The Automotive ADAS Market is constantly evolving, and new systems are being introduced to the market every year. However, all systems can generally be attributed to one of the submarkets stated. Additionally, as part of the product differentiation strategy of car manufacturers, different names might be allocated to describe an ADAS End-User Application, e.g. the Night Vision System term we use in this report corresponds to Mercedes-Benz’s Night View Assist Plus or BMW’s Night Vision with Dynamic Light Spot.

It is also worth mentioning that in 2018, many OEMs – premium automakers as well as volume car manufacturers – offered a number of ADAS applications as a safety-oriented package (bundle) with a substantial discount on the aggregated price. This strategy aims to introduce consumers to the new driving technologies and increase the awareness levels of the benefits of these systems. The demand for ADAS in vehicles is growing rapidly. Expectedly, this growth will continue throughout the forecast period. Customers are opting for ADAS applications for safety concerns as the number of road accidents is on the rise, especially in the developing countries. Therefore, in the current business scenario, the increasing concern for safety primarily drives the ADAS market. In order to reduce the number of accidents with excellent ADAS applications such as Adaptive Cruise Control, Blind Spot Detection System, Lane Departure Warning System and Night Vision are extensively promoting ADAS applications.

Since the vehicle’s price constitutes a major buying criterion especially in the small and medium-car segment, the ‘’packaging’’ strategy aims to enhance penetration since the price of the package is considerably cheaper than the price of the individual systems if they are selected independently.

A representative example is BMW’s Active Security Package available as an option for all models of the brand. The package comprises Lane departure warning, Forward Collision Warning, City Collision Mitigation, Pedestrian Recognition and Dynamic Safety Lane change warning priced at $1350 in the UK while LDW and PDW are priced $600, and $450 respectively if selected independently.

Report Highlights

106 Tables, Charts, And Graphs

Global Top 20 Automotive Advanced Driver Assistance Systems (ADAS) Companies And Analysis 2019

Analysis Of The Top 20 Automotive ADAS Companies Including Their ADAS Revenues, ADAS Market Share % And Ranking)

• Aisin Seiki Co

• Autoliv AB

• Bosch Group

• Continental AG

• Delphi Automotive

• Denso Corporation

• Freescale Semiconductors

• Gentex Corporation

• Harman International

• Hella KGaA Hueck & Co

• Hyundai Mobis

• Magna International Inc

• Mobileye N.V

• NVIDIA

• Panasonic Corporation

• Renesas Electronics

• Takata Corporation

• Texas Instruments

• Valeo SA

• ZF Group

Analysis of the challenges facing the industry

• Regulatory barriers

• Certification process

• Technological challenges

• Performance & reliability

• Cost issues

• Safety

• Semi-autonomous and autonomous technologies

• Emissions

Key questions answered

• What does the future hold for Automotive Advanced Driving Assistance Systems?

• Where should you target your business strategy?

• Which companies should you form strategic alliances with?

• Which company is likely to succeed, and why?

Target audience

• Leading Automotive OEMs

• Aerospace companies

• Component Suppliers

• Sensor specialists

• Electronic companies

• Software developers

• Autonomous vehicle developers

• Artificial intelligence (AI) specialists

• Composites companies

• Technologists

• R&D staff

• Consultants

• Market analysts

• Senior executives

• Business development managers

• Investors

• Governments

• Agencies

• Industry organisations

• Banks

Why You Must Buy This Report:

This report features news, insights, the latest developments and an in-depth survey of the Automotive Advanced Driving Assistance Systems companies with up-to-date analysis as well as tables, graphs and charts. This report is a vital addition to gaining an understanding of the potential for Automotive Advanced Driving Assistance Systems and will give your company ‘the edge’ on your competitors. You cannot afford to be without this latest report from Visiongain.

