Industries > Pharma > Global Pharma Contract Sales Market 2018-2028

Global Pharma Contract Sales Market 2018-2028

Contract Detailing, Contract Non-Personal Promotion, Medical Education Services, Sample Management Services, Teledetailing Services, Edetailing Services

The global pharma contract sales market is expected to grow at a CAGR of 9.6% in the first half of the forecast period. The market is expected to grow at a CAGR of 7.9% from 2017-2028. The market is estimated at $5.48bn in 2017 and $9.48bn in 2023.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand new 242-page report you will receive 90 tables and 65 figures– all unavailable elsewhere.

The 242-page report provides clear detailed insight into the global pharma contract sales market. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand-new report today you stay better informed and ready to act.

Report Scope

• Global Pharma Contract Sales Market forecasts from 2018-2028

• Along with revenue prediction for the overall world market for pharma contract sales market, our investigation shows forecasts to 2028 for the following submarkets:

– Contract detailing (personal promotion/field sales)

– Contract non-personal promotion, with further sub-forecasting for teledetailing, eDetailing and others

– Medical education services

– Sample management services

• This report also breaks down the revenue forecast for pharma contract sales market by therapeutic segments:

– Cardiovascular disease

– Metabolic disorders

– Cancer treatment

– Other

• This report provides individual revenue forecasts to 2028 for these regional and national markets:

– USA

– Japan

– Germany, UK, France, Italy and Spain (EU5 countries)

– China, India, Brazil and Russia (BRIC group)

• Our study discusses the SWOT and STEP factors of the global pharma contract sales market

• Our study discusses issues affecting the pharma contract sales industry and market from 2017:

– Outsourced and in-house sales reps – trends and emerging sales models, including multiple channels (multichannel marketing to medical professionals)

– Services CSOs offer and benefits to drug companies outsourcing medical sales

– Maturing brands and product launches, including flexibility in field sales teams

– Legislation and new market access requirements for pharma sales representatives

– Changes to online marketing and potential for IT technologies Risk-sharing agreements

– Key account management (KAM) and medical science liaison (MSL)

• This report discusses the leading companies in pharma contract sales

Visiongain’s study is intended for anyone requiring commercial analyses for the global pharma contract sales market. You find data, trends and predictions.

Buy our report today Global Pharma Contract Sales Market 2018-2028: Contract Detailing, Contract Non-Personal Promotion, Medical Education Services, Sample Management Services, Teledetailing Services, Edetailing Services.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Pharma Contract Sales Overview

