 Regional Revenue Share, 2022 (%)

15.12.3.4 Business Segment Revenue Share, 2022 (%)

15.12.4 Product Benchmarking

15.12.5 Strategic Outlook

15.13 Saab AB

15.13.1 Company Snapshot

15.13.2 Company Overview

15.13.3 Financial Analysis

15.13.3.1 Net Revenue, 2018-2022

15.13.3.2 R&D, 2018-2022

15.13.3.3 Regional Revenue Share, 2022 (%)

15.13.3.4 Business Segment Revenue Share, 2022 (%)

15.13.4 Product Benchmarking

15.13.5 Strategic Outlook

15.14 General Dynamics Corporation

15.14.1 Company Snapshot

15.14.2 Company Overview

15.14.3 Financial Analysis

15.14.3.1 Net Revenue, 2018-2022

15.14.3.2 R&D, 2018-2022

15.14.3.3 Regional Revenue Share, 2022 (%)

15.14.3.4 Business Segment Revenue Share, 2022 (%)

15.14.4 Product Benchmarking

15.14.5 Strategic Outlook

15.15 TE Connectivity Ltd.

15.15.1 Company Snapshot

15.15.2 Company Overview

15.15.3 Financial Analysis

15.15.3.1 Net Revenue, 2018-2022

15.15.3.2 R&D, 2018-2022

15.15.3.3 Regional Revenue Share, 2022 (%)

15.15.3.4 Business Segment Revenue Share, 2022 (%)

15.15.4 Product Benchmarking

15.15.5 Strategic Outlook

15.16 Viasat

15.16.1 Company Snapshot

15.16.2 Company Overview

15.16.3 Financial Analysis

15.16.3.1 Net Revenue, 2018-2022

15.16.3.2 R&D, 2018-2022

15.16.3.3 Regional Revenue Share, 2022 (%)

15.16.3.4 Business Segment Revenue Share, 2022 (%)

15.16.4 Product Benchmarking

15.16.5 Strategic Outlook

15.17 GE Aerospace

15.17.1 Company Snapshot

15.17.2 Company Overview

15.17.3 Financial Analysis

15.17.3.1 Net Revenue, 2018-2022

15.17.3.2 R&D, 2018-2022

15.17.3.3 Regional Revenue Share, 2022 (%)

15.17.3.4 Business Segment Revenue Share, 2022 (%)

15.17.4 Product Benchmarking

15.17.5 Strategic Outlook

16 Conclusion and Recommendations

16.1 Concluding Remarks from Visiongain

16.2 Recommendations for Market Players

List of Tables

Table 1 Military Embedded Systems Market Snapshot, 2024 & 2034 (US$ Million, CAGR %)

Table 2 Global Military Embedded Systems Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%)) (V-Shaped Recovery Scenario)

Table 3 Global Military Embedded Systems Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%)) (U-Shaped Recovery Scenario)

Table 4 Global Military Embedded Systems Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%)) (W-Shaped Recovery Scenario)

Table 5 Global Military Embedded Systems Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%)) (L-Shaped Recovery Scenario)

Table 6 Global Military Embedded Systems Market by Component, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 7 Hardware Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 8 Software Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 9 Global Military Embedded Systems Market by End-User, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 10 Army Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 11 Navy Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 12 Air Force Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 13 Global Military Embedded Systems Market by System, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 14 Avionics Systems Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 15 Land-Based Systems Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 16 Naval Systems Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 17 Space-Based Systems Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 18 Global Military Embedded Systems Market by Processor, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 19 Single Board Computers (SBC) Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 20 Microcontrollers (MCU) Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 21 Digital Signal Processors (DSP) Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 22 Field-Programmable Gate Arrays (FPGA) Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 23 Other Processor Type Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 24 Global Military Embedded Systems Market by Application, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 25 Communication and Navigation Systems Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 26 Command and Control Systems Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 27 Surveillance and Reconnaissance Systems Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 28 Weapon Systems Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 29 Electronic Warfare and Countermeasures Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 30 Other Applications Market by Region, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 31 Military Embedded Systems Market Forecast by Region, 2024-2034 (US$ Million, AGR%, CAGR%)

