The global clinical trials supply and logistics market for pharma is estimated to have reach $17.1bn in 2018, dominated by the clinical trial manufacturing segment. The global clinical trial supply and logistics market for pharma is expected to grow at a CAGR of 7.7% in the first half of the forecast period.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand new 204-page report you will receive 123 charts– all unavailable elsewhere.

The 204-page report provides clear detailed insight into the global clinical trial supply and logistics market for pharma. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand-new report today you stay better informed and ready to act.

Report Scope

• Revenue and growth forecasts from 2019 to 2029 for the global clinical trial supply and logistics market. This report also discusses the Drivers and Restraints of the global clinical trial supply and logistics market.

• Revenue and growth forecasts from 2019 to 2029 for the leading submarkets of the global clinical trial supply and logistics market:

• Manufacturing – also with sub forecasting for packaging and for other production

• Logistics and distribution – also with sub forecasts for cold chain logistics and for other services

• Supply chain management

This report discusses the Drivers and Restraints of each submarket.

• Revenue and growth forecasts from 2019 to 2029 for the leading national markets:

• United States

• Japan

• EU5: Germany, France, United Kingdom, Italy, Spain

• Brazil

• Russia

• China

• India

• Rest of the World

Revenues forecast for the US, Japan, EU5, Brazil, Russia, China, India are further broken down by submarket.

• This report profiles the leading companies offering clinical trial supply and logistics services to the pharmaceutical industry:

• ADAllen Pharma

• Almac Group

• Amatsigroup

• Biocair International Limited

• Catalent

• DHL

• Durbin PLC

• FedEx

• Fisher Clinical Services

• Marken

• Movianto

• Packaging Coordinators Inc.

• Parexel International

• Patheon

• Sharp Packaging Services, LLC

• TNT Express

• World Courier

• This report provides qualitative analysis of the clinical trial supply and logistics market. This report discusses the Strengths, Weaknesses, Opportunities and Threats of the clinical trial supply and logistics market. Social, Technological, Economic and Political factors that influence this market are also discussed.

• This report discusses trends in the clinical trial supply and logistics market, clinical trial manufacturing market, comparator sourcing, clinical trial packaging, clinical trial supply chain management.

• This report discusses the regulatory outlook of the clinical trial supply and logistics industry, outlook for cold chain logistics in the clinical trial sector, as well as regulatory aspects of cold chain distribution for clinical trial materials

Key Questions Answered by this Report:

• How is the clinical trial supply and logistics market for pharma evolving?

• What are the drivers and restraints for the growth of the clinical trial supply and logistics market for pharma?

• How will each clinical trial supply and logistics submarket for pharma grow over the forecast period and how much revenue will these submarkets account for in 2029?

• How will the market shares for each clinical trial supply and logistics submarket for pharma develop to 2029?

• What is the value of the leading clinical trial supply and logistics submarket for pharma s in important regions of the world?

• What will be the main driver for the overall market to 2029?

• How will the market shares of the national markets change by 2029 and which geographical region will lead the market by 2029?

• Who are the leading players and what are their prospects over the forecast period?

Visiongain’s study is intended for anyone requiring commercial analyses for the global clinical trial supply and logistics market for pharma. You find data, trends and predictions.

Buy our report today Clinical Trial Supply and Logistics Market for Pharma 2019-2029: Clinical Trial Manufacturing, Clinical Trial Logistics and Distributions, Clinical Trial Supply Chain Management, Clinical Trial Packaging, Clinical Trial Cold Chain Logistics.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Overview of the World Market for Clinical Trial Supply and Logistics

