Visiongain Publishes Medical Imaging Devices Market Report 2024-2034

20 March 2024

Visiongain Publishes Medical Imaging Devices Market Report 2024-2034

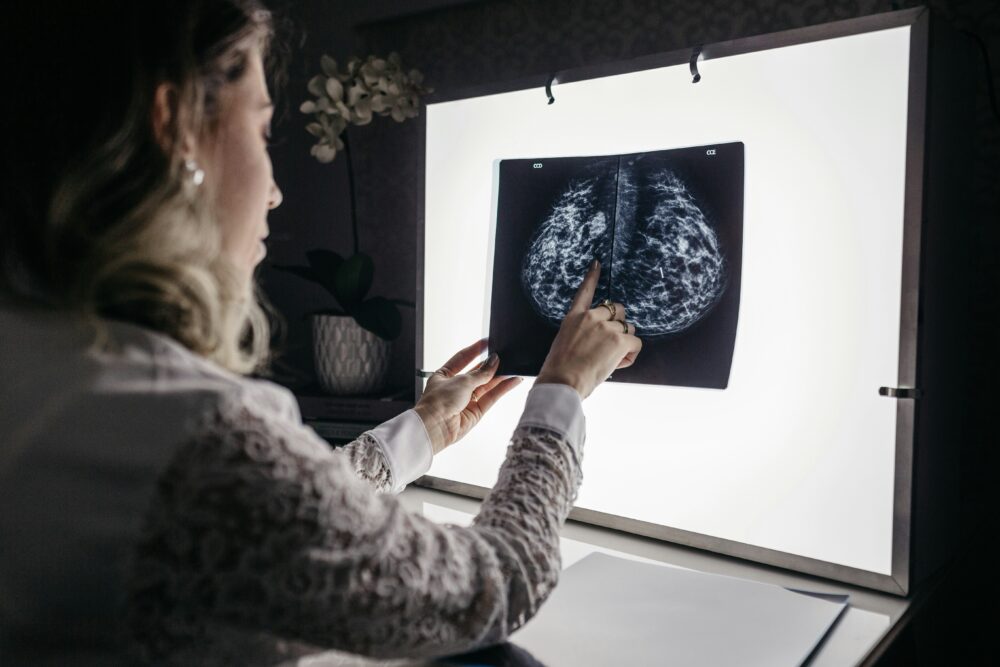

Visiongain has published a new report entitled Medical Imaging Devices Market Report 2024-2034: Forecasts by Type (MRI Systems, Ultrasound (2D, 3D, Others), CT Scanners (Conventional CT, Cone Beam CT), Nuclear Imaging Systems (SPECT, PET), X-ray Imaging Systems (Digital Systems, Analog Systems), Mammography Systems), by Application (Cardiology, Gynaecology/Obstetrics, Orthopaedics & Musculoskeletal, Radiology, Neurology & Spine, General Imaging, Others), by End-user (Hospital, Diagnostic Centres, Others) AND Regional and Leading National Market Analysis PLUS Analysis of Leading Companies AND COVID-19 Impact and Recovery Pattern Analysis.

The Medical Imaging Devices market was valued at US$ 54.3 billion in 2024 and is projected to grow at a CAGR of 4.6% during the forecast period 2024-2034.

Rise in public and private funding to boost market growth

Rising public and private sector initiatives in the form of grants and funds are expected to drive market growth. For instance, in October 2023, the UK government announced an investment of GBP 30 million (US$ 36 million) in medical technology. The funding will be used for adoption of technologies, including virtual wards for remote patient care and wearable devices for monitoring chronic conditions. Also, in April 2023, the provincial government of Alberta, Canada in Budget 2023 provided US$ 12 million in funding to expand capacity for patients waiting for medical imaging. The funding will enable Alberta Health Services (AHS) to perform additional 41,000 CT scans, for an annual total of 540,000; additional 12,000 MRI scans, for an annual total of 255,000.

Furthermore, in June 2023, Gradient Health, a leading medical AI data-sharing company, closed a US$ 2.75 million funding round led by ReMY Investors & Consultants. The funding will help to annotate medical imaging library into a secure, unified platform. Other new investors included Boro Capital, Supernode Ventures, MedMountain Ventures, The Triangle Tweener Fund, David Golan, and Silicon Valley Social Venture Fund (SV2) while existing investors included VentureSouth and Wavemaker Three-Sixty Health.

How has COVID-19 had a Significant Negative Impact on the Medical Imaging Devices Market?

COVID-19 presented an opportunity for the medical imaging devices market players to play an expanded role in care. The growing number of coronavirus cases across the globe in the previous years triggered the need for diagnostics for COVID cases. Furthermore, the rising relationship between technology and healthcare to enable access to care opened new revenue avenues for the market players over the forecast period. Increased risk of respiratory complications and pneumonia also triggered the use of imaging devices for diagnosis.

The Visiongain lead analyst comments: “COVID-19 has caused major issue in accessibility to healthcare. However, diagnostic medical procedures helped in early diagnosis of complications to help early treatment procedures. Furthermore, availability of medical imaging devices at diagnostic centers and easy access at hospitals has also impacted the uptake of these procedures. However, the major cause for the drop was owing to the reluctance among patients to visit healthcare facilities."

