Industries > Energy > Top 20 Wind Power Companies Report 2018

Top 20 Wind Power Companies Report 2018

Market Share (CAPEX & Installed Capacity) of Leading Companies Operating Within the Onshore & Offshore Wind Power Market Including Financial Analysis and In-Depth Analysis of Major Contracts & Projects in Various Regions

The latest research report from business intelligence provider Visiongain offers a comprehensive analysis of the Top Wind Power Companies.

Wind power is one of the fastest growing renewable energy sources which can be used in both commercial and residential applications.

With increasing concerns over energy security and carbon emission issues, there has been a significant increase in the adoption of renewable and nuclear sources for power generation. Increasing energy demand in several developing countries is, therefore, augmenting the demand for wind power.

As per the Global Wind Energy Council (GWEC), over 52 GW of wind power was added in 2017, registering total installations to 539 GW globally. Intense reductions in onshore and offshore wind prices will further favour the adoption of wind energy. This will only further the growth of the market.

Visiongain’s Top 20 Wind Power Companies Report 2018 will keep you informed and up to date with the developments in the market.

With reference to this report, it details the key investment trends in the global market,

Analyses total company sales, the share of total company sales from Wind Power and information on Wind Power Contracts/ Projects / Programmes.

The report will answer questions such as:

– How is the Wind Power market evolving?

– What is driving and restraining the Wind Power market dynamics?

– Who are the leading players and what are their prospects for the development of wind power projects?

Five Reasons Why You Must Order and Read This Report Today:

1) Financial structure of 20 Leading players in the Wind Power market

– Total Company Sales (US$m)

– Revenue of the Business Segment that includes Wind Power (US $m)

– Share of the Relevant Business Segment Revenue that comes from Wind Power (%)

– Wind Power Revenue (US$m)

– Share of Market CAPEX (%)

– Share of Market Installed Capacity (%)

– Net Income / Loss (US$m)

– Net Capital Expenditure (US$m)

– Total Company Sales by Region

2) The report reveals extensive details and analysis of 76 Wind Power contracts, projects and programmes:

– Date

– Country

– Capacity (MW)

– Project Details

3) The report lists Competitor Positioning in the Global Wind Power Market

– Strategic Supply Agreements and Partnerships

4) The report provides Drivers and Restraints affecting the Wind Power Market

5) The report provides market share analysis by CAPEX and Installed Capacity (GW) and detailed profiles of the leading companies operating within the Wind Power market:

– ABO wind AG

– Dong Energy

– Doosan Heavy Industries & Construction

– E.ON SE

– EDP Renewables

– Eneco Group

– Enercon GmbH

– Envision Energy

– General Electric Company

– Goldwind

– Mingyang Wind Power

– NextEra Energy, Inc.

– Nordex SE

– Northland Power

– RWE Group

– Senviron S.A.

– Siemens AG

– Suzlon Energy Limited

– Vattenfall AB

– Vestas

This independent 132-page report guarantees you will remain better informed than your competitors. With 131 tables and figures examining the Wind Power market space, the report gives you profiles of leading companies operating within the Wind Power market with financial analysis as well as in-depth analysis of contracts, projects and programmes.

This report is essential reading for you or anyone in the Energy sector. Purchasing this report today will help you to recognise those important market opportunities and understand the possibilities there. I look forward to receiving your order.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Wind Power Market Overview

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report Include:

