• Do you need definitive automated guided vehicle company information?

• Clear competitor analysis?

• Succinct automated guided vehicle industry analysis?

• Technological insight?

• Actionable business recommendations?

Read on to discover how this definitive report can transform your own research and save you time.

The aim of the report is to provide a quantitative evaluation of the largest 20 companies in the global automated guided vehicle market by detailing their revenues, market share, involvement and competitive positioning within the $2bn AGV ecosystem. If you want to be part of this growing industry, then read on to discover how you can maximise your investment potential.

Report highlights

The report focuses on providing detailed profiles of the leading and most innovative companies in the automated guided vehicle sector and analyzes their role in the market and their automated guided vehicle based offerings This report aims to look at automated guided vehicle companies from an end user perspective.

The report is aimed at business executives who wish to gain an overview and information about the automated guided vehicle market and leading companies with the competitive landscape. We believe this will help our clients to understand the industry, technology, market structure and to evaluate suppliers, and map potential other usages for the available technologies. Our research will help you to understand the rapidly evolving leading automated guided vehicle market space.

Report scope

Top 20 Automated Guided Vehicle (AGV) Companies With Market Share %, Revenues And Ranking Within the AGV Market Space

• Bastian Solutions

• Daifuku Co., Ltd.

• Dematic

• Hyster & Yale

• JBT

• Jungerech

• KION

• Konecranes

• Kuka

• Mecalux, S.A.

• Murata Machinery, Ltd.

• Schaefer Holding International GmbH

• Seegrid

• Swisslog

• TGW Logistics Group GmbH

• Toyota Motor Corporation

• Transbotics

• Universal Robots

• Vanderlande Industries

• Yokogawa

SWOT analysis of the major strengths and weaknesses of the AGV market, together with the opportunities available and the key threats faced.

The report serves as a guide for senior executives of small and medium businesses (SMBs), large enterprises, software developers, and automated guided vehicle industry players to:

• Use as a guideline for evaluating the potential of automated guided vehicle technologies across multiple industries and applications

• Inform themselves about automated guided vehicle benefits and issues;

• Understand the supplier landscape and their offerings;

• Anticipate potential for technological development and opportunities with regards to the automated guided vehicle market.

Key questions answered

• What potential is there for the automated guided vehicle industry?

• Where should you target your business strategy?

• Which applications should you focus upon?

• Which disruptive technologies should you invest in?

• Which companies should you form strategic alliances with?

• Which company is likely to succeed and why?

• What business models should you adopt?

• What industry trends should you be aware of?

Target audience

• Automated guided vehicle companies

• Manufacturers

• Automotive OEMs

• Logistics companies

• Component suppliers

• Software developers

• Technologists

• AI specialists

• R&D staff

• Consultants

• Analysts

• Executives

• Business development managers

• Investors

• Governments

• Agencies

• Industry organizations

• Banks

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Automated Guided Vehicle Market Overview

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered By This Analytical Report

1.5 Who Is This Report For ?

1.6 Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction To Automated Guided Vehicles

