Industries > Energy > Thermal Enhanced Oil Recovery (EOR) Market Report 2017-2027

Thermal Enhanced Oil Recovery (EOR) Market Report 2017-2027

CAPEX & OPEX ($bn) & Production (bpd) Forecasts For Oil Sands, Heavy Oil, Steam Injection (Cyclic Steam Stimulation (CSS), Steam Flooding), Steam-Assisted Gravity Drainage(SAGD) & Other Technologies Plus Analysis of Leading Companies

Visiongain values the global thermal EOR market at $17.93bn in 2017. Read on to discover the potential business opportunities available.

Many of the world’s conventional oil fields have already started the inevitable decline in production rate owing to years of extraction of a finite resource. While unconventional reserves do hold the possibility for enormous oil production levels, they are not found everywhere, and the difficulty in extraction of oil from such reserves means that it is not always feasible to develop them. This means that it is often most beneficial to apply EOR to existing fields to help achieve the maximum recovery rate from each well. As oil fields continue to age and their reserves continue to diminish, there is an increasing market for EOR technologies to try to recover as much oil as possible from each source.

EOR technologies have been in operation for a number of decades, primarily being used to recover more oil from ageing oil fields. However, the market is currently undergoing a period of slow growth with low oil prices and concerns over oil demand in emerging economies have a restraining effect. Nevertheless, in the long run improving technologies, ageing oil fields and a dearth of conventional oil finds help to drive investments in the market and increase production. Thermal EOR methods are no longer confined to a few select countries, with companies throughout the world beginning to implement projects to make the most of their existing reserves.

The global thermal EOR spending will expand gradually throughout the forecast period as oil prices are anticipated to recover. CAPEX will remain low during the first half of the forecast period as new developments have been shelved. OPEX increases will offset this decrease in CAPEX and contribute to expanding overall spending in the market.

The thermal EOR market will register lower growth over the next decade compared to other EOR technologies such as CO2 and chemical EOR. As the oldest and most-established market there are several EOR projects that will move towards the end of their project life cycle and see declining production over the next decade. Thermal EOR technologies are not coming to an end. Steam injection technologies and the SAGD method are constantly being improved while emerging thermal EOR technologies such as solar EOR have great potential for a strong production increase.

The thermal EOR market mainly consists of the rapidly growing Canadian oil sands, although the market will also see an expansion of heavy oil projects in the Middle East and Asia. SAGD – the primary technology used for oil production in the oil sands region of Alberta – will be by far the biggest thermal EOR submarket over the forecast period, ahead of steam injection and other technologies.

Visiongain’s global thermal EOR energy market report can keep you informed and up to date with the developments in the market. The report covers global and national market forecasts and analysis from 2017 to 2027 in terms of total spending for the ten leading countries in the thermal EOR market, plus the market for the rest of the world. Also, submarket forecasts and analysis covering the period 2017 to 2027 in terms of total spending for the thermal oil sands and thermal heavy oil submarkets, and the steam injection, SAGD and other thermal EOR technologies submarkets.

With reference to this report, it covers extensive details and analysis of all current thermal EOR projects currently taking place throughout the world. Through extensive secondary research and interviews with industry experts, visiongain has identified a series of market trends that will impact the thermal EOR market over the forecast timeframe.

The report will answer questions such as:

– How is the thermal EOR market evolving?

– What are the prospects for each of the thermal EOR submarkets over the next decade?

– Who are the main companies in the thermal EOR market and what are their market shares and future prospects?

– Where are the major thermal EOR projects currently taking place around the world?

– What is driving and restraining the thermal EOR market?

– Which individual technologies will prevail and how will these shifts be responded to?

– How will the market shares of the leading thermal EOR countries change by 2027?

– Who are the leading players and what are their prospects over the forecast period?

Five Reasons Why You Must Order and Read This Report Today:

1) The report provides SPENDING ($), and PRODUCTION (bpd) forecasts 2017-2027, plus analysis, for 10 national markets and the rest of the world market, providing unique insight into thermal EOR industry developments:

– Canada

– US

– Venezuela

– Kuwait

– Indonesia

– Oman

– China

– Russia

– Bahrain

– Saudi Arabia

– Rest of the World

2) The report also offers SPENDING ($), and PRODUCTION (bpd) forecasts 2017-2027, plus analysis, for 5 thermal EOR submarkets:

– Oil Sands

– Heavy Oil

– Steam Injection

– SAGD

– Other Technologies

3) The report also offers visiongain’s oil price forecast for the period between 2017 and 2027

