Are you interested or involved in Digital Home Food Delivery? Visiongain has produced an in-depth market research report on the rapidly growing Digital Home Food Delivery market. Technologies such as software platforms, on–demand and vertically integrated platforms are covered, whilst profiles of leading national/regional markets offer you insights into region-specific opportunities and developments.

Visiongain’s report will ensure that you keep informed and ahead of your competitors. Gain that competitive advantage.

The report will answer such questions as:

• Who are the leading companies in the digital home food delivery industry?

– What is their strategy?

– What is their existing customer base and where is it?

– What are their core strengths and weaknesses?

– Do they have expansionary plans, and if so where are they likely to go?

• What is driving and restraining the involvement of each leading company within the market?

• What is the total size of the digital home food delivery market?

• What are the strengths, weaknesses, opportunities and threats for the market as a whole?

Three reasons you must order and read this report today:

1) The study reveals where and how leading companies are investing in the digital home food delivery market. We show you the prospects for companies operating in:

• North America

• Asia

• Europe

• South America

• Middle East

2) The report provides a detailed individual profile for each of the 15 leading companies in the digital home food delivery market in 2017, providing data for revenue and order numbers

• Ele.me

• Meituan Waimai

• Just-eat

• GrubHub

• Delivery Hero

• UberEATS

• Doordash

• Postmates

• Takeaway.com

• Mr. D food

• Deliveroo

• Square Inc. (Caviar)

• Amazon Restaurant

• Zomato

• Waiter.com

3) The report provides a thorough SWOT analysis for the strengths, weaknesses, opportunities and threats facing the digital home food delivery market

Competitive Advantage

This independent, 108-page report guarantees that you will remain better informed than your competitors. With 47 tables and figures examining the companies within the digital home food delivery market space, the report gives you an immediate, one-stop breakdown of the leading home food delivery companies plus, analysis and future outlooks, keeping your knowledge one step ahead of your rivals.

Who should read this report?

• Anyone within the food value chain

• CEOs

• COOs

• CIOs

• Business development managers

• Marketing managers

• Technologists

• Suppliers

• Investors

• Banks

• Contractors

Don’t miss out

The report is essential reading for you or anyone in the food value chain (farming, processing, cooking, delivery) or with an interest in food. Purchasing this report today will help you to recognise those important market opportunities and understand the possibilities it presents. Order our Top Digital Home Food Delivery Companies today.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Digital Food Delivery Market Overview

