Industries > Energy > Waste to Energy (WtE) Market Outlook 2017-2027

Waste to Energy (WtE) Market Outlook 2017-2027

Capacity (tpa) & CAPEX ($m) Forecasts for Incineration of Municipal Solid Waste (MSW) & Refuse-Derived Fuel (RDF) in Electricity Generation, District Heating & Combined Heat and Power (CHP), Energy from Waste (EfW) Plants; Featuring Technologies: Mass Burn, Gasification, Pyrolysis, Fluidised Bed, Advanced Thermal Treatment (ATT), & Advanced Conversion Technology (ACT)

Visiongain assesses that the global waste-to-energy market will experience Capex of $12,914m in 2017. Read on to discover the potential business opportunities available.

The interest in WtE is growing as an option for sustainable waste management practices. Population and waste growth will be major drivers for the development of WtE technology, especially in developing countries. During the last several years, increased waste generation and narrowed prospects for landfill have brought strong growth prospects for the WtE industry. Not only is the world population growing, but it is also becoming increasingly urbanised. This leads to greater levels of waste being generated globally, in more concentrated levels and in close proximity to large urban areas. These issues are focusing more attention on waste management frameworks, with increased interest in alternatives to landfill. As a result, municipalities worldwide are considering the functionality of WtE plants to help deal with mounting waste being generated. Today, waste-to-energy projects based on combustion technologies are highly efficient power plants that utilise solid waste as their fuel as opposed to oil, coal or natural gas. Far better than burning up energy to search, recover, process and convey the fuel from some distant source, waste-to-energy technology finds worth in what others consider garbage.

With reference to this report, waste-to-energy (WtE) facilities are considered as plants using municipal solid waste (MSW) as a primary fuel source for energy production. This includes direct combustion and advanced thermal, but not biological processes. The report covers the CAPEX spending of new and upgraded WtE plants globally. The report also forecasts MSW-processing capacity for global, regional and national markets from 2017-2027.

The report will answer questions such as:

• What are the prospects for the overall waste-to-energy industry?

• Where are the major investments occurring?

• Who are the key players in the waste-to-energy industry?

• What are the market dynamics underpinning the sector?

• How consolidated is the sector amongst the large industry players?

Five Reasons Why You Must Order and Read This Report Today:

1) The report provides market share and detailed profiles of the leading companies operating within the waste-to-energy market:

– Babcock & Wilcox Vølund A/S

– China Everbright International Limited

– CISC

– Covanta Energy Corporation

– Hitachi Zosen Inova AG

– Hunan Yonker Environmental Protection Co. Ltd

– Keppel Seghers

– Mitsubishi Heavy Industries Environmental & Chemical Engineering Co. Ltd. (MHIEC)

– New Energy Corporation

– Sembcorp

– Suez Environnement (SITA)

– Viridor

2) The study reveals where companies are investing in waste-to-energy and how much waste-processing capacity from WtE is expected. Analysis of three regional markets, 12 national markets plus analysis of 20 other countries:

– The UK Waste-to-Energy Market Forecast 2017-2027

– The Polish Waste-to-Energy Market Forecast 2017-2027

– The Irish Waste-to-Energy Market Forecast 2017-2027

– The Danish Waste-to-Energy Market Forecast 2017-2027

– The Finnish Waste-to-Energy Market Forecast 2017-2027

– The Italian Waste-to-Energy Market Forecast 2017-2027

– The Swedish Waste-to-Energy Market Forecast 2017-2027

– The Czech Waste-to-Energy Market Forecast 2017-2027

– The Chinese Waste-to-Energy Market Forecast 2017-2027

– The Japanese Waste-to-Energy Market Forecast 2017-2027

– The US Waste-to-Energy Market Forecast 2017-2027

– The Canadian Waste-to-Energy Market Forecast 2017-2027

3) The analysis is underpinned by an exclusive interview with leading waste-to-energy experts:

Keppel Corporation

4) Discover details of more than 700 waste-to-energy projects revealing the following information in most cases:

– Company

– Project title

– TPA capacity

– MW capacity

– $m investment

– Completion year

– Status

5) Learn about the following business-critical issues:

– Legislation and landfill targets

– Costs

– Energy security

– Pollution and public opposition

– New technologies such as mass burn and advanced conversion

This independent 340-page report guarantees you will remain better informed than your competition. With 196 tables and figures examining the waste-to-energy market space, the report gives you a visual, one-stop breakdown of your market including capital expenditure forecasts from 2017-2027, as well as analysis PLUS municipal waste processing capacity forecasts from 2017-2027, keeping your knowledge that one step ahead helping you to succeed.

This report is essential reading for you or anyone in the energy or waste sectors with an interest in waste-to-energy. Purchasing this report today will help you to recognise those important market opportunities and understand the possibilities there. I look forward to receiving your order.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Waste-to-Energy Market Overview

1.2 Market Structure Overview and Market Definition

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report Include:

1.6 Who is This Report For?

1.7 Methodology

1.7.1 Primary Research

1.7.2 Secondary Research

1.7.3 Market Evaluation & Forecasting Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to the Waste-to-Energy Market

2.1 Waste-to-Energy Technologies

2.2 The Characteristics and Evolution of MSW Management

2.3 Global Waste-to-Energy Market Structure

2.4 Market Definition

3. Global Overview of Waste-to-Energy Market 2017-2027

3.1 Global Overview of Waste-to-Energy Market

3.2 Leading National and Regional Waste-to-Energy Markets 2017-2027

3.3 Global Waste-to-Energy Market Drivers & Restraints

3.3.1 The Issues with Increased Population Growth and Urbanisation

3.3.2 Can Waste-to-Energy Provide Added Energy Security?

3.3.3 Will Landfill Continue?

3.3.4 Do the Economics of Waste-to-Energy Stack Up?

3.3.5 High Costs and Limited Funding: Restraints for the Waste-to-Energy Market

3.3.6 Are Government Policies Driving the Waste-to-Energy Market?

3.3.7 Pollution, NIMBYism, Recycling: Public Opposition to Waste-to-Energy

3.3.8 A Balanced Argument: An Outlook for Waste-to-Energy

4. Leading Countries in the Waste-to-Energy Market 2017-2027

4.1 The UK Waste-to-Energy Market Forecast 2017-2027

4.1.1 Current Status of Waste-to-Energy in the UK

4.1.2 Drivers and Restraints in the UK Waste-to-Energy Market

4.1.3 High Landfill Costs Continue to Drive the UK WtE Market

4.1.4 Is Environmental Legislation Pressuring the WtE Market?

4.1.5 LATS and Waste Infrastructure Grants are Shelved

4.1.6 Fears of Overcapacity and European Competition

4.1.7 Government Policy Focusing on Reduction and Recycling

4.1.8 The Impact of Public Opposition

4.1.9 Major UK Waste-to-Energy Projects

4.2 The Polish Waste-to-Energy Market Forecast 2017-2027

4.2.1 Current Status of Waste-to-Energy in Poland

4.2.2 Drivers and Restraints in the Polish Waste-to-Energy Market

4.2.3 The Effect of New Legislation and National Targets on Poland’s Waste-to-Energy Market

4.2.4 Will Funding Support and PPPs Aid Waste-to-Energy?

4.2.5 New Processes and Legal Uncertainties: Can Poland Still Attract Investment?

4.2.6 Major Polish Waste-to-Energy Projects

4.3 The Irish Waste-to-Energy Market Forecast 2017-2027

4.3.1 Current Status of Waste-to-Energy in Ireland

4.3.2 The Irish Waste-to-Energy Market’s Growth Potential

4.3.3 Major Irish Waste-to-Energy Projects

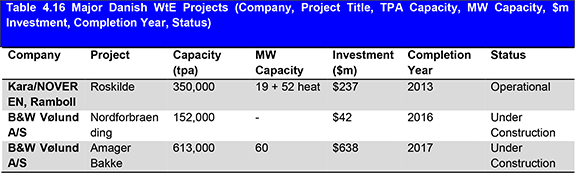

4.4 The Danish Waste-to-Energy Market Forecast 2017-2027

4.4.1 Current Status of Waste-to-Energy in Denmark

4.4.2 Drivers and Restraints in the Danish Waste-to-Energy Market

4.4.3 A History of Incineration: Denmark’s Energy Recovery Past

4.4.4 Is Denmark Going to Focus More on Recycling?

4.4.5 Inefficiencies in the Danish WtE Market

4.4.6 Major Danish Waste-to-Energy Projects

4.5 The Finnish Waste-to-Energy Market Forecast 2017-2027

4.5.1 Current Status of Waste-to-Energy in Finland

4.5.2 Drivers and Restraints in the Finnish Waste-to-Energy Market

4.5.3 Is a Tough Waste Plan Prompting Improvement in Finland?

4.5.4 Finland’s Waste-to-Energy Market is Restricted

4.5.5 Major Finnish Waste-to-Energy Projects

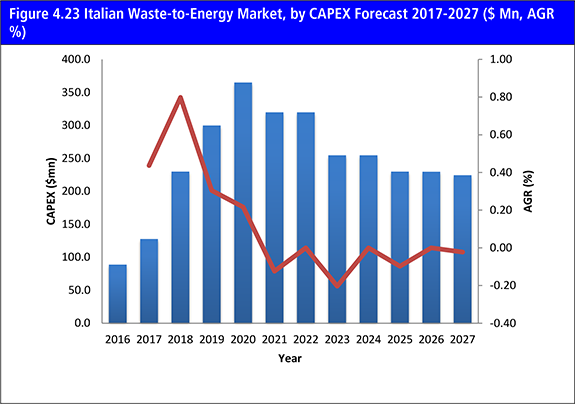

4.6 The Italian Waste-to-Energy Market Forecast 2017-2027

4.6.1 Current Status of Waste-to-Energy in Italy

4.6.2 Drivers and Restraints in the Italian Waste-to-Energy Market

4.6.3 Will Italian Targets Force the Waste-to-Energy Market to Grow?

4.6.4 Are Restraining Factors Going to Inhibit the Italian Market?

4.6.5 Major Italian Waste-to-Energy Projects

4.7 The Swedish Waste-to-Energy Market Forecast 2017-2027

4.7.1 Current Status of Waste-to-Energy in Sweden

4.7.2 Drivers and Restraints in the Swedish Waste-to-Energy Market

4.7.3 Major Swedish Waste-to-Energy Projects

4.8 The Czech Republic Waste-to-Energy Market Forecast 2017-2027

4.8.1 Current Status of Waste-to-Energy in Czech Republic Market

4.8.2 Prospects for the Czech Waste-to-Energy Market

4.8.3 Major Czech Waste-to-Energy Projects

4.9 Rest of Europe Waste-to-Energy Market Forecast 2017-2027

4.9.1 The Rest of Europe Waste-to-Energy Projects

4.9.2 The Emerging Markets of Eastern Europe

4.9.2.1 The Bulgarian Waste-to-Energy Market

4.9.2.2 The Croatian Waste-to-Energy Market

4.9.2.3 The Estonian Waste-to-Energy Market

4.9.2.4 The Lithuanian Waste-to-Energy Market

4.9.2.5 The Romanian Waste-to-Energy Market

4.9.2.6 The Slovakian Waste-to-Energy Market

4.9.2.7 The Slovenian Waste-to-Energy Market

4.9.2.8 The Netherlands Waste-to-Energy Market

4.9.2.9 The French Waste-to-Energy Market

4.9.2.10 The German Waste-to-Energy Market

4.9.2.11 The Norwegian Waste-to-Energy Market

4.10 The Chinese Waste-to-Energy Market Forecast 2017-2027

4.10.1 Current Status of the Chinese Waste-to-Energy Market

4.10.2 Drivers and Restraints in the Chinese Waste-to-Energy Market

4.10.3 Rising Levels of Waste and Pollution Causing Issues in China

4.10.4 Rising Energy Demand Could Lead to an Increase in Waste-to-Energy

4.10.5 The 12th Five Year Plan and the CDM as Drivers

4.10.6 What are the Issues with the Waste-to-Energy Plants in China?

4.10.7 Public Opposition: The Fight Against Incineration in China

4.10.8 Major Chinese Waste-to-Energy Projects

4.11 The Japanese Waste-to-Energy Market Forecast 2017-2027

4.11.1 Current Status of Waste-to-Energy in Japan

4.11.2 Drivers and Restraints in the Japanese Waste-to-Energy Market

4.11.3 What Potential is there for Japanese Waste-to-Energy Growth?

4.11.4 Can the Japanese Waste-to-Energy Market Keep Growing?

4.11.5 Major Japanese Waste-to-Energy Projects

4.12 Rest of Asia Pacific Waste-to-Energy Market Forecast 2017-2027

4.12.1 Rest of Asia-Pacific Waste-to-Energy Facilities and Upcoming Projects

4.12.2 Rest of Asia-Pacific Waste-to-Energy Market

4.12.3 Analysis of the Current Australian Waste-to-Energy Market

4.12.4 Drivers and Restraints in the Australian Waste-to-Energy Market

4.12.5 What Potential is there for Australian Waste-to-Energy Growth?

4.12.6 Will High Costs and Lack of Experience Inhibit Australian WtE Growth?

4.12.7 The Opportunity for Foreign Investment in India

4.12.8 What About the Indonesian Market Outlook?

4.12.9 The Waste-to-Energy Potential in Malaysia

4.12.10 Waste-to-Energy Growth Potential in the Philippines

4.12.11 The Waste-to-Energy Market in Singapore

4.12.12 Will Recycling Dominate over Waste-to-Energy in South Korea?

