Industries > Energy > Top 20 Internet of Things (IoT) Companies 2018

Top 20 Internet of Things (IoT) Companies 2018

Leaders in Machine to Machine (M2M) Connectivity, Enterprise & Consumer Connected Devices & Objects, Smart Grid, Smart Connected Home, Smart City, Connected Car, Connected Aircraft, Connected Health / Telemedicine, Industrial Control Systems (ICS) & Internet (IIoT), Wireless Infrastructure, Big Data & Cloud Technologies

• Do you need Top 20 Internet of Things Companies market data?

• Succinct Top 20 Internet of Things Companies analysis?

• Technological insight?

• Clear competitor analysis?

• Actionable business recommendations?

Read on to discover how this definitive Internet of Things report can transform your own research and save you time.

The global Top 20 Internet of Things Companies report provides the reader with a thorough overview of the competitive landscape in the Internet of Things market and to identify key growth areas and business opportunities. The report is valuable for anyone who wants to understand the dynamics of the Internet of Things industry and the implementation and adoption of Internet of Things services. It will be useful for existing players, new entrants and businesses who wish to expand into this sector or explore a new area for market development.

Report highlights

• Over 100+ tables, charts, and graphs

• Market Share Analysis, Revenues And Ranking Of The Top 20 Companies Within The Internet Of Things Ecosystem

• Amazon

• Apple Inc.

• AT&T

• China Mobile

• Cisco

• Fitbit, Inc.

• GE

• Google

• HP

• IBM

• Intel Corporation

• Microsoft

• Oracle Corporation

• Philips N.V.

• Qualcomm

• Robert Bosch GmbH

• Samsung Electronics Co., Ltd.

• Schneider Electric SE

• Verizon Communications, Inc.

• Vodafone

To provide context for the leading companies within the Internet of Things ecosystem, the report also provides IoT market forecasts and connections data

• Global Internet of Things Market Forecast 2018 – 2028 ($bn)

• Global Internet of Things Connections Forecast 2018 – 2028 (Connections)

• Qualitative Analysis of Recent Developments in the IoT Market

• SWOT Analysis Of Factors Affecting The Market

• Key questions answered

• What does the future hold for the companies in the global Internet of Things market?

• Where should you target your business strategy?

• Which applications should you focus upon?

• Which disruptive technologies should you invest in?

• Which companies should you form strategic alliances with?

• Which company is likely to succeed and why?

• What business models should you adopt?

• What industry trends should you be aware of?

Target audience

• Internet of Things solution providers

• IT companies

• Networking specialists

• Electronics companies

• Telecoms companies

• Software developers

• Cyber security specialists

• IT Contractors

• Technologists

• Consultants

• Market analysts

• CEO’s

• CIO’s

• COO’s

• Business development managers

• Investors

• Governments

• Agencies

• ICT and Semiconductor Industry organisations

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1. Internet of Things Market Set for Explosive Growth

