Industries > Pharma > Medical Devices Leader Series: Top In Vitro Diagnostics (IVD) Companies 2019-2029

Medical Devices Leader Series: Top In Vitro Diagnostics (IVD) Companies 2019-2029

Danaher Corporation, Abbott Laboratories, Bio-Rad Laboratories, Roche, Siemens AG, Sysmex, Other Companies

The global in vitro diagnostics (IVD) market is estimated to have reached $69.2bn in 2018. The largest sector of the IVD market in 2018 was point of care diagnostics segment, generating sales of $19.4bn in 2018, which accounted for 28.0% of overall IVD sales.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand new 204-page report you will receive 180 charts– all unavailable elsewhere.

The 204-page report provides clear detailed insight into the leading in vitro diagnostics (IVD) companies. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand-new report today you stay better informed and ready to act.

Report Scope

• In Vitro Diagnostics (IVD) revenues in 2017 and 2018 by Class:

• Point-of-Care

• Clinical Chemistry

• Immunochemistry

• Hematology

• Microbiology

• Genetic Testing

• Others

• In Vitro Diagnostics (IVD) revenue forecast for 2019, 2024 and 2029 by Class:

• Point-of-Care

• Clinical Chemistry

• Immunochemistry

• Hematology

• Microbiology

• Genetic Testing

• Others

• This report profiles and discusses the selected leading in vitro diagnostics (IVD) companies:

• Abbott Laboratories

• Arkray, Inc.

• Becton, Dickinson and Company (BD)

• bioMérieux SA

• Bio-Rad Laboratories, Inc.

• Dako (Agilent Technologies)

• Danaher Corporation

• Genomic Health

• Laboratory Corporation of America (LabCorp)

• MDxHealth

• Myriad Genetics

• QIAGEN

• Roche

• Siemens AG

• Sysmex Corporation

• Thermo Fisher Scientific

• Other companies

• This report discusses sales and recent performance analysis, key products, strengths and challenges, historical revenues, revenue forecast, market share forecast, mergers and acquisition (M&A) activity, strategic collaborations

• Analysis of factors that drive and restrain the in vitro diagnostics (IVD) market.

• Key Questions Answered by this Report:

• Who are the leading IVD manufacturers?

• What factors are driving and restraining growth for the leading IVD manufacturers?

• How have the leading IVD manufacturers performed financially in recent years?

• Which IVD manufacturers will experience revenue growth over the coming years?

• What are the strength and weakness of the leading IVD manufacturers?

• What strategies have IVD manufacturers been implementing for sales growth in recent years?

Visiongain’s study is intended for anyone requiring commercial analyses for the leading in vitro diagnostics (IVD) companies. You find data, trends and predictions.

Buy our report today Medical Devices Leader Series: Top In Vitro Diagnostics (IVD) Market Analysis : Danaher Corporation, Abbott Laboratories, Bio-Rad Laboratories, Roche, Siemens AG, Sysmex, Other Companies.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1. Report Overview

