Industries > Energy > Digital Oilfield Optimisation Market Forecast 2019-2029

Digital Oilfield Optimisation Market Forecast 2019-2029

Forecasts by Process (Production Optimization, Drilling Optimization, Reservoir Optimization, and Others), by Component (Hardware, Software, Services), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America) Plus Analysis of Leading Digital Oilfield Companies

This latest report by business intelligence provider visiongain assesses that digital oilfield spending will reach $22bn in 2019. Operational technology like the use of supervisory control and data acquisition system (SCADA), OPC servers, field devices and distributed control systems aid companies in efficiency measures. This technology is needed now more than ever as companies seek to provide the maximum amount of oil while maintaining the lowest price possible, in order to meet the continuously growing global demand. It is therefore critical that you have your timescales correct and your forecasting plans ready. This report will ensure that you do. Visiongain’s report will ensure that you keep informed and ahead of your competitors. Gain that competitive advantage.

The Digital Oilfield Market Forecast 2019-2029 responds to your need for definitive market data:

Read on to discover how you can exploit the future business opportunities emerging in this sector. Visiongain’s new study tells you and tells you NOW.

In this brand new report, you find 150+ in-depth tables, charts and graphs all unavailable elsewhere.

The 155-page report provides clear, detailed insight into the global Digital Oilfield market. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand new report today, you stay better informed and ready to act.

5 Reasons why you must order and read this report today:

1) Profiles of 10 leading companies operating within the Digital Oilfield Market

• Schlumberger

• Weatherford

• Baker Hughes

• Halliburton

• National Oilwell Varco

• Siemens

• Honeywell

• Rockwell

• ABB

• Emerson

2) 150+ tables & charts illustrating global, regional and digital oilfield submarket forecasts and analysis from 2019-2029

3) Regional forecasts from 2019-2029

North America

• U.S. Market 2019-2029

• Canada Market 2019-2029

• Mexico Market 2019-2029

Asia-Pacific

• China Market 2019-2029

• India Market 2019-2029

• Rest of APAC Market 2019-2029

Europe

• Russia Market 2019-2029

• Norway Market 2019-2029

• Rest of Europe Market 2019-2029

Middle East and Africa

• Saudi Arabia Market 2019-2029

• Iran Market 2019-2029

• Iraq Market 2019-2029

• UAE Market 2019-2029

• Kuwait Market 2019-2029

• Nigeria Market 2019-2029

• Qatar Market 2019-2029

• Rest of MEA Market 2019-2029

Latin America

• Brazil Market 2019-2029

• Venezuela Market 2019-2029

• Rest of Latin America Market 2019-2029

4) Forecasts by Digital Oilfield component from 2019-2029

• Hardware

• Software

• Services

5) Forecasts by Process in Digital Oilfield Market from 2019-2029

• Production optimization

• Drilling optimization

• Reservoir Optimization

• Others

How will you benefit from this report?

• Keep your knowledge base up to speed. Don’t get left behind

• Reinforce your strategic decision-making with definitive and reliable market data

• Learn how to exploit new technological trends

• Realise your company’s full potential within the market

• Understand the competitive landscape and identify potential new business opportunities & partnerships

Who should read this report?

• Anyone with involvement in the digital oilfield market

• Oil & gas operators

• Engineering contractors

• Natural gas traders

• Commodity traders

• Investment managers

• Arbitrage companies and divisions

• Energy price reporting companies

• Energy company managers

• Energy consultants

• Oil and gas company executives and analysts

• Heads of strategic development

• Business development managers

• Marketing managers

• Market analysts,

• Technologists

• Suppliers

• Investors

• Banks

• Government agencies

Visiongain’s study is intended for anyone requiring commercial analyses for thedigital oilfield market and leading companies. You find data, trends and predictions.

