Industries > Pharma > Global Smoking Cessation Drugs Market Forecast 2017-2027

Global Smoking Cessation Drugs Market Forecast 2017-2027

NRT, Non-nicotine Pharmacotherapy, Prescription Drugs, OTC Drugs

The global smoking cessation drugs market is expected to grow at a CAGR of 14.9% in the first half of the forecast period. In 2016, the non-nicotine pharmacotherapy submarket held 56.2% of the global smoking cessation drugs market.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand new 280-page report you will receive 175 tables and 150 figures– all unavailable elsewhere.

The 280-page report provides clear detailed insight into the global smoking cessation drugs market. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand new report today you stay better informed and ready to act.

Report Scope

• Global Smoking Cessation Drugs market forecasts from 2017-2027

• This report also breaks down the revenue forecast for the global smoking cessation drugs market by type of therapy:

– NRT

– Non-Nicotine Pharmacotherapy

• This report also breaks down the revenue forecast for the global smoking cessation drugs market by prescription vs OTC:

– Prescription drugs

– OTC

• This report provides individual revenue forecasts to 2027 for these regions:

– North America

– Europe

– Asia-Pacific

– RoW

Each region is further segmented by type of therapy.

• This report provides the following qualitative analysis:

– Epidemiology by geography, available treatment options, along with humanistic and economic burden

– A SWOT Analysis

– Pipeline molecules which are under development for the treatment of smoking cessation and detailed analysis on promising drug candidates

– Pricing and reimbursement overview of the smoking cessation drugs market.

– Leading companies that are the major players in the global smoking cessation drugs industry, including Pfizer, GlaxoSmithKline and Johnson & Johnson.

Visiongain’s study is intended for anyone requiring commercial analyses for the global smoking cessation drugs market. You find data, trends and predictions.

Buy our report today Global Smoking Cessation Drugs Market Forecast 2017-2027: NRT, Non-nicotine Pharmacotherapy, Prescription Drugs, OTC Drugs.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Why You Should Read This Report

1.2 How This Report Delivers

1.3 Key Questions Answered by This Analytical Report Include:

1.4 Who is This Report For?

1.5 Methodology

1.5.1 Primary Research

1.5.2 Secondary Research

1.5.3 Market Evaluation & Forecasting Methodology

1.6 Frequently Asked Questions (FAQ)

1.7 Associated visiongain Reports

1.8 About visiongain

2. Introduction to Smoking Cessation

2.1 What is Smoking?

2.1.1 Types of Tobacco Smoking

2.2 What are the various types of nicotine delivery systems?

2.3 Epidemiology of Smoking

2.3.1 Historical and Forecasted Prevalence of Current Tobacco Smoking in WHO Regions

2.3.2 Prevalence of Tobacco Smoking in the Major Markets

2.3.2.1 US

2.3.2.2 Australia

2.3.2.3 New Zealand

2.3.2.4 Italy

2.3.2.5 Germany

2.3.2.6 Spain

2.3.2.7 France

2.3.2.8 UK

2.4 Humanistic and Economic Burden

2.4.1 Mortality

2.4.2 Years Lost due to Disability (YLD)

2.4.3 Labour-years Lost (LYL)

2.4.4 Economic Impact

2.5 Smoking: Prevention and Treatment

2.5.1 Prevention

2.5.2 Treatment

3. Introduction to the Global Smoking Cessation Drugs Market

3.1 Market Definition and Scope

3.2 Global Smoking Cessation Drugs Market 2016

3.2.1 Global Smoking Cessation Drugs Market Forecast 2017-2027

3.3 Global Market Segmentation by Drug Class

3.3.1 Market Forecast by Drug Class, 2016-2027

3.4 Global Market Segmentation by Region

3.4.1 Market Forecast by Region, 2016-2027

3.4.1.1 North America

3.4.1.2 Europe

3.4.1.3 Asia-Pacific (Japan, Australia, and New Zealand)

3.4.1.4 RoW (Emerging Markets)

3.5 Global Market Segmentation by Country

3.6 Regional Market Segmentation by Drug Class, 2016-2027

3.6.1 North America

3.6.2 Europe

3.6.3 Asia-Pacific (Japan, Australia, and New Zealand)

3.6.4 Rest of the World (Emerging Markets)

3.7 Overall Global Smoking Cessation Drugs Market Drivers, Restraints and Trends

4. Research and Development for Treating Smoking Cessation

4.1 Novel Mechanism of Action of Pipeline Drugs

4.2 Active Pipeline Molecules

4.2.1 X-22

4.2.2 CQSS 2 (Chrono Quit Smoking Solution 2) System

4.2.3 CERC-501

4.2.4 SEL-070 (SELA-070)

4.2.5 EMB-001

4.2.6 CVSI-007

4.3 Discontinued Molecules

4.3.1 NicVax

4.3.2 SSR591813 (Dianicline)

4.3.3 SR141716 (Rimonabant)

4.3.4 TA-NIC

4.3.5 Nic-002

4.3.6 MK-0364 (Taranabant)

4.3.7 SR147778 (Surinabant)

4.3.8 APD356 (lorcaserin)

4.3.9 GW468816

4.3.10 EVP-6124

4.3.11 GSK598809

4.3.12 PF-05402536 (NIC7-001) and PF-06413367 (NIC7-003)

5. Pricing and Reimbursement Overview

5.1 Australia

5.2 New Zealand

5.3 Germany

5.4 France

5.5 Italy

5.6 Spain

5.7 UK

5.8 US

6. Smoking Cessation Therapies and NRT Market Overview, by Geography

6.1 US

6.2 UK

6.3 Spain

6.4 France

6.5 Australia

6.6 New Zealand

6.7 Italy

6.8 Germany

7. Qualitative Analysis of the Global Smoking Cessation Drugs Market

7.1 SWOT Analysis, 2016

7.2 Leading Companies in Global Smoking Cessation Drugs Market, 2016

7.2.1 Pfizer

7.2.2 GSK

7.2.3 J&J

8. Conclusions

Appendices

Glossary

Associated visiongain Reports

Visiongain Report Sales Order Form

About visiongain

Visiongain Report Evaluation Form

List of Tables

Table 2.1 Age-standardized Prevalence of Tobacco Smoking in People Aged 15 Years and More, by WHO Region, 2015

