Industries > Energy > Next Generation Energy Storage Technologies (EST) Market Report 2024-2034

Next Generation Energy Storage Technologies (EST) Market Report 2024-2034

Forecasts by Hydrogen (Hydrogen Fuel Cells, Hydrogen Compression and Storage), by Mechanical (Pumped Hydro Storage, Compressed Air Energy Storage (CAES), Flywheel Energy Storage), by Battery Type (Lithium-ion Batteries, Sodium-Sulfur Batteries, Flow Batteries, Advanced Lead-Acid Batteries), by Application (Electric Vehicles (EVs), Residential Energy Storage, Commercial and Industrial (C&I), Utility-Scale Storage, Other), by Technology Type (Battery Energy Storage, Mechanical Energy Storage, Thermal Energy Storage, Hydrogen Energy Storage, Advanced Capacitors, Other) AND Regional and Leading National Market Analysis PLUS Analysis of Leading Companies AND COVID-19 Impact and Recovery Pattern Analysis

The Next Generation Energy Storage Technologies (EST) Market Report 2024-2034: This report will prove invaluable to leading firms striving for new revenue pockets if they wish to better understand the industry and its underlying dynamics. It will be useful for companies that would like to expand into different industries or to expand their existing operations in a new region.

The Next Generation Energy Storage Technologies (EST) Market Is at the Forefront of a Transformative Shift in the Global Energy Landscape

The next generation energy storage technologies (EST) market is at the forefront of a transformative shift in the global energy landscape, driven by a growing demand for sustainable and efficient energy storage solutions. This market encompasses a diverse range of innovative technologies, including advanced batteries, hydrogen storage, and novel mechanical storage systems, aiming to address the challenges posed by intermittent renewable energy sources and optimize energy utilization across various sectors.

The market is propelled by several key drivers. Firstly, the increasing integration of renewable energy sources, such as solar and wind, into the power grid necessitates advanced energy storage solutions to manage fluctuations in energy supply. Additionally, a rising awareness of environmental sustainability and the urgent need to reduce carbon emissions are driving investments and policies favouring the adoption of cleaner and more efficient energy storage technologies. The electrification of transportation, particularly the rapid growth of electric vehicles (EVs), is further accelerating the demand for high-performance energy storage solutions.

Risk Associated with Battery Energy Storage System Hinder the Market Growth

The growth of the energy storage market is hindered by various restraining factors, with a prominent one being the risks associated with Battery Energy Storage Systems (BESS). The intricate nature of these systems poses challenges that could impede market expansion. One major concern is the potential for battery failure, which can occur due to a variety of reasons, including environmental factors, suboptimal construction, electrical abuse, physical damage, or temperature issues. The consequences of a failed system can range from the battery exploding to catching fire or emitting poisonous gases, highlighting the critical need for robust preventive measures and security protocols.

What Questions Should You Ask before Buying a Market Research Report?

- How is the next generation energy storage technologies (EST) market evolving?

- What is driving and restraining the next generation energy storage technologies (EST) market?

- How will each next generation energy storage technologies (EST) submarket segment grow over the forecast period and how much revenue will these submarkets account for in 2034?

- How will the market shares for each next generation energy storage technologies (EST) submarket develop from 2024 to 2034?

- What will be the main driver for the overall market from 2024 to 2034?

- Will leading next generation energy storage technologies (EST) markets broadly follow the macroeconomic dynamics, or will individual national markets outperform others?

- How will the market shares of the national markets change by 2034 and which geographical region will lead the market in 2034?

- Who are the leading players and what are their prospects over the forecast period?

- What are the next generation energy storage technologies (EST) projects for these leading companies?

- How will the industry evolve during the period between 2024 and 2034? What are the implications of next generation energy storage technologies (EST) projects taking place now and over the next 10 years?

- Is there a greater need for product commercialisation to further scale the next generation energy storage technologies (EST) market?

- Where is the next generation energy storage technologies (EST) market heading and how can you ensure you are at the forefront of the market?

- What are the best investment options for new product and service lines?

- What are the key prospects for moving companies into a new growth path and C-suite?

You need to discover how this will impact the next generation energy storage technologies (EST) market today, and over the next 10 years:

- Our 421-page report provides 130 tables and 210 charts/graphs exclusively to you.

- The report highlights key lucrative areas in the industry so you can target them – NOW.

- It contains in-depth analysis of global, regional and national sales and growth.

- It highlights for you the key successful trends, changes and revenue projections made by your competitors.

This report tells you TODAY how the next generation energy storage technologies (EST) market will develop in the next 10 years, and in line with the variations in COVID-19 economic recession and bounce. This market is more critical now than at any point over the last 10 years.

Forecasts to 2034 and other analyses reveal commercial prospects

- In addition to revenue forecasting to 2034, our new study provides you with recent results, growth rates, and market shares.

- You will find original analyses, with business outlooks and developments.

- Discover qualitative analyses (including market dynamics, drivers, opportunities, restraints and challenges), cost structure, impact of rising next generation energy storage technologies (EST) prices and recent developments.

This report includes data analysis and invaluable insight into how COVID-19 will affect the industry and your company. Four COVID-19 recovery patterns and their impact, namely, “V”, “L”, “W” and “U” are discussed in this report.

Segments Covered in the Report

Market Segment by Hydrogen

- Hydrogen Fuel Cells

- Hydrogen Compression and Storage

Market Segment by Mechanical

- Pumped Hydro Storage

- Compressed Air Energy Storage (CAES)

- Flywheel Energy Storage

Market Segment by Battery Type

- Lithium-ion Batteries

- Sodium-Sulfur Batteries

- Flow Batteries

- Advanced Lead-Acid Batteries

Market Segment by Application

- Electric Vehicles (EVs)

- Residential Energy Storage

- Commercial and Industrial (C&I)

- Utility-Scale Storage

- Other Applications

Market Segment by Technology Type

- Battery Energy Storage

- Mechanical Energy Storage

- Thermal Energy Storage

- Hydrogen Energy Storage

- Advanced Capacitors

- Other Technology Type

In addition to the revenue predictions for the overall world market and segments, you will also find revenue forecasts for four regional and 20 leading national markets:

North America

- U.S.

- Canada

Europe

- Germany

- Spain

- United Kingdom

- France

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Need industry data? Please contact us today.

The report also includes profiles and for some of the leading companies in the Next Generation Energy Storage Technologies (EST) Market, 2024 to 2034, with a focus on this segment of these companies’ operations.

Leading companies profiled in the report

- AES Energy Storage, LLC

- Alevo Group S.A.

- BYD Co. Ltd

- Fluence Energy

- General Electric Company

- Greensmith Energy Management Systems

- Hitachi Chemical Co., Ltd.

- Leclanché S.A.

- LG Chem Ltd.

- Maxwell Technologies Inc

- NEC Corporation

- Panasonic Holdings Corporation

- Saft Groupe SAS

- Samsung SDI Co. Ltd.

- Siemens AG

Overall world revenue for Next Generation Energy Storage Technologies (EST) Market, 2024 to 2034 in terms of value the market will surpass US$22.2 billion in 2024, our work calculates. We predict strong revenue growth through to 2034. Our work identifies which organizations hold the greatest potential. Discover their capabilities, progress, and commercial prospects, helping you stay ahead.

How will the Next Generation Energy Storage Technologies (EST) Market, 2024 to 2034 report help you?

In summary, our 420+ page report provides you with the following knowledge:

- Revenue forecasts to 2034 for Next Generation Energy Storage Technologies (EST) Market, 2024 to 2034 Market, with forecasts for hydrogen, mechanical, battery type, application, and technology type, each forecast at a global and regional level – discover the industry’s prospects, finding the most lucrative places for investments and revenues.

- Revenue forecasts to 2034 for four regional and 20 key national markets – See forecasts for the Next Generation Energy Storage Technologies (EST) Market, 2024 to 2034 market in North America, Europe, Asia-Pacific, Latin America and Middle East & Africa. Also forecasted is the market in the US, Canada, Brazil, Germany, France, UK, Italy, China, India, Japan, and Australia among other prominent economies.

