Drivers in the Global Aerospace Adhesives and Sealants Market 2020

Over the past few years, the adhesive and sealant industry has grown significantly internationally in the light of the expansion of technologies, including the aerospace and aeronautical industries. There are therefore a growing demand for high performance adhesives and sealants for this aircraft and space shuttle in extreme conditions. This has led to a significant growth of the adhesive and sealant industry over the past few decades. When side influences in demand and supply-side variables, the market for aerospace adhesives and densities are formed. Factors on the supply side include the availability of raw materials or additives used in or to make aerospace sticks and densities.

Growing aerospace operations in extreme conditions

In the past several decades, the aerospace industry has experienced a number of changes. The demand for high-efficiency aircraft and space shuttles increased significantly with technological developments and high-altitude flights. In fact, the need for space shuttles has increased significantly in the recent past with the rise in satellite launches and military operations. The space shuttles have to fly at extremely high temperatures while planes at high altitudes have to work under very low pressures. As a result, the efficient combination of the materials used for the bonding of surfaces and objects in the aircraft has become a primary need in the aerospace industry.

Increasing demand for lightweight composite materials

Increasing penetration of composition into the aircraft industry is projected to drive the global market of aerospace adhesives and sealants. The industries producing aircraft are using more lightweight materials in the assembly to boost the fuel efficiency of the plane by stressing light weight. The market for aerospace adhesives and sealants is increasing with expanded penetration of composite materials in aircraft. Another influential cause of the growth of the demand for aerospace adhesives and sealants is the increasing global aircraft production. The production of aircraft vehicles is mainly driven by increasing air traffic growth in emerging countries and growing urbanization in emerging countries such as China and India.

Innovations in adhesive technologies is expected to drive the global consumption of adhesives in aerospace industry

The adhesives are developed for various applications and with the combinations of adhesives and sealants under different conditions the role of adhesives in the product industry develops. In contrast, material advances for suppliers of adhesive and sealants become unavoidable as the build rate for commercial and non-commercial aircraft rises. In various uses in structural binding, adhesives are used to protect the connections within core components. Additionally, adhesive manufacturers now focus on developing multifunctional protection and lightning strike technologies to secure the aircraft under extreme circumstances. Furthermore, developments and improvements in adhesive technologies is expected to reduce the weight and cost of the aircrafts and its parts. This in turn is expected to augment the demand for adhesives and sealants in the aerospace operations in the years to come

What are the Opportunities to Explore in the Aerospace Adhesive and Sealant Market by 2020-2030?

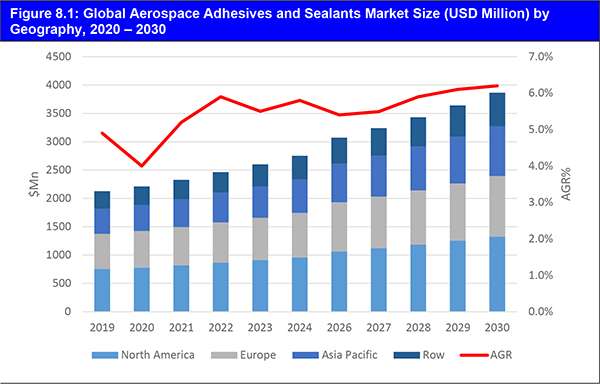

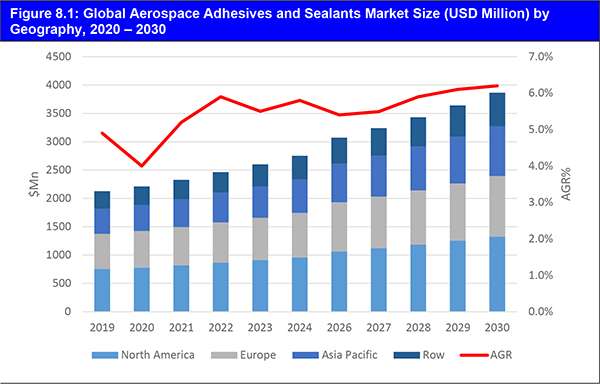

In the next 10 years, a significant growth in the global market for aerospace adhesives and sealants is expected to hit 3.8 billion US dollars by 2030. by 2030. The international aerospace adhesive and testing market growth is projected to be in the wake of the opportunities offered by the Asia-Pacific and Latin American emerging markets. Increased air passenger traffic and growing procurement of aircraft from markets such as India and Brazil were anticipated to expand aerospace adhesives market opportunities in the forecast period. In addition, the market for adhesives and sealants will further increase in the forecast period with increasing military operations in the Gulf countries and in the Indian subcontinent.

