Industries > Aviation > Top 15 Connected Aircraft Companies 2017

Top 15 Connected Aircraft Companies 2017

Contracts, Revenues & Market Share Analysis of Leaders of In Flight Entertainment & Connectivity (IFEC) Technologies & The Internet of Things (IoT)

• Do you need definitive connected aircraft market data?

• Clear competitor positioning analysis?

• Succinct connected aircraft market analysis?

• Technological insight?

• Actionable business recommendations?

Read on to discover how this definitive 439 page report can transform your own research and save you time.

The merger of Kontron AG and S&T Group, has led Visiongain to publish this timey report. The $2.7bn connected aircraft market is expected to flourish in the next few years because of growing demand for air transport. Along with fleet renewal and expansion this is expected to feed through in the latter part of the decade driving growth to new heights. If you want to be part of this growing industry, then read on to discover how you can maximise your investment potential.

Report highlights

327 tables, charts, and graphs

536 connected aircraft contracts

15 leading connected aircraft company revenue, rank & market share analysis

• BAE Systems plc

• Cobham plc

• Eutelsat Communications SA

• Global Eagle Entertainment Inc

• Gogo Inc

• Honeywell International Inc

• Inmarsat plc

• Iridium Communications Inc

• Kontron AG

• Panasonic Corporation

• Rockwell Collins Inc

• SITA OnAir

• Thales SA

• ViaSat Inc

• Zodiac Aerospace SA

Key questions answered

• What are the market shares for each leading company in the connected aircraft market?

• Who are the leading players, where are they positioned in the market and what are their future prospects?

• How is the connected aircraft market evolving?

• What is driving and restraining connected aircraft market dynamics?

• Which individual technologies will prevail and how will these shifts be responded to?

• How will political and regulatory factors influence demand for aircraft connectivity?

• How will the leading companies adapt their strategies to accommodate changes in market conditions?

Target audience

• Leading aviation companies

• In-flight entertainment & connectivity (IFEC) specialists

• Aircraft manufacturers

• Aircraft component contractors,

• Commercial airlines

• Electronics suppliers

• Systems integrators

• Connectivity specialists

• Internet of things (IoT) companies

• Technologists

• R&D staff

• Consultants

• Analysts

• CEO’s

• CIO’s

• COO’s

• Business development managers

• Investors

• Banks

• Governments

• Agencies

• Industry organisations’

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Top 15 Connected Aircraft Companies

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report Include:

1.5 Who is This Report For?

1.6 Methodology

1.6.1 Secondary Research

1.6.2 Market Share Sizing Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to the Connected Aircraft Market

2.1 Global Connected Aircraft Market Structure

2.2 Connected Aircraft Market Definition

2.2.1 In-Flight Entertainment & Connectivity

2.2.2 Internet of Things

2.3 IFEC and IoT Applications

2.3.1 Airborne Internet Communications

2.3.2 Mobile Phones

2.3.3 On-Board Conferencing

2.3.4 Personal Electronic Devices

2.4 Requirements for IFEC and IoT in Connected Aircraft

2.4.1 Hardware

2.4.2 Bandwidth

2.4.3 Air-to-Ground Infrastructure

2.4.4 Satellites

2.4.5 Content

2.5 Types of Connected Aircraft Technology

2.5.1 Ku-band and Ka-band

2.5.2 Antennas

2.5.3 In-Cabin Network Hardware

2.5.4 Power Outlets

2.6 Regulation and Safety of In-Flight Connectivity

3. Competitor Positioning in the Connected Aircraft Market

3.1 Top 15 Companies in the Connected Aircraft Market

3.2 Composition of the Connected Aircraft Market

3.2.1 Connected Aircraft Market Composition Overview

3.2.2 Composition of the Connected Aircraft Market

3.2.3 Leading Connected Aircraft Companies by Regional Distribution

3.3 Global Connected Aircraft Market Drivers & Restraints 2016

3.3.1 Market Drivers for Leading Connected Aircraft Companies

3.3.2 Market Challenges for Leading Connected Aircraft Companies

4. Top 15 Connected Aircraft Companies

4.1 BAE Systems plc

4.1.1 BAE Systems plc Connected Aircraft Market Selected Recent Contracts / Projects / Programmes 2013-2015

4.1.2 BAE Systems plc Total Company Sales 2012-2016

4.1.3 BAE Systems plc Net Income 2012-2016

4.1.4 BAE Systems plc Net Capital Expenditure 2012-2016

4.1.5 BAE Systems plc Sales by Segment of Business 2012-201

4.1.6 BAE Systems plc Regional Emphasis / Focus

4.1.7 BAE Systems plc Organisational Structure / Subsidiaries / Number of Employees

4.1.8 BAE Systems plc Connected Aircraft Market Products / Services

4.1.9 BAE Systems plc Primary Market Competitors 2017

4.1.10 BAE Systems plc Mergers & Acquisitions (M&A) Activity

4.1.11 BAE Systems plc Overview

4.1.12 Financial Performance of BAE Systems plc

4.1.13 A New Player in the Connected Aircraft Market?

4.1.14 BAE Systems plc Future Outlook

4.1.15 BAE Systems plc SWOT Analysis

4.2 Cobham plc

4.2.1 Cobham plc Connected Aircraft Market Selected Recent Contracts / Projects / Programmes 2014-2016

4.2.2 Cobham plc Total Company Sales 2012-2016

4.2.3 Cobham plc Net Income 2012-2016

4.2.4 Cobham plc Net Capital Expenditure 2012-2016

4.2.5 Cobham plc Sales by Segment of Business 2012-2016

4.2.6 Cobham plc Regional Emphasis / Focus

4.2.7 Cobham plc Organisational Structure / Subsidiaries / Number of Employees

4.2.8 Cobham plc Connected Aircraft Market Products / Services

4.2.9 Cobham plc Primary Market Competitors 2017

4.2.10 Cobham plc Mergers & Acquisitions (M&A) Activity

4.2.11 Cobham plc Overview

4.2.12 Financial Performance of Cobham plc

4.2.13 Partnership with Inmarsat in the Delivery of In-Flight Connectivity

4.2.14 Cobham plc Future Outlook

4.2.15 Cobham plc SWOT Analysis

4.3 Eutelsat Communications SA

4.3.1 Eutelsat Communications SA Connected Aircraft Market Selected Recent Contracts / Projects / Programmes 2015-2016

4.3.2 Eutelsat Communications SA Total Company Sales 2012-2017

4.3.3 Eutelsat Communications Net Income SA 2012-2017

4.3.4 Eutelsat Communications SA Regional Emphasis / Focus

4.3.5 Eutelsat Communications SA Organisational Structure / Subsidiaries / Number of Employees

4.3.6 Eutelsat Communications SA Connected Aircraft Market Products / Services

4.3.7 Eutelsat Communications SA Primary Market Competitors 2017

4.3.8 Eutelsat Communications SA Mergers & Acquisitions (M&A) Activity

4.3.9 Eutelsat Communications SA Overview

4.3.10 Eutelsat Communications and Aeronautical Connectivity

4.3.11 Eutelsat Communications SA Future Outlook

4.3.12 Eutelsat Communications SA SWOT Analysis

4.4 Global Eagle Entertainment Inc

4.4.1 Global Eagle Entertainment Inc Connected Aircraft Market Selected Recent Contracts / Projects / Programmes 2013-2016

4.4.2 Global Eagle Entertainment Inc Total Company Sales 2011-2015

4.4.3 Global Eagle Entertainment Inc Sales in the Connectivity Market 2012-2015

4.4.4 Global Eagle Entertainment Inc Net Loss 2011-2015

4.4.5 Global Eagle Entertainment Inc Sales by Segment of Business 2012-2015

4.4.6 Global Eagle Entertainment Inc Regional Emphasis / Focus

4.4.7 Global Eagle Entertainment Inc Organisational Structure / Subsidiaries

4.4.8 Global Eagle Entertainment Inc Connected Aircraft Market Products / Services

4.4.9 Global Eagle Entertainment Inc Primary Market Competitors 2017

4.4.10 Global Eagle Entertainment Inc Mergers & Acquisitions (M&A) Activity

4.4.11 Global Eagle Entertainment Inc Overview

4.4.12 Financial Performance of Global Eagle Entertainment Inc

4.4.13 A Leading Player in In-Flight Entertainment, Content Connectivity and Digital Media

4.4.14 Global Eagle Entertainment Inc Future Outlook

4.4.15 Global Eagle Entertainment Inc SWOT Analysis

4.5 Gogo Inc

4.5.1 Gogo Inc Connected Aircraft Market Selected Recent Contracts / Projects / Programmes 2012-2017

4.5.2 Gogo Inc Total Company Sales 2012-2016

4.5.3 Gogo Inc Net Income / Loss 2012-2016

4.5.4 Gogo Inc Net Capital Expenditure 2013-2016

4.5.5 Gogo Inc Sales by Segment of Business 2012-2016

4.5.6 Gogo Inc Regional Emphasis / Focus

4.5.7 Gogo Inc Organisational Structure / Subsidiaries / Number of Employees

4.5.8 Gogo Inc Connected Aircraft Market Products / Services

4.5.9 Gogo Inc Primary Market Competitors 2017

4.5.11 Gogo Inc Overview

4.5.12 Financial Performance of Gogo Inc

4.5.13 A Broad Array of Connectivity Solutions for Commercial and Business Aviation

4.5.14 Gogo Inc Future Outlook

4.5.15 Gogo Inc SWOT Analysis

4.6 Honeywell International Inc

4.6.1 Honeywell International Inc Connected Aircraft Market Selected Recent Contracts / Projects / Programmes 2010-2017

4.6.2 Honeywell International Inc Total Company Sales 2012-2016

4.6.3 Honeywell International Inc Net Income 2012-2016

4.6.4 Honeywell International Inc Net Capital Expenditure 2012-2016

4.6.5 Honeywell International Inc Sales by Segment of Business 2012-2016

4.6.6 Honeywell International Inc Regional Emphasis / Focus

4.6.7 Honeywell International Inc Organisational Structure / Subsidiaries / Number of Employees

4.6.8 Honeywell International Inc Connected Aircraft Market Products / Service

4.6.9 Honeywell International Inc Primary Market Competitors 2017

4.6.10 Honeywell International Inc Mergers & Acquisitions (M&A) Activity

4.6.11 Honeywell International Inc Overview

4.6.12 Financial Performance of Honeywell International Inc

4.6.13 Aircraft Connectivity for the Business Jet Sector

4.6.14 Honeywell International Inc Future Outlook

4.6.15 Honeywell International Inc SWOT Analysis

4.7 Inmarsat plc

4.7.1 Inmarsat plc Connected Aircraft Market Selected Recent Contracts / Projects / Programmes 2012-2017

Inmarsat announced the successful completion of its Global Xpress ‘Around the World’ test flight that covered more than 25,000 miles and demonstrated Global Xpress’ ability to deliver seamless, worldwide coverage across multiple spot beams and satellites.