- Prospects for established firms and those seeking to enter the market – including company profiles for 15 of the major companies involved in the Next Generation Energy Storage Technologies (EST) Market, 2024 to 2034.

Find quantitative and qualitative analyses with independent predictions. Receive information that only our report contains, staying informed with invaluable business intelligence.

Information found nowhere else

With our new report, you are less likely to fall behind in knowledge or miss out on opportunities. See how our work could benefit your research, analyses, and decisions. Visiongain’s study is for everybody needing commercial analyses for the Next Generation Energy Storage Technologies (EST) Market, 2024 to 2034, market-leading companies. You will find data, trends and predictions.

To access the data contained in this document please email contactus@visiongain.com

Buy our report today Next Generation Energy Storage Technologies (EST) Market Report 2024-2034: Forecasts by Hydrogen (Hydrogen Fuel Cells, Hydrogen Compression and Storage), by Mechanical (Pumped Hydro Storage, Compressed Air Energy Storage (CAES), Flywheel Energy Storage), by Battery Type (Lithium-ion Batteries, Sodium-Sulfur Batteries, Flow Batteries, Advanced Lead-Acid Batteries), by Application (Electric Vehicles (EVs), Residential Energy Storage, Commercial and Industrial (C&I), Utility-Scale Storage, Other), by Technology Type (Battery Energy Storage, Mechanical Energy Storage, Thermal Energy Storage, Hydrogen Energy Storage, Advanced Capacitors, Other) AND Regional and Leading National Market Analysis PLUS Analysis of Leading Companies AND COVID-19 Impact and Recovery Pattern Analysis. Avoid missing out by staying informed – order our report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for a specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: contactus@visiongain.com

1.1 Objectives of the Study

1.2 Introduction to Next Generation Energy Storage Technologies (EST) Market

1.3 What This Report Delivers

1.4 Why You Should Read This Report

1.5 Key Questions Answered by This Analytical Report

1.6 Who Is This Report for?

1.7 Methodology

1.7.1 Market Definitions

1.7.2 Market Evaluation & Forecasting Methodology

1.7.3 Data Validation

1.7.3.1 Primary Research

1.7.3.2 Secondary Research

1.8 Frequently Asked Questions (FAQs)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2 Executive Summary

3 Market Overview

3.1 Key Findings

3.2 Market Dynamics

3.2.1 Market Driving Factors

3.2.1.1 Growing Demand for Energy Coupled with Increasing Share of Renewable Sources

3.2.1.2 The Rising Global Demand for Energy, Driven by Population Growth and Industrialization

3.2.1.3 Ongoing Research and Development lead to Advancements in Energy Storage Technologies

3.2.2 Market Restraining Factors

3.2.2.1 Risk Associated with Battery Energy Storage System Hinder the Market Growth

3.2.2.2 High Cost of Installing Energy Storage Technologies Hinder the Market Growth

3.2.2.3 Meeting the Diverse needs of Long-Duration Energy Storage Remains a Challenge

3.2.3 Market Opportunities

3.2.3.1 Rapid Urbanization Trends and the Expansion of Microgrid Networks in Urban Areas Create Opportunities for Localized Energy Storage Solutions

3.2.3.2 Supportive Policies, Incentives, and Subsidies from Governments to Promote the Development and Deployment of Advanced Energy Storage Solutions

3.2.3.3 Growing Investments towards Sustainable Energy Resources opportunity for the Market

3.3 Porter’s Five Forces Analysis

3.3.1 Bargaining Power of Suppliers (Low to Medium)

3.3.2 Bargaining Power of Buyers (High)

3.3.3 Competitive Rivalry (High)

3.3.4 Threat from Substitutes (Low)

3.3.5 Threat of New Entrants (Medium)

3.4 COVID-19 Impact Analysis

3.4.1 “V-Shaped Recovery”

3.4.2 “U-Shaped Recovery”

3.4.3 “W-Shaped Recovery”

3.4.4 “L-Shaped Recovery”