1.2. Benefits Derived from Internet of Things

1.3. Internet of Things Growth Drivers

1.4. 5G, LTE and IoT Uptake

1.5. Aim of the Report

1.6. Structure of the Report

1.7. Report Scope

1.8. Highlights in the report include:

1.9. Who is This Report for?

1.10. Questions Answered by this Report

1.11. Benefits of This Report

1.12. Methodology

2. Introduction to the Internet of Things Market

2.1. What Defines the Internet of Things?

2.2. M2M Technology is the Backbone behind the Massive Potential in the Internet of Things Market

2.3. M2M History and Recent Developments

2.4. A Range of Benefits Derived from Internet of Things

2.5. IoT Applications by Industry

2.6. Cloud to Play Pivotal Role in the Internet of Things Industry Boom

2.7. Big-Data to Explode with the Rise in Internet of Things Market

2.8. Growth in the Wireless Sector

3. Global Internet of Things Market Forecasts

3.1. Market Definition

3.2. Global Internet of Things Market Forecast 2018-2028

3.3. Global Internet of Things Connections Forecast 2018-2028

4. Competitor Positioning in the Internet of Things Market

4.1. Leading 20 Company Revenues in the Internet of Things Market

5. Leading 20 Companies in the Internet of Things Market

5.1. Verizon Communications, Inc. Company Overview

5.1.1. Verizon Communications, Inc. Financials

5.1.2. Verizon Communications, Inc. IoT Key Developments

5.2. Vodafone Group Plc. Company Overview

5.2.1. Vodafone Group Plc. Financials

5.2.2. Vodafone Group Plc. IoT Key Developments

5.3. Oracle Corporation Company Overview

5.3.1. Oracle Corporation Financials

5.3.2. Oracle Corporation IoT Key Developments

5.4. China Mobile Ltd. Company Overview

5.4.1. China Mobile Ltd. Financials

5.4.2. China Mobile Ltd. IoT Key Developments

5.5. Fitbit, Inc. Company Overview

5.5.1. Fitbit, Inc. Financials

5.5.2. Fitbit, Inc. IoT Key Developments

5.6. Samsung Electronics Co., Ltd. Company Overview

5.6.1. Samsung Electronics Co., Ltd. Financials

5.6.2. Samsung Electronics Co., Ltd. IoT Key Developments

5.7. IBM Company Overview

5.7.1. IBM Financials

5.7.2. IBM IoT Key Developments

5.8. GE Company Overview

5.8.1. GE Financials

5.8.2. GE IoT Key Developments

5.9. AT&T Company Overview

5.9.1. AT&T Financials

5.9.2. AT&T Business Aims

5.9.3. AT&T Position in the Market

5.9.4. AT&T IoT Key Developments

5.10. Microsoft Company Overview

5.10.1. Retail

5.10.2. Healthcare

5.10.3. Automotive

5.10.4. Microsoft Financials

5.10.5. Microsoft IoT Key Developments

5.11. Google Company Overview

5.11.1. Google Financials

5.11.2. Google IoT Key Developments

5.12. Apple Inc. Company Overview

5.12.1. Apple Inc. Financials

5.12.2. Apple Inc. IoT Key Developments

5.13. Cisco Company Overview

5.13.1. Cisco Financials

5.13.2. Cisco IoT Key Developments

5.14. Intel Corporation Company Overview

5.14.1. Intel Corporation Financials

5.14.2. Intel Corporation IoT Key Developments

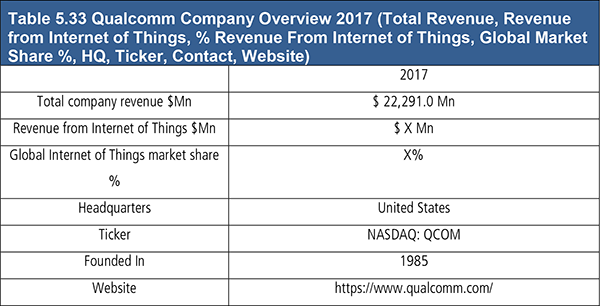

5.15. Qualcomm Company Overview

5.15.1. Qualcomm Financials

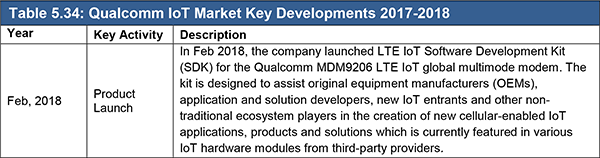

5.15.2. Qualcomm IoT Key Developments

5.16. Amazon Company Overview

5.16.1. Amazon Financials

5.16.2. Amazon IoT Key Developments

5.17. HP Company Overview

5.17.1. HP Financials

5.17.2. HP IoT Key Developments

5.18. Silver Springs Networks Company Overview

5.18.1.1. Silver Springs Networks Financials

5.18.2. Silver Springs Networks IoT Key Developments

5.19. Schneider Electric SE Company Overview

5.19.1. Schneider Electric SE Financials

5.19.2. Schneider Electric SE IoT Key Developments