1.1 How This Report Delivers Information

1.2 Main Questions This Report Answers

1.3 Who is This Report for?

1.4 Methods of Research and Analysis

1.5 Frequently Asked Questions (FAQs)

1.6 Associated Visiongain Reports

1.7 About Visiongain

2. An Introduction to In Vitro Diagnostics

2.1 The In Vitro Diagnostics Market

2.1.1 The In Vitro Diagnostics Market in 2018

2.2 What are In Vitro Diagnostic (IVD) Tests?

2.3 Classifying In Vitro Diagnostics

2.3.1 The US Classification

2.3.2 The EC (European Commission) Classification

2.3.3 Regulatory Issues in the IVD Market

2.3.3.1 Regulation of IVD Tests

2.3.3.2 Lack of Clarity Can Be Costly

2.4 Types of IVD Test

2.4.1 Point of Care Diagnostics

2.4.2 Clinical Chemistry

2.4.3 Microbiology

2.4.3.1 Regulatory Differences with IVD Microbiology Tests

2.4.4 Haematology

2.4.5 Immunochemistry

2.4.6 Genetic Testing

2.5 The IVD Market: Overall Revenue Forecast to 2029

2.5.1 Market Drivers, 2019-2029

2.5.2 Market Restraints, 2019-2029

2.5.3 Future of the IVD Industry

2.6 Company Comparison

2.6.1 Fragmented Market

2.6.2 IVD Market: Leading Manufacturers in 2018

3. The Leading US in Vitro Diagnostic Companies, 2019-2029

3.1 Danaher Corporation

3.1.1 Sales and Recent Performance Analysis

3.1.2 Diagnostics

3.1.3 Key Products

3.1.4 Danaher Manufacturing Capabilities

3.1.5 Danaher IVD Segment: Strengths and Challenges

3.1.6 Danaher’s Life Sciences and Diagnostics Revenues

3.1.7 IVD Revenue Forecast, 2018-2029

3.1.8 Recent Mergers and Acquisition (M&A) Activity

3.2 Abbott Laboratories

3.2.1 Sales and Recent Performance Analysis

3.2.2 Abbott: Diagnostics Segment

3.2.2.1 In Vitro Diagnostics Products

3.2.3 Abbott IVD Segment: Strengths and Challenges

3.2.4 Abbott Diagnostics Historical Revenues, 2015-2017

3.2.5 IVD Revenue Forecast, 2019-2029

3.2.6 Recent M&A Activity and Strategic Collaborations

3.2.6.1 Collaboration with GSK

3.2.6.2 Collaboration with Merck

3.2.6.3 Acquisition of Alere, Inc.

3.3 Bio-Rad Laboratories, Inc.

3.3.1 Sales and Recent Performance Analysis

3.3.2 Clinical Diagnostics

3.3.2.1 In Vitro Diagnostics

3.3.3 IVD Revenue 2018

3.3.4 IVD Revenue Forecast, 2019-2029

3.3.5 Recent M&A Activity and Strategic Collaborations

3.3.6 Potential Bio-Rad Labs Takeover Seen in Near-Term

3.4 Becton, Dickinson and Company

3.4.1 Global Presence

3.4.2 Distribution

3.4.3 R&D

3.4.4 Sales and Recent Performance Analysis

3.4.4.1 Historical Sales Performance Analysis

3.4.5 BD Diagnostics Revenue

3.4.6 IVD Revenue Forecast, 2019-2029

3.4.7 Recent M&A Activity and Strategic Collaborations

3.5 Thermo Fisher Scientific

3.5.1 Historical Sales and Recent Performance Analysis

3.5.2 Clinical Diagnostics

3.5.3 Key Products

3.5.4 Thermo Fisher’s Manufacturing Capabilities

3.5.5 Thermo Fisher’s Diagnostics Revenues

3.5.6 IVD Revenue Forecast 2019-2029

3.5.7 Recent Mergers and Acquisition Activity

4. The Leading European In Vitro Diagnostic Companies, 2019-2029

4.1 Hoffmann-La Roche Ltd.

4.1.1 Global Presence

4.1.2 Sales and Recent Performance Analysis

4.1.3 Roche Diagnostics

4.1.4 R&D Capabilities

4.1.5 Growing Portfolio of Diagnostic Products

4.1.5.1 Exploring Strategies in the Neurological Sector

4.1.6 IVD Revenue Forecast 2019-2029

4.1.7 Recent M&A Activity and Strategic Collaborations

4.2 Siemens AG

4.2.1 Sales and Recent Performance, 2017

4.2.2 Siemens Healthcare

4.2.2.1 Siemens Diagnostics

4.2.2.2 Outperforming the Market

4.2.2.3 In Vitro Diagnostics

4.2.3 IVD Revenue Forecast 2019-2029

4.2.4 Recent M&A Activity and Strategic Collaborations

4.2.4.1 Partnership with ViiV Healthcare

4.2.4.2 Partnership with Tocagen

4.2.4.3 Acquisition of Fast Track Diagnostics

4.3 bioMérieux S.A.

