Industries > Automotive > E-hailing Market Outlook Report 2019-2029

E-hailing Market Outlook Report 2019-2029

Forecasts by Vehicle Type (Passenger Car, Bikes, Other), by Distance Type (Short Distance, Long Distance, Outstation), by Payment Type (Cash/Mobile Wallet, In-App), by Region, Country and Profiling of Leading Mobility Service Providers (MSP) & Transportation Network Companies (TNC) Developing On-Demand Shared Mobility-as-a-Service (MaaS) Technologies

The phenomenal growth in E-hailing, popularised by Uber but also other key players, is a major transition in how people travel. Car usage is gradually shifting away from car ownership towards an ‘on-demand mobility’ model whereby cars are hailed for each individual journey. This is especially the case for younger people, and those in developing countries who cannot afford to purchase a car or pay for insurance. This not only has profound implications for the carmarkers, but also city planners, regulators and government.

As a result, the global e-hailing market has seen double-digit growth in the recent past, owing to the consistent inflows of investor funding coupled with the convenience offered by such apps. While, the developed countries already have a strong public transportation infrastructure, the developing countries with comparatively weaker infrastructure and commuting options, have been embracing e-hailing services even more positively. With the growing number of smart cities and usage of connectivity, the industry in the future is anticipated to become a major contributor to the mainframe public transportation infrastructure in several countries.

Visiongain evaluates the E-hailing market at $15.12bn in 2019.

Report scope

Global E-hailing Forecast From 2019-2029

E-hailing Forecasts By Vehicle Type From 2019-2029

Passenger Car E-hailing Forecast From 2019-2029

Bikes E-hailing Forecast From 2019-2029

Other E-hailing Forecast From 2019-2029

E-hailing Forecasts By Distance Type From 2019-2029

Short Distance E-hailing Forecast From 2019-2029

Long Distance E-hailing Forecast From 2019-2029

Outstation E-hailing Forecast From 2019-2029

E-hailing Forecasts By Payment Type From 2019-2029

Cash/ Mobile Wallet E-hailing Forecast From 2019-2029

In-App E-hailing Forecast From 2019-2029

Regional E-hailing Forecasts From 2019-2029

North America E-hailing Forecast From 2019-2029

US E-hailing Forecast From 2019-2029

Canada E-hailing Forecast From 2019-2029

Mexico E-hailing Forecast From 2019-2029

Latin America E-hailing Forecast From 2019-2029

Brazil E-hailing Forecast From 2019-2029

Argentina E-hailing Forecast From 2019-2029

Rest of Latin America E-hailing Forecast From 2019-2029

Europe E-hailing Forecast From 2019-2029

UK E-hailing Forecast From 2019-2029

Germany E-hailing Forecast From 2019-2029

France E-hailing Forecast From 2019-2029

Italy E-hailing Forecast From 2019-2029

Rest of Europe E-hailing Forecast From 2019-2029

Asia Pacific E-hailing Forecast From 2019-2029

China E-hailing Forecast From 2019-2029

India E-hailing Forecast From 2019-2029

Malaysia E-hailing Forecast From 2019-2029

Singapore E-hailing Forecast From 2019-2029

Rest of Asia Pacific E-hailing Forecast From 2019-2029

MEA E-hailing Forecast From 2019-2029

UAE E-hailing Forecast From 2019-2029

South Africa E-hailing Forecast From 2019-2029

Rest of MEA E-hailing Forecast From 2019-2029

Profiling Of Leading E-hailing Companies

Uber Technologies, Inc.

Ola Cabs

GrabTaxi Holdings Pte. Ltd.

Easy Taxi Serviços Ltda

Lyft, Inc.

Careem Inc.

Beijing Xiaoju Technology Co, Ltd

PT Aplikasi Karya Anak Bangsa

Ryde Technologies Pte Ltd

Who should read this report?

E-hailing companies

Automotive OEMs

Transportation network companies (TNC)

Mobility as a service (MaaS) companies

Mobility Service Providers (MSP)

Car sharing companies

Car rental companies

Software developers

Electric vehicle (EV) companies

Autonomous vehicle (AV) developers

Senior executives

Investors

Financial institutions

Market analysts

Consultants

Marketing managers

Regulatory authorities

Business development managers

Smart city planners and investors

Local authorities

Government agencies & departments

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global E-hailing Market Overview

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report Include:

1.5 Who is This Report For?

1.6 Methodology

1.6.1 Primary Research

1.6.2 Secondary Research

1.6.3 Market Evaluation & Forecasting Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to the E-hailing Market

2.1 E-hailing Market Structure

2.2 E-hailing Market Definition

2.3 E-hailing Submarkets Definition

2.3.1 E-hailing Market By Vehicle Type Definition

2.3.2 E-hailing Market by Distance Type Definition

2.3.3 E-hailing Market by Payment Type Definition

3. Global E-hailing Market 2019-2029

3.1 Global E-hailing Market Forecast 2019-2029

3.2 Global E-hailing Market, Drivers & Restraints 2019

3.3 Recent Trend in Global E-hailing Market 2019

3.4 Opportunity in the Global E-hailing Market 2019

3.5 E-hailing Payment Processing Flow

3.6 Driver’s Income – a Key Concern in E-hailing

3.7 Joint Mobility Effort of BMW and Daimler

4. Leading National E-hailing Market 2019-2029

4.1 Global E-hailing Market by National Market Share Forecast 2019-2029

5 Global E-hailing Vehicle Type Submarket Forecast 2019-2029

6 Global E-hailing Distance Submarket Forecast 2019-2029

7. Global E-hailing Payment Type Submarket Forecast 2019-2029

8 North America E-hailing Market 2019-2029

8.1 North America E-hailing Market Forecast, by Country, 2019-2029

8.2 North America E-hailing Vehicle Type Submarket Forecast, 2019-2029

8.3 North America E-hailing Distance Submarket Forecast, 2019-2029

8.4 North America E-hailing Payment Type Submarket Forecast, 2019-2029

9 Latin America E-hailing Market 2019-2029

9.1 Latin America E-hailing Market Forecast, by Country, 2019-2029

9.2 Latin America E-hailing Vehicle Type Submarket Forecast, 2019-2029

9.3 Latin America E-hailing Distance Submarket Forecast, 2019-2029

9.4 Latin America E-hailing Payment Type Submarket Forecast, 2019-2029

10 Europe E-hailing Market 2019-2029

10.1 Europe E-hailing Market Forecast, by Country, 2019-2029

10.2 Europe E-hailing Vehicle Type Submarket Forecast, 2019-2029

10.3 Europe E-hailing Distance Submarket Forecast, 2019-2029

10.4 Europe E-hailing Payment Type Submarket Forecast, 2019-2029

11 Asia Pacific E-hailing Market 2019-2029

11.1 Asia Pacific E-hailing Market Forecast, by Country, 2019-2029

11.2 Asia Pacific E-hailing Vehicle Type Submarket Forecast, 2019-2029

11.3 Asia Pacific E-hailing Distance Submarket Forecast, 2019-2029

11.4 Asia Pacific E-hailing Payment Type Submarket Forecast, 2019-2029

12 MEA E-hailing Market 2019-2029

12.1 MEA E-hailing Market Forecast, by Country, 2019-2029

12.2 MEA E-hailing Vehicle Type Submarket Forecast, 2019-2029

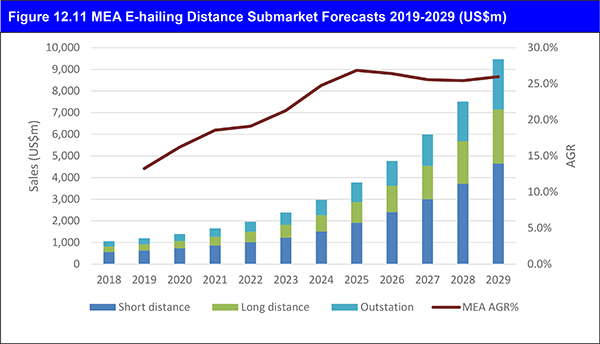

12.3 MEA E-hailing Distance Submarket Forecast, 2019-2029

12.4 MEA E-hailing Payment Type Submarket Forecast, 2019-2029

13 SWOT Analysis of the E-hailing Market 2019-2029

14. E-hailing Market Competition Canvas

14.1.Recent Development Benchmarking of Key Competitors

14.2.E-Hailing Market Development Focus

14.3.Regional Presence of Key Competitors

15. Company Profiles

15.1 Uber Technologies, Inc.

15.1.1 Introduction

15.1.2 Uber Technologies, Inc. Selected Recent New Feature Additions, 2019

15.1.3 Roadblocks for Uber

15.1.4 Uber Technologies Future Outlook

15.1.5 Uber Technologies Portfolio

15.1.6 Competitors of Uber Technologies, Inc.

15.1.7 Regional Emphasis

15.2 Ola Cabs

15.2.1 Introduction

15.2.2 Ola Cabs Selected Recent Geographical Expansion, Acquisition, and Investment, 2014-2018

15.2.3 Roadblocks for Ola

15.2.4 Ola Cabs Future Outlook

15.2.5 Ola Cabs Portfolio

15.2.6 Competitors of Ola Cabs

15.2.7 Regional Emphasis

15.3 GrabTaxi Holdings Pte. Ltd.

15.3.1 Introduction

15.3.2 GrabTaxi Holdings Pte. Ltd. Selected Recent Relocation, Investment, New Feature Addition, Rule Change, Repositioning, New Facility Addition, 2015-2019

