Why are Military Helicopters Important Today?

Military helicopters are a key aspect of any nation’s armed forces. They carry out essential roles, whether it be transporting troops and cargo to and from the battlefield or providing air support to forces on the ground. Helicopters also significantly expand the capabilities of ships which they embark on.

Helicopters have featured in practically all major conflicts since their introduction into military fleets. They played a prominent role in the Iraq War and most recently, have been utilised in naval operations to combat piracy. Rotorcraft have also provided critical support to humanitarian and peacekeeping missions involving disaster relief and search and rescue.

Due to the importance of military helicopters, visiongain expects there to be a robust market demand for their services over the next decade. The market will grow steadily – with acquisitions and upgrade programmes peaking around the middle of the decade – but witness a decline in sales toward the end of the forecast period as said programmes conclude and new projects remain in their infancy stages.

In terms of value, demand is driven by the requirement for the latest rotorcraft. In terms of units, new procurements are forecast to remain at a higher level than upgrades, yet the latter is set for an increased market share.

What are the Military Helicopter Market Prospects?

Visiongain expects the Military Helicopter market – which includes both new production rotorcraft and upgrades – to generate sales of USD 29.05 billion in 2019 and estimates that this figure will decline to USD 23.89 billion by 2029. The Compound Annual Growth Rate (CAGR) for the forecast period is -1.93 per cent.

This timely, 324-page study will enhance your strategic decision making, update you with crucial market developments and, ultimately, help to maximise your company’s profitability and potential.

Read on to discover even more ways of how this report can help to develop your business.

This Report Addresses the Pertinent Issues, Such As:

• How is the military helicopter market evolving?

• How will each military helicopter submarket segment grow over the forecast period, and how much sales revenue and production will these submarkets account for in 2029?

• How will political and economic factors influence the military helicopter market?

• How will shares of the national markets change by 2029 and which nation will lead the market in the same year?

• Who are the leading players, and what are their prospects over the forecast period?

Research & Analysis Highlights

• Independent, impartial and objective analysis of the global military helicopter market from 2019 to 2029, including close to 300 tables, charts and graphs.

• Forecasts by helicopter type, procurement and leading national markets, covering the period 2016-2029.

– Military Helicopter Forecasts by Type, 2016-2029

Attack Helicopters Forecast, 2016-2029

Reconnaissance Helicopters Forecast, 2016-2029

Heavy Cargo Helicopters Forecast, 2016-2029

Medium Utility Helicopters Forecast, 2016-2029

Light Utility Forecasts, 2016-2029

Maritime Helicopters Forecast, 2016-2029

Search & Rescue Helicopters Forecast, 2016-2029

– Military Helicopter Forecasts by Procurement, 2016-2029

New Production Helicopters Forecast, 2016-2029

Upgraded Helicopters Forecast, 2016-2029

MRO & Other Helicopters Forecast, 2016-2029

– Military Helicopter Forecasts by National Market, 2016-2029

US Military Helicopter Market Forecast 2016-2029

UK Military Helicopter Market Forecast 2016-2029

Germany Military Helicopter Market Forecast 2016-2029

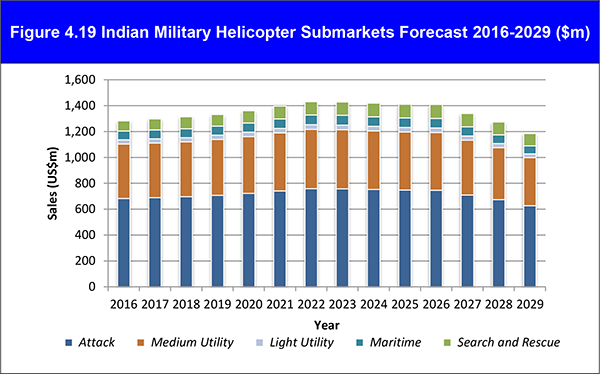

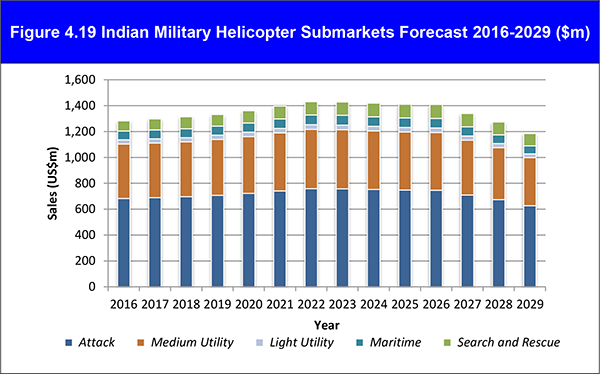

India Military Helicopter Market Forecast 2016-2029

Turkey Military Helicopter Market Forecast 2016-2029

France Military Helicopter Market Forecast 2016-2029

Australia Military Helicopter Market Forecast 2016-2029

Italy Military Helicopter Market Forecast 2016-2029

South Korea Military Helicopter Market Forecast 2016-2029

Russia Military Helicopter Market Forecast 2016-2029

Japan Military Helicopter Market Forecast 2016-2029

China Military Helicopter Market Forecast 2016-2029

Brazil Military Helicopter Market Forecast 2016-2029

UAE Military Helicopter Market Forecast 2016-2029

Algeria Military Helicopter Market Forecast 2016-2029

Taiwan Military Helicopter Market Forecast 2016-2029

Saudi Arabia Military Helicopter Market Forecast 2016-2029

Canada Military Helicopter Market Forecast 2016-2029

Iraq Military Helicopter Market Forecast 2016-2029

Spain Military Helicopter Market Forecast 2016-2029

Mexico Military Helicopter Market Forecast 2016-2029

Norway Military Helicopter Market Forecast 2016-2029

‘Rest of the World’ Military Helicopter Market Forecast 2016-2029

• Details of the most significant military helicopter products currently on the market.

• Profiles of the 14 leading companies involved with the design, development and production of military helicopters, including key financial metrics, an overview of their operations and latest announcements.

• SWOT analysis of the military helicopter market in its current form.

How This Report Will Benefit You

• You will most likely have a body of conflicting and unclear information, and so you require one, definitive report to base your business decisions upon. This visiongain study provides the clarity and expertise that you are after.

• Our insightful report speaks to your need for reliable market data, fair-minded analysis and authoritative conclusions. This will help you to develop informed growth strategies.

• You need the information in an easily digestible form. This report excels at delivering just that.

• Our forecasts give you a crucial advantage by enhancing your strategic decision making.

• Knowledge is vital to you and your business, and you desire as much evidence as possible to inform crucial investment decisions. Let visiongain increase your industry knowledge, build your technical insight and strengthen your competitor analysis.

• In short, without this exhaustive visiongain report, you will fall into the same pitfalls as your competitors.

Who Should Read This Report?

• Senior Executives

• Business Development Managers

• Marketing Managers

• Consultants

• CEOs

• CIOs

• COOs

Governments, agencies & organisations actively working or interested in the military helicopter industry will also find significant value in our research.