1.2 Why You Should Read This Report

1.3 Benefits of this Report

1.4 Report Structure

1.5 Who is This Report For?

1.6 Methodology

1.6.1 Primary Research

1.6.2 Secondary Research

1.7 Frequently Asked Questions (FAQs)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction

2.1 An Introduction to E-commerce

2.2 Changing Face of Restaurants Business

2.3 Market Analysis of Digital Food Delivery by region

2.4 The Global Top 20 Digital Food Delivery Companies

2.5 The Global Top 10 Digital Food Delivery Companies by Market Valuation

2.6 The Global Top 10 Digital Food Delivery Companies by Order

3. The Leading Digital Food Delivery Companies

3.1 Delivery Hero AG

3.1.1 Overview

3.1.2 Operations and Locations

3.1.3 Outlook

3.1.4 Mergers, Acquisitions & News

3.1.4.1 Foodora

3.1.4.2 Foodpanda

3.1.4.3 Yogiyo

3.2 GrubHub Inc.

3.2.1 Overview

3.2.2 Operations and Locations

3.2.3 Outlook

3.2.4 Mergers, Acquisitions & News

3.2.4.1 Eat24

3.2.4.2 Seamless

3.2.4.3 Foodler

3.3 Just East plc

3.3.1 Overview

3.3.2 Operations and Locations

3.3.3 Outlook

3.3.4 Mergers, Acquisitions & News

3.3.4.1 Hungry House

3.3.4.2 Skip the Dishes

3.4 Deliveroo

3.4.1 Overview

3.4.2 Operations and Locations

3.4.3 Outlook

3.4.4 Mergers, Acquisitions & News

3.5 Zomato Inc.

3.5.1 Overview

3.5.2 Operations and Locations

3.5.3 Outlook

3.5.4 Mergers, Acquisitions & News

3.6 Ele.Me Inc.

3.6.1 Overview

3.6.2 Operations and Locations

3.6.3 Outlook

3.6.4 Mergers, Acquisitions & News

3.6.4.1 Baidu Waimai

3.7 DoorDash

3.7.1 Overview

3.7.2 Operations and Locations

3.7.3 Outlook

3.7.4 Mergers, Acquisitions & News

3.8 Postmates

3.8.1 Overview

3.8.2 Operations and Locations

3.8.3 Outlook

3.8.4 Mergers, Acquisitions & News

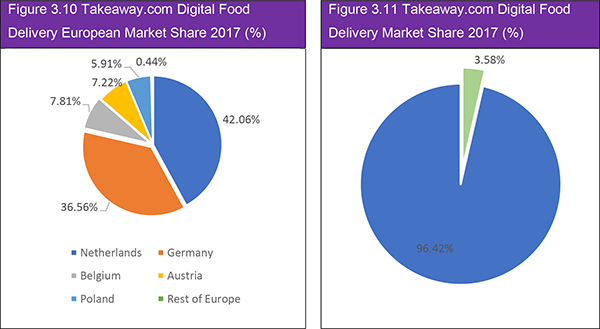

3.9 Takeaway.com

3.9.1 Overview

3.9.2 Operations and Locations

3.9.3 Outlook

3.9.4 Mergers, Acquisitions & News

3.10 Amazon Restaurant

3.10.1 Overview

3.10.2 Operations and Locations

3.10.3 Outlook

3.10.4 Mergers, Acquisitions & News

3.11 Meituan Waimai

3.11.1 Overview

3.11.2 Operations and Locations

3.11.3 Outlook

3.11.4 Mergers, Acquisitions & News

3.12 Waiter.com Inc.

3.12.1 Overview

3.12.2 Operations and Locations

3.12.3 Outlook

3.12.4 Mergers, Acquisitions & News

3.13 UberEATS

3.13.1 Overview

3.13.2 Operations and Locations

3.13.3 Outlook

3.13.4 Mergers, Acquisitions & News

3.14 Mr. D Food

3.14.1 Overview

3.14.2 Operations and Locations

3.14.3 Outlook

3.14.4 Mergers, Acquisitions & News

3.15 Square Inc. (Caviar Inc)

3.15.1 Overview

3.15.2 Operations and Locations

3.15.3 Outlook

3.15.4 Mergers, Acquisitions & News

4. SWOT Analysis of the Digital Food Delivery Market

4.1 Strengths

4.1.1 Understanding Consumers’ Need of Convenience

4.1.2 Streamlined logistics

4.2 Weaknesses

4.2.1 Violation of the Digital Platform

4.3 Opportunities

4.3.1 Rise in investments

4.3.2 Digital Marketing

4.3.3 Technology Advancement

4.4 Threats

4.4.1 Unrealistic Demand-Supply Situation

5. Expert Opinion

5.1.1 How is digitalisation impacting food delivery business and how will it shape the in the next 10 years?

5.1.2 What changes do technology has brought in the online food delivery business and what will be the futuristic scenario?

