Industries > Energy > Next Generation Energy Storage Technologies (EST) Market Forecast 2017-2027

Next Generation Energy Storage Technologies (EST) Market Forecast 2017-2027

Analysis of Technology Maturity, Performance & Commercialisation of Mechanical (Innovative PHS, AA-CAES, Isothermal CAES & LAES), Chemical (Hydrogen Storage & Fuel Cells), Electrical (SMES) & Electrochemical (Lithium-Air, Lithium-Sulphur, Magnesium-Ion & Zinc-Air Batteries)

The latest research report from business intelligence provider visiongain offers comprehensive analysis of the Next Generation EST market. Visiongain assesses that this market will generate $9.0 bn in 2017.

The Next Generation Energy Storage Technologies (EST) Market Forecast 2017-2027 responds to your need for definitive market data:

Read on to discover how you can exploit the future business opportunities emerging in this sector. Visiongain’s new study tells you and tells you NOW.

In this brand new report you find 187 in-Depth tables, charts and graphs all unavailable elsewhere.

The 240 page report provides clear detailed insight into the global Next Generation EST market. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand new report today you stay better informed and ready to act.

Report Scope

The report delivers considerable added value by revealing:

• 187 tables, charts and graphs analysing and revealing the growth prospects and outlook for the Next Generation EST market.

• Global Next Generation EST market forecasts and analysis from 2017-2027.

• Next Generation EST submarket forecasts from 2017-2027

• Thermal submarket forecast 2017-2027

• Electro Chemical submarket forecast 2017-2027

• Electro Mechanical submarket forecast 2017-2027

• Hydrogen Storage submarket forecast 2017-2027

• Regional Next Generation EST market forecasts from 2017-2027 with drivers and restraints for the regions including;

• North America

• Europe

• China and Japan

• ROW

• Company profiles for the leading 10 Next Generation EST companies

• Johnson Controls

• LG Chem Ltd.

• Duke Energy Corporation

• NextEra Energy, Inc.

• Edison International

• Samsung SDI Co. Ltd.

• Mitsubishi Electric Corporation

• BYD Co. Ltd.

• Robert Bosch GmbH

• ABB Group

• Conclusions and recommendations which will aid decision-making

How will you benefit from this report?

• Keep your knowledge base up to speed. Don’t get left behind

• Reinforce your strategic decision-making with definitive and reliable market data

• Learn how to exploit new technological trends

• Realise your company’s full potential within the market

• Understand the competitive landscape and identify potential new business opportunities & partnerships

Who should read this report?

• Anyone with interest in the Next Generation EST market

• Oil & gas operators

• Commodity traders

• Investment managers

• Arbitrage companies and divisions

• Energy price reporting companies

• Energy company managers

• Energy consultants

• Oil and gas company executives and analysts

• Heads of strategic development

• Business development managers

• Marketing managers

• Market analysts,

• Technologists

• Suppliers

• Investors

• Banks

• Government agencies

Visiongain’s study is intended for anyone requiring commercial analyses for the Next Generation EST market and leading companies. You find data, trends and predictions.

Buy our report today the Next Generation Energy Storage Technologies (EST) Market Forecast 2017-2027: Analysis of Technology Maturity, Performance & Commercialisation of Mechanical (Innovative PHS, AA-CAES, Isothermal CAES & LAES), Chemical (Hydrogen Storage & Fuel Cells), Electrical (SMES) & Electrochemical (Lithium-Air, Lithium-Sulphur, Magnesium-Ion & Zinc-Air Batteries). Avoid missing out by staying informed – get our report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Next Generation Energy Storage Technologies Market Overview