Buy our report today the Digital Oilfield Optimisation Market Forecast 2019-2029: Forecasts by Process (Production Optimization, Drilling Optimization, Reservoir Optimization, and Others), by Component (Hardware, Software, Services), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America) Plus Analysis of Leading Digital Oilfield Companies. Avoid missing out by staying informed – get our report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1.1 Global Digital Oilfield Market Overview

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report Include:

1.5 Who is This Report For?

1.6 Methodology

1.6.1 Primary Research

1.6.2 Secondary Research

1.6.3 Market Evaluation& Forecasting Methodology

1.7 Frequently Asked Questions (FAQ).

1.8 Associated Visiongain Reports.

1.9 About Visiongain

2. Introduction to Digital Oilfield Market

2.1 Digital Oilfield Market Definition

2.2 Digital Oilfield Market Structure

2.3 Evolution of Digital Oilfield.

2.4 Advantages of the Digital Oilfield.

2.5 Digital Oilfield Connect Upstream, Midstream and Downstream Operations

2.6 Problems Associated With the Adaption of Digital Oilfield

2.7 Overview of Digital Oilfield by Process

2.7.1 Overview of Digital Oilfield by Production Optimisation Process

2.7.2 Overview of Digital Oilfield by Drilling Optimisation Process

2.7.4 Overview of Digital Oilfield by Others Process

2.8 Overview of Digital Oilfield by Components

2.8.1 Overview of Digital Oilfield by Hardware

2.8.2 Overview of Digital Oilfield by Software

2.8.3 Overview of Digital Oilfield by Services

3. Global Digital Oilfield Market 2019-2029

3.1 Global Digital Oilfield Market Forecast 2019-2029

3.2 Global Digital Oilfield Market Drivers & Restraints 2019

3.2.1 Global Digital Oilfields Market Drivers 2019

3.2.2 Global Digital Oilfield Market Restraints 2019

4. Global Digital Oilfield Process Forecast 2019-2029

4.1 Digital Oilfield Production Optimisation Forecast by Regional 2019-2029

4.2 Digital Oilfield Drilling Optimisation Forecast by Regional 2019-2029

4.3 Digital Oilfield Reservoir Optimisation Forecast by Regional 2019-2029

4.4 Digital Oilfield Others Forecast by Regional 2019-2029

5. Global Digital Oilfield Component Forecast 2019-2029

5.1 Digital Oilfield Hardware Forecast by Regional 2019-2029

5.1.1 Digital Oilfield Hardware Forecast by Process 2019-2029

5.2 Digital Oilfield Software Forecast by Regional 2019-2029

5.2.1 Digital Oilfield Software Forecast by Process 2019-2029

5.3 Digital Oilfield Services Forecast by Regional 2019-2029

5.3.1 Digital Oilfield Services Forecast by Process 2019-2029

6. Regional Digital Oilfield Market Forecast 2019-2029

6.1 North America Digital Oilfield Market Forecast 2019-2029

6.1.1 North America Digital Oilfield Market by Process Forecast 2019-2029

6.1.2 North America Digital Oilfield Market by Components Forecast 2019-2029

6.1.3 North America Digital Oilfield Market by Country Forecast 2019-2029

6.2 Europe Digital Oilfield Market Forecast 2019-2029

6.2.1 Europe Digital Oilfield Market by Process Forecast 2019-2029

6.2.2 Europe Digital Oilfield Market by Components Forecast 2019-2029

6.2.3 Europe Digital Oilfield Market by Country Forecast 2019-2029

6.3 Asia-Pacific Digital Oilfield Market Forecast 2019-2029

6.3.1 Asia-Pacific Digital Oilfield Market by Process Forecast 2019-2029

6.3.2 Asia-Pacific Digital Oilfield Market by Components Forecast 2019-2029

6.3.3 Asia-Pacific Digital Oilfield Market by Country Forecast 2019-2029

6.4 The Middle East and Africa Digital Oilfield Market Forecast 2019-2029

6.4.1 The Middle East and Africa Digital Oilfield Market by Process Forecast 2019-2029

