Are you looking for a definitive report on automotive vehicle to everything (V2X) communications technologies?

You will receive a highly granular market analysis segmented by region, by subsector and by end use, providing you with that complete industry outlook, essential for your business strategy.

The reports assesses that Automotive V2X Communication Technologies are expected to reach 95.9 Million units In 2018.

Sector Profile

The automotive industry is undergoing a series of transitions, with the industry moving towards digitalization and connected mobility. There has been a significant rise in the use of electronics in the vehicles. The vehicles today have shifted from being a conventional vehicle to intelligent vehicles which are equipped with communication systems that alert or assist the driver with a potential accident. Moreover, the rising consumer demand for convenience features has enforced various OEMs to incorporate V2X communication systems. The implementation of the V2X communication will not only increase the safety aspect but will also provide an enhanced driving experience.

The 185 page report covers an overview of the overall market and various trials taking place in the V2X market, coupled with regional conclusions. Readers can expect to understand the difference between communication technologies, such as 802.11p and cellular, and benefit from analytical insights about the state of trials in different regions. They have also been provided with an assessment of OEMs offerings, supplier capabilities, and their respective product portfolios

Quantitative Market Analysis

• Global Automotive V2X Communications Forecasts From 2018-2028

• Regional Automotive V2X Communications Forecasts From 2018-2028 (Units)

• America V2X Communications Forecast 2018- 2028

• EMEA V2X Communications Forecast 2018- 2028

• APAC V2X Communications Forecast 2018- 2028

• Regional Automotive V2V Communications Forecasts From 2018-2028 (Units)

• America V2V Communications Forecast 2018- 2028

• EMEA V2V Communications Forecast 2018- 2028

• APAC V2V Communications Forecast 2018- 2028

• Automotive V2X Subsegment Forecasts By Type From 2018-2028 (Units)

• Vehicle to Vehicle (V2V) Forecast 2018-2028 (Units)

• DSRC V2V Modules Revenue Forecast 2018-2028 ($m)

• OEM V2V DSRC Modules Forecast 2018-2028

• Aftermarket V2V DSRC Modules Forecast 2018-2028

• Vehicle to Infrastructure (V2I) Forecast 2018-2028 (Units)

• Vehicle To Home (V2H) Forecast 2018-2028 (Units)

• In Vehicle (IN-V), Forecast 2018-2028 (Units)

• In Vehicle (IN-V) Revenue Forecast 2018-2028 ($m)

• Embedded Forecast 2018-2028

• Integrated Forecast 2018-2028

• Tethered Forecast 2018-2028

• In Vehicle (IN-V) Revenue Forecast By Service Provider From 2018-2028 ($m)

• OEM Forecast 2018-2028

• Aftermarket Forecast 2018-2028

• Telematics Forecast 2018-2028

• Connectivity Forecast 2018-2028

• DSRC Installation Forecast 2018-2028 (Units)

• Road Side Units (RSU) Forecast 2018-2028 (Units)

• Vehicle to Pedestrian (V2P) / DSRC Equipped Smartphones Forecast 2018-2028 (Units)

• Smartphone Shipments Forecast 2018-2028 (Units)

Qualitative Analysis

• SWOT Analysis Of The Automotive V2X Communications Market.

• Drivers And Restraints For Each Market Space

• Consideration Of Regulation, Policy And Legal Aspects

Competitive landscape analysis

• Analysis For The 5 Leading Automotive OEMS Involved With V2X Communications Technologies

• BMW AG

• Daimler AG

• General Motors

• Toyota Motor Corporation

• Volkswagen Group

• Profiling For The Leading Automotive V2X Communications Technology Suppliers

• Arada Systems

• Autotalks Ltd.

• Cohda Wireless

• Delphi Automotive PLC

• Denso Corporation

• eTrans Systems

• Kapsch TrafficCom

• Qualcomm Incorporated

• Savari Inc.

Who should read this report?