1.2 Why You Should Read This Report

1.3 How this Report Delivers

1.4 Main Questions Answered by this Report

1.5 Who is this Report for?

1.6 Research and Analysis Methods

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Reports

1.9 About Visiongain

2. Introduction to Pharma Contract Sales Market

2.1 Defining the Market

2.2 What is a CSO?

2.3 What Services do CSOs Provide?

2.4 Marketing Channels Employed by Pharma Companies in 2017

2.5 Growing Trend of Outsourcing in the Overall Pharma Industry

2.6 Detailing: Becoming Less Relevant or is it as Important as Ever?

2.6.1 Declining Access to Doctors: Trend Continues in 2017

2.7 Large Cuts in Sales Force in Various Companies

2.8 Companies Cannot Rely Solely Upon Detailing

2.8.1 Trends Driving the Need for New Sales Models

3. Global Pharma Contract Sales Market 2018-2028

3.1 The Market in 2017

3.2 Global Pharma Contract Sales Market 2018-2023

3.2.1 Growth in the Market in Recent Years

3.3 Global Pharma Contract Sales Market 2018-2028

3.4 The Factors that Will Drive Growth in this Market: Advantages of Outsourcing Pharma Sales

3.4.1 Cost and Flexibility

3.4.2 New Technologies and Sales Models

3.4.3 Emerging Markets and Mature Brands

3.4.4 Biosimilars

3.4.5 Account Management, Medical Education and Patient Support Services

3.4.6 Market Access Complexities Provide its Own Opportunities for CSOs

3.4.7 New Drug Launches

3.4.8 Summary

3.5 The Factors that Will Restrain Growth in this Market: Disadvantages of Outsourcing Pharma Sales

3.6 Leading Therapeutic Submarkets for Pharma Contract Sales, Forecast 2018-2028

3.7 The Rise in Pharma Contract Sales

3.8 How Will the Therapeutic Composition of the Market Change Between 2018 and 2028?

3.9 Contract Sales for Cardiovascular Drugs

3.9.1 Current Status

3.9.2 Recent Cardiovascular Drug Patent Expiries and FDA Approvals

3.9.3 Cardiovascular and Cerebrovascular Conditions are the World's Most Fatal Diseases

3.9.4 Contract Sales for Cardiovascular Drugs: Submarket Forecast 2018-2028

3.10 Contract Sales for Metabolic Disorder Drugs

3.10.1 Current Status

3.10.2 430 Million People Expected to be Diagnosed with Diabetes by 2030

3.10.3 Contract Sales for Metabolic Disorders: Submarket Forecast 2018-2028

3.11 Contract Sales for Oncology Drugs

3.11.1 Current Status

3.11.2 Patent Expiries and Recent Approvals

3.11.3 Contract Sales for Oncology Drugs Forecast 2018-2028

4. Leading Service Sectors of the Pharma Contract Sales Market 2018-2028

4.1 The Leading Services

4.1.1 Leading Service Sectors of the Market, Forecast 2018-2028

4.1.2 How Will the Service Composition over the Market Change over the Next Ten Years?

4.2 Contract Detailing Submarket

4.2.1 Are we in the Midst of a Turnaround in Sales Rep Numbers in the Overall Pharma Industry?

4.2.2 What are the Trends in Sales Reps Employed by CSOs?

4.2.3 Detailing Services Offered by CSOs

4.2.4 CSOs will be Impacted by Declining Physician Access as Much as In-House Reps

4.2.5 Contract Detailing Submarket Forecast 2018-2028

4.2.6 Drivers and Restraints for this Dominant Service Submarket

4.3 Contract Non-Personal Promotion Submarket

4.3.1 The Benefits for both Pharma Companies and Doctors

4.3.2 Contract Non-Personal Promotion Submarket Forecast 2018-2028

4.3.3 Drivers and Restraints for Contract Non-Personal Promotion: Multichannel Marketing in the 21st Century

4.3.4 Further Sub-Sectors Within the Contract Non-Personal Promotion Submarket: Teledetailing and EDetailing

4.3.4.1 Contract Teledetailing Submarket: Current Status

4.3.4.2 Contract Teledetailing Submarket Forecast 2018-2028

4.3.4.3 Drivers and Restraints for Outsourced Teledetailing

4.3.4.4 Contract eDetailing Current Status

4.3.4.5 Contract eDetailing Submarket Forecast 2018-2028

4.3.4.6 Drivers and Restraints for Outsourced eDetailing

4.4 Medical Education Services Submarket Current Status

4.4.1 Medical Education Services Submarket Forecast 2018-2028

4.4.2 Medical Education Services Drivers and Restraints

4.5 Sample Management Services Submarket: Current Status

4.5.1 Sample Management Services Submarket Forecast 2018-2028

4.5.2 Drivers and Restraints for the Sample Management Services Submarket

4.5.3 J. Knipper and Company Inc: A US Leader in Sample Management Services

4.5.3.1 Company Acquires Sample Management Divisions from Leading CSOs 2010-2014

4.5.3.2 Construction Underway for New State of the Art Distribution Centre

4.5.3.3 New Multi-Million Dollar Contact Centre Opened

4.5.3.4 New Technologies to Drive Growth over the Next Ten Years

5. Leading National Markets for Pharma Contract Sales: Regulatory and Commercial Outlook 2018-2028

5.1 Current Leading National Markets

5.2 Leading Regional Markets Forecast 2018-2028

5.3 How will the Regional Composition of the Market Change between now and 2028?

5.4 Pharma Sales Regulatory Developments

5.4.1 Physician Payment Legislation in the US, Europe and Japan

5.4.1.1 The Physician Payment Sunshine Act (PPSA)

5.4.1.2 Proposed Bill to Close a Large Loophole in the PPSA, Could Come into Effect in 2017

5.4.1.3 Physician Payments in France: Increased Scrutiny

5.4.2 Domestic and International Concerns over Bribery: Recent Legislation in the US and UK

5.4.2.1 Promotional Products in the EU: New Rules

5.4.3 New Market Access Requirements in EU5 Countries

5.4.3.1 AMNOG: Stricter Pricing for Drugs in Germany

5.4.3.2 AMNOG: Has Reduced Prices of Top Sellers by 23%

5.4.3.3 Healthcare Reform in France: Pricing and Reimbursements have been set to Change for a While, is 2018 the Year It Finally Happens?