– Supply-side factors

– Demand-side factors

– Other Major Variables that Impact the Oil Price

– Visiongain’s Oil Price Assumption and Forecast

– How the Oil Price Will Impact the Thermal EOR Market

4) The analysis is underpinned by our exclusive interviews from solar EOR pioneer GlassPoint:

– Oil Prices and Thermal EOR

– The Miraah Project

– Regions Particularly Suitable for Solar EOR

5) The report provides market share and detailed profiles of the leading companies operating within the Thermal Oil Sands and Thermal Heavy Oil EOR market:

– ConocoPhillips

– Cenovus

– China National Offshore Oil Corporation (CNOOC)

– Imperial Oil

– Suncor

– Chevron

– PDVSA

– Husky Energy

– Sinopec

– Occidental

This independent 192-page report guarantees you will remain better informed than your competitors. With 134 tables and figures that analyse the global market, five submarkets, ten leading national markets and the rest of the world market. The report also contains profiles and analysis of ten leading companies, and the transcript of an exclusive interview with solar EOR pioneer GlassPoint is also provided. This report will keep your knowledge that one step ahead of your rivals.

The Thermal Enhanced Oil Recovery (EOR) Market 2017-2027 report will be of value to anyone who wants to better understand the industry and its dynamics. It will be useful for businesses already involved in a segment of the thermal EOR market, or those wishing to enter this growing market in the future.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Executive Summary