• Automotive OEMs

• Tier 1 suppliers

• Electronic sensor manufacturers

• Component suppliers

• Hardware vendors

• Software developers

• Telecommunications companies

• Telematics providers

• Connected car developers

• Autonomous vehicle developers

• Battery electric vehicle companies

• Road infrastructure providers

• Technologists

• R&D staff

• NPD specialists

• Consultants

• Senior executives

• Business development managers

• Heads of strategic development

• Marketing staff

• Market analysts

• Procurement staff

• Banks

• investors

• Industry associations

• Regulators

• Governmental departments & agencies

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global V2X Market Overview

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report Include:

1.5 Who is This Report For?

1.6 Methodology

1.6.1 Primary Research

1.6.2 Secondary Research

1.6.3 Market Evaluation & Forecasting Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to the V2X Communications Market

2.1 Overview of the Global V2V-V2I Market Status in 2018

2.1.1 Automated Driving Systems (ADS): A Vision for Safety 2.0

2.1.2 The NHTSA Aims to Mandate V2V in All New Cars

2.1.3 The European Commission Announces Europe’s New Connected Car Standards

2.1.4 OEMs & Tier-1s Showcase V2V and V2I Technology

2.2 The Vehicle-to-Everything (V2X) Communications Market

2.3 Learn Which Wireless Communication Technologies Enable V2X

2.3.1 Dedicated Short Range Communication (DSRC) for V2V and V2I

2.3.2 Cellular: LTE-4G for V2V-V2I Communication

2.3.3 Bluetooth for V2V-V2I Communication

2.3.4 WiFi for V2V-V2I Communication

2.3.5 Mobile Networks for V2V-V2I Communication

2.3.6 GPS for V2V-V2I Communication

2.3.7 Short range radio for V2V-V2I Communication

2.3.8 Sensors for V2V-V2I Communication

2.4 Overview of the Vehicle-to-Vehicle Applications

2.4.1 V2V Communications Market Segmentation Overview

2.4.2 Vehicle-to-Infrastructure (V2I) Communication

2.4.3 V2I Segmentation Overview

2.4.4 Vehicle-to-Pedestrians (V2P) Communication

2.4.5 Vehicle-to-Home (V2H) Communication

2.4.6 In-Vehicle (IN-V) Communication

2.5 Market Definition-The V2X & V2V-V2I Markets

2.5.1 V2X, V2V & V2I Market Segmentation Overview

2.6 V2X Interconnected with Connected Car, ITS, and IoT Ecosystems

3. V2X Market Drivers, Challenges, and Trends

3.1 Global V2X Market Drivers 2018

3.2 Global V2X Market Trends 2018

3.3 Market Challenges

4. Global V2X Communications Market & Submarket Forecast 2018-2028

4.1 Global V2V Communication Market Forecast 2018-2028

4.2 Global V2V Market Segmentation Forecast 2018-2028: OEM vs. Aftermarket

4.2.1 Revenues from Aftermarket & OEM DSRC Modules 2018-2028

4.3 Global V2V Communications Market Status in 2018

4.3.1 Learn Why V2V Penetration in New Car Sales is Low in 2018

4.3.2 DSRC for Global V2P Communications

4.4 Global V2I Communications Market Forecast 2018-2028

4.4.1 Global V2I Penetration in New Car Sales Forecast 2018-2028

4.4.2 Learn What Are the Reasons for a Low V2I Penetration in 2016 And The Potential For Growth in US and European Market