5.1.3 Do you see any dynamics or levels in demand changing over the future?

5.1.4 What would say are the key trends and developments in the Digital Food Delivery industry right now?

5.1.5 What is the driving factor that influences the market for online food delivery?

5.1.6 What are the limiting factors that influencing the market for online food delivery?

5.1.7 What are the opportunities that are present in the market?

5.1.8 What are the possible challenges that this industry can face in the coming future?

5.1.9 Would you say this market is growing? Are you seeing more demand?

5.1.10 Which region is expecting a huge demand and why?

5.1.11 What role does the stakeholders in the digital business plays?

5.1.12 Who are the key competitors present in the digital food delivery market?

5.1.13 Where does your company stand in the domestic and global market of online food delivery?

5.1.14 How much cost-effective it becomes to hire drivers at contract basis and not putting them on roll?

5.1.15 How the e-commerce companies looks at online food delivery business?

5.1.16 Do you see this changing much in the next 10 years?

5.1.17 Do you see this as really being the way forward then? Will there be more collaboration within the industry?

5.1.18 A huge investments have taken place in this marketplace, what are the perspectives investors are looking at?

5.1.19 When we look at the competitive scenario, it is clearly seen that there are giant players at one end and start-ups at the other end?

5.1.20 What is the entry barriers in the marketplace for the new entrants?

5.1.21 Do you have any new projects in the pipeline or how do you see yourselves moving forward?

5.1.22 What is the role of technology and how is food delivery companies benefiting from the same?

6. Competitive Landscapes

6.1 Mergers & Acquisitions

6.2 Expansions

6.3 Investments & Divestments

6.4 New Service Launch

6.5 Partnership & Participation

7. Glossary

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 2.1 The Global Top 20 Digital Food Delivery Companies 2017 (Total Revenue $m, Total digital Food Delivery Market Share %)

Table 2.2 The Global Top 10 Digital Food Delivery Companies 2017 (Market Valuation ($bn)

Table 2.3 The Global Top 10 Digital Food Delivery Companies Order, 2017 (Million)

Table 3.1 Delivery Hero Overview 2017 (Total Revenue $mn, Gross Profit $m, Primary Sector, HQ, Ticker Symbol, Market Valuation $bn, GMV $bn, Market Share, Orders/ yr m, Employees, Website)

Table 3.2 GrubHub Inc. Overview 2017 (Year Founded, CEO, Total Revenue $m, Primary Sector, EBITDA $m, HQ, Ticker Symbol, Market Valuation $bn, Orders/ yr m, Market Share, Employees, Website)

Table 3.3 Just Eat plc Overview 2017 (Year Founded, CEO, Total Company Revenue $m, EBITDA $m, Primary Sector, HQ, Market Valuation $bn, Orders/ yr m, Market Share, Ticker Symbol, Website)

Table 3.4 Deliveroo Overview 2017 (Founding Year, CEO, Total Company Revenue $m, Primary Sector, Market Valuation $bn, Total Funding $m, Orders/yr m, Market Share, HQ, Website)

Table 3.5 Zomato Overview 2017 (Founding Year, CEO, Total Company Revenue $bn, Market Value $bn, Primary Sector, HQ, Countries of Operation, Orders/yr m, Website)

Table 3.6 Ele.me Overview 2017 (Year Founded, CEO, Total Company Revenue $m, Primary Sector, Market Valuation $bn, Orders/ yr m, Market Share, HQ, Employees, Ticker, Website)

Table 3.7 DoorDash Overview 2017 (Total Company Revenue $m, Primary Sector, CEO, Total Funding $m, Market Valuation $bn, Orders/yr m, Market Share, HQ, Estimated Employees, Website)

Table 3.8 Postmates Overview 2017 (Year Founded, Total Company Revenue $m, Total Earnings in 2017 $m, Primary Sector, Deliveries/yr m, Market Share, Primary Business region, HQ, No. Of Employees, Website)

Table 3.9 Takeaway.com Overview 2017 (Year Founded, Total Company Revenue $m, Market Valuation $bn, Orders/yr m, Market Share, Primary Sector, HQ, No. Of Employees, Ticker Symbol, Website)

Table 3.10 Names of Takeaway.com by Country

Table 3.11 Amazon.com, Inc., Overview 2017 (Total Company Revenue $bn, AmazonFresh Revenue $m, Market Share, Primary Sector, HQ, Locations of Operation, Ticker Symbol, Website)