1.1 Global Thermal Enhanced Oil Recovery (EOR) Market Overview

1.2 Market Structure Overview and Market Definition

1.3 Methodology

1.4 Why You Should Read This Report

1.5 How This Report Delivers

1.6 Key Questions Answered by this Analytical Report Include:

1.7 Who is this Report For?

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to the Thermal EOR Market

2.1 Stages of Oil Extraction

2.1.1 Primary Recovery

2.1.2 Secondary Recovery

2.1.3 Tertiary Recovery

2.2 Thermal EOR Processes

2.2.1 Steam Injection

2.2.1.1 Steam Flooding

2.2.1.2 Cyclic Steam Stimulation (CSS)

2.2.2 Steam-Assisted Gravity Drainage

2.2.3 Small-Scale Commercial EOR Technologies

2.2.3.1 In-Situ Combustion

2.2.3.2 Thermally Assisted Gas-Oil Gravity Drainage (TAGOGD)

2.2.3.3 Thermal-Assisted Gravity Drainage (TAGD)

2.2.3.4 Toe-to-Heel Air Injection (THAI®)

2.2.3.5 Solar EOR

2.2.3.6 Electro-Thermal Dynamic Stripping Process (ET-DSP™)

2.2.3.7 Synchronised Thermal Additional Recovery (STAR)

2.2.4 Other Thermal EOR Technologies

2.2.4.1 Expanding Solvent Steam-Assisted Gravity Drainage (ES-SAGD)

2.2.4.2 Steam and Gas Push (SAGP)

2.2.4.3 Controlled Atmospheric Pressure Resin Infusion (CAPRI)

2.2.4.4 Combustion Overhead Gravity Drainage (COGD)

2.3 Unconventional Oil and the Thermal EOR Market

2.3.1 Heavy Oil

2.3.2 Oil Sands

2.4 Thermal EOR Economics

3. The Global Thermal EOR Market 2017-2027

3.1 Global Thermal EOR Market Forecast 2017-2027

3.1.1 Capital and Operational Expenditure Forecasts

3.1.2 Production Forecast

3.2 Global Thermal EOR Market Analysis

3.3 Visiongain’s Oil Price Analysis

3.3.1 Visiongain’s Oil Price Analysis

3.3.1.1 Supply-Side Factors

3.3.1.2 Demand-Side Factors

3.3.1.3 Other Major Variables that Impact the Oil Price

3.3.1.4 Visiongain’s Oil Price Assumptions and Forecast

3.4 Drivers and Restraints in the Thermal EOR Market

3.4.1 Thermal EOR Market Drivers

3.4.1.1 Increasing Oil Demand

3.4.1.2 Unconventional Oil

3.4.2 Thermal EOR Market Restraints

3.4.2.1 High Costs

3.4.2.2 Transportation Issues

3.4.2.3 Environmental Concerns

3.4.2.5 Carbon Taxation

4. Thermal EOR Submarkets 2017-2027

4.1 Will the Oil Sands or Other Areas Provide the Strongest Growth?

4.1.1 The Oil Sands Thermal EOR Submarket Forecast 2017-2027

4.1.1.1 Current and Future In-Situ Oil Sands Production

4.1.1.2 Regulatory Climate

4.1.1.3 New and Alternative Transportation Solutions

4.1.1.4 Narrowing Price Differential Between WTI and WCS

4.1.1.5 Stricter Foreign Investment/ Regulations

4.1.1.6 High Water Demand

4.1.2 The Thermal Heavy Oil EOR Submarket Forecast 2017-2027

4.1.2.1 Heavy Oil Potential

4.1.2.2 Global Heavy Oil Resources

4.1.2.3 Current and Future Growth Areas

4.1.2.4 Potential Restraints on the Thermal Steam Heavy Oil Market

4.2 Which Technology Submarket Will Provide the Strongest Growth?

4.2.1 The Steam Injection Submarket Forecast 2017-2027

4.2.1.1 Leading Global Steam Injection Projects

4.2.1.2 Duri

4.2.1.3 Cold Lake

4.2.1.4 Primrose

4.2.1.5 Shengli

4.2.1.6 Midway-Sunset

4.2.2 The SAGD Submarket Forecast 2017-2027

4.2.2.1 Leading Global SAGD Projects

4.2.2.2 Firebag

4.2.2.4 Foster Creek and Christina Lake

4.2.2.3 Mukhaizna

4.2.2.5 Jackfish

4.2.3 Other EOR Technologies Submarket Forecast 2017-2027

4.2.3.1 Leading Global Other EOR Projects

4.2.3.2 Qarn Alam

4.2.3.3 Saleski Pilot

5. The Leading National Thermal EOR Market Forecasts 2017-2027

5.1 The Canadian Thermal EOR Market Forecast 2017-2027

58.1 The Five Leading Companies in the Thermal Oil Sands EOR Market – Market Shares and Profiles

8.1.1 Suncor

8.1.2 ConocoPhillips

8.1.3 Imperial Oil

8.1.4 Cenovus

8.1.5 China National Offshore Oil Corporation (CNOOC)

8.2 The Five Leading Companies in the Thermal Heavy Oil EOR Market – Market Shares and Profiles

8.2.1 Chevron Corporation

8.2.2 PDVSA

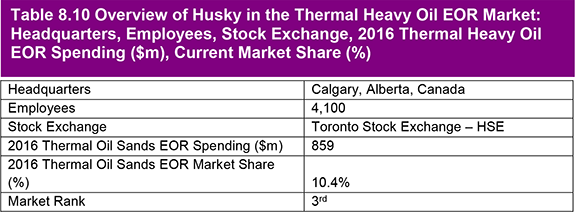

8.2.3 Husky Energy

8.2.4 Sinopec

8.2.5 Occidental

8.3 Other Leading Companies in the Thermal EOR Market

9. Conclusions and Recommendations

9.1 EOR Market Outlook

9.2 Key Findings in the Thermal EOR Market

9.3 Recommendations for the Thermal EOR Market

10. Glossary

Appendix

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

Appendix B

Visiongain Report Evaluation Form

List of Tables

Table 1.1 Comparison of Oil Grading By Leading International Agencies (⁰API, Viscosity cP)

Table 1.2 Leading National Thermal EOR Market Forecast 2017-2027 (Spending $m, AGR %, Cumulative)

Table 3.1 Global Thermal EOR Market Forecast 2017-2027 ($bn, AGR %, CAGR %, Cumulative)

Table 3.2 Leading National Thermal EOR Market Forecast 2017-2027 (Spending $m, AGR %, Cumulative)

Table 3.3 Global Thermal EOR Market Forecast CAPEX and OPEX 2017-2027 ($bn, AGR %, Cumulative)

Table 3.4 Global Thermal EOR Market Production Forecast 2017-2027 (MMbpd, AGR %)

Table 3.5 Visiongain’s Anticipated Brent Crude Oil Price, 2017, 2018, 2019-2021, 2022- 2024, 2025-2027 ($/bbl)

Table 3.6 Global Thermal EOR Market Drivers and Restraints

Table 4.1 Oil Sands and Non-Oil Sands Submarket Forecasts 2017-2027 ($m, MMbpd, AGR%)

Table 4.2 Oil Sands Forecast 2017-2027 (CAPEX and OPEX $m, AGR %, CAGR %, Cumulative)

Table 4.3 Thermal Heavy Oil Forecast 2017-2027 (Production MMbpd, CAPEX and OPEX $m, AGR %, CAGR %)