4.4.3 Road Side Units (RSU) Installations Forecast 2018-2027

4.5 Global Vehicle-to-Pedestrians (V2P) Market Forecast 2018-2028

4.5.1 Revenues from DSRC-Enabled Smartphones Forecast 2018-2028

4.5.2 Smartphone Shipments Forecast 2018-2028

4.5.3 DSRC Penetration in New Smartphone Sales Forecast 2018-2028

4.5.4 Drivers & Restraints of the V2P Communications Submarket

4.6 Global V2H Communications Submarket Forecast 2018-2028

4.7 Global IN-V Communications Submarket Forecast 2018-2028

4.7.1 Revenues Forecast from Cars with IN-V Modules 2018-2028

4.7.2 IN-V Communications Submarket Segmentation Forecast 2018-2028 - Type of Connectivity

4.7.3 IN-V Submarket Forecast 2018-2028 by Service Provider

4.8 Global V2X Legal Framework Analysis

4.9 Venture Capital investing in the Connected Car industry

5. Regional V2X Market Forecast 2018-2028

5.1 Passenger Car Sales Data: Historical 2006-16 & Forecast 2018-28

5.1.1 Historical Regional Passenger Car Sales 2006-2016

5.1.2 Historical Regional Passenger Car Sales Market Shares 2006, 2011, 2016

5.1.3 Regional Passenger Car Sales Forecast 2018-2028

5.1.4 Regional Market Shares Forecast of Passenger Car Sales 2018, 2023, 2028

5.2 Regional V2X Communications Submarket Forecast 2018-2028

5.2.1 Americas V2X Communications Forecast 2018- 2028

5.2.2 EMEA V2X Communications Forecast 2018- 2028

5.2.3 APAC V2X Communications Forecast 2018- 20278

5.3 Regional V2V Communications Submarket Forecast 2018-2028

5.4 Regional V2V Market Share Forecast Summary 2018, 2023, 2028

5.4.1 How Different Motivations Behind V2V Communications Will Lead to Different Regional Penetration of V2V

5.4.2 How Differences in Spectrum Allocation Among Different Regions Affect the Global Standardization of V2V Communications

