1. Report Overview

1.1 Waste-to-Energy Market Overview

1.2 Market Structure Overview and Market Definition

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report Include:

1.6 Who is This Report For?

1.7 Methodology

1.7.1 Primary Research

1.7.2 Secondary Research

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to The Waste-to-Energy Market

2.1 Waste-to-Energy Technologies

2.2 The Characteristics and Evolution of MSW Management

2.3 Market Definition

3. Leading Companies in Waste-to-Energy Market

3.1 The Leading 20 Companies in the WtE Market 2017 – Market Share Analysis

3.2 Veolia Environmental Services

3.2.1 Veolia Environmental Services Business Overview

3.2.2 Veolia Environmental Services Recent Developments

3.2.3 Veolia Environmental Services Business Strategy

3.3 China Everbright International Limited

3.3.1 China Everbright International Limited Company Analysis

3.3.2 China Everbright International Limited Future Outlook & Business Strategy

3.4 Covanta Energy Corporation

3.4.1 Covanta Energy Corporation Company Analysis

3.4.2 Covanta Energy Corporation Recent Developments

3.4.3 Covanta Energy Corporation Future Outlook & Business Strategy

3.5 EDF

3.5.1 EDF Business Overview

3.5.2 EDF Business Strategy

3.6 Suez Environnement (SITA)

3.6.1 Suez Environnement (SITA) Business Overview

3.6.2 Suez Environnement (SITA) Recent Developments

3.6.3 Suez Environnement (SITA) Company Outlook

3.7 Hitachi Zosen Inova AG

3.7.1 Hitachi Zosen Inova AG Company Analysis

3.7.2 Hitachi Zosen Inova AG Future Outlook & Business Strategy

3.8 Ramboll Group A/S

3.8.1 Ramboll Group A/S Business Overview

3.8.2 Ramboll Group A/S Recent Developments

3.8.3 Ramboll Group A/S Business Strategy

3.9 Grandblue Environment Co., Ltd.

3.9.1 Grandblue Environment Co., Ltd. Business Overview

3.9.2 Grandblue Environment Co., Ltd. Business Strategy

3.10 Wheelabrator Technologies Inc.

3.10.1 Wheelabrator Technologies Inc. Business Overview

3.10.2 Wheelabrator Technologies Inc. Recent Developments

3.10.3 Wheelabrator Technologies Inc. Business Strategy

3.11 EQT AB

3.11.1 EQT AB Business Overview

3.11.2 EQT AB Recent Developments

3.12 Keppel Seghers Belgium N.V.

3.12.1 Keppel Seghers Belgium N.V. Company Analysis

3.12.2 Keppel Seghers Belgium N.V. Recent Development

3.12.3 Keppel Seghers Belgium N.V. Future Outlook & Business Strategy

3.13 Attero

3.13.1 Attero Business Overview

3.13.2 Attero Business Strategy

3.14 Chongqing Iron & Steel Company (CISC)

3.14.1 Chongqing Iron & Steel Company (CISC) Company Analysis

3.14.2 Chongqing Iron & Steel Company (CISC) Future Outlook & Business Strategy

3.15 Clean Association of Tokyo 23

3.15.1 Clean Association of Tokyo 23 Business Overview

3.15.2 Clean Association of Tokyo 23 Business Strategy

3.16 Viridor

3.16.1 Viridor Company Analysis

3.16.2 Viridor Future Outlook & Business Strategy

3.17 China Metallurgical Group (MCC)

3.17.1 China Metallurgical Group (MCC) Business Overview

3.17.2 China Metallurgical Group (MCC) Business Strategy