Table 4.4 Thermal EOR Submarket Forecasts 2017-2027 (MMbpd, $m, AGR %, Cumulative)

Table 4.6 Top 5 Steam Injection Projects (Company, Project, bpd, Country, Resource)

Table 4.7 SAGD Submarket Forecast 2017-2027 (CAPEX and OPEX $m, AGR %, CAGR %, Cumulative)

Table 4.8 Top 5 SAGD Projects (Company, Project, bpd, Country, Resource)

Table 4.9 Other EOR Technologies Submarket Forecast 2017-2027 (CAPEX and OPEX $m, AGR %, CAGR %, Cumulative)

Table 4.10 Top 2 Other EOR Technologies Projects (Company, Project, bpd, Country, Method)

Table 5.1 Leading National Thermal EOR Market Forecast 2017-2027 (Spending $m, AGR %)

Table 5.2 Canadian Thermal EOR Market Forecast 2017-2027 (MMbpd production, CAPEX and OPEX $m, AGR %, CAGR %)

Table 5.3 Operational Thermal Oil Sands Projects (Company Name, Project Name, Technology, BPD Capacity, Current BPD)

Table 5.4 Canadian Thermal Heavy Oil Market Forecast 2017-2027 (Mbpd production, CAPEX and OPEX $m, AGR %, CAGR %)

Table 5.5 Operational Canadian Thermal Heavy Oil Projects (Company Name, Project Name, Technology, BPD Capacity, Current BPD)

Table 5.6 Planned Thermal Oil Sands Projects (Company Name, Project Name, Technology, bpd Capacity, Start Date)

Table 5.7 U.S. Thermal EOR Market Forecast 2016-2026 (Mbpd Production, CAPEX and OPEX $m AGR %, CAGR %)

Table 5.8 U.S. Thermal EOR Production (Company, Project Location, Production [bpd], Technology)

Table 5.9 Venezuelan Thermal EOR Market Forecast 2017-2027 (Mbpd production, CAPEX and OPEX $m, AGR %, CAGR %)

Table 5.10 Venezuelan Thermal EOR Production (Company, Project Location, Production [bpd], Technology)

Table 5.11 Indonesian Thermal EOR Market Forecast 2017-2027 (Mbpd production, CAPEX and OPEX $m, AGR %, CAGR %)

Table 5.12 Kuwaiti Thermal EOR Market Forecast 2017-2027 (Mbpd production, CAPEX and OPEX $m, AGR %, CAGR %)

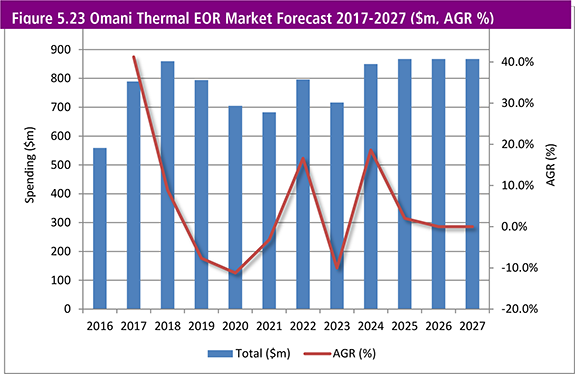

Table 5.13 Omani Thermal EOR Market Forecast 2017-2027 (Mbpd production, CAPEX and OPEX $m, AGR %, CAGR %)

Table 5.14 Omani Thermal EOR Production (Company, Project Location, Production [bpd], Technology)

Table 5.15 Chinese Thermal EOR Market Forecast 2017-2027 (Mbpd production, CAPEX and OPEX $m, AGR %, CAGR %)

Table 5.16 Russian Thermal EOR Market Forecast 2017-2027 (Mbpd production, CAPEX and OPEX $m, AGR %, CAGR %)

2025

Table 5.17 Bahraini Thermal EOR Market Forecast 2017-2027 (Mbpd production, CAPEX and OPEX $m, AGR %, CAGR %)

Table 5.18 Saudi Arabian Thermal EOR Market Forecast 2017-2027 (Mbpd production, CAPEX and OPEX $m, AGR %, CAGR %)

Table 5.19 Rest of the World Thermal EOR Market Forecast 2017-2027 (Mbpd production, CAPEX and OPEX $m, AGR %, CAGR %)

Table 6.1 PEST Analysis of the Thermal EOR Market 2017-2027

Table 8.1 Five Leading Companies in the Thermal Oil Sands EOR Market (Rank, 2017 Spending $m, Market Share %)