6. Regulation

6.1 Legal Framework Analysis for US and UK

6.1.1 US V2X Legal Framework and Standards

6.1.2 European V2X Legal Framework and Standards

7. Five Forces Analysis

8. Leading 10 Automotive V2X Companies

8.1 BMW AG

8.1.1 BMW AG Company Overview

8.1.2 BMW’s Role in the V2V & V2I Market

8.2 Daimler AG

8.2.1 Daimler AG Company Overview

8.2.2 Daimler’s Role in the V2V & V2I Market

8.2.3 Daimler’s Car-To-X Communications Technology

8.3 General Motors (GM)

8.3.1 General Motors (GM) Company Overview

8.3.2 GM’s Role in the V2V & V2I Market

8.4 Toyota Motor Corporation

8.4.1 Toyota Motor Corporation Overview

8.4.2 Toyota’s Role in the V2V & V2I Market

8.4.3 Toyota on the FCC’s Proposed Rulemaking to Open 5.9 GHz Band

8.5 Volkswagen Group AG

8.5.1 Volkswagen Group AG Company Overview

8.5.2 VW’s Role in the V2V & V2I Market

9. Leading Suppliers, Tier-1s in the V2V & V2I Market

9.1 Arada Systems

9.1.1 Arada Systems Company Overview

9.1.2 Arada Systems’ Role in the V2V & V2I Market

9.2 Autotalks Ltd.

9.2.1 Autotalks Ltd. Company Overview

9.2.2 Autotalks’s Role in the V2V & V2I Market

9.3 Cohda Wireless

9.3.1 Cohda Wireless Company Overview

9.3.2 Cohda Wireless Role in the V2V & V2I Market

9.4 Delphi Automotive PLC

9.4.1 Delphi Automotive PLC Company Overview

9.4.2 Delphi’s Role in the V2V & V2I Market

9.5 Denso Corporation

9.5.1 Denso Corporation Company Overview

9.5.2 Denso’s Role in the V2V & V2I Market

9.6 eTrans Systems

9.6.1 eTrans Systems Company Overview

9.6.2 eTrans Systems’ Role in the V2V & V2I Market

9.7 Kapsch TrafficCom

9.7.1 Kapsch Trafficom Company Overview

9.7.2 Kapsch’s Role in the V2V & V2I Market

9.8 Qualcomm Incorporated

9.8.1 Qualcomm Incorporated Company Overview

9.8.2 Qualcomm’s Role in the V2V & V2I Market

9.9 Savari Inc.

9.9.1 Savari Inc. Company Overview

9.9.2 Savari’s Role in the V2V & V2X Market

9.10 Other Leading Companies in the V2V & V2I Market

10. Conclusions and Recommendations

10.1 Key Findings from Our Research

10.2 V2V & V2I Penetration in New Vehicle Sales Forecast 2018-2028

10.3 What Will Drive Demand in the V2X Market from 2018to 2028?

10.4 Learn Which Connectivity Technology is Most Suitable to Support V2V and V2I: DSRC, Wi-Fi, LTE, or LIDAR?

11. Glossary

List of Tables

Table 2.1 European Commission’s Action Plan for the Deployment of ITS in Europe

Table 2.2 Dedicated Short Range Communications (DSRC) Service At a Glance

Table 2.3 ADAS Sensors Usage in ADAS End-User Applications

Table 2.4 Vehicle-to-Vehicle (V2V) Communication Applications

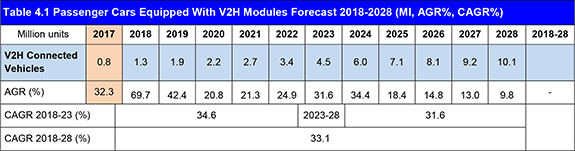

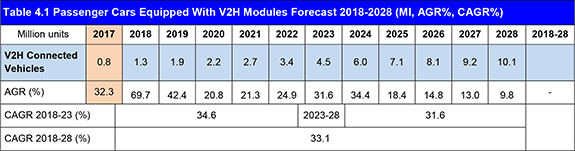

Table 4.1 Global Sales of New Passenger Cars Equipped with V2V, V2I, V2H, IN-V Modules Forecast 2018-2028 (Millions, AGR%, CAGR%)

Table 4.2 New Passenger Cars Equipped with V2V Modules Sales Forecast 2018-2028 (million units, AGR%, CAGR%)

Table 4.3 Aftermarket & OEM DSRC Modules Revenue Forecast 2018-2028 ($bn, AGR%, CAGR%)

Table 4.4 Total DSRC Installation Market Forecast 2018-2028 (Million Units, AGR %, CAGR %, Cumulative)

Table 4.5 Cost of DSRC Installations In New Vehicles for OEMs & Consumers 2018, 2023, 2028 ($)

Table 4.6 Passenger Cars Equipped With V2I Modules Sales Forecast 2018-2028 (Millions, AGR%, CAGR%)

Table 4.7 Road Side Units (RSU) Installations Forecast 2018-2028 (Ml, AGR%, CAGR%)

Table 4.8 Revenues Forecast From DSRC-Equipped Smartphones 2018-28 ($bn, AGR%, CAGR%)

Table 4.9 Smartphone Shipments Forecast 2018-2028 (Billion Units, AGR%, CAGR%)

Table 4.10 Drivers & Restraints of the V2P Communications Submarket

Table 4.11 Passenger Cars Equipped With V2H Modules Forecast 2018-2028 (Ml, AGR%, CAGR%)

Table 4.12 Drivers & Restraints of the V2H Communications Submarket

Table 4.13 Passenger Cars Equipped With IN-V Modules Sales Forecast 2018-2028 (Ml, AGR%, CAGR%)

Table 4.14 Revenue Forecast from Cars With IN-V Modules 2018-2028 ($bn, AGR%, CAGR%)

Table 4.15 Global IN-V Connected Vehicles Submarket Drivers & Restraints

Table 4.16 IN-V Communications Submarket Forecast by Type of Connectivity 2018-2028 ($bn, AGR %)

Table 4.17 IN-V Submarket Forecast by Service Provider 2018-2028 ($bn, AGR %)

Table 5.1 Historical Regional Passenger Car Sales 2006-2016 (Million, AGR%)

Table 5.2 Regional Passenger Car Sales Forecast 2018-2028 (Million units, AGR%)