1.5 Who is This Report For?

1.6 Methodology

1.6.1 Primary Research

1.6.2 Secondary Research

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to the Wind Power Market

2.1 Wind Power Market Structure

2.2 Wind Power Market Definition

2.3 Brief History of Wind Power

2.4 Wind Energy Submarkets Definition

2.4.1 Wind Power – Onshore Wind Submarket Definition

2.4.2 Wind Power – Offshore Wind Submarket Definition

2.5 Wind Power Market Drivers & Restraints 2018

2.5.1 Drivers in Wind Power Market

2.5.1.1 Favourable Government Initiatives

2.5.1.2 Increasing Electricity Demand

2.5.1.3 Rising Demand For Clean Energy

2.5.2 Restraints in the Wind Power Market

2.5.2.1 High Initial Investment

2.5.2.2 Increasing Adoption of Other Renewable Technologies

3. Competitor Positioning in the Global Wind Power Market

3.1 Increasing Supply Agreements

3.2 Increasing Demand for Electricity

3.3 Cost Competitiveness and Economy of Scale

3.4 The Leading Companies’ Market Share (CAPEX) in the Global Wind Power Market 2017

3.5 The Leading Companies’ Market Share (Installed Capacity) in the Global Wind Power Market 2017

3.6 Regional Wind Power Investment Emphasis

4. The Leading Twenty Companies in Wind Power Market 2018

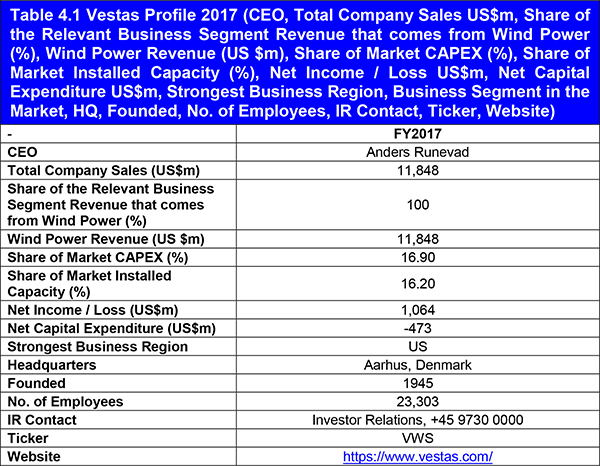

4.1 Vestas

4.1.1 Vestas Wind Power Selected Recent Contracts / Projects / Programmes 2017-2018

4.1.2 Vestas Total Company Regional Sales 2017

4.1.3 Vestas Total Company Sales 2011-2017

4.1.4 Vestas SWOT Analysis

4.2 Suzlon Energy Limited

4.2.1 Suzlon Energy Limited Wind Power Selected Recent Contracts / Projects / Programmes 2017-2018

4.2.2 Suzlon Energy Limited Total Company Regional Sales 2017

4.2.3 Suzlon Energy Limited Total Company Sales 2011-2017

4.2.4 Suzlon Energy Limited SWOT Analysis

4.3 General Electric Company

4.3.1 General Electric Company Wind Power Selected Recent Contracts / Projects / Programmes 2017-2018

4.3.2 General Electric Total Company Regional Sales 2017

4.3.3 General Electric Company Total Company Sales 2012-2017

4.3.4 General Electric Company Sales in the Business Segment that includes Wind Power Market 2012-2017

4.3.5 General Electric Company SWOT Analysis

4.4 Siemens AG

4.4.1 Siemens AG Wind Power Selected Recent Contracts / Projects / Programmes 2017-2018

4.4.2 Siemens AG Total Company Regional Sales 2017

4.4.3 Siemens AG Total Company Sales 2011-2017

4.4.4 Siemens AG Sales in the Business Segment that includes Wind Power Market 2012-2017

4.4.5 Siemens AG SWOT Analysis

4.5 Goldwind

4.5.1 Goldwind Wind Power Selected Recent Contracts / Projects / Programmes 2017-2018

4.5.2 Goldwind Total Company Regional Sales 2017

4.5.3 Goldwind Total Company Sales 2013-2017

4.5.4 Goldwind SWOT Analysis

4.6 Enercon GmbH

4.6.1 Enercon GmbH Wind Power Selected Recent Contracts / Projects / Programmes 2017

4.6.2 Enercon GmbH SWOT Analysis

4.7 Nordex SE

4.7.1 Nordex SE Wind Power Selected Recent Contracts / Projects / Programmes 2017-2018

4.7.2 Nordex SE Total Company Regional Sales 2017

4.7.3 Nordex SE Total Company Sales 2011-2017

4.7.4 Nordex SE SWOT Analysis

4.8 Senvion S.A.

4.8.1 Senvion S.A. Wind Power Selected Recent Contracts / Projects / Programmes 2017-2018

4.8.2 Senvion S.A. Total Company Regional Sales 2017

4.8.3 Senvion S.A. Total Company Sales 2011-2017

4.8.4 Senvion S.A. SWOT Analysis

4.9 Envision Energy

4.9.1 Envision Energy Wind Power Selected Recent Contracts / Projects / Programmes 2017

4.9.2 Envision Energy SWOT Analysis

4.10 ABO Wind AG

4.10.1 ABO Wind AG Total Company Regional Sales 2017

4.10.2 ABO Wind AG Total Company Sales 2012-2017

4.10.3 ABO Wind AG SWOT Analysis

4.11 Vattenfall AB

4.11.1 Vattenfall AB Wind Power Selected Recent Contracts / Projects / Programmes 2017-2018

4.11.2 Vattenfall AB Total Company Regional Sales 2017

