Industries > Pharma > Global Antibacterial Drugs Market 2019-2029

Global Antibacterial Drugs Market 2019-2029

Cephalosporins, Penicillins, Fluoroquinolones, Macrolides, Carbapenems and Others

The global antibacterial drugs market is estimated to have reach $43bn in 2018 and is expected to grow at a CAGR of 2% in the first half of the forecast period. The Cephalosporins submarket held 28% of the global antibacterial drugs market in 2018.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand new 297-page report you will receive 144 tables and 105 figures– all unavailable elsewhere.

The 297-page report provides clear detailed insight into the global antibacterial drugs market analysis. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand-new report today you stay better informed and ready to act.

Report Scope

• Global Antibacterial Drugs Market forecasts from 2019-2029

• Revenue forecasts for the 6 leading submarkets from 2019-2029:

• Cephalosporins

• Penicillins

• Fluoroquinolones

• Macrolides

• Carbapenems

• Others

• Revenue forecasts for the 43 leading marketed antibacterial drugs from 2019-2029:

• Cephalosporins: Rocephin, Sulperazon, Ceftin/Zinnat, Meiact, Flomox, Teflaro, Zeftera, Ceftolozane-tazobactam, Ceftazidime-Avibactam

• Penicillins: Generic amoxicillin, Augmentin, Zosyn/Tazocin, Unasyn, Generic amoxicllin-clavulanic acid, Amoxil

• Fluoroquinolones: Avelox, Cravit, Vigamox, Ciprodex, Cipro/Ciprobay, Geninax, Defafloxacin

• Macrolides: Biaxin/Clarith, Zithromax, Dalacin, Dificid, Solithromycin

• Carbapenems: Invanz, Merrem/Meropen, Primaxin, Doribax

• Other antibacterial drugs: Zyvox, Cubicin, Tygacil, TOBI/TIP, Solodyn, Vibativ, Sirturo, Tedizolid, Oritavancin, Dalbavancin, Nemonoxacin, Surotomycin

• Revenue forecasts for the leading regional markets forecasted in this report are the following:

• North America

• Europe

• Asia-Pacific

• RoW

Each regional market is further segmented by the 6 leading submarkets.

• Revenue forecasts for the leading national markets forecasted in this report are the following:

• The US

• Japan

• Italy

• France

• The UK

• Spain

• Germany

• China

• India

• Brazil

• Russia

• South Korea

• This report discusses the selected leading companies:

• Adenium Biotech ApS,

• Allecra Therapeutics GmbH

• AstraZeneca

• Bayer

• BioVersys AG

• Eli Lilly

• GlaxoSmithKline (GSK)

• Merck & Co.

• Novartis

• Pfizer

• Analysis of the strengths, weaknesses as well as the opportunities and threats of the antibacterial drugs industry and market

• Coverage of antibacterial drug candidates in the R&D pipeline. Discussions of research and development – see progress in this industry, finding technological, clinical and commercial outlooks and opportunities

• Key Questions Answered by this Report:

• Gain forecasts from 2019 to 2029 for the overall world market and its leading submarkets, as well as those for prominent national markets.

• Explore the regulatory landscape for leading regional and national markets, as well as expected developments for the period 2019-2029.

• Identify drug development trends that will affect market participants from 2019 to 2029. This report contains SWOT and STEP analysis for the forecast period.

• See discussions of companies developing, manufacturing and marketing antibiotics, exploring products, technologies, R&D, partnerships, M&A and outlooks.

Visiongain’s study is intended for anyone requiring commercial analyses for the Global Antibacterial Drugs Market. You find data, trends and predictions.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Overview of Findings

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Main Questions Answered by This Analysis