Table 2.2 WHO Definitions for Smoking Status

Table 2.3 Prevalence (%) of Current Tobacco Smoking in WHO Regions by Gender, 2010 and 2025

Table 2.4 List of Countries with >= 25% of Current Tobacco Smoking, in People Aged 15 Years and Above, 2015

Table 2.5 List of Countries with >= 25% of Daily Tobacco Smoking, in People Aged 15 Years and Above, 2015

Table 2.6 Crude Prevalence (%)of Current Tobacco Smoking in Key Geographies by Gender, 2010 and 2025

Table 2.7 Crude Prevalence (%) of Daily Tobacco Smoking in Key Geographies by Gender, 2010 and 2025

Table 2.8 Crude Prevalence (%) of Current Cigarette Smoking in Key Geographies by Gender, 2010 and 2025

Table 2.9 Crude Prevalence (%) of Daily Cigarette Smoking in Key Geographies by Gender, 2010 and 2025

Table 2.10 Prevalence (%) of Age-standardized Tobacco Smoking in People Aged 15 Years and More, 2015

Table 2.11 Key Tobacco and Smoking Related Surveys Conducted and/or Supported by the Office on Smoking and Health, US

Table 2.12 Prevalence (%)of Current Cigarette Smoking Among High School Students and Adults in the US, 1965–2014

Table 2.13 Prevalence (%) of Using Tobacco Products in Middle and High School Students by Product in the US, 2016

Table 2.14 Prevalence (%) of Using Tobacco Products in Middle and High School Students by Product in the US, 2015

Table 2.15 Percent of Students Who Report Smoking Cigarettes Daily in the US, by grade, 1976-2015

Table 2.16 Percent of Students who Reported Using Smokeless Tobacco in the US in the Last 30 Days, by grade, 1993-2015

Table 2.17 Prevalence of Any Tobacco Use of Any Tobacco Product among Adults Aged 18 Years and Over, by Gender and Age Group, US, 2009-2014

Table 2.18 Prevalence of Current Cigarette Smoking among Adults Aged 18 Years and Over, by Gender and Year, US, 1991-2015

Table 2.19 Prevalence of Current Cigarette Smoking among Males aged 18 Years and Over, by Age Group and Year, US, 1965-2014

Table 2.20 Prevalence of Current Cigarette Smoking among Females aged 18 Years and Over, by Age Group and Year, US, 1965-2014

Table 2.21 Prevalence of Current Cigarette Smoking among Adults aged 18 Years and Over, by Age Group, Gender, and Smoking Status, US, 2013-2015

Table 2.22 Prevalence (%) of Daily Tobacco Smoking by Gender, US, 2010, 2025 and 2030

Table 2.23 Prevalence (%) of Current Tobacco Smoking by Gender, US, 2010, 2025 and 2030

Table 2.24 Tobacco Smoking among People aged 14 Years and Over, by Smoking Status, Australia, 1991-2015 (%)

Table 2.25 Distribution of Tobacco Smoking Status among People aged 12 Years and Over, by Age Group and Gender, Australia, 2016

Table 2.26 Distribution of Tobacco Smoking Status among People aged 12 Years and Over, by Age Group and Gender, Australia, 2016

Table 2.27 Number of Smokers (in thousands), by Smoking Status, Age Group and Gender, Australia, 2014-2015

Table 2.28 Five-year Prevalence (%) of Current Tobacco Smoking in Australia, by Gender, 2000-2030

Table 2.29 Prevalence (%) of Current Tobacco Smoking in Australia, by Age, 2000-2030

Table 2.30 Prevalence (%) of Current Tobacco Smoking in Australia, by Age and Gender, 2000-2030

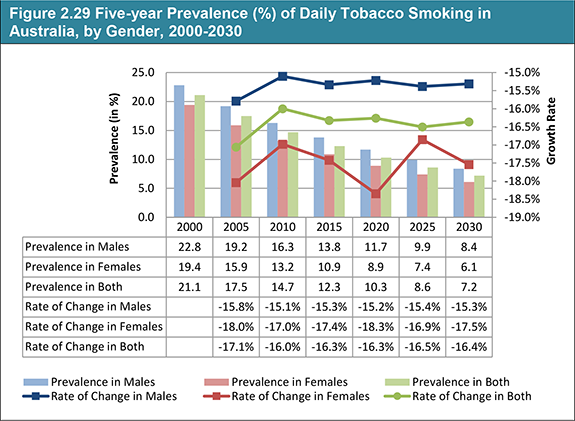

Table 2.31 Five-year Prevalence (%) of Daily Tobacco Smoking in Australia, by Gender, 2000-2030

Table 2.32 Definitions for Smoking Status Used in New Zealand Health Survey

Table 2.33 Prevalence(%) of Current Tobacco Smoking in New Zealand, by Gender, 2006-2016

Table 2.34 Prevalence (%) of Current Tobacco Smoking in New Zealand, by Age Group, 2006-2016

Table 2.35 Prevalence (%) of Current Tobacco Smoking in New Zealand, by Age Group and Gender, 2015/2016

Table 2.36 Prevalence (%) of Daily Tobacco Smoking in New Zealand, by Gender, 2006-2016

Table 2.37 Prevalence(%) of Daily Tobacco Smoking in New Zealand, by Age Group, 2006-2016

Table 2.38 Prevalence (%) of Daily Tobacco Smoking in New Zealand, by Age Group and Gender, 2015/2016

Table 2.39 Prevalence (%) of Current Tobacco Smoking in New Zealand, 1983-2015

Year

Table 2.40 Five-year Prevalence (%) of Daily Tobacco Smoking in New Zealand, by Gender, 2000-2030

Table 2.41 Five-year Prevalence (%) of Current Tobacco Smoking in New Zealand, by Gender, 2000-2030

Table 2.42 Prevalence (in thousands) of Smoking in People Aged 14 Years and Above, by Smoking Status, Italy, 2016