1.2 Benefits of This Report

1.3 How This Report Delivers

1.4 Main Questions Answered by This Analysis

1.5 Who Is This Study For?

1.6 Methods of Research and Analysis

1.7 Frequently Asked Questions (FAQs)

1.8 Some Related Reports

1.9 About Visiongain

2. Defining the Clinical Trial Supply and Logistics Market

2.1 An Introduction to the Clinical Trial Supply and Logistics Market

2.2 Clinical Trials are Becoming Increasingly Complex

2.3 Clinical Trial Globalisation: Access to New Markets and New Patients

2.4 Outsourcing Clinical Trial Supply and Logistics

2.5 What Services Are Most Commonly Outsourced?

2.6 Which Companies Participate in the Clinical Trial Supply and Logistics Market?

2.7 Clinical Trial Supply and Logistics: Trends and Future Outlook

3. Clinical Trial Supply and Logistics: World Market Outlook and Forecasting 2019-2029

3.1 The World Clinical Trial Supply and Logistics Market 2018

3.1.1 Which Were the Leading Market Sectors in 2018?

3.2 The World Clinical Trial Supply and Logistics Market Forecast 2019-2029

3.2.1 What Will Drive Market Growth to 2029?

3.2.2 Clinical Trial Supply and Logistics: Market Restraints 2019-2029

3.3 Clinical Trial Manufacturing Submarket 2019-2029

3.3.1 Outlook and Forecast for the Clinical Trial Manufacturing Submarket 2019-2029

3.3.2 Complex Manufacturing and Packaging to Drive Growth 2019-2029

3.3.3 Clinical Trial Packaging Submarket Forecast 2019-2029

3.4 Clinical Trial Logistics and Distribution Submarket 2019-2029

3.4.1 Clinical Trial Logistics and Distribution Submarket Forecast 2019-2029

3.4.2 Clinical Trial Logistics and Distribution: Drivers and Restraints 2019-2029

3.4.3 Clinical Trial Cold Chain Distribution Submarket Forecast 2019-2029

3.5 Clinical Trial Supply Chain Management Submarket 2019-2029

3.5.1 Clinical Trial Supply Chain Management Submarket Forecast 2019-2029

3.5.2 Drivers and Restraints for the Clinical Trial Supply Chain Management Submarket 2019-2029

4. Leading National Markets for Clinical Trial Supply and Logistics 2019-2029

4.1 Defining National Submarkets for Clinical Trial Supply and Logistics

4.2 Leading National Submarkets for Clinical Trial Supply and Logistics 2018

4.2.1 How Will These Leading Submarkets Grow during 2019-2029?

4.3 The US: Clinical Trial Supply and Logistics Market, 2019-2029

4.3.1 How Will Demand for Clinical Trial Logistics Grow in the US to 2029?

4.3.2 US Clinical Trial Supply and Logistics Submarket

4.4 EU5 Markets for Clinical Trial Supply and Logistics, 2019-2029

4.4.1 The Clinical Trial Supply and Logistics Market for Germany: 2019-2029

4.4.2 France: Clinical Trial Supply and Logistics Market, 2019-2029

4.4.3 The UK: Clinical Trial Supply and Logistics Market, 2019-2029

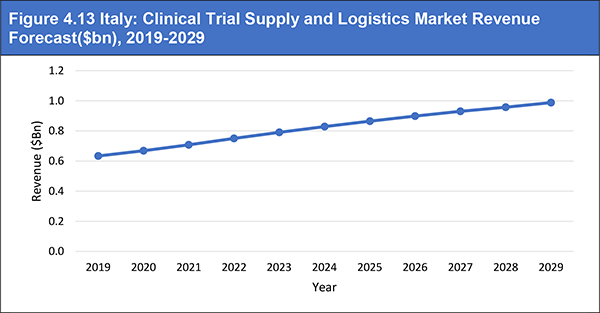

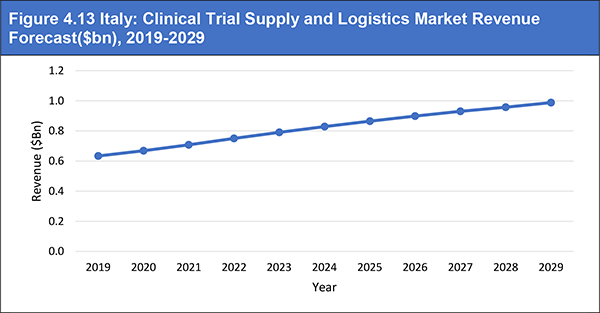

4.4.4 Italy: Clinical Trial Supply and Logistics Market, 2019-2029

4.4.5 Spain: Clinical Trial Supply and Logistics Market, 2019-2029

4.4.6 EU5 Clinical Trial Supply and Logistics Submarket

4.5 Japan: A New and Growing Market for Outsourced Logistics

4.5.1 Japanese Clinical Trial Supply and Logistics Submarket Forecast 2019-2029