1.5 Who is This Study For?

1.6 Research and Analysis Methods

1.7 Frequently Asked Questions (FAQs)

1.8 Some Associated Reports

1.9 About Visiongain

2. Introduction to Antibacterial Drugs

2.1 Types of Bacterial Infection

2.2 Main Bacteria Causing Infections in Human Beings

2.3 Incidence and Mortality Profiles for Common Bacterial Infection

2.4 Treating Infections

2.4.1 The History of Antibacterial Drug Development

2.4.2 Mechanisms of Action

2.4.3 Leading Classes of Antibacterial Medicines

2.4.3.1 Cephalosporins

2.4.3.2 Penicillins

2.4.3.3 Carbapenems

2.4.3.4 Fluoroquinolones

2.4.3.5 Macrolides

2.4.4 Antibacterial Drug Resistance

3. Antibacterial Drugs: World Market 2019-2029

3.1 Antibacterial Drugs Revenues Plateau between 2013 and 2018

3.2 Antibacterial Agents - Market Segmentation

3.3 Antibacterial Drugs Market Forecast 2019-2029: Decline in Revenues for Fluoroquinolones

3.4 Drivers and Restraints in the Antibacterial Drugs Market, 2019-2029

3.5 Generic Erosion and Prescription Control Will Limit Market Growth

3.6 Changes in that Industry Sector’s Market Shares, 2019-2029

3.7 Pfizer is the Leader in the Antibacterial Drugs Market, 2018

3.8 Fragmented Market to Fracture Further

4. Cephalosporins Market Forecast 2019-2029

4.1 Cephalosporins Market 2018 – No Dominant Brands

4.1.1 Late-Stage Cephalosporins to Gain Market Share Between 2019 and 2029

4.1.2 Basilea, Merck, Actavis and AstraZeneca to Lead the Cephalosporins Market Between 2019 and 2029

4.1.3 Drivers and Restraints on the Cephalosporins Market, 2019-2029

4.1.4 Cephalosporins Lack Market Exclusivity

4.1.5 Strong Pipeline for Novel Cephalosporins

4.1.6 Rocephin (Roche) – The Only Treatment for Gonorrhoea in the US

4.1.6.1 Off Patent but Still Effective

4.1.6.2 Declining Revenues Owing to Competition - Forecast 2019-2029

4.1.7 Sulperazon – India’s Leading Treatment for RTIs and UTIs

4.1.7.1 Continued Growth in the Emerging Markets, Revenue Forecast 2019-2029

4.1.8 Zinnat/Ceftin – GSK’s Established Cephalosporin

4.1.8.1 Continued Decline in Revenue - Forecast 2019-2029

4.1.9 Meiact – A Broad Range Community Antibiotic

4.1.9.1 Spectracef Sales in the US Leads to Pass the Product

4.1.9.2 Competition in Japan to Hinder Growth – Revenue Forecast 2019-2029

4.1.10 Flomox - Shionogi’s Third-Generation Cephalosporin

4.1.10.1 Patent Issues and Litigation

4.1.10.2 Genericization and Safety to Restrict Sales - Forecast 2019-2029

4.1.11 Zinforo/Teflaro (ceftaroline fosamil): The First of the Fifth- Generation Cephalosporins

4.1.11.1 Unmet Needs in Pneumonia to Drive Growth - Revenue Forecast 2019-2029

4.1.12 Zeftera (ceftobiprole): Approved for Pneumonia in Europe

4.1.12.1 Future Sales Dictated by US Approval - Revenue Forecast 2019-2029

4.1.13 CXA-201 (Ceftolozane-Tazobactam): The Next Blockbuster Antibacterial

4.1.13.1 Broad Label and Spectrum of Activity Leads to Rapid Uptake - Revenue Forecast 2019-2029

4.1.14 Zavicefta (CAZ-AVI) (Ceftazidime-Avibactam): Approved in 2015

4.1.14.1 Competition from Zebraxa will Limit Sales of Zavicefta - Forecast 2019-2029

5. Penicillins Market Forecast 2019-2029

5.1 Generics and Augmentin Dominate the Penicillins Market in 2018

5.2 Augmentin to Lose its Dominance over the Coming 10 Years - Market Shares for Penicillin Drugs, 2019-2029

5.3 Penicillin Antibacterial Drugs: Market Forecast 2019-2029

5.4 Drivers and Restraints for the Penicillin Market 2019-2029

5.5 Augmentin – Blockbuster Facing Generic Competition

5.5.1 Augmentin – Challenges in Some Countries

5.5.2 Stable Revenues Regardless of Generic Competition

5.5.3 Revenue Forecast 2019-2029

5.6 Zosyn/Tazocin (Piperacillin-Tazobactam) - Pneumonia Therapeutic

5.6.1 Patent Expiry and Revenue Extension for Pfizer

5.6.2 Historic and Current Revenue Performance

5.6.3 Revenue Forecast 2019-2029

5.7 Unasyn – Gram-negative and Positive Antibiotic

5.7.1 Falling Revenues - Forecast 2019-2029

5.8 Amoxil (Amoxicillin) – A Historic Antibacterial Brand

5.8.1 Marginal Decline in Revenue - Forecast 2019-2029

5.9 Generic Amoxicillin

5.9.1 Revenue Forecast 2019-2029

5.10 Generic Amoxicillin-Clavulanic Acid

5.10.1 Revenue Forecast 2019-2029

6. Fluoroquinolones Market Forecast 2019-2029

6.1 The Fluoroquinolone Market 2018

6.2 Changing Market Share for Fluoroquinolone Antibacterial Drugs, 2019-2029

6.3 Fluoroquinolone Antibacterial Drugs: Market Forecast 2019-2029

6.4 Trends in the Fluoroquinolone Market

6.4.1 Safety Fears for Fluoroquinolones

6.4.2 Avelox Patent Cliff

6.4.3 Inhaled Fluoroquinolone Formulations

6.5 Fluoroquinolone Market Forecast 2019-2029

6.6 Avelox

6.6.1 Safety Profile Hampers Sales

6.6.2 Generic Competition

6.6.3 Revenue Forecast 2019-2029

6.7 Cravit/Levaquin (levofloxacin)

6.7.1 Generic Competition Affecting Revenue Worldwide

6.7.2 Lifecycle Management for Cravit and Levaquin

6.7.3 Revenue Forecast 2019-2029

6.8 Vigamox

6.8.1 Vigamox: Branded and Generic Challenges

6.8.2 Moxeza: A Next-Generation Form of Vigamox

6.8.3 Revenue Forecast 2019-2029

6.9 Ciprodex and Cipro – two Preparations of ciprofloxacin