3.5 PEST Analysis

4 Next Generation Energy Storage Technologies (EST) Market Analysis by Hydrogen

4.1 Key Findings

4.2 Hydrogen Segment: Market Attractiveness Index

4.3 Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Hydrogen

4.4 Hydrogen Fuel Cells

4.4.1 Market Size by Region, 2024-2034 (US$ Billion)

4.4.2 Market Share by Region, 2024 & 2034 (%)

4.5 Hydrogen Compression and Storage

4.5.1 Market Size by Region, 2024-2034 (US$ Billion)

4.5.2 Market Share by Region, 2024 & 2034 (%)

5 Next Generation Energy Storage Technologies (EST) Market Analysis by Mechanical

5.1 Key Findings

5.2 Mechanical Segment: Market Attractiveness Index

5.3 Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Mechanical

5.4 Pumped Hydro Storage

5.4.1 Market Size by Region, 2024-2034 (US$ Billion)

5.4.2 Market Share by Region, 2024 & 2034 (%)

5.5 Compressed Air Energy Storage (CAES)

5.5.1 Market Size by Region, 2024-2034 (US$ Billion)

5.5.2 Market Share by Region, 2024 & 2034 (%)

5.6 Flywheel Energy Storage

5.6.1 Market Size by Region, 2024-2034 (US$ Billion)

5.6.2 Market Share by Region, 2024 & 2034 (%)

6 Next Generation Energy Storage Technologies (EST) Market Analysis by Battery

6.1 Key Findings

6.2 Battery Segment: Market Attractiveness Index

6.3 Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Battery

6.4 Lithium-ion Batteries

6.4.1 Market Size by Region, 2024-2034 (US$ Billion)

6.4.2 Market Share by Region, 2024 & 2034 (%)

6.5 Sodium-Sulfur Batteries

6.5.1 Market Size by Region, 2024-2034 (US$ Billion)

6.5.2 Market Share by Region, 2024 & 2034 (%)

6.6 Flow Batteries

6.6.1 Market Size by Region, 2024-2034 (US$ Billion)

6.6.2 Market Share by Region, 2024 & 2034 (%)

6.7 Advanced Lead-Acid Batteries

6.7.1 Market Size by Region, 2024-2034 (US$ Billion)

6.7.2 Market Share by Region, 2024 & 2034 (%)

7 Next Generation Energy Storage Technologies (EST) Market Analysis by Application

7.1 Key Findings

7.2 Application Segment: Market Attractiveness Index

7.3 Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Application

7.4 Electric Vehicles (EVs)

7.4.1 Market Size by Region, 2024-2034 (US$ Billion)

7.4.2 Market Share by Region, 2024 & 2034 (%)

7.5 Residential Energy Storage

7.5.1 Market Size by Region, 2024-2034 (US$ Billion)

7.5.2 Market Share by Region, 2024 & 2034 (%)

7.6 Commercial and Industrial (C&I)

7.6.1 Market Size by Region, 2024-2034 (US$ Billion)

7.6.2 Market Share by Region, 2024 & 2034 (%)

7.7 Utility-Scale Storage

7.7.1 Market Size by Region, 2024-2034 (US$ Billion)

7.7.2 Market Share by Region, 2024 & 2034 (%)

7.8 Other Applications

7.8.1 Market Size by Region, 2024-2034 (US$ Billion)

7.8.2 Market Share by Region, 2024 & 2034 (%)

8 Next Generation Energy Storage Technologies (EST) Market Analysis by Technology Type

8.1 Key Findings

8.2 Technology Type Segment: Market Attractiveness Index

8.3 Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Technology Type

8.4 Battery Energy Storage

8.4.1 Market Size by Region, 2024-2034 (US$ Million)

8.4.2 Market Share by Region, 2024 & 2034 (%)

8.5 Mechanical Energy Storage

8.5.1 Market Size by Region, 2024-2034 (US$ Million)

8.5.2 Market Share by Region, 2024 & 2034 (%)

8.6 Thermal Energy Storage

8.6.1 Market Size by Region, 2024-2034 (US$ Million)

8.6.2 Market Share by Region, 2024 & 2034 (%)

8.7 Hydrogen Energy Storage

8.7.1 Market Size by Region, 2024-2034 (US$ Million)

8.7.2 Market Share by Region, 2024 & 2034 (%)

8.8 Advanced Capacitors

8.8.1 Market Size by Region, 2024-2034 (US$ Million)

8.8.2 Market Share by Region, 2024 & 2034 (%)

8.9 Other Technology Type

8.9.1 Market Size by Region, 2024-2034 (US$ Million)

8.9.2 Market Share by Region, 2024 & 2034 (%)

9 Next Generation Energy Storage Technologies (EST) Market Analysis by Region

9.1 Key Findings

9.2 Regional Market Size Estimation and Forecast

10 North America Next Generation Energy Storage Technologies (EST) Market Analysis

10.1 Key Findings

10.2 North America Next Generation Energy Storage Technologies (EST) Market Attractiveness Index

10.3 North America Next Generation Energy Storage Technologies (EST) Market by Country, 2024, 2029 & 2034 (US$ Billion)

10.4 North America Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast

10.5 North America Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Country

10.6 North America Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Hydrogen

10.7 North America Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Mechanical

10.8 North America Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Battery

10.9 North America Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Application

10.10 North America Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Technology Type

10.11 U.S. Next Generation Energy Storage Technologies (EST) Market Analysis

10.12 Canada Next Generation Energy Storage Technologies (EST) Market Analysis

11 Europe Next Generation Energy Storage Technologies (EST) Market Analysis

11.1 Key Findings

11.2 Europe Next Generation Energy Storage Technologies (EST) Market Attractiveness Index

11.3 Europe Next Generation Energy Storage Technologies (EST) Market by Country, 2024, 2029 & 2034 (US$ Billion)

11.4 Europe Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast

11.5 Europe Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Country

11.6 Europe Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Hydrogen

11.7 Europe Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Mechanical

11.8 Europe Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Battery Type

11.9 Europe Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Application

11.10 Europe Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Technology Type

11.11 Germany Next Generation Energy Storage Technologies (EST) Market Analysis

11.12 UK Next Generation Energy Storage Technologies (EST) Market Analysis

11.13 France Next Generation Energy Storage Technologies (EST) Market Analysis

11.14 Italy Next Generation Energy Storage Technologies (EST) Market Analysis

11.15 Spain Next Generation Energy Storage Technologies (EST) Market Analysis

11.16 Rest of Europe Next Generation Energy Storage Technologies (EST) Market Analysis

12 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market Analysis

12.1 Key Findings

12.2 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market Attractiveness Index

12.3 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market by Country, 2024, 2029 & 2034 (US$ Billion)

12.4 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast

12.5 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Country

12.6 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Hydrogen

12.7 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Mechanical

12.8 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Battery Type

12.9 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Application

12.10 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Technology Type

12.11 China Next Generation Energy Storage Technologies (EST) Market Analysis

12.12 India Next Generation Energy Storage Technologies (EST) Market Analysis

12.13 Japan Next Generation Energy Storage Technologies (EST) Market Analysis

12.14 South Korea Next Generation Energy Storage Technologies (EST) Market Analysis

12.15 Australia Next Generation Energy Storage Technologies (EST) Market Analysis

12.16 Rest of Asia-Pacific Next Generation Energy Storage Technologies (EST) Market Analysis

13 Middle East and Africa Next Generation Energy Storage Technologies (EST) Market Analysis

13.1 Key Findings

13.2 Middle East and Africa Next Generation Energy Storage Technologies (EST) Market Attractiveness Index

13.3 Middle East and Africa Next Generation Energy Storage Technologies (EST) Market by Country, 2024, 2029 & 2034 (US$ Billion)

13.4 Middle East and Africa Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast

13.5 Middle East and Africa Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Country

13.6 Middle East and Africa Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Hydrogen

13.7 Middle East and Africa Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Mechanical

13.8 Middle East and Africa Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Battery

13.9 Middle East and Africa Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Application

13.10 Middle East and Africa Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Technology Type

13.11 GCC Next Generation Energy Storage Technologies (EST) Market Analysis

13.12 South Africa Next Generation Energy Storage Technologies (EST) Market Analysis

13.13 Rest of Middle East & Africa Next Generation Energy Storage Technologies (EST) Market Analysis

14 Latin America Next Generation Energy Storage Technologies (EST) Market Analysis

14.1 Key Findings

14.2 Latin America Next Generation Energy Storage Technologies (EST) Market Attractiveness Index

14.3 Latin America Next Generation Energy Storage Technologies (EST) Market by Country, 2024, 2029 & 2034 (US$ Billion)

14.4 Latin America Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast

14.5 Latin America Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Country

14.6 Latin America Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Hydrogen

14.7 Latin America Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Mechanical

14.8 Latin America Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Battery Type

14.9 Latin America Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Application

14.10 Latin America Next Generation Energy Storage Technologies (EST) Market Size Estimation and Forecast by Technology Type