4.11.3 Vattenfall AB Total Company Sales 2011-2017

4.11.4 Vattenfall AB SWOT Analysis

4.12 RWE Group

4.12.1 RWE Group Wind Power Selected Recent Contracts / Projects / Programmes 2017-2018

4.12.2 RWE Group Total Company Regional Sales 2017

4.12.3 RWE Group Total Company Sales 2011-2017

4.12.4 RWE Group Sales in the Business Segment that includes Wind Power Market 2011-2017

4.13 E.ON SE

4.13.1 E.ON SE Wind Power Selected Recent Contracts / Projects / Programmes 2018

4.3.2 E.ON SE Total Company Regional Sales 2017

4.13.3 E.ON SE Total Company Sales 2011-2017

4.13.4 E.ON SE Sales in Wind Power Market 2011-2017

4.13.5 E.ON SE SWOT Analysis

4.14 Eneco Group

4.14.1 Eneco Group Wind Power Selected Recent Contracts / Projects / Programmes 2017-2018

4.14.2 Eneco Group Total Company Sales 2011-2017

4.14.3 Eneco Group Sales in the Business Segment that includes Wind Power Market 2011-2017

4.15 Doosan Heavy Industries & Construction

4.15.1 Doosan Heavy Industries & Construction Wind Power Selected Recent Contracts / Projects / Programmes 2018

4.15.2 Doosan Heavy Industries & Construction Total Company Sales 2011-2017

4.15.3 Doosan Heavy Industries & Construction Sales in the Business Segment that includes Wind Power Market 2012-2017

4.15.4 Doosan Heavy Industries & Construction SWOT Analysis

4.16 Northland Power

4.16.1 Northland Power Wind Power Selected Recent Contracts / Projects / Programmes 2017

4.16.2 Northland Power Total Company Regional Sales 2017

4.16.3 Northland Power Total Company Sales 2011-2017

4.16.4 Northland Power Sales in the Business Segment that includes Wind Power Market 2011-2017

4.16.5 Northland Power SWOT Analysis

4.17 Dong Energy

4.17.1 Dong Energy Wind Power Selected Recent Contracts / Projects / Programmes 2017

4.17.2 Dong Energy Total Company Regional Sales 2017

4.17.3 Dong Energy Total Company Sales 2011-2017

4.17.5 Dong Energy SWOT Analysis

4.18 NextEra Energy, Inc.

4.18.1 NextEra Energy, Inc. Wind Power Selected Recent Contracts / Projects / Programmes 2017

4.18.2 NextEra Energy, Inc. Total Company Sales 2011-2017

4.18.3 NextEra Energy, Inc. Sales in the Business Segment that includes Wind Power Market 2011-2017

4.18.4 NextEra Energy, Inc. SWOT Analysis

4.19 EDP Renewables

4.19.1 EDP Renewables Wind Power Selected Recent Contracts / Projects / Programmes 2017-2018

4.19.2 EDP Renewables Total Company Regional Sales 2017

4.19.3 EDP Renewables Total Company Sales 2011-2017

4.19.4 EDP Renewables SWOT Analysis

4.20 Mingyang Wind Power

4.20.1 Mingyang Wind Power Wind Power Selected Recent Contracts / Projects / Programmes 2018

4.20.2 Mingyang Wind Power Total Company Sales 2011-2015

5. SWOT Analysis of the Wind Power Market 2018-2028

6. PEST Analysis of the Wind Power Market 2018-2028

7. Conclusion & Recommendations

8. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix

Visiongain report evaluation form

List of Figures

Figure 2.1 Global Wind Power Market Segmentation Overview

Figure 3.1 The Leading Companies in the Wind Power Market by CAPEX in 2017 (Market Share %)

Figure 3.2 The Leading Companies in the Wind Power Market by Installed Capacity in 2017 (Market Share %)

Figure 3.3 Leading Regional Wind Power Market Share Forecast 2017 (%)

Figure 4.1 Vestas Total Company Regional Sales 2017 (%)

Figure 4.2 Vestas Total Company Sales 2011-2017 (US $m, AGR %)

Figure 4.3 Suzlon Energy Limited Total Company Regional Sales 2017 (%)

Figure 4.4 Suzlon Energy Limited Total Company Sales 2011-2017 (US$m, AGR %)

Figure 4.5 General Electric Total Company Regional Sales 2017 (%)

Figure 4.6 General Electric Company Total Company Sales 2012-2017 (US$m, AGR %)

Figure 4.7 General Electric Company Sales in the Business Segment that includes Wind Power Market 2012-2017 (US$m, AGR %)

Figure 4.8 Siemens AG Total Company Regional Sales 2017 (%)