6.9.1 Ciprodex: A Second-Generation Ophthalmic Antibiotic

6.9.1.1 Revenue Forecast 2019-2029

6.9.2 Cirpo Revenue Forecast 2019-2029: Continued Generic Erosion

6.10 Geninax

6.10.1 Revenue Forecast 2019-2029

6.11 Baxdela (delafloxacin)

6.11.1 Revenue Forecast 2019-2029

7. Macrolides Market Forecast 2019-2029

7.1 Macrolide Market in 2018

7.2 Changing Market Share for Macrolides, 2019-2029

7.3 Macrolide Antibacterial Drugs: Market Forecast 2019-2029

7.4 Trends in the Macrolide Market

7.5 Biaxin/Clarith

7.5.1 Past Revenue 2011-2015

7.5.2 Lifecycle Management for Continued Market Presence

7.5.3 Revenue Forecast 2019-2029

7.6 Zithromax

7.6.1 Concerns over Safety and Marketing in the US

7.6.2 Effectiveness in Drug-Resistant Strains

7.6.3 Revenue Forecast 2019-2029

7.7 Dalacin

7.7.1 Revenue Forecast 2019-2029

7.8 Dificid

7.8.1 Rapid Uptake Slowed by High Cost

7.8.2 New Approvals and Expanded Indications

7.8.3 Revenue Forecast 2019-2029

7.9 Solithera (solithromycin)

7.9.1 Revenue Forecast 2019-2029

8. Carbapenems Market Forecast 2019-2029

8.1 Carbapenem Market 2018

8.2 Changing Market Share for Carbapenems, 2019-2029

8.3 Carbapenem Antibacterial Drugs: Market Forecast 2019-2029

8.4 Trends in the Carbapenem Market

8.4.1 Rising Prevalence of Carbapenemases and β-Lactamases

8.4.2 No New Carbapenems in Late-Stage Trials

8.5 Merrem/Meropenem

8.5.1 Generics Affecting Revenue Worldwide

8.5.2 Revenue Forecast 2019-2029

8.6 Primaxin

8.6.1 Combination Therapy for Lifecycle Management

8.6.2 Historic and Current Revenues

8.6.3 Revenue Forecast 2019-2029

8.7 Invanz

8.7.1 Revenue Forecast 2019-2029

8.8 Doribax

8.8.1 Doribax in HAP and VAP

8.8.2 Lifecycle Management in Japan and the Rest of the World

8.8.3 Revenue Forecast 2019-2029

9. Other Antibacterial Drugs Forecast, 2019-2029

9.1 The Market for Other Classes of Antibacterial Drugs

9.2 Changing Market Share for Fluoroquinolone Antibacterials 2019-2029

9.3 Other Antibacterials: Market Forecast 2019-2029

9.4 Trends in the Other Classes of Antibacterial Drugs

9.4.1 New Oxazolidinones Will Drive Growth

9.4.2 New Drug Classes to Drive Submarket Growth to 2029

9.5 Zyvox – The Market Leading Antibacterial

9.5.1 MRSA Activity Driving Revenue Growth

9.5.2 Promise in Tuberculosis and Anthrax

9.5.3 Patents, Litigation, and Competition – When and Who Will Produce Generic Linezolid?

9.5.4 Flat Growth to Patent Expiry, Revenue Forecast 2019-2029

9.6 Cubicin – The Leading Brand for ABSSSIs

9.6.1 Revenue Boosted by Approvals Worldwide

9.6.2 Patents, Litigation and Deals – How Long Will Market Exclusivity Last?

9.6.3 Sustained Growth through to 2021, Revenue Forecast 2019-2029

9.7 Tygacil – A Tetracycline with Many Approved Indications

9.7.1 Concerns Limiting Revenue Potential

9.7.2 Competition from Other Therapies Restricts Growth: Revenue Forecast 2019-2029

9.8 TOBI/TOBI Podhaler – The Market Leading Inhaler for Cystic Fibrosis

9.8.1 Historic and Current Revenue Performance

9.8.2 Approvals and Launches in New Markets to Drive Revenue Growth

9.8.3 Competition to Limit Long-term Growth, Revenue Forecast 2019-2029

9.9 Solodyn – A Treatment for Severe Acne

9.9.1 Generic Competition and Lifecycle Management

9.9.2 Limited Potential for Dermatology, Revenue Forecast 2019-2029

9.10 Vibativ – Limited Potential for Novel Lipoglycopeptide

9.10.1 Astellas Ends its Collaboration with Theravance

9.10.2 Limited HAP Label in the US - Revenue Forecast 2019-2029

9.11 Sirturo – A New Option for Multi-Drug Resistant TB

9.11.1 Chronic Treatment Schedule and Emerging Demand Drive Revenue Growth, Forecast 2019-2029

9.12 Tedizolid – Market Leading Follow-on to Zyvox?

9.12.1 Competition Increasing: Revenue Forecast 2019-2029

9.13 Oritavancin – An Antibiotic with a Novel PK Profile

9.13.1 Single Dose Differentiation to Deliver Market Share (%), Revenue Forecast 2019-2029

9.14 Dalvance (dalbavancin) – Competing in a Crowded Indication

9.14.1 Sustained Growth Over the Coming 10 Years, Revenue Forecast 2019-2029

9.15 Surotomycin –Treatment for C. difficile

9.15.1 Delayed Launch to Limit Potential, Revenue Forecast 2019-2029

9.16 Nemonoxacin – Taiwan’s Global Antibacterial Drug

9.16.1 Slow Initial Growth to Accelerate with US Approval, Revenue Forecast 2019-2029

10. Global Anti-Bacterial Drugs Market by Region 2019-2029

10.1 North America Antibacterial Drugs Market, by Sector 2019-2029

10.2 Europe Antibacterial Drugs Market, by Sector 2019-2029

10.3 Asia-Pacific Antibacterial Drugs Market, by Sector 2019-2029

10.4 Rest-of-the-World Antibacterial Drugs Market, by Sector 2019-2029

11. The Leading National Markets 2019-2029

11.1 US and China Dominate the Global Antibacterial Market

11.2 Above-Average Growth in US: Regional Forecasts 2019-2029

11.3 China to Slump in Market Share, While Brazil and India Push on

11.4 Incidence of Infection by Country, 2016

11.4.1 Incidence of Pneumonia in National Markets – Pneumonia Predominant in America

11.4.2 Incidence of Community Acquired Urinary Tract Infections in National Markets – High Incidence Rates in the UK, US and Spain

