This latest report by business intelligence provider Visiongain assesses that the global Car Rental market is expected to grow at a lucrative rate during the forecast period.

Car Rental Service is defined as the vehicle renting service offered by the companies to the user looking to use a car for any term which can be as short as 5-12 hours or long as a year. The customers use the mobile app or desktop browser which provides them the ability to register and log in to the Web App to book, track or cancel their rental plan and cost. The Web App is responsive, allowing the customer to view it on any device, from tablets to mobile phones and desktop computers. The administrator or the rental companies are also able to login through the same form but have the ability to add/remove new car rentals, change prices, and so on. Potential customers are able to view all the cars available to rent even without logging in as well as rent without having an account, though the option is provided upon checkout.

Companies offer car rental service for both foreign and local customers. These companies carry out their daily work by providing; their service to the customers using manual system or automatic systems. The companies use a business intelligence system or traditional manual systems for reserving, renting, register and to keep record of all the rental activities and customer information.

Customers are the vital stakeholders, and with a mobile/web car rental service, one can find the convenience of obtaining a car with circumstances ranging from their current vehicle breaking down to needing a means of transport during vacation or a corporate meeting. The mobile app and ability to rent at a click puts an extreme time saving benefit for the customer having to search around to even find a car rental building. With the car rental service, the companies also assist to locate the store as well as even take the car for the customers, if the customer chooses so.

Car Rental encompasses three discrete sub segments and is segmented by end-use, and vehicle type

• Based on the End-use the global car rental market is segmented as Local Usage, Air Transport, Outstation, and others.

• Based on the Vehicle Type technique the global car rental market is segmented as executive cars, luxury cars, economy cars, SUV’s, and MUV’s.

• Based on the geographic penetration the global car rental market is segmented as North America, Europe, Asia-Pacific and Rest of World

The 161-page report provides clear, detailed insight into the global Car Rental market. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand-new report today, you stay better informed and ready to act.

Report Scope

The report delivers considerable added value by revealing:

• 190 tables, charts and graphs are analysing and revealing the growth prospects and outlook for the Car Rental market.

• Global Car Rental market forecasts and analysis from 2020-2030

• Car Rental market provides CAPEX forecasts and analysis from 2020-2030 for the Car Rental submarkets:

• Top 5 prominent Countries in the Car Rental market

• UK

• India

• Australia

• South Korea

• China

Top 5 companies in the Car Rental market:

• Enterprise Holdings

• Hertz Global Holdings

• Avis Budget Group

• Europcar Mobility Group

• Sixt SE

Recent Companies Activity

Nation Car Rental, a company owned Enterprise Holdings announced an enhanced Car and Driver service offering that makes visiting China more efficient and convenient than ever. The customers can now book transportation – including a car and professional driver – directly through National Car Rental’s website and mobile app.

The Enterprise Rent-A-Car Foundation has donated US$40 Mn to-date to food banks around the world as part of Enterprise’s Fill Your Tank® program, one of the largest donations aimed at fighting hunger.

Hertz announced a new campaign that recognizes the people who helped make Hertz #1 in customer satisfaction. To start, the company partnered with American football running back, Jerome “The Bus” Bettis to celebrate customers with special experiences at the Big Game.

Hertz earned the No. 1 overall ranking in the J.D. Power 2019 North America Rental Car Satisfaction Study – a direct result of the company’s commitment to providing caring, personalized service, offering top-rated vehicles and investing in customer-centric technologies that enhance the travel experience.

Avis Budget Group announced a new agreement with Fiat Chrysler Automobiles (FCA) Group to connect more than 22,000 Fiat vehicles in Avis Budget Group’s European fleet. This allow Avis customers to manage their entire rental experience through the Avis mobile app, including choosing the exact vehicle they want, selecting an upgrade and extending the duration of their rental from their phones

The report provides detailed profiles of key companies operating within the Car Rentals market:

• Enterprise Holdings

• Hertz Global Holdings

• Avis Budget Group

• Europcar Mobility Group

• Sixt SE

• Localiza

• National Car Rental

• Zoomcar Inc.

