The Battery Energy Storage Systems Market is Booming

09 October 2019

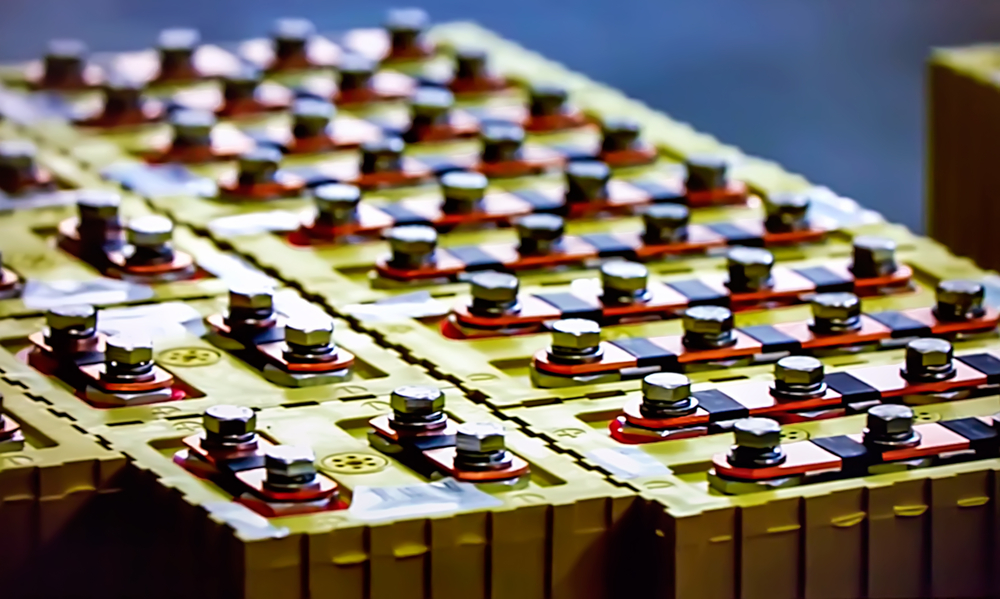

Storing alternative forms of energy is certainly not a new idea. However, for those invested in the battery energy storage sector, there’s going to be big growth in the coming years. Due to the increasing adoption of electric vehicles and favorable government initiatives, such as tax rebates and subsidies, the demand for Lithium-ion batteries is only going to increase.

As a result of the ever-growing need for Lithium-ion batteries, so will the need for innovative ways to store such energy, leading to a boom in the battery energy storage systems market. In fact, Visiongain values the Lithium-ion battery market at approximately $42.3 billion this year, so let’s look at some of the areas of growth and opportunities within the sector.

Increasing Number of Electric Vehicles

According to recent studies, due to the increasing number of electric vehicles across the globe, the need for more grid-operated battery technology to prevent blackouts is essential. This means that battery energy storage systems markets need to expand in order to keep up with demand and prevent large-scale power issues. Markets with greater grid instability are going to need to adapt to this growing demand or face serious repercussions further down the road.

Next Steps for Energy Usage

Experts in the energy sector are saying that battery energy storage systems are on the edge of profitability. What precisely does this statement “edge of profitability” mean? Well, for starters, it means that markets that utilize and reward battery energy storage system technology are drastically underdeveloped. This can often be due to state or federal regulations and global restrictions.

In the coming years, in addition to relaxed regulations and oversight, some of the next steps for energy usage will come in the form of reduced costs for battery hardware and software, standardization, and improvement of design.

Growth Rates & Opportunities

According to the most recent statistics, the battery energy storage system market is expected to grow approximately 10.2% between now and 2029. Some of the leading areas for growth and opportunities will come in the form of increased battery maintenance solutions and oversight for operators and manufacturers. In the years to come, owners of warehouses, fleets, and other sectors will become increasingly reliant on efficient management and storage systems that offer decreased downtime.

Get the battery storage market insight you need from Visiongain!

Gain an edge in the battery energy storage market sector today with the innovative data and insight available from Visiongain. To learn more about our reports and forecasts, contact us online or call +44 (0) 20 7549 9987.

Recent News

Visiongain Publishes Carbon Capture Utilisation and Storage (CCUS) Market Report 2024-2034

The global carbon capture utilisation and storage (CCUS) market was valued at US$3.75 billion in 2023 and is projected to grow at a CAGR of 20.6% during the forecast period 2024-2034.

19 April 2024

Read

Visiongain Publishes Liquid Biofuels Market Report 2024-2034

The global Liquid Biofuels market was valued at US$90.7 billion in 2023 and is projected to grow at a CAGR of 6.7% during the forecast period 2024-2034.

03 April 2024

Read

Visiongain Publishes Hydrogen Generation Market Report 2024-2034

The global Hydrogen Generation market was valued at US$162.3 billion in 2023 and is projected to grow at a CAGR of 3.7% during the forecast period 2024-2034.

28 March 2024

Read

Visiongain Publishes Biofuel Industry Market Report 2024-2034

The global Biofuel Industry market was valued at US$123.2 billion in 2023 and is projected to grow at a CAGR of 7.6% during the forecast period 2024-2034.