Developments in automotive start-stop systems have had a significant impact on the automotive industry. it is now commonplace to hear a vehicle’s engine stop at traffic lights, and then almost instantly resume when the vehicle pulls away. Visiongain’s report on this sector gives a detailed overview of the market outlook, creating an accurate picture that will offer clarity to anyone involved in the automotive start-stop systems sector. Importantly, the report delivers a forecast of the market, giving you an insight into the future opportunities that exist in the automotive start-stop systems market over the next decade.

Report highlights

Global Automotive Start-Stop Systems Forecast 2018-2028 (Units)

Automotive Start-Stop Systems Forecast By Technology 2018-2028 (Units)

• Belt-Driven Starter Generator (BAS) Forecast 2018-2028

• Enhanced Starter Forecast 2018-2028

• Direct Starter Forecast 2018-2028

• Integrated Starter Generator (ISG) Forecast 2018-2028

Regional Automotive Start-Stop Systems Forecast 2018-2028 (Units)

• Asia Pacific Automotive Start-Stop Systems Forecast 2018-2028 (Units)

• China Automotive Start-Stop Systems Forecast 2018-2028

• India Automotive Start-Stop Systems Forecast 2018-2028

• Japan Automotive Start-Stop Systems Forecast 2018-2028

• South Korea Automotive Start-Stop Systems Forecast 2018-2028

• Rest Of Asia Pacific Automotive Start-Stop Systems Forecast 2018-2028

• North America Automotive Start-Stop Systems Forecast 2018-2028 (Units)

• US Automotive Start-Stop Systems Forecast 2018-2028

• Canada Automotive Start-Stop Systems Forecast 2018-2028

• Mexico Automotive Start-Stop Systems Forecast 2018-2028

• Europe Automotive Start-Stop Systems Forecast 2018-2028 (Units)

• Germany Automotive Start-Stop Systems Forecast 2018-2028

• UK Automotive Start-Stop Systems Forecast 2018-2028

• France Automotive Start-Stop Systems Forecast 2018-2028

• Rest of Europe Automotive Start-Stop Systems Forecast 2018-2028

• Rest Of The World (Row) Automotive Start-Stop Systems Forecast 2018-2028 (Units)

• Brazil Automotive Start-Stop Systems Forecast 2018-2028

• South Africa Automotive Start-Stop Systems Forecast 2018-2028

• Others Automotive Start-Stop Systems Forecast 2018-2028

Profiles Of The Following Leading Companies:

• Continental AG

• Controlled Power Technologies Ltd

• Delphi Automotive Plc

• Denso Corporation

• Borgwarner Inc.

• Robert Bosch GmbH

• Johnson Controls International Plc

• Mitsubishi Electric Corporation

• Valeo SA

Detailed Tables Of Partnerships, Collaborations and Joint Ventures

With 82 tables and charts, this report is a fantastic opportunity to increase your knowledge of the automotive start-stop sector. Porter’s five force analysis the drivers and restraints for the overall market concisely informs you of the major factors affecting this market, whilst Visiongain’s data-rich approach provides greater insight into the market.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Start-Stop Systems Market Overview