14.11 Brazil Next Generation Energy Storage Technologies (EST) Market Analysis

14.12 Mexico Next Generation Energy Storage Technologies (EST) Market Analysis

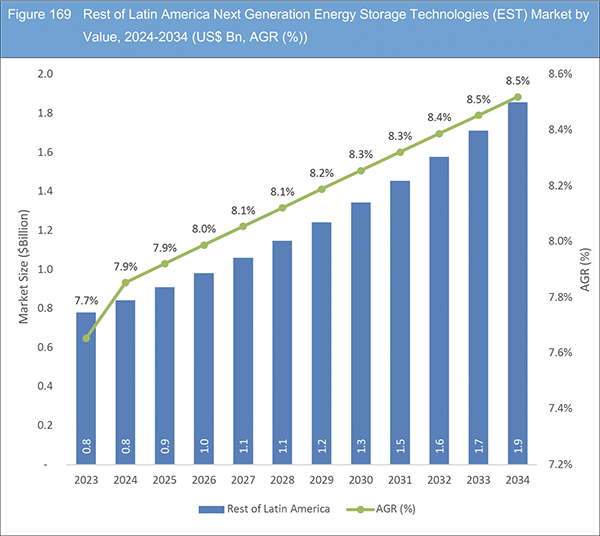

14.13 Rest of Latin America Next Generation Energy Storage Technologies (EST) Market Analysis

15 Company Profiles

15.1 Competitive Landscape, 2022

15.2 Strategic Outlook

15.3 Siemens AG

15.3.1 Company Snapshot

15.3.2 Company Overview

15.3.3 Financial Analysis

15.3.3.1 Net Revenue, 2018-2022

15.3.3.2 R&D, 2018-2022

15.3.3.3 Regional Revenue Share, 2023 (%)

15.3.3.4 Business Segment Revenue Share, 2022 (%)

15.3.4 Product Benchmarking

15.3.5 Strategic Outlook

15.4 General Electric Company

15.4.1 Company Snapshot

15.4.2 Company Overview

15.4.3 Financial Analysis

15.4.3.1 Net Revenue, 2018-2022

15.4.3.2 R&D, 2018-2022

15.4.3.3 Regional Revenue Share, 2022 (%)

15.4.3.4 Business Segment Revenue Share, 2022 (%)

15.4.4 Product Benchmarking

15.4.5 Strategic Outlook

15.5 Panasonic Holdings Corporation

15.5.1 Company Snapshot

15.5.2 Company Overview

15.5.3 Financial Analysis

15.5.3.1 Net Revenue, 2019-2023

15.5.3.2 R&D, 2018-2022

15.5.3.3 Regional Revenue Share, 2023 (%)

15.5.3.4 Business Segment Revenue Share, 2023 (%)

15.5.4 Product Benchmarking

15.5.5 Strategic Outlook

15.6 LG Chem Ltd.

15.6.1 Company Snapshot

15.6.2 Company Overview

15.6.3 Financial Analysis

15.6.3.1 Net Revenue, 2018-2022

15.6.3.2 R&D, 2018-2022

15.6.3.3 Regional Revenue Share, 2022 (%)

15.6.3.4 Business Segment Revenue Share, 2022 (%)

15.6.4 Product Benchmarking

15.6.5 Strategic Outlook

15.7 BYD Co. Ltd

15.7.1 Company Snapshot

15.7.2 Company Overview

15.7.3 Financial Analysis

15.7.3.1 Net Revenue, 2017-2021

15.7.3.2 R&D, 2017-2021

15.7.3.3 Regional Revenue Share, 2021 (%)

15.7.4 Product Benchmarking

15.7.5 Strategic Outlook

15.8 Samsung SDI Co. Ltd.

15.8.1 Company Snapshot

15.8.2 Company Overview

15.8.3 Financial Analysis

15.8.3.1 Net Revenue, 2018-2022

15.8.3.2 R&D, 2018-2022

15.8.3.3 Regional Revenue Share, 2022 (%)

15.8.3.4 Business Segment Revenue Share, 2022 (%)

15.8.4 Product Benchmarking

15.8.5 Strategic Outlook

15.9 Saft Groupe SAS

15.9.1 Company Snapshot

15.9.2 Company Overview

15.9.3 Financial Analysis

15.9.3.1 Net Revenue, 2018-2022

15.9.3.2 R&D, 2018-2022

15.9.3.3 Regional Revenue Share, 2022 (%)

15.9.3.4 Business Segment Revenue Share, 2022 (%)

15.9.4 Product Benchmarking

15.9.5 Strategic Outlook

15.10 Hitachi Chemical Co., Ltd.

15.10.1 Company Snapshot

15.10.2 Company Overview

15.10.3 Financial Analysis

15.10.3.1 Net Revenue, 2019-2023

15.10.3.2 Regional Revenue Share, 2022 (%)

15.10.3.3 Business Segment Revenue Share, 2022 (%)

15.10.4 Product Benchmarking

15.10.5 Strategic Outlook

15.11 Maxwell Technologies Inc

15.11.1 Company Snapshot

15.11.2 Company Overview

15.11.3 Financial Analysis

15.11.3.1 Net Revenue, 2019-2023

15.11.3.2 R&D, 2019-2023

15.11.3.3 Regional Revenue Share, 2022 (%)

15.11.3.4 Business Segment Revenue Share, 2022 (%)

15.11.4 Product Benchmarking

15.11.5 Strategic Outlook

15.12 Fluence Energy

15.12.1 Company Snapshot

15.12.2 Company Overview

15.12.3 Financial Analysis

15.12.3.1 Net Revenue, 2019-2023

15.12.3.2 R&D, 2019-2023

15.12.4 Product Benchmarking

15.12.5 Strategic Outlook

15.13 AES Energy Storage, LLC

15.13.1 Company Snapshot

15.13.2 Company Overview

15.13.3 Financial Analysis

15.13.3.1 Net Revenue, 2019-2023

15.13.4 Product Benchmarking

15.13.5 Strategic Outlook

15.14 NEC Corporation

15.14.1 Company Snapshot

15.14.2 Company Overview

15.14.3 Financial Analysis

15.14.3.1 Net Revenue ,2019-2023

15.14.3.2 R&D, 2019-2023

15.14.3.3 Business Segment Revenue Share, 2022 (%)

15.14.4 Product Benchmarking

15.14.5 Strategic Outlook

15.15 Alevo Group S.A.

15.15.1 Company Snapshot

15.15.2 Company Overview

15.15.3 Product Benchmarking

15.15.4 Strategic Outlook

15.16 Leclanché S.A.

15.16.1 Company Snapshot

15.16.2 Company Overview

15.16.3 Product Benchmarking

15.16.4 Strategic Outlook

15.17 Greensmith Energy Management Systems

15.17.1 Company Snapshot

15.17.2 Company Overview

15.17.3 Product Benchmarking

15.17.4 Strategic Outlook

16 Conclusion and Recommendations

16.1 Concluding Remarks from Visiongain

16.2 Recommendations for Market Players

List of Tables

Table 1 Next Generation Energy Storage Technologies (EST) Market Snapshot, 2024 & 2034 (US$ Billion, CAGR %)

Table 2 Global Next Generation Energy Storage Technologies (EST) Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%)) (V-Shaped Recovery Scenario)

Table 3 Global Next Generation Energy Storage Technologies (EST) Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%)) (U-Shaped Recovery Scenario)

Table 4 Global Next Generation Energy Storage Technologies (EST) Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%)) (W-Shaped Recovery Scenario)

Table 5 Global Next Generation Energy Storage Technologies (EST) Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%)) (L-Shaped Recovery Scenario)

Table 6 Global Next Generation Energy Storage Technologies (EST) Market by Hydrogen, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 7 Hydrogen Fuel Cells Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 8 Hydrogen Compression and Storage Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 9 Global Next Generation Energy Storage Technologies (EST) Market by Mechanical, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 10 Pumped Hydro Storage Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 11 Compressed Air Energy Storage (CAES) Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 12 Flywheel Energy Storage Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 13 Global Next Generation Energy Storage Technologies (EST) Market by Battery Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 14 Lithium-ion Batteries Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 15 Sodium-Sulphur Batteries Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 16 Flow Batteries Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 17 Advanced Lead-Acid Batteries Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 18 Global Next Generation Energy Storage Technologies (EST) Market by Application, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 19 Electric Vehicles (EVs) Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 20 Residential Energy Storage Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 21 Commercial and Industrial (C&I) Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 22 Utility-Scale Storage Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 23 Other Applications Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 24 Global Next Generation Energy Storage Technologies (EST) Market by Technology Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 25 Battery Energy Storage Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 26 Mechanical Energy Storage Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 27 Thermal Energy Storage Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 28 Hydrogen Energy Storage Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 29 Advanced Capacitors Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 30 Other Technology Type Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 31 Global Next Generation Energy Storage Technologies (EST) Market by Region, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 32 North America Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 33 North America Next Generation Energy Storage Technologies (EST) Market by Country, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 34 North America Next Generation Energy Storage Technologies (EST) Market by Hydrogen, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 35 North America Next Generation Energy Storage Technologies (EST) Market by Mechanical, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 36 North America Next Generation Energy Storage Technologies (EST) Market by Battery Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 37 North America Next Generation Energy Storage Technologies (EST) Market by Application, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 38 North America Next Generation Energy Storage Technologies (EST) Market by Technology Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 39 US Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 40 Canada Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 41 Europe Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 42 Europe Next Generation Energy Storage Technologies (EST) Market by Country, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 43 Europe Next Generation Energy Storage Technologies (EST) Market by Hydrogen, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 44 Europe Next Generation Energy Storage Technologies (EST) Market by Mechanical, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 45 Europe Next Generation Energy Storage Technologies (EST) Market by Battery Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 46 Europe Next Generation Energy Storage Technologies (EST) Market by Application, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 47 Europe Next Generation Energy Storage Technologies (EST) Market by Technology Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 48 Germany Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 49 UK Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 50 France Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 51 Italy Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 52 Spain Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 53 Rest of Europe Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 54 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 55 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market by Country, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 56 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market by Hydrogen, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 57 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market by Mechanical, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 58 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market by Battery Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 59 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market by Application, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 60 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market by Technology Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 61 China Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 62 India Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 63 Japan Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 64 South Korea Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 65 Australia Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 66 Rest of Asia-Pacific Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 67 Middle East & Africa Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 68 Middle East & Africa Next Generation Energy Storage Technologies (EST) Market by Country, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 69 Middle East & Africa Next Generation Energy Storage Technologies (EST) Market by Hydrogen, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 70 Middle East & Africa Next Generation Energy Storage Technologies (EST) Market by Mechanical, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 71 Middle East & Africa Next Generation Energy Storage Technologies (EST) Market by Battery Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 72 Middle East & Africa Next Generation Energy Storage Technologies (EST) Market by Application, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 73 Middle East & Africa Next Generation Energy Storage Technologies (EST) Market by Technology Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 74 GCC Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 75 South Africa Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 76 Rest of Middle East & Africa Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 77 Latin America Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 78 Latin America Next Generation Energy Storage Technologies (EST) Market by Country, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 79 Latin America Next Generation Energy Storage Technologies (EST) Market by Hydrogen, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 80 Latin America Next Generation Energy Storage Technologies (EST) Market by Mechanical, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 81 Latin America Next Generation Energy Storage Technologies (EST) Market by Battery Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 82 Latin America Next Generation Energy Storage Technologies (EST) Market by Application, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 83 Latin America Next Generation Energy Storage Technologies (EST) Market by Technology Type, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 84 Brazil Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 85 Mexico Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 86 Rest of Latin America Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%), CAGR (%))