Table 32 North America Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 33 North America Military Embedded Systems Market by Country, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 34 North America Military Embedded Systems Market by Component, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 35 North America Military Embedded Systems Market by End-User, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 36 North America Military Embedded Systems Market by System, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 37 North America Military Embedded Systems Market by Processor, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 38 North America Military Embedded Systems Market by Application, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 39 US Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 40 Canada Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 41 Europe Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 42 Europe Military Embedded Systems Market by Country, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 43 Europe Military Embedded Systems Market by Component, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 44 Europe Military Embedded Systems Market by End-User, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 45 Europe Military Embedded Systems Market by System, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 46 Europe Military Embedded Systems Market by Processor, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 47 Europe Military Embedded Systems Market by Application, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 48 Germany Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 49 UK Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 50 France Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 51 Italy Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 52 Russia Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 53 Rest of Europe Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 54 Asia-Pacific Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 55 Asia-Pacific Military Embedded Systems Market by Country, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 56 Asia-Pacific Military Embedded Systems Market by Component, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 57 Asia-Pacific Military Embedded Systems Market by End-User, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 58 Asia-Pacific Military Embedded Systems Market by System, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 59 Asia-Pacific Military Embedded Systems Market by Processor, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 60 Asia-Pacific Military Embedded Systems Market by Application, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 61 China Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 62 India Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 63 Japan Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 64 South Korea Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 65 Australia Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 66 Rest of Asia-Pacific Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 67 Middle East & Africa Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 68 Middle East & Africa Military Embedded Systems Market by Country, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 69 Middle East & Africa Military Embedded Systems Market by Component, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 70 Middle East & Africa Military Embedded Systems Market by End-User, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 71 Middle East & Africa Military Embedded Systems Market by System, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 72 Middle East & Africa Military Embedded Systems Market by Processor, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 73 Middle East & Africa Military Embedded Systems Market by Application, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 74 GCC Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 75 South Africa Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 76 Rest of Middle East & Africa Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 77 Latin America Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%)

Table 78 Latin America Military Embedded Systems Market by Country, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 79 Latin America Military Embedded Systems Market by Component, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 80 Latin America Military Embedded Systems Market by End-User, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 81 Latin America Military Embedded Systems Market by System, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 82 Latin America Military Embedded Systems Market by Processor, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 83 Latin America Military Embedded Systems Market by Application, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 84 Brazil Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 85 Mexico Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

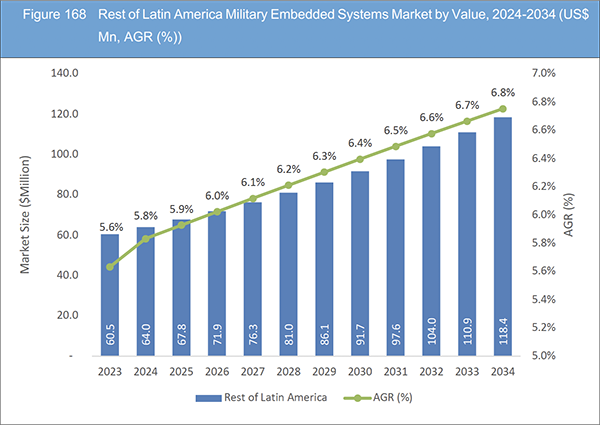

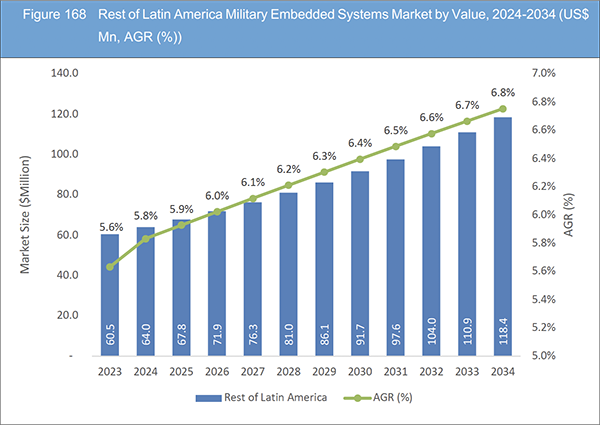

Table 86 Rest of Latin America Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%), CAGR (%))

Table 87 Strategic Outlook - Contract

Table 88 BAE Systems PLC: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 89 BAE Systems PLC: Product Benchmarking

Table 90 BAE Systems PLC: Strategic Outlook

Table 91 Lockheed Martin Corporation: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 92 Lockheed Martin Corporation: Product Benchmarking