4.12.13 Will the Taiwanese Market Grow?

4.12.14 Can Thailand’s Waste-to-Energy Market Grow?

4.12.15 Vietnam’s Waste-to-Energy Market

4.13 The US Waste-to-Energy Market Forecast 2017-2027

4.13.1 Current Status of Waste-to-Energy in the US Market

4.13.2 Drivers and Restraints in the US Waste-to-Energy Market

4.13.3 The Problems with Municipal Waste in the US

4.13.4 US Waste Legislation and Renewable Energy Potential

4.13.5 Waste Management at State Level

4.13.6 High Costs and Strong Public Opposition

4.13.7 Major US Waste-to-Energy Projects

4.14 The Canadian Waste-to-Energy Market Forecast 2017-2027

4.14.1 Current Status of Waste-to-Energy in Canada

4.14.2 Drivers and Restraints in the Canadian Waste-to-Energy Market

4.14.3 Why is Waste-to-Energy Set to Grow in Canada?

4.14.4 What is Holding the Canadian Market Back?

4.14.5 Major Canadian Waste-to-Energy Projects

4. 15 The Rest of the World Waste-to-Energy Market 2017-2027

4.15.1 Waste-to-Energy Projects in the Rest of the World

4.15.2 Analysis of the Rest of the World Waste-to-Energy Market

4.15.3 WTE Potential in the Middle East

5. PESTEL Analysis of the Waste-to-Energy Market

5.1 Political Impact

5.2 Economic Impact

5.3 Social Impact

5.4 Technological Impact

6. Expert Opinion

6.1 Primary Correspondents

6.2 Waste-to-energy Market Outlook

6.3 Driver & Restraints

6.5 Dominant Region in the Waste-to-energy Market

6.5 Overall Growth Rate, Globally

7. WtE Installed Capacity & Company Market Share Analysis

7.1 Waste-to-Energy Company-wise Installed Capacity & Market Share

8. Leading Companies in Waste-to-Energy Market

8.1 Covanta Energy Corporation

8.1.1 Company Analysis

8.1.2 Future Outlook & Business Strategy

8.2 China Everbright International Limited

8.2.1 Company Analysis

8.2.2 Future Outlook & Business Strategy

8.3 Sembcorp Industries

8.3.1 Company Analysis

8.3.2 Future Outlook & Business Strategy

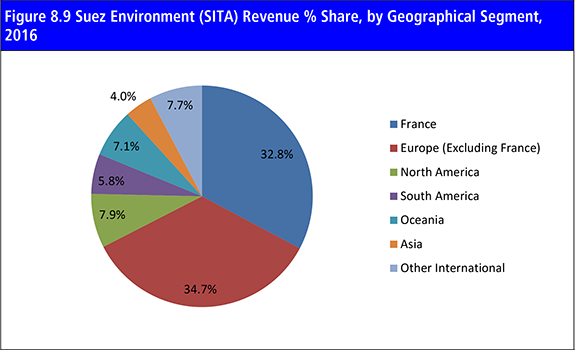

8.4 Suez Environment (SITA)

8.4.1 Company Analysis

8.4.2 Future Outlook & Business Strategy

8.5 Hunan Yonker Environmental Protection Co., Ltd.

8.5.1 Company Analysis

8.5.2 Future Outlook & Business Strategy

8.6 New Energy Corporation

8.6.1 Company Analysis

8.6.2 Future Outlook & Business Strategy

8.7 Chongqing Iron & Steel Company (CISC)

8.7.1 Company Analysis

8.7.2 Future Outlook & Business Strategy

8.8 Keppel Seghers Belgium N.V.

8.8.1 Company Analysis

8.8.2 Future Outlook & Business Strategy

8.9 Hitachi Zosen Inova AG

8.9.1 Company Analysis

8.9.2 Future Outlook & Business Strategy

8.10 Babcock & Wilcox Vølund A/S

8.10.1 Company Analysis

8.10.2 Future Outlook & Business Strategy

8.11 Mitsubishi Heavy Industries Environmental & Chemical Engineering Co. Ltd. (MHIEC)

8.11.1 Company Analysis

8.11.2 Future Outlook & Business Strategy

8.12 Viridor

8.12.1 Company Analysis

8.12.2 Future Outlook & Business Strategy

9. Conclusions and Recommendations

9.1 Key Findings

9.2 Recommendations

10. Glossary

Appendix

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

Appendix B

Visiongain Report Evaluation Form

List of Tables

Table 1.1 Global Waste-to-Energy Market, by Region Forecast 2017-2027 (US $Mn & Mtpa, AGR %, CAGR %, Cumulative)

Table 2.1 Income Streams Available for the Waste-to-Energy Market

Table 2.2 Sources of Municipal Solid Waste

Table 3.1 Global Waste-to-Energy Market Forecast 2017-2027 ($ mn, Mtpa, AGR %, CAGR %, Cumulative)

Table 3.2 Global Waste-to-Energy Market, by Region Forecast 2017-2027 ($mn, AGR %, CAGR %, Cumulative)

Table 3.3 Global Waste-to-Energy Market, by Region Forecast 2017-2027 (Mtpa, AGR %, CAGR %, Cumulative)

Table 3.4 Leading National Waste-to-Energy Market Cumulative spending, $ Mn (2017-2027)

Table 3.5 Drivers & Restraints

Table 4.1 U.K. Waste-to-Energy Market Forecast 2017-2027 ($ mn, Mtpa, AGR %, CAGR %, Cumulative)

Table 4.2 Key UK WtE Statistics (Population, Annual MSW Production, Annual MSW Production per Capita, Incineration Rate, Landfill Rate, Recycling/Compost Rate, WtE Facilities, WtE Capacity, New Plants Under Planning / Construction)

Table 4.3 Driver and Restraints in the U.K. Waste-to-Energy Market

Table 4.4 Projects Awarded Contracts for Difference under Allocation Round One (Project Name, Developer, Technology, MW, £ / $ Strike Price, Delivery Year)

Table 4.5 Major UK WtE Projects (Company, Project Title, TPA Capacity, MW Capacity, $m Investment, Completion Year, Status)

Table 4.6 Polish Waste-to-Energy Market Forecast 2017-2027 ($ mn, Mtpa, AGR %, CAGR %, Cumulative)

Table 4.7 Key Polish WtE Statistics (Population, Annual MSW Production, Annual MSW Production per Capita, Incineration Rate, Landfill Rate, Recycling/Compost Rate, WtE Facilities, WtE Capacity, New Plants Under Planning / Construction)

Table 4.8 Drivers and Restraints in the Polish Waste-to-Energy Market

Table 4.9 Major Polish WtE Projects (Company, Project Title, TPA Capacity, MW Capacity, $m Investment, Completion Year, Status)

Table 4.10 Irish Waste-to-Energy Market Forecast 2017-2027 ($ mn, Mtpa, AGR %, CAGR %, Cumulative)

Table 4.11 Key Irish WtE Statistics (Population, Annual MSW Production, Incineration Rate, Landfill Rate, Recycling/Compost Rate, WtE Facilities, WtE Capacity, New Plants Under Planning / Construction)

Table 4.12 Major Irish WtE Projects (Company, Project Title, TPA Capacity, MW Capacity, $m Investment, Completion Year, Status)

Table 4.13 Danish Waste-to-Energy Market Forecast 2017-2027 ($ mn, Mtpa, AGR %, CAGR %, Cumulative)

Table 4.14 Key Danish WtE Statistics (Population, Annual MSW Production, Incineration Rate, Landfill Rate, Recycling/Compost Rate, WtE Facilities, WtE Capacity, New Plants Under Planning / Construction)

Table 4.15 Drivers and Restraints in the Danish Waste-to-Energy Market

Table 4.16 Major Danish WtE Projects (Company, Project Title, TPA Capacity, MW Capacity, $m Investment, Completion Year, Status)

Table 4.17 Finnish Waste-to-Energy Market Forecast 2017-2027 ($ mn, Mtpa, AGR %, CAGR %, Cumulative)

Table 4.18 Key Finnish WtE Statistics (Population, Annual MSW Production, Incineration Rate, Landfill Rate, Recycling/Compost Rate, WtE Facilities, WtE Capacity, New Plants Under Planning / Construction)

Table 4.19 Drivers and Restraints in the Finnish Waste-to-Energy Market

Table 4.20 Major Finnish WtE Projects (Company, Project Title, TPA Capacity, MW Capacity, $m Investment, Completion Year, Status)