2.1 Automated Guided Vehicle Market Overview

2.1.1 Industrial Automation Penetration Is Increasing Globally

2.1.2 Growth Of Connected Technology in Supply Chain Industry

2.2 AGV History

2.2.1 Review of the State-of-Art of AGVs

2.3 Market Opportunity For Warehouses Players

2.4 Automated Guided Vehicle `Potential Benefits For Consumers

2.5 Emergence of intelligent AGVs

2.7 Market Definition

2.8 Automated Guided Vehicle Market Drivers

2.8.1 Reduced Cost Of Labour

2.8.2 Enhanced Safety in Workplaces

2.8.3 Enriched Productivity & Accuracy

2.9 Automated Guided Vehicle Market Restraints

2.9.1 High initial investments

2.9.2 Not Suitable for Non-Repetitive Tasks

2.9.3 Complicated End-User Requirements

2.9.4 Lack of Standardization

2.10 Automated Guided Vehicle Market Opportunities

2.10.1 Introduction of IoT and Industry 4.0

2.10.2 Wide Spread of Factory Automation

2.10.3 Emergence of Industrial IoT

3. Value Chain Analysis

3.1 OEMs and Component suppliers

3.2 System Integrators

3.3 End Users

3.4 Suppliers & Distributors

4. Porter’s Five Forces Analysis

4.1 Low Threat Of Forward Integration And Price-Sensitive Buyers Have Led To Low Bargaining Power Among Suppliers

4.2. Presence Of Substitutes And Low Switching Costs Have Led To High Bargaining Power Among Buyers

4.3. Government And Legal Barriers And Well-Known Brand Names Have Led To Low Threat Of New Entrants In The Market

4.4. Low Switching Cost And Product Differentiation Have Led To Moderate Threat Of Substitutes In The Market

4.5. Numerous And Strategically Diverse Competitors Instil High Rivalry In The Market

5. The Automated Guided Vehicle Market Landscape

6. Automated Guided Vehicle Type

6.1 Towed Vehicle Type

6.2 Unit Loader Carrier Type

6.3 Pallet Truck Type Market

6.4 Forklift Truck Type Market

7. Automated Guided Vehicle Navigation Technology

7.1 Laser Guidance

7.2 Magnetic Guidance

7.3 Natural Navigation

7.4 Inductive Guidance

8. Automated Guided Vehicle Application

8.1 Transportation

8.2 Assembly and Packaging

9. Automated Guided Vehicle End-User

9.1 Automotive

9.2 Food & Beverage

9.3 Aerospace Market

9.4 Healthcare Market

9.5 Logistics Market

9.6 Others Market

10. Industry Developments Automated Guided Vehicle Markets

10.1 Industry Landscape

10.1.1 New Product Developments

10.2 Recent Developments

11. Automated Guided Robotics Market Revenue Share, By Key companies

12. Major Players In Automated Guided Vehicles

12.1 Daifuku

12.1.1 Daifuku Company Overview

12.1.2 Daifuku Company Snapshot

12.1.3 Daifuku SWOT Analysis

12.2 JBT Corporation

12.2.1 JBT Corporation Company Overview

12.2.2 JBT Corporation Company Snapshot

12.2.3 JBT Corporation SWOT Analysis

12.3 Kion Group

12.3.1 Kion Group Company Overview

12.3.2 Kion Group Company Snapshot

12.3.3 Kion Group SWOT Analysis

12.4 Toyota Motor Corporation

12.4.1 Toyota Motor Corporation Company Overview

12.4.2 Toyota Motor Corporation Company Snapshot

12.4.3 Toyota Motor Corporation SWOT Analysis

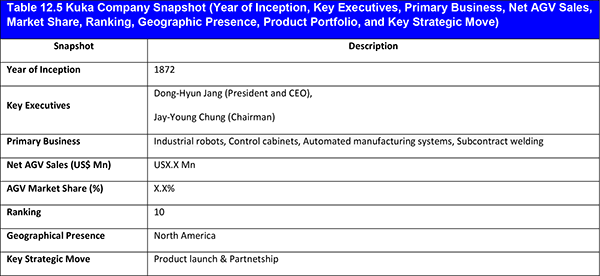

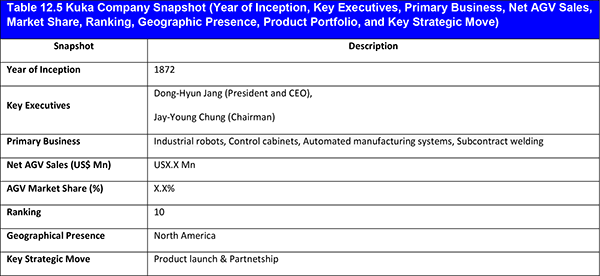

12.5 Kuka

12.5.1 Kuka Company Overview

12.5.2 Kuka Company Snapshot

12.5.3 Kuka SWOT Analysis

12.6 Hyster-Yale Materials Handling

12.6.1 Hyster-Yale Materials Handling Company Overview

12.6.2 Hyster-Yale Materials Handling Company Snapshot

12.6.3 Hyster-Yale Materials Handling SWOT Analysis

12.7 Seegrid Corporation

12.7.1 Seegrid Corporation Company Overview

12.7.2 Seegrid Corporation Company Snapshot

12.7.3 Seegrid Corporation SWOT Analysis

12.8 Jungheinrich AG