6.4.2 The Middle East and Africa Digital Oilfield Market by Components Forecast 2019-2029

6.4.3 Middle East and Africa Digital Oilfield Market by Country Forecast 2019-2029

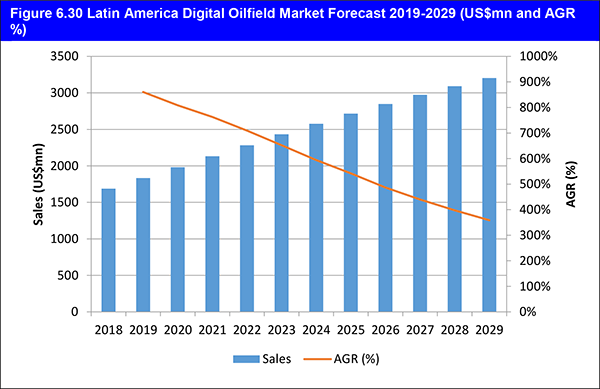

6.5 Latin America Digital Oilfield Market Forecast 2019-2029

6.5.1 Latin America Digital Oilfield Market by Process Forecast 2019-2029

6.5. 2 Latin America Digital Oilfield Market by Components Forecast 2019-2029

6.5.3 Latin America Digital Oilfield Market by Country Forecast 2019-2029

7. Leading Companies in Digital Oilfield Market

7.1 Schlumberger (US)

7.1.1Schlumberger Introduction

7.1.2 Schlumberger Total Company Sales/ Profits and Expenditure 2013-2018

7.1.3 Schlumberger Strategic Alliances

7.1.5 Digital Oilfield Experience of Schlumberger

7.2 Weatherford

7.2.1 Weatherford Introduction

7.2.2 Weatherford Total Company Sales/ Profits and Expenditure 2013-2018

7.2.3 Weatherford Strategic Alliances

7.3 Baker Hughes, a GE company (BHGE):

7.3.1 Baker Hughes Introduction

7.3.2 Baker Hughes Total Company Sales/ Profits and Expenditure 2013-2018

7.3.3 Baker Hughes Strategic Alliances

7.3.4 Digital Oilfield Experience of Baker Hughes

7.4 Halliburton

7.4.1 Halliburton Introduction

7.4.2 Halliburton Total Company Sales/ Profits and Expenditure 2013-2018

7.4.3 Halliburton Strategic Alliances

7.4.6 Digital Oilfield Experience of Halliburton

7.5 National Oilwell Varco

7.5.1 National Oilwell Varco Introduction

7.5.2 National Oilwell Varco Total Company Sales/ Income and Expenditure 2013-2018

7.5.3 National Oilwell Varco Strategic Alliances

7.5.4 Digital Oilfield Experience of National Oilwell Varco

7.6 Siemens

7.6.1 Siemens Introduction

7.6.2 Siemens Total Company Sales and Incomes 2013-2018

7.6.3 Siemens Strategic Alliances

7.6.4 Digital Oilfield Experience of Siemens

7.7 Honeywell

7.7.1 Honeywell Introduction

7.7.2 Honeywell Total Company Sales/ Income and Expenditure 2013-2018

7.7.3 Honeywell Strategic Alliances

7.7.5 Digital Oilfield Experience of Honeywell

7.8 Rockwell

7.8.1 Rockwell Introduction

7.8.2 Rockwell Total Company Sales/Income and Expenditure 2013-2018

7.8.3 Rockwell Strategic Alliances

7.8.4 Digital Oilfield Experience of Rockwell

7.9 ABB

7.9.1 ABB Introduction

7.9.2 ABB Total Company Sales/ Income and Expenditure 2013-2018

7.9.3 ABB Strategic Alliances

7.9.6 Digital Oilfield Experience of ABB

7.10 Emerson

7.10.1 Emerson Introduction

7.10.2 Emerson Total Company Sales/ Income and Expenditure 2013-2018

7.10.3 Emerson Strategic Alliances

7.10.4 Digital Oilfield Experience of Emerson

7.11 Other Companies in the Digital Oilfield Market

8. Conclusions and Recommendations

8.1 Key Findings

8.2 Recommendations

9. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

Appendix B

Visiongain report evaluation form

List of Tables

Table 3.1 Global Digital Oilfield Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 3.2 Global Digital Oilfield Market Drivers & Restraints 2019

Table 4.1 Global Digital Oilfield Market By Process Forecast 2019-2029 (US$mn, AGR %, Cumulative)

Table 4.2 Global Digital Oilfield Production Optimization by Regional Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 4.3 Global Digital Oilfield Drilling Optimization by Regional Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 4.4 Global Digital Oilfield Reservoir Optimization by Regional Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 4.5 Global Digital Oilfield Others by Regional Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.1 Global Digital Oilfield Market By Component Forecast 2019-2029 (US$mn, AGR %, Cumulative)