• Alamo Rent a Car

• Thrifty Car Rental

• Rentalcars.com

• UNIDAS S.A.

as well as key analysis and assessment of other important players

This independent, 161-page report guarantees you will remain better informed than your competition. With more than 122 tables and figures examining the Car Rentals market space, the report gives you a visual, one-stop breakdown of your market. PLUS, capital expenditure forecasts, as well as analysis, from 2020- 2030 keeps your knowledge that one step ahead that you require to succeed.

This report is essential reading for you or anyone in the Automotive sector with an interest in Car Rentals. Purchasing this report today will help you to recognize those important market opportunities and understand the possibilities there. I look forward to receiving your order.

Buy our report today Car Rental Market Analysis Research: Forecasts by End-use (Local Usage, Airport Transport, Outstation, Others) & by Vehicle Type (Luxury Cars, Executive Cars, Economy Cars, SUV’s, MUV’s), Analysis of Technological Advancements Driving the Market. Avoid missing out by staying informed – order our report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1. Report Overview

1.1 Car Rental Market Overview

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by this Analytical Report include:

1.5 Who is This Report for?

1.6 Methodology

1.6.1 Secondary Research

1.6.2 Market Evaluation & Forecasting Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to the Car Rental Market

2.1 Car Rental Market Structure in 2020

2.2 Car Rental Market Definition

2.3 Car Rental End-use Submarkets Definitions

2.3.1 Local usage

2.3.2 Airport Transport

2.3.3 Outstation

2.3.4 Others

2.4 Car Rental Vehicle Type Submarkets Definitions

2.4.1 Executive Cars

2.4.2 Luxury Cars

2.4.3 Economy Cars

2.4.4 SUV’s

2.4.5 MUV’s

3. Vehicle Production by Country 2015-2018

4. Car Rental Rate Analysis by Country

5. Car Rental Fleet Size Analysis by Country

6. Legislative and Regulatory Analysis in the Global Car Rental Industry

7. Business Model and Innovation

8. Fleet Fuel Economy and Utilization

9. Car Rental Market 2020-2030

9.1 Car Rental Market Forecast 2020-2030

9.2 Car Rental Drivers & Restraints

9.2.1 Car Rental Market Drivers 2020

9.2.2 Car Rental Market Restraints 2020

9.2.3 Trends in the Car Rental and Leasing Industry 2020

9.2.4 Car Rental Market Opportunities 2020

9.2.5 Car Rental Market User and Penetration Rate 2017-2030

10. Car Rental Submarket Forecast 2020-2030

10.1 Car Rental End-use Forecast 2020-2030

10.1.1 Local usage Forecast by Region 2020-2030

10.1.2 Airport Transport Forecast by Region 2020-2030

10.1.3 Outstation Forecast by Region 2020-2030

10.1.4 Others Forecast by Region 2020-2030

10.2 Car Rental Vehicle Type Forecast 2020-2030

10.2.1 Luxury Cars Car Rental Forecast 2020-2030

10.2.2 Executive Cars Car Rental Forecast 2020-2030

10.2.3 Economy Cars Car Rental Forecast 2020-2030

10.2.4 SUV’s Car Rental Forecast 2020-2030

10.2.5 MUV’s Car Rental Forecast 2020-2030

11 Leading Regional Car Rental Markets Forecast 2020-2030

11.1 Overview of Regional Car Rental Market Forecast

11.2 North America Car Rental Market Forecast 2020-2030