4.5.2 Japanese Clinical Trial Supply and Logistics Submarket

4.6 Clinical Trials Increasing Demand in Emerging National Markets

4.7 China: Clinical Trial Supply and Logistics Market, 2019-2029

4.7.1 Foreign Investment in Chinese Clinical Trial Logistics

4.7.2 Strong Growth for Clinical Trial Supply and Logistics in China 2019-2029

4.7.3 Chinese Clinical Trial Supply and Logistics Submarket

4.8 India: An Emerging Destination for Outsourced Clinical Trials

4.8.1 India: Clinical Trial Supply and Logistics Market, 2019-2029

4.8.2 Indian Clinical Trial Supply and Logistics Submarket

4.9 The Latin American Clinical Trial Supply and Logistics Market

4.9.1 Challenging Distribution Conditions

4.9.2 Brazil: Clinical Trial Supply and Logistics Market, 2019-2029

4.8.3 Brazil Clinical Trial Supply and Logistics Submarket

4.10 Russia: Clinical Trial Supply and Logistics Market, 2019-2029

4.10.1 Russia Benefiting from Close Proximity to European Union

4.10.2 Outsourcing Will Grow Strongly in Russia

4.10.3 Russia Clinical Trial Supply and Logistics Submarket

5. Clinical Trial Supply and Logistics: Regulatory Outlook 2019-2029

5.1 How do Regulatory Standards Affect Clinical Trial Supply?

5.1.1 Good Practices (GxP) in Clinical Trial Distribution

5.1.1.1 Good Manufacturing Practice (GMP)

5.1.1.2 Good Distribution Practice (GDP)

5.1.2 Import Regulations Complicate International Manufacturing and Trials

5.2 Clinical Trial Supply Regulations in the US 2018

5.2.1 Importing Drugs into the US: A Reinterpretation of the Rules

5.3 Clinical Trial Regulations in the EU 2018

5.3.1 Manufacturing Requirements for Clinical Trial Materials in the EU

5.3.2 The European Commission Releases New GDP Guidelines 2013

5.4 GMP and Importation Regulations for Pharmaceuticals in Japan 2017

5.5 Clinical Trial Supply Chain Regulations in Emerging Markets

5.5.1 China: Tougher Regulations for Pharmaceutical Companies and Service Providers

5.5.1.1 Improving Supply Chain Security in China 2018

5.5.2 India: Drug Manufacturing and Imports for Clinical Trials

5.5.2.1 The CDSCO Drafts New GDP Guidelines

5.5.3 Brazil: Slow Regulatory Approval for Clinical Trials

5.5.4 Recent Updates to Pharmaceutical Regulation in Russia

6. Clinical Trial Supply and Logistics: Industry Trends 2019-2029

6.1 Clinical Trial Supply and Logistics Market: Strengths and Weaknesses 2018

6.2 Clinical Trial Supply and Logistics Market: Opportunities and Threats 2019-2029

6.3 Clinical Trial Supply and Logistics Market: STEP Analysis 2019-2029

6.3.1 Social Factors

6.3.2 How Will Novel Technologies Affect the Market to 2029?

6.3.3 Economic Pressure: Demands for Lower Cost Trials and Logistics

6.3.4 Political Issues

6.4 Securing the Clinical Trial Supply Chain 2019-2029

6.4.1 How Will Technology Improve Supply Chain Security?

6.5 How Will Clinical Trial Globalisation Impact Supply and Logistics?

6.6 Trends in Clinical Trial Manufacturing 2019-2029

6.6.1 The Challenge of Comparator Sourcing for Clinical Trials

6.6.1.1 Comparators Are a Source of Risk for Supply Chain Security