12.8.1 Jungheinrich AG Company Overview

12.8.2 Jungheinrich AG Company Snapshot

12.8.3 Jungheinrich AG SWOT Analysis

12.9 Swisslog Holding AG

12.9.1 Swisslog Holding AG Company Overview

12.9.2 Swisslog Holding AG Company Snapshot

12.9.3 Swisslog Holding AG SWOT Analysis

12.10 Konecranes Oyj

12.10.1 Konecranes Oyj Company Overview

12.10.2 Konecranes Oyj Company Snapshot

12.10.3 Konecranes Oyj SWOT Analysis

12.11 TGW Logistics Group

12.11.1 TGW Logistics Group Company Overview

12.11.2 TGW Logistics Group Company Snapshot

12.11.3 TGW Logistics Group SWOT Analysis

12.12 Yokogawa Electric Corporation

12.12.1 Yokogawa Electric Corporation Company Overview

12.12.2 Yokogawa Electric Corporation Company Snapshot

12.12.3 Yokogawa Electric Corporation SWOT Analysis

12.13 Transbotics Corporation

12.13.1 Transbotics Corporation Company Overview

12.13.2 Transbotics Corporation Company Snapshot

12.13.3 Transbotics Corporation SWOT Analysis

12.14 Universal Robots

12.14.1 Universal Robots Company Overview

12.14.2 Universal Robots Company Snapshot

12.14.3 Universal Robots SWOT Analysis

12.15 SSI Schaefer Holding International GmbH

12.15.1 SSI Schaefer Holding International GmbH Company Overview

12.15.2 SSI Schaefer Holding International GmbH Company Snapshot

12.15.3 SSI Schaefer Holding International GmbH SWOT Analysis

12.16 Murata Machinery Ltd.

12.16.1 Murata Machinery Ltd. Company Overview

12.16.2 Murata Machinery Ltd. Company Snapshot

12.16.3 Murata Machinery Ltd. SWOT Analysis

12.17. Mecalux, S.A

12.17.1 Mecalux, S.A Company Overview

12.17.2 Mecalux, S.A Company Snapshot

12.17.3 Mecalux, S.A SWOT Analysis

12.18 Vanderlande Industries

12.18.1 Vanderlande Industries Company Overview

12.18.2 Vanderlande Industries Company Snapshot

12.18.3 Vanderlande Industries SWOT Analysis

12.19 Bastian Solution LLC

12.19.1 Bastian Solution LLC Company Overview

12.19.2 Bastian Solution LLC Company Snapshot

12.19.3 Bastian Solution LLC SWOT Analysis

12.20 Dematic Corporation

12.20.1 Dematic Corporation Company Overview

12.20.2 Dematic Corporation Company Snapshot

12.20.3 Dematic Corporation SWOT Analysis

13. Conclusions and Recommendations

13.1 Automated Guided Vehicle Affords A Competitive Edge

13.3 Advantages On Automated Guided Vehicle

13.4 Disadvantages Of Automated Guided Vehicle

14. List Of Other The Companies In The AGV Value Chain

15. Glossary

List of Tables

Table 10.1 List of Product Innovations In Automated Guided Vehicle By The Leading Organizations, Their Advantage And Specific Technical Details

Table 10.2 Recent Developments (Market Initiatives, Mergers & Acquisitions) in Automated Guided Vehicle Market

Table 11.1 Leading 20 Automated Guided Vehicle Companies 2018 (Market Ranking, Automated Guided Vehicle Revenue, Market Share %)

Table 12.1 Daifuku Company Snapshot (Year of Inception, Key Executives, Primary Business, Net AGV Sales, Market Share, Ranking, Geographic Presence, Product Portfolio, and Key Strategic Move)

Table 12.2 JBT Corporation Snapshot (Year of Inception, Key Executives, Primary Business, Net AGV Sales, Market Share, Ranking, Geographic Presence, Product Portfolio, and Key Strategic Move)

Table 12.3 Kion Group Snapshot (Year of Inception, Key Executives, Primary Business, Net AGV Sales, Market Share, Ranking, Geographic Presence, Product Portfolio, and Key Strategic Move)

Table 12.4 Toyota Motor Corporation Snapshot (Year of Inception, Key Executives, Primary Business, Net AGV Sales, Market Share, Ranking, Geographic Presence, Product Portfolio, and Key Strategic Move