1.2 Market Definition

1.3 Why You Should Read This Report

1.4 Benefits of This Report

1.5 Structure of This Report

1.6 Key Questions Answered by This Analytical Report Include:

1.7 Who is This Report For?

1.8 Methodology

1.8.1 Primary Research

1.8.2 Secondary Research

1.8.3 Market Sizing

1.8.4 Forecasting

1.8.5 Visiongain’s Added Value

1.9 Frequently Asked Questions (FAQ)

1.10 Associated visiongain Reports

1.11 About visiongain

2. Introduction to Established and Emerging Energy Storage Technologies

2.1 Categorisation of Energy Storage Technologies

2.2 Installed Energy Storage Capacity

2.3 The Rise of Emerging Energy Storage Technologies

3. The Drivers and Restraints of Next-Generation Energy Storage Technologies

3.1 An Introduction to the Dynamics of the Market

3.2 The Factors that Will Drive and Restraint the Market

3.2.1 Rising Energy Prices Indirectly Incentivise EST

3.2.2 Investments in Research, Development and Demonstration

3.2.3 The Importance of Renewable Energy Integration

3.2.4 Smart Grids and Distributed Power Generation Systems

3.2.5 Growing Electricity Demand

3.2.6 The Developing Alternative Vehicle Market as a Growth Factor

3.2.7 The High Capital Costs of Emerging Energy Storage Technologies

3.2.8 Limited Cost Recovery Opportunities

3.2.9 The Policy and Regulatory Challenges Ahead

3.2.10 The Impact of Weak Market Demand for ESTs

3.2.11 Geographical and Spatial Constraints of Mature Energy Storage Technologies

3.2.12 Conservatism in the Utility Industry

3.2.13 The Need for Large-Scale Demonstration Projects

3.2.14 Raw Material Availability

3.2.15 Technology Development and Deployment Patterns

3.2.16 The Limitations of Established Energy Storage Technologies

3.2.17 Long Investment Cycles

3.2.18 Opportunities for Home Energy Storage and Arbitrage

4. Next-Generation Mechanical Energy Storage Technologies

4.1 Innovative Pumped Hydro Storage

4.1.1 An Introduction to Innovative Pumped Hydro Storage

4.1.2 The Nature of the Innovation

4.1.3 The Performance Characteristics of Innovative PHS Installations

4.1.4 The Applications and Key Competitors of Innovative PHS

4.1.5 Current Deployment of Innovative PHS

4.1.6 Drivers and Restraints of Innovative PHS

4.1.7 The Outlook for Innovative PHS

4.1.8 Companies and Stakeholders Involved in the Innovative PHS Market

4.2 Adiabatic and Isothermal Compressed Air Energy Storage

4.2.1 An Introduction to Adiabatic and Isothermal Compressed Air Energy Storage

4.2.2 The Nature of the Innovation

4.2.3 The Performance Characteristics of Adiabatic and Isothermal CAES

4.2.4 The Applications and Key Competitors of Advanced CAES

4.2.5 Current Deployment of Compressed Air Energy Storage

4.2.6 Drivers and Restraints of Advanced Compressed Air Energy Storage

4.2.7 The Outlook for Advanced Compressed Air Energy Storage

4.2.8 Companies and Stakeholders Involved in the Advanced CAES Market

4.3 Liquid Aid Energy Storage (LAES)

4.3.1 An Introduction to Liquid Air Energy Storage

4.3.2 The Nature of the Innovation

4.3.3 The Performance Characteristics of Liquid Air Energy Storage

4.3.4 The Applications and Key Competitors of Liquid Air Energy Storage

5. Next-Generation Chemical Energy Storage Technologies

5.1 Large-Scale Hydrogen Energy Storage Systems and Hydrogen Fuel Cells

5.1.1 An Introduction to Large-Scale Hydrogen Energy Storage Systems and Hydrogen Fuel Cells

5.1.2 The Nature of the Innovation

5.1.3 The Performance Characteristics of Large-Scale Hydrogen Energy Storage Systems and Hydrogen Fuel Cells

5.1.4 The Applications and Key Competitors of Large-Scale Hydrogen Storage Systems and Hydrogen Fuel Cells

5.1.5 Current Deployment of Large-Scale Hydrogen Energy Storage Systems and Hydrogen Fuel Cells

5.1.6 Drivers and Restraints of Large-Scale Hydrogen Storage Systems and Hydrogen Fuel Cells

5.1.7 The Outlook for Large-Scale Hydrogen Energy Storage Systems and Hydrogen Fuel Cells

5.1.8 Companies and Stakeholders Involved in the Hydrogen and Fuel Cells Energy Storage Market

6. Next-Generation Electrical Energy Storage Technologies

6.1 Superconducting Magnetic Energy Storage (SMES)

6.1.1 An Introduction to Superconducting Magnetic Energy Storage (SMES)

6.1.2 The Nature of the Innovation

6.1.3 The Performance Characteristics of Superconducting Magnetic Energy Storage

6.1.4 The Applications and Key Competitors of Superconducting Magnetic Energy Storage

6.1.5 Current Deployment of Superconducting Magnetic Energy Storage

6.1.6 Drivers and Restraints of Superconducting Magnetic Energy Storage

6.1.7 The Outlook for Superconducting Magnetic Energy Storage

6.1.8 Companies and Stakeholders Involved in the Superconducting Magnetic Energy Storage Market

7. Next-Generation Electrochemical Energy Storage Technologies

7.1 An Introduction to Next-Generation Battery Technologies

7.2 The Key Drivers of Innovation in the Market

7.3 Key Patterns of Innovation in the Market

7.4 Lithium-air (Li-Air)

7.4.1 Nature of the Innovation

7.4.2 The Performance Characteristics of Lithium Air Batteries

7.4.3 The Applications and Key Competitors of Lithium Air Batteries

7.4.4 Current Deployment of Lithium Air Batteries

7.4.5 The Drivers and Restraints of the Lithium Air Batteries Market

7.4.6 The Outlook for Lithium Air Batteries

7.4.7 Key Companies and Stakeholders Involved in the Lithium Air Battery Market

7.5 Lithium-Sulphur (Li-S)

7.5.1 Nature of the Innovation

7.5.2 The Performance Characteristics of Lithium Sulphur Batteries

7.5.3 The Applications and Key Competitors of Lithium Sulphur Batteries

7.5.4 Current Deployment of Lithium Sulphur Batteries

7.5.5 The Drivers and Restraints of the Lithium Sulphur Battery Market

7.5.6 The Outlook for Lithium Sulphur Batteries

7.5.7 Key Companies and Stakeholders Involved in the Lithium Sulphur Battery Market