4.7.2 Inmarsat plc Total Company Sales 2012-2016

4.7.3 Inmarsat plc Net Income 2012-2016

4.7.4 Inmarsat plc Net Capital Expenditure 2012-2016

4.7.5 Inmarsat plc Sales by Segment of Business 2014-2016

4.7.6 Inmarsat plc Regional Emphasis / Focus

4.7.7 Inmarsat plc Organisational Structure / Subsidiaries / Number of Employees

4.7.8 Inmarsat plc Connected Aircraft Market Products / Services

4.7.9 Inmarsat plc Primary Market Competitors 2017

4.7.10 Inmarsat plc Mergers & Acquisitions (M&A) Activity

4.7.11 Inmarsat plc Overview

4.7.12 Financial Performance of Inmarsat plc

4.7.13 Inmarsat Sees Healthy Growth Prospects in Aircraft Connectivity

4.7.14 Inmarsat plc Future Outlook

4.7.15 Inmarsat plc SWOT Analysis

4.8 Iridium Communications Inc

4.8.1 Iridium Communications Inc Connected Aircraft Market Selected Recent Contracts / Projects / Programmes 2013-2017

4.8.2 Iridium Communications Inc Total Company Sales 2012-2016

4.8.3 Iridium Communications Inc Net Income 2012-2016

4.8.4 Iridium Communications Inc Net Capital Expenditure 2012-2016

4.8.5 Iridium Communications Inc Sales by Segment of Business 2012-2016

4.8.6 Iridium Communications Inc Regional Emphasis / Focus

4.8.7 Iridium Communications Inc Organisational Structure / Subsidiaries

4.8.8 Iridium Communications Inc Connected Aircraft Market Products / Services

4.8.9 Iridium Communications Inc Primary Market Competitors 2017

4.8.10 Iridium Communications Inc Overview

4.8.11 Iridium Communications Inc Financial Performance

4.8.12 Growing Opportunities for Air Passenger Communications Services

4.8.13 Iridium Communications Inc Future Outlook

4.8.14 Iridium Communications Inc SWOT Analysis

4.9 Kontron AG

4.9.1 Kontron AG Connected Aircraft Market Selected Recent Contracts / Projects / Programmes 2011-2017

4.9.2 Kontron AG Total Company Sales 2012-2016

4.9.3 Kontron AG Net Income / Loss 2012-2016

4.9.4 Kontron AG Sales by Segment of Business 2016

4.9.5 Kontron AG Regional Emphasis / Focus

4.9.6 Kontron AG Organisational Structure / Subsidiaries / Number of Employees

4.9.7 Kontron AG Connected Aircraft Market Products / Services

4.9.8 Kontron AG Primary Market Competitors 2017

4.9.9 Kontron AG Divestitures Activity

4.9.10 Kontron AG and S&T Group Merger

4.9.11 Kontron AG Overview

4.9.12 Financial Performance of Kontron AG

4.9.13 Developing the Next Generation of IFEC

4.9.14 Kontron AG Future Outlook

4.9.15 Kontron AG SWOT Analysis

4.10 Panasonic Corporation

4.10.1 Panasonic Avionics Corporation Connected Aircraft Market Selected Recent Contracts / Projects / Programmes 2011-2015