Table 12.5 Kuka Company Snapshot (Year of Inception, Key Executives, Primary Business, Net AGV Sales, Market Share, Ranking, Geographic Presence, Product Portfolio, and Key Strategic Move)

Table 12.6 Hyster & Yale Material Handling Snapshot (Year of Inception, Key Executives, Primary Business, Net AGV Sales, Market Share, Ranking, Geographic Presence, Product Portfolio, and Key Strategic Move)

Table 12.7 Seegrid Corporation Snapshot (Year of Inception, Key Executives, Primary Business, Net AGV Sales, Market Share, Ranking, Geographic Presence, Product Portfolio, and Key Strategic Move

Table 12.8 Jungheinrich AG Snapshot (Year of Inception, Key Executives, Primary Business, Net AGV Sales, Market Share, Ranking, Geographic Presence, Product Portfolio, and Key Strategic Move)

Table 12.9 Swisslog Holding Snapshot (Year of Inception, Key Executives, Primary Business, Net AGV Sales, Market Share, Ranking, Geographic Presence, Product Portfolio, and Key Strategic Move)

Table 12.10 Konecrane Oyj Snapshot (Year of Inception, Key Executives, Primary Business, Net AGV Sales, Market Share, Ranking, Geographic Presence, Product Portfolio, and Key Strategic Move)

Table 12.11 TGW Logistics Group Snapshot (Year of Inception, Key Executives, Primary Business, Net AGV Sales, Market Share, Ranking, Geographic Presence, Product Portfolio, and Key Strategic Move)

Table 12.12 Yokogawa Electric Snapshot (Year of Inception, Key Executives, Primary Business, Net AGV Sales, Market Share, Ranking, Geographic Presence, Product Portfolio, and Key Strategic Move)

Table 12.13 Transbotics Snapshot (Year of Inception, Key Executives, Primary Business, Net AGV Sales, Market Share, Ranking, Geographic Presence, Product Portfolio, and Key Strategic Move)

Table 12.14 Universal Robotics (Year of Inception, Key Executives, Primary Business, Net AGV Sales, Market Share, Ranking, Geographic Presence, Product Portfolio, and Key Strategic Move)

Table 12.15 SSI Schaefer Holding International GmbH Company Snapshots (Year of Inception, Key Executives, Primary Business, Net AGV Sales, Market Share, Ranking, Geographic Presence, Product Portfolio, and Key Strategic Move)

Table 12.16 Murata Machinery Ltd. Company Snapshots (Year of Inception, Key Executives, Primary Business, Net AGV Sales, Market Share, Ranking, Geographic Presence, Product Portfolio, and Key Strategic Move)

Table 12.17 Mecalux S.A Company Snapshots (Year of Inception, Key Executives, Primary Business, Net AGV Sales, Market Share, Ranking, Geographic Presence, Product Portfolio, and Key Strategic Move)

Table 12.18 Vanderlande Industries Company Snapshots (Year of Inception, Key Executives, Primary Business, Net AGV Sales, Market Share, Ranking, Geographic Presence, Product Portfolio, and Key Strategic Move)

Table 12.19 Bastian Solution LLC Company Snapshots (Year of Inception, Key Executives, Primary Business, Net AGV Sales, Market Share, Ranking, Geographic Presence, Product Portfolio, and Key Strategic Move)

Table 12.20 Dematic Company Snapshots (Year of Inception, Key Executives, Primary Business, Net AGV Sales, Market Share, Ranking, Geographic Presence, Product Portfolio, and Key Strategic Move)

List of Figures

Figure 2.1 Automated Guided Vehicle Market Drivers

Figure 2.2 Automated Guided Vehicle Market Restraints

Figure 2.3 Automated Guided Vehicle Market Opportunities

Figure 3.1 Value Chain Analysis

Figure 4.1 Porter’s Five Forces Analysis

Figure 11.1 Leading 20 Automated Guided Vehicle Companies 2018 (Market Share %)

Figure 12.1 Daifuku, Revenue 2015-2017 (Japanese Yen Mn)

Figure 12.2 Daifuku, Gross Profit and R&D Expenses (Yen Mn) 2015-2017

Figure 12.3 JBT Corporation Revenue 2015-2017 (US$m)