Visiongain is a trading partner with the US Federal Government

CCR Ref number KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help sara.peerun@visiongain.com

1. Report Overview

1.1 Top 20 ADAS Suppliers Overview

1.2 Global Automotive ADAS Market Segmentation

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report Include:

1.6 Who is This Report for?

1.7 Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to the Automotive ADAS Market

2.1 Read Why ADAS Suppliers Are Instrumental For Autonomous Driving

2.2 Automotive ADAS Market Definition

2.3 ADAS vs Active Safety Definition

2.4 Automotive ADAS Market by End-User Application

2.5 Adaptive Cruise Control (ACC) Submarket

2.6 Adaptive Front Lights (AFL) Submarket

2.7 Blind Spot Monitoring (BSM) Submarket

2.8 Driver Monitoring Systems (DMS) Submarket

2.9 Forward Collision Warning (FCW) Submarket

2.10 Heads-Up Display (HUD) Submarket

2.11 Intelligent Speed Adaptation (ISA) Submarket

2.12 Lane Departure Warning (LDW) Submarket

2.13 Night Vision System (NVS) Submarket

2.14 Parking Assistance (PA) Submarket

2.15 Pedestrian Detection System (PDS) Submarket

2.16 Road Sign Recognition (RSR) Submarket

2.17 Surround View Cameras (SVC) Submarket

2.18 V2V and V2X Systems Submarket

2.19 Automotive ADAS Sensors

2.20 Overview of the Sensors Used in ADAS End-User Applications

3 Global Automotive ADAS Market & Sensor Submarkets 2018

3.1 Market Value of the Global Automotive ADAS Market in 2018

3.2 Learn How Government Mandates Will Drive ADAS Penetration

3.3 Restraints in the Global ADAS Market

3.4 Sales Volume of ADAS Sensors by Category in 2018

3.5 Market Value of ADAS Sensors in 2018

3.6 Market Value of the Automotive ADAS Submarkets in 2018

4 Top-20 Companies Positioning in the Automotive ADAS Market 2018

4.1 Ranking of the Leading 20 Companies by Revenues in the ADAS Market in 2018

4.2 Read about the Composition of the Top-20 ADAS Companies Ranking in 2018

4.3 How Does Regional ADAS Penetration Affect the Ranking of German, Japanese and American ADAS Suppliers?

4.4 What is the Level of Revenue Concentration in the ADAS Marketplace in 2018?

4.5 M&A in the ADAS Marketplace in 2014 – 2018

4.6 Landscape in the ADAS Market vs. Active Safety vs Passive Safety Market

5 The Leading 20 Automotive ADAS Companies

5.1 Aisin Seiki Co Company Overview

5.1.1 Aisin Seiki’s Role in the Automotive ADAS Market 2018

5.1.2 Aisin Seiki’s Automotive ADAS Portfolio

5.1.3 Aisin Seiki’s Future Outlook

5.2 Autoliv AB Company Overview

5.2.1 Autoliv’s Role in the Automotive ADAS Market 2018

5.2.2 Autoliv’s Automotive ADAS Portfolio

5.2.3 Autoliv’s Future Outlook

5.3 Bosch Company Overview

5.3.1 Bosch’s role in the Automotive ADAS Systems Market 2018

5.3.2 Bosch’s Automotive ADAS Portfolio

5.3.3 Bosch’s Future Outlook

5.4 Continental AG Company Overview

5.4.1 Continental’s Role in the Automotive ADAS Market 2018

5.4.2 Continental’s Automotive ADAS Portfolio

5.4.3 Continental’s Future Outlook

5.5 Delphi Automotive (Aptiv PLC) Company Overview

5.5.1 Delphi’s Role in the Automotive ADAS Market 2018

5.5.2 Delphi’s Automotive ADAS Portfolio

5.5.3 Delphi’s Future Outlook

5.6 Denso Corporation Company Overview

5.6.1 Denso’s Role in the Automotive ADAS Market 2018

5.6.2 Denso’s Automotive ADAS Portfolio

5.6.3 Denso’s Future Outlook

5.7 Freescale Semiconductors/NXP Semiconductors Company Overview

5.7.1 Freescale’s Role in the Automotive ADAS Market 2018

5.7.2 Freescale’s Automotive ADAS Portfolio

5.7.3 Freescale’s Future Outlook

5.8 Gentex Corporation Company Overview