Table 5.2 Global Digital Oilfield Hardware by Regional Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.3 Global Digital Oilfield Hardware by Process Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.4 Global Digital Oilfield Software by Regional Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.5 Global Digital Oilfield Software by Process Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.6 Global Digital Oilfield Services by Regional Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5.7 Global Digital Oilfield Services by Process Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 6.1 Regional Digital Oilfield Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 6.2 North America Digital Oilfield Market Forecast 2019-2029 (US$mn, AGR %, CAGR %, Cumulative)

Table 6.3 North America Digital Oilfield Market By Process Forecast 2019-2029 (US$mn, AGR %, Cumulative)

Table 6.4 North America Digital Oilfield Market By Component Forecast 2019-2029 (US$mn, AGR %, Cumulative)

Table 6.5 North America Digital Oilfield Market By Country Forecast 2019-2029 (US$mn, AGR %, Cumulative)

Table 6.6 Europe Digital Oilfield Market Forecast 2019-2029 (US$mn, AGR %, CAGR %, Cumulative)

Table 6.7 Europe Digital Oilfield Market By Process Forecast 2019-2029 (US$mn, AGR %, Cumulative)

Table 6.8 Europe Digital Oilfield Market By Component Forecast 2019-2029 (US$mn, AGR %, Cumulative)

Table 6.9 Europe Digital Oilfield Market By Country Forecast 2019-2029 (US$mn, AGR %, Cumulative)

Table 6.10 Asia-Pacific Digital Oilfield Market Forecast 2019-2029 (US$mn, AGR %, CAGR %, Cumulative)

Table 6.11 Asia-Pacific Digital Oilfield Market By Process Forecast 2019-2029 (US$mn, AGR %, Cumulative)

Table 6.12 Asia Pacific Digital Oilfield Market By Component Forecast 2019-2029 (US$mn, AGR %, Cumulative)

Table 6.13 Asia-Pacific Digital Oilfield Market By Country Forecast 2019-2029 (US$mn, AGR %, Cumulative)

Table 6.14 Middle East and Africa Digital Oilfield Market Forecast 2019-2029 (US$mn, AGR %, CAGR %, Cumulative)

Table 6.15 Middle East and Africa Digital Oilfield Market By Process Forecast 2019-2029 (US$mn, AGR %, Cumulative)

Table 6.16 Middle East and Africa Digital Oilfield Market By Component Forecast 2019-2029 (US$mn, AGR %, Cumulative)

Table 6.17 Middle East and Africa Digital Oilfield Market By Country Forecast 2019-2029 (US$mn, AGR %, Cumulative)

Table 6.18 Latin America Digital Oilfield Market Forecast 2019-2029 (US$mn, AGR %, CAGR %, Cumulative)

Table 6.19 Latin America Digital Oilfield Market By Process Forecast 2019-2029 (US$mn, AGR %, Cumulative)

Table 6.20 Latin America Digital Oilfield Market By Component Forecast 2019-2029 (US$mn, AGR %, Cumulative)

Table 6.21 Latin America Digital Oilfield Market By Country Forecast 2019-2029 (US$mn, AGR %, Cumulative)

Table 7.1 Schlumberger 2018 (CEO, Strongest Business Region, Total Revenue $m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.2 Schlumberger Total Company Sales 2013-2018 (US$m, AGR %)

Table 7.3 Schlumberger Total Company Net Income/ Loss 2013-2018 (US$m, AGR %)

Table 7.4 Schlumberger Total Company Capital Expenditure 2013-2018 (US$m, AGR %)

Table 7.5 Schlumberger Strategic Alliances

Table 7.6 Weatherford: 2018 (CEO, Strongest Business Region, Total Revenue $m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.7 Weatherford Total Company Sales 2013-2018 (US$m, AGR %)

Table 7.8 Weatherford Total Company Net Income / Loss 2013-2018 (US$m, AGR %)

Table 7.9 Weatherford Total Company Capital Expenditure 2013-2018 (US$m, AGR %)

Table 7.10 Weatherford Strategic Alliances

Table 7.11 BHGE: 2018 (CEO, Strongest Business Region, Total Revenue $m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.12 Baker Hughes Total Company Sales 2013-2018 (US$m, AGR %)

Table 7.13 Baker Hughes Total Company Net Income 2013-2018 (US$m, AGR %)