7.6 Magnesium-Ion (Mg-Ion)

7.6.1 Nature of the Innovation

7.6.2 The Performance Characteristics of Magnesium Ion Batteries

7.6.3 The Applications and Key Competitors of Magnesium-Ion Batteries

7.6.4 Current Deployment of Magnesium Ion Batteries

7.6.5 The Drivers and Restraints of Magnesium-Ion Batteries

7.6.6 The Outlook for Magnesium-Ion Batteries

7.6.7 Key Companies and Stakeholders Involved in the Magnesium Ion Battery Market

7.7 Zinc-Air (Zn-air)

7.7.1 Nature of the Innovation

7.7.2 The Performance Characteristics of Zinc-Air Batteries

7.7.3 The Main Applications and Key Competitors of Zinc-Air Batteries

7.7.4 Current Deployment of Zinc-Air Batteries

7.7.5 The Drivers and Restraints of the Zinc Air Battery Market

7.7.6 The Outlook for Zinc-Air Batteries

7.7.7 Key Companies and Stakeholders in the Zinc-Air Battery Market

7.8 Concluding Remarks on Emerging Battery Storage Technologies

8. Next-Generation Thermal Energy Storage Technologies

8.1 An Introduction to Next-Generation Thermal Battery Storage Technologies

9. Expert Opinions

9.1 Expert Interview with Paul DiRenzo, Jr from Peak Hour Power

9.1.1 The Growing Interest in Innovative Pumped Hydro Storage Installations

9.1.2 The Opportunities and Challenges of Seawater PHS

9.1.3 The Competition of Other Next-Generation Bulk Storage Technologies

9.2 Expert Interview with Giw Zanganeh, Airlight Energy

9.2.1 Latest Developments at Airlight Energy

9.2.2 CAES and Thermal Energy Storage in the Context of Other ESTs

9.2.3 The Market Space and Applications of Thermal Energy Storage

9.2.4 The Maturity and Key Markets of the AA-CAES Technology

9.3 Expert Interview with Gareth Brett Highview Power

9.3.1 Latest Developments at Highview Power

9.3.2 Liquid Air Energy Storage Technology

9.3.3 The Maturity and Commercial Viability of the Technology

9.3.4 The Key Challenges and Competitors

9.3.5 Media Attention and the Hype Surrounding Emerging Technologies

9.3.6 The Technical Specifications and Performance of the Technology

9.3.7 Key Markets and Main Regulatory Drivers/Restraints

9.3.8 The Status of Energy Storage Assets

9.3.9 The Outlook for Next-Generation ESTs

9.4 Expert Interview with Philippe Bouchard, EoS Energy Storage

9.4.1 Latest Developments at EoS Energy Storage

9.4.2 EoS Energy Storage and Next-Generation Battery Chemistries

9.4.3 The Performance Characteristics of Eos Battery Chemistries

9.4.4 The Key Competitors in the Market

9.4.5 The Maturity of the Hybrid Cathode Battery Technology

9.4.6 The Main Patterns of Innovation in the Energy Storage Sector

9.4.7 Key National Markets

10. PEST Analysis of the Next-Generation Energy Storage Market

11. Established and Emerging Energy Storage Technologies, a Comparative Analysis

12. The Global Landscape of the Emerging Energy Storage Technologies Market

12.1 Next-Generation Energy Storage Technologies in North America

12.1.1 Drivers and Restraints of Next-Generation EST development and Deployment in North America

12.2 Next-Generation Energy Storage Technologies in Europe

12.2.1 Drivers and Restraints of Next-Generation EST Development and Deployment in Europe

12.3 Next-Generation Energy Storage Technologies in Asia

13. The Leading Companies in the Next Generation Energy Storage Technologies Market

13.1 Johnson Controls

13.1.1 Johnson Controls Total Company Sales 2011-2016

13.1.2 Johnson Controls Sales in the Energy Storage Technologies Market 2011-2016

13.2 LG Chem Ltd.

13.2.1 LG Chem Ltd. Total Company Sales 2012-2016

13.2.2 LG Chem Ltd. Sales in the Energy Storage Technologies Market 2011-2015

13.3 Duke Energy Corporation

13.3.1 Duke Energy Corporation Total Company Sales 2011-2016

13.3.2 Duke Energy Corporation Sales in the Energy Storage Technologies Market 2013-2016

13.4 NextEra Energy, Inc.

13.4.1 NextEra Energy, Inc. Total Company Sales 2011-2016

13.4.2 NextEra Energy, Inc. Sales in the Energy Storage Tehnologies Market 2011-2016

13.5 Edison International

13.5.1 Edison International Total Company Sales 2011-2016

13.6 Samsung SDI Co. Ltd.

13.6.1 Samsung SDI Co. Ltd. Total Company Sales 2011-2016

13.6.2 Samsung SDI Co. Ltd. Sales in the Energy Storage Technologies Market 2014-2016

13.7 Mitsubishi Electric Corporation

13.7.1 Mitsubishi Electric Corporation Total Company Sales 2011-2016

13.7.2 Mitsubishi Electric Corporation Sales in the Energy Storage Technologies Market 2011-2016

13.8 BYD Co. Ltd.

13.8.1 BYD Co. Ltd. Total Company Sales 2011-2016

13.8.2 BYD Co. Ltd Sales in the Energy Storage Technologies Market 2011-2016

13.9 Robert Bosch GmbH

13.9.1 Robert Bosch GmbH Total Company Sales 2013-2016

13.9.2 Robert Bosch GmbH Sales in the Energy Storage Technologies Market 2015-2016

13.10 ABB Group

13.10.1 ABB Group Total Company Sales 2011-2016

13.10.2 ABB Group Sales in the Energy Storage Technologies 2014-2016

13.11 Other Companies Involved in the Next Generation Energy Storage Technologies Market 2016

14. Conclusions and Recommendations

14.1 Drivers and Restraints of the Emerging Energy Storage Technologies Market

14.2 The Outlook for Innovative Pumped Hydro Storage

14.3 The Outlook for Advanced Compressed Air Energy Storage

15. Glossary

Associated visiongain Reports

visiongain Report Sales Order Form

Appendix A

About visiongain

Appendix B

visiongain report evaluation form

List of Tables

Table 1.1 Example of Standardised Metric Used for the Comparison of Energy Storage Technologies in Radial Graphs Presented Throughout This Report

Table 2.1 Global Next Generation Energy Storage Technologies Market Forecast 2017-2027 (MW, AGR %, CAGR %, Cumulative)

Table 2.2 List and Description of Main EST Applications

Table 3.1 Recent Demonstration Projects Funded by ARRA (Name, EST, MW Size, $m Cost, Planned Application)