Table 87 Strategic Outlook – Recent Development

Table 88 Siemens AG: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 89 Siemens AG: Product Benchmarking

Table 90 Siemens AG: Strategic Outlook

Table 91 General Electric Company: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 92 General Electric Company: Product Benchmarking

Table 93 General Electric Company: Strategic Outlook

Table 94 Panasonic Holdings Corporation: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 95 Panasonic Holdings Corporation: Product Benchmarking

Table 96 Panasonic Holdings Corporation: Strategic Outlook

Table 97 LG Chem Ltd.: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 98 LG Chem Ltd.: Product Benchmarking

Table 99 LG Chem Ltd.: Strategic Outlook

Table 100 BYD Co. Ltd: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 101 BYD Co. Ltd: Product Benchmarking

Table 102 BYD Co. Ltd: Strategic Outlook

Table 103 Samsung SDI Co. Ltd.: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 104 Samsung SDI Co. Ltd.: Product Benchmarking

Table 105 Samsung SDI Co. Ltd.: Strategic Outlook

Table 106 Saft Groupe SAS: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 107 Saft Groupe SAS: Product Benchmarking

Table 108 Saft Groupe SAS: Strategic Outlook

Table 109 Hitachi Chemical Co., Ltd.: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 110 Hitachi Chemical Co., Ltd.: Product Benchmarking

Table 111 Hitachi Chemical Co., Ltd.: Strategic Outlook

Table 112 Maxwell Technologies Inc: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 113 Maxwell Technologies Inc: Product Benchmarking

Table 114 Fluence Energy: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 115 Fluence Energy: Product Benchmarking

Table 116 Fluence Energy: Strategic Outlook

Table 117 AES Energy Storage, LLC: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 118 AES Energy Storage, LLC: Product Benchmarking

Table 119 AES Energy Storage, LLC: Strategic Outlook

Table 120 NEC Corporation: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 121 NEC Corporation: Product Benchmarking

Table 122 NEC Corporation: Strategic Outlook

Table 123 Alevo Group S.A.: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 124 Alevo Group S.A.: Product Benchmarking

Table 125 Alevo Group S.A.: Strategic Outlook

Table 126 Leclanché S.A.: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 127 Leclanché S.A.: Product Benchmarking

Table 128 Leclanché S.A.: Strategic Outlook

Table 129 Greensmith Energy Management Systems: Key Details, (CEO, HQ, Revenue, Founded, No. of Employees, Company Type, Website, Business Segment)

Table 130 Greensmith Energy Management Systems: Product Benchmarking

List of Figures

Figure 1 Next Generation Energy Storage Technologies (EST) Market Segmentation

Figure 2 Next Generation Energy Storage Technologies (EST) Market by Hydrogen: Market Attractiveness Index

Figure 3 Next Generation Energy Storage Technologies (EST) Market by Mechanical: Market Attractiveness Index

Figure 4 Next Generation Energy Storage Technologies (EST) Market by Battery: Market Attractiveness Index

Figure 5 Next Generation Energy Storage Technologies (EST) Market by Application: Market Attractiveness Index

Figure 6 Next Generation Energy Storage Technologies (EST) Market by Technology Type: Market Attractiveness Index

Figure 7 Next Generation Energy Storage Technologies (EST) Market Attractiveness Index by Region

Figure 8 Next Generation Energy Storage Technologies (EST) Market: Market Dynamics

Figure 9 Renewable Energy Production, 2020-2023,

Figure 10 Next Generation Energy Storage Technologies (EST) Market: Porter’s Five Forces Analysis

Figure 11 Global Next Generation Energy Storage Technologies (EST) Market Share Forecast by COVID, 2024-2034 (%)

Figure 12 Global Next Generation Energy Storage Technologies (EST) Market by Region, 2024-2034 (US$ Bn, AGR (%)) (V-Shaped Recovery Scenario)

Figure 13 Global Next Generation Energy Storage Technologies (EST) Market by Region, 2024-2034 (US$ Bn, AGR (%)) (U-Shaped Recovery Scenario)

Figure 14 Global Next Generation Energy Storage Technologies (EST) Market by Region, 2024-2034 (US$ Bn, AGR (%)) (W-Shaped Recovery Scenario)

Figure 15 Global Next Generation Energy Storage Technologies (EST) Market by Region, 2024-2034 (US$ Bn, AGR (%)) (L-Shaped Recovery Scenario)

Figure 16 Next Generation Energy Storage Technologies (EST) Market: PEST Analysis

Figure 17 Next Generation Energy Storage Technologies (EST) Market by Hydrogen: Market Attractiveness Index

Figure 18 Global Next Generation Energy Storage Technologies (EST) Market by Hydrogen, 2024-2034 (US$ Bn, AGR (%))

Figure 19 Next Generation Energy Storage Technologies (EST) Market Share Forecast by Hydrogen, 2024, 2029, 2034 (%)

Figure 20 Hydrogen Fuel Cells Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 21 Hydrogen Fuel Cells Market Share Forecast by Region, 2024 & 2034 (%)

Figure 22 Hydrogen Compression and Storage Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 23 Hydrogen Compression and Storage Market Share Forecast by Region, 2024 & 2034 (%)

Figure 24 Next Generation Energy Storage Technologies (EST) Market by Mechanical: Market Attractiveness Index

Figure 25 Global Next Generation Energy Storage Technologies (EST) Market by Mechanical, 2024-2034 (US$ Bn, AGR (%))

Figure 26 Next Generation Energy Storage Technologies (EST) Market Share Forecast by Mechanical, 2024, 2029, 2034 (%)

Figure 27 Pumped Hydro Storage Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 28 Pumped Hydro Storage Market Share Forecast by Region, 2024 & 2034 (%)

Figure 29 Compressed Air Energy Storage (CAES) Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 30 Compressed Air Energy Storage (CAES) Market Share Forecast by Region, 2024 & 2034 (%)

Figure 31 Flywheel Energy Storage Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 32 Flywheel Energy Storage Market Share Forecast by Region, 2024 & 2034 (%)

Figure 33 Next Generation Energy Storage Technologies (EST) Market by Battery: Market Attractiveness Index

Figure 34 Global Next Generation Energy Storage Technologies (EST) Market by Battery Type, 2024-2034 (US$ Bn, AGR (%))

Figure 35 Next Generation Energy Storage Technologies (EST) Market Share Forecast by Battery, 2024, 2029, 2034 (%)

Figure 36 Lithium-ion Batteries Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 37 Lithium-ion Batteries Market Share Forecast by Region, 2024 & 2034 (%)

Figure 38 Sodium-Sulfur Batteries Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 39 Sodium-Sulfur Batteries Market Share Forecast by Region, 2024 & 2034 (%)

Figure 40 Flow Batteries Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 41 Flow Batteries Market Share Forecast by Region, 2024 & 2034 (%)

Figure 42 Advanced Lead-Acid Batteries Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 43 Advanced Lead-Acid Batteries Market Share Forecast by Region, 2024 & 2034 (%)

Figure 44 Next Generation Energy Storage Technologies (EST) Market by Application: Market Attractiveness Index

Figure 45 Global Next Generation Energy Storage Technologies (EST) Market by Application, 2024-2034 (US$ Bn, AGR (%))