1.1.1 Start-Stop Systems Market: By Technology

1.1.2 Start-Stop Systems Market: By Geography

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report Include

1.5 Who is This Report For?

1.6 Methodology

1.6.1 Primary Research

1.6.2 Secondary Research

1.6.3 Market Evaluation & Forecasting Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

2. Introduction to the Start-Stop Systems Market

2.1 Start-Stop Systems, By Technologies

2.1.1 Belt-driven Alternator Starter (BAS)

2.1.2 Enhanced Starter

2.1.3 Direct Starter

2.1.4 Integrated Starter Generator (ISG)

3. Executive Summary

4. Technological Overview

4.1 Introduction

4.2 Start-Stop Systems Overview

4.2.1 Comparison of Start-Stop Technologies

5. Market Dynamics

5.1 Global Start Stop Market Drivers

5.1.1 Strict CO2 Emission Regulations

5.1.2 Improved Vehicle Performance and Efficiency

5.2 Global Start Stop Market Restraints

5.2.1 High Cost of System

5.3 Global Start Stop Market Opportunities

5.3.1 Increasing Production of Start-Stop Vehicles in Europe and North America

5.4 Start Stop Market: Key Issues

5.4.1 Effect of Temperature on Functioning of Start-Stop Systems

5.5 Start Stop Market: Winning Imperatives

5.5.1 Collaborative Product Development

6. Start-Stop Systems Market, By Geography

6.1 Introduction

6.2 Start-Stop Systems Market, By Geography 2018-2028

6.2.1 Asia-Pacific Start-Stop Systems Market 2018-2028

6.2.1.1 Asia-Pacific Start-Stop Systems Market 2018-2028 By Countries

6.2.1.2 Asia-Pacific Start-Stop Systems Market 2018-2028 By Technologies

6.2.2 Europe Start-Stop Systems Market 2018-2028

6.2.2.1 Europe Start-Stop Systems Market 2018-2028 By Countries

6.2.2.2 Europe Start-Stop Systems Market 2018-2028 By Technologies

6.2.3 North America Start-Stop Systems Market 2018-2028

6.2.3.1 North America Start-Stop Systems Market 2018-2028 By Countries

6.2.3.2 North America Start-Stop Systems Market 2018-2028 By Technologies

6.2.4 RoW Start-Stop Systems Market 2018-2028

6.2.4.1 RoW Start-Stop Systems Market 2018-2028 By Countries

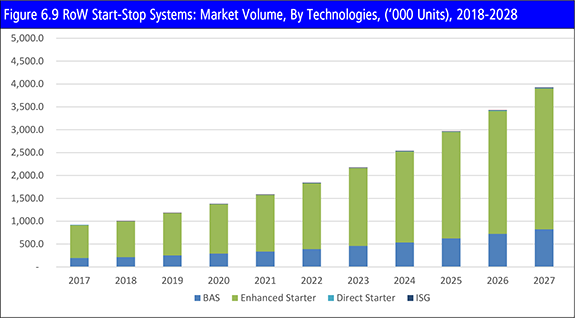

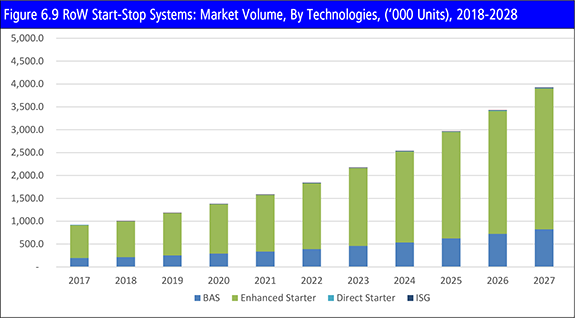

6.2.4.2 RoW Start-Stop Systems Market 2018-2028 By Technologies

7 Start-Stop Systems Market, By Technology 2018-2028

7.1 Introduction

7.2 Start-Stop Systems Market 2018-2028 By Technology

7.2.1 Belt-Driven Alternator Starter Start-Stop Systems Market 2018-2028

7.2.2 Enhanced Starter Start-Stop Systems Market 2018-2028

7.2.3 Direct Starter Start-Stop Systems Market 2018-2028

7.2.4 Integrated Starter Generator (ISG) Start-Stop Systems Market 2018-2028

8 Market Analysis

8.1 Start Stop Systems: Porter’s Five Forces Analysis

8.1.1 Start Stop Systems: Bargaining Power of Supplier

8.1.2 Start Stop Systems: Bargaining Power of Buyer

8.1.3 Start Stop Systems: Industry Rivalry

8.1.4 Start Stop Systems: Threat of New Entrants

8.1.5 Start Stop Systems: Threat of Substitutes

8.2 Start Stop Systems Value Chain

8.2.1 Start Stop Systems Key Players

9. Automotive Start-Stop Systems Company Profiles

9.1 Continental AG

9.1.1 Continental AG: Products & Service

9.1.2 Continental AG: Key Developments

9.1.3 Continental AG: Future Outlook and Growth Strategy

9.2 Controlled Power Technologies Ltd

9.2.1 Controlled Power Technologies Ltd: Products & Service

9.2.2 Controlled Power Technologies Ltd: Key Developments

9.2.3 Controlled Power Technologies Ltd: Future Outlook and Growth Strategy

9.3 Delphi Automotive Plc

9.3.1 Delphi Automotive PLC: Products & Service

9.3.2 Delphi Automotive PLC: Key Developments

9.3.3 Delphi Automotive PLC: Future Outlook and Growth Strategy

9.4 Denso Corporation

9.4.1 Denso Corporation: Products & Service

9.4.2 Denso Corporation: Key Developments

9.4.3 Denso Corporation: Future Outlook and Growth Strategy

9.5 Borgwarner Inc.

9.5.1 Borgwarner Inc. Company Overview

9.5.2 Borgwarner Inc.: Product Portfolio

9.5.3 Borgwarner Inc.: Key Developments

9.5.4 Borgwarner Inc.’s Future Outlook