11.4.3 Incidence of Bacterial Skin and Skin Structure Infections in National Markets – High Potential in the US

11.4.4 Incidence of Upper Respiratory Tract Infections in National Markets – Europe Leads the Way

11.5 Antibacterial Drug Consumption by Country, 2016

11.5.1 Antibacterial Drug Consumption in the Major National Markets

11.5.2 Antibacterial Drug Consumption in Some Other National Markets

11.6 The Antibacterials Market in the US

11.6.1 Continued Dominance of the US Market

11.7 The European Union Forms Second Largest Regional Market

11.7.1 Marginal Expansion in Antibacterial Spending – Market Forecast 2019-2029

11.7.2 Action to Encourage Antibacterial Drug Development in the EU

11.7.3 Italy Continues to Lead the Way in Antibiotic Use

11.7.4 The French Fascination with Expensive Antibacterial Drugs

11.7.5 Germany – Europe’s Antibiotic Steward

11.7.6 Rising Use of Antibacterials Drugs in the UK

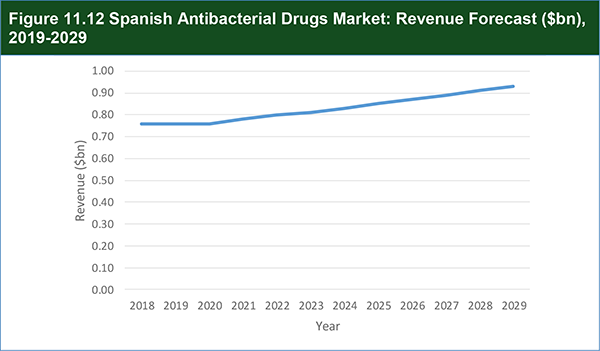

11.7.7 Spanish Antibacterials Market to Expand from 2021 to 2027

11.8 Japan – Still the Fourth Largest National Market

11.8.1 The Pause before Growth in the Japanese Market

11.9 Will South Korea Continue Its High Use of Antibiotics?

11.10 BRIC Nation Sales Still Expanding – Market Forecast 2019-2029

11.11 Chinese Antibacterial Market Bloated by Reported Overuse

11.11.1 Developing Antibacterials in China, for China

11.11.2 Governmental Controls Subdue Recent Growth – Market Forecast 2019-2029

11.12 Indian Market to Expand by 50% Over the Forecast Period

11.12.1 Restricting Antibiotic Use in India

11.12.2 Sustained Expansion of the Indian Market, Forecast 2019-2029

11.13 Brazilian Antibacterial Market to Double in Size

11.13.1 Brazilian Market to Be Driven by Drug Resistance

11.14 Russia: TB Prevalence to Stimulate Antibiotic Sales - Forecast 2019-2029

12. Leading Companies in the Antibacterial Drugs Market

12.1 Pfizer Inc.

12.1.1 Overview

12.1.2 Financials

12.1.3 Pipeline Portfolio

12.1.4 Key Developments

12.2 Novartis AG

12.2.1 Overview

12.2.2 Financials

12.2.3 Pipeline Portfolio

12.2.4 Key Developments

12.3 Merck & Co. Inc.

12.3.1 Overview

12.3.2 Financials

12.3.3 Product Portfolio

12.3.4 Key Developments

12.4 GlaxoSmithKline PLC

12.4.1 Overview

12.4.2 Financials

12.4.3 Product Portfolio

12.4.4 Key Developments

12.5 BioVersys AG

12.5.1 Overview

12.5.2 Pipeline Portfolio

12.5.3 Key Developments

12.6 AstraZeneca PLC

12.6.1 Overview

12.6.2 Financials

12.6.3 Pipeline Portfolio

12.6.4 Key Developments

12.7 Allecra Therapeutics GmbH

12.7.1 Overview

12.7.2 Pipeline Portfolio

12.7.3 Key Developments

12.8 Adenium Biotech ApS

12.8.1 Overview

12.8.2 Pipeline Portfolio

12.9 Bayer AG

12.9.1 Overview

12.9.2 Financials

12.9.3 Product Portfolio

12.10 Eli Lilly and Company

12.10.1 Overview

12.10.2 Financials

12.10.3 Pipeline Portfolio

13. Antibacterials R&D Pipeline Review, 2018

13.1 Gram-Positive vs. Gram-Negative

13.2 Pipeline Dominated by Small Molecule Drugs

13.3 Some of the Leading Phase I Drug Candidates

13.3.1 Nemiralisib (GlaxoSmithKline plc)

13.3.2 Piperacillin/AAI101 (Allecra Therapeutics GmbH

13.3.3 MEDI3502 (AstraZeneca plc)

13.3.4 PF-06760805 (Pfizer, Inc.)

13.3.5 GSK3335065 (GlaxoSmithKline plc)

13.4 Some of Leading Phase II Drug Candidates

13.4.1 Cefepime/AAI101 (Allecra Therapeutics GmbH)

13.4.2 Gepotidacin (GlaxoSmithKline plc)

13.4.3 GSK3536852A (GlaxoSmithKline plc)

13.4.4 QBW251 (Novartis AG)

13.4.5 GSK2982772 (GlaxoSmithKline plc)

13.5. Some of the Leading Phase III Drug Candidates

13.5.1 V114 (Merck & Co., Inc.)

13.5.2 ZERBAXA (Merck & Co., Inc.)

13.5.3 PT010 (AstraZeneca plc)

14. Qualitative Analysis of the Antibacterial Industry and Market, 2019-2029

14.1 SWOT Analysis: Strengths, Weaknesses, Opportunities and Threats Affecting Antibacterials, their Developers, Producers and Marketers

14.2 STEP Analysis: Social, Technological, Economic and Political Forces Affecting the Antibacterial Drug Industry and Market

14.2.1 Social Factors

14.2.2 Technological Developments

14.2.3 Economic Pressures

14.2.4 Political Issues

14.3 Market is Well Established and Demand Will Remain Strong

14.4 High Prevalence of Bacterial Infection Worldwide

14.5 Worldwide Demand for Antibacterials

14.6 Animal Models of Infection are Highly Predictive Compared with Other Therapeutic Fields

14.7 Cutting into a Saturated Market

14.8 Superior Benefit over Generics?

14.9 Resistance – Nature’s Patent Expiry

14.10 Acute Treatment Limits Commercial Potential

14.11 Did Big Pharma Back Away from Antibacterial Drugs?

14.12 Resistance Will Continue to Present New Targets

14.13 First Biologic Antibacterials

14.14 Potential for Smaller Firms to Capitalise

14.15 Developing Preventative Vaccines Rather Than Treatments

14.16 Antibacterial Stewardship Reduces Usage

14.17 Clinical Confusion from Inconsistent Guidance Between Regulatory Bodies

14.17.1 Therapeutic Success in European Clinical Trials

14.17.2 Primary End Points in FDA Guidelines

14.18 Reduction in Hospital Infection Rates - Reducing Demand for Antibacterial Drugs

14.19 Enticing Antibacterial Drug Discovery – Push and Pull Incentives

14.19.1 GAIN act: Post-Development Pull Incentives in the US

14.19.2 ADAPT – Building on the GAIN act

14.19.3 EMA Update Guideline – Streamlining Clinical Trials in the EU

14.19.4 Push Incentives for Antibacterial Drug Discovery with Public Funding

14.19.5 IMI: Public-Private Collaboration with GSK and AstraZeneca

14.19.6 Public Finance Pumping Money into Antibacterial Development

15. Antibacterial Drugs Market 2019 - 2029: Conclusions

15.1 Three Blockbuster Antibacterials in 2018 - Leading Brands

15.2 The Leading Branded Antibacterial Drugs in 2029

15.3 Stemming the Tide of Antibacterial Drug Resistance

15.4 The Changing Face of Antibacterial Clinical Development

Appendices

Some Associated Visiongain Reports

Visiongain Report Sales Order Form

About Visiongain

Visiongain Report Evaluation Form

List of Tables

Table 2.1 Common Bacterial Infections and Their Causes

Table 2.2 Details of the ESKAPE Bacteria

Table 2.3 Leading Causes of Infectious Diseases Deaths Worldwide, 2010

Table 2.4 Mechanisms of Action for Antibacterial Drugs

Table 3.1 Antibacterial Drugs: Historic Global Market Size ($bn), Annual Growth (%), and CAGR (%), 2013-2018

Table 3.2 Global Antibacterial Drug Market by Sector: Market Size ($bn) and Share (%), 2018

Table 3.3 Global Antibacterial Drugs Market: Revenue Forecasts by Sector ($bn), Annual Growth (%) and CAGR, 2019-2029

Table 3.4 Antibacterial Drugs Market: Forecasted Sector Market Shares (%), 2018-2029

Table 3.5 Leading Branded Antibacterials Manufacturers: Revenues ($bn) and Market Shares (%), 2018

Table 4.1 Leading Branded Cephalosporin Antibacterial Drugs: Important Facts, 2018

Table 4.2 Cephalosporin Market by Product: Revenue ($bn) and Market Share (%), 2018

Table 4.3 Cephalosporin Market by Product: Revenue ($bn) and Market Share (%), 2021