Figure 4.9 Siemens AG Total Company Sales 2011-2017 (US$m, AGR %)

Figure 4.10 Siemens AG Sales in the Business Segment that includes Wind Power Market 2012-2017 (US$m, AGR %)

Figure 4.11 Goldwind Total Company Regional Sales 2017 (%)

Figure 4.12 Goldwind Total Company Sales 2013-2017 (US$m, AGR %)

Figure 4.13 Nordex SE Total Company Regional Sales 2017 (%)

Figure 4.14 Nordex SE Total Company Sales 2011-2017 (US$m, AGR %)

Figure 4.15 Senvion S.A. Total Company Regional Sales 2017 (%)

Figure 4.16 Senvion S.A. Total Company Sales 2011-2017 (US$m, AGR %)

Figure 4.17 ABO Wind AG Total Company Regional Sales 2017 (%)

Figure 4.18 ABO Wind AG Total Company Sales 2012-2017 (US$m, AGR %)

Figure 4.19 Vattenfall AB Total Company Regional Sales 2017 (%)

Figure 4.20 Vattenfall AB Company Sales 2011-2017 (US$m, AGR %)

Figure 4.21 RWE Group Total Company Regional Sales 2017 (%)

Figure 4.22 RWE Group Company Sales 2011-2017 (US$m, AGR %)

Figure 4.23 RWE Group Sales in the Business Segment that includes Wind Power Market 2011-2017 (US$m, AGR %)

Figure 4.24 E.ON SE Total Company Regional Sales 2017 (%)

Figure 4.25 E.ON SE Company Sales 2011-2017 (US$m, AGR %)

Figure 4.26 E.ON SE Sales in the Business Segment that includes Wind Power Market 2011-2017 (US$m, AGR %)

Figure 4.27 Eneco Group Company Sales 2011-2017 (%)

Figure 4.28 Eneco Group Sales in the Business Segment that includes Wind Power Market 2011-2017 (US$m, AGR %)

Figure 4.29 Doosan Heavy Industries & Construction Total Company Sales 2011-2017 (US$m, AGR %)

Figure 4.30 Doosan Heavy Industries & Construction Sales in the Business Segment that includes Wind Power Market 2012-2017 (US$m, AGR %)

Figure 4.31 Northland Power Total Company Regional Sales 2017 (%)

Figure 4.32 Northland Power Company Sales 2011-2017 (US$m, AGR %)

Figure 4.33 Northland Power Sales in the Business Segment that includes Wind Power Market 2011-2017 (US$m, AGR %)

Figure 4.34 Dong Energy Total Company Regional Sales 2017 (%)

Figure 4.35 Dong Energy Company Sales 2011-2017 (US$m, AGR %)

Figure 4.36 NextEra Energy, Inc. Company Sales 2011-2017 (US$m, AGR %)

Figure 4.37 NextEra Energy, Inc. Sales in the Business Segment that includes Wind Power Market 2011-2017 (US$m, AGR %)

Figure 4.38 EDP Renewables Total Company Regional Sales 2017 (%)

Figure 4.39 EDP Renewables Company Sales 2011-2017 (US$m, AGR %)

Figure 4.40 Mingyang Wind Power Company Sales 2011-2015 (US$m, AGR %)

List of Tables

Table 2.1 Wind Power Market Drivers & Restraints

Table 3.1 The Leading Twenty Companies in the Wind Power Market by CAPEX in 2017 (Rank, Company, Market Share %, CAPEX $m)

Table 3.2 The Leading Twenty Companies in the Wind Power Market by Installed Capacity in 2017 (Rank, Company, Market Share %, Capacity GW)

Table 4.1 Vestas Profile 2017 (CEO, Total Company Sales US$m, Share of the Relevant Business Segment Revenue that comes from Wind Power (%), Wind Power Revenue (US $m), Share of Market CAPEX (%), Share of Market Installed Capacity (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.2 Selected Recent Vestas Wind Power Contracts / Projects / Programmes 2017-2018 (Date, Country, Capacity MW, Project Details)

Table 4.3 Vestas Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.4 SWOT Analysis of Vestas

Table 4.5 Suzlon Energy Limited Profile 2017 (CEO, Total Company Sales US$m, Share of the Relevant Business Segment Revenue that comes from Wind Power (%), Wind Power Revenue (US $m), Share of Market CAPEX (%), Share of Market Installed Capacity (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.6 Selected Recent Suzlon Energy Limited Wind Power Contracts / Projects / Programmes 2017-2018 (Date, Country, Capacity MW, Project Details)