4.3.1 Sales and Recent Performance, 2017

4.3.2 IVD Revenue Forecast 2019-2029

4.3.3 Recent M&A Activity and Strategic Collaborations

4.3.3.1 Partnership with GSK

4.3.3.2 Partnership with Ipsen

4.3.3.3 Partnership with Institute Merieux and Institute Pasteur

4.3.3.4 Collaboration with Hospices Civils de Lyon

4.3.3.5 Acquisition of ARGENE

4.3.3.6 Equity Interest in Knome

5. The Leading Japanese In Vitro Diagnostic Companies, 2019-2029

5.1 Sysmex Corporation

5.1.1 Global Presence and Distribution

5.1.2 Sales and Recent Performance Analysis

5.1.3 Sysmex Diagnostics

5.1.4 IVD Revenue Forecast 2019-2029

5.1.5 Recent M&A Activity and Strategic Collaborations

5.1.5.1 Acquisition of Katakura’s Research Institute of Biological Science

5.1.5.2 Collaboration with IDEXX Labs to Expand into Animal Diagnostics

5.2 Arkray, Inc.

5.2.1 Global Presence

5.2.2 R&D

5.2.3 IVD Product Portfolio

5.2.4 Sales and Recent Performance Analysis

5.2.5 IVD Revenue Forecast 2019-2029

6. Emerging In Vitro Diagnostic Companies, 2018

6.1 Pipeline and Other Companies: An Overview, 2018

6.2 Other Prominent In Vitro Diagnostic Players

6.3 Dako (Agilent Technologies)

6.3.1 Sales and Recent Performance Analysis

6.3.2 M&A Activity and Other Key Developments

6.4 Genomic Health, Inc.

6.4.1 Sales and Recent Performance Analysis

6.4.2 R&D Capabilities

6.4.2.1 TAILORx Clinical Trial

6.4.2.2 RxPonder Trial

6.4.2.3 Partnership with Oncomed

6.5 Laboratory Corporation of America (LabCorp)

6.5.1 Sales and Recent Performance Analysis

6.5.2 In Vitro Diagnostics

6.6 Recent M&A Activity and Other Key Developments

6.6.1 Non-Exclusive License Agreement with Merck

6.6.2 Acquisition of Genzyme Genetics

6.6.3 Partnership with ARCA Biopharma

6.7 MDxHealth, Inc.

6.7.1 Sales and Recent Performance Analysis, 2017

6.7.2 R&D Capabilities

6.7.3 In Vitro Diagnostics

6.7.3.1 PharmacoMDx

6.7.3.2 PredictMDx for Brain Cancer

6.7.3.3 PredictMDx for Colon Cancer

6.7.3.4 Partnership with GSK

6.8 Myriad Genetics, Inc.

6.8.1 Sales and Recent Performance Analysis

6.8.2 R&D Capabilities

6.8.3 In Vitro Diagnostics

6.8.3.1 Myriad RBM

6.8.4 M&A Activity and Recent Partnerships

6.8.4.1 Agreement with BioMarin Pharmaceutical

6.8.4.2 Acquisition of Myriad RBM

6.8.4.3 Strategic Debt Investment in Crescendo Bioscience

6.8.4.4 Agreement with Cephalon

6.8.4.5 Agreement with PharmaMar

6.9 QIAGEN N.V.

6.9.1 Sales and Recent Performance Analysis

6.9.2 Continued Expansion in the Emerging Markets

6.9.3 R&D Capabilities

6.9.3.1 More than 15 Projects to Co-Develop and Market Diagnostic Products

6.9.3.2 Provider of Choice for Molecular Diagnostic Tools

6.9.4 Recent M&A Activity and Other Developments

6.9.4.1 Acquisition of Cellestis Ltd.

6.9.4.2 Acquisition of Ipsogen

6.9.4.3 Partnership with Pfizer

6.9.4.4 Partnership with Eli Lilly

7. Other In-Vitro Diagnostic Companies, 2018

7.1 Hologic, Inc.

7.1.1 Sales and Recent Performance Analysis

7.1.2 In Vitro Diagnostics

7.1.3 Recent M&A Activity and Strategic Collaborations

7.2 Bayer AG

7.2.1 Sales and Recent Performance Analysis

7.2.2 In Vitro Diagnostics

7.2.3 Recent M&A Activity and Strategic Collaborations

7.3 Transasia Bio-Medicals Ltd.

7.3.1 In Vitro Diagnostics

7.3.2 Recent M&A Activity and Strategic Collaborations

7.4 PerkinElmer, Inc.

7.4.1 Sales and Recent Performance Analysis

7.4.2 In Vitro Diagnostics

7.4.3 Recent M&A Activity and Strategic Collaborations

7.5 DiaSorin S.p.A.

7.5.1 Sales and Recent Performance Analysis

7.5.2 In Vitro Diagnostics

7.5.3 Recent M&A Activity and Strategic Collaborations

7.6 Koninklijke Philips N.V.

7.6.1 Sales and Recent Performance Analysis

7.6.2 In Vitro Diagnostics

7.6.3 Recent M&A Activity and Strategic Collaborations

7.7 Illumina, Inc.

7.7.1 Sales and Recent Performance Analysis

7.7.2 In Vitro Diagnostics

7.7.3 Recent M&A Activity and Strategic Collaborations

7.8 Kem-en-tec Diagnostics A/S

7.8.1 In Vitro Diagnostics

7.8.2 Recent M&A Activity and Strategic Collaborations

8. Conclusions

8.1 In Vitro Diagnostics: Attractive Segment of the Healthcare Market

8.2 Big Pharma Dominated the IVD Market in 2018

8.3 The Rise of ‘Generic Medical Devices’

8.4 What Will Succeed in the IVD Market?

8.5 Small Companies Can Have a Big Impact on the Industry and Market to 2029

Appendices

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 2.1 IVD Revenues ($bn) and Market Shares (%) by Class, 2017-2018

Table 2.2 Advantages and Disadvantages of POC Diagnostics

Table 2.3 IVD Tests: Overall World Market and Submarket Revenue Forecasts ($bn), 2018, 2019, 2024 & 2029

Table 2.4 Leading Manufacturers: IVD Market Share (%), 2018

Table 2.5 Leading Companies in the IVD Market: Net Sales ($bn) and Market Shares (%), 2018

Table 3.1 Danaher: Key Facts

Table 3.2 Danaher: Net Sales ($bn) and Revenue Shares (%) by Business Segment, 2017