Table 8.2 Overview of Suncor in the Thermal Oil Sands EOR Market: Headquarters, Employees, Stock Exchange, Current Thermal Oil Sands EOR Spending ($m), Current Market Share (%)

Table 8.3 Overview of ConocoPhillips in the Thermal Oil Sands EOR Market: Headquarters, Employees, Stock Exchange, 2017 Thermal Oil Sands EOR Spending ($m), Current Market Share (%)

Table 8.4 Overview of Imperial Oil in the Thermal Oil Sands EOR Market: Headquarters, Employees, Stock Exchange, 2016 Thermal Oil Sands EOR Spending ($m), Current Market Share (%)

Table 8.5 Overview of Cenovus in the Thermal Oil Sands EOR Market: Headquarters, Employees, Stock Exchange, 2016 Thermal Oil Sands EOR Spending ($m), Current Market Share (%)

Table 8.6 Overview of CNOOC in the Thermal Oil Sands EOR Market: Headquarters, Employees, Stock Exchange, 2017 Thermal Oil Sands EOR Spending ($m), Current Market Share (%)

Table 8.7 Leading Five Companies in the Thermal Heavy Oil EOR Market (Rank, 2016 Spending $m, Current Market Share %)

Table 8.8 Overview of Chevron in the Thermal Heavy Oil EOR Market: Headquarters, Employees, Stock Exchange, 2016 Thermal Heavy Oil EOR Spending ($m), Current Market Share (%)

Table 8.9 Overview of PDVSA in the Thermal Heavy Oil EOR Market: Headquarters, Employees, Stock Exchange, 2016 Thermal Heavy Oil EOR Spending ($m), Current Market Share (%)

Table 8.10 Overview of Husky in the Thermal Heavy Oil EOR Market: Headquarters, Employees, Stock Exchange, 2016 Thermal Heavy Oil EOR Spending ($m), Current Market Share (%)

Table 8.11 Overview of Sinopec in the Thermal Heavy Oil EOR Market: Headquarters, Employees, Stock Exchange, 2016 Thermal Heavy Oil EOR Spending ($m), Current Market Share (%)

Table 8.12 Overview of Occidental Petroleum in the Thermal Heavy Oil EOR Market: Headquarters, Employees, Stock Exchange, 2016 Thermal Heavy Oil EOR Spending ($m), Current Market Share (%)

Table 8.13 Other Leading Companies in the Thermal EOR Market 2016 (Company, Sector, Technology)

List of Figures

Figure 1.1 Global Oil and Gas Consumption Forecasts 2015-2035 (MMtoe)

Figure 1.2 Global Thermal EOR Market Structure Overview

Figure 2.1 USGS Survey Of Global Heavy Oil Resources by Region (Billion Barrels)

Figure 2.2 World Map of Bitumen Reserves (Million Barrels of Bitumen)

Figure 3.1 Global Thermal EOR Market Forecast 2017-2027 ($bn, AGR %)

Figure 3.2 Global Thermal EOR Market and Submarket CAGRs (%), 2017-2022, 2022-2027 and 2017-2027

Figure 3.3 Total Spending by Leading National Thermal EOR Markets, 2017-2027 ($bn)

Figure 3.4 Global Thermal EOR Market CAPEX Forecast 2017-2027 ($bn, AGR %)

Figure 3.6 WTI and Brent Oil Prices 2004-2016 ($/bbl)

Figure 3.7 Weekly WTI and Brent Oil Prices June-2014 – April-2017 ($/bbl)

Figure 3.8 Chinese and Indian Annual GDP Growth Rates, 2006-2017 (%)

Figure 3.9 U.S. Refined Product Consumption January-2015 to July-2016 Four-Week Average (Mbpd)

Figure 3.10 Visiongain’s Anticipated Brent Crude Oil Price, 2017, 2018, 2019-2021, 2022-2024, 2025-2027 ($/bbl)

Figure 4.1 Thermal EOR Submarket Production Share Forecasts, 2017 (%)

Figure 4.2 Thermal EOR Submarket Production Share Forecasts, 2022 (%)

Figure 4.3 Thermal EOR Submarket Production Share Forecasts, 2027 (%)

Figure 4.4 Thermal EOR Submarket Forecasts 2017-2027 ($m)

Figure 4.5 Thermal EOR Submarket Spending Share, 2017-2027 (%)

Figure 4.6 Oil Sands Forecast 2017-2027 ($m, AGR %)