Don’t Miss Out on This Business Advantage

This information is not available elsewhere. With our report, you are less likely to fall behind your business competitors and miss any emerging market opportunities.

Discover how this study benefits your research and analysis and watch how you save time and receive recognition for commercial and technical insight.

Visiongain’s report is for anyone wanting to better understand the military helicopter industry and its underlying dynamics. It proves useful for businesses who wish to expand into different sectors or explore a new region for their existing operations.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1. Executive Summary

1.1 Key Drivers and Restraints of the Military Helicopter Market

1.2 Highlights of the Report

1.3 Structure of the Report

1.4 Methodology

1.5 Global Military Helicopter Market Forecast 2019-2029

1.6 Military Helicopter New Acquisitions and Upgrades Forecast 2019-2029

1.7 Military Helicopter Submarket Forecasts 2019-2029

1.8 Leading Military Helicopter National Market Forecasts 2019-2029

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to the Military Helicopter Market

2.1 Types of Helicopters

2.1.1 Attack

2.1.2 Reconnaissance

2.1.3 Heavy Cargo

2.1.4 Medium Utility

2.1.5 Light Utility

2.1.6 Maritime

2.1.7 Search and Rescue

3. The Global Military Helicopter Market 2019-2029

3.1 Global Military Helicopter Market Forecast 2019-2029

3.1.1 Global Military Helicopter Market New Units and Upgrades Forecast 2016-2029

3.2 Military Helicopter Submarket Forecasts 2016-2029

3.2.1 Medium Utility Helicopter Submarket Forecast 2016-2029

3.2.2 Heavy Cargo Helicopter Submarket Forecast 2016-2029

3.2.3 Attack Helicopter Submarket Forecast 2016-2029

3.2.4 Maritime Helicopter Submarket Forecast 2016-2029

3.2.5 Search and Rescue Helicopter Submarket Forecast 2016-2029

3.2.6 Light Utility Helicopter Submarket Forecast 2016-2029

3.2.7 Reconnaissance Helicopter Submarket Forecast 2016-2029

3.3 Leading National Markets for Military Helicopters 2016-2029

4. Leading National Military Helicopter Markets 2019-2029

4.1 US Military Helicopter Market Forecast 2019-2029

4.1.1 US Major Helicopter Programmes

4.2 Significant US Army Military Helicopter Programmes

4.2.1 Future Attack Reconnaissance Aircraft (FARA)

4.2.2 AH-64D Apache Block III

4.2.3 Armed Aerial Scout

4.2.4 OH-58F Kiowa Warrior Upgrade

4.2.5 CH-47F Chinook

4.2.6 UH-60M Black Hawk

4.2.7 UH-72 Lakota Light Utility Helicopter (LUH)

4.2.8 Joint Multi Role

4.2.9 Bell's V-280

4.2.10 CH–47 Chinook

4.2.11 UH–60 Black Hawk

4.3 Significant US Marine Corps Military Helicopter Programmes

4.3.1 CH-53K

4.3.2 MV-22 Osprey Tiltrotor

4.3.3 UH-1Y Venom

4.3.4 AH-1Z Viper

4.3.5 Sikorsky CH-53K King Stallion

4.4 Significant US Navy Military Helicopter Programmes

4.4.1 MH-60R

4.4.2 MH-60S

4.4.3 VXX Presidential Helicopters

4.5 Significant US Air Force Military Helicopter Programmes

4.5.1 CVLSP

4.5.2 UH-1N Helicopter Replacement Programmes

4.6 Significant US Special Operations Military Helicopter Programmes

4.6.1 MH-47G

4.6.2 MH-60M

4.6.3 Mission-Enhanced Little Bird (MELB)

4.6.4 CV-22 Tiltrotor

4.6.5 Personnel Recovery Recapitalization Program (PRRP)

4.7 UK Military Helicopter Market Forecast 2019-2029

4.7.1 UK Major Helicopter Programmes

4.8 Significant UK Military Helicopter Programmes

4.8.1 Apache AH1

4.8.2 Chinook HC2/2A/3

4.8.3 Merlin HM1 Upgrades

4.8.4 Merlin HC3 Upgrades

4.8.5 Puma Upgrade

4.8.6 Lynx Wildcat

4.9 German Military Helicopter Market Forecast 2019-2029

4.9.1 Germany Major Helicopter Programmes

4.10 Significant German Military Helicopter Programmes

4.10.1 Heavy-lift Military Helicopter

4.10.2 Tiger UHT

4.10.3 CH-53GA Upgrade

4.10.4 NH90

4.10.5 Maritime Helicopter

4.10.6 CSAR

4.11 Indian Military Helicopter Market Forecast 2019-2029

4.11.1 India Major Helicopter Programmes

4.12 Significant Indian Military Helicopter Programmes

4.12.1 Naval Utility Helicopter (NUH)

4.12.2 Attack Helicopters

4.12.3 Light Combat Helicopter

4.12.4 Mi-17 Fleet

4.12.5 Dhruv ALH

4.12.6 Army/Air Force LUH

4.12.7 Navy LUH

4.12.8 Maritime Helicopters

4.12.9 The HAL Light Combat Helicopter (LCH)

4.13 Turkish Military Helicopter Market Forecast 2019-2029

4.13.1 Turkey Major Helicopter Programmes

4.14 Significant Turkish Military Helicopter Programmes

4.14.1 Turkish Heavy Class Attack Helicopter Program

4.14.2 T129 ATAK

4.14.3 A129

4.14.4 T-70 Black Hawk Selected

4.14.5 Light Utility Helicopters

4.14.6 Seahawk Maritime Helicopters

4.14.7 T129

4.15 French Military Helicopter Market Forecast 2019-2029

4.15.1 France Major Helicopter Programmes

4.16 Significant French Military Helicopter Programmes

4.16.1 Joint Light Helicopters

4.16.2 Tiger Attack Helicopters

4.16.3 Gazelle Scout Helicopters

4.16.4 Hélicoptère de Transport Lourd (HTL)

4.16.5 NH90 TTH

4.16.6 EC-725 Caracal for Combat Search and Rescue

4.16.7 Cougar Upgrades

4.16.8 NH90 NFH

4.16.9 Panther Mk2 Light Maritime

4.16.10 Hélicoptère Interarmées Cross-Service Helicopter Programme

4.17 Australian Military Helicopter Market Forecast 2019-2029

4.17.1 Australia Major Helicopter Programmes

4.18 Significant Australian Military Helicopter Programmes

4.18.1 Tiger ARH

4.18.2 CH-47F Chinooks

4.18.3 MRH90 (NH90)

4.18.4 Black Hawks

4.18.5 Maritime Support Helicopter

4.19 Italian Military Helicopter Market Forecast 2019-2029

4.19.1 Italy Major Helicopter Programmes

4.20 Significant Italian Military Helicopter Programmes

4.20.1 AgustaWestland AH-249

4.20.2 A129 Mangusta

4.20.3 CH-47 Chinook

4.20.4 NH90 TTH

4.20.5 Italian Navy AW101

4.20.6 AW101 AEW

4.20.7 AW101 CSAR

