Industries > Pharma > Pharma Leader Series: Top Generic Drug Producers Market Forecast 2017-2027

Pharma Leader Series: Top Generic Drug Producers Market Forecast 2017-2027

North America, Europe, India, Japan, South Africa, MENA

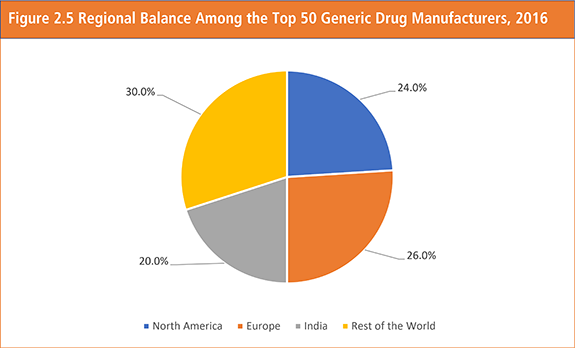

The top 50 generic drug producers had combined revenues of $92bn in 2016. The top 10 generic drug producers have 62% share of the total revenue made by these top 50 companies. 30% of the top 50 generic drug producers fall under the RoW region. This figure reflects the increasing penetration of generics on a global scale with many pharmaceutical companies realising this industry as a primary source of revenue.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand new 214-page report you will receive 74 tables and 71 figures – all unavailable elsewhere.

The 214-page report provides clear detailed insight into the top 50 generic drug producers. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand new report today you stay better informed and ready to act.

Report Scope

• This report ranks the world’s top 50 generic drug manufacturers according to their generic drug revenues in 2016.

• Our report assesses the leading generic drug manufacturers worldwide. In general a company profile gives you the following information:

• Discussion of activities, technologies and recent financial results

• Assessment of developments – mergers and acquisitions (M&A), new products, outlooks, challenges and plans

• Historical revenue ($) and CAGR (%) of top players

• Forecasting of generic drug revenues to 2027 (for 18 leading companies).

• This report discusses the factors that affect the industry:

• M&A activity and related partnerships

• Global and regional strategies – extending business reach

• Competition from companies based in emerging national markets

• Increasing specialisation by leading players, including big pharma companies

• Increasing consolidation of the generics industry

• Advances in production technologies, including difficult-to-make generics and biosimilars – important shifts and opportunities in the industry.

• This report analyses the leading generic drug manufacturers in North America, including these companies:

• Mylan

• Pfizer

• Abbott

• Endo Pharmaceuticals

• Valeant

• This report analyses the leading generic drug manufacturers in Europe, including these companies:

• Novartis (Sandoz)

• Sanofi

• Fresenius Kabi

• Pharmstandard

• Gedeon Richter

• Stada Arzneimittel.

• Perrigo

• This report analyses the leading generic drug manufacturers in India, including these companies:

• Sun Pharmaceutical Industries

• Dr. Reddy’s Laboratories

• Lupin

• Cipla

• Aurobindo

• Glenmark

• Torrent Pharma

• This report analyses the leading generic drug manufacturers in RoW, including these companies:

• Teva Pharmaceutical Industries

• EMS

• Aspen Pharmacare

• Nichi-Iko

• Sawai Pharmaceutical

• Taro Pharmaceutical

• Abdi Ibrahim

Visiongain’s study is intended for anyone requiring commercial analyses for the top generic drug manufacturers. You find data, trends and predictions.

Buy our report today Pharma Leader Series: Top Generic Drug Producers Market Forecast 2017-2027: North America, Europe, India, Japan, South Africa, MENA.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Introduction to this Survey

1.2 Main Report Findings

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Questions Answered by This Analytical Report

1.6 Who is This Report For?

1.7 Methods of Research and Analysis

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Top 50 Generic Drug Manufacturers