3.18 Hunan Junxin Environmental Protection

3.18.1 Hunan Junxin Environmental Protection Business Overview

3.18.2 Hunan Junxin Environmental Protection Business Strategy

3.19 Babcock & Wilcox Vølund A/S

3.19.1 Babcock & Wilcox Vølund A/S Company Analysis

3.19.2 Babcock & Wilcox Vølund A/S Future Outlook & Business Strategy

3.20 AVR

3.20.1 AVR Business Overview

3.20.2 AVR Business Strategy

3.21 GCL-Poly

3.21.1 GCL-Poly Business Overview

3.21.2 GCL-Poly Business Strategy

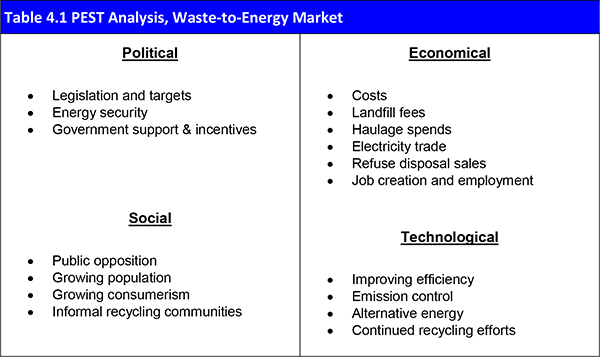

4. PEST Analysis

4.1 Political Impact

4.2 Economic Impact

4.3 Social Impact

4.4 Technological Impact

5. Expert Opinion - Veolia

5.1 Wastewater Treatment to Energy Market

5.1.1 Primary Correspondents

5.1.2 Wastewater treatment-to-energy Market Outlook

5.1.3 Driver & Restraints

5.1.4 Dominant Region/nation in the Wastewater treatment-to-energy Market

5.1.5 Overall Growth Rate, Globally

6. Conclusions & Recommendations

6.1 Recommendations

7. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 2.1 Income Streams Available for the Waste-to-Energy Market

Table 2.2 Sources of Municipal Solid Waste

Table 3.1: The Leading 20 Companies in WtE Market- Waste Processing Capacity (Million Tons Per Annum), Market Share (%), 2017

Table 3.2 Veolia Environmental Services Profile 2017 (Market Entry, Public/Private, Headquarters, No. of Employees, Total Company Revenue $ bn, Change in Revenue, WtE Revenue $bn, Waste Processing Capacity (MTPA), Electricity Generated from WtE facilities (GWh), Number of WtE Facilities, Strongest WtE Business Region, Geography, Key Markets, Listed On, Products/ Services)

Table 3.3 Veolia Environmental Services Total Company Revenue 2013-2017 ($bn, AGR %)

Table 3.4 Veolia Environmental Services WtE Operations (Plant, Country, Start, MSW Capacity (tpa))

Table 3.5 China Everbright International Limited Profile 2017 (Inception, Public/Private, Headquarters, No. of Employees, Total Company Revenue $mn, Change in Revenue, Waste Processing Capacity (MTPA), Number of WtE Facilities, Electricity Generated from WtE Facilities (billion kWh), Environmental Energy Projects Revenue $mn, Geography, Strongest Business Region/ Nation, Key Markets, Listed on, Products/ Services)

Table 3.6 China Everbright International Limited Total Company Revenue 2013-2017 ($bn, AGR %)

Table 3.7 China Everbright Waste-to-Energy Projects (Project Name, TPA Capacity, Completion Year, Status)

Table 3.8 Covanta Energy Corporation Profile 2017 (Inception, Public/Private, Headquarters, No. of Employees, Total Company Revenue $ bn, Change in Revenue 2016 (%), Waste Processing Capacity (MTPA), No. of EfW Facilities, Waste and Service Revenue $mn, Energy Revenue $mn, Geography, Strongest Business Region/ Country, Key Markets, Listed On, Products/Services)

Table 3.9 Covanta Energy Corporation Total Company Revenue 2013-2017 ($bn, AGR %)

Table 3.10 Covanta Energy Corporation Projects Details (Location, Waste Processing, Gross electric (MW), Nature of Interest, Contract Expiry Dates)