Table 3.2 Global EST Market Drivers & Restraints

Table 4.1 Global Next Generation Energy Storage Technologies Market Forecast, By Mechanical Energy Storage Technology 2017-2027 (MW, AGR %, CAGR %, Cumulative)

Table 4.2 PHS main characteristics (Lifetime, Capacity MW, Efficiency %, Maturity)

Table 4.3 List of all Operating Innovative Pumped Hydro Installations (Name, Location, Capacity MW, Type, Commissioning)

Table 4.4 Pumped Hydro Storage (PHS) Market Drivers & Restraints

Table 4.5 List of all Planned Innovative Pumped Hydro Installations (Name, Location, Capacity MW, Type, Commissioning)

Table 4.6 Performance Characteristics of Conventional and Advanced CAES (Lifetime, Capacity MW, Efficiency %, Maturity)

Table 4.7 Installed CAES Capacity by National Market (MW)

Table 4.8 Key Diabatic and Adiabatic Compressed Air Energy Projects (Name, Location, Capacity MW, Type, Commissioning)

Table 4.9 Advanced CAES Market Drivers & Restraints

Table 4.10 Project Details for the Poleggio-Loderio Pilot AA-CAES Plant (Name, Location, Companies and Organisations Involved, Capacity kW, Type, Commissioning Date)

Table 4.11 The Main Characteristics of Liquid Air Energy Storage (Lifetime, Capacity MW, Efficiency %, Maturity)

Table 4.12 Drivers and Restraints of the LAES technology

Table 5.1 Global Next Generation Energy Storage Technologies Market Forecast, By Chemical Energy Storage Technology 2017-2027 (MW, AGR %, CAGR %, Cumulative)

Table 5.2 Hydrogen Main Characteristics (Lifetime, Capacity, Efficiency, Maturity)

Table 5.3 Large Scale Hydrogen Energy Storage and Hydrogen Fuel Cell Drivers & Restraints

Table 6.1 Performance characteristics SMES (Lifetime, Capacity MW, Efficiency %, Maturity)

Table 6.2 Drivers & Restraints of the SMES Market

Table 7.1 Global Next Generation Energy Storage Technologies Market Forecast, By Electrochemical Energy Storage Technology 2017-2027 (MW, AGR %, CAGR %, Cumulative)

Table 7.2 Main Performance Characteristics of Lithium-Air Batteries (Energy density, Cycle life, Efficiency, Maturity)

Table 7.3 Lithium Air Batteries Market Drivers & Restraints

Table 7.4 Main Performance Characteristics of Lithium Sulphur Batteries (Energy Density, Cycle Life, Efficiency, Maturity)

Table 7.5 Lithium Sulphur Batteries Market Drivers and Restraints

Table 7.6 Main Performance Characteristics for Magnesium Ion Batteries (Energy Density, Cycle Life, Efficiency, Maturity)

Table 7.7 Magnesium Ion Batteries Market Drivers & Restraints

Table 7.8 Main Performance Characteristics of Zinc Air Batteries (Energy Density, Cycle Life, Efficiency, Maturity)

Table 7.9 Zinc Air Batteries Market Drivers & Restraints

Table 10.1 PEST Analysis of the Emerging EST Market

Table 11.1 Comparison of Key Established and Emerging Energy Storage Technologies (Maturity, Capacity, Efficiency, Lifecycle)

Table 11.2 The Development Stage and Challenges of Established and Emerging Energy Storage Technologies

Table 12.1 Global Next Generation Energy Storage Technologies Market Forecast, By Region 2017-2027 ($bn, AGR %, CAGR %, Cumulative)

Table 12.2 Innovative PHS Submarket Forecast 2017-2027 ($m, AGR %, CAGR %, Cumulative)

Table 12.3 North America Next Generation Energy Storage Technologies Market Forecast 2017-2027 ($bn, AGR %, CAGR %, Cumulative)

Table 12.4 North America Next-Generation EST Market Drivers & Restraints

Table 12.5 Europe Next Generation Energy Storage Technologies Market Forecast 2017-2027 ($bn, AGR %, CAGR %, Cumulative)

Table 12.6 Innovative PHS Submarket Forecast 2017-2027 ($m, AGR %, CAGR %, Cumulative)

Table 12.7 European Next-Generation EST Market Drivers & Restraints

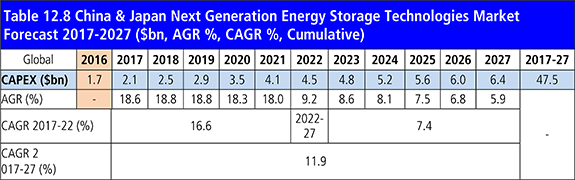

Table 12.8 China & Japan Next Generation Energy Storage Technologies Market Forecast 2017-2027 ($bn, AGR %, CAGR %, Cumulative)

Table 12.9 Asian Next-Generation EST Market Drivers & Restraints

Table 13.1 Johnson Controls 2016 ((CEO, Total Company Sales US$m, Sales From Company Division That Includes EST (US$m), Share of Total Company Sales From Company Division That Includes EST (%), Net Income / Loss US$m, Net Capital ExpenditureUS$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.2 Johnson Controls Total Company Sales 2010-2016 (US$m, AGR %)

Table 13.3 Johnson Controls Sales in the Energy Storage Technologies Market 2011-2016 (US$m, AGR %)

Table 13.4 LG Chem Ltd. 2015 (CEO, Total Company Sales US$m, Sales From Company Division That Includes EST (US$m), Share of Total Company Sales From Company Division That Includes EST (%), Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.5 LG Chem Ltd. Total Company Sales 2011-2016 (US$m, AGR %)