5.20. Philips N.V. Company Overview

5.20.1. Philips N.V. Financials

5.20.2. Philips N.V. IoT Key Developments

6. Other Companies in the Internet of Things (IoT) Market 2018

7. SWOT Analysis of the Internet of Things Market

7.1. Strengths

7.1.1 Cost savings

7.1.2 Creating New Revenue Streams

7.1.3 Connected Devices Growing Rapidly

7.2. Weaknesses

7.2.1 IoT Solutions Can Be Expensive

7.2.2 Technical Problems

7.2.3 Limited 3G Infrastructure

7.2.4 Limited Awareness

7.3. Opportunities

7.3.1 IoT Gaining Popularity

7.3.2 Enhanced Market Segmentation

7.3.3 IoT can be Expanded to Any Vertical

7.4. Threats

7.4.1 Security Concerns

7.4.2 Highly Fragmented Market Place

7.4.3 Unclear Business Models

8. Internet of Things Technical Ecosystem Analysis

8.1. Network Concerns for M2M

8.2. Requirements to Solve M2M Deployment Issues

8.3. Data Security a Big Concern for Internet of Things Adoption

8.4. GPRS / SMS / CDMA / LTE

8.5. Two-Way Communication

8.6.Support for More than One Communication Type

8.7. Ensuring Minimum Downtime

8.8. Cost Effective

8.9. Utilising the Right Toolsets

8.10. Optimised Billing

8.11.Business Case for IoT

8.12. Smart Services for IoT

8.13. Smart Service Business Plan for OEMs

8.14. IoT in the Future

8.15. System Awareness

8.16. Business Case for System Awareness

8.17. M2M Platform Requirements and Opportunities

8.18. Internet of Things in the LTE Era

8.19. Switching from 3G to LTE

8.20. Impact of Switch from 3G to LTE on M2M

8.21. Internet Protocol Version 6 – IPv6

8.22. Potential Impact of IPv6 on IoT

8.23. Successful IoT Migration to IPv6

8.24. IPv6 to Benefit IoT

8.25. IoT Standards and Standards Bodies

9. Conclusions

9.1. Internet of Things Market Drivers

9.2. Network Coverage

9.3. Telematics and Telemetry Increasing Efficiency

9.4. Service Providers Need to Expand Offerings

9.5. Telematics Initiatives

9.6. IPv6 Will Increase IoT Opportunities

9.7. M2M Creating Scope for Development of New Applications

9.8. Internet of Things Market Restraints

9.9. Fragmented Value Chain

9.10. Lack of Universal Standards

9.11. Marketing Challenges

9.12. Roaming

9.13. Security Concerns

9.14. Opportunities with the Internet of Things

9.15. E-health

9.16. Smart Grid

9.17. Connected Appliances

9.18. Connected Home

9.19. Way Forward

9.19.1. Increase in M2M Partnerships

9.19.2. Standardisation

9.19.3. Measuring Data

9.19.4. New Business Models

10. Glossary

List of Tables

Table 2.1 IoT Applications by Industry

Table 3.1 Global Internet of Things Market Forecast 2017-2028 ($ billion, AGR %, CAGR%, Cumulative)

Table 3.2 Global Internet of Things Connections Forecast 2017-2028 (billion, AGR %, CAGR%, Cumulative)

Table 4.1 Leading 20 Internet of Things Companies 2018 (Market Ranking, Total Revenue, IoT Revenue, Market Share %)

Table 5.1 Verizon Communications, Inc. Company Overview 2017 (Total Revenue, Revenue from Internet of Things, % Revenue from Internet of Things, Global Market Share %, HQ, Contact, Website)

Table 5.2: Verizon Communications, Inc. IoT Market Key Developments

Table 5.3 Vodafone Group Plc. Company Overview 2017 (Total Revenue, Revenue from Internet of Things, % Revenue from Internet of Things, Global Market Share %, HQ, Ticker, Website)

Table 5.4 Key Features and Benefits of Vodafone’s M2M Solution

Table 5.5: Vodafone Group Plc. IoT Market Key Developments

Table 5.6 Oracle Corporation Company Overview 2017 (Total Revenue, Revenue from Internet of Things, % Revenue from Internet of Things, Global Market Share %, HQ, Website)