Table 3.3 Danaher: Life Sciences & Diagnostics Revenue ($bn), AGR (%), 2015-2017

Table 3.4 Danaher: IVD Revenue ($bn), Growth (%), CAGR (%), Market Share (%), Forecast 2019-2029

Table 3.5 Abbott: Key Facts

Table 3.6 Abbott: Net Sales ($bn) and Revenue Shares (%) by Business Segment, 2017

Table 3.7 Abbott: Revenues ($bn) and Revenue Shares (%) by Geographical Region, 2017

Table 3.8 Abbott: Diagnostics Revenue ($bn), AGR (%), 2015-2017

Table 3.9 Abbott: IVD Revenue ($bn), Growth (%), CAGR (%), Market Share (%), Forecast 2019-2029

Table 3.10 Bio-Rad: Key Facts

Table 3.11 Bio-Rad: Clinical Diagnostics Revenue ($bn), AGR (%) 2015-2017

Table 3.12 Bio-Rad: IVD Revenue Forecast ($bn), Growth (%), CAGR (%), Market Share (%) 2019-2029

Table 3.13 BD: Key Facts

Table 3.14 Becton Dickinson: Net Sales ($bn) and Revenue Shares (%) by Sector, 2017

Table 3.15 BD: Diagnostics Revenue ($bn), AGR (%) 2015-2017

Table 3.16 BD: IVD Revenue ($bn), Growth (%), CAGR (%), Market Share (%), Forecast 2019-2029

Table 3.17 Thermo Fisher: Key Facts

Table 3.18 Thermo Fisher: IVD Sales ($bn), AGR (%), 2015-2017

Table 3.19 Thermo Fisher: IVD Revenue ($bn), Growth (%), CAGR (%), Market Share (%), Forecast 2019-2029

Table 4.1 Roche: Key Facts

Table 4.2 Roche: Revenue ($bn) and Revenue Shares (%) by Sector, 2017

Table 4.3 Roche Diagnostics: Revenue ($bn) and Revenue Shares (%) by Sector, 2017

Table 4.4 Roche Diagnostics: Marketed Diagnostic Products

Table 4.5 Roche: IVD Revenue ($bn), Growth (%), CAGR (%), Market Share (%), Forecast 2019-2029

Table 4.6 Siemens: Key Facts

Table 4.7 Siemens: Revenue ($bn) and Revenue Shares (%) by Sector, 2017

Table 4.8 Siemens: Revenue ($bn) and Revenue Shares (%) by Region, 2017

Table 4.9 Siemens: IVD Revenue ($bn), Growth (%), CAGR (%), Market Share (%), Forecast 2019-2029

Table 4.10 bioMérieux: Key Facts

Table 4.11 bioMérieux: Revenue ($bn) and Revenue Shares (%) by Sector, 2017

Table 4.12 bioMérieux: Clinical Applications Revenue ($bn) and Revenue Shares (%) by Sector, 2017

Table 4.13 bioMérieux: IVD Revenue ($bn), Growth (%), CAGR (%), Market Share (%), Forecast 2019-2029

Table 5.1 Sysmex: Key Facts

Table 5.2 Sysmex: Revenue ($bn) by Sector, 2017

Table 5.3 Sysmex: IVD Revenue ($bn), Growth (%), CAGR (%), Market Share (%), Forecast 2019-2029

Table 5.4 Arkray: Key Facts

Table 5.5 Arkray: IVD Revenue ($bn), Growth (%), CAGR (%), Market Share (%), Forecast 2019-2029

Table 6.1 Agilent: Revenue ($bn) and Revenue Shares (%) by Sector, 2017

Table 6.2 Dako: Marketed Diagnostic Products, 2017

Table 6.3 Genomic Health: Revenue ($m) and Revenue Shares (%) by Reporting Segment, 2017

Table 6.4 Genomic Health: R&D Expense ($m) and R&D Expense as a Percentage of Sales (%), 2013-2017

Table 6.5 LabCorp: Revenues ($bn) and Revenue Shares (%) by Reporting Segment, 2017

Table 6.6 Selected List of LabCorp’s Menu of Diagnostic Products, 2017

Table 6.7 MDxHealth: Revenue ($m) and Revenue Shares (%) by Reporting Segment, 2017

Table 6.8 MDxHealth: In Vitro Diagnostics Pipeline, 2017

Table 6.9 Myriad: Revenue ($m) and Revenue Shares (%) by Sector, 2017

Table 6.10 Myriad Molecular Diagnostics: Revenue ($m) and Revenue Shares (%) by Product, 2017

Table 6.11 Myriad Molecular Diagnostics: Revenue ($m) and Revenue Shares (%) by Sector, 2017