Table 13.6 LG Chem Ltd. Sales in the Energy Storage Technologies Market 2011-2015 (US$m, AGR %)

Table 13.7 Duke Energy Corporation Profile 2016 (CEO, Total Company Sales US$m, Sales From Company Division That Includes EST (US$m), Share of Total Company Sales From Company Division That Includes EST (%), Net Capital ExpenditureUS$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.8 Duke Energy Corporation Total Company Sales 2010-2016 (US$m, AGR %)

Table 13.9 Duke Energy Corporation Sales in the Energy Storage Technologies Market 2013-2015 (US$m, AGR %)

Table 13.10 NextEra Energy, Inc. Profile 2016 (CEO, Total Company Sales US$m, Sales From Company Division That Includes EST (US$m), Share of Total Company Sales From Company Division That Includes EST (%), Net Capital ExpenditureUS$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.11 NextEra Energy, Inc. Total Company Sales 2010-2016 (US$m, AGR %)

Table 13.12 NextEra Energy, Inc. Sales in the Energy Storage Technologies Market 2010-2016 (US$m, AGR %)

Table 13.13 Edison International 2016 (CEO, Total Company Sales US$m, Net Income / Loss US$m, Net Capital ExpenditureUS$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.14 Edison International Total Company Sales 2010-2016 (US$m, AGR %)

Table 13.15 Samsung SDI Co. Ltd. 2016 (CEO, Total Company Sales US$m, Sales From Company Division That Includes EST (US$m), Share of Total Company Sales From Company Division That Includes EST (%), Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.16 Samsung SDI Co. Ltd. Total Company Sales 2010-2015 (US$m, AGR %)

Table 13.17 Samsung SDI Co. Ltd. Sales in the Energy Storage Technologies Market 2014-2015 (US$m, AGR %)

Table 13.18 Mitsubishi Electric Corporation Profile 2016 (CEO, Total Company Sales US$m, Sales From Company Division That Includes EST (US$m), Share of Total Company Sales From Company Division That Includes EST (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.19 Mitsubishi Electric Corporation Total Company Sales 2010-2016 (US$m, AGR %)

Table 13.20 Mitsubishi Electric Corporation Sales in the Energy Storage Technologies Market 2010-2016 (US$m, AGR %)

Table 13.21 BYD Co. Ltd Profile 2016 (CEO, Total Company Sales US$m, Sales From Company Division That Includes EST (US$m), Share of Total Company Sales From Company Division That Includes EST (%), Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.22 BYD Co. Ltd Total Company Sales 2010-2016 (US$m, AGR %)

Table 13.23 BYD Co. Ltd Sales in the Energy Storage Technologies Market 2010-2016 (US$m, AGR %)

Table 13.24 Robert Bosch GmbH Profile 2016 (CEO, Total Company Sales US$m, Sales From Company Division That Includes EST (US$m), Share of Total Company Sales From Company Division That Includes EST (%), Net Capital Expenditure S$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.25 Robert Bosch GmbH Total Company Sales 2012-2016 (US$m, AGR %)

Table 13.26 Robert Bosch GmbH Sales in the Energy Storage Technologies Market 2015-2016 (US$m, AGR %)

Table 13.27 ABB Group Profile 2016 (CEO, Total Company Sales US$m, Sales From Company Division That Includes EST (US$m), Share of Total Company Sales From Company Division That Includes EST (%), Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.28 ABB Group Total Company Sales 2010-2016 (US$m, AGR %)

Table 13.29 ABB Group Sales in the Energy Storage Technologies 2014-2016 (US$m, AGR %)

Table 13.30 Other Companies Involved in the Next Generation Energy Storage Technologies Market 2016 (Company, Location)

Table 14.1 Global Next Generation Energy Storage Technologies Market Forecast 2017-2027 (MW, AGR %, CAGR %, Cumulative)

Table 14.2 Global Next Generation Energy Storage Technologies Market Forecast, By Region 2017-2027 ($bn, AGR %, CAGR %, Cumulative)

Table 14.3 Global EST Market Drivers & Restraints

List of Figures

Figure 1.1 Next-Generation Energy Storage Technologies Market Overview

Figure 1.2 Development Stage of Different Energy Storage Technologies

Figure 1.3 The Performance Characteristics of Advanced and Conventional CAES (Lifecycle-Years, Efficiency %, Capacity, Maturity) on a Metric Standardised for all Emerging Technologies

Figure 2.1 Energy Storage Technologies Categorisation

Figure 2.2 Electricity Storage Matrix: EST Characteristics and Requirements of Key Applications

Figure 2.3 Global EST Market Structure Overview

Figure 2.4 Global Energy Storage Capacity by EST type (GW) 1996-2015

Figure 2.5 Global Energy Storage Capacity by EST type (GW) 1996-2015

Figure 2.6 Key Next-Generation EST Market Structure Overview

Figure 2.7 EST Overview of Types of Applications

Figure 3.1 Industrial Electricity Price History in France, Germany, Italy, UK, Japan and USA 1979-2014 (Pence/kWh)

Figure 3.2 Industrial Electricity Prices for Medium-Sized Industries in European Countries 2004-2014 (EUR/kWh)

Figure 3.3 Industrial Electricity Prices for Medium Sized Industries in Germany, Spain, France and the United Kingdom 2004-2014 (EUR/kWh)

Figure 3.4 Total Public Energy RD&D Spending of IEA Members 2015 (% of Total RD&D Spending on Energy-Related Projects)

Figure 3.5 Evolution of Total Public Energy RD&D Spending by Selected IEA members 1985-2013 ($m)

Figure 3.6 The Scale and Composition of Installed RES capacity in Selected Countries and Regions (GW)