15.3.3 Funding Raised by Grab

15.3.4 Roadblocks for GrabTaxi

15.3.5 GrabTaxi Holdings Pte. Ltd. Future Outlook

15.3.6 GrabTaxi Holdings Pte. Ltd. Portfolio

15.3.7 Competitors of GrabTaxi Holdings Pte. Ltd.

15.3.8 Regional Emphasis

15.4 Easy Taxi Serviços Ltda

15.4.1 Introduction

15.4.2 Easy Taxi Serviços Ltda Selected Recent Geographical Expansion, 2013

15.4.3 Funding Raised by Easy Taxi

15.4.5 Roadblocks for Easy Taxi

15.4.6 Easy Taxi Serviços Ltda Future Outlook

15.4.7 Easy Taxi Serviços Ltda Portfolio

15.4.8 Competitors of Easy Taxi Serviços Ltda

15.4.9 Regional Emphasis

15.5 Lyft, Inc.

15.5.1 Introduction

15.5.2 Lyft, Inc. Selected Recent Listing, Fleet Expansion, Acquisition, New Service, Partnership, Geographical Expansion, and New Feature Addition, 2014-2019

15.5.3 Funding Raised by Lyft

15.5.4 Roadblocks for Lyft

15.5.5 Lyft, Inc. Future Outlook

15.5.6 Lyft, Inc. Portfolio

15.5.7 Competitors of Lyft, Inc.

15.5.8 Regional Emphasis

15.6 Careem Inc.

15.6.1 Introduction

15.6.2 Careem Inc. Selected Recent Geographical Expansion, and New Service Addition, 2017-2018

15.6.3 Funding Raised by Careem

15.6.4 Roadblocks for Careem

15.6.5 Careem Inc. Future Outlook

15.6.6 Careem Inc. Portfolio

15.6.7 Competitors of Careem Inc.

15.6.8 Regional Emphasis

15.7 Beijing Xiaoju Technology Co, Ltd

15.7.1 Introduction

15.7.2 Beijing Xiaoju Technology Co, Ltd Selected Recent Geographical Expansion, Service Enhancement, Joint Venture, App Launch, Partnership, Investment and Acquisition, 2016-2018

15.7.3 Funding Raised by Didi

15.7.4 Roadblocks for Didi

15.7.5 Beijing Xiaoju Technology Co, Ltd. Future Outlook

15.7.6 Beijing Xiaoju Technology Co, Ltd Portfolio

15.7.7 Competitors of Beijing Xiaoju Technology Co, Ltd

15.7.8 Regional Emphasis

15.8 PT Aplikasi Karya Anak Bangsa

15.8.1 Introduction

15.8.2 PT Aplikasi Karya Anak Bangsa Selected Recent Geographical Expansion, Service Enhancement, Joint Venture, App Launch, Partnership, Investment and Acquisition, 2016-2019

15.8.3 Funding Raised by Go-Jek

15.8.4 Roadblocks for Go-Jek

15.8.5 PT Aplikasi Karya Anak Bangsa. Future Outlook

15.8.6 PT Aplikasi Karya Anak Bangsa Portfolio

15.8.7 Competitors of PT Aplikasi Karya Anak Bangsa

15.8.8 Regional Emphasis

15.9 Ryde Technologies Pte Ltd

15.9.1 Introduction

15.9.2 Ryde Technologies Pte Ltd Selected Recent Geographical Expansion, Service Enhancement, Joint Venture, App Launch, Partnership, Investment and Acquisition, 2018

15.9.3 Funding Raised by Ryde Technologies

15.9.4 Roadblocks for Ryde Technologies

15.9.5 Ryde Technologies Pte Ltd. Future Outlook

15.9.6 Ryde Technologies Pte Ltd Portfolio

15.9.7 Competitors of Ryde Technologies Pte Ltd

15.9.8 Regional Emphasis

16 Conclusion

17 Glossary

List of Tables

Table 3.1 Global E-hailing Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 3.2 Global E-hailing Market, Drivers & Restraints 2019

Table 4.1 Leading National E-hailing Market Forecast 2019-2029 (US$m, Global AGR %, Cumulative)

Table 4.2 Global E-hailing Market CAGR Forecast 2019-2023, 2024-2029, 2019-2029 (CAGR %)

Table 5.1 Global E-hailing Vehicle Type Submarket Forecast by Regional Market 2019-2029 (US $m, CAGR %)

Table 6.1 Global E-hailing Distance Submarket Forecast by Regional Market 2019-2029 (US $m, CAGR %)

Table 7.1 Global E-hailing Payment Type Submarket Forecast by Regional Market 2019-2029 (US $m, CAGR %)

Table 8.1 North America E-hailing Market Forecast, by Country, 2019-2029 (US $m, AGR %, CAGR %)

Table 8.2 North America E-hailing Market Forecast, by Vehicle Type, 2019-2029 (US $m, AGR %, CAGR %)

Table 8.3 North America E-hailing Market Forecast, by Distance, 2019-2029 (US $m, AGR %, CAGR %)

Table 8.4 North America E-hailing Market Forecast, by Payment Type, 2019-2029 (US $m, AGR %, CAGR %)

Table 9.1 Latin America E-hailing Market Forecast, by Country, 2019-2029 (US $m, AGR %, CAGR %)

Table 9.2 Latin America E-hailing Market Forecast, by Vehicle Type, 2019-2029 (US $m, AGR %, CAGR %)

Table 9.3 Latin America E-hailing Market Forecast, by Distance, 2019-2029 (US $m, AGR %, CAGR %)

Table 9.4 Latin America E-hailing Market Forecast, by Payment Type, 2019-2029 (US $m, AGR %, CAGR %)