2.1 Top 50 Generic Drug Manufacturers: Revenues and Ranking, 2016

2.2 Top 50 Generic Drug Companies: Revenue Analysis, 2016

2.3 Top 50 Generic Drug Companies Regional Distribution, 2016

2.4 Report Coverage

2.5 Report Complexity

2.5.1 Obtaining Data from Private Companies

2.5.2 Financial Years Variability

2.5.3 Generics Revenue Identification

2.5.4 Defining Generics 1: Difference Between Biosimilars and Generics

2.5.5 Defining Generics 2: ‘Super-Generics’ and APIs

2.5.6 Defining Generics 3: Rx and OTC

3. Top North American Generic Drug Manufacturers: Activities and Prospects, 2017-2027

3.1 Companies Covered in this Chapter

3.2 Leading North American Generic Drug Manufacturers: Financial Performance outline, 2016

3.3 Mylan: Largest North American Manufacturer of Generic drugs, 2016

3.3.1 Mylan Historical Performance and Financial Results Analysis, 2016

3.3.2 Mylan Generic Drugs Revenue Forecast, 2017-2027

3.3.3 First Class II Transdermal Approval Consolidates Mylan’s Top Status in the US Market

3.3.4 Mylan’s European Portfolio is Diversifying

3.3.5 Mylan’s Generic Portfolio Remains the Company’s Core Strength

3.3.6 Mylan’s Winning Acquisition Strategy

3.4 Pfizer – The Leading Research-Based Pharmaceutical: Company Overview, 2016

3.4.1 Pfizer Historical Performance and Financial Results Analysis, 2016

3.4.2 Pfizer Generic Drugs Revenue Forecast, 2017-2027

3.4.3 Pfizer Internationalization and Restructuring Strategy

3.4.4 Pfizer’s Acquisition of Hospira: Has it Boosted Revenue from Generics?

3.4.5 Prospects for Pfizer’s Generic Drugs Business

3.5 Abbott: Company Overview, 2016

3.5.1 Abbott Business Segments Performance

3.5.2 Abbott Historical Performance and Financial Results Analysis, 2016

3.5.3 Abbott Generic Drugs Revenue Forecast, 2017-2027

3.5.4 Abbott’s Acquisitions: Overview and Analysis, 2010-2016

3.5.5 Abbott’s Sale of its Overseas Branded Generic Business: Implications

3.5.6 Future Prospects for Abbott Generic Drugs Business

3.6 Apotex – The Largest Pharmaceutical Company in Canada: Company Overview, 2016

3.6.1 Apotex Expansion to Europe and Beyond

3.6.2 Apotex Announces $184 Million US Expansion Move for 2017

3.7 Endo Pharmaceuticals: Company Overview, 2016

3.7.1 Endo: Divests to Specialise in Generics

3.7.2 Endo Reducing Presence on the South African Market

3.7.3 Performance Analysis on Endo’s US Generic Pharmaceuticals Segment

3.7.4 Future Prospects for Endo Pharmaceuticals Generic Drugs Business

3.7.5 Endo Generic Drugs Revenue Forecast, 2017-2027

3.7.6 Par Pharmaceuticals: Merged with Endo Qualitest: Company Overview, 2016

3.7.7 Par Pharmaceuticals’ Acquisition of JPH Group Holdings

3.7.8 Concentrated Generic Revenue Stream and Over 60 Generic Prescription Drugs

3.7.9 Buy Out of Indian Ethics Bio Lab Demonstrates Par’s Interest in Niche Products

3.8 Valeant Pharmaceuticals: Company Overview, 2016

3.8.1 Valeant: A Major Challenger in the Emerging Markets

3.8.2 Valeant Generic Drugs Revenue Forecast, 2017-2027

3.9 Pharmascience - Another Major Canadian Player: Company Overview, 2016

3.9.1 Over 200 Generic Product Families

3.9.2 Korean Venture Driving Diversification for Pharmascience

3.10 Mallinckrodt: Company Overview, 2016

3.10.1 Mallinckrodt Generics: Valuable Addition to the Company’s Portfolio

3.10.2 Reclassification of Methylphenidate ER Products: Effects on Mallinckrodt’s Income

3.10.3 What is Mallinckrodt’s Advantage Against Strong Competition?

3.10.4 Partnerships and Acquisitions: Crucial for Mallinckrodt’s Rapid Expansion

3.11 Akorn Pharmaceuticals: Company Overview, 2016

3.11.1 Akorn Acquisition of Small Companies: A Strategic Shift Towards Broad Market Reach

3.11.2 Akorn Strengthens its Position on the US Ophthalmology Market

3.12 Alvogen is a Privately-Owned US Company and the One to Watch: Company Overview, 2016

3.12.1 Alvogen Unique Business Model Proves Good Results

3.12.2 Alvogen Target is to Become Top 10 Global Generic Player

3.13 Impax Laboratories: A New Entrant on the Visiongain US List, Company Overview 2016

3.13.1 Generic Revenues Decrease in 2016 for Impax

4. Top European Generic Drug Manufacturers: Activities and Prospects, 2017-2027

4.1 Companies Covered in this Chapter

4.2 Leading European Generic Drug Manufacturers: Financial Performance Outline, 2016

4.3 CEE Markets Home to Many Big Generic Contenders

4.4 Novartis (Sandoz) - the World’s Second Largest Generic Pharmaceutical Company: Overview, 2016

4.4.1 Novartis (Sandoz) Historical Performance and Financial Results Analysis, 2016

4.4.2 Novartis (Sandoz) Generic Drugs Revenue Forecast, 2017-2027

4.4.3 Novartis (Sandoz) Key Developments Analysis, 2017

4.4.4 Emphasis on Complex, Differentiated Generics and Biosimilars