Table 6.12 Myriad: Biomarker Product Portfolio, 2017

Table 6.13 Myriad: Diagnostic Products, 2017

Table 6.14 QIAGEN: Revenue ($m) and Revenue Shares (%) by Customer Class, 2017

Table 6.15 QIAGEN: Revenue ($m) and Revenue Shares (%) by Region, 2017

Table 6.16 QIAGEN: Selected List of Co-development Projects

Table 6.17 QIAGEN: Selected Marketed Diagnostic Products

Table 6.18 QIAGEN: Recent M&A Activity

Table 6.19 Other Companies Operating in the IVD Market, 2018

Table 7.1 Hologic, Inc.: Key Facts

Table 7.2 Hologic, Inc.: Revenue ($bn) and Revenue Shares (%) by Reporting Segment, 2017

Table 7.3 Hologic, Inc.: Product Revenue ($bn) and Revenue Shares (%) by Reporting Segment, 2017

Table 7.4 Hologic, Inc.: Clinical Diagnostics Revenue ($bn), AGR (%) 2015-2017

Table 7.5 Bayer AG: Key Facts, 2017

Table 7.6 Bayer AG: Revenue ($bn) and Revenue Shares (%) by Reporting Segment, 2017

Table 7.7 Transasia Bio-Medicals Ltd: Key Facts, 2017

Table 7.8 PerkinElmer, Inc.: Key Facts, 2017

Table 7.9 PerkinElmer, Inc.: Revenue ($bn) and Revenue Shares (%) by Reporting Segment, 2017

Table 7.10 PerkinElmer, Inc.: Product Revenue ($bn) and Revenue Shares (%) by Reporting Segment, 2017

Table 7.11 PerkinElmer, Inc.: Clinical Diagnostics Revenue ($bn), AGR (%) 2015-2017

Table 7.12 DiaSorin: Key Facts, 2017

Table 7.13 DiaSorin: Revenue ($m) and Revenue Shares (%) by Geography, 2017

Table 7.14 Koninklijke Philips N.V.: Key Facts, 2017

Table 7.15 Koninklijke Philips N.V.: Revenue ($bn) and Revenue Shares (%) by Reporting Segment, 2017

Table 7.16 Koninklijke Philips N.V.: Diagnosis & Treatment Revenue ($bn), AGR (%) 2015-2017

Table 7.17 Koninklijke Philips N.V.: Diagnosis & Treatment Product Revenue ($bn) and Revenue Shares (%) by Reporting Segment, 2017

Table 7.18 Illumina, Inc.: Key Facts

Table 7.19 Illumina, Inc.: Revenue ($bn) and Revenue Shares (%) by Reporting Segment, 2017