Figure 46 Next Generation Energy Storage Technologies (EST) Market Share Forecast by Application, 2024, 2029, 2034 (%)

Figure 47 Electric Vehicles (EVs) Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 48 Electric Vehicles (EVs) Market Share Forecast by Region, 2024 & 2034 (%)

Figure 49 Residential Energy Storage Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 50 Residential Energy Storage Market Share Forecast by Region, 2024 & 2034 (%)

Figure 51 Commercial and Industrial (C&I) Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 52 Commercial and Industrial (C&I) Market Share Forecast by Region, 2024 & 2034 (%)

Figure 53 Utility-Scale Storage Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 54 Utility-Scale Storage Market Share Forecast by Region, 2024 & 2034 (%)

Figure 55 Other Applications Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 56 Other Applications Market Share Forecast by Region, 2024 & 2034 (%)

Figure 57 Next Generation Energy Storage Technologies (EST) Market by Technology Type: Market Attractiveness Index

Figure 58 Global Next Generation Energy Storage Technologies (EST) Market by Technology Type, 2024-2034 (US$ Bn, AGR (%))

Figure 59 Next Generation Energy Storage Technologies (EST) Market Share Forecast by Technology Type, 2024, 2029, 2034 (%)

Figure 60 Battery Energy Storage Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 61 Battery Energy Storage Market Share Forecast by Region, 2024 & 2034 (%)

Figure 62 Mechanical Energy Storage Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 63 Mechanical Energy Storage Market Share Forecast by Region, 2024 & 2034 (%)

Figure 64 Thermal Energy Storage Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 65 Thermal Energy Storage Market Share Forecast by Region, 2024 & 2034 (%)

Figure 66 Hydrogen Energy Storage Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 67 Hydrogen Energy Storage Market Share Forecast by Region, 2024 & 2034 (%)

Figure 68 Advanced Capacitors Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 69 Advanced Capacitors Market Share Forecast by Region, 2024 & 2034 (%)

Figure 70 Other Technology Type Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 71 Other Technology Type Market Share Forecast by Region, 2024 & 2034 (%)

Figure 72 Next Generation Energy Storage Technologies (EST) Market Forecast by Region 2024 and 2034 (Revenue, CAGR%)

Figure 73 Next Generation Energy Storage Technologies (EST) Market Share Forecast by Region 2024, 2029, 2034 (%)

Figure 74 Global Next Generation Energy Storage Technologies (EST) Market by Region, 2024-2034 (US$ Bn, AGR (%))

Figure 75 North America Next Generation Energy Storage Technologies (EST) Market Attractiveness Index

Figure 76 North America Next Generation Energy Storage Technologies (EST) Market by Region, 2024, 2029 & 2034 (US$ Billion)

Figure 77 North America Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 78 North America Next Generation Energy Storage Technologies (EST) Market by Country, 2024-2034 (US$ Bn, AGR (%))

Figure 79 North America Next Generation Energy Storage Technologies (EST) Market Share Forecast by Country, 2024 & 2034 (%)

Figure 80 North America Next Generation Energy Storage Technologies (EST) Market by Hydrogen, 2024-2034 (US$ Bn, AGR (%))

Figure 81 North America Next Generation Energy Storage Technologies (EST) Market Share Forecast Hydrogen, 2024 & 2034 (%)

Figure 82 North America Next Generation Energy Storage Technologies (EST) Market by Mechanical, 2024-2034 (US$ Bn, AGR (%))

Figure 83 North America Next Generation Energy Storage Technologies (EST) Market Share Forecast by Mechanical, 2024 & 2034 (%)

Figure 84 North America Next Generation Energy Storage Technologies (EST) Market by Battery Type, 2024-2034 (US$ Bn, AGR (%))

Figure 85 North America Next Generation Energy Storage Technologies (EST) Market Share Forecast by Battery, 2024 & 2034 (%)

Figure 86 North America Next Generation Energy Storage Technologies (EST) Market by Application, 2024-2034 (US$ Bn, AGR (%))

Figure 87 North America Next Generation Energy Storage Technologies (EST) Market Share Forecast by Application, 2024 & 2034 (%)

Figure 88 North America Next Generation Energy Storage Technologies (EST) Market by Technology Type, 2024-2034 (US$ Bn, AGR (%))

Figure 89 North America Next Generation Energy Storage Technologies (EST) Market Share Forecast by Technology Type, 2024 & 2034 (%)

Figure 90 US Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 91 Canada Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 92 Europe Next Generation Energy Storage Technologies (EST) Market Attractiveness Index

Figure 93 Europe Next Generation Energy Storage Technologies (EST) Market by Region, 2024, 2029 & 2034 (US$ Billion)

Figure 94 Europe Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 95 Europe Next Generation Energy Storage Technologies (EST) Market by Country, 2024-2034 (US$ Bn, AGR (%))

Figure 96 Europe Next Generation Energy Storage Technologies (EST) Market Share Forecast by Country, 2024 & 2034 (%)

Figure 97 Europe Next Generation Energy Storage Technologies (EST) Market by Hydrogen, 2024-2034 (US$ Bn, AGR (%))

Figure 98 Europe Next Generation Energy Storage Technologies (EST) Market Share Forecast Hydrogen, 2024 & 2034 (%)

Figure 99 Europe Next Generation Energy Storage Technologies (EST) Market by Mechanical, 2024-2034 (US$ Bn, AGR (%))

Figure 100 Europe Next Generation Energy Storage Technologies (EST) Market Share Forecast by Mechanical, 2024 & 2034 (%)

Figure 101 Europe Next Generation Energy Storage Technologies (EST) Market by Battery Type, 2024-2034 (US$ Bn, AGR (%))

Figure 102 Europe Next Generation Energy Storage Technologies (EST) Market Share Forecast by Battery, 2024 & 2034 (%)

Figure 103 Europe Next Generation Energy Storage Technologies (EST) Market by Application, 2024-2034 (US$ Bn, AGR (%))

Figure 104 Europe Next Generation Energy Storage Technologies (EST) Market Share Forecast by Application, 2024 & 2034 (%)

Figure 105 Europe Next Generation Energy Storage Technologies (EST) Market by Technology Type, 2024-2034 (US$ Bn, AGR (%))

Figure 106 Europe Next Generation Energy Storage Technologies (EST) Market Share Forecast by Technology Type, 2024 & 2034 (%)

Figure 107 Germany Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 108 UK Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 109 France Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 110 Italy Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 111 Spain Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 112 Rest of Europe Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 113 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market Attractiveness Index

Figure 114 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market by Region, 2024, 2029 & 2034 (US$ Billion)

Figure 115 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 116 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market by Country, 2024-2034 (US$ Bn, AGR (%))

Figure 117 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market Share Forecast by Country, 2024 & 2034 (%)

Figure 118 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market by Hydrogen, 2024-2034 (US$ Bn, AGR (%))

Figure 119 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market Share Forecast Hydrogen, 2024 & 2034 (%)

Figure 120 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market by Mechanical, 2024-2034 (US$ Bn, AGR (%))

Figure 121 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market Share Forecast by Mechanical, 2024 & 2034 (%)

Figure 122 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market by Battery Type, 2024-2034 (US$ Bn, AGR (%))

Figure 123 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market Share Forecast by Battery Type, 2024 & 2034 (%)

Figure 124 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market by Application, 2024-2034 (US$ Bn, AGR (%))

Figure 125 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market Share Forecast by Application, 2024 & 2034 (%)

Figure 126 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market by Technology Type, 2024-2034 (US$ Bn, AGR (%))

Figure 127 Asia-Pacific Next Generation Energy Storage Technologies (EST) Market Share Forecast by Technology Type, 2024 & 2034 (%)

Figure 128 China Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 129 India Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 130 Japan Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 131 South Korea Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 132 Australia Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 133 Rest of Asia-Pacific Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 134 Middle East and Africa Next Generation Energy Storage Technologies (EST) Market Attractiveness Index