Table 5.7: Oracle Corporation IoT Market Key Developments

Table 5.8 China Mobile Ltd. Company Overview 2017 (Total Revenue, Revenue from Internet of Things, % Revenue from Internet of Things, Global Market Share %, HQ, Ticker, Website)

Table 5.9: China Mobile Ltd. IoT Market Key Developments 2016-2018

Table 5.10 Fitbit, Inc. Company Overview 2017 (Total Revenue, Revenue from Internet of Things, % Revenue from Internet of Things, Global Market Share %, HQ, Ticker, Contact, Website)

Table 5.11: Fitbit, Inc. IoT Market Key Developments

Table 5.12 Samsung Electronics Co., Ltd. Company Overview 2017 (Total Revenue, Revenue from Internet of Things, % Revenue from Internet of Things, Global Market Share %, HQ, Ticker, Contact, Website)

Table 5.13: Samsung Electronics Co., Ltd. IoT Market Key Developments 2017-2018

Table 5.14 IBM Company Overview 2017 (Total Revenue, Revenue from Internet of Things, % Revenue from Internet of Things, Global Market Share %, HQ, Contact, Website)

Table 5.15 IBM Adept Performance Management Solution Focus Areas

Table 5.16: IBM IoT Market Key Developments

Table 5.17 GE Company Overview 2017 (Total Revenue, Revenue from Internet of Things, % Revenue from Internet of Things, Global Market Share %, HQ, Contact, Website)

Table 5.18: GE IoT Market Key Developments

Table 5.19 AT&T Company Overview 2017 (Total Revenue, Revenue from Internet of Things, % Revenue from Internet of Things, Global Market Share %, HQ, Contact, Website)

Table 5.20 AT&T M2M Solution, Assets, and Advantages

Table 5.21: AT&T IoT Market Key Developments

Table 5.22 Microsoft Company Overview 2017 (Total Revenue, Revenue from Internet of Things, % Revenue from Internet of Things, Global Market Share %, HQ, Ticker, Contact, Website)

Table 5.23 Windows Embedded Product Portfolio

Table 5.24: Microsoft IoT Market Key Developments

Table 5.25 Google Company Overview 2017 (Total Revenue, Revenue from Internet of Things, % Revenue from Internet of Things, Global Market Share %, HQ, Ticker, Contact, Website)

Table 5.26: Google IoT Market Key Developments

Table 5.27 Apple Inc. Company Overview 2017 (Total Revenue, Revenue from Internet of Things, % Revenue from Internet of Things, Global Market Share %, HQ, Ticker, Contact, Website)

Table 5.28: Apple Inc. IoT Market Key Developments

Table 5.29 Cisco Company Overview 2017 (Total Revenue, Revenue from Internet of Things, % Revenue from Internet of Things, Global Market Share %, HQ, Ticker, Contact, Website)

Table 5.30: Cisco IoT Market Key Developments

Table 5.31 Intel Corporation Company Overview 2017 (Total Revenue, Revenue from Internet of Things, % Revenue from Internet of Things, Global Market Share %, HQ, Ticker, Contact, Website)

Table 5.32: Intel Corporation IoT Market Key Developments

Table 5.33 Qualcomm Company Overview 2017 (Total Revenue, Revenue from Internet of Things, % Revenue from Internet of Things, Global Market Share %, HQ, Ticker, Contact, Website)

Table 5.34: Qualcomm IoT Market Key Developments

Table 5.35 Amazon Company Overview 2017 (Total Revenue, Revenue from Internet of Things, % Revenue from Internet of Things, Global Market Share %, HQ, Ticker, Contact, Website)

Table 5.36: Amazon IoT Market Key Developments

Table 5.37 HP Company Overview 2017 (Total Revenue, Revenue from Internet of Things, % Revenue from Internet of Things, Global Market Share %, HQ, Ticker, Contact, Website)

Table 5.38: HP IoT Market Key Developments

Table 5.39 Robert Bosch GmbH Company Overview 2017 (Total Revenue, Revenue from Internet of Things, % Revenue from Internet of Things, Global Market Share %, HQ, Ticker, Contact, Website)

Table 5.40: Robert Bosch GmbH Market Products / Services (Product Segment, Products)