4.4.5 Future Prospects for Novartis Generic Drugs Business

4.5 Sanofi: Company Overview, 2016

4.5.1 Sanofi Historical Performance and Financial Results Analysis, 2016

4.5.2 Sanofi Generic Drugs Revenue Forecast, 2017-2027

4.5.3 Sanofi Announces Intentions to Divest European Generics Business

4.5.4 Future Prospects for Sanofi’s Generic Drug Business

4.6 Fresenius Kabi - Leading Generic Intravenous Drug Player: Company Overview, 2016

4.6.1 Intra Venous Drugs: The Main Product Line for Fresenius Kabi

4.6.2 Fresenius Kabi Will Continue to Expand

4.7 Pharmstandard - The Largest Russian Pharmaceutical Manufacturer: Company Overview, 2016

4.7.1 Acquisitions Strengthen Pharmstandard Manufacturing and Product Base

4.7.2 Pharmstandard Benefits from Strong Organic Production Capacity

4.7.3 Pharmstandard Generic Drugs Revenue Forecast, 2017-2027

4.8 Gedeon Richter – Hungarian Leader Looking Further Afield: Company Overview, 2016

4.8.1 Female Health and Fertility Segments Form Core Strengths for Gedeon Richter

4.8.2 Specialisation Strategy for Further Growth

4.8.3 A Pan-European Pharmaceutical Presence for the Future?

4.8.4 Gedeon Richter Generic Drugs Revenue Forecast, 2017-2027

4.9 Krka Pharmaceuticals- Slovenian Generic Giant Active in 70+ Countries: Company Overview, 2016

4.9.1 Prescription Generics: Krka’s Major Focus

4.9.2 Eastern Europe is Still the Largest National Market for Krka

4.9.3 Krka Generic Drugs Revenue Forecast, 2017-2027

4.10 Stada Arzneimittel - Major Presence in Germany and Central Europe: Company Overview, 2016

4.10.1 Germany is the Largest Market for Stada’s Generics Segment

4.10.2 Strong Product Development with Over 660 Product Launches in 2016

4.10.3 Stada Arzneimittel Generic Drugs Revenue Forecast, 2017-2027

4.11 Perrigo: Company Overview, 2016

4.11.1 Perrigo Drives Generic Segment Growth through Acquisitions, but Will it be Acquired Itself?

4.11.2 Rx Pharmaceuticals: Main Contributors to Perrigo’s Revenue Stream

4.12 Polpharma - Poland’s Generic Powerhouse: Company Overview, 2016

4.12.1 Polpharma’s Continuous Product Portfolio Enlargement

4.12.2 Strong Regional Presence in Poland, Russia and Kazakhstan

4.12.3 Acquisition Increases Polpharma Dominance in the Polish Market

4.13 Chemo: New Entrant on the Visiongain European Generics List, Company Overview 2016

5. Top Indian Generic Drug Manufacturers: Activities and Prospects, 2017-2027

5.1 Companies Covered in This Chapter

5.2 India: Generics Supplier to the World

5.3 Top 10 Indian Generic Drug Manufacturers: Financial Performance Outline, 2016

5.4 Sun Pharmaceutical - Leader in the Indian Generic Drug Market, Company Overview, 2016

5.4.1 Sun Has a Leading Presence in the Generic Export Market

5.4.2 Mega Acquisition of Ranbaxy to Enlarge Sun’s Market Share

5.4.3 Sun Pharmaceutical Generic Drugs Revenue Forecast, 2017-2027

5.5 Dr. Reddy’s Laboratories: Company Overview, 2016

5.5.1 At the Forefront of the Indian Generic Boom: Dr. Reddy’s Gerneric Revenue Approaching $2bn in 2016

5.5.2 North America is the Largest Export Markets for Dr. Reddy’s

5.5.3 Dr. Reddy’s Early Leadership in Biosimilar Antibodies

5.5.4 Dr. Reddy’s: Generic Drugs Revenue Forecast, 2017-2027

5.6 Lupin - The Most Successful Indian Generic Firm in the US Market: Company Overview, 2016

5.6.1 Lupin’s Continuous Portfolio Growth and Focus on Complex Injectables

5.6.2 Strong R&D Investment in New Delivery Systems and Original Products

5.6.3 Lupin Generic Drugs Revenue Forecast, 2017-2027

5.7 Cipla - Mumbai Based Generic Giant: Company Overview, 2016

5.7.1 Cipla Targets a US Expansion Through Acquisitions

5.7.2 Cipla’s Leadership in Anti-Retroviral Drugs and Focus on Key Markets

5.7.3 Chronic Disease: A Significant Target for Cipla

5.7.4 Cipla Generic Drugs Revenue Forecast, 2017-2027

5.8 Aurobindo – The Largest FDA APIs Supplier, Moved Into Original Drugs: Company Overview, 2016

5.8.1 High-Margin Specialty Generics

5.8.2 ANDA Filings and Approvals by Region, 2016

5.8.3 CRAMS Opportunities

5.9 Glenmark - Specialty Company Still Leveraging Generic Growth: Overview, 2016

5.9.1 Generics Remain Part of Global Growth Strategy for Glenmark

5.9.2 Glenmark Benefits from a Surge in the US and India

5.9.3 Glenmark Generic Drugs Revenue Forecast, 2017-2027

5.10 Wockhardt -Increasing Presence in US and Europe Generics Market: Company Overview, 2016

5.10.1 US Market Growth in 2016

5.10.2 Biosimilars, Novel Delivery Systems and Original Drugs Will Drive Growth for Wockhardt

5.11 Cadila - Leader in Indian Cardiovascular Market: Company Overview, 2016

5.11.1 Biochem Acquisition Boosts Cadila’s Revenue

5.11.2 Increasing Presence in the US Market

5.11.3 Cadila: A Future Biosimilar Force?

5.12 Ipca Laboratories - One of Top 10 Indian Pharma Exporters: Company Overview, 2016