Further competition for players in the market for aerospace adhesives and sealants should be created by advances in adhesive engineering. Moreover, increasing competition among the large players is expected to increase research and development expenses, resulting in the expected entry onto the market of high quality and more efficient aerospace adhesives during the forecast period.

Our new study reveals trends, market progress, and predicted revenues

Where is the Aerospace Adhesives and Sealants market heading? If you are involved in the Aerospace Adhesives and Sealants sector you must read this brand new report. Visiongain’s report shows you the potential revenues streams to 2030, assessing data, trends, opportunities and business prospects there.

Discover how to stay ahead

Our 157 page report provides 118 tables, charts, and graphs. Read on to discover the most lucrative areas in the Aerospace Adhesives and Sealants sector and the future market prospects. Our new study lets you assess forecast sales at overall world market and regional level. You will see financial results, interviews, trends, opportunities, and revenue predictions. Much opportunity remains in this growing Aerospace Adhesives and Sealants market.

Discover sales predictions for the world market and submarkets

Along with revenue prediction for the overall world market, you will find revenue forecasts to 2030 for the following segments:

• By Type: Epoxy, Silicone, Polyurethane, Others

• By Technology: Water-borne, Solvent-borne, Other Technologies

• By End-Use Applications: Non-Commercial, Commercial

• By Region: North America, Asia-Pacific, Europe, ROW

Our investigation discusses what stimulates and restrains business. You will understand the dynamics of the industry and assess its potential future sales, discovering the critical factors likely to achieve success.

Leading companies and the potential for market growth

The global adhesives and sealants industry is projected to reach $2.2 billion in 2020 and is projected to reach $3.8 billion by 2030, which is projected to increase by 5.7% by 2020-2030. On the marketing and distribution hand, companies invest in innovation / R&D, brand development and cultivate strong customer partnerships to maintain their competitive position. Henkel, for instance, spent more than $300 million on research and development in its Adhesive Technology sector in 2015 and accounts for approximately 30% of its adhesive sales from products introduced during the past 5 years. Another instance is Bostik which, together with other local brands, is streamlining its portfolio of 40 brands into a global Bostik product. Bostik incorporates this initiative to streamline and strengthen advertising in order to increase visibility around the Bostik name. Cost-focused efforts include improved efficiency and construction by capital and M&A in manufacturing and supply chain. For example, H.B. Fuller recently set a target for manufacturing costs reduction by 200 basis points by focusing more on sourcing efforts, manufacturing excellence and infrastructure investment between 2015 and 2020. The successful formulators are incredibly savvy when it comes to balancing growth investments with cost management in order to maximize long-term profitability and competitiveness.

What issues will affect the Aerospace Adhesives and Sealants industry?

Our new report discusses the issues and events affecting the Aerospace Adhesives and Sealants market. You will find discussions, including qualitative analyses of:

• Non-Reactive Aerospace Adhesives

• Nature of The Technologies Related To Adhesives And Sealants

• Selection of Adhesives

• Consideration of Alternative Bonding Methods

• Aircraft and The Space Shuttle Operations In Extreme Conditions

• Innovations in Adhesive Technologies

You will see discussions of technological, commercial, and economic matters, with emphasis on the competitive landscape and business outlooks.

How the Aerospace Adhesives and Sealants report helps you

In summary, our 157-page report provides you with the following knowledge:

Market Forecasts by:

• By Type: Epoxy, Silicone, Polyurethane, Others

• By Technology: Water-borne, Solvent-borne, Other Technologies

• By End-Use Applications: Non-Commercial, Commercial

• By Region: North America, Asia-Pacific, Europe, ROW

• Discussion of what stimulates and restrains companies and the market

• Prospects for established firms and those seeking to enter the market

• See detailed tables of relevant contracts for Aerospace Adhesives and Sealants

You will find quantitative and qualitative analyses with independent predictions. You will receive information that only our report contains, staying informed with this invaluable business intelligence.

Information found nowhere else

With our survey you are less likely to fall behind in knowledge or miss opportunity. See how you could benefit your research, analyses, and decisions. Also see how you can save time and receive recognition for commercial insight.

Visiongain’s study is for everybody needing commercial analyses for the Aerospace Adhesives and Sealants market and leading companies. You find data, trends and predictions.