Figure 3.7 Electricity Generated from Renewable Sources, EU 28, 2003-2013 (TWh, % of Consumption)

Figure 3.8 Number of FCEVs expected to operate in the US, South Korea, Japan and Europe, 2020

Figure 3.9 Technology and Innovation Adoption Lifecycle

Energy Storage Technology 2017-2027 (MW, AGR %, CAGR %, Cumulative)

Figure 4.1 Main Types of PHS Installations

Figure 4.2 Evolution of Installed Capacity in the Open-Loop, Closed-Loop and Innovative PHS Submarkets (1926-2015, MW)

Figure 4.3 Main Patterns of Innovation in the Global PHS Sector

Figure 4.4 Average Capacity of Existing and Planned PHS Installations (Submarket, MW)

Figure 4.5 The Performance Characteristics of Innovative PHS (Lifecycle-years, Efficiency %, Capacity, Maturity) on a Metric Standardised for all Emerging Technologies

Figure 4.6 Main Applications of Innovative PHS

Figure 4.7 Main Competitors of Innovative PHS

Figure 4.8 Key Market Spaces for Innovative PHS

Figure 4.9 Evolution of Installed Capacity in the Innovative PHS Submarket 1966 - 2015 (MW)

Figure 4.10 Total CAPEX on Innovative PHS by National Market (Cumulative $m)

Figure 4.11 Structure of the CAES Market

Figure 4.12 Round-Trip Efficiency of Conventional Diabatic CAES and Advanced CAES (%)

Figure 4.13 The Performance Characteristics of Advanced and Conventional CAES (Lifecycle-years, Efficiency %, Capacity, Maturity) on a Metric Standardised for all Emerging Technologies

Figure 4.14 Main Applications of Advanced Compressed Air Energy Storage

Figure 4.15 Main Competitors of Advanced Compressed Air Energy Storage

Figure 4.16 Key Market Spaces for Advanced CAES

Figure 4.17 Installed CAES Capacity by Category: Diabatic and Isothermal (MW, % of total)

Figure 4.18 Anticipated progress of AA-CAES through the pilot stage onto commercialisation (2014-2020)

Figure 4.19 Selection of Stakeholders and Companies Involved in the Advanced Compressed Air Energy Storage Market

Figure 4.20 The Stages Involved in Liquid Air Energy Storage

Figure 4.21 Round-Trip Efficiency of Liquid Air Energy Storage Variants (Standalone, Integrating Waste Heat and Integrating Waste Cold, %)

Figure 4.22 The Performance Characteristics of Liquid Air Energy Storage (Lifecycle-years, Efficiency %, Capacity, Maturity) on a Metric Standardised for all Emerging Technologies

Figure 4.23 Main Applications of Liquid Air Energy Storage

Figure 4.24 Main Competitors of Liquid Air Energy Storage

Figure 4.25 Key Market Spaces for Liquid Air Energy Storage

Figure 4.26 The Historic and Expected Development of Liquid Air Energy Storage (Conceptualisation to Commercialisation, 2005-2018)

Figure 4.27 Selection of Stakeholders and Companies Involved in the Liquid Air Energy Storage Market

Figure 5.1 The Fundamentals of Hydrogen Storage and Hydrogen Fuel Cells

Figure 5.2 The Round-Trip Efficiency of Hydrogen Storage by Pathway Variant ( Electricity > Gas > Electricity and Heat, Electricity > Gas > Electricity and Electricity > Gas) (%)

Figure 5.3 The Performance Characteristics of Large-Scale Hydrogen Energy Storage Systems and Hydrogen Fuel Cells (Lifecycle-Years, Efficiency %, Capacity, Maturity) on a Metric Standardised for all Emerging Technologies

Figure 5.4 Main Applications of Large-Scale Hydrogen Storage Systems and Hydrogen Fuel Cells

Figure 5.5 Main Competitors of Large-Scale Hydrogen Storage Systems

Figure 5.6 Main Competitors of Hydrogen Fuel Cells

Figure 5.7 Key Market Spaces for Hydrogen Storage and Hydrogen Fuel Cells

Figure 5.8 FCEV Fleet in Operation in Leading National and Regional Markets as of 2014

Figure 5.9 Hydrogen Fuelling Stations in Operation in Leading National and Regional Markets as of 2014

Figure 5.10 The Main Types of Hydrogen Storage

Figure 5.11 Existing and Planned Hydrogen Infrastructure in Leading Global Markets (Hydrogen Fuelling Stations)

Figure 5.12 Existing and Planned Hydrogen Infrastructure in Leading Global Markets (Hydrogen Fuelling Stations)

Figure 5.13 Existing and Planned Alternative Fuelling Infrastructure in Leading Global Markets (Hydrogen Fuelling Stations)

Figure 5.14 Selection of Stakeholders and Companies Involved in the Large Scale Hydrogen Energy Storage Systems and Hydrogen Fuel Cells Market

Figure 6.1 Variants of SMES technology

Figure 6.2 The Performance Characteristics of Superconducting Magnetic Energy Storage (Lifecycle-Years, Efficiency %, Capacity, Maturity) on a Metric Standardised for all Emerging Technologies

Figure 6.3 Main Applications for Superconducting Magnetic Energy Storage

Figure 6.4 Main Competitors of Superconducting Magnetic Energy Storage

Figure 6.5 Key Market Spaces for Superconducting Magnetic Energy Storage

Figure 6.6 Selection of Stakeholders and Companies Involved in the Superconducting Magnetic Energy Storage Market

Figure 7.1 Key Emerging Battery Chemistries

Figure 7.2 Li-air Categorisation by Electrolyte

Figure 7.3 The Performance Characteristics of Lithium Air Batteries (Lifecycle-years, Efficiency %, Capacity, Maturity) on a Metric Standardised for all Emerging Technologies

