Industries > Cyber > Industrial Internet of Things (IoT) Market 2017-2022

Industrial Internet of Things (IoT) Market 2017-2022

Forecasts by Industry (Aerospace/Defense IIoT, Healthcare IIoT, Automotive & Transportation IIoT, Energy & Utilities IIoT, Agriculture IIoT, Retail IIoT, Manufacturing IIoT, Others IIoT), by Region, and by Key National Markets (Including USA, UK, China, India and More) & Prospects For Machine to Machine (M2M) Technologies in the Manufacturing IoT Ecosystem, LTE, RFID, 3G/4G

Interested or involved in Industrial Internet of Things? Visiongain has produced an in-Depth market research report into Industrial Internet of Things, forecasting the rapid growth of this market. This report offers forecasts for specific industries, whilst profiles of leading national/regional markets offers you insights into region-specific opportunities and developments. Visiongain has estimated this market to be worth $228.4bn in 2017.

• North America

– USA

• Asia Pacific

– China

– Japan

– India

• Europe

– UK

– Germany

– France

– Italy

– Russia

• Middle East & Africa

• Latin America

– Brazil

The development of this market and industry interest in IoT continues, with Visiongain forecasting significant growth rates for this market. This report covers forecasts for the market, as well as other factors that could affect Industrial Internet of Things. By also covering the below submarkets, the report gives readers a concise overview of the market:

• Aerospace/Defense IIoT

• Healthcare IIoT

• Automotive & Transportation IIoT

• Energy & Utilities IIoT

• Agriculture IIoT

• Retail IIoT

• Manufacturing IIoT

• Others IIoT

Detailed information on Industrial Internet of Things can be used to help develop your business plans and strategy. With a Visiongain report, the reader is able to see a clear overview of a market. Concise, clear analysis supports Visiongain’s conclusions, and our market evaluations will help your company when considering the Industrial Internet of Things market. View company profiles of key players within the market:

• ARM

• AT&T

• Blackberry

• Bosch

• Cisco

• Emerson Electric

• General Electric (GE)

• Alphabet Inc./Google

• Hewlett-Packard (HP)

• IBM

• Intel

• NXP

• Microsoft

• Omron

• Oracle

• PTC

• Qualcomm

• Rockwell Automation

• RTI

• Samsung

• SAP

• Texas Instruments

• Verizon

With an optimistic outlook forecast for this market, Visiongain believes this market will be worth $228.4bn in 2017 alone.

With 101 tables and charts and a total length of 160 pages, this report is a fantastic opportunity to increase your knowledge of this sector. A SWOT analysis table, as well as analysis of the drivers and restraints for the overall market concisely informs you of the major factors affecting this market, whilst Visiongain’s data-rich approach provides greater insight into this market.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Executive Summary