Table 4.4 Cephalosporin Market by Product: Revenue ($bn) and Market Share (%), 2029

Table 4.5 Cephalosporin Market Forecast by Product: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 4.6 Cephalosporin Market Forecast by Product: Market Share (%), 2018-2029

Table 4.7 Rocephin Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 4.8 Sulperazon Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 4.9 Zinnat/Ceftin Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 4.10 Meiact Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 4.11 Flomox Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 4.12 Zinforo in-vitro Antibacterial Activity: Gram-positive and Gram-negative Bacteria

Table 4.13 Zinforo/Teflaro Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 4.14 Zeftera Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 4.15 Zerbraxa Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 4.16 Zavicefta Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 5.1 Leading Branded Penicillin Drugs: Important Facts

Table 5.2 Penicillin Market by Product: Revenue ($bn) and Market Shares (%), 2018

Table 5.3 Penicillin Market by Product: Revenue ($bn) and Market Shares (%), 2019

Table 5.4 Penicillin Market by Product: Revenue ($bn) and Market Shares (%), 2029

Table 5.5 Penicillin Market Forecast by Product: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 5.6 Penicillin Market Forecast by Product: Market Share (%), 2019-2029

Table 5.7 Augmentin Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 5.8 Zosyn/Tazocin Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 5.9 Unasyn Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 5.10 Amoxil Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 5.11 Generic Amoxicillin Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 5.12 Generic Amoxicillin-Clavulanic Acid Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 6.1 Leading Branded Fluoroquinolone Drugs: Important Facts

Table 6.2 Fluoroquinolone Market by Product: Revenue ($bn) and Market Share (%), 2018

Table 6.3 Fluoroquinolone Market by Product: Revenue ($bn) and Market Share (%), 2019

Table 6.4 Fluoroquinolone Market by Product: Revenue ($bn) and Market Share (%), 2029

Table 6.5 Fluoroquinolone Market Forecast by Product: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 6.6 Fluoroquinolone Market Forecast by Product: Market Share (%), 2018-2029

Table 6.7 Avelox Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 6.8 Generic Manufacturers of Levofloxacin, 2017

Table 6.9 Cravit/Levaquin Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 6.10 Vigamox Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 6.11 Ciprodex Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 6.12 Cipro/Ciprobay Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 6.13 Geninax Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 6.14 Baxdxela Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 7.1 Leading Branded Macrolides: Important Facts

Table 7.2 Macrolide Market by Product: Revenue ($bn) and Market Share (%), 2018

Table 7.3 Macrolide Market by Product: Revenue ($bn) and Market Share (%), 2019

Table 7.4 Macrolide Market by Product: Revenue ($bn) and Market Share (%), 2029

Table 7.5 Macrolide Market Forecast by Product: Revenues ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 7.6 Macrolide Market Forecast by Product: Market Shares (%), 2019-2029

Table 7.7 Biaxin/Clarith Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 7.8 Zithromax Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 7.9 Dalacin Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 7.10 Dificid Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 7.11 Solithera Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 8.1 Leading Branded Carbapenems: Important Facts

Table 8.2 Carbapenem Market by Product: Revenue ($bn) and Market Share (%), 2018

Table 8.3 Carbapenem Market by Product: Revenue ($bn) and Market Share (%), 2019

Table 8.4 Carbapenem Market by Product: Revenue ($bn) and Market Share (%), 2029

Table 8.5 Carbapenem Market Forecasts by Product: Revenues ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 8.6 Carbapenem Market Forecast by Product: Market Share (%), 2019-2029

Table 8.7 Merrem Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 8.8 Primaxin Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 8.9 Invanz Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 8.10 Doribax Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 9.1 Other Leading Branded Antibacterials: Important Facts

Table 9.2 Other Classes of Antibacterial Drugs by Product: Revenue ($bn) and Market Share (%), 2018

Table 9.3 Other Classes of Antibacterial Drugs by Product: Revenue ($bn) and Market Share (%), 2019

Table 9.4 Other Classes of Antibacterial Drugs by Product: Revenue ($bn) and Market Share (%), 2029

Table 9.5 Others Market Forecasts by Product: Revenues ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 9.6 Other Agents: Market Forecast by Product - Market Share (%), 2018-2029

Table 9.7 Oxazolidinones in Mid to Late Stage Clinical Development, 2017

Table 9.8 Zyvox Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 9.9 Cubicin Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 9.10 Tygacil Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 9.11 TOBI/TOBI Podhaler Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 9.12 Solodyn Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 9.13 Vibativ Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 9.14 Sirturo Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 9.15 Tedizolid Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 9.16 Oritavancin Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 9.17 Dalvance Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 9.18 Surotomycin Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 9.19 Nemonoxacin Forecast: Revenue ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 10.1 Antibacterial Drug Sales by Regions: Market Size ($bn) and Share (%), 2018

Table 10.2 North America Antibacterial Drug Sales, 2018-2029

Table 10.3 Europe Antibacterial Drug Sales, 2018-2029

Table 10.4 Asia-Pacific Antibacterial Drug Sales, 2018-2029

Table 10.5 Rest-of-the-World Antibacterial Drug Sales, 2018-2029

Table 11.1 Antibacterial Drug Sales by National and Regional Markets: Market Size ($bn) and Share (%), 2018

Table 11.2 Antibacterial Drug Markets: National and Regional Market Sizes ($bn), Annual Growth (%), and CAGR (%), 2019-2029

Table 11.3 Antibacterial Drug Markets: National and Regional Market Shares (%), 2018-2029

Table 11.4 Incidence of Pneumonia in National Markets, 2016

Table 11.5 Incidence of Community Acquired Urinary Tract Infections in National Markets, 2016

Table 11.6 Incidence of Bacterial Skin and Skin Structure Infections in National Markets, 2016

Table 11.7 Incidence of Upper Respiratory Tract Infections in National Markets, 2016

Table 11.8 Antibacterial Drug Consumption in the Major National Markets: DDD per Capita per Day and Absolute DDD per year, 2016

Table 11.9 Antibacterial Drug Consumption in the Smaller National Markets: DDD per Capita per Day and Absolute DDD per year, 2016

Table 11.10 US Antibacterial Drugs Market: Revenue Forecast ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 11.11 EU Antibacterial Drugs Market Overall and by Leading Country (EU5): Revenue Forecasts ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 11.12 Italian Antibacterial Drugs Market: Revenue Forecast ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 11.13 French Antibacterial Drugs Market: Revenue Forecast ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 11.14 German Antibacterial Drugs Market: Revenue Forecast ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 11.15 UK Early Stage Antibacterial Drug Developers, 2016