Figure 7.4 The Performance Characteristics of Lithium Sulphur Batteries (Lifecycle-years, Efficiency %, Capacity, Maturity) on a Metric Standardised for all Emerging Technologies

Figure 7.5 Main Types of Applications of Lithium Sulphur Batteries

Figure 7.6 Key Market Spaces for Lithium Sulphur Batteries

Figure 7.7 Selection of Stakeholders and Companies Involved in the Lithium Sulphur battery Market

Figure 7.8 Selection of Stakeholders and Companies Involved in the Magnesium-Ion Battery Market

Figure 7.9 The Performance Characteristics of Zinc Air (Lifecycle-Years, Efficiency %, Capacity, Maturity) on a Metric Standardised for all Emerging Technologies

Figure 7.10 Main Applications of Zinc Air Batteries

Figure 7.11 Selection of Stakeholders and Companies Involved in the Zinc-Air Battery Market

Figure 9.1 Eos Energy Storage Aurora Product Specifications

Figure 9.2 Eos Energy Storage: Technology Schematic

Figure 11.1 EST Characteristics and Requirements of Key Applications

Figure 11.2 Cost and Backup Time Comparison of Power Quality Energy Storage Technologies Except Pumped Storage (Euro/kWh & hours)

Figure 11.3 Comparison of the Round-trip Efficiency of Key Established and Emerging Energy Storage Technologies (%)

Figure 12.1 Key National Markets Involved in the Development of Next-Generation Energy Storage Technologies

Figure 12.2 Overview of the Key Next-Generation ESTs Under Development in North America

Figure 12.3 Overview of the Key Next-Generation ESTs Under Development in Europe

Figure 12.4 Overview of the Key Next-Generation ESTs Under Development in Asia

Figure 13.1 Johnson Controls Total Company Sales 2011-2016 (US$m, AGR %)

Figure 13.2 Johnson Controls Sales in the Enery Storage Technologies 2011-2016 (US$m, AGR %)

Figure 13.3 LG Chem Ltd. Total Company Sales 2012-2016 (US$m, AGR %)

Figure 13.4 LG Chem Ltd. Sales in the Energy Storage Technologies Market 2011-2015 (US$m, AGR %)

Figure 13.5 Duke Energy Corporation Total Company Sales 2011-2016 (US$m, AGR %)

Figure 13.6 Duke Energy Corporation Sales in the Energy Storage Technologies Market 2013-2016 (US$m, AGR %)

Figure 13.7 NextEra Energy, Inc. Total Company Sales 2011-2016 (US$m, AGR %)

Figure 13.8 NextEra Energy, Inc. Sales in the Energy Storage Technologies Market 2011-2016 (US$m, AGR %)

Figure 13.9 Edison International Total Company Sales 2011-2016 (US$m, AGR %)

Figure 13.10 Samsung SDI Co. Ltd. Total Company Sales 2011-2016 (US$m, AGR %)

Figure 13.11 Samsung SDI Co. Ltd. Sales in the Energy Storage Technologies Market 2014-2016 (US$m, AGR %)

Figure 13.12 Mitsubishi Electric Corporation Total Company Sales 2011-2016 (US$m, AGR %)

Figure 13.13 Mitsubishi Electric Corporation Sales in the Energy Storage Technologies Market 2011-2016 (US$m, AGR %)

Figure 13.14 BYD Co. Ltd Total Company Sales 2011-2016 (US$m, AGR %)

Figure 13.15 BYD Co. Ltd Sales in the Energy Storage Technologies Market 2011-2016 (US$m, AGR %)

Figure 13.16 Robert Bosch GmbH Total Company Sales 2013-2016 (US$m, AGR %)

Figure 13.17 Robert Bosch GmbH Sales in the Energy Storage Technologies Market 2015-2016 (US$m)

Figure 13.18 ABB Group Total Company Sales 2011-2016 (US$m, AGR %)

Figure 13.19 ABB Group Sales in the Energy Storage Technologies 2014-2016 (US$m, AGR %)

Figure 14.1 Next-Generation Energy Storage Technologies Market Overview

Figure 14.2 Development Stage of Different Energy Storage Technologies

Figure 14.3 Anticipated progress of AA-CAES through the pilot stage onto commercialisation (2014-2020)

Figure 14.4 The Historic and Expected Development of Liquid Air Energy Storage (Conceptualisation to Commercialisation, 2005-2018)

Figure 14.5 Existing and Planned Hydrogen Infrastructure in Leading Global Markets (Hydrogen Fuelling Stations)

ABB Group

A123 Systems

Air Liquide

Air Products

Airbus Defense and Space

ALACAES

Alpiq

Axpo

Ballard Power Systems

Bruker

Byd Co. Ltd.

Chubu Electric

DLR

Dresser Rand

Duke Energy Corporation

E.ON

Eagle Crest Energy

Edison International

EDF

Electric Power Development Co.,

Ener1

Enercon

Energias de Portugal

EnZinc

Eos Energy Storage

Fluidic Energy

Fujikura

Furukawa Electric

Gartner

General Compression

General Electric

General Motors

Grid Logic

Gridflex Energy LLC Principals

Highview Power

Hitachi

Honda

Hydrogenics

IBM

Illwerge AG

ITM Power

J-Power

Johnson Controls

Linde

LG Chem Ltd.

Magnum Energy Storage

Mercedes-Benz

Mitsubishi Electric Corporation

NextEra Energy Inc.