Table 10.1 Europe E-hailing Market Forecast, by Country, 2019-2029 (US $m, AGR %, CAGR %)

Table 10.2 Europe E-hailing Market Forecast, by Vehicle Type, 2019-2029 (US $m, AGR %, CAGR %)

Table 10.3 Europe E-hailing Market Forecast, by Distance, 2019-2029 (US $m, AGR %, CAGR %)

Table 10.4 Europe E-hailing Market Forecast, by Payment Type, 2019-2029 (US $m, AGR %, CAGR %)

Table 11.1 Asia Pacific E-hailing Market Forecast, by Country, 2019-2029 (US $m, AGR %, CAGR %)

Table 11.2 Asia Pacific E-hailing Market Forecast, by Vehicle Type, 2019-2029 (US $m, AGR %, CAGR %)

Table 11.3 Asia Pacific E-hailing Market Forecast, by Distance, 2019-2029 (US $m, AGR %, CAGR %)

Table 11.4 Asia Pacific E-hailing Market Forecast, by Payment Type, 2019-2029 (US $m, AGR %, CAGR %)

Table 12.1 MEA E-hailing Market Forecast, by Country, 2019-2029 (US $m, AGR %, CAGR %)

Table 12.2 MEA E-hailing Market Forecast, by Vehicle Type, 2019-2029 (US $m, AGR %, CAGR %)

Table 12.3 MEA E-hailing Market Forecast, by Distance, 2019-2029 (US $m, AGR %, CAGR %)

Table 12.4 MEA E-hailing Market Forecast, by Payment Type, 2019-2029 (US $m, AGR %, CAGR %)

Table 13.1 Global E-hailing Market SWOT Analysis 2019-2029

Table 14.1 Recent Development Benchmarking of Key Competitors

Table 14.2 Regional Presence of Key Competitors

Table 15.1 Uber Technologies, Inc. Profile 2018 (CEO, Total Company Sales US$m, HQ, Founded, No. of Employees, Website)

Table 15.2 Selected Recent Uber Technologies, Inc. New Feature Additions, 2019 (Year, Type, Details)

Table 15.3 Ola Cabs Profile 2018 (CEO, Total Company Sales US$m, HQ, Founded, No. of Employees, Website)

Table 15.4 Selected Recent Ola Cabs Geographical Expansion, Acquisition, and Investment, 2014 - 2018 (Year, Type, Details)

Table 15.5 GrabTaxi Holdings Pte. Ltd. Profile 2018 (CEO, Total Company Sales US$m, HQ, Founded, No. of Employees, Website)

Table 15.6 Selected Recent GrabTaxi Holdings Pte. Ltd. Relocation, Investment, New Feature Addition, Rule Change, Repositioning, New Facility Addition, 2015 - 2019 (Year, Type, Details)

Table 15.7 Easy Taxi Serviços Ltda Profile 2018 (CEO, Total Company Sales US$m, HQ, Founded, No. of Employees, Website)

Table 15.8 Selected Recent Easy Taxi Serviços Ltda Geographical Expansion, 2013 (Year, Type, Details)

Table 15.9 Lyft, Inc. Profile 2018 (CEO, Total Company Sales US$m, Net Income, HQ, Founded, No. of Employees, Website)

Table 15.10 Selected Recent Lyft, Inc. Listing, Fleet Expansion, Acquisition, New Service, Partnership, Geographical Expansion, and New Feature Addition, 2014 - 2019 (Year, Type, Details)

Table 15.11 Careem Inc. Profile 2018 (CEO, Total Company Sales US$m, HQ, Founded, No. of Employees, Website)

Table 15.12 Selected Recent Careem Inc. Geographical Expansion, and New Service Addition, 2017 - 2018 (Year, Type, Details)

Table 15.13 Beijing Xiaoju Technology Co, Ltd Profile 2018 (CEO, Total Company Sales US$m, HQ, Founded, No. of Employees, Website)

Table 15.14 Selected Recent Beijing Xiaoju Technology Co, Ltd Geographical Expansion, Service Enhancement, Joint Venture, App Launch, Partnership, Investment and Acquisition, 2016 - 2018 (Year, Type, Details)

Table 15.15 PT Aplikasi Karya Anak Bangsa Profile 2018 (CEO, Total Company Sales US$m, HQ, Founded, No. of Employees, Website)

Table 15.16 Selected Recent PT Aplikasi Karya Anak Bangsa Service Launch, Geographical Expansion, Acquisition, 2016 - 2019 (Year, Type, Details)

Table 15.17 Ryde Technologies Pte Ltd Profile 2018 (CEO, Total Company Sales US$m, HQ, Founded, No. of Employees, Website)

Table 15.18 Selected Recent Ryde Technologies Pte Ltd Certification, 2018 (Year, Type, Details)

List of Figures

Figure 2.1 Global E-hailing Market Segmentation Overview

Figure 3.1 Global E-hailing Market Forecast 2019-2029 (US$m, AGR %)

Figure 3.2 E-Hailing Driver’s Return on Investment

Figure 4.1 Global E-hailing Market by National Market Forecast 2019-2029 (US$m, Global AGR %)