4.20.8 AW139 SAR

4.20.9 M-346

4.21 South Korean Military Helicopter Market Forecast 2019-2029

4.21.1 South Korea Major Helicopter Programmes

4.22 Significant South Korean Military Helicopter Programmes

4.22.1 Maritime Operational Helicopter Programme

4.22.2 AH-X Heavy Attack Helicopter (AH-64)

4.22.3 Korea Attack Helicopter (KAH)

4.22.4 CH-47 Chinook

4.22.5 Surion Utility Helicopter

4.22.6 Black Hawk

4.22.7 Lynx Naval Helicopters and Possible Replacements

4.22.8 Interest in Ka-32 for Marines

4.22.9 KA-32 for SAR

4.22.10 S-92 VVIP

4.22.11 KAI KUH-1 Surion

4.22.12 UH-X Multipurpose Helicopter

4.23 Russian Military Helicopter Market Forecast 2019-2029

4.23.1 Russia Major Helicopter Programmes

4.24 Significant Russian Military Helicopter Programmes

4.24.1 Mi-38T

4.24.2 Arms Procurement Program

4.24.3 Mi-28 and Ka-50/52 New Attack Helicopters

4.24.4 Mi-24 Attack Helicopters

4.24.5 Ansat 2RT

4.24.6 Mi-6 and Possible New Heavy-Lift Helicopter Project

4.24.7 Mi-8M

4.24.8 Ansat Light Helicopters

4.25 Japanese Military Helicopter Market Forecast 2019-2029

4.25.1 Japan Major Helicopter Programmes

4.26 Significant Japanese Military Helicopter Programmes

4.26.1 Attack Helicopter Program

4.26.2 AH-64DJP

4.26.3 OH-1

4.26.4 CH-47

4.26.5 AW101

4.26.6 UH-60JA

4.26.7 SH-60K

4.26.8 UH-1J Replacement

4.26.9 EC-135

4.26.10 UH-60J SAR

4.26.11 UH-X Multipurpose Helicopter

4.27 Chinese Military Helicopter Market Forecast 2019-2029

4.27.1 China Major Helicopter Programmes

4.28 Significant Chinese Military Helicopter Programmes

4.28.1 Chinese Medium Helicopter (CMH)

4.28.2 Z-19E Attack Helicopter

4.28.3 Zhi-10 Attack Helicopter

4.28.4 Mi-17

4.28.5 Kamov Ka-28 ASW Helicopters

4.28.6 Kamov Ka-31 Ship-Based Radar Helicopters

4.28.7 Z-9 Light Utility Helicopter

4.28.8 The Z-19

4.28.9 General Designer of the WZ-19

4.29 Brazilian Military Helicopter Market Forecast 2019-2029

4.29.1 Brazil Major Helicopter Programmes

4.30 Significant Brazilian Military Helicopter Programmes

4.30.1 Mi-35 Attack Helicopters

4.30.2 CH-X Heavy-lift Helicopter

4.30.3 EC-725 Caracal

4.30.4 The Foreign Military Sale (FMS) Programme

4.31 UAE Military Helicopter Market Forecast 2019-2029

4.31.1 UAE Major Helicopter Programmes

4.32 Significant UAE Military Helicopter Programmes

4.32.1 AH-64 Apache Helicopter

4.32.2 AH-64D Block III Apache

4.32.3 UH-60M Black Hawks

4.32.4 Possible Chinook Purchase

4.33 Algerian Military Helicopter Market Forecast 2019-2029

4.33.1 Algeria Major Helicopter Programmes

4.34 Significant Algerian Military Helicopter Programmes

4.34.1 Mi-171Sh Attack Helicopter

4.34.2 Agusta Westland Helicopter Package

4.34.3 Interest in Mi-28 Attack Helicopters

4.34.4 Algerian Air Force Helicopter Upgrades

4.34.5 AW101 Helicopters

4.34.6 Super Lynx for Algerian Navy

4.35 Taiwanese Military Helicopter Market Forecast 2019-2029

4.35.1 Taiwan Major Helicopter Programmes

4.36 Significant Taiwanese Military Helicopter Programmes

4.36.1 AH-64D Longbow Apache

4.36.2 AH-1W

4.36.3 OH-58

4.36.4 Chinooks

4.36.5 UH-60M Black Hawks

4.36.6 Naval Seahawks

4.37 Saudi Arabian Military Helicopter Market Forecast 2019-2029

4.37.1 Saudi Arabia Major Helicopter Programmes

4.38 Significant Saudi Arabian Military Helicopter Programmes

4.38.1 MH-60R Multi-Mission Helicopter

4.38.2 CH-47F

4.38.3 AH-64D Longbow Apache

4.38.4 Future Heavy-Lift Helicopter

4.38.5 UH-60M

4.38.6 UH-60 Black Hawk Upgrades

4.38.7 S-70i International Black Hawk

4.38.8 AH-6i

4.38.9 MD-530

4.38.10 Possible Interest in Russian Helicopters

4.39 Canadian Military Helicopter Market Forecast 2019-2029

4.40 Significant Canadian Military Helicopter Programmes

4.40.1 CH-47F

4.40.2 CH-47D

4.40.3 Griffon Helicopters

4.40.4 CH-148 Cyclone Maritime Helicopters

4.40.5 CH-149 ‘Cormorant’ SAR Helicopters

4.40.6 V-22 Offered as CSAR Aircraft Solution

4.40.7 CH-148

4.41 Iraqi Military Helicopter Market Forecast 2019-2029

4.42 Significant Iraqi Military Helicopter Programmes

4.42.1 407GX Light Attack Helicopter

4.42.2 Mi-17 Fleet

4.42.3 Bell 407

4.42.4 EC-635

4.42.5 Medium and Light Helicopters

4.42.6 The EC145

4.42.7 The Aero L-39NG (Next Generation)

4.43 Spanish Military Helicopter Market Forecast 2019-2029

4.43.1 Spain Major Helicopter Programmes

4.44 Significant Spanish Military Helicopter Programmes

4.44.1 Tiger HAP/HAD

4.44.2 CH-47 Chinook Upgrades

4.45 Mexican Military Helicopter Market Forecast 2019-2029

4.45.1 Mexico Major Helicopter Programmes

4.46 Significant Mexico Military Helicopter Programmes

4.46.1 MH-60R

4.47 Norway Military Helicopter Market Forecast 2019-2029

4.48 Significant Norway Military Helicopter Programmes

4.48.1 NH90

4.48.2 SAR Helicopter

4.49 Rest of the World Military Helicopter Market Forecast 2019-2029

5. SWOT Analysis of the Military Helicopter Market 2019-2029

6. Political & Economic Analysis of the Military Helicopter Market 2019-2029

7. Leading Military Helicopter Companies

7.1 Bell Helicopter

7.1.1 Bell Helicopter Overview

7.1.2 Bell’s Key Military Helicopter Products

7.1.3 Bell Helicopter Financial Snapshot

7.1.4 Bell Helicopter Key News and Announcements

7.2 NHIndustries

7.2.1 NHIndustries Overview

7.2.2 NHIndustries’ Key Military Helicopter Products

7.2.3 NHIndustries Key News and Announcements

7.3 Mitsubishi Heavy Industries, Ltd.

7.3.1 Mitsubishi Heavy Industries, Ltd. Overview

7.3.2 Mitsubishi Heavy Industries, Ltd.’s Key Military Helicopter Products

7.3.3 Mitsubishi Heavy Industries, Ltd. Financial Snapshot

7.4 Russian helicopter (Mil Moscow Helicopter Plant)

7.4.1 Russian Helicopters Overview

7.4.2 Russian Helicopters’ Key Military Helicopter Products