5.4.3.4 PCTs Replaced by CCGs in the UK

5.4.3.5 Pricing in the UK: Contentious Issue

5.4.4 Overtime for Sales Reps in the US: Rule Clarifications

5.5 US Pharma Contract Sales Market

5.5.1 US Pharma Contract Sales Market Has Grown Rapidly

5.5.2 Pharma Sales Regulation in the US

5.5.3 US Pharma Contract Sales Market Forecast 2018-2028

5.6 EU5 Pharma Contract Sales Market

5.6.1 Regulating Pharma Sales in the EU

5.6.2 Overall EU5 Pharma Contract Sales Market Forecast 2018-2028

5.6.3 UK Pharma Contract Sales Market Forecast 2018-2028

5.6.4 German Pharma Contract Sales Market Forecast 2018-2028

5.6.5 French Pharma Contract Sales Market Forecast 2018-2028

5.6.6 Italian Pharma Contract Sales Market Forecast 2018-2028

5.6.7 Spanish Pharma Contract Sales Market Forecast 2018-2028

5.7 Japanese Pharma Contract Sales Market

5.7.1 Regulation

5.7.2 Current Market Landscape

5.7.3 Japanese Pharma Contract Sales Market Forecast 2018-2028

6. Leading Emerging Markets for Pharma Contract Sales: Regulatory and Commercial Outlook 2018-2028

6.1 Pharma Contract Sales in Leading Emerging Markets in 2018

6.2 BRIC Pharma Contract Sales Markets Forecast 2018-2028

6.3 Chinese Pharma Contract Sales Market

6.3.1 Current Pharma Contract Sales Landscape in China

6.3.2 Rising In-House and Outsourced Sales Numbers

6.3.3 Concerns over Bribery

6.3.4 Chinese Pharma Contract Sales Market Forecast 2018-2028

6.4 Indian Pharma Contract Sales Market

6.4.1 Current Pharma Contract Landscape in India

6.4.2 Government and Regulatory Guidelines for Interactions between Healthcare Professionals and Pharma Companies

6.4.3 Indian Pharma Contract Sales Market Forecast 2018-2028

6.5 Brazilian Pharma Contract Sales Market

6.5.1 Current Pharma Contract Sales Landscape in Brazil

6.5.2 State Payment Rules and Online Marketing Rules for Prescription Drugs

6.5.3 Brazilian Pharma Contract Sales Market Forecast 2018-2028

6.6 Russian Pharma Contract Sales Market

6.6.1 Current Pharma Contract Sales Landscape in Russia

6.6.2 New State Procurement Rules for Drugs Introduced in 2013

6.6.3 Tougher Rules on Interactions between Doctors and Sales Reps in Russia

6.6.4 Russian Pharma Contract Sales Market Forecast 2018-2028

7. Pharma Contract Sales: Industry and Market Trends 2018-2028

7.1 Strengths and Weaknesses for the Global Pharma Contract Sales Market 2018-2028

7.2 Opportunities and Threats for the Global Pharma Contract Sales Market 2018-2028

7.3 Pharma Contract Sales Market: STEP Analysis 2018-2028

7.3.1 Social Factors Affecting Pharma Contract Sales to 2028

7.3.1.1 The Role of Ethics in Pharma Sales

7.4 Technological Developments to Improve Sales Strategies

7.4.1 Advantages of Using Tablets and Smartphones for Detailing

7.4.1.1 CSOs Need to Maximise on the Benefits of New Technologies

7.4.2 Closed Loop Marketing (CLM)

7.4.3 Customer Relationship Management (CRM)

7.4.4 The Advantages of Cloud Computing in Pharma Contract Sales

7.4.5 Does Big Data Have a Role in Pharma Sales?

7.4.6 Social Media in Relation to Pharma Sales

7.4.6.1 FDA Releases Long-Awaited Guidance on the use of Social Media

7.4.6.2 Pharma Industry is not Using Social Media to its Full Potential, but it offers many Benefits

7.5 Economic Pressures are Limiting Healthcare and Marketing Budgets

7.6 Political Issues: Stricter Regulations for Pharma Sales around the World

7.7 Trends in Pharma Contract Sales 2018-2028

7.7.1 Cuts to In-House Sales Staff Will Continue 2018-2028

7.7.2 There will be in an Increase in Strategic Partnering in Order to Provide Long-Term Revenue Growth

7.7.3 Leading CSOs have consolidated, and will continue to Consolidate, in Order to Increase Market Penetration

7.7.4 CSOs and Pharma Clients Alike Need to Stay Vigilant about the Risks of Outsourcing Pharma Sales

7.8 Drug Development Trends Affecting Pharma Sales 2018-2028

7.8.1 How will Orphan Drug Diseases Influence Pharma Contract Sales?

7.8.2 Promotion for Biosimilar Drugs over the Next Ten Years

7.8.3 There will be Greater Demand for Specialty Medicines

7.8.4 Emerging National Markets are Becoming Increasingly Important

7.9 Sales Models Need to Evolve

7.9.1 Why are Sales Reps Struggling for Access?