Figure 4.2 Leading National E-hailing Market CAGR Forecast 2019-2023 (CAGR %)

Figure 4.3 Leading National E-hailing Market CAGR Forecast 2024-2029 (CAGR %)

Figure 4.4 Leading National E-hailing Market CAGR Forecast 2019-2029 (CAGR %)

Figure 4.5 Global E-hailing Market by National Market Share Forecast 2019 (% Share)

Figure 4.6 Global E-hailing Market by National Market Share Forecast 2023 (% Share)

Figure 4.7 Global E-hailing Market by National Market Share Forecast 2029 (% Share)

Figure 5.1 Global E-hailing Vehicle Type Submarket Forecasts 2019-2029 (US$m)

Figure 5.2 Global E-hailing Vehicle Type Submarket Forecast (AGR%) 2019-2029

Figure 5.3 Global E-hailing Vehicle Type Submarket Forecast 2019 (% Share)

Figure 5.4 Global E-hailing Vehicle Type Submarket Forecast 2023 (% Share)

Figure 5.5 Global E-hailing Vehicle Type Submarket Forecast 2029 (% Share)

Figure 6.1 Global E-hailing Distance Submarket Forecasts 2019-2029 (US$m)

Figure 6.2 Global E-hailing Distance Submarket Forecast 2019 (% Share)

Figure 6.3 Global E-hailing Distance Submarket Forecast 2023 (% Share)

Figure 6.4 Global E-hailing Distance Submarket Forecast 2029 (% Share)

Figure 7.1 Global E-hailing Payment Type Submarket Forecasts 2019-2029 (US$m)

Figure 7.2 Global E-hailing Payment Type Submarket Forecast (AGR%) 2019-2029

Figure 7.3 Global E-hailing Payment Type Submarket Forecast 2019 (% Share)

Figure 7.4 Global E-hailing Payment Type Submarket Forecast 2023 (% Share)

Figure 7.5 Global E-hailing Payment Type Submarket Forecast 2029 (% Share)

Figure 8.1 North America E-hailing Market Forecasts, by Country 2019-2029 (US$m)

Figure 8.2 North America E-hailing Market Forecast, AGR%, by Country, 2019-2029

Figure 8.3 North America E-hailing Market Forecast, by Country, 2019 (% Share)

Figure 8.4 North America E-hailing Market Forecast, by Country, 2023 (% Share)

Figure 8.5 North America E-hailing Market Forecast, by Country, 2029 (% Share)

Figure 8.6 North America E-hailing Vehicle Type Submarket Forecasts 2019-2029 (US$m)

Figure 8.7 North America E-hailing Vehicle Type Submarket Forecast (AGR%) 2019-2029

Figure 8.8 North America E-hailing Vehicle Type Submarket Forecast 2019 (% Share)

Figure 8.9 North America E-hailing Vehicle Type Submarket Forecast 2023 (% Share)

Figure 8.10 North America E-hailing Vehicle Type Submarket Forecast 2029 (% Share)

Figure 8.11 North America E-hailing Distance Submarket Forecasts 2019-2029 (US$m

Figure 8.12 North America E-hailing Distance Submarket Forecast (AGR%) 2019-2029

Figure 8.13 North America E-hailing Distance Submarket Forecast 2019 (% Share)

Figure 8.14 North America E-hailing Distance Submarket Forecast 2023 (% Share)

Figure 8.15 North America E-hailing Distance Submarket Forecast 2029 (% Share)

Figure 8.16 North America E-hailing Payment Type Submarket Forecasts 2019-2029 (US$m)

Figure 8.17 North America E-hailing Payment Type Submarket Forecast (AGR%) 2019-2029

Figure 8.18 North America E-hailing Payment Type Submarket Forecast 2019 (% Share)

Figure 8.19 North America E-hailing Payment Type Submarket Forecast 2023 (% Share)

Figure 8.20 North America E-hailing Payment Type Submarket Forecast 2029 (% Share)

Figure 9.1 Latin America E-hailing Market Forecasts, by Country 2019-2029 (US$m)

Figure 9.2 Latin America E-hailing Market Forecast, AGR%, by Country, 2019-2029

Figure 9.3 Latin America E-hailing Market Forecast, by Country, 2019 (% Share)

Figure 9.4 Latin America E-hailing Market Forecast, by Country, 2023 (% Share)

Figure 9.5 Latin America E-hailing Market Forecast, by Country, 2029 (% Share)

Figure 9.6 Latin America E-hailing Vehicle Type Submarket Forecasts 2019-2029 (US$m)

Figure 9.7 Latin America E-hailing Vehicle Type Submarket Forecast (AGR%) 2019-2029

Figure 9.8 Latin America E-hailing Vehicle Type Submarket Forecast 2019 (% Share)

Figure 9.9 Latin America E-hailing Vehicle Type Submarket Forecast 2023 (% Share)

Figure 9.10 Latin America E-hailing Vehicle Type Submarket Forecast 2029 (% Share)

Figure 9.11 Latin America E-hailing Distance Submarket Forecasts 2019-2029 (US$m)