4.10.2 Aeromobile Communications Ltd Connected Aircraft Market Selected Recent Contracts / Projects / Programmes

4.10.3 Panasonic Corporation Total Company Sales 2012-2016

4.10.4 Panasonic Corporation Net Income / Loss 2012-2016

4.10.5 Panasonic Corporation Net Capital Expenditure 2011-2015

4.10.6 Panasonic Corporation Sales by Segment of Business 2011-2015

4.10.7 Panasonic Corporation Regional Sales

4.10.8 Panasonic Corporation Organisational Structure / Subsidiaries / Number of Employees

4.10.9 Panasonic Avionics Connected Aircraft Market Products / Services

4.10.10 Panasonic Corporation Primary Market Competitors 2017

4.10.11 Panasonic Corporation Mergers & Acquisitions (M&A) Activity

4.10.12 Panasonic Corporation Overview

4.10.13 Financial Performance of Panasonic Corporation

4.10.14 Panasonic Avionics is a World Leader in IFEC Solutions for Commercial Aircraft

4.10.15 Panasonic Corporation Future Outlook

4.10.16 Panasonic Corporation SWOT Analysis

4.11 Rockwell Collins Inc

4.11.1 Rockwell Collins Connected Aircraft Market Selected Recent Contracts / Projects / Programmes 2012-2015

4.11.2 Rockwell Collins Inc Total Company Sales 2010-2015

4.11.3 Rockwell Collins Inc Sales in the Connected Aircraft Market 2013-2015

4.11.4 Rockwell Collins Inc Net Income 2010-2015

4.11.5 Rockwell Collins Inc Net Capital Expenditure 2010-2015

4.11.6 Rockwell Collins Inc Sales by Segment of Business 2012-2016

4.11.7 Rockwell Collins Inc Regional Emphasis / Focus

4.11.8 Rockwell Collins Inc Organisational Structure / Subsidiaries / Number of Employees

4.11.9 Rockwell Collins Inc Connected Aircraft Market Products / Services

4.11.10 Rockwell Collins Inc Primary Market Competitors 2017

4.11.11 Rockwell Collins Inc Mergers & Acquisitions (M&A) Activity

4.11.12 Rockwell Collins Inc Overview

4.11.12 Rockwell Collins Acquired B/E Aerospace

4.11.13 Financial Performance of Rockwell Collins Inc

4.11.14 Rockwell Collins Inc and Aircraft Connectivity

4.11.15 Rockwell Collins Inc Future Outlook

4.11.16 Rockwell Collins Inc SWOT Analysis

4.12 SITA OnAir

4.12.1 SITA OnAir Connected Aircraft Market Selected Recent Contracts / Projects / Programmes 2012-2015

4.12.2 SITA OnAir Regional Emphasis / Focus

4.12.3 SITA OnAir Organisational Structure / Partners

4.12.4 SITA OnAir Connected Aircraft Market Products / Services

4.12.5 SITA OnAir Primary Market Competitors 2017

4.12.6 SITA Mergers & Acquisitions (M&A) Activity

4.12.7 SITA OnAir Overview

4.12.8 SITA OnAir Provides Comprehensive Passenger In-Flight Connectivity

4.12.9 SITA OnAir Future Outlook

4.12.10 SITA OnAir SWOT Analysis

4.13 Thales SA

4.13.1 Thales SA Connected Aircraft Market Selected Recent Contracts / Projects / Programmes 2012-2015

4.13.2 Thales SA Total Company Sales 2012-2016

4.13.3 Thales SA Net Income / Loss 2012-2016

4.13.4 Thales SA Net Capital Expenditure 2012-2016

4.13.5 Thales SA Sales by Segment of Business 2012-2016

4.13.6 Thales SA Regional Emphasis / Focus

4.13.7 Thales SA Organisational Structure / Subsidiaries / Number of Employees

4.13.8 Thales SA Connected Aircraft Market Products / Services

4.13.9 Thales SA Primary Market Competitors 2017

4.13.10 Thales SA Mergers & Acquisitions (M&A) Activity

4.13.11 Thales SA Overview

4.13.12 Financial Performance of Thales SA

4.13.13 Thales SA and Connected Aircraft

4.13.14 Thales SA Future Outlook

4.13.15 Thales SA SWOT Analysis

4.14 ViaSat Inc

4.14.1 ViaSat Inc Connected Aircraft Market Selected Recent Contracts / Projects / Programmes 2010-2015

4.14.2 ViaSat Inc Total Company Sales 2012-2016

4.14.3 ViaSat Inc Net Income / Loss 2012-2016

4.14.4 ViaSat Inc Net Capital Expenditure 2012-2016

4.14.5 ViaSat Inc Sales by Segment of Business 2012-2016

4.14.6 ViaSat Inc Regional Emphasis / Focus

4.14.7 ViaSat Inc Organisational Structure / Subsidiaries

4.14.8 ViaSat Inc Connected Aircraft Market Products / Services

4.14.9 ViaSat Inc Primary Market Competitors 2017

4.14.10 ViaSat Inc Mergers & Acquisitions (M&A) Activity

4.14.11 ViaSat Inc Overview

4.14.12 Financial Performance of ViaSat Inc

4.14.13 Enabling Commercial and Business Aviation In-Flight Connectivity

4.14.13 ViaSat Inc Future Outlook

4.14.14 ViaSat Inc SWOT Analysis

4.15 Zodiac Aerospace SA

4.15.1 Zodiac Aerospace Connected Aircraft Market Selected Recent Contracts / Projects / Programmes 2012-2015

4.15.2 Zodiac Aerospace SA Total Company Sales 2012-2016

4.15.3 Zodiac Aerospace SA Net Income 2012-2016

4.15.4 Zodiac Aerospace Net Capital Expenditure 2010-2012

4.15.5 Zodiac Aerospace SA Sales by Segment of Business 2010-2015

4.15.6 Zodiac Aerospace Regional Emphasis / Focus

4.15.7 Zodiac Aerospace SA Organisational Structure / Subsidiaries / Number of Employees

4.15.8 Zodiac Aerospace SA Connected Aircraft Market Products / Services

4.15.9 Zodiac Aerospace SA Primary Market Competitors 2017

4.15.10 Zodiac Aerospace SA Mergers & Acquisitions (M&A) Activity

4.15.11 Zodiac Aerospace SA Overview

4.15.12 Financial Performance of Zodiac Aerospace SA

4.15.13 An Expanding Presence in Aircraft Connectivity and Strong Ties with Airbus

4.15.14 Zodiac Aerospace SA Future Outlook

4.15.15 Zodiac Aerospace SA SWOT Analysis

5. Other Notable Companies Operating in the Connected Aircraft Market

6. SWOT Analysis of the Connected Aircraft Market 2017

7. Conclusions

8. Glossary

List of Tables

Table 1.1 Sample Company Sales by Geographic Region 2012-2016 (US$m, AGR %)

Table 3.1 Top 15 Connected Aircraft Market Companies Sales Share 2016 (Ranking, Company, FY2016 Total Company Sales US$m, FY2016 Sales in the Connected Aircraft Market US$m, % of Connected Aircraft Sales from Total Company 2016 Sales, Connected Aircraft Market Share 2016%)

Table 3.2 Connected Aircraft Technologies of the Leading 15 Companies in the Connected Aircraft Market 2016 (Company, Connected Aircraft Technologies)

Table 3.3 Global Connected Aircraft Market Drivers & Restraints 2016

Table 4.1BAE Systems plc Profile 2016 (Connected Aircraft Market Ranking, Connected Aircraft Market Share %, CEO, Total Company Sales US$m, Sales in the Connected Aircraft Market US$m, Share of Company Sales from the Connected Aircraft Market %, Net Income US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.2Selected Recent BAE Systems plc Connected Aircraft Market Contracts / Projects / Programmes 2013-2015 (Date, Country / Region, Subcontractor, Product, Details)

Table 4.3 BAE Systems plc Total Company Sales 2012-2016 (US$m, AGR %)

Table 4.4 BAE Systems plc Net Income 2012-2016 (US$m, AGR %)

Table 4.5 BAE Systems plc Net Capital Expenditure 2012-2016 (US$m, AGR %)

Table 4.6 BAE Systems plc Sales by Segment of Business 2012-2016 (US$m, AGR %)

Table 4.7 BAE Systems plc Sales by Geographical Location 2012-2016 (US$m, AGR %)

Table 4.8BAE Systems plc Subsidiaries 2017 (Subsidiary, Location)

Table 4.9 BAE Systems plc Number of Employees 2012-2016 (No. of Employees, AGR %)

Table 4.10 BAE Systems plc Connected Aircraft Market Products / Services (Segment of Business, Product, Specification / Features)

Table 4.11 BAE Systems plc Mergers and Acquisitions 2014 (Date, Company Involved, Value US$m, Details)

Table 4.12 BAE Systems plc Divestitures 2015 (Date, Company Involved, Details)

Table 4.13 BAE Systems plc SWOT Analysis 2017

Table 4.14 Cobham plc Profile 2016 (Connected Aircraft Market Ranking, Connected Aircraft Market Share, CEO, Total Company Sales US$m, Sales in the Connected Aircraft Market US$m, Share of Company Sales from the Connected Aircraft Market %, Net Loss FY2016 US$m, Net Capital Expenditure FY2014 US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.15 Selected Recent Cobham plc Connected Aircraft Contracts / Projects / Programmes 2014-2016 (Date, Country / Region, Subcontractor, Value US$m, Product, Details)

Table 4.16 Cobham plc Total Company Sales 2012-2016 (US$m, AGR %)

Table 4.17 Cobham plc Net Income 2012-2016 (US$m, AGR %)

Table 4.18 Cobham plc Net Capital Expenditure 2012-2016 (US$m, AGR %)

Table 4.19 Cobham plc Sales by Segment of Business 2012-2016 (US$m, AGR %)

Table 4.20 Cobham plc Sales by Geographical Location 2012-2016 (US$m, AGR %)

Table 4.21 Cobham plc Select Subsidiaries 2017 (Subsidiary, Location)

Table 4.22 Cobham plc Number of Employees 2012-2016 (No. of Employees, AGR %)

Table 4.23 Cobham plc Connected Aircraft Market Products / Services (Segment of Business, Product, Specification / Features)

Table 4.24 Cobham plc Mergers and Acquisitions 2014 (Date, Company Involved, Value US$m, Details)

Table 4.25 Cobham plc SWOT Analysis 2017

Table 4.26 Eutelsat Communications SA Profile 2016 (Connected Aircraft Market Ranking, Connected Aircraft Market Share %, CEO, Total Company Sales US$m, Sales in the Connected Aircraft Market US$m, Share of Company Sales from the Connected Aircraft Market %, Net Income US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.27 Selected Recent Eutelsat Communications SA Connected Aircraft Market Contracts / Projects / Programmes 2015-2016 (Date, Country / Region, Subcontractor, Product, Details)

Table 4.28 Eutelsat Communications SA Total Company Sales 2012-2017 (US$m, AGR %)

Table 4.29 Eutelsat Communications SA Net Income 2012-2016 (US$m, AGR %)

Table 4.30 Eutelsat Communications SA Sales by Geographical Location 2012-2017 (US$m, AGR %)

Table 4.31 Eutelsat Communications SA Subsidiaries 2017 (Subsidiary, Location)

Table 4.32 Eutelsat Communications SA Number of Employees 2012-2017 (No. of Employees, AGR %)

Table 4.33 Eutelsat Communications SA Connected Aircraft Market Products / Services (Segment of Business, Product, Specification / Features)

Table 4.34 Eutelsat Communications SA Mergers and Acquisitions 2014 (Date, Company Involved, Value US$m, Details)

Table 4.35 Eutelsat Communications SA Divestitures 2014 (Date, Company Involved, Value US$m, Details)

Table 4.36 Eutelsat Communications SASWOT Analysis 2017

Table 4.37 Global Eagle Entertainment Inc Profile 2016 (FY2015 Financial Information) (Connected Aircraft Market Ranking, Connected Aircraft Market Share %, CEO, Total Company Sales US$m, Sales in the Connected Aircraft Market US$m, Share of Company Sales from the Connected Aircraft Market %, Net Loss US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.38Selected Recent Global Eagle Entertainment Connected Aircraft Market Contracts / Projects / Programmes 2013-2015 (Date, Country / Region, Subcontractor, Product, Details)

Table 4.39 Global Eagle Entertainment Inc Total Company Sales 2011-2015 (US$m, AGR %)

Table 4.40 Global Eagle Entertainment Inc Sales in the Connectivity Market 2012-2015 (US$m, AGR %)

Table 4.41 Global Eagle Entertainment Inc Net Loss 2011-2015 (US$m)

Table 4.42 Global Eagle Entertainment Inc Sales by Segment of Business 2012-2015 (US$m, AGR %)

Table 4.43 Global Eagle Entertainment Inc Sales by Geographical Location 2011-2015 (US$m, AGR %)

Table 4.44 Global Eagle Entertainment Inc Subsidiaries 2017 (Subsidiary, Location)

Table 4.45 Global Eagle Entertainment Inc Connected Aircraft Market Products / Services (Segment of Business, Product, Specification / Features)

Table 4.46 Global Eagle Entertainment Inc Mergers and Acquisitions 2015-2016 (Date, Company Involved, Value US$m, Details)

Table 4.47Global Eagle Entertainment Inc SWOT Analysis 2017

Table 4.48 Gogo Inc Profile 2017 (Connected Aircraft Market Ranking, Connected Aircraft Market Share %, CEO, Total Company Sales US$m, Sales in the Connected Aircraft Market US$m, Share of Company Sales from the Connected Aircraft Market %, Net Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, IR Contact, Ticker, Website)

Table 4.49 Selected Recent Gogo Inc Connected Aircraft Market Contracts / Projects / Programmes 2012-2017 (Date, Country / Region, Subcontractor, Value US$m, Product, Details)

Table 4.50 Gogo Inc Total Company Sales 2012-2016 (US$m, AGR %)

Table 4.51 Gogo Inc Net Income / Loss 2012-2016 (US$m)

Table 4.52 Gogo Inc Net Capital Expenditure 2013-2016 (US$m, AGR %)

Table 4.53 Gogo Inc Sales by Segment of Business 2012-2016 (US$m, AGR %)

Table 4.54 Gogo Inc Sales by Geographical Location 2014-2016 (US$m, AGR %)

Table 4.55 Gogo Inc Subsidiaries 2017 (Subsidiary, Location)