Buy our report today Aerospace Adhesives and Sealants Market 2020-2030: Volume (KT) & Value ($m) Forecasts by Type (Epoxy, Silicone, Polyurethane, Others), by Technology (Water-borne, Solvent-borne, Other Technologies), by End-use Applications (Non-Commercial, Commercial), by Region, Plus Analysis of Leading Companies. Avoid missing out – order our report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1. Report Overview

1.1 Global Aerospace Adhesives and Sealants Market Overview

1.2 Global Aerospace Adhesives and Sealant Market Segmentation

1.3 Market Definition

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report Include:

1.6 Why You Should Read This Report?

1.7 Research Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to the Aerospace Adhesives and Sealants Market

2.1 What are Commonly used Aerospace Adhesives and Sealants?

3. Global Aerospace Adhesives and Sealants Market: Market Dynamics

3.1 Factors Shaping the Global Aerospace Adhesives and Sealants Market growth

3.2 Demand Side Factors

3.3 Supply Side Factor

3.4 Global Aerospace Adhesives and Sealants Market: What are the Market Dynamics of the Global Market for Aerospace adhesives and Sealants?

3.5 Drivers: What are the factors promoting the growth in the Aerospace adhesives and sealants market?

3.6 Restraints: What are the Factors Hampering the Growth in the Aerospace Adhesives and Sealants Market?

3.7 Opportunities: What are the Opportunities to Explore in the Aerospace Adhesive and Sealant Market by 2020 – 2030?

3.8 What are the Prospects in the Global Market for Aerospace Adhesives and Sealants Over the Period of 2020 – 2030?

4. Global Aerospace Adhesives and Sealants Market by Type Forecast 2020-2030

4.1 Global Aerospace Adhesives and Sealants Market by Type Forecast 2020-2030

4.2 Epoxy Aerospace Adhesives and Sealants: Global Market Size and Forecasts to 2030

4.3 Silicone Aerospace Adhesives and Sealants: Global Market Size and Forecasts to 2029

4.4 Polyurethane Aerospace Adhesives and Sealants: Global Market Size and Forecasts to 2029

4.5 Other Aerospace Adhesives and Sealants: Global market size and Forecasts to 2029

5. Global Aerospace Adhesives and Sealants Market by Technology 2020-2030

5.1 Global Aerospace Adhesives and Sealants Market by Technology: Overview

5.2 What are the Major Technologies Used for Aerospace Adhesives and Sealants Consumed in the World Market?

5.3 Water-borne: Global Market Size and Forecast 2020-2030

5.4 Solvent-borne: Global Market Size and Forecasts to 2030

5.5 Other Technologies Global Market Size and Forecasts to 2029

6. The Global Aerospace Adhesives and Sealants Market by Applications 2020-2030

6.1 Aerospace Adhesives and Sealants Market by Applications: Overview

6.2 What are the Major Applications of Aerospace Adhesives and Sealants Consumed in the World Market?

6.2.1 Non-commercial Applications: Global Market Size and Forecasts to 2030

6.2.3 Commercial Applications: Global Market Size and Forecasts to 2029

7. Regional Aerospace Adhesives and Sealants Markets Forecasts 2020-2030

7.1 Global Aerospace Adhesives and Sealants Market: Overview

7.2 North American Aerospace Adhesives and Sealants Market Forecast 2020-2030

7.2.1 What are the dynamics in North America’s Aerospace Adhesives and Sealants market?

7.2.2 Aerospace Adhesives and Sealants in North America Market by Type 2020-2030

7.2.3 Aerospace Adhesives and Sealants in North America market by Technology 2020 – 2030

7.2.4 Aerospace Adhesives and Sealants in North America Market by Applications 2020 - 2030

7.2.5 Which is the Largest Market Among the North American Aerospace Adhesives and Sealants Market 2019?

7.2.6 North America Aerospace Adhesives and Sealants Market Forecast 2020-2030

7.3 European Aerospace Adhesives and Sealants Market Forecast 2020-2030

7.3.1 What are the Dynamics in Europe’s Aerospace Adhesives and Sealants Market?

7.3.2 What is the Current Status of the European Aerospace Adhesives and Sealants Market by Type 2020-2030?