Table 4.7 Suzlon Energy Limited Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.8 SWOT Analysis of Suzlon Energy Limited

Table 4.9 General Electric Company 2017 (CEO, Total Company Sales US$m, Revenue of the Business Segment that includes Wind Power Market US$m, Share of the Relevant Business Segment Revenue that comes from Wind Power (%), Wind Power Revenue (US $m), Share of Market CAPEX (%), Share of Market Installed Capacity (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.10 Selected Recent General Electric Company Wind Power Contracts / Projects / Programmes 2017-2018 (Date, Country, Capacity MW, Project Details)

Table 4.11 General Electric Company Total Company Sales 2011-2017 (US$m, AGR %)

Table 4.12 General Electric Company Sales in the Business Segment that includes Wind Power Market 2011-2017 (US$m, AGR %)

Table 4.13 SWOT Analysis of General Electric Company

Table 4.14 Siemens AG 2017 (CEO, Total Company Sales US$m, Revenue of the Business Segment that includes Wind Power Market US$m, Share of the Relevant Business Segment Revenue that comes from Wind Power (%), Wind Power Revenue (US $m), Share of Market CAPEX (%), Share of Market Installed Capacity (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.15 Selected Recent Siemens AG Wind Power Contracts / Projects / Programmes 2017-2018 (Date, Country, Capacity MW, Project Details)

Table 4.16 Siemens AG Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.17 Siemens AG Sales in the Business Segment that includes Wind Power Market 2011-2017 (US$m, AGR %)

Table 4.18 SWOT Analysis of Siemens AG

Table 4.19 Goldwind 2017 (CEO, Total Company Sales US$m, Revenue of the Business Segment that includes Wind Power Market US$m, Share of the Relevant Business Segment Revenue that comes from Wind Power (%), Wind Power Revenue (US $m), Share of Market CAPEX (%), Share of Market Installed Capacity (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.20 Selected Recent Goldwind Wind Power Contracts / Projects / Programmes 2017-2018 (Date, Country, Capacity MW, Project Details)

Table 4.21 Goldwind Total Company Sales 2012-2017 (US$m, AGR %)

Table 4.22 SWOT Analysis of Goldwind

Table 4.23 Enercon GmbH 2017 (CEO, Estimated Revenue of the Business Segment that includes Wind Power US$m, Share of the Relevant Business Segment Revenue that comes from Wind Power (%), Wind Power Revenue (US $m), Share of Market CAPEX (%), Share of Market Installed Capacity (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.24 Selected Recent Enercon GmbH Wind Power Contracts / Projects / Programmes 2017 (Date, Country, Capacity MW, Project Details)

Table 4.25 SWOT Analysis of Enercon GmbH

Table 4.26 Nordex SE 2017 (CEO, Revenue of the Business Segment that includes Wind Power US$m, Share of the Relevant Business Segment Revenue that comes from Wind Power (%), Wind Power Revenue (US $m), Share of Market CAPEX (%), Share of Market Installed Capacity (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.27 Selected Recent Nordex SE Wind Power Contracts / Projects / Programmes 2017-2018 (Date, Country, Capacity MW, Project Details)

Table 4.28 Nordex SE Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.29 SWOT Analysis of Nordex SE

Table 4.30 Senvion S.A. 2017 (CEO, Revenue of the Business Segment that includes Wind Power US$m, Share of the Relevant Business Segment Revenue that comes from Wind Power (%), Wind Power Revenue (US $m), Share of Market CAPEX (%), Share of Market Installed Capacity (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.31 Selected Recent Senvion S.A. Wind Power Contracts / Projects / Programmes 2017-2018 (Date, Country, Capacity MW, Project Details)

Table 4.32 Senvion S.A. Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.33 SWOT Analysis of Senvion S.A.

Table 4.34 Envision Energy 2017 (CEO, Wind Power Revenue (US $m), Share of Market CAPEX (%), Share of Market Installed Capacity (%), HQ, Founded, Website)

Table 4.35 Selected Recent Envision Energy Wind Power Contracts / Projects / Programmes 2017 (Date, Country, Capacity MW, Project Details)

Table 4.36 SWOT Analysis of Envision Energy

Table 4.37 ABO Wind AG 2017 (CEO, Total Company Sales US$m, Revenue of the Business Segment that includes Wind Power Market US$m, Share of the Relevant Business Segment Revenue that comes from Wind Power (%), Wind Power Revenue (US $m), Share of Market CAPEX (%), Share of Market Installed Capacity (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.38 ABO Wind AG Total Company Sales 2011-2017 (US$m, AGR %)