Table 11.16 UK Antibacterial Drugs Market: Revenue Forecast ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 11.17 Spanish Antibacterial Drugs Market: Revenue Forecast ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 11.18 Japanese Antibacterial Drugs Market: Revenue Forecast ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 11.19 South Korean Antibacterial Drugs Market: Revenue Forecast ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 11.20 Antibacterial Drugs Market in BRIC Nations: National Revenue Forecasts ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 11.21 Chinese Antibacterial Drugs Market: Revenue Forecast ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 11.22 Indian Antibacterial Drugs Market: Revenue Forecast ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 11.23 Brazilian Antibacterial Drugs Market: Revenue Forecast ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 11.24 Russian Antibacterial Drugs Market: Revenue Forecast ($bn), Annual Growth (%), CAGR (%), 2019-2029

Table 12.1 Pfizer Inc. Recent Financials, 2015-2017

Table 12.2 Pfizer Inc. Recent Financials, 2015-2017

Table 12.3 Novartis AG: Pipeline Portfolio

Table 12.4 Novartis AG: Developments

Table 12.5 Merck & Co. Inc.: Product Portfolio

Table 12.6 Merck & Co. Inc.: Developments

Table 12.7 Merck & Co. Inc.: Product Portfolio

Table 12.8 GlaxoSmithKline PLC: Developments

Table 12.9 BioVersys AG: Pipeline Portfolio

Table 12.10 BioVersys AG: Pipeline Portfolio

Table 12.11 AstraZeneca PLC: Product Portfolio

Table 12.12 AstraZeneca PLC: Developments

Table 12.13 Allecra Therapeutics GmbH: Pipeline Portfolio

Table 12.14 Allecra Therapeutics GmbH: Developments

Table 12.15 Adenium Biotech ApS: Pipeline Portfolio

Table 12.16 Bayer AG Product Portfolio

Table 12.17 Eli Lilly and Company: Recent Financials, 2015-2017

Table 13.1 Antibacterial Drug Candidates in Phase I Development, 2018

Table 13.2 Antibacterial Drug Candidates in Other Drug Development Phase, 2018

Table 13.3 Antibacterial Drug Candidates in Phase II Development, 2018

Table 13.4 Antibacterial Drug Candidates in Phase III Development, 2018

Table 14.1 Social, Technological, Economic, and Political Factors Affecting the Antibacterial Drug Market, 2019-2029

Table 14.2 Bacterial Related Funding for BARDA, 2011-2014

Table 15.1 World Antibacterial Drugs Market by Class: Revenues ($bn), Market Shares (%), CAGRs (%), 2019, 2021, 2024, and 2029

List of Figures

Figure 2.1 Leading Causes of Infectious Disease Deaths Worldwide, 2010

Figure 2.2 Key Events in the History of Antibacterial Drug Development

Figure 3.1 Historic Global Market Size ($bn), 2013-2017

Figure 3.2 Global Antibacterial Drug Market by Sector: Market Share (%), 2018

Figure 3.3 Global Antibacterial Drugs Market: Forecasted Sector (Class) Revenues ($bn), 2019-2029

Figure 3.4 Antibacterial Drugs Market: Forecasted Sector Market Shares (%), 2019

Figure 3.5 Antibacterial Drugs Market: Forecasted Sector Market Shares (%), 2029

Figure 3.6 Leading Branded Antibacterial Manufacturers: Market Share (%), 2018

Figure 4.1 Cephalosporin Market by Product: Market Share (%), 2018

Figure 4.2 Cephalosporin Market by Product: Market Share (%), 2021

Figure 4.3 Cephalosporin Market by Product: Market Share (%), 2029

Figure 4.4 Cephalosporin Market Forecast: Revenue ($bn), 2019-2029

Figure 4.5 Cephalosporin Market: Drivers and Restraints, 2019-2029

Figure 4.6 Rocephin Forecast: Revenue ($bn), 2019-2029

Figure 4.7 Sulperazon Forecast: Revenue ($bn), 2019-2029

Figure 4.8 Zinnat/Ceftin Forecast: Revenue ($bn), 2019-2029

Figure 4.9 Meiact Forecast: Revenue ($bn), 2019-2029

Figure 4.10 Flomox Forecast: Revenue ($bn), 2019-2029

Figure 4.11 Zinforo/Teflaro Forecast: Revenue ($bn), 2019-2029

Figure 4.12 Zeftera Forecast: Revenue ($bn), 2019-2029

Figure 4.13 Zerbraxa Forecast: Revenue ($bn), 2019-2029

Figure 4.14 Zavicefta Forecast: Revenue ($bn), 2019-2029

Figure 5.1 Penicillin Market by Product: Market Share (%), 2018

Figure 5.2 Penicillin Market by Product: Market Share (%), 2019

Figure 5.3 Penicillin Market by Product: Market Share (%), 2029

Figure 5.4 Penicillin Market Forecast: Revenue ($bn), 2019-2029

Figure 5.5 Augmentin Forecast: Revenue ($bn), 2019-2029

Figure 5.6 Zosyn/Tazocin Forecast: Revenue ($bn), 2019-2029

Figure 5.7 Unasyn Forecast: Revenue ($bn), 2019-2029

Figure 5.8 Amoxil Forecast: Revenue ($bn), 2019-2029

Figure 5.9 Generic Amoxicillin Forecast: Revenue ($bn), 2019-2029

Figure 5.10 Generic Amoxicillin-Clavulanic Acid Forecast: Revenue ($bn), 2019-2029