1.1 Industrial Internet Market Gaining Increased Traction

1.2 Market Definition

1.3 Market Segmentation

1.4 Benefits of This Report

1.5 Report Scope

1.6 Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 About Visiongain

1.9 Associated Visiongain Reports

2. Introduction to the Industrial Internet Market

2.1 What is the Industrial Internet?

2.2 Defining Internet of Things (IoT)

2.2.1 M2M Technology is the Backbone behind the Massive Potential in the Industrial Internet Market

2.2.2 M2M History and Recent Developments

2.3 A Range of Benefits Derived From Industrial Internet

2.4 IoT Applications by Industry

2.5 Cloud to Play Pivotal Role in the Industrial Internet Industry Boom

2.6 Big-Data to Explode With the Rise in Industrial Internet Market

2.7 Growth in the Wireless Sector

2.8 Industrial Internet Growth Drivers

2.9 The Internet of Things Value Chain

2.10 Big Opportunity for Companies to Thrive in Booming Industrial Internet Market

3. Global Industrial Internet Market Forecasts 2017-2022

3.1 Market Definition

3.2 Global Industrial Internet Market Forecast 2017-2022

3.3 Global Industrial Internet Connections Forecast 2017-2022

3.4 Global Industrial RFID Market Forecast 2017-2022

3.5 Global Industrial RFID Tag Connections Forecast 2017-2022

4. Global Industrial Internet Submarket Forecasts 2017-2022

4.1 What are the Leading Submarkets in the Industrial Internet Revenue Forecast 2017-2022?

4.1.1 Global Industrial Internet of Things Revenue Submarket Forecast AGR & CAGR

4.1.2 Automotive and Transportation Leading Submarket in IIoT Ecosystem in 2017 with a Market Share of 28.1% In 2017

4.2 Aerospace/Defense IIoT Submarket Forecast Summary 2017-2022

4.3 Healthcare IIoT Submarket Forecast Summary 2017-2022

4.4 Automotive & Transportation IIoT Submarket Forecast Summary 2017-2022

4.5 Energy & Utilities IIoT Submarket Forecast Summary 2017-2022

4.6 Agriculture IIoT Submarket Forecast Summary 2017-2022

4.7 Retail IIoT Submarket Forecast Summary 2017-2022

4.8 Manufacturing IIoT Submarket Forecast Summary 2017-2022

4.9 Others IIoT Submarket Forecast Summary 2017-2022

5. Regional Industrial Internet of Things Forecasts 2017-2022

5.1 Overview

5.2 Asia Pacific Leading Region in Terms of IIoT Revenue in 2017

5.2.1 Regional Industrial Internet of Things Revenue Forecast AGR & CAGR

5.2.2 Asia Pacific Leading Regional Industrial Internet of Things Market Shares in 2017 with 33.2%

5.3 Top 10 National Industrial Internet of Things Market Forecasts 2017-2022

5.3.1 USA IIoT National Market Forecast 2017-2027

5.3.2 China IIoT National Market Forecast 2017-2027

5.3.3 UK IIoT National Market Forecast 2017-2027

5.3.4 Japan IIoT National Market Forecast 2017-2027

5.3.5 Germany IIoT National Market Forecast 2017-2027

5.3.6 France IIoT National Market Forecast 2017-2027

5.3.7 Italy IIoT National Market Forecast 2017-2027

5.3.8 Russia IIoT National Market Forecast 2017-2027

5.3.9 Brazil IIoT National Market Forecast 2017-2027

5.3.10 India IIoT National Market Forecast 2017-2027

5.3.11 Rest of World IIoT National Market Forecast 2017-2027

6. SWOT Analysis of the Industrial Internet Market

7. Industrial Internet Ecosystem Analysis

7.1 Network Concerns in Industrial Internet Application

7.2 Requirements for Widespread Deployment of Industrial Internet

7.2.1 Data Security a Big Concern for Industrial Internet Adoption

7.2.2 GPRS / SMS / CDMA / LTE

7.2.3 Two-Way Communication

7.2.4 Support for More than One Communication Type

7.2.5 Ensuring Minimum Downtime

7.2.6 Cost Effective

7.2.7 Utilising the Right Toolsets

7.2.8 Optimised Billing

7.3 Business Case for Industrial Internet Adoption

7.3.1 Smart Services for Industrial Internet Applications

7.3.1.1 Smart Service Business Plan for OEMs

7.4 The Future Potential of Industrial Internet

7.4.1 System Awareness

7.4.2 Business Case for System Awareness

7.4.3 M2M Platform Requirements and Opportunities

7.4.4 Industrial Internet in the LTE Era

7.4.4.1 Switching from GSM to LTE

7.4.4.2 Impact of Switch from GSM to LTE on M2M

7.5 Internet Protocol Version 6 – IPv6

7.5.1 IoT Migration to IPv6

8. Leading Companies in the Industrial Internet Ecosystem

8.1 Introduction

8.2 ARM

8.3 AT&T

8.4 Blackberry

8.5 Bosch

8.6 Cisco

8.7 Emerson Electric

8.8 General Electric (GE)