Figure 4.8 Oil Sands Production Forecast 2017-2027 (MMbpd, AGR %)

Figure 4.9 Oil Sands CAPEX and OPEX Forecasts, 2017-2027 ($m)

Figure 4.10 Benchmark Oil Prices, June-2014 to April-2017($/bbl)

Figure 4.11 Map of US Petroleum Administration for Defense Districts (PADD)

Figure 4.12 Thermal Heavy Oil Forecast 2017-2027 ($m, AGR %)

Figure 4.13 Thermal Heavy Oil Market Share Forecast 2017, 2022, and 2027 (% Share)

Figure 4.14 Thermal Heavy Oil Production Forecast, 2017-2027 (MMbpd)

Figure 4.15 Thermal Heavy Oil CAPEX and OPEX Forecasts, 2017-2027 ($m)

Figure 4.16 Conventional Oil Discovery History 1960-2012 (Billion Barrels)

Figure 4.17 USGS Survey of Global Heavy Oil Resources by Region (Billion Bbls)

Figure 4.19 Thermal EOR Submarkets Share Forecast, 2022 (%)

Figure 4.20 Thermal EOR Submarkets Share Forecast, 2027 (%)

Figure 4.21 Thermal EOR Submarket Forecasts 2017-2027 (Spending $m)

Figure 4.22 Thermal EOR Submarkets Cumulative Spending 2017-2027 ($m)

Figure 4.23 Steam Injection Submarket Forecast 2017-2027 ($m, AGR %)

Figure 4.24 Steam Injection Market Share Forecast, 2017, 2022 and 2027 (% Share)

Figure 4.25 Steam Injection Production Forecast, 2017-2027 (MMbpd)

Figure 4.26 Steam Injection CAPEX and OPEX Forecasts, 2017-2027 ($m)

Figure 4.27 SAGD Submarket Forecast 2017-2027 ($m, AGR %)

Figure 4.28 SAGD Market Share Forecast, 2017, 2022 and 2027 (% Share)

Figure 4.29 SAGD Production Forecast, 2017-2027 (MMbpd)

Figure 4.30 SAGD CAPEX and OPEX Forecasts, 2017-2027 ($m)

Figure 4.31 Other EOR Technologies Submarket Forecast 2017-2027 ($m, AGR %)

Figure 4.32 Other EOR Technologies Market Share Forecast, 2017, 2022 and 2027 (% Share)

Figure 4.33 Other EOR Technologies Production Forecast, 2017-2027 (MMbpd)

Figure 4.34 Other EOR Technologies CAPEX and OPEX Forecasts, 2017-2027 ($m)

Figure 5.1 Leading National Thermal EOR Market Forecasts 2017-2027 ($m)

Figure 5.2 Leading National Thermal EOR Markets Share Forecast, 2017 (%)

Figure 5.3 Leading National Thermal EOR Markets Share Forecast, 2022 (%)

Figure 5.4 Leading National Thermal EOR Markets Share Forecast, 2027 (%)

Figure 5.5 Leading National Thermal EOR Markets CAGR Forecast, 2017-2027 (%)

Figure 5.6 Leading National Thermal EOR Markets Cumulative Spending Forecast 2017-2027 ($m)

Figure 5.7 Canadian Thermal EOR Market Forecast 2017-2027 ($m, AGR %)

Figure 5.8 Canadian Thermal EOR Market Share Forecast, 2017, 2022 and 2027 (% Share)

Figure 5.9 Canadian Oil Sands Deposits in Alberta

Figure 5.10 Canadian Thermal Heavy Oil Market Forecast 2017-2027 ($m, AGR %)

Figure 5.11 Canadian Thermal Heavy Oil Market Share Forecast, 2017, 2022 and 2027 (% Share)

Figure 5.12 U.S. Thermal EOR Market Forecast 2017-2027 ($m, AGR %)

Figure 5.13 U.S. Thermal EOR Market Share Forecast, 2017, 2022 and 2027 (% Share)

Figure 5.15 Venezuelan Thermal EOR Market Forecast 2017-2027 ($m, AGR %)

Figure 5.16 Venezuelan Thermal EOR Market Share Forecast, 2017, 2022 and 2027 (% Share)

Figure 5.17 Venezuela Oil Production 1980-2016 (Mbpd) and Reserves 1980-2016 (Billion Bbls)

Figure 5.18 Indonesian Thermal EOR Market Forecast 2017-2027 ($m, AGR %)