Table 93 Lockheed Martin Corporation: Strategic Outlook

Table 94 Northrop Grumman Corporation: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 95 Northrop Grumman Corporation: Product Benchmarking

Table 96 Northrop Grumman Corporation: Strategic Outlook

Table 97 Raytheon Technologies Corporation: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 98 Raytheon Technologies Corporation: Product Benchmarking

Table 99 Raytheon Technologies Corporation: Strategic Outlook

Table 100 Honeywell International Inc.: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 101 Honeywell International Inc.: Product Benchmarking

Table 102 Honeywell International Inc.: Strategic Outlook

Table 103 L3Harris Technologies, Inc.: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 104 L3Harris Technologies, Inc.: Product Benchmarking

Table 105 L3Harris Technologies, Inc.: Strategic Outlook

Table 106 Thales Group: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 107 Thales Group: Product Benchmarking

Table 108 Thales Group: Strategic Outlook

Table 109 Curtiss-Wright Corporation: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 110 Curtiss-Wright Corporation: Product Benchmarking

Table 111 Curtiss-Wright Corporation: Strategic Outlook

Table 112 Leonardo S.p.A.: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 113 Leonardo S.p.A.: Product Benchmarking

Table 114 Leonardo S.p.A.: Strategic Outlook

Table 115 Elbit Systems Ltd.: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 116 Elbit Systems Ltd.: Product Benchmarking

Table 117 Elbit Systems Ltd.: Strategic Outlook

Table 118 Saab AB: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 119 Saab AB: Product Benchmarking

Table 120 : Strategic Outlook

Table 121 General Dynamics Corporation: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 122 General Dynamics Corporation: Product Benchmarking

Table 123 General Dynamics Corporation: Strategic Outlook

Table 124 TE Connectivity Ltd.: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 125 TE Connectivity Ltd.: Product Benchmarking

Table 126 TE Connectivity Ltd.: Strategic Outlook

Table 127 Viasat: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 128 Viasat: Product Benchmarking

Table 129 Viasat: Strategic Outlook

Table 130 GE Aerospace: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 131 GE Aerospace: Product Benchmarking

Table 132 GE Aerospace: Strategic Outlook

List of Figures

Figure 1 Military Embedded Systems Market Segmentation

Figure 2 Military Embedded Systems Market by Component: Market Attractiveness Index

Figure 3 Military Embedded Systems Market by End-User: Market Attractiveness Index

Figure 4 Military Embedded Systems Market by System: Market Attractiveness Index

Figure 5 Military Embedded Systems Market by Processor: Market Attractiveness Index

Figure 6 Military Embedded Systems Market by Application: Market Attractiveness Index

Figure 7 Military Embedded Systems Market Attractiveness Index by Region

Figure 8 Military Embedded Systems Market: Market Dynamics

Figure 9 Military Embedded Systems Market: Porter’s Five Forces Analysis

Figure 10 Global Military Embedded Systems Market Share Forecast by COVID, 2024-2034 (%)

Figure 11 Global Military Embedded Systems Market by Region, 2024-2034 (US$ Mn, AGR (%)) (V-Shaped Recovery Scenario)

Figure 12 Global Military Embedded Systems Market by Region, 2024-2034 (US$ Mn, AGR (%)) (U-Shaped Recovery Scenario)

Figure 13 Global Military Embedded Systems Market by Region, 2024-2034 (US$ Mn, AGR (%)) (W-Shaped Recovery Scenario)

Figure 14 Global Military Embedded Systems Market by Region, 2024-2034 (US$ Mn, AGR (%)) (L-Shaped Recovery Scenario)

Figure 15 Military Embedded Systems Market: PEST Analysis

Figure 16 Military Embedded Systems Market by Component: Market Attractiveness Index

Figure 17 Global Military Embedded Systems Market by Component, 2024-2034 (US$ Mn, AGR (%))

Figure 18 Military Embedded Systems Market Share Forecast by Component, 2024, 2029, 2034 (%)

Figure 19 Hardware Market by Region, 2024-2034 (US$ Mn, AGR (%))

Figure 20 Hardware Market Share Forecast by Region, 2024 & 2034 (%)

Figure 21 Software Market by Region, 2024-2034 (US$ Mn, AGR (%))

