The Inflammatory Bowel Diseases (IBD) Drugs Market Report 2024-2034: This report is essential for prominent enterprises seeking fresh revenue opportunities, aiming to enhance their comprehension of the industry and its inherent dynamics. It provides valuable insights for firms interested in diversifying across various sectors or expanding their current activities into new geographical areas.

Rise in IBD Incidence to Boost the Demand of IBD Drugs Market

The global incidence and prevalence of Inflammatory Bowel Disease (IBD) are increasing, with marked variations between developed and developing nations. Crohn’s disease and ulcerative colitis are more common in developed countries, potentially due to Western diets and lifestyle factors. Rapid urbanization has also contributed to the rise in autoimmune diseases, including IBD. While the incidence appears stable in the West, it is increasing in the developing countries, possibly due to Westernization and improved disease awareness. Recent studies show rising incidence rates, especially in regions with previously low rates. Europe has the highest incidence rates, followed by North America and Asia/Middle East. According to EFCCA (European Federation of Crohn´s and Ulcerative Colitis Associations) in 2022 there were 10 million people living with IBD worldwide. While according to CCFA ( Crohn’s & Colitis Foundation of America), as many as 70,000 new cases of IBD are diagnosed in the United States each year and estimated that approximately 80,000 children in the U.S. are affected with IBD. The IBD has reported to affect almost 1.6 million Americans, most of whom are diagnosed before the age of 35.

Genetic factors play a role, but changing incidence rates emphasize the significance of environmental factors. Socioeconomic shifts and the spread of Western lifestyle contribute to this rise. Extra intestinal manifestations and complications like colon cancer pose significant risks to patients, with long-term implications of treatment are still being understood. Gastroenterology clinics will face challenges managing both younger IBD patients and an aging population with comorbidities, necessitating careful management strategies.

Significant success in IBD Drug Development to Drive the Market Demand

Previously, the diagnosis rate of Inflammatory Bowel Disease (IBD) was low particularly impacting developing countries. Even in developed nations, diagnosing IBD was challenging, leading to prolonged misdiagnoses for many sufferers. However, recent improvements in diagnostics have expanded the patient pool, consequently driving demand for treatments and boosting market revenue.

There has been a rapid surge in randomized clinical trials for Crohn’s disease (CD) and ulcerative colitis (UC) treatments, accompanied by detailed epidemiological studies. Despite initial debates, it’s now evident that IBD predominantly affects individuals in industrialized nations, with its incidence on the rise. With the advent of newer technologies, there has been a paradigm shift reported in treatment of IBD. Some of the major recent developments include launch and approval of new drugs for instance:

In February 2024, Pfizer Inc. disclosed that the European Commission (EC) has approved marketing authorization for VELSIPITY (etrasimod) within the European Union for the management of moderately to severely active ulcerative colitis (UC) in patients aged 16 and above. This approval extends to individuals who have shown insufficient response, loss of response, or intolerance to conventional therapy or a biological agent.

In March 2024, Celltrion USA has introduced ZYMFENTRA (infliximab-dyyb), a subcutaneous (SC) version of infliximab, marking a significant advancement in treatment options. ZYMFENTRA stands as the sole subcutaneous infliximab approved by the U.S. Food and Drug Administration (FDA) in 2023.

In July 2023, the launch of Yuflyma (adalimumab-aaty) has been announced by Celltrion USA, presenting patients with a high-concentration (100mg/mL) and citrate-free formulation as an alternative option. Yuflyma is approved for the treatment of eight conditions, which encompass rheumatoid arthritis, juvenile idiopathic arthritis, psoriatic arthritis, ankylosing spondylitis, Crohn’s disease, ulcerative colitis, plaque psoriasis, and hidradenitis suppurativa.

Additionally, Fiberoptic colonoscopy with biopsies and ileocolonoscopy have transformed the diagnosis of both UC and CD globally, particularly in defining disease extent and severity, consequently helping the patients to manage and control IBD.

What Questions Should You Ask before Buying a Market Research Report?

- How is the Inflammatory Bowel Diseases Drugs market evolving?

- What is driving and restraining the Inflammatory Bowel Diseases Drugs market?

- How will each Inflammatory Bowel Diseases Drugs submarket segment grow over the forecast period and how much revenue will these submarkets account for in 2034?

- How will the market shares for each Inflammatory Bowel Diseases Drugs submarket develop from 2024 to 2034?

What will be the main driver for the overall market from 2024 to 2034?

- Will leading Inflammatory Bowel Diseases Drugs markets broadly follow the macroeconomic dynamics, or will individual national markets outperform others?

- How will the market shares of the national markets change by 2034 and which geographical region will lead the market in 2034?

- Who are the leading players and what are their prospects over the forecast period?

- What are the Inflammatory Bowel Diseases Drugs projects for these leading companies?

- How will the industry evolve during the period between 2024 and 2034? What are the implications of Inflammatory

- Bowel Diseases Drugs projects taking place now and over the next 10 years?

- Is there a greater need for product commercialisation to further scale the Inflammatory Bowel Diseases Drugs market?

- Where is the Inflammatory Bowel Diseases Drugs market heading and how can you ensure you are at the forefront of the market?

- What are the best investment options for new product and service lines?

- What are the key prospects for moving companies into a new growth path and C-suite?

You need to discover how this will impact the Inflammatory Bowel Diseases Drugs market today, and over the next 10 years:

- Our 318-page report provides 112 tables and 192 charts/graphs exclusively to you.

- The report highlights key lucrative areas in the industry so you can target them – NOW.

- It contains in-depth analysis of global, regional and national sales and growth.

- It highlights for you the key successful trends, changes and revenue projections made by your competitors.

This report tells you TODAY how the Inflammatory Bowel Diseases Drugs market will develop in the next 10 years, and in line with the variations in COVID-19 economic recession and bounce. This market is more critical now than at any point over the last 10 years.

Forecasts to 2034 and other analyses reveal commercial prospects

- In addition to revenue forecasting to 2034, our new study provides you with recent results, growth rates, and market shares.

- You will find original analyses, with business outlooks and developments.

- Discover qualitative analyses (including market dynamics, drivers, opportunities, restraints and challenges), cost structure, impact of rising Inflammatory Bowel Diseases Drugs prices and recent developments.

This report includes data analysis and invaluable insight into how COVID-19 will affect the industry and your company. Four COVID-19 recovery patterns and their impact, namely, “V”, “L”, “W” and “U” are discussed in this report.