7.3.3 What is the Current Status of the European Aerospace Adhesives and Sealants Market by Technology 2020-2030?

7.3.4 What is the Current Status the European Aerospace Adhesives and Sealants Market by Applications 2020-2030?

7.3.5 Which is the Largest Market Among the European Aerospace Adhesives and Sealants Market 2020-2030?

7.3.6 Europe Aerospace Adhesives and Sealants Market Forecast 2020-2030

7.4 Asia-Pacific Aerospace Adhesives and Sealants Market Forecast 2020-2030

7.4.1 What are the Dynamics in Asia-Pacific’s Aerospace Adhesives and Sealants Market?

7.4.2 What is the Scenario of Aerospace Adhesives and Sealants in the Asia-Pacific Market by type 2020-2030?

7.4.3 What is the Scenario of Aerospace Adhesives and Sealants in Asia-Pacific Market by Technology 2020-2030?

7.3.4 What is the Scenario of Aerospace Adhesives and Sealants in Asia-Pacific Market by Applications 2020-2030?

7.3.5 Which is the Largest Market Among the Asia-Pacific Aerospace Adhesives and Sealants Market 2020-2030?

7.3.6 Asia-Pacific Aerospace Adhesives and Sealants Market Forecast 2020-2030

7.5 RoW Aerospace Adhesives and Sealants Market Forecast 2020-2030

7.5.1 What are the dynamics in RoW’s Aerospace Adhesives and Sealants market?

7.5.2 What is the scenario of Aerospace Adhesives and Sealants in the RoW market by Type 2020-2030?

7.5.3 What is the scenario of Aerospace Adhesives and Sealants in RoW Market by Technology 2020-2030?

7.5.4 What is the scenario of Aerospace Adhesives and Sealants in RoW market by Application 2020-2030?

7.5.5 Which is the largest market among the RoW Aerospace Adhesives and Sealants Market 2019?

8. Leading Aerospace Adhesives and Sealants Companies

8.1 3M Company

8.1.1 3M Company Contact Info

8.1.2 3M Company Revenue Analysis

8.1.3 3M Company SWOT Analysis

8.1.4 3M Company Product Portfolio

8.1.5 3M Company Recent Developments

8.2 Solvay SA (Subsidiary: Cytec Industries Inc.)

8.2.1 Solvay SA Contact Info

8.2.2 Solvay SA Revenue Analysis

8.2.3 Solvay SA Product Portfolio

8.2.4 Solvay SA Recent Developments

8.3 Henkel AG & Co. KGaA

8.3.1 Henkel AG & Co. KGaA Contact Info

8.3.2 Henkel AG & Co. KGaA Revenue Analysis

8.3.3 Henkel AG & Co. KGaA Product Portfolio

8.3.4 Henkel AG & Co. KGaA Recent Developments

8.4 Hexcel Corporation

8.4.1 Hexcel Corporation Contact Info

8.4.2 Hexcel Corporation Revenue Analysis

8.4.3 Hexcel Corporation Product Portfolio

8.5 Beacon Adhesive Inc.

8.5.1 Beacon Adhesive Inc. Contact Info

8.5.2 Beacon Adhesive Inc. Revenue Analysis

8.5.3 Beacon Adhesive Inc. Product Portfolio

8.6 H.B. Fuller Company

8.6.1 H.B. Fuller Company Contact Info

8.6.2 Royal Adhesive and Sealants Revenue Analysis (2015-17)

8.6.3 Royal Adhesive and Sealants LLC Product Portfolio

8.6.4 Royal Adhesive and Sealants LLC Recent Developments

8.7 PPG Industries Inc.

8.7.1 PPG industries Inc. Contact Info

8.7.2 PPG industries Inc Revenue Analysis

8.7.3 PPG industries Inc Product Portfolio

8.8 Arkema S.A.

8.8.1 Arkema S.A. Contact Info

8.8.2 Arkema S.A. Revenue Analysis

8.8.3 Arkema S.A. Product Portfolio

8.8.4 Arkema S.A. Recent Developments

8.9 Huntsman Corporation

8.9.1 Huntsman Corporation Contact Info

8.9.2 Huntsman Corporation Revenue Analysis

8.9.3 Huntsman Corporation Product Portfolio

8.9.4 Huntsman Corporation Recent Developments

8.10 Master Bond Inc.

8.10.1 Master Bond Inc. Contact Info

8.10.2 Master Bond Inc. Product Portfolio

9. Conclusions & Recommendations

9.1 Aerospace Adhesives and Sealants Market Outlook

9.2 Most Promising Segment

9.3 Most Promising Geographical Area

10. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 1.1 Regional Aerospace Adhesives And Sealants Markets Forecasts ($Mn, AGR (%), 2020-2030

Table 4.1 Global Aerospace Adhesives And Sealants Market by Type Forecast ($Mn, AGR (%), CAGR (%), 2020-2030

Table 4.2 Global Aerospace Adhesives and Sealants Market by Type Forecast (KT, AGR (%), Cumulative, 2020-2030

Table 4.3 Global Epoxy Aerospace Adhesives and Sealants Market by Regions Forecast ($Mn), AGR (%), Cumulative, 2020-2030