Table 5.41: Robert Bosch GmbH IoT Market Key Developments

Table 5.42 Schneider Electric SE Company Overview 2017 (Total Revenue, Revenue from Internet of Things, % Revenue from Internet of Things, Global Market Share %, HQ, Ticker, Contact, Website)

Table 5.43: Schneider Electric SE IoT Market Key Developments

Table 5.44 Philips N.V. Company Overview 2017 (Total Revenue, Revenue from Internet of Things, % Revenue from Internet of Things, Global Market Share %, HQ, Ticker, Contact, Website)

Table 5.45: Philips N.V. IoT Market Key Developments

Table 6.1 Other Companies In The Internet of Things Market 2018

Table 7.1 SWOT Analysis of the Internet of Things Market 2018

Table 8.1 IoT Standards Bodies

Table 8.2 IoT Industry and Sector Opportunities

List of Figures

Figure 3.1 Global Internet of Things Market Definition Flowchart

Figure 3.2 Global Internet of Things Market Forecast 2018-2028($ billion, AGR %)

Figure 3.3 Global Internet of Things Connections Forecast 2018-2028(billion, AGR %)

Figure 4.1 Leading Internet of Things Companies Market Share 2017 (%)

Figure 5.1 Verizon Communications, Inc. Financial Analysis 2015 - 2017

Figure 5.2 Verizon Communications, Inc. Financial Analysis 2015 - 2017 by Region and by Business Segment 2017

Figure 5.3 Vodafone Group Plc. Financial Analysis 2015 - 2017

Figure 5.4 Vodafone Group Plc. Financial Analysis 2015 - 2017 by Region and by Business Segment 2017

Figure 5.5 Oracle Corporation Financial Analysis 2015 - 2017

Figure 5.6 Oracle Corporation Financial Analysis 2015 - 2017 by Region and by Business Segment 2017

Figure 5.7 China Mobile Ltd. Financial Analysis 2015 - 2017

Figure 5.8 China Mobile Ltd. Financial Analysis 2015 - 2017 by Region and by Business Segment 2017

Figure 5.9 Fitbit, Inc. Financial Analysis 2015 - 2017

Figure 5.10 Fitbit, Inc. Financial Analysis 2015 - 2017 by Region and by Business Segment 2017

Figure 5.11 Samsung Electronics Co., Ltd. Financial Analysis 2015 - 2017

Figure 5.12 Samsung Electronics Co., Ltd. Financial Analysis 2015 - 2017 By Region and By Business Segment 2017

Figure 5.13 IBM MessageSight System

Figure 5.14 IBM Financial Analysis 2015 - 2017

Figure 5.15 IBM Financial Analysis 2015 - 2017 by Region and by Business Segment 2017

Figure 5.16 GE Financial Analysis 2015 - 2017

Figure 5.17 GE Financial Analysis 2015 - 2017 by Region and by Business Segment 2017

Figure 5.18 AT&T Financial Analysis 2015 - 2017

Figure 5.19 AT&T Financial Analysis 2015 - 2017 by Region and by Business Segment 2017

Figure 5.20 Microsoft Azure Intel Corporationligent Systems

Figure 5.21 Microsoft Financial Analysis 2015 - 2017

Figure 5.22 Microsoft Financial Analysis 2015 - 2017 by Region and by Business Segment 2017

Figure 5.23 Google Financial Analysis 2015 - 2017

Figure 5.24 Google Financial Analysis 2015 - 2017 by Region

Figure 5.25 Apple Inc. Financial Analysis 2015 - 2017

Figure 5.26 Apple Inc. Financial Analysis 2015 - 2017 by Region and by Business Segment 2017

Figure 5.27 Cisco Financial Analysis 2015 - 2017

Figure 5.28 Cisco Financial Analysis 2015 - 2017 by Region and by Business Segment 2017

Figure 5.29 Intel Corporation Financial Analysis 2015 - 2017

Figure 5.30 Intel Corporation Financial Analysis 2015 - 2017 by Region and by Business Segment 2017

Figure 5.31 Qualcomm Financial Analysis 2015 - 2017

Figure 5.32 Qualcomm Financial Analysis 2015 - 2017 by Region and by Business Segment 2017