Table 7.14 Baker Hughes Total Company Capital Expenditure 2013-2018 (US$m, AGR %)

Table 7.15 Baker Hughes Strategic Alliances

Table 7.16 Halliburton: 2018 (CEO, Strongest Business Region, Total Revenue $m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.17 Halliburton Total Company Sales 2013-2018 (US$m, AGR %)

Table 7.18 Halliburton Total Company Net Income / Loss 2013-2018 (US$m, AGR %)

Table 7.19 Halliburton Total Company Capital Expenditure 2013-2018 (US$m, AGR %)

Table 7.20 Halliburton Strategic Alliances

Table 7.21 National Oilwell Varco: 2018 (CEO, Strongest Business Region, Total Revenue $m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.22 National Oilwell Varco Total Company Sales 2013-2018 (US$m, AGR %)

Table 7.23 National Oilwell Varco Total Company Net Income / Loss 2013-2018 (US$m, AGR %)

Table 7.24 National Oilwell Varco Total Company Capital Expenditure 2013-2018 (US$m, AGR %)

Table 7.25 National Oilwell Verco Strategic Alliances

Table 7.26 Siemens 2018 (CEO, Strongest Business Region, Total Revenue $m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.27 Siemens Total Company Sales 2013-2018 (US$m, AGR %)

Table 7.28 Siemens Total Company Net Income 2013-2018 (US$m, AGR %)

Table 7.29 Siemens Strategic Alliances

Table 7.30 Honeywell 2018 (CEO, Strongest Business Region, Total Revenue $m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.31 Honeywell Total Company Sales 2013-2018 (US$m, AGR %)

Table 7.32 Honeywell Total Company Net Income / Loss 2013-2018 (US$m, AGR %)

Table 7.33 Honeywell Total Company Capital Expenditure 2013-2018 (US$m, AGR %)

Table 7.34 Honeywell Strategic Alliances

Table 7.35 Rockwell 2018 (CEO, Strongest Business Region, Total Revenue $m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.36 Rockwell Total Company Sales 2013-2018 (US$m, AGR %)

Table 7.37 Rockwell Total Company Net Income / Loss 2013-2018 (US$m, AGR %)

Table 7.38 Rockwell Total Company Capital Expenditure 2013-2018 (US$m, AGR %)

Table 7.39 Rockwell Strategic Alliances

Table 7.40 ABB 2018 (CEO, Strongest Business Region, Total Revenue $m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.41 ABB Total Company Sales 2013-2018(US$m, AGR %)

Table 7.42 ABB Total Company Net Income / Loss 2013-2018 (US$m, AGR %)

Table 7.43 ABB Total Company Capital Expenditure 2013-2018 (US$m, AGR %)

Table 7.44 ABB Strategic Alliances

Table 7.45 Emerson 2018 (CEO, Strongest Business Region, Total Revenue $m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.46 Emerson Total Company Sales 2013-2018 (US$m, AGR %)

Table 7.47 Emerson Total Company Net Income / Loss2013-2018 (US$m, AGR %)

Table 7.48 Emerson Total Company Capital Expenditure 2013-2018 (US$m, AGR %)

Table 7.49 Emerson Strategic Alliances

List of Figures

Figure 2.1 Global Digital Oilfield Market Segmentation Overview

Figure 3.1 Global Digital Oilfield Market Forecast 2019-2029 (US$mn, AGR %)

Figure 4.1 Global Digital Oilfield Market By Process AGR Forecast 2019-2029 (AGR %)

Figure 4.2 Global Digital Oilfield Market By Process Forecast 2019-2029 (US$mn)

Figure 5.1 Global Digital Oilfield Market By Components AGR Forecast 2019-2029 (AGR %)

Figure 5.2 Global Digital Oilfield Market By Components Forecast 2019-2029 (US$mn)

Figure 5.3 Global Digital Oilfield Hardware by Regional Market Forecast 2019-2029 (US$m and Global AGR %)

Figure 5.4 Global Digital Oilfield Hardware by Process Market Forecast 2019-2029 (US$m and Global AGR %)

Figure 5.5 Global Digital Oilfield Software by Regional Market Forecast 2019-2029 (US$m and Global AGR %)