Segments Covered in the Report

Indication Outlook

- Crohn’s Disease

- Ulcerative Colitis

Route of Administration Outlook

Distribution Channel Outlook

- Hospital Pharmacy

- Retail Pharmacy

- E-commerce Pharmacy

- Others

Drug Class Outlook

- TNF-alpha Blockers

- Integrin Blockers

- Interleukin Inhibitors

- JAK Inhibitors

- S1Ps Modulators and Others

Drugs Outlook

- Cimzia

- Entyvio

- Humira

- Rinvoq

- Skyrizi

- Remicade

- Simponi

- Stelara

- Others

In addition to the revenue predictions for the overall world market and segments, you will also find revenue forecasts for five regional and 21 leading national markets:

North America

Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

MEA

- GCC

- South Africa

- Rest of MEA

Need industry data? Please contact us today.

The report also includes profiles and for some of the leading companies in the Inflammatory Bowel Diseases Drugs Market, 2024 to 2034, with a focus on this segment of these companies’ operations.

Leading companies profiled in the report

- AbbVie

- Biogen

- Celltrion Healthcare Co.,Ltd.

- F. Hoffmann-La Roche Ltd

- Ferring B.V.

- Johnsons & Johnsons

- Novartis AG

- Pfizer

- Takeda Pharmaceutical Company Limited

- UCB S.A.

Overall world revenue for Inflammatory Bowel Diseases Drugs Market, 2024 to 2034 in terms of value the market will surpass US$29.09 billion in 2024, our work calculates. We predict strong revenue growth through to 2034. Our work identifies which organizations hold the greatest potential. Discover their capabilities, progress, and commercial prospects, helping you stay ahead.

How will the Inflammatory Bowel Diseases Drugs Market, 2024 to 2034 report help you?

In summary, our 310+ page report provides you with the following knowledge:

- Revenue forecasts to 2034 for Inflammatory Bowel Diseases Drugs Market, 2024 to 2034 Market, with forecasts for drugs, drug class, indication and route of administration each forecast at a global and regional level – discover the industry’s prospects, finding the most lucrative places for investments and revenues.

- Revenue forecasts to 2034 for five regional and 21 key national markets – See forecasts for the Inflammatory Bowel Diseases Drugs Market, 2024 to 2034 market in North America, Europe, Asia-Pacific, Latin America, and MEA. Also forecasted is the market in the US, Canada, Mexico, Brazil, Germany, France, UK, Italy, China, India, Japan, and Australia among other prominent economies.

- Prospects for established firms and those seeking to enter the market – including company profiles for 15 of the major companies involved in the Inflammatory Bowel Diseases Drugs Market, 2024 to 2034.

Find quantitative and qualitative analyses with independent predictions. Receive information that only our report contains, staying informed with invaluable business intelligence.

Information found nowhere else

With our new report, you are less likely to fall behind in knowledge or miss out on opportunities. See how our work could benefit your research, analyses, and decisions. Visiongain’s study is for everybody needing commercial analyses for the Inflammatory Bowel Diseases Drugs Market, 2024 to 2034, market-leading companies. You will find data, trends and predictions.

To access the data contained in this document please email contactus@visiongain.com

Buy our report today Inflammatory Bowel Diseases (IBD) Drugs Market Report 2024-2034: Forecasts by Indication (Crohn’s Disease, Ulcerative Colitis), by Route of Administration (Oral, Parenteral, Rectal), by Distribution Channel (Hospital Pharmacy, Retail Pharmacy, E-commerce Pharmacy, Others), by Drug Class (TNF-alpha Blockers, Integrin Blockers, Interleukin Inhibitors, JAK Inhibitors, S1Ps Modulators, Others), by Drugs (Cimzia, Entyvio, Humira, Rinvoq, Skyrizi, Remicade, Simponi, Stelara, Others) AND Regional and Leading National Market Analysis PLUS Analysis of Leading Companies AND COVID-19 Impact and Recovery Pattern Analysis. Avoid missing out by staying informed – order our report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for a specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: contactus@visiongain.com