Table 4.21 Italian Waste-to-Energy Market Forecast 2017-2027 ($ mn, Mtpa, AGR %, CAGR %, Cumulative)

Table 4.22 Key Italian WtE Statistics (Population, Annual MSW Production, Incineration Rate, Landfill Rate, Recycling/Compost Rate, WtE Facilities, WtE Capacity, New Plants Under Planning / Construction)

Table 4.23 Drivers and Restraints in the Italian Waste-to-Energy Market

Table 4.24 Major Italian WtE Projects (Company, Project Title, TPA Capacity, MW Capacity, $m Investment, Completion Year, Status)

Table 4.25 Swedish Waste-to-Energy Market Forecast 2017-2027 ($ mn, Mtpa, AGR %, CAGR %, Cumulative)

Table 4.26 Key Swedish WtE Statistics (Population, Annual MSW Production, Incineration Rate, Landfill Rate, Recycling/Compost Rate, WtE Facilities, WtE Capacity, New Plants Under Planning / Construction)

Table 4.27 Drivers and Restraints in the Swedish Waste-to-Energy Market

Table 4.28 Major Swedish WtE Projects (Company, Project Title, TPA Capacity, MW Capacity, $m Investment, Completion Year, Status)

Table 4.29 Czech Republic Waste-to-Energy Market Forecast 2017-2027 ($ mn, Mtpa, AGR %, CAGR %, Cumulative)

Table 4.30 Key Czech WtE Statistics (Population, Annual MSW Production, Incineration Rate, Landfill Rate, Recycling/Compost Rate, WtE Facilities, WtE Capacity, New Plants Under Planning / Construction)

Table 4.31 Major Czech WtE Projects (Company, Project Title, TPA Capacity, MW Capacity, $m Investment, Completion Year, Status)

Table 4.32 Rest of Europe Waste-to-Energy Market Forecast 2017-2027 ($ mn, Mtpa, AGR %, CAGR %, Cumulative)

Table 4.33 Rest of Europe Waste-to-Energy Projects by Country

Table 4.34 German WtE Capacity Changes (Company, Project Title, TPA Capacity, MW Capacity, Work Expected)

Table 4.35 Chinese Waste-to-Energy Market Forecast 2017-2027 ($ mn, Mtpa, AGR %, CAGR %, Cumulative)

Table 4.36 Key Chinese WtE Statistics (Population, Annual MSW Production, Incineration Rate, Landfill Rate, Recycling/Compost Rate, WtE Facilities, WtE Capacity, New Plants Under Planning / Construction)

Table 4.37 Drivers and Restraints in the Chinese Waste-to-Energy Market

Table 4.38 Major Chinese WtE Projects (Company, Project Title, TPA Capacity, MW Capacity, $m Investment, Completion Year)

Table 4.39 Japanese Waste-to-Energy Market Forecast 2017-2027 ($ mn, Mtpa, AGR %, CAGR %, Cumulative)

Table 4.40 Key Japanese WtE Statistics (Population, Annual MSW Production, Annual MSW Production per Capita, Incineration Rate, Landfill Rate, Recycling/Compost Rate, WtE Facilities, WtE Capacity, New Plants Under Planning / Construction)

Table 4.41 Drivers and Restraints in the Japanese Waste-to-Energy Market

Table 4.42 Major Japanese WtE Projects (Company, Project Title, TPA Capacity, $m Investment, Completion Year)

Table 4.43 Rest of Asia Pacific Waste-to-Energy Market Forecast 2017-2027 ($ mn, Mtpa, AGR %, CAGR %, Cumulative)

Table 4.44 Rest of Asia-Pacific WtE Projects by Country

Table 4.45 Key Australian WtE Statistics (Population, Annual MSW Production, Incineration Rate, Landfill Rate, Recycling/Compost Rate, WtE Facilities, WtE Capacity, Planning / Construction)

Table 4.46 Major Australian WtE Projects (Company, Project Title, TPA Capacity, MW Capacity, $m Investment, Completion Year, Status)

Table 4.47 Drivers and Restraints in the Australian Waste-to-Energy Market

Table 4.48 Major Indian WtE Projects (Project Title, TPA Capacity, MW Capacity, $m Investment, Completion Year, Status)

Table 4.49 US Waste-to-Energy Market Forecast 2017-2027 ($ mn, Mtpa, AGR %, CAGR %, Cumulative)

Table 4.50 Key US WtE Statistics (Population, Annual MSW Production, Incineration Rate, Landfill Rate, Recycling/Compost Rate, WtE Facilities, WtE Capacity, Energy Output, New Plants Under Planning / Construction)

Table 4.51 Drivers and Restraints in the US Waste-to-Energy Market

Table 4.52 Major US WtE Projects (Company, Project Title, TPA Capacity, $m Investment, Completion Year)

Table 4.53 Canadian Waste-to-Energy Market Forecast 2017-2027 ($ mn, Mtpa, AGR %, CAGR %, Cumulative)

Table 4.54 Key Canadian WtE Statistics (Population, Annual MSW Production, Incineration Rate, Landfill Rate, Recycling/Compost Rate, WtE Facilities, WtE Capacity, New Plants Under Planning / Construction)

Table 4.55 Drivers and Restraints in the Canadian Waste-to-Energy Market

Table 4.56 Major Canadian Waste-to-Energy Projects (Company, Project Title, TPA Capacity, $m Investment, Completion Year)

Table 4.57 Rest of the World Waste-to-Energy Market Forecast 2017-2027 ($ mn, Mtpa, AGR %, CAGR %, Cumulative)

Table 4.58 Major WtE Projects in the Rest of the World (Company, Project Title, Country, TPA Capacity, Completion Year, Status)

Table 5.1 PESTEL Analysis, Waste-to-Energy Market

Table 8.1 Covanta Energy Corporation Profile 2016(Market Entry, Public/Private, Headquarters, Total Company Sales $mn, Change in Revenue, Geography, Key Market, Company Sales from Waste-to-Energy Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 8.2 Covanta Energy Corporation Total Company Revenue 2012-2016 ($bn, AGR %)

Table 8.3 Covanta Energy Corporation Revenue % Share, by Waste &Services Revenue Breakup, 2016

Table 8.4 China Everbright International Limited Profile 2016 (Market Entry, Public/Private, Headquarters, Total Company Sales $mn, Change in Revenue, Geography, Key Market, Company Sales from Marine Seismic Equipment and Acquisition Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 8.5 China Everbright International Limited Total Company Revenue 2012-2015 ($bn, AGR %)

Table 8.6 China Everbright Waste-to-Energy Projects (Project Name, TPA Capacity, Completion Year, Status)

Table 8.7 Sembcorp Industries2016 (Market Entry, Public/Private, Headquarters, Total Company Sales $bn, Change in Revenue, Geography, Key Market, Company Sales from Marine Seismic Equipment and Acquisition Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 8.8 Suez Environment (SITA) 2016 (Market Entry, Public/Private, Headquarters, Total Company Sales $bn, Change in Revenue, Geography, Key Market, Company Sales from Marine Seismic Equipment and Acquisition Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 8.9 Suez Environment (SITA)Total Company Revenue 2011-2015 ($bn, AGR %)

Table 8.10 Suez Environment (SITA) Suez Environnment Waste-to-Energy Projects (Project, Country, TPA Capacity, Completion Year)

Table 8.11 Hunan Yonker Environmental Protection Co., Ltd.2016 (Market Entry, Public/Private, Headquarters, Total Company Sales $bn, Change in Revenue, Geography, Key Market, Company Sales from Marine Seismic Equipment and Acquisition Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 8.12 SWOT Analysis of Hunan Yonker Environmental Protection in the WtE Market