7.9.1.1 One way to Fight Against Reduced Access is to Target the System as a Whole

7.9.1.2 Multichannel Marketing to Overcome Problems of Access

7.9.2 Key Account Management (KAM)

7.9.3 Silos in Sales and Marketing

7.9.4 The Use of KOLs in Pharma Sales

7.10 Market Access

7.10.1 Emerging Stakeholders in Pharma Sales

7.10.2 The Rise of ACOs

7.10.2.1 20% of US Hospitals were Part of an ACO in 2014

7.10.3 Market Access in the EU Over the Next Ten Years

7.10.4 CSOs and Market Access Consulting

7.11 Summary: Main Trends Shaping Pharma Contract Sales 2018-2028

8. Leading Contract Sales Organisations (CSOs)

8.1 Current Industry Landscape

8.2 QuintilesIMS

8.2.1 World Market Leader for Contract Sales and Market Access

8.2.2 New Services and Strategic Partnerships

8.2.3 Quintiles Integrated Health Services Segment Performance 2010-2015

8.2.4 Outlook for QuintilesIMS Contract Sales to 2028

8.2.5 QuintilesIMS Financial Performance Quarterly Review 2017

8.3 UDG Healthcare

8.3.1 Global Service Provider with Various Business Units

8.3.2 Geographic and Service Growth Through Acquisitions

8.3.3 Joint Venture with CMIC

8.3.4 UDG Healthcare Financial Performance 2010-2015 and Beyond

8.4 inVentiv Health (Syneous Health)

8.4.1 Combined CRO and CCO

8.4.2 Global Structure

8.4.3 inVentiv Health Presence in US, EU and Asia

8.4.4 Possible $500m IPO in the Near Future

8.4.5 inVentiv Health Contract Sales Outlook to 2028

8.5 Publicis Healthcare Communications Group

8.5.1 PHCG Purchases PDI Commercial Services Business

8.5.1.1 PDI Prior to Acquisition: Broad Service Portfolio, Resources which PHCG now Acquires

8.5.1.2 PDI Past Financial Performance

8.5.2 Publicis Touchpoint Solutions

8.5.2.1 New Services in Recent Years, and Tardis Medical to be Aligned with the Company

8.6 OnCall, LLC

8.6.1 Range of Services

8.6.2 Contracts with Promius Pharma

8.7 Marvecs

8.7.1 A Local Leader in Germany

8.7.2 New Services Added in Recent Years: Sales 3.0

8.8 Sofip

8.9 CMIC

8.9.1 CSO Business in Japan Since 2000

8.10 Leading Players in China are not Just CSOs

9. Conclusions

9.1 The Global Pharma Contract Sales Market in 2017

9.1.1 Which Sectors Generated the Most Revenues in 2017?

9.1.2 Spending on Contract Sales is Highest in the US and EU

9.2 Outlook for the Pharma Contract Sales Market 2018-2028

9.2.1 Growth Trends for the Leading Submarkets 2018-2028

9.2.1.1 Therapeutic Sector Growth 2018-2028

9.3 Commercial Drivers for Pharma Contract Sales

Associated Reports

Appendix A

Appendix B

Table of Tables

Table 2.1 Recent Big Pharma Sales Force Cuts, Based Upon Reports and Predictions

Table 3.1 Global Pharma Contract Sales Market: Revenues ($bn), AGR (%),

CAGR (%), 2018-2023

Table 3.2 Global Pharma Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 3.3 Pharma Contract Sales Market Segmented by Therapeutic Area:

Revenue ($bn), AGR (%), CAGR (%), 2018-2023

Table 3.4 Pharma Contract Sales Market Segmented by Therapeutic Area: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 3.5 Leading Therapeutic Submarket Shares (%), 2018-2028

Table 3.6 Selected Recent Cardiovascular Disease Drug Patent Expiries, 2018

Table 3.7 Selected Cardiovascular Drugs Going Off-Patent

2017-2025

Table 3.8 Cardiovascular Drugs Approved by the FDA in 2016

Table 3.9 Cardiovascular Drugs Approved by the FDA in 2015

Table 3.10 Cardiovascular Drugs Approved by the FDA in 2015

Table 3.11 Cardiovascular Drugs Approved by the FDA in 2015

Table 3.12 Cardiovascular Drugs Approved by the FDA in 2014

Table 3.13 Projected Global Deaths from Ischaemic Heart Disease and Stroke (millions), % of Total Deaths, Deaths Per 100,000 Population, 2015 and 2030

Table 3.14 Cardiovascular Disease Submarket Forecast: Revenue ($bn),

AGR (%), CAGR (%), 2018-2023

Table 3.15 Cardiovascular Disease Submarket Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 3.16 Selected Metabolic Disorder Drugs Going Off-Patent 2016-2022

Table 3.17 Diabetes Prevalence in Leading National Markets,

2014

Table 3.18 Metabolic Disorders Submarket Forecast: Revenue ($bn), AGR (%), CAGR (%), 2018-2028

Table 3.19 Metabolic Disorders Submarket Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 3.20 Selected Recent and Future Oncology Patent