8.9 Alphabet Inc. / Google

8.10 Hewlett-Packard (HP)

8.11 IBM

8.12 Intel

8.13 NXP

8.14 Microsoft

8.15 Omron

8.16 Oracle

8.17 PTC

8.18 Qualcomm

8.19 Rockwell Automation

8.20 RTI

8.21 Samsung

8.22 SAP

8.23 Texas Instruments

8.24 Verizon

8.25 Industrial Internet Consortium (IIC)

9. Conclusions

9.1 Industrial Internet Market Drivers

9.1.1 Network Coverage

9.1.2 Telematics and Telemetry Increasing Efficiency

9.1.3 Service Providers Need to Expand Offerings

9.1.4 IPv6 Will Increase IoT Opportunities

9.1.5 IoT Creating Scope for Development of New Applications

9.2 Industrial Internet of Things Market Challenges

9.2.1 Fragmented Value Chain

9.2.2 Lack of Universal Standards

9.2.3 Migration from 2G to 3G/4G and Seamless Connectivity

9.2.4 Marketing Challenges

9.2.5 Security Concerns

9.2.6 Financing Problems a Hurdle in Industrial Internet Growth

9.3 Opportunities with the Industrial Internet

9.4 Way Forward

9.4.1 Increase in Partnerships

9.4.2 Standardisation in Technical Framework

9.4.3 Measuring Big Data via Meaningful Analytics

9.4.4 Generate New Business Models

9.5 Key Areas for Successful Adoption of Industrial Internet

9.6 Industrial Internet Gaining Increased Support from Major Players

9.7 Further Conclusions

9.8 Recommendations

10. Glossary

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 2.1 IoT Applications by Industry

Table 3.1 Global Industrial Internet Market Forecast 2017-2022 ($ billion, AGR %, CAGR%, Cumulative)

Table 3.2 Global Industrial Internet Connections Forecast 2017-2022 (billion, AGR %, CAGR%, Cumulative)

Table 3.3 Global Industrial RFID Market Forecast 2017-2022 ($ million, AGR %, CAGR%, Cumulative)

Table 3.4 Global Industrial RFID Tag Connections Forecast 2017-2022(billion, AGR %, CAGR%, Cumulative)

Table 4.1 Global Industrial Internet Submarket Revenue Forecast2017-2022 ($ billion)

Table 4.2 Global Industrial Internet of Things Submarket Revenue AGR Forecast 2018-2022 (AGR %)

Table 4.3 Global Industrial Internet of Things Submarket Revenue CAGR Forecast (%) 2017-2020, 2020-2022, and 2017-2022

Table 4.4 Global Industrial Internet of Things Market Share Forecast by Type 2017-2022 (%)

Table 4.5 Aerospace/Defense IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR %, CAGR%, Cumulative)

Table 4.6 Healthcare IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR %, CAGR%, Cumulative)

Table 4.7 Automotive & Transportation IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR %, CAGR%, Cumulative)

Table 4.8 Energy & Utilities IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR %, CAGR%, Cumulative)

Table 4.9 Agriculture IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR %, CAGR%, Cumulative)

Table 4.10 Retail IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR %, CAGR%, Cumulative)

Table 4.11 Manufacturing IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR %, CAGR%, Cumulative)

Table 4.12 Others IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR %, CAGR%, Cumulative)

Table 5.1 Regional Industrial Internet of Things Revenue Forecast 2017-2022 ($ billion)

Table 5.2 Regional Industrial Internet of Things Revenue AGR Forecast 2018-2022 (AGR %)

Table 5.3 Regional Industrial Internet of Things Revenue CAGR Forecast (%) 2017-2020, 2020-2022, and 2017-2022

Table 5.4 Regional Industrial Internet of Things Market Share Forecast 2017-2022 (%)

Table 5.5 Leading Regional IIoT Markets Cumulative Sales 2017-2022 (Revenue US$bn)

Table 5.6 Top 10 National Industrial Internet of Things Market Forecasts 2017-2022 ($ Billions, AGR%, % Share)

Table 5.7 USA IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR %)

Table 5.8 China IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR %)

Table 5.9 UK IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR %)

Table 5.10 Japan IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR %)

Table 5.11 Germany IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR %)

Table 5.12 France IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR %)

Table 5.13 Italy IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR %)

Table 5.14 Russia IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR %)

Table 5.15 Brazil IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR %)

Table 5.16 India IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR %)