11.2.1 North America Car Rental End-use Forecast 2020-2030

11.2.2 North America Car Rental Vehicle Type Forecast 2020-2030

11.2.3 North America Car Rental Market Country Forecast 2020-2030

11.3 Europe Car Rental Market Forecast 2020-2030

11.3.1 Europe Car Rental End-use Forecast 2020-2030

11.3.2 Europe Car Rental Vehicle Type Forecast 2020-2030

11.3.3 Europe Car Rental Market Country Forecast 2020-2030

11.4 Asia-Pacific Car Rental Market Forecast 2020-2030

11.4.1 Asia-Pacific Car Rental End-use Forecast 2020-2030

11.4.2 Asia-Pacific Car Rental Vehicle Type Forecast 2020-2030

11.4.3 Asia-Pacific Car Rental Market Country Forecast 2020-2030

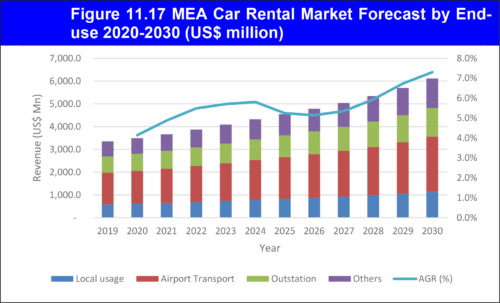

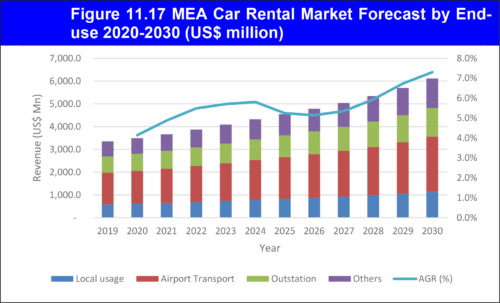

11.5 MEA Car Rental Market Forecast 2020-2030

11.5.1 MEA Car Rental End-use Forecast 2020-2030

11.5.2 MEA Car Rental Vehicle Type Forecast 2020-2030

11.5.3 MEA Car Rental Market Country Forecast 2020-2030

11.6 Latin America Car Rental Market Forecast 2020-2030

11.6.1 Latin America Car Rental End-use Forecast 2020-2030

11.6.2 Latin America Car Rental Vehicle Type Forecast 2020-2030

11.6.3 Latin America Car Rental Market Country Forecast 2020-2030

12. Car Rental Users Analysis by Country, 2020

13. SWOT Analysis of the Global Car Rental Market 2020 - 2030

14. Five Forces Analysis of the Global Car Rental Market 2020 - 2030

15. Competitive Landscape - 13 Car Rental Companies

15.1 Comparative Analysis of 13 Leading Car Rental Companies 2020

15.2 Enterprise Holdings

15.2.1 Introduction

15.2.2 Enterprise Holdings Total Company Sales 2014-2018

15.2.3 Enterprise Holdings Selected Recent Acquisitions, Contracts, and New Product Launches 2015-2019

15.2.4 Enterprise Holdings, Inc.: Strategic Overview of the Car Rental Service Market

15.2.5 Enterprise Holdings, Inc. Primary Market Competitors 2020

15.3 Hertz Global Holdings

15.3.1 Introduction

15.3.2 Hertz Global Holdings Total Company Sales 2014-2018

15.3.3 Hertz Global Holdings Total Company Sales by Rental Service 2019

15.3.4 Hertz Global Holdings Fleet Composition 2019

15.3.5 Hertz Global Holdings Selected Recent Acquisitions, Contracts, and New Product Launches 2015-2019

15.3.6 Hertz Global Holdings: Strategic Overview of the Car Rental Service Market

15.3.7 Hertz Global Holdings Primary Market Competitors 2020

15.4 Avis Budget Group

15.4.1 Introduction

15.4.2 Avis Budget Group Total Company Sales 2014-2018

15.4.3 Avis Budget Group Total Company Sales by Rental Service 2018

15.4.4 Avis Budget Group by Brand 2018

15.4.5 Avis Budget Group by Customer 2018

15.4.6 Avis Budget Group Selected Recent Acquisitions, Contracts, and New Product Launches 2015-2019

15.4.7 Avis Budget Group: Strategic Overview of the Car Rental Service Market

15.4.8 Avis Budget Group Primary Market Competitors 2020

15.5 Europcar Mobility Group

15.5.1 Introduction

15.5.2 Europcar Mobility Group Total Company Sales 2016-2018

15.5.3 Europcar Mobility Group by Business Unit 2018

15.5.4 Europcar Mobility Group by Customer 2018

15.5.5 Europcar Mobility Group Selected Recent Acquisitions, Contracts, and New Product Launches 2015-2019