6.6.1.2 Regulators and Payers Will Increasingly Demand Comparative Effectiveness Research

6.6.2 Trends in Packaging for Clinical Trials 2019-2029

6.7 Clinical Trial Supply Chain Management Trends to 2029

6.7.1 Forecasting and Modelling to Ensure Sufficient Supply

6.7.2 IT Systems Improve Clinical Trial Planning: IVRS and IWRS

6.7.3 Home-Based Trial Participation: Opportunities and Challenges for Logistics

6.7.4 How Will Greater Use of Adaptive Clinical Trials Impact Trial Logistics?

6.8 Outsourcing Clinical Trial Supply and Logistics

6.8.1 Managing Multiple Supplier Networks

7. The Rise of Cold Chain Logistics in Clinical Trials 2019-2029

7.1 An Introduction to Cold Chain Supply and Distribution

7.1.1 The Importance of Cold Chain for Clinical Trials

7.1.2 Maintaining the Cold Chain

7.2 The Regulatory Outlook for Cold Chain Logistics

7.2.1 International Air Transport Regulations and Guidance: The Temperature Sensitive Label

7.3 Cold Chain Will Account for an Increasing Proportion of Clinical Trial Logistics 2019-2029

7.3.1 Biologic Drug Development Will Stimulate Demand

7.3.1.1 Emerging Trends in Biological Drug Development

7.3.2 Pharma Cold Chain Logistics in Emerging Markets

7.4 The Role of Technology in Clinical Cold Chain Logistics

7.4.1 Active and Passive Temperature Control

7.4.2 There Are Many Ways to Maintain Temperature in the Cold Chain

7.4.2.1 Developments in Phase Change Materials

7.4.2.2 The Benefits of Liquid Nitrogen for Sample Transportation

7.4.3 Advances in RFID for Temperature Monitoring

7.4.3.1 Will Uptake for RFID Grow Among Biopharma Companies to 2029?

7.4.4 Future Technologies for Cold Chain Supply Management

7.4.4.1 Demand for Reusable Cold Chain Packaging

8. Clinical Trial Supply and Logistics Market: Leading Companies

8.1 Third Party Logistics Providers: Leading Clinical Distributors

8.1.1 World Courier: A Pharmaceutical Supply Specialist

8.1.1.1 Distribution Services for Pharma, CROs and Central Laboratories

8.1.1.2 World Courier Is the Clinical Trial Distribution Market Leader

8.1.1.3 World Courier Service Expansion

8.1.2 DHL: A Global Leader in Supply Chain Logistics

8.1.2.1 Life Sciences: A Fast-Growing Source of Revenue for DHL Supply Chain

8.1.2.2 DHL: Services for Healthcare and Clinical Trial Clients

8.1.3 Marken: A leader in Direct to Patient Services

8.1.3.1 What Services Does Marken Offer Clinical Trial Sponsors?

8.1.3.2 Marken: Challenging Market Conditions 2010-2015

8.1.3.3 Marken Continues to Expand Worldwide

8.1.3.4 Expertise in Biological Sample Management

8.1.4 Other Leading and Emerging Players in the Market 2018

8.1.4.1 FedEx

8.1.4.2 Biocair International Limited

8.1.4.3 Movianto - A European Healthcare Specialist

8.2 Clinical Trial Manufacturing: Submarket Leaders

8.2.1 Catalent Pharma Solutions

8.2.1.1 Clinical Trial Manufacturing and Supply Services

8.2.1.2 Strong Growth for Clinical Manufacturing Revenue

8.2.1.3 Catalent Expanding its Clinical Supply Services

8.2.2 Patheon N.V.

8.2.2.1 Patheon – Global leader in Pharmaceutical Development Services

8.2.3 Almac Group: Manufacturing, Packaging and Logistics Services