Figure 5.19 Indonesian Thermal EOR Market Share Forecast, 2017, 2022 and 2027 (% Share)

Figure 5.20 Indonesian Oil Production and Proven Reserves 1990-2014 (Mbpd, Billion bpd)

Figure 5.21 Kuwaiti Thermal EOR Market Forecast 2017-2027 ($m, AGR %)

Figure 5.22 Kuwaiti Thermal EOR Market Share Forecast, 2017, 2022 and 2027 (% Share)

Figure 5.23 Omani Thermal EOR Market Forecast 2017-2027 ($m, AGR %)

Figure 5.24 Omani Thermal EOR Market Share Forecast, 2017, 2022 and 2027 (% Share)

Figure 5.25 Omani Oil Production 1980-2016 (Thousand barrels)

Figure 5.26 Chinese Thermal EOR Market Forecast 2017-2027 ($m, AGR %)

Figure 5.27 Chinese Thermal EOR Market Share Forecast, 2017, 2022 and 2027 (% Share)

Figure 5.28 Russian Thermal EOR Market Forecast 2017-2027 ($m, AGR %)

Figure 5.29 Russian Thermal EOR Market Share Forecast, 2017, 2022 and 2027 (% Share)

Figure 5.30 Bahraini Thermal EOR Market Share Forecast, 2017, 2022 and 2027 (% Share)

Figure 5.31 Bahraini Thermal EOR Market Forecast 2017-2027 ($m, AGR %)

Figure 5.32 Saudi Arabian Thermal EOR Market Forecast 2017-2027 ($m, AGR %)

Figure 5.33 Saudi Arabian Thermal EOR Market Share Forecast, 2017, 2022 and 2027 (% Share)

Figure 5.34 Rest of the World Thermal EOR Market Forecast 2017-2027 ($m, AGR%)

Figure 5.35 Rest of the World Thermal EOR Market Share Forecast, 2017, 2022 and 2027 (% Share)

Figure 8.1 Five Leading Companies in the Thermal Oil Sands EOR Market (2017 Spending $m)

Figure 8.2 Five Leading Companies in the Thermal Oil Sands EOR Market (Market Share %)

Figure 8.3 Leading Five Companies in the Thermal Heavy Oil EOR Market (2016 Spending $m)

Figure 8.4 Leading Five Companies in the Thermal Heavy Oil EOR Market (Market Share %)

Aera Energy

Andora Energy

Athabasca Oil

Bayou State Oil Corporation

Bayshore Petroleum

Baytex Energy Corp

BlackPearl Resources

BP

BrightSource Energy

Brion Energy

Canadian Natural Resources Ltd. (CNRL)

Cenovus

Chevron

China National Offshore Oil Corporation (CNOOC)

China National Petroleum Corporation (CNPC)

China Petroleum and Chemical Corporation (Sinopec)

Chinese state-owned enterprise (SOE)

Chrysalix Energy Venture Capital

Connacher Oil & Gas

ConocoPhillips

Continental Resources

Denbury Resources

Devon Energy

E-T Energy

Excelsior Energy

ExxonMobil

Gazprom Neft

GlassPoint

Harvest Operations

Husky Energy

Imperial Oil

Japan Canada Oil Sands

Kuwait Gulf Oil Company (KGOC)

Kuwait Oil Company (KOC)

Kuwait Petroleum Corporation

Laricina Energy

Linn Energy

Liwa Energy

Lukoil

Maha Energy

MEG Energy

Naftex

NAM

Nexen

Nth Power

Occidental Petroleum

Oil and Natural Gas Corporation Limited (ONGC)

Oman Oil Company

Osum Oil Sands

Pacific Exploration and Production

Partex

PDO

Pengrowth Energy

Pertamina

Petro River Oil

Petrobank Energy & Resources

Petrobras

Petro-Canada

Petróleos de Venezuela, S.A. (PDVSA)

Petroleum Company of Trinidad and Tobago Limited (Petrotrin)

Petroleum Development Oman (PDO)

Prosper Petroleum

Reliance Industries Ltd (RIL)

RockPort Capital

Rosneft

Royal Dutch Shell

Saudi Aramco

Schlumberger

Scimitar

Seneca Resources

Shell

Shell Oman Marketing Company

Sinopec

SKSPMIGAS

Southern Pacific Resources

Statoil

Suncor Energy Inc.