Figure 5.33 Amazon Financial Analysis 2015 - 2017

Figure 5.34 Amazon Financial Analysis 2015 - 2017 by Region and by Business Segment 2017

Figure 5.35 HP Financial Analysis 2015 - 2017

Figure 5.36 HP Financial Analysis 2015 - 2017 by Region and by Business Segment 2017

Figure 5.37: Robert Bosch GmbH Total Company Revenue 2012-2016

Figure 5.38 Robert Bosch GmbH Financial Analysis 2015 - 2017 by Region and by Business Segment 2017

Figure 5.39 Schneider Electric SE Financial Analysis 2015 - 2017

Figure 5.40 Schneider Electric SE Financial Analysis 2015 - 2017 by Region and by Business Segment 2017

Figure 5.41 Philips N.V. Financial Analysis 2015 - 2017

Figure 5.42 Philips N.V. Financial Analysis 2015 - 2017 by Region and by Business Segment 2017

Figure 8.1 OEM Revenues from Services vs. Other Revenues 2018 (%)

Figure 8.2 OEM Margin Contributions from Services vs. Other Revenues 2014 (%)

Figure 8.3 Smart Service Business Plan for OEMs

Figure 8.4 M2M Benefits

A+E Networks

Accenture Plc.

Aclara Incorporated

Adept Enterprise Solutions

Afrimax

Aisle411

Altice

Amazon

Ameresco, Inc.

America Movil

Amerlux

Andreessen Horowitz

Apple Inc.

AT&T

Audi

AXA

Axeda Corporation

Best Buy

BlackBerry

Blaze

Boston Dynamics

CFDA

China Mobile Ltd.

Cinterion

Cisco

Cloudera

ColdLightCostco

Costco

Dai Telecom Holdings (2000) Ltd.

DeepMind

Deutsche Telekom

DexCom

Dick’s Sporting Goods

ENGIE

Ericsson

Ernst & Young (EY)

Essence

Etisalat

Etisalat Digital

Exponent

Fitbit, Inc.

Fleetmatics Group

Ford Motor Company

Garmin Pay

General Electric (GE)

General Motors

Google

Groupe ENGIE

Gutor Electronic LLC

Hewlett Packard Enterprise (HPE)

Honeywell International Inc

HP

HP Enterprise

Huawei Technologies

Hughes Telematics

Husqvarna

IBM

IBM’s Institute for Business Value (IBV)

Intel Corporation

Itron Inc.

Jasper Wireless, Inc.

Kepware

Kleiner Perkins Caufield & Byers.

KORE Telematics

KPN

KTM

Lenovo

LexInnova

LQD WiFi

LSK Global Pharma Services

Luminous Power Technologies Pvt Ltd

Macy’s

Mastercard

McKinsey & Company

Microchip

Microsoft Corporation

Mobility Ado

Motorola M2M

M-PESA

National Instruments

Nest Labs

Niara

Niddel Corp

NIU Technologies

Nokia

Nordea Bank AB

Norwest Venture Partners

nPhase

NRTC

NTT DoCoMo

O’stin

Oklahoma Gas & Electric (OG&E)

OnStar

Oracle Communications

Oracle Corporation

Orange

Orange Business Services

OSIsoft

Panasonic Corporation

Peugeot Citroen

Philips Lighting.

Philips N.V.

Podsystem

Prosodie-Capgemin

Providence St. Joseph Health

PST Electronics

PTC

Qualcomm Technologies

Quirky

Red Bull

REI

Rice Electronics.

Robert Bosch GmbH

Rodale Inc

Rogers

Royal Philips

RRE

Rubikloud

Samsung Electronics Co., Ltd. ‘

SAP

Schlumberger Limited

Schneider Electric SE

SFR

Siemens AG

SingTel

SKY

Sky Network Television

Skyward

Smart Parking Limited

SolveIT Software

SP Group

SparklineData

Speculur

Sprint

Staples

Target Corporation

Telcel

Telefónica

Telekom Austria

Telemecanique,

Telenor Connexion

Telenor Objects

Telit

Telit Automotive Solutions S.a.r.l

Telit Communication PLC

Telit Communications Spain SL

Telit Wireless Services Ltd

Telit Wireless Solutions GmbH

Telit Wireless Solutions Hong Kong Limited.