8.2.3.1 Clinical Trial Supply and Management Solutions

8.2.3.2 Almac Opens New Facilities to Expand its Clinical Trial Expertise

8.2.4 Amatsigroup SAS:

8.3 The Role of CROs in the Clinical Trial Supply and Logistics Market

8.3.1 PAREXEL International Corp.

8.3.1.1 Parexel’s Clinical Trial Supply and Logistics Services

8.3.1.2 Parexel Expands Worldwide

8.4 Other Leading Companies in the Clinical Trial Supply and Logistics Market 2018

8.4.1 Fisher Clinical Services (FCS)

8.4.1.1 FCS Offers Manufacturing, Packaging, Storage and Distribution Services

8.4.1.2 Fisher BioServices: Clinical Logistics for the Cell Therapy Industry

8.4.2 Packaging Coordinators Inc. (PCI)

8.4.3 ADAllen Pharma

8.4.4 Sharp Packaging Services, LLC

8.4.5 Durbin PLC

9. Conclusions of Our Study

9.1 The Clinical Trial Supply and Logistics Market in 2018

9.2 Outlook for the Market, 2019-2029

9.3 Growing Demand for Clinical Logistics in Emerging Countries

9.4 Technology and Innovation to Drive Outsourcing

Appendices

Associated Visiongain Reports

Visiongain Report Sales Order Form

About Visiongain

Report Evaluation Form

List of Tables

Table 2.1 Clinical Trials Registered by Location, December 2018

Table 3.1 R&D Outsourcing Market: Submarket Size ($bn) and Market Share (%) by Sector, 2018

Table 3.2 Clinical Trial Supply and Logistics Market: Submarket Size ($bn) and Market Share (%) by Sector, 2018

Table 3.3 Clinical Trial Supply and Logistics Market Revenue Forecast by Sector: Revenue ($bn), AGR (%) and CAGR (%), 2019-2023

Table 3.4 Clinical Trial Supply and Logistics Market Revenue Forecasts by Sector: Revenue ($bn), AGR (%) and CAGR (%), 2023-2029

Table 3.5 Clinical Trial Supply and Logistics Market: Submarket Shares (%), 2019-2029

Table 3.6 Clinical Trial Manufacturing Submarket: Submarket Size ($bn) and Submarket Share (%) by Sector, 2018

Table 3.7 Clinical Trial Manufacturing Market Revenue Forecast by Submarket: Revenue ($bn), AGR (%) and CAGR (%), 2019-2023

Table 3.8 Clinical Trial Manufacturing Market Revenue Forecast by Submarket: Revenue ($bn), AGR (%) and CAGR (%), 2023-2029

Table 3.9 Clinical Trial Packaging Submarket: Revenue Forecast ($bn), AGR (%) and CAGR (%), 2019-2029

Table 3.10 Clinical Trial Logistics and Distribution Market: Submarket Size ($bn) and Submarket Share (%) by Sector, 2018

Table 3.11 Clinical Trial Logistics and Distribution Market Revenue Forecast by Submarket: Revenue ($bn), AGR (%) and CAGR (%), 2019-2023

Table 3.12 Clinical Trial Logistics and Distribution Market Revenue Forecast by Submarket: Revenue ($bn), AGR (%) and CAGR (%), 2023-2029

Table 3.13 Clinical Trial Cold Chain Logistics Submarket: Revenue Forecast($bn), AGR (%) and CAGR (%), 2019-2029

Table 3.14 Clinical Trial Supply Chain Management Market: Revenue Forecast ($bn), AGR (%) and CAGR (%), 2019-2029

Table 4.1 Clinical Trial Supply and Logistics Market: Market Size ($bn) and Market Shares (%) by Leading Country and Region, 2018

Table 4.2 Clinical Trial Supply and Logistics Market: Country Submarket Revenue Forecast ($bn), AGR (%) and CAGR (%), 2019-2029