Figure 22 Software Market Share Forecast by Region, 2024 & 2034 (%)

Figure 23 Military Embedded Systems Market by End-User: Market Attractiveness Index

Figure 24 Global Military Embedded Systems Market by End-User, 2024-2034 (US$ Mn, AGR (%))

Figure 25 Military Embedded Systems Market Share Forecast by End-User, 2024, 2029, 2034 (%)

Figure 26 Army Market by Region, 2024-2034 (US$ Mn, AGR (%))

Figure 27 Army Market Share Forecast by Region, 2024 & 2034 (%)

Figure 28 Navy Market by Region, 2024-2034 (US$ Mn, AGR (%))

Figure 29 Navy Market Share Forecast by Region, 2024 & 2034 (%)

Figure 30 Air Force Market by Region, 2024-2034 (US$ Mn, AGR (%))

Figure 31 Air Force Market Share Forecast by Region, 2024 & 2034 (%)

Figure 32 Military Embedded Systems Market by System: Market Attractiveness Index

Figure 33 Global Military Embedded Systems Market by System, 2024-2034 (US$ Mn, AGR (%))

Figure 34 Military Embedded Systems Market Share Forecast by System, 2024, 2029, 2034 (%)

Figure 35 Avionics Systems Market by Region, 2024-2034 (US$ Mn, AGR (%))

Figure 36 Avionics Systems Market Share Forecast by Region, 2024 & 2034 (%)

Figure 37 Land-Based Systems Market by Region, 2024-2034 (US$ Mn, AGR (%))

Figure 38 Land-Based Systems Market Share Forecast by Region, 2024 & 2034 (%)

Figure 39 Naval Systems Market by Region, 2024-2034 (US$ Mn, AGR (%))

Figure 40 Naval Systems Market Share Forecast by Region, 2024 & 2034 (%)

Figure 41 Space-Based Systems Market by Region, 2024-2034 (US$ Mn, AGR (%))

Figure 42 Space-Based Systems Market Share Forecast by Region, 2024 & 2034 (%)

Figure 43 Military Embedded Systems Market by Processor: Market Attractiveness Index

Figure 44 Global Military Embedded Systems Market by Processor, 2024-2034 (US$ Mn, AGR (%))

Figure 45 Military Embedded Systems Market Share Forecast by Processor, 2024, 2029, 2034 (%)

Figure 46 Single Board Computers (SBC) Market by Region, 2024-2034 (US$ Mn, AGR (%))

Figure 47 Single Board Computers (SBC) Market Share Forecast by Region, 2024 & 2034 (%)

Figure 48 Microcontrollers (MCU) Market by Region, 2024-2034 (US$ Mn, AGR (%))

Figure 49 Microcontrollers (MCU) Market Share Forecast by Region, 2024 & 2034 (%)

Figure 50 Digital Signal Processors (DSP) Market by Region, 2024-2034 (US$ Mn, AGR (%))

Figure 51 Digital Signal Processors (DSP) Market Share Forecast by Region, 2024 & 2034 (%)

Figure 52 Field-Programmable Gate Arrays (FPGA) Market by Region, 2024-2034 (US$ Mn, AGR (%))

Figure 53 Field-Programmable Gate Arrays (FPGA) Market Share Forecast by Region, 2024 & 2034 (%)

Figure 54 Other Processor Type Market by Region, 2024-2034 (US$ Mn, AGR (%))

Figure 55 Other Processor Type Market Share Forecast by Region, 2024 & 2034 (%)

Figure 56 Military Embedded Systems Market by Application: Market Attractiveness Index

Figure 57 Global Military Embedded Systems Market by Application, 2024-2034 (US$ Mn, AGR (%))

Figure 58 Military Embedded Systems Market Share Forecast by Application, 2024, 2029, 2034 (%)

Figure 59 Communication and Navigation Systems Market by Region, 2024-2034 (US$ Mn, AGR (%))

Figure 60 Communication and Navigation Systems Market Share Forecast by Region, 2024 & 2034 (%)

Figure 61 Command and Control Systems Market by Region, 2024-2034 (US$ Mn, AGR (%))

Figure 62 Command and Control Systems Market Share Forecast by Region, 2024 & 2034 (%)

Figure 63 Surveillance and Reconnaissance Systems Market by Region, 2024-2034 (US$ Mn, AGR (%))