Table 5.3 Regional V2X Communication Submarket Forecast 2018-2028 (Million units, AGR%, CAGR%)

Table 5.4 Americas V2X Communication Market Forecast 2018-2028 (in Million Units, AGR %, CAGR %, Cumulative)

Table 5.5 EMEA V2X Communication Market Forecast 2018-2028 (in Million Units, AGR %, CAGR %, Cumulative)

Table 5.6 APAC V2X Communication Market Forecast 2018-2028 (in Million Units, AGR %, CAGR %, Cumulative)

Table 5.7 Regional V2V Communication Submarket Forecast 2018-2028 (Million, AGR%, CAGR%)

Table 6.1 NHTSA Cooperation with the FTC In the Setting of Safety Standards Against hacking for Connected Car and V2V Technology

Table 8.1 Leading Companies in the V2X Market

Table 8.2 BMW AG Overview (Revenue, Car Sales, Market Share in Car Sales, No. of Employees, HQ, Ticker, Contact, Website)

Table 8.3 BMW Revenues 2012-2016 (Euro million)

Table 8.4 Daimler AG Overview (Revenue, HQ, Car Sales 2016, No. of Employees, Ticker, IR, Website)

Table 8.5 Daimler AG Financials 2012-2016 (Euro million)

Table 8.6 General Motors Company Overview (Revenue, HQ, Employees, Ticker, Contact, Website)

Table 8.7 General Motors (GM) Financial Services Financials 2013-2016

Table 8.8 Toyota Motor Company Overview (Company Revenue, Auto Financing Segment, Auto Financing Portfolio, HQ, Ticker, Employees, Website)

Table 8.9 Toyota Motor Company Financials 2012-2016 (Yen Million)

Table 8.10 Strategic Alliances with Sumitomo and SPARX

Table 8.11 Volkswagen Company Overview (Revenue, Cars Sold, HQ, Global Car Sales Market Share, Ticker, Website)

Table 8.12 Volkswagen AG Financials 2012-2016 (Euro millions)

Table 9.1 Arada Systems Overview 2016 (Products, Services, HQ, Website)

Table 9.2 Autotalks Overview 2016 (Products, Services, IR, HQ, Website)

Table 9.3 Cohda Wireless Overview 2016 (Revenue, Products, HQ, IR, Employees, Website))

Table 9.4 Delphi Automotive PLC Overview (Company Revenue, Auto Financing Segment, Auto Financing Portfolio, HQ, Ticker, Employees, Website)

Table 9.5 Delphi Automotive PLC Financials 2012-2016 (5-year Net Sales, Operating Income, Net Income) 2012-2016

Table 9.6 Denso Overview 2016 (Revenue, Products, Market Cap, Ticker, HQ, Employees, Website)

Table 9.7 eTrans Systems Overview 2015 (Products, Services, HQ, Website)

Table 9.8 Kapsch 2015 (Revenue, Products, HQ, Employees, Ticker, Website)

Table 9.9 Qualcomm Overview 2016 (Revenue, Product, HQ, Ticker, Contact, Website)

Table 9.10 Savari Company 2015 (Revenue, Products, HQ, Contact, Website)

Table 10.1 Global Sales of New Passenger Cars Equipped with V2V, V2I, V2H, IN-V Modules Forecast 2018-2028 (Million units, AGR%, CAGR%)

Table 10.2 Key Findings

Table of Figures

Figure 2.1 The Vehicle-to-Everything (V2X) & the V2V, V2I, V2P, V2H, IN-V Markets

Figure 2.2 V2V Segmentation Overview: V2M, OEM, Aftermarket

Figure 2.3 V2I Segmentation Overview: ETC, EPP, V2G

Figure 2.4 IN-V Communications’ Segmentation

Figure 2.5 V2X Market Submarket Definition

Figure 2.6 V2V, V2I & V2X Market Segmentation Overview

Figure 2.7 Phases of Evolution of the Connected Car

Figure 3.1 IEEE802.11P v/s Cellular V2X

Figure 3.2 UN Regulation for Vehicle Safety

Figure 3.3 Regulation and NCAP Ratings for ADAS

Figure 4.1 Global Sales of New Passenger Cars Equipped with V2V, V2I, V2H, IN-V Modules Forecast 2018-2028 (Million units, AGR%, CAGR%)