Table 8.13 New Energy Corporation Profile 2016 (Market Entry, Public/Private, Headquarters, Total Company Sales $mn, Change in Revenue, Geography, Key Market, Company Sales from Waste-to-Energy Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 8.14 Chongqing Iron & Steel Company (CISC) Profile 2016 (Market Entry, Public/Private, Headquarters, Total Company Sales $mn, Change in Revenue, Geography, Key Market, Company Sales from Waste-to-Energy Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 8.15 CISC WtE Operations (Project Name, TPA Capacity, Completion

Table 8.16 Keppel Seghers Belgium N.V. Profile 2016 (Market Entry, Public/Private, Headquarters, Total Company Sales $mn, Change in Revenue, Geography, Key Market, Company Sales from Waste-to-Energy Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 8.17 Keppel Seghers Belgium N.V. Waste-to-Energy Projects (Project Name, Country, TPA Capacity, Completion Year)

Table 8.18 Keppel Seghers Belgium N.V. Company Divisions & Capabilities

Table 8.19 Hitachi Zosen Inova AG Profile 2016 (Market Entry, Public/Private, Headquarters, Total Company Sales $mn, Change in Revenue, Geography, Key Market, Company Sales from Waste-to-Energy Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 8.20 Hitachi Zosen Inova Waste-to-Energy Projects (Project, Country, TPA Capacity, Completion Year)

Table 8.21 Babcock & Wilcox Vølund A/S Profile 2016 (Market Entry, Public/Private, Headquarters, Total Company Sales $mn, Change in Revenue, Geography, Key Market, Company Sales from Waste-to-Energy Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 8.22 Babcock & Wilcox Vølund Waste-to-Energy Projects (Project, Country, TPA Capacity, Completion Year)

Table 8.23 Babcock & Wilcox Vølund Company Divisions & Capabilities

Table 8.24 MHIEC Profile 2016 (Market Entry, Public/Private, Headquarters, Total Company Sales $mn, Change in Revenue, Geography, Key Market, Company Sales from Waste-to-Energy Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 8.25 Mitsubishi Heavy Industries Environmental & Chemical Waste-to-Energy Projects (Project Name, Country, TPA Capacity, Completion Year)

Table 8.26 Mitsubishi Heavy Industries Environmental & Chemical Divisions & Capabilities

Table 8.27 Viridor Profile 2016 (Market Entry, Public/Private, Headquarters, Total Company Sales $mn, Change in Revenue, Geography, Key Market, Company Sales from Waste-to-Energy Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 8.28 Viridor Overview (Total Revenue 2015 $m, Market Share by 2016 CAPEX %, Operational WtE Capacity TPA, HQ, Employees, Website)

List of Figures

Figure 1.1 The Waste-to-Energy Market by Country/Region Market Share Forecast 2017, 2022, 2027 (% Share)

Figure 2.1 Inputs, Technological Processes and Outputs for the Waste-to-Energy Market

Figure 2.2 Factors Impacting MSW Management

Figure 2.3 Breakdown of Typical US MSW Content (%)

Figure 2.4 Global Waste-to-Energy Market Segmentation Overview

Figure 3.1 Global Waste-to-Energy Market, by CAPEX Forecast 2017-2027 ($ Mn, AGR %)

Figure 3.2 Global Waste-to-Energy Market, by Capacity Forecast 2017-2027 (Mtpa)

Figure 3.3 Regional Waste-to-Energy Market, by Capacity Forecast 2017-2027 (Mtpa, AGR %)

Figure 3.4 Regional Waste-to-Energy Market Forecast 2017-2027 (Mtpa, AGR %)

Figure 3.5 Leading National Waste-to-Energy Market Share, 2017

Figure 3.6 Leading National Waste-to-Energy Market Share, 2022

Figure 3.7 Leading National Waste-to-Energy Market Share, 2027

Figure 3.8 Leading National Waste-to-Energy Market Total Cumulative spending, $ Mn (2017-2027)

Figure 3.9 Regional Market Attractiveness

Figure 4.1 U.K. Waste-to-Energy Market, by CAPEX Forecast 2017-2027 ($ Mn, AGR %)

Figure 4.2 U.K. Waste-to-Energy Market, by Capacity Forecast 2017-2027 (Mtpa)

Figure 4.3 U.K. Waste-to-Energy Market Share Forecast 2017, 2022, 2027 (% Share)

Figure 4.5 U.K. Waste Hierarchy

Figure 4.6 Total Household Waste Volumes Treated, Incinerated, Recycled and Recycling Rate, UK 1995-2014

Figure 4.7 Number of Facilities Operating in CHP Mode in 2009 and 2016

Figure 4.8 Polish Waste-to-Energy Market, by CAPEX Forecast 2017-2027 ($ Mn, AGR %)

Figure 4.9 Polish Waste-to-Energy Market, by Capacity Forecast 2017-2027 (Mtpa)

Figure 4.10 Polish Waste-to-Energy Market Share Forecast 2017, 2022, 2027 (% Share)

Figure 4.11 Irish Waste-to-Energy Market, by CAPEX Forecast 2017-2027 ($ Mn, AGR %)

Figure 4.12 Irish Waste-to-Energy Market, by Capacity Forecast 2017-2027 (Mtpa)

Figure 4.13 Irish Waste-to-Energy Market Share Forecast 2017, 2022, 2027 (% Share)

Figure 4.14 Danish Waste-to-Energy Market, by CAPEX Forecast 2017-2027 ($ Mn, AGR %)

Figure 4.15 Danish Waste-to-Energy Market, by Capacity Forecast 2017-2027 (Mtpa)

Figure 4.16 Danish Waste-to-Energy Market Share Forecast 2017, 2022, 2027 (% Share)

Figure 4.17 Breakdown of Danish Municipal Waste Management, 2013 (%)

Figure 4.18 Municipal Solid Waste Generated & Waste Incinerated in Denmark 2002-2011

Figure 4.19 Finnish Waste-to-Energy Market, by CAPEX Forecast 2017-2027 ($ Mn, AGR %)

Figure 4.20 Finnish Waste-to-Energy Market, by Capacity Forecast 2017-2027 (Mtpa)

Figure 4.21 Finnish Waste-to-Energy Market Share Forecast 2017, 2022, 2027 (% Share)

Figure 4.22 Municipal Waste Generated in Finland 1995-2013 (Ktpa)

Figure 4.23 Italian Waste-to-Energy Market, by CAPEX Forecast 2017-2027 ($ Mn, AGR %)

Figure 4.24 Italian Waste-to-Energy Market, by Capacity Forecast 2017-2027 (Mtpa)

Figure 4.25 Italian Waste-to-Energy Market Share Forecast 2017, 2022, 2027 (% Share)

Figure 4.26 Top 15 Waste Producers in Europe (Ktpa)

Figure 4.27 Italian Municipal Solid Waste Production 1995-2013 (Ktpa)

Figure 4.28 Swedish Waste-to-Energy Market, by CAPEX Forecast 2017-2027 ($ Mn, AGR %)

Figure 4.29 Swedish Waste-to-Energy Market, by Capacity Forecast 2017-2027 (Mtpa)

Figure 4.30 Swedish Waste-to-Energy Market Share Forecast 2017, 2022, 2027 (% Share)