7.4.3 Russian Helicopters Financial Snapshot

7.4.4 Russian Helicopters Key News and Announcements

7.5 Korea Aerospace Industries Ltd (KAI)

7.5.1 Korea Aerospace Industries Ltd (KAI) Overview

7.5.2 KAI’s Key Military Helicopter Products

7.6 Leonardo

7.6.1 Leonardo Overview

7.6.2 Leonardo’s Key Military Helicopter Products

7.6.3 Leonardo Financial Snapshot

7.6.4 Leonardo’s Key News and Announcements

7.7 Lockheed Martin Corporation

7.7.1 Lockheed Martin Corporation Overview

7.7.2 Lockheed Martin Corporation’s Key Military Helicopter Products

7.7.3 Lockheed Martin Corporation Financial Snapshot

7.7.4 Lockheed Martin Corporation Key News and Announcements

7.8 Hindustan Aeronautics Limited (HAL)

7.8.1 Hindustan Aeronautics Limited Overview

7.8.2 Hindustan Aeronautics Limited’s Key Military Helicopter Products

7.8.3 Hindustan Aeronautics Limited Financial Snapshot

7.8.4 Hindustan Aeronautics Limited Key News and Announcements

7.9 Kawasaki Heavy Industries Ltd

7.9.1 Kawasaki Heavy Industries Overview

7.9.2 Kawasaki Heavy Industries’ Key Military Helicopter Products

7.9.3 Kawasaki Heavy Industries Financial Snapshot

7.9.4 Kawasaki Heavy Industries Key News and Announcements

7.10 The Boeing Company

7.10.1 Boeing Company Overview

7.10.2 Boeing Company’s Key Military Helicopter Products

7.10.3 Boeing Company Financial Snapshot

7.10.4 Boeing Company Key News and Announcements

7.11 Airbus SE

7.11.1 Airbus SE Overview

7.11.2 Airbus SE’s Key Military Helicopter Products

7.11.3 Airbus SE Financial Snapshot

7.11.4 Airbus SE Key News and Announcements

7.12 MD Helicopters

7.12.1 MD Helicopters Overview

7.12.2 MD Helicopters’ Key Military Helicopter Products

7.12.3 MD Helicopters Key News and Announcements

7.13 Robinson Helicopter Company

7.13.1 Robinson Helicopter Overview

7.13.2 Robinson Helicopter’s Key Military Helicopter Products

7.13.3 Robinson Helicopter Company Key News and Announcements

7.14 Turkish Aerospace Industries

7.14.1 Turkish Aerospace Industries Overview

7.14.2 Turkish Aerospace Industries’ Key Military Helicopter Products

7.14.3 Turkish Aerospace Industries Key News and Announcements

8. Conclusions

8.1 Military Helicopter Market Key Drivers and Restraints

8.2 The Global Military Helicopter Market 2019-2029

9. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain Report Evaluation Form

List of Tables

Table 3.1 Global Military Helicopter Market Forecast Summary 2019, 2024 and 2029 ($bn, CAGR %, Cumulative)

Table 3.2 Global Military Helicopter Market Forecast 2016-2029 ($m, AGR %, Units)

Table 3.3 Global Military Helicopter Market Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 3.4 Global Military Helicopter Market Forecast 2016-2029, New vs Upgrades ($m, AGR %)

Table 3.5 Global Military Helicopter Market Forecast CAGR, New vs Upgrades (%) 2019-2029, 2019-2024, and 2024-2029

Table 3.6 Global Military Helicopter Submarkets Forecast 2016-2029 ($m, AGR% Units)

Table 3.7 Global Military Helicopter Submarkets Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 3.8 Global Military Helicopter Market share (%) , by Country, 2019,2024 and 2029( % Share , $m)

Table 4.1 Leading National Military Helicopter Market Forecasts 2016-2029 ($m, AGR %, Units)

Table 4.2 US Military Helicopter Market Forecast Summary 2019, 2024 and 2029 ($m, % Share, CAGR %,)

Table 4.3 US Military Helicopter Market Forecast 2019-2029 ($m, AGR %, Units)

Table 4.4 US Military Helicopter Market Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.5 US Military Helicopter Submarkets Forecast 2016-2029 ($m, AGR %, Units)

Table 4.6 US Military Helicopter Submarkets Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.7 US Major Helicopter Programmes (Type, Quantity, Enter to Service Date, Operational Roles)

Table 4.8 UK Military Helicopter Market Forecast Summary 2019, 2024 and 2029 ($m, % Share, CAGR %,)

Table 4.9 UK Military Helicopter Market Forecast 2016-2029 ($m, AGR %, Units)

Table 4.10 UK Military Helicopter Market Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.11 UK Military Helicopter Submarkets Forecast 2016-2029 ($m, AGR %, Units)

Table 4.12 UK Military Helicopter Submarkets Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.13 UK Major Helicopter Programmes (Type, Quantity, Enter to Service Date, Operational Roles)

Table 4.14 German Military Helicopter Market Forecast Summary 2019, 2024 and 2029 ($m, % Share, CAGR %,)

Table 4.15 German Military Helicopter Market Forecast 2016-2029 ($m, AGR %, Units)

Table 4.16 German Military Helicopter Market Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.17 German Military Helicopter Submarkets Forecast 2016-2029 ($m, AGR %, Units)

Table 4.18 German Military Helicopter Submarkets Forecast CAGR (%) 2019-2029, 2024-2029, and 2024-2029

Table 4.19 Germany Major Helicopter Programmes (Type, Quantity, Enter to Service Date, Operational Roles)

Table 4.20 Indian Military Helicopter Market Forecast Summary 2019, 2024 and 2029 ($m, % Share, CAGR %,)

Table 4.21 Indian Military Helicopter Market Forecast 2016-2029 ($m, AGR %, Units)

Table 4.22 Indian Military Helicopter Market Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.23 Indian Military Helicopter Submarkets Forecast 2016-2029 ($m, AGR %, Units)

Table 4.24 Indian Military Helicopter Submarkets Forecast Sales CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.25 India Major Helicopter Programmes (Type, Quantity, Enter to Service Date, Operational Roles)

Table 4.26 Turkish Military Helicopter Market Forecast Summary 2019, 2024 and 2029 ($m, % Share, CAGR %)

Table 4.27 Turkish Military Helicopter Market Forecast 2016-2029 ($m, AGR %, Units)