Figure 9.12 Latin America E-hailing Distance Submarket Forecast (AGR%) 2019-2029

Figure 9.13 Latin America E-hailing Distance Submarket Forecast 2019 (% Share)

Figure 9.14 Latin America E-hailing Distance Submarket Forecast 2023 (% Share)

Figure 9.15 Latin America E-hailing Distance Submarket Forecast 2029 (% Share)

Figure 9.16 Latin America E-hailing Payment Type Submarket Forecasts 2019-2029 (US$m)

Figure 9.17 Latin America E-hailing Payment Type Submarket Forecast (AGR%) 2019-2029

Figure 9.18 Latin America E-hailing Payment Type Submarket Forecast 2019 (% Share)

Figure 9.19 Latin America E-hailing Payment Type Submarket Forecast 2023 (% Share)

Figure 9.20 Latin America E-hailing Payment Type Submarket Forecast 2029 (% Share)

Figure 10.1 Europe E-hailing Market Forecasts, by Country 2019-2029 (US$m)

Figure 10.2 Europe E-hailing Market Forecast, AGR%, by Country, 2019-2029

Figure 10.3 Europe E-hailing Market Forecast, by Country, 2019 (% Share)

Figure 10.4 Europe E-hailing Market Forecast, by Country, 2023 (% Share)

Figure 10.5 Europe E-hailing Market Forecast, by Country, 2029 (% Share)

Figure 10.6 Europe E-hailing Vehicle Type Submarket Forecasts 2019-2029 (US$m)

Figure 10.7 Europe E-hailing Vehicle Type Submarket Forecast (AGR%) 2019-2029

Figure 10.8 Europe E-hailing Vehicle Type Submarket Forecast 2019 (% Share)

Figure 10.9 Europe E-hailing Vehicle Type Submarket Forecast 2023 (% Share)

Figure 10.10 Europe E-hailing Vehicle Type Submarket Forecast 2029 (% Share)

Figure 10.11 Europe E-hailing Distance Submarket Forecasts 2019-2029 (US$m)

Figure 10.12 Europe E-hailing Distance Submarket Forecast (AGR%) 2019-2029

Figure 10.13 Europe E-hailing Distance Submarket Forecast 2019 (% Share)

Figure 10.14 Europe E-hailing Distance Submarket Forecast 2023 (% Share)

Figure 10.15 Europe E-hailing Distance Submarket Forecast 2029 (% Share)

Figure 10.16 Europe E-hailing Payment Type Submarket Forecasts 2019-2029 (US$m)

Figure 10.17 Europe E-hailing Payment Type Submarket Forecast (AGR%) 2019-2029

Figure 10.18 Europe E-hailing Payment Type Submarket Forecast 2019 (% Share)

Figure 10.19 Europe E-hailing Payment Type Submarket Forecast 2023 (% Share)

Figure 10.20 Europe E-hailing Payment Type Submarket Forecast 2029 (% Share)

Figure 11.1 Asia Pacific E-hailing Market Forecasts, by Country 2019-2029 (US$m)

Figure 11.2 Asia Pacific E-hailing Market Forecast, AGR%, by Country, 2019-2029

Figure 11.3 Asia Pacific E-hailing Market Forecast, by Country, 2019 (% Share)

Figure 11.4 Asia Pacific E-hailing Market Forecast, by Country, 2023 (% Share)

Figure 11.5 Asia Pacific E-hailing Market Forecast, by Country, 2029 (% Share)

Figure 11.6 Asia Pacific E-hailing Vehicle Type Submarket Forecasts 2019-2029 (US$m)

Figure 11.7 Asia Pacific E-hailing Vehicle Type Submarket Forecast (AGR%) 2019-2029

Figure 11.8 Asia Pacific E-hailing Vehicle Type Submarket Forecast 2019 (% Share)

Figure 11.9 Asia Pacific E-hailing Vehicle Type Submarket Forecast 2023 (% Share)

Figure 11.10 Asia Pacific E-hailing Vehicle Type Submarket Forecast 2029 (% Share)

Figure 11.11 Asia Pacific E-hailing Distance Submarket Forecasts 2019-2029 (US$m)

Figure 11.12 Asia Pacific E-hailing Distance Submarket Forecast (AGR%) 2019-2029

Figure 11.13 Asia Pacific E-hailing Distance Submarket Forecast 2019 (% Share)

Figure 11.14 Asia Pacific E-hailing Distance Submarket Forecast 2023 (% Share)

Figure 11.15 Asia Pacific E-hailing Distance Submarket Forecast 2029 (% Share)

Figure 11.16 Asia Pacific E-hailing Payment Type Submarket Forecasts 2019-2029 (US$m)

Figure 11.17 Asia Pacific E-hailing Payment Type Submarket Forecast (AGR%) 2019-2029

Figure 11.18 Asia Pacific E-hailing Payment Type Submarket Forecast 2019 (% Share)

Figure 11.19 Asia Pacific E-hailing Payment Type Submarket Forecast 2023 (% Share)

Figure 11.20 Asia Pacific E-hailing Payment Type Submarket Forecast 2029 (% Share)