9.6 Robert Bosch GmbH

9.6.1 Robert Bosch GmbH Company Overview

9.6.2 Robert Bosch GmbH: Product Portfolio

9.6.3 Robert Bosch GmbH: Key Developments

9.6.4 Robert Bosch GmbH’s Future Outlook

9.7 Johnson Controls International Plc

9.7.1 Johnson Controls International Plc Company Overview

9.7.2 Johnson Controls International Plc: Product Portfolio

9.7.3 Johnson Controls International Plc: Key Developments

9.7.4 Johnson Controls International Plc’s Future Outlook

9.8 Mitsubishi Electric Corporation

9.8.1 Mitsubishi Electric Corporation Company Overview

9.8.2 Mitsubishi Electric Corporation: Product Portfolio

9.8.3 Mitsubishi Electric Corporation: Key Developments

9.8.4 Mitsubishi Electric Corporation’s Future Outlook

9.9 Valeo SA

9.9.1 Valeo SA Company Overview

9.9.2 Valeo SA: Product Portfolio

9.9.3 Valeo SA’s Future Outlook

10. Competitive Landscape

10.1 Introduction

10.1.1 Partnerships, Collaborations and Joint Ventures

10.1.2 Product Launch/Development

10.1.3 Expansion

11. Conclusion

List of Tables

Table 4.1 Types of Start-Stop Systems

Table 4.2 Key Automotive Manufacturers Start-Stop Adoption, By Vehicle Model

Table 6.1 Start-Stop Systems: Market Volume, By Geography, 2018 – 2028 (‘000 Units)

Table 6.2 Asia-Pacific: Start-Stop Systems Market Volume, By Countries, 2018 – 2028 (‘000 Units)

Table 6.3 Asia-Pacific: Start-Stop Systems Market Volume, By Technologies, 2018 – 2028 (‘000 Units)

Table 6.4 Europe: Start-Stop Systems Market Volume, By Countries, 2018 – 2028 (‘000 Units)

Table 6.5 Europe: Start-Stop Systems Market Volume, By Technologies, 2018 – 2028 (‘000 Units)

Table 6.6 North America: Start-Stop Systems Market Volume, By Countries, 2018 – 2028 (‘000 Units)

Table 6.7 North America: Start-Stop Systems Market Volume, By Technologies, 2018 – 2028 (‘000 Units)

Table 6.8 RoW Start-Stop Systems Market Volume, By Countries, 2018 – 2028 (‘000 Units)

Table 6.9 RoW: Start-Stop Systems Market Volume, By Technologies, 2018 – 2028 (‘000 Units)

Table 7.1 Global Start-Stop Systems: Market Volume, By Technologies, 2018 – 2028 (‘000 Units)

Table 7.2 BAS Based Start-Stop Systems: Market Volume, By Geography, 2018 – 2028 (‘000 Units)

Table 7.3 Enhanced Starter Based Start-Stop Systems: Market Volume, By Geography, 2018 – 2028 (‘000 Units)

Table 7.4 Direct Starter Based Start-Stop Systems: Market Volume, By Geography, 2018 – 2028 (‘000 Units)

Table 7.5 ISG Based Start-Stop Systems: Market Volume, By Geography, 2018 – 2028 (‘000 Units)

Table 9.1 Continental AG Overview (Company Revenue, Start Stop System Segment, HQ, Employees, Website)

Table 9.2 Continental AG (5-year Revenue, Net Income, Operating Income, Net Profit), (In Million Euro)

Table 9.3 Controlled Power Technologies Ltd. Overview (Company Revenue, Start Stop System Segment, HQ, Employees, Website)

Table 9.4 Controlled Power Technologies Ltd.: List of Products & Services Offered

Table 9.5 Delphi Automotive PLC Overview (Company Revenue, Start Stop System Segment, HQ, Employees, Website)

Table 9.6 Delphi Automotive PLC (5-year Revenue, Net Income, Operating Income, Net Profit), (In Million US$)

Table 9.7 Denso Corporation Overview (Company Revenue, Start Stop System Segment, HQ, Employees, Website)

Table 9.8 Denso Corporation (5-year Revenue, Operating Profit), (In Million Yen)

Table 9.9 Denso Corporation: List of Products & Services Offered

Table 9.10 Denso Corporation: Key Developments

Table 9.11 Borgwarner Inc. Company Overview (Company Revenue, Start-Stop System Segment, HQ, Employees, Website)

Table 9.12 Borgwarner Inc. Financials 2012-2016 (5-year Revenue, Operating Income, R&D Expenditure), (In $Million)

Table 9.13 Borgwarner Inc.: List of Products & Services Offered

Table 9.14 Borgwarner Inc.: List of Key Developments

Table 9.15 Robert Bosch GmbH Company Overview (Company Revenue, Start-Stop System Segment, HQ, Employees, Website)

Table 9.16 Robert Bosch GmbH Financials 2012-2016 (5-year Revenue, EBIT, PAT), (In $Million)