Table 4.28 Turkish Military Helicopter Market Forecast Sales CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.29 Turkish Military Helicopter Submarkets Forecast 2016-2029 ($m, AGR %, Units)

Table 4.30 Turkish Military Helicopter Submarkets Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.31 Turkey Major Helicopter Programmes (Type, Quantity, Enter to Service Date, Operational Roles)

Table 4.32 French Military Helicopter Market Forecast Summary 2019, 2024 and 2029 ($m, Rank, % Share, CAGR %, Cumulative)

Table 4.33 French Military Helicopter Market Forecast 2016-2029 ($m, AGR %, Units)

Table 4.34 French Military Helicopter Market Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.35 French Military Helicopter Submarkets Forecast 2016-2029 ($m, AGR %, Units)

Table 4.36 French Military Helicopter Submarkets Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.37 France Major Helicopter Programmes (Type, Quantity, Enter to Service Date, Operational Roles)

Table 4.38 Australian Military Helicopter Market Forecast Summary 2019, 2024 and 2029 ($m, % Share, CAGR %)

Table 4.39 Australian Military Helicopter Market Forecast 2016-2029 ($m, AGR %, Units)

Table 4.40 Australian Military Helicopter Market Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.41 Australian Military Helicopter Submarkets Forecast 2016-2029 ($m, AGR %, Units)

Table 4.42 Australian Military Helicopter Submarkets Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.43 Australia Major Helicopter Programmes (Type, Quantity, Enter to Service Date, Operational Roles)

Table 4.44 Italian Military Helicopter Market Forecast Summary 2019, 2024 and 2029 ($m, % Share, CAGR %)

Table 4.45 Italian Military Helicopter Market Forecast 2016-2029 ($m, AGR %, Units)

Table 4.46 Italian Military Helicopter Market Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.47 Italian Military Helicopter Submarkets Forecast 2016-2029 ($m, AGR %, Units)

Table 4.48 Italian Military Helicopter Submarkets Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.49 Italy Major Helicopter Programmes (Type, Quantity, Enter to Service Date, Operational Roles)

Table 4.50 South Korean Military Helicopter Market Forecast Summary 2019, 2024 and 2029 ($m, % Share, CAGR %)

Table 4.51 South Korean Military Helicopter Market Forecast 2016-2029 ($m, AGR %, Units)

Table 4.52 South Korean Military Helicopter Market Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.53 South Korean Military Helicopter Submarkets Forecast 2016-2029 ($m, AGR %, Units)

Table 4.54 South Korean Military Helicopter Submarkets Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.55 South Korea Major Helicopter Programmes (Type, Quantity, Enter to Service Date, Operational Roles)

Table 4.56 Russian Military Helicopter Market Forecast Summary 2019, 2024 and 2029 ($m, % Share, CAGR %)

Table 4.57 Russian Military Helicopter Market Forecast 2016-2029 ($m, AGR %, Units)

Table 4.58 Russian Military Helicopter Market Forecast CAGR (%) 2019-2029, 2019-2024, and 2019-2029

Table 4.59 Russian Military Helicopter Submarkets Forecast 2016-2029 ($m, AGR %, Units)

Table 4.60 Russian Military Helicopter Submarkets Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.61 Russia Major Helicopter Programmes (Type, Quantity, Enter to Service Date, Operational Roles)

Table 4.62 Japanese Military Helicopter Market Forecast Summary 2019, 2024 and 2029 ($m, % Share, CAGR %)

Table 4.63 Japanese Military Helicopter Market Forecast 2016-2029 ($m, AGR %, Units)

Table 4.64 Japanese Military Helicopter Market Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.65 Japanese Military Helicopter Submarkets Forecast 2016-2029 ($m, AGR %, Units)

Table 4.66 Japanese Military Helicopter Submarkets Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.67 Japan Major Helicopter Programmes (Type, Quantity, Enter to Service Date, Operational Roles)

Table 4.68 Chinese Military Helicopter Market Forecast Summary 2019, 2023 and 2029 ($m, % Share, CAGR %)

Table 4.69 Chinese Military Helicopter Market Forecast 2016-2029 ($m, AGR %, Units)

Table 4.70 Chinese Military Helicopter Market Forecast CAGR (%) 2019-2029, 2024-2029, and 2019-2024

Table 4.71 Chinese Military Helicopter Submarkets Forecast

Table 4.72 Chinese Military Helicopter Submarkets Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.73 China Major Helicopter Programmes (Type, Quantity, Enter to Service Date, Operational Roles)

Table 4.74 Brazilian Military Helicopter Market Forecast Summary 2019, 2024 and 2029 ($m, % Share, CAGR %)

Table 4.75 Brazilian Military Helicopter Market Forecast 2016-2029 ($m, AGR %, Units)

Table 4.76 Brazilian Military Helicopter Market Forecast CAGR (%) 2019-2029, 2024-2029, and 2019-2024

Table 4.77 Brazilian Military Helicopter Submarkets Forecast 2016-2029 ($m, AGR %, Units)

Table 4.78 Brazilian Military Helicopter Market Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.79 Brazil Major Helicopter Programmes (Type, Quantity, Enter to Service Date, Operational Roles)

Table 4.80 UAE Military Helicopter Market Forecast Summary 2019, 2024 and 2029 ($m, % Share, CAGR %)

Table 4.81 UAE Military Helicopter Market Forecast 2019-2029 ($m, AGR %, Units)

Table 4.82 UAE Military Helicopter Market Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.83 UAE Military Helicopter Submarkets Forecast 2016-2029 ($m, AGR %, Units)

Table 4.84 UAE Military Helicopter Submarkets Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.85 UAE Major Helicopter Programmes (Type, Quantity, Enter to Service Date, Operational Roles)

Table 4.86 Algerian Military Helicopter Market Forecast Summary 2019, 2024 and 2029 ($m, % Share, CAGR %,)

Table 4.87 Algerian Military Helicopter Market Forecast 2016-2029 ($m, AGR %, Units)

Table 4.88 Algerian Military Helicopter Market Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.89 Algerian Military Helicopter Submarkets Forecast 2019-2029 ($m, AGR %, Units)

Table 4.90 Algerian Military Helicopter Submarkets Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.91 Algeria Major Helicopter Programmes (Type, Quantity, Enter to Service Date, Operational Roles)

Table 4.92 Taiwanese Military Helicopter Market Forecast Summary 2019, 2024 and 2029 ($m, % Share, CAGR %,)

Table 4.93 Taiwanese Military Helicopter Market Forecast 2016-2029 ($m, AGR %, Units)

Table 4.94 Taiwanese Military Helicopter Market Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.95 Taiwanese Military Helicopter Submarkets Forecast 2016-2029 ($m, AGR %, Units)

Table 4.96 Taiwanese Military Helicopter Submarkets Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.97 Taiwan Major Helicopter Programmes (Type, Quantity, Enter to Service Date, Operational Roles)

Table 4.98 Saudi Arabian Military Helicopter Market Forecast Summary 2019, 2024 and 2029 ($m, % Share, CAGR %,)