Table 4.39 SWOT Analysis of ABO Wind AG

Table 4.40 Vattenfall AB 2017 (CEO, Total Company Sales US$m, Share of the Relevant Business Segment Revenue that comes from Wind Power (%), Wind Power Revenue (US $m), Share of Market CAPEX (%), Share of Market Installed Capacity (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.41 Selected Recent Vattenfall AB Wind Power Contracts / Projects / Programmes 2017-2018 (Date, Country, Capacity MW, Project Details)

Table 4.42 Vattenfall AB Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.43 SWOT Analysis of Vattenfall AB

Table 4.44 RWE Group 2017 (CEO, Total Company Sales US$m, Share of the Relevant Business Segment Revenue that comes from Wind Power (%), Wind Power Revenue (US $m), Share of Market CAPEX (%), Share of Market Installed Capacity (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.45 Selected Recent RWE Group Wind Power Contracts / Projects / Programmes 2017-2018 (Date, Country, Capacity MW, Project Details)

Table 4.46 RWE Group Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.47 RWE Group Sales in the Business Segment that includes Wind Power Market 2010-2017 (US$m, AGR %)

Table 4.48 E.ON SE 2017 (CEO, Total Company Sales US$m, Share of the Relevant Business Segment Revenue that comes from Wind Power (%), Wind Power Revenue (US $m), Share of Market CAPEX (%), Share of Market Installed Capacity (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.49 Selected Recent E.ON SE Wind Power Contracts / Projects / Programmes 2018 (Date, Country, Capacity MW, Project Details)

Table 4.50 E.ON SE Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.51 E.ON SE Sales in the Business Segment that includes Wind Power Market 2010-2017 (US$m, AGR %)

Table 4.52 SWOT Analysis of E.ON SE

Table 4.53 Eneco Group 2017 (CEO, Total Company Sales US$m, Revenue of the Business Segment that includes Wind Power US$m, Share of the Relevant Business Segment Revenue that comes from Wind Power (%), Wind Power Revenue (US $m), Share of Market CAPEX (%), Share of Market Installed Capacity (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.54 Selected Recent Eneco Group Wind Power Contracts / Projects / Programmes 2017-2018 (Date, Country, Capacity MW, Project Details)

Table 4.55 Eneco Group Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.56 Eneco Group Sales in the Business Segment that includes Wind Power Market 2010-2017 (US$m, AGR %)

Table 4.57 Doosan Heavy Industries & Construction 2017 (CEO, Total Company Sales (US$m), Revenue of the Business Segment that includes Wind Power (US $m), Share of the relevant Business Segment Revenue that comes from Wind Power (%), Share of Market CAPEX (%), Share of Market Installed Capacity (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.58 Selected Recent Doosan Heavy Industries & Construction Wind Power Contracts / Projects / Programmes 2018 (Date, Country, Capacity MW, Project Details)

Table 4.59 Doosan Heavy Industries & Construction Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.60 Doosan Heavy Industries & Construction Sales in the Business Segment that includes Wind Power Market 2011-2017 (US$m, AGR %)

Table 4.61 SWOT Analysis of Doosan Heavy Industries & Construction

Table 4.62 Northland Power 2017 (CEO, Total Company Sales US$m, Revenue of the Business Segment that includes Wind Power US$m, Share of the Relevant Business Segment Revenue that comes from Wind Power (%), Wind Power Revenue (US $m), Share of Market CAPEX (%), Share of Market Installed Capacity (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.63 Selected Recent Northland Power Wind Power Contracts / Projects / Programmes 2017 (Date, Country, Capacity MW, Project Details)

Table 4.64 Northland Power Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.65 Northland Power Sales in the Business Segment that includes Wind Power Market 2010-2017 (US$m, AGR %)

Table 4.66 SWOT Analysis of Northland Power

Table 4.67 Dong Energy 2017 (CEO, Total Company Sales US$m, Revenue of the Business Segment that includes Wind Power US$m, Share of the Relevant Business Segment Revenue that comes from Wind Power (%), Wind Power Revenue (US $m), Share of Market CAPEX (%), Share of Market Installed Capacity (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.68 Selected Recent Dong Energy Wind Power Contracts / Projects / Programmes 2017 (Date, Country, Capacity MW, Project Details)

Table 4.69 Dong Energy Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.70 SWOT Analysis of Dong Energy

Table 4.71 NextEra Energy, Inc. 2017 (CEO, Total Company Sales US$m, Revenue of the Business Segment that includes Wind Power US$m, Share of the Relevant Business Segment Revenue that comes from Wind Power (%), Wind Power Revenue (US $m), Share of Market CAPEX (%), Share of Market Installed Capacity (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.72 Selected Recent NextEra Energy, Inc. Wind Power Contracts / Projects / Programmes 2017 (Date, Country, Capacity MW, Project Details)

Table 4.73 NextEra Energy, Inc. Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.74 NextEra Energy, Inc. Sales in the Business Segment that includes Wind Power Market 2010-2017 (US$m, AGR %)

Table 4.75 SWOT Analysis of NextEra Energy, Inc.