Table 9.17 Robert Bosch GmbH: List of Products & Services Offered

Table 9.18 Robert Bosch GmbH: List of Key Developments

Table 9.19 Johnson Controls International Plc Company Overview (Company Revenue, Start-Stop System Segment, HQ, Employees, Website)

Table 9.20 Johnson Controls International Plc Financials 2013-2017 (5-year Revenue, EBITA, Net Income), (In $Million)

Table 9.21 Johnson Controls International Plc: List of Products & Services Offered

Table 9.22 Johnson Controls International Plc: List of Key Developments

Table 9.23 Mitsubishi Electric Corporation Company Overview (Company Revenue, Start-Stop System Segment, HQ, Employees, Website)

Table 9.24 Mitsubishi Electric Corporation Financials 2012-2016 (5-year Revenue, Operating Income, & Net Income), (In $Million)

Table 9.25 Mitsubishi Electric Corporation: List of Key Developments

Table 9.26 Valeo SA Company Overview (Company Revenue, Start-Stop System Segment, HQ, Employees, Website)

Table 9.27 Valeo SA Financials 2013-2017 (5-year Revenue, Operating Income, Net Income), (In $Million)

Table 9.28 Valeo SA: List of Products & Services Offered

Table 10.1 Key Partnerships, Collaborations and Joint Ventures

Table 10.2 Key Product Developments

Table 10.3 Key Expansions

List of Figures

Figure 3.1 Global Start-Stop Systems Market, 2018-2028, (Million Units)

Figure 4.1 Start- Stop Technologies Comparison

Figure 6.1 Start-Stop Systems: Market Volume, By Geography, (‘000 Units), 2018-2028

Figure 6.2 Asia-Pacific Start-Stop Systems: Market Volume, By Country, (‘000 Units), 2018-2028

Figure 6.3 Asia-Pacific Start-Stop Systems: Market Volume, By Technologies, (‘000 Units), 2018-2028

Figure 6.4 Europe Start-Stop Systems: Market Volume, By Country, (‘000 Units), 2018-2028

Figure 6.5 European Start-Stop Systems: Market Volume, By Technology, (‘000 Units), 2018-2028

Figure 6.6 North America Start-Stop Systems: Market Volume, By Country, (‘000 Units), 2018-2028

Figure 6.7 North America Start-Stop Systems: Market Volume, By Technologies, (‘000 Units), 2018-2028

Figure 6.8 RoW Start-Stop Systems: Market Volume, By Country, (‘000 Units), 2018-2028

Figure 6.9 RoW Start-Stop Systems: Market Volume, By Technologies, (‘000 Units), 2018-2028

Figure 7.1 Global Start-Stop Systems: Market Volume, By Technologies, (‘000 Units), 2018-2028

Figure 7.2 BAS Based Start-Stop Systems: Market Volume, By Geography, (‘000 Units), 2018-2028

Figure 7.3 Enhanced Starter Based Start-Stop Systems: Market Volume, By Geography, (‘000 Units), 2018-2028

Figure 7.4 Direct Starter Based Start-Stop Systems: Market Volume, By Geography, (‘000 Units), 2018-2028

Figure 7.5 ISG Based Start-Stop Systems: Market Volume, By Geography, (‘000 Units), 2018-2028

Figure 8.1 Global Start Stop Systems Market Porter’s Five Forces Analysis, 2018

Figure 8.2 Start Stop Systems Market Value Chain

Figure 9.1 Continental AG 2016 Sales by Region (%)

Figure 9.2 Continental AG 2016 Sales by Business Segment (%)

Figure 9.3 Delphi Automotive PLC 2017 Sales by Region (%)

Figure 9.4 Delphi Automotive PLC 2017 Sales by Business Segment (%)

Figure 9.5 Denso Corporation 2016 Sales by Region (%)

Figure 9.6 Borgwarner Inc. 2016 Sales by Region (%)

Figure 9.7 Borgwarner Inc. 2016 Sales by Products Category (%)

Figure 9.8 Robert Bosch GmbH 2016 Sales by Region (%)

Figure 9.9 Robert Bosch GmbH 2016 Sales by Products Category (%)

Figure 9.10 Johnson Controls International Plc 2017 Sales by Products Category (%)

Figure 9.11 Mitsubishi Electric Corporation 2017 Sales by Region (%)

Figure 9.12 Mitsubishi Electric Corporation 2017 Sales by Products Category (%)

Figure 9.13 Valeo SA 2017 Sales by Region (%)

Figure 9.14 Valeo SA 2017 Sales by Products Category (%)

Figure 10.1 Start Stop Systems Market Key Development Strategies

Figure 10.2 Key Development Strategies Trend in Start-Stop Market

Figure 11.1 Start Stop Systems Market Key Development Strategies