Table 3.11 EDF Profile 2017 (Inception, Public/Private, Headquarter, Total Company Sales $ bn, Change in Revenue, Geography, Key Market, Company Sales from Wte Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 3.12 EDF Total Company Revenue 2014-2017 ($bn, AGR %)

Table 3.13 EDF WtE Operations: Name, Country, Start, MSW

Table 3.14 Suez Environnement (SITA) 2016 (Market Entry, Public/Private, Headquarters, No. of Employees, Total Company Sales $bn, Change in Revenue, WtE Revenue $bn, Waste processing Capacity (MTPA), Electricity Generated from WtE Facilities (GWh), Geography, Key Market, Company Sales from wte Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement)

Table 3.15 Suez Environnement (SITA) Total Company Revenue 2013-2017 ($bn, AGR %)

Table 3.16 Suez Environnement (SITA) Suez Environnement Waste-to-Energy Projects (Project, Country, TPA Capacity, Completion Year)

Table 3.17 Hitachi Zosen Inova AG Profile 2017 (Market Entry, Public/Private, Headquarters, Total Company Revenue $Bn 2016, Change in Revenue, No. of Employees, Waste Processing Capacity (MTPA), Strongest Business Region/ Nation, Geography, Key Markets, Products/Services)

Table 3.18 Hitachi Zosen Inova AG Total Company Revenue 2013-2016 ($bn, AGR %)

Table 3.19 Hitachi Zosen Inova Waste-to-Energy Projects (Project, Country, TPA Capacity, Completion Year)

Table 3.20 Ramboll Group A/S Profile 2017 (Inception, Public/Private, Headquarters, No. of Employees, Total Company Revenue $ bn, Change in Revenue 2016 (%),Revenue from Energy Segment, Waste Processing Capacity (MTPA), Geography, Key Markets, Products/Services, Strongest Business Regions)

Table 3.21 Ramboll Group A/S Total Company Revenue 2013-2017 ($bn, AGR %)

Table 3.22 Grandblue Environment Co., Ltd. Profile 2017 (Market Entry, Public/Private, Headquarters, No. of Employees, Waste Processing Capacity (MTPA), Electricity Generated from WtE Facilities (Million MWh), Number of WtE Facilities, Total Company Revenue $ mn, Change in Revenue, Geography, Key Markets)

Table 3.23 Grandblue Environment Co., Ltd. Company Revenue 2013-2017 ($mn, AGR (%))

Table 3.24 Grandblue Environment Co., Ltd. WtE Operations (Name, Start, MSW Capacity (tpa))

Table 3.25 Wheelabrator Technologies Inc. Profile 2017 (Market Entry, Public/Private, Headquarters, Total Company Revenue $ bn, No. of Employees, Waste Processing Capacity (MTPA), Electricity Generated from WtE Facilities (TWh), Number of WtE Facilities, Strongest WtE Business Region, Geography, Key Markets)

Table 3.26 Wheelabrator Technologies Inc. WtE Operations: Name, MSW Capacity (tpa)

Table 3.27 EQT AB Profile 2017 (Inception, Public/Private, Headquarters, Total Company Revenue $ bn, Change in Revenue, Geography, Key Market, Company Sales from Wte Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 3.28 Keppel Seghers Belgium N.V. Profile 2017 (Market Entry, Public/Private, Headquarters, Total Company Revenue $mn, Change in Revenue, Waste Processing Capacity (MTPA), 2017, Geography, Key Markets, Products/Services)

Table 3.29 Keppel Corporation Total Company Revenue 2013-2017 ($bn, AGR %)

Table 3.30 Keppel Seghers Belgium N.V. Waste-to-Energy Projects (Project Name, Country, TPA Capacity, Completion Year)

Table 3.31 Keppel Seghers Belgium N.V. Company Divisions & Capabilities

Table 3.32 Attero Profile 2017 (Market Entry, Public/Private, Headquarters, No. of Employees, Waste Processing Capacity (MTPA), Number of WtE Facilities, Strongest WtE Region/ Nation, Geography, Key Markets)