Table 4.76 EDP Renewables 2017 (CEO, Total Company Sales US$m, Share of the Relevant Business Segment Revenue that comes from Wind Power (%), Wind Power Revenue (US $m), Share of Market CAPEX (%), Share of Market Installed Capacity (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.77 Selected Recent EDP Renewables Wind Power Contracts / Projects / Programmes 2017-2018 (Date, Country, Capacity MW, Project Details)

Table 4.78 EDP Renewables Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.79 SWOT Analysis of EDP Renewables

Table 4.80 Mingyang Wind Power 2017 (CEO, Wind Power Revenue (US $m), Share of Market CAPEX (%), Share of Market Installed Capacity (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.81 Selected Recent Mingyang Wind Power Wind Power Contracts / Projects / Programmes 2018 (Date, Country, Capacity MW, Project Details)

Table 4.82 Mingyang Wind Power Total Company Sales 2010-2015 (US$m, AGR %)

Table 5.1 SWOT Analysis of the Wind Power Market 2018 - 2028

Table 6.1 PEST Analysis of the Wind Power Market 2018 – 2028

ABO Wind AG

Acciona Windpower

Allete Clean Energy

Alstom

American Electric Power (AEP)

Arroyo Energy Compania de Energias Renovables Limitada

Aurora Energy

BASF

Beleolico Srl

British Wind Energy

Capital Power

Concord New Energy Group Ltd.

DELTA

Dominion Energy Virginia

Dong Energy

Doosan Heavy Industries & Construction

E.ON SE

EDP Renewables

Eneco Group

Enercon GmbH

Energie Baden-Wuerttemberg AG

ENGIE

Enlight Renewable Energy

Envision Energy

Fina Enerji

Flack Renewables

Florida Power & Light (FPL) Company

Gamesa Corporacion Tecnologica S.A.

Gazprom

General Electric Company

Goldwind

Great Plains Energy

Lagerway

Limak

LM Wind Power

Japan Wind Development Co., Ltd.

MHI Vestas Offshore Wind

Microsoft

Mingyang Wind Power

Mitsubishi Corporation

Mitsui Engineering & Shipbuilding Co.

NextEra Energy, Inc. (NEE)

NextEra Energy Resources, LLC (NEER)

Nestle

Nordex SE

Northland Power

OMV

One Energy Enterprises LLC

ReNew Power

Renewable Energy Systems Americas, Inc.

RWE Group

Senvion S.A.

Shell

Siemens AG

Siemens Gamesa Renewable Energy, S.A

Statoil

Suzlon Energy Limited

Tesla Inc

Van Oord

Vattenfall AB

Vestas

Windlab Limited

YARD Energy

Yushan Energy

List of Other Organisations Mentioned in this Report

Alberta Electricity System Operator (AESO)

Global Wind Energy Council (GWEC)

Indian Renewable Energy Development Agency Ltd (IREDA)

Ministry of New and Renewable Energy, India (MNRE)

The US Government

US Department of Energy

US Energy Information Administration

Download sample pages

Complete the form below to download your free sample pages for Top 20 Wind Power Companies Report 2018

Related reports

-

Next Generation Energy Storage Technologies (EST) Market Forecast 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global next-generation energy storage technologies market. Visiongain...

Full DetailsPublished: 16 April 2018 -

Global Transformer Core Market 2017-2027

Visiongain has calculated that the Transformer Core market will see a capital expenditure (CAPEX) of $7,853 mn in 2017.Read on...

Full DetailsPublished: 20 October 2017 -

The Gas Insulated Substation (GIS) Market Forecast 2018-2028

Visiongain has calculated that the global Gas Insulated Substation (GIS) Market will see a capital expenditure (CAPEX) of $26,069 mn...

Full DetailsPublished: 01 February 2018 -

The Electric Power Transmission & Distribution (T&D) Infrastructure Market Forecast 2018-2028

The latest research report from business intelligence provider Visiongain offers comprehensive analysis of the Electric Power Transmission & Distribution (T&D)...