Table 7.20 Kem-en-tec Diagnostics A/S: Key Facts

Table 8.1 Leading IVD Manufacturers by Company Type, 2018

List of Figures

Figure 2.1 IVD Market ($bn) by Class 2018

Figure 2.2 IVD: Overall Market ($bn) Forecast, 2018, 2019, 2024 & 2029

Figure 2.3 IVD Market: Drivers and Restraints, 2019-2029

Figure 2.4 Leading Companies in the IVD Market: Net Sales ($bn), 2018

Figure 2.5 Leading Companies in the IVD Market: (% Share), 2018

Figure 3.1 Danaher: Net Sales ($bn) by Business Segment, 2017

Figure 3.2 Danaher: Revenue Shares (%) by Business Segment, 2017

Figure 3.3 Danaher: IVD Revenue ($bn) Forecast, AGR (%), 2019-2029

Figure 3.4 Danaher: IVD Market Share (%), 2019-2029

Figure 3.5 Abbott: Net Sales ($bn) by Business Segment, 2017

Figure 3.6 Abbott: Revenue Shares (%) by Business Segment, 2017

Figure 3.7 Abbott: Revenues ($bn) by Region, 2017

Figure 3.8 Abbott: Revenue Shares (%) by Region, 2017

Figure 3.9 Abbott: IVD Revenue ($bn) Forecast, AGR (%), 2019-2029

Figure 3.10 Abbott: IVD Market Share (%), 2019-2029

Figure 3.11 Bio-Rad: Historical Diagnostics Revenues ($bn) 2014-2017

Figure 3.12 Bio-Rad: Revenue Shares (%) by Business Segment, 2017

Figure 3.13 Bio-Rad: Revenue Shares (%) by Region, 2017

Figure 3.14 Bio-Rad: IVD Revenue Forecast ($bn), AGR (%), 2019-2029

Figure 3.15 Bio-Rad: IVD Market Share (%), 2019-2029

Figure 3.16 Becton Dickinson: Revenue Shares (%) by Sector, 2017

Figure 3.17 BD: Company Revenue ($bn), 2015-2017

Figure 3.18 BD IVD Revenue Forecast ($bn), AGR (%), 2019-2029

Figure 3.19 BD: IVD Market Share (%), 2019-2029

Figure 3.20 Thermo Fisher: IVD Net Sales ($bn), 2015-2017

Figure 3.21 Thermo Fisher: Revenue Shares (%) by Sector, 2017

Figure 3.22 Thermo Fisher: IVD Revenue ($bn) Forecast, AGR (%), 2019-2029

Figure 3.23 Thermo Fisher: IVD Market Share (%), 2019-2029

Figure 3.24 Thermo Fisher: Mergers & Acquisitions

Figure 4.1 Roche: Revenues ($bn) by Sector, 2017

Figure 4.2 Roche: Revenue Shares (%) by Sector, 2017

Figure 4.3 Roche Diagnostics: Revenues ($bn) by Sector, 2017

Figure 4.4 Roche Diagnostics: Revenue Shares (%) by Sector, 2017

Figure 4.5 Roche: IVD Revenue ($bn), AGR (%), Forecast, 2019-2029

Figure 4.6 Roche: IVD Market Share (%), 2019-2029

Figure 4.7 Siemens: Revenue Shares (%) by Sector, 2017

Figure 4.8 Siemens Healthcare: Revenue Shares (%) by Region, 2017

Figure 4.9 Siemens: IVD Revenue ($bn), AGR (%), Forecast 2019-2029

Figure 4.10 Siemens: IVD Market Share (%), 2019-2029

Figure 4.11 bioMérieux: Revenue ($bn) by Sector, 2017

Figure 4.12 bioMérieux: Revenue Shares (%) by Sector, 2017

Figure 4.13 bioMérieux: Clinical Applications Revenue ($bn) by Sector, 2017

Figure 4.14 bioMérieux: Clinical Applications Revenue Shares (%) by Sector, 2017

Figure 4.15 bioMérieux: IVD Revenue ($bn), AGR (%), Forecast, 2019-2029

Figure 4.16 bioMérieux: IVD Market Share (%), 2019-2029

Figure 5.1 Sysmex: Revenues ($bn) by Sector, 2017

Figure 5.2 Sysmex: Revenue Shares (%) by Sector, 2017

Figure 5.3 Sysmex: Net Sales (%) by Geographical Region, 2017

Figure 5.4 Sysmex: IVD Revenue ($bn) Forecast, AGR (%), 2019-2029

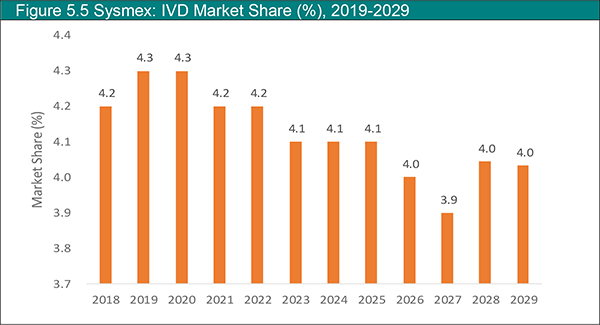

Figure 5.5 Sysmex: IVD Market Share (%), 2019-2029

Figure 5.6 Arkray: IVD Revenue ($bn) Forecast, (AGR %), 2019-2029

Figure 5.7 Arkray: IVD Market Share (%), 2019-2029

Figure 6.1 Agilent: Revenue ($bn) by Sector, 2017

Figure 6.2 Dako: Revenue Shares (%) by Sector, 2017

Figure 6.3 Genomic Health: Historical Revenues ($m) and Net Income ($m), 2013-2017

Figure 6.4 Genomic Health: Revenue Shares (%) by Reporting Segment, 2017

Figure 6.5 Genomic Health: Historical R&D Expense ($m) and R&D as a Percentage of Net Sales (%), 2013-2017

Figure 6.6 LabCorp: Historical Revenue ($bn), Profit ($bn), 2013-2017

Figure 6.7 LabCorp: Revenues ($bn) by Reporting Segment, 2017

Figure 6.8 LabCorp: Revenue Shares (%) by Reporting Segment, 2017

Figure 6.9 MDxHealth: Revenues ($m) by Reporting Segment, 2017

Figure 6.10 MDxHealth: Revenue Shares (%) by Reporting Segment, 2017

Figure 6.11 Myriad: Historical Net Revenues ($m), 2013-2017

Figure 6.12 Myriad: Revenue Shares (%) by Sector, 2017

Figure 6.13 Myriad Molecular Diagnostics: Revenue Shares (%) by Product, 2017

Figure 6.14 Myriad Molecular Diagnostics: Revenue Shares (%) by Sector, 2017

Figure 6.15 Myriad: Historical R&D Investments ($m), 2013-2017

Figure 6.16 QIAGEN: Historical Revenue ($bn), Net Income ($bn), 2013-2017

Figure 6.17 QIAGEN: Revenues ($m) by Customer Class, 2017

Figure 6.18 QIAGEN: Revenue Shares (%) by Customer Class, 2017

Figure 6.19 QIAGEN: Revenue Shares (%) by Region, 2017

Figure 6.20 QIAGEN: Historical R&D Expense ($m) and R&D Expense as a Percentage of Net Revenue (%), 2013-2017