1 Report Overview

1.1 Objectives of the Study

1.2 Introduction to Inflammatory Bowel Diseases Drugs Market

1.3 What This Report Delivers

1.4 Why You Should Read This Report

1.5 Key Questions Answered by This Analytical Report

1.6 Who is This Report for?

1.7 Methodology

1.7.1 Market Definitions

1.7.2 Market Evaluation & Forecasting Methodology

1.7.3 Data Validation

1.7.3.1 Primary Research

1.7.3.2 Secondary Research

1.8 Frequently Asked Questions (FAQs)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2 Executive Summary

3 Market Overview

3.1 Key Findings

3.2 Market Dynamics

3.2.1 Market Driving Factors

3.2.1.1 Rise in IBD Incidence to Boost the Demand of IBD Drugs Market

3.2.1.2 Significant success in IBD Drug Development to Drive the Market Demand

3.2.1.3 Advancements in Oral Drug Delivery for Inflammatory Bowel Disease

3.2.2 Market Restraining Factors

3.2.2.1 Lack of Understanding of Disease Aetiology

3.2.2.2 Compliance – Frequent Dosing is Inconvenient

3.2.2.3 Limitations of IBD Drugs – Side Effect Profiles

3.2.3 Market Opportunities

3.2.3.1 Advancements in Biological Drugs to Drive the Market Significantly

3.2.3.2 Rising Opportunities for IBD Drugs in Asian Markets

3.3 COVID-19 Impact Analysis

3.4 Porter’s Five Forces Analysis

3.4.1 Bargaining Power of Suppliers

3.4.2 Bargaining Power of Buyers

3.4.3 Competitive Rivalry

3.4.4 Threat from Substitutes

3.4.5 Threat of New Entrants

3.5 PEST Analysis

4 Inflammatory Bowel Diseases Drugs Market Analysis by Indication

4.1 Key Findings

4.2 Indication Segment: Market Attractiveness Index

4.3 Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Indication

4.4 Crohn’s Disease

4.4.1 Market Size by Region, 2024-2034 (US$ Billion)

4.4.2 Market Share by Region, 2024 & 2034 (%)

4.5 Ulcerative Colitis

4.5.1 Market Size by Region, 2024-2034 (US$ Billion)

4.5.2 Market Share by Region, 2024 & 2034 (%)

5 Inflammatory Bowel Diseases Drugs Market Analysis by Route of Administration

5.1 Key Findings

5.2 Indication Segment: Market Attractiveness Index

5.3 Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Route of Administration

5.4 Oral

5.4.1 Market Size by Region, 2024-2034 (US$ Billion)

5.4.2 Market Share by Region, 2024 & 2034 (%)

5.5 Parenteral

5.5.1 Market Size by Region, 2024-2034 (US$ Billion)

5.5.2 Market Share by Region, 2024 & 2034 (%)

5.6 Rectal

5.6.1 Market Size by Region, 2024-2034 (US$ Billion)

5.6.2 Market Share by Region, 2024 & 2034 (%)

6 Inflammatory Bowel Diseases Drugs Market Analysis by Distribution Channel

6.1 Key Findings

6.2 Indication Segment: Market Attractiveness Index

6.3 Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Distribution Channel

6.4 Hospital Pharmacy

6.4.1 Market Size by Region, 2024-2034 (US$ Billion)

6.4.2 Market Share by Region, 2024 & 2034 (%)

6.5 Retail Pharmacy

6.5.1 Market Size by Region, 2024-2034 (US$ Billion)

6.5.2 Market Share by Region, 2024 & 2034 (%)

6.6 E-commerce Pharmacy

6.6.1 Market Size by Region, 2024-2034 (US$ Billion)

6.6.2 Market Share by Region, 2024 & 2034 (%)

6.7 Others

6.7.1 Market Size by Region, 2024-2034 (US$ Billion)

6.7.2 Market Share by Region, 2024 & 2034 (%)

7 Inflammatory Bowel Diseases Drugs Market Analysis by Drug Class

7.1 Key Findings

7.2 Drug Class Segment: Market Attractiveness Index

7.3 Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Drug Class

7.4 TNF-alpha Blockers

7.4.1 Market Size by Region, 2024-2034 (US$ Billion)

7.4.2 Market Share by Region, 2024 & 2034 (%)

7.5 Integrin Blockers

7.5.1 Market Size by Region, 2024-2034 (US$ Billion)

7.5.2 Market Share by Region, 2024 & 2034 (%)

7.6 Interleukin Inhibitors

7.6.1 Market Size by Region, 2024-2034 (US$ Billion)

7.6.2 Market Share by Region, 2024 & 2034 (%)

7.7 JAK inhibitors

7.7.1 Market Size by Region, 2024-2034 (US$ Billion)

7.7.2 Market Share by Region, 2024 & 2034 (%)

7.8 S1Ps Modulators and Others

7.8.1 Market Size by Region, 2024-2034 (US$ Billion)

7.8.2 Market Share by Region, 2024 & 2034 (%)

8 Inflammatory Bowel Diseases Drugs Market Analysis by Drugs

8.1 Key Findings

8.2 Drugs Segment: Market Attractiveness Index

8.3 Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Drugs

8.4 Cimzia

8.4.1 Market Size by Region, 2024-2034 (US$ Billion)

8.4.2 Market Share by Region, 2024 & 2034 (%)

8.5 Entyvio

8.5.1 Market Size by Region, 2024-2034 (US$ Billion)

8.5.2 Market Share by Region, 2024 & 2034 (%)

8.6 Humira

8.6.1 Market Size by Region, 2024-2034 (US$ Billion)

8.6.2 Market Share by Region, 2024 & 2034 (%)

8.7 Rinvoq

8.7.1 Market Size by Region, 2024-2034 (US$ Billion)

8.7.2 Market Share by Region, 2024 & 2034 (%)

8.8 Skyrizi

8.8.1 Market Size by Region, 2024-2034 (US$ Billion)

8.8.2 Market Share by Region, 2024 & 2034 (%)

8.9 Remicade

8.9.1 Market Size by Region, 2024-2034 (US$ Billion)

8.9.2 Market Share by Region, 2024 & 2034 (%)

8.10 Simponi

8.10.1 Market Size by Region, 2024-2034 (US$ Billion)

8.10.2 Market Share by Region, 2024 & 2034 (%)

8.11 Stelara

8.11.1 Market Size by Region, 2024-2034 (US$ Billion)

8.11.2 Market Share by Region, 2024 & 2034 (%)

8.12 Others

8.12.1 Market Size by Region, 2024-2034 (US$ Billion)

8.12.2 Market Share by Region, 2024 & 2034 (%)

9 Inflammatory Bowel Diseases Drugs Market Analysis by Region

9.1 Key Findings

9.2 Regional Market Size Estimation and Forecast

10 North America Inflammatory Bowel Diseases Drugs Market Analysis

10.1 Key Findings

10.2 North America Inflammatory Bowel Diseases Drugs Market Attractiveness Index

10.3 North America Inflammatory Bowel Diseases Drugs Market by Country, 2024, 2029 & 2034 (US$ Billion)

10.4 North America Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Country

10.5 North America Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Indication

10.6 North America Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Route of Administration

10.7 North America Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Distribution Channel

10.8 North America Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Drug Class

10.9 North America Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Drugs

10.10 U.S. Inflammatory Bowel Diseases Drugs Market Analysis

10.11 Canada Inflammatory Bowel Diseases Drugs Market Analysis

11 Europe Inflammatory Bowel Diseases Drugs Market Analysis

11.1 Key Findings

11.2 Europe Inflammatory Bowel Diseases Drugs Market Attractiveness Index

11.3 Europe Inflammatory Bowel Diseases Drugs Market by Country, 2024, 2029 & 2034 (US$ Billion)

11.4 Europe Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Country

11.5 Europe Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Indication

11.6 Europe Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Route of Administration

11.7 Europe Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Distribution Channel

11.8 Europe Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Drug Class

11.9 Europe Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Drugs

11.10 Germany Inflammatory Bowel Diseases Drugs Market Analysis

11.11 France Inflammatory Bowel Diseases Drugs Market Analysis

11.12 UK Inflammatory Bowel Diseases Drugs Market Analysis

11.13 Italy Inflammatory Bowel Diseases Drugs Market Analysis

11.14 Spain Inflammatory Bowel Diseases Drugs Market Analysis

11.15 Rest of Europe Inflammatory Bowel Diseases Drugs Market Analysis

12 Asia Pacific Inflammatory Bowel Diseases Drugs Market Analysis

12.1 Key Findings

12.2 Asia Pacific Inflammatory Bowel Diseases Drugs Market Attractiveness Index

12.3 Asia Pacific Inflammatory Bowel Diseases Drugs Market by Country, 2024, 2029 & 2034 (US$ Billion)

12.4 Asia Pacific Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Country

12.5 Asia Pacific Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Indication

12.6 Asia Pacific Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Route of Administration

12.7 Asia Pacific Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Distribution Channel

12.8 Asia Pacific Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Drug Class

12.9 Asia Pacific Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Drugs

12.10 Japan Inflammatory Bowel Diseases Drugs Market Analysis

12.11 China Inflammatory Bowel Diseases Drugs Market Analysis

12.12 India Inflammatory Bowel Diseases Drugs Market Analysis

12.13 Australia Inflammatory Bowel Diseases Drugs Market Analysis

12.14 South Korea Inflammatory Bowel Diseases Drugs Market Analysis

12.15 Rest of Asia Pacific Inflammatory Bowel Diseases Drugs Market Analysis

13 Latin America Inflammatory Bowel Diseases Drugs Market Analysis

13.1 Key Findings

13.2 Latin America Inflammatory Bowel Diseases Drugs Market Attractiveness Index

13.3 Latin America Inflammatory Bowel Diseases Drugs Market by Country, 2024, 2029 & 2034 (US$ Billion)

13.4 Latin America Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Country

13.5 Latin America Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Indication

13.6 Latin America Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Route of Administration

13.7 Latin America Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Distribution Channel

13.8 Latin America Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Drug Class

13.9 Latin America Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Drugs

13.10 Brazil Inflammatory Bowel Diseases Drugs Market Analysis

13.11 Mexico Inflammatory Bowel Diseases Drugs Market Analysis

13.12 Rest of Latin America Inflammatory Bowel Diseases Drugs Market Analysis

14 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Analysis

14.1 Key Findings

14.2 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Attractiveness Index

14.3 Middle East and Africa Inflammatory Bowel Diseases Drugs Market by Country, 2024, 2029 & 2034 (US$ Billion)

14.4 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Country

14.5 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Indication

14.6 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Route of Administration