Table 3.12 Meituan Waimai Overview 2017 (Total Company Revenue $bn, Primary Sector, Market Valuation $bn, Orders/yr m, Market Share, HQ, Website)

Table 3.13 Waiter.com Inc., Overview 2017 (Total Revenue $m, Primary Sector, HQ, Ticker Symbol, Website)

Table 3.14 Uber Technologies Inc., HQ, Ticker Symbol, Website)

Table 3.15 Mr. D Food Overview 2017 (Total Revenue $m, Primary Sector, HQ, Ticker Symbol, Website)

Table 3.16 Square Inc., Overview 2017 (Total Company Revenue $bn 2017, Total Sector Revenue $m 2017, Primary Sector, HQ, No. Of Employees, Market Share, Ticker Symbol, Website)

Table 4.1 SWOT Analysis of the Digital Food Delivery Market

Table 6.1 Mergers & Acquisitions 2015-218

Table 6.2 Expansions 2015-2018

Table 6.3 Investments and Divestments 2015-2018

Table 6.4 New Service Launch 2015-2018

Table 6.5 Partnership & Participation 2015-2018

List of Figures

Figure 2.1 The Global Digital Food Delivery Market by Region 2017 (Market Share %)

Figure 2.2 The Global Digital Food Delivery Market by Region 2017 (Market Share %)

Figure 2.3 The Global Top 10 Digital Food Delivery Companies 2017 (Market valuation, ($bn)

Figure 2.4 The Global Top 10 Digital Food Delivery Companies Order, 2017 (Million)

Figure 3.1 Delivery Hero Geographic Revenue Mix Share 2017 (%)

Figure 3.2 Delivery Hero Digital Food Delivery Market Share 2017 (%)

Figure 3.3 GrubHub Inc. Digital Food Delivery Market Share 2017 (%)

Figure 3.4 Just Eat Plc Digital Food Delivery Market Share 2017 (%)

Figure 3.5 Deliveroo Digital Food Delivery Market Share 2017 (%)

Figure 3.6 Zomato Digital Food Delivery Market Share 2017 (%)

Figure 3.7 Ele.Me Digital Food Delivery Market Share 2017 (%)

Figure 3.8 DoorDash Digital Food Delivery Market Share 2017 (%)

Figure 3.9 Postmates Digital Food Delivery Market 2017 (%)

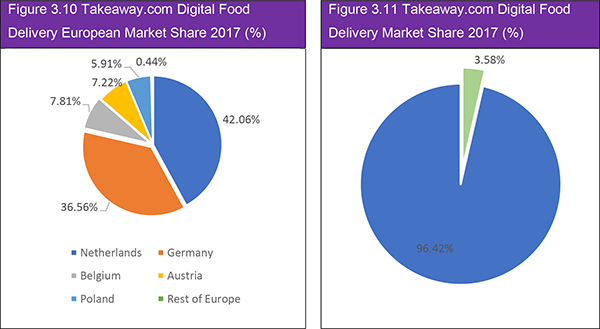

Figure 3.10 Takeaway.com Digital Food Delivery European Market Share 2017 (%)

Figure 3.11 Takeaway.com Digital Food Delivery Market Share 2017 (%)

Figure 3.12 Amazon Digital Food Delivery Market Share by Country (%)

Figure 3.13 Amazon Restaurant Digital Food Delivery Market Share (%)

Figure 3.14 Meituan Waimai Digital Food Delivery Market Share 2017 (%)

Figure 3.15 Waiter.com Inc. Digital Food Delivery Market Share 2017 (%)

Figure 3.16 UberEATS Digital Food Delivery Market Share 2017 (%)

Figure 3.17 Mr. D Food Digital Food Delivery Market Share 2017 (%)

Figure 3.18 Square Inc. Revenue Split by Service 2017 (%)

Figure 3.19 Square Inc. Digital Food Delivery Market Share 2017 (%)