Figure 7.1 Hologic, Inc.: Historical Revenues ($bn) and Net Income ($bn), 2013-2017

Figure 7.2 Hologic, Inc.: Revenue Shares (%) by Reporting Segment, 2017

Figure 7.3 Hologic, Inc.: Revenue Shares (%) by Reporting Segment, 2017

Figure 7.4 Hologic, Inc.: Revenue Shares (%) by Region, 2017

Figure 7.5 Hologic, Inc.: Diagnostics Revenue Shares (%), 2017

Figure 7.6 Bayer AG: Historical Revenues ($bn) and Net Income ($bn), 2013-2017

Figure 7.7 Bayer AG: Revenue Shares (%) by Reporting Segment, 2017

Figure 7.8 Bayer AG: Revenue Shares (%) by Region, 2017

Figure 7.9 PerkinElmer, Inc.: Historical Revenues ($bn), 2013-2017

Figure 7.10 PerkinElmer, Inc.: Revenue Shares (%) by Reporting Segment, 2017

Figure 7.11 PerkinElmer, Inc.: Revenue Shares (%) by Reporting Segment, 2017

Figure 7.12 PerkinElmer, Inc.: Revenue Shares (%) by Region, 2017

Figure 7.13 PerkinElmer, Inc.: Diagnostics Revenue Shares (%), 2017

Figure 7.14 DiaSorin: Historical Revenues ($m), 2013-2017

Figure 7.15 DiaSorin: Revenue Shares (%) by Region, 2017

Figure 7.16 Koninklijke Philips N.V.: Historical Revenues ($bn), 2013-2017

Figure 7.17 Koninklijke Philips N.V.: Revenue Shares (%) by Reporting Segment, 2017

Figure 7.18 Koninklijke Philips N.V.: Revenue Shares (%) by Region, 2017

Figure 7.19 Koninklijke Philips N.V.: Diagnosis & Treatment Revenue ($b), 2017

Figure 7.20 Koninklijke Philips N.V.: Diagnosis & Treatment Revenue ($bn) by Product, 2017

Figure 7.21 Koninklijke Philips N.V.: Diagnosis & Treatment Revenue Shares (%) by Product, 2017

Figure 7.22 Illumina, Inc.: Historical Revenues ($bn) and Net Income ($bn), 2013-2017

Figure 7.23 Illumina, Inc.: Revenue Shares (%) by Reporting Segment, 2017

Figure 7.24 Illumina, Inc.: Revenue Shares (%) by Region, 2017

Figure 8.1 IVD Market: Overall World Revenue ($bn), (AGR%) 2019-2029

Figure 8.2 IVD Market: Revenue ($bn) Forecasts, 2018, 2019, 2024, and 2029

AB SCIEX

Abbott Laboratories

AbD Serotec

Agilent Technologies

Alacris Theranostics GmbH

Alere

Amoy Diagnostics Co. Ltd

Analytical Informatics, Inc.

Arca biopharma

ARGENE

Arkray, Inc.

Astute Medical

Bayer

Beckman Coulter

Becton Dickinson

BioFire Diagnostics, LLC

BioMarin Pharmaceutical Inc.

bioMérieux

Bio-Rad Laboratories

Bristol-Myers Squibb

C. R. Bard, Inc.

Calbiotech Group of Companies

CareFusion

Carmel Pharma AB

Cartagenia

Cell Signaling Technology

Celldex Therapeutics

Cellestis Ltd.

Cellular Research

Cephalon

Cepheid

Chugai Pharmaceuticals

Clearbridge BioMedics

Constitutional Medical, Inc. (CMI)

Crescendo Bioscience

Dako

Danaher

DiaMed Holding

Diasis Diagnostik Sistemler Ticaret Ve Sanayi A.S.

DiaSorin S.p.A.

Diesse

Dionex

Eli Lilly

Epitomics

EQT

Erba Diagnostics Mannheim GmbH Group

Erba -Transasia

eScreen Inc.

EskoArtwork

European Commission (EC)

Fast Track Diagnostics (FTD)

Focus Diagnostics

Food and Drug Administration (FDA)

Furuno Electric Co., Ltd.

GenCell Biosystems

Genentech

Genetic Analysis

Genomic Health

Genzyme Genetics

GlaxoSmithKline (GSK)

GnuBIO Inc.

Grifols

Haliodx

Hologic, Inc.

Illumina, Inc.

Inostics Inc.

Institut Merieux

InterMune

Ipsogen S.A.

IRIS International

JEOL Ltd.

Johnson & Johnson

Kappa Biosystems, Inc.

Katakura Industries Co., Ltd.

Kem-En-Tec Diagnostics

Knome, Inc.

Koninklijke Philips N.V.

LabIndia

Laboratory Corporation of America (LabCorp)

Laetus

Leica Microsystems

Life Technologies

LipoScience, Inc.