Table 4.4 Global Epoxy Aerospace Adhesives and Sealants Market by Regions Forecast (Kilo Tons), AGR (%), Cumulative, 2020-2030

Table 4.5 Global Silicone Aerospace Adhesives and Sealants Market by Regions Forecast ($Mn), AGR (%), Cumulative, 2020-2030

Table 4.6 Global Silicone Aerospace Adhesives and Sealants Market by Regions Forecast (Kilo Tons, AGR (%), Cumulative, 2020-2030

Table 4.7 Global Polyurethane Aerospace Adhesives and Sealants Market by Regions Forecast ($Mn), AGR (%), Cumulative, 2020-2030

Table 4.8 Global Polyurethane Aerospace Adhesives and Sealants Market by Regions Forecast (Kilo Tons), AGR (%), Cumulative, 2020-2030

Table 4.9 Global Other Aerospace Adhesives and Sealants Market by Regions Forecast ($Mn), AGR (%), Cumulative, 2020-2030

Table 4.10 Global Other Aerospace Adhesives and Sealants Market by Regions

Table 5.1 Global Aerospace Adhesives and Sealants Market By Technology Forecast ($Mn, AGR (%), 2019-2021

Table 5.2 Global Aerospace Adhesives and Sealants Market By Technology Forecast (Kilo Tons), AGR (%), Cumulative, 2020-2030

Table 5.3 Water-borne Submarket Forecast ($Mn), AGR (%), Cumulative, 2020-2030

Table 5.4 Water-borne Submarket Forecast (Kilo Tons, AGR (%), Cumulative, 2020-2030

Table 5.5 Solvent-borne Adhesives Submarket Forecast ($Mn), AGR (%), Cumulative, 2020-2030

Table 5.6 Solvent-borne Adhesives Submarket Forecast (Kilo Tons, AGR (%), Cumulative, 2020-2030

Table 5.7 Other Technologies Submarket Forecast ($Mn), AGR (%), Cumulative, 2020-2030

Table 6.1 Global Aerospace Adhesives and Sealants Markets by Application Forecasts ($Mn), AGR (%), Cumulative, 2020-2030

Table 6.2 Global Aerospace Adhesives and Sealants Markets by Application Forecasts (Kilo Tons, AGR (%), Cumulative, 2020-2030

Table 6.3 Non-Commercial Applications Submarket Forecast ($Mn), AGR (%), Cumulative, 2020-2030

Table 6.4 Non-Commercial Applications Submarket Forecast (Kilo Tons, AGR (%), Cumulative, 2020-2030

Table 6.5 Commercial Applications Submarket Forecast ($Mn), AGR (%), CAGR (%), 2020-2030

Table 6.6 Commercial Applications Submarket Forecast (Kilo Tons), AGR (%), Cumulative, 2020-2030

Table 7.1 Regional Aerospace Adhesives and Sealants Markets Forecasts ($Mn), AGR (%), 2020-2030

Table 7.2 Regional Aerospace Adhesives and Sealants Markets Forecasts (Kilo Tons), AGR (%), 2020-2030

Table 7.3 North America Aerospace Adhesives and Sealants Market by Type Forecast ($Mn), AGR (%), Cumulative, 2019-2

Table 7.4 North America Aerospace Adhesives and Sealants Market by Type Forecast (Kilo Tons), AGR (%), Cumulative, 2020-2030

Table 7.5 North America Aerospace Adhesives and Sealants Market by Technology Forecast ($Mn), AGR (%), Cumulative, 2020-2030

Table 7.6 North America Aerospace Adhesives and Sealants Market by Technology Forecast (Kilo Tons), AGR (%), Cumulative, 2020-2030

Table 7.7 North America Aerospace Adhesives and Sealants Market by Application Forecast ($Mn), AGR

Table 7.8 North America Aerospace Adhesives and Sealants Market by Application Forecast (Kilo Tons), AGR (%), Cumulative, 2020-2030 (%), Cumulative, 2020-2030

Table 7.9 North America Aerospace Adhesives and Sealants Market Forecast ($Mn), AGR (%), Cumulative, 2020-2030

Table 7.10 North America Aerospace Adhesives and Sealants Market Forecast (Kilo Tons, AGR (%), Cumulative, 2020-2030

Table 7.11 Europe Aerospace Adhesives and Sealants Market by Type Forecast ($Mn), AGR (%), Cumulative, 2020-2030

Table 7.12 Europe Aerospace Adhesives and Sealants Market by Type Forecast (Kilo Tons), AGR (%), Cumulative, 2020-2030