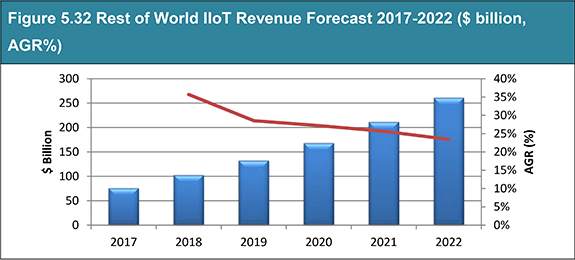

Table 5.17 Rest of World IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR %)

Table 5.18 Leading National IIoT Markets Cumulative Sales 2017-2022 (Revenue US$bn)

Table 6.1 SWOT Analysis of the Industrial Internet Market

Table 8.1 AT&T’s M2M Solution Advantages

Table 8.2 List of Companies Part of the Industrial Internet Consortium

Table 9.1 Industrial Internet Application Opportunities

List of Figures

Figure 2.1: IoT Value Chain

Figure 3.1 Industrial Internet Sub-Market Segmentation

Figure 3.2 Global Industrial Internet Market Forecast 2017-2022 ($ billion, AGR%)

Figure 3.3 Global Industrial Internet Connections Forecast 2017-2022 (billion, AGR%)

Figure 3.4 Global Industrial RFID Market Forecast 2017-2022 ($ million, AGR%)

Figure 3.5 Global Industrial RFID Tag Connections Forecast 2017-2022 (billion, AGR%)

Figure 4.1 Global Industrial Internet of Things Submarket Revenue Forecast 2017-2022 ($ billion)

Figure 4.2 Global Industrial Internet of Things Submarket Revenue AGR Forecast 2018-2022 (AGR %)

Figure 4.3 Global Industrial Internet of Things Market Share Forecast by Type 2017 (%)

Figure 4.4 Global Industrial Internet of Things Market Share Forecast by Type 2020 (%)

Figure 4.5 Global Industrial Internet of Things Market Share Forecast by Type 2022 (%)

Figure 4.6 Aerospace/Defense IIoT Submarket Revenue Forecast2017-2022($ billion, AGR%)

Figure 4.7 Aerospace/Defense IIoT Submarket Revenue Forecast2017, 2020 and 2022 (% Share)

Figure 4.8 Healthcare IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR%)

Figure 4.9 Healthcare IIoT Submarket Share Forecast 2017, 2020 and 2022 (% Share)

Figure 4.10 Automotive & Transportation IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR%)

Figure 4.11 Automotive & Transportation IIoT Submarket Share Forecast 2017, 2020 and 2022 (% Share)

Figure 4.12 Energy & Utilities IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR%)

Figure 4.13 Energy &Utilities IIoT Submarket Share Forecast 2017, 2020 and 2022 (% Share)

Figure 4.14 Agriculture IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR%)

Figure 4.15 Agriculture IIoT Submarket Share Forecast 2017, 2020 and 2022 (% Share)

Figure 4.16 Retail IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR%)

Figure 4.17 Retail IIoT Submarket Share Forecast 2017, 2020 and 2022 (% Share)

Figure 4.18 Manufacturing IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR%)

Figure 4.19 Manufacturing IIoT Submarket Share Forecast 2017, 2020 and 2022 (% Share)

Figure 4.20 Others IIoT Submarket Revenue Forecast 2017-2022 ($ billion, AGR%)

Figure 4.21 Others IIoT Submarket Share Forecast 2017, 2020 and 2022 (% Share)

Figure 5.1 Regional Industrial Internet of Things Revenue Forecast 2017-2022 ($ billion)

Figure 5.2 Regional Industrial Internet of Things Revenue AGR Forecast 2018-2022 (AGR%)

Figure 5.3 Regional Industrial Internet of Things Market Share Forecast 2017 (%)

Figure 5.4 Regional Industrial Internet of Things Market Share Forecast 2020 (%)

Figure 5.5 Regional Industrial Internet of Things Market Share Forecast 2022 (%)

Figure 5.6 Leading Regional IIoT Markets Cumulative Sales 2017-2022 (Revenue US$bn)

Figure 5.7 Top 10 National Internet of Things Market AGR Forecasts2017-2022 (AGR%)

Figure 5.8 Top 10 National Internet of Things Market Forecasts2017-2022 ($ Billions, AGR%)