Figure 4.31 Breakdown of Swedish MSW Management, 2013 (%)

Figure 4.32 Czech Republic Waste-to-Energy Market, by CAPEX Forecast 2017-2027 ($ Mn, AGR %)

Figure 4.33 Czech Republic Waste-to-Energy Market, by Capacity Forecast 2017-2027 (Mtpa)

Figure 4.34 Czech Republic Waste-to-Energy Market Share Forecast 2017, 2022, 2027 (% Share)

Figure 4.35 Czech Municipal Solid Waste Production, Recycling Rate, Incineration Rate 1995-2013 (Ktpa, %)

Figure 4.36 Rest of Europe Waste-to-Energy Market, by CAPEX Forecast 2017-2027 ($ Mn, AGR %)

Figure 4.37 Rest of Europe Waste-to-Energy Market, by Capacity Forecast 2017-2027 (Mtpa)

Figure 4.38 Rest of Europe Waste-to-Energy Market Share Forecast 2017, 2022, 2027 (% Share)

Figure 4.39 Chinese Waste-to-Energy Market, by CAPEX Forecast 2017-2027 ($ Mn, AGR %)

Figure 4.40 Chinese Waste-to-Energy Market, by Capacity Forecast 2017-2027 (Mtpa)

Figure 4.41 Chinese Waste-to-Energy Market Share Forecast 2017, 2022, 2027 (% Share)

Figure 4.42 Coal Consumption in China and Other Leading Coal-Consuming Countries, 2012 (US Thousand Short Tons)

Figure 4.43 Chinese Total Primary Energy Consumption, Total Coal Consumption, Coal as a Proportion of Energy Consumption (Quadrillion Btu, %)

Figure 4.44 Chinese Energy Consumption 1980-2012(Quadrillion Btu)

Figure 4.45 Japanese Waste-to-Energy Market, by CAPEX Forecast 2017-2027 ($ Mn, AGR %)

Figure 4.46 Japanese Waste-to-Energy Market, by Capacity Forecast 2017-2027 (Mtpa)

Figure 4.47 Japanese Waste-to-Energy Market Share Forecast 2017, 2022, 2027 (% Share)

Figure 4.48 Rest of Asia Pacific Waste-to-Energy Market, by CAPEX Forecast 2017-2027 ($ Mn, AGR %)

Figure 4.49 Rest of Asia Pacific Waste-to-Energy Market, by Capacity Forecast 2017-2027 (Mtpa)

Figure 4.50 Rest of Asia Pacific Waste-to-Energy Market Share Forecast 2017, 2022, 2027 (% Share)

Figure 4.51 US Waste-to-Energy Market, by CAPEX Forecast 2017-2027 ($ Mn, AGR %)

Figure 4.52 US Waste-to-Energy Market, by Capacity Forecast 2017-2027 (Mtpa)

Figure 4.53 US Waste-to-Energy Market Share Forecast 2017, 2022, 2027 (% Share)

Figure 4.54 Breakdown of US MSW Management, 2013 (%)

Figure 4.55 Canadian Waste-to-Energy Market, by CAPEX Forecast 2017-2027 ($ Mn, AGR%)

Figure 4.56 Canadian Waste-to-Energy Market, by Capacity Forecast 2017-2027 (Mtpa)

Figure 4.57 Canadian Waste-to-Energy Market Share Forecast 2017, 2022, 2027 (% Share)

Figure 4.58 Rest of the World Waste-to-Energy Market, by CAPEX Forecast 2017-2027 ($ Mn, AGR %)

Figure 4.59 Rest of the World Waste-to-Energy Market, by Capacity Forecast 2017-2027 (Mtpa)

Figure 4.60 Rest of the World Waste-to-Energy Market Share Forecast 2017, 2022, 2027 (% Share)

Figure 7.1 Company-wise Waste-to-Energy Installed Capacity 2015

Figure 7.2 Leading Company Market Share (%), 2016, Waste-to-Energy Market

Figure 8.1 Covanta Energy Corporation Revenue % Share, by Operating Segment, 2016

Figure 8.2 Covanta Energy Corporation Revenue % Share, by Waste &Services Revenue Breakup, 2016

Figure 8.3 Covanta Energy Corporation Waste-to-Energy Facilities

Figure 8.4 Covanta Energy Corporation Total Company Revenue, ($bn & AGR %), 2012-2016

Figure 8.5 China Everbright International Limited Revenue % Share, by Business Segment, 2016

Figure 8.6 China Everbright International Limited Total Company Revenue, ($bn& AGR %), 2012-2016

Figure 8.7 Sembcorp Industries Revenue % Share, by Business Segment, 2016

Figure 8.8 Sembcorp Industries Revenue % Share, Capacity (MW), by Power Plant Type, 2016

Figure 8.9 Suez Environment (SITA)Revenue % Share, by Geographical Segment, 2016

Figure 8.10 Suez Environment (SITA)Total Company Revenue, ($bn& AGR %), 2012-2016

Figure 8.11 Chongqing Iron & Steel Company (CISC) SWOT Analysis

Figure 9.1 Global Waste-to-Energy Market Forecast 2017-2027 ($ mn, AGR %)

A2A

Abengoa

Abiko City Hall

Acea Group

ACWA Power

Aem Cremona

Air Products

AISA IMPIANTI

Akita City

Algonquin

Amagasaki City

Amager Resource Centre (ARC)

Ambiente 2000

AmeyCespa

An Hui Wenergy

Anhui Shengyun Machinery Co.

Arcadis

Associated Energy Projects

Associated Energy Projects PLC

Atami City

Atlantic County Utilities Authority (ACUA)

Atsugi City

Azienda Autonoma Municipale Pubblici Servizi

B&W Power Generation Group

B&W Vølund A/S

Babcock & Wilcox

Babcock & Wilcox Vølund A/S

Bee’ah

Beijing Municipal Government

Beijing Municipal Government / Shougang Corporation

Better World Green PCL

BH EnergyGap (Walsall) Ltd

Biffa

Bioessence and ATCO Power

Biogen Power

Bodens Energi

Bollnäs Energi AB

Borås Energi Miljo

Borlänge Energi

Borui Green Energy

Bouygues Energies & Services

Brianza Energia Ambiente

Broadcrown

C&G Environmental Protection Holdings

Cadence EnviroPower

CAGT Engineering

CECEP

Changsha Municipal Solid Waste Advanced & Comprehensive Treatment (Clean Incineration) Project

Changshu Pufa Thermoelectricity

Chant Group

Chengdu Waste-to-Energy Company

Chengdu Xingrong Renewable Energy

Chiba City

Chichibu Municipal Union

Chikoshino City

China Boqi

China Everbright

China Power New Energy

China Power New Energy Development Company Limited

Chinook Urban Mining

Chita City

Chongqing Iron & Steel Company (CISC)

Chongqing Sanfeng Covanta

ChonqingSanfeng Environmental Industry Group Co. Ltd

CISC

City of Ames

City of Chitose

City of Fukuoka

City of Hakodate

City of Hampton

City of Harrisonburg

City of Hitachinaka

City of Kobe

City of Poznan

City of Yokohama

Cixi Zhongke Zhongmao

CJ Global Green Energy Philippines Corp

Clean Association of Tokyo 23

Clean Energy Finance Corporation (CEFC)