14.7 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Distribution Channel

14.8 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Drug Class

14.9 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Size Estimation and Forecast by Drugs

14.10 GCC Inflammatory Bowel Diseases Drugs Market Analysis

14.11 South Africa Inflammatory Bowel Diseases Drugs Market Analysis

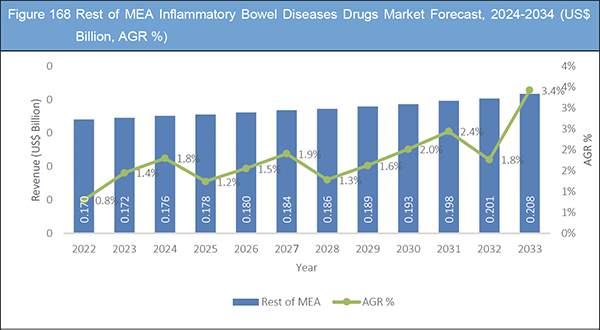

14.12 Rest of MEA Inflammatory Bowel Diseases Drugs Market Analysis

15 Company Profiles

15.1 Competitive Landscape, 2023

15.2 Strategic Outlook

15.3 AbbVie

15.3.1 Company Snapshot

15.3.2 Company Overview

15.3.3 Financial Analysis

15.3.3.1 Net Revenue, 2018-2022

15.3.3.2 R&D, 2018-2022

15.3.3.3 Regional Market Shares, 2022

15.3.4 Product Benchmarking

15.3.5 Strategic Outlook

15.4 Johnsons & Johnsons

15.4.1 Company Snapshot

15.4.2 Company Overview

15.4.3 Financial Analysis

15.4.3.1 Net Revenue, 2018-2022

15.4.3.2 Regional Market Shares, 2022

15.4.4 Product Benchmarking

15.4.5 Strategic Outlook

15.5 Takeda Pharmaceutical Company Limited

15.5.1 Company Snapshot

15.5.2 Company Overview

15.5.3 Financial Analysis

15.5.3.1 Net Revenue, 2019-2023

15.5.3.2 R&D, 2019-2023

15.5.3.3 Regional Market Shares, 2022

15.5.4 Product Benchmarking

15.5.5 Strategic Outlook

15.6 Pfizer

15.6.1 Company Snapshot

15.6.2 Company Overview

15.6.3 Financial Analysis

15.6.3.1 Net Revenue, 2018-2022

15.6.3.2 R&D, 2018-2022

15.6.3.3 Regional Market Shares, 2022

15.6.4 Product Benchmarking

15.6.5 Strategic Outlook

15.7 Novartis AG

15.7.1 Company Snapshot

15.7.2 Company Overview

15.7.3 Financial Analysis

15.7.3.1 Net Revenue, 2018-2022

15.7.3.2 R&D, 2018-2022

15.7.3.3 Regional Market Shares, 2022

15.7.4 Product Benchmarking

15.7.5 Strategic Outlook

15.8 UCB S.A.

15.8.1 Company Snapshot

15.8.2 Company Overview

15.8.3 Financial Analysis

15.8.3.1 Net Revenue, 2019-2023

15.8.3.2 R&D, 2019-2023

15.8.3.3 Regional Market Shares, 2023

15.8.4 Product Benchmarking

15.8.5 Strategic Outlook

15.9 Biogen

15.9.1 Company Snapshot

15.9.2 Company Overview

15.9.3 Financial Analysis

15.9.3.1 Net Revenue, 2019-2023

15.9.3.2 R&D, 2019-2023

15.9.4 Product Benchmarking

15.9.5 Strategic Outlook

15.10 F. Hoffmann-La Roche Ltd

15.10.1 Company Snapshot

15.10.2 Company Overview

15.10.3 Financial Analysis

15.10.3.1 Net Revenue, 2018-2022

15.10.3.2 R&D, 2018-2022

15.10.4 Product Benchmarking

15.11 Celltrion Corporation

15.11.1 Company Snapshot

15.11.2 Company Overview

15.11.3 Financial Analysis

15.11.3.1 Net Revenue, 2018-2022

15.11.3.2 R&D, 2018-2022

15.11.4 Product Benchmarking

15.11.5 Strategic Outlook

15.12 Ferring B.V.

15.12.1 Company Snapshot

15.12.2 Company Overview

15.12.3 Product Benchmarking

15.12.4 Strategic Outlook

16 Conclusion and Recommendations

16.1 Concluding Remarks from Visiongain

16.2 Recommendations for Market Players

List of Tables

Table 1 Inflammatory Bowel Diseases Drugs Market Snapshot, 2024 & 2034 (US$ Billion, CAGR %)

Table 2 Inflammatory Bowel Diseases Drugs Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%): “V” Shaped Recovery

Table 3 Inflammatory Bowel Diseases Drugs Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%): “U” Shaped Recovery

Table 4 Inflammatory Bowel Diseases Drugs Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%): “W” Shaped Recovery

Table 5 Inflammatory Bowel Diseases Drugs Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%): “L” Shaped Recovery

Table 6 Inflammatory Bowel Diseases Drugs Market Forecast by Indication, 2024-2034 (US$ Billion, AGR%, CAGR %)

Table 7 Crohn’s Disease Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR %)