Expiries, 2016

Table 3.21 Oncology Drugs Approved by the FDA in 2015

Table 3.22 Oncology Drugs Approved by the FDA in 2016

Table 3.23 Oncology Drugs Approved by the FDA in 2017

Table 3.24 Oncology Submarket Forecast: Revenue ($bn), AGR (%),

CAGR (%), 2018-2023

Table 3.25 Oncology Submarket Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 3.26 Selected Drugs Which Have Faced Market Access Challenges from NICE, 2013-2015

Table 4.1 Pharma Contract Sales Market Segmented by Service Sectors: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2018-2023

Table 4.2 Pharma Contract Sales Market Segmented by Service Sectors: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 4.3 Contract Detailing Submarket Forecast: Revenue ($bn), AGR (%),

CAGR (%), Market Share (%), 2018-2023

Table 4.4 Contract Detailing Submarket Forecast: Revenue ($bn), AGR (%),

CAGR (%), Market Share (%), 2023-2028

Table 4.5 Contract Non-Personal Promotion Submarket Forecast: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2018-2023

Table 4.6 Contract Non-Personal Promotion Submarket Forecast: Revenue ($bn), AGR (%), CAGR (%), Market Share, 2023-2028

Table 4.7 Further Sub-Sectors Within the Contract Non-Personal Promotion Submarket, Forecast: Revenues ($bn), AGR (%), CAGR (%), Market Share (%), 2018-2023

Table 4.8 Further Sub-Sectors Within the Contract Non-Personal Promotion Submarket, Forecast: Revenues ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 4.9 Contract Teledetailing Submarket Forecast: Revenues ($bn), AGR (%), CAGR (%), Market Share (%), 2017-2023

Table 4.10 Contract Teledetailing Submarket Forecast: Revenues ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 4.11 Contract eDetailing Submarket Forecast: Revenues ($bn), AGR (%), CAGR (%), Market Share (%), 2017-2023

Table 4.12 Contract eDetailing Submarket Forecast: Revenues ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 4.13 Medical Education Services Submarket Forecast: Revenues ($bn), AGR (%), CAGR (%), Market Share (%), 2017-2023

Table 4.14 Medical Education Services Submarket Forecast: Revenues ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 4.15 Sample Management Services Forecast: Revenues ($bn), AGR (%), CAGR (%), Market Share (%), 2017-2023

Table 4.16 Sample Management Services Submarket Forecast: Revenues ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 5.1 Leading Regional Pharma Contract Sales Markets: Forecast Revenue ($bn), AGR (%), CAGR (%), Market Shares (%), 2017-2023

Table 5.2 Leading Regional Pharma Contract Sales Markets: Forecast Revenue ($bn), AGR (%), CAGR (%), Market Shares (%), 2023-2028

Table 5.3 US Contract Sales Market:

Revenue ($bn), CAGR (%),1995 and 2017

Table 5.4 US Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Market Share, 2017-2023

Table 5.5 US Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 5.6 EU5 Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Market Share, 2017-2023

Table 5.7 EU5 Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 5.8 UK Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Market Share, 2017-2023

Table 5.9 UK Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 5.10 German Pharma Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Global Market Share, 2017-2023

Table 5.11 German Pharma Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Global Market Share (%), 2023-2028

Table 5.12 French Pharma Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Global Market Share, 2017-2023

Table 5.13 French Pharma Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Global Market Share (%), 2023-2028

Table 5.14 Italian Pharma Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Global Market Share, 2017-2023

Table 5.15 Italian Pharma Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Global Market Share (%), 2023-2028

Table 5.16 Spanish Pharma Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Global Market Share, 2017-2023

Table 5.17 Spanish Pharma Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Global Market Share (%), 2023-2028

Table 5.18 Japanese Pharma Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Global Market Share, 2018-2023

Table 5.19 Japanese Pharma Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Global Market Share (%), 2023-2028

Table 6.1 BRIC Pharma Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Global Market Share, 2017-2023

Table 6.2 BRIC Pharma Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Global Market Share (%), 2023-2028

Table 6.3 Chinese Pharma Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Global Market Share, 2017-2023

Table 6.4 Chinese Pharma Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Global Market Share (%), 2023-2028

Table 6.5 Indian Pharma Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Global Market Share, 2017-2023

Table 6.6 Indian Pharma Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Global Market Share (%), 2023-2028

Table 6.7 Brazilian Pharma Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Global Market Share, 2017-2023

Table 6.8 Brazilian Pharma Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Global Market Share (%), 2023-2028

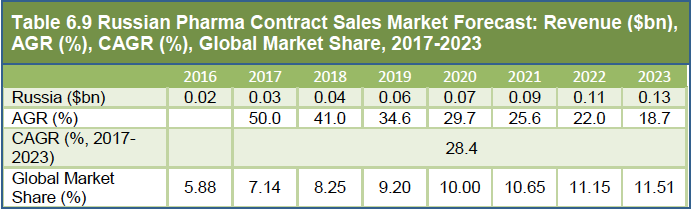

Table 6.9 Russian Pharma Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Global Market Share, 2017-2023