Table 2.43 Prevalence (in %) of Smoking in People Aged 14 Years and Above, by Gender, Italy, 2007-2016

Table 2.44 Prevalence (in thousands) of Smoking in People Aged 14 Years and Above, by Smoking Status, Italy, 2007-2016

Table 2.45 Prevalence (in %) of Smoking in People Aged 14 Years and Above, by Smoking Status, Italy, 2007-2016

Table 2.46 Prevalence (in %) of Smoking in Males Aged 14 Years and Above, by Smoking Status, Italy, 2007-2016

Table 2.47 Prevalence (in %) of Smoking in Females Aged 14 Years and Above, by Smoking Status, Italy, 2007-2016

Table 2.48 Prevalence (in %) of Smoking in People Aged 14 Years and Above, by Age , Italy, 2007-2016

Table 2.49 Prevalence (in thousands) of Smoking in People Aged 14 Years and Above, by Smoking Status and Age, Italy, 2001-2003 and 2005-2016

Table 2.50 Five-year Prevalence (%) of Current Tobacco Smoking in Italy, by Gender, 2000-2030

Table 2.51 Prevalence (%) of Current Tobacco Smoking in Italy, by Age, 2000-2030

Table 2.52 Prevalence (%) of Current Tobacco Smoking in Italy, by Age and Gender, 2000-2030

Table 2.53 Five-year Prevalence (%) of Daily Tobacco Smoking in Italy, by Gender, 2000-2030

Table 2.55 Definitions for Smoking Status used by Federal Health Reporting System

Table 2.56 Surveys Used to Determine Smoking Behavior by Federal Health Reporting System, Germany

Table 2.57 Prevalence (%) of Smoking in People aged 18 Years and Above, by Gender, Germany, 2009-2014/2015

Table 2.58 Prevalence (%) of Smoking in People aged 18 Years and Above, by Age and Gender, Germany, 2009-2014/2015

Table 2.59 Prevalence (%) of Smoking in Females aged 18 Years and Above, by Age and Smoking Status, Germany, 2014/2015

Table 2.60 Prevalence (%) of Smoking in Males aged 18 Years and Above, by Age and Smoking Status, Germany, 2014/2015

Table 2.61 Prevalence (%) of Smoking in Females aged 18 Years and Above, by Age and Smoking Status, Germany, 2010

Table 2.62 Prevalence (%) of Smoking in Males aged 18 Years and Above, by Age and Smoking Status, Germany, 2010

Table 2.63 Prevalence (%) of Smoking in Females aged 18 Years and Above, by Age and Smoking Status, Germany, 2009

Table 2.64 Prevalence (%) of Smoking in Males aged 18 Years and Above, by Age and Smoking Status, Germany, 2009

Table 2.65 Prevalence (%) of Smoking in People Aged 15 Years and Above, by Smoking Status and Gender, Germany, 1992-2013

Table 2.66 Prevalence (%) of Smoking in People Aged 15 Years and Above, by Age and Gender, Germany, 1992-2013

Table 2.67 Five-year Prevalence (%) of Current Tobacco Smoking in Germany, by Gender, 2000-2030

Table 2.68 Prevalence(%) of Current Tobacco Smoking in Germany, by Age, 2000-2030

Table 2.69 Prevalence(%) of Current Tobacco Smoking in Germany, by Age and Gender, 2000-2030

Table 2.70 Five-year Prevalence(%) of Daily Tobacco Smoking in Germany, by Gender, 2000-2030

Table 2.71 Relative Prevalence(%) of Tobacco Smoking in Population Aged 15 Years and Above, by Gender and Smoking Status, in Spain, 2014

Table 2.72 Relative Prevalence(%) of Tobacco Smoking in Population Aged 15 Years and Above, by Age and Smoking Status, in Spain, 2014

Table 2.73 Prevalence(%) of Tobacco Smoking in Population Aged 15 Years and Above, by Gender, Age, and Smoking Status, in Spain, 2014

Table 2.74 Number of Current Tobacco Smokers Aged 15 Years and Above – Daily and Occasional (in thousands), by Gender, in Spain, 2011-2012

Table 2.75 Number of Tobacco Smokers (in thousands) Aged 15 Years and Above, by Gender and Smoking Status, in Spain, 2011-2012

Table 2.76 Number of Tobacco Smokers (in thousands) Aged 15 Years and Above, by Age and Smoking Status, in Spain, 2011-2012

Table 2.77 Prevalence (%) of Tobacco Smoking, by Gender, Age, and Smoking Status in People Aged 15 Years and Above, in Spain, 2011-2012

Table 2.78 Relative Prevalence of Daily Tobacco Smoking (%) in People Aged 15 Years and Above, by Age and Gender, in Spain, 1993-2014

Table 2.79 Relative Prevalence of Daily Tobacco Smoking (%) in People Aged 15 Years and Above, by Age and Gender, in Spain, 1993-2014

Table 2.80 Relative Prevalence of Current Tobacco Smoking (%) in People Aged 15 Years and Above, by Age and Gender, in Spain, 1993-2014

Table 2.81 Relative Prevalence of Current Tobacco Smoking (%) in People Aged 15 Years and Above, by Age and Gender, in Spain, 1993-2014

Table 2.82 Five-year Prevalence (%) of Current Tobacco Smoking in Spain, by Gender, 2000-2030

Table 2.83 Prevalence (%) of Current Tobacco Smoking in Spain, by Age, 2000-2030

Table 2.84 Prevalence (%) of Current Tobacco Smoking in Spain, by Age and Gender, 2000-2030

Table 2.85 Five-year Prevalence (%) of Daily Tobacco Smoking in Spain, by Gender, 2000-2030

Table 2.86 Distribution of Smoking Status (in %), in France, 2010 and 2014

Table 2.87 Prevalence (%) of Regular Smoking in Males Aged 15 Years and Above, by Age in France, 2005, 2010 and 2014

Table 2.88 Prevalence (%) of Regular Smoking in Females Aged 15 Years and Above, by Age in France, 2005, 2010 and 2014

Table 2.89 Five-year Prevalence (%) of Current Tobacco Smoking in France, by Gender, 2000-2030