Table 4.56 Gogo Inc Number of Employees 2015-2016 (No. of Employees)

Table 4.57 Gogo Inc Connected Aircraft Market Products / Services (Segment of Business, Product, Specification / Features)

Table 4.58 Gogo Inc SWOT Analysis 2017

Table 4.59 Honeywell International Inc Profile 2017 (Connected Aircraft Market Ranking, Connected Aircraft Market Share %, CEO, Total Company Sales US$m, Sales in the Connected Aircraft Market US$m, Share of Company Sales from the Connected Aircraft Market %, Net Income US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.60 Selected Recent Honeywell International Inc Connected Aircraft Market Contracts / Projects / Programmes 2010-2017 (Date, Country / Region, Subcontractor, Value US$m, Product, Details)

Table 4.61 Honeywell International Inc Total Company Sales 2012-2016 (US$m, AGR %)

Table 4.62 Honeywell International Inc Net Income 2010-2014 (US$m, AGR %)

Table 4.63 Honeywell International Inc Net Capital Expenditure 2012-2016 (US$m, AGR %)

Table 4.64 Honeywell International Inc Sales by Segment of Business 2012-2016 (US$m, AGR %)

Table 4.65 Honeywell International Inc Sales by Geographical Location 2012-2016 (US$m, AGR%)

Table 4.66 Honeywell International Inc Select Subsidiaries 2017 (Subsidiary, Location)

Table 4.67 Honeywell International Inc Number of Employees 2012-2016 (No. of Employees, AGR %)

Table 4.68 Honeywell International Inc Connected Aircraft Market Products / Services (Segment of Business, Product, Specification / Features)

Table 4.69 Honeywell International Inc Mergers and Acquisitions 2015 (Date, Company Involved, Value US$m, Details)

Table 4.70 Honeywell International Inc Divestitures (Date, Company Involved, Value US$m, Details)

Table 4.71 Honeywell International Inc SWOT Analysis 2017

Table 4.72 Inmarsat plc Profile 2017 (Connected Aircraft Market Ranking, Connected Aircraft Market Share %, CEO, Total Company Sales US$m, Sales in the Connected Aircraft Market US$m, Share of Total Company Sales from the Connected Aircraft Market %, Net Income US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.73 Selected Recent Inmarsat plc Connected Aircraft Market Contracts / Projects / Programmes 2012-2017 (Date, Country / Region, Subcontractor, Value US$m, Product, Details)

Table 4.74 Inmarsat plc Total Company Sales 2012-2016 (US$m, AGR %)

Table 4.75 Inmarsat plc Net Income 2012-2016 (US$m, AGR %)

Table 4.76 Inmarsat plc Net Capital Expenditure 2012-2016 (US$m, AGR %)

Table 4.77 Inmarsat plc Sales by Segment of Business 2014-2016 (US$m, AGR %)

Table 4.78 Inmarsat plc Sales by Geographical Location 2012-2016 (US$m, AGR %)

Table 4.79 Inmarsat plc Subsidiaries 2017 (Subsidiary, Location)

Table 4.80 Inmarsat plc Number of Employees 2012-2016 (No. of Employees, AGR %)

Table 4.81 Inmarsat plc Connected Aircraft Market Products / Services (Segment of Business, Product, Specification / Features)

Table 4.82 Inmarsat plc Mergers and Acquisitions 2014 (Date, Company Involved, Value US$m, Details)

Table 4.83 Inmarsat plc SWOT Analysis 2017

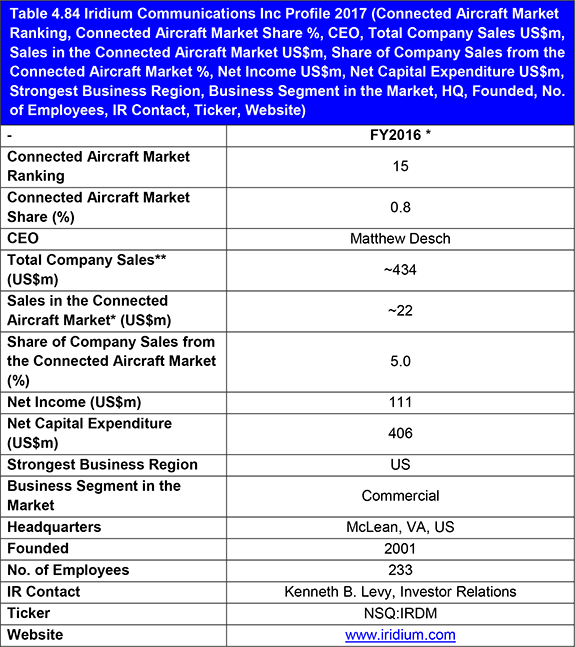

Table 4.84 Iridium Communications Inc Profile 2017 (Connected Aircraft Market Ranking, Connected Aircraft Market Share %, CEO, Total Company Sales US$m, Sales in the Connected Aircraft Market US$m, Share of Company Sales from the Connected Aircraft Market %, Net Income US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.85 Selected Recent Iridium Communications Inc Connected Aircraft Market Contracts / Projects / Programmes 2013-2017 (Date, Country / Region, Subcontractor, Value US$m, Product, Details)

Table 4.86 Iridium Communications Inc Total Company Sales 2012-2016 (US$m, AGR %)

Table 4.87 Iridium Communications Inc Net Income 2012-2016 (US$m, AGR %)

Table 4.88 Iridium Communications Inc Net Capital Expenditure 2012-2016 (US$m, AGR %)

Table 4.89 Iridium Communications Inc Sales by Segment of Business 2012-2016 (US$m, AGR %)

Table 4.90 Iridium Communications Inc Sales by Geographical Location 2012-2016 (US$m, AGR %)

Table 4.91 Iridium Communications Inc Subsidiaries 2017 (Subsidiary, Location)

Table 4.92 Iridium Communications Inc Connected Aircraft Market Products / Services (Segment of Business, Product, Specification / Features)

Table 4.93 Iridium Communications Inc SWOT Analysis 2017

Table 4.94 Kontron AG Profile 2016 (Connected Aircraft Market Ranking, Connected Aircraft Market Share %, CEO, Total Company Sales US$m, Sales in the Connected Aircraft Market US$m, Share of Company Sales from the Connected Aircraft Market %, Net Loss US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.95 Selected Recent Kontron AG Connected Aircraft Market Contracts / Projects / Programmes 2011-2017 (Date, Country / Region, Subcontractor, Product, Details)

Table 4.96 Kontron AG Total Company Sales 2012-2016 (US$m, AGR %)

Table 4.97 Kontron AG Net Income / Loss 2012-2016 (US$m)

Table 4.98 Kontron Sales by Segment of Business 2016 (Business Division, Sales US$m)

Table 4.99 Kontron AG Sales by Geographical Location 2014-2016 (US$m, AGR%)

Table 4.100 Kontron AG Subsidiaries 2017 (Subsidiary, Location)

Table 4.101 Kontron AG Number of Employees 2010-2014 (No. of Employees, AGR %)

Table 4.102 Kontron AG Connected Aircraft Market Products / Services (Segment of Business, Product, Specification / Features)

Table 4.103 Kontron AG Divestitures 2014 (Date, Company Involved, Value US$m, Details)

Table 4.104 Kontron AG SWOT Analysis 2017

Table 4.105 Panasonic Corporation Profile 2016 (Connected Aircraft Market Ranking, Connected Aircraft Market Share %, President, Total Company Sales US$m, Sales in the Connected Aircraft Market US$m, Share of Company Sales from the Connected Aircraft Market %, Net Income US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.106 Selected Recent Panasonic Corporation Connected Aircraft Market Contracts / Projects / Programmes 2011-2015 (Date, Country / Region, Subcontractor, Value US$m, Product, Details)

Table 4.107 Selected Recent Aeromobile Communications Ltd Connected Aircraft Market Contracts / Projects / Programmes 2012-2015 (Date, Country / Region, Subcontractor, Value US$m, Product, Details)

Table 4.108 Panasonic Corporation Total Company Sales 2012-2016 (US$m, AGR %)

Table 4.109 Panasonic Corporation Net Income / Loss 2012-2016 (US$m)

Table 4.110 Panasonic Corporation Net Capital Expenditure 2011-2015 (US$m, AGR %)

Table 4.111 Panasonic Corporation Sales by Segment of Business 2012-2016 (US$m, AGR %)

Table 4.112 Panasonic Corporation Sales by Geographical Location 2013-2016 (US$m, AGR%)

Table 4.113 Panasonic Corporation Select Subsidiaries 2017 (Subsidiary, Location)

Table 4.114 Panasonic Corporation Number of Employees 2011-2015 (No. of Employees, AGR %)

Table 4.115 Panasonic Avionics Connected Aircraft Market Products / Services (Segment of Business, Product, Specification / Features)

Table 4.116 Panasonic Corporation Mergers and Acquisitions 2015 (Date, Company Involved, Value US$m, Details)

Table 4.117 Panasonic Corporation SWOT Analysis 2017

Table 4.118 Rockwell Collins Inc Profile 2016 (Connected Aircraft Market Ranking, Connected Aircraft Market Share %, CEO, Total Company Sales US$m, Sales in the Connected Aircraft Market US$m, Share of Company Sales from the Connected Aircraft Market %, Net Income US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.119 Selected Recent Rockwell Collins Connected Aircraft Market Contracts / Projects / Programmes 2012-2015 (Date, Country / Region, Subcontractor, Product, Details)

Table 4.120 Rockwell Collins Inc Total Company Sales 2012-2016 (US$m, AGR %)