Table 6.10 Russian Pharma Contract Sales Market Forecast: Revenue ($bn), AGR (%), CAGR (%), Global Market Share (%), 2023-2028

Table 7.1 Pharma Contract Sales Market: Strengths and Weaknesses 2018-2028

Table 7.2 Pharma Contract Sales Market: Opportunities and Threats 2018-2028

Table 7.3 Top 10 US Patent Expiries, 2015

Table 7.4 Notable US Patent Expiries, 2014

Table 7.5 Selected CRM Providers for Pharma Sales, 2016

Table 7.6 Orphan Drug Definitions in Leading Regions

Table 7.7 Orphan Drug Pipeline by Disease Area, 2013

Table 8.1 Quintiles Emerging Market Entries, 2010-2012

Table 8.2 Quintiles Integrated Health Services Segment 2010-2015:

Revenues ($bn), AGR (%), CAGR (%), 2010-2015

Table 8.3 QuintilesIMS Total Revenues ($bn), AGR (%), CAGR (%), 2012-2016

Table 8.4 QuintilesIMS: Financial Performance for Third Quarter Review 2017

Table 8.5 UDG Healthcare Group Profile, Business Units and Areas of Expertise, 2016

Table 8.6 UDG Healthcare: Ashfield Commercial and Medical Services

Segment: Revenues ($bn), AGR (%), CAGR (%), 2012-2016

Table 8.7 UDG Healthcare divisions, profit and employees

Table 8.8 inVentiv Health Commercial Division

Subsidiaries, 2016

Table 8.9 PDI: Commercial Services Revenues ($bn), AGR (%),

CAGR (%), 2010-2014

Table 9.1 Pharma Contract Sales Market: Revenues ($bn),

CAGR (%) and Market Shares (%) by Sector, 2017, 2023, 2028

Table 9.2 Pharma Contract Sales Market: Revenues ($bn), CAGR (%) and Market Shares (%) by Therapeutic Area, 2017, 2023, 2028

Table of Figures

Figure 2.1 The Services Offered by CSOs that Comprise the Pharma Contract Sales Market, 2017

Figure 2.2 Outsourcing Processes in the Pharma Industry, 2017

Figure 2.3 Trends Driving the Need for New Sales Models 2018-2028

Figure 3.1 Global Pharma Contract Sales Market: Revenues ($bn), 2016-2023

Figure 3.2 Global Pharma Contract Sales Market Forecast: Revenue ($bn), 2018-2028

Figure 3.3 FDA New Drug Approvals, 2012-2015

Figure 3.4 Pharma Contract Sales: Market Growth Drivers, 2018-2028

Figure 3.5 Pharma Contract Sales Market: Restraints, 2018-2028

Figure 3.6 Pharma Contract Sales Market Segmented by Therapeutic Area (Line Graph): Revenue ($bn), 2018-2028

Figure 3.7 Pharma Contract Sales Market Segmented by Therapeutic Area (Area Chart): Revenue ($bn), 2018-2028

Figure 3.8 Pharma Contract Sales Market Segmented by Therapeutic Area: Market Shares (%), 2017

Figure 3.9 Pharma Contract Sales Market Segmented by Therapeutic Area: Market Shares (%), 2023

Figure 3.10 Pharma Contract Sales Market Segmented by Therapeutic Area: Market Shares (%), 2028

Figure 3.11 Projected Global Deaths from Ischaemic Heart Disease and Stroke (millions), 2015 and 2030

Figure 3.12 Cardiovascular Disease Submarket Forecast: Revenue ($bn), 2018-2028

Figure 3.13 Diabetes Prevalence in Leading National Markets, 2014

Figure 3.14 Metabolic Disorders Submarket Forecast: Revenue ($bn), 2018-2028

Figure 3.15 Oncology Submarket Forecast: Revenue ($bn), 2018-2028

Figure 4.1 Pharma Contract Sales Market Segmented by Service Sectors: Revenue ($bn), 2018-2028

Figure 4.2 Pharma Contract Sales Market Segmented by Service Sectors: Market Share (%), 2017

Figure 4.3 Pharma Contract Sales Market Segmented by Service Sectors: Market Share (%), 2023

Figure 4.4 Pharma Contract Sales Market Segmented by Service Sectors: Market Share (%), 2028

Figure 4.5 Contract Detailing Submarket Forecast: Revenue ($bn), 2018-2028

Figure 4.6 Contract Detailing Submarket: Drivers and Restraints, 2018-2028

Figure 4.7 Contract Non-Personal Promotion Submarket Forecast: Revenue ($bn), 2018-2028