Figure 5.9 Leading National IIoT Markets Market Forecast 2017 (Share %)

Figure 5.10 Leading National IIoT Markets Market Forecast 2020 (Share %)

Figure 5.11 Leading National IIoT Markets Market Forecast 2022 (Share %)

Figure 5.12 USA IIoT Revenue Forecast 2017-2022 ($ billion, AGR%)

Figure 5.13 USA IIoT Submarket Share Forecast 2017, 2020 and 2022 (% Share)

Figure 5.14 China IIoT Revenue Forecast 2017-2022 ($ billion, AGR%)

Figure 5.15 China IIoT Submarket Share Forecast 2017, 2020 and 2022 (% Share)

Figure 5.16 UK IIoT Revenue Forecast 2017-2022 ($ billion, AGR%)

Figure 5.17 UK IIoT Submarket Share Forecast 2017, 2020 and 2022 (% Share)

Figure 5.18 Japan IIoT Revenue Forecast 2017-2022 ($ billion, AGR%)

Figure 5.19 Japan IIoT Submarket Share Forecast 2017, 2020 and 2022 (% Share)

Figure 5.20 Germany IIoT Revenue Forecast 2017-2022 ($ billion, AGR%)

Figure 5.21 Germany IIoT Submarket Share Forecast 2017, 2020 and 2022 (% Share)

Figure 5.22 France IIoT Revenue Forecast 2017-2022 ($ billion, AGR%)

Figure 5.23 France IIoT Submarket Share Forecast 2017, 2020 and 2022 (% Share)

Figure 5.24 Italy IIoT Revenue Forecast 2017-2022 ($ billion, AGR%)

Figure 5.25 Italy IIoT Submarket Share Forecast 2017, 2020 and 2022 (% Share)

Figure 5.26 Russia IIoT Revenue Forecast 2017-2022 ($ billion, AGR%)

Figure 5.27 Russia IIoT Submarket Share Forecast 2017, 2020 and 2022 (% Share)

Figure 5.28 Brazil IIoT Revenue Forecast 2017-2022 ($ billion, AGR%)

Figure 5.29 Brazil IIoT Submarket Share Forecast 2017, 2020 and 2022 (% Share)

Figure 5.30 India IIoT Revenue Forecast 2017-2022 ($ billion, AGR%)

Figure 5.31 India IIoT Submarket Share Forecast 2017, 2020 and 2022 (% Share)

Figure 5.32 Rest of World IIoT Revenue Forecast 2017-2022 ($ billion, AGR%)

Figure 5.33 Rest of World IIoT Submarket Share Forecast 2017, 2020 and 2022 (% Share)

Figure 5.34 Leading National IIoT Markets Cumulative Sales 2017-2022 (Revenue US$bn)

Figure 7.1 Smart Service Business Plan for OEMs

3M Company

ABB

Accenture

Advansys ESC

Agency for Science, Technology and Research (A*STAR), Singapore

aicas

Almaty Tech Garden

Alphabet Inc.

Amazon

Analog Devices, Inc

Applied Risk B.V

ARM

Asavie

Ascent Intellimation Pvt Ltd

Asia IoT Alliance

Association For Manufacturing Technology (AMT)

AT&T

Atomation

Attunix

Auburn University

Azbil Corporation

B&R Industrial Automation

Bayshore Networks, Inc.

Bedrock Automation

Beijing Proudsmart Info. Technology Co., Ltd.

Beijing University of Technology

Belden, Inc.

BioPhorum Operations Group

Blackberry

Bosch

Bug Labs

Cambium Networks, Ltd.

Canonical Group Limited

Care Innovations

CEA-TECH

CENTRI Technology

Certified Security Solutions

China Academy of Information and Communications Technology

China Electronics Standardization Institute

China Telecom

Chirp

Cisco Systems Inc.

ClearBlade, Inc.

Combient AB

Conduce Inc.

Connio, Inc.

Contextere

Cork Institute of Technology

CSA Group

CSIRO

CWRU School of Engineering

CyberX

CypherBridge Systems

Datawatch

Decisyon

DeepMind

Dell Technologies

Deloitte LLP

DENSO International America, Inc.