Nissan

Norsk Hydro

Oxis Energy

Pacific Gas and Electric

Peak Hour Power LLC

Pellion Technologies

PG&E

Phinergy

PJM

Proinso

Proton Motor

Proton Motor

ReVolt Technology

Robert Bosch GmbH

RWE

Samsung SDI Co. Ltd.

Siemens Dailmer

Sion Power

Sony

Superconductor Technologies

SuperPower

SustainX

Tesla

Texas Center for Superconductivity

Thüga

Toyota

UTC Power

Valence Technology

Verbund

Volkswagen

ZAF Energy Systems

Züblin

Other Organisations Mentioned in This Report

Advanced Research Projects Agency – Energy (ARPA-E)

Brookhaven National Laboratory

California Public Utility Commission (CPUC)

Cambridge University

China Electrical Power Research Initiative (CEPRI)

Companies and organisations to look into

Electric Power Research Institute (EPRI)

Electric Vehicle Initiative (EVI)

Electricity Storage Association

European Commission

European Institute for Energy Research (EIFER)

European Parliament

European Photovoltaic Industry Association (EPIA)

European Union (EU)

Fraunhofer Center for Energy Storage

Fraunhofer Institute

German National Research Center for Aeronautics

Germany Federal Association of Energy and Water Industries (BDEW)

Germany Federal Association of Energy Storage (BVES)

Global Wind Energy Council (GWEC)

Hessian Ministry for the Environment, Energy, Agriculture and Consumer Protection

High Energy Research Organisation

International Energy Agency (IEA)

Italian Ministry of Economy and Finances

Japan the Ministry of Economy, Trade and Industry (METI)

Korea Institute of Energy Research (KIER)

Lawrence Berkeley National Lab

National Energy Administration (NEA)

Ontario Ministry of Energy

Organisation for Economic Co-operation and Development (OECD)

REN21 (The Renewable Energy Network for the 21st Century)

Southern California Edison

Swiss Federal Office of Energy (SFOE)

Texas Centre for Superconductivity

Toyota Research Institute of North America (TRINA)

UK Department of Energy and Climate Change (DECC)

UK National Grid

United States Department of Energy (DOE).

Universität Magdeburg

United Nations Framework Convention on Climate Change (UNFCC)

US Energy Information Administration (EIA)

US Federal Energy Regulatory Commission (FERC)

Vehicle Technologies Office (VTO)

Download sample pages

Complete the form below to download your free sample pages for Next Generation Energy Storage Technologies (EST) Market Forecast 2017-2027

Download sample pages

Complete the form below to download your free sample pages for Next Generation Energy Storage Technologies (EST) Market Forecast 2017-2027

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain energy reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and industry experts where possible but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain energy reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

“The Visiongain report was extremely insightful and helped us construct our basic go-to market strategy for our solution.”

H.

“F.B has used Visiongain to prepare two separate market studies on the ceramic proppants market over the last 12 months. These reports have been professionally researched and written and have assisted FBX greatly in developing its business strategy and investment plans.”

F.B

“We just received your very interesting report on the Energy Storage Technologies (EST) Market and this is a very impressive and useful document on that subject.”

I.E.N

“Visiongain does an outstanding job on putting the reports together and provides valuable insight at the right informative level for our needs. The EOR Visiongain report provided confirmation and market outlook data for EOR in MENA with the leading countries being Oman, Kuwait and eventually Saudi Arabia.”

E.S

“Visiongain produced a comprehensive, well-structured GTL Market report striking a good balance between scope and detail, global and local perspective, large and small industry segments. It is an informative forecast, useful for practitioners as a trusted and upto-date reference.”

Y.N Ltd

Association of Dutch Suppliers in the Oil & Gas Industry

Society of Naval Architects & Marine Engineers

Association of Diving Contractors

Association of Diving Contractors International

Associazione Imprese Subacquee Italiane

Australian Petroleum Production & Exploration Association

Brazilian Association of Offshore Support Companies

Brazilian Petroleum Institute

Canadian Energy Pipeline

Diving Medical Advisory Committee

European Diving Technology Committee

French Oil and Gas Industry Council

IMarEST – Institute of Marine Engineering, Science & Technology

International Association of Drilling Contractors

International Association of Geophysical Contractors

International Association of Oil & Gas Producers

International Chamber of Shipping

International Shipping Federation

International Marine Contractors Association

International Tanker Owners Pollution Federation

Leading Oil & Gas Industry Competitiveness

Maritime Energy Association

National Ocean Industries Association

Netherlands Oil and Gas Exploration and Production Association

NOF Energy

Norsk olje og gass Norwegian Oil and Gas Association

Offshore Contractors’ Association

Offshore Mechanical Handling Equipment Committee

Oil & Gas UK

Oil Companies International Marine Forum

Ontario Petroleum Institute

Organisation of the Petroleum Exporting Countries

Regional Association of Oil and Natural Gas Companies in Latin America and the Caribbean

Society for Underwater Technology

Society of Maritime Industries

Society of Petroleum Engineers

Society of Petroleum Enginners – Calgary

Step Change in Safety

Subsea UK

The East of England Energy Group

UK Petroleum Industry Association

All the events postponed due to COVID-19.

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Energy news

Energy as a Service (EaaS) Market

The global Energy as a Service (EaaS) market is projected to grow at a CAGR of 12.6% by 2034

25 July 2024

Synthetic Fuels Market

The global Synthetic Fuels market is projected to grow at a CAGR of 23% by 2034

18 July 2024

Power-to-X (P2X) Market

The global Power-to-X (P2X) market is projected to grow at a CAGR of 10.6% by 2034

09 July 2024

Airborne Wind Energy Market

The global Airborne Wind Energy market is projected to grow at a CAGR of 9.7% by 2034

05 June 2024