Figure 4.8 Contract Non-Personal Promotion Submarket Drivers and Restraints, 2018-2028

Figure 4.9 Further Sub-Sectors Within the Contract Non-Personal Promotion Submarket: Forecast: Revenues ($bn), 2018-2028

Figure 4.10 Further Sub-Sectors Within the Contract Non-Personal Promotion Submarket: Market Shares (%), 2017

Figure 4.11 Further Sub-Sectors Within the Contract Non-Personal Promotion Submarket: Market Shares (%), 2028

Figure 4.12 Contract Teledetailing Submarket Forecast: Revenues ($bn), 2018-2028

Figure 4.13 Contract Teledetailing Submarket: Drivers and Restraints, 2018-2028

Figure 4.14 Contract eDetailing Submarket Forecast: Revenues ($bn),

2018-2028

Figure 4.15 Contract eDetailing Submarket Drivers and Restraints, 2018-2028

Figure 4.16 Medical Education Services Submarket Forecast: Revenues ($bn), 2018-2028

Figure 4.17 Medical Education Services Submarket: Drivers and Restraints, 2018-2028

Figure 4.18 Sample Management Services Submarket Forecast: Revenues ($bn), 2018-2028

Figure 4.19 Sample Management Services Submarket Drivers and Restraints, 2018-2028

Figure 5.1 Leading Regional Pharma Contract Sales Markets: Forecast Revenue ($bn), 2018-2028

Figure 5.2 Regional Composition of the Global Pharma Contract Sales Market: Market Shares (%), 2017

Figure 5.3 Regional Composition of the Global Pharma Contract Sales Market: Market Shares (%), 2023

Figure 5.4 Regional Composition of the Global Pharma Contract Sales Market: Market Shares (%), 2028

Figure 5.5 US Pharma Contract Sales Market Forecast: Revenue ($bn), 2018-2028

Figure 5.6 EU5 Pharma Contract Sales Market Forecast: Revenue ($bn), 2018-2028

Figure 5.7 Composition of the EU5 Pharma Contract Sales Market, 2017

Figure 5.8 Composition of the EU5 Pharma Contract Sales Market, 2028

Figure 5.9 UK Pharma Contract Sales Market Forecast: Revenue ($bn), 2018-2028

Figure 5.10 German Pharma Contract Sales Market Forecast: Revenue ($bn), 2018-2028

Figure 5.11 French Pharma Contract Sales Market Forecast: Revenue ($bn), 2018-2028

Figure 5.12 Italian Pharma Contract Sales Market Forecast: Revenue ($bn), 2018-2028

Figure 5.13 Spanish Pharma Contract Sales Market Forecast: Revenue ($bn), 2018-2028

Figure 5.14 Japanese Pharma Contract Sales Market Forecast: Revenue ($bn), 2018-2028

Figure 6.1 BRIC Pharma Contract Sales Market Forecast: Revenue ($bn), 2018-2028

Figure 6.2 BRIC Pharma Contract Sales Market Composition: Revenue ($bn), 2017

Figure 6.3 Chinese Pharma Contract Sales Market Forecast: Revenue ($bn), 2018-2028

Figure 6.4 Indian Pharma Contract Sales Market Forecast: Revenue ($bn), 2018-2028

Figure 6.5 Brazilian Pharma Contract Sales Market Forecast: Revenue ($bn), 2018-2028

Figure 6.6 Russian Pharma Contract Sales Market Forecast: Revenue ($bn), 2018-2028

Figure 7.1 Orphan Drug Pipeline by Disease Area, 2013

Figure 8.1 Quintiles Integrated Health Services Segment: Revenues ($bn), 2010-2015

Figure 8.2 QuintilesIMS Total Revenues ($bn), 2012-2016

Figure 8.3 QuintilesIMS Total Revenues ($bn), 2016-2017

Figure 8.4 UDG Healthcare: Ashfield Commercial and Medical Services Segment: Revenues ($bn), 2010-2016

Figure 8.5 PDI: Commercial Services Revenues ($bn), 2010-2014

Figure 9.1 Pharma Contract Sales Market: Revenues ($bn) by Sector, 2017, 2023, 2028

Figure 9.2 Pharma Contract Sales Market: Revenues ($bn), by Therapeutic Area, 2017, 2021, 2027

AbbVie

Actavis

Actelion Pharmaceuticals

Addison Whitney

Adheris Health

Agence Nationale de Sécurité du Médicament et des Produits de Santé (ANSM)

Agência Nacional de Vigilância Sanitária (ANVISA)

Akrikhin

Alexion

Allergan

Amgen

Apple

Aquilant Specialist Healthcare Services

Arbor Pharmaceuticals Ireland

Arena Pharmaceuticals

Ashfield Commercial and Medical Services

Association of the British Pharmaceutical Industry (ABPI)

AstraZeneca

Bayer Healthcare

Biogaran

Biogaran

Boehringer Ingelheim

Brazilian Ministério da Saúde (Ministry of Health)

Bristol Myers Squibb

Cegedim

Celesio

Celgene

Centers of Medicare and Medicaid Services (CMS)

Chinese Ministry of Health

CMIC

Daiichi Sankyo

Dayarn Pharma

Dendreon

Depomed

DottNet.it

Drug Safety Alliance (DSA)

Eisai

Eli Lilly and Co.