Table 3.33 Attero WtE Operations: Name, Start, MSW

Table 3.34 Chongqing Iron & Steel Company (CISC) Profile 2017 (Market Entry, Public/Private, Headquarters, Geography, Total Company Revenue $mn, No. of Employees, Waste Processing Capacity (MTPA), Special Grants for Energy Saving and Environmental Protection 2017 $mn, Key Markets, Products/Services)

Table 3.35 Chongqing Iron & Steel Company (CISC) SWOT Analysis

Table 3.36 CISC WtE Operations (Plant, Start, MSW Capacity (tpa))

Table 3.37 Clean Association of Tokyo 23 Profile 2017 (Market Entry, Public/Private, Headquarters, No. of Employees, Waste Processing Capacity (MTPA), Total Waste Treatment Volume (tpd), Total Power Output (MWh/yr), Strongest Business Region/ Nation, Geography, Key Markets)

Table 3.38 Clean Association of Tokyo 23 WtE Operations (Name, Start, MSW Capacity (tpa))

Table 3.39 Viridor Profile 2017 (Market Entry, Public/Private, Headquarters, Total Company Revenue $bn, Number of WtE Facilities, Total Renewable Energy Generation (GWh), No. of Employees, Geography, Strongest Business Region, Key Markets, Products/ Services)

Table 3.40 Viridor Overview Project (Project, Country, Capacity (tpa), CAPEX $m, Completion Year)

Table 3.41 China Metallurgical Group (MCC) Profile 2017 (Market Entry, Public/Private, Headquarters, Total Company Revenue $ bn, Change in Revenue, Waste Processing Capacity (MTPA), Number of WtE Facilities, Strongest WtE Business Region/ Nation, Geography, Key Markets)

Table 3.42 China Metallurgical Group (MCC), Total Company Revenue 2012-2017 ($mn, AGR %)

Table 3.43 China Metallurgical Group (MCC) Operations (Name, Start, MSW)

Table 3.44 Hunan Junxin Environmental Protection Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Sales $mn, Change in Revenue, Waste Processing Capacity, Geography, Key Market, Company Sales from Waste-to-Energy Market, Listed on, Products/Services, Strongest Business Region/Nation, No. of Employees)

Table 3.45 Babcock & Wilcox Vølund A/S Profile 2017 (Market Entry, Public/Private, Headquarters, Total Company Revenue $mn, Change in Revenue, No. of Employees, Geography, Key Markets, Products/Services)

Table 3.46 Babcock & Wilcox Enterprises, Inc. Total Company Revenue 2013-2017 ($bn, AGR %)

Table 3.47 Babcock & Wilcox Vølund Waste-to-Energy Projects (Project, Country, TPA Capacity, Completion Year)

Table 3.48 Babcock & Wilcox Vølund Company Divisions & Capabilities

Table 3.49 AVR Profile 2017 (Market Entry, Public/Private, Headquarters, No. of Employees, Total Waste Processing Capacity (MTPA), Number of WtE Facilities, Strongest WtE Business Region/ Nation, Geography, Key Markets)

Table 3.50 AVR WtE Operations: Name, Start, MSW

Table 3.51 GCL-Poly Profile 2017 (Inception, Public/Private, Headquarter, Total Company Sales $ bn, Change in Revenue, Geography, Key Market, Company Sales from Wte Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 3.52 GCL-Poly WtE Operations: Name, Start, MSW

Table 4.1 PEST Analysis, Waste-to-Energy Market

List of Figures

Figure 2.1 Inputs, Technological Processes and Outputs for the Waste-to-Energy Market

Figure 2.2 Factors Impacting MSW Management

Figure 2.3 Breakdown of Typical US MSW Content (%)

Figure 3.1 The Leading 20 Companies in WtE Market Share by Capacity 2017 (%)