Table 8 Ulcerative Colitis Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 9 Inflammatory Bowel Diseases Drugs Market Forecast by Route of Administration, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 10 Oral Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 11 Parenteral Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 12 Rectal Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 13 Inflammatory Bowel Diseases Drugs Market Forecast by Distribution Channel, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 14 Hospital Pharmacy Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 15 Retail Pharmacy Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 16 E-commerce Pharmacy Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 17 Others Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 18 Inflammatory Bowel Diseases Drugs Market Forecast by Drug Class, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 19 TNF-alpha Blockers Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 20 Integrin Blockers Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 21 Interleukin Inhibitors Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 22 JAK inhibitors Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 23 S1Ps Modulators and Others Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 24 Inflammatory Bowel Diseases Drugs Market Forecast by Drugs, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 25 Cimzia Blockers Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 26 Entyvio Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 27 Humira Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 28 Rinvoq Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 29 Skyrizi Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 30 Remicade Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 31 Simponi Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 32 Stelara Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 33 Others Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 34 Inflammatory Bowel Diseases Drugs Market Forecast by Region, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 35 North America Inflammatory Bowel Diseases Drugs Market Forecast by Country, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 36 North America Inflammatory Bowel Diseases Drugs Market Forecast by Indication, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 37 North America Inflammatory Bowel Diseases Drugs Market Forecast by Route of Administration, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 38 North America Inflammatory Bowel Diseases Drugs Market Forecast by Distribution Channel, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 39 North America Inflammatory Bowel Diseases Drugs Market Forecast by Drug Class, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 40 North America Inflammatory Bowel Diseases Drugs Market Forecast by Drugs, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 41 U.S. Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 42 Canada Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 43 Europe Inflammatory Bowel Diseases Drugs Market Forecast by Country, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 44 Europe Inflammatory Bowel Diseases Drugs Market Forecast by Indication, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 45 Europe Inflammatory Bowel Diseases Drugs Market Forecast by Route of Administration, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 46 Europe Inflammatory Bowel Diseases Drugs Market Forecast by Distribution Channel, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 47 Europe Inflammatory Bowel Diseases Drugs Market Forecast by Drug Class, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 48 Europe Inflammatory Bowel Diseases Drugs Market Forecast by Drugs, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 49 Germany Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 50 France Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 51 UK Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 52 Italy Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 53 Spain Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 54 Rest of Europe Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 55 Asia Pacific Vaccine Contract Manufacturing Market Forecast by Country, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 56 Asia Pacific Inflammatory Bowel Diseases Drugs Market Forecast by Indication, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 57 Asia Pacific Inflammatory Bowel Diseases Drugs Market Forecast by Route of Administration, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 58 Asia Pacific Inflammatory Bowel Diseases Drugs Market Forecast by Distribution Channel, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 59 Asia Pacific Inflammatory Bowel Diseases Drugs Market Forecast by Drug Class, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 60 Asia Pacific Inflammatory Bowel Diseases Drugs Market Forecast by Drugs, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 61 Japan Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 62 China Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 63 India Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 64 Australia Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 65 South Korea Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 66 Rest of Asia Pacific Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 67 Latin America Inflammatory Bowel Diseases Drugs Market Forecast by Country, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 68 Latin America Inflammatory Bowel Diseases Drugs Market Forecast by Indication, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 69 Latin America Inflammatory Bowel Diseases Drugs Market Forecast by Route of Administration, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 70 Latin America Inflammatory Bowel Diseases Drugs Market Forecast by Distribution Channel, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 71 Latin America Inflammatory Bowel Diseases Drugs Market Forecast by Drug Class, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 72 Latin America Inflammatory Bowel Diseases Drugs Market Forecast by Drugs, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 73 Brazil Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 74 Mexico Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 75 Rest of Latin America Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 76 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Forecast by Country, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 77 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Forecast by Indication, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 78 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Forecast by Route of Administration, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 79 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Forecast by Distribution Channel, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 80 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Forecast by Drug Class, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 81 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Forecast by Drugs, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 82 GCC Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 83 South Africa Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 84 Rest of MEA Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR%, CAGR%)

Table 85 Strategic Outlook

Table 86 AbbVie: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 87 AbbVie: Product Benchmarking

Table 88 AbbVie: Strategic Outlook

Table 89 Johnsons & Johnsons: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 90 Johnsons & Johnsons: Product Benchmarking

Table 91 Johnsons & Johnsons: Strategic Outlook

Table 92 Takeda Pharmaceutical Company Limited: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 93 Takeda Pharmaceutical Company Limited: Product Benchmarking

Table 94 Takeda Pharmaceutical Company Limited: Strategic Outlook

Table 95 Pfizer: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 96 Pfizer: Product Benchmarking

Table 97 Pfizer: Strategic Outlook

Table 98 Novartis AG: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 99 Novartis AG: Product Benchmarking

Table 100 Novartis AG: Strategic Outlook

Table 101 UCB S.A.: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 102 UCB S.A.: Product Benchmarking

Table 103 UCB S.A.: Strategic Outlook

Table 104 Biogen: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 105 Biogen: Product Benchmarking

Table 106 Biogen: Strategic Outlook

Table 107 F. Hoffmann-La Roche Ltd: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 108 F. Hoffmann-La Roche Ltd: Product Benchmarking

Table 109 Celltrion Corporation: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 110 Celltrion Corporation: Product Benchmarking

Table 111 Celltrion Corporation: Strategic Outlook

Table 112 Ferring B.V.: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 113 Ferring B.V.: Product Benchmarking

Table 114 Ferring B.V.: Strategic Outlook

List of Figures

Figure 1 Inflammatory Bowel Diseases Drugs Market Segmentation

Figure 2 Inflammatory Bowel Diseases Drugs Market by Indication: Market Attractiveness Index

Figure 3 Inflammatory Bowel Diseases Drugs Market by Route of Administration: Market Attractiveness Index

Figure 4 Inflammatory Bowel Diseases Drugs Market by Distribution Channel: Market Attractiveness Index

Figure 5 Inflammatory Bowel Diseases Drugs Market by Drug Class: Market Attractiveness Index

Figure 6 Inflammatory Bowel Diseases Drugs Market by Drugs: Market Attractiveness Index

Figure 7 Inflammatory Bowel Diseases Drugs Market Attractiveness Index by Region

Figure 8 Inflammatory Bowel Diseases Drugs Market: Market Dynamics

Figure 9 Inflammatory Bowel Diseases Drugs Market by Region, 2024-2034 (US$ Billion, AGR %): “V” Shaped Recovery

Figure 10 Inflammatory Bowel Diseases Drugs Market by Region, 2024-2034 (US$ Billion, AGR %): “U” Shaped Recovery

Figure 11 Inflammatory Bowel Diseases Drugs Market by Region, 2024-2034 (US$ Billion, AGR %): “W” Shaped Recovery

Figure 12 Inflammatory Bowel Diseases Drugs Market by Region, 2024-2034 (US$ Billion, AGR %): “L” Shaped Recovery

Figure 13 Inflammatory Bowel Diseases Drugs Market: Porter’s Five Forces Analysis

Figure 14 IBD Drugs Market: PEST Analysis

Figure 15 Inflammatory Bowel Diseases Drugs Market by Indication: Market Attractiveness Index

Figure 16 Inflammatory Bowel Diseases Drugs Market Forecast by Indication, 2024-2034 (US$ Billion, AGR %)

Figure 17 Inflammatory Bowel Diseases Drugs Market Share Forecast by Indication, 2024, 2029, 2034 (%)

Figure 18 Crohn’s Disease Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR %)

Figure 19 Crohn’s Disease Segment Market Share Forecast by Region, 2024 & 2034 (%)

Figure 20 Ulcerative Colitis Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR %)

Figure 21 Ulcerative Colitis Segment Market Share Forecast by Region, 2024 & 2034 (%)