5.8.1 Gentex’s Role in the Automotive ADAS Market 2018

5.8.2 Gentex’s Automotive ADAS Portfolio

5.8.3 Gentex’s Future Outlook

5.9 Harman International Company Overview

5.9.1 Harman’s Role in the Automotive ADAS Market 2018

5.9.2 Harman’s Automotive ADAS Portfolio

5.9.3 Harman’s Future Outlook

5.10 Hella KGaA Hueck & Co Company Overview

5.10.1 Hella’s Role in the Automotive ADAS Market 2018

5.10.2 Hella’s Automotive ADAS Portfolio

5.10.3 Hella’s Future Outlook

5.11 Hyundai Mobis Company Overview

5.11.1 Hyundai Mobis’s Role in the Automotive ADAS Market 2018

5.11.2 Hyundai Mobis’s Automotive ADAS Portfolio

5.11.3 Hyundai Mobis’s Future Outlook

5.12 Magna International Company Overview

5.12.1 Magna’s Role in the Automotive ADAS Market 2019

5.12.2 Magna’s Automotive ADAS Portfolio

5.12.3 Magna’s Future Outlook

5.13 Mobileye B.V Company Overview

5.13.1 Mobileye’s Role in the Automotive ADAS Market 2018

5.13.2 Mobileye’s Automotive ADAS Portfolio

5.13.3 Mobileye’s Future Outlook

5.14 NVIDIA Corporation Company Overview

5.14.1 NVIDIA’s Role in the Automotive ADAS Market 2018

5.14.2 NVIDIA’s Automotive ADAS Portfolio

5.14.3 NVIDIA’s Future Outlook

5.15 Panasonic Corporation Company Overview

5.15.1 Panasonic’s Role in the Automotive ADAS Market 2018

5.15.2 Panasonic’s Automotive ADAS Portfolio

5.15.3 Panasonic’s Future Outlook

5.16 Renesas Electronics Corporation Company Overview

5.16.1 Renesas’s Role in the Automotive ADAS Market 2018

5.16.2 Renesas’s Automotive ADAS Portfolio

5.16.3 Renesas’s Future Outlook

5.17 Takata Corporation Company Overview

5.17.1 Takata’s Role in the Automotive ADAS Market 2018

5.17.2 Takata’s Automotive ADAS Portfolio

5.17.3 Takata’s Future Outlook

5.18 Texas Instruments Company Overview

5.18.1 Texas Instruments’ Role in the Automotive ADAS Market 2018

5.18.2 Texas Instruments’ Automotive ADAS Portfolio

5.18.3 Texas Instruments’ Future Outlook

5.19 ZF Group Company Overview

5.19.1 ZF Group’s Role in the Automotive ADAS Market 2018

5.19.2 ZF Group’s Automotive ADAS Portfolio

5.19.3 ZF Group’s Future Outlook

5.20 Valeo S.A Company Overview

5.20.1 Valeo’s Role in the Automotive ADAS Market 2018

5.20.2 Valeo Automotive’s ADAS Portfolio

5.20.3 Valeo’s Future Outlook

5.21 Other Leading Suppliers in the Automotive ADAS Market 2019

6 SWOT Analysis of the Automotive ADAS Market 2019

6.1 Advantages and Disadvantages of the Automotive ADAS Sensors

6.2 Drivers and Restraints of the Automotive ADAS Market in 2019

7 Conclusions & Recommendations

7.1 Key Findings from Our Research

7.2 ADAS Market Share for the Top 20 Suppliers Split into Three Categories ADAS Market Share

7.3 Recommendations for Automotive ADAS Suppliers

Glossary

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain Report Evaluation Form

List of Figures

Figure 1.1 Segmentation of the Automotive ADAS Market

Figure 2.1 ADAS & Autonomous Driving

Figure 2.2 Segmentation of the Automotive ADAS Market

Figure 2.3 Overview of the Automotive ADAS Market by End-User Application

Figure 2.4 Schematic Of In-Vehicle System Adaptive Cruise Control. A Red Car Automatically' Follows a Blue Car

Figure 2.5 Adaptive Headlight assembly on a 2014 Toyota Avalon

Figure 2.6 A Driver Monitoring System Display In A Lexus Vehicle

Figure 2.7 Heads-Up Display of a BMW E60 Model

Figure 2.8 Lane Assist in a VW Golf

Figure 2.9 Parking sensor in a Audi A4 Model

Figure 3.1 Market Value of the Top 20 ADAS Companies - Global ADAS Market 2018 ($bn)

Figure 3.2 Sales Volume of ADAS Sensors by Category in 2018 (Million Units)

Figure 3.3 Average Pricing Assumption of ADAS Sensors in 2018 ($)