Figure 135 Middle East and Africa Next Generation Energy Storage Technologies (EST) Market by Region, 2024, 2029 & 2034 (US$ Billion)

Figure 136 Middle East & Africa Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 137 Middle East & Africa Next Generation Energy Storage Technologies (EST) Market by Country, 2024-2034 (US$ Bn, AGR (%))

Figure 138 Middle East and Africa Next Generation Energy Storage Technologies (EST) Market Share Forecast by Country, 2024 & 2034 (%)

Figure 139 Middle East & Africa Next Generation Energy Storage Technologies (EST) Market by Hydrogen, 2024-2034 (US$ Bn, AGR (%))

Figure 140 Middle East and Africa Next Generation Energy Storage Technologies (EST) Market Share Forecast Hydrogen, 2024 & 2034 (%)

Figure 141 Middle East & Africa Next Generation Energy Storage Technologies (EST) Market by Mechanical, 2024-2034 (US$ Bn, AGR (%))

Figure 142 Middle East and Africa Next Generation Energy Storage Technologies (EST) Market Share Forecast by Mechanical, 2024 & 2034 (%)

Figure 143 Middle East & Africa Next Generation Energy Storage Technologies (EST) Market by Battery Type, 2024-2034 (US$ Bn, AGR (%))

Figure 144 Middle East and Africa Next Generation Energy Storage Technologies (EST) Market Share Forecast by Battery, 2024 & 2034 (%)

Figure 145 Middle East & Africa Next Generation Energy Storage Technologies (EST) Market by Application, 2024-2034 (US$ Bn, AGR (%))

Figure 146 Middle East and Africa Next Generation Energy Storage Technologies (EST) Market Share Forecast by Application, 2024 & 2034 (%)

Figure 147 Middle East & Africa Next Generation Energy Storage Technologies (EST) Market by Technology Type, 2024-2034 (US$ Bn, AGR (%))

Figure 148 Middle East and Africa Next Generation Energy Storage Technologies (EST) Market Share Forecast by Technology Type, 2024 & 2034 (%)

Figure 149 GCC Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 150 South Africa Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 151 Rest of Middle East & Africa Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 152 Latin America Next Generation Energy Storage Technologies (EST) Market Attractiveness Index

Figure 153 Latin America Next Generation Energy Storage Technologies (EST) Market by Region, 2024, 2029 & 2034 (US$ Billion)

Figure 154 Latin America Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 155 Latin America Next Generation Energy Storage Technologies (EST) Market by Country, 2024-2034 (US$ Bn, AGR (%))

Figure 156 Latin America Next Generation Energy Storage Technologies (EST) Market Share Forecast by Country, 2024 & 2034 (%)

Figure 157 Latin America Next Generation Energy Storage Technologies (EST) Market by Hydrogen, 2024-2034 (US$ Bn, AGR (%))

Figure 158 Latin America Next Generation Energy Storage Technologies (EST) Market Share Forecast Hydrogen, 2024 & 2034 (%)

Figure 159 Latin America Next Generation Energy Storage Technologies (EST) Market by Mechanical, 2024-2034 (US$ Bn, AGR (%))

Figure 160 Latin America Next Generation Energy Storage Technologies (EST) Market Share Forecast by Mechanical, 2024 & 2034 (%)

Figure 161 Latin America Next Generation Energy Storage Technologies (EST) Market by Battery Type, 2024-2034 (US$ Bn, AGR (%))

Figure 162 Latin America Next Generation Energy Storage Technologies (EST) Market Share Forecast by Battery, 2024 & 2034 (%)

Figure 163 Latin America Next Generation Energy Storage Technologies (EST) Market by Application, 2024-2034 (US$ Bn, AGR (%))

Figure 164 Latin America Next Generation Energy Storage Technologies (EST) Market Share Forecast by Application, 2024 & 2034 (%)

Figure 165 Latin America Next Generation Energy Storage Technologies (EST) Market by Technology Type, 2024-2034 (US$ Bn, AGR (%))

Figure 166 Latin America Next Generation Energy Storage Technologies (EST) Market Share Forecast by Technology Type, 2024 & 2034 (%)

Figure 167 Brazil Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 168 Mexico Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 169 Rest of Latin America Next Generation Energy Storage Technologies (EST) Market by Value, 2024-2034 (US$ Bn, AGR (%))

Figure 170 Next Generation Energy Storage Technologies (EST) Market: Company Share, 2022

Figure 171 Siemens AG.: Net Revenue, 2019-2023 (US$ Million, AGR%)

Figure 172 Siemens AG.: R&D, 2019-2023 (US$ Million, AGR%)

Figure 173 Siemens AG.: Regional Revenue Share, 2023 (%)

Figure 174 Siemens AG.: Business Segment Revenue Share, 2022 (%)

Figure 175 General Electric Company.: Net Revenue, 2018-2022 (US$ Million, AGR%)

Figure 176 General Electric Company.: R&D, 2018-2022 (US$ Million, AGR%)

Figure 177 General Electric Company.: Regional Revenue Share, 2022 (%)

Figure 178 General Electric Company.: Business Segment Revenue Share, 2022 (%)

Figure 179 Panasonic Holdings Corporation.: Net Revenue, 2019-2023 (US$ Million, AGR%)

Figure 180 Panasonic Holdings Corporation.: R&D, 2019-2023 (US$ Million, AGR%)

Figure 181 Panasonic Holdings Corporation.: Regional Revenue Share, 2032 (%)

Figure 182 Panasonic Holdings Corporation.: Business Segment Revenue Share, 2023 (%)

Figure 183 LG Chem Ltd..: Net Revenue, 2018-2022 (US$ Million, AGR%)

Figure 184 LG Chem Ltd..: R&D, 2018-2022 (US$ Million, AGR%)

Figure 185 LG Chem Ltd..: Regional Revenue Share, 2022 (%)

Figure 186 LG Chem Ltd..: Business Segment Revenue Share, 2022 (%)

Figure 187 BYD Co. Ltd.: Net Revenue, 2017-2021 (US$ Million, AGR%)

Figure 188 BYD Co. Ltd.: R&D, 2017-2021 (US$ Million, AGR%)

Figure 189 BYD Co. Ltd.: Regional Revenue Share, 2021 (%)

Figure 190 Samsung SDI Co. Ltd..: Net Revenue, 2018-2022 (US$ Million, AGR%)

Figure 191 Samsung SDI Co. Ltd..: R&D, 2018-2022 (US$ Million, AGR%)

Figure 192 Samsung SDI Co. Ltd..: Regional Revenue Share, 2022 (%)

Figure 193 Samsung SDI Co. Ltd..: Business Segment Revenue Share, 2022 (%)

Figure 194 Saft Groupe SAS.: Net Revenue, 2018-2022 (US$ Million, AGR%)

Figure 195 Saft Groupe SAS.: R&D, 2018-2022 (US$ Million, AGR%)

Figure 196 Saft Groupe SAS.: Regional Revenue Share, 2022 (%)

Figure 197 Saft Groupe SAS.: Business Segment Revenue Share, 2022 (%)

Figure 198 Hitachi Chemical Co., Ltd..: Net Revenue, 2019-2023 (US$ Million, AGR%)

Figure 199 Hitachi Chemical Co., Ltd..: Regional Revenue Share, 2022 (%)

Figure 200 Hitachi Chemical Co., Ltd..: Business Segment Revenue Share, 2022 (%)

Figure 201 Maxwell Technologies Inc.: Net Revenue, 2019-2023 (US$ Million, AGR%)

Figure 202 Maxwell Technologies Inc.: R&D, 2019-2023 (US$ Million, AGR%)

Figure 203 Maxwell Technologies Inc.: Regional Revenue Share, 2022 (%)

Figure 204 Maxwell Technologies Inc.: Business Segment Revenue Share, 2022 (%)

Figure 205 Fluence Energy.: Net Revenue, 2019-2023 (US$ Million, AGR%)

Figure 206 Fluence Energy.: R&D, 2019-2023 (US$ Million, AGR%)

Figure 207 Fluence Energy.: Business Segment Revenue Share, 2022 (%)

Figure 208 AES Energy Storage, LLC.: Net Revenue, 2019-2023 (US$ Million, AGR%)

Figure 209 NEC Corporation.: Net Revenue, 2019-2023 (US$ Million, AGR%)

Figure 210 NEC Corporation.: R&D, 2019-2023 (US$ Million, AGR%)

Figure 211 NEC Corporation.: Business Segment Revenue Share, 2022 (%)

AES Energy Storage, LLC

Alevo Group S.A.