Figure 6.1 Fluoroquinolone Market by Product: Market Share (%), 2018

Figure 6.2 Fluoroquinolone Market by Product: Market Share (%), 2019

Figure 6.3 Fluoroquinolone Market by Product: Market Share (%), 2029

Figure 6.4 Fluoroquinolone Market Forecast: Revenue ($bn), 2019-2029

Figure 6.5 Avelox Forecast: Revenue ($bn), 2019-2029

Figure 6.6 Cravit/Levaquin Forecast: Revenue ($bn), 2019-2029

Figure 6.7 Vigamox Forecast: Revenue ($bn), 2019-2029

Figure 6.8 Ciprodex Forecast: Revenue ($bn), 2019-2029

Figure 6.9 Cipro/Ciprobay Forecast: Revenue ($bn), 2019-2029

Figure 6.10 Geninax Forecast: Revenue ($bn), 2019-2029

Figure 6.11 Baxdela Forecast: Revenue ($bn), 2019-2029

Figure 7.1 Macrolide Market by Product: Market Share (%), 2018

Figure 7.2 Macrolide Market by Product: Market Share (%), 2019

Figure 7.3 Macrolide Market by Product: Market Share (%), 2029

Figure 7.4 Macrolide Market Forecast: Revenue ($bn), 2019-2029

Figure 7.5 Biaxin/Clarith Forecast: Revenue ($bn), 2019-2029

Figure 7.6 Zithromax Forecast: Revenue ($bn), 2019-2029

Figure 7.7 Dalacin Forecast: Revenue ($bn), 2019-2029

Figure 7.8 Dificid Forecast: Revenue ($bn), 2019-2029

Figure 7.9 Solithera Forecast: Revenue ($bn), 2019-2029

Figure 8.1 Carbapenem Market by Product: Market Share (%), 2018

Figure 8.2 Carbapenem Market by Product: Market Share (%), 2019

Figure 8.3 Carbapenem Market by Product: Market Share (%), 2029

Figure 8.4 Carbapenem Market Forecast: Revenue ($bn), 2019-2029

Figure 8.5 Merrem Forecast: Revenue ($bn), 2019-2029

Figure 8.6 Primaxin Forecast: Revenue ($bn), 2019-2029

Figure 8.7 Invanz Forecast: Revenue ($bn), 2019-2029

Figure 8.8 Doribax Forecast: Revenue ($bn), 2019-2029

Figure 9.1 Other Classes of Antibacterial Drugs by Product: Market Share (%), 2018

Figure 9.2 Other Classes of Antibacterial Drugs by Product: Market Share (%), 2019

Figure 9.3 Other Classes of Antibacterial Drugs by Product: Market Share (%), 2029

Figure 9.4 Other Agents Market Forecast by Product: Revenue ($bn), 2019-2029

Figure 9.5 Zyvox Forecast: Revenue ($bn), 2019-2029

Figure 9.6 Cubicin Forecast: Revenue ($bn), 2019-2029

Figure 9.7 Tygacil Forecast: Revenue ($bn), 2019-2029

Figure 9.8 TOBI/TOBI Podhaler Forecast: Revenue ($bn), 2019-2029

Figure 9.9 Solodyn Forecast: Revenue ($bn), 2019-2029

Figure 9.10 Vibativ Forecast: Revenue ($bn), 2019-2029

Figure 9.11 Sirturo Forecast: Revenue ($bn), 2019-2029

Figure 9.12 Tedizolid Forecast: Revenue ($bn), 2019-2029

Figure 9.13 Oritavancin Forecast: Revenue ($bn), 2019-2029

Figure 9.14 Dalvance Forecast: Revenue ($bn), 2019-2029

Figure 9.15 Surotomycin Forecast: Revenue ($bn), 2019-2029

Figure 9.16 Nemonoxacin Forecast: Revenue ($bn), 2019-2029

Figure 10.1 Global Antibacterial Drug Sales by Regions: Market Share (%), 2018

Figure 11.1 Antibacterial Drug Sales by National and Regional Markets: Market Share (%), 2018

Figure 11.2 Antibacterial Drug Market Forecasts: National and Regional Market Sizes ($bn), 2019-2029

Figure 11.3 Absolute Annual Antibacterial Drug Consumption by Nation, 2016

Figure 11.4 Per Capita Antibacterial Drug Consumption by Nation, 2016

Figure 11.5 US Antibacterial Drugs Market: Revenue Forecast ($bn), 2019-2029

Figure 11.6 EU Antibacterial Drugs Market by Leading Country (EU5): Revenue Forecasts ($bn), 2019-2029

Figure 11.7 Italian Antibacterial Drugs Market: Revenue Forecast ($bn), 2019-2029

Figure 11.8 French Antibacterial Drugs Market: Revenue Forecast ($bn), 2019-2029

Figure 11.9 German Antibacterial Drugs Market: Revenue Forecast ($bn), 2019-2029

Figure 11.10 UK Antibacterial Drugs Market: Revenue Forecast ($bn), 2019-2029

Figure 11.11 Spanish Antibacterial Drugs Market: Revenue Forecast ($bn), 2019-2029

Figure 11.12 Japanese Antibacterial Drugs Market: Revenue Forecast ($bn), 2019-2029

Figure 11.13 South Korean Antibacterial Drugs Market: Revenue Forecast ($bn), 2019-2029

Figure 11.14 Antibacterial Drugs Market in BRIC Nations: National Revenue Forecasts ($bn), 2019-2029

Figure 11.15 Chinese Antibacterial Drugs Market: Revenue Forecast ($bn), 2019-2029

Figure 11.16 Indian Antibacterial Drugs Market: Revenue Forecast ($bn), 2019-2029

Figure 11.17 Brazilian Antibacterial Drugs Market: Revenue Forecast ($bn), 2019-2029

Figure 11.18 Russian Antibacterial Drugs Market: Revenue Forecast ($bn), 2019-2029

Figure 12.1 Pfizer Inc. Recent Financials, 2015-2017

Figure 12.2 Novartis AG: Recent Financials, 2015-2017

Figure 12.3 Merck & Co. Inc. Recent Financials, 2015-2017

Figure 12.4 GlaxoSmithKline PLC: Recent Financials, 2015-2017

Figure 12.5 AstraZeneca PLC: Recent Financials, 2015-2017

Figure 12.6 Bayer AG: Recent Financials, 2015-2017

Figure 12.7 Eli Lilly and Company: Recent Financials, 2015-2017

Figure 14.1 Strengths and Weaknesses of the Antibacterial Drug Market, 2019-2029

Figure 14.2 Opportunities and Threats for the Antibacterial Drug Market, 2019-2029

Figure 14.3 Strategies and Technologies to Prevent Hospital Acquired Infections, 2018

Abbott Laboratories

AbbVie

Achaogen

Actavis

Actelion

Affinium Pharmaceutical

AiCuris GmbH & Co. KG

Alcon

Alkem Laboratories

Allergan

Allied Pharma

Apotex

APP Pharmaceuticals

Aptalis Pharma

Aquapharm Biodiscovery

Aradigm

Aridis Pharmaceuticals

Ascend Therapeutics

Astellas Pharma

AstraZeneca

Aurobindo Pharma

Barr Pharmaceuticals

Basilea Pharmaceuticals

Bayer Laboratories

Biomax Biotechnics

Bristol-Myers Squibb

Cadila Healthcare

Calixa Therapeutics

Cardeas Pharma

Cellceutix

Cempra Pharmaceuticals

Cipla

Claris Lifesciences

Cornerstone Biopharma

Cornerstone Therapeutics

Corona Remedies

Critical Therapeutics

Cubist Pharmaceuticals

Daiichi Sankyo

Dainippon Sumitomo

Discuva

Dr. Reddy’s Laboratories

Durata Therapeutics

Eli Lilly

Emcure Pharmaceuticals

Eros Pharma

Forest Laboratories

Furiex Pharmaceuticals

Gate Pharma

Gilead Sciences

Glenmark

GlycoVaxyn

GlaxoSmithKline (GSK)

Hetero

Hi-Tech Pharma

Hikma Farmaceutica

Hospira

Insmed

Intercell

Itochu Chemical Frontier

Janssen Pharmaceuticals

Johnson & Johnson

KaloBios

Kenta Biotech

Kuhnil Pharm

Lupin

Macleod Pharmaceuticals

Medicis

MedImmune

Meiji

Melinta Therapeutics

Merck & Co.