Figure 3.4 Share of ADAS Sensors in 2018 ADAS Sensors Market Value (%)

Figure 3.5 Market Value of the Automotive ADAS Submarkets 2018 ($bn)

Figure 3.6 ADAS Revenue in 2018 by End-User Application ($bn)

Figure 3.7 Market Share in ADAS Revenue 2018 by End-User Application (%)

Figure 4.1 Ranking of the 20 Leading Suppliers by Revenues in the ADAS Market in 2018 ($bn)

Figure 4.2 ADAS Market Share in Europe, America, Asia/Oceania/ME and RoW 2018 (% Share)

Figure 4.3 Allocation of Market Shares in the Top-20 ADAS Ranking (%, Top 5, Top 6-10, Top 11-15, Top 16-20, Other)

Figure 5.1 Aisin’s Sales Breakdown by Product Category 2018 (%)

Figure 5.2 Aisin’s Sales Breakdown by Region 2018 (%)

Figure 5.3 Autoliv’s 2018 Sales by Products (%)

Figure 5.4 Autoliv’s 2018 Sales by Region (%)

Figure 5.5 Bosch Group’s 2018 Sales by Region (%)

Figure 5.6 Bosch Group’s 2018 Sales by Business Segment (%)

Figure 5.7 Delphi’s 2018 Revenue by Segment (%)

Figure 5.8 Delphi’s 2018 Net Sales by Region (%)

Figure 5.9 Freescale’s Net Sales by Region in 2018 (%)

Figure 5.10 Freescale’s Net Sales by Product Category in 2018 (%)

Figure 5.11 Magna 2018 Sales Breakdown by Segment (%)

Figure 5.12 Takata’s 2017 Sales by Product Category (%)

Figure 5.13 Takata’s 2017 Sales by Region (%)

Figure 5.14 ZF GROUP’s Sales by Business Segment in 2018 (%)

Figure 5.15 Valeo’s 2018 Revenue by Segment (%)

Figure 7.1 ADAS Actual Market Share for the Top 20 Suppliers (%, Ranking)

List of Tables

Table 1.1 Overview of the 20 Automotive ADAS Suppliers Analysed (Key ADAS Suppliers, Country, ADAS-Related Business Segment)

Table 2.1 Overview of the ADAS Sensors: Radar, Camera, Infrared, Ultrasonic, Lidar

Table 2.2 Overview of the Sensors Used in ADAS End-User Applications (ADAS End-User Application, Radar (LRR, MRR, SRR), LIDAR, Infrared (IR) Camera, (Vision) Camera, Ultrasonic)

Table 3.1 Market Value of the Top 20 ADAS Companies - Global ADAS Market 2018 ($bn, AGR%, CAGR%)

Table 3.2 Japan ADAS Developments (2014-2018)

Table 3.3 Europe ADAS Developments (2013-2018)

Table 3.4 Europe Regulations And Safety Features (2011-2015)

Table 3.5 Market Value of ADAS Sensors in 2018 ($ Million)

Table 4.1 20 Leading Suppliers Revenues in the ADAS Market Share in 2018 (Key Players, ADAS Market Share, Revenue from ADAS ($ Bn), Position)

Table 4.2 Number of Companies in the Top 20 by ADAS Revenue In Country 2018 (Country, No of Companies in the Top 20, ADAS Revenue 2018)

Table 5.1 Overview of the 20 Leading ADAS Suppliers and their ADAS Portfolio in 2018 (Ranking in the ADAS Market 2018, ADAS End-User Applications, ADAS Sensors)

Table 5.2 Aisin Seiki Company Overview 2018 (Company Revenue, Revenue, Ranking & Market Share in the ADAS Market 2018, ADAS Segment, ADAS Portfolio, HQ, Ticker, Employees, Website)

Table 5.3 Aisin Financials 2013-2018 (5-year Revenue, R&D exp, Operating Income, Capital expenditure)

Table 5.4 Aisin’s Automotive ADAS Portfolio

Table 5.5 Autoliv AB Overview 2018 (Company Revenue, Revenue, Ranking & Market Share in the ADAS Market 2018, ADAS Segment, ADAS Portfolio, HQ, Ticker, Contact, Employees, Website)