15.5.6 Europcar Mobility Group: Strategic Overview of the Car Rental Service Market

15.5.7 Europcar Mobility Group Primary Market Competitors 2020

15.6 Sixt SE

15.6.1 Introduction

15.6.2 Sixt SE Total Company Sales 2015-2018

15.6.3 Sixt SE Total Company Sales by Service 2018

15.6.4 Sixt SE Selected Recent Acquisitions, Contracts, and New Product Launches 2019-2020

15.6.5 Sixt SE: Strategic Overview of the Car Rental Service Market

15.6.6 Sixt SE Primary Market Competitors 2020

15.7 National Car Rental

15.7.1 Introduction

15.7.2 National Car Rental Selected Recent Acquisitions, Contracts, and New Product Launches 2015-2019

15.7.3 National Car Rental: Strategic Overview of the Car Rental Service Market

15.7.4 National Car Rental Primary Market Competitors 2020

15.8 Alamo Rent a Car

15.8.1 Introduction

15.8.2 Alamo Rent a Car: Strategic Overview of the Car Rental Service Market

15.8.3 Alamo Rent a Car Primary Market Competitors 2020

15.9 Localiza

15.9.1 Introduction

15.9.2 Localiza Total Company Sales 2014-2018

15.9.3 Localiza Total Company Sales by Service 2018

15.9.4 Localiza by Geography 2018

15.9.5 Localiza Selected Recent Acquisitions, Contracts, and New Product Launches 2015-2019

15.9.6 Localiza: Strategic Overview of the Car Rental Service Market

15.9.7 Localiza Primary Market Competitors 2020

15.10 Thrifty Car Rental

15.10.1 Introduction

15.10.2 Thrifty Car Rental Selected Recent Acquisitions, Contracts, and New Product Launches 2015-2019

15.10.3 Thrifty Car Rental Primary Market Competitors 2020

15.11 Rentalcars.com

15.11.1 Introduction

15.11.2 Rentalcars.com: Strategic Overview of the Car Rental Service Market

15.11.3 Rentalcars.com Primary Market Competitors 2020

15.12 Zoomcar Inc.

15.12.1 Introduction

15.12.2 Zoomcar Inc. Selected Recent Acquisitions, Contracts, and New Product Launches 2015-2019

15.12.3 Zoomcar Inc.: Strategic Overview of the Car Rental Service Market

15.12.4 Zoomcar Inc. Primary Market Competitors 2020

15.13 UNIDAS S.A.

15.13.1 Introduction

15.13.2 UNIDAS S.A. Total Company Sales 2017-2018

15.13.3 UNIDAS S.A. Total Company Sales by Service 2018

15.13.4 UNIDAS S.A. Selected Recent Acquisitions, Contracts, and New Product Launches 2015-2019

15.13.5 UNIDAS S.A. Primary Market Competitors 2020

15.14 Other Companies in Car Rental Market

16. Conclusions and Recommendations

17. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Figure

Figure 2.1 Car Rental Market Segmentation Overview

Figure 3.1 Car Rental Market Forecast 2020-2030 (US$ million, Global AGR %)

Figure 9.1 Car Rental Market Forecast 2020-2030 (US$ million, Global AGR %)

Figure 9.2 Car Rental Market User 2017-2030

Figure 9.3 Car Rental Market Penetration Rate 2017-2030

Figure 10.1 Car Rental End Submarket AGR Forecast 2020-2030 (AGR %)

Figure 10.2 Car Rental Application Market Forecast 2020-2030 (US$ million, Global AGR %)

Figure 10.3 Car Rental End Submarket Shares Forecast 2020, 2025, 2030 (% Share)

Figure 10.4 Local usage Submarket Forecast by Regional Market 2020-2030 (US$ million)

Figure 10.5 Local usage Share by Region 2020, 2025, 2030 (% Share)

Figure 10.6 Airport Transport Submarket Forecast by Regional Market 2020-2030 (US$ million)