Figure 12.1 MEA E-hailing Market Forecasts, by Country 2019-2029 (US$m)

Figure 12.2 MEA E-hailing Market Forecast, AGR%, by Country, 2019-2029

Figure 12.3 MEA E-hailing Market Forecast, by Country, 2019 (% Share)

Figure 12.4 MEA E-hailing Market Forecast, by Country, 2023 (% Share)

Figure 12.5 MEA E-hailing Market Forecast, by Country, 2029 (% Share)

Figure 12.6 MEA E-hailing Vehicle Type Submarket Forecasts 2019-2029 (US$m)

Figure 12.7 MEA E-hailing Vehicle Type Submarket Forecast (AGR%) 2019-2029

Figure 12.8 MEA E-hailing Vehicle Type Submarket Forecast 2019 (% Share)

Figure 12.9 MEA E-hailing Vehicle Type Submarket Forecast 2023 (% Share)

Figure 12.10 MEA E-hailing Vehicle Type Submarket Forecast 2029 (% Share)

Figure 12.11 MEA E-hailing Distance Submarket Forecasts 2019-2029 (US$m)

Figure 12.12 MEA E-hailing Distance Submarket Forecast (AGR%) 2019-2029

Figure 12.13 MEA E-hailing Distance Submarket Forecast 2019 (% Share)

Figure 12.14 MEA E-hailing Distance Submarket Forecast 2023 (% Share)

Figure 12.15 MEA E-hailing Distance Submarket Forecast 2029 (% Share)

Figure 12.16 MEA E-hailing Payment Type Submarket Forecasts 2019-2029 (US$m)

Figure 12.17 MEA E-hailing Payment Type Submarket Forecast (AGR%) 2019-2029

Figure 12.18 MEA E-hailing Payment Type Submarket Forecast 2019 (% Share)

Figure 12.19 MEA E-hailing Payment Type Submarket Forecast 2023 (% Share)

Figure 12.20 MEA E-hailing Payment Type Submarket Forecast 2029 (% Share)s

Figure 15.1 Uber Technologies Portfolio Structure

Figure 15.2 Ola Cabs Portfolio Structure

Figure 15.3 GrabTaxi Holdings Pte. Ltd. Portfolio Structure

Figure 15.4 Easy Taxi Serviços Ltda Portfolio Structure

Figure 15.5 Lyft, Inc. Portfolio Structure

Figure 15.6 Careem Inc. Portfolio Structure

Figure 15.7 Beijing Xiaoju Technology Co, Ltd. Portfolio Structure

Figure 15.8 PT Aplikasi Karya Anak Bangsa Portfolio Structure

Figure 15.9 Ryde Technologies Pte Ltd Portfolio Structure

AEON Credit Service

Al Tayyar Travel Group

Alibaba Group Holding Ltd.

Allscripts

Alphabet Inc.

Andreessen Horowitz

ANI Technologies Pvt. Ltd

Apple Inc.

Arabnet

Astra International

Aviva

Beijing Xiaoju Technology Co, Ltd (Didi)

BliBli.com

Blue Bird

Blue Vision Labs

BPJS Kesehatan

Bytedance

C42 Engineering

Cabify

Capital Group Co.

Capital International Private Equity Fund

CapitalG

Careem Inc.

Carl Icahn

China Investment Corporation (CIC)

China Life Insurance Co.

China Merchants Bank Co.

Coatue Management

CodeIgnition

Cubigo

Didi Chuxing

Didi Dache

Didi Kuadi

DiDi Research Institute

Djarum

DST Global

Easy Taxi Serviços Ltda.

Enterprise Holdings

Enterprise Rent-A-Car

Facebook

Farallon Capital Management LLC

Fasten

Fidelity Management & Research Company

Floodgate Fund

Ford Motor Company

Founders Fund

Free2Move

General Motors

Geotagg

GGV Capital

Go-Auto

Go-Car

Go-Jek

GoMentum Station

Google

GrabTaxi Holdings Pte Ltd

Haxi

Honda

IBM

iMENA

Indonesia Stock Exchange (IDX)

JD.com Inc.

Jochum Shore & Trossevin

Jump

K9 Ventures

Kartuku

Kenya Airways

KKR

Kuaidi Dache

Latin America Internet Holding (LIH)

LEDI Technology Co

Leftshift

Lippo Group

Little Cab

Loket.com

Lyft, Inc.

Magna

Mapan

Maxi Mobility Spain, S.L.

Mayfield Fund

Meituan-Dianping

Meru Cabs

Midtrans

Millicom

MNC Vision

Mondo Ride

Mytaxi

Nasdaq

Northstar Group

NSI Ventures

NuTonomy

Ola Cabs

Ontario Teachers’ Pension Fund

Peixe Urbano.

Pianta

Ping An Insurance Group Co of China Ltd.

Ping An Ventures

PLN

PT Aplikasi Karya Anak Bangsa (Go-Jek)

PT Global Digital Prima (GDP) Venture

Qunar

Rakuten Inc.