5.12.1 Fast Development Due to Niche Strategic Approach

5.13 Torrent Pharma Establishes Itself on the Global Generics Market: Company Overview 2016

5.13.1 Domestic and US Expansion Continued in 2016

6. Top Generic Drug Manufacturers from the Rest of the World: Activities and Prospects, 2017-2027

6.1 Companies Covered in this Chapter

6.2 Leading Rest of the World Generic Drug Manufacturers: Financial Performance Outline, 2016

6.3 Japanese and Brazilian Generic Environment Particularly Significant to the Global Generic Drug Market

6.4 Teva Pharmaceutical Industries: Company Overview of the World’s Generic Industry Leader, 2016

6.4.1 Teva Historical Performance and Financial Results Analysis, 2014-2016

6.4.2 Teva Generic Drugs Revenue Forecast, 2017-2027

6.4.3 Teva’s Global Presence

6.4.4 How did Teva Achieve its Success?

6.4.5 Teva Operational Strategy: Focus on Cost Reduction

6.4.6 The US Market Stagnates but Teva Sustains its Strong Penetration

6.4.7 From Volume to Value Driven Strategy in the European Markets

6.4.8 Teva Strengthens its Position in the Central Nervous System Market Through the Acquisition of Auspex Pharma

6.4.9 Teva Acquires Actavis Consolidating Position as the Global Leader

6.4.9.1 Actavis: Company History

6.5 EMS - Leading the South American Generic Market: Company Overview, 2016

6.5.1 First Brazilian Company to Export Generics to Europe

6.5.2 EMS Has the Most Advanced Latin American R&D Base

6.6 Aspen Pharmacare - South African Giant Continues to Expand: Company Overview, 2016

6.6.1 Continuing Dominance in South Africa Generic Market

6.6.2 Asia-Pacific and International Business Main Revenue Contributors in 2016

6.6.3 Europe/CIS and Latin America: Another Major Growth Opportunity for Aspen

6.6.4 Aspen Generic Drugs Revenue Forecast, 2017-2027

6.7 Nichi-Iko: Company Overview, 2016

6.7.1 More Than 900 Generic Products in Nichi-Iko Portfolio

6.7.2 Nichi-Iko Acquires Sagent Pharmaceuticals

6.8 Abdi Ibrahim: Turkey’s Leading Pharmaceutical Company 2016

6.8.1 Large Product Portfolio Helps to Sustain Market Position

6.8.2 Abdi Ibrahim has a Vast International Scope

6.9 Hypermarcas SA - Brazilian Pharmaceutical and OTC Giant: Company Overview, 2016

6.10 Eurofarma - Rapidly-Growing Generics Power in Brazil: Company Overview, 2016

6.10.1 Nine Diversified Business Divisions

6.10.2 M&A Extending Latin American Reach for Eurofarma

6.11 Taro Pharmaceuticals - The Second Largest Israeli Pharmaceutical Manufacturer: Company Overview, 2016

6.11.1 Taro Acquires Zalicus Pharmaceutical in 2015

6.12 Towa Pharmaceuticals - Another Big Japanese Player: Company Overview, 2016

6.12.1 Large Number of Generic Products in Towa’s Portfolio

6.12.2 Towa’s Broad and Expanding Production Capacity

6.13 Sawai Pharmaceuticals - Osaka-Based Generic Leader: Company Overview, 2016

6.13.1 Annual Manufacturing Ambitions to Reach 15 Billion Tablets in 2017

6.13.2 Cardiovascular Drugs are the Most Significant Therapeutic Area for Sawai

6.13.3 M&A Boosts Sawai’s R&D

7. Conclusions

7.1 Companies’ Growth Strategies

7.2 Why are Big Pharma Companies Targeting Generics?

7.3 Teva’s Acquisition of Actavis: The Latest Major Consolidation for the Generic Drug Industry

7.4 Big Pharma Business Models Evolve

7.5 Biosimilars Will Have a Transformative Effect on Both Generic and Originator Drug Companies

7.6 Complex Generics with High Entry Barriers Continue to Increase in Importance

7.7 Future Trends for Generic Drug Producers – What’s Possible?

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Associated Visiongain Reports

Appendix C

Visiongain report evaluation form

List of Figures

Figure 2.1 Top 50 Generic Drug Manufacturers: Revenues ($m), 2016

Figure 2.2 Generic Drug Manufacturers: Revenue ($m) Comparison by Group Rank, 2016

Figure 2.3 Top 50 Generic Drug Manufacturers: Market Share (%) Amongst the Top 50 Companies According to Group Rank, 2016

Figure 2.4 Top 10 Generic Drug Manufacturers: Market Share (%) Among the Top 50 Companies, 2016

Figure 2.5 Regional Balance Among the Top 50 Generic Drug Manufacturers, 2016

Figure 2.6 Biosimilars and Generics: Overview, 2017

Figure 3.1 Top 10 North American Generic Manufacturers: Revenues ($m), 2016

Figure 3.2 Mylan: Historical Generic Drugs Revenue Estimate($m), AGR (%), 2012-2016

Figure 3.3 Mylan: Generic Drugs Revenue Forecast ($m), 2017-2027

Figure 3.4 Mylan: Generic Drugs AGR Forecast (%), 2017-2027

Figure 3.5 Pfizer: Historical Generic Drugs Revenue Estimate($m), AGR (%), 2012-2016

Figure 3.6 Pfizer: Generic Drugs Revenue Forecast ($m), 2017-2027

Figure 3.7 Pfizer: Generic Drugs AGR Forecast (%), 2017-2027

Figure 3.8 Abbott: Historical Generic Drugs Revenue Estimate($m), AGR (%), 2012-2016