Figure 4.2 V2X Submarkets’ Share Forecast Summary 2018, 2023, 2028 (%)

Figure 4.3 New Passenger Cars Equipped with V2V Modules Sales Forecast 2018-2028 (Ml, AGR%)

Figure 4.4 New Passenger Cars Equipped with V2V Modules Sales Forecast 2018-2028 ($bn, AGR%)

Figure 4.5 Market Share Forecast of OEM & Aftermarket DSRC-Installations Revenues 2018, 2023, 2028 (%)

Figure 4.6 Total DSRC Installation Market Forecast 2018-2028 (Million Units, AGR %)

Figure 4.7 Passenger Cars Equipped With V2I Modules Sales Forecast 2018-2028 (Ml, AGR%)

Figure 4.8 V2I & V2V Penetration in New Vehicles Sales Forecast 2018-2028 (in Million units)

Figure 4.9 Road Side Units (RSU) Installations Forecast 2018-2028 (Millions, AGR%)

Figure 4.10 Revenues Forecast From DSRC-Equipped Smartphones 2018-28 ($bn, AGR%)

Figure 4.11 Smartphone Shipments Forecast 2018-2028 (Billion Units, AGR%)

Figure 4.12 Passenger Cars Equipped With V2H Modules Forecast 2018-2028 (Ml, AGR%)

Figure 4.13 Passenger Cars Equipped With IN-V Modules Sales Forecast 2018-2028 (Ml, AGR%)

Figure 4.14 Revenue Forecast from Cars With IN-V Modules 2018-2028 ($bn, AGR%)

Figure 4.15 IN-V Communications Submarket Share Forecast 2018, 2023, 2028 by Type of Connectivity (%)

Figure 4.16 Global IN-V Submarket Share Forecast 2018, 2023, 2028 by Service Provider (%)

Figure 4.17 Venture Capital Companies in the Automotive Industry

Figure 5.1 Historical Regional Passenger Car Sales 2005-2016 (Million, AGR%)

Figure 5.2 Historical Regional Market Shares in Passenger Car Sales 2006, 2011, 2016 (%)

Figure 5.3 Regional Market Share Forecast in Passenger Car Sales 2018, 2023, 2028 (%)

Figure 5.4 Regional V2X Communication Submarket Forecast 2018-2028 (Million units, AGR%)

Figure 5.5 Americas V2X Communication Market Forecast 2018-2028 (in Million Units, AGR %)

Figure 5.6 Americas Luxury Car Market 2018-2028 (in Million Units)

Figure 5.7 EMEA V2X Communication Market Forecast 2018-2028 (in Million Units, AGR %)

Figure 5.8 EMEA Luxury Car Market 2018-2028 (in Million Units)

Figure 5.9 APAC V2X Communication Market Forecast 2018-2028 (in Million Units, AGR %)

Figure 5.10 APAC Luxury Car Market 2018-2028 (in Million Units)

Figure 5.11 Regional V2V Communication Submarket Forecast 2018-2028 (Million, AGR%)

Figure 5.12 Regional Market Share Forecast of the V2V Submarket 2018, 2023, 2028 (%)

Figure 8.1 Ranking of the 10 leading Automotive OEMs by 2016 Revenue ($ bn)

Figure 8.2 Ranking of the 10 leading Automotive OEMs by Sales (million vehicles) in 2016-17

Figure 8.3 BMW- Market Share in 2016 BMW Group’s Sales in Selected Regions (%)

Figure 9.1 Delphi’s 2015 Revenue by Segment (%)

Figure 9.2 Delphi’s 2015 Net Sales by Region (%)