Table 4.121 Rockwell Collins Inc Sales in the Connected Aircraft Market 2013-2016 (US$m, AGR %)

Table 4.122 Rockwell Collins Inc Net Income 2012-2016 (US$m, AGR %)

Table 4.123 Rockwell Collins Inc Net Capital Expenditure 2010-2015 (US$m, AGR %)

Table 4.124 Rockwell Collins Inc Sales by Segment of Business 2012-2016 (US$m, AGR %)

Table 4.125 Rockwell Collins Inc Subsidiaries 2017 (Subsidiary, Location)

Table 4.126 Rockwell Collins Inc Number of Employees 2010-2015 (No. of Employees, AGR %)

Table 4.127 Rockwell Collins Inc Connected Aircraft Market Products / Services (Segment of Business, Product, Specification / Features)

Table 4.128 Rockwell Collins Inc Mergers and Acquisitions 2015 (Date, Company Involved, Value US$m, Details)

Table 4.129 Rockwell Collins Inc Divestitures (Date, Company Involved, Details)

Table 4.130 Rockwell Collins Inc SWOT Analysis 2017

Table 4.131 SITA OnAir Profile 2016 (Connected Aircraft Market Ranking, Connected Aircraft Market Share %, CEO, Parent Company Sales US$m, Sales in the Market US$m, Share of Company Sales from the Market %, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.132 Selected Recent SITA OnAir Connected Aircraft Market Contracts / Projects / Programmes 2012-2015 (Date, Country / Region, Subcontractor, Value US$m, Product, Details)

Table 4.133 SITA OnAir Partners 2016 (Partner, Location)

Table 4.134 SITA OnAir Connected Aircraft Market Products / Services (Segment of Business, Product, Specification / Features)

Table 4.135 SITA Mergers and Acquisitions 2015 (Date, Company Involved, Details)

Table 4.136 SITA OnAir SWOT Analysis 2017

Table 4.137 Thales SA Profile 2016 (Connected Aircraft Market Ranking, Connected Aircraft Market Share %, CEO, Total Company Sales US$m, Sales in the Connected Aircraft Market US$m, Share of Company Sales from the Connected Aircraft Market %, Net Income US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.138 Selected Recent Thales SA Connected Aircraft Market Contracts / Projects / Programmes 2012-2015 (Date, Country / Region, Subcontractor, Value US$m, Product, Details)

Table 4.139 Thales SA Total Company Sales 2012-2016 (US$m, AGR %)

Table 4.140 Thales SA Net Income / Loss 2012-2016 (US$m, AGR %)

Table 4.141 Thales SA Net Capital Expenditure 2012-2016 (US$m, AGR %)

Table 4.142 Thales SA Sales by Segment of Business 2012-2016 (US$m, AGR %)

Table 4.143 Thales SA Sales by Geographical Location 2013-2016 (US$m, AGR %)

Table 4.144 Thales SA Select Subsidiaries 2017 (Subsidiary, Location)

Table 4.145 Thales SA Number of Employees 2010-2014 (No. of Employees, AGR %)

Table 4.146 Thales SA Connected Aircraft Market Products / Services (Segment of Business, Product, Specification / Features)

Table 4.147 Thales SA Mergers and Acquisitions 2015 (Date, Company Involved, Value US$m, Details)

Table 4.148 Thales SA SWOT Analysis 2017

Table 4.149 ViaSat Inc Profile 2016 (Connected Aircraft Market Ranking, Connected Aircraft Market Share %, CEO, Total Company Sales US$m, Sales in the Connected Aircraft Market US$m, Share of Company Sales from the Market %, Net Income US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.150 Selected Recent ViaSat Inc Connected Aircraft Market Contracts / Projects / Programmes 2010-2015 (Date, Country / Region, Subcontractor, Value US$m, Product, Details)

Table 4.151 ViaSat Inc Total Company Sales 2012-2016 (US$m, AGR %)

Table 4.152 ViaSat Inc Net Income / Loss 2012-2016 (US$m)

Table 4.153 ViaSat Inc Net Capital Expenditure 2012-2016 (US$m, AGR %)

Table 4.154 ViaSat Inc Sales by Segment of Business 2012-2016 (US$m, AGR %)

Table 4.155 ViaSat Inc Sales by Geographical Location 2010-2015 (US$m, AGR %)

Table 4.156 ViaSat Inc Select Subsidiaries 2017 (Subsidiary, Location)

Table 4.157 ViaSat Inc Connected Aircraft Market Products / Services (Segment of Business, Product, Specification / Features)

Table 4.158 ViaSat Inc Mergers and Acquisitions (Date, Company Involved, Details)

Table 4.159 ViaSat Inc SWOT Analysis 2017

Table 4.160 Zodiac Aerospace SA Profile 2016 (Connected Aircraft Market Ranking, Connected Aircraft Market Share %, CEO, Total Company Sales US$m, Sales in the Connected Aircraft Market US$m, Share of Company Sales from the Connected Aircraft Market %, Net Income US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.161 Selected Recent Zodiac Aerospace Connected Aircraft Market Contracts / Projects / Programmes 2012-2015 (Date, Country / Region, Product, Details)

Table 4.162 Zodiac Aerospace SA Total Company Sales 2012-2016 (US$m, AGR %)

Table 4.163 Zodiac Aerospace Net Income 2012-2016 (US$m, AGR %)

Table 4.164 Zodiac Aerospace SA Net Capital Expenditure 2010-2012 (US$m, AGR %)

Table 4.165 Zodiac Aerospace SA Sales by Segment of Business 2010-2014 (US$m, AGR %)

Table 4.166 Zodiac Aerospace Select Subsidiaries 2017 (Subsidiary, Location)

Table 4.167 Zodiac Aerospace SA Number of Employees 2010-2015 (No. of Employees, AGR %)

Table 4.168 Zodiac Aerospace SA Connected Aircraft Market Products / Services (Segment of Business, Product, Specification / Features)

Table 4.169 Zodiac Aerospace SA Mergers and Acquisitions 2013-2014 (Date, Company Involved, Value US$m, Details)

Table 4.170 Zodiac Aerospace SA SWOT Analysis 2017

Table 5.1 Other Notable Companies in the Connected Aircraft Market (Company, Product / Service)

Table 6.1 Global Connected Aircraft Market SWOT Analysis 2017

List of Figures

Figure 1.1 Sample Map of Company Regional Focus 2016

Figure 1.2 Sample of Company Sales by Business Sector (Sales US$m, Total Company Sales AGR %)

Figure 2.1 Leading 15 Connected Aircraft Market Companies 2016

Figure 3.1 Top 15 Companies in the Connected Aircraft Market 2016 (% Share)

Figure 3.2 Top 15 Companies in the Connected Aircraft Market 2016 (Company, Sales US$m)

Figure 3.3 Top 15 Companies in the Connected Aircraft Market 2016 (Company, Market Share %

Figure 3.4 Share of the Top 15 Connected Aircraft Market Companies by the Top 1-3 Vs. Top 4-15 vs. Other Companies

Figure 3.5 Sales of the Leading 6 Vs. the Next 9 Companies in the Connected Aircraft Market (Company Ranking, Sales US$m)

Figure 3.6 Leading 15 Companies in the Connected Aircraft Market 2016 by Headquarter Location (Number of Companies)

Figure 4.1 BAE Systems plc Total Company Sales 2012-2016 (US$m, AGR %)

Figure 4.2 BAE Systems plc Net Income 2012-2016 (US$m, AGR %)

Figure 4.3 BAE Systems plc Net Capital Expenditure 2012-2016 (US$m, AGR %)

Figure 4.4 BAE Systems plc Sales by Segment of Business 2012-2016 (US$m, Total Company Sales AGR %)

Figure 4.5 BAE Systems plc Sales AGR by Segment of Business 2013-2016 (AGR %)

Figure 4.6 BAE Systems plc Primary International Operations 2017

Figure 4.7 BAE Systems plc Sales AGR by Geographical Location 2013-2016 (AGR %)

Figure 4.8 BAE Systems plc Sales by Geographical Location 2012-2016 (US$m, Total Company Sales AGR %)

Figure 4.9 BAE Systems plc Organisational Structure 2017

Figure 4.10 BAE Systems plc Number of Employees 2012-2016 (No. of Employees, AGR %)

Figure 4.11 BAE Systems plc Primary Market Competitors 2017

Figure 4.12 Cobham plc Total Company Sales 2012-2016 (US$m, AGR %)

Figure 4.13 Cobham plc Net Income 2012-2016 (US$m)

Figure 4.14Cobham plc Net Capital Expenditure 2012-2016 (US$m, AGR %)

Figure 4.15 Cobham plc Sales by Segment of Business 2012-2016 (US$m, Total Company Sales AGR %)

Figure 4.16 Cobham plc Sales AGR by Segment of Business 2013-2016 (AGR %)

Figure 4.17 Cobham plc Primary International Operations 2017

Figure 4.18 Cobham plc sales AGR by Geographical Location 2032-2016 (AGR %)

Figure 4.19 Cobham plc Sales by Geographical Location 2012-2016 (US$m, Total Company Sales AGR %)

Figure 4.20 Cobham plc Organisational Structure 2017

Figure 4.21Cobham plc Number of Employees 2012-2016 (No. of Employees, AGR %)

Figure 4.22 Cobham plc Primary Market Competitors 2017

Figure 4.23 Eutelsat Communications SA Total Company Sales 2012-2017 (US$m, AGR %)

Figure 4.24 Eutelsat Communications SA Net Income 2012-2017 (US$m, AGR %)