Figure 3.9 Abbott: Generic Drugs Revenue Forecast ($m), 2017-2027

Figure 3.10 Abbott: Generic Drugs AGR Forecast (%), 2017-2027

Figure 3.11 Endo: Generic Drugs Revenue Forecast ($m), 2017-2027

Figure 3.12 Endo: Generic Drugs AGR Forecast (%), 2017-2027

Figure 3.13 Valeant: Revenue Breakdown by Business Segment, 2016

Figure 3.14 Valeant: Generic Drugs Revenue Forecast ($m), 2017-2027

Figure 3.15 Valeant: Generic Drugs AGR Forecast (%), 2017-2027

Figure 3.16 Akorn’s Key Acquisition: Reasons Overview

Figure 4.1 Top 10 European Generic Manufacturers: Revenues ($m), 2016

Figure 4.2 Novartis: Revenue Breakdown by Business Segment, 2016

Figure 4.3 Novartis (Sandoz): Historical Generic Drugs Revenues ($m), AGR (%), 2012-2016

Figure 4.4 Novartis (Sandoz): Generic Drugs Revenue Forecast ($m), 2017-2027

Figure 4.5 Novartis (Sandoz): Generic Drugs AGR Forecast (%), 2017-2027

Figure 4.6 Sanofi: Historical Generic Drugs Revenues ($m), AGR (%), 2012-2016

Figure 4.7 Sanofi: Generic Drugs Revenue Forecast ($m), 2017-2027

Figure 4.8 Sanofi: Generic Drugs AGR Forecast (%), 2017-2027

Figure 4.9 Pharmstandard: Generic Drugs Revenue Forecast ($m), 2017-2027

Figure 4.10 Pharmstandard: Generic Drugs AGR Forecast (%), 2017-2027

Figure 4.11 Gedeon Richter: Revenue Breakdown by Therapeutic Segment, 2016

Figure 4.12 Gedeon Richter: Geographical Revenue Breakdown, 2016

Figure 4.13 Gedeon Richter: Generic Drugs Revenue Forecast ($m), 2017-2027

Figure 4.14 Gedeon Richter: Generic Drugs AGR Forecast (%), 2017-2027

Figure 4.15 Krka Pharmaceuticals: Revenue Breakdown by Business Segment, 2016

Figure 4.16 Krka Pharmaceuticals: Generic Drugs Revenue Forecast ($m), 2017-2027

Figure 4.17 Krka Pharmaceuticals: Generic Drugs AGR Forecast (%), 2017-2027

Figure 4.18 Stada: Revenue Breakdown (%) by Business Segment, 2016

Figure 4.19 Stada: Top 8 Generic Markets by Revenue, 2016

Figure 4.20 Stada Arzneimittel: Generic Drugs Revenue Forecast ($m), 2017-2027

Figure 4.21 Stada Arzneimittel: Generic Drugs AGR Forecast (%), 2017-2027

Figure 5.1 Top Indian Generic Manufacturers: Revenues ($m), 2016

Figure 5.3 Sun Pharmaceutical: Generic Drugs Revenue Forecast ($m), 2017-2027

Figure 5.4 Sun Pharmaceutical: Generic Drugs AGR Forecast (%), 2017-2027

Figure 5.5 Dr. Reddy’s: Revenue Breakdown by Business Segment, 2016

Figure 5.6 Dr. Reddy’s: Revenue Breakdown by Region, 2016

Figure 5.7 Dr. Reddy’s: Generic Drugs Revenue Forecast ($m), 2017-2027

Figure 5.8 Dr. Reddy’s: Generic Drugs AGR Forecast (%), 2017-2027

Figure 5.9 Lupin: Revenue Breakdown by Markets, 2016

Figure 5.10 Lupin: Revenue Breakdown by Therapeutic Area, 2016

Figure 5.11 Lupin: Generic Drugs Revenue Forecast ($m), 2017-2027

Figure 5.12 Lupin: Generic Drugs AGR Forecast (%), 2017-2027

Figure 5.13 Cipla: Revenue Breakdown by Region, 2016

Figure 5.14 Cipla: Generic Drugs Revenue Forecast ($m), 2017-2027

Figure 5.15 Cipla: Generic Drugs AGR Forecast (%), 2017-2027

Figure 5.16 Glenmark: Generic Drugs Revenue Forecast ($m), 2017-2027

Figure 5.17 Glenmark: Generic Drugs AGR Forecast (%), 2017-2027

Figure 5.18 Wockhardt: Revenue Breakdown by Region, 2016

Figure 5.19 Ipca: Revenue Breakdown by Region, 2016

Figure 6.1 Top 10 Rest of the World Generic Manufacturers: Revenues ($m), 2016

Figure 6.2 Teva: Revenue Breakdown by Region, 2016

Figure 6.3 Teva: Historical Generic Drugs Revenues ($m), AGR (%), 2010-2014

Figure 6.4 Teva: Generic Drugs Revenue Forecast ($m), 2017-2027

Figure 6.5 Teva: Generic Drugs AGR Forecast (%), 2017-2027

Figure 6.6 Teva: Revenue Breakdown by Region, 2016

Figure 6.7 Teva: Annual Generic Revenue Change (%) in EU Countries, 2015-2016

Figure 6.8 Aspen: Revenue Breakdown (%) by Region, 2016

Figure 6.9 Aspen: Generic Drugs Revenue Forecast ($m), 2017-2027

Figure 6.10 Aspen: Generic Drugs AGR Forecast (%), 2017-2027

Figure 7.1 Top 10 Generic Drug Manufacturers: Market Share (%) Among the Top 50 Companies, 2016