Figure 64 Surveillance and Reconnaissance Systems Market Share Forecast by Region, 2024 & 2034 (%)

Figure 65 Weapon Systems Market by Region, 2024-2034 (US$ Mn, AGR (%))

Figure 66 Weapon Systems Market Share Forecast by Region, 2024 & 2034 (%)

Figure 67 Electronic Warfare and Countermeasures Market by Region, 2024-2034 (US$ Mn, AGR (%))

Figure 68 Electronic Warfare and Countermeasures Market Share Forecast by Region, 2024 & 2034 (%)

Figure 69 Other Applications Market by Region, 2024-2034 (US$ Mn, AGR (%))

Figure 70 Other Applications Market Share Forecast by Region, 2024 & 2034 (%)

Figure 71 Military Embedded Systems Market Forecast by Region 2024 and 2034 (Revenue, CAGR%)

Figure 72 Military Embedded Systems Market Share Forecast by Region 2024, 2029, 2034 (%)

Figure 73 Military Embedded Systems Market by Region, 2024-2034 (US$ Million, AGR %)

Figure 74 North America Military Embedded Systems Market Attractiveness Index

Figure 75 North America Military Embedded Systems Market by Region, 2024, 2029 & 2034 (US$ Million)

Figure 76 North America Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 77 North America Military Embedded Systems Market by Country, 2024-2034 (US$ Mn, AGR (%))

Figure 78 North America Military Embedded Systems Market Share Forecast by Country, 2024 & 2034 (%)

Figure 79 North America Military Embedded Systems Market by Component, 2024-2034 (US$ Mn, AGR (%))

Figure 80 North America Military Embedded Systems Market Share Forecast Component, 2024 & 2034 (%)

Figure 81 North America Military Embedded Systems Market by End-User, 2024-2034 (US$ Mn, AGR (%))

Figure 82 North America Military Embedded Systems Market Share Forecast by End-User, 2024 & 2034 (%)

Figure 83 North America Military Embedded Systems Market by System, 2024-2034 (US$ Mn, AGR (%))

Figure 84 North America Military Embedded Systems Market Share Forecast by System, 2024 & 2034 (%)

Figure 85 North America Military Embedded Systems Market by Processor, 2024-2034 (US$ Mn, AGR (%))

Figure 86 North America Military Embedded Systems Market Share Forecast by Processor, 2024 & 2034 (%)

Figure 87 North America Military Embedded Systems Market by Application, 2024-2034 (US$ Mn, AGR (%))

Figure 88 North America Military Embedded Systems Market Share Forecast by Application, 2024 & 2034 (%)

Figure 89 US Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 90 Canada Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 91 Europe Military Embedded Systems Market Attractiveness Index

Figure 92 Europe Military Embedded Systems Market by Region, 2024, 2029 & 2034 (US$ Million)

Figure 93 Europe Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 94 Europe Military Embedded Systems Market by Country, 2024-2034 (US$ Mn, AGR (%))

Figure 95 Europe Military Embedded Systems Market Share Forecast by Country, 2024 & 2034 (%)

Figure 96 Europe Military Embedded Systems Market by Component, 2024-2034 (US$ Mn, AGR (%))

Figure 97 Europe Military Embedded Systems Market Share Forecast Component, 2024 & 2034 (%)

Figure 98 Europe Military Embedded Systems Market by End-User, 2024-2034 (US$ Mn, AGR (%))

Figure 99 Europe Military Embedded Systems Market Share Forecast by End-User, 2024 & 2034 (%)

Figure 100 Europe Military Embedded Systems Market by System, 2024-2034 (US$ Mn, AGR (%))

Figure 101 Europe Military Embedded Systems Market Share Forecast by System, 2024 & 2034 (%)

Figure 102 Europe Military Embedded Systems Market by Processor, 2024-2034 (US$ Mn, AGR (%))

Figure 103 Europe Military Embedded Systems Market Share Forecast by Processor, 2024 & 2034 (%)

Figure 104 Europe Military Embedded Systems Market by Application, 2024-2034 (US$ Mn, AGR (%))

Figure 105 Europe Military Embedded Systems Market Share Forecast by Application, 2024 & 2034 (%)