Figure 22 Inflammatory Bowel Diseases Drugs Market by Route of Administration: Market Attractiveness Index

Figure 23 Inflammatory Bowel Diseases Drugs Market Forecast by Route of Administration, 2024-2034 (US$ Billion, AGR %)

Figure 24 Inflammatory Bowel Diseases Drugs Market Share Forecast by Route of Administration, 2024, 2029, 2034 (%)

Figure 25 Oral Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR %)

Figure 26 Oral Segment Market Share Forecast by Region, 2024 & 2034 (%)

Figure 27 Parental Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR %)

Figure 28 Parenteral Segment Market Share Forecast by Region, 2024 & 2034 (%)

Figure 29 Rectal Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR %)

Figure 30 Rectal Segment Market Share Forecast by Region, 2024 & 2034 (%)

Figure 31 Inflammatory Bowel Diseases Drugs Market by Distribution Channel: Market Attractiveness Index

Figure 32 Inflammatory Bowel Diseases Drugs Market Forecast by Distribution Channel, 2024-2034 (US$ Billion, AGR %)

Figure 33 Inflammatory Bowel Diseases Drugs Market Share Forecast by Distribution Channel, 2024, 2029, 2034 (%)

Figure 34 Hospital Pharmacy Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR %)

Figure 35 Hospital Pharmacy Segment Market Share Forecast by Region, 2024 & 2034 (%)

Figure 36 Retail Pharmacy Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR %)

Figure 37 Retail Pharmacy Segment Market Share Forecast by Region, 2024 & 2034 (%)

Figure 38 E-commerce Pharmacy Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR %)

Figure 39 E-commerce Pharmacy Segment Market Share Forecast by Region, 2024 & 2034 (%)

Figure 40 Others Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR %)

Figure 41 Others Segment Market Share Forecast by Region, 2024 & 2034 (%)

Figure 42 Inflammatory Bowel Diseases Drugs Market by Drug Class: Market Attractiveness Index

Figure 43 Inflammatory Bowel Diseases Drugs Market Forecast by Drug Class, 2024-2034 (US$ Billion, AGR %)

Figure 44 Inflammatory Bowel Diseases Drugs Market Share Forecast by Drug Class, 2024, 2029, 2034 (%)

Figure 45 TNF-alpha Blockers Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR %)

Figure 46 TNF-alpha Blockers Segment Market Share Forecast by Region, 2024 & 2034 (%)

Figure 47 Integrin Blockers Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR %)

Figure 48 Integrin Blockers Segment Market Share Forecast by Region, 2024 & 2034 (%)

Figure 49 Interleukin Inhibitors Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR %)

Figure 50 Interleukin Inhibitors Segment Market Share Forecast by Region, 2024 & 2034 (%)

Figure 51 JAK inhibitors Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR %)

Figure 52 JAK inhibitors Segment Market Share Forecast by Region, 2024 & 2034 (%)

Figure 53 S1Ps Modulators and Others Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR %)

Figure 54 S1Ps Modulators and Others Segment Market Share Forecast by Region, 2024 & 2034 (%)

Figure 55 Inflammatory Bowel Diseases Drugs Market by Drugs: Market Attractiveness Index

Figure 56 Inflammatory Bowel Diseases Drugs Market Forecast by Drugs, 2024-2034 (US$ Billion, AGR %)

Figure 57 Inflammatory Bowel Diseases Drugs Market Share Forecast by Drug Class, 2024, 2029, 2034 (%)

Figure 58 Cimzia Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR %)

Figure 59 Cimzia Segment Market Share Forecast by Region, 2024 & 2034 (%)

Figure 60 Entyvio Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR %)

Figure 61 Entyvio Segment Market Share Forecast by Region, 2024 & 2034 (%)

Figure 62 Humira Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR %)

Figure 63 Humira Segment Market Share Forecast by Region, 2024 & 2034 (%)

Figure 64 Rinvoq Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR %)

Figure 65 Rinvoq Segment Market Share Forecast by Region, 2024 & 2034 (%)

Figure 66 Skyrizi Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR %)

Figure 67 Skyrizi Segment Market Share Forecast by Region, 2024 & 2034 (%)

Figure 68 Remicade Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR %)

Figure 69 Remicade Segment Market Share Forecast by Region, 2024 & 2034 (%)

Figure 70 Simponi Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR %)

Figure 71 Simponi Segment Market Share Forecast by Region, 2024 & 2034 (%)

Figure 72 Stelara Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR %)

Figure 73 Stelara Segment Market Share Forecast by Region, 2024 & 2034 (%)

Figure 74 Others Segment Market Forecast by Region, 2024-2034 (US$ Billion, AGR %)

Figure 75 Others Segment Market Share Forecast by Region, 2024 & 2034 (%)

Figure 76 Inflammatory Bowel Diseases Drugs Market Forecast by Region 2024 and 2034 (Revenue, CAGR%)

Figure 77 Inflammatory Bowel Diseases Drugs Market Share Forecast by Region 2024, 2029, 2034 (%)

Figure 78 Inflammatory Bowel Diseases Drugs Market by Region, 2024-2034 (US$ Billion, AGR %)

Figure 79 North America Inflammatory Bowel Diseases Drugs Market Attractiveness Index

Figure 80 North America Inflammatory Bowel Diseases Drugs Market by Region, 2024, 2029 & 2034 (US$ Billion)

Figure 81 North America Inflammatory Bowel Diseases Drugs Market Forecast by Country, 2024-2034 (US$ Billion, AGR %)

Figure 82 North America Inflammatory Bowel Diseases Drugs Market Share Forecast by Country, 2024 & 2034 (%)

Figure 83 North America Inflammatory Bowel Diseases Drugs Market Forecast by Indication, 2024-2034 (US$ Billion, AGR %)

Figure 84 North America Inflammatory Bowel Diseases Drugs Market Share Forecast by Indication, 2024 & 2034 (%)

Figure 85 North America Inflammatory Bowel Diseases Drugs Market Forecast by Route of Administration, 2024-2034 (US$ Billion, AGR %)

Figure 86 North America Inflammatory Bowel Diseases Drugs Market Share Forecast by Route of Administration, 2024 & 2034 (%)

Figure 87 North America Inflammatory Bowel Diseases Drugs Market Forecast by Distribution Channel, 2024-2034 (US$ Billion, AGR %)

Figure 88 North America Inflammatory Bowel Diseases Drugs Market Share Forecast by Distribution Channel, 2024 & 2034 (%)

Figure 89 North America Inflammatory Bowel Diseases Drugs Market Forecast by Drug Class, 2024-2034 (US$ Billion, AGR %)

Figure 90 North America Inflammatory Bowel Diseases Drugs Market Share Forecast by Drug Class, 2024 & 2034 (%)