Figure 10.7 Airport Transport Market Share by Region 2020, 2025, 2030 (% Share)

Figure 10.8 Outstation Submarket Forecast by Regional Market 2020-2030 (US$ million)

Figure 10.9 Outstation Share by Region 2020, 2025, 2030 (% Share)

Figure 10.10 Others Submarket Forecast by Regional Market 2020-2030 (US$ million)

Figure 10.11 Others Share by Region 2020, 2025, 2030 (% Share)

Figure 10.12 Car Rental Vehicle Type Submarket AGR Forecast 2020-2030 (AGR %)

Figure 10.13 Car Rental Vehicle Type Forecast 2020-2030 (US$ million, Global AGR %)

Figure 10.14 Car Rental Vehicle Type Shares 2020, 2025, 2030 (% Share)

Figure 10.15 Luxury Cars Submarket Forecast by Regional Market 2020-2030 (US$ million)

Figure 10.16 Luxury Cars Share by Region 2020, 2025, 2030 (% Share)

Figure 10.17 Executive Cars Submarket Forecast by Regional Market 2020-2030 (US$ million)

Figure 10.18 Executive Cars Share by Region 2020, 2025, 2030 (% Share)

Figure 10.19 Economy Cars Submarket Forecast by Regional Market 2020-2030 (US$ million)

Figure 10.20 Economy Cars Share by Region 2020, 2025, 2030 (% Share)

Figure 10.21 SUV’s Submarket Forecast by Regional Market 2020-2030 (US$ million)

Figure 10.22 SUV’s Share by Region 2020, 2025, 2030 (% Share)

Figure 10.23 MUV’s Submarket Forecast by Regional Market 2020-2030 (US$ million)

Figure 10.24 MUV’s Share by Region 2020, 2025, 2030 (% Share)

Figure 11.1 Leading Regional Car Rental Markets Forecast 2020-2030 (US$ million, Global AGR %)

Figure 11.2 Leading Regional Car Rental Markets Forecast2020-2030(Sales US$ million, Global AGR %)

Figure 11.3 Leading Regional Car Rental Market Share by Region 2020, 2025, 2030 (% Share)

Figure 11.4 North America Car Rental Market Forecast 2020-2030 (US$ million, AGR %)

Figure 11.5 North America Car Rental Market Forecast by End-use 2020-2030 (US$ million)

Figure 11.6 North America Car Rental Market Forecast by Vehicle Type 2020-2030 (US$ million)

Figure 11.7 North America Car Rental Market Forecast by Country 2020-2030 (US$ million, Global AGR

Figure 11.8 Europe Car Rental Market Forecast 2020-2030 (US$ million, AGR %)

Figure 11.9 Europe Car Rental Market Forecast by End-use 2020-2030 (US$ million)

Figure 11.10 Europe Car Rental Market Forecast by Vehicle Type 2020-2030 (US$ million)

Figure 11.11 Europe Car Rental Market Forecast by Country 2020-2030 (US$ million, Global AGR %)

Figure 11.12 Asia Pacific Car Rental Market Forecast 2020-2030 (US$ million, AGR %)

Figure 11.13 Asia-Pacific Car Rental Market Forecast by End-use 2020-2030 (US$ million)

Figure 11.14 Asia-Pacific Car Rental Market Forecast by Vehicle Type 2020-2030 (US$ million)

Figure 11.15 Asia-Pacific Car Rental Market Forecast by Country Market 2020-2030 (US$ million, Global AGR

Figure 11.16 MEA Car Rental Market Forecast 2020-2030 (US$ million, AGR %)

Figure 11.17 MEA Car Rental Market Forecast by End-use 2020-2030 (US$ million)

Figure 11.18 MEA Car Rental Market Forecast by Vehicle Type 2020-2030 (US$ million)

Figure 11.19 MEA Car Rental Market Forecast by Country Market 2020-2030 (US$ million, Global AGR

Figure 11.20 Latin America Car Rental Market Forecast 2020-2030 (US$ million, AGR %)

Figure 11.21 Latin America Car Rental Market Forecast by End-use 2020-2030 (US$ million)