Deutschsprachige SAP Anwendergruppe (DSAG)

Device Authority

digiBlitz Inc.

DIMECC

Distrix Networks Ltd.

Draper

Eclipse Foundation

Ecole Polytechnique Federale de Lausanne (EPFL)

Ei3 Corporation

Electric Imp

Emerson Electric

Equinix

Ericsson

Evonik Industries AG

Finger Food Studios

First Line Software, Inc

Fluke Corporation

FogHorn

Fraunhofer Gesellschaft

Fuji Electric Co., Ltd.

Fujifilm Corporation

Fujitsu Limited

Fundacion Tecnalia Research & Innovation

General Electric (GE)

Genpact

Georgia Institute of Technology

GlobalSign, Inc.

Google

GS1 International

Haier Group

Hanyang University

HARTING KGaA

Hazelcast inc.

HCL Technologies

Hewlett Packard Enterprise

Hewlett-Packard (HP)

Hilscher Gesellschaft für Systemautomation mbH

Hitachi, Ltd.

Honeywell

Huawei Technologies Co., Ltd.

Humber College

i2CAT Foundation

IBM

ICT Austria

IGnPower Inc.

Industrial Internet Consortium

Industrial Technology Research Institute

Industry Development Augmentation Division (III)

Infineon Technologies

Infosys Limited

Inspiralia

Institute for Information Industry

Intel

Intelligent Structures Inc.

InterDigital

Internet of Things Institute

IoT Design Shop

IoT ONE

IoTium Inc.

Itron, Inc.

Ivar Jacobson

iVeia

Jama Software

Johns Hopkins University

Kabuku Inc.

Kaiser Permanente

Kalycito Infotech Private Limited

Kaspersky Lab UK Ltd.

KEDGE BS

Keysight Technologies, Inc.

Konica Minolta

Korea Electronics Technology Institute

KUKA AG

Lantronix Inc.

Larsen & Toubro Infotech Ltd

LG

Lido Stone Works

Ligado Networks LLC

LSEC - Leaders In Security

LUT School of Business and Management

Lynx Software Technologies

M2M Alliance

Machine-to-Machine Intelligence (M2Mi)

MD PnP

MESHDYNAMICS

Michelin

Micromem Technologies Inc.

Micron Technology

Microsoft Corporation

Midokura

MilliporeSigma Corp

MITRE Corporation

Mitsubishi Electric Corporation

MITSUBISHI HEAVY INDUSTRIES, LTD.

Mobiliya Technologies

Mocana Corporation

Moxa Inc

Mtell

National Association of Electrical Distributors (NAED)

National Engineering Research Center for Broadband Networks & Applications

National Instruments

NATION-E LTD

NEC Corporation

Nest

Netgear

Nexmatix LLC

NIST

No Magic

Nozomi Networks Inc.

NXP

Olympus Corporation

Omni-ID

Omron

Open Group.

OptimalPlus

Oracle

OTSL Inc.

Parallel Machines

Parker Hannifin

Pegasystems

PFP Cybersecurity

Plethora IIoT

PMMI

Pollux Automation

PricewaterhouseCoopers LLP

ProSyst Software GmbH

PSJC Rostelcom

PTC Inc

Putman Media

QiO

QNX Software Systems

Qualcomm

Qualcomm Technologies, Inc.

QualiCal

Quoin Inc

Real-Time Innovations

Red Hat

Renesas Electronics Corporation

Rensselaer Polytechnic Institute

Representative of German Industry and Trade

Republic of Things

RF Code, Inc.

Ricoh Company, Ltd.

Rockwell Automation

ROI Management Consulting

Rostelecom

RTI

Rubicon Labs Omc

Saison Information Systems Co., Ltd.

Samsung

Samsung Electronics

SAP SE

SAS Institute

Savigent Software

Schindler Digital Business Ltd.

Schlumberger Technology Corporation

Schneider Electric

SENAI/SC - National Service of Industrial Apprenticeship of Santa Catarina State

Sensify Security

Sensogram Technologies Inc.