Figure 12.4 JBT Corporation Gross Profit and R&D Expenses 2015-2017 (Yen Mn)

Figure 12.5 JBT Corporation Geographic Segment Breakdown (2017, %)

Figure 12.6 JBT Corporation Division Breakdown (2017, %)

Figure 12.7 Kion Group Revenue 2015-2017 (US$m)

Figure 12.8 Kion Group Gross Profit and R&D Expense 2015-2017 (US$m)

Figure 12.9 Kion Group Business Segment Breakdown (2017, %)

Figure 12.10 Toyota Corporation Revenue 2016-2018 (US$b)

Figure 12.11 Gross Profit Of Toyota Industries., 2016-2018 (US$b)

Figure 12.12 Toyota Corporation Revenue 2016-2018 (US$b)

Figure 12.13 Toyota Corporation Business Segment (2018,%)

Figure 12.14 Kuka Revenue Of 2015-2017 (US$m)

Figure 12.15 Hyster & Yale, Inc. Revenue 2015-2017 (US$m)

Figure 12.16 Swisslog Holding Revenue 2015-2017 (US$m)

Figure 12.17 Konecrane,Oyj..Revenue 2015-2017 (US$m)

Figure 12.18 Yokogawa Group .Revenue 2015-2017 (Japanese Yen, Billion)

Figure 12.19 Yokogawa Group. Geographic Revenue 2017 (Share%)

Figure 12.20 Yokogawa Group Business Segment Revenue 2017 (Share%)

Figure 12.21 Murata Machinery Ltd. Revenue & Gross Profit 2017 - 2018 (Yen, Mn)

Figure 12.22 Vanderlande Industries Revenue By Business Segment (2017,%)

AGVE AB

AGVE Group

AutoGuide Mobile Robots

BA System Designs

Bastian Solutions LLC

Bell and Howell

Bolzoni Auramo Beyer

Clearpath

Columbia Machine

Creform Corporation

Daifuku Company Limited

Daihatsu Motor

Dalian Konecranes Company Ltd.

DARPA Autonomy

Dematic Corporation

Dematic GmbH & Co. KG.

DMG Mori Co Ltd

Egemin Automation

Egemin Group

EP Equipment Co., Ltd

Eurofactory GmbH

FedEx

Fetch Robotics

Grenzebach Corporation

Handling Specialty Manufacturing

Hino Motors

Hyster-Yale Materials Handling, Inc.

JBT AeroTech

JBT Corporation

JBT FoodTech

Jungheinrich AG

Kayaba Industry Co Ltd

KION Group

KNAPP

Konecranes AS

Konecranes CZ s.r.o.

Konecranes Kft.

Konecranes N.V.

Konecranes Oyj

Konecranes Pty. Ltd., S.A.

KUKA AG

KUKA de Mexico S. de RL. de C.V.

KUKA Roboter CEE GmbH

KUKA Roboter Italia S.p.A.

KUKA Robotics Australia Pty. Ltd.

KUKA Robotics Canada Ltd.

KUKA Robotics Hungaria Ipari Kft.

KUKA Robotics UK Limited

KUKA Systems (India) Pvt. Ltd.

Linde Gas

Materials Handling International S.A.

Materials Solutions Limited

Mecalux SA

Mitsubishi Logisnext Co Ltd

Morris Middle East Ltd.

Murata Machinery Ltd.

NextLevel Logistik

Nosturiexpertit Oy

OTTO Motors

Raymond Corporation

RedViking

Ricoh USA

Saudi Cranes & Steel Works Factory Co. Ltd.

Schaefer Systems International

Scott Group

Seegrid Corporation

SIA Konecranes Latvija

SSI Schaefer Holding International GmbH

Stahl CraneSystems (India) Pvt. Ltd.

Stanley Black & Decker

Swisslog

Swisslog Holding AG

TGW Future Private Foundation

TGW Logistics Group GmbH

Topper Industrial

Toyota Advanced Logistics

Toyota Financial Services (TFSC)

Toyota Motor Corporation

Transbotics Corporation

Universal Robots A/S

Vanderlande Industries

Vecna Robotics

Velodyne LiDAR

Waypoint

Wesley International

Yaskawa

Yokogawa Electric Corporation