Figure 11.22 Latin America Car Rental Market Forecast by Vehicle Type 2020-2030 (US$ million)

Figure 11.23 Latin America Car Rental Market Forecast by Country Market 2020-2030 (US$ million, Global

Figure 14.1 Five Force Analysis of the Global Car Rental Market 2020-2030

Figure 15.1 Enterprise Holdings Total Company Sales 2014-2018 (US$ million, AGR%)

Figure 15.2 Enterprise Holdings, Inc. Primary Market Competitors 2020

Figure 15.3 Hertz Global Holdings Total Company Sales 2014-2018 (US$ million, AGR%)

Figure 15.4 Hertz Global Holdings By Rental Service Area, 2019

Figure 15.5 Hertz Global Holdings Fleet Composition, 2019

Figure 15.6 Hertz Global Holdings Primary Market Competitors 2020

Figure 15.7 Avis Budget Group Total Company Sales 2014-2018 (US$ million, AGR%)

Figure 15.8 Avis Budget Group By Rental Service Area, 2018

Figure 15.9 Avis Budget Group By Brand, 2018

Figure 15.10 Avis Budget Group By Customer, 2018

Figure 15.11 Avis Budget Group Primary Market Competitors 2020

Figure 15.12 Europcar Mobility Group Total Company Sales 2016-2018 (US$ million, AGR%)

Figure 15.13 Europcar Mobility Group By Business Unit, 2018

Figure 15.14 Europcar Mobility Group By Customer, 2018

Figure 15.15 Europcar Mobility Group Primary Market Competitors 2020

Figure 15.16 Sixt SE Total Company Sales 2015-2018 (US$ million, AGR%)

Figure 15.17 Sixt SE By Service Area, 2018

Figure 15.18 Sixt SE Primary Market Competitors 2020

Figure 15.19 National Car Rental Primary Market Competitors 2020

Figure 15.20 Alamo Rent a Car Primary Market Competitors 2020

Figure 15.21 Localiza Total Company Sales 2015-2018 (US$ million, AGR%)

Figure 15.22 Localiza By Service, 2018

Figure 15.23 Localiza By Geography, 2018

Figure 15.24 Localiza Primary Market Competitors 2020

Figure 15.25 Thrifty Car Rental Primary Market Competitors 2020

Figure 15.26 Rentalcars.com Primary Market Competitors 2020

Figure 15.27 Zoomcar Inc. Primary Market Competitors 2020

Figure 15.28 UNIDAS S.A. Total Company Sales 2017-2018 (US$ million, AGR%)

Figure 15.29 UNIDAS S.A. By Service, 2018

Figure 15.30 UNIDAS S.A. Primary Market Competitors 2020

List of Table

Table 3.1 Vehicle Production By Country, 2015-2018

Table 4.1 Car Rental Rate Analysis By Country, 2020

Table 5.1 Rental Car in Service By Country, 2019

Table 9.1 Car Rental Market Forecast 2020-2030 (US$ million, AGR %, CAGR %, Cumulative)

Table 9.2 Car Rental Market Drivers, Restraints, Trends and Opportunities 2020

Table 10.1 Car Rental End Submarket Forecast 2020-2030 (US$ million, AGR %, Cumulative)

Table 10.2 Local usage Submarket by Regional Market Forecast 2020-2030 (US$ million, AGR %, CAGR %, Cumulative)

Table 10.3 Airport Transport Submarket by Regional Market Forecast 2020-2030 (US$ million, AGR %, CAGR %, Cumulative)

Table 10.4 Outstation Submarket by Regional Market Forecast 2020-2030 (US$ million, AGR %, CAGR %, Cumulative)

Table 10.5 Others Submarket by Regional Market Forecast 2020-2030 (US$ million, AGR %, CAGR %, Cumulative)

Table 10.6 Car Rental Vehicle Type Submarket Forecast 2020-2030 (US$ million, AGR %, CAGR %, Cumulative)

Table 10.7 Luxury Cars Submarket by Regional Market Forecast 2020-2030 (US$ million, AGR %, CAGR %, Cumulative)