Figure 5.6 Global Digital Oilfield Software by Process Market Forecast 2019-2029 (US$m and Global AGR %)

Figure 5.7 Global Digital Oilfield Services by Regional Market Forecast 2019-2029 (US$m and Global AGR %)

Figure 5.8 Global Digital Oilfield Services by Process Market Forecast 2019-2029 (US$m and Global AGR %)

Figure 6.1 Regional Digital Oilfield Market Forecast 2019-2029 (US$m and Global AGR %)

Figure 6.2 North America Digital Oilfield Market Forecast 2019-2029 (US$mn and AGR %)

Figure 6.3 North America Digital Oilfield Market By Process AGR Forecast 2019-2029 (AGR %)

Figure 6.4 North America Digital Oilfield Market By Process Forecast 2019-2029 (US$mn)

Figure 6.5 North America Digital Oilfield Market By Components AGR Forecast 2019-2029 (AGR %)

Figure 6.6 North America Digital Oilfield Market By Components Forecast 2019-2029 (US$mn)

Figure 6.7 North America Digital Oilfield Market By Country AGR Forecast 2019-2029 (AGR %)

Figure 6.8 North America Digital Oilfield Market By Country Forecast 2019-2029 (US$mn)

Figure 6.9 Europe Digital Oilfield Market Forecast 2019-2029 (US$mn and AGR %)

Figure 6.10 Europe Digital Oilfield Market By Process AGR Forecast 2019-2029 (AGR %)

Figure 6.11 Europe Digital Oilfield Market By Process Forecast 2019-2029 (US$mn)

Figure 6.12 Europe Digital Oilfield Market By Components AGR Forecast 2019-2029 (AGR %)

Figure 6.13 Europe Digital Oilfield Market By Components Forecast 2019-2029 (US$mn)

Figure 6.14 Europe Digital Oilfield Market By Country AGR Forecast 2019-2029 (AGR %)

Figure 6.15 Europe Digital Oilfield Market By Country Forecast 2019-2029 (US$mn)

Figure 6.16 Asia-Pacific Digital Oilfield Market Forecast 2019-2029 (US$mn and AGR %)

Figure 6.17 Asia Pacific Digital Oilfield Market By Process AGR Forecast 2019-2029 (AGR %)

Figure 6.18 Asia-Pacific Digital Oilfield Market By Process Forecast 2019-2029 (US$mn)

Figure 6.19 Asia-Pacific Digital Oilfield Market By Components AGR Forecast 2019-2029 (AGR %)

Figure 6.20 Asia-Pacific Digital Oilfield Market By Components Forecast 2019-2029 (US$mn)

Figure 6.21 Asia-Pacific Digital Oilfield Market By Country AGR Forecast 2019-2029 (AGR %)

Figure 6.22 Asia Pacific Digital Oilfield Market By Country Forecast 2019-2029 (US$mn)

Figure 6.23 Middle East and Africa Digital Oilfield Market Forecast 2019-2029 (US$mn and AGR %)

Figure 6.24 Middle East and Africa Digital Oilfield Market By Process AGR Forecast 2019-2029 (AGR %)

Figure 6.25 Middle East and Africa Digital Oilfield Market By Process Forecast 2019-2029 (US$mn)

Figure 6.26 Middle East and Africa Digital Oilfield Market By Components AGR Forecast 2019-2029 (AGR %)

Figure 6.27 Middle East and Africa Digital Oilfield Market By Components Forecast 2019-2029 (US$mn)

Figure 6.28 Middle East and Africa Digital Oilfield Market By Country AGR Forecast 2019-2029 (AGR %)

Figure 6.29 Middle East and Africa Digital Oilfield Market By Country Forecast 2019-2029 (US$mn and AGR %)

Figure 6.30 Latin America Digital Oilfield Market Forecast 2019-2029 (US$mn and AGR %)

Figure 6.31 Latin America Digital Oilfield Market By Process AGR Forecast 2019-2029 (AGR %)

Figure 6.32 Latin America Digital Oilfield Market By Process Forecast 2019-2029 (US$mn and AGR %)

Figure 6.33Latin America Digital Oilfield Market By Components AGR Forecast 2019-2029 (AGR %)

Figure 6.34 Latin America Digital Oilfield Market By Components Forecast 2019-2029 (US$mn)