Table 2.90 Prevalence (%) of Current Tobacco Smoking in France, by Age, 2000-2030

Table 2.91 Prevalence (%) of Current Tobacco Smoking in France, by Age and Gender, 2000-2030

Table 2.92 Five-year Prevalence (%) of Daily Tobacco Smoking in France, by Gender, 2000-2030

Table 2.93 Prevalence (%) of Current Tobacco Smoking in People Aged 18 Years and Above, in the UK, 2010-2016

Table 2.94 Prevalence (%) of Current Tobacco Smoking in People Aged 18 Years and Above, by Age, in the UK, 2010-2016

Table 2.95 Prevalence (%) of Current Tobacco Smoking in People Aged 16 Years and Above, by Gender, in the UK, 2010-2015

Table 2.96 Prevalence (%) of Current Tobacco Smoking in People Aged 16 Years and Above, by Age, in the UK, 2010-2015

Table 2.97 Prevalence (%) of Current Tobacco Smoking in Males Aged 16 Years and Above, by Age, in the UK, 2010-2015

Table 2.98 Prevalence (%) of Current Tobacco Smoking in Females Aged 16 Years and Above, by Age, in the UK, 2010-2015

Table 2.99 Prevalence (%) of Daily Tobacco Smoking in People Aged 16 Years and Above, by Gender, in the UK, 2010-2015

Table 2.100 Prevalence (%) of Daily Tobacco Smoking in People Aged 16 Years and Above, by Age, in the UK, 2010-2015

Table 2.101 Prevalence (%) of Daily Tobacco Smoking in Females Aged 16 Years and Above, by Age, in the UK, 2010-2015

Table 2.102 Prevalence (%) of Current Tobacco Smoking in Males Aged 16 Years and Above, by Age, in the UK, 2010-2015

Table 2.103 Prevalence (%) of Tobacco Smoking in, by Gender and Smoking Status, in the UK, 2010, 2025, and 2030

Table 2.104 Number of Smoking-related Deaths in the WHO Regions, All Ages, 2010

Table 2.105 Smoking-attributable Burden of Disease and LYL Among Adults aged 30–69 years, 2012

Table 2.106 Smoking-attributable Burden of Disease, by Geography, 2012

Table 2.107 Economic Cost of Smoking-attributable Diseases, 2012

Table 2.108 Economic Cost of Smoking-attributable Diseases, Adjusted for 2016 PPP

Table 3.1 Global Smoking Cessation Drugs Market by Segmentation, 2016

Table 3.2 Global Smoking Cessation Drugs Market Forecast 2017-2027: Revenue ($m), AGR (%), CAGR (%)

Table 3.3 Global Smoking Cessation Drugs Market Forecast by Drug Class 2016-2027: Revenue ($m), AGR (%), CAGR (%)

Table 3.4 Global Smoking Cessation Drugs Market by Region, 2016

Table 3.5 Global Smoking Cessation Drugs Market Forecast by Region 2016-2027: Revenue ($m), AGR (%), CAGR (%)

Table 3.6 Global Smoking Cessation Drugs Market by Country, 2016

Table 3.7 North American Smoking Cessation Drugs Market Segmentation by Drug Class 2016-2027: Revenue ($m), AGR (%), CAGR (%)

Table 3.8 European Smoking Cessation Drugs Market Segmentation by Drug Class 2016-2027: Revenue ($m), AGR (%), CAGR (%)

Table 3.9 APAC Smoking Cessation Drugs Market Segmentation by Drug Class 2016-2027: Revenue ($m), AGR (%), CAGR (%)

Table 3.10 RoW Smoking Cessation Drugs Market Segmentation by Drug Class 2016-2027: Revenue ($m), AGR (%), CAGR (%)

Table 4.1 Active Pipeline Molecules for Smoking Cessation, 2017

Table 4.2 Discontinued Pipeline Molecules for Smoking Cessation, 2017

Table 5.1 Status of Smoking Cessation Reimbursement in Australia, as of December 2016

Table 5.2 Status of Smoking Cessation Reimbursement in New Zealand, as of December 2016

Table 5.3 Status of Smoking Cessation Reimbursement in Germany, as of December 2016

Table 5.4 Status of Smoking Cessation Reimbursement in France, as of December 2016

Table 5.5 Status of Smoking Cessation Reimbursement in Italy, as of December 2016

Table 5.6 Status of Smoking Cessation Reimbursement in Spain, as of December 2016

Table 5.7 Status of Smoking Cessation Reimbursement in the UK, as of December 2016

Table 5.8 Status of Smoking Cessation Reimbursement in the US, as of December 2016

Table 6.1 Type of Smoking Cessation Therapies Approved in the US, 2017

Table 6.2 List of Smoking Cessation Drugs Approved in the US, 2017

Table 6.3 List of Smoking Cessation Drugs with Discontinued/Tentative Approval Marketing Status in the US, 2017

Table 6.4 NRT Market in the US

Table 6.5 NRT Market Leaders for Traditional Product Categories in the US, 2016

Table 6.6 Nicotine Gums Market in the US

Table 6.7 Nicotine Lozenges Market in the US

Table 6.8 Nicotine Patch Market in the US

Table 6.9 Non-Nicotine Smoking Cessation Pharmacotherapy Market in the US

Table 6.10 Usage of Any Smoking Cessation Method (Alone or in Combination) in the US, in Past 3 Months, 2014-2016

Table 6.11 Usage of Only One Smoking Cessation Method (Alone or in Combination) in the US, in Past 3 Months, 2014-2016

Table 6.12 Type of Smoking Cessation Therapies Approved in the UK, 2017

Table 6.13 List of Smoking Cessation Drugs Approved in the UK, 2017

Table 6.14 List of Smoking Cessation Drugs with Discontinued Marketing Status in the UK, 2017

Table 6.15 NRT Market in the UK

Table 6.16 Nicotine Gums Market in the UK

Table 6.17 Nicotine Lozenges Market in the UK

Table 6.18 Nicotine Patches Market in the UK

Table 6.19 Non-Nicotine Smoking Cessation Pharmacotherapy Market in the UK

Table 6.20 Number of Prescriptions (in thousands) of Smoking Cessation Drugs Prescribed in Primary Care, in England, 2004/05 to 2014/15