Clean Power Properties

Clean Power Properties

Clean Power Properties & Network Rail Infrastructure Ltd

Clean System

Consorzio Gaia

Consorzio Recuperi Energetici

Consulasia

Cory Environmental

Covanta Energy Corporation

Coventry & Solihull Waste Disposal Company

CTCI

Dais Cleaning Facility Union

Dalian TEDA Environmental Protection

Dan Municipal Sanitation Association/Nesher

Datong Fuqiao Waste Incineration Electricity

Detroit Renewable Energy

Devon Waste Management

Dingzhou Ruiquan Solid Waste Treatment

Dong Energy

Doosan

Douglas Solid Waste

Dream Engineering

Drenl

Dubai Municipality

Dundee Energy Recycling Ltd

Dynamis Energy

E. ON

Ebara

Eco Center

Eco Energy

Ecomaine

EDF

Edosaki Local Health Civil Union

EEW Energy from Waste

Ekokem Group

Ekokogeneracja subsidiary Kotlownia

Eksjö Energi

Emerald Energy From Waste Inc

Energia

Energy Answers

Energy Recovery Operations, Inc

Energy Works (Hull) Limited

Energy Works (Spencer Group)

EnGen

Entech Renewable Energy Technologies Pty Ltd (Entech)

Enviroparks Operations

EQT Energy

ESOCO Orrington

Esti Energia

Ethiopian Electric Power Corporation

Euro Energy Group

Europlasma

Eurostat

Falascaia

FCC Environment

Ferrero

Fiberight

Finspang

Fortum

Fortum Keilaniemi

Foster Wheeler

Fujinomiya City

Fujisawa City

Funabashi City

Furlprotection

GCL-Poly

Gent Fairhead

GHPE

GM Pearson

Grandblue Environment

Great River Energy

Green Dynamic

Green EfW Investments

Green Fuel

Green Point Global Partners

Green Power

Grontmij

Grundon Waste

Guangdong Tianyi

Guangzhou Tianyi

Gyoda City

Hachinohe Office Union

Hachioji City

Hadano Isehara Environmental Sanitation Union

Hamamatsu City

Hanamaki City

Hangzhou Green Initiatives Generation

Hanoi Urban Environment Company

Hatsukaichi City

Hebei Construction & Investment

Hebei Jiantou Lingfeng Power Generation

Hebei Lingda Huanbao Energy

Hekinan City

Hem

Herambiente

Hfab

Higashi Osaka City Cleaning Facility Union

Higashimatsuyama City

Hinata Higashiusuki Interjurisdictional

Hirakata City

Hiroshima City

Hisashi Kennan Environment Union

Hitachi Zosen Corporation

Hitachi Zosen Inova

Hitachi Zosen Inova AG

Hofu City Hall

Hunan Junxin Environmental Protection Group

Hyflux

Ibaraki City

Ichihara City

Ichinomiya City

Ichinoseki Administrative Union

Iles de la Madelaine

Imabari City Hall

Imizu City Hall

IMPSA

Inagawa Upstream Garbage Treatment Facilities Union

Indaver

International Electric Power

Interstate Waste Technologies

Inzai District Environment Maintenance Business Union

Iren

Ishinomaki City

Ishinomaki District Integrated Administration Work Association

Japanese New Energy and Industrial Technology Development Organisation

Jersey Transport and Technical Services

JFE

Jinjiang Group

Joint Powers Board

Jönköping Energi

K3CHP Ltd

Kagoshima City

Kakamigahara City

Kakegawa and Kikugawa Cities Sanitation Union

Kamoeisei Union

Kara

Kariya City

Karlskoga Energi

Karlstad Energi

Kasama City

Kashihara City

Kashiwa City Hall

Kashiwa Hato Environmental Partnership

Kashiwa-Shiroi-Kamagaya Kankyo Eisei Kumiai

Kasugai City

Kasukabe City

Kawasaki City Hall

Kazo City Hall

Kenoukennan Regional Environment Association

Keppel Corporation

Keppel Infrastructure Holdings Pte Ltd

Keppel Seghers

KIC Odpapdy

Kils Energi

Kishiwada Kaizuka Clean Facility Union

Kitaakita City

Kitaibaraki City

Kitakata Union

Kodaira Murayama Yamato Sanitation Union

Kodama-Gun City Affairs Division

Kofu City

Kotka Energia

Kyoritsu Hygiene Processing Union

Lahti Energy

Landskrona Energi AB

LECH

Levis City

Lidköping

Lietuvos Energija

Ljungby Energi

Lomellina e

M+W

Marcegaglia Energy

Martin GmbH

Martin Technologies

MCC Energy

Mercia (FCC Environment)

MES Environmental

Metro Vancouver

Mid‐Maine Waste Action Corporation

Minamikawachi Environmental Partnership Secretariat

Mitsubishi Heavy Industries Environmental & Chemical Engineering (MHIEC)

Mizuda Group

Mizushima Eco Works

Mostostal Warszawa

Müllpyrolyseanlage Burgau

Multifuel Energy

MVV Environment

Naanovo Energy

NAES Corp

Nesher Energy

Network Rail Infrastructure Ltd

New Earth Energy (New Earth Solutions)

New Energy

Ningbo Beilun II

North London Waste Authority

Noshiro-Yamamoto

NOY & P3P Partners

Nybro Energi

Oita City

Olmsted County

Öresundskraft

Origin Renewable Energy

Osaka City Hall

Oulun Energia

Peel Energy

Peel Environmental

Pei County

PEI Energy Systems

PGNiG Termika

PHG Energy

Phoenix Energy

Pingdu

Planara

Plasco Energy Group

Polk County

Pope

Pope Energy

Posco E&C

POSCO Engineering & Construction

Prairie Lakes Municipal Solid Waste Authority

Pražské služby

Premier Aggregates

Proctor & Gamble Co.

ProNatura

Qionghai City Construction Bureau

Quadrifoglio

Rabbit Group

Rambol

Rank Progress

REA Dalmine

Reform Energy

Region of Peel

Renova

Resource Recovery Solutions

Resource Recovery Technologies

Riikinvoima

Romelectro

Sako

San-Ei Regulator

Sanitation Districts of Los Angeles County

Sashimakankyou

Savini

Scarborough Power

Scarlino Energia

Se. Ver. A. SPA

Sembcorp

Sembcorp Utilities Ltd

Senboku Environment Maintenance Facility Union

Sennan Cleaning Office Union

Shanghai Canzhou

Shengyuan Environment

Shenzhen Energy

Shetland Heat Energy & Power

Shida Office Union

Shore Energy

Shougang Corporation

Sichuan Electric Power Construction Ltd

Sita Energia

SITA Scandinavia

SITA Sembcorp UK

SITA UK

SITA Zielona Energia

Skövde Värmeverk AB

Söder Energi

Sound Environmental Resources

Southern Yue Cleaning Union

Spokane City

SSE Energy

State Communal Enterprise Koktem

Steinmuller Babcock Environment

Stockholm Town

Suez Environnment

Sundsvall Energi

Synthos

Sysav

Tai'an Zhongke Environment

Takarazuka City

Tammervoima Oy

Taqa

Tata

Tekniska Verken

Termizo

The Waste and Resources Action Programme (WRAP)