Table 10.8 Executive Cars Submarket by Regional Market Forecast 2020-2030 (US$ million, AGR %, CAGR %, Cumulative)

Table 10.9 Economy Cars Submarket by Regional Market Forecast 2020-2030 (US$ million, AGR %, CAGR %, Cumulative)

Table 10.10 SUV’s Submarket by Regional Market Forecast 2020-2030 (US$ million, AGR %, CAGR %, Cumulative)

Table 10.11 MUV’s Submarket by Regional Market Forecast 2020-2030 (US$ million, AGR %, CAGR %, Cumulative)

Table 11.1 Leading Regional Car Rental Markets by Submarket Forecast 2020-2030 (US$ million, Global AGR %, Cumulative)

Table 11.3 North America Car Rental Market Forecast by End-use 2020-2030 (US$ million, Cumulative)

Table 11.2 North America Car Rental Market Forecast 2020-2030 (US$ million, AGR %, CAGR %, Cumulative)

Table 11.4 North America Car Rental Market Forecast by Vehicle Type 2020-2030 (US$ million, Cumulative)

Table 11.5 North America Car Rental Market Forecast by Country 2020-2030 (US$ million, AGR %, Cumulative)

Table 11.6 Europe Car Rental Market Forecast 2020-2030 (US$ million, AGR %, CAGR %, Cumulative)

Table 11.7 Europe Car Rental Market Forecast by End-use 2020-2030 (US$ million, Cumulative)

Table 11.8 Europe Car Rental Market Forecast by Vehicle Type 2020-2030 (US$ million, Cumulative)

Table 11.9 Europe Car Rental Market Forecast by Country 2020-2030 (US$ million, AGR %, CAGR %, Cumulative)

Table 11.10 Asia Pacific Car Rental Market Forecast 2020-2030 (US$ million, AGR %, CAGR %, Cumulative)

Table 11.11 Asia-Pacific Car Rental Market Forecast by End-use 2020-2030 (US$ million, CAGR %)

Table 11.12 Asia-Pacific Car Rental Market Forecast by Vehicle Type 2020-2030 (US$ million, Cumulative)

Table 11.13 Asia-Pacific Car Rental Market Forecast by Country 2020-2030 (US$ million, AGR %, CAGR %, Cumulative)

Table 11.14 MEA Car Rental Market Forecast 2020-2030 (US$ million, AGR %, CAGR %, Cumulative)

Table 11.15 MEA Car Rental Market Forecast by End-use 2020-2030 (US$ million, Cumulative)

Table 11.16 MEA Car Rental Market Forecast by Vehicle Type 2020-2030 (US$ million, Cumulative)

Table 11.17 MEA Car Rental Market Forecast by Country 2020-2030 (US$ million, AGR %, CAGR %, Cumulative)

Table 11.18 Latin America Car Rental Market Forecast 2020-2030 (US$ million, AGR %, CAGR %, Cumulative)

Table 11.19 Latin America Car Rental Market Forecast by End-use 2020-2030 (US$ million, Cumulative)

Table 11.20 Latin America Car Rental Market Forecast by Vehicle Type 2020-2030 (US$ million, Cumulative)

Table 11.21 Latin America Car Rental Market Forecast by Country 2020-2030 (US$ million, AGR %, CAGR %, Cumulative)

Table 12.1 Car Rental Average Revenue Per User, Number of Users (Mn) and User Penetration (%), By Country 2020

Table 13.1 Global Car Rental Market SWOT Analysis 2020-2030

Table 15.1 Leading 13 Car Rental Companies (Company, FY 2018 Total Company Sales US $m*Latest, HQ)

Table 15.2 Enterprise Holdings Profile 2019 (CEO, Total Company Sales US$bn, Net Income US$ million, HQ, Founded, No. of Employees, Ticker, Website)

Table 15.3 Enterprise Holdings Total Company Sales 2014-2018 (US$ million, AGR%)

Table 15.4 Enterprise Holdings Selected Recent Acquisitions, Contracts, and New Product Launches 2015-2019 (Date, Programme Type, Details)