Table 6.21 Net Ingredient Cost of Smoking Cessation Drugs Prescribed in Primary Care, in England, 2004/05 to 2014/15

Table 6.22 Type of Smoking Cessation Therapies Approved in Spain, 2017

Table 6.23 List of Smoking Cessation Drugs Approved in Spain, 2017

Table 6.24 List of Smoking Cessation Drugs with Discontinued Marketing Status in Spain, 2017

Table 6.25 NRT Market in Spain

Table 6.26 Type of Smoking Cessation Therapies Approved in France, 2017

Table 6.27 List of Smoking Cessation Drugs Approved in France, 2017

Table 6.28 NRT Market in France, 2017

Table 6.29 Type of Smoking Cessation Therapies Approved in Australia, 2017

Table 6.30 List of Smoking Cessation Drugs Approved in Australia, 2017

Table 6.31 NRT Market in Australia

Table 6.32 Type of Smoking Cessation Therapies Approved in New Zealand, 2017

Table 6.33 List of Smoking Cessation Drugs Approved in New Zealand, 2017

Table 6.34 List of Smoking Cessation Drugs with Lapsed Approval in New Zealand, 2017

Table 6.35 List of Smoking Cessation Drugs with Status ‘Not Available’ in New Zealand, 2017

Table 6.36 NRT Market in New Zealand

Table 6.37 Type of Smoking Cessation Therapies Approved in Italy, 2017

Table 6.38 List of Smoking Cessation Drugs Approved in Italy, 2017

Table 6.39 List of Smoking Cessation Drugs with status ‘Revoked’ in Italy, 2017

Table 6.40 NRT Market in Italy

Table 6.41 NRT Market in Germany

Table 7.1 Global Smoking Cessation Market Leaders, 2016

Table 7.2 Sales (in US$ Million) of Chantix/Champix

Table 7.3 Chantix: Exclusivity and Patent Expiry Status in the US

Table 7.4 Sales of Perrigo’s Smoking Cessation Products

Table 8.1 Age-standardized Prevalence of Tobacco Smoking in People Aged 15 Years and More, by WHO Region, 2015

Table 8.2 Prevalence (%) of Current Tobacco Smoking in WHO Regions by Gender, 2010 and 2025

List of Figures

Figure 2.1 Types of Nicotine Delivery Systems

Figure 2.2 Prevalence (%) of Current Tobacco Smoking in WHO Regions, 2010 and 2025

Figure 2.3 Trend of Current Cigarette Smoking Among High School Students and Adults in the US, 1965–2014

Figure 2.4 Trend of Current Cigarette Smoking Among High School Students in the US, 2011-2016

Figure 2.5 Trend of Current Cigarette Smoking Among Middle School Students in the US, 2011-2016

Figure 2.6 Trend of Daily Cigarette Smoking in the US, by Grade, 1976-2015

Figure 2.7 Trend of Students who Reported Using Smokeless Tobacco in the US in the Last 30 Days, by Grade, 1993-2015

Figure 2.8 Trend of Current Cigarette Smoking among Adults Aged 18 Years and Over in the US, by Gender and Year, 1991-2015

Figure 2.9 Age Group-wise Prevalence of Current Cigarette Smoking among Males aged 18 Years and Over in the US, by Year, 1965-2014

Figure 2.10 Year-wise Prevalence of Current Cigarette Smoking among Males aged 18 Years and Over in the US, by Age Group, 1965-2014

Figure 2.11 Age Group-wise Prevalence of Current Cigarette Smoking among Females Aged 18 Years and Over in the US, by Year, 1965-2014

Figure 2.12 Year-wise Prevalence of Current Cigarette Smoking among Females aged 18 Years and Over in the US, by Age Group, 1965-2014

Figure 2.13 Prevalence of Current Cigarette Smoking among Adults aged 18 Years and Over, by Smoking Status, US, 2013-2015

Figure 2.14 Trend in Prevalence of Current Cigarette Smoking among Adults aged 18 Years and Over, by Smoking Status, US, 2013-2015

Figure 2.15 Prevalence (%) of Daily Tobacco Smoking by Gender, US, 2010, 2025 and 2030

Figure 2.16 Prevalence (%) of Current Tobacco Smoking by Gender, US, 2010, 2025 and 2030

Figure 2.17 Trend in Prevalence of Tobacco Smoking among People aged 14 Years and Over, by Smoking Status, Australia, 1991-2015

Figure 2.18 Year-wise Distribution (in %) of Tobacco Smoking Status in Australia in People Aged 14 Years and Above, 1991-2016

Figure 2.19 Trend in Year-wise Distribution of Tobacco Smoking Status in Australia in People Aged 14 Years and Above, 1991-2016 (%)

Figure 2.20 Year-wise Distribution (in %) of Tobacco Smoking Status in Australia in People Aged 12 Years and Above, 2016

Figure 2.21 Trend in Year-wise Distribution of Daily Smokers in Australia, by Age Group, 1991-2016 (%)

Figure 2.22 Trend in Year-wise Distribution of Current Smokers in Australia, by Age Group, 1991-2016 (%)

Figure 2.23 Prevalence (in thousands) of Smoking in Australia, by Age Group, 2014-2015

Figure 2.24 Prevalence (in thousands) of Smoking in Australia, by Age Group and Gender, 2014-2015

Figure 2.25 Distribution (in %) of Tobacco Smoker in Australia, by Age Group and Smoking Status, 2014-2015

Figure 2.26 Five-year Prevalence (%) of Current Tobacco Smoking in Australia, by Gender, 2000-2030

Figure 2.27 Five-year Prevalence(%) of Current Tobacco Smoking in Australia, 2000-2030

Figure 2.28 Trend of Current Tobacco Smoking in Australia, by Age, 2000-2030

Figure 2.29 Five-year Prevalence(%) of Daily Tobacco Smoking in Australia, by Gender, 2000-2030