Figure 7.2 Regional Balance Among the Top 50 Generic Drug Manufacturers, 2016

List of Tables

Table 2.1 Top 50 Generic Drug Manufacturers: Global Rank 1-25, Country and Revenues from Generics ($m), 2016

Table 2.2 Top 50 Generic Drug Manufacturers: Global Rank 26-50, Country and Revenues from Generics ($m), 2016

Table 2.3 Top 50 Generic Drug Manufacturers: Revenue ($m) and Market Share (%) According to Group Rank, 2016

Table 2.4 Regional Distribution of the Top 50 Companies, 2016

Table 3.1 Top 10 North American Generic Drug Manufacturers: Revenues ($m) and Ranking, 2016

Table 3.2 Mylan: Company Overview, 2016

Table 3.3 Mylan: Historical Generic Drugs Revenue Estimate($m), AGR (%), 2012-2016

Table 3.4 Mylan: Generic Drugs Revenue Forecast ($m, AGR%, CAGR%), 2017-2027

Table 3.5 Pfizer: Company Overview, 2016

Table 3.6 Pfizer: Historical Generic Drugs Revenue Estimate ($m), AGR (%), 2012-2016

Table 3.7 Pfizer: Generic Drugs Revenue Forecast ($m, AGR%, CAGR%), 2017-2027

Table 3.8 Abbott: Company Overview, 2016

Table 3.9 Abbott: Historical Generic Drugs Revenue Estimate ($m), AGR (%), 2012-2016

Table 3.10 Abbott: Generic Drugs Revenue Forecast ($m, AGR%, CAGR%), 2017-2027

Table 3.11 Apotex: Company Overview, 2016

Table 3.12 Endo: Company Overview, 2016

Table 3.13 Endo: Generic Drugs Revenue Forecast ($m, AGR%, CAGR%), 2017-2027

Table 3.14 Valeant: Company Overview, 2016

Table 3.15 Valeant: Generic Drugs Revenue Forecast ($m, AGR%, CAGR%), 2017-2027

Table 3.16 Pharmascience: Company Overview, 2016

Table 3.17 Mallinckrodt: Company Overview, 2016

Table 3.18 Akorn Pharmaceuticals: Company Overview, 2016

Table 3.19 Alvogen Pharmaceuticals: Company Overview, 2016

Table 3.20 Impax Laboratories: Company Overview, 2016

Table 4.1 Top European Generic Manufacturers: Revenues ($m), 2016

Table 4.2 Novartis (Sandoz): Company Overview, 2016

Table 4.3 Novartis (Sandoz): Historical Generic Drugs Revenues ($m), AGR (%), 2012-2016

Table 4.4 Novartis (Sandoz): Generic Drugs Revenue Forecast ($m, AGR%, CAGR%), 2017-2027

Table 4.5 Sanofi: Company Overview, 2016

Table 4.6 Sanofi: Historical Generic Drugs Revenues ($m), AGR (%), 2012-2016

Table 4.7 Sanofi: Generic Drugs Revenue Forecast ($m, AGR%, CAGR%), 2017-2027

Table 4.8 Fresnius Kabi: Company Overview, 2016

Table 4.9 Pharmstandard: Company Overview, 2016

Table 4.10 Pharmstandard: Generic Drugs Revenue Forecast ($m, AGR%, CAGR%), 2017-2027

Table 4.11 Gedeon Richter: Company Overview, 2016

Table 4.12 Gedeon Richter: Generic Drugs Revenue Forecast ($m, AGR%, CAGR%), 2017-2027

Table 4.13 Krka Pharmaceuticals Company Overview, 2016

Table 4.14 Krka Pharmaceuticals: Generic Drugs Revenue Forecast ($m, AGR%, CAGR%), 2017-2027

Table 4.15 Stada Arzneimittel Company Overview, 2016

Table 4.16 Stada Arzneimittel Pharmaceuticals: Generic Drugs Revenue Forecast ($m, AGR%, CAGR%), 2017-2027

Table 4.17 Perrigo: Company Overview, 2016

Table 4.18 Polpharma: Company Overview, 2016

Table 4.19 Chemo: Company Overview, 2016

Table 5.1 Top 10 Indian Generic Manufacturers: Revenues($m) and Ranking, 2016

Table 5.2 Sun Pharmaceutical: Company Overview, 2016

Table 5.3 Sun Pharmaceutical: Generic Drugs Revenue Forecast ($m, AGR%, CAGR%), 2017-2027

Table 5.4 Dr. Reddy’s: Company Overview, 2016

Table 5.5 Dr. Reddy’s: Generic Drugs Revenue Forecast ($m, AGR%, CAGR%), 2017-2027

Table 5.6 Lupin: Company Overview, 2016

Table 5.7 Lupin: Generic Drugs Revenue Forecast ($m, AGR%, CAGR%), 2017-2027

Table 5.8 Cipla: Company Overview, 2016

Table 5.9 Cipla: Generic Drugs Revenue Forecast ($m, AGR%, CAGR%), 2017-2027

Table 5.10 Aurobindo: Company Overview, 2016

Table 5.11 Aurobindo: ANDA Filings and Approvals by Region, 2016

Table 5.12 Glenmark: Company Overview, 2016

Table 5.13 Glenmark: Generic Drugs Revenue Forecast ($m, AGR%, CAGR%), 2017-2027

Table 5.14 Wockhardt: Company Overview, 2016

Table 5.15 Cadila: Company Overview, 2016

Table 5.16 Ipca: Company Overview, 2016

Table 5.17 Torrent Pharma: Company Overview, 2016

Table 6.1 Top 10 Rest of the World Generic Drug Manufacturers, Revenues ($m) and Ranking, 2016