Merlion Pharmaceuticals

Microlabs

MicuRx Pharmaceuticals

Mpex Pharmaceuticals

Mylan

Nabriva Therapeutics

Nalneva

Neiss Labs

Nektar Therapeutics

Novacta Biosystems

Novartis

Novexel

Optimer Biotechnology

Orchid Chemicals

Orchid Healthcare

Ortho-McNeil

Paratek Pharmaceuticals

Peninsula Pharmaceuticals

Pfizer

Pharmacia

Phico Therapeutics

Piramal Healthcare

Plenus Pharmaceuticals

Pliva

Polyphor

Procarta Biosystems

Procter & Gamble Pharmaceuticals

Ranbaxy

Redx Pharma

Roche

Roxane

R-Pharma

Sagent Pharmaceuticals

Sandoz

Sanofi

Savara Pharmaceuticals

Sawai Pharmaceutical

Schering Plough

Seika Pharma

Sequella

Shanghai MengKe Pharmaceuticals

Shionogi

Shire

Sidmak Labs

Solitaire Pharmacia

Specialised Therapeutics Australia

Sunovion Pharma

TaiGen Biotechnology

Taisho Toyama

Takeda

TAP Holdings

Targanta Therapeutics

Tetraphase Pharmaceuticals

Teva Pharmaceutical Industries

The Medicines Company

Theravance

Torrent Pharmaceuticals

Trius Therapeutics

TTY Biopharma

Unichem Laboratories

Valeant Pharmaceuticals

Vansen Pharma

ViroPharma

Warner Chilcott

Watson

Wockhardt

Zhejiang Medicine Company

Zuellig Pharma

Zydus Pharmaceuticals

List of Organisations Mentioned in the Report

Agência Nacional de Vigilância Sanitária (ANVISA)

Duke University

European Medicines Agency (EMA)

Food and Drug Administration (FDA)

Ministry of Health, Labour and Welfare (MHLW)

Michigan State University

National Institute for Health and Clinical Excellence (NICE)

National Institutes of Health (NIH)

University of Connecticut

World Health Organization (WHO)

Download sample pages

Complete the form below to download your free sample pages for Global Antibacterial Drugs Market 2019-2029

Related reports

-

Global Urology Devices Market Forecast 2019-2029

In 2018, the urology devices market is estimated at $6.9bn and is expected to grow at a CAGR of 6.1%...

Full DetailsPublished: 21 May 2019 -

Global Drug Discovery Outsourcing Market Forecast to 2028

The global drug discovery outsourcing market is estimated to have reach $22.69bn in 2018, dominated by the chemistry services segment....

Full DetailsPublished: 16 April 2019 -

mRNA Vaccines and Therapeutics Market Forecast 2019-2029

The mRNA Vaccines and Therapeutics Market is estimated at $3.43 billion in 2018. The Standardized Therapeutic Cancer mRNA Vaccines segment...

Full DetailsPublished: 07 May 2019 -

Global Precision Medicine Market Forecast 2019-2029

The global precision medicine market is expected to grow at an estimated CAGR of 10.5% from 2018 to 2029. In...Full DetailsPublished: 30 May 2019 -

Pharma Leader Series: Top Generic Drug Producers Market Forecast 2019-2029

The top 10 generic drug producers have 61% share of the total revenue made by these top 50 companies. ...Full DetailsPublished: 29 January 2019 -

Needle-Free Delivery Technology Market 2018-2028

The global needle-free delivery technology market was valued at $1.7bn in 2017 and is estimated to reach $5.5bn by 2028,...Full DetailsPublished: 21 August 2018 -

Global Antidepressant and Anti-Anxiety Drugs Market 2019-2029

The global antidepressant and Anti-anxiety drugs market is estimated to have reached $12.16bn in 2018. In 2018, the SSRIs segment...

Full DetailsPublished: 29 March 2019 -

The Global Respiratory Inhalers Market 2018-2028

The global respiratory inhalers market reached $33bn in 2017 and is estimated to reach $38bn by 2023. In 2017, the...

Full DetailsPublished: 24 October 2018 -

Top 25 Dermatological Drugs Manufacturers 2019

Dermatological drugs market has been growing over the last decade. A combination of significant new market launches, and corporate activities...

Full DetailsPublished: 15 April 2019 -

Biobanking Market Forecasts 2019-2029

In 2018, biobanking for research purposes was estimated at $2.2bn. The overall biobanking market is estimated to grow at a...Full DetailsPublished: 23 May 2019

Download sample pages

Complete the form below to download your free sample pages for Global Antibacterial Drugs Market 2019-2029

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Latest Pharma news

Press Release: Peripheral Vascular Device Market Report 2024-2034

The global Peripheral Vascular Devices market is estimated at US$12.49 billion in 2024 and is projected to grow at a CAGR of 8.5% during the forecast period 2024-2034.

30 April 2024

Press Release: Drug Delivery Technologies Market Report 2024-2034

The global Drug Delivery Technologies market is estimated at US$1,729.6 billion in 2024 and is projected to grow at a CAGR of 5.5% during the forecast period 2024-2034.

23 April 2024

Visiongain Publishes Cell Therapy Technologies Market Report 2024-2034

The cell therapy technologies market is estimated at US$7,041.3 million in 2024 and is projected to grow at a CAGR of 10.7% during the forecast period 2024-2034.

18 April 2024

Visiongain Publishes Automation in Biopharma Industry Market Report 2024-2034

The global Automation in Biopharma Industry market is estimated at US$1,954.3 million in 2024 and is projected to grow at a CAGR of 7% during the forecast period 2024-2034.

17 April 2024