Figure 2.30 Five-year Prevalence(%) of Daily Tobacco Smoking in Australia, 2000-2030

Figure 2.31 Prevalence(%) of Current Tobacco Smoking in New Zealand, by Gender, 2006-2016

Figure 2.32 Prevalence(%) of Current Tobacco Smoking in New Zealand, by Age Group, 2006-2016

Figure 2.33 Trend in Prevalence (%) of Current Tobacco Smoking in New Zealand, by Age Group, 2006-2016

Figure 2.34 Prevalence(%) of Current Tobacco Smoking in New Zealand, by Age Group, 2006-2016

Figure 2.35 Prevalence(%) of Daily Tobacco Smoking in New Zealand, by Gender, 2006-2016

Figure 2.36 Prevalence(%) of Daily Tobacco Smoking in New Zealand, by Age Group, 2006-2016

Figure 2.37 Trend in Prevalence(%) of Daily Tobacco Smoking in New Zealand, by Age Group, 2006-2016

Figure 2.38 Prevalence (%) of Daily Tobacco Smoking in New Zealand, by Age Group, 2006-2016

Figure 2.39 Trend of Prevalence(%) of Current Tobacco Smoking in New Zealand, 1983-2015

Figure 2.40 Five-year Prevalence (%) of Daily Tobacco Smoking in New Zealand, by Gender, 2000-2030

Figure 2.41 Five-year Prevalence(%) of Daily Tobacco Smoking in New Zealand, 2000-2030

Figure 2.42 Five-year Forecasted Prevalence(%) of Current Tobacco Smoking in New Zealand, by Gender, 2000-2030

Figure 2.43 Five-year Prevalence(%) of

Current Tobacco Smoking in New Zealand, 2000-2030

Figure 2.44 Prevalence (in thousands) of Smoking in People Aged 14 Years and Above, by Smoking Status, Italy, 2016

Figure 2.45 Trend in Prevalence (in %) of Smoking in People Aged 14 Years and Above, by Gender, Italy, 2007-2016

Figure 2.46 Prevalence (in thousands) of Smoking in People Aged 14 Years and Above, by Smoking Status, Italy, 2007-2016

Figure 2.47 Trend in Prevalence (in %) of Smoking in People Aged 14 Years and Above, by Smoking Status, Italy, 2007-2016

Figure 2.48 Trend in Prevalence (in %) of Smoking in Males Aged 14 Years and Above, by Smoking Status, Italy, 2007-2016

Figure 2.49 Trend in Prevalence (in %) of Smoking in Females Aged 14 Years and Above, by Smoking Status, Italy, 2007-2016

Figure 2.50 Prevalence (in %) of Smoking in People Aged 14 Years and Above, by Age, Italy, 2007-2016

Figure 2.51 Trend in Prevalence (in %) of Smoking in People Aged 14 Years and Above, by Age, Italy, 2007-2016

Figure 2.52 Five-year Prevalence(%) of Current Tobacco Smoking in Italy, by Gender, 2000-2030

Figure 2.53 Five-year Prevalence(%) of Current Tobacco Smoking in Italy, by Gender, 2000-2030

Figure 2.54 Trend of Current Tobacco Smoking in Italy, by Age, 2000-2030

Figure 2.55 Five-year Prevalence(%) of Daily Tobacco Smoking in Italy, by Gender, 2000-2030

Figure 2.56 Five-year Prevalence (%) of Daily Tobacco Smoking in Italy, 2000-2030

Figure 2.57 Trend in Prevalence (%) of Smoking in People aged 18 Years and Above, by Gender, Germany, 2009-2014/2015

Figure 2.58 Trend in Prevalence(%) of Smoking in People aged 18 Years and Above, Germany, 2009-2014/2015

Figure 2.59 Trend in Prevalence(%) of Smoking in People aged 18 Years and Above, by Age and Gender, Germany, 2009-2014/2015

Figure 2.60 Prevalence(%) of Smoking in Females aged 18 Years and Above, by Age and Smoking Status, Germany, 2014/2015

Figure 2.61 Prevalence (%) of Smoking in Males aged 18 Years and Above, by Age and Smoking Status, Germany, 2014/2015

Figure 2.62 Prevalence (%) of Smoking in Females aged 18 Years and Above, by Age and Smoking Status, Germany, 2010

Figure 2.63 Prevalence (%) of Smoking in Males aged 18 Years and Above, by Age and Smoking Status, Germany, 2010

Figure 2.64 Prevalence (%) of Smoking in Females aged 18 Years and Above, by Age and Smoking Status, Germany, 2009

Figure 2.65 Prevalence (%) of Smoking in Males aged 18 Years and Above, by Age and Smoking Status, Germany, 2009

Figure 2.66 Trend in Prevalence(%) of Smoking in People aged 15 Years and Above, by Gender and Smoking Status, Germany, 1992-2013

Figure 2.67 Five-year Prevalence(%) of Current Tobacco Smoking in Italy, by Gender, 2000-2030

Figure 2.68 Five-year Prevalence(%) of Current Tobacco Smoking in Germany, 2000-2030

Figure 2.69 Trend of Current Tobacco Smoking in Germany, by Age, 2000-2030

Figure 2.70 Five-year Prevalence(%) of Daily Tobacco Smoking in Germany, 2000-2030

Figure 2.71 Five-year Prevalence(%) of Daily Tobacco Smoking in Germany, 2000-2030

Figure 2.72 Relative Prevalence(%) of Tobacco Smoking in Population Aged 15 Years and Above, by Gender and Smoking Status, in Spain, 2014

Figure 2.73 Relative Prevalence (%) of Tobacco Smoking in Population Aged 15 Years and Above, by Age and Smoking Status, in Spain, 2014

Figure 2.74 Number of Tobacco Smokers (in thousands), by Gender and Smoking Status, in Spain, 2011-2012

Figure 2.75 Number of Tobacco Smokers (in thousands) Aged 15 Years and Above, by Age and Smoking Status, in Spain, 2011-2012

Figure 2.76 Relative Prevalence of Daily Tobacco Smoking (%) in People Aged 15 Years and Above, by Gender, in Spain, 1993-2014