Table 7.13 Europe Aerospace Adhesives and Sealants Market by Technology Forecast ($Mn), AGR (%), Cumulative, 2020-2030

Table 7.14 Europe Aerospace Adhesives and Sealants Market by Technology Forecast (Kilo Tons), AGR (%), Cumulative, 2020-2030

Table 7.15 Europe Aerospace Adhesives and Sealants Market by Application Forecast ($Mn), AGR (%), Cumulative, 2020-2030

Table 7.16 Europe Aerospace Adhesives and Sealants Market by Application (Kilo Tons), AGR (%), Cumulative, 2020-2030

Table 7.17 Europe Aerospace Adhesives and Sealants Market Forecast ($Mn), AGR (%), Cumulative, 2020-2030

Table 7.18 Europe Aerospace Adhesives and Sealants Market Forecast (Kilo Tons, AGR (%), Cumulative, 2020-2030

Table 7.19 Asia-Pacific Aerospace Adhesives and Sealants Market by Type Forecast ($Mn), AGR (%), Cumulative, 2020-2030

Table 7.20 Asia-Pacific Aerospace Adhesives and Sealants Market by Type Forecast (Kilo Ton), AGR (%), Cumulative, 2020-2030

Table 7.21 Asia-Pacific Aerospace Adhesives and Sealants Market by Technology Forecast ($Mn), AGR (%), Cumulative, 2020-2030

Table 7.22 Asia-Pacific Aerospace Adhesives and Sealants Market by Technology Forecast (Kilo Tons), AGR (%), Cumulative, 2020-2030

Table 7.23 Asia-Pacific Aerospace Adhesives and Sealants Market by Application Forecast ($Mn), AGR (%), Cumulative, 2020-2030

Table 7.24 Asia-Pacific Aerospace Adhesives and Sealants Market by Application Forecast (Kilo Tons), AGR (%), Cumulative, 2020-2030

Table 7.25 Asia-Pacific Aerospace Adhesives and Sealants Market Forecast ($Mn), AGR (%), Cumulative, 2020-2030

Table 7.26 Asia-Pacific Aerospace Adhesives and Sealants Market Forecast (Kilo Tons), AGR (%), Cumulative, 2020-2030

Table 7.27 RoW Aerospace Adhesives and Sealants Market by Type Forecast ($Mn), AGR (%), Cumulative, 2020-2030

Table 7.28 RoW Aerospace Adhesives and Sealants Market by Type Forecast (Kilo Tons), AGR (%), Cumulative, 2020-2030

Table 7.29 RoW Aerospace Adhesives and Sealants Market by Technology Forecast ($Mn), AGR (%), Cumulative, 2020-2030

Table 7.30 RoW Aerospace Adhesives and Sealants Market by Technology Forecast (Kilo Tons), AGR (%), Cumulative, 2020-2030

Table 7.31 RoW Aerospace Adhesives and Sealants Market by Application Forecast ($Mn), AGR (%), Cumulative, 2020-2030

Table 7.32 RoW Aerospace Adhesives and Sealants Market by Application Forecast (Kilo Tons), AGR (%), Cumulative, 2020-2030

Table 8.1 3M Company Contact info

Table 8.2 3M Company Product Portfolio

Table 8.3 3M Company Recent Developments

Table 8.4 Solvay SA Contact Info

Table 8.5 Solvay SA Product Portfolio

Table 8.6 Solvay SA Recent Developments

Table 8.7 Henkel AG & Co. KGaA Contact info

Table 8.8 Henkel AG & Co. KGaA Product Portfolio

Table 8.9 Henkel AG & Co. KGaA Recent Developments

Table 8.10 Hexcel Corporation Contact Info.

Table 8.11 Hexcel Corporation Product Portfolio

Table 8.12 Beacon Adhesives Inc. Contact Info

Table 8.13 Beacon Adhesives Inc. Product Portfolio

Table 8.14 Royal Adhesives and Sealants LLC Contact Info

Table 8.15 Royal Adhesives and Sealants LLC Product Portfolio

Table 8.16 Royal Adhesives and Sealants LLC Recent Developments

Table 8.17 PPG Industries Contact Info

Table 8.18 PPG Industries Product Portfolio

Table 8.19 Arkema S.A. Contact Info

Table 8.20 Arkema S.A. Product Portfolio

Table 8.21 Arkema S.A. Recent Developments

Table 8.22 Huntsman Corporation Contact Info

Table 8.23 Huntsman Corporation Product Portfolio

Table 8.24 Huntsman Corporation Recent Developments

Table 8.25 Master Bond Inc. Contact Info

Table 8.26 Master Bond Inc. Product Portfolio

List of Figures

Figure 1.2 Global Aerospace Adhesives And Sealants Market Segmentation

Figure 2.1 How Do Aerospace Adhesives And Sealants Work?