Figure 91 North America Inflammatory Bowel Diseases Drugs Market Forecast by Drugs, 2024-2034 (US$ Billion, AGR %)

Figure 92 North America Inflammatory Bowel Diseases Drugs Market Share Forecast by Drugs, 2024 & 2034 (%)

Figure 93 U.S. Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR %)

Figure 94 Canada Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR %)

Figure 95 Europe Inflammatory Bowel Diseases Drugs Market Attractiveness Index

Figure 96 Europe Inflammatory Bowel Diseases Drugs Market by Region, 2024, 2029 & 2034 (US$ Billion)

Figure 97 Europe Inflammatory Bowel Diseases Drugs Market Forecast by Country, 2024-2034 (US$ Billion, AGR %)

Figure 98 Europe Inflammatory Bowel Diseases Drugs Market Share Forecast by Country, 2024 & 2034 (%)

Figure 99 Europe Inflammatory Bowel Diseases Drugs Market Forecast by Indication, 2024-2034 (US$ Billion, AGR %)

Figure 100 Europe Inflammatory Bowel Diseases Drugs Market Share Forecast by Indication, 2024 & 2034 (%)

Figure 101 Europe Inflammatory Bowel Diseases Drugs Market Forecast by Route of Administration, 2024-2034 (US$ Billion, AGR %)

Figure 102 Europe Inflammatory Bowel Diseases Drugs Market Share Forecast by Route of Administration, 2024 & 2034 (%)

Figure 103 Europe Inflammatory Bowel Diseases Drugs Market Forecast by Distribution Channel, 2024-2034 (US$ Billion, AGR %)

Figure 104 Europe Inflammatory Bowel Diseases Drugs Market Share Forecast by Distribution Channel, 2024 & 2034 (%)

Figure 105 Europe Inflammatory Bowel Diseases Drugs Market Forecast by Drug Class, 2024-2034 (US$ Billion, AGR %)

Figure 106 Europe Inflammatory Bowel Diseases Drugs Market Share Forecast by Drug Class, 2024 & 2034 (%)

Figure 107 Europe Inflammatory Bowel Diseases Drugs Market Forecast by Drugs, 2024-2034 (US$ Billion, AGR %)

Figure 108 Europe Inflammatory Bowel Diseases Drugs Market Share Forecast by Drugs, 2024 & 2034 (%)

Figure 109 Germany Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR %)

Figure 110 France Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR %)

Figure 111 UK Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR %)

Figure 112 Italy Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR %)

Figure 113 Spain Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR %)

Figure 114 Rest of Europe Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR %)

Figure 115 Asia Pacific Inflammatory Bowel Diseases Drugs Market Attractiveness Index

Figure 116 Asia Pacific Inflammatory Bowel Diseases Drugs Market by Region, 2024, 2029 & 2034 (US$ Billion)

Figure 117 Asia Pacific Inflammatory Bowel Diseases Drugs Market Forecast by Country, 2024-2034 (US$ Billion, AGR %)

Figure 118 Asia Pacific Inflammatory Bowel Diseases Drugs Market Share Forecast by Country, 2024 & 2034 (%)

Figure 119 Asia Pacific Inflammatory Bowel Diseases Drugs Market Forecast by Indication, 2024-2034 (US$ Billion, AGR %)

Figure 120 Asia Pacific Inflammatory Bowel Diseases Drugs Market Share Forecast by Indication, 2024 & 2034 (%)

Figure 121 Asia Pacific Inflammatory Bowel Diseases Drugs Market Forecast by Route of Administration, 2024-2034 (US$ Billion, AGR %)

Figure 122 Asia Pacific Inflammatory Bowel Diseases Drugs Market Share Forecast by Route of Administration, 2024 & 2034 (%)

Figure 123 Asia Pacific Inflammatory Bowel Diseases Drugs Market Forecast by Distribution Channel, 2024-2034 (US$ Billion, AGR %)

Figure 124 Asia Pacific Inflammatory Bowel Diseases Drugs Market Share Forecast by Distribution Channel, 2024 & 2034 (%)

Figure 125 Asia Pacific Inflammatory Bowel Diseases Drugs Market Forecast by Drug Class, 2024-2034 (US$ Billion, AGR %)

Figure 126 Asia Pacific Inflammatory Bowel Diseases Drugs Market Share Forecast by Drug Class, 2024 & 2034 (%)

Figure 127 Asia Pacific Inflammatory Bowel Diseases Drugs Market Forecast by Drugs, 2024-2034 (US$ Billion, AGR %)

Figure 128 Asia Pacific Inflammatory Bowel Diseases Drugs Market Share Forecast by Drugs, 2024 & 2034 (%)

Figure 129 Japan Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR %)

Figure 130 China Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR %)

Figure 131 India Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR %)

Figure 132 Australia Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR %)

Figure 133 South Korea Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR %)

Figure 134 Rest of Asia Pacific Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR %)

Figure 135 Latin America Inflammatory Bowel Diseases Drugs Market Attractiveness Index

Figure 136 Latin America Inflammatory Bowel Diseases Drugs Market by Region, 2024, 2029 & 2034 (US$ Billion)

Figure 137 Latin America Inflammatory Bowel Diseases Drugs Market Forecast by Country, 2024-2034 (US$ Billion, AGR %)

Figure 138 Latin America Inflammatory Bowel Diseases Drugs Market Share Forecast by Country, 2024 & 2034 (%)

Figure 139 Latin America Inflammatory Bowel Diseases Drugs Market Forecast by Indication, 2024-2034 (US$ Billion, AGR %)

Figure 140 Latin America Inflammatory Bowel Diseases Drugs Market Share Forecast by Indication, 2024 & 2034 (%)

Figure 141 Latin America Inflammatory Bowel Diseases Drugs Market Forecast by Route of Administration, 2024-2034 (US$ Billion, AGR %)

Figure 142 Latin America Inflammatory Bowel Diseases Drugs Market Share Forecast by Route of Administration, 2024 & 2034 (%)

Figure 143 Latin America Inflammatory Bowel Diseases Drugs Market Forecast by Distribution Channel, 2024-2034 (US$ Billion, AGR %)

Figure 144 Latin America Inflammatory Bowel Diseases Drugs Market Share Forecast by Distribution Channel, 2024 & 2034 (%)

Figure 145 Latin America Inflammatory Bowel Diseases Drugs Market Forecast by Drug Class, 2024-2034 (US$ Billion, AGR %)

Figure 146 Latin America Inflammatory Bowel Diseases Drugs Market Share Forecast by Drug Class, 2024 & 2034 (%)

Figure 147 Latin America Inflammatory Bowel Diseases Drugs Market Forecast by Drugs, 2024-2034 (US$ Billion, AGR %)

Figure 148 Latin America Inflammatory Bowel Diseases Drugs Market Share Forecast by Drugs, 2024 & 2034 (%)

Figure 149 Brazil Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR %)

Figure 150 Mexico Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR %)