Table 4.99 Saudi Arabian Military Helicopter Market Forecast 2016-2029 ($m, AGR %, Units)

Table 4.100 Saudi Arabian Military Helicopter Market Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.101 Saudi Arabian Military Helicopter Submarkets Forecast 2016-2029 ($m, AGR %, Units)

Table 4.102 Saudi Arabian Military Helicopter Submarkets Forecast CAGR (%) 2019-2029, 2019-2024, 2024-2029

Table 4.103 Saudi Arabia Major Helicopter Programmes (Type, Quantity, Enter to Service Date, Operational Roles)

Table 4.104 Canadian Military Helicopter Market Forecast Summary 2019, 2024 and 2029 ($m, Rank, % Share, CAGR %, Cumulative)

Table 4.105 Canadian Military Helicopter Market Forecast 2016-2029 ($m, AGR %, Units)

Table 4.106 Canadian Military Helicopter Market Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.107 Canadian Military Helicopter Submarkets Forecast 2016-2029 ($m, AGR %, Units)

Table 4.108 Canadian Military Helicopter Submarkets Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.109 Iraqi Military Helicopter Market Forecast Summary 2019, 2024 and 2029 ($m, % Share, CAGR %)

Table 4.110 Iraqi Military Helicopter Market Forecast 2016-2029 ($m, AGR %, Units)

Table 4.111 Iraqi Military Helicopter Market Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.112 Iraqi Military Helicopter Submarkets Forecast 2016-2029 ($m, AGR %, Units)

Table 4.113 Iraqi Military Helicopter Submarkets Forecast Sales CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.114 Spanish Military Helicopter Market Forecast Summary 2019, 2024 and 2029 ($m, % Share, CAGR %)

Table 4.115 Spanish Military Helicopter Market Forecast 2016-2029 ($m, AGR %, Units)

Table 4.116 Spanish Military Helicopter Market Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.117 Spanish Military Helicopter Submarkets Forecast 2016-2029 ($m, AGR %, Units)

Table 4.118 Spanish Military Helicopter Submarkets Forecast CAGR (%) 2019-2029, 2019-2024, 2024-2029

Table 4.119 Spain Major Helicopter Programmes (Type, Quantity, Enter to Service Date, Operational Roles)

Table 4.120 Mexican Military Helicopter Market Forecast Summary 2019, 2024 and 2029 ($m, % Share, CAGR %)

Table 4.121 Mexican Military Helicopter Market Forecast 2016-2029 ($m, AGR %, Units)

Table 4.122 Mexican Military Helicopter Market Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.123 Mexican Military Helicopter Submarkets Forecast 2016-2029 ($m, AGR %, Units)

Table 4.124 Mexican Military Helicopter Submarkets Forecast CAGR (%) 2019-2029, 2019-2024, 2024-2029

Table 4.125 Mexico Major Helicopter Programmes (Type, Quantity, Enter to Service Date, Operational Roles)

Table 4.126 Norway Military Helicopter Market Forecast Summary 2019, 2024 and 2029 ($m, % Share, CAGR %)

Table 4.127 Norway Military Helicopter Market Forecast 2016-2029 ($m, AGR %, Units)

Table 4.128 Norway Military Helicopter Market Forecast CAGR (%) 2019-2029, 2019-2024, and 2024-2029

Table 4.129 Norway Military Helicopter Submarkets Forecast 2016-2029 ($m, AGR %, Units)

Table 4.130 Norway Military Helicopter Submarkets Forecast CAGR (%) 2019-2029, 2019-2024, 2024-2029

Table 4.131 Rest of the World Military Helicopter Market Forecast Summary 2019, 2024 and 2029 ($m, % Share, CAGR %)

Table 5.1 SWOT Analysis of the Military Helicopter Market 2019-2029

Table 7.1 Bell Helicopter Overview

Table 7.2 Bell Helicopter Key News and Announcements

Table 7.3 NHIndustries Overview

Table 7.4 NHIndustries Key News and Announcements

Table 7.5 Mitsubishi Heavy Industries, Ltd. Overview

Table 7.6 Russian Helicopters Overview

Table 7.7 Russian Helicopters Key News and Announcements

Table 7.8 Korea Aerospace Industries Ltd (KAI) Overview

Table 7.9 Leonardo Overview

Table 7.10 Leonardo Key News and Announcements

Table 7.11 Lockheed Martin Corporation Overview

Table 7.12 Lockheed Martin Corporation Key News and Announcements

Table 7.13 Hindustan Aeronautics Limited (HAL) Overview

Table 7.14 Hindustan Aeronautics Limited (HAL) Key News and Announcements

Table 7.15 Kawasaki Heavy Industries Ltd Overview

Table 7.16 Kawasaki Heavy Industries Key News and Announcements

Table 7.17 The Boeing Company Overview

Table 7.19 Airbus SE Overview

Table 7.20 Airbus SE Key News and Announcements

Table 7.21 MD Helicopters Overview

Table 7.22 MD Helicopters Key News and Announcements

Table 7.23 Robinson Helicopter Company Overview

Table 7.24 Robinson Helicopter Company Key News and Announcements

Table 7.25 Turkish Aerospace Industries Overview

Table 7.26 Turkish Aerospace Industries Key News and Announcements

List of Figures

Figure 3.1 Global Military Helicopter Market Forecast 2016-2029 ($m)

Figure 3.2 Global Military Helicopter Market Forecast 2016-2029 (Units)

Figure 3.3 Global Military Helicopter Market Forecast, New vs Upgrades 2016-2029 ($M)

Figure 3.4 Global Military Helicopter Market Forecast, New vs Upgrades 2016-2029 (Units)

Figure 3.5 Global Military Helicopter Market Forecast, New vs Upgrades 2019 (% Share)

Figure 3.6 Global Military Helicopter Market Forecast, New vs Upgrades 2024 (% Share)

Figure 3.7 Global Military Helicopter Market Forecast, New vs Upgrades 2029 (% Share)

Figure 3.8 Global Military Helicopter Submarkets Forecast 2016-2029 ($m)

Figure 3.9 Global Military Helicopter Submarkets Forecast 2016-2029 (Units)

Figure 3.10 Global Military Helicopter Submarkets Forecast 2019 (% Share)

Figure 3.11 Global Military Helicopter Submarkets Forecast 2024 (% Share)

Figure 3.12 Global Military Helicopter Submarkets Forecast 2029 (% Share)

Figure 3.13 Leading Military Helicopter National Markets 2019 (% Share)

Figure 3.14 Leading Military Helicopter National Markets 2024 (% Share)

Figure 3.15 Leading Military Helicopter National Markets 2029 (% Share)

Figure 4.1 US Military Helicopter Market Share Forecast 2019, 2024 and 2029 (% Share)

Figure 4.2 US Military Helicopter Market Forecast 2016-2029 ($m)

Figure 4.3 US Military Helicopter Market Forecast 2016-2029 (Units)

Figure 4.4 US Military Helicopter Submarkets Forecast 2016-2029 ($m)

Figure 4.5 US Military Helicopter Submarkets Forecast 2016-2029 (Units)