ReachNow

Ridlr

Rocket Internet

RoundMenu

Ryde Technologies Pte Ltd (Ryde Technologies)

Safr

Saudi Telecom

Sequoia Capital

SheKab

SheCab

SoftBank Corp.

STC Ventures

Suzuki Finance Indonesia

TaxiForSure

Taxify

Temasek Holdings (Private) Ltd.

Tencent

The Abraaj Group

Tiger Global

Toyota

TwinLogic Strategies

Uber Technologies, Inc.

Vertex Venture Holdings

Vogo

Walt Disney

Warburg Pincus

Yandex

Yidao Yongche

Zimride

Organisations Mentioned

American Automobile Association (AAA)

California Public Utilities Commission

Egyptian Government

Electronic Frontier Foundation

Independent Workers Union of Great Britain (IWGB)

Indonesia Stock Exchange

Kenya Tourism Board

Land Transport Authority (LTA)

Land Transportation Franchising and Regulatory Board (LTFRB)

Latin America Internet Holding

Malaysian Public Land Transport Commission (SPAD)

New South Wales and Australian Capital Territory Government

Seattle City Council

Transport for London (TFL)

Virginia Department of Transportation

Western Australia and the Tasmanian Governments

Download sample pages

Complete the form below to download your free sample pages for E-hailing Market Outlook Report 2019-2029

Related reports

-

Automotive Communication Technology Market Report 2021-2031

UN has mandated the integration of antilock braking system and other safety technologies such as Geo Positioning System (GPS), radars,...Full DetailsPublished: 19 August 2021 -

Grid-Scale Battery Storage Technologies Market Forecast 2019-2029

The latest research report from business intelligence provider Visiongain offers comprehensive analysis of the Grid Scale Battery Storage market. Visiongain...

Full DetailsPublished: 06 June 2019 -

Automotive Digital Cockpit Market Report 2020-2030

Where is the automotive digital cockpit market heading? If you are involved in this sector you must read this newly...

Full DetailsPublished: 16 July 2020 -

Top 20 Lithium-Ion Battery Manufacturing Companies 2018

The development of the automotive battery market is important for the automotive sector as batteries serve different automotive applications in...Full DetailsPublished: 09 August 2018 -

Automotive Sensor Market Report 2019-2029

Visiongain calculates that the automotive sensor market will reach $19.3bn in 2019....Full DetailsPublished: 18 December 2018 -

Autonomous Vehicle (AV) Market Analysis Report 2017-2027

This report presents the realistic outlook for autonomous vehicles (AV) and provides the expected timelines for the implementation of 3...

Full DetailsPublished: 19 May 2017 -

Battery Electric Vehicle (BEV) Market Report 2019-2029

The increasing need to reduce vehicular emissions, decreasing battery prices, and the introduction of stringent regulations by government bodies, has...Full DetailsPublished: 20 November 2018 -

Top 20 Companies Developing Flying Car Technologies 2019

There is understandable scepticism around the entire concept of flying cars and their widespread deployment. Nonetheless, the technology is at...

Full DetailsPublished: 15 March 2019 -

Hybrid Powertrain Systems Market Report 2019-2029

The latest report from business intelligence provider Visiongain offers a comprehensive analysis of the global Hybrid powertrain systems market. Visiongain...

Full DetailsPublished: 31 July 2019 -

Automotive Composites Market Report 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global Automotive Composites market. Visiongain assesses that...

Full DetailsPublished: 15 March 2018

Download sample pages

Complete the form below to download your free sample pages for E-hailing Market Outlook Report 2019-2029

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain automotive reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and automotive industry experts but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain automotive reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

Alliance of Automobile Manufacturers (USA)

Association of Russian Automakers

Audio Video Bridging (AVB)

China Association Of Automoblie Manufacturers

European Association of Automotive Suppliers

European Automobile Manufacturers’ Association

European Council for Automotive Research and Development

Former Society of Automotive Engineers

German Association of the Automotive Industry

International Organization of Motor Vehicle Manufacturers

In-Vehicle Infotainment (IVI)

Italian Association of the Automotive Industry

Japan Automobile Manufacturers Association

One-Pair Ether-Net

Society of Indian Automobile Manufacturers (SIAM)

Society of Motor Manufacturers and Traders

The International Council For Clean Transport

US National Highway Traffic Safety Administration

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Automotive news

Hydrogen Vehicle Market

The global Hydrogen Vehicle market was valued at US$23.34 billion in 2023 and is projected to grow at a CAGR of 22.7% during the forecast period 2024-2034.

17 May 2024

Autonomous Vehicle Market

The global Autonomous Vehicle market was valued at US$35.4 billion in 2023 and is projected to grow at a CAGR of 22.7% during the forecast period 2024-2034.

16 May 2024

Automotive Infotainment Market

The global Automotive Infotainment market is estimated at US$20.2 billion in 2023 and is projected to grow at a CAGR of 6.3% during the forecast period 2024-2034.

14 May 2024

Automotive Cyber Security Market

The global Automotive Cyber Security market was valued at US$2,991.6 million in 2024 and is projected to grow at a CAGR of 19.4% during the forecast period 2024-2034.

13 May 2024