Figure 3.1 Global Aerospace Adhesives And Sealants Market Drivers And Restrains

Figure 3.2 U.S. Sales Growth Of Aircraft, 2005-2015 (US$bn)

Figure 3.1 Global Aerospace Adhesives And Sealants Market Forecast ($Mn, AGR (%), 2020-2030

Figure 4.1 Global Aerospace Adhesives And Sealants Market Forecast ($Mn, AGR (%), 2020-2030

Figure 4.2 Global Epoxy Aerospace Adhesives and Sealants Market by Region Forecast ($Mn, AGR (%), 2020-2030

Figure 4.3 Global Silicone Aerospace Adhesives and Sealants Market by Region Forecast ($Mn), AGR (%), 2020-2030

Figure 4.4 Global Polyurethane Aerospace Adhesives and Sealants Market by Region Forecast ($Mn), AGR (%), 2020-2030

Figure 4.5 Global Other Aerospace Adhesives and Sealants Market by Region Forecast ($Mn), AGR (%), 2020-2030

Figure 5.1 Global Aerospace Adhesives And Sealants Market By Technology Forecast ($Mn, AGR (%), 2020-2030

Figure 5.2 Leading Aerospace Adhesives and Sealants Submarkets by technology Shares Forecast (% Share), 2020

Figure 5.3 Leading Aerospace Adhesives and Sealants Submarkets by Technology Shares Forecast (% Share), 2025

Figure 5.4 Leading Aerospace Adhesives and Sealants Submarkets by Technology Shares Forecast (% Share), 2030

Figure 7.1 Regional Aerospace Adhesives and Sealants Markets Forecasts ($Mn, AGR (%), 2020-2030

Figure 7.2 Regional Aerospace Adhesives and Sealants Markets Share Forecast (% Share), 2020

Figure 7.3 Regional Aerospace Adhesives and Sealants Markets Share Forecast (% Share), 2025

Figure 7.4 Regional Aerospace Adhesives and Sealants Markets Share Forecast (% Share), 2030

Figure 7.5 Figure 7.5 North American Aircraft on Order, By Airline

Figure 7.6 North America Aerospace Adhesives and Sealants Market By Type Share (%), 2020 vs 2030

Figure 7.7 North America Aerospace Adhesives and Sealants Market By Technology Share (%), 2020 vs 2030

Figure 7.8 North America Aerospace Adhesives and Sealants Market By Application Share (%), 2020 vs 2030

Figure 7.9 North American Aerospace Adhesives and Sealants Market By Country (% Share), 2020

Figure 7.10 Europe Aerospace Adhesives and Sealants Market Share By Type (%), 2020 vs 2030

Figure 7.11 Europe Aerospace Adhesives and Sealants Market Share by Technology (%), 2020 vs 2030

Figure 7.12 Europe Aerospace Adhesives and Sealants Market Share by Application (%), 2020 vs 2030

Figure 7.13 Europe Aerospace Adhesives and Sealants Market By Country (% Share), 2020

Figure 7.14 Asia-Pacific Aerospace Adhesives and Sealants Market Share By Type (%), 2020 vs 2030

Figure 7.15 Asia-Pacific Aerospace Adhesives and Sealants Market Share by Technology (%), 2020 vs 2030

Figure 7.16 Asia-Pacific Aerospace Adhesives and Sealants Market Share by Application (%), 2020 vs 2030

Figure 7.17 Asia-Pacific Aerospace Adhesives and Sealants Market By Country (% Share), 2020

Figure 7.18 RoW Aerospace Adhesives and Sealants Market Share By Type (%), 2020 vs 2030

Figure 7.19 RoW Aerospace Adhesives and Sealants Market Share By Technology (%), 2020 vs 2030

Figure 7.20 RoW Aerospace Adhesives and Sealants Market Share By Application (%), 2020 vs 2030

Figure 7.21 RoW Aerospace Adhesives and Sealants Market By Country (% Share), 2020

Figure 8.1 3M Company Revenue Comparison (Y-O-Y) 2015-2018 ($m)

Figure 8.2 3M Company Revenue Breakdown By Category, 2018 (%)

Figure 8.3 3M Company Revenue Breakdown By Region 2018 (%)

Figure 8.4 3M Company SWOT Analysis

Figure 8.5 Solvay SA Revenue comparison (Y-o-Y) 2015-2018 ($m)