Shenyang Institute of Automation

SICK AG

Siemens

Sight Machine

SINTEF

Sixth Energy Technologies Private Limited

Skylab Holding Pte. LTd

Smart Connect Technologies, Inc.

Space and Naval Warfare Systems Center Pacific

SparkCognition

Star Lab Corp.

Steinbeis Transfer Center Innovationsforum Industrie (STCII)

SWIM-IOT

Synapse Wireless

System Insights

System View Inc.

Taiwan Network Information Center

Tampere University of Technology,Finland

Tata Consultancy Services

TE Connectivity

Tech Mahindra Limited

Technische Hochschule Mittelhessen

Technische Universität Darmstadt

Tego Inc

Telecommunications Technology Association

Texas Instruments

Thales e-Security

The Boeing Company

The Hartford Steam Boiler Inspection and Insurance Company

Thematix Partners, LLC

ThetaRay LTD

Thingswise

ThyssenKrupp Elevator

TNO

Tongfang Shenzhen Cloudcomputing Technology CO LTD.

Toshiba

Toumetis

TTTech

Tuev Sued AG

Twin Oaks Computing

UI LABS

UL

University of Pennsylvania

University of Pittsburgh

Uptake

Utthunga Technologies

V2COM

Vadict Inc.

Vanderbilt University

Verisign, Inc.

Verizon

VMware

Vodafone

VTT Technical Research Centre of Finland

Water & Process Group (WPG)

Waterfall Security Solutions LTD

WIBU-SYSTEMS AG

Wind River

Wipro Limited

Wireless Research Center of North Carolina

Works Systems, Inc.

World Economic Forum

Xilinx, Inc.

XMPro

Yokohama National University

YRP R&D Promotions Committee

ZingBox

ZTE Corporation

Download sample pages

Complete the form below to download your free sample pages for Industrial Internet of Things (IoT) Market 2017-2022

Related reports

-

Top 20 Internet of Things (IoT) Companies 2018

The global Top 20 Internet of Things Companies report provides the reader with a thorough overview of the competitive landscape...

Full DetailsPublished: 19 July 2018 -

Global IoT Healthcare Market Forecast 2017-2027

The global IoT healthcare market is estimated at $10.6bn in 2016 and is expected to grow at a CAGR of...

Full DetailsPublished: 24 May 2017 -

Internet of Things (IoT) Market Report 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global Internet of Things market. Visiongain assesses...

Full DetailsPublished: 13 April 2018 -

Industrial Internet of Things (IIoT) Market Report 2018-2028

Visiongain has produced an in-Depth market research report studying the Industrial Internet of Things, analysing the rapid growth of this...

Full DetailsPublished: 01 May 2018 -

IoT in Oil and Gas Market Forecast 2017-2027

The latest research report from business intelligence provider Visiongain offers comprehensive analysis of the IoT in Oil and Gas market....

Full DetailsPublished: 22 June 2017 -

Internet of Things (IoT) in Aerospace & Defence Market Forecast 2017-2027

Developments in IoT have had a significant impact on the aerospace and defence market. Visiongain’s report on this sector gives...

Full DetailsPublished: 13 June 2017

Download sample pages

Complete the form below to download your free sample pages for Industrial Internet of Things (IoT) Market 2017-2022

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain cyber reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, Visiongain analysts reach out to market-leading vendors and industry experts but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“A quick thanks for the IoT Security Report 2021 received yesterday. It’s well put together and just what I wanted. The whole buying process was quick, as was the delivery. I’ll definitely buy more from Visiongain. Good price too.”

Jack Schuster, Intertek

Latest Cyber news

Quantum Sensors Market

The global Quantum Sensors market is projected to grow at a CAGR of 15.3% by 2034

10 June 2024

Quantum Communication Market

The global Quantum Communication market is projected to grow at a CAGR of 25.7% by 2034

05 June 2024

Predictive Analytics Market

The global predictive analytics market was valued at US$13.69 billion in 2023 and is projected to grow at a CAGR of 21.7% during the forecast period 2024-2034.

29 May 2024

Cloud Security Market

The global Cloud Security market was valued at US$41.15 billion in 2023 and is projected to grow at a CAGR of 12.7% during the forecast period 2024-2034.

24 May 2024