Figure 2.77 Trend in Relative Prevalence of Tobacco Smokers (%) in Spain, by Gender, 2011-2012

Figure 2.78 Relative Prevalence of Current Tobacco Smoking (%) in People Aged 15 Years and Above, by Age Gender, in Spain, 1993-2014

Figure 2.79 Trend in Relative Prevalence of Current Tobacco Smokers (%) in Spain, by Gender, 2011-2012

Figure 2.80 Five-year Prevalence(%) of Current Tobacco Smoking in Spain, by Gender, 2000-2030

Figure 2.81 Five-year Prevalence (%) of Current Tobacco Smoking in Spain, 2000-2030

Figure 2.82 Trend of Current Tobacco Smoking in Spain, by Age, 2000-2030

Figure 2.83 Five-year Prevalence(%) of Daily Tobacco Smoking in Spain, by Gender, 2000-2030

Figure 2.84 Five-year Prevalence(%) of Daily Tobacco Smoking in Spain, 2000-2030

Figure 2.85 Distribution of Smoking Status, in France, 2010 and 2014

Figure 2.86 Trend in Distribution of Smoking Status, in France, 2010 and 2014

Figure 2.87 Prevalence (%) of Regular Smoking in Males Aged 15 Years and Above, by Age in France, 2005, 2010 and 2014

Figure 2.88 Trend in Prevalence (%) of Regular Smoking in Males Aged 15 Years and Above, by Age in France, 2005, 2010 and 2014

Figure 2.89 Prevalence (%) of Regular Smoking in Females Aged 15 Years and Above, by Age in France, 2005, 2010 and 2014

Figure 2.90 Trend in Prevalence (%) of Regular Smoking in Females Aged 15 Years and Above, by Age in France, 2005, 2010 and 2014

Figure 2.91 Five-year Prevalence(%) of Current Tobacco Smoking in France, by Gender, 2000-2030

Figure 2.92 Five-year Prevalence(%) of Current Tobacco Smoking in France, 2000-2030

Figure 2.93 Trend of Current Tobacco Smoking in France,by Age, 2000-2030

Figure 2.94 Five-year Prevalence(%) of Daily Tobacco Smoking in France, by Gender, 2000-2030

Figure 2.95 Five-year Prevalence (%) of Daily Tobacco Smoking in France, 2000-2030

Figure 2.96 Prevalence(%) of Current Tobacco Smoking in People Aged 18 Years and Above, in the UK, 2010-2016

Figure 2.97 Prevalence(%) of Current Tobacco Smoking in People Aged 18 Years and Above, by Age Group, in the UK, 2016

Figure 2.98 Prevalence(%) of Current Tobacco Smoking in People Aged 18 Years and Above, by Age Group, in the UK, 2010-2016

Figure 2.99 Trend in Prevalence(%) of Current Tobacco Smoking in People Aged 18 Years and Above, by Age Group, in the UK, 2010-2016

Figure 2.100 Prevalence(%) of Current Tobacco Smoking in People Aged 16 Years and Above, by Age Group, in the UK, 2010-2015

Figure 2.101 Trend in Prevalence (%) of Current Tobacco Smoking in People Aged 16 Years and Above, by Age Group, in the UK, 2010-2015

Figure 2.102 Prevalence(%) of Current Tobacco Smoking in People Aged 16 Years and Above, by Age Group, in the UK, 2010-2015

Figure 2.103 Prevalence (%) of Current Tobacco Smoking in Males Aged 16 Years and Above, by Age Group, in the UK, 2010-2015

Figure 2.104 Prevalence (%) of Current Tobacco Smoking in Females Aged 16 Years and Above, by Age Group, in the UK, 2010-2015

Figure 2.105 Prevalence(%) of Daily Tobacco Smoking in People Aged 16 Years and Above, by Age Group, in the UK, 2010-2015

Figure 2.106 Trend in Prevalence (%) of Daily Tobacco Smoking in People Aged 16 Years and Above, by Age Group, in the UK, 2010-2015

Figure 2.107 Prevalence(%) of Daily Tobacco Smoking in People Aged 16 Years and Above, by Age Group, in the UK, 2010-2015

Figure 2.108 Prevalence(%) of Daily Tobacco Smoking in Females Aged 16 Years and Above, by Age Group, in the UK, 2010-2015

Figure 2.109 Prevalence(%) of Current Tobacco Smoking in Males Aged 16 Years and Above, by Age Group, in the UK, 2010-2015

Figure 2.110 Prevalence(%) of Tobacco Smoking in, by Gender and Smoking Status, in the UK, 2010, 2025, and 2030

Figure 2.111 Strategies to Prevent Smoking Initiation in Children and Adolescents

Figure 3.1 Global Smoking Cessation Drugs Market Forecast 2016-2027: Revenue ($m), AGR (%)

Figure 3.2 Global Smoking Cessation Drugs Market Segmentation by Drug Class 2016: Share (%)

Figure 3.3 Global NRT Smoking Cessation Market Forecast 2016-2027: Revenue ($m), AGR (%)

Figure 3.4 Global Non-nicotine Pharmacotherapy Smoking Cessation Market Forecast 2016-2027: Revenue ($m), AGR (%)

Figure 3.5 Global Smoking Cessation Drugs Market Forecast by Drug Class 2016-2027: Revenue ($m)

Figure 3.6 Trend in Global Smoking Cessation Drugs Market by Drug Class 2016-2027: Revenue ($m)

Figure 3.7 Global Smoking Cessation Drugs Market Segmentation by Drug Class 2027: Share (%)

Figure 3.8 Global Smoking Cessation Drugs Market by Region, 2016: Share (%)

Figure 3.9 Global Smoking Cessation Drugs Market by Region, 2027: Share (%)

Figure 3.10 Smoking Cessation Drugs Market Forecast 2016-2027, North America: Revenue ($m), AGR (%)

Figure 3.11 Smoking Cessation Drugs Market Forecast 2016-2027, Europe: Revenue ($m), AGR (%)

Figure 3.12 Smoking Cessation Drugs Market Forecast 2016-2027, Asia-Pacific: Revenue ($m), AGR (%)