Table 6.2 Teva: Company Overview, 2016

Table 6.3 Teva: Historical Generic Drugs Revenues ($m), AGR (%), 2014-2016

Table 6.4 Teva: Generic Drugs Revenue Forecast ($m, AGR%, CAGR%), 2017-2027

Table 6.5 EMS: Company Overview, 2016

Table 6.6 Aspen Pharmacare: Company Overview, 2016

Table 6.7 Aspen: Generic Drugs Revenue Forecast ($m, AGR%, CAGR%), 2017-2027

Table 6.8 Nichi-Iko: Company Overview, 2016

Table 6.9 Abdi Ibrahim: Company Overview, 2016

Table 6.10 Hypermarcas: Company Overview, 2016

Table 6.11 Eurofarma: Company Overview, 2016

Table 6.12 Taro Pharmaceutical: Company Overview, 2016

Table 6.13 Towa Pharmaceutical: Company Overview, 2016

Table 6.14 Sawai Pharmaceutical: Company Overview, 2016

AbbVie

Abdi Ibrahim

Abrika Pharmaceuticals

Ache

Actavis

Active Pharma

Adcock Ingram

Advanced Vision Research

Aegera

Afrexa Life Sciences

Agouron Pharmaceuticals

Akorn Pharmaceuticals

Akrikhin

Alcon

Allergan

Alpharma

Alvogen

AmerisourceBergen

Amide

Amneal Pharmaceuticals

AMS

APL Holdings Limited

ApoPharma

Apotex

Apotex Fermentation

APP Pharmaceuticals

Aprogen

Arrow Group

Asahi Kasei Pharma Corporation

Ascent Pharmahealth

ASKA Pharmaceutical

Aspen

Aspen Pharmacare

Aspen Trading

AstraZeneca

Auden McKenzie

Aurigene Discovery Technologies

Auro Pharma

Aurobindo

Balkanpharma

Barr Pharmaceuticals

Bausch and Lomb Holdings

Bayer

Bayer Yakuhin

BeiKang Pharmaceutical

Bever

Biocad Holding

Bioniche Pharma

Biovena

Boca Pharmacal

Boehringer Ingelheim

Brainfarma Industria e Farmaceutica

Bremer Pharma

Bunker and Delta

Cadila Healthcare

Cardinal Health

Cenova Pharma

CFR Pharmaceuticals

Chattem Chemicals

Chemo Group

Chimpharm

Chiron Corporation

Chirotech Technology

CIBA VISION

Cipla

CNS Therapeutics

Colotech

Cosmed Industria de Cosmeticos e Medicamentos S.A.

D. Searle & Company

Dabur Pharma

DACA Pharmaceuticals

Daichi Kasei

Dialfor Health

DKSH

Dr. Reddy’s Laboratories

Dream Pharma

Dusa Pharmaceuticals

EBEWE Pharma

Elan Pharmaceuticals

Elder Pharmaceuticals

Emcure

Emergent Biosolutions

Emploi Quebec

EMS

Endo

Eon Labs

Ethics Bio Lab

Eurofarma

European Medicines Agency (EMA)

Facet Biotech

Fako

Fenwal

Filaxis

Fougera Pharmaceuticals

Fresenius Kabi

Fuso Pharmaceutical Industries

Gangene Corp

Gedeon Richter

Generic Health

Generic Pharmaceutical Association (GPhA)

Genfar S.A.

Genzyme

Germa Pharm

GlaxoSmithKline (GSK)