How will this Report Benefit you?

Visiongain’s 312-page report provides 126 tables, 204 charts and graphs. Our new study is suitable for anyone requiring commercial, in-depth analyses for the Medical Imaging Devices Market, along with detailed segment analysis in the market. Our new study will help you evaluate the overall global and regional market for Medical Imaging Devices. Get financial analysis of the overall market and different segments including drug class, route of administration and distribution channel market share. We believe that there are strong opportunities in this fast-growing Medical Imaging Devices market. See how to use the existing and upcoming opportunities in this market to gain revenue benefits in the near future. Moreover, the report will help you to improve your strategic decision-making, allowing you to frame growth strategies, reinforce the analysis of other market players, and maximise the productivity of the company.

What are the Current Market Drivers?

High prevalence of chronic conditions

Increasing prevalence of chronic conditions is a major cause for the need of diagnostic imaging. These diseases urge the need for screening and detection with medical imaging equipment. Non-communicable diseases (NCDs), also known as chronic diseases, include cardiovascular diseases, cancers, chronic respiratory diseases (such as chronic obstructive pulmonary disease and asthma) and diabetes. According to WHO, NCDs lead to 41 million deaths each year (account for 74% of all deaths globally). As per CDC, annually, in the US, 6 in 10 adults have a chronic disease and 4 in 10 adults have two or more chronic diseases. These chronic diseases are a leading cause of death and disability in the US with annual healthcare costs of US$4.1 trillion. With growing awareness of these lifestyle diseases patients are now opting for regular health check-ups thereby, driving the market growth.

Technological

Innovation continues to drive the market with advanced equipment and accurate diagnosis for disease predictions. Number of features such as accuracy and precision, early detection, workflow efficiency, affordability, and integration of multimodal data are being implemented to enhance the devices. Further characteristics could include combination of light and audio, modalities for lightweight, portable, intelligent, connected, and dedicated systems. In addition, portable and wearable scanners are expected to trigger market growth. For instance, in Sep 2021, the US FDA approved the first major imaging device advancement for computed tomography in nearly a decade. The new diagnostic imaging device, called Siemens NAEOTOM Alpha, designed to transform the information from X-ray photons received by a detector, into a detailed 3D image. The images can be used in diagnosis, train staff, radiation therapy planning. The FDA reviewed the system through the 510(k) premarket clearance pathway, such advancements are expected help in enhancing the market growth.

Where are the Market Opportunities?

Development of innovative technologies

Novel technologies such as artificial and augmented intelligence, augmented and virtual reality combined with 3D imaging are expected to provide new opportunities. Virtual reality could help in providing training to personnel while AI could help in automating reasoning and enhancing human diagnostic characteristics. Some examples include, DeepMind uses GoogleAI to reduce false results in breast cancer screening; Cardiac MRI segmentation and analysis model to provide real time diagnosis of cardiovascular diseases; ProFound AI to enhance accuracy of tomosynthesis imaging to detect breast cancer. In addition, increasing funding in AI for imaging technologies has boosted the market growth. For instance, according to Rock Health’s Digital funding reported radiology AI funding has increased from US$ 2 billion in 2013 to $13 billion in 2022. It is expected that by 2028 there would be 147 new AI products based on the funding of 2022 of US$13 billion.

Competitive Landscape

The major players operating in the Medical Imaging Devices market are Canon Medical Systems, FUJIFILM VisualSonics Inc., GE Healthcare, Hologic, Inc, Koning Corporation, Koninklijke Philips N.V., Mindray Medical International, PerkinElmer, Inc. (Revvity Inc.), Samsung Medison Co. Ltd, and Siemens Healthineers AG. These major players operating in this market have adopted various strategies comprising M&A, investment in R&D, collaborations, partnerships, regional business expansion, and new product launch.

Recent Developments

- On February 2024, GE HealthCare and MedQuest Associates announced a three-year collaboration to deliver excellence in patient care by providing access to innovative technologies from GE HealthCare and the infrastructure and resources from MedQuest that are needed to optimize multi-site outpatient imaging networks for success.

- On January 2024, Koning Health and Gentle Scan Health, LP, announce their strategic partnership to revolutionize breast cancer imaging by installing 20 state-of-the-art Koning Vera Breast CT devices across the United States in 2024, with the inaugural installations scheduled for the Metropolitan New York City area, Atlanta, and Southern California at the start of the year.

Notes for Editors

If you are interested in a more detailed overview of this report, please send an e-mail to contactus@visiongain.com or call +44 207 336 6100.

About Visiongain

Visiongain is one of the fastest-growing and most innovative independent media companies in Europe. Based in London, UK, Visiongain produces a host of business-to-business reports focusing on the automotive, aviation, chemicals, cyber, defence, energy, food & drink, materials, packaging, pharmaceutical and utilities sectors.

Visiongain publishes reports produced by analysts who are qualified experts in their field. Visiongain has firmly established itself as the first port of call for the business professional who needs independent, high-quality, original material to rely and depend on.