Table 5.6 Autoliv’s Automotive ADAS Portfolio

Table 5.7 Bosch Company Overview (Company Revenue, Revenue, Ranking & Market Share in the ADAS Market 2018, ADAS Segment, ADAS Portfolio, HQ, Employees, Website)

Table 5.8 Bosch’s Automotive ADAS Portfolio

Table 5.9 Continental Overview (Company Revenue, Revenue, Ranking & Market Share in the ADAS Market 2018, ADAS Segment, ADAS Portfolio, HQ, Ticker, Employees, Website)

Table 5.10 Continental’s Financials (5-year Revenue, Gross Profit, Operating Income, Net income, Diluted EPS) 2013 - 2018

Table 5.11 Continental’s Automotive ADAS Portfolio

Table 5.12 Delphi Overview (Company Revenue, Revenue, Ranking & Market Share in the ADAS Market 2018, ADAS Segment, ADAS Portfolio, HQ, Ticker, Employees, Website)

Table 5.13 Delphi’s Automotive ADAS Portfolio

Table 5.14 Denso Company Overview (Company Revenue, Revenue, Ranking & Market Share in the ADAS Market 2018, ADAS Segment, ADAS Portfolio, HQ, Employees, Website)

Table 5.15 Denso’s Financials (5-year Revenue, Gross Profit, R&D Expense, Net income 2014 – 2018)

Table 5.16 Denso’s Sales by Segment 2015-2018 (Billion Yen)

Table 5.17 Denso’s Automotive ADAS Portfolio

Table 5.18 Freescale Company Overview (Company Revenue, Revenue, Ranking & Market Share in the ADAS Market 2018, ADAS Segment, ADAS Portfolio, HQ, Employees, Website)

Table 5.19 Freescale’s Automotive ADAS Portfolio

Table 5.20 Gentex Company Overview (Company Revenue, Revenue, Ranking & Market Share in the ADAS Market 2018, ADAS Segment, ADAS Portfolio, HQ, Ticker, Website)

Table 5.21 Gentex’s Financials 2013-2018 (5-year Revenue, Gross Profit, Op. Income, Net income, Diluted EPS)

Table 5.22 Gentex’s Automotive ADAS Portfolio

Table 5.23 Harman Company Overview (Company Revenue, Revenue, Ranking & Market Share in the ADAS Market 2018, ADAS Segment, ADAS Portfolio, HQ, Ticker, Employees, Website)

Table 5.24 Harman’s Financials (5-year Revenue, Gross Profit, Op. Income, Net income, Diluted EPS), 2014-2018

Table 5.25 Harman’s Automotive ADAS Portfolio

Table 5.26 Hella Company Overview (Company Revenue, Revenue, Ranking & Market Share in the ADAS Market 2018, ADAS Segment, ADAS Portfolio, HQ, Employees, Website)

Table 5.27 Hella’s Automotive ADAS Portfolio

Table 5.28 Hyundai Mobis Company Overview (Company Revenue, Revenue, Ranking & Market Share in the ADAS Market 2018, ADAS Segment, ADAS Portfolio, HQ, Ticker, Website)

Table 5.29 Hyundai Mobis’s Automotive ADAS Portfolio

Table 5.30 Magna Company Overview (Company Revenue, Revenue, Ranking & Market Share in the ADAS Market 2018, ADAS Segment, ADAS Portfolio, HQ, Employees, Website)

Table 5.31 Magna’s Financials 2013-2018 (5-year Revenue, Gross Profit, Op. Income, Net income, Diluted EPS)