Figure 4.6 UK Military Helicopter Market Share Forecast 2019, 2024 and 2029 (% Share)

Figure 4.7 UK Military Helicopter Market Forecast 2016-2029 ($m)

Figure 4.8 UK Military Helicopter Market Forecast 2016-2029 (Units)

Figure 4.9 UK Military Helicopter Submarkets Forecast 2016-2029 ($m)

Figure 4.10 UK Military Helicopter Submarkets Forecast 2016-2029 (Units)

Figure 4.11 German Military Helicopter Market Share Forecast 2019, 2024 and 2029 (% Share)

Figure 4.12 German Military Helicopter Market Forecast 2016-2029 ($m)

Figure 4.13 German Military Helicopter Market Forecast 2016-2029 (Units)

Figure 4.14 German Military Helicopter Submarkets Forecast 2016-2029 ($m)

Figure 4.15 German Military Helicopter Submarkets Forecast 2016-2029 (Units)

Figure 4.16 Indian Military Helicopter Market Share Forecast 2019, 2024 and 2029 (% Share)

Figure 4.17 Indian Military Helicopter Market Forecast 2016-2029 ($m)

Figure 4.18 Indian Military Helicopter Market Forecast 2016-2029 (Units)

Figure 4.19 Indian Military Helicopter Submarkets Forecast 2016-2029 ($m)

Figure 4.20 Indian Military Helicopter Submarkets Forecast 2016-2029 (Units)

Figure 4.21 Turkish Military Helicopter Market Share Forecast 2019, 2024 and 2029 (% Share)

Figure 4.22 Turkish Military Helicopter Market Forecast 2016-2029 ($m)

Figure 4.23 Turkish Military Helicopter Market Forecast 2016-2029 (Units)

Figure 4.24 Turkish Military Helicopter Submarkets Forecast 2016-2029 ($m)

Figure 4.25 Turkish Military Helicopter Submarkets Forecast 2016-2029 (Units)

Figure 4.26 French Military Helicopter Market Share Forecast 2019, 2024 and 2029 (% Share)

Figure 4.27 French Military Helicopter Market Forecast 2016-2029 ($m)

Figure 4.28 French Military Helicopter Market Forecasts 2016-2029 (Units)

Figure 4.29 French Military Helicopter Submarkets Forecast 2016-2029 ($m)

Figure 4.30 French Military Helicopter Submarkets Forecast 2016-2029 (Units)

Figure 4.31 Australian Military Helicopter Market Share Forecast 2019, 2024 and 2029 (% Share)

Figure 4.32 Australian Military Helicopter Market Forecast 2016-2029 ($m)

Figure 4.33 Australian Military Helicopter Market Forecast 2016-2029 (Units)

Figure 4.34 Australian Military Helicopter Submarkets Forecast 2016-2029 ($m)

Figure 4.35 Australian Military Helicopter Submarkets Forecast 2016-2029 (Units)

Figure 4.36 Italian Military Helicopter Market Share Forecast 2019, 2024 and 2029 (% Share)

Figure 4.37 Italian Military Helicopter Market Forecast 2016-2029 ($m)

Figure 4.38 Italian Military Helicopter Market Forecasts 2016-2029 (Units)

Figure 4.39 Italian Military Helicopter Submarkets Forecast 2016-2029 ($m)

Figure 4.40 Italian Military Helicopter Submarkets Forecast 2016-2029 (Units)

Figure 4.41 South Korean Military Helicopter Market Share Forecast 2019, 2024 and 2029 (% Share)

Figure 4.42 South Korean Military Helicopter Market Forecast 2016-2029 ($m)

Figure 4.43 South Korean Military Helicopter Market Forecast 2016-2029 (Units)

Figure 4.44 South Korean Military Helicopter Submarkets Forecast 2016-2029 ($m)

Figure 4.45 South Korean Military Helicopter Submarkets Forecast 2016-2029 (Units)

Figure 4.46 Russian Military Helicopter Market Share Forecast 2019, 2024 and 2029 (% Share)

Figure 4.47 Russian Military Helicopter Market Forecast 2019-2029 ($m)

Figure 4.48 Russian Military Helicopter Market Forecast 2019-2029 (Units)

Figure 4.49 Russian Military Helicopter Submarkets Forecast 2016-2029 ($m)

Figure 4.50 Russian Military Helicopter Submarkets Forecast 2016-2029 (Units)

Figure 4.51 Japanese Military Helicopter Market Share Forecast 2019, 2024 and 2029 (% Share)

Figure 4.52 Japanese Military Helicopter Market Forecast 2016-2029 ($m)

Figure 4.53 Japanese Military Helicopter Market Forecast 2016-2029 (Units)

Figure 4.54 Japanese Military Helicopter Submarkets Forecast 2016-2029 ($m)

Figure 4.55 Japanese Military Helicopter Submarkets Forecast 2016-2029 (Units)

Figure 4.56 Chinese Military Helicopter Market Share Forecast 2019, 2024 and 2029 (% Share)

Figure 4.57 Chinese Military Helicopter Market Forecast 2016-2029 ($m)

Figure 4.58 Chinese Military Helicopter Market Forecast 2016-2029 (Units)

Figure 4.59 Chinese Military Helicopter Submarkets Forecast 2016-2029 ($m)

Figure 4.60 Chinese Military Helicopter Submarkets Forecast 2016-2029 (Units)

Figure 4.61 Brazilian Military Helicopter Market Share Forecast 2019, 2024 and 2029(% Share)

Figure 4.62 Brazilian Military Helicopter Market Forecast 2016-2029 ($m)

Figure 4.63 Brazilian Military Helicopter Market Forecast 2016-2029 (Units)

Figure 4.64 Brazilian Military Helicopter Submarket Forecast 2016-2029 ($m)

Figure 4.65 Brazilian Military Helicopter Submarket Forecast 2016-2029 (Units)

Figure 4.66 UAE Military Helicopter Market Share Forecast 2019, 2024 and 2029 (% Share)

Figure 4.68 UAE Military Helicopter Market Forecast 2016-2029 (Units)

Figure 4.67 UAE Military Helicopter Market Forecast 2016-2029 ($m)

Figure 4.69 UAE Military Helicopter Submarkets Forecast 2016-2029 ($m)

Figure 4.70 UAE Military Helicopter Submarkets Forecast 2016-2029 (Units)

Figure 4.71 Algerian Military Helicopter Market Share Forecast 2019, 2024 and 2029 (% Share)

Figure 4.72 Algerian Military Helicopter Market Forecast 2016-2029 ($m)

Figure 4.73 Algerian Military Helicopter Market Forecast 2016-2029 (Units)

Figure 4.74 Algerian Military Helicopter Submarkets Forecast 2016-2029 ($m)

Figure 4.75 Algerian Military Helicopter Submarkets Forecast 2016-2029 (Units)

Figure 4.76 Taiwanese Military Helicopter Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 4.77 Taiwanese Military Helicopter Market Forecast 2016-2029 ($m)