Figure 106 Germany Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 107 UK Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 108 France Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 109 Italy Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 110 Russia Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 111 Rest of Europe Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 112 Asia-Pacific Military Embedded Systems Market Attractiveness Index

Figure 113 Asia-Pacific Military Embedded Systems Market by Region, 2024, 2029 & 2034 (US$ Million)

Figure 114 Asia-Pacific Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 115 Asia-Pacific Military Embedded Systems Market by Country, 2024-2034 (US$ Mn, AGR (%))

Figure 116 Asia-Pacific Military Embedded Systems Market Share Forecast by Country, 2024 & 2034 (%)

Figure 117 Asia-Pacific Military Embedded Systems Market by Component, 2024-2034 (US$ Mn, AGR (%))

Figure 118 Asia-Pacific Military Embedded Systems Market Share Forecast Component, 2024 & 2034 (%)

Figure 119 Asia-Pacific Military Embedded Systems Market by End-User, 2024-2034 (US$ Mn, AGR (%))

Figure 120 Asia-Pacific Military Embedded Systems Market Share Forecast by End-User, 2024 & 2034 (%)

Figure 121 Asia-Pacific Military Embedded Systems Market by System, 2024-2034 (US$ Mn, AGR (%))

Figure 122 Asia-Pacific Military Embedded Systems Market Share Forecast by System, 2024 & 2034 (%)

Figure 123 Asia-Pacific Military Embedded Systems Market by Processor, 2024-2034 (US$ Mn, AGR (%))

Figure 124 Asia-Pacific Military Embedded Systems Market Share Forecast by Processor, 2024 & 2034 (%)

Figure 125 Asia-Pacific Military Embedded Systems Market by Application, 2024-2034 (US$ Mn, AGR (%))

Figure 126 Asia-Pacific Military Embedded Systems Market Share Forecast by Application, 2024 & 2034 (%)

Figure 127 China Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 128 India Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 129 Japan Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 130 South Korea Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 131 Australia Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 132 Rest of Asia-Pacific Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 133 Middle East and Africa Military Embedded Systems Market Attractiveness Index

Figure 134 Middle East and Africa Military Embedded Systems Market by Region, 2024, 2029 & 2034 (US$ Million)

Figure 135 Middle East & Africa Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 136 Middle East & Africa Military Embedded Systems Market by Country, 2024-2034 (US$ Mn, AGR (%))

Figure 137 Middle East and Africa Military Embedded Systems Market Share Forecast by Country, 2024 & 2034 (%)

Figure 138 Middle East & Africa Military Embedded Systems Market by Component, 2024-2034 (US$ Mn, AGR (%))

Figure 139 Middle East and Africa Military Embedded Systems Market Share Forecast Component, 2024 & 2034 (%)

Figure 140 Middle East & Africa Military Embedded Systems Market by End-User, 2024-2034 (US$ Mn, AGR (%))

Figure 141 Middle East and Africa Military Embedded Systems Market Share Forecast by End-User, 2024 & 2034 (%)

Figure 142 Middle East & Africa Military Embedded Systems Market by System, 2024-2034 (US$ Mn, AGR (%))

Figure 143 Middle East and Africa Military Embedded Systems Market Share Forecast by System, 2024 & 2034 (%)

Figure 144 Middle East & Africa Military Embedded Systems Market by Processor, 2024-2034 (US$ Mn, AGR (%))

Figure 145 Middle East and Africa Military Embedded Systems Market Share Forecast by Processor, 2024 & 2034 (%)

Figure 146 Middle East & Africa Military Embedded Systems Market by Application, 2024-2034 (US$ Mn, AGR (%))

Figure 147 Middle East and Africa Military Embedded Systems Market Share Forecast by Application, 2024 & 2034 (%)

Figure 148 GCC Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 149 South Africa Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 150 Rest of Middle East & Africa Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 151 Latin America Military Embedded Systems Market Attractiveness Index

Figure 152 Latin America Military Embedded Systems Market by Region, 2024, 2029 & 2034 (US$ Million)

Figure 153 Latin America Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 154 Latin America Military Embedded Systems Market by Country, 2024-2034 (US$ Mn, AGR (%))

Figure 155 Latin America Military Embedded Systems Market Share Forecast by Country, 2024 & 2034 (%)

Figure 156 Latin America Military Embedded Systems Market by Component, 2024-2034 (US$ Mn, AGR (%))