Table 4.3 Clinical Trial Supply and Logistics Market: Leading National Market Share (%), 2018, 2023 and 2029

Table 4.4 US Clinical Trial Supply and Logistics Market Forecast Revenue ($bn), 2019-2029

Table 4.5 US Clinical Trial Supply and Logistics Submarkets Revenue Forecast($bn), 2019-2029

Table 4.6 EU5 Clinical Trial Supply and Logistics: Submarket Revenue Forecasts ($bn), AGR (%) and CAGR (%), 2019-2029

Table 4.7 The EU5 Clinical Trial Supply and Logistics Submarket: Market Size ($bn) and Market Shares (%), 2018

Table 4.8 Germany: Clinical Trial Supply and Logistics Market: Revenue Forecast ($bn), AGR (%) and CAGR (%), 2019-2029

Table 4.9 France Clinical Trial Supply and Logistics Submarket: Revenue Forecast ($bn), AGR (%) and CAGR (%),2019-2029

Table 4.10 The UK: Clinical Trial Supply and Logistics Market: Revenue Forecast ($bn), AGR (%) and CAGR (%), 2019-2029

Table 4.11 Italy: Clinical Trial Supply and Logistics Market: Revenue Forecast ($bn), AGR (%) and CAGR (%), 2019-2029

Table 4.12 Spain: Clinical Trial Supply and Logistics Market: Revenue Forecast ($bn), AGR (%) and CAGR (%), 2019-2029

Table 4.13 EU5 Clinical Trial Supply and Logistics Submarkets Revenue Forecast ($bn), 2019-2029

Table 4.14 Japan: Clinical Trial Supply and Logistics Market: Revenue Forecast ($bn), AGR (%) and CAGR (%), 2019-2029

Table 4.15 Japanese Clinical Trial Supply and Logistics Submarkets Revenue Forecast ($bn), 2019-2029

Table 4.16 China: Clinical Trial Supply and Logistics: Revenue Forecast ($bn), AGR (%) and CAGR (%), 2019-2029

Table 4.17 Chinese Clinical Trial Supply and Logistics Submarkets Revenue Forecast ($bn), 2019-2029

Table 4.18 India: Clinical Trial Supply and Logistics: Revenue Forecast ($bn), AGR (%) and CAGR (%), 2019-2029

Table 4.19 Indian Clinical Trial Supply and Logistics Submarkets Revenue Forecast ($bn), 2019-2029

Table 4.20 Brazil: Clinical Trial Supply and Logistics Market: Revenue Forecast ($bn), AGR (%) and CAGR (%), 2019-2029

Table 4.21 Brazil Clinical Trial Supply and Logistics Submarkets Revenue Forecast ($bn), 2019-2029

Table 4.22 Russia: Clinical Trial Supply and Logistics: Revenue Forecast ($bn), AGR (%) and CAGR (%), 2019-2029

Table 4.30 Russia Clinical Trial Supply and Logistics Submarkets Revenue Forecast ($bn), 2019-2029

Table 5.1 ICH Manufacturing Guidelines, 2001-2012

Table 6.1 Clinical Trial Supply and Logistics Market: Strengths and Weaknesses, 2019-2029

Table 6.2 Clinical Trial Supply and Logistics Market: Opportunities and Threats, 2019-2029

Table 6.3 Clinical Trial Supply and Logistics Market: STEP Analysis, 2019-2029

Table 6.4 Comparative Costs of Orphan and Non-Orphan Clinical Trials, 2015

Table 6.5 TransCelerate BioPharma Member Companies, 2018

Table 6.6 Benefits of Advanced Forecasting Tools for Clinical Trial Logistics

Table 6.7 Selected Clinical Trial Supply Forecasting Tools Available, 2016

Table 6.8 Selected IVRS/IWRS Tools Available for Clinical Trials, 2019

Table 6.9 Home-Based Clinical Trial Distribution: Advantages and Disadvantages, 2019

Table 6.10 Outsourcing Clinical Trial Supply and Logistics: Advantages and Disadvantages, 2019