Figure 4.78 Taiwanese Military Helicopter Market Forecast 2016-2029 (Units)

Figure 4.79 Taiwanese Military Helicopter Submarkets Forecast 2016-2029 ($m)

Figure 4.80 Taiwanese Military Helicopter Submarkets Forecast 2016-2029 (Units)

Figure 4.81 Saudi Arabian Military Helicopter Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 4.82 Saudi Arabian Military Helicopter Market Forecast 2016-2029 ($m)

Figure 4.83 Saudi Arabian Military Helicopter Market Forecast 2016-2029 (Units)

Figure 4.84 Saudi Arabian Military Helicopter Submarkets Forecast 2016-2029 ($m)

Figure 4.85 Saudi Arabian Military Helicopter Submarkets Forecast 2016-2029 (Units)

Figure 4.86 Canadian Military Helicopter Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 4.87 Canadian Military Helicopter Market Forecast 2016-2029 ($m)

Figure 4.88 Canadian Military Helicopter Market Forecast 2016-2029 (Units)

Figure 4.89 Canadian Military Helicopter Submarkets Forecast 2016-2029 ($m)

Figure 4.90 Canadian Military Helicopter Submarkets Forecast 2016-2029 (Units)

Figure 4.91 Iraqi Military Helicopter Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 4.92 Iraqi Military Helicopter Market Forecast 2016-2029 ($m)

Figure 4.93 Iraqi Military Helicopter Market Forecast 2016-2029 (Units)

Figure 4.94 Iraqi Military Helicopter Submarkets Forecast 2016-2029 ($m)

Figure 4.95 Iraqi Military Helicopter Submarkets Forecast 2016-2029 (Units)

Figure 4.96 Spanish Military Helicopter Market Share Forecast 2019, 2024, 2029 (%)

Figure 4.97 Spanish Military Helicopter Market Forecast 2016-2029 ($m)

Figure 4.98 Spanish Military Helicopter Market Forecast 2016-2029 (Units)

Figure 4.99 Spanish Military Helicopter Submarkets Forecast 2016-2029 ($m)

Figure 4.100 Spanish Military Helicopter Submarkets Forecast 2016-2029 (Units)

Figure 4.101 Mexican Military Helicopter Market Share Forecast 2019, 2024, 2029 (%)

Figure 4.102 Mexican Military Helicopter Market Forecast 2016-2029 ($m)

Figure 4.103 Mexican Military Helicopter Market Forecast 2016-2029 (Units)

Figure 4.104 Mexican Military Helicopter Submarkets Forecast 2016-2029 ($m)

Figure 4.105 Mexican Military Helicopter Submarkets Forecast 2016-2029 (Units)

Figure 4.106 Norway Military Helicopter Market Share Forecast 2019, 2024, 2029 (%)

Figure 4.107 Norway Military Helicopter Market Forecast 2016-2029 ($m)

Figure 4.108 Norway Military Helicopter Market Forecast 2016-2029 (Units)

Figure 4.109 Norway Military Helicopter Submarkets Forecast 2019-2029 ($m)

Figure 4.110 Norway Military Helicopter Submarkets Forecast 2019-2029 (Units)

Figure 7.1 Bell Helicopter Revenue, 2015-2018

Figure 7.2 Mitsubishi Heavy Industries, Ltd. Revenue 2015-2018

Figure 7.3 Russian helicopter Revenue 2014-2016

Figure 7.4 Leonardo’s Revenue 2014-2018

Figure 7.5 Lockheed Martin Corporation Revenue 2014-2018

Figure 7.6 Hindustan Aeronautics Limited Revenue 2014-2018

Figure 7.7 Kawasaki Heavy Industries Ltd Revenue, 2015-2018

Figure 7.8 Boeing Company Revenue 2014-2018 (US$m, AGR %)

Figure 7.9 Airbus SE Revenue 2014-2018 (US$m, AGR %)

Aero Vodochody

AgustaWestland

Airbus

Airbus Helicopters Deutschland GmbH

Airbus ProSky

Airbus SE

Alenia Aermacchi

ARINC Engineering Services

Aselsan

ATE Aerospace

Australian Aerospace Ltd

AVIC

Avio

AVX Aircraft

BAE Systems

Bell Helicopter

Bell Helicopter Textron

Bell-Boeing (partnership for V-22)

Bendix

Boeing Company

Boeing Defense, Space & Security (BDS)

Changhe Aircraft Industries Corporation (CAIC)

CHC Helicopter

China Helicopter Research and Development Institute (CHRDI)

CoxHealth

Denel

Dillon

EADS CASA

EADS North America

Elettronica Group

Eurocopter

Eurocopter Deutschland

Eurocopter España

Eurocopter France

European Aeronautics Defence & Space Company (EADS)

Finmeccanica (now Leonardo)

FLIR Systems

Fuji Heavy Industries

Galileo Avionica

General Dynamics

General Electric (GE)

GKN Aerospace

Global Vectra Helicorp

GRPZ

Harbin Aircraft Manufacturing Company (HAMC)

Helibras

Helitrans

Hensoldt

Hindustan Aeronautics Ltd (HAL)

Honeywell International Inc

Indra

ISDEFE

ITT Corporation

Kaman Corporation

Kamov Design Bureau

Kawasaki Heavy Industries Ltd

Kazan Helicopter Plant

Klimov JSC

Korea Aerospace Industries Ltd (KAI)

Korean Air

Korean Air Aerospace

L-3 Communications

L-3 Technologies

Lectern Aviation Supplies Co.

Leonardo

Light Helicopter Turbine Engine Company (LHTEC)

Litton

Lockheed Martin

Lockheed Martin Missiles and Fire Control

MD Helicopters

Mil Moscow Helicopter Plant (Mil Helicopter)

Mitsubishi Group

Mitsubishi Heavy Industries Ltd

Naini Aerospace Limited

Nexter

NHIndustries (NHI)

Northern Vietnam Helicopter Corporation

OPK Oboronprom

Phazotron-NIIR

Politecnico di Milano

PZL Mielec

PZL-Świdnik

Rafale

Raytheon

Robinson Helicopter Company

Roketsan

Rolls-Royce

Rolls-Royce Turbomeca

Rosoboronexport

Rostec

Rostvertol

Royal Bank of Scotland

Russian Helicopters

Safran

Safran Helicopter Engines

Sagem

Sapura Aero

Sichuan Lantian Helicopter Company

Sikorsky Aerospace Services

Sikorsky Aircraft Corporation

Sino-US Intercontinental Helicopter Investment Company

SKY Helicopters

Sloane Helicopters Limited

Soteria Search and Rescue

SparkCognition

Stork Fokker Aerospace

Subaru

Sukhoi

Telephonics Corporation

Tennessee Valley Authority

Textron Inc

Thales

Thales UK

Thales Underwater Systems

Turbomeca

Turkish Aerospace Industries (TAI)

TUSAS Engine Industries Inc (TEI)

UIC Oboronprom

United Technologies Corporation (UTC)

Vietnam Helicopter Corporation

Viking Air

Visiongain

Weststar Aviation Services