Tianjin Electric Power

Tianjin Taihuan Recycling Resource Utilization

Tianjin Teda

Tianjin-Binhai Environmental Industry Development

TIRU

Trisun Green Energy Co

Trisun International

TRM

Turku Energia

Uddevalla Energi

Umeå Energi

Urbaser Balfour Beatty

VafabMiljö

Vantaan Energia

Västervik

Vattenfall

Veolia

Vietnam Waste Solutions

Viridor

Warsaw City

Wasatch Integrated Waste Management District

Waste Gas Technology UK

Waste Infrastructure Grants

Waste Management

Weiming

West Akikawa Sanitation Union

Westenergy Oy

Wheelabrator

Würzburg

Wuxi Xuelang Environmental Technology

Xcel Energy

Xiamen Municipal Environmental Energy Investment Development

Yokosuka City

Yorii Eco Services Corp

ZAC

Zaklad Utylizacyjny

Zevo

Zhangzhou Environment Renewable Energy

Zhanjiang

Zhaodong Longjie Environmental Protection

Zhaoyuan

Zhejiang Wanna

ZhongDe

Zhongshan South

Zhucheng Baoyuan New Energy Power Generation

Zweckverband Abfallwirtschaft Raum

Government Agencies and Other Organisations Mentioned in This Report

Asian Development Bank

Bradford City Council

Calderdale Council

Canadian Government

Center of Intelligent Spatial Computing for Water/Energy Science (CISC)

China Energy Conservation and Environmental Protection (CECEP)

China National Development and Reform Commission

Chinese Academy of Sciences

Dan Municipal Sanitation Association

Devon County Council

Energy Information Administration (EIA)

European Commission

European Union (EU)

Glasgow Recycling and Renewable Energy Centre (GRREC)

Green Energy Centre

Hunan Yonker Environmental Protection

Independent Police Complaints Commission (IPCC)

Merseyside Recycling and Waste Authority

Nordic Investment Bank (NIB)

Norfolk County Council

North Yorkshire County Council

Peel Energy Recovery Centre

Peel Regional Council

Polish Ministry of Environment

Senate Finance Committee

Severnside Energy Recovery Centre

South Korean government

Taiwanese Environmental Protection Agency

Thailand’s Ministry of Natural Resources and Environment

The Organisation for Economic Co-operation and Development (OECD

The Slovak Investment and Trade Development Agency (SARIO)

The Department for Environment, Food and Rural Affairs (Defra)

United Nations (UN)

United States Environmental Protection Agency (EPA)

Waste-to-Energy Research and Technology Council (WTERT)

World Bank

Worldwide Holdings Bhd

Download sample pages

Complete the form below to download your free sample pages for Waste to Energy (WtE) Market Outlook 2017-2027

Related reports

-

Global Landfill Gas to Energy Market 2018-2028

Visiongain has calculated that the global landfill gas to energy market will see a total expenditure of $3.525bn in 2018,...

Full DetailsPublished: 07 June 2018 -

Waste to Energy (WtE) Yearbook 2018

Visiongain assesses that CAPEX on Waste-to-Energy will reach $15.4bn in 2018.

...Full DetailsPublished: 28 September 2018 -

Top 20 Companies in The Waste to Energy (WtE) Market 2018

The leading players comprise a diverse range of companies, including international utilities, national agencies and devolved bodies, and smaller engineering,...

Full DetailsPublished: 08 October 2018 -

Nuclear Waste Management Market Report 2017-2027

The latest report from business intelligence provider Visiongain offers fresh analysis of the global nuclear waste management market. Visiongain assesses...Full DetailsPublished: 02 December 2016 -

The Cryogenic Pump Market Forecast 2018-2028

Visiongain has calculated that the global Cryogenic Pump market will see a capital expenditure (CAPEX) of $1,842 mn in 2018....

Full DetailsPublished: 11 December 2017 -

Global Wastewater Treatment to Energy (WWTtE) Market Report 2017-2027

Visiongain has calculated that the global WWTtE market will see a total expenditure of $531m in 2017, including both capital...

Full DetailsPublished: 20 September 2017

Download sample pages

Complete the form below to download your free sample pages for Waste to Energy (WtE) Market Outlook 2017-2027

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain energy reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and industry experts where possible but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain energy reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

“The Visiongain report was extremely insightful and helped us construct our basic go-to market strategy for our solution.”

H.

“F.B has used Visiongain to prepare two separate market studies on the ceramic proppants market over the last 12 months. These reports have been professionally researched and written and have assisted FBX greatly in developing its business strategy and investment plans.”

F.B

“We just received your very interesting report on the Energy Storage Technologies (EST) Market and this is a very impressive and useful document on that subject.”

I.E.N

“Visiongain does an outstanding job on putting the reports together and provides valuable insight at the right informative level for our needs. The EOR Visiongain report provided confirmation and market outlook data for EOR in MENA with the leading countries being Oman, Kuwait and eventually Saudi Arabia.”

E.S

“Visiongain produced a comprehensive, well-structured GTL Market report striking a good balance between scope and detail, global and local perspective, large and small industry segments. It is an informative forecast, useful for practitioners as a trusted and upto-date reference.”

Y.N Ltd

Association of Dutch Suppliers in the Oil & Gas Industry

Society of Naval Architects & Marine Engineers

Association of Diving Contractors

Association of Diving Contractors International

Associazione Imprese Subacquee Italiane

Australian Petroleum Production & Exploration Association

Brazilian Association of Offshore Support Companies

Brazilian Petroleum Institute

Canadian Energy Pipeline

Diving Medical Advisory Committee

European Diving Technology Committee

French Oil and Gas Industry Council

IMarEST – Institute of Marine Engineering, Science & Technology

International Association of Drilling Contractors

International Association of Geophysical Contractors

International Association of Oil & Gas Producers

International Chamber of Shipping

International Shipping Federation

International Marine Contractors Association

International Tanker Owners Pollution Federation

Leading Oil & Gas Industry Competitiveness

Maritime Energy Association

National Ocean Industries Association

Netherlands Oil and Gas Exploration and Production Association

NOF Energy

Norsk olje og gass Norwegian Oil and Gas Association

Offshore Contractors’ Association

Offshore Mechanical Handling Equipment Committee

Oil & Gas UK

Oil Companies International Marine Forum

Ontario Petroleum Institute

Organisation of the Petroleum Exporting Countries

Regional Association of Oil and Natural Gas Companies in Latin America and the Caribbean

Society for Underwater Technology

Society of Maritime Industries

Society of Petroleum Engineers

Society of Petroleum Enginners – Calgary

Step Change in Safety

Subsea UK

The East of England Energy Group

UK Petroleum Industry Association

All the events postponed due to COVID-19.

Latest Energy news

Visiongain Publishes Carbon Capture Utilisation and Storage (CCUS) Market Report 2024-2034

The global carbon capture utilisation and storage (CCUS) market was valued at US$3.75 billion in 2023 and is projected to grow at a CAGR of 20.6% during the forecast period 2024-2034.

19 April 2024

Visiongain Publishes Liquid Biofuels Market Report 2024-2034

The global Liquid Biofuels market was valued at US$90.7 billion in 2023 and is projected to grow at a CAGR of 6.7% during the forecast period 2024-2034.

03 April 2024

Visiongain Publishes Hydrogen Generation Market Report 2024-2034

The global Hydrogen Generation market was valued at US$162.3 billion in 2023 and is projected to grow at a CAGR of 3.7% during the forecast period 2024-2034.

28 March 2024

Visiongain Publishes Biofuel Industry Market Report 2024-2034

The global Biofuel Industry market was valued at US$123.2 billion in 2023 and is projected to grow at a CAGR of 7.6% during the forecast period 2024-2034.

27 March 2024