Figure 6.35 Latin America Digital Oilfield Market By Country AGR Forecast 2019-2029 (AGR %)

Figure 6.36 Latin America Digital Oilfield Market By Country Forecast 2019-2029 (US$mn)

Figure 7.1 Schlumberger Total Company Sales 2013-2018(US$m, AGR %)

Figure 7.2 Schlumberger Total Company Net Income / Loss 2013-2018(US$m, AGR %)

Figure 7.3 Schlumberger Total Company Capital Expenditure 2013-2018(US$m, AGR %)

Figure 7.4 Weatherford Total Company Sales 2013-2018 (US$m, AGR %)

Figure 7.5 Weatherford Total Company Net Income / Loss 2013-2018(US$m, AGR %)

Figure 7.6 Weatherford Total Company Capital Expenditure 2013-2018(US$m, AGR %)

Figure 7.7 Baker Hughes Total Company Sales 2013-2018(US$m, AGR %)

Figure 7.8 Baker Hughes Total Company Net Income / Loss 2013-2018(US$m, AGR %)

Figure 7.9 Baker Hughes Total Company Capital Expenditure 2013-2018(US$m, AGR %)

Figure 7.10 Halliburton Total Company Sales 2013-2018(US$m, AGR %)

Figure 7.11 Halliburton Total Company Net Income / Loss 2013-2018(US$m, AGR %)

Figure 7.12 Halliburton Total Company Capital Expenditure 2013-2018(US$m, AGR %)

Figure 7.13 National Oilwell Varco Total Company Sales 2013-2018(US$m, AGR %)

Figure 7.14 National Oilwell Varco Total Company Net Income / Loss 2013-2018(US$m, AGR %)

Figure 7.15 National Oilwell Varco Total Company Capital Expenditure 2013-2018(US$m, AGR %)

Figure 7.16 Siemens Total Company Sales 2013-2018(US$m, AGR %)

Figure 7.17 Siemens Total Company Net Income / Loss 2013-2018(US$m, AGR %)

Figure 7.18 Honeywell Total Company Sales 2013-2018(US$m, AGR %)

Figure 7.19 Honeywell Total Company Net Income / Loss 2013-2018(US$m, AGR %)

Figure 7.20 Honeywell Total Company Capital Expenditure 2013-2018(US$m, AGR %)

Figure 7.21 Rockwell Total Company Sales2013-2018(US$m, AGR %)

Figure 7.22 Rockwell Total Company Net Income / Loss 2013-2018(US$m, AGR %)

Figure 7.23 Rockwell Total Company Capital Expenditure 2013-2018(US$m, AGR %)

Figure 7.24 ABB Total Company Sales 2013-2018(US$m, AGR %)

Figure 7.25 ABB Total Company Net Income / Loss 2013-2018(US$m, AGR %)

Figure 7.26 ABB Total Company Capital Expenditure 2013-2018(US$m, AGR %)

Figure 7.27 Emerson Total Company Sales 2013-2018(US$m, AGR %)

Figure 7.28 Emerson Total Company Net Income / Loss 2013-2018(US$m, AGR %)

Figure 7.29 Emerson Total Company Capital Expenditure 2013-2018(US$m, AGR %)

Baker Hughes

BP

Cisco

Cyviz

Elf Acquitaine

Emerson

Equinor

ExxonMobil

GA Drilling

GE Oil & Gas

Halliburton

Healthineers

Hexacom

Honeywell

IBM

Infosys

Kongsberg

Microsoft

National Oilwell Varco

Oracle

Rockwell Automation

Saudi Aramco

Schlumberger

Schneider Electric

Shell

Siemens

Siemens Gamesa Renewable Energy (SGRE).

Sinopec Oilfield Service Corporation

TechnipFMC Plc

VSG

Weatherford

Organisations Mentioned

European Union

Institute Francis du Perol

State Oil Company of Azerbaijan Republic (SOCAR)

Download sample pages

Complete the form below to download your free sample pages for Digital Oilfield Optimisation Market Forecast 2019-2029

Related reports

-

Carbon Dioxide (CO2) Enhanced Oil Recovery (EOR) Market 2019-2029

The latest report from business intelligence provider visiongain offers in depth analysis of the global carbon dioxide (CO2) enhanced oil...Full DetailsPublished: 13 December 2018 -

Oil & Gas Subsea Umbilicals, Risers & Flowlines (SURF) Market Report 2019-2029

Visiongain has calculated that the global subsea umbilicals, risers and flowlines (SURF) market will see a capital expenditure (CAPEX) of...