Table 7.1 Top Ten Prescription Drugs: Overall Biologics Share, 2015 and 2016

Table 7.2 Leading Providers of RFID Tags for the Pharmaceutical Market, 2019

Table 8.1 AmerisourceBergen: Other Service Revenue ($bn), 2015-2017

Table 8.2 DHL Supply Chain: Revenue ($m) by Sector, 2016

Table 8.3 DHL Life Sciences and Healthcare: Revenue ($m) and AGR (%), 2014-2016

Table 8.4 Marken Historical Revenue: Revenue ($m), Annual Growth (%),2015-2017

Table 8.5 Catalent Clinical Supply Services: Revenue ($m), 2015-2017

Table 8.6 Patheon Pharmaceutical Development Projects (%) by Phase, 2016

Table 8.7 Patheon Pharmaceutical Development Services: Revenue ($bn), 2014-2016

Table 8.8 Almac Group: Revenue ($m), 2014-2016

Table 8.9 Parexel: Clinical Research Services Revenue ($m), 2012-2016

Table 9.1 Clinical Trial Supply and Logistics Market: Revenue ($bn) and Market Share (%) by Sector, 2018, 2023 and 2029

Table 9.2 Clinical Trial Supply and Logistics Market: Revenue ($bn) and Market Share (%) by Region in 2018, 2023 and 2029

List of Figures

Figure 2.1 Sectors and Services in the Clinical Trial Supply and Logistics Market, 2018

Figure 2.2 Clinical Trials Registered by Location, 2018

Figure 2.3 Trends Affecting the Clinical Trial Supply and Logistics Market, 2019-2029

Figure 3.1 Pharma R&D Outsourcing Market: Market Share (%) by Sector, 2019

Figure 3.2 Clinical Trial Supply and Logistics Market: Market Share (%) by Sector, 2018

Figure 3.3 Clinical Trial Supply and Logistics Market Forecast ($bn), 2019-2029

Figure 3.4 Clinical Trial Supply and Logistics Market: Submarket Shares (%), 2023

Figure 3.5 Clinical Trial Supply and Logistics Market: Submarket Shares (%), 2029

Figure 3.6 Clinical Trial Supply and Logistics: Market Drivers, 2019-2029

Figure 3.7 Clinical Trial Supply and Logistics: Market Restraints, 2019-2029

Figure 3.8 Clinical Trial Manufacturing Market: Sector Shares (%), 2018

Figure 3.9 Clinical Trial Manufacturing Market Forecast ($bn), 2019-2029

Figure 3.10 Clinical Trial Manufacturing: Drivers and Restraints, 2019-2029

Figure 3.11 Clinical Trial Packaging Submarket Forecast ($bn), 2019-2029

Figure 3.12 Clinical Trial Logistics and Distribution Market: Sector Shares (%), 2018

Figure 3.13 Clinical Trial Logistics and Distribution Market Forecast ($bn), 2019-2029

Figure 3.14 Clinical Trial Logistics and Distribution: Drivers and Restraints, 2019-2029

Figure 3.15 Clinical Trial Cold Chain Logistics Submarket Forecast ($bn), 2019-2029

Figure 3.16 Clinical Trial Supply Chain Management Market Forecast ($bn), 2019-2029

Figure 3.17 Clinical Trial Supply Chain Management: Drivers and Restraints, 2019-2029

Figure 4.1 Clinical Trial Supply and Logistics Market: Market Share (%) by Country and Region, 2018

Figure 4.2 Clinical Trial Supply and Logistics Market: Market Share (%) by Region, 2018, 2023 and 2029

Figure 4.3 US Clinical Trial Supply and Logistics Market Forecast Revenue ($bn), 2019-2029

Figure 4.4 US Clinical Trial Supply and Logistics Market Share (%), 2018, 2023 and 2029

Figure 4.5 US Clinical Trial Supply and Logistics: Drivers and Restraints, 2019-2029