Figure 3.13 Smoking Cessation Drugs Market Forecast 2016-2027, RoW: Revenue ($m), AGR (%)

Figure 3.14 Global Smoking Cessation Drugs Market by Country, 2016: Share (%)

Figure 3.15 NRT Smoking Cessation Market Forecast 2016-2027, North America: Revenue ($m), AGR (%)

Figure 3.16 Non-nicotine Pharmacotherapy Smoking Cessation Market Forecast 2016-2027, North America: Revenue ($m), AGR (%)

Figure 3.17 North American Smoking Cessation Drugs Market Forecast by Drug Class 2016-2027: Revenue ($m)

Figure 3.18 Trend in North American Smoking Cessation Drugs Market by Drug Class 2016-2027: Revenue ($m)

Figure 3.19 NRT Smoking Cessation Market Forecast 2016-2027, Europe: Revenue ($m), AGR (%)

Figure 3.20 Non-nicotine Pharmacotherapy Smoking Cessation Market Forecast 2016-2027, Europe: Revenue ($m), AGR (%)

Figure 3.21 European Smoking Cessation Drugs Market Forecast by Drug Class 2016-2027: Revenue ($m)

Figure 3.22 Trend in European Smoking Cessation Drugs Market by Drug Class 2016-2027: Revenue ($m)

Figure 3.23 NRT Smoking Cessation Market Forecast 2016-2027, APAC: Revenue ($m), AGR (%)

Figure 3.24 Non-nicotine Pharmacotherapy Smoking Cessation Market Forecast 2016-2027, APAC: Revenue ($m), AGR (%)

Figure 3.25 APAC Smoking Cessation Drugs Market Forecast by Drug Class 2016-2027: Revenue ($m)

Figure 3.26 Trend in APAC Smoking Cessation Drugs Market by Drug Class 2016-2027: Revenue ($m)

Figure 3.27 NRT Smoking Cessation Market Forecast 2016-2027, RoW: Revenue ($m), AGR (%)

Figure 3.28 Non-nicotine Pharmacotherapy Smoking Cessation Market Forecast 2016-2027, RoW: Revenue ($m), AGR (%)

Figure 3.29 RoW Smoking Cessation Drugs Market Forecast by Drug Class 2016-2027: Revenue ($m)

Figure 3.30 Trend in RoW Smoking Cessation Drugs Market Forecast by Drug Class 2016-2027: Revenue ($m)

Figure 3.31 Trends in Global Smoking Cessation Drugs Market

Figure 6.1 Usage of Any Smoking Cessation Method (Alone or in Combination) in the US, in Past 3 Months, 2014-2016*

Figure 6.2 Usage of Only One Smoking Cessation Method (Alone or in Combination) in the US, in Past 3 Months, 2014-2016*

Figure 6.3 Trend in Number of Prescriptions (in thousands) of Smoking Cessation Drugs Prescribed in Primary Care, in England, 2004/05 to 2014/15

Figure 6.4 Distribution of Net Ingredient Cost of Smoking Cessation Drugs Prescribed in Primary Care, in England, 2004/05 to 2014/15

Figure 6.5 Sales of Smoking Cessation Treatments in France, 1998-2016

Figure 7.1 Global Smoking Cessation Market Leaders by Market Share, 2016: Share (%)

Figure 8.1 Global Smoking Cessation Drugs Market Forecast 2017-2027: Revenue ($m), AGR (%)

22nd Century Group, Inc

Actavis (Teva)

AFT Pharmaceuticals

Alphapharm

Apotex

Aveva

Celtic Pharmaceuticals (earlier Xenova Group)

Cerecor Inc

Chefaro Pharma

Chrono Therapeutics

CV Sciences

Douglas Pharmaceuticals

Dr Reddys Labs

Eisai/Arena Pharmaceuticals

Embera NeuroTherapeutics

FDA

Forum Pharmaceuticals Mitsubishi Tanabe Pharma

Geiss, Destin & Dunn (GDD) Inc.

Gelmedic Holding

GSK

GSKSS

Ivax Sub Teva Pharms

Kern Pharma

McNeil (J&J)

Medis Pharma

Merck

Mylan

Nabi Pharmaceuticals (now Aviragen)/GSK

National Institute on Drug Abuse

Novartis

Novartis/Cytos Biotechnology (now Kuros BioSciences)

Office on Smoking and Health

Omega Pharma

Orion Laboratories (Perrigo)

Perrigo

Pfizer

Pharmacia and Upjohn (Pfizer)

Pharmacia Italia

Pierre Fabre

Pinney Associates

Recordati Chimica Industria E Farmaceutica

Reynolds America

Sanofi

Sanofi Aventis

Selecta Biosciences

Tarbis Farma

Teva

The Boots Company

University of Washington

Watson Labs (Teva)

WHO

Wrafton Laboratories (Perrigo)

Download sample pages

Complete the form below to download your free sample pages for Global Smoking Cessation Drugs Market Forecast 2017-2027

Download sample pages

Complete the form below to download your free sample pages for Global Smoking Cessation Drugs Market Forecast 2017-2027

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Latest Pharma news

Visiongain Publishes Drug Delivery Technologies Market Report 2024-2034

The global Drug Delivery Technologies market is estimated at US$1,729.6 billion in 2024 and is projected to grow at a CAGR of 5.5% during the forecast period 2024-2034.

23 April 2024

Visiongain Publishes Cell Therapy Technologies Market Report 2024-2034

The cell therapy technologies market is estimated at US$7,041.3 million in 2024 and is projected to grow at a CAGR of 10.7% during the forecast period 2024-2034.

18 April 2024

Visiongain Publishes Automation in Biopharma Industry Market Report 2024-2034

The global Automation in Biopharma Industry market is estimated at US$1,954.3 million in 2024 and is projected to grow at a CAGR of 7% during the forecast period 2024-2034.

17 April 2024

Visiongain Publishes Anti-obesity Drugs Market Report 2024-2034

The global Anti-obesity Drugs market is estimated at US$11,540.2 million in 2024 and is expected to register a CAGR of 21.2% from 2024 to 2034.

12 April 2024