Telit Wireless Solutions Srl

Telstra

T-Mobile

Toshiba Corporation

Trilliant Holdings, Inc.

Troy-CSL Lighting

Tyntec.

Unity Technologies

USI

Verizon Communications, Inc.

Verizon Wireless

Vimpelcom

Visa

Vodafone

Vodafone New Zealand

Volkswagen

Vuforia

Walmart

Wipro

WPG Americas

Xiaomi

Xively

Xylem Inc..

ZF Friedrichshafen

Organisations mentioned

6LowPAN

Association of Radio Industries and Businesses (ARB)

CENELEC

China Communications Standards Association (CCSA)

Dubai Electricity & Water Authority (DEWA)

EPCGlobal

EU CASAGRAS

European Commission

European Smart Metering Industry Group (ESMIG)

European Telecommunications Standards Institute (ETSI)

German Patent and Trade Mark Office (GPTO)

Golden Valley Electric Association (GVEA )

GSM Association

Home Gateway Initiative (HGI)

IETF ROLL

Industrial Internet Consortium (IIC)

Institute of Electrical and Electronics Engineers (IEEE)

International Cricket Council (ICC)

International Standards Organization (ISO)

IOTA Foundation

KNX

Massachusetts Institute of Technology (MIT)

Midwestern Higher Education Compact (MHEC)

Port of Rotterdam

Telecommunication Technology Committee (TTC) of Japan

Telecommunications Industry Association (TIA)

Telecommunications Technology Association of Korea (TTA)

Telecommunication Technology Committee (TTC) of Japan

The Alliance for Telecommunications Industry Solutions (ATIS) of the U.S

The Association of Radio Industries and Businesses (ARIB) and the

The China Communications Standards Association (CCSA)

The European Telecommunications Standards Institute (ETSI)

The Telecommunications Department of Energy (TTA) of Korea

UK's Department for Energy and Climate Change (DECC)

US Air Force

W-Mbus

Download sample pages

Complete the form below to download your free sample pages for Top 20 Internet of Things (IoT) Companies 2018

Related reports

-

Connected Home Market Forecast 2017-2027

Developments in connected home have had a significant impact on the consumer electronics and wider IT market. Visiongain’s report on...

Full DetailsPublished: 24 August 2017 -

IoT in Oil and Gas Market Forecast 2017-2027

The latest research report from business intelligence provider Visiongain offers comprehensive analysis of the IoT in Oil and Gas market....

Full DetailsPublished: 22 June 2017 -

Machine-to-Machine (M2M) Market Report 2017-2027

Our 202-page report provides 160 tables, charts, and graphs. Read on to discover the most lucrative areas in the industry...

Full DetailsPublished: 31 October 2017 -

Top 100 Cyber Security Companies: Ones to Watch in 2018

The aim of the report is to provide an evaluation of the 100 significant major companies in the global Cyber...

Full DetailsPublished: 29 May 2018 -

Industrial Control Systems (ICS) Market Report 2018-2028

The industry developments at the HANNOVER MESSE 2017 trade fair has led Visongain to publish this timely report. The $126.2...

Full DetailsPublished: 29 January 2018 -

Critical Infrastructure Protection (CIP) Market Report 2020-2030

In today's business environment, there is increase in the usage of digital solutions, connected devices, and IT systems due to...Full DetailsPublished: 20 November 2019 -

Global IoT Healthcare Market Forecast 2017-2027

The global IoT healthcare market is estimated at $10.6bn in 2016 and is expected to grow at a CAGR of...

Full DetailsPublished: 24 May 2017 -

Industrial Internet of Things (IoT) Market 2017-2022

Visiongain has produced an in-Depth market research report into Industrial Internet of Things, forecasting the rapid growth of this market....

Full DetailsPublished: 29 June 2017 -

Next Generation Cyber Security Market Report 2018-2028

The latest report from business intelligence provider visiongain assesses that the global Next Generation Cyber Security market is expected to...