Encore Health Resources

Endo Pharmaceuticals

European Commission (EC)

European Federation of Pharmaceutical Industries and Associations (EFPIA)

European Medicines Agency (EMA)

European Promotional Product Association (EPPA)

Expansis

Food and Drugs Administration (FDA)

Galliard

German FSA

Gesamtverband der Werbeartikel Wirtschaft e.V. (GWW)

Go! Healthcare Marketing

Google

Gralise

Group DCA

GSK

Haymarket Media

Hospira

In2Focus

Innovex

Institut für Qualität und Wirtschaftlichkeit im Gesundheitswesenis (IQWiG)

International Federation of Pharmaceutical Manufacturers & Associations

Interpace BioPharma

inVentiv Health

Invida

J. Knipper and Company

Janssen Biotech

Japanese Pharmaceutical Manufacturers Association (JPMA)

Kadrige

Kare Pharma International

Knowledge Point360

L'Agenzia Italiana del Farmaco (AIFA)

Liberty Lane Partners

Lupin

Marvecs

Medical Communications Group (MCG)

Medical Council of India (MCI)

MediMedia Health

Menarini Asia-Pacific

Merck & Co.

Merqurio Pharma

Merrimack

Millennium Pharmaceuticals

Ministère des Affaires Sociales et de la Santé

National Health Service (NHS)

National Institute for Health and Care Excellence (NICE)

Navicor

Neurocrine Biosciences

Neurocrine Biosciences.

NovaMed

Novartis

Novella Clinical

Novo Nordisk

OnCall LLC

Organization of Pharmaceutical Producers of India (OPPI)

Otsuka

PALIO

PDI

Pharmaceutical Research and Manufacturers of America (PhRMA)

Pharmagistics

Pharmexx

Polpharma

Promius Pharma

Publicis Healthcare Communications Group

Publicis Touchpoint

Qforma

Quantia

QuintilesIMS

Ramco Import Export

Roche

Salesforce.com

Sanofi

Schering-Plough

Sermo

Sharp Packaging Services

Sinclair IS Pharma

Smithkline Beecham

Sofip (Société de Franchise pour l'Information Pharmaceutique)

StayinFront

Symplmed Pharmaceuticals

Synopia Rx

Taiho Oncology

Takeda

Tardis Medical

Temasek Holdings

Tesaro

Teva Pharmaceutical Industries

The Dartmouth Institute for Health Policy and Clinical Practice

The Medicines Company

The Organization of Pharmaceutical Producers of India (OPPI)

Thomas H. Lee Partners

Transgenomic

UDG Healthcare

UK Department of Health

United Therapeutics

Univadis

US Center for Disease Prevention and Control (CDC)

US Congressional Budget Office (CBO)

US Supreme Court

Veeva Systems

Vivus

World Health Organisation (WHO)

ZS Associates

Zuellig Pharma

Download sample pages

Complete the form below to download your free sample pages for Global Pharma Contract Sales Market 2018-2028

Download sample pages

Complete the form below to download your free sample pages for Global Pharma Contract Sales Market 2018-2028

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Latest Pharma news

Visiongain Publishes Drug Delivery Technologies Market Report 2024-2034

The global Drug Delivery Technologies market is estimated at US$1,729.6 billion in 2024 and is projected to grow at a CAGR of 5.5% during the forecast period 2024-2034.

23 April 2024

Visiongain Publishes Cell Therapy Technologies Market Report 2024-2034

The cell therapy technologies market is estimated at US$7,041.3 million in 2024 and is projected to grow at a CAGR of 10.7% during the forecast period 2024-2034.

18 April 2024

Visiongain Publishes Automation in Biopharma Industry Market Report 2024-2034

The global Automation in Biopharma Industry market is estimated at US$1,954.3 million in 2024 and is projected to grow at a CAGR of 7% during the forecast period 2024-2034.

17 April 2024

Visiongain Publishes Anti-obesity Drugs Market Report 2024-2034

The global Anti-obesity Drugs market is estimated at US$11,540.2 million in 2024 and is expected to register a CAGR of 21.2% from 2024 to 2034.

12 April 2024