Lyon Civil Hospitals

Maxmat SA

MDS

MDxHealth

Medica

Merck & Co.

Merck KGaA

Monogram Biosciences

MorphoSys AG

Myriad Genetics

Navman Wireless

Nobel Biocare

NovioGendix Holding B.V.

Oncomed

Oxford University

Pall

Pasteur Sanofi Diagnostics

PerkinElmer, Inc.

Pfizer

Phadia

Pharma Mar

Phenomenex

PreAnalytiX GmbH

Propel Labs

QIAGEN

Quest Diagnostics

Remote Diagnostic Technologies (RDT)

Roche

Rules-Based Medicine Inc.

Schering Plough

Seahorse Bioscience

Siemens AG

Siemens Healthcare GmbH

Siemens Healthineers

Sividon Diagnostics

St. Jude Medical

Sysmex

Sysmex Corporation

Sysmex Inostics GmBH

Thermo Fisher

Thermo Fisher Scientific

TOA Corporation

TOA Medical Electronics

Tocagen

Transasia Bio-Medicals Ltd.

Tulip Diagnostics Private Ltd.

Unisensor

Van Andel Research Institute

Vanadis Diagnostics, AB

Ventana

ViiV Healthcare

VSS Monitoring

XOS

X-Rite

Download sample pages

Complete the form below to download your free sample pages for Medical Devices Leader Series: Top In Vitro Diagnostics (IVD) Companies 2019-2029

Related reports

-

Global Stem Cell Technologies and Applications Market 2019-2029

The global stem cell technologies and applications market is estimated to have reached $14bn in 2018 and is expected to...

Full DetailsPublished: 31 July 2019 -

Global Diagnostic Imaging Market Forecast 2019-2029

The global diagnostic imaging market is estimated to have reached $24.1bn in 2018. Ultrasound Imaging Systems segment held the largest...Full DetailsPublished: 20 September 2019 -

Drug Delivery Technologies Market Forecast 2019-2029

The Drug Delivery Technologies market is estimated to grow at a CAGR of 8.3% in the first half of the...

Full DetailsPublished: 27 February 2019 -

Global Alzheimer’s Disease Therapeutics and Diagnostics Market 2018-2028

The Alzheimer’s Disease Therapeutics and Diagnostics Market will reach $7.93bn in 2018. The Alzheimer’s Disease Therapeutics and Diagnostics Market is...

Full DetailsPublished: 18 June 2018 -

Needle-Free Delivery Technology Market 2018-2028

The global needle-free delivery technology market was valued at $1.7bn in 2017 and is estimated to reach $5.5bn by 2028,...Full DetailsPublished: 21 August 2018 -

Global Urology Devices Market Forecast 2019-2029

In 2018, the urology devices market is estimated at $6.9bn and is expected to grow at a CAGR of 6.1%...

Full DetailsPublished: 21 May 2019 -

Radiation Oncology Market Report 2020-2030

Much opportunity remains in this growing radiation oncology market. See how to exploit the opportunities

...Full DetailsPublished: 01 January 1970 -

Global Cancer Immunotherapy Market Forecast 2019-2029

The world cancer immunotherapy market is expected to grow at a CAGR of 11.4% in the second half of the...Full DetailsPublished: 21 January 2019 -

Molecular Diagnostics Market Report 2020-2030

Read on to discover the most lucrative areas in the industry and the future market prospects. Our new study lets...

Full DetailsPublished: 01 January 1970 -

Global Parkinson’s Disease Drug Market Forecast 2018-2028

Besides revenue forecasting to 2026, our new study provides you with recent results, growth rates, and market shares. We provide...

Full DetailsPublished: 22 January 2018

Download sample pages

Complete the form below to download your free sample pages for Medical Devices Leader Series: Top In Vitro Diagnostics (IVD) Companies 2019-2029

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Latest Pharma news

Visiongain Publishes Drug Delivery Technologies Market Report 2024-2034

The global Drug Delivery Technologies market is estimated at US$1,729.6 billion in 2024 and is projected to grow at a CAGR of 5.5% during the forecast period 2024-2034.

23 April 2024

Visiongain Publishes Cell Therapy Technologies Market Report 2024-2034

The cell therapy technologies market is estimated at US$7,041.3 million in 2024 and is projected to grow at a CAGR of 10.7% during the forecast period 2024-2034.

18 April 2024

Visiongain Publishes Automation in Biopharma Industry Market Report 2024-2034

The global Automation in Biopharma Industry market is estimated at US$1,954.3 million in 2024 and is projected to grow at a CAGR of 7% during the forecast period 2024-2034.

17 April 2024

Visiongain Publishes Anti-obesity Drugs Market Report 2024-2034

The global Anti-obesity Drugs market is estimated at US$11,540.2 million in 2024 and is expected to register a CAGR of 21.2% from 2024 to 2034.

12 April 2024