Full DetailsPublished: 21 August 2018 -

Internet of Things (IoT) Security Market Report 2020-2030

Visiongain assesses the market to be valued at $13.21 billion in 2020 and with continued advancement and sustained market demand,...

Full DetailsPublished: 23 March 2020

Download sample pages

Complete the form below to download your free sample pages for Top 20 Internet of Things (IoT) Companies 2018

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain energy reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and industry experts where possible but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain energy reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

“The Visiongain report was extremely insightful and helped us construct our basic go-to market strategy for our solution.”

H.

“F.B has used Visiongain to prepare two separate market studies on the ceramic proppants market over the last 12 months. These reports have been professionally researched and written and have assisted FBX greatly in developing its business strategy and investment plans.”

F.B

“We just received your very interesting report on the Energy Storage Technologies (EST) Market and this is a very impressive and useful document on that subject.”

I.E.N

“Visiongain does an outstanding job on putting the reports together and provides valuable insight at the right informative level for our needs. The EOR Visiongain report provided confirmation and market outlook data for EOR in MENA with the leading countries being Oman, Kuwait and eventually Saudi Arabia.”

E.S

“Visiongain produced a comprehensive, well-structured GTL Market report striking a good balance between scope and detail, global and local perspective, large and small industry segments. It is an informative forecast, useful for practitioners as a trusted and upto-date reference.”

Y.N Ltd

Association of Dutch Suppliers in the Oil & Gas Industry

Society of Naval Architects & Marine Engineers

Association of Diving Contractors

Association of Diving Contractors International

Associazione Imprese Subacquee Italiane

Australian Petroleum Production & Exploration Association

Brazilian Association of Offshore Support Companies

Brazilian Petroleum Institute

Canadian Energy Pipeline

Diving Medical Advisory Committee

European Diving Technology Committee

French Oil and Gas Industry Council

IMarEST – Institute of Marine Engineering, Science & Technology

International Association of Drilling Contractors

International Association of Geophysical Contractors

International Association of Oil & Gas Producers

International Chamber of Shipping

International Shipping Federation

International Marine Contractors Association

International Tanker Owners Pollution Federation

Leading Oil & Gas Industry Competitiveness

Maritime Energy Association

National Ocean Industries Association

Netherlands Oil and Gas Exploration and Production Association

NOF Energy

Norsk olje og gass Norwegian Oil and Gas Association

Offshore Contractors’ Association

Offshore Mechanical Handling Equipment Committee

Oil & Gas UK

Oil Companies International Marine Forum

Ontario Petroleum Institute

Organisation of the Petroleum Exporting Countries

Regional Association of Oil and Natural Gas Companies in Latin America and the Caribbean

Society for Underwater Technology

Society of Maritime Industries

Society of Petroleum Engineers

Society of Petroleum Enginners – Calgary

Step Change in Safety

Subsea UK

The East of England Energy Group

UK Petroleum Industry Association

All the events postponed due to COVID-19.

Latest Energy news

Visiongain Publishes Carbon Capture Utilisation and Storage (CCUS) Market Report 2024-2034

The global carbon capture utilisation and storage (CCUS) market was valued at US$3.75 billion in 2023 and is projected to grow at a CAGR of 20.6% during the forecast period 2024-2034.

19 April 2024

Visiongain Publishes Liquid Biofuels Market Report 2024-2034

The global Liquid Biofuels market was valued at US$90.7 billion in 2023 and is projected to grow at a CAGR of 6.7% during the forecast period 2024-2034.

03 April 2024

Visiongain Publishes Hydrogen Generation Market Report 2024-2034

The global Hydrogen Generation market was valued at US$162.3 billion in 2023 and is projected to grow at a CAGR of 3.7% during the forecast period 2024-2034.

28 March 2024

Visiongain Publishes Biofuel Industry Market Report 2024-2034

The global Biofuel Industry market was valued at US$123.2 billion in 2023 and is projected to grow at a CAGR of 7.6% during the forecast period 2024-2034.

27 March 2024