Figure 157 Latin America Military Embedded Systems Market Share Forecast Component, 2024 & 2034 (%)

Figure 158 Latin America Military Embedded Systems Market by End-User, 2024-2034 (US$ Mn, AGR (%))

Figure 159 Latin America Military Embedded Systems Market Share Forecast by End-User, 2024 & 2034 (%)

Figure 160 Latin America Military Embedded Systems Market by System, 2024-2034 (US$ Mn, AGR (%))

Figure 161 Latin America Military Embedded Systems Market Share Forecast by System, 2024 & 2034 (%)

Figure 162 Latin America Military Embedded Systems Market by Processor, 2024-2034 (US$ Mn, AGR (%))

Figure 163 Latin America Military Embedded Systems Market Share Forecast by Processor, 2024 & 2034 (%)

Figure 164 Latin America Military Embedded Systems Market by Application, 2024-2034 (US$ Mn, AGR (%))

Figure 165 Latin America Military Embedded Systems Market Share Forecast by Application, 2024 & 2034 (%)

Figure 166 Brazil Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 167 Mexico Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 168 Rest of Latin America Military Embedded Systems Market by Value, 2024-2034 (US$ Mn, AGR (%))

Figure 169 Military Embedded Systems Market: Company Share, 2022

Figure 170 BAE Systems PLC.: Net Revenue, 2018-2022 (US$ Million, AGR%)

Figure 171 BAE Systems PLC.: R&D, 2018-2022 (US$ Million, AGR%)

Figure 172 BAE Systems PLC.: Regional Revenue Share, 2022 (%)

Figure 173 BAE Systems PLC.: Business Segment Revenue Share, 2022 (%)

Figure 174 Lockheed Martin Corporation.: Net Revenue, 2018-2022 (US$ Million, AGR%)

Figure 175 Lockheed Martin Corporation.: R&D, 2018-2022 (US$ Million, AGR%)

Figure 176 Lockheed Martin Corporation.: Regional Revenue Share, 2022 (%)

Figure 177 Lockheed Martin Corporation.: Business Segment Revenue Share, 2022 (%)

Figure 178 Northrop Grumman Corporation.: Net Revenue, 2018-2022 (US$ Million, AGR%)

Figure 179 Northrop Grumman Corporation.: R&D, 2018-2022 (US$ Million, AGR%)

Figure 180 Northrop Grumman Corporation.: Regional Revenue Share, 2022 (%)

Figure 181 Northrop Grumman Corporation.: Business Segment Revenue Share, 2022 (%)

Figure 182 Raytheon Technologies Corporation.: Net Revenue, 2018-2022 (US$ Million, AGR%)

Figure 183 Raytheon Technologies Corporation.: R&D, 2018-2022 (US$ Million, AGR%)

Figure 184 Raytheon Technologies Corporation.: Regional Revenue Share, 2022 (%)

Figure 185 Raytheon Technologies Corporation.: Business Segment Revenue Share, 2022 (%)

Figure 186 Honeywell International Inc..: Net Revenue, 2018-2022 (US$ Million, AGR%)

Figure 187 Honeywell International Inc..: R&D, 2018-2022 (US$ Million, AGR%)

Figure 188 Honeywell International Inc..: Regional Revenue Share, 2022 (%)

Figure 189 Honeywell International Inc..: Business Segment Revenue Share, 2022 (%)

Figure 190 L3Harris Technologies, Inc..: Net Revenue, 2018-2022 (US$ Million, AGR%)

Figure 191 L3Harris Technologies, Inc..: R&D, 2018-2022 (US$ Million, AGR%)

Figure 192 L3Harris Technologies, Inc..: Regional Revenue Share, 2022 (%)

Figure 193 L3Harris Technologies, Inc..: Business Segment Revenue Share, 2022 (%)

Figure 194 Thales Group.: Net Revenue, 2018-2022 (US$ Million, AGR%)

Figure 195 Curtiss-Wright Corporation.: Net Revenue, 2018-2022 (US$ Million, AGR%)

Figure 196 Curtiss-Wright Corporation.: R&D, 2018-2022 (US$ Million, AGR%)

Figure 197 Leonardo S.p.A..: Net Revenue, 2018-2022 (US$ Million, AGR%)

Figure 198 Leonardo S.p.A..: R&D, 2018-2022 (US$ Million, AGR%)