Figure 3.2 Veolia Environmental Services Total Company Revenue, ($bn & AGR %), 2013-2017

Figure 3.3 Veolia Environmental Services Revenue % Share, by Geographical Segment, 2017

Figure 3.4 China Everbright International Limited Revenue % Share, by Business Segment, 2017

Figure 3.5 China Everbright International Limited Total Company Revenue, ($bn & AGR %), 2013-2017

Figure 3.6 Covanta Energy Corporation Revenue % Share, by Operating Segment, 2017

Figure 3.7 Covanta Energy Corporation Revenue % Share, by Waste & Services Revenue Breakup, 2017

Figure 3.8 Covanta Energy Corporation Waste-to-Energy Facilities

Figure 3.9 Covanta Energy Corporation Total Company Revenue, ($bn & AGR %), 2013-2017

Figure 3.10 EDF Total Company Revenue, ($bn & AGR %), 2014-2017

Figure 3.11 EDF Revenue % Share, by Geographical Segment, 2017

Figure 3.12 Location of EDF WtE Operations

Figure 3.13 Suez Environnement (SITA) Revenue % Share, by Geographical Segment, 2017

Figure 3.14 Suez Environnement (SITA) Total Company Revenue, ($bn & AGR %), 2013-2017

Figure 3.15 Hitachi Zosen Inova AG Total Company Revenue, ($bn & AGR %), 2013-2016

Figure 3.16 Hitachi Zosen Inova AG Revenue % Share, by Business Segment, FY-2016

Figure 3.17 Hitachi Zosen Inova AG Revenue % Share, by Geographical Segment, FY-2016

Figure 3.18 Ramboll Group A/S Total Company Revenue,($bn, AGR %), 2013-2017

Figure 3.19 Ramboll Group A/S Revenue % Share, by Business Segment, 2017

Figure 3.20 Ramboll Group A/S Revenue % Share, by Geographical Segment, 2017

Figure 3.21 Grandblue Environment Co., Ltd. Company Revenue 2013-2017 ($mn, AGR (%))

Figure 3.22 Grandblue Environment Co., Ltd., WtE Operation Location

Figure 3.23 Wheelabrator Technologies Inc., Location of WtE Operations

Figure 3.24 EQT, by Geographic Presence, 2017

Figure 3.25 Location of EQT’s WtE Operations

Figure 3.26 Keppel Corporation Total Company Revenue, ($bn & AGR %), 2013-2017

Figure 3.27 Keppel Corporation Revenue % Share, by Business Segment, 2017

Figure 3.28 Keppel Corporation Revenue % Share, by Geographical Segment, 2017

Figure 3.29 Location of Attero WtE Operations

Figure 3.30 Clean Association of Tokyo 23, Location of WtE Tokyo Operations

Figure 3.31 Pennon Group Revenue % Share, by Business Segment, 2017

Figure 3.32 Pennon Group Revenue % Share, by Geographical Segment, 2017

Figure 3.33 China Metallurgical Group (MCC), Total Company Revenue 2012-2017 ($mn, AGR %)

Figure 3.34 China Metallurgical Group (MCC), WtE Operation Location

Figure 3.35 Hunan Junxin Environmental Protection, WtE Operation Location

Figure 3.36 Babcock & Wilcox Enterprises, Inc. Total Company Revenue, ($bn & AGR %), 2013-2017

Figure 3.37 Babcock & Wilcox Enterprises, Inc. Revenue % Share, by Business Segment, 2017

Figure 3.38 Babcock & Wilcox Enterprises, Inc. Revenue % Share, by Geographical Segment, 2017

Figure 3.39 Location of AVR WtE Operations

Figure 3.40 GCL-Poly, by Sales, 2017

Figure 3.41 Location of GCL-Poly’s WtE Operations

Figure 5.1 Top 20 Waste-to-Energy Companies, Waste Processing Capacity (mtpa), 2017