Table 15.5 Hertz Global Holdings Profile 2019 (CEO, Total Company Sales US$bn, Net Income US$ million, HQ, Founded, No. of Employees, Ticker, Website)

Table 15.6 Hertz Global Holdings Total Company Sales 2014-2018 (US$ million, AGR%)

Table 15.7 Hertz Global Holdings Selected Recent Acquisitions, Contracts, and New Product Launches 2015-2019 (Date, Programme Type, Details)

Table 15.8 Avis Budget Group Profile 2018 (CEO, Total Company Sales US$bn, Net Income US$ million, HQ, Founded, No. of Employees, Ticker, Website)

Table 15.9 Avis Budget Group Total Company Sales 2014-2018 (US$ million, AGR%)

Table 15.10 Avis Budget Group Selected Recent Acquisitions, Contracts, and New Product Launches 2015-2019 (Date, Programme Type, Details)

Table 15.11 Europcar Mobility Group Profile 2018 (CEO, Total Company Sales US$bn, Net Income US$ million, HQ, Founded, No. of Employees, Ticker, Website)

Table 15.12 Europcar Mobility Group Total Company Sales 2014-2018 (US$ million, AGR%)

Table 15.13 Europcar Mobility Group Selected Recent Acquisitions, Contracts, and New Product Launches 2015-2019 (Date, Programme Type, Details)

Table 15.14 Sixt SE Profile 2018 (CEO, Total Company Sales US$bn, Net Income US$ million, HQ, Founded, No. of Employees, Ticker, Website)

Table 15.15 Sixt SE Total Company Sales 2015-2018 (US$ million, AGR%)

Table 15.16 Sixt SE Selected Recent Acquisitions, Contracts, and New Product Launches 2015-2019 (Date, Programme Type, Details)

Table 15.17 National Car Rental Profile 2018 (CEO, Total Company Sales US$ MILLIONn, Net Income US$ million, HQ, Founded, No. of Employees, Ticker,

Table 15.18 National Car Rental Selected Recent Acquisitions, Contracts, and New Product Launches 2015-2019 (Date, Programme Type, Details)

Table 15.19 Alamo Rent a Car Profile 2018 (CEO, Total Company Sales US$bn, Net Income US$ million, HQ, Founded, No. of Employees, Ticker,

Table 15.20 Localiza Profile 2018 (CEO, Total Company Sales US$bn, HQ, Founded, No. of Employees, Ticker, Website)

Table 15.21 Localiza Total Company Sales 2014-2018 (US$ million, AGR%)

Table 15.22 Localiza Selected Recent Acquisitions, Contracts, and New Product Launches 2015-2019 (Date, Programme Type, Details)

Table 15.23 Thrifty Car Rental Profile 2018 (CEO, Total Company Sales US$bn, Net Income US$ million, HQ, Founded, No. of Employees, Ticker, Website)

Table 15.24 Thrifty Car Rental Selected Recent Acquisitions, Contracts, and New Product Launches 2015-2019 (Date, Programme Type, Details)

Table 15.25 Rentalcars.com Profile 2018 (CEO, Total Company Sales US$bn, Net Income US$ million, HQ, Founded, No. of Employees, Ticker, Website)

Table 15.26 Zoomcar Inc. Profile 2018 (CEO, Total Company Sales US$ MILLIONn, HQ, Founded, No. of Employees, Ticker, Website)

Table 15.27 Zoomcar Inc. Selected Recent Acquisitions, Contracts, and New Product Launches 2015-2019 (Date, Programme Type, Details)

Table 15.28 UNIDAS S.A. Profile 2019 (CEO, Total Company Sales US$bn, Net Income US$ million, HQ, Founded, No. of Employees, Ticker, Website)

Table 15.29 UNIDAS S.A. Total Company Sales 2017-2018 (US$ million, AGR%)

Table 15.30 UNIDAS S.A. Selected Recent Acquisitions, Contracts, and New Product Launches 2015-2019 (Date, Programme Type, Details)

Table 15.31 Other Companies in the Car Rental Market