Glenmark

Globalpharma

Golden Cross Pharma

Greenstone

Handok

HealthTronics

Helvepharm

Herbapol Pruszkow

Hexa

Hikma

Hi-Tech Pharmacal

Hospira

Hypermarcas

IDEV Technologies

Ikaria

Impax Laboratories

Innopharma

Inspire Pharmaceuticals

Investissement Quebec

Ipca Laboratories

J-DOLPH Pharmaceutical

Johnson & Johnson

JPH Group Holdings

Kanghong Sagen Pharmaceuticals

Keri Pharma

Kilitch Drugs

Kolmar Holdings

Krka

Kunwha Pharmaceuticals

Kyowa Pharmaceuticals

Labesfal

Laboratorio Sanderson

Laboratorios Gautier

Laboratorios Grin

Laboratorios Kendrick

Labormed Pharma

Leek

Lekko

Les Laboratoires Servier SAS

Lotus Pharmaceuticals

Lupin

mAbxience

Madaus

Mallinckrodt

Maruko Pharmaceutical

Masterlek

McKesson Drug Company

Mechnikov Biomed

Mediate Specialities

Medina

Medisa Shinyaku

Medley Industria Farmaceutica

Meiji Seika Pharma

Merck & Co

Microdose

Mitani Sangyo

Mitsubishi Tanabe Pharma

MJ Pharma

Multicare

Mylan Laboratories

Nanomi B.V

National Druggists

NBZ Pharma Limited

Negma

Nichi-Iko

Nichi-Iko Pharma Tech

Nicox

Nippon Chemipher

Nippon Kayaku

NIXS Corporation

Novartis

Nycomed

Oak Pharmaceuticals

OctoPlus

Omega Laboratories Limited

Onset Dermatologics

Onyx

Oriel Therapeutics

Orion

Paladin Labs

Par Pharmaceutical

Parke-Davis

Pendopharm

Perrigo Company

Pfizer

PGT Healthcare

Pharma Avalanche

Pharmacin

Pharmapark

Pharmascience

Pharmascience Korea

PharmaSwiss

Pharmstandard

Pharmstandard Biotec

Phlox Pharma

Pinewood Laboratories

Piramal Healthcare Solutions

Polfa Warszawa

Polpharma

Pradeep Drug Company

Promius Pharma

Pymepharco

Qalitest

Questcor

Ranbaxy Laboratories

Ranbaxy Life Sciences Research

Ratiopharm

Ribbon

Richter-Helm

Roche

Romark Laboratories

Sabex

Sagent Acquisition Corp

Salix Pharmaceuticals

Sandoz

Sanofi

Sanofi Pasteur

Sawai Pharmaceuticals

Schein Pharmaceutical

Sekisui Medical

Shantha Biotechnics

Silom Medical Company

Sindan

Solus Pharmaceuticals

Solvay Pharmaceuticals

Somar

Specifar Pharmaceuticals S.A.

SPIL de Mexico

Spirig Pharma

Stada Arzneimittel

STARLIMS

Sun Pharmaceutical

Swisse Wellness

Taiyo Cephalon

Taro

Technologies Inc

Teikoku Medix

Terapia S.A.

Teva Pharmaceutical Industries

The European Generic Medicines Association (EGA)

TKS Pharmaceutical

Torrent Pharmaceuticals

Towa

UDL Laboratories

United Research Laboratories

URL Pharma

US Food and Drug Administration (FDA)

Uteron Pharma S.A.

Valeant

Velefarm

Veropharm

VersaPharm Incorporated

Vindexpharm

VPI Holdings Corp

Warner Chilcott

Warner Lambert

Watson Pharmaceuticals

Winthrop

Wockhardt

Wyeth

World Health Organisation (WHO)

Yakuhan Pharmaceuticals

ZAO Ranbaxy

Zao Sun Pharma

Zhejiang Chiral Medicine Chemicals Company

ZiO Zdorovje

Zoetis

Zydus Pharmaceuticals

Zydus Wellness

Download sample pages

Complete the form below to download your free sample pages for Pharma Leader Series: Top Generic Drug Producers Market Forecast 2017-2027

Related reports

-

Global Drug-Device Combination Market 2017-2027

The global drug-device combination market was valued at $137bn in 2016 and is projected to grow at a CAGR of...

Full DetailsPublished: 30 August 2017 -

Advanced Wound Care Market Forecast 2018-2028

Our 277-page report provides 175 tables, charts, and graphs. Read on to discover the most lucrative areas in the industry...

Full DetailsPublished: 29 August 2018 -

Global Medical Marijuana Market 2017-2027

The global medical marijuana market was valued at $12bn in 2016 and is projected to grow at a CAGR of...Full DetailsPublished: 22 August 2017 -

Global Translational Regenerative Medicine Market Prospects 2018-2028

The Global Translational Regenerative Medicine market is estimated to grow at a CAGR of 22.1% in the first half of...

Full DetailsPublished: 27 March 2018 -

Pain Relieving Drugs Market Forecast 2017-2027

The global pain relieving drugs market is expected to grow at a CAGR of 2.1% from 2021-2027. The market is...

Full DetailsPublished: 15 December 2016 -

Neurostimulation Devices Market 2017-2027

Our 178-page report provides 102 tables, charts, and graphs, providing over 2900 unique datapoints. Read on to discover the most...Full DetailsPublished: 21 August 2017 -

Global Bioactive Wound Care Market Forecasts 2017-2027

The global bioactive wound care market is expected to grow at a CAGR of 8.7% in the first half of...

Full DetailsPublished: 23 January 2017 -

Global OTC Pharmaceutical Market Forecast 2018-2028

In this brand new 201-page report you will receive 84 tables and 79 figures– all unavailable elsewhere. The 201-page report...

Full DetailsPublished: 05 April 2018

Download sample pages

Complete the form below to download your free sample pages for Pharma Leader Series: Top Generic Drug Producers Market Forecast 2017-2027

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Latest Pharma news

Visiongain Publishes Peripheral Vascular Device Market Report 2024-2034

The global Peripheral Vascular Devices market is estimated at US$12.49 billion in 2024 and is projected to grow at a CAGR of 8.5% during the forecast period 2024-2034.

30 April 2024

Visiongain Publishes Drug Delivery Technologies Market Report 2024-2034

The global Drug Delivery Technologies market is estimated at US$1,729.6 billion in 2024 and is projected to grow at a CAGR of 5.5% during the forecast period 2024-2034.

23 April 2024

Visiongain Publishes Cell Therapy Technologies Market Report 2024-2034

The cell therapy technologies market is estimated at US$7,041.3 million in 2024 and is projected to grow at a CAGR of 10.7% during the forecast period 2024-2034.

18 April 2024

Visiongain Publishes Automation in Biopharma Industry Market Report 2024-2034

The global Automation in Biopharma Industry market is estimated at US$1,954.3 million in 2024 and is projected to grow at a CAGR of 7% during the forecast period 2024-2034.

17 April 2024