Figure 4.25 Eutelsat Communications SA Primary International Operations 2017

Figure 4.26 Eutelsat Communications SA Sales AGR by Geographical Location 2013-2017 (AGR %)

Figure 4.27 Eutelsat Communications SA Sales by Geographical Location 2012-2017 (US$m, Total Company Sales AGR %)

Figure 4.28 Eutelsat Communications SA Organisational Structure 2017

Figure 4.29 Eutelsat Communications SA Number of Employees 2012-2017 (No. of Employees, AGR %)

Figure 4.30 Eutelsat Communications SA Primary Market Competitors 2017

Figure 4.31Global Eagle Entertainment Inc Total Company Sales 2011-2015 (US$m, AGR %)

Figure 4.32Global Eagle Entertainment Inc Sales in the Connectivity Market 2012-2015 (US$m, AGR %)

Figure 4.33Global Eagle Entertainment Inc Net Loss 2011-2015 (US$m)

Figure 4.34Global Eagle Entertainment Inc Sales by Segment of Business 2012-2015 (US$m, Total Company Sales AGR %)

Figure 4.35Global Eagle Entertainment Inc Sales AGR by Segment of Business 2013-2015 (AGR %)

Figure 4.36 Global Eagle Entertainment Inc Primary International Operations 2017

Figure 4.37 Global Eagle Entertainment Inc Sales by Geographical Location 2011-2015 (US$m, Total Company Sales AGR %)

Figure 4.38 Global Eagle Entertainment Inc Organisational Structure 2017

Figure 4.39 Global Eagle Entertainment Inc Primary Market Competitors 2017

Figure 4.40 Gogo Inc Total Company Sales 2012-2016 (US$m, AGR %)

Figure 4.41 Gogo Inc Net Income / Loss 2012-2016 (US$m)

Figure 4.42 Gogo Inc Net Capital Expenditure 2013-2016 (US$m, AGR %)

Figure 4.43 Gogo Inc Sales by Segment of Business 2012-2016 (US$m, Total Company Sales AGR %)

Figure 4.44 Gogo Inc Sales AGR by Segment of Business 2013-2016 (AGR %)

Figure 4.45 Gogo Inc Primary International Operations 2017

Figure 4.46 Gogo Inc Sales by Geographical Location 2014-2016 (US$m, Total Company Sales AGR %)

Figure 4.47 Gogo Inc Organisational Structure 2017

Figure 4.48 Gogo Inc Number of Employees 2015-2016 (No. of Employees)

Figure 4.49 Gogo Inc Primary Market Competitors 2017

Figure 4.50 Honeywell International Inc Total Company Sales 2012-2016 (US$m, AGR %)

Figure 4.51 Honeywell International Inc Net Income 2012-2016 (US$m, AGR %) 255

Figure 4.52 Honeywell International Inc Net Capital Expenditure 2012-2016 (US$m, AGR %)

Figure 4.53 Honeywell International Inc Sales by Segment of Business 2012-2016 (US$m, Total Company Sales AGR %)

Figure 4.54 Honeywell International Inc Sales AGR by Segment of Business 2013-2016 (AGR %)

Figure 4.55 Honeywell International Inc Primary International Operations 2017

Figure 4.56 Honeywell International Inc Sales AGR by Geographical Location 2013-2016 (AGR %)

Figure 4.57 Honeywell International Inc Sales by Geographical Location 2012-2016 (US$m, Total Company Sales AGR %)

Figure 4.58 Honeywell International Inc Organisational Structure 2017

Figure 4.59 Honeywell International Inc Number of Employees 2012-2016 (No. of Employees, AGR %)

Figure 4.60 Honeywell International Inc Primary Market Competitors 2017

Figure 4.61 Inmarsat plc Total Company Sales 2012-2016 (US$m, AGR %)

Figure 4.62 Inmarsat plc Net Income 2012-2016 (US$m, AGR %)

Figure 4.63 Inmarsat plc Net Capital Expenditure 2012-2016 (US$m, AGR %)

Figure 4.64 Inmarsat plc Sales by Segment of Business 2014-2016 (US$m, Total Company Sales AGR %)

Figure 4.65 Inmarsat plc Primary International Operations 2017

Figure 4.66 Inmarsat plc Sales AGR by Geographical Location 2013-2016 (AGR %)

Figure 4.67 Inmarsat plc Sales by Geographical Location 2012-2016 (US$m, Total Company Sales AGR %)

Figure 4.68 Inmarsat plc Organisational Structure 2017

Figure 4.69 Inmarsat plc Number of Employees 2012-2016 (No. of Employees, AGR %)

Figure 4.70 Inmarsat plc Primary Market Competitors 2017

Figure 4.71 Iridium Communications Inc Total Company Sales 2012-2016 (US$m, AGR %)

Figure 4.72 Iridium Communications Inc Net Income 2012-2016 (US$m, AGR %)

Figure 4.73 Iridium Communications Inc Net Capital Expenditure 2012-2016 (US$m, AGR %)

Figure 4.74 Iridium Communications Inc Sales by Segment of Business 2012-2016 (US$m, Total Company Sales AGR %)

Figure 4.75 Iridium Communications Inc Sales AGR by Segment of Business 2013-2016 (AGR %)

Figure 4.76 Iridium Communications Inc Primary International Operations 2017

Figure 4.77 Iridium Communications Inc Sales AGR by Geographical Location 2013-2016 (AGR %)

Figure 4.78 Iridium Communications Inc Sales by Geographical Location 2012-2016 (US$m, Total Company Sales AGR %)

Figure 4.79 Iridium Communications Inc Organisational Structure 2017

Figure 4.80 Iridium Communications Inc Primary Market Competitors 2017

Figure 4.81 Kontron AG Total Company Sales 2012-2016 (US$m, AGR %)

Figure 4.82 Kontron AG Net Income / Loss 2012-2016 (US$m)

Figure 4.83 Kontron AG Sales by Segment of Business 2016 (% Share)

Figure 4.84 Kontron AG Primary International Operations 2017

Figure 4.85 Kontron AG Sales AGR by Geographical Location 2015-2016 (AGR %)

Figure 4.86 Kontron AG Sales by Geographical Location 2014-2016 (US$m, Total Company Sales AGR %)

Figure 4.87 Kontron AG Organisational Structure 2017

Figure 4.88 Kontron AG Number of Employees 2010-2014 (No. of Employees, AGR %)

Figure 4.89 Kontron AG Primary Market Competitors 2017

Figure 4.90 Panasonic Corporation Total Company Sales 2012-2016 (US$m, AGR %)

Figure 4.91 Panasonic Corporation Net Income / Loss 2012-2016 (US$m, AGR %)

Figure 4.92 Panasonic Corporation Net Capital Expenditure 2011-2015 (US$m, AGR %)

Figure 4.93 Panasonic Corporation Sales by Segment of Business 2012-2016 (US$m, Total Company Sales AGR %)

Figure 4.94 Panasonic Corporation Sales AGR by Segment of Business 2013-2016 (AGR %)

Figure 4.95 Panasonic Corporation Primary International Operations 2017

Figure 4.96 Panasonic Corporation Sales by Geographical Location 2014-2015 (US$m)

Figure 4.94 Panasonic Corporation Sales AGR by Geographical Location 2014-2016 (AGR %)

Figure 4.97 Panasonic Corporation Organisational Structure 2017

Figure 4.98 Panasonic Corporation Number of Employees 2011-2015 (No. of Employees, AGR %)

Figure 4.99 Panasonic Corporation Primary Market Competitors 2017

Figure 4.100 Rockwell Collins Inc Total Company Sales 2012-2016 (US$m, AGR %)

Figure 4.101 Rockwell Collins Inc Sales in the Connected Aircraft Market 2013-2016 (US$m, AGR %)

Figure 4.102 Rockwell Collins Inc Net Income 2012-2016 (US$m, AGR %)

Figure 4.103 Rockwell Collins Inc Net Capital Expenditure 2010-2015 (US$m, AGR %)

Figure 4.104 Rockwell Collins Inc Sales by Segment of Business 2012-2016 (US$m, Total Company Sales AGR %)

Figure 4.105 Rockwell Collins Inc Sales AGR by Segment of Business 2013-2016 (AGR %)

Figure 4.106 Rockwell Collins Inc Primary International Operations 2017

Figure 4.107 Rockwell Collins Inc Organisational Structure 2017

Figure 4.108 Rockwell Collins Inc Number of Employees 2010-2015 (No. of Employees, AGR %)

Figure 4.109 Rockwell Collins Inc Primary Market Competitors 2017

Figure 4.110 SITA OnAir Primary International Operations 2017

Figure 4.111 SITA OnAir Organisational Structure 2017

Figure 4.112 SITA OnAir Primary Market Competitors 2017

Figure 4.113 Thales SA Total Company Sales 2012-2016 (US$m, AGR %)

Figure 4.114 Thales SA Net Income / Loss 2012-2016 (US$m)

Figure 4.115 Thales SA Net Capital Expenditure 2012-2016 (US$m, AGR %)

Figure 4.116 Thales SA Sales by Segment of Business 2012-2016 (US$m, Total Company Sales AGR %)

Figure 4.117 Thales SA Sales AGR by Segment of Business 2012-2016 (AGR %)

Figure 4.118 Thales SA Primary International Operations 2017

Figure 4.119 Thales SA Sales AGR by Geographical Location 2014-2016 (AGR %)

Figure 4.120 Thales SA Sales by Geographical Location 2013-2016 (US$m, Total Company Sales AGR %)

Figure 4.121 Thales SA Organisational Structure 2017

Figure 4.122 Thales SA Number of Employees 2010-2014 (No. of Employees, AGR %)