Figure 199 Leonardo S.p.A..: Regional Revenue Share, 2022 (%)

Figure 200 Leonardo S.p.A..: Business Segment Revenue Share, 2022 (%)

Figure 201 Elbit Systems Ltd..: Net Revenue, 2018-2022 (US$ Million, AGR%)

Figure 202 Elbit Systems Ltd..: R&D, 2018-2022 (US$ Million, AGR%)

Figure 203 Elbit Systems Ltd..: Regional Revenue Share, 2022 (%)

Figure 204 Elbit Systems Ltd..: Business Segment Revenue Share, 2022 (%)

Figure 205 Saab AB.: Net Revenue, 2018-2022 (US$ Million, AGR%)

Figure 206 Saab AB.: R&D, 2018-2022 (US$ Million, AGR%)

Figure 207 Saab AB.: Regional Revenue Share, 2022 (%)

Figure 208 Saab AB.: Business Segment Revenue Share, 2022 (%)

Figure 209 General Dynamics Corporation.: Net Revenue, 2018-2022 (US$ Million, AGR%)

Figure 210 General Dynamics Corporation.: R&D, 2018-2022 (US$ Million, AGR%)

Figure 211 General Dynamics Corporation.: Regional Revenue Share, 2022 (%)

Figure 212 General Dynamics Corporation.: Business Segment Revenue Share, 2022 (%)

Figure 213 TE Connectivity Ltd..: Net Revenue, 2018-2022 (US$ Million, AGR%)

Figure 214 TE Connectivity Ltd..: R&D, 2018-2022 (US$ Million, AGR%)

Figure 215 TE Connectivity Ltd..: Regional Revenue Share, 2022 (%)

Figure 216 TE Connectivity Ltd..: Business Segment Revenue Share, 2022 (%)

Figure 217 Viasat.: Net Revenue, 2018-2022 (US$ Million, AGR%)

Figure 218 Viasat.: R&D, 2018-2022 (US$ Million, AGR%)

Figure 219 Viasat.: Regional Revenue Share, 2022 (%)

Figure 220 Viasat.: Business Segment Revenue Share, 2022 (%)

Figure 221 GE Aerospace.: Net Revenue, 2018-2022 (US$ Million, AGR%)

Figure 222 GE Aerospace.: R&D, 2018-2022 (US$ Million, AGR%)

Figure 223 GE Aerospace.: Regional Revenue Share, 2022 (%)

Figure 224 GE Aerospace.: Business Segment Revenue Share, 2022 (%)

List of Companies Profiled in the report

BAE Systems PLC

Curtiss-Wright Corporation

Elbit Systems Ltd.

GE Aerospace

General Dynamics Corporation

Honeywell International Inc.

L3Harris Technologies, Inc.

Leonardo S.p.A.

Lockheed Martin Corporation

Northrop Grumman Corporation

Raytheon Technologies Corporation

Saab AB

TE Connectivity Ltd.

Thales Group

Viasat

List of Other Companies Mentioned in the report

Abaco Systems

Advantech

ASELSAN A.Ş.

BAE Systems

Cobham plc

Collins Aerospace

Ecrin Systems

Esterel Technologies

Harris Corporation

Interface Concept

Kontron S&T AG

Kratos Defense & Security Solutions, Inc.

Leidos Holdings, Inc.

Mercury Systems, Inc.

Rheinmetall AG

Rockwell Collins, Inc.

Rostec State Corporation

Safran Electronics & Defense

Textron Systems Corporation

Ultra Electronics Holdings plc

List of Associations Mentioned in the Report

Aerospace Industries Association (AIA)

Association for Unmanned Vehicle Systems International (AUVSI)

Defense Advanced Research Projects Agency (DARPA)

Electronic Frontier Foundation (EFF)

European Defence Agency (EDA)

Institute of Electrical and Electronics Engineers (IEEE)

International Traffic in Arms Regulations (ITAR)

Ministry of Defence (MOD) - United Kingdom

Missile Defence Agency (MDA)

National Aeronautics and Space Administration (NASA)

National Defense Industrial Association (NDIA)

NATO (North Atlantic Treaty Organization)

SAE International (Society of Automotive Engineers International)

The Open Group FACE™ Consortium

U.S. Department of Defense (DoD)