Figure 4.6 EU5 Clinical Trial Supply and Logistics: Overall Revenue Forecast ($bn), 2019-2029

Figure 4.7 EU5 Clinical Trial Supply and Logistics Market Share (%), 2018, 2023 and 2029

Figure 4.8 EU5 Clinical Trial Supply and Logistics: Drivers and Restraints, 2019-2029

Figure 4.9 The EU5 Clinical Trial Supply and Logistics Submarket Shares (%), 2018

Figure 4.10 Germany: Clinical Trial Supply and Logistics Market Revenue Forecast ($bn), 2019-2029

Figure 4.11 France: Clinical Trial Supply and Logistics Market Revenue Forecast ($bn), 2019-2029

Figure 4.12 The UK: Clinical Trial Supply and Logistics Market Revenue Forecast ($bn), 2019-2029

Figure 4.13 Italy: Clinical Trial Supply and Logistics Market Revenue Forecast($bn), 2019-2029

Figure 4.14 Spain: Clinical Trial Supply and Logistics Market Revenue Forecast ($bn), 2019-2029

Figure 4.15 Japan: Clinical Trial Supply and Logistics Market Revenue Forecast ($bn), 2019-2029

Figure 4.16 Japanese Clinical Trial Supply and Logistics Market Share (%) in 2018, 2023 and 2029

Figure 4.17 Japanese Clinical Trial Supply and Logistics: Drivers and Restraints, 2019-2029

Figure 4.18 China: Clinical Trial Supply and Logistics Market Revenue Forecast ($bn), 2019-2029

Figure 4.19 Chinese Clinical Trial Supply and Logistics Market Share (%), 2018, 2023 and 2029

Figure 4.20 Chinese Clinical Trial Supply and Logistics: Drivers and Restraints, 2019-2029

Figure 4.21 India: Clinical Trial Supply and Logistics Market Revenue Forecast ($bn), 2019-2029

Figure 4.22 Indian Clinical Trial Supply and Logistics Market Share (%), 2018, 2023 and 2029

Figure 4.23 Indian Clinical Trial Supply and Logistics: Drivers and Restraints, 2019-2029

Figure 4.24 Brazil: Clinical Trial Supply and Logistics Market Revenue Forecast ($bn), 2019-2029

Figure 4.25 Brazilian Clinical Trial Supply and Logistics Market Share (%), 2018, 2023 and 2029

Figure 4.26 Brazilian Clinical Trial Supply and Logistics: Drivers and Restraints, 2019-2029

Figure 4.27 Russia: Clinical Trial Supply and Logistics Market Revenue Forecast ($bn), 2019-2029

Figure 4.28 Russia: Clinical Trial Supply and Logistics Market Share (%), 2018, 2023 and 2029

Figure 4.29 Russian Clinical Trial Supply and Logistics: Drivers and Restraints, 2019-2029

Figure 6.1 Players in the Clinical Trial Supply Chain, 2019

Figure 8.1 AmerisourceBergen Other Service: Revenue ($bn), 2015-2017

Figure 8.2 DHL Supply Chain: Revenue Share (%) by Sector, 2016

Figure 8.3 Marken: Revenue ($m), 2015-2017

Figure 8.4 Catalent: Clinical Manufacturing Space by Region (%), 2017

Figure 8.5 Catalent Clinical Supply Services: Revenue ($m), 2015-2017

Figure 8.6 Patheon Pharmaceutical Development Projects (%) by Phase, 2016

Figure 8.7 Patheon Pharmaceutical Development Services: Revenue ($bn), 2014-2016

Figure 8.8 Almac Group: Revenue ($m), 2014-2016

Figure 8.9 Parexel: Clinical Research Services Revenue ($m), 2012-2016

Figure 9.1 Clinical Trial Supply and Logistics Market: Revenue ($bn) by Sector, 2018, 2023 and 2029

Figure 10.2 Clinical Trial Supply and Logistics Market: Revenue ($bn) by Region, 2018, 2023 and 2029