Figure 4.123 Thales SA Primary Market Competitors 2017

Figure 4.124 ViaSat Inc Total Company Sales 2012-2016 (US$m, AGR %)

Figure 4.125 ViaSat Inc Net Income / Loss 2012-2016 (US$m)

Figure 4.126 ViaSat Inc Net Capital Expenditure 2012-2016 (US$m, AGR %)

Figure 4.127 ViaSat Inc Sales by Segment of Business 2012-2016 (US$m, Total Company Sales AGR %)

Figure 4.128 ViaSat Inc Sales AGR by Segment of Business 2011-2015 (AGR %)

Figure 4.129 ViaSat Inc Primary International Operations 2017

Figure 4.130 ViaSat Inc Sales AGR by Geographical Location 2011-2015 (AGR %)

Figure 4.131 ViaSat Inc Sales by Geographical Location 2010-2015 (US$m, Total Company Sales AGR %)

Figure 4.132 ViaSat Inc Organisational Structure 2017

Figure 4.133 ViaSat Inc Primary Market Competitors 2017

Figure 4.134 Zodiac Aerospace SA Total Company Sales 2012-2016 (US$m, AGR %)

Figure 4.135 Zodiac Aerospace SA Net Income 2012-2016 (US$m, AGR %)

Figure 4.136 Zodiac Aerospace SA Net Capital Expenditure 2010-2012 (US$m, AGR %)

Figure 4.137 Zodiac Aerospace SA Sales by Segment of Business 2010-2015 (US$m, Total Company Sales AGR %)

Figure 4.138 Zodiac Aerospace SA Sales AGR by Segment of Business 2011-2015 (AGR %)

Figure 4.139 Zodiac Aerospace SA Primary International Operations 2017

Figure 4.140 Zodiac Aerospace SA Organisational Structure 2017

Figure 4.141 Zodiac Aerospace SA Number of Employees 2010-2015 (No. of Employees, AGR %)

Figure 4.142 Zodiac Aerospace SA Primary Market Competitors 2017

Abertis

AC BidCo LLC

ACCEL (Tianjin) Flight Simulation Co. Ltd.

AccuWeather

Advanced Film GmbH

Advanced Inflight Alliance AG

Advanced Inflight Alliance Ltd

Aegean Airlines

Aer Lingus

Aerodocs Limited (Arconics)

Aeroflex Ltd

Aeroflex Wichita Inc

Aerolineas Argentinas

Aeromexico

AeroMobile Communications Ltd

Aeromod

AFP

Aiirbus

Air Astana

Air Canada

Air Canada Rouge

Air Caraibes

Air China

Air Costa

Air Cote d’lvoire

Air Europa

Air France

Air France-KLM

Air Methods

Air New Zealand

Air Précision SAS

Air Serbia

Air Seychelles

Air Transat

AirAsia

AirAsia India

AirBerlin Group

Aircell

AirCloud

Aireon LLC

Airline Media Network Business

Airservices Australia

Airtanker Holdings Ltd

Al Jazeera

Alaska Airlines

Alcatel-Lucent

Alitalia

All Nippon Airways (ANA)

Allied Signal Aerospace Service Corporation

AltegroSky

Amazon

American Airlines

Amjet Executive SA

Anchor Electrical Pvt Ltd

Andesat SA

Appareo Systems LLC

Apple

Arconics

ARINC Direct

ARINC Inc

Arion

Asia Satellite Telecommunications Co. Ltd

Associated Air Center (AAC)

AT&T Inc.

Aures Technologies SA

Australian Satellite Communications

Austrian Airlines

Avanade

Avianca

Avianca Brazil

Aviaso AG

Aviation Communications & Surveillance Systems

Aviation Data Communication Corporation (ADCC)

Axell Wireless Ltd

Azerbaijan Airlines

Azerfon

Azul Brazilian Airlines

B/E Aerospace

BAE Intelligence and Security

BAE Systems (Operations) Ltd

BAE Systems Controls Inc

BAE Systems Information and Electronic Systems Integration Inc

BAE Systems Information Solutions Inc

BAE Systems Land & Armaments LP

BAE Systems plc

BAE Systems Surface Ships Ltd

Barclays

BBC

Beats Music

Beijing Blue Sky Aviation Technology

Beijing Marine Communication & Navigation Company (MCN)

Bendix/King

Berkshire Hathaway

BOC Aviation

Boeing

Boeing Business Jet

Boeing Commercial Airplanes

Bombardier

Bombardier Business Aircraft

Borg-Warner

Bristow Helicopters Ltd

British Airways

BT Group PLC

Cantwell Cullen & Company Inc

Carlisle Interconnect Technologies

Cathay Pacific

Cebu Pacific Air

Chelton Avionics Inc

Chelton Ltd

Chelton Telecom and Microwave SAS

Chelton Inc

China Eastern Airlines

China Satellite Communications Co. Ltd

China Southern Airlines

China Telecom

China Telecom Satellite Communications Ltd

Christie Digital Systems

Cisco Systems Inc

Clay Lacy Aviation

CNBC

CNN International

Cobham Aerospace Communications

Cobham CTS Ltd

Cobham plc

Cobham SATCOM

Cobham TCS Ltd

Cobham Defence Communications Ltd

Comlux Aviation

Continental Airlines

Corsair

Cupcake Digital

Dassault

Dassault Falcon Services Le Bourget

Datacolor AG

Datalogic SpA

Delair Air Traffic Systems GmbH

Delta Airlines

Deutsche Telekom Group

Diehl Aerospace GmbH

DISH Networks

DTC Communications Inc

DTI Software FZ-LLC

DTI Solutions Inc

EAD Aerospace

eBay

Eclair

Eclipse Electronic Systems

EE

El Al

Elster Group GmbH

Embraer

Emerging Markets Communications (EMC)

Emirates

Emphasis Video Entertainment Ltd

EMS Aviation Inc

ENAV

Engreen Inc

Entertainment in Motion Inc

Etihad Airways

Eutelsat America Corporation

Eutelsat Americas

Eutelsat Asia Pte Ltd

Eutelsat Beijing

Eutelsat Communications Inc

Eutelsat do Brasil

Eutelsat GmbH

Eutelsat Italia

Eutelsat Madeira

Eutelsat Middle East

Eutelsat Polska

Eutelsat South Africa

Eutelsat UK Ltd

EVA Air

Evac GmbH

Evac Train Vacuum System Trading

Evolis SA

Fairdeal Multimedia Pvt Ltd

Fairdeal Studios Pvt Ltd

Federal Mogul Corporation

Fiji Airways

Finnair

Flight Level Media

FlightAware

Flydubai

French Blue

Garuda Indonesia

General Dynamics

Global Eagle Entertainment GmbH

Global Eagle Entertainment Inc

Global Eagle Entertainment Luxembourg sarl

Global Wireless

Globalstar Inc

Glympse Inc

Gogo Air International Sarl

Gogo Air Mexico S de RL de CV

Gogo Business Aviation LLC

Gogo Connectivity Ltd

Gogo GK

Gogo Inc

Gogo Intermediate Holdings LLC

Gogo LLC

Gogo Singapore Pte Ltd

GOL

Google

Greenpoint Technologies

Grimes Aerospace Company

GuestLogix

Gulfstream Aerospace Corporation

Hainan Airlines

Harris Corporation

Havelsan

Hawaiian Airlines (HAL)

Heathrow Airport

hinKom Solutions

HNA Technik Co. Ltd

Honeywell (China) Co. Ltd

Honeywell Aerospace

Honeywell Aerospace Avionics Malaysia Sdn Bhd

Honeywell Aerospace de Mexico S de RL de CV

Honeywell Aerospace UK

Honeywell International inc

Honeywell Technology Solutions Inc

Hong Kong Airlines

Hubei Ali Jiatai

Hughes Network Systems

Hunter Communications

Hunter Communications Canada

Hussman Parent Inc

Iberia

Iberia Express Airlines

Icelandair

ICG (International Communications Group)

IFE Alliance Licensing GmbH

IFP

IMG

Immfly

Immobiliere Galli

IMS

IN Services Asia

Inflight Management Development Centre Ltd

Inflight Productions BV

Inflight Productions FZ-LLC

Inflight Productions Germany GmbH

Inflight Productions Pte Ltd

Inflight Productions USA Inc

Inmarsat Australia Pty Ltd

Inmarsat Canada Holdings Inc

Inmarsat Employment Company Ltd

Inmarsat Finance plc

Inmarsat Global Ltd

Inmarsat Hellas Satellite Services SA

Inmarsat Investments Ltd

Inmarsat Leasing (Two) Ltd

Inmarsat Mobile Networks Inc

Inmarsat Navigation Ventures Ltd

Inmarsat New Zealand Ltd

Inmarsat plc

Inmarsat Solutions (Canada) Inc

Inmarsat Solutions (US) Inc

Inmarsat Solutions AS

Inmarsat Solutions BV

Inmarsat Solutions Global Ltd

Inmarsat Solutions Pte Ltd

Intelsat SA

International Airlines Group (IAG)

International Communications Group Inc

International Lease Finance Corporation (ILFC)

Intertrust

InTheAirNet LLC

IOM Licensing Holding Company Ltd

Iridium Blocker-B Inc

Iridium Carrier Services LLC

Iridium Communications Inc

Iridium Constellation LLC

Iridium Government Services LLC

Iridium Holdings LLC

Iridium Norway A/S

Iridium Satellite LLC

ITC Global Inc

Japan Airlines

Japan Transocean Air (JTA)

JAST SA

Jazeera Airways

Jet Aviation Geneva

Jet Aviation St. Louis

Jetblue Airways

JetTech Aerospace

Jordanian Airlines

JRC

JTA

Juneyao Airlines

K5-Aviation

KID Systeme GmbH

KLM

Kontron (Beijing) Technology Co Ltd

Kontron AG

Kontron America Inc

Kontron Asia Pacific Design Sdn Bhd

Kontron Australia Pty Ltd

Kontron Canada Inc

Kontron Compact Computers AG iL

Kontron East Europe Sp zoo

Kontron ECT Designs sro

Kontron Europe GmbH

Kontron Hongkong Technology Co Ltd

Kontron Management GmbH

Kontron Modular Computers SAS

Kontron Technology A/S

Kontron Technology India Pvt Ltd

Kontron UK Ltd

Kuwait Airways

Kymeta

L-3 Communications Holdings

L-3 Platform Integration

LAN Airlines

LeoSat

Libyan Airlines

Lindsey Manufacturing

LiveTV

Lockheed Martin Corporation

Lonely Planet

Los Angeles International Airport

Lufthansa Group

Lufthansa Systems AG

Lufthansa Technik

M1

MagicInk Interactive LLC

Magnolia Pictures

Magzter

Malaysia Airlines

Mango Airlines

Martinair

masFlight

Melrose Industries plc.