BYD Co. Ltd

Fluence Energy

General Electric Company

Greensmith Energy Management Systems

Hitachi Chemical Co., Ltd.

Leclanché S.A.

LG Chem Ltd.

Maxwell Technologies Inc

NEC Corporation

Panasonic Holdings Corporation

Saft Groupe SAS

Samsung SDI Co. Ltd.

Siemens AG

List of Other Companies Mentioned in the report

5N Plus Inc.

AES Corporation

AZUR SPACE Solar Power GmbH

BASF Stationary Energy Storage GmbH (BSES)

Brill Power

CATL (Contemporary Amperex Technology Co. Limited)

China National Development and Reform Commission (NDRC)

Energy-Storage.news (media outlet)

Engie EPS (Now NHOA S.A.)

G-Philos Co., Ltd.

Grenergy Renovables SA

Korea Electric Power Corporation (KEPCO)

Korea Midland Power Co., Ltd. (KOMIPO)

NGK INSULATORS, LTD.

NHOA Energy

NHOA Group

Quartux

RayGen Power Plant

Sella 2 (SolarEdge's battery cell manufacturing facility)

SolarEdge Technologies

Solaria

Tata Power

Tesla

List of Associations Mentioned in the Report

Canadian Electricity Association (CEA)

China Energy Storage Alliance (CNESA)

Clean Energy Council (CEC, Australia)

Cornwall Insight Australia

Electric Power Research Institute (EPRI)

Global Wind Energy Council (GWEC)

International Energy Agency (IEA)

International Renewable Energy Agency (IRENA)

Korea Institute of Energy Research (KIER)

National Development and Reform Commission (NDRC)

National Energy Administration (NEA)

Saudi Power Procurement Co. (SPPC)

SEMARNAT (Ministry of Environment and Natural Resources, Mexico)

Solar Energy Industries Association (SEIA)

United States Energy Storage Association (ESA)

Very Fast Frequency Control Ancillary Services (VF FCAS)

Download sample pages

Complete the form below to download your free sample pages for Next Generation Energy Storage Technologies (EST) Market Report 2024-2034

Related reports

-

Energy Security Market Report 2024-2034

The global Energy Security market is projected to grow at a CAGR of 7.7% by 2034...Full DetailsPublished: 15 March 2024 -

Vehicle to Grid (V2G) Market Report 2024-2034

The global Vehicle to Grid (V2G) market is projected to grow at a CAGR of 27.6% by 2034...Full DetailsPublished: 08 March 2024 -

Virtual Power Plant (VPP) Market Report 2024-2034

The global Virtual Power Plant (VPP) market is projected to grow at a CAGR of 21.1% by 2034...Full DetailsPublished: 02 January 2024 -

Grid-Scale Battery Storage Technologies Market Report 2023-2033

The global Grid-Scale Battery Storage Technologies market is projected to grow at a CAGR of 23% by 2033...Full DetailsPublished: 26 September 2023 -

Carbon Capture Utilisation and Storage (CCUS) Market Report 2024-2034

The global Carbon Capture Utilisation and Storage (CCUS) market is projected to grow at a CAGR of 20.6% by 2034

...Full DetailsPublished: 19 April 2024 -

Lithium-Ion Battery Market Report 2023-2033

The global Lithium-Ion Battery market is projected to grow at a CAGR of 14.8% by 2033...Full DetailsPublished: 19 May 2023 -

Lead Acid Battery Market Report 2023-2033

The global Lead Acid Battery market is projected to grow at a CAGR of 4.24% by 2033...Full DetailsPublished: 28 March 2023 -

Carbon Capture, Transportation & Storage Market Report 2023-2033

The global Carbon Capture, Transportation & Storage market is projected to grow at a CAGR of 19.4% by 2033...Full DetailsPublished: 22 August 2023 -

Energy Storage Systems (ESS) Market Report 2023-2033

The global Energy Storage Systems (ESS) market is projected to grow at a CAGR of 8% by 2033...Full DetailsPublished: 06 June 2023 -

Electric Vehicle Charging Infrastructure Market Report 2023-2033

The global Electric Vehicle Charging Infrastructure market is projected to grow at a CAGR of 28.3% by 2033...Full DetailsPublished: 08 August 2023

Download sample pages

Complete the form below to download your free sample pages for Next Generation Energy Storage Technologies (EST) Market Report 2024-2034

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain energy reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and industry experts where possible but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain energy reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

“The Visiongain report was extremely insightful and helped us construct our basic go-to market strategy for our solution.”

H.

“F.B has used Visiongain to prepare two separate market studies on the ceramic proppants market over the last 12 months. These reports have been professionally researched and written and have assisted FBX greatly in developing its business strategy and investment plans.”

F.B

“We just received your very interesting report on the Energy Storage Technologies (EST) Market and this is a very impressive and useful document on that subject.”

I.E.N

“Visiongain does an outstanding job on putting the reports together and provides valuable insight at the right informative level for our needs. The EOR Visiongain report provided confirmation and market outlook data for EOR in MENA with the leading countries being Oman, Kuwait and eventually Saudi Arabia.”

E.S

“Visiongain produced a comprehensive, well-structured GTL Market report striking a good balance between scope and detail, global and local perspective, large and small industry segments. It is an informative forecast, useful for practitioners as a trusted and upto-date reference.”

Y.N Ltd

Association of Dutch Suppliers in the Oil & Gas Industry

Society of Naval Architects & Marine Engineers

Association of Diving Contractors

Association of Diving Contractors International

Associazione Imprese Subacquee Italiane

Australian Petroleum Production & Exploration Association

Brazilian Association of Offshore Support Companies

Brazilian Petroleum Institute

Canadian Energy Pipeline

Diving Medical Advisory Committee

European Diving Technology Committee

French Oil and Gas Industry Council

IMarEST – Institute of Marine Engineering, Science & Technology

International Association of Drilling Contractors

International Association of Geophysical Contractors

International Association of Oil & Gas Producers

International Chamber of Shipping

International Shipping Federation

International Marine Contractors Association

International Tanker Owners Pollution Federation

Leading Oil & Gas Industry Competitiveness

Maritime Energy Association

National Ocean Industries Association

Netherlands Oil and Gas Exploration and Production Association

NOF Energy

Norsk olje og gass Norwegian Oil and Gas Association

Offshore Contractors’ Association

Offshore Mechanical Handling Equipment Committee

Oil & Gas UK

Oil Companies International Marine Forum

Ontario Petroleum Institute

Organisation of the Petroleum Exporting Countries

Regional Association of Oil and Natural Gas Companies in Latin America and the Caribbean

Society for Underwater Technology

Society of Maritime Industries

Society of Petroleum Engineers

Society of Petroleum Enginners – Calgary

Step Change in Safety

Subsea UK

The East of England Energy Group

UK Petroleum Industry Association

All the events postponed due to COVID-19.

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Energy news

Energy as a Service (EaaS) Market

The global Energy as a Service (EaaS) market is projected to grow at a CAGR of 12.6% by 2034

25 July 2024

Synthetic Fuels Market

The global Synthetic Fuels market is projected to grow at a CAGR of 23% by 2034

18 July 2024

Power-to-X (P2X) Market

The global Power-to-X (P2X) market is projected to grow at a CAGR of 10.6% by 2034

09 July 2024

Airborne Wind Energy Market

The global Airborne Wind Energy market is projected to grow at a CAGR of 9.7% by 2034

05 June 2024