Full DetailsPublished: 02 November 2018 -

The Airborne Geophysical Services Market Forecast 2019-2029

The airborne geophysical services market entails high capital investments along with high risk. The risk involved is comparatively high owing...Full DetailsPublished: 19 March 2019 -

Oil & Gas Cyber Security Market 2017-2027

This latest report by business intelligence provider Visiongain assesses that oil & gas cyber security spending will reach $31.45bn in...

Full DetailsPublished: 17 March 2017 -

Internet of Things (IoT) Security Market Report 2019-2029

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global Internet of Things security market. Visiongain...

Full DetailsPublished: 19 November 2018

Download sample pages

Complete the form below to download your free sample pages for Digital Oilfield Optimisation Market Forecast 2019-2029

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain energy reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and industry experts where possible but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain energy reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

“The Visiongain report was extremely insightful and helped us construct our basic go-to market strategy for our solution.”

H.

“F.B has used Visiongain to prepare two separate market studies on the ceramic proppants market over the last 12 months. These reports have been professionally researched and written and have assisted FBX greatly in developing its business strategy and investment plans.”

F.B

“We just received your very interesting report on the Energy Storage Technologies (EST) Market and this is a very impressive and useful document on that subject.”

I.E.N

“Visiongain does an outstanding job on putting the reports together and provides valuable insight at the right informative level for our needs. The EOR Visiongain report provided confirmation and market outlook data for EOR in MENA with the leading countries being Oman, Kuwait and eventually Saudi Arabia.”

E.S

“Visiongain produced a comprehensive, well-structured GTL Market report striking a good balance between scope and detail, global and local perspective, large and small industry segments. It is an informative forecast, useful for practitioners as a trusted and upto-date reference.”

Y.N Ltd

Association of Dutch Suppliers in the Oil & Gas Industry

Society of Naval Architects & Marine Engineers

Association of Diving Contractors

Association of Diving Contractors International

Associazione Imprese Subacquee Italiane

Australian Petroleum Production & Exploration Association

Brazilian Association of Offshore Support Companies

Brazilian Petroleum Institute

Canadian Energy Pipeline

Diving Medical Advisory Committee

European Diving Technology Committee

French Oil and Gas Industry Council

IMarEST – Institute of Marine Engineering, Science & Technology

International Association of Drilling Contractors

International Association of Geophysical Contractors

International Association of Oil & Gas Producers

International Chamber of Shipping

International Shipping Federation

International Marine Contractors Association

International Tanker Owners Pollution Federation

Leading Oil & Gas Industry Competitiveness

Maritime Energy Association

National Ocean Industries Association

Netherlands Oil and Gas Exploration and Production Association

NOF Energy

Norsk olje og gass Norwegian Oil and Gas Association

Offshore Contractors’ Association

Offshore Mechanical Handling Equipment Committee

Oil & Gas UK

Oil Companies International Marine Forum

Ontario Petroleum Institute

Organisation of the Petroleum Exporting Countries

Regional Association of Oil and Natural Gas Companies in Latin America and the Caribbean

Society for Underwater Technology

Society of Maritime Industries

Society of Petroleum Engineers

Society of Petroleum Enginners – Calgary

Step Change in Safety

Subsea UK

The East of England Energy Group

UK Petroleum Industry Association

All the events postponed due to COVID-19.

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Energy news

Energy as a Service (EaaS) Market

The global Energy as a Service (EaaS) market is projected to grow at a CAGR of 12.6% by 2034

25 July 2024

Synthetic Fuels Market

The global Synthetic Fuels market is projected to grow at a CAGR of 23% by 2034

18 July 2024

Power-to-X (P2X) Market

The global Power-to-X (P2X) market is projected to grow at a CAGR of 10.6% by 2034

09 July 2024

Airborne Wind Energy Market

The global Airborne Wind Energy market is projected to grow at a CAGR of 9.7% by 2034

05 June 2024