Table 5.32 Magna’s Automotive ADAS Portfolio

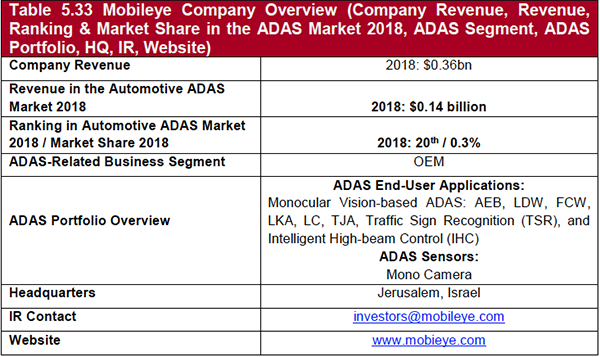

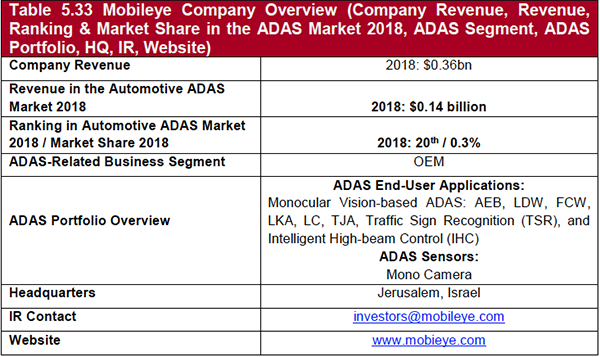

Table 5.33 Mobileye Company Overview (Company Revenue, Revenue, Ranking & Market Share in the ADAS Market 2018, ADAS Segment, ADAS Portfolio, HQ, IR, Website)

Table 5.34 Mobileye’s Financials (3-year Revenue, Gross Profit, Op. Income, Net income, Diluted EPS) 2012 - 2016

Table 5.35 Mobileye’s Automotive ADAS Portfolio

Table 5.36 NVIDIA Company Overview (Company Revenue, Revenue, Ranking & Market Share in the ADAS Market 2018, ADAS Segment, ADAS Portfolio, HQ, Employees, Website)

Table 5.37 NVIDIA’s Automotive ADAS Portfolio

Table 5.38 Panasonic Company Overview (Company Revenue, Revenue, Ranking & Market Share in the ADAS Market 2018, ADAS Segment, ADAS Portfolio, HQ, Employees, Website)

Table 5.39 Panasonic’s Financials (5-year Revenue (Mn), Op. Income (Mn), Net income (Mn), Diluted EPS), 2014 – 2019

Table 5.40 Panasonic’s Automotive ADAS Portfolio

Table 5.41 Renesas Company Overview (Company Revenue, Revenue, Ranking & Market Share in the ADAS Market 2018, ADAS Segment, ADAS Portfolio, HQ, Employees, Website)

Table 5.42 Renesas Automotive ADAS Portfolio

Table 5.43 Takata Company Overview (Company Revenue, Revenue, Ranking & Market Share in the ADAS Market 2018, ADAS Segment, ADAS Portfolio, HQ, Ticker, Website)

Table 5.44 Takata’s Automotive ADAS Portfolio

Table 5.45 Texas Instruments Company Overview (Company Revenue, Revenue, Ranking & Market Share in the ADAS Market 2018, ADAS Segment, ADAS Portfolio, HQ, Employees, Website)

Table 5.46 T.I’s Financials (5-year Revenue, Gross Profit, Op. Income, Net income, Diluted EPS) 2012 – 2018

Table 5.47 Texas Instruments Automotive ADAS Portfolio

Table 5.48 ZF Group Overview (Company Revenue, Revenue, Ranking & Market Share in the ADAS Market 2018, ADAS Segment, ADAS Portfolio, HQ, Employees, Website)

Table 5.49 ZF GROUP’s Financials (5-year Revenue, Gross Profit, Op. Income, Net income, Diluted EPS), 2012 - 2018

Table 5.50 ZF Group’s ADAS Portfolio

Table 5.51 Valeo Company Overview (Company Revenue, Revenue, Ranking & Market Share in the ADAS Market 2018, ADAS Segment, ADAS Portfolio, HQ, Employees, Website)

Table 5.52 Valeo’s Automotive ADAS Portfolio

Table 5.53 Other Leading Suppliers in the Automotive ADAS Market 2019 (Company, Country)

Table 6.1 SWOT Analysis of the Automotive ADAS Market

Table 6.2 Advantages & Disadvantages of Automotive ADAS Sensors (Radar, Camera, Lidar, Ultrasonic)

Table 6.3 Drivers and Restraints of the Automotive ADAS Market in 2019

Table 7.1 Key Findings from Our Research

Table 7.2 ADAS Market Share in 2018 for the Top 20 Suppliers Split into Three Categories (%, Ranking)

Table 7.3 ADAS Market Share for the Top 20 Suppliers, Global Market Share (%)

Table 7.4 Recommendations for Automotive ADAS Suppliers