MGI SA

Myanmar International Airlines

N44HQ LLC

NAV CANADA

navAero

Naviair

Netflix

NetJets

New York JFK Airport

Nok Air

Northrop Grumman Corporation

Norwegian Air Shuttle

Norwegian Airlines

Oi

Oman Air

OneWeb Ltd

OOO Iridium Communications

OOO Iridium Services

Orange

Orange Business Services

ORBCOMM Inc

OSN

OTE

Pacific Avionics Pty. Ltd

Panasonic Asia Pacific Pte Ltd

Panasonic Avionics Corporation

Panasonic Avionics Corporation Services Singapore (PACSS)

Panasonic Corporation

Panasonic Corporation of China

Panasonic Corporation of North America

Panasonic do Brasil Ltda

Panasonic Europe Ltd

Panasonic Factory Solutions Co. Ltd

Panasonic Healthcare Holdings Co. Ltd

Panasonic India Pvt Ltd

Panasonic Information Systems Co. Ltd

Panasonic North America Corporation

Panasonic Semiconductor Solutions Co. Ltd

Panasonic Taiwan Co Ltd

Parachutes Industries of South Africa

PATS Aircraft Systems

Perimeter Internetworking Corporation

Philippines Airlines

Prague Airport

PT Telekomunikasi Indonesia

Qantas

Qatar Airways

QEST Quantenelektronische Systeme GmbH

Quick Service Software Inc

Radio Holdings Inc

Raytheon Company

RMG Networks Holding Corp

Rockwell Collins EUMEA Holdings SAS

Rockwell Collins European Holdings Sarl

Rockwell Collins Inc

Rockwell Collins International Financing Sarl

Rockwell Collins International Holdings Sarl

Rockwell Collins’ Advanced Technology Center

roKKi

Rovi Corporation

Row 44 Inc

Royal Air Maroc

Royal Brunei Airlines

RTSoft ZAO

RuSat

S&T Deutschland Holding AG

S&T Group

Sabena Technics

Samsung

Samsung Thales Co. Ltd

San Francisco Airport

Sanyo Electric Co. Ltd

Satcom Direct

Satcom1

Satélites Mexicanos SA de CV

Saudia

Scandinavian Avionics

Sea Tel Inc

Segovia Inc

SeS SA

Shenzhen Airlines

SIA Engineering Company Ltd (SIAEC)

Sichuan Airlines

Singapore Airlines

SingTel

SITA Group

SITA OnAir

SKY Perfect JSAT

SkyCast Solutions

Skymark Airlines

Skyware Technologies

Smiths Microwave

Softswitch LLC

Sony Music Entertainment

South African Airways

Southwest Airlines

Spafax

Spotify

Spring Airlines

SriLankan Airlines

StandardAero

StarHub

SwiftBroadband

Swiss International Airlines (SWISS)

Syncom-Iridium Holdings Corporation

TAAG Angola Airlines

Tactel AB

TAM Airlines

TAP Portugal

TEAM SA

TECOM Industries

Teledyne Controls

Telesat

Thai Airways International

Thaicom plc

Thales Air Systems & Electron Devices GmbH

Thales Air Systems SAS

Thales Alenia Space Italia SpA

Thales Alenia Space SAS

Thales Avionics Electrical Systems SAS

Thales Avionics Inc

Thales Avionics Ltd

Thales Avionics SAS

Thales InFlyt Experience

Thales Research & Technology (TRT)

Thales SA

Thales Systèmes Aéroportés SAS

The Lab Aero Inc

The Weather Channel

ThinKom Solutions

Thomas Cook Group

Thrane&Thrane A/S

Thuraya Telecommunications Company

T-Mobile

Transaero Airlines

Transasia Airways

Travel Management Company (TMC)

TriaGnoSys GmbH

Trivec-Avant Corporation

TRJet Havacilik Teknolojileri Anonim Şirketi (TRJet)

TUI Group

Tupolev

Turkish Airlines

Turkish Technic

ubitronix solutions GmbH

United Airlines

United Continental Holdings

United Technologies Corporation

UTair

ViaSat Australia Pty Ltd

ViaSat Canada Company

ViaSat China Services Inc

ViaSat Communications Inc

ViaSat Credit Corp

ViaSat Europe Srl

ViaSat Inc

ViaSat Inc Limitada

ViaSat India Pvt Ltd

ViaSat Peru Srl

ViaSat Satellite Holdings Ltd

ViaSat Satellite Ventures Holdings Luxembourg Sarl

ViaSat Satellite Ventures LLC

ViaSat UK Ltd

ViaSat Worldwide Ltd

Vietnam Airlines

Virgin America

Virgin Atlantic

Virgin Australia.

Vistara

Vizocom

Vormetric Inc

Vueling

Western Outdoor Interactive Pvt Ltd

WestJet

WildBlue Communications LLC

Xiamen Airlines

XOJET

Yahsat

Zinio

Zodia Aerospace SA

Zodiac Aero Duct Systems

Zodiac Aerosafety Systems

Zodiac Aerospace (Jiangsu) Co Ltd

Zodiac Aerospace Germany Investment GmbH

Zodiac Aerospace Holding Australia Pty Ltd

Zodiac Aerospace Maroc

Zodiac Aerospace Netherlands Investment NV

Zodiac Aerospace Services Europe

Zodiac Aerospace Services Middle East

Zodiac Aerospace Services UK Ltd

Zodiac Aerospace UK Investment Ltd

Zodiac Aerotechnics

Zodiac Cabin Interiors Europe

Zodiac Composite Monuments Tunisie

Zodiac Engineering

Zodiac Inflight Innovations

Zodiac Seats France

Zodiac Seats Tunisie Sarl

Organisations Mentioned in This Report

Administración Nacional de Avianción Civil (ANAC)

Airline Passenger Experience Association (APEX)

Civil Aviation Authority of China (CAAC)

European Aviation Network

European Aviation Safety Agency (EASA)

Federal Aviation Administration (FAA)

Committee (PARC) Communications Working Group (CWG)

Federal Communication Commission (FCC)

Indian Ministry of Defence

Industry Canada

International Civil Aviation Organization (ICAO)

Irish Aviation Authority (IAA)

Japanese Civil Aviation Bureau (JCAB)

National Business Aviation Association (NBAA)

Polish Air Navigation Services Agency (PANSA)

Skytrax

United States Defense Information Systems Agency (DISA)

US Department of Defense (DoD)

US Government Accountability Office (GAO)

Download sample pages

Complete the form below to download your free sample pages for Top 15 Connected Aircraft Companies 2017

Download sample pages

Complete the form below to download your free sample pages for Top 15 Connected Aircraft Companies 2017

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Visiongain aviation reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and automotive industry experts but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology please email jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Would you like to get the latest Visiongain aviation reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

Airline Passenger Experience Association (APEX)

Airlines for America

Airport Consultants Council (ACC)

Airports Council International (ACI)

Airports Council International-North America

American Association of Airport Executives

Arab Air Carriers Organization (AACO)

European Aerospace Cluster Partnership

Global Business Travel Association (GBTA)

International Air Transport Association (IATA)

Security Industry Association (SIA)

Security Manufacturers Coalition

Women in Aviation

World Aviation Services

Latest Aviation news

Visiongain Publishes Space-Based Laser Communication Market Report 2024-2034

The global space-based laser communication market was valued at US$1,558.0 million in 2023 and is projected to grow at a CAGR of 13.6% during the forecast period 2024-2034.

13 March 2024

Visiongain Publishes Smart Airport Technologies Market Report 2024-2034

The global Smart Airport Technologies market was valued at US$9.4 billion in 2023 and is projected to grow at a CAGR of 13.8% during the forecast period 2024-2034.

05 February 2024

Visiongain Publishes Air Traffic Control Training Simulator Market Report 2024-2034

The global air traffic control training simulator market was valued at US$966.0 million in 2023 and is projected to grow at a CAGR of 6.5% during the forecast period 2024-2034.

01 February 2024

Visiongain Publishes Commercial Aircraft Maintenance, Repair & Overhaul (MRO) Market Report 2024-2034

The global commercial aircraft maintenance, repair & overhaul (MRO) market was valued at US$78.5 billion in 2023 and is projected to grow at a CAGR of 5.1% during the forecast period 2024-2034.

30 January 2024