Figure 8.6 Solvay SA Revenue Breakdown by Segments 2018 (%)

Figure 8.7 Solvay SA Revenue Breakdown By Region 2018 (%)

Figure 8.8 Henkel AG & Co. KGaA Revenue Comparison (Y-o-Y) 2015-2018 ($m)

Figure 8.9 Henkel AG & Co. KGaA Revenue Breakdown By Segments 2018 (%)

Figure 8.10 Henkel AG & Co. KGaA Revenue Breakdown By Region 2018 (%)

Figure 8.11 Hexcel Corporation Revenue Comparison (Y-o-Y) 2015-2018 ($m)

Figure 8.12 Hexcel Corporation Revenue Breakdown By Category 2018 (%)

Figure 8.13 Hexcel Corporation Revenue Breakdown By Region 2018 (%)

Figure 8.14 Beacon Adhesive Inc. Revenue (Y-o-Y) 2015-2018 ($ Mn)

Figure 8.15 Beacon Adhesive Inc. Revenue breakdown by segment 2018 (%)

Figure 8.16 Royal Adhesive and Sealants Revenue (2015-2018 ($ Mn)

Figure 8.17 Royal Adhesive and Sealants Revenue Breakdown By Category, 2018 (%)

Figure 8.18 PPG Industries Inc. Revenue comparison (Y-o-Y) 2015-2018($ Mn)

Figure 8.19 PPG Industries Inc. Revenue Breakdown By Category 2018 (%)

Figure 8.20 PPG Industries Inc Revenue Breakdown By Region 2018 (%)

Figure 8.21 Arkema S.A Revenue Comparison (Y-o-Y) 2015-2018($ Mn)

Figure 8.22 Arkema S.A Revenue Breakdown by Category 2018 (%)

Figure 8.23 Arkema S.A Revenue Breakdown By Region 2018 (%)

Figure 8.24 Huntsman Corporation Revenue Comparisons (Y-o-Y) 2015-2018 ($ Mn)

Figure 8.25 Huntsman Corporation Revenue Breakdown By Category 2018 (%)

Figure 8.26 Huntsman Corporation Revenue Breakdown By Region 2018 (%)

3M Company

Solvay SA (Subsidiary: Cytec Industries Inc.)

Henkel AG & Co. KGaA

Hexcel Corporation

Beacon Adhesive Inc.

Royal Adhesive and Sealants LLC

PPG Industries Inc.

Arkema S.A.

Huntsman Corporation

Master Bond Inc.

Other Companies Listed

Avery Dennison Corp.

Baker Hughes, a GE Co.

Barclays Plc

BASF Corporation

BASF SE

Becton, Dickinson & Co.

Beiersdorf AG

Brenntag AG

Cerner Corporation

Clariant AG

Colgate-Palmolive Co.

Corning, Inc.

Dentsply Sirona, Inc.

Domtar Corp.

Dow Corning Corporation

E.I. du Pont de Nemours & Co.

Evonik Industries AG

Expeditors International of Washington, Inc.

Ferguson Enterprises Inc.

Gazprom PJSC

Gemalto NV

Grifols SA

Heidelberg Cement AG

Henkel AG & Co. KGaA

Heraeus Holding GmbH

Hero MotoCorp Ltd.

Hexion, Inc.

Honeywell International, Inc.

HP, Inc.

Huntsman Corporation

Illinois Tool Works, Inc.

Imerys SA

International Business Machines Corp.

Johnson Controls, Inc.

LafargeHolcim Ltd.

Lockheed Martin Corp.

Mahindra & Mahindra Ltd.

Martin Marietta Materials, Inc.

Maruti Suzuki India Ltd.

M-I L.L.C.

Moodys Corporation

Nan Ya Plastics Corp.

National Oilwell Varco, Inc.

Nexeo Solutions, Inc.

Olin Corp.

PPG Industries, Inc.

Pricewaterhousecoopers Llp

Procter & Gamble Co.

Reckitt Benckiser Group Plc

RPM International, Inc.

Rush Enterprises, Inc.

salesforce.com, inc.

Siemens AG

Sika AG

Solvay SA

Sony Corporation

Sumitomo Electric Industries Ltd.

Tata Motors Ltd.

Tate & Lyle Plc

Tetra Pak International Sa

Texas Department Of Transportation

The Clorox Co.

The Dow Chemical Co.

The Sherwin-Williams Co.

The Yokohama Rubber Co. Ltd.

Toppan Printing Co., Ltd.

Trane Inc.

Umicore

Unilever Plc

Univar, Inc.

Volkswagen AG

Vulcan Materials Co.

Wintershall AG