Full DetailsPublished: 06 March 2018 -

The Power Transformers Market Forecast 2018-2028

The increased focus on a more efficient energy grid infrastructure has led Visiongain to publish this timely report. The market...Full DetailsPublished: 27 July 2018 -

Ultra-Thin Solar Cells Market Report 2019-2029

The USD 3.34 billion Ultra-Thin Solar Cells Market is expected to flourish in the next few years. ...Full DetailsPublished: 22 February 2019 -

Emerging Technologies in Solar Power Market Report 2017-2027

Visiongain assesses that emerging technologies in solar power will generate $163.9bn in revenues during 2017....Full DetailsPublished: 15 March 2017 -

Top 20 Solar Power Companies Report 2017

The latest research report from business intelligence provider Visiongain offers comprehensive analysis of the solar power companies market. Visiongain assesses...

Full DetailsPublished: 24 May 2017 -

Hydropower Market Report 2018-2028

This latest report by business intelligence provider Visiongain assesses that Hydropower spending will reach $70.36bn in 2018, including spending on...

Full DetailsPublished: 11 April 2018 -

Offshore Wind Power Market Report 2018-2028

Visiongain has calculated that the global offshore wind market will see capital expenditure (CAPEX) of $24,448m in 2018, including spending...Full DetailsPublished: 14 September 2018

Download sample pages

Complete the form below to download your free sample pages for Top 20 Wind Power Companies Report 2018

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain energy reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and industry experts where possible but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain energy reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

“The Visiongain report was extremely insightful and helped us construct our basic go-to market strategy for our solution.”

H.

“F.B has used Visiongain to prepare two separate market studies on the ceramic proppants market over the last 12 months. These reports have been professionally researched and written and have assisted FBX greatly in developing its business strategy and investment plans.”

F.B

“We just received your very interesting report on the Energy Storage Technologies (EST) Market and this is a very impressive and useful document on that subject.”

I.E.N

“Visiongain does an outstanding job on putting the reports together and provides valuable insight at the right informative level for our needs. The EOR Visiongain report provided confirmation and market outlook data for EOR in MENA with the leading countries being Oman, Kuwait and eventually Saudi Arabia.”

E.S

“Visiongain produced a comprehensive, well-structured GTL Market report striking a good balance between scope and detail, global and local perspective, large and small industry segments. It is an informative forecast, useful for practitioners as a trusted and upto-date reference.”

Y.N Ltd

Association of Dutch Suppliers in the Oil & Gas Industry

Society of Naval Architects & Marine Engineers

Association of Diving Contractors

Association of Diving Contractors International

Associazione Imprese Subacquee Italiane

Australian Petroleum Production & Exploration Association

Brazilian Association of Offshore Support Companies

Brazilian Petroleum Institute

Canadian Energy Pipeline

Diving Medical Advisory Committee

European Diving Technology Committee

French Oil and Gas Industry Council

IMarEST – Institute of Marine Engineering, Science & Technology

International Association of Drilling Contractors

International Association of Geophysical Contractors

International Association of Oil & Gas Producers

International Chamber of Shipping

International Shipping Federation

International Marine Contractors Association

International Tanker Owners Pollution Federation

Leading Oil & Gas Industry Competitiveness

Maritime Energy Association

National Ocean Industries Association

Netherlands Oil and Gas Exploration and Production Association

NOF Energy

Norsk olje og gass Norwegian Oil and Gas Association

Offshore Contractors’ Association

Offshore Mechanical Handling Equipment Committee

Oil & Gas UK

Oil Companies International Marine Forum

Ontario Petroleum Institute

Organisation of the Petroleum Exporting Countries

Regional Association of Oil and Natural Gas Companies in Latin America and the Caribbean

Society for Underwater Technology

Society of Maritime Industries

Society of Petroleum Engineers

Society of Petroleum Enginners – Calgary

Step Change in Safety

Subsea UK

The East of England Energy Group

UK Petroleum Industry Association

All the events postponed due to COVID-19.

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Energy news

Energy as a Service (EaaS) Market

The global Energy as a Service (EaaS) market is projected to grow at a CAGR of 12.6% by 2034

25 July 2024

Synthetic Fuels Market

The global Synthetic Fuels market is projected to grow at a CAGR of 23% by 2034

18 July 2024

Power-to-X (P2X) Market

The global Power-to-X (P2X) market is projected to grow at a CAGR of 10.6% by 2034

09 July 2024

Airborne Wind Energy Market

The global Airborne Wind Energy market is projected to grow at a CAGR of 9.7% by 2034

05 June 2024