Figure 151 Rest of Latin America Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR %)

Figure 152 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Attractiveness Index

Figure 153 Middle East and Africa Inflammatory Bowel Diseases Drugs Market by Region, 2024, 2029 & 2034 (US$ Billion)

Figure 154 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Forecast by Country, 2024-2034 (US$ Billion, AGR %)

Figure 155 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Share Forecast by Country, 2024 & 2034 (%)

Figure 156 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Forecast by Indication, 2024-2034 (US$ Billion, AGR %)

Figure 157 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Share Forecast by Indication, 2024 & 2034 (%)

Figure 158 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Forecast by Route of Administration, 2024-2034 (US$ Billion, AGR %)

Figure 159 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Share Forecast by Route of Administration, 2024 & 2034 (%)

Figure 160 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Forecast by Distribution Channel, 2024-2034 (US$ Billion, AGR %)

Figure 161 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Share Forecast by Distribution Channel, 2024 & 2034 (%)

Figure 162 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Forecast by Drug Class, 2024-2034 (US$ Billion, AGR %)

Figure 163 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Share Forecast by Drug Class, 2024 & 2034 (%)

Figure 164 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Forecast by Drugs, 2024-2034 (US$ Billion, AGR %)

Figure 165 Middle East and Africa Inflammatory Bowel Diseases Drugs Market Share Forecast by Drugs, 2024 & 2034 (%)

Figure 166 GCC Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR %)

Figure 167 South Africa Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR %)

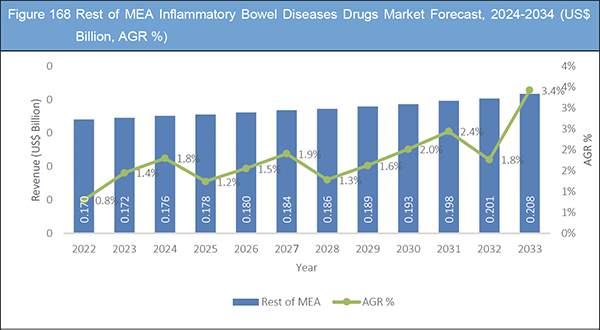

Figure 168 Rest of MEA Inflammatory Bowel Diseases Drugs Market Forecast, 2024-2034 (US$ Billion, AGR %)

Figure 169 Inflammatory Bowel Diseases Drugs Market: Company Share/Ranking, 2023

Figure 170 AbbVie: Net Revenue, 2018-2022 (US$ Million, AGR%)

Figure 171 AbbVie: R&D, 2018-2022 (US$ Million, AGR%)

Figure 172 AbbVie: Regional Market Shares, 2022

Figure 173 Johnson & Johnson Private Limited: Annual Revenue, 2018-2022 (US$ Million, AGR%)

Figure 174 Johnson & Johnson Private Limited: Regional Market Shares, 2022

Figure 175 Takeda Pharmaceutical Company Limited: Net Revenue, 2019-2023 (US$ Billion, AGR%)

Figure 176 Takeda Pharmaceutical Company Limited: R&D, 2019-2023 (US$ Billion, AGR%)

Figure 177 Takeda Pharmaceutical Company Limited: Regional Market Shares, 2022

Figure 178 Pfizer: Net Revenue, 2018-2022 (US$ Million, AGR%)

Figure 179 Pfizer: R&D, 2018-2022 (US$ Million, AGR%)

Figure 180 Pfizer: Regional Market Shares, 2022

Figure 181 Novartis AG: Net Revenue, 2018-2022 (US$ Billion, AGR%)

Figure 182 Novartis AG: R&D, 2018-2022 (US$ Billion, AGR%)

Figure 183 Novartis AG: Regional Market Shares, 2022

Figure 184 UCB S.A.: Net Revenue, 2019-20233 (US$ Billion, AGR%)

Figure 185 UCB S.A.: R&D, 2019-2023 (US$ Billion, AGR%)

Figure 186 UCB S.A.: Regional Market Shares, 2023

Figure 187 Biogen: Net Revenue, 2019-2023 (US$ Billion, AGR%)

Figure 188 Biogen: R&D, 2019-2023 (US$ Billion, AGR%)

Figure 189 F. Hoffmann-La Roche Ltd: Net Revenue, 2018-2022 (US$ Billion, AGR%)

Figure 190 F. Hoffmann-La Roche Ltd: R&D Expense, 2018-2022 (US$ Billion, AGR%)

Figure 191 Celltrion Corporation: Net Revenue, 2018-2022 (US$ Billion, AGR%)

Figure 192 Celltrion Corporation: R&D, 2018-2022 (US$ Billion, AGR%)

List of Companies Profiled in the Report

AbbVie

Biogen

Celltrion Healthcare Co.,Ltd.

F. Hoffmann-La Roche Ltd

Ferring B.V.

Johnsons & Johnsons

Novartis AG

Pfizer

Takeda Pharmaceutical Company Limited

UCB S.A.

List of Other Companies Mentioned in the Report

Aché Laboratórios Farmacêuticos S.A.

Adcock Ingram

Alvotech

Amgen

Arena

Asieris Pharmaceuticals

Aspen Pharmacare

AstraZeneca

Bayer AG

Biocon Ltd.

Boehringer Ingelheim

Boehringer Ingelheim

Celltrion Healthcare Co., Ltd.

Chiesi Farmaceutici

Daewoong Pharmaceutical Co.

Digestive Solutions Ltd.

Dompé

EA Pharma Co., Ltd.

EMS S/A

Eurofarma Laboratórios S.A.

Evotec SE

Faes Farma

GastroHealth Pharmaceuticals

Genomma Lab Internacional

Gubra

Hanmi Pharmaceutical Co., Ltd.

I-Mab

Kissei Pharmaceutical Co., Ltd.

Laboratoires Réunis

Laboratorios Almirall

Laboratorios Esteve

Medivir

Merck KGaA

Molteni Farmaceutici

Nimbus Lakshmi, Inc.

Orion Corporation

PharmaBiome

Reata Pharmaceuticals, Inc.

S.A.B. de C.V.

Sandoz Austria

Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO)

Shire Pharmaceuticals

Silanes Laboratories

Teva Pharmaceuticals USA

Tillotts Pharma AG

List of Associations Mentioned in the Report

Crohn's & Colitis Australia (CCA)

Crohn's and Colitis Foundation of South Africa (CCFSA)

Department of Health Sciences/Public Health, Institute and Policlinic for Occupational and Social Medicine

European Commission (EC)

Food and Drug Administration (FDA)

French National Association of Gastroenterology (ANGH)

French National College of Gastroenterology (CNGE)

French Society of Digestive Endoscopy (SFED)

International Trade Administration

National Institute of Health (NIH)

National Medical Products Administration (NMPA)

South African Gastroenterology Society (SAGES)