Sunshine Oil Sands

Tatweer Petroleum

Total

Total E&P Canada

Touchstone

Wintershall

Other Organisations Mentioned in This Report

California Department of Oil, Gas & Geothermal Resources (DOGGR)

California Resources Corporation

Canadian Centre For Energy Information

European Union (EU)

International Atomic Energy Agency (IAEA)

International Energy Agency (IEA)

International Monetary Fund (IMF)

Organization of the Petroleum Exporting Countries (OPEC)

State General Reserve Fund (SGRF)

The United States Geological Survey (USGS)

U.S. Energy Information Administration (EIA)

United Nations (UN)

United States Geological Survey (USGS)

US Department of Energy (DOE)

World Energy Council

Download sample pages

Complete the form below to download your free sample pages for Thermal Enhanced Oil Recovery (EOR) Market Report 2017-2027

Download sample pages

Complete the form below to download your free sample pages for Thermal Enhanced Oil Recovery (EOR) Market Report 2017-2027

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain energy reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and industry experts where possible but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain energy reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

“The Visiongain report was extremely insightful and helped us construct our basic go-to market strategy for our solution.”

H.

“F.B has used Visiongain to prepare two separate market studies on the ceramic proppants market over the last 12 months. These reports have been professionally researched and written and have assisted FBX greatly in developing its business strategy and investment plans.”

F.B

“We just received your very interesting report on the Energy Storage Technologies (EST) Market and this is a very impressive and useful document on that subject.”

I.E.N

“Visiongain does an outstanding job on putting the reports together and provides valuable insight at the right informative level for our needs. The EOR Visiongain report provided confirmation and market outlook data for EOR in MENA with the leading countries being Oman, Kuwait and eventually Saudi Arabia.”

E.S

“Visiongain produced a comprehensive, well-structured GTL Market report striking a good balance between scope and detail, global and local perspective, large and small industry segments. It is an informative forecast, useful for practitioners as a trusted and upto-date reference.”

Y.N Ltd

Association of Dutch Suppliers in the Oil & Gas Industry

Society of Naval Architects & Marine Engineers

Association of Diving Contractors

Association of Diving Contractors International

Associazione Imprese Subacquee Italiane

Australian Petroleum Production & Exploration Association

Brazilian Association of Offshore Support Companies

Brazilian Petroleum Institute

Canadian Energy Pipeline

Diving Medical Advisory Committee

European Diving Technology Committee

French Oil and Gas Industry Council

IMarEST – Institute of Marine Engineering, Science & Technology

International Association of Drilling Contractors

International Association of Geophysical Contractors

International Association of Oil & Gas Producers

International Chamber of Shipping

International Shipping Federation

International Marine Contractors Association

International Tanker Owners Pollution Federation

Leading Oil & Gas Industry Competitiveness

Maritime Energy Association

National Ocean Industries Association

Netherlands Oil and Gas Exploration and Production Association

NOF Energy

Norsk olje og gass Norwegian Oil and Gas Association

Offshore Contractors’ Association

Offshore Mechanical Handling Equipment Committee

Oil & Gas UK

Oil Companies International Marine Forum

Ontario Petroleum Institute

Organisation of the Petroleum Exporting Countries

Regional Association of Oil and Natural Gas Companies in Latin America and the Caribbean

Society for Underwater Technology

Society of Maritime Industries

Society of Petroleum Engineers

Society of Petroleum Enginners – Calgary

Step Change in Safety

Subsea UK

The East of England Energy Group

UK Petroleum Industry Association

All the events postponed due to COVID-19.

Latest Energy news

Visiongain Publishes Carbon Capture Utilisation and Storage (CCUS) Market Report 2024-2034

The global carbon capture utilisation and storage (CCUS) market was valued at US$3.75 billion in 2023 and is projected to grow at a CAGR of 20.6% during the forecast period 2024-2034.

19 April 2024

Visiongain Publishes Liquid Biofuels Market Report 2024-2034

The global Liquid Biofuels market was valued at US$90.7 billion in 2023 and is projected to grow at a CAGR of 6.7% during the forecast period 2024-2034.

03 April 2024

Visiongain Publishes Hydrogen Generation Market Report 2024-2034

The global Hydrogen Generation market was valued at US$162.3 billion in 2023 and is projected to grow at a CAGR of 3.7% during the forecast period 2024-2034.

28 March 2024

Visiongain Publishes Biofuel Industry Market Report 2024-2034

The global Biofuel Industry market was valued at US$123.2 billion in 2023 and is projected to grow at a CAGR of 7.6% during the forecast period 2024-2034.

27 March 2024